When market closing prices are not available, the Managing Owner may value an asset of the Master Fund pursuant to policies the Managing Owner has adopted, which are consistent with normal industry standards.

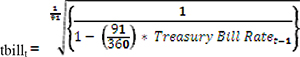

Interest income on United States Treasury Obligations is recognized on an accrual basis when earned. PremiumsDiscounts and discountspremiums are amortized or accreted over the life of the United States Treasury Obligations.

Realized gains (losses) and changes in unrealized gain (loss) on open positions are determined on a specific identification basis and recognized in the consolidated statementstatements of income and expenses in the period in which the contract is closed or the changes occur, respectively.

The Fund records its futures contracts and United States Treasury Obligations on a trade date basis and at fair value in the consolidated financial statements, with changes in fair value reported in the consolidated statement of income and expenses.

In determining fair value of United States Treasury Obligations and commodity futures contracts, the Fund uses unadjusted quoted market prices in active markets and a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. See Note 4 withinto the financial statements in Item 8 for further information regarding this accounting policy.

See sectionSection 1A – Risk Factors and Section 7A – Quantitative and Qualitative Disclosures About Market Risk for a complete discussion of market risk

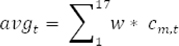

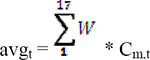

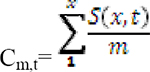

The Master Fund holds two types of investments. The first is long positions in futures contracts on the seventeen commodities in the Index. Since the Index allocates equally among the components and is rebalanced daily, performance risk of the futures contracts is divided equally among the components. Each of the component commodities is traded on the CME Group or ICE exchanges.

The CME Group and ICE exchanges guarantee the performance of its outstanding futures contracts. Each exchange is also publicly traded and, in management’s opinion, well-capitalized. Each uses a system of margining and daily cash settlement of unrealized gains and losses in open positions, which reduces counterparty risk for market participants. Hence, management believes that the Fund faces minimal credit or counterparty risk in its futures trading and contract positions.

The Master Fund will also hold significant cash balances representing the excess of invested funds above the margin requirements for its futures positions. To the extent practical, the Fund will hold this excess cash in short-term obligations of the United States Treasury. Hence, management assigns no counterparty risk to such holdings.

The Exchange May Halt TradingFunds do not anticipate making use of borrowings or other lines of credit to meet its obligations. The Master Fund meets liquidity needs in the normal course of business from cash, cash equivalents, and/or from the sale of United States Treasury Obligations it holds. The Funds’ liquidity needs include: redeeming Shares, Which Would Adversely Impact Your Ability to Sell Shares.

Tradingproviding margin deposits for existing futures contracts, the purchase of additional futures contracts and paying expenses.The Funds generate cash primarily from (i) the sale of creation Baskets, (ii) the sale of Futures Contracts, and (iii) interest earned on cash, cash equivalents and investments in Shares may be halted due to market conditions or, in light of NYSE rules and procedures, for reasons that, in the viewcollateralizing United States Treasury Obligations. Substantially all of the NYSE, make trading in Shares inadvisable. In addition, trading is subject to trading halts caused by extraordinary market volatility pursuant to “circuit breake” rules that require trading to be halted for a specified period based on a specified market decline in the equity markets. There can be no assurance that the requirements necessary to maintain the listingnet assets of the Shares will continue to be met or will remain unchanged. The Fund and the Master Fund are allocated to trading in futures contracts. Most of the assets of the Master Fund are held in United States Treasury Obligations, cash and/or cash equivalents that could or are used as margin or collateral for trading in futures contracts. The percentage that such assets bear to the total net assets will vary from period to period as the market values of the futures contracts change. Interest earned on interest-bearing assets of the Master Fund is paid to the Master Fund.

The investments of the Master Fund in futures contracts could be terminated ifsubject to periods of illiquidity because of market conditions, regulatory considerations and other reasons. Such conditions could prevent the Shares are de-listed.

Master Fund from promptly liquidating a position in futures contracts.The Lack Of An Active Trading Market for the Shares May Result in Losses on Your Investment at the Time of Disposition of Your Shares.

See Item 1A- Risk Factors

Possible Illiquid Markets May Exacerbate Losses.

See Item 1A – Risk Factors

The Fund and Master Fund’s contractual obligations are with the Managing Owner and the Commodity Broker. Management Fee payments made to the Managing Owner are calculated as a fixed percentage of the Master Fund’s Net Asset Value. CommissionCommissions paid by the Fund to the Commodity Broker are on a per contract half-turntrade basis. As such, the Managing Owner cannot anticipate the amount of payments and commissions related to half turns or round turns that will be required under these arrangements for future periods as net asset values are not known until a future date.

trades.Off-Balance Sheet Risk

In the normal course of its business, the Fund isFunds are party to financial instruments with off-balance sheet risk. The term “off-balance sheet risk”risk” refers to an unrecorded potential liability that, even though it does not appear on the balance sheet, may result in a future obligation or loss. The financial instruments used by the Fund are standardized commodity futures contracts traded on regulated exchanges and are recognized on the balance sheet at fair value pursuant to the accounting standards for derivatives and hedging activities, “Accounting for Derivative Instruments and Hedging Activities”.Activities.” As of the balance sheet date, therefore, the Fund hasFunds have no unrecorded liabilities relating to futures contracts. However, until these contracts are closed, they will fluctuate in value with changing commodity prices.

| QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

INTRODUCTION

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Introduction

The Fund isFunds are designed to replicate a commodity index. The market-sensitive instruments held by itthe Master Fund are subject to the risk of trading loss. Unlike an operating company, the risk of market-sensitive instruments is integral, not incidental, to the Fund’sFunds’ main line of business.

Market movements can produce frequent changes in the fair market value of the Master Fund’s open positions and, consequently, in its earnings and cash flow.flows. The Fund’sFunds’ market risk is primarily influenced by changes in the price of commodities.

QUALITATIVE DISCLOSURES REGARDING NON-TRADING RISK EXPOSURE

General

Qualitative Disclosures Regarding Non-Trading Risk Exposure

The Fund isFunds are unaware of any (i) anticipated known demands, commitments or capital expenditures; (ii) material trends, favorable or unfavorable, in its capital resources; or (iii) trends or uncertainties that will have a material effect on operations.

QUALITATIVE DISCLOSURES REGARDING MEANS OF MANAGING RISK EXPOSURE

Qualitative Disclosures Regarding Means of Managing Risk Exposure

Under ordinary circumstances, the Managing Owner’sOwner’s discretionary power is limited to determining whether the Fund will make a distribution. Under emergency or extraordinary circumstances, the Managing Owner’s discretionary powers increase, but remain circumscribed. These special circumstances, for example, include the unavailability of the Index or certain natural or man-made disasters. The Managing Owner does not apply risk management techniques. The Master Fund initiates positions only on the “long” side of the market and does not employ “stop-loss” techniques.

Accordingly, tabular presentations of Market Risk or Sensitivity or Value-at-Risk analyses thereof are not applicable.

| FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | Financial Statements and Supplementary Data. |

See the Index to Financial Statements

GreenHaven Continuous Commodity Index Fund and GreenHaven Continuous Commodity Index Master Fund

|

| | 48 |

| | |

| | 49 |

| | |

| | 50 |

| | |

| | 50 |

| | |

| | 51 |

| | |

| | 52 |

| | |

| | 53 |

| | |

| | 54 |

| | |

| | 55 |

| | |

| | 56 |

| | |

| | 57 |

| | |

| | 58 |

| | |

| | 58 |

| | |

| | 59 |

| | |

| | 60 |

| | |

| | 61 |

| | |

| | 62 |

| | |

| | 63 |

| | |

| | 64 |

| | |

| | 65 |

| | |

| | 66 |

Board of Managers and Shareholders of

GreenHaven Continuous Commodity Index Fund:

We have audited the accompanying consolidated statements of financial condition of GreenHaven Continuous Commodity Index Fund and subsidiary as of December 31, 2012 and 2011, the consolidated schedules of investments as of December 31, 2012 and 2011, and the related consolidated statements of income and expenses, changes in shareholders’ equity, and cash flows for each of the three years in the period ended December 31, 2012. These financial statements are the responsibility of the GreenHaven Continuous Commodity Index Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of GreenHaven Continuous Commodity Index Fund and subsidiary as of December 31, 2012 and 2011, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the GreenHaven Continuous Commodity Index Fund’s internal control over financial reporting as of December 31, 2012, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated February 26, 2013 expressed an unqualified opinion thereon.

/s/ Grant Thornton LLP

Atlanta, Georgia

February 26, 2013

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Managers and Shareholders of

GreenHaven Continuous Commodity Index Master Fund:

We have audited the accompanying statements of financial condition of GreenHaven Continuous Commodity Index Master Fund as of December 31, 2012 and 2011, the schedules of investments as of December 31, 2012 and 2011, and the related statements of income and expenses, changes in shareholders’ equity, and cash flows for each of the three years in the period ended December 31, 2012. These financial statements are the responsibility of the GreenHaven Continuous Commodity Index Master Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of GreenHaven Continuous Commodity Index Master Fund as of December 31, 2012 and 2011, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the GreenHaven Continuous Commodity Index Master Fund’s internal control over financial reporting as of December 31, 2012, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated February 26, 2013 expressed an unqualified opinion thereon.

/s/ Grant Thornton LLP

Atlanta, Georgia

February 26, 2013

| | | | | | | |

| | | 2012 | | | 2011 | |

| Assets | | | | | | |

| Equity in broker trading accounts: | | | | | | |

| U.S. Treasury Obligations (cost $469,979,439 and $9,999,989 as of 2012 and 2011, respectively) | | $ | 469,995,420 | | | $ | 9,999,990 | |

| Cash held by broker | | | 22,210,626 | | | | 619,079,494 | |

| Net unrealized depreciation on futures contracts | | | (12,514,458 | ) | | | (45,001,789 | ) |

| Total assets | | $ | 479,691,588 | | | $ | 584,077,695 | |

| | | | | | | | | |

| Liabilities and shareholders’ equity | | | | | | | | |

| Capital shares payable | | $ | 4,327,722 | | | $ | 1,497,826 | |

| Management fee payable to related party | | | 354,469 | | | | 438,205 | |

| Accrued brokerage fees and expenses payable | | | 401,297 | | | | 983,648 | |

| Total liabilities | | | 5,083,488 | | | | 2,919,679 | |

| | | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| General Units: | | | | | | | | |

| Paid in capital - 50 units issued | | | 1,500 | | | | 1,500 | |

| Accumulated deficit | | | (57 | ) | | | (2 | ) |

| Total General Units | | | 1,443 | | | | 1,498 | |

| Limited Units: | | | | | | | | |

| | | | | | | | | |

Paid in capital - 16,450,000 and 19,400,000 redeemable units issued and outstanding as of 2012 and 2011, respectively | | | 470,214,957 | | | | 549,362,581 | |

| Retained earnings | | | 4,391,700 | | | | 31,793,937 | |

| | | | | | | | | |

| Total Limited Units | | | 474,606,657 | | | | 581,156,518 | |

| | | | | | | | | |

| Total shareholders’ equity | | | 474,608,100 | | | | 581,158,016 | |

| | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 479,691,588 | | | $ | 584,077,695 | |

| | | | | | | | | |

| Net asset value per share | | | | | | | | |

| | | | | | | | | |

| General Units | | $ | 28.86 | | | $ | 29.96 | |

| | | | | | | | | |

| Limited Units | | $ | 28.85 | | | $ | 29.96 | |

See accompanying notes to consolidated financial statements

| | | Percentage of | | | Fair | | | Face | |

| Description | | Net Assets | | | Value | | | Value | |

| U.S. Treasury Obligations | | | | | | | | | |

| U.S. Treasury Bills, 0.06% due January 03, 2013 | | | 37.93 | % | | $ | 180,000,000 | | | $ | 180,000,000 | |

| U.S. Treasury Bills, 0.05% due January 10, 2013 | | | 6.32 | | | | 29,999,820 | | | | 30,000,000 | |

| U.S. Treasury Bills, 0.05% due January 24, 2013 | | | 40.03 | | | | 189,997,910 | | | | 190,000,000 | |

| U.S. Treasury Bills, 0.11% due February 14, 2013 | | | 14.75 | | | | 69,997,690 | | | | 70,000,000 | |

| Total U.S. Treasury Obligations (cost $469,979,439) | | | 99.03 | % | | $ | 469,995,420 | | | $ | 470,000,000 | |

| | | | | | | | | | |

| | | Percentage of | | | Fair | | | Notional | |

| Description | | Net Assets | | | Value | | | Value | |

| Unrealized Appreciation/(Depreciation) on Futures Contracts | | | | | | | | | | | | |

| Cocoa (414 contracts, settlement date March 13, 2013) | | | (0.20 | )% | | $ | (948,620 | ) | | $ | 9,257,040 | |

| Cocoa (415 contracts, settlement date May 15, 2013) | | | (0.20 | ) | | | (932,590 | ) | | | 9,320,900 | |

| Cocoa (414 contracts, settlement date July 16, 2013) | | | (0.10 | ) | | | (485,050 | ) | | | 9,331,560 | |

| Coffee (168 contracts, settlement date March 18, 2013) | | | (0.28 | ) | | | (1,303,556 | ) | | | 9,059,400 | |

| Coffee (170 contracts, settlement date May 20, 2013) | | | (0.28 | ) | | | (1,324,350 | ) | | | 9,352,125 | |

| Coffee (169 contracts, settlement date July 19, 2013) | | | (0.14 | ) | | | (671,381 | ) | | | 9,477,731 | |

| Copper (102 contracts, settlement date March 26, 2013) | | | 0.12 | | | | 554,000 | | | | 9,313,875 | |

| Copper (102 contracts, settlement date May 29, 2013) | | | 0.11 | | | | 544,763 | | | | 9,338,100 | |

| Copper (101 contracts, settlement date July 29, 2013) | | | 0.11 | | | | 529,500 | | | | 9,271,800 | |

| Corn (267 contracts, settlement date March 14, 2013) | | | (0.25 | ) | | | (1,180,150 | ) | | | 9,321,637 | |

| Corn (266 contracts, settlement date May 14, 2013) | | | (0.23 | ) | | | (1,104,225 | ) | | | 9,313,325 | |

| Corn (266 contracts, settlement date July 12, 2013) | | | (0.08 | ) | | | (389,100 | ) | | | 9,273,425 | |

| Cotton (246 contracts, settlement date March 06, 2013) | | | 0.08 | | | | 361,630 | | | | 9,242,220 | |

| Cotton (244 contracts, settlement date May 08, 2013) | | | 0.02 | | | | 99,440 | | | | 9,254,920 | |

| Cotton (245 contracts, settlement date July 09, 2013) | | | 0.10 | | | | 489,040 | | | | 9,416,575 | |

| FCOJ-A (838 contracts, settlement date March 08, 2013) | | | (0.06 | ) | | | (301,343 | ) | | | 14,750,895 | |

| FCOJ-A (435 contracts, settlement date May 10, 2013) | | | 0.03 | | | | 133,620 | | | | 7,777,800 | |

| FCOJ-A (285 contracts, settlement date July 11, 2013) | | | (0.01 | ) | | | (61,987 | ) | | | 5,185,575 | |

| Gold (56 contracts, settlement date February 26, 2013) | | | 0.07 | | | | 312,270 | | | | 9,384,480 | |

| Gold (55 contracts, settlement date April 26, 2013) | | | 0.05 | | | | 236,130 | | | | 9,229,000 | |

| Gold (55 contracts, settlement date June 26, 2013) | | | (0.07 | ) | | | (317,080 | ) | | | 9,240,000 | |

| Heating Oil (44 contracts, settlement date January 31, 2013) | | | 0.00 | * | | | (14,960 | ) | | | 5,602,766 | |

| Heating Oil (44 contracts, settlement date February 28, 2013) | | | 0.00 | * | | | (10,185 | ) | | | 5,575,046 | |

| Heating Oil (44 contracts, settlement date March 28, 2013) | | | 0.00 | * | | | (1,571 | ) | | | 5,535,869 | |

| Heating Oil (44 contracts, settlement date April 30, 2013) | | | 0.02 | | | | 85,352 | | | | 5,587,982 | |

| Heating Oil (44 contracts, settlement date May 31, 2013) | | | 0.02 | | | | 90,959 | | | | 5,558,045 | |

| Lean Hogs (189 contracts, settlement date February 14, 2013) | | | 0.07 | | | | 323,420 | | | | 6,480,810 | |

| Lean Hogs (189 contracts, settlement date April 12, 2013) | | | 0.01 | | | | 24,060 | | | | 6,707,610 | |

| Lean Hogs (188 contracts, settlement date June 14, 2013) | | | (0.04 | ) | | | (163,170 | ) | | | 7,358,320 | |

| Lean Hogs (188 contracts, settlement date July 15, 2013) | | | (0.04 | ) | | | (193,660 | ) | | | 7,322,600 | |

| Light, Sweet Crude Oil (60 contracts, settlement date January 22, 2013) | | | (0.01 | ) | | | (45,010 | ) | | | 5,509,200 | |

| Light, Sweet Crude Oil (61 contracts, settlement date February 20, 2013) | | | (0.01 | ) | | | (57,300 | ) | | | 5,628,470 | |

| Light, Sweet Crude Oil (60 contracts, settlement date March 20, 2013) | | | (0.01 | ) | | | (38,330 | ) | | | 5,563,800 | |

| Light, Sweet Crude Oil (60 contracts, settlement date April 22, 2013) | | | 0.06 | | | | 279,100 | | | | 5,589,600 | |

| Light, Sweet Crude Oil (60 contracts, settlement date May 21, 2013) | | | 0.06 | | | | 274,100 | | | | 5,609,400 | |

| Live Cattle (175 contracts, settlement date February 28, 2013) | | | 0.03 | | | | 163,800 | | | | 9,261,000 | |

| Live Cattle (174 contracts, settlement date April 30, 2013) | | | 0.02 | | | | 106,530 | | | | 9,491,700 | |

| Live Cattle (175 contracts, settlement date June 28, 2013) | | | 0.02 | | | | 96,290 | | | | 9,152,500 | |

| Natural Gas (163 contracts, settlement date January 29, 2013) | | | (0.06 | ) | | | (298,990 | ) | | | 5,462,130 | |

| Natural Gas (163 contracts, settlement date Februay 26, 2013) | | | (0.05 | ) | | | (251,910 | ) | | | 5,484,950 | |

| Natural Gas (163 contracts, settlement date March 26, 2013) | | | (0.04 | ) | | | (189,680 | ) | | | 5,546,890 | |

| Natural Gas (163 contracts, settlement date April 26, 2013) | | | (0.07 | ) | | | (316,420 | ) | | | 5,628,390 | |

| Natural Gas (163 contracts, settlement date May 29, 2013) | | | (0.06 | ) | | | (298,280 | ) | | | 5,718,040 | |

| Platinum (181 contracts, settlement date April 26, 2013) | | | (0.06 | ) | | | (267,470 | ) | | | 13,958,720 | |

| Platinum (180 contracts, settlement date July 29, 2013) | | | (0.07 | ) | | | (329,455 | ) | | | 13,911,300 | |

| Silver (62 contracts, settlement date March 26, 2013) | | | 0.01 | | | | 58,585 | | | | 9,370,370 | |

| Silver (61 contracts, settlement date May 29, 2013) | | | 0.03 | | | | 143,405 | | | | 9,235,095 | |

| Silver (61 contracts, settlement date July 29, 2013) | | | (0.14 | ) | | | (680,860 | ) | | | 9,249,125 | |

| Soybean (133 contracts, settlement date March 14, 2013) | | | (0.16 | ) | | | (772,287 | ) | | | 9,373,175 | |

| Soybean (132 contracts, settlement date May 14, 2013) | | | (0.10 | ) | | | (461,563 | ) | | | 9,235,050 | |

| Soybean (133 contracts, settlement date July 12, 2013) | | | (0.01 | ) | | | (61,712 | ) | | | 9,278,413 | |

| Sugar (424 contracts, settlement date February 28, 2013) | | | (0.10 | ) | | | (456,109 | ) | | | 9,264,909 | |

| Sugar (424 contracts, settlement date April 30, 2013) | | | (0.07 | ) | | | (317,901 | ) | | | 9,307,648 | |

| Sugar (423 contracts, settlement date June 28, 2013) | | | 0.06 | | | | 278,678 | | | | 9,352,022 | |

| Wheat (237 contracts, settlement date March 14, 2013) | | | (0.28 | ) | | | (1,303,087 | ) | | | 9,219,300 | |

| Wheat (237 contracts, settlement date May 14, 2013) | | | (0.24 | ) | | | (1,134,200 | ) | | | 9,334,838 | |

| Wheat (235 contracts, settlement date July 12, 2013) | | | (0.22 | ) | | | (1,015,588 | ) | | | 9,326,563 | |

| Net Unrealized Depreciation on Futures Contracts | | | (2.64 | )% | | $ | (12,514,458 | ) | | $ | 473,904,029 | |

* | Denotes greater than 0.000% yet less than 0.005% |

See accompanying notes to consolidated financial statements

| | | Percentage of | | | Fair | | | Face | |

| Description | | Net Assets | | | Value | | | Value | |

| U.S. Treasury Obligations | | | | | | | | | |

| U.S. Treasury Bill, 0.00% due January 05, 2012 (cost $9,999,989) | | | 1.72 | % | | $ | 9,999,990 | | | $ | 10,000,000 | |

| | | | | | | | | | | | | |

| | | Percentage of | | | Fair | | | Notional | |

| Description | | Net Assets | | | Value | | | Value | |

| Unrealized Appreciation/(Depreciation) on Futures Contracts | | | | | | | | | | | | |

| Cocoa (535 contracts, settlement date March 15, 2012) | | | (0.55 | )% | | $ | (3,205,990 | ) | | $ | 11,283,150 | |

| Cocoa (536 contracts, settlement date May 15, 2012) | | | (0.53 | ) | | | (3,093,380 | ) | | | 11,422,160 | |

| Cocoa (536 contracts, settlement date July 16, 2012) | | | (0.33 | ) | | | (1,932,240 | ) | | | 11,513,280 | |

| Coffee (133 contracts, settlement date March 20, 2012) | | | (0.15 | ) | | | (896,456 | ) | | | 11,314,144 | |

| Coffee (132 contracts, settlement date May 18, 2012) | | | (0.16 | ) | | | (919,744 | ) | | | 11,367,675 | |

| Coffee (132 contracts, settlement date July 19, 2012) | | | (0.06 | ) | | | (352,538 | ) | | | 11,493,900 | |

| Copper (133 contracts, settlement date March 28, 2012) | | | (0.10 | ) | | | (592,150 | ) | | | 11,424,700 | |

| Copper (132 contracts, settlement date May 29, 2012) | | | (0.11 | ) | | | (608,013 | ) | | | 11,376,750 | |

| Copper (132 contracts, settlement date July 27, 2012) | | | 0.01 | | | | 51,438 | | | | 11,401,500 | |

| Corn (349 contracts, settlement date March 14, 2012) | | | (0.15 | ) | | | (862,200 | ) | | | 11,281,425 | |

| Corn (349 contracts, settlement date May 14, 2012) | | | (0.15 | ) | | | (839,875 | ) | | | 11,425,387 | |

| Corn (348 contracts, settlement date July 13, 2012) | | | 0.01 | | | | 33,125 | | | | 11,505,750 | |

| Cotton (249 contracts, settlement date March 08, 2012) | | | (0.13 | ) | | | (726,570 | ) | | | 11,429,100 | |

| Cotton (248 contracts, settlement date May 08, 2012) | | | (0.15 | ) | | | (851,265 | ) | | | 11,368,320 | |

| Cotton (248 contracts, settlement date July 09, 2012) | | | (0.12 | ) | | | (721,380 | ) | | | 11,322,440 | |

| FCOJ-A (561 contracts, settlement date March 12, 2012) | | | 0.04 | | | | 257,978 | | | | 14,221,350 | |

| FCOJ-A (486 contracts, settlement date May 10, 2012) | | | 0.15 | | | | 856,470 | | | | 12,261,780 | |

| FCOJ-A (306 contracts, settlement date July 11, 2012) | | | (0.01 | ) | | | (32,880 | ) | | | 7,738,740 | |

| Gold (72 contracts, settlement date February 27, 2012) | | | (0.09 | ) | | | (527,380 | ) | | | 11,280,960 | |

| Gold (72 contracts, settlement date April 26, 2012) | | | (0.21 | ) | | | (1,233,460 | ) | | | 11,299,680 | |

| Gold (73 contracts, settlement date June 27, 2012) | | | (0.25 | ) | | | (1,434,620 | ) | | | 11,472,680 | |

| Heating Oil (57 contracts, settlement date January 31, 2012) | | | (0.02 | ) | | | (109,389 | ) | | | 6,976,595 | |

| Heating Oil (56 contracts, settlement date February 29, 2012) | | | (0.02 | ) | | | (101,056 | ) | | | 6,834,677 | |

| Heating Oil (56 contracts, settlement date March 30, 2012) | | | (0.02 | ) | | | (111,661 | ) | | | 6,789,283 | |

| Heating Oil (56 contracts, settlement date April 30, 2012) | | | (0.09 | ) | | | (493,088 | ) | | | 6,734,482 | |

| Heating Oil (56 contracts, settlement date May 31, 2012) | | | (0.08 | ) | | | (488,053 | ) | | | 6,693,557 | |

| Lean Hogs (236 contracts, settlement date February 14, 2012) | | | (0.07 | ) | | | (384,030 | ) | | | 7,957,920 | |

| Lean Hogs (236 contracts, settlement date April 16, 2012) | | | (0.06 | ) | | | (325,560 | ) | | | 8,278,880 | |

| Lean Hogs (235 contracts, settlement date June 14, 2012) | | | (0.05 | ) | | | (275,680 | ) | | | 8,977,000 | |

| Lean Hogs (236 contracts, settlement date July 16, 2012) | | | (0.04 | ) | | | (210,990 | ) | | | 8,951,480 | |

| Light, Sweet Crude Oil (69 contracts, settlement date January 20, 2012) | | | 0.13 | | | | 727,240 | | | | 6,819,270 | |

| Light, Sweet Crude Oil (69 contracts, settlement date February 21, 2012) | | | 0.13 | | | | 746,950 | | | | 6,831,000 | |

| Light, Sweet Crude Oil (69 contracts, settlement date March 20, 2012) | | | 0.13 | | | | 746,560 | | | | 6,845,490 | |

| Light, Sweet Crude Oil (69 contracts, settlement date April 20, 2012) | | | 0.01 | | | | 82,600 | | | | 6,859,290 | |

| Light, Sweet Crude Oil (68 contracts, settlement date May 22, 2012) | | | 0.02 | | | | 113,320 | | | | 6,764,640 | |

| Live Cattle (229 contracts, settlement date February 29, 2012) | | | 0.00 | * | | | 2,380 | | | | 11,124,820 | |

| Live Cattle (230 contracts, settlement date April 30, 2012) | | | (0.02 | ) | | | (131,730 | ) | | | 11,541,400 | |

| Live Cattle (230 contracts, settlement date June 29, 2012) | | | (0.02 | ) | | | (122,410 | ) | | | 11,460,900 | |

| Natural Gas (224 contracts, settlement date January 27, 2012) | | | (0.40 | ) | | | (2,315,920 | ) | | | 6,695,360 | |

| Natural Gas (224 contracts, settlement date February 27, 2012) | | | (0.38 | ) | | | (2,204,450 | ) | | | 6,755,840 | |

| Natural Gas (220 contracts, settlement date March 28, 2012) | | | (0.36 | ) | | | (2,067,940 | ) | | | 6,773,800 | |

| Natural Gas (220 contracts, settlement date April 26, 2012) | | | (0.20 | ) | | | (1,188,850 | ) | | | 6,888,200 | |

| Natural Gas (219 contracts, settlement date May 29, 2012) | | | (0.20 | ) | | | (1,169,040 | ) | | | 6,968,580 | |

| Platinum (243 contracts, settlement date April 26, 2012) | | | (0.43 | ) | | | (2,468,450 | ) | | | 17,069,535 | |

| Platinum (243 contracts, settlement date July 27, 2012) | | | (0.44 | ) | | | (2,566,290 | ) | | | 17,124,210 | |

| Silver (82 contracts, settlement date March 28, 2012) | | | (0.35 | ) | | | (2,055,925 | ) | | | 11,445,150 | |

| Silver (81 contracts, settlement date May 29, 2012) | | | (0.38 | ) | | | (2,222,650 | ) | | | 11,323,800 | |

| Silver (81 contracts, settlement date July 27, 2012) | | | (0.33 | ) | | | (1,944,665 | ) | | | 11,338,785 | |

| Soybean (186 contracts, settlement date March 14, 2012) | | | (0.17 | ) | | | (1,016,225 | ) | | | 11,232,075 | |

| Soybean (187 contracts, settlement date May 14, 2012) | | | (0.16 | ) | | | (954,425 | ) | | | 11,383,625 | |

| Soybean (187 contracts, settlement date July 13, 2012) | | | 0.05 | | | | 264,900 | | | | 11,472,450 | |

| Sugar (444 contracts, settlement date February 29, 2012) | | | (0.24 | ) | | | (1,406,339 | ) | | | 11,586,624 | |

| Sugar (444 contracts, settlement date April 30, 2012) | | | (0.20 | ) | | | (1,152,122 | ) | | | 11,412,576 | |

| Sugar (444 contracts, settlement date June 29, 2012) | | | (0.09 | ) | | | (545,496 | ) | | | 11,218,637 | |

| Wheat (343 contracts, settlement date March 14, 2012) | | | (0.20 | ) | | | (1,133,987 | ) | | | 11,194,662 | |

| Wheat (340 contracts, settlement date May 14, 2012) | | | (0.19 | ) | | | (1,118,513 | ) | | | 11,411,250 | |

| Wheat (340 contracts, settlement date July 13, 2012) | | | 0.04 | | | | 230,325 | | | | 11,666,250 | |

| Net Unrealized Depreciation on Futures Contracts | | | (7.74 | )% | | $ | (45,001,789 | ) | | $ | 580,606,964 | |

* | Denotes greater than 0.000% yet less than 0.005% |

See accompanying notes to consolidated financial statements

| | | 2012 | | | 2011 | | | 2010 | |

| Income | | | | | | | | | |

| Interest Income | | $ | 331,044 | | | $ | 335,677 | | | $ | 301,808 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Management fee to related party | | | 4,637,997 | | | | 5,895,201 | | | | 2,523,863 | |

| Brokerage fees and expenses | | | 377,195 | | | | 1,300,472 | | | | 712,620 | |

| Total expenses | | | 5,015,192 | | | | 7,195,673 | | | | 3,236,483 | |

| Net Investment Loss | | | (4,684,148 | ) | | | (6,859,996 | ) | | | (2,934,675 | ) |

Realized and Net Change in Unrealized Gain (Loss) on Investments and Futures Contracts | | | | | | | | | | | | |

| Realized Gain (Loss) on | | | | | | | | | | | | |

| Investments | | | 1,429 | | | | 451 | | | | (403 | ) |

| Futures Contracts | | | (55,222,884 | ) | | | 36,755,383 | | | | 43,285,484 | |

| Net Realized Gain (Loss) | | | (55,221,455 | ) | | | 36,755,834 | | | | 43,285,081 | |

| Net Change in Unrealized Gain (Loss) on | | | | | | | | | | | | |

| Investments | | | 15,980 | | | | (20,292 | ) | | | 18,076 | |

| Futures Contracts | | | 32,487,331 | | | | (103,641,471 | ) | | | 46,259,451 | |

| Net Change in Unrealized Gain (Loss) | | | 32,503,311 | | | | (103,661,763 | ) | | | 46,277,527 | |

Net Realized and Unrealized Gain (Loss) on Investments and Future Contracts | | | (22,718,144 | ) | | | (66,905,929 | ) | | | 89,562,608 | |

| | | | | | | | | | | | | |

| Net Gain (Loss) | | $ | (27,402,292 | ) | | $ | (73,765,925 | ) | | $ | 86,627,933 | |

See accompanying notes to consolidated financial statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Units | | | Limited Units | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Total | | | | | | | | | Total | | | | |

| | | | | | | | | General | | | | | | | | | Limited | | | Total | |

| | | General Units | | | Accumulated | | | Shareholders’ | | | Limited Units | | | Accumulated | | | Shareholders’ | | | Shareholders’ | |

| | | Units | | | Amount | | | Deficit | | | Equity | | | Units | | | Amount | | | Earnings | | | Equity | | | Equity | |

| Balance at January 1, 2012 | | | 50 | | | $ | 1,500 | | | $ | (2 | ) | | $ | 1,498 | | | | 19,400,000 | | | $ | 549,362,581 | | | $ | 31,793,937 | | | $ | 581,156,518 | | | $ | 581,158,016 | |

| Creation of Limited Units | | | - | | | | - | | | | - | | | | - | | | | 3,250,000 | | | | 101,149,075 | | | | - | | | | 101,149,075 | | | | 101,149,075 | |

| Redemption of Limited Units | | | - | | | | - | | | | - | | | | - | | | | (6,200,000 | ) | | | (180,296,699 | ) | | | - | | | | (180,296,699 | ) | | | (180,296,699 | ) |

| Net loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | - | | | | - | | | | (13 | ) | | | (13 | ) | | | - | | | | - | | | | (4,684,135 | ) | | | (4,684,135 | ) | | | (4,684,148 | ) |

Net realized loss on Investments and Futures Contracts | | | - | | | | - | | | | (135 | ) | | | (135 | ) | | | - | | | | - | | | | (55,221,320 | ) | | | (55,221,320 | ) | | | (55,221,455 | ) |

Net change in unrealized gain on Investments and Futures Contracts | | | - | | | | - | | | | 93 | | | | 93 | | | | - | | | | - | | | | 32,503,218 | | | | 32,503,218 | | | | 32,503,311 | |

| Net loss | | | - | | | | - | | | | (55 | ) | | | (55 | ) | | | - | | | | - | | | | (27,402,237 | ) | | | (27,402,237 | ) | | | (27,402,292 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2012 | | | 50 | | | $ | 1,500 | | | $ | (57 | ) | | $ | 1,443 | | | | 16,450,000 | | | $ | 470,214,957 | | | $ | 4,391,700 | | | $ | 474,606,657 | | | $ | 474,608,100 | |

See accompanying notes to consolidated financial statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Units | | | Limited Units | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Total | | | | | | | | | | | | Total | | | | |

| | | | | | | | | General | | | | | | | | | | | | Limited | | | Total | |

| | | General Units | | | Accumulated | | | Shareholders’ | | | Limited Units | | | Accumulated | | | Shareholders’ | | | Shareholders’ | |

| | | Units | | | Amount | | | Deficit | | | Equity | | | Units | | | Amount | | | Earnings | | | Equity | | | Equity | |

| Balance at January 1, 2011 | | | 50 | | | $ | 1,500 | | | $ | 144 | | | $ | 1,644 | | | | 16,250,000 | | | $ | 428,801,695 | | | $ | 105,559,716 | | | $ | 534,361,411 | | | $ | 534,363,055 | |

| Creation of Limited Units | | | - | | | | - | | | | - | | | | - | | | | 11,200,000 | | | | 383,075,174 | | | | - | | | | 383,075,174 | | | | 383,075,174 | |

| Redemption of Limited Units | | | - | | | | - | | | | - | | | | - | | | | (8,050,000 | ) | | | (262,514,288 | ) | | | - | | | | (262,514,288 | ) | | | (262,514,288 | ) |

| Net loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | - | | | | - | | | | (17 | ) | | | (17 | ) | | | - | | | | - | | | | (6,859,979 | ) | | | (6,859,979 | ) | | | (6,859,996 | ) |

Net realized gain on Investments and Futures Contracts | | | - | | | | - | | | | 88 | | | | 88 | | | | - | | | | - | | | | 36,755,746 | | | | 36,755,746 | | | | 36,755,834 | |

Net change in unrealized loss on Investments and Futures Contracts | | | - | | | | - | | | | (217 | ) | | | (217 | ) | | | - | | | | - | | | | (103,661,546 | ) | | | (103,661,546 | ) | | | (103,661,763 | ) |

| Net loss | | | - | | | | - | | | | (146 | ) | | | (146 | ) | | | - | | | | - | | | | (73,765,779 | ) | | | (73,765,779 | ) | | | (73,765,925 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2011 | | | 50 | | | $ | 1,500 | | | $ | (2 | ) | | $ | 1,498 | | | | 19,400,000 | | | $ | 549,362,581 | | | $ | 31,793,937 | | | $ | 581,156,518 | | | $ | 581,158,016 | |

See accompanying notes to consolidated financial statements

GreenHaven Continous Commodity Index Fund

For the Year Ended December 31, 2010

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Units | | | Limited Units | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Total | | | | | | | | | | | | Total | | | | |

| | | | | | | | | | | | General | | | | | | | | | | | | Limited | | | Total | |

| | | General Units | | | Accumulated | | | Shareholders’ | | | Limited Units | | | Accumulated | | | Shareholders’ | | | Shareholders’ | |

| | | Units | | | Amount | | | Earnings | | | Equity | | | Units | | | Amount | | | Earnings | | | Equity | | | Equity | |

| Balance at January 1, 2010 | | | 50 | | | $ | 1,500 | | | $ | (189 | ) | | $ | 1,311 | | | | 8,750,000 | | | $ | 210,500,911 | | | $ | 18,932,116 | | | $ | 229,433,027 | | | $ | 229,434,338 | |

| Creation of Limited Units | | | - | | | | - | | | | - | | | | - | | | | 9,200,000 | | | | 262,051,675 | | | | - | | | | 262,051,675 | | | | 262,051,675 | |

| Redemption of Limited Units | | | - | | | | - | | | | - | | | | - | | | | (1,700,000 | ) | | | (43,750,891 | ) | | | - | | | | (43,750,891 | ) | | | (43,750,891 | ) |

| Net gain: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | - | | | | - | | | | (15 | ) | | | (15 | ) | | | - | | | | - | | | | (2,934,660 | ) | | | (2,934,660 | ) | | | (2,934,675 | ) |

Net realized gain on Investments

and Futures Contracts | | | - | | | | - | | | | 165 | | | | 165 | | | | - | | | | - | | | | 43,284,916 | | | | 43,284,916 | | | | 43,285,081 | |

Net change in unrealized gain on Investments and Futures Contracts | | | - | | | | - | | | | 183 | | | | 183 | | | | - | | | | - | | | | 46,277,344 | | | | 46,277,344 | | | | 46,277,527 | |

| Net gain | | | - | | | | - | | | | 333 | | | | 333 | | | | - | | | | - | | | | 86,627,600 | | | | 86,627,600 | | | | 86,627,933 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2010 | | | 50 | | | $ | 1,500 | | | $ | 144 | | | $ | 1,644 | | | | 16,250,000 | | | $ | 428,801,695 | | | $ | 105,559,716 | | | $ | 534,361,411 | | | $ | 534,363,055 | |

See accompanying notes to consolidated financial statements | |

GreenHaven Continuous Commodity Index Fund

For the Years Ended December 31, 2012, 2011, and 2010

| | | | | | | | | | |

| | | 2012 | | | 2011 | | | 2010 | |

| Cash flow from operating activities: | | | | | | | | | |

| Net gain (loss) | | $ | (27,402,292 | ) | | $ | (73,765,925 | ) | | $ | 86,627,933 | |

| Adjustments to reconcile net gain (loss) to net cash used for operating activities: | | | | | | | | | | | | |

| Purchase of investment securities | | | (2,089,638,671 | ) | | | (1,594,743,929 | ) | | | (1,159,625,357 | ) |

| Proceeds from sales of investment securities | | | 1,629,991,694 | | | | 2,054,999,635 | | | | 809,997,503 | |

| Net accretion of discount | | | (331,044 | ) | | | (335,677 | ) | | | (301,808 | ) |

| Net realized loss (gain) on investment securities | | | (1,429 | ) | | | (451 | ) | | | 403 | |

| Unrealized depreciation (appreciation) on investments | | | (32,503,311 | ) | | | 103,661,763 | | | | (46,277,527 | ) |

| Increase in payable - capital shares | | | 2,829,896 | | | | 1,497,826 | | | | - | |

| Increase (decrease) in accrued expenses | | | (666,087 | ) | | | 717,847 | | | | 515,001 | |

| Net cash provided by (used for) operating activities | | | (517,721,244 | ) | | | 492,031,089 | | | | (309,063,852 | ) |

| | | | | | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | | | | |

| Proceeds from creation of Limited Units | | | 101,149,075 | | | | 383,075,174 | | | | 262,051,675 | |

| Redemption of Limited Units | | | (180,296,699 | ) | | | (262,514,288 | ) | | | (43,750,891 | ) |

| Net cash provided by (used for) financing activities | | | (79,147,624 | ) | | | 120,560,886 | | | | 218,300,784 | |

| | | | | | | | | | | | | |

| Net change in cash | | | (596,868,868 | ) | | | 612,591,975 | | | | (90,763,068 | ) |

| Cash held by broker at beginning of year | | | 619,079,494 | | | | 6,487,519 | | | | 97,250,587 | |

| Cash held by broker at end of year | | $ | 22,210,626 | | | $ | 619,079,494 | | | $ | 6,487,519 | |

See accompanying notes to consolidated financial statements | |

December 31, 2012 and 2011

| | | | | | | |

| | | 2012 | | | 2011 | |

| Assets | | | | | | |

| Equity in broker trading accounts: | | | | | | |

| U.S. Treasury Obligations (cost $469,979,439 and $9,999,989 as of 2012 and 2011, respectively) | | $ | 469,995,420 | | | $ | 9,999,990 | |

| Cash held by broker | | | 22,210,626 | | | | 619,079,494 | |

| Net unrealized depreciation on futures contracts | | | (12,514,458 | ) | | | (45,001,789 | ) |

| Total assets | | $ | 479,691,588 | | | $ | 584,077,695 | |

| | | | | | | | | |

| Liabilities and shareholders’ equity | | | | | | | | |

| Capital shares payable | | $ | 4,327,722 | | | $ | 1,497,826 | |

| Management fee payable to related party | | | 354,469 | | | | 438,205 | |

| Accrued brokerage fees and expenses payable | | | 401,297 | | | | 983,648 | |

| Total liabilities | | | 5,083,488 | | | | 2,919,679 | |

| | | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| General Units: | | | | | | | | |

| Paid in capital - 50 units issued | | | 1,500 | | | | 1,500 | |

| Accumulated deficit | | | (57 | ) | | | (2 | ) |

| Total General Units | | | 1,443 | | | | 1,498 | |

| Limited Units: | | | | | | | | |

| Paid in capital - 16,450,000 and 19,400,000 redeemable units | | | | | | | | |

issued and outstanding as of 2012 and 2011, respectively | | | 470,214,957 | | | | 549,362,581 | |

| Retained earnings | | | 4,391,700 | | | | 31,793,937 | |

| | | | | | | | | |

| Total Limited Units | | | 474,606,657 | | | | 581,156,518 | |

| | | | | | | | | |

| Total shareholders’ equity | | | 474,608,100 | | | | 581,158,016 | |

| | | | | | | | | |

| Total liabilities and shareholders’ equity | | $ | 479,691,588 | | | $ | 584,077,695 | |

| | | | | | | | | |

| Net asset value per share | | | | | | | | |

| | | | | | | | | |

| General Units | | $ | 28.86 | | | $ | 29.96 | |

| | | | | | | | | |

| Limited Units | | $ | 28.85 | | | $ | 29.96 | |

See accompanying notes to consolidated financial statements | |

| | | | | | | | | | |

| | | Percentage of | | | Fair | | | Face | |

| Description | | Net Assets | | | Value | | | Value | |

| U.S. Treasury Obligations | | | | | | | | | |

| U.S. Treasury Bills, 0.06% due January 03, 2013 | | | 37.93 | % | | $ | 180,000,000 | | | $ | 180,000,000 | |

| U.S. Treasury Bills, 0.05% due January 10, 2013 | | | 6.32 | | | | 29,999,820 | | | | 30,000,000 | |

| U.S. Treasury Bills, 0.05% due January 24, 2013 | | | 40.03 | | | | 189,997,910 | | | | 190,000,000 | |

| U.S. Treasury Bills, 0.11% due February 14, 2013 | | | 14.75 | | | | 69,997,690 | | | | 70,000,000 | |

| Total U.S. Treasury Obligations (cost $469,979,439) | | | 99.03 | % | | $ | 469,995,420 | | | $ | 470,000,000 | |

| | | | | | | | | | | | | |

| | | Percentage of | | | Fair | | | Notional | |

| Description | | Net Assets | | | Value | | | Value | |

| Unrealized Appreciation/(Depreciation) on Futures Contracts | | | | | | | | | | | | |

| Cocoa (414 contracts, settlement date March 13, 2013) | | | (0.20 | )% | | $ | (948,620 | ) | | $ | 9,257,040 | |

| Cocoa (415 contracts, settlement date May 15, 2013) | | | (0.20 | ) | | | (932,590 | ) | | | 9,320,900 | |

| Cocoa (414 contracts, settlement date July 16, 2013) | | | (0.10 | ) | | | (485,050 | ) | | | 9,331,560 | |

| Coffee (168 contracts, settlement date March 18, 2013) | | | (0.28 | ) | | | (1,303,556 | ) | | | 9,059,400 | |

| Coffee (170 contracts, settlement date May 20, 2013) | | | (0.28 | ) | | | (1,324,350 | ) | | | 9,352,125 | |

| Coffee (169 contracts, settlement date July 19, 2013) | | | (0.14 | ) | | | (671,381 | ) | | | 9,477,731 | |

| Copper (102 contracts, settlement date March 26, 2013) | | | 0.12 | | | | 554,000 | | | | 9,313,875 | |

| Copper (102 contracts, settlement date May 29, 2013) | | | 0.11 | | | | 544,763 | | | | 9,338,100 | |

| Copper (101 contracts, settlement date July 29, 2013) | | | 0.11 | | | | 529,500 | | | | 9,271,800 | |

| Corn (267 contracts, settlement date March 14, 2013) | | | (0.25 | ) | | | (1,180,150 | ) | | | 9,321,637 | |

| Corn (266 contracts, settlement date May 14, 2013) | | | (0.23 | ) | | | (1,104,225 | ) | | | 9,313,325 | |

| Corn (266 contracts, settlement date July 12, 2013) | | | (0.08 | ) | | | (389,100 | ) | | | 9,273,425 | |

| Cotton (246 contracts, settlement date March 06, 2013) | | | 0.08 | | | | 361,630 | | | | 9,242,220 | |

| Cotton (244 contracts, settlement date May 08, 2013) | | | 0.02 | | | | 99,440 | | | | 9,254,920 | |

| Cotton (245 contracts, settlement date July 09, 2013) | | | 0.10 | | | | 489,040 | | | | 9,416,575 | |

| FCOJ-A (838 contracts, settlement date March 08, 2013) | | | (0.06 | ) | | | (301,343 | ) | | | 14,750,895 | |

| FCOJ-A (435 contracts, settlement date May 10, 2013) | | | 0.03 | | | | 133,620 | | | | 7,777,800 | |

| FCOJ-A (285 contracts, settlement date July 11, 2013) | | | (0.01 | ) | | | (61,987 | ) | | | 5,185,575 | |

| Gold (56 contracts, settlement date February 26, 2013) | | | 0.07 | | | | 312,270 | | | | 9,384,480 | |

| Gold (55 contracts, settlement date April 26, 2013) | | | 0.05 | | | | 236,130 | | | | 9,229,000 | |

| Gold (55 contracts, settlement date June 26, 2013) | | | (0.07 | ) | | | (317,080 | ) | | | 9,240,000 | |

| Heating Oil (44 contracts, settlement date January 31, 2013) | | | 0.00 | * | | | (14,960 | ) | | | 5,602,766 | |

| Heating Oil (44 contracts, settlement date February 28, 2013) | | | 0.00 | * | | | (10,185 | ) | | | 5,575,046 | |

| Heating Oil (44 contracts, settlement date March 28, 2013) | | | 0.00 | * | | | (1,571 | ) | | | 5,535,869 | |

| Heating Oil (44 contracts, settlement date April 30, 2013) | | | 0.02 | | | | 85,352 | | | | 5,587,982 | |

| Heating Oil (44 contracts, settlement date May 31, 2013) | | | 0.02 | | | | 90,959 | | | | 5,558,045 | |

| Lean Hogs (189 contracts, settlement date February 14, 2013) | | | 0.07 | | | | 323,420 | | | | 6,480,810 | |

| Lean Hogs (189 contracts, settlement date April 12, 2013) | | | 0.01 | | | | 24,060 | | | | 6,707,610 | |

| Lean Hogs (188 contracts, settlement date June 14, 2013) | | | (0.04 | ) | | | (163,170 | ) | | | 7,358,320 | |

| Lean Hogs (188 contracts, settlement date July 15, 2013) | | | (0.04 | ) | | | (193,660 | ) | | | 7,322,600 | |

| Light, Sweet Crude Oil (60 contracts, settlement date January 22, 2013) | | | (0.01 | ) | | | (45,010 | ) | | | 5,509,200 | |

| Light, Sweet Crude Oil (61 contracts, settlement date February 20, 2013) | | | (0.01 | ) | | | (57,300 | ) | | | 5,628,470 | |

| Light, Sweet Crude Oil (60 contracts, settlement date March 20, 2013) | | | (0.01 | ) | | | (38,330 | ) | | | 5,563,800 | |

| Light, Sweet Crude Oil (60 contracts, settlement date April 22, 2013) | | | 0.06 | | | | 279,100 | | | | 5,589,600 | |

| Light, Sweet Crude Oil (60 contracts, settlement date May 21, 2013) | | | 0.06 | | | | 274,100 | | | | 5,609,400 | |

| Live Cattle (175 contracts, settlement date February 28, 2013) | | | 0.03 | | | | 163,800 | | | | 9,261,000 | |

| Live Cattle (174 contracts, settlement date April 30, 2013) | | | 0.02 | | | | 106,530 | | | | 9,491,700 | |

| Live Cattle (175 contracts, settlement date June 28, 2013) | | | 0.02 | | | | 96,290 | | | | 9,152,500 | |

| Natural Gas (163 contracts, settlement date January 29, 2013) | | | (0.06 | ) | | | (298,990 | ) | | | 5,462,130 | |

| Natural Gas (163 contracts, settlement date Februay 26, 2013) | | | (0.05 | ) | | | (251,910 | ) | | | 5,484,950 | |

| Natural Gas (163 contracts, settlement date March 26, 2013) | | | (0.04 | ) | | | (189,680 | ) | | | 5,546,890 | |

| Natural Gas (163 contracts, settlement date April 26, 2013) | | | (0.07 | ) | | | (316,420 | ) | | | 5,628,390 | |

| Natural Gas (163 contracts, settlement date May 29, 2013) | | | (0.06 | ) | | | (298,280 | ) | | | 5,718,040 | |

| Platinum (181 contracts, settlement date April 26, 2013) | | | (0.06 | ) | | | (267,470 | ) | | | 13,958,720 | |

| Platinum (180 contracts, settlement date July 29, 2013) | | | (0.07 | ) | | | (329,455 | ) | | | 13,911,300 | |

| Silver (62 contracts, settlement date March 26, 2013) | | | 0.01 | | | | 58,585 | | | | 9,370,370 | |

| Silver (61 contracts, settlement date May 29, 2013) | | | 0.03 | | | | 143,405 | | | | 9,235,095 | |

| Silver (61 contracts, settlement date July 29, 2013) | | | (0.14 | ) | | | (680,860 | ) | | | 9,249,125 | |

| Soybean (133 contracts, settlement date March 14, 2013) | | | (0.16 | ) | | | (772,287 | ) | | | 9,373,175 | |

| Soybean (132 contracts, settlement date May 14, 2013) | | | (0.10 | ) | | | (461,563 | ) | | | 9,235,050 | |

| Soybean (133 contracts, settlement date July 12, 2013) | | | (0.01 | ) | | | (61,712 | ) | | | 9,278,413 | |

| Sugar (424 contracts, settlement date February 28, 2013) | | | (0.10 | ) | | | (456,109 | ) | | | 9,264,909 | |

| Sugar (424 contracts, settlement date April 30, 2013) | | | (0.07 | ) | | | (317,901 | ) | | | 9,307,648 | |

| Sugar (423 contracts, settlement date June 28, 2013) | | | 0.06 | | | | 278,678 | | | | 9,352,022 | |

| Wheat (237 contracts, settlement date March 14, 2013) | | | (0.28 | ) | | | (1,303,087 | ) | | | 9,219,300 | |

| Wheat (237 contracts, settlement date May 14, 2013) | | | (0.24 | ) | | | (1,134,200 | ) | | | 9,334,838 | |

| Wheat (235 contracts, settlement date July 12, 2013) | | | (0.22 | ) | | | (1,015,588 | ) | | | 9,326,563 | |

| Net Unrealized Depreciation on Futures Contracts | | | (2.64 | )% | | $ | (12,514,458 | ) | | $ | 473,904,029 | |

* Denotes greater than 0.000% yet less than 0.005% | | | | | | | | | | | |

See accompanying notes to consolidated financial statements

| | | | | | | | | | |

| | | Percentage of | | | Fair | | | Face | |

| Description | | Net Assets | | | Value | | | Value | |

| U.S. Treasury Obligations | | | | | | | | | |

| U.S. Treasury Bill, 0.00% due January 05, 2012 (cost $9,999,989) | | | 1.72 | % | | $ | 9,999,990 | | | $ | 10,000,000 | |

| | | | | | | | | | | | | |

| | | Percentage of | | | Fair | | | Notional | |

| Description | | Net Assets | | | Value | | | Value | |

| Unrealized Appreciation/(Depreciation) on Futures Contracts | | | | | | | | | | | | |

| Cocoa (535 contracts, settlement date March 15, 2012) | | | (0.55 | ) % | | $ | (3,205,990 | ) | | $ | 11,283,150 | |

| Cocoa (536 contracts, settlement date May 15, 2012) | | | (0.53 | ) | | | (3,093,380 | ) | | | 11,422,160 | |

| Cocoa (536 contracts, settlement date July 16, 2012) | | | (0.33 | ) | | | (1,932,240 | ) | | | 11,513,280 | |

| Coffee (133 contracts, settlement date March 20, 2012) | | | (0.15 | ) | | | (896,456 | ) | | | 11,314,144 | |

| Coffee (132 contracts, settlement date May 18, 2012) | | | (0.16 | ) | | | (919,744 | ) | | | 11,367,675 | |

| Coffee (132 contracts, settlement date July 19, 2012) | | | (0.06 | ) | | | (352,538 | ) | | | 11,493,900 | |

| Copper (133 contracts, settlement date March 28, 2012) | | | (0.10 | ) | | | (592,150 | ) | | | 11,424,700 | |

| Copper (132 contracts, settlement date May 29, 2012) | | | (0.11 | ) | | | (608,013 | ) | | | 11,376,750 | |

| Copper (132 contracts, settlement date July 27, 2012) | | | 0.01 | | | | 51,438 | | | | 11,401,500 | |

| Corn (349 contracts, settlement date March 14, 2012) | | | (0.15 | ) | | | (862,200 | ) | | | 11,281,425 | |

| Corn (349 contracts, settlement date May 14, 2012) | | | (0.15 | ) | | | (839,875 | ) | | | 11,425,387 | |

| Corn (348 contracts, settlement date July 13, 2012) | | | 0.01 | | | | 33,125 | | | | 11,505,750 | |

| Cotton (249 contracts, settlement date March 08, 2012) | | | (0.13 | ) | | | (726,570 | ) | | | 11,429,100 | |

| Cotton (248 contracts, settlement date May 08, 2012) | | | (0.15 | ) | | | (851,265 | ) | | | 11,368,320 | |

| Cotton (248 contracts, settlement date July 09, 2012) | | | (0.12 | ) | | | (721,380 | ) | | | 11,322,440 | |

| FCOJ-A (561 contracts, settlement date March 12, 2012) | | | 0.04 | | | | 257,978 | | | | 14,221,350 | |

| FCOJ-A (486 contracts, settlement date May 10, 2012) | | | 0.15 | | | | 856,470 | | | | 12,261,780 | |

| FCOJ-A (306 contracts, settlement date July 11, 2012) | | | (0.01 | ) | | | (32,880 | ) | | | 7,738,740 | |

| Gold (72 contracts, settlement date February 27, 2012) | | | (0.09 | ) | | | (527,380 | ) | | | 11,280,960 | |

| Gold (72 contracts, settlement date April 26, 2012) | | | (0.21 | ) | | | (1,233,460 | ) | | | 11,299,680 | |

| Gold (73 contracts, settlement date June 27, 2012) | | | (0.25 | ) | | | (1,434,620 | ) | | | 11,472,680 | |

| Heating Oil (57 contracts, settlement date January 31, 2012) | | | (0.02 | ) | | | (109,389 | ) | | | 6,976,595 | |

| Heating Oil (56 contracts, settlement date February 29, 2012) | | | (0.02 | ) | | | (101,056 | ) | | | 6,834,677 | |

| Heating Oil (56 contracts, settlement date March 30, 2012) | | | (0.02 | ) | | | (111,661 | ) | | | 6,789,283 | |

| Heating Oil (56 contracts, settlement date April 30, 2012) | | | (0.09 | ) | | | (493,088 | ) | | | 6,734,482 | |

| Heating Oil (56 contracts, settlement date May 31, 2012) | | | (0.08 | ) | | | (488,053 | ) | | | 6,693,557 | |

| Lean Hogs (236 contracts, settlement date February 14, 2012) | | | (0.07 | ) | | | (384,030 | ) | | | 7,957,920 | |

| Lean Hogs (236 contracts, settlement date April 16, 2012) | | | (0.06 | ) | | | (325,560 | ) | | | 8,278,880 | |

| Lean Hogs (235 contracts, settlement date June 14, 2012) | �� | | (0.05 | ) | | | (275,680 | ) | | | 8,977,000 | |

| Lean Hogs (236 contracts, settlement date July 16, 2012) | | | (0.04 | ) | | | (210,990 | ) | | | 8,951,480 | |

| Light, Sweet Crude Oil (69 contracts, settlement date January 20, 2012) | | | 0.13 | | | | 727,240 | | | | 6,819,270 | |

| Light, Sweet Crude Oil (69 contracts, settlement date February 21, 2012) | | | 0.13 | | | | 746,950 | | | | 6,831,000 | |

| Light, Sweet Crude Oil (69 contracts, settlement date March 20, 2012) | | | 0.13 | | | | 746,560 | | | | 6,845,490 | |

| Light, Sweet Crude Oil (69 contracts, settlement date April 20, 2012) | | | 0.01 | | | | 82,600 | | | | 6,859,290 | |

| Light, Sweet Crude Oil (68 contracts, settlement date May 22, 2012) | | | 0.02 | | | | 113,320 | | | | 6,764,640 | |

| Live Cattle (229 contracts, settlement date February 29, 2012) | | | 0.00 | * | | | 2,380 | | | | 11,124,820 | |

| Live Cattle (230 contracts, settlement date April 30, 2012) | | | (0.02 | ) | | | (131,730 | ) | | | 11,541,400 | |

| Live Cattle (230 contracts, settlement date June 29, 2012) | | | (0.02 | ) | | | (122,410 | ) | | | 11,460,900 | |

| Natural Gas (224 contracts, settlement date January 27, 2012) | | | (0.40 | ) | | | (2,315,920 | ) | | | 6,695,360 | |

| Natural Gas (224 contracts, settlement date February 27, 2012) | | | (0.38 | ) | | | (2,204,450 | ) | | | 6,755,840 | |

| Natural Gas (220 contracts, settlement date March 28, 2012) | | | (0.36 | ) | | | (2,067,940 | ) | | | 6,773,800 | |

| Natural Gas (220 contracts, settlement date April 26, 2012) | | | (0.20 | ) | | | (1,188,850 | ) | | | 6,888,200 | |

| Natural Gas (219 contracts, settlement date May 29, 2012) | | | (0.20 | ) | | | (1,169,040 | ) | | | 6,968,580 | |

| Platinum (243 contracts, settlement date April 26, 2012) | | | (0.43 | ) | | | (2,468,450 | ) | | | 17,069,535 | |

| Platinum (243 contracts, settlement date July 27, 2012) | | | (0.44 | ) | | | (2,566,290 | ) | | | 17,124,210 | |

| Silver (82 contracts, settlement date March 28, 2012) | | | (0.35 | ) | | | (2,055,925 | ) | | | 11,445,150 | |

| Silver (81 contracts, settlement date May 29, 2012) | | | (0.38 | ) | | | (2,222,650 | ) | | | 11,323,800 | |

| Silver (81 contracts, settlement date July 27, 2012) | | | (0.33 | ) | | | (1,944,665 | ) | | | 11,338,785 | |

| Soybean (186 contracts, settlement date March 14, 2012) | | | (0.17 | ) | | | (1,016,225 | ) | | | 11,232,075 | |

| Soybean (187 contracts, settlement date May 14, 2012) | | | (0.16 | ) | | | (954,425 | ) | | | 11,383,625 | |

| Soybean (187 contracts, settlement date July 13, 2012) | | | 0.05 | | | | 264,900 | | | | 11,472,450 | |

| Sugar (444 contracts, settlement date February 29, 2012) | | | (0.24 | ) | | | (1,406,339 | ) | | | 11,586,624 | |

| Sugar (444 contracts, settlement date April 30, 2012) | | | (0.20 | ) | | | (1,152,122 | ) | | | 11,412,576 | |

| Sugar (444 contracts, settlement date June 29, 2012) | | | (0.09 | ) | | | (545,496 | ) | | | 11,218,637 | |

| Wheat (343 contracts, settlement date March 14, 2012) | | | (0.20 | ) | | | (1,133,987 | ) | | | 11,194,662 | |

| Wheat (340 contracts, settlement date May 14, 2012) | | | (0.19 | ) | | | (1,118,513 | ) | | | 11,411,250 | |

| Wheat (340 contracts, settlement date July 13, 2012) | | | 0.04 | | | | 230,325 | | | | 11,666,250 | |

| Net Unrealized Depreciation on Futures Contracts | | | (7.74 | )% | | $ | (45,001,789 | ) | | $ | 580,606,964 | |

* Denotes greater than 0.000% yet less than 0.005% | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements

GreenHaven Continuous Commodity Index Master Fund

| | | 2012 | | | 2011 | | | 2010 | |

| Income | | | | | | | | | |

| Interest Income | | $ | 331,044 | | | $ | 335,677 | | | $ | 301,808 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Management fee to related party | | | 4,637,997 | | | | 5,895,201 | | | | 2,523,863 | |

| Brokerage fees and expenses | | | 377,195 | | | | 1,300,472 | | | | 712,620 | |

| Total expenses | | | 5,015,192 | | | | 7,195,673 | | | | 3,236,483 | |

| Net Investment Loss | | | (4,684,148 | ) | | | (6,859,996 | ) | | | (2,934,675 | ) |

| | | | | | | | | | | | | |

Realized and Net Change in Unrealized Gain (Loss) on Investments and Futures Contracts | | | | | | | | | | | | |

| Realized Gain (Loss) on | | | | | | | | | | | | |

| Investments | | | 1,429 | | | | 451 | | | | (403 | ) |

| Futures Contracts | | | (55,222,884 | ) | | | 36,755,383 | | | | 43,285,484 | |

| Net Realized Gain (Loss) | | | (55,221,455 | ) | | | 36,755,834 | | | | 43,285,081 | |

| Net Change in Unrealized Gain (Loss) on | | | | |

| Investments | | | 15,980 | | | | (20,292 | ) | | | 18,076 | |

| Futures Contracts | | | 32,487,331 | | | | (103,641,471 | ) | | | 46,259,451 | |

| Net Change in Unrealized Gain (Loss) | | | 32,503,311 | | | | (103,661,763 | ) | | | 46,277,527 | |

Net Realized and Unrealized Gain (Loss) on Investments and Future Contracts | | | (22,718,144 | ) | | | (66,905,929 | ) | | | 89,562,608 | |

| | | | | | | | | | | | | |

| Net Gain (Loss) | | $ | (27,402,292 | ) | | $ | (73,765,925 | ) | | $ | 86,627,933 | |

See accompanying notes to consolidated financial statements

GreenHaven Continuous Commodity Index Master Fund

For the Year Ended December 31, 2012

| | | General Units | | Limited Units | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Total | | | | | | | | | | | | Total | | | | |

| | | | | | | | | | | | General | | | | | | | | | | | | Limited | | | Total | |

| | | General Units | | | Accumulated | | | Shareholders’ | | | Limited Units | | | Accumulated | | | Shareholders’ | | | Shareholders’ | |

| | | Units | | | Amount | | | Deficit | | | Equity | | | Units | | | Amount | | | Earnings | | | Equity | | | Equity | |

| Balance at January 1, 2012 | | | 50 | | | $ | 1,500 | | | $ | (2 | ) | | $ | 1,498 | | | | 19,400,000 | | | $ | 549,362,581 | | | $ | 31,793,937 | | | $ | 581,156,518 | | | $ | 581,158,016 | |

| Creation of Limited Units | | | - | | | | - | | | | - | | | | - | | | | 3,250,000 | | | | 101,149,075 | | | | - | | | | 101,149,075 | | | | 101,149,075 | |

| Redemption of Limited Units | | | - | | | | - | | | | - | | | | - | | | | (6,200,000 | ) | | | (180,296,699 | ) | | | - | | | | (180,296,699 | ) | | | (180,296,699 | ) |

| Net loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | - | | | | - | | | | (13 | ) | | | (13 | ) | | | - | | | | - | | | | (4,684,135 | ) | | | (4,684,135 | ) | | | (4,684,148 | ) |

| Net realized loss on Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| and Futures Contracts | | | - | | | | - | | | | (135 | ) | | | (135 | ) | | | - | | | | - | | | | (55,221,320 | ) | | | (55,221,320 | ) | | | (55,221,455 | ) |

| Net change in unrealized gain on | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Futures Contracts | | | - | | | | - | | | | 93 | | | | 93 | | | | - | | | | - | | | | 32,503,218 | | | | 32,503,218 | | | | 32,503,311 | |

| Net loss | | | - | | | | - | | | | (55 | ) | | | (55 | ) | | | - | | | | - | | | | (27,402,237 | ) | | | (27,402,237 | ) | | | (27,402,292 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2012 | | | 50 | | | $ | 1,500 | | | $ | (57 | ) | | $ | 1,443 | | | | 16,450,000 | | | $ | 470,214,957 | | | $ | 4,391,700 | | | $ | 474,606,657 | | | $ | 474,608,100 | |

See accompanying notes to consolidated financial statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Units | | Limited Units | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Total | | | | | | | | | | | | Total | | | | |

| | | | | | | | | | | | General | | | | | | | | | | | | Limited | | | Total | |

| | | General Units | | | Accumulated | | | Shareholders’ | | | Limited Units | | | Accumulated | | | Shareholders’ | | | Shareholders’ | |

| | | Units | | | Amount | | | Deficit | | | Equity | | | Units | | | Amount | | | Earnings | | | Equity | | | Equity | |

| Balance at January 1, 2011 | | | 50 | | | $ | 1,500 | | | $ | 144 | | | $ | 1,644 | | | | 16,250,000 | | | $ | 428,801,695 | | | $ | 105,559,716 | | | $ | 534,361,411 | | | $ | 534,363,055 | |

| Creation of Limited Units | | | - | | | | - | | | | - | | | | - | | | | 11,200,000 | | | | 383,075,174 | | | | - | | | | 383,075,174 | | | | 383,075,174 | |

| Redemption of Limited Units | | | - | | | | - | | | | - | | | | - | | | | (8,050,000 | ) | | | (262,514,288 | ) | | | - | | | | (262,514,288 | ) | | | (262,514,288 | ) |

| Net loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | - | | | | - | | | | (17 | ) | | | (17 | ) | | | - | | | | - | | | | (6,859,979 | ) | | | (6,859,979 | ) | | | (6,859,996 | ) |

| Net realized gain on Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| and Futures Contracts | | | - | | | | - | | | | 88 | | | | 88 | | | | - | | | | - | | | | 36,755,746 | | | | 36,755,746 | | | | 36,755,834 | |

| Net change in unrealized loss on | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Futures Contracts | | | - | | | | - | | | | (217 | ) | | | (217 | ) | | | - | | | | - | | | | (103,661,546 | ) | | | (103,661,546 | ) | | | (103,661,763 | ) |

| Net loss | | | - | | | | - | | | | (146 | ) | | | (146 | ) | | | - | | | | - | | | | (73,765,779 | ) | | | (73,765,779 | ) | | | (73,765,925 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2011 | | | 50 | | | $ | 1,500 | | | $ | (2 | ) | | $ | 1,498 | | | | 19,400,000 | | | $ | 549,362,581 | | | $ | 31,793,937 | | | $ | 581,156,518 | | | $ | 581,158,016 | |

See accompanying notes to consolidated financial statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Units | | Limited Units | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Total | | | | | | | | | | | | Total | | | | |

| | | | | | | | | | | | General | | | | | | | | | | | | Limited | | | Total | |

| | | General Units | | | Accumulated | | | Shareholders’ | | | Limited Units | | | Accumulated | | | Shareholders’ | | | Shareholders’ | |

| | | Units | | | Amount | | | Earnings | | | Equity | | | Units | | | Amount | | | Earnings | | | Equity | | | Equity | |

| Balance at January 1, 2010 | | | 50 | | | $ | 1,500 | | | $ | (189 | ) | | $ | 1,311 | | | | 8,750,000 | | | $ | 210,500,911 | | | $ | 18,932,116 | | | $ | 229,433,027 | | | $ | 229,434,338 | |

| Creation of Limited Units | | | - | | | | - | | | | - | | | | - | | | | 9,200,000 | | | | 262,051,675 | | | | - | | | | 262,051,675 | | | | 262,051,675 | |

| Redemption of Limited Units | | | - | | | | - | | | | - | | | | - | | | | (1,700,000 | ) | | | (43,750,891 | ) | | | - | | | | (43,750,891 | ) | | | (43,750,891 | ) |

| Net gain: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | - | | | | - | | | | (15 | ) | | | (15 | ) | | | - | | | | - | | | | (2,934,660 | ) | | | (2,934,660 | ) | | | (2,934,675 | ) |

| Net realized gain on Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| and Futures Contracts | | | - | | | | - | | | | 165 | | | | 165 | | | | - | | | | - | | | | 43,284,916 | | | | 43,284,916 | | | | 43,285,081 | |

| Net change in unrealized gain on | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments and | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Futures Contracts | | | - | | | | - | | | | 183 | | | | 183 | | | | - | | | | - | | | | 46,277,344 | | | | 46,277,344 | | | | 46,277,527 | |

| Net gain | | | - | | | | - | | | | 333 | | | | 333 | | | | - | | | | - | | | | 86,627,600 | | | | 86,627,600 | | | | 86,627,933 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at December 31, 2010 | | | 50 | | | $ | 1,500 | | | $ | 144 | | | $ | 1,644 | | | | 16,250,000 | | | $ | 428,801,695 | | | $ | 105,559,716 | | | $ | 534,361,411 | | | $ | 534,363,055 | |

See accompanying notes to consolidated financial statements

GreenHaven Continuous Commodity Index Master Fund

Statements of Cash Flows

For the Years Ended December 31, 2012, 2011, and 2010| | | | | | | | | | |

| | | 2012 | | | 2011 | | | 2010 | |

| Cash flow from operating activities: | | | | | | | | | |

| Net gain (loss) | | $ | (27,402,292 | ) | | $ | (73,765,925 | ) | | $ | 86,627,933 | |

| Adjustments to reconcile net gain (loss) to net cash used for operating activities: | | | | | | | | | | | | |

| Purchase of investment securities | | | (2,089,638,671 | ) | | | (1,594,743,929 | ) | | | (1,159,625,357 | ) |

| Proceeds from sales of investment securities | | | 1,629,991,694 | | | | 2,054,999,635 | | | | 809,997,503 | |

| Net accretion of discount | | | (331,044 | ) | | | (335,677 | ) | | | (301,808 | ) |

| Net realized loss (gain) on investment securities | | | (1,429 | ) | | | (451 | ) | | | 403 | |

| Unrealized depreciation (appreciation) on investments | | | (32,503,311 | ) | | | 103,661,763 | | | | (46,277,527 | ) |

| Increase in payable - capital shares | | | 2,829,896 | | | | 1,497,826 | | | | - | |

| Increase (decrease) in accrued expenses | | | (666,087 | ) | | | 717,847 | | | | 515,001 | |

| Net cash provided by (used for) operating activities | | | (517,721,244 | ) | | | 492,031,089 | | | | (309,063,852 | ) |

| | | | | | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | | | | |

| Proceeds from creation of Limited Units | | | 101,149,075 | | | | 383,075,174 | | | | 262,051,675 | |

| Redemption of Limited Units | | | (180,296,699 | ) | | | (262,514,288 | ) | | | (43,750,891 | ) |

| Net cash provided by (used for) financing activities | | | (79,147,624 | ) | | | 120,560,886 | | | | 218,300,784 | |

| | | | | | | | | | | | | |

| Net change in cash | | | (596,868,868 | ) | | | 612,591,975 | | | | (90,763,068 | ) |

| Cash held by broker at beginning of year | | | 619,079,494 | | | | 6,487,519 | | | | 97,250,587 | |

| Cash held by broker at end of year | | $ | 22,210,626 | | | $ | 619,079,494 | | | $ | 6,487,519 | |

See accompanying notes to consolidated financial statements

GreenHaven Continuous Commodity Index Fund

GreenHaven Continuous Commodity Index Master Fund

Years Ended December 31, 2012, 2011, and 2010

(1) Organization

The GreenHaven Continuous Commodity Index Fund (the “Fund”) was formed as a Delaware statutory trust on October 27, 2006, and GreenHaven Continuous Commodity Master Index Fund (the “Master Fund”, and together with the Fund, the “Funds”), was formed as a Delaware statutory trust on October 27, 2006. The Fund offers common units of beneficial interest (the “Shares”). Upon inception of the Fund, 50 General Units of the Fund were issued to GreenHaven Commodity Services, LLC (the “Managing Owner”) in exchangepage F-1 for a capital contribution of $1,500. The Managing Owner serves the Fund as commodity pool operator, commodity trading advisor, and managing owner.

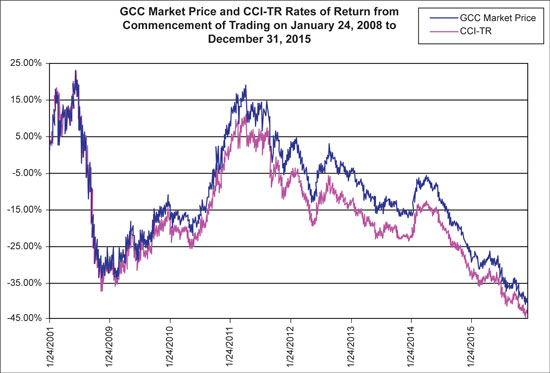

Shares are purchased from the Fund only by Authorized Participants in one or more blocks of 50,000 Shares, called a Basket. The proceeds from the offering of Shares are invested in the Master Fund. The Master Fund actively trades exchange traded futures in the commodities comprising the Reuters Continuous Commodity Index (“the Index”), with a view to tracking the performance of the Index over time. The Master Fund’s portfolio also includes United States Treasury securities and other high credit quality short term fixed income securities for deposit with the Master Fund’s commodities brokers as margin. The Fund wholly owns the Master Fund.

The Fund commenced trading on the American Stock Exchange (the AMEX) on January 24, 2008. On November 24, 2008 the Fund de-listed from the AMEX and on November 25, 2008 the Fund listed on NYSE Arca. Prior to January 23, 2008, the only activity in the Fund was the subscription in 2006 by the Managing Owner for the General Units and the related payment for them in January 2008.

The Index is intended to reflect the performance of certain commodities. Through January 6, 2013 the commodities comprising the Index (the “Index Commodities”) were: corn, soybeans, wheat, live cattle, lean hogs, gold, silver, copper, cocoa, coffee, sugar, cotton, orange juice, platinum, crude oil, heating oil, and natural gas. The Index was revised on January 7, 2013 to include soybean oil and remove orange juice.

The Managing Owner and the Shareholders share in any profits and losses of the Fund attributable to the Fund in proportion to the percentage interest owned by each.

The Managing Owner, the Fund, and the Master Fund retain the services of third party service providers to operate the ongoing operations of the Fund and the Master Fund (See Note (2)).

(2) Service Providers and Related Party Agreements

(a) “The Trustee” – CSC Trust is the trustee for the Fund and Master Fund. CSC Trust is headquartered in Wilmington, DE.

(b) “The Managing Owner” – GreenHaven Commodity Services, LLC is the managing owner of the Fund and Master Fund and is responsible for the day to day operations of both entities. The Managing Owner charges the Fund a management fee for its services. GreenHaven Commodity Services, LLC is a Delaware limited liability company with operations in Atlanta, GA.

(c) “The Administrator” – The Bank of New York Mellon Corporation has been appointed by the Managing Owner as the administrator, custodian and transfer agent of the Fund and the Master Fund, and has entered into separate administrative, custodian, transfer agency and service agreements (collectively referred to as the “Administration Agreement”). Pursuant to the Administration Agreement, the Administrator performs or supervises the services necessary for the operation and administration of the Fund and the Master Fund (other than making investment decisions), including receiving net asset value calculations, accounting and other fund administrative services. As the Fund’s transfer agent, the Administrator will process creations and redemptions of Shares. These transactions will be processed on Depository Trust Company’s (“DTC’s”) book entry system. The Administrator retains certain financial books and records, including: Basket creation and redemption books and records, fund accounting records, ledgers with respect to assets, liabilities, capital, income and expenses, the registrar, transfer journals and related details and trading and related documents received from futures commission merchants. The Bank of New York Mellon Corporation is based in New York, New York.

(d) “The Commodity Broker” – Morgan Stanley & Co. Incorporated (“MS&Co.”) is the Master Fund’s Commodity Broker. In its capacity as the Commodity Broker, it executes and clears each of the Master Fund’s futures transactions and performs certain administrative services for the Master Fund. MS&Co. is based in New York, New York.

(e) “The Distributor” – The Managing Owner, on behalf of the Fund and the Master Fund, has appointed ALPS Distributors, Inc., or the Distributor, to assist the Managing Owner and the Administrator with certain functions and duties relating to the creation and redemption of Baskets, including receiving and processing orders from Authorized Participants to create and redeem Baskets, coordinating the processing of such orders and related functions and duties. The Distributor retains all marketing materials and Basket creation and redemption books and records at c/o ALPS Distributors, Inc., 1290 Broadway, Suite 1100, Denver, CO 80203; Telephone number (303) 623-2577. Investors may contact the Distributor toll-free in the U.S. at (800) 320-2577. The Fund has entered into a Distribution Services Agreement with the Distributor.

The Distributor is affiliated with ALPS Mutual Fund Services, Inc., a Denver-based service provider of administration, fund accounting, transfer agency and shareholder services for mutual funds, closed-end funds and exchange-traded funds.

(f) “The Authorized Participant” — Authorized Participants may create or redeem shares of the Master Fund. Each Authorized Participant must (1) be a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) be a participant in the Depository Trust Company, or DTC, and (3) have entered into a participant agreement with the Fund and the Managing Owner, or a Participant Agreement. The Participant Agreement sets forth the procedures for the creation and redemption of Baskets of Shares and for the delivery of cash required for such creations or redemptions. A list of the current Authorized Participants can be obtained from the Administrator. A similar agreement between the Fund and the Master Fund sets forth the procedures for the creation and redemption of Master Unit Baskets by the Fund.

(3) Summary of Significant Accounting Policies

(a) Use of Estimates