Crown Castle International completed its merger with Global Signal, Inc. in 2007. As a result of these consolidations, American Tower and Crown Castle are substantially larger and have greater financial resources than us which provides them advantages with respect to leasing terms with wireless services providers or ability to acquire available towers. Wireless service providers that own and operate their own tower networks and several of the other tower companiesare also generally are substantially larger and have greater financial resources than we do. We believe that tower location and capacity, quality of service, density within a geographic market and, to a lesser extent, price historically have been and will continue to be the most significant competitive factors affecting the site leasing business.

Our primary competitors for our site leasing activities and building and/or acquiring new tower assets are fivethe large independent tower companies, American Tower Corporation and Crown Castle International Corp., Global Signal, Inc., SpectraSite, Inc., and AAT Communications Corp., and a large number of smaller independent tower owners. In addition, we compete with AT&T Wireless, Sprint PCS and other wireless service providers who currently market excess space on their owned towers to other wireless service providers.

The site development business is extremely competitive and price sensitive. We believe that the majority of our competitors in the site development business operate within local market areas exclusively, while some firms appear to offer their services nationally, including American Tower Corporation, Alcoa Fujikura Ltd., Bechtel Corporation, Black & Veach Corporation, General Dynamics Corporation, LCC International, Inc. and Wireless Facilities, Inc. The market includes participants from a variety of market segments offering individual, or combinations of, competing services. The field of competitors includes site development consultants, zoning consultants, real estate firms, right-of-way consulting firms, construction companies, tower owners/managers, radio frequency engineering consultants, telecommunications equipment vendors, which provide end-to-end site development services through multiple subcontractors, and wireless service providers’ internal staff. We believe that providers base their decisions for site development services on a number of criteria, including a company’s experience, track record, local reputation, price and time for completion of a project. We believe that weour experience base and our established relationships with wireless service providers have allowed us to favorably compete favorablyfor higher margin site development contracts, which has resulted in these areas.

increasing margins in this segment during 2006 as compared to prior years.

Employees

As of December 31, 2003,2006, we had approximately 600615 employees, none of whom isare represented by a collective bargaining agreement. We consider our employee relations to be good.

Regulatory and Environmental Matters

Federal Regulations.Both the FCCFederal Communications Commission (the “FCC”) and the FAAFederal Aviation Administration (the “FAA”) regulate antenna towers and structures that support wireless communications and radio or television antennas. Many FAA requirements are implemented in FCC regulations. These regulations govern the construction, lighting and painting or other marking of towers and structures and may, depending on the characteristics of particular towers or structures, require prior approval and registration of towers or structures. Wireless communications equipment and radio or television stations operating on towers or structures are separately regulated and may require independent licensing depending upon the particular frequency or frequency band used.

Pursuant to the requirements of the Communications Act of 1934, as amended, the FCC, in conjunction with the FAA, has developed standards to consider proposals involving new or modified antenna towers or structures.

These standards mandate that the FCC and the FAA consider the height of the proposed tower or structure, the relationship of the tower or structure to existing natural or man-made obstructions and the proximity of the tower or structure to runways and airports. Proposals to construct or to modify existing towers or structures above certain heights must be reviewed by the FAA to ensure the structure will not present a hazard to air navigation. The FAA may condition its issuance of a no-hazard determination upon compliance with specified lighting and/or painting requirements. Antenna towers that meet certain height and location criteria must also be registered with the FCC. A tower or structure that

requires FAA clearance will not be registered by the FCC until it is cleared by the FAA. Upon registration, the FCC may also require special lighting and/or painting. Owners of wireless communications antenna towers and structures may have an obligation to maintain painting and lighting or other marking in conformance with FAA and FCC standards. Antenna tower and structure owners and licensees that operate on those towers or structures also bear the responsibility of monitoring any lighting systems and notifying the FAA of any lighting outage or malfunction. In addition, any applicant for an FCC antenna tower or structure registration must certify that, consistent with the Anti-Drug Abuse Act of 1988, neither the applicant nor its principals are subject to a denial of Federal benefits because of a conviction for the possession or distribution of a controlled substance. We generally indemnify our customers against any failure to comply with applicable regulatory standards.standards relating to the construction, modification, or placement of antenna towers or structures. Failure to comply with the applicable requirements may lead to civil penalties.

The Telecommunications Act of 1996 amended the Communications Act of 1934 by preserving state and local zoning authorities’ jurisdiction over the construction, modification and placement of towers. The law, however, limits local zoning authority by prohibiting any action that would (1) discriminate among different providers of personal wireless services or (2) ban altogether the construction, modification or placement of radio communication towers. Finally, the Telecommunications Act of 1996 requires the federal government to help licensees for wireless communications services gain access to preferred sites for their facilities. This may require that federal agencies and departments work directly with licensees to make federal property available for tower facilities.

Owners and operators of antenna towers and structures may be subject to, and therefore must comply with, environmental laws. Any licensed radio facility on an antenna tower or structure is subject to environmental review pursuant to the National Environmental Policy Act of 1969, among other statutes, which requires federal agencies to evaluate the environmental impact of their decisions under certain circumstances. The FCC has issued regulations implementing the National Environmental Policy Act. These regulations place responsibility on applicants to investigate potential environmental effects of their operations and to disclose any potential significant effects on the environment in an environmental assessment prior to constructing or modifying an antenna tower or structure and prior to commencing certain operation of wireless communications or radio or television stations from the tower or structure. In the event the FCC determines the proposed structure or operation would have a significant environmental impact based on the standards the FCC has developed, the FCC would be required to prepare an environmental impact statement, which will be subject to public comment. This process could significantly delay the registration of a particular tower or structure.

As an owner and operator of real property, we are subject to certain environmental laws that impose strict, joint and several liability for the cleanup of on-site or off-site contamination and related personal or property damage. We are also subject to certain environmental laws that govern tower or structure placement, including pre-construction environmental studies. Operators of towers or structures must also take into consideration certain radio frequency (“RF”) emissions regulations that impose a variety of procedural and operating requirements. Certain proposals to operate wireless communications and radio or television stations from antenna towers and structures are also reviewed by the FCC to ensure compliance with requirements relating to human exposure to RF emissions. Exposure to high levels of RF energy can produce negative health effects. The potential connection between low-level RF energy and certain negative health effects, including some forms of cancer, has been the subject of substantial study by the scientific community in recent years. We believe that we are in substantial compliance with and we have no material liability under any applicable environmental laws. These costs of compliance with existing or future environmental laws and liability related thereto may have a material adverse effect on our prospects, financial condition or results of operations.

State and Local Regulations.Most states regulate certain aspects of real estate acquisition, leasing activities and construction activities. Where required, we conduct the site acquisition portions of our site development services business through licensed real estate brokers’ agents, who may be our employees or hired as independent contractors, and conduct the construction portions of our site development services

through licensed contractors, who may be our employees or independent contractors.

Local regulations include city and other local ordinances, zoning restrictions and restrictive covenants imposed by community developers. These regulations vary greatly from jurisdiction to jurisdiction, but typically require tower and structure owners to obtain approval from local officials or community standards organizations, or certain other entities prior to tower or structure construction and establish regulations regarding maintenance and removal of towers or structures. In addition, many local zoning authorities require tower and structure owners to post bonds or cash collateral to secure their removal obligations. Local zoning authorities generally have been unreceptive to construction of new antenna towers and structures in their communities because of the height and visibility of the towers or structures, and have, in some instances, instituted moratoria.

Backlog

Our backlogBacklog related to our site leasing business consists of pending leases for antenna space on our towers varies from time to timelease agreements and reflects the relatively short-cycle of three to six months of the antenna space leasing process. Leasing backlogs vary widely within a fiscal quarter, and are generally lowest on the last day of a quarter as our customers strive to meet their own quarterly antenna site deployment goals.amendments, which have been signed, but have not yet commenced. As of December 31, 20032006, we had136 179 new leases and 15 amendments which had been executed with customers but which had not begun generating revenue. These leases contractually provided for approximately $2.8$3.7 million of annual revenues. As ofrevenue. By comparison, at December 31, 20022005 we had150 122 new leases and 9 amendments which had been executed with customers but which had not begun generating revenue. These leases contractually provided for approximately $3.3$2.6 million of annual revenues.

revenue.

Our backlog for site development services was approximately $80$37.4 million of contractually committed revenue as of December 31, 2006 as compared to approximately $47.5 million as of December 31, 2003 as compared to approximately $29 million as of December 31, 2002.2005. The increasedecrease in 20032006 is attributable to a 2003 contract received fromsigned with Sprint for site development work whichthat is expected to result in revenues of $70be completed by early 2008. This contract represented approximately $11.7 million to $90 million over a two year period of which approximately $60 million is reflected in backlog as of December 31, 2003. We had no2006 and approximately $25.8 million in backlog for pending tower acquisitions as of December 31, 2003.2005.

Availability of Reports and Other Information

Our corporate website iswww.sbasite.com. We make available, free of charge, access to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statement on Schedule 14A and amendments to those materials filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 on our website under “Investor Relations—SEC Filings,” as soon as reasonably practicable after we file electronically such material with, or furnish it to, the United States Securities and Exchange Commission (the “Commission”). In addition, the Commission’s website iswww.sec.gov. The Commission makes available on this website, free of charge, reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically with the Commission. Additionally, our reports, proxy and information statements may be read and copied at the Commission’s public reference room at 100 F Street, NE, Washington, DC 20549. Information on our website or the Commission’s website is not part of this document.

| ITEM 1A. | RISK FACTORS |

Risks Related to Our Business

We may not secure as many site leasing tenants as planned or our lease rates for new tenant leases may decline.

If tenant demand for tower space or our lease rates on new leases decrease, we may not be able to servicesuccessfully grow our substantial indebtedness.

As indicated below, we have and will continue to have a significant amount of indebtedness relative to our equity.

| As of December 31, | ||||||

| 2003 | 2002 | |||||

| (in thousands) | ||||||

Total indebtedness* | $ | 866,199 | $ | 1,019,046 | ||

Shareholders’ equity | $ | 43,877 | $ | 203,490 | ||

Our ability to service our debt obligations will depend on our future operating performance. Our earnings were insufficient to cover our fixed charges for the year ended December 31, 2003 by $162 million and $184 million for the year ended December 31, 2002. Subsequent to December 31, 2003 we obtained a new senior credit facility. A portion of the proceeds from this facility were used to repay the then existing credit facility, to purchase 12% senior discount notes in the open market, to redeem all 12% senior discount notes outstanding on March 1, 2004, and to repurchase 10¼% senior notes in the open market. As adjusted for these transactions, we would require approximately $53.5 million of cash flow from operating activities (before net cash interest expenses) to discharge our cash interest and principal obligations for the year ending December 31, 2004. By comparison, for the year ended December 31, 2003, we generated $56.7 million of cash flow from operations (before net cash interest expenses). In order to manage our substantial amount of indebtedness, wesite leasing business. This may from time to time sell assets, issue equity, or

repurchase, restructure or refinance some or all of our debt. We may not be able to effectuate any of these alternative strategies on satisfactory terms, if at all. The implementation of any of these alternative strategies may dilute our current shareholders or subject us to additional costs or restrictions on our ability to manage our business and as a result could have a material adverse effect on our financial conditionstrategy, revenue growth and growth strategy.

We may not have sufficient liquidity or cash flow from operations to repay the remaining amount of our outstanding senior credit facility, our 10¼% senior notes and our 9¾% senior discount notes upon their respective maturities in 2008, 2009 and 2011. Therefore, prior to the maturity of our outstanding debt we may be required to refinance and/or restructure some or all of this debt. There can be no assurance that we will be able to refinance or restructure this debt on acceptable terms or at all. If we were unable to refinance, restructure or otherwise repay the principal amount of this debt upon its maturity, we may need to sell assets, cease operations and/or file for protection under the bankruptcy laws.

As of December 31, 2003, adjusted for the transactions discussed above, we would have had approximately $21 million of additional borrowing capacity under our senior credit facility, subject to maintenance covenants, borrowing base limitations and other conditions. Furthermore, we and our subsidiaries may be able to incur significant additional indebtedness in the future, subject to the restrictions contained in our debt instruments, some of which may be secured debt.

We are dependent on the financial stability of our customers and any deterioration in their financial condition may reduce the demand for our services which would adversely affect our growth strategy, revenues and financial condition.

Our business depends on the financial stability of our customers. The economic slowdown and intense competition in the wireless and telecommunications industries over the past several years have impaired the financial condition of some of our customers, certain of which operate with substantial leverage and certain of which have filed or may file for bankruptcy. The financial uncertainties facing our customers could reduce demand for our communications sites, increase our bad debt expense and reduce prices on new customer contracts. This could affect our ability to satisfy our obligations.

In addition, we may be negatively impacted by our customers’ limited access to debtfinancial and equity capital. Recently when capital market conditions were difficultother contractual obligations. Our plan for the telecommunications industry, wireless service providers conserved capital by not spending as much as originally anticipated to finance expansion activities. This decrease adversely impacted demand for our services and consequently our financial condition. As a result, we adjusted our business during 2002 and early 2003 to significantly reduce and subsequently suspend any material investment for new towers andgrowth of our site development activities. Ifleasing business largely depends on our customers are not able to access the capital markets in themanagement’s expectations and assumptions concerning future our growth strategy, revenuestenant demand and financial condition may again be adversely affected.

Our substantial indebtedness may negatively impact our ability to implement our business plan.

Our substantial indebtedness may negatively impact our ability to implement our business plan. For example, it could:

Our debt instruments contain restrictive covenants that could adversely affect our business.

Our senior credit facility and the indentures governing our outstanding notes each contain certain restrictive covenants. Among other things, these covenants restrict our ability to:

If we fail to comply with these covenants, it could result in an event of default under one or all of these debt instruments. The acceleration of amounts due under one of our debt instruments would also cause a cross-default under our other debt instruments.

SBA Senior Finance Inc. (“SBA Senior Finance”), which owns, directly or indirectly, all of the common stock of our operating subsidiaries, is the borrower under our senior credit facility. The senior credit facility requires SBA Senior Finance to maintain specified financial ratios, including ratios regarding SBA Senior Finance’s debt to annualized operating cash flow, debt service, cash interest expense and fixed charges for each quarter. In addition, the senior credit facility contains additional negative covenants that, among other things, restrict our ability to commit to capital expenditures and build towers without anchor tenants. Our ability to meet these financial ratios and tests and comply with these covenants can be affected by events beyond our control, and we may not be able to do so. A breach of any of these covenants, if not remedied within the specified period, could result in an event of default under the senior credit facility.

Upon the occurrence of any default, our senior credit facility lenders can prevent us from borrowing any additional amounts under the senior credit facility. In addition, upon the occurrence of any event of default, other than certain bankruptcy events, senior credit facility lenders, by a majority vote, can elect to declare all amounts of principal outstanding under the senior credit facility, together with all accrued interest, to be immediately due and payable. The acceleration of amounts due under our senior credit facility would cause a cross-default under our indentures, thereby permitting the acceleration of such indebtedness. If the indebtedness under the senior credit facility and/or indebtedness under our outstanding notes were to be accelerated, our current assets would not be sufficient to repay in full the indebtedness. If we were unable to repay amounts that become due under the senior credit facility, the senior credit lenders could proceed against the collateral granted to them to secure that indebtedness. Substantially all of our assets are pledged as security under the senior credit facility. In such an event of default, our assets may not be sufficient to satisfy our obligations under the notes.

independently owned towers.

If our wireless service provider customers combine their operations to a significant degree, our growth, our revenue and our ability to generate positive cash flowservice our indebtedness could be adversely affected.

Demand for our services may decline if there is significant consolidation among our wireless service provider customers as they may then reduce capital expenditures in the aggregate because many of their existing networks and expansion plans overlap. InAs a result of regulatory changes in January 2003 the spectrum cap, which previously prohibitedremoved prior restrictions on wireless carriersservice providers from owning more than 45 MHz of spectrum in any given geographical area, expired. Some wireless carriers may be encouraged to consolidate with each other as a resultthere have been significant consolidations of this regulatory change and as a means to strengthen their financial condition. Economic conditions have resulted in the consolidation of severallarge wireless service providersproviders. Specifically, Cingular acquired AT&T Wireless in October 2004 and this trend is likelySprint PCS and Nextel merged to continue.form Sprint Nextel Corporation in August 2005. To the

extent that our customers have consolidated or that other customers may consolidate in the future, they may not renew any duplicative leases that they have on our towers and/or may not lease as many spacesmuch space on our towers in the future. This would adversely affect our growth, our revenue and our ability to generate positive cash flow. In February 2004, Cingular Wireless and AT&T Wireless entered into an agreement by which Cingular would acquire AT&T in a transaction anticipated to close in late 2004 or 2005. service our indebtedness.

As of December 31, 20032006, Cingular and the former AT&T wereWireless both tenantshad leases on 287an aggregate of our 3,032 towers.290 of the 5,551 towers that we owned on such date. The annualized contractual revenue generated by both of these tenants on these 287 towersleases at December 31, 20032006 was approximately $12$14.9 million. If, as a result of this transaction,Consequently, if Cingular were not to renew duplicate leases, we could lose up to 50% or more of such revenue. TheAs of December 31, 2006, the average remaining contractual life of such duplicate leases was approximately 32.9 years. Our risk of revenue loss from the integration of Cingular and AT&T Wireless is not limited to leases on the same tower. We expect Cingular (now AT&T) to terminate or not renew some leases on our towers where they have other antenna sites in close proximity. During the second half of 2006, we began experiencing some decommissioning of antennae sites and non-renewal of leases from the Cingular and AT&T Wireless acquisition. Cingular terminated lease agreements during 2006 with total annualized revenue of $1.5 million. In addition, we have received termination or non-renewal notices for leases expiring in the twenty-four months after December 31, 2006 with total annualized revenue of $4.4 million. In addition, we have received notifications from Cingular that it expects to non-renew other leases with lease terms expiring in three or more years and we may receive additional notifications in the future. Such terminations or non-renewals could have a material adverse impact on our growth rate.

As of December 31, 2006, Sprint Nextel and affiliated entities had multiple leases on 555 of the 5,551 towers that we owned on such date. The annualized contractual revenue generated by these leases at December 31, 2006 was approximately $27.1 million. During the second half of 2006, Sprint Nextel extended by seven years the term of each duplicate lease. Consequently, as of December 31, 2006, the average remaining contractual life of such duplicate leases was approximately 9.6 years. However, our risk of revenue loss from the integration of Sprint and Nextel is not limited to leases on the same tower. Sprint Nextel could terminate or not renew some leases on our towers where they have other antenna sites in close proximity. Furthermore at the end of such lease extensions, Sprint Nextel may terminate the duplicate leases. Such terminations or non-renewals could have a material adverse impact on our growth rate.

Similar consequences may occur if wireless service providers engage in extensive sharing or roaming or resale arrangements as an alternative to leasing our antenna space. Wireless voice service providers frequently

enter into roaming agreements with competitors allowing them to use another’s wireless communications facilities to accommodate customers who are out of range of their home provider’s services. Wireless voice service providers may view these roaming agreements as a superior alternative to leasing antenna space on communications sites owned or controlled by us or others. The proliferation of these roaming agreements could have a material adverse effect on our revenue.

New technologies and their use by carriers may have a material adverse effect on our growth rate and results of operations.

The emergence of new technologies could reduce the demand for space on our towers. For example, the increased use by wireless service providers of signal combining and related technologies and products that allow two or more wireless service providers to provide services on different transmission frequencies using the communications antenna and other facilities normally used by only one wireless service provider could reduce the demand for our tower space. Additionally, the use of technologies that enhance spectral capacity, such as beam forming or “smart antennae,” that can increase the range and capacity of an antenna could reduce the number of additional sites a wireless service provider needs to adequately serve a certain subscriber base and therefore reduce demand for our tower space. The development and growth of communications and other new technologies that do not require ground-based sites, such as the growth in delivery of video, voice and data services by satellites or other technologies, could also adversely affect the demand for our tower space. In addition, the deployment of WiFi and WiMax technologies could impact the network needs of our existing customers providing wireless telephony services. This could have a material adverse effect on our growth rate and results of operations.

We depend on a relatively small number of customers for most of our revenue.

We derive a significant portion of our revenue from a small number of customers, particularly in our site development services business. The loss of any significant customer could have a material adverse effect on our revenue.

The following is a list of significant customers and the percentage of our total revenues for the specified time periods derived from these customers:

| Percentage of Total Revenues for the years ended December 31, | ||||||

| 2003 | 2002 | |||||

Bechtel Corporation | 14.3 | % | 15.3 | % | ||

AT&T Wireless | 10.8 | % | 10.1 | % | ||

Cingular Wireless | 10.2 | % | 12.6 | % | ||

Percentage of Total Leasing Revenues for the year ended December 31, | |||||||||

| 2006 | 2005 | 2004 | |||||||

Sprint Nextel | 27.6 | % | 30.9 | % | 31.0 | % | |||

Cingular (now AT&T) | 21.4 | % | 25.5 | % | 22.7 | % | |||

We also have client concentrations with respect to revenues in each of our financial reporting segments:

Percentage of Site Leasing ended December 31, | ||||||

| 2003 | 2002 | |||||

AT&T Wireless | 16.9 | % | 15.5 | % | ||

Cingular Wireless | 11.1 | % | 10.8 | % | ||

Percentage of Site Leasing Revenue for the year ended December 31, | |||||||||

| 2006 | 2005 | 2004 | |||||||

Cingular (now AT&T) | 26.7 | % | 28.0 | % | 27.5 | % | |||

Sprint Nextel | 26.2 | % | 30.7 | % | 29.4 | % | |||

Verizon | 9.7 | % | 10.1 | % | 9.5 | % | |||

Percentage of Site Development Consulting Revenue for the year ended December 31, Sprint Nextel Verizon Wireless Bechtel Corporation* Cingular (now AT&T) 2006 2005 2004 38.0 % 1.9 % 2.6 % 26.6 % 32.4 % 26.1 % 10.0 % 23.3 % 24.7 % 6.8 % 28.3 % 26.7 %

Percentage of Site Development Consulting Revenue for the years | ||||||

| 2003 | 2002 | |||||

Bechtel Corporation | 30.5 | % | 34.2 | % | ||

Cingular Wireless | 24.0 | % | 29.6 | % | ||

Verizon Wireless | 14.5 | % | 3.9 | % | ||

Percentage of Site Revenue for the years ended | ||||||

| 2003 | 2002 | |||||

Bechtel Corporation | 37.7 | % | 28.1 | % | ||

Sprint PCS | 12.9 | % | 3.0 | % | ||

Percentage of Site Development Construction Revenue for the year ended December 31, Sprint Nextel Bechtel Corporation* Cingular (now AT&T) 2006 2005 2004 30.0 % 36.0 % 39.7 % 17.4 % 11.6 % 14.5 % 6.9 % 20.3 % 12.5 %

| * | Substantially all of the work performed for Bechtel Corporation was for its client Cingular (now AT&T). |

Revenues from these clients are derived from numerous different site leasing contracts and site development contracts. Each site leasing contract relates to the lease of space at an individual tower site and is generally for an initial term of five years renewable for five five-year periods at the option of the tenant. Our site development customers engage us on a project-by-project basis, and a customer can generally terminate an assignment at any time without penalty. In addition, a customer’s need for site development services can decrease, and we may not be successful in establishing relationships with new customers. Furthermore, our existing customers may not continue to engage us for additional projects.

We may not secure as many site leasing tenants as planned or our lease rates may decline.

If tenant demand for tower space or our lease rates for new tenants decrease, we may not be able to successfully growservice our site leasing business. Thissubstantial indebtedness.

As indicated below, we have and will continue to have a significant amount of indebtedness relative to our equity.

| As of December 31, | ||||||

| 2006 | 2005 | |||||

| (in thousands) | ||||||

Total indebtedness | $ | 1,555,000 | $ | 784,392 | ||

Shareholders’ equity | $ | 385,921 | $ | 81,431 | ||

As of December 31, 2006, we had approximately $1.6 billion in indebtedness, all of which is secured in the CMBS market. In addition, we have the ability to borrow additional amounts under our senior revolving credit facility and may incur additional indebtedness through other debt instruments. Our ability to service our current and future debt obligations will depend on our future operating performance. In order to manage our substantial amount of indebtedness, we may from time to time sell assets, issue equity, restructure or refinance some or all of our debt (all of which we have done at various times in the last four years). We may not be able to effectuate any of these alternative strategies on satisfactory terms in the future, if at all. The implementation of any of these alternative strategies may dilute our current shareholders or subject us to additional costs or restrictions on our ability to manage our business and as a result could have a material adverse effect on our strategy, revenuefinancial condition and growth strategy.

We may not have sufficient liquidity or cash flow from operations to repay the CMBS Certificates. The amounts borrowed under the mortgage loan in connection with the Initial CMBS Certificates have an anticipated repayment date of November 2010 and a final repayment date of November 2035 while the amounts borrowed under the mortgage loan in connection with the Additional CMBS Certificates have an anticipated repayment date of November 2011 and a final repayment date of November 2036. However, if we do not repay the full amount of each mortgage loan component before its respective anticipated repayment date, the interest rate payable on such mortgage loan outstanding will significantly increase in accordance with the formula set forth in the mortgage loan. We may not be able to service these higher interests costs if we cannot refinance the amounts outstanding under the mortgage loan before their anticipated repayment dates. Furthermore, if we cannot refinance these amounts prior to the final repayment date, we may be required to sell a portion or all of our interests in the 4,975 tower sites that, among other things, secure along with their operating cash flows the mortgage loan. Although, the mortgage loan is a limited recourse obligation of SBA Properties, Inc., SBA Sites, Inc., SBA Structures, Inc., SBA Towers, Inc., SBA Towers Puerto Rico, Inc. and SBA Towers USVI, Inc. (collectively, the “Borrowers”) and no holder of the mortgage loan will have recourse to SBA Communications, our operations would be adversely affected if the Borrowers are unable to repay the components of the mortgage loan. We cannot assure you that our assets would be sufficient to repay this indebtedness in full.

We and our subsidiaries may incur significant additional indebtedness in the future, subject to the restrictions contained in our debt instruments, some of which may be secured debt.

Our substantial indebtedness may negatively impact our ability to satisfyimplement our business plan.

Our substantial indebtedness may negatively impact our ability to implement our business plan. For example, it could:

limit our ability to fund future working capital, capital expenditures and development costs;

limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

increase our vulnerability to general economic and industry conditions;

subject us to interest rate risk in connection with any potential future refinancing of our CMBS Certificates;

place us at a competitive disadvantage to our competitors that are less leveraged;

require us to sell debt or equity securities or sell some of our core assets, possibly on unfavorable terms in order to meet payment obligations; and

limit our ability to borrow additional funds.

Risks associated with our plans to increase our tower portfolio could negatively impact our results of operations or our financial condition.

We currently intend to increase our tower portfolio through new builds and other contractual obligations. Ouracquisitions. We intend to review all available acquisition opportunities and some of these acquisitions could have the effect of materially increasing our tower portfolio. While we intend to fund a portion of the cash required to implement this plan forfrom our cash flow from operating activities, we may finance some or all of the growthcosts associated with these new builds and acquisitions. Furthermore, if we were to consummate any significant acquisition, we would be required to finance these acquisitions through additional indebtedness, which would increase our indebtedness and interest expense and could increase our leverage ratio, and/or issuances of equity, which could be dilutive to our site leasing business largely depends onshareholders. If we were unable to recognize the expected returns from these new towers, or if we did not recognize the expected returns in our management’s expectationsanticipated time frames, an increase in debt levels without a proportionate increase in our revenues could negatively impact our results of operations and assumptions concerning future tenant demand and potential lease rates for independently owned towers.

our financial condition.

Due to the long-term expectationsnature of revenue from our tenant leases, we are very sensitive todependent on the financial strength and creditworthiness of our tenants.customers.

Due to the long-term nature of our tenant leases, we, like others in the tower industry, are dependent on the continued financial strength of our tenants. Wireless service providers oftenThe economic slowdown and intense competition in the wireless and telecommunications industries in 2001 through 2003 had impaired the financial condition of some of our customers, certain of which operate with substantial leverage, and financial problems for our customers couldleverage. As a result, in uncollected accounts receivable, the loss of customers and lower than anticipated lease revenues. During the past three years, a number of our site leasing customers have filed for bankruptcy including almost all of our paging customers. Although these bankruptcies have not had a material adverse effect on our business or revenues, any future bankruptcies may have a material adverse effect on our business, revenues, and/or the collectability of our accounts receivable. In the future, the financial uncertainties facing our customers could reduce demand for our communications sites, increase our bad debt expense and reduce prices on new customer contracts. This could affect our ability to satisfy our obligations.

In addition, our anticipated growth could be negatively impacted if our customers’ access to debt and equity capital were limited. From 2001 through 2003, when capital market conditions were difficult for the telecommunications industry, wireless service providers conserved capital by not spending as much as originally anticipated to finance expansion activities. This decrease adversely impacted demand for our services and consequently our financial condition. If our customers are not able to access the capital markets in the future, our growth strategy, revenues and financial condition may again be adversely affected.

Our debt instruments contain restrictive covenants that could adversely affect our business.

Our senior revolving credit facility contains certain restrictive covenants. Among other things, these covenants limit the ability of certain of our subsidiaries to:

| �� | • | incur additional indebtedness; |

engage in mergers and acquisitions or sell all or substantially all of their assets;

pay dividends, repurchase capital stock or engage in other restricted payments;

make certain investments;

make certain capital expenditures;

incur liens; and

enter into affiliate transactions.

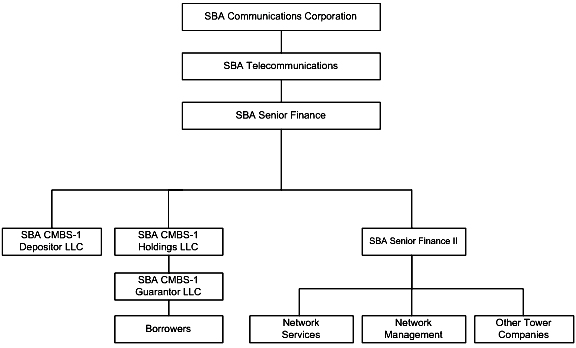

If our subsidiaries fail to comply with these covenants, it could result in an event of default under our senior revolving credit facility. Additionally, under our senior revolving credit facility, SBA Senior Finance II, LLC (“Senior Finance II”) which owns, directly or indirectly, all of the common stock and membership interests of certain of our operating subsidiaries and is the borrower under our senior revolving credit facility, is required to maintain specified financial ratios, including ratios regarding Senior Finance II’s debt to annualized operating cash flow, cash interest expense and fixed charges for each quarter. In addition, the senior revolving credit facility contains additional negative covenants that, among other things, limit our ability to commit to capital expenditures and build or acquire towers without anchor or acceptable tenants. Our ability to meet these financial ratios and tests and comply with these covenants can be affected by events beyond our control, and we may not be able to do so.

A breach of any of these covenants, if not remedied within the specified period, could result in an event of default. Amounts borrowed under the senior revolving credit facility are secured by a lien on substantially all of Senior Finance II’s assets and are guaranteed by us and certain of our subsidiaries.

Upon the occurrence of any default, our senior revolving credit facility lenders can prevent us from borrowing any additional amounts under the senior revolving credit facility. In addition, upon the occurrence of any event of default, other than certain bankruptcy events, the lenders under our senior revolving credit facility, by a majority vote, can elect to declare all amounts of principal outstanding under such facility, together with all accrued interest, to be immediately due and payable. If we were unable to repay amounts that become due under the senior revolving credit facility, such lenders could proceed against the collateral granted to them to secure that indebtedness.

Our mortgage loan relating to our CMBS Certificates contains a covenant requiring that all of the Borrowers’ cash flow in excess of amounts required to make debt service payments, fund required reserves, pay management fees and budgeted operating expenses and make other payments required under the loan documents be deposited into a reserve account if the debt service coverage ratio is less than 1.30 times, as of the end of any calendar quarter. The mortgage loan defines debt service coverage ratio as the Net Cash Flow (as defined in the mortgage loan) divided by the amount of interest on the mortgage loan, servicing fees and trustee fees that the Borrowers will be required to pay over the succeeding twelve months. If the debt service coverage ratio is less than 1.15 times as of the end of any calendar quarter, then an “amortization period” will commence and all funds on deposit in the reserve account will be applied to prepay the mortgage loan. If the debt service coverage ratio is less than 1.30 times, then the funds in the reserve account will not be released to the Borrowers until the debt service coverage ratio exceeds 1.30 times for two consecutive calendar quarters. As significantly all of our cash flow is generated by the Borrowers, failure to maintain the debt service coverage ratio above 1.30 times would impact our ability to pay our indebtedness, other than the mortgage loan, and to operate our business.

The mortgage loan provides for customary remedies if an event of default occurs including foreclosure against all or part of the property pledged as security for the mortgage loan. The mortgage loan is secured by (1) mortgages, deeds of trust and deeds to secure debt on substantially all of the Borrowers’ tower sites and their operating cash flows, (2) a security interest in substantially all of the Borrowers’ personal property and fixtures and (3) the Borrowers’ rights under the management agreement they entered into with SBA Network Management, Inc. (“SBA Network Management”) relating to the management of the Borrowers’ tower sites by SBA Network Management pursuant to which SBA Network Management arranges for the payment of all operating expenses and the funding of all capital expenditures out of amounts on deposit in one or more operating accounts maintained on the Borrowers’ behalf. We cannot assure you that our assets would be sufficient to repay this indebtedness in full.

Our quarterly operating results for our site development services fluctuate and therefore shouldwe may not be considered indicative ofable to adjust our long-term results.cost structure on a timely basis with regard to such fluctuations.

The demand for our site development services fluctuates from quarter to quarter and should not be considered as indicative of long-term results. Numerous factors cause these fluctuations, including:

the timing and amount of our customers’ capital expenditures;

the size and scope of assignments;our projects;

the business practices of customers, such as deferring commitments on new projects until after the end of the calendar year or the customers’ fiscal year;

seasonal factors, such as weather, vacation days and total business days in a quarter;

the use of third party providers by our customers;

the rate and volume of wireless service providers’ network development; and

general economic conditions.

Although the demand for our site development services fluctuates, we incur significant fixed costs, such as maintaining a staff and office space in anticipation of future contracts. In addition, the timing of revenues is difficult to forecast because our sales cycle may be relatively long. Therefore, we may not be able to adjust our cost structure in a timely basis to adjustrespond to market slowdowns.the fluctuations in demand for our site development services.

We are not profitable and expect to continue to incur losses.

We are not profitable. The following chart shows the net losses we incurred for the periods indicated:

| For the years ended December 31, | |||||||||

| 2003 | 2002 | 2001 | |||||||

| (in thousands) | |||||||||

Net losses | $ | 172,171 | $ | 248,996 | $ | 125,792 | |||

| For the year ended December 31, | ||||||||||||

| 2006 | 2005 | 2004 | ||||||||||

| (in thousands) | ||||||||||||

Net loss | $ | (133,448 | ) | $ | (94,709 | ) | $ | (147,280 | ) | |||

Our losses are principally due to significant interest expense, depreciation, amortization, and depreciationaccretion expenses and amortization in each of the periods presented above. We recorded an asset impairment charge of $17.0 million, a charge associated with the write-off of deferred financing fees and loss on extinguishment of debt of $24.2 million, and a restructuring charge of $2.5 million during the year ended December 31, 2003. Additionally, we recognized a loss, net of taxes, of approximately $7.7 million for the year ended December 31, 2003 in connection with discontinued operations. We recorded restructuring and other charges of $47.8 million, a $60.7 million charge related to the cumulative effect of a change in accounting principle related to the adoption of SFAS No. 142, and an asset impairment charge of $25.5 million in the year ended December 31, 2002. We recorded restructuring and other charges of $24.4 million in the year ended December 31, 2001.

In 2004, we expect to incur material additional charges forlosses from the write-off of deferred financing fees and extinguishment of debt associatedin the periods presented above. For the year ended December 31, 2006, we had interest expense, non-cash interest expense and amortization of deferred financing fees of $99.7 million, depreciation, amortization, and accretion expense of $133.1 million, and losses from the write-off of deferred financing fees and extinguishment of debt of $57.2 million in connection with the senior credit facility refinancing, 10¼extinguishment of our outstanding 9 3/4% senior note repurchasesdiscount notes, our outstanding 8 1/2% senior notes, and our $1.1 billion bridge loan. For the year ended December 31, 2005, we had interest expense, non-cash interest expense and amortization of deferred financing fees of $69.6 million, depreciation, amortization, and accretion expense of $87.2 million, and losses from the write-off of deferred financing fees and extinguishment of debt of $29.3 million in connection with the extinguishment of a portion of our outstanding 9 3/4% senior discount notes, a portion of our outstanding 8 1/2% senior notes, our remaining outstanding 10 1/4% senior notes, and our prior credit facility. For the year ended December 31, 2004, we had interest expense, non-cash interest expense and amortization of deferred financing fees of $79.0 million, depreciation, amortization and accretion expense of $90.5 million, and losses from the write-off of deferred financing fees and extinguishment of debt of $41.2 million in connection with the retirement of our outstanding 12% senior discount note repurchasesnotes, a portion of our 10 1/4% senior notes, and redemptions which occurred subsequentthe termination of another prior credit facility. We expect to December 31, 2003. Interest expense and depreciation charges will continue to be substantial in the future.

incur significant losses, which may affect our ability to service our indebtedness.

Increasing competition in the tower industry may adversely affect us.

Our industry is highly competitive, particularly with respect to securing quality tower assets and adequate capital to support tower networks.competitive. Competitive pressures for tenants on their towers from theseour competitors could adversely affect our lease rates and services income. In addition, the loss of existing customers or the failure to attract new customers would lead to an accompanying adverse effect on our revenues, margins and financial condition. Increasing competition could also make the acquisition of quality tower assets more costly.costly, which could adversely affect our ability to successfully implement and/or maintain our tower acquisition program.

WeIn the site leasing business, we compete with:

wireless service providers that own and operate their own towers and lease, or may in the future decide to lease, antenna space to other providers;

smaller local independent tower operators.

There has been significant consolidation among the large independent tower companies in the past three years. Specifically, American Tower Corporation completed its merger with SpectraSite, Inc. in 2005, we completed our acquisition of AAT in 2006 and

Crown Castle International completed its merger with Global Signal, Inc. in 2007. As a result of these consolidations, American Tower and Crown Castle are substantially larger and have greater financial resources than us. This could provide them with advantages with respect to establishing favorable leasing terms with wireless service providers or in their ability to acquire available towers.

Wireless service providers that own and operate their own tower networks and several of the other tower companiesare also generally are substantially larger and have greater financial resources than we do. We believe that tower location and capacity, quality of service, density within a geographic market and, to a lesser extent, price historically have been and will continue to be the most significant competitive factors affecting the site leasing business.

The site development market includes participants from a varietyservices segment of market segments offering individual,our industry is also extremely competitive. There are numerous large and small companies that offer one or combinationsmore of competing services. We believe that a company’s experience, track record, local reputation, price and time for completion of a project have been and will continue to be the most significant competitive factors affecting theservices offered by our site development business.

We may not be able to build and/or acquire as many towers as we anticipate.

We currently intend to build 80 to 100 new towers during 2007 and to consummate a number of tower acquisitions. However, our ability to build these new towers is dependent upon the availability of sufficient capital to fund construction, our ability to locate, and acquire at commercially reasonable prices, attractive locations for such towers and our ability to obtain the necessary zoning and permits.

Our ability to consummate tower acquisitions is also subject to risks. Specifically, these risks include (1) sufficient cash flow from operations or our ability to use debt or equity to fund such acquisitions, (2) our ability to identify those towers that would be attractive to our clients and accretive to our financial results, and (3) our ability to negotiate and consummate agreements to acquire such towers.

Due to these risks, it may take longer to complete our new tower builds than anticipated, the costs of constructing or acquiring these towers may be higher than we expect or we may not be able to add as many towers as we had planned in 2007. If we are not able to increase our tower portfolio as anticipated, it could negatively impact our ability to achieve our financial goals.

The loss of the services of certain of our key personnel or a significant number of our employees may negatively affect our business.

Our success depends to a significant extent upon performance and active participation of our key personnel. We cannot guarantee that we will be successful in retaining the services of these key personnel. We have employment agreements with Jeffrey A. Stoops, our President and Chief Executive Officer, Kurt L. Bagwell, our Senior Vice President and Chief Operating Officer, and Thomas P. Hunt, our Senior Vice President and General Counsel.Counsel and Anthony J. Macaione, our Senior Vice President and Chief Financial Officer. We do not have employment agreements with any of our other key personnel. If we were to lose any key personnel, we may not be able to find an appropriate replacement on a timely basis and our results of operations could be negatively affected. We do not currently have a permanent Chief Financial Officer, and if we are unable to timely hire one, our business may be negatively impacted. Further, the loss of a significant number of employees or our inability to hire a sufficient number of qualified employees could have a material adverse effect on our business.

NewDelays or changes in the deployment or adoption of new technologies as well as lower consumer demand and their use by carriersslower consumer adoption rates than anticipated may have a material adverse effect on our growth rate and results of operations.rate.

The emergence ofThere can be no assurances that 3G, 4G or other new wireless technologies will be deployed or adopted as rapidly as projected or that these new technologies could reducewill be implemented in the manner anticipated. The deployment of 3G has already experienced significant delays from the original projected timelines of the wireless and broadcast industries. The announcement of 4G is relatively new and its deployment schedule has not been determined as of yet. Additionally, the demand by consumers and the adoption rate of consumers for space on our towers. For example, the development of and use of products that would permit multiple wireless carriers to use a single antenna, share networksthese new technologies once deployed may be lower or increase the range and capacity of an antenna could reduce the number of antennas needed by our customers. Thisslower than anticipated. These factors could have a material adverse effect on our growth rate since growth opportunities and resultsdemand for our tower space as a result of operations.such new technologies may not be realized at the times or to the extent anticipated.

Our costs could increase and our revenues could decrease due to perceived health risks from radio frequency (“RF”) energy.

The government imposes requirements and other guidelines on our towers relating to RF energy. Exposure to high levels of RF energy can cause negative health effects.

Theeffects the potential connection between exposure to low levels of RF energy and certain negative health effects, including some forms of cancer, has been the subject of substantial study by the scientific community in recent years. According to the Federal Communications Commission (“FCC”(the “FCC”), the results of these studies to date have been inconclusive. However, public perception of possible health risks associated with cellular and other wireless communications media could slow the growth of wireless companies, which could in turn slow our growth. In particular, negative public perception of, and regulations regarding, health risks could cause a decrease in the demand for wireless communications services. Moreover, if a connection between exposure to low levels of RF energy and possible negative health effects, including cancer, were demonstrated, we could be subject to numerous claims. If we were subject to claims relating to RF energy, even if such claims were not ultimately found to have merit, our financial condition wouldcould be materially and adversely affected.

Our business is subject to government regulations and changes in current or future regulations could harm our business.

We are subject to federal, state and local regulation of our business. In particular, both the Federal Communications Commission (“FCC”) and the Federal Aviation Administration (“FAA”) and FCC regulate the construction and maintenance of antenna towers and structures that support wireless communications and radio and television antennas. In addition, the FCC separately licenses and regulates wireless communications equipment and television and radio stations operating from such towers and structures. FAA and FCC regulations govern construction, lighting, painting and marking of towers and structures and may, depending on the characteristics of the tower or structure, require registration of the tower or structure. Certain proposals to construct new towers or structures or to modify existing towers or structures are reviewed by the FAA to ensure that the tower or structure will not present a hazard to air navigation.

Antenna tower owners and antenna structure owners may have an obligation to mark or paint towers or structures or install lighting to conform to FAA standardsand FCC regulations and to maintain such marking, painting and lighting. Antenna tower owners and antenna structure owners may also bear the responsibility of notifying the FAA of any lighting outages. Certain proposals to operate wireless communications and radio or television stations from antenna towers and structures are also reviewed by the FCC to ensure compliance with environmental impact requirements. Failure to comply with existing or future applicable requirements may lead to civil penalties or other liabilities and may subject us to significant indemnification liability to our customers against any such failure to comply. In addition, new regulations may impose additional costly burdens on us, which may affect our revenues and cause delays in our growth.

Local regulations, including municipal or local ordinances, zoning restrictions and restrictive covenants imposed by community developers, vary greatly, but typically require antenna tower owners and antenna structure owners to obtain approval from local officials or community standards organizations prior to tower or structure construction or modification. Local regulations can delay, prevent, or increase the cost of new construction, co-locations, or site upgrade projects,upgrades, thereby limiting our ability to respond to customer demand. In addition, new regulations may be adopted that increase delays or result in additional costs to us. These factors could have a material adverse effect on our future growth and operations.

Our towers are subject to damage from natural disasters.

Our towers are subject to risks associated with natural disasters such as tornadoes and hurricanes. We maintain insurance to cover the estimated cost of replacing damaged towers, but these insurance policies are subject to loss limits and deductibles. We also maintain third party liability insurance, subject to loss limits and deductibles, to protect us in the event of an accident involving a tower. A tower accident for which we are uninsured or underinsured, or damage to a significant number of our towers, could require us to make significant capital expenditures and may have a material adverse effect on our operations or financial condition.

We could have liability under environmental laws that could have a material adverse effect on our business, financial condition and results of operations.

Our operations, like those of other companies engaged in similar businesses, are subject to the requirements of various federal, state, local and foreign environmental and occupational safety and health laws and regulations, including those relating to the management, use, storage, disposal, emission and remediation of, and exposure to, hazardous and non-hazardous substances, materials, and wastes. As owner, lessee or operator of numerous tower sites, we may be liable for substantial costs of remediating soil and groundwater contaminated by hazardous materials, without regard to whether we, as the owner, lessee or operator, knew of or were responsible for the contamination. We may be subject to potentially significant fines or penalties if we fail to comply with any of these requirements. The current cost of complying with these laws is not material to our financial condition or results of operations. However, the requirements of these laws and regulations are complex, change frequently, and could become more stringent in the future. It is possible that these requirements will change or that liabilities will arise in the future in a manner that could have a material adverse effect on our business, financial condition and results of operations.

Our dependence on our subsidiaries for cash flow may negatively affect our business.

We are a holding company with no business operations of our own. Our only significant asset is and is expected to be the outstanding capital stock and membership interests of our subsidiaries. We conduct, and expect to conduct, all of our business operations through our subsidiaries. Accordingly, our ability to pay our obligations including the principal and interest, premium, if any, and additional interest, if any, on our outstanding 10¼% senior notes and our 9¾% senior discount notes, is dependent upon dividends and other distributiondistributions from our subsidiaries to us. Additionally, the Borrowers under the CMBS Transaction must repay the components of the mortgage loan thereto. If the Borrowers’ cash flow is insufficient to cover such repayments, we may be required to refinance the mortgage loan or sell a portion or all of our interests in the 4,975 tower sites that among other things, secure, along with their operating cash flows, the mortgage loan. Other than the amounts required to make interest and principal payments onrepayment of amounts under the notes,CMBS Transaction, we currently expect that the earnings and cash flow of our subsidiaries will be retained and used by

them in their operations, including servicing their debt obligations. Our operating subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise to payrepay the principal, interestcomponents of the mortgage loan pursuant to the CMBS Transaction (other than the Borrowers and other amounts on the notesSBA CMBS-1 Guarantor LLC and CMBS-1 Holdings, LLC, as guarantors), or make any funds available to us for payment. The ability of our operating subsidiaries to pay dividends or transfer assets to us may be restricted by applicable state law and contractual restrictions, including the terms of the senior revolving credit facility. Althoughfacility and the indenture governing the notes willCMBS Certificates.

We have adopted anti-takeover provisions that could make it more difficult for a third party to acquire us.

Provisions of our articles of incorporation, our bylaws and Florida law could make it more difficult for a third party to acquire us, even if doing so would be beneficial to our shareholders. We adopted a shareholder rights agreement, which could make it considerably more difficult or costly for a person or group to acquire control of us in a transaction that our board of directors opposes. These provisions, alone or in combination with each other, may discourage transactions involving actual or potential changes of control, including transactions that otherwise could involve payment of a premium over prevailing market prices to holders of our Class A common stock, or could limit the ability of our operating subsidiariesshareholders to enter into consensual restrictions onapprove transactions that they may deem to be in their best interests.

Our issuance of equity securities and other associated transactions may trigger a future ownership change which may negatively impact our ability to pay dividendsutilize net operating loss deferred tax assets in the future.

The issuance of equity securities and other associated transactions may increase the chance that we will have a future ownership change under Section 382 of the Internal Revenue Code of 1986. We may also have a future ownership change, outside of our control, caused by future equity transactions by our current shareholders. Depending on our market value at the time of such future ownership change, an ownership change under Section 382 could negatively impact our ability to us, these limitations are subject toutilize our net operating loss deferred tax assets in the event we generate future taxable income. Currently we have recorded a number of significant qualifications and exceptions.full valuation allowance against our net operating loss deferred tax asset because we have concluded that our loss history indicates that it is not “more likely than not” that such deferred tax assets will be realized.

As a company whoseThe market price of our Class A common stock could be affected by significant volatility.

The market price of our Class A common stock has historically experienced significant fluctuations. The market price of our Class A common stock is publicly traded, we arelikely to continue to be volatile and subject to the rulessignificant price and regulations of federal, state and financial market exchange entities.

Involume fluctuations in response to recent laws enacted by Congress (most notably the Sarbanes-Oxley Act of 2002), some of these entities have recently issued new requirements and some are continuing to develop additional requirements (most notably, the requirements associated with Section 404 of the Sarbanes-Oxley Act). Our material internal control systems, processes and procedures will have to be in compliance with the new requirements and such compliance may require the commitment of significant financial and managerial resources and significant changes to such controls, systems, processes and procedures.

Availability of Reports and Other Information

Our corporate website iswww.sbasite.com. We make available, free of charge, access to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statement on Schedule 14A and amendments to those materials filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 on our website under “Investor Relations—SEC Filings,” as soon as reasonably practicable after we file electronically such material with, or furnish it to, the United States Securities and Exchange Commission (the “Commission”). In addition, the Commission’s website iswww.sec.gov. The Commission makes available on this website, free of charge, reports, proxy and information statements,market and other information regarding issuers, such as us, that file electronically withfactors, including the Commission. Additionally,other factors discussed elsewhere in “Risk Factors” and in “Forward-Looking Statements.” Volatility or depressed market prices of our reports, proxy and information statements may be read and copiedClass A common stock could make it difficult for shareholders to resell their shares of Class A common stock, when they want or at the Commission’s public reference room at 450 Fifth Street, NW, Washington, DC 20549. Information on our website or the Commission’s website is not part of this document.attractive prices.

| ITEM | UNRESOLVED STAFF COMMENTS |

None.

| ITEM | 2. PROPERTIES |

We are headquartered in Boca Raton, Florida, where we currently lease approximately 73,000 square feet of space. We have entered into long-term leases for regional and certain site development office locations where we expect our activities to be longer-term. We open and close project offices from time to time in connection with our site development business,business. We believe our existing facilities are adequate for our current and officesplanned levels of operations and that additional office space suited for new tower build projects are generally leased for periods not to exceed 18 months.

our needs is reasonably available in the markets within which we operate.

Our interests in towers are comprised of a variety of fee interests, leasehold interests created by long-term lease agreements, private easements, easements and licenses or rights-of-way granted by government entities. Of the 3,0325,551 towers in our portfolio, approximately 16%11% are located on parcels of land that we own and approximately 84%89% are located on parcels of land that have leasehold interests created by long-term lease agreements, private easements and easements, licenses or right-of-way granted by government entities. In rural areas, a wireless communications site typically consists of up to a 10,000 square foot tract, which supports towers, equipment shelters and guy wires to stabilize the structure. Less than 2,500 square feet is required for a monopole or self-supporting tower structure of the kind typically used in metropolitan areas for wireless communication tower sites. Land leases generally have an initial term of five years with five or more additional automatic renewal periods of five years, for a total of thirty years or more. In some instances, we have entered into 99 year ground leases.

| ITEM | 3. LEGAL PROCEEDINGS |

We are involved in various legal proceedings relating to claims arising in the ordinary course of business. We do not believe that the ultimate resolution of these matters will have a material adverse effect on our business, financial condition, results of operations or liquidity.

| ITEM | 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matter was submitted to the vote of security holders during the fourth quarter of fiscal 2003.2006.

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

TheOur Class A common stock commenced tradingis traded under the symbol “SBAC” on The Nasdaq National Market System (“Nasdaq”) on June 16, 1999.NASDAQ Global Select Market. The following table presents trading informationthe high and low sales price for the Class A common stock for the periods indicated on the Nasdaq:indicated:

| High | Low | |||||

Quarter ended March 31, 2003 | $ | 1.45 | $ | 0.40 | ||

Quarter ended June 30, 2003 | $ | 3.49 | $ | 1.11 | ||

Quarter ended September 30, 2003 | $ | 4.13 | $ | 2.47 | ||

Quarter ended December 31, 2003 | $ | 4.35 | $ | 3.10 | ||

Quarter ended March 31, 2002 | $ | 14.05 | $ | 1.59 | ||

Quarter ended June 30, 2002 | $ | 3.40 | $ | 1.14 | ||

Quarter ended September 30, 2002 | $ | 1.92 | $ | 1.04 | ||

Quarter ended December 31, 2002 | $ | 1.03 | $ | 0.19 | ||

| High | Low | |||

Quarter ended December 31, 2006 | 28.89 | 23.97 | ||

Quarter ended September 30, 2006 | 25.90 | 21.95 | ||

Quarter ended June 30, 2006 | 26.75 | 20.60 | ||

Quarter ended March 31, 2006 | 24.19 | 18.29 | ||

Quarter ended December 31, 2005 | 19.19 | 14.45 | ||

Quarter ended September 30, 2005 | 16.59 | 13.72 | ||

Quarter ended June 30, 2005 | 13.96 | 8.45 | ||

Quarter ended March 31, 2005 | 10.06 | 8.14 | ||

As of March 10, 2004,February 26, 2007, there were 194152 record holders of our Class A common stock.

Dividends

We have never paid a dividend on any class of common stock and anticipate that we will retain future earnings, if any, to fund the development and growth of our business. Consequently, we do not anticipate paying cash dividends on our common stock in the foreseeable future. In addition, we are restricted under theour Initial CMBS Certificates, Additional CMBS Certificates and our senior credit facility the 9¾% senior discount notes and the 10¼% senior notes from paying dividends or making distributions and repurchasing, redeeming or otherwise acquiring any shares of common stock except under certain circumstances.

Equity Compensation Plan Information

The following table gives information about our common stock that may be issued upon the exercise of options, warrants, and rights under all existing equity compensation plans as of December 31, 2003.2006:

| Equity Compensation Plan Information | Equity Compensation Plan Information | |||||||||||||

| (in thousands except exercise price) | (in thousands except exercise price) | |||||||||||||

| Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column) | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in first column) | |||||||||

Equity compensation plans approved by security holders | 3,788 | $ | 7.79 | 8,159 | 4,152 | $ | 9.87 | 8,301 | ||||||

Equity compensation plans not approved by security holders | — | — | — | — | — | — | ||||||||

Total | 3,788 | $ | 7.79 | 8,159 | 4,152 | $ | 9.87 | 8,301 | ||||||

| ITEM 6. | SELECTED |

The following table sets forth selected historical financial data as of and for each of the five years ended December 31, 2003.2006. The financial data for the fiscal years ended 2006, 2005, 2004, 2003, 2002 and 2001 have been derived from, and are qualified by reference to, our restated audited consolidated financial statements. The financial data as of and for the fiscal years ended 2000 and 1999,2002 have been derived from our unauditedaudited consolidated financial statements. The unaudited financial data as of and for the years ended December 31, 2000 and 1999, have been derived from our books and records without audit and, in the opinion of management, include all adjustments, (consisting only of normal, recurring adjustments) that management considers necessary for a fair statement of results for these periods. The following consolidated financial statements have been reclassified to reflect the discontinued operations treatment of our western site development services and the disposition, or intended disposition2004 reclassification of 848 towers.14 towers previously classified as discontinued operations into continuing operations. You should read the information set forth below in conjunction with our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes to those consolidated financial statements included in this Form 10-K.

| For the years ended December 31, | ||||||||||||||||||||

| 2003 | 2002 | 2001 | 2000 | 1999 | ||||||||||||||||

| (audited) | (audited) | (audited) | (unaudited) | |||||||||||||||||

| (in thousands) | ||||||||||||||||||||

Operating Data: | ||||||||||||||||||||

Revenues: | ||||||||||||||||||||

Site leasing | $ | 127,842 | $ | 115,081 | $ | 85,487 | $ | 44,332 | $ | 23,176 | ||||||||||

Site development | 84,218 | 125,041 | 139,735 | 115,892 | 60,570 | |||||||||||||||

Total revenues | 212,060 | 240,122 | 225,222 | 160,224 | 83,746 | |||||||||||||||

Cost of revenues (exclusive of depreciation, accretion and amortization shown below): | ||||||||||||||||||||

Cost of site leasing | 42,021 | 40,650 | 30,657 | 16,904 | 10,742 | |||||||||||||||

Cost of site development | 77,810 | 102,473 | 108,532 | 88,892 | 45,804 | |||||||||||||||

Total cost of revenues | 119,831 | 143,123 | 139,189 | 105,796 | 56,546 | |||||||||||||||

Gross profit | 92,229 | 96,999 | 86,033 | 54,428 | 27,200 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Selling, general and administrative | 31,244 | 34,352 | 42,103 | 27,404 | 19,659 | |||||||||||||||

Restructuring and other charges | 2,505 | 47,762 | 24,399 | — | — | |||||||||||||||

Asset impairment charges | 16,965 | 25,545 | — | — | — | |||||||||||||||

Depreciation, accretion and amortization | 84,380 | 85,728 | 66,104 | 27,921 | 13,275 | |||||||||||||||

Total operating expenses | 135,094 | 193,387 | 132,606 | 55,325 | 32,934 | |||||||||||||||

Operating loss from continuing operations | (42,865 | ) | (96,388 | ) | (46,573 | ) | (897 | ) | (5,734 | ) | ||||||||||

Other income (expense): | ||||||||||||||||||||

Interest income | 692 | 601 | 7,059 | 6,253 | 881 | |||||||||||||||

Interest expense, net of amounts capitalized | (81,501 | ) | (54,822 | ) | (47,709 | ) | (4,879 | ) | (5,244 | ) | ||||||||||

Non-cash interest expense | (9,277 | ) | (29,038 | ) | (25,843 | ) | (23,000 | ) | (20,467 | ) | ||||||||||

Amortization of debt issuance costs | (5,115 | ) | (4,480 | ) | (3,887 | ) | (3,006 | ) | (1,596 | ) | ||||||||||

Write-off of deferred financing fees and loss on extinguishment of debt | (24,219 | ) | — | (5,069 | ) | — | (1,150 | ) | ||||||||||||

Other | 169 | (169 | ) | (76 | ) | 68 | 48 | |||||||||||||

Total other expense | (119,251 | ) | (87,908 | ) | (75,525 | ) | (24,564 | ) | (27,528 | ) | ||||||||||