UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 20042005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 1-11535

Burlington Northern Santa Fe Corporation

Exact name of registrant as specified in its charter

| Delaware | 41-1804964 | |

| State of Incorporation | I.R.S. Employer Identification No. | |

2650 Lou Menk Drive Fort Worth, Texas 76131-2830 | (800) 795-2673 | |

| Address of principal executive offices, including zip code | Registrant’s telephone number, including area code | |

Securities registered pursuant to Section 12(b) of the Act:

| ||

Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.01 par value | New York Stock Exchange

| |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YesxNo¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Act).

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is an accelerated filera shell company (as defined in Rule 12b-2 of the Act). Yes x No ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $12.908$17.373 billion on June 30, 2004.2005. For purposes of this calculation only, the registrant has excluded stock beneficially owned by directors and officers. By doing so, the registrant does not admit that such persons are affiliates within the meaning of Rule 405 under the Securities Act of 1933 or for any other purpose.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: Common Stock, $0.01 par value, 377,927,038372,960,559 shares outstanding as of February 2, 2005.2006.

DOCUMENTS INCORPORATED BY REFERENCE

LIST HEREUNDER THE DOCUMENTS FROM WHICH PARTS THEREOF HAVE BEEN INCORPORATED BY REFERENCE AND THE PART OF THE FORM 10-K INTO WHICH SUCH INFORMATION IS INCORPORATED:

Burlington Northern Santa Fe Corporation’s definitive Proxy Statement, to be filed not

later than 120 days after the end of the fiscal year covered by this report Part III

Part I |

| 3 | ||

| 7 | ||||

| 8 | ||||

| 15 | ||||

Part II | Item 5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

Item 7A.Quantitative and Qualitative Disclosures About Market Risk | ||||

Item 9.Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | ||||

Part III | ||||

Item 12.Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||||

Part IV | ||||

| S-1 | ||||

| E-1 | ||||

Items 1 and 2.Item 1. Business and Properties

Burlington Northern Santa Fe Corporation (BNSF or Company) was incorporated in the State of Delaware on December 16, 1994. On September 22, 1995, the stockholders of Burlington Northern Inc. (BNI) and Santa Fe Pacific Corporation (SFP) became the stockholders of BNSF pursuant to a business combination of the two companies.

On December 30, 1996, BNI merged with and into SFP. On December 31, 1996, The Atchison, Topeka and Santa Fe Railway Company (ATSF) merged with and into Burlington Northern Railroad Company (BNRR), and BNRR changed its name to The Burlington Northern and Santa Fe Railway Company. On January 2, 1998, SFP merged with and into The Burlington Northern and Santa Fe Railway Company. On January 20, 2005, The Burlington Northern and Santa Fe Railway Company changed its name to BNSF Railway Company (BNSF Railway).

Through its subsidiaries, BNSF is engaged primarily in the rail transportation business. At December 31, 2004,2005, BNSF and its subsidiaries had approximately 38,00040,000 employees. The rail operations of BNSF Railway, BNSF’s principal operating subsidiary, comprise one of the largest railroad systems in North America. BNSF Railway’s business and operations are described below.

BNSF’s Internet address is www.bnsf.com. Through this internet website (under the “Investors” link), BNSF makes available, free of charge, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, andas well as all amendments to those reports, as soon as reasonably practicable after these reports are electronically filed with or furnished to the Securities and Exchange Commission.Commission (SEC). Filing on Forms 3, 4 and 5 are also available on this website within one day after filing. BNSF’s annual CEO certification filed pursuant to the New York Stock Exchange’s Corporate Governance Listing Standards is filed as an exhibit to this Form 10-K. BNSF also makes available on its website other previously filed SEC reports, registration statements and exhibits via a link to the SEC’s website at www.sec.gov. The following documents are also made available on the Company’s website, and a copy will be mailed, without charge, upon request to Investor Relations:

Further discussion of the Company’s business, including equipment and business sectors, is incorporated by reference from Item 2, “Properties.”

The Company faces intense competition from rail carriers and other transportation providers, and its failure to compete effectively could adversely affect its results of operations, financial condition or liquidity.

The Company operates in a highly competitive business environment. Depending on the specific market, the Company faces intermodal, intramodal, product and geographic competition. For example, the Company believes that high service truck lines, due to their ability to deliver non-bulk products on an expedited basis, have had and will continue to have an adverse effect on the Company’s ability to compete for deliveries of non-bulk, time-sensitive freight. While the Company must build or acquire and maintain its rail system, trucks and barges are able to use public rights-of-way maintained by public entities. Any material increase in the scope and quality of these alternative methods or the passage of legislation granting greater latitude to motor carriers with respect to size and weight restrictions could have an adverse effect on the Company’s results of operations, financial condition or liquidity.

A downturn in the economy or change in government policy could negatively impact demand for the Company’s services.

Significant, extended negative changes in economic conditions that impact the producers and consumers of the commodities transported by the Company may have an adverse effect on the Company’s operating results, financial condition or liquidity. In addition, changes in United States and foreign government policies could change the economic environment and affect demand for our services. For example, changes in clean air laws may impact demand for coal and United States and foreign government agriculture subsidies may impact the demand for grain.

As part of its railroad operations, the Company frequently transports chemicals and other hazardous materials.

The Company is required to transport these commodities to the extent of its common carrier obligation. An accidental release of these commodities could result in a significant loss of life and extensive property damage. The associated costs could have an adverse effect on the Company’s operating results, financial condition or liquidity.

Future acts of terrorism or war, as well as the threat of war, may cause significant disruptions in the Company’s business operations.

Terrorist attacks, such as those that occurred on September 11, 2001, as well as the more recent attacks on the transportation systems in Madrid and London, any government response to those types of attacks and war or risk of war may adversely affect the Company’s results of operations, financial condition or liquidity. The Company’s rail lines and facilities could be direct targets or indirect casualties of an act or acts of terror, which could cause significant business interruption and result in increased costs and liabilities and decreased revenues, which could have an adverse effect on its operating results and financial condition. Such effects could be magnified where releases of hazardous materials are involved. Any act of terror, retaliatory strike, sustained military campaign or war or risk of war may have an adverse impact on the Company’s operating results and financial condition by causing or resulting in unpredictable operating or financial conditions, including disruptions of rail lines, volatility or sustained increase of fuel prices, fuel shortages, general economic decline and instability or weakness of financial markets which could restrict its ability to raise capital. In addition, insurance premiums charged for some or all of the coverage currently maintained by the Company could increase dramatically or certain coverage may not be available to the Company in the future.

The Company is subject to stringent environmental laws and regulations which may impose significant costs on its business operations.

The Company’s operations are subject to extensive federal, state and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; the generation, handling, storage, transportation and disposal of waste and hazardous materials; and the cleanup of hazardous material or petroleum releases. In addition, many of the Company’s land holdings are and have been used for industrial or transportation-related purposes or leased to commercial or industrial companies whose activities may have resulted in discharges onto the property. Environmental liability can extend to previously owned or operated properties, leased properties and properties owned by third parties, as well as to properties currently owned and used by the Company. Environmental liabilities have arisen and may continue to arise from claims asserted by adjacent landowners or other third parties in toxic tort litigation. The Company has been and may continue to be subject to allegations or findings to the effect that it has violated, or is strictly liable under, these laws or regulations. The Company’s operating results, financial condition or liquidity could be adversely affected as a result of any of the foregoing, and it may be required to incur significant expenses to investigate and remediate environmental contamination. The Company records liabilities for environmental cleanup when the amount of its liability is both probable and reasonably estimable.

The Company’s future success depends on its ability to continue to comply with the significant federal, state and local governmental regulations to which it is subject.

The Company is subject to a significant amount of governmental regulation with respect to its rates and practices, railroad operations and a variety of health, safety, labor, environmental and other matters. Failure to comply with applicable laws and regulations could have a material adverse effect on the Company. Governments may change the legislative framework within which the Company operates without providing the Company with any recourse for any adverse effects that the change may have on its business. Also, some of the regulations require the Company to obtain and maintain various licenses, permits and other authorizations, and it cannot assure that it will continue to be able to do so. Increased economic regulation of the rail industry could negatively impact the Company’s ability to determine prices for rail services and to make capital improvements to its rail network, resulting in an adverse effect on the Company’s results of operations, financial condition or liquidity.

The availability of qualified personnel and an aging workforce may adversely affect the Company’s operations.

Changes in demographics, training requirements and the availability of qualified personnel, particularly train crew members, could negatively impact service levels. In addition, approximately 45 percent of the workforce will be eligible for retirement within the next 10 years. The Company’s efforts to attract and retain qualified personnel may be hindered due to increased demand in the job market. Unpredictable increases in demand for rail services may exacerbate these risks and may have an adverse effect on the Company’s operating results, financial condition or liquidity.

Most of the Company’s employees are represented by unions, and failure to successfully negotiate collective bargaining agreements may result in strikes, work stoppages, or substantially higher ongoing labor costs.

A significant majority of BNSF Railway’s employees are union-represented. BNSF Railway’s union employees work under collective bargaining agreements with various labor organizations. A negotiating process for new, major collective bargaining agreements covering all of BNSF Railway’s union employees has been underway since the bargaining round was initiated on November 1, 2004. Wages, health and welfare benefits, work rules and other issues have traditionally been addressed through industry-wide negotiations. These negotiations have generally taken place over an extended period of time and have previously not resulted in any extended work stoppages. The existing agreements have remained in effect and will continue to remain in effect until new agreements are reached or the Railway Labor Act’s procedures (which include mediation, cooling-off periods and the possibility of Presidential intervention) are exhausted. While the negotiations have not yet resulted in any extended work stoppages, if the Company is unable to negotiate acceptable new agreements, it could result in strikes by the affected workers, loss of business and increased operating costs as a result of higher wages or benefits paid to union members, any of which could have an adverse effect on the Company’s operating results, financial condition or liquidity.

Severe weather and natural disasters could disrupt normal business operations, which would result in increased costs and liabilities and decreases in revenues.

The Company’s success is dependent on its ability to operate its railroad system efficiently. Severe weather and natural disasters, such as tornados, flooding and earthquakes, could cause significant business interruptions and result in increased costs and liabilities and decreased revenues. In addition, damages to or loss of use of significant aspects of the Company’s infrastructure due to natural or man-made disruptions could have an adverse affect on the Company’s operating results, financial condition or liquidity for an extended period of time until repairs or replacements could be made. Extreme swings in weather could also negatively affect the performance of locomotives and rolling stock.

Fuel supply availability and fuel prices may adversely affect the Company’s results of operations, financial condition or liquidity.

Fuel supply availability could be impacted as a result of limitations in refining capacity, disruptions to the supply chain, or rising global demand. A significant reduction in fuel availability could impact the Company’s ability to provide transportation services at current levels, increase fuel costs and impact the economy. Each of these factors could have an adverse effect on the Company’s operating results, financial condition or liquidity. Additionally, the Company is expected to be able to offset a significant portion of the anticipated higher fuel costs through its fuel surcharge program and fuel hedging activities in 2006. However, to the extent that the Company is unable to maintain and expand its existing fuel surcharge program, increases in fuel prices could have an adverse effect on the Company’s operating results, financial condition or liquidity.

The Company depends on the stability and availability of its information technology systems.

The Company relies on information technology in all aspects of its business. A significant disruption or failure of its information technology systems could result in service interruptions, safety failures, security violations, regulatory compliance failures, and the inability to protect corporate information assets against intruders or other operational difficulties. Although the Company has taken steps to mitigate these risks, including Business Continuity Planning, Disaster Recovery Planning and Business Impact Analysis, a significant disruption could adversely affect the Company’s results of operations, financial condition or liquidity. Additionally, if the Company is unable to acquire or implement new technology, it may suffer a competitive disadvantage, which could also have an adverse effect on the Company’s results of operations, financial condition or liquidity.

Personal injury claims constitute a significant expense, and increases in the amount or severity of these claims could adversely affect the Company’s operating results.

The Company is subject to various personal injury claims by third parties and employees, including claims by employees who worked around asbestos until it was substantially eliminated by 1985. Personal injury claims by BNSF Railway employees are subject to the Federal Employees’ Liability Act (FELA), rather than state workers’ compensation laws. The Company believes that the FELA system, which includes unscheduled awards and a reliance on the jury system, has contributed to increased expenses in the past. Future events, such as increases in the number of claims that will be filed, developments in legislative and judicial standards and the costs of settling claims, could result in an adverse effect on the Company’s operating results.

Item 1B. Unresolved Staff Comments

None

TRACK CONFIGURATION

As of December 31, 2004, BNSF Railway operates over a railroad system consisting of approximately 32,000 route miles of track (excluding second, third and fourth main tracks, yard tracks, and sidings), approximately 24,000 miles of which are owned route miles, including easements, in 28 states and two Canadian provinces.provinces as of December 31, 2005. Approximately 8,000 route miles of BNSF Railway’s system consist of trackage rights that permit BNSF Railway to operate its trains with its crews over another railroad’sother railroads’ tracks. BNSF Railway operates over other trackage through lease or other contractual arrangements.

As of December 31, 2004,2005, the total BNSF Railway system, including first, second, third and fourth main tracks, yard tracks, and sidings, consists of approximately 50,000 operated miles of track, all of which are owned by or held under easement by BNSF Railway except for approximately 9,000 route miles operated under trackage rights. At December 31, 2004,2005, approximately 26,000 miles of BNSF Railway’s track consists of 112-pound per yard or heavier rail, including approximately 19,000 track miles of 131-pound per yard or heavier rail.

EQUIPMENT CONFIGURATION

BNSF Railway owned or had under non-cancelable leases exceeding one year the following units of railroad rolling stock and other equipment as of the dates shown below:

At December 31, | 2004 | 2003 | 2002 | 2005 | 2004 | 2003 | ||||||

Locomotives | 5,715 | 5,377 | 5,226 | 5,790 | 5,715 | 5,377 | ||||||

Freight Cars: | ||||||||||||

Covered hopper | 35,066 | 36,255 | 37,609 | 34,631 | 35,066 | 36,255 | ||||||

Gondola | 16,070 | 15,327 | 14,942 | 12,579 | 16,070 | 15,327 | ||||||

Open hopper | 10,973 | 11,257 | 10,866 | |||||||||

Box-specially equipped | 9,625 | 10,021 | 9,612 | 8,658 | 9,625 | 10,021 | ||||||

Open hopper | 11,257 | 10,866 | 10,848 | |||||||||

Flat | 8,132 | 7,854 | 7,946 | 8,537 | 8,132 | 7,854 | ||||||

Refrigerator | 5,420 | 5,427 | 5,588 | 4,983 | 5,420 | 5,427 | ||||||

Autorack | 894 | 827 | 843 | 748 | 894 | 827 | ||||||

Tank | 612 | 639 | 501 | 422 | 612 | 639 | ||||||

Box-general purpose | 27 | 31 | 559 | 27 | 27 | 31 | ||||||

Other | 273 | 302 | 319 | 323 | 273 | 302 | ||||||

Total freight cars | 87,376 | 87,549 | 88,767 | 81,881 | 87,376 | 87,549 | ||||||

Domestic chassis | 12,649 | 9,846 | 9,864 | |||||||||

Domestic containers | 10,501 | 10,627 | 8,197 | 10,412 | 10,501 | 10,627 | ||||||

Domestic chassis | 9,846 | 9,864 | 8,180 | |||||||||

Company service cars | 3,999 | 4,028 | 4,035 | 4,091 | 3,999 | 4,028 | ||||||

Trailers | 2,152 | 2,152 | 2,163 | 1,916 | 2,152 | 2,152 | ||||||

Commuter passenger cars | 166 | 163 | 160 | 179 | 166 | 163 | ||||||

Average age from date of manufacture- locomotive fleet (years)a | 15 | 15 | 15 | 15 | 15 | 15 | ||||||

Average age from date of manufacture- freight car fleet (years)a | 16 | 16 | 16 | 15 | 16 | 16 | ||||||

| a | These averages are not weighted to reflect the greater capacities of the newer equipment. |

CAPITAL EXPENDITURES AND MAINTENANCE

CAPITAL EXPENDITURES

The extent of the BNSF Railway’s maintenance and capacity program is outlined in the following table:

Year Ended December 31, | 2006 Estimate | 2005 | 2004 | 2003 | ||||

Track miles of rail laida | 854 | 711 | 695 | 749 | ||||

Cross ties inserted (thousands)a | 3,314 | 3,171 | 2,695 | 2,353 | ||||

Track resurfaced (miles) | 14,528 | 12,790 | 11,450 | 12,399 |

| a | Includes both maintenance of existing route system and expansion projects. Expenditures for these maintenance programs are primarily capitalized. |

A breakdown of the Company’s cash capital expenditures for the three years ended December 31, 2004,2005, is incorporated by reference from a table in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations under the headings “Liquidity and Capital Resources,Resources; Investing Activities.”

BNSF’s planned 20052006 cash capital expenditures are incorporated by reference from Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations under the heading “Introduction.headings “Executive Summary; Business Outlook for 2006.”

MAINTENANCE

As of December 31, 2004,2005, General Electric Company, Alstom Transportation Inc., OmniTRAX Locomotive Services, LLC and the Electro-Motive Division of General Motors CorporationDiesel, Inc. performed locomotive maintenance and overhauls for BNSF Railway at its facilities under various maintenance agreements that covered approximately 3,6504,080 locomotives.

The extent of the BNSF Railway’s maintenance and capacity program is outlined in the following table:

Year Ended December 31, | 2005 Estimate | 2004 | 2003 | 2002 | ||||

Track miles of rail laida | 630 | 695 | 749 | 685 | ||||

Cross ties inserted (thousands)a | 3,100 | 2,695 | 2,353 | 2,248 | ||||

Track resurfaced (miles) | 12,100 | 11,450 | 12,399 | 12,499 |

PROPERTY AND FACILITIES

BNSF Railway operates various facilities and equipment to support its transportation system, including its infrastructure and locomotives and freight cars as previously described. It also owns or leases other equipment to support rail operations, including highway trailers, containers and vehicles. Support facilities for rail operations include yards and terminals throughout its rail network, system locomotive shops to perform locomotive servicing and maintenance, a centralized network operations center for train dispatching and network operations monitoring and management in Fort Worth, Texas, regional dispatching centers, computers, telecommunications equipment, signal systems, and other support systems. Transfer facilities are maintained for rail-to-rail as well as intermodal transfer of containers, trailers and other freight traffic. These facilities include 3533 major intermodal hubs located across the system. BNSF Railway’s largest intermodal facilities in terms of 20042005 volume were:were as follows:

Intermodal Facilities | Lifts | |

Hobart Yard (Los Angeles, California) | ||

Willow Springs (Illinois) | 770,000 | |

Corwith Yard (Chicago, Illinois) | ||

| ||

Alliance (Fort Worth, Texas) | ||

San Bernardino (California) | ||

Cicero (Illinois) | ||

Logistics Park Chicago (Illinois) | 454,000 | |

Argentine (Kansas City, Kansas) | ||

|

BNSF Railway owns 23 automotive distribution facilities and serves eight port facilities where automobiles are loaded or unloaded from multi-level rail cars and serves eight port facilities in the United States and Canada.

BNSF Railway’s largest freight car classification yards based on the average daily number of cars processed (excluding cars that do not change trains at the terminal and intermodal and coal cars) are shown below:

Classification Yard | Daily Average Cars Processed | |

Argentine (Kansas City, Kansas) | ||

Galesburg (Illinois) | ||

Pasco (Washington) | 1,393 | |

Barstow (California) | ||

| ||

Memphis (Tennessee) |

As of December 31, 2004,2005, certain BNSF Railway properties and other assets are subject to liens securing $388$384 million of mortgage debt. Certain locomotives and rolling stock of BNSF Railway are subject to equipment obligations and leases, as referred to in Notes 9 and 10 of the Consolidated Financial Statements.

PRODUCTIVITY

Productivity in 2005, as measured by thousand gross ton miles per employee, has risen steadily in the last three yearswas relatively consistent with 2004 as shown in the table below. Gross ton miles is defined as the product of the number of loaded and empty miles traveled and the combined weight of the car and contents.

Year Ended December 31, | 2004 | 2003 | 2002 | 2005 | 2004 | 2003 | ||||||

Thousand gross ton miles divided by average number of employees | 26,898 | 24,875 | 23,368 | 26,847 | 26,898 | 24,875 |

Volumes as measured by gross ton miles increased 5 percent in 2005 over 2004 and 11 percent in 2004 over 2003 and 4 percent in 2003 over 2002.2003. In turn, the increase in volumes has led the Company to increase employee headcounts. A discussion of Employees and Labor Relations is incorporated by reference from Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, under the heading “Other Matters; Employee and Labor Relations.”

BUSINESS MIX

In serving the Midwest, Pacific Northwest and the Western, Southwestern, and Southeastern regions and ports of the country, BNSF Railway transports, through one operating transportation services segment, a range of products and commodities derived from manufacturing, agricultural and natural resource industries. Approximately 7065 percent of the freight revenuerevenues originated by the Company is covered by contractual agreements of varying duration, while the balance is subject to common carrier, published prices or quotations offered by the Company. BNSF’s financial performance is influenced by, among other things, general and industry economic conditions at the international, national and regional levels. The following map below illustrates the Company’s primary routes, including trackage rights, which allow BNSF Railway to access major cities and ports in the western United States as well as Canadian and Mexican traffic. In addition to major cities and ports, BNSF Railway efficiently serves many smaller markets by working closely with approximately 200 shortline partners. BNSF has also entered into marketing agreements with Canadian National Railway Company and Kansas City Southern Railway Company, expanding the marketing reach for the organizations.each railroad and their customers.

CONSUMER PRODUCTS:

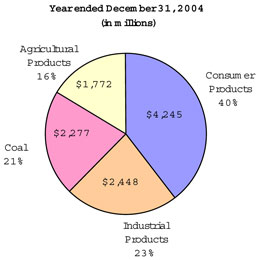

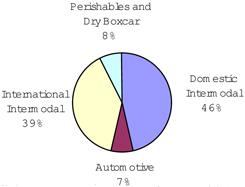

The Consumer Products’ freight business provided approximately 4041 percent of freight revenues in 20042005 and consisted of the following business sectors:

INDUSTRIAL PRODUCTS:

Industrial Products’ freight business provided approximately 23 percent of BNSF’s freight revenues in 20042005 and consisted of the following four business areas:

COAL:

In 2004,2005, the transportation of coal contributed about 2119 percent of freight revenues. BNSF Railway is the largest transporter of low-sulfur coal originating from the Powder River Basin of Wyoming and Montana, which accounted for approximately 9093 percent of all BNSF Railway’s coal tons during the three years endingyear ended December 31, 2004.2005. These coal shipments were destined for coal-fired electric generating stations located primarily in the North Central, South Central, Southeast and Mountain regions of the United States. BNSF Railway also transports coal from the Powder River Basin to markets in Canada and the eastern United States. Demand for Powder River Basin coal has increased substantially over the past 20 years due to environmental compliance issues, abundant reserves, relatively inexpensive mine production and competitive delivered cost to power plants.

Other BNSF coal shipments originate principally in Colorado, Illinois, New Mexico and North Dakota. These shipments move to electrical generating stations and industrial plants in the Mountain and North Central regions of the United States and to Mexico.

The Company has received a Civil Investigative Demand from the Antitrust Division of the Department of Justice requesting information concerning the Company’s pricing activities relating to the shipment of coal from the southern Powder River Basin. The Company is responding to the request.

AGRICULTURAL PRODUCTS:

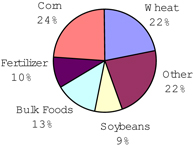

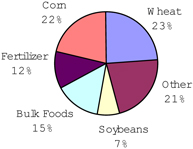

The transportation of Agricultural Products provided approximately 1617 percent of 20042005 total freight revenues and includes wheat, corn, bulk foods, soybeans, oil seeds and meals, feeds, barley, oats and rye, flour and mill products, milo, oils, specialty grains, malt, ethanol and fertilizer. The BNSF Railway system is strategically located to serve the grain-producing regions of the Midwest and Great Plains. The Company is developing and operating a shuttle network for grain and grain products, and fertilizer, which allows more efficient use of equipment and improved cycle times as a result of the shuttle process.times. In addition to serving most grain-producing areas, BNSF Railway serves most major terminal, storage, feeding and food-processing locations. Furthermore, BNSF Railway has access to major export markets in the Pacific Northwest, western Great Lakes, Texas Gulf and Mexico.

FREIGHT STATISTICS:

The following table sets forth certain freight statistics relating to rail operations for the periods indicated:

Year Ended December 31, | 2004 | 2003 | 2002 | 2005 | 2004 | 2003 | ||||||||||||

Revenue ton miles (millions) | 570,688 | 508,200 | 490,234 | |||||||||||||||

Revenue ton miles (millions)* | 596,575 | 570,688 | 508,200 | |||||||||||||||

Freight revenue per thousand revenue ton miles | $ | 18.82 | $ | 18.27 | $ | 18.10 | $ | 21.13 | $ | 18.82 | $ | 18.27 | ||||||

Average length of haul (miles) | 1,045 | 1,014 | 992 | 1,068 | 1,045 | 1,014 | ||||||||||||

| * | Revenue ton miles is defined as the product of the number of loaded miles traveled and the weight of the contents. |

Revenue, cars/units and average revenue per car/unit information for the three years ended December 31, 2004,2005, is incorporated by reference from a table in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, under the headings “Results of Operations; Revenue Table.”

GOVERNMENT REGULATION AND LEGISLATION

The Company is subject to federal, state and local laws and regulations generally applicable to all businesses. Rail operations are subject to the regulatory jurisdiction of the Surface Transportation Board (STB) of the United States Department of Transportation (DOT), the Federal Railroad Administration of the DOT, the Occupational Safety and Health Administration (OSHA), as well as other federal and state regulatory agencies. The STB has jurisdiction over disputes and complaints involving certain rates, routes and services, the sale or abandonment of rail lines, applications for line extensions and construction, and consolidation or merger with, or acquisition of control of, rail common carriers. The outcome of STB proceedings can affect the profitability of BNSF’s business.

DOT and OSHA have jurisdiction under several federal statutes over a number of safety and health aspects of rail operations, including the transportation of hazardous materials. State agencies regulate some aspects of rail operations with respect to health and safety in areas not otherwise preempted by federal law.

BNSF Railway’s rail operations, as well as those of its competitors, are also subject to extensive federal, state and local environmental regulation. These laws cover discharges to water, air emissions, toxic substances, and the generation, handling, storage, transportation and disposal of waste and hazardous materials. This regulation has the effect of increasing the cost and liabilities associated with rail operations. Environmental risks are also inherent in rail operations, which frequently involve transporting chemicals and other hazardous materials.

Many of BNSF Railway’s land holdings are and have been used for industrial or transportation-related purposes or leased to commercial or industrial companies whose activities may have resulted in discharges onto the property. As a result, BNSF Railway is now subject to, and will from time to time continue to be subject to, environmental cleanup and enforcement actions. In particular, the federal Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), also known as the Superfund law, generally imposes joint and several liability for cleanup and enforcement costs on current and former owners and operators of a site, without regard to fault or the legality of the original conduct. Accordingly, BNSF Railway may be responsible under CERCLA and other federal and state statutes for all or part of the costs to cleanupclean up sites at which certain substances may have been released by BNSF Railway, its current lessees, former owners or lessees of properties, or other third parties. Further discussion is incorporated by reference from Note 10 of the Consolidated Financial Statements.

RAILROAD RETIREMENT

Railroad industry personnel are covered by the Railroad Retirement System instead of Social Security. BNSF Railway’s contributions under the Railroad Retirement System have been approximately triple those in industries covered by Social Security. The Railroad Retirement System, funded primarily by payroll taxes on covered employers and employees, includes a benefit roughly equivalent to Social Security (Tier I), an additional benefit similar to that allowed in some private defined-benefit plans (Tier II), and other benefits. For 2005, the Railroad Retirement System required up to a 20.25 percent contribution by railroad employers on eligible wages, while the Social Security and Medicare Acts only required a 7.65 percent contribution on similar wage bases.

COMPETITION

The business environment in which BNSF Railway operates is highly competitive. Depending on the specific market, deregulated motor carriers, other railroads and river barges may exert pressure on price and service levels. The presence of advanced, high service truck lines with expedited delivery, subsidized infrastructure and minimal empty mileage continues to affect the market for non-bulk, time sensitivetime-sensitive freight. The potential expansion of longer combination vehicles could further encroach upon markets traditionally served by railroads. In order to remain competitive, BNSF Railway and other railroads continue to develop and implement operating efficiencies to improve productivity.

As railroads streamline, rationalize and otherwise enhance their franchises, competition among rail carriers intensifies. BNSF Railway’s primary rail competitor in the western region of the United States is the Union Pacific Railroad Company (UP). Other Class I railroads and numerous regional railroads and motor carriers also operate in parts of the same territories served by BNSF Railway.

Based on weekly reporting to the Association of American Railroads, in 2004, BNSF’s share of the western United States rail traffic in 2005 was approximately 46.448 percent.

Ray Ridgeway, et al. v. Burlington Northern Santa Fe Corporation and The Burlington Northern and Santa Fe Railway Company, No. 48-185170-00 (District Court of Tarrant County, Texas, 48th48th Judicial District) is a state court action filed on October 27, 2000. The plaintiffs’ causes of action include alleged breach of contract, negligence, and breach of fiduciary duties with respect to a special dividend that was paid in 1988 by a Burlington Northern Santa Fe Corporation (BNSF)BNSF predecessor, Santa Fe Southern Pacific Corporation (SFSP). The complaint alleges that SFSP erroneously informed shareholders as to the tax treatment of the dividend–specifically, the apportionment of the dividend as either a distribution of earnings and profits or a return of capital–which allegedly caused some shareholders to overpay their income taxes. The plaintiffs assert, through their expert’s report, that SFSP had essentially no accumulated earnings and profits and that the entire dividend distribution should have been treated as a return of capital, rather than the approximately 34 percent that SFSP determined was a return of capital. On December 15, 2004,July 8, 2005, the court issued a letter to the parties indicating that it intends to denyentered an order denying the plaintiffs’ requests to certify a class action, and will be issuingthe plaintiffs subsequently filed an orderappeal of this ruling to that effect.the Texas Court of Appeals. BNSF believes these claims lack merit and that it has substantial defenses on both the merits of these claims and the attempted class action, as evidenced by the court’s letter, and it is defending these claims vigorously.

ReferenceBNSF Railway was notified by the Minnesota Pollution Control Agency (MPCA) of a proposed Stipulation Agreement to resolve alleged environmental violations with respect to BNSF Railway’s Dilworth, Minnesota fueling facility. The MPCA alleges violations involving BNSF Railway’s wastewater permit, tank regulations, and hazardous waste regulations. In October 2005, the MPCA presented BNSF Railway with proposed monetary sanctions. Although the parties are negotiating a settlement, it is made topossible that resolution of this matter could result in monetary sanctions exceeding $100,000.

Information concerning certain pending tax-related administrative or adjudicative state proceedings or appeals is incorporated by reference from Note 5 of the Consolidated Financial Statements, forand information concerning certain pending tax related administrative or adjudicative state proceedings or appealsother claims and tolitigation is incorporated by reference from Note 10 of the Consolidated Financial Statements for information concerning other claims and litigation.Statements.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted by BNSF to a vote of its securities holders during the fourth quarter of 2004.2005.

EXECUTIVE OFFICERS OF THE REGISTRANT

Listed below are the names, ages, and positions of all executive officers of BNSF and their business experience during the past five years. Executive officers hold office until their successors are elected or appointed, or until their earlier death, retirement, resignation, or removal.

MATTHEW K. ROSE, 4546

Chairman, President and Chief Executive Officer of BNSF since March 2002. Previously President and Chief Executive Officer of BNSF from December 2000. Also, Chairman, President and Chief Executive Officer of BNSF Railway from December 2000. Previously, President and Chief Operating Officer of BNSF from June 1999 to December 2000.

THOMAS N. HUND, 5152

Executive Vice President and Chief Financial Officer since January 2001. Prior to that, Senior Vice President and Chief Financial Officer and Treasurer from August 1999.

CARL R. ICE, 4849

Executive Vice President and Chief Operations Officer since January 2001. Prior to that, Senior Vice President-Operations from June 1999.

DENNIS R. JOHNSON, 43

Vice President and Controller since August 1999.

JOHN P. LANIGAN, JR., 4950

Executive Vice President and Chief Marketing Officer since January 2003. Prior to that, President and Chief Executive Officer of Logistics.com, Inc. (provider of ASP-based transportation procurement services to shippers and carriers) from May 2000, and President and Chief Operating Officer from March 2000; and Chief Operating Officer of Schneider National, Inc. (truckload freight hauler) from 1999 to 2000.

JEFFREY R. MORELAND, 6061

Executive Vice President Law & Government Affairs and Secretary since December 2001. Prior to that, Executive Vice President-Law and Chief of Staff since January 2001, and Senior Vice President-Law and Chief of Staff since February 1998.

PETER J. RICKERSHAUSER, 5657

Vice President-Network Development since May 1999.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

BNSF’s common stock is listed on the New York Stock Exchange under the symbol “BNI.” TheIn 2005, the Company decided to de-list its common stock is also listed onfrom the Chicago Stock Exchange and the Pacific Exchange.Exchange, effective December 31, 2005, due to low trading volume and regulatory compliance costs. Information as to the high and low sales prices of such stock for the two years ending December 31, 2004,2005, and the frequency and amount of dividends declared on such stock during such periods, is set forth in Note 17 of the Consolidated Financial Statements. The approximate number of holders of record of the common stock at February 2, 2005,2006, was 40,000.35,000.

COMMON STOCK REPURCHASES

The following table presents repurchases by the Company of its common stock for each of the three months for the quarter ended December 31, 20042005 (shares in thousands):

Issuer Purchases of Equity Securities

| |||||||||

Period | Total Number (a) | Average Price Per | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (b) | Maximum Number May Yet Be Under the Plans or Programs | |||||

October 1 – 31 | 965 | $ | 40.18 | 950 | 17,601 | ||||

November 1 – 30 | 980 | 44.01 | 950 | 16,651 | |||||

December 1 – 31 | 848 | 45.85 | 816 | 15,835 | |||||

Total | 2,793 | $ | 43.25 | 2,716 | |||||

Issuer Purchases of Equity Securities

Period | Total Number of Shares Purchaseda | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programsb | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programsb | |||||

October 1 – 31 | 37 | $ | 60.12 | — | 5,160 | ||||

November 1 – 30 | 1,625 | 63.89 | 1,597 | 3,563 | |||||

December 1 – 31 | 1,840 | 66.38 | 1,800 | 31,763 | |||||

Total | 3,502 | $ | 65.15 | 3,397 | |||||

| Total number of shares purchased includes approximately |

| On July 17, 1997, the Board initially authorized and the Company announced the repurchase of up to 30 million shares of the Company’s common stock from time to time |

Item 6. Selected Financial Data

The following table presents, as of and for the dates indicated, selected historical financial information for the Company (dollars in millions, except per share data):

December 31, | 2004 | 2003 | 2002 | 2001 | 2000 | 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||||||||||||||||

For the year ended: | ||||||||||||||||||||||||||||||||||||||||

Revenues | $ | 10,946 | $ | 9,413 | $ | 8,979 | $ | 9,208 | $ | 9,207 | $ | 12,987 | $ | 10,946 | $ | 9,413 | $ | 8,979 | $ | 9,208 | ||||||||||||||||||||

Operating income | $ | 1,686 | a | $ | 1,665 | $ | 1,656 | $ | 1,750 | $ | 2,113 | $ | 2,922 | a | $ | 1,686 | b | $ | 1,665 | $ | 1,656 | $ | 1,750 | |||||||||||||||||

Income before cumulative effect of accounting change | $ | 791 | a | $ | 777 | b | $ | 760 | $ | 731 | $ | 980 | $ | 1,531 | a | $ | 791 | b | $ | 777 | c | $ | 760 | $ | 731 | |||||||||||||||

Basic earnings per share (before cumulative effect of accounting change) | $ | 2.14 | a | $ | 2.10 | $ | 2.01 | $ | 1.89 | $ | 2.38 | $ | 4.12 | a | $ | 2.14 | b | $ | 2.10 | c | $ | 2.01 | $ | 1.89 | ||||||||||||||||

Average basic shares (in millions) | 370.0 | 369.1 | 378.0 | 387.3 | 412.1 | 371.8 | 370.0 | 369.1 | 378.0 | 387.3 | ||||||||||||||||||||||||||||||

Diluted earnings per share (before cumulative effect of accounting change) | $ | 2.10 | a | $ | 2.09 | b | $ | 2.00 | $ | 1.87 | $ | 2.36 | $ | 4.01 | a | $ | 2.10 | b | $ | 2.09 | c | $ | 2.00 | $ | 1.87 | |||||||||||||||

Average diluted shares (in millions) | 376.6 | 372.3 | 380.8 | 390.7 | 415.2 | 381.8 | 376.6 | 372.3 | 380.8 | 390.7 | ||||||||||||||||||||||||||||||

Dividends declared per common share | $ | 0.64 | $ | 0.54 | $ | 0.48 | $ | 0.48 | $ | 0.48 | $ | 0.74 | $ | 0.64 | $ | 0.54 | $ | 0.48 | $ | 0.48 | ||||||||||||||||||||

At year end: | ||||||||||||||||||||||||||||||||||||||||

Total assets | $ | 28,925 | $ | 26,947 | $ | 25,767 | $ | 24,721 | $ | 24,375 | $ | 30,304 | $ | 28,925 | $ | 26,947 | $ | 25,767 | $ | 24,721 | ||||||||||||||||||||

Long-term debt and commercial paper, including current portion | $ | 6,516 | $ | 6,684 | $ | 6,814 | $ | 6,651 | $ | 6,846 | $ | 7,154 | $ | 6,516 | $ | 6,684 | $ | 6,814 | $ | 6,651 | ||||||||||||||||||||

Stockholders’ equity | $ | 9,311 | $ | 8,495 | $ | 7,932 | $ | 7,849 | $ | 7,480 | $ | 9,508 | $ | 9,311 | $ | 8,495 | $ | 7,932 | $ | 7,849 | ||||||||||||||||||||

Net debt to total capitalizationc | 39.9 | % | 44.0 | % | 46.1 | % | 45.8 | % | 47.7 | % | ||||||||||||||||||||||||||||||

Net debt to total capitalizationd | 42.7 | % | 39.9 | % | 44.0 | % | 46.1 | % | 45.8 | % | ||||||||||||||||||||||||||||||

For the year ended: | ||||||||||||||||||||||||||||||||||||||||

Total capital expenditures | $ | 1,527 | $ | 1,726 | $ | 1,358 | $ | 1,459 | $ | 1,399 | $ | 1,750 | $ | 1,527 | $ | 1,726 | $ | 1,358 | $ | 1,459 | ||||||||||||||||||||

Depreciation and amortization | $ | 1,012 | $ | 910 | $ | 931 | $ | 909 | $ | 895 | $ | 1,075 | $ | 1,012 | $ | 910 | $ | 931 | $ | 909 | ||||||||||||||||||||

| a | 2005 operating income, income before cumulative effect of accounting change and earnings per share include a loss related to an agreement to sell certain line segments to the state of New Mexico in the future of $71 million pre-tax, $44 million net of tax, or $0.12 per basic and diluted share. |

| b | 2004 operating income, |

| 2003 income before cumulative effect of accounting change excludes the favorable cumulative effect of an accounting change of $39 million, net of tax, or $0.11 per basic share and $0.10 per diluted share, as described in Note 2 of the Consolidated Financial Statements. |

| Net debt is calculated as total debt less cash and cash equivalents, and total capitalization is calculated as the sum of net debt and total stockholders’ equity. |

CALCULATION OF RETURN ON INVESTED CAPITAL

BNSF’s return on invested capital (ROIC), as discussed in the “Letter from the Chairman, President, and Chief Executive Officer” in the Company’s 2005 Annual Report, is a non-GAAP measure and should be considered in addition to, but not as a substitute or preferable to, other information prepared in accordance with GAAP. However, the information is included herein as management believes that ROIC provides meaningful information that can be useful in assessing the long-term performance of the Company’s business and in evaluating potential strategic transactions. Below is the calculation of ROIC for the years ended December 31, 2005, 2004 and 2003.

Year ended December 31, | 2005 | 2004 | 2003 | |||||||||

Average capitalizationa | $ | 19,831 | $ | 19,069 | $ | 18,409 | ||||||

Operating income | $ | 2,922 | $ | 1,686 | $ | 1,665 | ||||||

Other expense | (37 | ) | (4 | ) | (14 | ) | ||||||

Financing chargesb | 305 | 274 | 262 | |||||||||

Exclude 2004 charge for change in estimate of unasserted asbestos and environmental liabilities | — | 465 | — | |||||||||

Taxesc | (1,196 | ) | (917 | ) | (707 | ) | ||||||

After-tax income excluding financing charges and 2004 charge | $ | 1,994 | $ | 1,504 | $ | 1,206 | ||||||

Return on invested capitald | 10.1 | % | 7.9 | % | 6.6 | % | ||||||

| a | Average capitalization is calculated as the average of the sum of stockholders’ equity, net debt (total debt less cash and cash equivalents), the net present value of future operating lease commitments, and the receivables sold under the accounts receivable sales program for the most recent preceding 13 month ends. |

| b | Financing charges represent the estimated interest expense included in operating lease payments and A/R sales fees. |

| c | Taxes are calculated as the sum of monthly operating income, other expense, A/R sales, and an operating lease interest factor (estimated interest expense included in operating lease payments) multiplied by a federal tax rate respective to each month. |

| d | Return on invested capital is calculated as the total after-tax income excluding financing charges and 2004 charge divided by average capitalization. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s discussion and analysis relates to the financial condition and results of operations of Burlington Northern Santa Fe Corporation and its majority-owned subsidiaries and a variable interest entity for which Burlington Northern Santa Fe is the primary beneficiary, all of which are separate legal entities (collectively BNSF, Registrant or Company). The principal operating subsidiary of BNSF is the BNSF Railway Company (BNSF Railway). through which BNSF derives substantially all of its revenues. All earnings per share information is stated on a diluted basis.

INTRODUCTIONCOMPANY OVERVIEW

Through its subsidiaries, BNSF is engaged primarily in the rail transportation business. The rail operations of BNSF’s primary operating subsidiary, BNSF Railway, continues to be one of the primary rail transporters in North America withcomprise one of the largest railroad networks consisting ofin North America, with 32,000 route miles in 28 states and two Canadian provinces. Through one operating transportation services segment, BNSF Railway transports a wide range of products and commodities including the transportation of Consumer Products, Industrial Products, Coal and Agricultural Products. Based on

Additional operational information, including weekly reportingintermodal and carload unit reports as submitted to the American Association of American Railroads for 2004, BNSF’s share ofand annual reports submitted to the western United States rail traffic was approximately 46.4 percent.Surface Transportation Board, are available on the Company’s website at www.bnsf.com/investors.

BNSFEXECUTIVE SUMMARY

FISCAL YEAR 2005 – FINANCIAL OVERVIEW

2004 earnings per share were $2.10, which includes the impact of the charge discussed below. This compares to 2003 earnings per share of $2.19, which included the favorable cumulative effect of an accounting change of $0.10 per diluted share.

During the third quarter of 2004, BNSF recorded a $465 million pre-tax charge in 2004 related to reflect changesa change in its estimateBNSF’s estimates of unasserted asbestos liabilities and environmental liabilities. Of this amount, $293 million and $172 million were related

Operating expenses for 2004 increased 20 percent compared to 2003, primarily driven by the charge mentioned above. The increase in expenses was also the result of an 11 percent increase in gross ton-miles handled and significant fuel price increases.

BUSINESS OUTLOOK FOR 2006

RESULTS OF OPERATIONS

REVENUE TABLE

The following table presents BNSF’s revenue information by commodity group for the years ended December 31, 2005, 2004 2003 and 2002:2003:

Revenues (in millions) | Cars / units (in thousands) | Average revenue per car / unit | Revenues (in millions) | Cars / units (in thousands) | Average revenue per car / unit | |||||||||||||||||||||||||||||||||||||||||||

Year ended December 31, | 2004 | 2003 | 2002 | 2004 | 2003 | 2002 | 2004 | 2003 | 2002 | 2005 | 2004 | 2003 | 2005 | 2004 | 2003 | 2005 | 2004 | 2003 | ||||||||||||||||||||||||||||||

Consumer Products | $ | 4,245 | $ | 3,657 | $ | 3,353 | 4,859 | 4,336 | 3,880 | $ | 874 | $ | 843 | $ | 864 | $ | 5,156 | $ | 4,245 | $ | 3,657 | 5,306 | 4,859 | 4,336 | $ | 972 | $ | 874 | $ | 843 | ||||||||||||||||||

Industrial Products | 2,448 | 2,138 | 2,041 | 1,561 | 1,428 | 1,415 | 1,568 | 1,497 | 1,442 | 2,871 | 2,448 | 2,138 | 1,564 | 1,561 | 1,428 | 1,836 | 1,568 | 1,497 | ||||||||||||||||||||||||||||||

Coal | 2,277 | 2,025 | 2,071 | 2,216 | 2,048 | 2,097 | 1,028 | 989 | 988 | 2,448 | 2,277 | 2,025 | 2,238 | 2,216 | 2,048 | 1,094 | 1,028 | 989 | ||||||||||||||||||||||||||||||

Agricultural Products | 1,772 | 1,465 | 1,408 | 900 | 834 | 794 | 1,969 | 1,757 | 1,773 | 2,131 | 1,772 | 1,465 | 916 | 900 | 834 | 2,326 | 1,969 | 1,757 | ||||||||||||||||||||||||||||||

Total freight revenues | 10,742 | 9,285 | 8,873 | 9,536 | 8,646 | 8,186 | $ | 1,126 | $ | 1,074 | $ | 1,084 | 12,606 | 10,742 | 9,285 | 10,024 | 9,536 | 8,646 | $ | 1,258 | $ | 1,126 | $ | 1,074 | ||||||||||||||||||||||||

Other revenues | 204 | 128 | 106 | 381 | 204 | 128 | ||||||||||||||||||||||||||||||||||||||||||

Total operating revenues | $ | 10,946 | $ | 9,413 | $ | 8,979 | $ | 12,987 | $ | 10,946 | $ | 9,413 | ||||||||||||||||||||||||||||||||||||

EXPENSE TABLE

The following table presents BNSF’s expense information for the years ended December 31, 2005, 2004, 2003, and 20022003 (in millions):

Year Ended December 31, | 2004 | 2003 | 2002 | 2005 | 2004 | 2003 | ||||||||||||||

Compensation and benefits | $ | 3,322 | $ | 2,963 | $ | 2,894 | $ | 3,515 | $ | 3,322 | $ | 2,963 | ||||||||

Fuel | 1,959 | 1,335 | 1,093 | |||||||||||||||||

Purchased services | 1,424 | 1,252 | 1,146 | 1,714 | 1,424 | 1,252 | ||||||||||||||

Depreciation and amortization | 1,012 | 910 | 931 | 1,075 | 1,012 | 910 | ||||||||||||||

Equipment rents | 790 | 705 | 698 | 886 | 790 | 705 | ||||||||||||||

Fuel | 1,335 | 1,093 | 848 | |||||||||||||||||

Materials and other | 1,377 | a | 825 | 806 | 916 | 1,377 | a | 825 | ||||||||||||

Total operating expenses | $ | 9,260 | $ | 7,748 | $ | 7,323 | $ | 10,065 | $ | 9,260 | $ | 7,748 | ||||||||

Interest expense | $ | 409 | $ | 420 | $ | 428 | $ | 437 | $ | 409 | $ | 420 | ||||||||

Other expense, net | $ | 4 | $ | 14 | $ | 12 | $ | 37 | $ | 4 | $ | 14 | ||||||||

Income tax expense | $ | 482 | $ | 454 | $ | 456 | $ | 917 | $ | 482 | $ | 454 | ||||||||

| a | 2004 materials and other expense includes a $465 million pre-tax charge related to changes in estimates of the Company’s unasserted asbestos and environmental liabilities (see Note 10 of the Consolidated Financial Statements). |

YEAR ENDED DECEMBER 31, 2005 COMPARED WITH YEAR ENDED DECEMBER 31, 2004

BNSF recorded net income for 2005 of $1,531 million, or $4.01 per share, which included a $0.12 per share loss related to an agreement to sell certain line segments to the state of New Mexico (see Item 7, Management’s Discussion and Analysis of Financial Position and Results of Operations under the heading “New Mexico Department of Transportation”). In comparison, net income for 2004 was $791 million, or $2.10 per share, which included a $288 million, net of tax, or $0.77 per share charge for a change in the Company’s estimate of unasserted asbestos liabilities and environmental liabilities (see Note 10 of the Consolidated Financial Statements).

REVENUES

FREIGHT

Freight revenues of $12,606 million for 2005 were $1,864 million, or 17 percent, higher than 2004. Freight revenues were up due to a 5 percent increase in volumes, despite a decrease in car velocity from 199 miles per day in 2004 to approximately 190 miles per day in 2005. Freight revenues in 2005 included fuel surcharges of approximately $1.1 billion compared with approximately $350 million in the prior year. Growth in rates and fuel surcharges drove average revenue per car/unit up 12 percent in 2005 to $1,258 from $1,126 in 2004.

CONSUMER PRODUCTS The Consumer Products’ freight business consists of the following business areas: international intermodal, domestic intermodal, automotive, and perishables and dry boxcar. Consumer Products revenues of $5,156 million for 2005 were $911 million, or 22 percent, greater than 2004. The increase in Consumer Products revenues was strong in all sectors. The increase in average revenue per unit of 11 percent was primarily related to rate increases and increased fuel surcharges. |  | |

INDUSTRIAL PRODUCTS Industrial Products’ freight business consists of four business areas: building products, construction products, chemicals and plastic products, and petroleum products. | | |

Industrial Products revenues increased $423 million, or 17 percent, to $2,871 million for 2005. The revenue increase was primarily due to increased lumber, panel and paper traffic in the building products sector, as well as increased traffic in petroleum products, partially offset by decreased volumes in waste products in the building products sector as well as steel and taconite in the construction products sector. Rate increases along with increased fuel surcharges contributed to a 17 percent increase in average revenue per car. | ||

COAL

BNSF is one of the largest transporters of low-sulfur coal in the United States. Approximately 93 percent of all BNSF Railway’s coal tons originate from the Powder River Basin of Wyoming and Montana.

Coal revenues of $2,448 million for 2005 increased $171 million, or 8 percent, versus a year ago. Coal volumes increased slightly as a result of new customer business and higher demand from existing customers, partially offset by weather-related operational and maintenance disruptions in the Powder River Basin. Average revenue per car increased 6 percent primarily driven by contractual rate escalations and increased average length of haul.

AGRICULTURAL PRODUCTS The Agricultural Products’ freight business transports agricultural products including corn, wheat, soybeans, bulk foods, fertilizer and other products. |  | |

Agricultural Products revenues of $2,131 million for 2005 were $359 million, or 20 percent, higher than revenues for 2004. Average revenue per car increased 18 percent primarily driven by mix as a result of strong exports out of the Pacific Northwest, price increases and increased fuel surcharges. |

OTHER REVENUES

Other Revenues increased $177 million, or 87 percent, to $381 million for 2005 compared to 2004. This increase was primarily attributable to increases in storage-related revenues and volume growth, in addition to the acquisitions and volume growth of BNSF Logistics, a wholly-owned non-rail subsidiary that specializes in providing third-party logistic services.

EXPENSES

Total operating expenses for 2005 were $10,065 million, an increase of $805 million, or 9 percent, over 2004. The increase in operating expenses was the result of significant fuel price increases, a 5-percent increase in gross-ton miles handled and a $71 million pre-tax loss related to an agreement to sell certain line segments to the state of New Mexico, offset by lower asbestos and environmental costs due to the $465 million pre-tax charge taken in 2004 to reflect changes in the Company’s estimate of unasserted asbestos liabilities and environmental liabilities.

COMPENSATION AND BENEFITS

Compensation and benefits includes expenses for BNSF employee compensation and benefit programs. The primary factors influencing the expenses recorded are volume, headcount, utilization, wage rates, incentives earned during the period, benefit plan participation as well as pension-related expenses.

Compensation and benefits expenses of $3,515 million were $193 million, or 6 percent, higher than 2004. The increase was primarily related to the significant increase in freight volumes experienced in 2005. The increases in freight volumes drove an increase in crew training costs and an approximate 5 percent increase in employee headcount.

FUEL

Fuel expense is driven by market price, the level of locomotive consumption of diesel fuel and the effects of hedging activities.

Fuel expenses of $1,959 million for 2005 were $624 million, or 47 percent, higher than 2004. The increase in fuel expense is due to an increase in the average all-in cost per gallon of diesel fuel, as well as an increase in consumption driven by higher volumes. The average all-in cost per gallon of diesel fuel increased by 40 cents, or $566 million, which is comprised of an increase in the average purchase price of 53 cents, or $759 million, partially offset by an increase in the hedge benefit of 13 cents, or $193 million (2005 benefit of $531 million less 2004 benefit of $338 million). Consumption in 2005 was 1,402 million gallons compared with 1,344 million gallons in 2004, resulting in a $58 million increase in fuel expense.

In the future, benefits from hedging activities are expected to decrease as the Company increases its fuel surcharge program. When compared to 2005, operating income is expected to be negatively impacted by the combination of fuel prices, hedges and fuel surcharge recoveries.

PURCHASED SERVICES

Purchased services expense includes ramping (lifting of containers onto and off of cars); drayage (highway movements to and from railway facilities); maintenance of locomotives, freight cars and equipment; transportation costs over other railroads; technology services outsourcing; professional services; and other contract services provided to BNSF. Purchased services expense also includes purchased transportation costs for BNSF Logistics. The expenses are driven by the rates established in the related contracts and the volume of services required.

Purchased services expenses of $1,714 million for 2005 were $290 million, or 20 percent, higher than 2004. This increase was primarily due to increases in the following volume-related costs: approximately $75 million higher intermodal ramp costs; approximately $70 million higher locomotive, freight car and equipment maintenance expense; approximately $45 million higher purchased transportation costs for BNSF Logistics and approximately $30 million higher payments for transportation over other railroads.

DEPRECIATION AND AMORTIZATION

Depreciation and amortization expenses for the period are determined by using the group method of depreciation, applying a single rate to the gross investment in a particular class of property. Due to the capital-intensive nature of BNSF’s operations, depreciation expense is a significant component of the Company’s operating expense. The full effect of inflation is not reflected in operating expenses since depreciation is based on historical cost.

Depreciation and amortization expenses of $1,075 million for 2005 were $63 million, or 6 percent, higher than 2004. This increase was primarily due to ongoing capital expenditures.

EQUIPMENT RENTS

Equipment rents expense includes long-term and short-term payments primarily for locomotives, freight cars, containers and trailers. Variances in expense are driven primarily by volume, lease and rental rates, utilization of equipment and changes in business mix resulting in equipment usage variances.

Equipment rents expenses for 2005 of $886 million were $96 million, or 12 percent, higher than 2004. Expense increases of $70 million for freight car equipment and $26 million for locomotive leases were driven by increases in units resulting from significant volume increases as well as higher lease rates.

MATERIALS AND OTHER

Material expenses consist mainly of the costs involved to purchase mechanical and engineering materials and other items for construction and maintenance of property and equipment. Other expenses include personal injury claims, environmental remediation and derailments as well as employee separation costs, utilities, impairments of long-lived assets and property and miscellaneous taxes. The total is offset by gains on land sales and other recoveries.

Materials and other expenses of $916 million for 2005, which consists of approximately $360 million of materials expense with the remainder consisting of numerous other items, were $461 million, or 33 percent, lower than 2004. In 2005, materials and other expense was impacted by an impairment charge of $71 million related to the future sale of certain line segments as well as $70 million of increased material costs for locomotives, freight cars and track structure, partially offset by lower environmental and personal injury expense in 2005. However, the $465 million pre-tax charge recorded in 2004 to reflect a change in BNSF’s estimates of unasserted asbestos and environmental liabilities more than offset these changes by a significant amount.

INTEREST EXPENSE

Interest expense of $437 million for 2005 was $28 million, or 7 percent, higher than 2004. This increase was primarily the result of higher average interest rates in 2005.

OTHER EXPENSE, NET

Other expense of $37 million for 2005 was $33 million higher than in 2004. The increase in other expense, net was predominantly due to the receipt of interest income on a settlement that occurred in 2004, losses on BNSF’s participation in a synthetic fuel partnership for which tax credits are generated and higher accounts receivable sales fees driven primarily by higher interest rates.

YEAR ENDED DECEMBER 31, 2004 COMPARED WITH YEAR ENDED DECEMBER 31, 2003

BNSF recorded net income for 2004 of $791 million, or $2.10 per share. 2004 net income includes a $288 million, net of tax, or $0.77 per share charge for a change in the Company’s estimate of unasserted asbestos liabilities and environmental liabilities (see Note 10 of the Consolidated Financial Statements). In comparison, net income for 2003 was $816 million, or $2.19 per share, which includes the favorable cumulative effect of an accounting change of $39 million, net of tax, or $0.10 per share (see Note 2 of the Consolidated Financial Statements).

REVENUES

FREIGHT

Freight revenues of $10,742 million for 2004 were $1,457 million, or 16 percent, higher than 2003. Freight revenues in 2004 included fuel surcharges of $357approximately $350 million compared with $110approximately $100 million in the prior year. Average revenue per car/unit increased 5 percent in 2004 to $1,126 from $1,074 in 2003.

CONSUMER PRODUCTS

The Consumer Products’ freight business includes a significant intermodal component and consists of the following business areas: international, direct marketing, truckload, intermodal marketing companies, automotive, and perishables and dry boxcar.

Consumer Products revenues of $4,245 million for 2004 were $588 million, or 16 percent, greater than 2003. The increase in Consumer Products revenue is primarily due to double digit volume growth in the international, truckload, and perishables sectors. The increase in average revenue per unit of 4 percent is primarily related to rate increases and increased fuel surcharges.

INDUSTRIAL PRODUCTS

Industrial Products’ freight business consists of four business areas: building products, construction products, chemicals and plastics, and petroleum products.

Industrial Products revenues increased $310 million, or 15 percent, to $2,448 million for 2004. The revenue increase is primarily due to increased lumber, plywood, particle board

CONSUMER PRODUCTS Consumer Products revenues of $4,245 million for 2004 were $588 million, or 16 percent, greater than 2003. The increase in Consumer Products revenues was primarily due to double-digit volume growth in the international and domestic intermodal sectors. The increase in average revenue per unit of 4 percent was primarily related to rate increases and increased fuel surcharges. |  | |

INDUSTRIAL PRODUCTS | ||

Industrial Products revenues increased $310 million, or 15 percent, to $2,448 million for 2004. The revenue increase was primarily due to increased lumber, plywood, particleboard and paper traffic in the building products sector and increased business in steel, taconite and clay in the construction products sector, as well as increased traffic in petroleum products and plastics. Rate increases along with increased fuel surcharges contributed to a 5 percent increase in average revenue per car. |  |

COAL

BNSF is one of the largest transporters of low-sulfur coal in the United States. Approximately 90 percent of all BNSF Railway’s coal tons originate from the Powder River Basin of Wyoming and Montana.

Coal revenues of $2,277 million for 2004 increased $252 million, or 12 percent, versus a year ago. The increase iswas primarily a result of new customer business volumes and higher demand from existing customers. Average revenue per car increased 4 percent primarily driven by contractual rate escalations and increased average length of haul.

AGRICULTURAL PRODUCTS

The Agricultural Products’ freight business is the transportation of agricultural products including corn, wheat, soybeans, bulk foods, fertilizer, and other products.

Agricultural Products revenues of $1,772 million for 2004 were $307 million, or 21 percent, higher than revenues for 2003. This increase is primarily driven by strong corn and wheat exports out of the Pacific Northwest. The average revenue per car increased 12 percent primarily driven by the mix of commodity and destination price increases, increased fuel surcharges and increased average length of haul.

AGRICULTURAL PRODUCTS

Agricultural Products revenues of $1,772 million for 2004 were $307 million, or 21 percent, higher than revenues for 2003. This increase was primarily driven by strong corn and wheat exports out of the Pacific Northwest. The average revenue per car increased 12 percent primarily driven by the mix of commodity and destination price increases, increased fuel surcharges and increased average length of haul. |  |

OTHER REVENUES

Other Revenues increased $76 million, or 59 percent, to $204 million for 2004 compared to 2003. This increase iswas primarily attributable to increased volumes related to BNSF Logistics, a wholly-owned non-rail subsidiary that specializes in providing third-party logistic services, and demurrage.

EXPENSES

Total operating expenses for 2004 were $9,260 million, an increase of $1,512 million, or 20 percent, over 2003. The increase was primarily due to a $465 million pre-tax charge to reflect changes in the Company’s estimate of unasserted asbestos liabilities and environmental liabilities. The increase in operating expenses was also the result of an 11 percent increase in gross-ton miles handled and significant fuel price increases.

COMPENSATION AND BENEFITS

Compensation and benefits includes expenses for BNSF employee compensation and benefit programs. The primary factors influencing the expenses recorded are volume, headcount, utilization, wage rates, incentives earned during the period, benefit plan participation and pension expenses.

Compensation and benefits expenses of $3,322 million were $359 million, or 12 percent, higher than 2003. The increase iswas primarily related to the significant increase in volumes. These increases in traffic volume drove an approximate 3 percent increase in employee headcount as well as greater overtime and crew training costs. Improved financial performance has led to higher incentive expenses for the Company’s salaried and scheduled workforce. Additionally, BNSF recognized increased pension costs of $17 million.

FUEL

Fuel expenses of $1,335 million for 2004 were $242 million, or 22 percent, higher than 2003. The increase in fuel expense is due to an increase in the average all-in cost per gallon of diesel fuel, as well as an increase in consumption driven by higher volumes. The average all-in cost per gallon of diesel fuel increased by 9 cents, or $124 million, which is comprised of an increase in the average purchase price of 29 cents, or $394 million, partially offset by an increase in the hedge benefit of 20 cents, or $270 million (2004 benefit of $338 million less 2003 benefit of $68 million). Consumption in 2004 was 1,344 million gallons compared with 1,213 million gallons in 2003.

PURCHASED SERVICES

Purchased services expense includes ramping and drayage, maintenance of locomotive and freight car equipment and technology services outsourcing, and other services, such as vegetation control, provided to BNSF, as well as purchased transportation costs for BNSF Logistics. The expenses are driven by the rates established in the service contracts and the volume of services required.

Purchased services expenses of $1,424 million for 2004 were $172 million, or 14 percent, higher than 2003 primarily due to higher costs for locomotive contract maintenance expense of $50 million, haulage expense of $27 million and intermodal ramp costs of $20 million for contracted transportation over other railroads, all of which were primarily driven by higher volume. Additionally, purchased transportation costs for BNSF Logistics increased $45 million as a result of increases in its business.

DEPRECIATION AND AMORTIZATION

Depreciation and amortization expenses for the period are determined by using the group method of depreciation, applying a single rate to the gross investment in a particular class of property. Due to the capital-intensive nature of BNSF’s operations, depreciation expense is a significant component of the Company’s operating expense. The full effect of inflation is not reflected in operating expenses since depreciation is based on historical cost.

Depreciation and amortization expenses of $1,012 million for 2004 were $102 million, or 11 percent, higher than 2003. The majority of the increase iswas due to ongoing capital expenditures. Additionally, about $40 million of this increase was due to the expiration of credits to depreciation expense resulting from the application of purchase accounting at the time of the merger in 1996. As a result of a depreciation rate study completed with the assistance of third-party consultants in 2004, BNSF adopted new depreciation rates applied to track structure. This change in rate caused a net decrease in annual depreciation expense of approximately $5 million for 2004 and approximately $16 million on an ongoing annual basis, as calculated using the asset base at the time of the rate change.

EQUIPMENT RENTS

Equipment rents expense includes long-term and short-term payments primarily for locomotives, freight cars, containers and trailers. Variances in expense are driven primarily by volume, rental rates, the results of lease negotiations, utilization of owned equipment versus leased equipment, and changes in business mix resulting in equipment usage variances.

Equipment rents expenses for 2004 of $790 million were $85 million, or 12 percent, higher than 2003. Expense increases of $68 million for freight car equipment and $17 million for locomotive leases are predominantly related to significant volume increases.

FUEL

Fuel expense is driven by the level of locomotive consumption, market price and the effects of hedging activities.

Fuel expenses of $1,335 million for 2004 were $242 million, or 22 percent, higher than 2003. The increase in fuel expense is due to an increase in the average all-in cost per gallon of diesel fuel, as well as an increase in consumption driven by higher volumes. The average all-in cost per gallon of diesel fuel increased by 9-cents, or $124 million, which is comprised of an increase in the average purchase price of 29 cents, or $394 million, partially offset by an increase in the hedge benefit of 20-cents, or $270 million (2004 benefit of $338 million less 2003 benefit of $68 million). Consumption in 2004 was 1,344 million gallons compared with 1,213 million gallons in 2003.

MATERIALS AND OTHER

Material expenses consist mainly of the costs involved to purchase mechanical and engineering materials and other items for construction and maintenance of property and equipment. Other expenses include personal injury claims, environmental remediation, and derailments as well as employee separation costs, utilities, and property and miscellaneous taxes. The total is offset by gains on land sales and other recoveries.