UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934(Mark One)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 20042005

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number 001-31240

Newmont Mining Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 84-1611629 | |

(State or Other Jurisdiction Incorporation or Organization) | (I.R.S. Employer

| |

1700 Lincoln Street Denver, Colorado | 80203 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code (303) 863-7414

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $1.60 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

(Check one): Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark whether the Registrantregistrant is an accelerated filera shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨ No x

StateAs of June 30, 2005, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates computed by reference toof the registrant was $17,126,388,000 based on the closing sale price at whichas reported on the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2004: $17,161,160,854.New York Stock Exchange. There were 409,987,107417,383,659 shares of common stock outstanding (and 35,698,48831,145,915 exchangeable shares exchangeable into Newmont Mining Corporation common stock on a one-for-one basis) on March 3, 2005.

February 22, 2006.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s definitive Proxy Statement submitted to the Registrant’s stockholders in connection with our 20052006 Annual Stockholders Meeting to be held on April 27, 2005,25, 2006, are incorporated by reference into Part III of this report.

| Page | ||||||||

| PART I | ||||||||

ITEM 1. | 1 | |||||||

| 1 | ||||||||

| 1 | ||||||||

| 2 | ||||||||

| 3 | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 6 | ||||||||

| 6 | ||||||||

| 6 | ||||||||

| 7 | ||||||||

| 7 | ||||||||

| 8 | ||||||||

ITEM 1A. | ||||||||

ITEM 2. | 16 | |||||||

| 16 | ||||||||

| 17 | ||||||||

| 17 | ||||||||

ITEM 3. | ||||||||

ITEM 4. | ||||||||

ITEM 4A. | ||||||||

| PART II | ||||||||

ITEM 5. | ||||||||

ITEM 6. | ||||||||

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF CONSOLIDATED FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 37 | ||||||

| 37 | ||||||||

| 39 | ||||||||

| 40 | ||||||||

| 47 | ||||||||

| 58 | ||||||||

| 76 | ||||||||

| 76 | ||||||||

i

ITEM 7A. | ||||||||

ITEM 8. | ||||||||

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |||||||

ITEM 9A. | ||||||||

ITEM 9B. | ||||||||

| PART III | ||||||||

ITEM 10. | ||||||||

ITEM 11. | ||||||||

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |||||||

ITEM 13. | ||||||||

ITEM 14. | ||||||||

| PART IV | ||||||||

ITEM 15. | ||||||||

NUSA TENGGARA PARTNERSHIP V.O.F. CONSOLIDATED FINANCIAL STATEMENTS | NT-1 | |||||||

| S-1 | ||||||||

| E-1 | ||||||||

ii

This document (including information incorporated herein by reference) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which involve a degree of risk and uncertainty due to various factors affecting Newmont Mining Corporation and our affiliates and subsidiaries. For a discussion of some of these factors, see the discussion in Item 1A, Risk Factors, of this report.

| ITEM 1. | BUSINESS (dollars in millions except per share, per ounce and per pound amounts) |

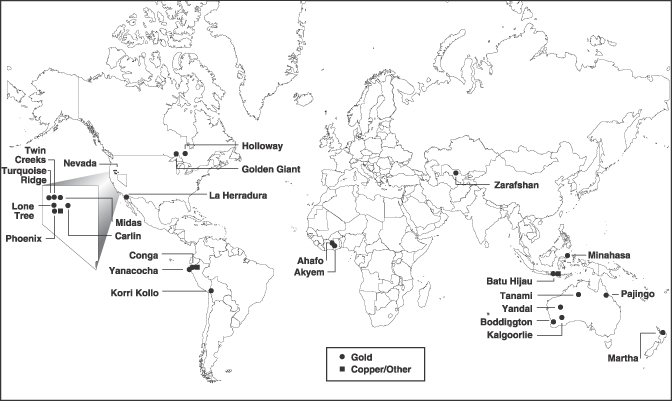

Newmont Mining Corporation is the world’s largestprimarily a gold producer with significant assets or operations in the United States, Australia, Peru, Indonesia, Ghana, Canada, Uzbekistan, Bolivia, New Zealand Ghana and Mexico. As of December 31, 2004,2005, Newmont had proven and probable gold reserves of 92.493.2 million equity ounces and an aggregate land position of approximately 51,50050,600 square miles (133,500(131,100 square kilometers). In 2004, we derived more than 65% of our equity gold sales from politically and economically stable countries, namely the United States, Australia and Canada. Newmont is also engaged in the production of silver, copper, and zinc.

principally through its Batu Hijau operation in Indonesia. Newmont Mining Corporation’s original predecessor corporation was incorporated in 1921 under the laws of Delaware. On February 13, 2002, at a special meeting of the stockholders of Newmont, stockholders approved adoption of an Agreement and Plan of Merger that provided for a restructuring of Newmont to facilitate the February 2002 acquisitions described below and to create a more flexible corporate structure. Newmont merged with an indirect, wholly-owned subsidiary, which resulted in Newmont becoming a wholly-owned subsidiary of a new holding company. The new holding company was renamed Newmont Mining Corporation. There was no impact to the consolidated financial statements of Newmont as a result of this restructuring and former stockholders of Newmont became stockholders of the new holding company. In this report, “Newmont,” the “Company” and “we” refer to Newmont Mining Corporation and/or our affiliates and subsidiaries.

On February 16, 2002, Newmont completed the acquisition of Franco-Nevada Mining Corporation Limited, a Canadian company, pursuant to a Plan of Arrangement. On February 20, 2002, Newmont gained control of Normandy Mining Limited (“Normandy”), an Australian company, through an off-market bid for all of the ordinary shares of Normandy. On February 26, 2002, when Newmont’s off-market bid for Normandy expired, Newmont had a relevantan interest in more than 96% of Normandy’s outstanding shares. Newmont exercised compulsory acquisition rights under Australian law to acquire all of the remaining shares of Normandy in April 2002. The results of

Of Newmont’s revenues in 2005, 2004, and 2003, 24%, 24% and 30%, respectively, were derived from the United States, with the balance derived from operations of Normandyin Peru, Australia, Indonesia, Canada, Mexico, Bolivia, New Zealand and Franco-Nevada have been included in this Annual Report and Newmont’s financial statements from February 16, 2002 forward.

In November 2003, Newmont completed a public offering of 25 million shares of common stock, receiving proceeds of approximately $1.0 billion.

Uzbekistan. For the years ended December 31,2005, 2004 and 2003, 39%, 34% and 2002, Newmont had34%, respectively, of revenues came from Peru; 19%, 22% and 25%, respectively, from Australia; and 8%, 9% and 1%, respectively, from Indonesia. In 2005, 2004 and 2003, 54%, 52% and 54%, respectively, of $4.52 billion, $3.16 billion,the Company’s long-lived assets were located in the United States, with the balance located in Peru, Australia, Indonesia, Ghana, Canada, Mexico, Bolivia, and $2.62 billion, respectively. InUzbekistan. For the years 2005, 2004 and 2003, 11%, 11% and 2002, Newmont had net income applicable to common shares12%, respectively, of $434.5 million, $475.7 millionthe Company’s long-lived assets were located in Peru; 7%, 10% and $154.3 million, respectively.(1)

16%, respectively, were located in Australia; and 17%, 19% and 10%, respectively, were located in Indonesia.

Newmont’s corporate headquarters are in Denver, Colorado, USA. In this report, “Newmont,” the “Company”, “our” and “we” refer to Newmont Mining Corporation and/or our affiliates and subsidiaries. All dollars are in millions, except per share, per ounce, and per pound amounts.

For additional information, see Item 7, Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations.

Segment Information, Export Sales, etc.

Newmont predominantly operates in a single industry, namely exploration for and production of gold and copper. Newmont’sgold. Our major operations are in North America, South America,Nevada, Peru, Indonesia and Australia/New Zealand. Newmont also hasZealand and we have two significant development projects in Ghana, West Africa. NewmontGhana. We also hashave a Merchant Banking Segment and an Exploration Segment. See Note 2528 to the Consolidated Financial Statements for information relating to our business segments, our domestic and export sales, and our customers.

Gold

General.Newmont sold 7.0had consolidated sales of 8.6 million equity ounces of gold (6.5 million equity ounces) in 2005, 8.8 million ounces (7.0 million equity ounces) in 2004 7.4and 8.4 million ounces (7.4 million equity ouncesounces) in 2003. For 2005, 2004 and 2003, 85%, 82% and 7.6 million equity ounces in 2002.100%, respectively, of our net revenues were attributable to gold sales. Of our 2005 gold sales, approximately 39% came from Yanacocha, 28% from Nevada, 19% from Australia/New Zealand and 8% from Indonesia. References in this report to “equity ounces” or “equity pounds” mean that portion of gold or base metals respectively, produced, sold or included in proven and probable reserves that is attributable to our ownership or economic interest. For the years ended December 31, 2004, 2003 and 2002, 81%, 98% and 98%, respectively, of Newmont’s revenues were attributable to gold sales.

Approximately 39% of Newmont’s equity gold sales in 2004 and 2003 came from North American operations and 61% came from overseas operations. Of Newmont’s 2004 equity gold sales, approximately 22% came from Yanacocha and 7% from Indonesia. As of December 31, 2004, approximately 46% of our total long-lived assets were related to operations outside North America, with 19% of that total in Indonesia and 11% in Peru.

Most of Newmont’sour revenue comes from the sale of refined gold in the international market. The end product at each of Newmont’sour gold operations, however, is generally doré bars. In certain limited circumstances Newmont sells doré directly to a customer, but generally, because doréDoré is an alloy consisting mostly of gold but also containing silver, copper and other metals, doré bars aremetals. Doré is sent to refiners to produce bullion that meets the required market standard of 99.95% pure gold. Under the terms of refining agreements, the doré bars are refined for a fee, and Newmont’sour share of the refined gold and the separately-recovered silver are credited to Newmont’sour account or delivered to buyers, except in the case of the doré produced from Newmont’sour operation in Uzbekistan. Doré from that operation is refined locally and the refined gold is physically returned to Newmontus for sale in international markets.

Newmont has interests Gold sold from Batu Hijau is contained in two gold refining businesses: a 40% interest in the AGR Matthey joint venture in Australia, which is one of the world’s largest gold refineries and the largest distributor into the Asian market; and a 50% interest in European Gold Refineries SA in Switzerland, which owns 100% of a gold refining business and 66.65% of a gold distribution business.

concentrate.

Gold Uses.Gold has two main categories of use—productuse: fabrication and investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors buy gold bullion, official coins and high-karat jewelry.

Gold Supply. The worldwide supply of gold consists of a combination of new production from mining and the draw-down of existing stocks of bullion and fabricated gold held by governments, financial institutions, industrial organizations and private individuals. In recent years, mine production has accounted for 60% to 70% of the total annual supply of gold.

Gold Price. The following table presents the annual high, low and average afternoon fixing prices for gold over the past ten years, expressed in U.S. dollars per ounce on the London Bullion Market.

Year | High | Low | Average | High | Low | Average | ||||||||||||

1995 | $ | 396 | $ | 372 | $ | 384 | ||||||||||||

1996 | $ | 415 | $ | 367 | $ | 388 | $ | 415 | $ | 367 | $ | 388 | ||||||

1997 | $ | 362 | $ | 283 | $ | 331 | $ | 362 | $ | 283 | $ | 331 | ||||||

1998 | $ | 313 | $ | 273 | $ | 294 | $ | 313 | $ | 273 | $ | 294 | ||||||

1999 | $ | 326 | $ | 253 | $ | 279 | $ | 326 | $ | 253 | $ | 279 | ||||||

2000 | $ | 313 | $ | 264 | $ | 279 | $ | 313 | $ | 264 | $ | 279 | ||||||

2001 | $ | 293 | $ | 256 | $ | 271 | $ | 293 | $ | 256 | $ | 271 | ||||||

2002 | $ | 349 | $ | 278 | $ | 310 | $ | 349 | $ | 278 | $ | 310 | ||||||

2003 | $ | 416 | $ | 320 | $ | 363 | $ | 416 | $ | 320 | $ | 363 | ||||||

2004 | $ | 454 | $ | 375 | $ | 410 | $ | 454 | $ | 375 | $ | 410 | ||||||

2005 (through March 3, 2005) | $ | 435 | $ | 411 | $ | 424 | ||||||||||||

2005 | $ | 536 | $ | 411 | $ | 444 | ||||||||||||

2006 (through February 22, 2006) | $ | 572 | $ | 524 | $ | 552 | ||||||||||||

Source: Kitco and Reuters |

On March 3, 2005,February 22, 2006, the afternoon fixing price for gold on the London Bullion Market was $430.20$553 per ounce and the spot market price of gold on the New York Commodity Exchange was $429.40$553 per ounce.

NewmontWe generally sells itssell our gold or doré at the prevailing market prices during the month in which the gold or doré is delivered to the customer. Newmont recognizesWe recognize revenue from a sale when the price is determinable, the gold or doré has been delivered, the title has been transferred to the customer and collection of the sales price is reasonably assured.

Copper

General. At December 31, 2004,2005, Newmont had a 52.875% economic interest (a 45% ownership interest) in the Batu Hijau mineoperation in Indonesia, which began production in 1999. Production at Batu Hijau is in the form of a copper/gold concentrate that is sold to smelters for smeltingfurther treatment and refining. During 2004,2005, Batu Hijau sold concentrates containing 378.8 million equity pounds of copper and 396,300 equity ounces of gold. The 100% owned Golden Grove operation in Western Australia produces concentrates that contain copper, gold, lead and zinc. Golden Grove sold concentrates containing 43.5572.7 million pounds of payable copper during 2004. Except for hedged commitments (see Note 16 to the Consolidated Financial Statements), the majorityand 720,500 ounces of Newmont’s copper production is sold under long-term contracts at market prices,payable gold. For 2005 and the balance on the spot market. For the years ended December 31, 2004, 200315% and 2002, 19%, 2% and 1%18%, respectively, of Newmont’sour net revenues were attributable to copper sales. During 2005, Newmont sold its Golden Grove copper/zinc operation in Australia.

Copper Uses. Refined copper the final product from the treatment of concentrates, is incorporated into wire and cable products for use in the construction, electric utility, communications and transportation industries. Copper is also used in industrial equipment and machinery, consumer products and a variety of other electrical and electronic applications, and is also used to make brass. Copper substitutes include aluminum, plastics, stainless steel and fiber optics. Refined, or cathode, copper is also an internationally traded commodity.

Copper Supply. The supply of copper consists of a combination of production from mining and recycled scrap material. Copper supply has not kept pace with increasing demand in recent years, resulting in price increases reflected in the chart below.

Copper Price. The price of copper is quoted on the London Metal Exchange in terms of dollars per metric ton of high grade copper. The volatility of the copper market is illustrated by the following table which showspresents the dollar per pound equivalent of the high, low and average prices of high grade copper on the London Metal Exchange in each ofover the lastpast ten years.

Year | High | Low | Average | High | Low | Average | ||||||||||||

1995 | $ | 1.47 | $ | 1.23 | $ | 1.33 | ||||||||||||

1996 | $ | 1.29 | $ | 0.83 | $ | 1.04 | $ | 1.29 | $ | 0.83 | $ | 1.04 | ||||||

1997 | $ | 1.23 | $ | 0.77 | $ | 1.03 | $ | 1.23 | $ | 0.77 | $ | 1.03 | ||||||

1998 | $ | 0.85 | $ | 0.65 | $ | 0.75 | $ | 0.85 | $ | 0.65 | $ | 0.75 | ||||||

1999 | $ | 0.84 | $ | 0.61 | $ | 0.71 | $ | 0.84 | $ | 0.61 | $ | 0.71 | ||||||

2000 | $ | 0.91 | $ | 0.73 | $ | 0.82 | $ | 0.91 | $ | 0.73 | $ | 0.82 | ||||||

2001 | $ | 0.83 | $ | 0.60 | $ | 0.72 | $ | 0.83 | $ | 0.60 | $ | 0.72 | ||||||

2002 | $ | 0.77 | $ | 0.64 | $ | 0.71 | $ | 0.77 | $ | 0.64 | $ | 0.71 | ||||||

2003 | $ | 1.05 | $ | 0.70 | $ | 0.81 | $ | 1.05 | $ | 0.70 | $ | 0.81 | ||||||

2004 | $ | 1.49 | $ | 1.06 | $ | 1.30 | $ | 1.49 | $ | 1.06 | $ | 1.30 | ||||||

2005 (through March 3, 2005) | $ | 1.54 | $ | 1.39 | $ | 1.46 | ||||||||||||

2005 | $ | 2.11 | $ | 1.39 | $ | 1.67 | ||||||||||||

2006 (through February 22, 2006) | $ | 2.33 | $ | 2.06 | $ | 2.20 | ||||||||||||

Source: London Metal Exchange |

On March 3, 2005,February 22, 2006, the closing price of high grade copper was $1.51$2.28 per pound on the London Metal Exchange.

Newmont generally avoids gold hedging. Newmont’sOur philosophy is to provide shareholders with leverage to changes in metal pricesthe gold price by selling itsour gold production at market prices. Newmont has, on a limited basis,We have entered into derivative contracts to protect the selling price for certain anticipated gold and copper production and to manage risks associated with commodities, interest rates and foreign currencies.

At the time of Normandy’s acquisition, three of Normandy’s affiliates had substantial derivative instrument positions. Normandy entered into gold forward sales contracts with fixed and floating gold lease rates, but did not enter into contracts that required margin calls and had no outstanding long-dated sold call options.

Following the acquisition, and in accordance with Newmont’s philosophy regarding gold hedging, the Normandy hedge positions were reduced by approximately 9.6 million ounces from February 16, 2002 to December 31, 2004. Gold forward sales contracts and other “committed hedging obligations” were reduced by 7.5 million ounces by delivering production into the contracts or through early close-outs. Similarly, uncommitted contracts for 2.1 million ounces were either delivered into, were allowed to lapse or were closed out early. As of December 31, 2004, the Normandy hedge positions had been reduced to 324,750 uncommitted ounces with a negative mark-to-market valuation of $9 million.

During the year ended December 31, 2004, Newmont entered into copper option collar contracts.

For additional information, see Hedging in Item 7A, Quantitative and Qualitative Disclosures about Market Risk, and Note 1621 to the Consolidated Financial Statements.

Merchant Banking is a “reportable segment” for financial reporting purposes. Merchant Banking, also referred to as Newmont Capital, manages a Royalty Portfolio,royalty portfolio, an Equity Portfolio, andequity portfolio, a Downstream Gold Refining downstream gold refining

business, and engages in Value Realizationportfolio management activities (managing interests in oil and gas, iron ore and coal properties as well as providing in-house investment banking and advisory services).

Merchant Banking manages Newmont’s Royalty Portfolio.royalty portfolio. Royalties generally offer a natural hedge against lower gold prices by providing free cash flow from a diversified set of assets with limited operating, capital or environmental risk, while retaining upside exposure to further exploration discoveries and reserve expansions. Merchant Banking seeks to grow Newmont’sthe royalty portfolio in a number of different ways, and looks for opportunities to acquire existing royalties from third parties or to create them in connection with transactions. Merchant Banking also identifies current Newmont properties or exploration targets for sale if they are incompatible with our core objectives.non-core in nature. In the case of a sale, Merchant Banking often seeks to retain royalty or other future participation rights in addition to cash or other consideration received in the sale. Through this process, Newmont intends to continue to benefit from any discoveries made by other operators on lands on which we have a

In 2005, our royalty and to obtain revenues from the properties without incurring operating or capital risk.

In 2004, Newmont’s royalty interests and investmentsequity portfolios generated $65.8 million$79 inRoyalty and dividend income. Newmont hasWe have royalty interests in Barrick Gold Corporation’s (“Barrick”) Goldstrike, and Eskay Creek, mines, Placer Dome’s Henty and Bald Mountain mines and Stillwater Mining’s Stillwater and East Boulder palladium-platinum mines, among others. NewmontWe also hashave a significant oil and gas royalty portfolio in western Canada. During the year, new royalties were added through property transactions and asset sales. A land lease program in Nevada is accelerating exploration of non-core lands with Newmont retaining royalties and future participation rights. For additional information regarding Newmont’sour royalty portfolio, see Item 2, Properties, Royalty Properties, below.

As of December 31, 2004,2005, Merchant Banking’s Equity Portfolioequity portfolio had a market value of approximately $0.5 billion.$940. The Equity Portfolioequity portfolio is primarily composed of our investments in Kinross Gold Corporation, Canadian Oil Sands Trust, Shore Gold, Inc., Mirimar Mining Corporation and Gabriel Resources, Ltd.

Merchant Banking also manages our interests in downstream gold refining and distribution businesses (40% interest in AGR Matthey Joint Venture (“AGR”) and 50% interest in European Gold Refineries (“EGR”)). Merchant Banking earned $2.6 million$4 inEquity income (loss) of affiliatesthrough its investments in AGR and EGR in 2004.2005.

Merchant Banking’s Value Realizationportfolio management activities include managing the reserve delineation program on our 100% owned heavy oil sands leases in Alberta, Canada, and advancing our other interests in coal, iron ore and natural gas.

Merchant Banking provides advisory services to Newmont to assist it in managing itsthe portfolio of operating and property interests. The Merchant Banking group helps Newmont maximize net asset value per share and increase cash flow, earnings and reserves by working with Newmont’sthe exploration, operations and finance teams to prioritize near-term goals within longer-term strategies. Merchant Banking is engaged in developing value optimization strategies for operating and non-operating assets, business development activities, potential merger and acquisition analysis and negotiations, monetizing inactive exploration properties, capitalizing on Newmont’s proprietary technology and know-how and acting as an internal resource for other corporate groups to improve and maximize business outcomes. In 2004,2005, Merchant Banking’sBanking provided assistance was provided in the sale of non-core properties, including BronzewingGolden Grove in Australia, PeramaOvacik in GreeceTurkey and Midwest UraniumMezcala in Canada. In addition, Merchant Banking participated in the restructuring of Australian Magnesium Corporation, which eliminated all remaining Newmont obligations.

Mexico.

A key aspect of these advisory services is assisting Newmont in extracting economies of scale with its partners and neighboring mines. Merchant Banking continues to evaluate district optimization opportunities in Nevada, Australia and Canada, covering a broad range of alternatives, including asset exchanges, unitization, joint ventures, partnerships, sales, spinouts and buyouts.

Exploration is a “reportable segment” for financial reporting purposes. Newmont’s exploration group is responsible for all activities, regardless of location, associated with the Company’s world-wide efforts to discover new mineralized material and, if successful, advance such mineralized material into proven and probable reserves.

Exploration work is conducted in areas surrounding our existing mines for the purpose of locating additional deposits and determining mine geology, and in other prospective gold regions globally. Near-mine exploration can result

in the discovery of new gold mineralization, which will receive the economic benefit of existing operating, processing, and administrative infrastructures. Greenfields exploration is where a discovery of new gold mineralization would likely require the investment of new capital to build a separate, stand-alone operation away from any of the Company’s existing infrastructure. Our exploration teams employ state-of-the-art technology, including airborne geophysical data acquisition systems, satellite location devices and field-portable imaging systems, as well as geochemical and geological prospecting methods, to identify prospective targets. NewmontWe spent $192.4 million$147 in 2005, $107 in 2004 $115.2 millionand $76 in 2003 and $88.9 million in 2002 onExploration research and development.

As of December 31, 2004, Newmont2005, we had proven and probable gold reserves of 92.493.2 million equity ounces. As a result of exploration efforts and the assumption of a higher gold price, NewmontWe added 12.49.4 million equity ounces to proven and probable reserves, in 2004, with 11.38.6 million equity ounces of depletion and divestitures and reclassifications during 2005. A reconciliation of the year.

In Nevada, exploration efforts resultedchanges in proven and probable reserves during the past three years is as follows:

| (millions of equity ounces) | 2005 | 2004 | 2003 | ||||||

Opening balance | 92.4 | 91.3 | 86.9 | ||||||

Additions(1)(2) | 9.4 | 12.4 | 15.1 | ||||||

Acquisitions | — | — | 2.3 | ||||||

Depletion | (8.3 | ) | (8.3 | ) | (8.8 | ) | |||

Reclassifications(3) | — | (2.0 | ) | — | |||||

Other divestments | (0.3 | ) | (1.0 | ) | (4.4 | ) | |||

Closing balance | 93.2 | 92.4 | 91.3 | ||||||

| (1) | Additions attributable to the Exploration Segment |

Total additions | 9.4 | 12.4 | 15.1 | ||||||

Previously valued in purchase accounting | (1.2 | ) | (1.9 | ) | (6.5 | ) | |||

Reclassifications(3) | — | (2.0 | ) | — | |||||

| 8.2 | 8.5 | 8.6 | |||||||

| (2) | The impact of the change in gold price on reserve additions was 2.6, 3.8 and 2.8 million equity ounces in 2005, 2004 and 2003, respectively. |

| (3) | Yanacocha reassessed the challenges involved in obtaining required permits for Cerro Quilish, primarily related to increased community concerns. Based upon this reassessment, Yanacocha reclassified 3.9 million ounces (2.0 million equity ounces) from proven and probable reserves to mineralized material not in reserve as of December 31, 2004. |

In Nevada, exploration efforts during 2005 added 2.2 million equity ounces to proven and probable reserves, offset by depletion of 34.02.9 million equity ounces, resulting in total proven and probable reserves in Nevada of 33.3 million equity ounces as of December 31, 2004, after depletion of 3.0 million equity ounces during 2004.

2005.

In Peru, equity gold reserves increased to 16.616.8 million ounces, after depletion of 2.02.4 million ounces and a reclassification of 2.0 million ounces to mineralized material not in reserves at Cerro Quilish.ounces. At Minas Conga, 4.51.6 million equity ounces of gold and 1.10.5 billion equity pounds of copper were added to proven and probable reserves. Minas Conga is a development project that currently consists of two gold-copper porphyry deposits located northeast of the Minera Yanacocha operating area in the provinces of Celendin, Cajamarca and Hualgayoc.

In Australia/New Zealand, the Company depleted 1.9replaced depletion of 1.7 million equity ounces during 2004.2005. Australia/New Zealand reported proven and probable reserves of 14.9 million equity ounces as of December 31, 2005.

At Batu Hijau, the Company depleted 0.4 billion equity pounds of copper and 0.5 million equity ounces of gold during 2005. Batu Hijau had proven and probable reserves of 15.1 million equity ounces at December 31, 2004.

At Batu Hijau, positive mine optimization efforts resulted in proven and probable reserves of 6.36.1 billion equity pounds of copper and 7.26.7 million equity ounces of gold as of December 31, 2004, which approximated 2003 reserves, notwithstanding depletion of approximately 450 million equity pounds of copper and 500,000 equity ounces of gold.2005.

In addition, exploration and mine development efforts in 2004 focused onAt the Ahafo and Akyem projects in Ghana, substantially increasing proven and probable reserves thereincreased by 3.01.6 million and 1.1 million equity ounces, respectively. As of December 31, 2004,2005, the Company reported reserves of 10.612.2 million ounces at Ahafo and 5.46.5 million equity ounces at Akyem.

For additional information, see Item 2, Properties, Proven and Probable Reserves.

Other than operating licenses for our mining and processing facilities, there are no third party patents, licenses or franchises material to Newmont’sour business. In many countries, however, we conduct our mining and exploration activities pursuant to concessions granted by, or under contract with, the host government. These countries include, among others, Australia, Bolivia, Canada, Ghana, Indonesia, Peru, New Zealand, Mexico and Uzbekistan. The concessions and contracts are subject to the political risks associated with foreign operations. See Item 1A, Risk Factors, Risks Related to Newmont Operations, below. For a more detailed description of our Indonesian ContractsContract of Work, see Item 2, Properties, below.

Condition of Physical Assets and Insurance

Our business is capital intensive, requiring ongoing capital investment for the replacement, modernization or expansion of equipment and facilities. For more information, see Item 7, Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, Liquidity and Capital Resources, below.

We maintain insurance policies against property loss and business interruption and insure against risks that are typical in the operation of our business, in amounts that we believe to be reasonable. Such insurance, however, contains exclusions and limitations on coverage, particularly with respect to environmental liability and political risk. There can be no assurance that claims would be paid under such insurance policies in connection with a particular event. See Item 1A, Risk Factors, Risks Related to Newmont Operations, below.

Newmont’s United States mining and exploration activities are subject to various federal and state laws and regulations governing the protection of the environment, including the Clean Air Act; the Clean Water Act; the Comprehensive Environmental Response, Compensation and Liability Act; the Emergency Planning and Community Right-to-Know Act; the Endangered Species Act; the Federal Land Policy and Management Act; the National Environmental Policy Act; the Resource Conservation and Recovery Act; and related state laws. These laws and regulations are continually changing and are generally becoming more restrictive. Newmont’sOur activities outside the United States are also subject to governmental regulations for the protection of the environment. In general, environmental regulations have not had, and are not expected to have, a material adverse impact on Newmont’sour operations or our competitive position.

We conduct our operations so as to protect public health and the environment and believe our operations are in compliance with applicable laws and regulations in all material respects. Each operating Newmont mine has a reclamation plan in place that meets all applicable legal and regulatory requirements. We have made, and expect to make in the future, expenditures to comply with such laws and regulations. We have made estimates of the amount of such expenditures, but cannot precisely predict the amount of such future expenditures. Estimated future reclamation costs are based principally on legal and regulatory requirements. At December 31, 2004, $410.3 million2005, $431 was accrued for reclamation costs relating to currently producing mineral properties.

Newmont isWe are also involved in several matters concerning environmental obligations associated with former, primarily historic, mining activities. Generally, these matters concern developing and implementing remediation plans at the various sites. We believe that the related environmental obligations associated with these sites are

similar in nature with respect to the development of remediation plans, their risk profile and the activities required to meet general environmental standards. Based upon our best estimate of our liability for these matters, $74.9 million$77 was accrued as of December 31, 20042005 for such obligations associated with properties previously owned or operated by Newmontus or our subsidiaries. These amounts are included inOther current liabilities andReclamation andremediation liabilities.Depending upon the ultimate resolution of these matters, we believe that it is reasonably possible that the liability for these matters could be as much as 81%101% greater or 34% lower than the amount accrued as of December 31, 2004.2005. The amounts accrued for these matters are reviewed periodically based upon facts and circumstances available at the time. Changes in estimates are charged to costs and expenses in the period estimates are revised.

For a discussion of the most significant reclamation and remediation activities, see Item 7, Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, and Notes 1513 and 2730 to the Consolidated Financial Statements, below.

There were approximately 14,00015,000 people employed by Newmont and our affiliates worldwide atas of December 31, 2004.

2005.

Certain statements contained in this report (including information incorporated by reference) are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provided for under these sections. Our forward-looking statements include, without limitation:

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. Such risks include, but are not

limited to: the price of gold, copper and copper;other commodities; currency fluctuations; geological and metallurgical assumptions; operating performance of equipment, processes and facilities; labor relations; timing of receipt of necessary governmental permits or approvals; domestic and foreign laws or regulations, particularly relating to the environment and mining; domestic and international economic and political conditions; the ability of Newmont to obtain or maintain necessary financing; and other risks and hazards associated with mining operations. More detailed information regarding these factors is included in Item 1, Business, Item 1A, Risk Factors, and elsewhere throughout this report. Given these uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements.

All subsequent written and oral forward-looking statements attributable to Newmont or to persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Newmont disclaims any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Newmont maintains an internet web site atwww.newmont.com.www.newmont.com. Newmont makes available, free of charge, through the Investor Information section of the web site, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Section 16 filings and all amendments to those reports, as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission. Newmont has provided same day access to such reports through its web site since November 15, 2002. Newmont’s Corporate Governance Guidelines, the charters of key committees of its Board of Directors and its Code of Business Ethics and Conduct are also available on the web site. Any of the foregoing information is available in print to any stockholder who requests it by contacting Newmont’s Investor Relations Department.

The Company filed with the New York Stock Exchange (“NYSE”) on May 24, 2004,26, 2005, the annual certification by its Chief Executive Officer, certifying that, as of the date of the certification, he was not aware of any violation by the Company of the NYSE’s corporate governance listing standards, as required by Section 303A.12(a) of the NYSE Listed Company Manual. The Company has filed the required certifications under Section 302 of the Sarbanes-Oxley Act of 2002 regarding the quality of its public disclosures as Exhibits 31.1 and 31.2 to this report.

| ITEM 1A. | RISK FACTORS (dollars in millions except per share, per ounce and per pound amounts) |

Every investor or potential investor in Newmont should carefully consider the following risks, which have been separated into two groups:

Risks Related to the Mining Industry Generally

A Substantial or Extended Decline in Gold or Copper Prices Would Have a Material Adverse Effect on Newmont

Newmont’s business is dependent on the pricesrealized price of gold and copper, which are affected by numerous factors beyond Newmont’sour control. Factors tending to put downward pressure on the prices of gold and copper include:

Any drop in the pricesrealized price of gold or copper adversely impacts our revenues, profitsnet income and cash flows, particularly in light of our philosophy of avoiding gold hedging. Newmont hasWe have recorded asset write-downs in prior years as a resultduring periods of low gold prices in the past and may experience additional asset impairments as a result of low gold or copper prices in the future.

In addition, sustained low gold or copper prices can:

Also see the discussion in Item 1, Business, Gold or Copper Price.

Gold and Copper Producers Must Continually Obtain Additional Reserves

Gold and copper producers must continually replace reserves depleted by production. Depleted reserves must be replaced by expanding known ore bodies or by locating new deposits in order for producers to maintain production levels over the long term. Exploration is highly speculative in nature, involves many risks and frequently is unproductive. No assurances can be given that any of our new or ongoing exploration programs will result in new mineral producing operations. Once mineralization is discovered, it maywill likely take many years from the initial phases of drillingexploration until production is possible, during which time the economic feasibility of production may change.

Estimates of Proven and Probable Reserves Are Uncertain

��

Estimates of proven and probable reserves are subject to considerable uncertainty. Such estimates are, to a large extent, based on interpretations of geologic data obtained from drill holes and other sampling techniques. Producers use feasibility studies to derive estimates of capital and operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore body, expected recovery rates of metals from the ore, the costs of comparable facility,facilities, the costs of operating and processing equipment operating costs, and other factors. Actual operating costs and economic returns on projects may differ significantly from original estimates. Further, it may take many years from the initial phase of drillingexploration before production is possible and, during that time, the economic feasibility of exploiting a discovery may change.

Increased Costs Could Affect Profitability

Costs at any particular mining location frequently are subject to variation from one year to the next due to a number of factors, such as changing ore grade, changing metallurgy and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities, such as fuel, electricity and electricity. Such commoditieslabor. Commodity costs are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. Reported costs may be affected by changes in accounting standards. A material increase in costs at any significant location could have a significant effect on Newmont’s profitability.

Mining Accidents or Other Adverse Events or Conditions at a Mining Location Could Reduce Our Production Levels

At any of Newmont’s operations, production may fall below historic or estimated levels as a result of mining accidents such as a pit wall failure in an open pit mine, or cave-ins or flooding at underground mines. In addition, production may be unexpectedly reduced at a location if, during the course of mining, unfavorable ground conditions or seismic activity are encountered; ore grades are lower than expected; the physical or metallurgical characteristics of the ore are less amenable to mining or treatment than expected; or our equipment, processes or facilities fail to operate properly or as expected.

Mining Companies Are Subject to Extensive Environmental Laws and Regulations

Newmont’s exploration, mining and processing operations are regulated in all countries in which we operate under various federal, state, provincial and local laws relating to the protection of the environment, which generally include air and water quality, hazardous waste management and reclamation. Delays in obtaining, or failure to obtain, government permits and approvals may adversely impact our operations. The regulatory environment in which Newmont operates could change in ways that would substantially increase costs to achieve compliance, or otherwise could have a material adverse effect on Newmont’s operations or financial position. For a more detailed discussion of potential environmental liabilities, see the discussion in Environmental Matters, Note 2730 to the Consolidated Financial Statements.

Risks Related to Newmont Operations

Our Operations Outside North America and Australia Are Subject to Risks of Doing Business Abroad

Exploration, development and production activities outside of North America and Australia are potentially subject to political and economic risks, including:

Consequently, Newmont’s exploration, development and production activities outside of North America and Australia may be substantially affected by factors beyond Newmont’s control, any of which could materially

adversely affect Newmont’s financial position or results of operations. Furthermore, in the event ofif a dispute arisingarises from such activities, Newmont may be subject to the exclusive jurisdiction of courts outside North America or Australia, which could adversely affect the outcome of a dispute.

Newmont has substantial investments in Indonesia, a nation that since 1997 has undergone financial crises and devaluation of its currency, outbreaks of political and religious violence, changes in national leadership, and the secession of East Timor, one of its former provinces. These factors heighten the risk of abrupt changes in the national policy toward foreign investors, which in turn could result in unilateral modification of concessions or contracts, increased taxation, denial of permits or permit renewals or expropriation of assets. If this were to occur with respect to the Batu Hijau Contract of Work,operation, Newmont’s financial condition and results of operations could be materially adversely affected.

In July 2004, a criminal complaint was filed against P.T. Newmont Minahasa Raya (“PTNMR”),PTNMR, the Newmont subsidiary that operated the Minahasa mine in Indonesia, alleging environmental pollution relating to submarine tailings placement into nearby Buyat Bay. The Indonesian police detained five PTNMR employees during September and October of 2004. The police investigation and the detention of PTNMR’s employees was declared illegal by the South Jakarta District Court in December 2004, but in March 2005, the Indonesian Supreme Court upheld the legality of 2004,the police investigation, and the police have appealed that decisionturned their evidence over to the Indonesian Supreme Court. A civil lawsuit, which waslocal prosecutor. In July 2005, the prosecutor filed by three residents ofan indictment against PTNMR and its President Director, alleging environmental pollution at Buyat Pante, a village located nearBay. After the Minahasa mine, was settled without paymentcourt rejected motions to dismiss the plaintiffsproceeding, the prosecutor called its first witnesses in December 2004. In addition, onOctober 2005. The trial is continuing and is expected to conclude in mid-2006.

On March 9, 2005, the Indonesian Ministry of the Environment reportedly filed a civil lawsuit against PTNMRPT Newmont Minahasa Raya (“PTNMR”) and itsit’s President Director in relation to these allegations.

allegations, seeking in excess of $100 in monetary damages. In October 2005, PTNMR filed an objection to the court’s jurisdiction, contending that the Government previously agreed to resolve any disputes through out-of-court conciliation or arbitration. The Court upheld PTNMR’s objection and dismissed the case in November 2005. The Government filed a notice appeal of this ruling. On February 16, 2006, PTNMR and the Government of the Republic of Indonesia signed an agreement settling the civil lawsuit. Under the terms of the agreement, the Government and PTNMR will nominate members to an independent scientific panel that will develop and implement a ten-year environmental monitoring and assessment program to make a definitive, scientific conclusion regarding the condition of Buyat Bay. PTNMR is required to fund specific remedial measures if, as a result of its mining operations, pollution has occurred. The agreement also provides for enhanced community development programs in North Sulawesi. PTNMR will provide initial funding of $12 to cover the cost of the monitoring and community development programs. Over a ten year period, PTNMR will contribute an additional $18. The funds will be managed by an organization governed by interested stakeholders. Accountability for the funds will be ensured through yearly reports that will be made available to the public. The transparency of the scientific panel’s activities will also be assured through annual reports to the public. The agreement is expected to end the civil lawsuit against PTNMR.

Independent sampling and testing of Buyat Bay water and fish, as well as area residents, conducted by the World Health Organization and the Australian Commonwealth Scientific and Industrial Research Organization,

confirm that PTNMR has not polluted the Buyat Bay environment, and, therefore, has not adversely affected the fish in theBuyat Bay or the health of nearby residents. The Company remains steadfast that it has not caused pollution or health problems and will continue to vigorously defend itself against these allegations. However, Newmont cannot predict the outcome of these actionsthe criminal proceeding or whether additional legal actions may occur. Any of these actionsThis matter could adversely affect our ability to operate in Indonesia.

During the last several years, Minera Yanacocha, of which Newmont owns a 51.35% interest, has been the target of numerous local political protests, including ones that blocked the road between the Yanacocha mine complex and the cityCity of Cajamarca in Peru. During SeptemberIn 2004, individuals fromlocal opposition to the Cajamarca region conducted a sustained blockade of the road in protest of drilling activities at Cerro Quilish one of the ore deposits within theproject became so pronounced that Yanacocha mine complex. Yanacocha suspended alldecided to relinquish its drilling activities at Cerropermit for Quilish and the blockadedeposit was resolved. At the request of Yanacocha, the Cerro Quilish drilling permit was revoked in November 2004. Newmont has reassessed the challenges involved in obtaining required permits for Cerro Quilish primarily related to increased community concerns. Based upon this reassessment, Newmont has reclassified the deposit’s 1.98 million equity gold ounces from proven and probable reserves to mineralizednon-reserve mineralization. In 2005, no material not in reserves as of December 31, 2004.roadblocks or protests

occurred involving Yanacocha. We cannot predict, however, whether thesesuch incidents will continue, nor can werecur in the future, and the recurrence of significant community opposition or protests could adversely affect Minera Yanacocha’s assets and operations in Peru, and could lead to the reclassification of other deposits out of reserves.

Presidential, congressional and regional elections will take place in Peru in 2006, and a new national government will take office in July 2006. We cannot predict the new government’s continuing positions on foreign investment, mining concessions, land tenure, environmental regulation or taxation. The continuation or intensification of protests or aA change in prior governmentalgovernment positions on these issues could adversely affect Yanacocha’s assets and operations in Peru.

During 2005, relations between the Republic of Uzbekistan and the U.S. deteriorated significantly, and in July 2005 the government of Uzbekistan evicted the U.S. military from its base at Karshi-Khanabad, south of Tashkent. A further deterioration of relations between the two countries could adversely affect our ability to operate in Uzbekistan.

Recent violence committed by radical elements in Indonesia and other countries, and the presence of U.S. forces in Iraq and Afghanistan, may increase the risk that operations owned by U.S. companies will be the target of further violence. If any of Newmont’s operations were so targeted it could have an adverse effect on our business.

Our Success May Depend on Our Social and Environmental Performance

Newmont’s ability to operate successfully in communities around the world will likely depend on our ability to develop, operate and close mines in a manner that is consistent with the health and safety of our employees, the protection of the environment, and the creation of long-term economic and social opportunities in the communities in which we operate. Newmont has implemented a management system designed to promote continuous improvement in health and safety, environmental performance and community relations. However, our ability to operate may be adversely impacted by accidents or events detrimental (or perceived to be detrimental) to the health and safety of our employees, the environment or the communities in which we operate.

Remediation Costs for Environmental Liabilities May Exceed the Provisions We Have Made

Newmont has conducted extensive remediation work at two inactive sites in the United States. At one of these sites, remediation requirements have not been finally determined, and, therefore, the final cost cannot be determined. At a third site in the United States, an inactive uranium mine and mill formerly operated by a subsidiary of Newmont, remediation work at the mill is ongoing, but remediation at the mine is subject to dispute and has not yet commenced. The environmental standards that may ultimately be imposed at this site remain uncertain and there is a risk that the costs of remediation may exceed the provision that has been made for such remediation by a material amount.

For a more detailed discussion of potential environmental liabilities, see the discussion in Environmental Matters, Note 30 to the Consolidated Financial Statements.

Whenever a previously unrecognized remediation liability becomes known, or a previously estimated reclamation cost is increased, the amount of that liability orand additional cost canwill be recorded at that time and could materially reduce net income in that period.

The Use of Hedging Instruments May Prevent Gains Being Realized from Subsequent Price Increases

Newmont does not intend to enter into material new gold hedging positions and intends to continue to decrease gold hedge positions over time by opportunistically delivering gold into our existingoutstanding hedge contracts, or

by seeking to eliminate our hedge position when economically attractive. Nonetheless, Newmont currently has gold hedging positions and may, from time-to-time, enter into hedge contracts for copper, other metals or commodities, interest rates or foreign currencies. In 2004, Newmont entered into copper hedging positions covering approximately 459 million pounds of copper. If the gold, copper or other metal price rises above the price at which future production has been committed under these hedge instruments, Newmont will have an

opportunity loss. However, if the gold, copper or other metal price falls below that committed price, Newmont’s revenues will be protected to the extent of such committed production. In addition, we may experience losses if a hedge counterparty defaults under a contract when the contract price exceeds the gold, copper or other metal price.

For a more detailed description of the Newmont hedge positions, see the discussion in Hedging in Item 7A, Quantitative and Qualitative Disclosures About Market Risk, and Note 1621 to the Consolidated Financial Statements.

Currency Fluctuations May Affect Costs

Currency fluctuations may affect the costs that we incur at our operations. Gold is sold throughout the world based principally on the U.S. dollar price, but a portion of Newmont’s operating expenses are incurred in local currencies. The appreciation of non-U.S. dollar currencies against the U.S. dollar can increase the costs of gold production in U.S. dollar terms at mines located outside the United States, making such mines less profitable. The foreign currencies that primarily impact Newmont’s results of operations are the Australian and Canadian dollars.

During 2004,2005, the Australian and Canadian dollars strengthened by an average of 13%5% and 7%, respectively, against the U.S. dollar. This increased U.S. dollar reported operating costsCosts applicable to sales in Australia and Canada by approximately $56.6 million$24 and $4.8 million, respectively.$3, respectively from 2004 to 2005. For additional information, see Item 7, Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, Results of Operations, Foreign Currency Exchange Rates, below. For a more detailed description of how currency exchange rates may affect costs, see discussion in Foreign Currency in Item 7A, Quantitative and Qualitative Disclosures About Market Risk.

Our Level of Indebtedness May Affect Our Business

As of December 31, 2004,2005, Newmont had debt of $1.6 billion,$1,929, as compared to $1.1 billion$1,602 as of December 31, 2003.2004. We expect to spend significant funds on capital expenditures essential to existing operations as well as for acquisitions and new project development. Our level of indebtedness could have important consequences for our operations, including:

Newmont expects to be able to pay principal and interest on our debt by utilizing cash flow from operations, and Newmont’sour ability to meet these payment obligations will depend on our future financial performance, which will be affected by financial, business, economic and other factors. Newmont will not be able to control many of these factors, such as economic conditions in the markets in which Newmont operates. NewmontConsequently, we cannot be certain that our future cash flow from operations will be sufficient to allow us to pay principal and interest on our debt, fund required capital expenditures and meet our other obligations. If cash flow from operations is insufficient, we may be required to refinance all or part of our existing debt, sell assets, utilize existing cash balances, borrow more money or issue additional equity. We cannot be surecertain that we will be able to do soaccomplish any of these measures on commercially reasonable terms, if at all.

Our Interest in the Batu Hijau Mine in Indonesia May Be Reduced Under the Contract of Work

Under the Batu Hijau Contract of Work with the Indonesian government, beginning in 2005 and continuing through 2010, a portion of each foreign shareholders’shareholder’s equity interest in the Batu Hijau project must be offered for sale to

the Indonesian government or to Indonesian nationals. The price at which such interest must be offered for sale to the Indonesian parties is the highest of the then-current replacement cost, the price at which shares of the project company would be accepted for listing on the Jakarta Stock Exchange, or the fair market value of such interest in the project company as a going concern. An Indonesian national currently owns a 20% interest in Batu Hijau, which would require Newmont and requires the Newmont/Sumitomo collectively,partnership to offer a 3% interest to the Indonesian government or to Indonesian nationals in 2006. Pursuant to this provision of the Batu Hijau Contract of Work, it is possible that the ownership interest of the Newmont/Sumitomo partnership in Batu Hijau could be reduced to 49% by the end of 2010.

Costs Estimates and Timing of New Projects Are Uncertain

The capital expenditures and time required to develop new mines or other projects are considerable. Changes in costs or construction schedules can affect project economics. There are a number of factors that can affect costs and construction schedules, including, among others:

Occurrence of Events for Which We Are Not Insured May Affect Our Cash Flow and Overall Profitability

We maintain insurance policies to protect ourselvesthat mitigate against certain risks related to our operations. This insurance is maintained in amounts that we believe to beare reasonable depending upon the circumstances surrounding each identified risk. However, Newmont may elect not to have insurance for certain risks because of the high premiums associated with insuring those risks or for various other reasons; in other cases, insurance may not be available for certain risks. Some concern always exists with respect to investments in parts of the world where civil unrest, war, nationalist movements, political violence or economic crisis are possible. These countries may also pose heightened risks of expropriation of assets, business interruption, increased taxation and a unilateral modification of concessions and contracts. Newmont does not maintain insurance policies against political risk. Occurrence of events for which Newmont is not insured may affect our cash flow and overall profitability.

Our Business Depends on Good Relations with Our Employees

Newmont could experience labor disputes, work stoppages or other disruptions in production that could adversely affect us. AtAs of December 31, 2004,2005, unions represented approximately 20%37% of our worldwide work force. On that date,force: Newmont had 1,0981,243 employees at its Carlin, Nevada operations, 21178 employees in Canada at its Golden Giant operations, 2,7272,822 employees in Indonesia at its Batu Hijau operations, 4142 employees in New Zealand at its Martha operation, 325390 employees in Bolivia at its Kori Kollo operation, 628194 employees at its Australia operations, and 552667 employees in Peru at its Yanacocha operation, working under a collective bargaining agreement or similar labor agreement. Currently there are labor agreements in effect for all of these workers.

Our Earnings Could Be Affected by the Prices of Other Commodities

The earnings of Newmont also could be affected by the prices of other commodities such as fuel and other consumable items, although to a lesser extent than by the price of gold or copper. The prices of these commodities are affected by numerous factors beyond Newmont’s control.

Title to Some of Our Properties May Be Defective or Challenged

Although we have conducted title reviews of our properties, title review does not necessarily preclude third parties from challenging our title. While Newmont believeswe believe that it haswe have satisfactory title to itsour properties, some risk exists that some titles may be defective or subject to challenge. In addition, certain of our Australian properties could be subject to native title or traditional landowner claims, but such claims would not deprive us of the properties. For information regarding native title or traditional landowner claims, see the discussion under the AustraliaAustralia/New Zealand section of Item 2, Properties, below.

We Compete With Other Mining Companies

We compete with other mining companies to attract and retain key executives and other employees with technical skills and experience in the mining industry. We also compete with other mining companies for rights to mine properties containing gold and other minerals. There can be no assurance that Newmont will continue to attract and retain skilled and experienced employees, or to acquire additional rights to mine properties.

Certain Factors Outside of Our Control May Affect Our Ability to Support the Carrying Value of Goodwill

AtAs of December 31, 2004,2005, the carrying value of our goodwill was approximately $3.0 billion$2,879 or 24%21% of our total assets. Such goodwill has been assigned to our Merchant Banking ($1.6 billion)1,562) and Exploration ($1.1 billion)1,126) Segments, and to various mine site reporting units ($0.3 billion in the aggregate)Australia/New Zealand Segment ($191). This goodwill primarily arose in connection with our February 2002 acquisitions of Normandy and Franco-Nevada, and it represents the excess of the aggregate purchase price over the fair value of the identifiable net assets of Normandy and Franco-Nevada. We evaluate, on at least an annual basis, the carrying amount of goodwill to determine whether current events and circumstances indicate that such carrying amount may no longer be recoverable. This evaluation involves a comparison of the estimated fair value of our reporting units to their carrying values.

Based on valuations of the Merchant Banking and Exploration Segments, the Company concluded that the estimated fair values significantly exceeded the respective carrying values as of December 31, 2004.2005. The fair values of the reporting unitsMerchant Banking and Exploration Segments are based in part on certain factors that may be partially or completely outside of our control, such as the investing environment, the discovery of proven and probable reserves, commodity prices and other factors. In addition, certain of the assumptions underlying the December 31, 20042005 Merchant Banking and Exploration valuations may not be easily achieved by the Company, even though such assumptions were based on historical experience and the Company considers such assumptions to be reasonable under the circumstances.

At December 31, 2004, the $1.6 billion carrying value of the Merchant Banking Segment goodwill represented approximately 65% of the carrying value of the total assets of the Merchant Banking Segment. The December 31, 2004 discounted cash flow analysis for the equity portfolio sub-segment of the Merchant Banking Segment assumed: (i) a discount rate of 9%; (ii) a time horizon of ten years; (iii) pre-tax returns on investment ranging from 35% starting in 2005 and gradually declining to 15% in 2012 through 2014; (iv) an initial equity portfolio investment of approximately $0.5 billion; (v) capital infusions of $50 million annually for the next three years; and (vi) a terminal value of approximately $2.2 billion. The December 31, 2004 discounted cash flow analysis for the royalty portfolio sub-segment of the Merchant Banking Segment assumed: (i) a discount rate of 9%; (ii) a time horizon of ten years; (iii) an annual growth rate of 5% in the royalty portfolio; and (iv) a pre-tax rate of return on investment of 13%. The December 31, 2004 discounted cash flow analysis for the portfolio management sub-segment of the Merchant Banking Segment assumed: (i) a discount rate of 9%; (ii) a time horizon of ten years; and (iii) a pre-tax advisory fee of 5% on approximately $0.5 billion of transactions and value-added activities in 2005, with the dollar amount of such transactions and activities increasing by 5% annually thereafter. The December 31, 2004 discounted cash flow analysis for the value realization sub-segment of the Merchant Banking Segment assumed: (i) a discount rate of 9%; (ii) a time horizon of ten years; and (iii) a pre-tax annual return on investments of $4.2 million. The December 31, 2004 discounted cash flow analysis assumed a combined terminal value for the royalty portfolio, portfolio management and downstream gold refining sub-segments of approximately $0.7 billion.

At December 31, 2004, the $1.1 billion carrying value of the Exploration Segment goodwill represented approximately 98% of the carrying value of the total assets of the Exploration Segment. Based on the review of historical additionsAdditions to proven and probable reserves and on management’s expectation of the growth rate and levels of reserve additions that could be expected to continueused in the Company’s valuation models were based on management reviews of historical performance and expectations of future the discounted cash flow model developed to value the Exploration Segment at December 31, 2004 assumed that (i) the Exploration Segment

would be responsible for 11.0 million ounces of additions to proven and probable reserves in 2005; (ii) such additions would increase by 5% annually; and (iii) approximately 9.1%, 8.7%, 8.3% and 7.9% of additions in years 2005, 2006, 2007 and 2008, respectively, would represent ounces that had previously been valued in the Normandy purchase accounting. In addition, the discounted cash flow model for the Exploration Segment assumed, among other matters: (i) a 16-year time horizon, including a seven-year time lapse between additions to proven and probable reserves and the initiation of production and a five-year production period; (ii) a discount rate of 8%; (iii) a terminal value of approximately $5.8 billion; (iv) an average gold price of $375 per ounce during the time horizon; (v) total cash costs per ounce of $230; and (vi) capital costs of $50 per ounce. The Company believes that anyreserve additions. Any model used to value the Exploration Segment will need to take into account the relatively long time horizon required to evaluate the activities of the Exploration Segment. Reserve additions may vary significantly from year to year based on the timing of when proven and probable reserves can be reported under the Securities and Exchange Commission (“SEC”) Industry Guide 7. A period of several years may be required to advance a project from initial discovery to proven and probable reserves.

Based on valuations of various mine site reporting units in the Australia/New Zealand Segment, the Company concluded that the estimated fair values exceeded the respective carrying values as of December 31, 2005. The Company concluded that the estimated fair value of the Nevada Segment did not support the carrying value as of December 31, 2005 and recorded a $41 goodwill impairment charge. In 2004, the Company recorded goodwill and long-lived assets impairment charges of $52 and $6, respectively, relating to the Pajingo reporting unit in the Australia/NewZealand Segment. The Company’s fair value estimates are based on numerous assumptions and it is possible that actual fair value could be significantly different than these estimates, as actual future quantities of recoverable minerals, gold and other commodity prices, production levels, operating costs and capital costs are each subject to significant risks and uncertainties.

In the absence of any mitigating valuation factors, the Company’s failure to achieve one or more of the December 31, 20042005 valuation assumptions willmay over time result in an impairment charge. Accordingly, no assurance can be given that significant non-cash impairment charges will not be recorded in the future due to possible declines in the fair values of our reporting units. For a more detailed description of the estimates and assumptions involved in assessing the recoverability of the carrying value of goodwill, see Item 7, Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, Critical Accounting Policies, below.

Our accounting policies and methods of reporting financial condition, including accounting for goodwill, require certain estimates, assumptions and judgments for which there is no clear authoritative guidance. Management makes such estimates, assumptions and judgments in good faith based on what they believe is the best available information. The Company has received from the SEC two letters, dated December 27, 2005 and February 17, 2006, requesting additional information and additional disclosure regarding accounting for Exploration and Merchant Banking Segment goodwill. The Company is responding to these letters and will continue to work with the SEC to resolve any further issues it raises.

Our Ability to Recognize the Benefits of Deferred Tax Assets is DependantDependent on Future Cash Flows and Taxable Income

The Company recognizes the expected future tax benefit from deferred tax assets when the tax benefit is considered to be more likely than not of being realized. Otherwise, a valuation allowance is applied against deferred tax assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and taxable income differ significantly from estimates, the ability of the Company to realize the deferred tax assets recorded at the balance date could be impacted. Additionally, future changes in tax laws in the jurisdictions in which the Company operates could limit the Company’s ability to obtain the future tax benefits represented by its deferred tax assets recorded at the balance sheet date.assets. At December 31, 2004,2005, the Company recorded $173.6 million and $491.7 million ofCompany’s current and long-term deferred tax assets were $159 and $517, respectively.

Returns for Investments in Pension Plans Are Uncertain

We maintain defined benefit pension plans for our employees, which provide for specified payments after retirement for certain employees. The ability of the pension plans to provide the specified benefits depends on our funding of the plans and returns on investments made by the plans. Returns, if any, on investments are subject to fluctuations based on investment choices and market conditions. A sustained period of low returns or losses on investments could require us to fund the pension plans to a greater extent than anticipated.

| ITEM 2. | PROPERTIES (dollars in millions except per share, per ounce and per pound amounts) |

Gold and Copper Processing Methods

Gold is extracted from naturally-oxidized ores by either heap leaching or milling, depending on the amount of gold contained in the ore and the amenability of the ore to treatment. Higher grade oxide ores are generally processed through mills, where the ore is ground into a fine powder and mixed with water in slurry, which then passes through a cyanide leaching circuit. Lower grade oxide ores are generally processed using heap leaching. Heap leaching consists of stacking crushed or run-of-mine ore on impermeable pads, where a weak cyanide solution is applied to the top surface of the heap to dissolve the gold. In both cases, the gold-bearing solution is then collected and pumped to process facilities to remove the gold by collection on carbon or by zinc precipitation directly from leach solutions.

Gold contained in ores that are not naturally oxidized can be directly milled if the gold is amenable to cyanidization, generally known as free milling sulfide ores. Ores that are not amenable to cyanidization, known as refractory ores, require more costly and complex processing techniques than oxide or free milling ore. Higher-grade refractory ores are processed through either roasters or autoclaves. Roasters heat finely ground ore with air and oxygen to a high temperature, burn off the carbon and oxidize the sulfide minerals that prevent efficient leaching. Autoclaves use heat, oxygen and pressure to oxidize sulfide minerals in the ore.

Some gold-bearing sulfide ores may be processed through a flotation plant or by bio-milling. In flotation, ore is finely ground, turned into slurry, then placed in a tank known as a flotation cell. Chemicals are added to the

slurry causing the gold-containing sulfides to float in air bubbles to the top of the tank, where they can be separated from waste particles that sink to the bottom. The sulfides are removed from the cell and converted into a concentrate that can then be processed in an autoclave or roaster to recover the gold. Bio-milling incorporates patented technology that involves inoculation of suitable crushed ore on a leach pad with naturally occurring bacteria strains, which oxidize the sulfides over a period of time. The ore is then processed through an oxide mill.

At Batu Hijau, mined ore containing copper and gold is crushed to a coarse size at the mine and then transported from the mine via conveyor to a concentrator. The ore is finely ground and then treated by successive stages of flotation, resulting in a concentrate of copper sulfides containing approximately 30% copper. The concentrate is transferred by pipeline to port facilities. At the port, the concentrate is dewatered and stored for later reclaiming and loading onto ships for transport to smelters.

Set forth below is a description of theNewmont’s significant production properties of Newmont and its subsidiaries. Total cash costs and total production costsproperties.Costs applicable to sales for each operation are presented in a table in the next section of this Item 2. Total cash costs and total production costs represent measures of performance that are not calculated in accordance with generally accepted accounting principles (“GAAP”). Management uses these non-GAAP financial measures to analyze the cash generating capacities and performance of Newmont’s mining operations. For a reconciliation of these non-GAAP measures toCosts Applicable to Sales as calculated and presented under GAAP, see Item 2, Properties, Operating Statistics.

North AmericaNevada

Nevada.Newmont has been mining gold in Nevada since 1965. Newmont’s Nevada operations include Carlin, located west of the city of Elko on the geologic feature known as the Carlin Trend, the Twin Creeks mine approximately 15 miles north of Golconda, the Lone Tree Complex near the town of Valmy, and the Midas mine near the town of the same name. Newmont also participates in the Turquoise Ridge joint venture with Placer

Dome,Barrick, which utilizes mill capacity at Twin Creeks. The Phoenix gold/copper project, located 10 miles south of Battle Mountain, is under construction with production expected in mid-2006.by April 2006. The Leeville underground project, located on the Carlin Trend northwest of the Carlin East underground mine, is under construction, with completion scheduled for late 2006.