UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 20042007

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number 001-13533

NOVASTAR FINANCIAL, INC.

(Exact Name of Registrant as Specified in its Charter)

| Maryland | 74-2830661 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| 8140 Ward Parkway, Suite 300, Kansas City, MO | 64114 | |

| (Address of Principal Executive Office) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code:(816) 237-7000

Securities Registered Pursuant to Section 12(b) of the Act:

| ||

Securities Registered Pursuant to Section 12(g) of the Act:

NoneTitle of Each Class

Common Stock, $0.01 par value

Redeemable Preferred Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is an accelerated filera shell company (as defined in Exchange Act Rule 12b-2). Yes x¨ No x¨

The aggregate market value of voting and non-voting stock held by non-affiliates of the registrant as of June 30, 20042007 was approximately $948,751,931$239,636,773, based upon the closing sales price of the registrant’s common stock as reported byon the New York Stock Exchange Composite Transactions on such date.

The number of shares of the Registrant’s Common Stock outstanding on March 11, 200531, 2008 was 27,860,629.

9,390,840.

Documents Incorporated by Reference

Items 10, 11, 12, 13 and 14 of Part III are incorporated by reference to the NovaStar Financial, Inc. definitive proxy statement to shareholders, which will be filed with the Commission no later than 120 days after December 31, 2004.2007.

FORM 10-K

For the Fiscal Year Ended December 31, 20042007

TABLE OF CONTENTS

Item 1.BusinessSafe Harbor Statement

Statements in this report regarding NovaStar Financial, Inc. and its business, which are not historical facts, are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking statements are those that predict or describe future events and that do not relate solely to historical matters and include statements regarding management’s beliefs, estimates, projections, and assumptions with respect to, among other things, our future operations, business plans and strategies, as well as industry and market conditions, all of which are subject to change at any time without notice. Words such as “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those discussed herein. Some important factors that could cause actual results to differ materially from those anticipated include: our ability to manage our business during this difficult period for the subprime industry; our ability to continue as a going concern; decreases in cash flows from our mortgage securities; our ability to reduce expenses from our discontinued operations; increases in the credit losses on mortgage loans underlying our mortgage securities and our mortgage loans – held in portfolio; our ability to repay Wachovia in a manner and time period acceptable to Wachovia; our ability to remain in compliance with the agreements governing our indebtedness; impairments on our mortgage assets; increases in prepayment or default rates on our mortgage assets; increases in margin calls and loan repurchase requests; changes in assumptions regarding estimated loan losses and fair value amounts; our ability to maintain effective internal control over financial reporting and disclosure controls and procedures in the future; events impacting the subprime mortgage industry in general, including events impacting our competitors and liquidity available to the industry; residential property values; interest rate fluctuations on our assets that differ from our liabilities; the outcome of litigation or regulatory actions pending against us or other legal contingencies; our compliance with applicable local, state and federal laws and regulations; our ability to adapt to and implement technological changes; compliance with new accounting pronouncements; the impact of general economic conditions; and the risks that are from time to time included in our filings with the Securities and Exchange Commission (“SEC”), including this report on Form 10-K. Other factors not presently identified may also cause actual results to differ. This report on Form 10-K speaks only as of its date and we expressly disclaim any duty to update the information herein except as required by federal securities laws.

OverviewItem 1. Business

We are a Maryland corporation formed on September 13, 1996 which operates solely as a specialty finance company that originates, purchases, investsnon-conforming residential mortgage portfolio manager. Prior to significant changes in our business during 2007 and the first quarter of 2008, we originated, purchased, securitized, sold, invested in and servicesserviced residential nonconforming loans.mortgage loans and mortgage backed securities. We operateretained, through three separate but inter-related units—our mortgage lending and loan servicing, mortgagesecurities investment portfolio, management and branch operations. We offer a wide range of mortgage loan products to borrowers, commonly referred to as “nonconforming borrowers,” who generally do not satisfy the credit, collateral, documentation or other underwriting standards prescribed by conventional mortgage lenders and loan buyers, including United States of America government-sponsored entities such as Fannie Mae or Freddie Mac. We retain significant interests in the nonconforming loans we originateoriginated and purchasepurchased, and through our mortgage securities investment portfolio. Through our servicing platform, we then serviceserviced all of the loans in which we retain interestsretained interests. During 2007 and early 2008, we discontinued our mortgage lending operations and sold our mortgage servicing rights which subsequently resulted in in orderthe abandonment of our servicing operations. See “Executive Overview of Performance” and “Known Material Trends, Significant Events and Uncertainties” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion of the severely disrupted mortgage industry and credit markets and the changes we made to betterour operations to manage the credit performance ofthrough those loans.changes.

We currently intend to manage only our mortgage portfolio management segment. In the event we are able to significantly increase our liquidity position (as to which no assurance can be given), we may use excess cash to make certain investments if we determine that such investments could provide attractive risk-adjusted returns to shareholders, including, potentially investing in new or existing operating companies. Because of certain state licensing requirements, it is unlikely we are able, ourselves, to directly recommence mortgage lending activities so long as we continue to have a shareholders’ deficit. Segment information for the three years ended December 31, 2007 is included in Note 16 to our consolidated financial statements.

Historically, we had elected to be taxed as a real estate investment trust or REIT,(“REIT”) under the Internal Revenue Code of 1986, as amended (Code)(the “Code”). Management believes the tax-advantaged structure ofDuring 2007, we announced that we would not be able to pay a REIT maximizes the after-tax returns from mortgage assets. We must meet numerous rules established by the Internal Revenue Service (IRS)dividend on our common stock with respect to retainour 2006 taxable income, and as a result, our status as a REIT. In summary, they require us to:

As long as we maintainJanuary 1, 2006. This retroactive revocation of our REIT status distributions to stockholders will generally be deductible byresulted in us becoming taxable as a C corporation for income tax purposes. This deduction effectively eliminates REIT level income taxes. Management believes it has2006 and will continue to meet the requirements to maintain our REIT status.subsequent years.

Our consolidated financial statements have been prepared on a going concern basis of accounting which contemplates continuity of operations, realization of assets, liabilities and commitments in the normal course of business. There are substantial doubts that we will be able to continue as a going concern and, therefore, may be unable to realize our assets and discharge our liabilities in the normal course of business. The financial statements do not reflect any adjustments relating to the recoverability and classification of recorded asset amounts or to the amounts and classification of liabilities that may be necessary should we be unable to continue as a going concern.

Mortgage Portfolio Management

The continued deterioration of the secondary market for subprime mortgage assets generated primarilyhas altered the focus of our portfolio management business from that of seeking investment opportunities to that of only managing our current portfolio of mortgage securities and mortgage loans. Our portfolio of mortgage securities includes interest-only, prepayment penalty, and overcollateralization securities retained from our origination and purchasesecuritizations of nonconforming, single-family residential mortgage loans.

The long-term mortgage securitiesloan portfolio investor.

Our mortgage portfolio management operations generate earnings primarily from the return oninterest income generated from our mortgage securities and mortgage loan portfolio.

Earnings from our portfolio of mortgage loans and securities generate a substantial portion of our earnings. Gross interest income was $224.0 million, $170.4 million and $107.1 million in the three years ended December 31, 2004, 2003 and 2002, respectively. Net interest income before credit losses/recoveries from the portfolio was $171.4 million, $130.1 million and $79.4 million in the three years ended December 31, 2004, 2003 and 2002, respectively. See our discussion of interest income under the heading “Results of Operations” and “Net Interest Income”. See Note 15 to our consolidated financial statements for a summary of operating results and total assets for mortgage portfolio management.portfolios.

A significant risk toThe credit performance and prepayment rates of the nonconforming loans underlying our operations, relating to our portfolio management, issecurities, as well as the risk thatloans classified as held-in-portfolio, directly affects the profitability of this segment. In addition, short-term interest rates have a significant impact on our assets will not adjust at the same times or amounts that rates on our liabilities adjust. Many of the loans in our portfolio have fixed rates of interest for a period of time ranging from 2 to 30 years. Our funding costs are generally not constant or fixed. We use derivative instruments to mitigate the risk of our cost of funding increasing or decreasing at a faster rate than the interest on the loans (both those on the balance sheet and those that serve as collateral for mortgage securities – available-for-sale).this segment’s profitability.

In certain circumstances, because we enter into interest rate agreements that do not meet the hedging criteria set forth in accounting principles generally accepted in the United States of America,event we are requiredable to record the changesignificantly increase our liquidity position (as to which no assurance can be given), we may use excess cash to make certain investments if we determine that such investments could provide attractive risk-adjusted returns to shareholders, including, potentially investing in the value of derivatives as a component of earnings even though they may reduce our interest rate risk. In times where short-term rates risenew or drop significantly, the value of our agreements will increase or decrease, respectively. As a result, we recognized losses on these derivatives of $8.9 million, $30.8 million and $36.8 millionexisting operating companies.

Market in 2004, 2003 and 2002, respectively.

Mortgage Lending and Loan ServicingWhich NovaStar Competes

The mortgage lending operationindustry is significant to ourdominated by large, sophisticated financial resultsinstitutions. To compete effectively, we must have a very high level of operational, technological, and managerial expertise as it produces the loans that ultimately collateralize the mortgage securities – available-for-sale that we hold in our portfolio. During 2004, we originated and purchased $8.4 billion in nonconforming mortgage loans, the majority of which were retained in our servicing portfolio and servewell as collateral for our securities. The loans we originate and purchase are sold, either in securitization transactions or in outright sales to third parties. We recognized gains on sales of mortgage assets totaling $145.0 million, $144.0 million and $53.3 million during the three years ended December 31, 2004, 2003 and 2002, respectively. In securitization transactions accounted for as sales, we retain interest-only, prepayment penalty, overcollateralization and other subordinated securities, along with the right to service the loans. See Note 15 to our consolidated financial statements for a summary of operating results and total assets for mortgage lending and loan servicing.

Our wholly-owned subsidiary, NovaStar Mortgage, Inc., originates and purchases primarily nonconforming, single-family residential mortgage loans. In our nonconforming lending operations, we lend to individuals who generally do not qualify for agency/conventional lending programs because of a lack of available documentation or previous credit difficulties. These types of borrowers are generally willing to pay higher mortgage loan origination fees and interest rates than those charged by conventional lending sources. Because these borrowers typically use the proceeds of the mortgage loans to consolidate debt and to finance home improvements, education and other consumer needs, loan volume is generally less dependent on general levels of interest rates or home sales and therefore less cyclical than conventional mortgage lending.

Our nationwide loan origination network includes wholesale loan brokers, correspondent institutions and direct to consumer operations. We have developed a nationwide network of wholesale loan brokers and mortgage lenders who submit mortgage loans to us. Except for NovaStar Home Mortgage brokers described below, these brokers and mortgage lenders are independent from any of the NovaStar entities. Our sales force, which includes account executives in 39 states, develops and maintains relationships with this network of independent retail brokers. Our correspondent origination channel consists of a network of institutions from which we purchase nonconforming mortgage loans on a bulk or flow basis. Our direct to consumer origination channel consists of call centers, which use telemarketing and internet loan lead sources to originate mortgage loans.

We underwrite, process, fund and service the nonconforming mortgage loans sourced through our broker network in centralized facilities. Further details regarding the loan originations are discussed under the “Mortgage Loans” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

A significant risk to our mortgage lending operations is liquidity risk – the risk that we will not have financing facilities and cash available to fund and hold loans prior to their sale or securitization. We maintain committed lending facilities with large banking and investment institutions to reduce this risk. On a short-term basis, we finance mortgage loans using warehouse repurchase agreements. In addition, we have access to facilities secured by our mortgage securities – available-for-sale. Details regarding available financing arrangements and amounts outstanding under those arrangements are included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 7 to the consolidated financial statements.

For long-term funding, we pool our mortgage loans and issue asset-backed bonds (ABB). Primary bonds – AAA through BBB rated – are issued to the public. We retain the interest-only, prepayment penalty, overcollateralization and other subordinated bonds. We also retain the right to service the loans. Prior to 1999, our ABB transactions were executed and designed to meet accounting rules that resulted in securitizations being treated as financing transactions. The mortgage loans and related debt continue to be presented on our consolidated balance sheets, and no gain was recorded. Beginning in 1999, our securitization transactions have been structured to qualify as sales for accounting and income tax purposes. The loans and related bond liability are not recorded in our consolidated financial statements. We do, however, record the value of the securities and servicing rights we retain. Details regarding ABBs we issued can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 7 to our consolidated financial statements.

Loan servicing remainscapital at a critical part of our business operation. In the opinion of management, maintaining contact with our borrowers is critical in managing credit risk and in borrower retention. Nonconforming borrowers are more prone to late payments and are more likely to default on their obligations than conventional borrowers. By servicing our loans, we strive to identify problems with borrowers early and take quick action to address problems. Borrowers may be motivated to refinance their mortgage loans either by improving their personal credit or due to a decrease in interest rates. By keeping in close touch with borrowers, we can provide them with information about company products to encourage them to refinance with us. Mortgage servicing yields fee income for us in the form of fees paid by the borrowers for normal customer service and processing fees. In addition we receive contractual fees approximating 0.50% of the outstanding balance and rights to future cash flows arising after the investors in the securitization trusts have received the return for which they contracted. We recognized $41.5 million, $21.1 million and $10.0 million in loan servicing fee income from the securitization trusts during the three years ended December 31, 2004, 2003 and 2002, respectively. See also “Mortgage Loan Servicing” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion and analysis of the servicing operations.

Branch Operations

In 1999, we opened our retail mortgage broker business operating under the name NovaStar Home Mortgage, Inc. (“NHMI”). Prior to 2004, many of these NHMI branches were supported by LLC’s operating under LLC agreements where we owned a minority interest in the LLC and the branch manager was the majority interest holder. In December 2003, we decided to terminate the LLC’s effective January 1, 2004. As of January 1, 2004, continuing branches that formerly operated under LLC agreements became operating units of NHMI and their financial results are included in the consolidated financial statements. See Note 14 to our consolidated financial statements for further discussion. Branch offices offer conforming and nonconforming loans to potential borrowers. Loans are brokered for approved investors, including NovaStar Mortgage. The NHMI branches are considered departmental functions of NHMI under which the branch manager (department head) is an employee of NHMI and receives compensation based on the profitability of the branch (department) as bonus compensation. See Note 15 to our consolidated financial statements for a summary of operating results and total assets for our branches.

We routinely close branches and branch managers voluntarily terminate their employment with us, which generally results in the branch’s closure. As the demand for conforming loans declined significantly during 2004, many branches were not able to produce sufficient fees to meet operating expense demands.competitive cost. As a result of these conditions, a significant number of branch managers voluntarily terminated employment with us. We have also terminated many branches when loan production results were substandard. In these terminations, the branch and all operations are eliminated. Note 14 to our consolidated financial statements provides detail regarding the impact of the discontinued operations and modifications to our branch program.

The branch business provides an additional source for mortgage loan originations that, in most cases, we will eventually sell, either in securitizations or in outright sales to third parties. During 2004 and 2003, our branches brokered $3.7 billion and $6.4 billion, respectively, in nonconforming loans, of which we funded $1.7 billion and $1.2 billion, respectively.

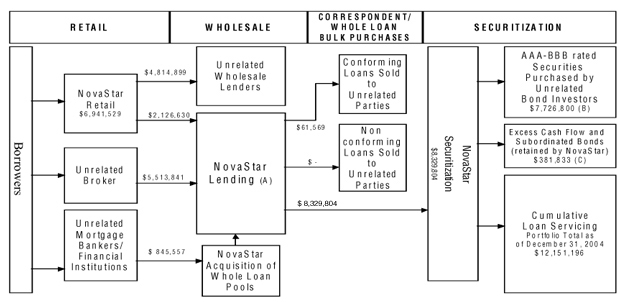

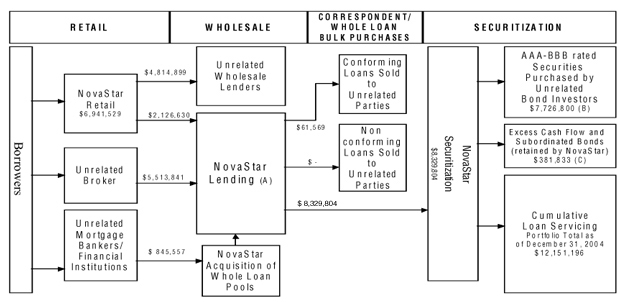

Following is a diagram of the industry in which we operate and our loan production including nonconforming and conforming during 2004 (in thousands).

Market in Which NovaStar Operates and Competes

We face intense competition in the business of originating, purchasing, selling and securitizing mortgage loans. The number of market participants is believed to be well in excess of 100 companies who originate and purchase nonconforming loans. No single participant holds a dominant share of the lending market. We compete for borrowers with consumer finance companies, conventional mortgage bankers, commercial banks, credit unions, thrift institutions and other independent wholesale mortgage lenders. Our principal competition in the business of holding mortgage loans and mortgage securities – available-for-sale are life insurance companies, institutional investors such as mutual funds and pension funds, other well-capitalized publicly-owned mortgage lenders and certain other mortgage acquisition companies structured as REITs. Many of these competitors are substantially larger than we are and have considerably greater financial resources than we do.

Competition among industry participants can take many forms, including convenience in obtaining a loan, amount and term of the loan, customer service, marketing/distribution channels, loan origination fees and interest rates. To the extent any competitor significantly expands their activities in the nonconforming and subprime market, we could be materially adversely affected.

One of our key competitive strengths is our employees and the level of service they are able to provide our borrowers. We service our nonconforming loans and, in doing so, we are able to stay in close contact with our borrowers and identify potential problems early.

We also believe we compete successfully due to our:

Risk Management

Management recognizes the following primary risks associated with the business and industry in which it operates.

Interest Rate/Market

Liquidity

Credit

Prepayment

Interest Rate/Market Risk

Risk.Our investment policy sets the following general goals:

(1) Maintaingoals are to maintain the net interest margin between our assets and liabilities and

(2) Diminish to diminish the effect of changes in interest rate levels on ourthe market value of our assets, to the extent consistent with our liquidity needs.

Interest Rate Risk. When interest rates on our assets do not adjust at the same time or in the same amounts as the interest rates ason our liabilities or when the assets have fixed rates and the liabilities are adjusting,have adjustable rates, future earnings potential is affected. We express this interest rate risk as the risk that the market value of our assets will increase or decrease at different rates than that of theour liabilities. Expressed another way, this is the risk that our net asset value will experience an adverse change when interest rates change. We assess the risk based on the change in market values given increases and decreases in interest rates. We also assess the risk based on the impact to net income in changing interest rate environments.

Management primarily useshistorically has used financing sources whereunder which the interest rate resets frequently. As of December 31, 2004,2007, all borrowings under allour financing arrangements adjust daily or monthly.monthly off LIBOR. On the other hand, very few of the mortgage assets we own adjust on a monthly or daily basis. Most of the mortgage loans contain features where their rates that are fixed for some period of time and then adjust frequently thereafter. For example, one of our loan products is the “2/28” loan. This loan is fixed for its first two years and then adjusts every six months thereafter.

While short-term borrowing rates are low and long-term asset rates are high, this portfolio structure produces good results. However, if short-term interest rates rise rapidly, earning potential is significantly affected and impairments may be incurred, as the asset rate resets would lag the borrowing rate resets.

Historically, we have transferred interest rate agreements at the time of securitization into the securitization trusts to protect the third-party bondholders from interest rate risk and to decrease the volatility of future cash flows related to the securitized mortgage loans. We entered into these interest rate agreements as we originated and purchased mortgage loans in our mortgage lending segment. At the time of a securitization structured as a sale, we transferred interest rate agreements into the securitization trusts and they were removed from our balance sheet. The trust assumed the obligation to make payments and obtained the right to receive payments under these agreements. Generally, net settlement obligations paid by the trust for these interest rate agreements reduce the excess interest cash flows to our residual securities. Net settlement receipts from these interest rate agreements are used either to cover interest shortfalls on the third-party primary bonds or to provide credit enhancement with any remaining funds then flowing to our residual securities. For securitizations structured as financings the derivatives remain on our balance sheet. Generally, these interest rate agreements do not meet the hedging criteria set forth in Generally Accepted Accounting Principles (“GAAP”) while they are on our balance sheet; therefore, we are required to record their change in value as a component of earnings even though they may reduce our interest rate risk. In times when short-term rates rise or drop significantly, the value of our agreements will increase or decrease, respectively. Occasionally, we enter into interest rate agreements that do meet the hedging criteria set forth in GAAP. In these instances, we record their change in value, if effective, directly to other comprehensive income on our statement of shareholder’s equity.

Interest Rate Sensitivity AnalysisAnalysis..To assess interest sensitivity as an indication of exposure to interest rate risk, management relies on models of financial information in a variety of interest rate scenarios. Using these models, the fair value and interest rate sensitivity of each financial instrument, or groups of similar instruments is estimated, and then aggregated to form a comprehensive picture of the risk characteristics of the balance sheet. The risks are analyzed on a market value and cash flow basis.

The following table summarizes management’s estimates of the changes in market value of our same mortgage assets and interest rate agreements assuming interest rates were 100 and 200 basis points, or 1 and 2 percent, higher andor lower. The cumulative change in market value represents the change in market value of mortgage assets, net of the change in market value of interest rate agreements. The change in market value of the liabilities on our balance sheet due to a change in interest rates is insignificant since a majority of our short-term borrowings and asset-backed bonds (“ABB”) are adjustable rate; however, as noted above, rapid increases in short-term interest rates would negatively impact the interest-rate spread between our liabilities onand assets and, consequently, our balance sheet which finance our mortgage assets is insignificant.earnings.

Interest Rate Sensitivity - Market Value

(dollars in thousands)

| Basis Point Increase (Decrease) in Interest Rate (A) | Basis Point Increase (Decrease) in Interest Rates (A) | ||||||||||||||||||||||||||||||

| (200) (C) | (100) | 100 | 200 | (200) | (100) | 100 | 200 | ||||||||||||||||||||||||

As of December 31, 2004: | |||||||||||||||||||||||||||||||

As of December 31, 2007: | |||||||||||||||||||||||||||||||

Change in market values of: | |||||||||||||||||||||||||||||||

Assets | 70,438 | $ | 33,198 | $ | (34,045 | ) | $ | (72,840 | ) | ||||||||||||||||||||||

Assets – non trading (B) | $ | 42,484 | $ | 19,234 | $ | (18,057 | ) | $ | (32,868 | ) | |||||||||||||||||||||

Assets – trading (C) | 33,448 | 15,269 | (14,210 | ) | (26,053 | ) | |||||||||||||||||||||||||

Cumulative change in market value | $ | 75,932 | $ | 34,503 | $ | (32,267 | ) | $ | (58,921 | ) | |||||||||||||||||||||

Percent change of market value portfolio equity (D) | 61.0 | % | 24.6 | % | (17.5 | %) | (30.5 | %) | |||||||||||||||||||||||

As of December 31, 2006: | |||||||||||||||||||||||||||||||

Change in market values of: | |||||||||||||||||||||||||||||||

Assets – non trading (B) | $ | 226,262 | $ | 105,038 | $ | (78,698 | ) | $ | (150,481 | ) | |||||||||||||||||||||

Assets – trading (C) | 9,999 | 7,080 | (14,120 | ) | (30,707 | ) | |||||||||||||||||||||||||

Interest rate agreements | (54,085 | ) | (28,046 | ) | 27,832 | 55,113 | (40,018 | ) | (20,946 | ) | 23,998 | 49,264 | |||||||||||||||||||

Cumulative change in market value | 16,353 | $ | 5,152 | $ | (6,213 | ) | $ | (17,727 | ) | $ | 196,243 | $ | 91,172 | $ | (68,820 | ) | $ | (131,924 | ) | ||||||||||||

Percent change of market value portfolio equity (B) | 3.3 | % | 1.0 | % | (1.3 | )% | (3.6 | )% | |||||||||||||||||||||||

Percent change of market value portfolio equity (D) | 34.0 | % | 15.8 | % | (11.9 | %) | (22.9 | %) | |||||||||||||||||||||||

As of December 31, 2003: | |||||||||||||||||||||||||||||||

Change in market values of: | |||||||||||||||||||||||||||||||

Assets | N/A | $ | 34,499 | $ | (65,216 | ) | $ | (144,343 | ) | ||||||||||||||||||||||

Interest rate agreements | N/A | (31,250 | ) | 34,073 | 69,497 | ||||||||||||||||||||||||||

Cumulative change in market value | N/A | $ | 3,249 | $ | (31,143 | ) | $ | (74,846 | ) | ||||||||||||||||||||||

Percent change of market value portfolio equity (B) | N/A | 1.0 | % | (9.1 | )% | (21.9 | )% | ||||||||||||||||||||||||

| (A) | Change in market value of assets or interest rate agreements in a parallel shift in the yield curve, up and down 1% and 2%. |

| (B) | Includes mortgage loans held-for-sale, mortgage loans held-in-portfolio and mortgage securities—available-for-sale for 2007 and 2006, and also includes mortgage servicing rights for 2006 as well. |

| (C) | Consists of mortgage securities – trading. |

| (D) | Total change in estimated market value as a percent of market value portfolio equity as of December |

HedgingHedging..In order to address a mismatch ofWe use derivative instruments, including interest rate indicesswap and adjustment periodscap contracts, to mitigate the risk of our cost of funding increasing at a faster rate than the interest on our assets and liabilities, the hedging section of the investment policy is followed, as approved by the Board. Specifically, theassets. We adhere to an interest rate risk management program that is approved by our Board. This program is formulated with the intent to offsetmitigate the potential adverse effects resulting from rate adjustment limitations on mortgage assets and the differences between interest rate adjustment indices and interest rate adjustment periods of adjustable-rate mortgage loans and related borrowings.

We use interest rate cap However, our hedging strategy is subject to, and swap contracts to mitigate the riskis currently limited by, considerations of the cost of variable rate liabilities increasing at a faster rate than the earnings on assets during a period of rising rates. In this way, management intends generally to hedge as much of the interest rate risk as determined to be in our best interest, given the cost and risk of hedging transactions and the need to maintain REIT status.

We seek to build a balance sheet and undertake an interest rate risk management program that is likely, in management’s view, to enable us to maintain an equity liquidation value sufficient to maintain operations given a variety of potentially adverse circumstances. Accordingly, the hedging program addresses both income preservation, as discussed in the first part of this section, and capital preservation concerns.liquidity risk.

Interest rate cap and swap agreements are legal contracts between us and a third-party firm or “counterparty”. TheUnder an interest rate cap agreement the counterparty agrees to make payments to us in the future should the one-month LIBOR interest rate rise above the strike rate specified in the contract. We make either quarterly or monthly premium payments or have chosen to pay the premiums at the beginning to the counterparties under contract. Each contract has either a fixed or amortizing notional face amount on which the interest is computed, and a set term to maturity. When the referenced LIBOR interest rate rises above the contractual strike rate, we earn cap income. Payments on an annualized basis equal the contractual notional face amount times the difference between actual LIBOR and the strike rate. Interest rate swaps have similar characteristics. However,Under interest rate swap agreements allow us towe pay a fixed rate of interest while receiving a rate that adjusts with one-month LIBOR.

The following table summarizes the key contractual terms associated with our interest rate risk management contracts. Substantiallycontracts as of December 31, 2007, all of thewhich are held by securitization trusts. All of our pay-fixed swapsswap contracts and interest rate capscap contracts are indexed to one-month LIBOR. During 2007, we terminated all of our derivative instruments not in securitization trusts. The cash impact was minimal to settle the terminations.

We have determined the following estimated net fair value amounts by using available market information and valuation methodologies we deem appropriate as of December 31, 2004.2007.

Interest Rate Risk Management Contracts

(dollars in thousands)

| Maturity Range | |||||||||||||||||||

Net Fair Value | Total Notional Amount | 2005 | 2006 | 2007 | |||||||||||||||

Pay-fixed swaps: | |||||||||||||||||||

Contractual maturity | $ | 6,143 | $ | 1,350,000 | $ | 285,000 | $ | 840,000 | $ | 225,000 | |||||||||

Weighted average pay rate | 3.0 | % | 2.4 | % | 3.1 | % | 3.5 | % | |||||||||||

Weighted average receive rate | 2.4 | % | (A | ) | (A | ) | (A | ) | |||||||||||

Interest rate caps: | |||||||||||||||||||

Contractual maturity | $ | 5,819 | $ | 650,000 | $ | 450,000 | $ | 200,000 | $ | — | |||||||||

Weighted average strike rate | 1.7 | % | 1.6 | % | 2.0 | % | — | ||||||||||||

| Net Fair Value | Total Notional Amount | Maturity Range | |||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 and beyond | |||||||||||||||||||||||

Pay-fixed swaps: | |||||||||||||||||||||||||||

Contractual maturity | $ | (9,441 | ) | $ | 1,165,000 | $ | 720,000 | $ | 405,000 | $ | 40,000 | $ | — | $ | — | ||||||||||||

Weighted average pay rate | 4.9 | % | 5.0 | % | 4.9 | % | 5.0 | % | — | — | |||||||||||||||||

Weighted average receive rate | 4.6 | % | (A | ) | (A | ) | (A | ) | (A | ) | — | ||||||||||||||||

Interest rate caps: | |||||||||||||||||||||||||||

Contractual maturity | $ | 85 | $ | 220,000 | $ | 180,000 | $ | 40,000 | $ | — | $ | — | $ | — | |||||||||||||

Weighted average strike rate | 5.0 | % | 5.0 | % | 5.0 | % | — | — | — | ||||||||||||||||||

| (A) | The pay-fixed swaps receive rate is indexed to one-month |

Liquidity/Funding Risk

Mortgage lending requiresLiquidity Risk.A significant risk to our operations is the risk that we will not have enough cash to fund loan originations and purchases. Our warehouse lending arrangements, including repurchase agreements, support the mortgage lending operation. Our warehouse mortgage lenders allow us to borrow between 98% and 100% of the outstanding principal. Funding for the difference – generally 2% of the principal - must come from cash on hand. If we are unable to obtain sufficient cash resources, we may not be ableliquidity available to operate our mortgage lending (banking) segment.

We are currently dependent upon a limited number of primary credit facilities for funding of our mortgage loan originations and acquisitions. Any failure to renew or obtain adequate funding under these financing arrangements could harm our lending operations and our overall performance. An increase in the cost of financing in excess of any change in the income derived from our mortgage assets could also harm our earnings and reduce the cash available for distributions to our stockholders. In October 1998, the subprime mortgage loan market faced a liquidity crisis with respect to the availability of short-term borrowings from major lenders and long-term borrowings through securitization. At that time, we faced significant liquidity constraints that harmed our business and meet our profitability.debt payment and other obligations. We can provide no assurance that those adverse circumstances will not recur.

We use repurchase agreements to finance the acquisition of mortgage assets in the short-term. In a repurchase agreement, we sell an assetcurrently face substantial liquidity risk and agree to repurchase the same asset at some period in the future. Generally, the repurchase agreements we entered into stipulate that we must repurchase the asset in 30 days. For financial accounting purposes, these arrangements are treated as secured financings. We retain the assets onuncertainty, near-term and otherwise, which threatens our balance sheet and record an obligation to repurchase the asset. For our repurchase agreements secured by mortgage loans, the amount we may borrow is generally 98% of the mortgage loan market value. For our repurchase agreements secured by mortgage securities, the amount we may borrow is generally 75% of the mortgage securities market value. When asset market values decrease, we are required to repay the margin, or difference in market value. To the extent the market values of assets financed with repurchase agreements decline rapidly, we will be required to meet cash margin calls. If cash is unavailable, we may default on our obligations under the applicable repurchase agreement. In that event, the lender retains the right to liquidate the collateral we provided to it to settle the amount due from us.

We are dependent on the securitization market for the sale of our loans because we securitize loans directly and many of our whole loan buyers purchase our loans with the intention to securitize. The securitization market is dependent upon a number of factors, including general economic conditions, conditions in the securities market generally and conditions in the asset-backed securities market specifically. In addition, poor performance of our previously securitized loans could harm our access to the securitization market. Accordingly, a decline in the securitization market, the ability to obtain attractive terms orcontinue as a change in the market’s demand for our loans could have a material adverse effect on our results of operations, financial conditiongoing concern and business prospects.

avoid bankruptcy. See the “Liquidity and Capital Resources” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion of liquidity risks and resources available to us.

Credit Risk

Risk.Credit risk is the risk that we will not fully collect the principal we have invested in mortgage loans or the amount we have invested in securities. Nonconforming mortgage loans comprise substantially all of our entire mortgage loan portfolio and serve as collateral for our mortgage securities – available-for-sale. Our nonconformingsecurities. Nonconforming borrowers include individuals who do not qualify for agency/conventional lending programs because of a lack of conventional documentation or previous credit difficulties, but have considerable equity in their homes.difficulties. Often, they are individuals or families who have built up high-rate consumer debt and are attempting to use the equity in their home to consolidate debt and reduce the amount of money it takes to service their monthly debt obligations. Our underwriting guidelines are intended

We have traditionally utilized our role as servicer of our securitized pools of mortgage loans to evaluate the credit historyattempt to identify and address potential and actual borrower delinquencies and defaults. As a result of the potential borrower,sale of our mortgage servicing rights effective November 1, 2007, we no longer control the capacitylender-borrower relationship, which may exacerbate the increase in delinquencies and willingness of the borrower to repay the loan,defaults under such mortgage loans and the adequacy of the collateral securing the loan.

Underwriting staff work under the credit policies established by our Chief Credit Officer. Underwriters are given approval authority only after their work has been reviewed for a period of time. Thereafter, the Chief Credit Officer re-evaluates the authority levels of all underwriting personnel on an ongoing basis. All loans in excess of $350,000 currently require the approval of an underwriting supervisor. Our Chief Credit Officer or our President must approve loans in excess of $1,000,000.

The underwriting guidelines take into consideration the number of times the potential borrower has recently been late on a mortgage payment and whether that payment was 30, 60 or 90 days past due. Factors such as FICO score, bankruptcy and foreclosure filings, debt-to-income ratio, and loan-to-value ratio are also considered. The credit grade that is assigned to the borrower is a reflection of the borrower’s historical credit and the loan-to-value determined by the amount of documentation the borrower could produce to support income. Maximum loan-to-value ratios for each credit grade dependnegative impact on the level of income documentation provided by the potential borrower. In some instances, when the borrower exhibits strong compensating factors, exceptions to the underwriting guidelines may be approved.

Key to our successful underwriting process is the use of NovaStarIS®. NovaStarIS® is the second generationvalue and cash flows of our proprietary automated underwriting system. IS provides more consistency in underwritingresidual and subordinated securities and mortgage loans – held-in-portfolio resulting from such delinquencies and allows underwriting personnel to focus more of their time on loans that are not initially accepted by the IS system.

Our mortgage loan portfolio by credit grade, all of which are nonconforming can be accessed via our website at www.novastarmortgage.com.

A tool for managing credit risk is to diversify the markets in which we originate, purchase and own mortgage loans. Presented via our website at www.novastarmortgage.com is a breakdown of the geographic diversification of our loans. Details regarding loans charged off are disclosed in Note 2 to our consolidated financial statements.

We have purchased mortgage insurance on many of the loans that are held in our portfolio – on the balance sheet and those that serve as collateral for our mortgage securities – available-for-sale. The use of mortgage insurance is discussed under “Premiums for Mortgage Loan Insurance” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.defaults.

Prepayment Risk

.Generally speaking, when market interest rates decline, borrowers are more likely to refinance their mortgages. The higher the interest rate a borrower currently has on his or her mortgage the more incentive he or she has to refinance the mortgage when rates decline. In addition, the higher the credit grade, the more incentive there is to refinance increases when credit ratings improve. When home values rise, loan-to-value ratios drop, making it more likely that a borrower has a low loan-to-value ratio, he or she is more likely towill do a “cash-out” refinance. Each of these factors increases the chance for higher prepayment speeds during the term of the loan.speeds.

The majority of our residual securities portfolio consists of securities which are “interest-only” in nature. These securities represent the net cash flow – interest income – on the underlying loans in excess of the cost to finance the loans. When borrowers repay the principal on their mortgage loans early, the effect is to shorten the period over which interest is earned, and therefore, reduce the cash flow and yield on our securities.

We mitigatemitigated prepayment risk by originating and purchasing loans that include a penalty if the borrower repays the loan in the early months of the loan’s life. For theA majority of our loans have a prepayment penalty is charged equalup to but no greater than 80% of six months interest on the principal balance that is to be paid in full.being repaid. As of December 31, 2004, 73%2007, 51% of our securitizedthe loans had a prepayment penalty. These loanswhich serve as collateral for our mortgage securities – available-for-sale.had a prepayment penalty. As of December 31, 2004, 65%2007, 62% of our mortgage loans - held-for-sale– held-in-portfolio had a prepayment penalty, which serve as collateral for our short-term borrowings. During 2004, 72% of the loans we originated and purchased had prepayment penalties.penalty.

Regulatory Risk

As a mortgage lender, we are subject to many laws and regulations. Any failure to comply with these rules and their interpretations or with any future interpretations or judicial decisions could harm our profitability or cause a change in the way we do business. For example, several lawsuits have been filed challenging types of payments made by mortgage lenders to mortgage brokers. Similarly, in our branch operations, we allow our branch managers considerable autonomy, which could result in our facing greater exposure to third-party claims if our compliance programs are not strictly adhered to.

Several states and cities are considering or have passed laws, regulations or ordinances aimed at curbing predatory lending practices. The federal government is also considering legislative and regulatory proposals in this regard. In general, these proposals involve lowering the existing federal Homeownership and Equity Protection Act thresholds for defining a “high-cost” loan, and establishing enhanced protections and remedies for borrowers who receive such loans. Passage of these laws and rules could reduce our loan origination volume. In addition, many whole loan buyers may elect not to purchase any loan labeled as a “high cost” loan under any local, state or federal law or regulation. Rating agencies likewise may refuse to rate securities backed by such loans. Accordingly, these laws and rules could severely restrict the secondary market for a significant portion of our loan production. This would effectively preclude us from continuing to originate loans either in jurisdictions unacceptable to the rating agencies or otherwise within newly defined thresholds and could have a material adverse effect on our business.

Recently enacted and effective laws, regulations and standards relating to corporate governance and disclosure requirements applicable to public companies, including the Sarbanes-Oxley Act of 2002, new Securities and Exchange Commission regulations and New York Stock Exchange rules have increased the costs of corporate governance, reporting and disclosure practices. These costs may increase in the future due to our continuing implementation of compliance programs mandated by these requirements. In addition, these new laws, rules and regulations create new legal bases for administrative enforcement and civil and criminal proceedings against us in case of non-compliance, thereby increasing our risks of liability and potential sanctions.

Other Risk Factors

Although management considers the risk components set forth above to be its primary business risks, the following are other risks that should be considered by our investors. Further information regarding these risks is included in our registration statements filed with the Commission.

U.S. Federal Income Tax Consequences

General. We believeHistorically, we have complied, and intendwere taxed as a REIT under Section 857 of the Code. As a REIT, we generally were not subject to comply in the future, with the requirements forfederal income tax. To maintain our qualification as a REIT, under the Code. To the extent that we qualify as ahad to distribute at least 90% of our REIT for federaltaxable income tax purposes,to our shareholders and meet certain other tests relating to assets, income and ownership. However, we generally will not be subjecthad elected to federal income tax on the amount of income or gain that is distributed to shareholders. However, origination and broker operations are conducted through NovaStar Mortgage and NovaStar Home Mortgage, which are owned bytreat NFI Holding – aCorporation and its subsidiaries as taxable REIT subsidiary (TRS). Consequently, all ofsubsidiaries (collectively the taxable income of NFI Holding is subject to federal and state corporate income taxes.“TRS”). In general, athe TRS maycould hold assets that athe REIT cannotcould not hold directly and generally maycould engage in any real estate or non-real estate related business. However, special rules do apply to certain activities between a REIT and its TRS. For example, aThe subsidiaries comprising the TRS will bewere subject to earnings stripping limitations on the deductibility of interest paid to its REIT. In addition, a REIT will be subject to a 100% excisecorporate federal and state income tax on certain excess amounts to ensure that (i) tenants who pay a TRS for services are charged an arm’s-length amount by the TRS, (ii) fees paid to a REIT by its TRS are reflected at fair market value and (iii) interest paid by a TRS to its REIT is commercially reasonable.were taxed as regular C corporations.

The REIT rules generally require that a REIT invest primarily in real estate related assets, its activities be passive rather than active and it distribute annually to its shareholders substantially all of its taxable income. We could be subject to a number of taxes ifDuring 2007, we failedwere unable to satisfy those rulesthe REIT distribution requirement for the tax year ended December 31, 2006 either in the form of cash or if we acquired certain types of income-producing real property through foreclosure. Although no complete assurance can be given, we do not expect that we will be subject to material amounts of such taxes.

Failure to satisfy certain Code requirements could causepreferred stock. This action resulted in our loss of REIT status. Ifstatus retroactive to January 1, 2006. Our failure to satisfy the REIT distribution test resulted from demands on our liquidity and the substantial decline in our market capitalization during 2007.

As a result of our termination of REIT status, we failelected to qualify asfile a REIT for any taxable year, we would be subject toconsolidated federal income tax (including any applicable minimum tax) at regular corporate rates and would not receive deductions for dividends paid to shareholders. As a result, the amountreturn with our eligible affiliated members. We reported taxable income in 2006 of after-tax earnings available for distribution to shareholders would decrease substantially. While we intend to operateapproximately $212 million, which resulted in a manner that will enabletax liability of approximately $74 million along with interest and penalties due of approximately $5.8 million. After applying the payments and credits, we reported an amount owed to the IRS of approximately $67 million. We applied for and received an extension of time to pay the income taxes due to our expectation of generating a net operating loss for 2007, which may be carried back to 2006. This approved extension should allow us to qualify as a REIT in future taxable years, there can be no certainty that such intention will be realized.

Qualification as a REIT. Qualification as a REIT requires that we satisfy a variety of tests relating to income, assets, distributions and ownership. The significant tests are summarized below.

Sources of Income. We must satisfy two tests with respect to the sources of income: the 75% income test, and the 95% income test. The 75% income test requires that we derive at least 75% of gross income, excluding gross income from prohibited transactions, from certain passive real estate-related activities. In order to satisfy the 95% income test, at least 95% of gross income must be derived from the same sources as the 75% income test or from dividends or interest from any source. Management believes that we were in compliance with both of the income tests for the 2004 and 2003 calendar years.

Nature and Diversification of Assets. As of the last day of each calendar quarter, we must meet six requirements under the two asset tests. Under the 75% of assets test, at least 75% of the value of our total assets must represent cash or cash items (including receivables), government securities or real estate assets. Under the 25% assets test, no more than 25% of our total assets can be represented by securities, other than government securities, stock of a qualified REIT subsidiary, and securities that qualify as real estate assets under the 75% assets test (collectively “75% Securities”). Additionally, under the 25% assets test, no more than 20% of the value of our total assets can be represented by securities of one or more taxable REIT subsidiaries and no more than 5% of the value of our total assets can be represented by the securities of a single issuer, excluding 75% Securities. Furthermore, we may not own more than 10% of the total voting power or the total value of the outstanding securities of any one issuer, excluding 75% Securities.

If we inadvertently fail to satisfy one or more of the asset tests at the end of a calendar quarter, such failure would not cause us to lose our REIT status. We could still avoid disqualification by eliminating any discrepancy within 30 days after the close of the calendar quarter in which the discrepancy arose. Management believes that we are in compliance withreduce all of the requirements of both asset tests for all quarters during 2004 and 2003.

Ownership of Common Stock. Our capital stock must be held by a minimum of 100 persons for at least 335 days of each year. In addition, at all times during the second half of each taxable year, no more than 50% in value of our capital stock may be owned directly or indirectly by 5 or fewer individuals. We use the calendar year as our taxable year for income tax purposes. The Code requires us to send annual information questionnaires to specified shareholders in order to assure compliance with the ownership tests. Management believes that we have complied with these stock ownership tests for 2004 and 2003.

Distributions. We must distribute at least 90% of our taxable income (excluding excess inclusion income) from 2006, and eliminate the outstanding tax liability due to the IRS. However, we will be required to pay interest and any after-taxpenalties that apply on the balance due to the IRS in 2008.

Because we terminated our REIT status effective January 1, 2006 and were taxable as a C corporation for 2006 and beyond, we recorded deferred taxes based on the estimated cumulative temporary differences as of December 31, 2007.

In determining the amount of deferred tax assets to recognize in the financial statements, we evaluate the likelihood of realizing such benefits in future periods. Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standard No. 109 “Accounting for Income Taxes” (“SFAS 109”) requires the recognition of a valuation allowance if it is more likely than not that all or some portion of the deferred tax asset will not be realized. SFAS 109 indicates the more likely than not threshold is a level of likelihood that is more than 50 percent.

Based on the evidence available as of December 31, 2007, including the significant pre-tax losses incurred by us in both the current quarter and previous quarters, the ongoing disruption to the credit markets, the liquidity issues facing us and our decision to close all of our mortgage lending operations, we concluded that it is more likely than not that our entire net income from certain typesdeferred tax asset will not be realized. Based on these conclusions, we recorded a valuation allowance of foreclosure property less any non-cash income. No distributions are required in$368.3 million for deferred tax assets as of December 31, 2007 compared to $0.7 million as of December 31, 2006. In future periods, in which there is no income.we will continue to monitor all factors that impact positive and negative evidence relating to our deferred tax assets.

Taxable Income.As of December 31, 2007, we had a federal net operating loss of approximately $368.4 million. We useare expecting to carryback $196.1 million of the calendar year for both tax and financial reporting purposes. However, there may be differences between2007 projected federal net operating loss against our 2006 taxable income and have recorded a current receivable for such benefit. The receivable was netted against the 2006 federal liability. The remaining $172.3 federal net operating loss may be carried forward to offset future taxable income, computed in accordance with accounting principles generally acceptedsubject to provisions of the Code, including substantial limitations that would be imposed in the United Statesevent of America (GAAP). These differences primarily arise from timingan “ownership change” as defined by Section 382 of the Code. If not used, this net operating loss will begin to expire in 2025.

The IRS is currently examining the 2005 federal income tax return of NFI Holding Corporation, a wholly-owned subsidiary. We are not aware of any significant findings as a result of this exam, however, the exam is still ongoing. Management believes it has adequately provided for potential tax liabilities that may be assessed for years in which the statute of limitations remains open. However, the assessment of any material liability would adversely affect our financial condition, liquidity and character differences in the recognition of revenue and expense and gains and losses for tax and GAAP purposes. Additionally, taxable income does not include the taxable income of our taxable subsidiary, although the subsidiary’s operating results are included in our GAAP results.ability to continue as a going concern.

Personnel

As of December 31, 2004,2007, we employed 3,502247 people. Of these, 1,738 were employedBecause of further reductions in our mortgage portfolio management and mortgage lending and loan servicing operations. Our branches employed 1,721workforce subsequent to December 31, 2007, we employ approximately 53 people as of December 31, 2004. The remainingMarch 27, 2008. None of our employees were employed in our branch administrative functions.are represented by a union or covered by a collective bargaining agreement.

Available Information

A copyCopies of the filings we have madeour annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports filed or furnished with the Securities and Exchange Commission (SEC) may be obtained onSEC are available free of charge through our Internet site (www.novastarmortgage.com) as soon as reasonably practicable after filing with the SEC. References to our website (www.novastarmortgage.com), throughdo not incorporate by reference the information on such website into this Annual Report on Form 10-K and we disclaim any such incorporation by reference. Copies of our board committee charters, our board’s Corporate Governance Guidelines, Code of Conduct, and other corporate governance information are available at the SEC (www.sec.gov)Corporate Governance section of our Internet site (www.novastarmortgage.com), or by contacting us directly. Our investor relations contact information follows.

Investor Relations

8140 Ward Parkway, Suite 300

Kansas City, MO 64114

816.237.7000816.237.7424

Email: ir@novastar1.com

Risk Factors

You should carefully consider the risks described below in evaluating our business and before investing in our publicly traded securities. Any of the risks we describe below or elsewhere in this report could negatively affect our results of operations, financial condition, liquidity, business prospects and ability to continue as a going concern. The risks described below are not the only ones facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially adversely affect our results of operations, financial condition, liquidity, business prospects and ability to continue as a going concern. Our business is also subject to the risks that affect many other companies, such as competition, inflation, technological obsolescence, labor relations, general economic conditions and geopolitical events.

Risks Related to Recent Changes in Our Business

The subprime loan market has largely ceased to operate, which has adversely affected our business and may adversely affect our ability to continue as a going concern.

Due to a number of market factors, including increased delinquencies and defaults on residential mortgage loans, investor concerns over asset quality, a weakening of the United States housing market and the failure of certain subprime mortgage companies and hedge funds that have invested in subprime loans, there has been extreme uncertainty and disruption in the subprime mortgage industry as a whole. As a result, our business has been materially and adversely affected in a number of ways. Due to the fact that the

secondary market for mortgage loans has effectively been unavailable to us since the middle of 2007, we have discontinued our mortgage lending business and have sold, at a loss, most of the loans that we originated during 2007 and had not previously securitized. Further, we have sold our mortgage servicing assets to generate cash to repay existing indebtedness and to reduce cash requirements. We have also terminated a substantial portion of our workforce. All of these events have had a material adverse effect on our business and have forced us to change business strategies. Our business now is focused solely on managing our portfolio of mortgage securities. If the subprime market fails to significantly improve, our results of operations, financial condition, liquidity, and business prospects will be further adversely affected and there can be no assurance that we will be able to continue as a going concern. Further, because of state licensing requirements, we are unlikely to be able, ourselves, to recommence mortgage lending activities so long as we continue to have a shareholders’ deficit. As a result of this and other factors, in the event that the subprime market recovers, there can be no assurance that we will be able to operate in the manner or at the levels that we have historically.

Payments on our mortgage securities are currently our only source of cash flows and will decrease in the next several months. Absent the reestablishment of profitable operations and reduction of our expenses from discontinued operations and other obligations, our cash flows will not be sufficient for us to continue as a going concern.

Our residual and subordinated mortgage securities are currently our only source of cash flows. Based on the current projections, the cash flows from our mortgage securities will decrease in the next several months as the underlying mortgage loans are repaid, and could be significantly less than the current projections if losses on the underlying mortgage loans exceed the current assumptions. In addition, we have significant operating expenses associated with office leases, software contracts, and other obligations relating to our discontinued operations, as well as payment obligations with respect to secured and unsecured debt, including periodic interest payments with respect to junior subordinated debentures relating to the trust preferred securities of NovaStar Capital Trust I and NovaStar Capital Trust II. We intend to use available cash inflows in excess of our immediate operating needs, including debt service payments, to repay all of Wachovia’s short-term borrowings and any remaining fees due under the repurchase agreements at the earliest practical date. Any new advances under our financing facilities are at Wachovia’s sole discretion and we do not expect any such advances to be made. If, as the cash flows from mortgage securities decrease, we are unable to recommence or invest in mortgage loan origination or brokerage business on a profitable basis, and restructure our unsecured debt and contractual obligations or if the cash flows from our mortgage securities are less than currently anticipated, there can be no assurance that we will be able to continue as a going concern and avoid seeking the protection of applicable federal and state bankruptcy laws.

To the extent that the mortgage loans underlying our residual and subordinated securities continue to experience significant credit losses, our liquidity and ability to continue as a going concern will be adversely affected.

Our mortgage securities consist of certain residual securities retained from our past securitizations of mortgage loans, which typically consist of interest-only, prepayment penalty, and over collateralization bonds, and certain investment grade and non-investment grade rated subordinated mortgage securities retained from our past securitizations and purchased from other ABS issuers. These residual and subordinated securities are generally unrated or rated below investment grade and, as such, involve significant investment risk that exceeds the aggregate risk of the full pool of securitized loans. By holding the residual and subordinated securities, we generally retain the “first loss” risk associated with the underlying pool of mortgage loans. As a result, losses on the underlying mortgage loans directly affect our returns on, and cash flows from, these mortgage securities. In addition, if delinquencies and/or losses on the underlying mortgage loans exceed specified levels, the level of over-collateralization required for higher rated securities held by third parties may be increased, further decreasing cash flows presently payable to us.

Increased delinquencies and defaults on the mortgage loans underlying our residual and subordinated mortgage securities have resulted in a decrease in the cash flow we receive from these investments. To the extent we continue to experience significant realized losses and decreased cash flows from these assets, our results of operations, financial condition, liquidity, and ability to continue as a going concern will be adversely affected. In addition, because we have financed our mortgage securities under short-term warehouse repurchase agreements, continued decreases in the value of these retained securities may result in additional margin calls, which will further undermine our liquidity and ability to continue as a going concern.

There can be no assurance that we will have access to financing necessary to support our business and assets. Further, if we are unable to remain in compliance with agreements governing our indebtedness or to obtain waivers of any noncompliance, we will not be able to continue as a going concern.

We have incurred significant debt to finance our past operations, including the origination and purchase of mortgage loans and the purchase of mortgage securities. A significant amount of our indebtedness is represented by multiple secured financing facilities with Wachovia and the junior subordinated debentures related to the trust preferred securities of NovaStar Capital Trust I and NovaStar Capital Trust II.

We currently intend to use available cash inflows in excess of our immediate operating needs, including debt service payments, to repay all of Wachovia’s outstanding borrowings and any remaining fees due under the repurchase agreements at the earliest practical date. During and after this period of repayment, any new advances under the Wachovia lending facilities are at Wachovia’s sole discretion and we do not expect any such advances to be made.

As of December 31, 2007 and thereafter, we are out of compliance with the net worth and liquidity covenants in our financing agreements with Wachovia. While Wachovia has waived this non compliance through April 30, 2008, there can be no assurance that we will be able to obtain further waivers of, or amendments to, our financing facilities if we were to breach any representation, warranty or covenant contained in such financing facilities or waiver or amendment. In addition, we project that we will be out of compliance with our current waiver prior to its expiration of April 30, 2008. Any default under our secured financing facilities and failure to obtain any necessary waivers or amendments in the future could result in the acceleration of the indebtedness under these facilities and the liquidation by the lender of the related collateral. Any acceleration of indebtedness would have a material adverse affect on our liquidity and ability to continue as a going concern and any liquidation of our collateral could be at a substantial loss.

Our wholly owned subsidiary NovaStar Mortgage, Inc. has outstanding junior subordinated debentures related to the outstanding trust preferred securities of NovaStar Capital Trust I and NovaStar Capital Trust II. We have guaranteed NovaStar Mortgage’s obligations under these debentures, including NovaStar Mortgage’s obligations to make periodic interest payments thereon. Our financing facilities with Wachovia prohibit us from making any such payments without Wachovia’s consent in the event that we have less than $30 million of available liquidity. In the event that any such payments are not made when due, whether as a result of the restrictions in our financing agreements with Wachovia or otherwise, or we or NovaStar Mortgage otherwise breach any of our obligations relating to the debentures or trust preferred securities and fail to remedy the default within the applicable cure period, if any, all of our obligations with respect thereto, including the repayment of principal, may be accelerated and declared to be immediately due and payable, in which case we would be forced to seek the protection of applicable federal and state bankruptcy laws.

In light of current market conditions, our current financial condition, and our lack of significant unencumbered assets, no assurance can be given regarding our ability to meet our debt service obligations or to secure additional financing. To the extent we are unable to meet our debt service obligations or do not have access to adequate financing, our business prospects and ability to continue as a going concern will be negatively affected. There is no assurance that we will continue to have access to financing at levels necessary for operations or other liquidity needs or that we will not be forced to file for bankruptcy.

Various legal proceedings could adversely affect our financial condition, our results of operations, liquidity and our ability to continue as a going concern.

In the course of our business, we are subject to various legal proceedings and claims. See Part I “Item 3—Legal Proceedings.” The resolution of these legal matters or other legal matters could result in a material adverse impact on our results of operations, liquidity, financial condition and ability to continue as a going concern.

The Securities and Exchange Commission (the “Commission”) has requested information from issuers in our industry, including us, regarding accounting for mortgage loans and other mortgage related assets. In addition, we have received requests or subpoenas for information relating to our operations from various federal and state regulators and law enforcement, including, without limitation, the Federal Trade Commission, the Department of Housing and Urban Development, the United States Department of Justice, the Federal Bureau of Investigation, the New York Attorney General and the Department of Labor. While we have provided, or are in the process of providing, the requested information to the applicable officials, we may be subject to further information requests from, or action by, these or other regulators or law enforcement officials. To the extent we are subject to any actions, our financial condition, liquidity, and ability to continue a going concern could be materially adversely affected.

There can be no assurance that our common stock or Series C Preferred Stock will continue to be traded in an active market.

Our common stock and our 8.90% Series C Preferred Stock were delisted by the New York Stock Exchange (“NYSE”) in January 2008, as a result of failure to meet applicable standards for continued listing on the NYSE. Our common stock and Series C Preferred Stock are currently quoted on the OTC Bulletin Board and on the Pink Sheets. However, there can be no assurance that an active trading market will be maintained. Trading of securities on the OTC and Pink Sheets is generally limited and is effected on a less regular basis than on exchanges, such as the NYSE, and accordingly investors who own or purchase our stock will find that the

liquidity or transferability of the stock may be limited. Additionally, a shareholder may find it more difficult to dispose of, or obtain accurate quotations as to the market value of, our stock. If an active public trading market cannot be sustained, the trading price of our common and preferred stock could be adversely affected and your ability to transfer your shares of our common and preferred stock may be limited.

We are not likely to pay dividends to our common or preferred stockholders in the near future.

We are not required to pay out our taxable income in the form of dividends, as we are no longer subject to a REIT distribution requirement. Instead, payment of dividends is at the discretion of our board of directors. To preserve liquidity and to remain in compliance with our financing facilities, our board of directors has suspended dividend payments on our Series C and Series D-1 Preferred Stock. Dividends on our Series C and D-1 Preferred Stock continue to accrue and the dividend rate on our Series D-1 Preferred Stock increased from 9.0% to 13.0%, compounded quarterly, effective January 16, 2008 with respect to all unpaid dividends and subsequently accruing dividends. No dividends can be paid on any of our common stock until all accrued and unpaid dividends on our Series C and Series D-1 Preferred Stock are paid in full. Accumulating dividends with respect to our preferred stock will negatively affect the ability of our common stockholders to receive any distribution or other value upon liquidation.

Risks Related to Mortgage Asset Financing, Sale, and Investment Activities

We may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or certain borrower defaults, which could further harm our liquidity and ability to continue as a going concern.