PAGE 9

Item 1A. RISK FACTORS — continued

changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies

If S&T does not adjust to changes in the financial services industry, its financial performance may suffer.

S&T’s ability to maintain its history of strong financial performance and return on investment to shareholders will depend in part on its ability to expand its scope of available financial services to its customers. In addition to other banks, competitors include security dealers, brokers, mortgage bankers, investment advisors, and finance and insurance companies. The increasingly competitive environment is, in part, a result of changes in regulation, changes in technology and product delivery systems, and the accelerating pace of consolidation among financial service providers.

PAGE 9

Item 1A. RISK FACTORS — continued

Future governmental regulation and legislation could limit our growth.

S&T is subject to extensive state and federal regulation, supervision and legislation that govern nearly every aspect of our operations. Changes to these laws could affect our ability to deliver or expand our services and diminish the value of our business. See “Supervision and Regulation” for additional information.

ChangesInterest rate movements impact the earnings of S&T.

S&T is exposed to interest rate risk, through the operations of its banking subsidiary, since substantially all of S&T Bank’s assets and liabilities are monetary in nature. Interest rate risk arises from market driven fluctuations in interest rates could reducethat affect cash flows, income, expense and cash flow.

value of financial instruments. S&T’s&T Bank’s earnings, like that of most financial institutions, largely depend on net interest income, and cash flow depends to a great extent onwhich is the difference between the interest income earned on interest-earning assets, such as loans and investments, and the interest expense paid on interest-bearing liabilities, such as deposits and borrowings. In an increasing interest rate environment, the cost of funds is expected to increase more rapidly than the interest earned on the loans and securities because the primary source of funds are deposits with generally shorter maturities than the maturities on loans and investment securities,securities. This causes the net interest rate spread to compress and negatively impact S&T Bank’s profitability.

S&T’s business strategy includes growth plans through internal growth and acquisitions. Our financial condition and results of operations could be negatively affected if we fail to grow or fail to manage our growth effectively.

S&T intends to continue pursuing a profitable growth strategy. Our prospects must be considered in light of the interest paidrisks, expenses and difficulties frequently encountered by companies in growth stages of development. We cannot assure you that we will be able to expand our market presence in our existing markets or successfully enter new markets or that any such expansion will not adversely affect our results of operations. Failure to manage our growth effectively could have a material adverse effect on depositsour business, future prospects, financial condition or results of operations and could adversely affect our ability to successfully implement our business strategy. Also, if we grow more slowly than anticipated, our operating results could be materially adversely affected.

Our ability to grow successfully will depend on a variety of factors including the continued availability of desirable business opportunities, the competitive responses from other borrowings. Interest ratesfinancial institutions in our market areas and our ability to manage our growth. While we believe we have the management resources and internal systems in place to successfully manage our future growth, there can be no assurance that growth opportunities will be available or that growth will be successfully managed.

Downturn in the local economies may adversely affect our business.

S&T’s business is concentrated in the western-Pennsylvania area. As a result, its financial condition, results of operations and cash flows are beyond our control, and they fluctuatesubject to changes if there are changes in response to generalthe economic conditions in this area. A prolonged period of economic recession or other adverse economic conditions in this area could have a negative impact on S&T. S&T can provide no assurance that conditions in its market area economies will not deteriorate in the future and the policies of various governmental and regulatory agencies, in particular, the Federal Reserve Board. Changes in monetary policy, including changes in interest rates, will influence the origination of loans, the purchase of investments, the generation of deposits and the rates receivedthat such deterioration would not have a material adverse effect on loans and investment securities and paid on deposits. Although increases in interest rates would result in additional interest income from each new loan made or serviced, the number of new loans is likely to decrease as interest rates rise. Any revenue reductions from fewer loans and increased interest expense paid in connection with borrowed funds and deposits may not be offset by the higher income as a result of increased interest rates.S&T.

Item 1B. UNRESOLVED STAFF COMMENTS

There were no unresolved comments received from the Securities and Exchange CommissionSEC regarding S&T’s periodic or current reports within the last 180 days prior to December 31, 2005.2006.

PAGE 10

S&T operates 5049 banking offices in Allegheny, Armstrong, Blair, Butler, Cambria, Clarion, Clearfield, Indiana, Jefferson, Westmoreland and surrounding counties in Pennsylvania.

S&T owns land and banking offices at the following locations:

133 Philadelphia Street Armagh, PA 15920 | 205 East Market Street Blairsville, PA 15717 | 111 Resort Plaza Drive Blairsville, PA 15717 | 456 Main Street Brockway, PA 15824 | |||

256 Main Street Brookville, PA 15825 | 209 Allegheny Boulevard Brookville, PA 15825 | 100 South Chestnut Street Derry, PA 15627 | 410 Main Street Clarion, PA 16214 | |||

650 Main Street Clarion, PA 16214 | 85 Greensburg Street Delmont, PA 15626 | 200 Patchway Road Duncansville, PA 16635 | 614 Liberty Boulevard DuBois, PA 15801 | |||

Coral Reef & Crooked Island Roads DuBois, PA 15801 | 35 West Scribner Avenue DuBois, PA 15801 | 34 North Main Street Homer City, PA 15748 | 420 Pleasantview Drive & Armstrong Street Ford City, PA 16226 | |||

920 Fifth Avenue Ford City, PA 16226 | 701 East Pittsburgh Street Greensburg, PA 15601 |

225 Lucerne Road Lucernemines, PA 15754 | 2175 Route 286 South Indiana, PA 15701 | |||

100 South Fourth Street Youngwood, PA 15697 | 501 Philadelphia Street Indiana, PA 15701 | 2190 Hulton Road Verona, PA 15147 | 4385 Old Wm. Penn Hwy Monroeville, PA 15146 | |||

4251 Old Wm. Penn Hwy Murrysville, PA 15668 | 628 Broad Street New Bethlehem, PA 16242 | 539 West Mahoning Street Punxsutawney, PA 15767 | 12262 Frankstown Road Pittsburgh, PA 15235 | |||

301 Unity Center Road Pittsburgh, PA 15239 | 7660 Saltsburg Road Pittsburgh, PA 15239 | 30 Towne Center Drive Leechburg, PA 15656 | 232 Hampton Avenue Punxsutawney, PA 15767 | |||

418 Main Street Reynoldsville, PA 15851 | 602 Salt Street Saltsburg, PA 15681 | 800 Philadelphia Street Indiana, PA 15701 | 355 North Fifth Street Indiana, PA 15701 | |||

| 196 Industrial Park Ebensburg, PA 15931 | ||||||

S&T leases land where S&T owns the banking offices and remote ATM buildings at the following locations:

8th & Merle Street Clarion, PA 16214 | 2320 Route 286 Pittsburgh, PA 15239 | 523 Franklin Avenue Vandergrift, PA 15690 | 435 South Seventh Street Indiana, PA 15701 | |||

1107 Wayne Avenue Indiana, PA 15701 | 1176 Grant Street Indiana, PA 15701 | 229 Westmoreland Drive, Route 30 Greensburg, PA 15601 | 220 New Castle Road Butler, PA 16001 | |||

| 835 Hospital Road Indiana, PA 15701 | ||||||

PAGE 11

Item 2. PROPERTIES — continued

S&T leases land and banking offices at the following locations:

| 20001 Route 19 Suite B Cranberry Township, PA 16066 | 6700 Hollywood Delmont, PA 15626 | 5522 Shaffer Road

| 206 East High Street Ebensburg, PA 15931 | |||||

Lawruk Plaza

| 324 North Fourth Street Indiana, PA 15701 |

| 3884 Route 30 East Latrobe, PA 15650 | |||||

3100 Oakland Avenue

|

| |||||||

|

|

| Two Gateway Center 603 Stanwix Street, Suite 125

| 33 South Sixth Street Indiana, PA 15701 | ||||

| 2388 Route 286 Holiday Park, PA 15239 | Shadyside Village 820 South Aiken Avenue Pittsburgh, PA 15232 | |||||||

The nature of our business generates a certain amount of litigation involving matters arising in the ordinary course of business. However, in management’s opinion, there are no proceedings pending to which S&T is a party or to which our property is subject, which, if determined adversely to S&T, would be material in relation to our shareholders’ equity or financial condition. In addition, no material proceedings are pending nor are known to be threatened or contemplated against us by governmental authorities or other parties.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There were no matters during the fourth quarter of the fiscal year covered by this report that were submitted to a vote of our security holders through solicitation of proxies or otherwise.

PAGE 12

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER REPURCHASES OF EQUITY SECURITIES

STOCK PRICES AND DIVIDEND INFORMATION

S&T’s common stock is listed on the NASDAQ NationalGlobal Select Market System (“NASDAQ”) under the symbol STBA. The range of sale prices for the years 20052006 and 20042005 are as follows and is based upon information obtained from NASDAQ. As of the close of business February 9, 2006,January 25, 2007, there were 3,1133,062 shareholders of record of S&T. Dividends paid by S&T are primarily provided from S&T Bank’s dividends to S&T. The payment of dividends by S&T Bank to S&T is subject to the restrictions described in Note J to the Consolidated Financial Statements. The cash dividends declared shown below represent the historical per share amounts for S&T Common Stock.

| Price Range of Common Stock | Cash | |||||||||||||||||

| 2006 | Low | High | ||||||||||||||||

Fourth Quarter | $ | 31.14 | $ | 35.60 | $ | 0.30 | ||||||||||||

Third Quarter | 29.67 | 33.25 | 0.29 | |||||||||||||||

Second Quarter | 31.93 | 36.68 | 0.29 | |||||||||||||||

First Quarter | 35.59 | 37.68 | 0.29 | |||||||||||||||

| Price Range of Common Stock | Cash Dividends Declared | |||||||||||||||||

| 2005 | Low | High | ||||||||||||||||

Fourth Quarter | $ | 33.95 | $ | 39.24 | $ | 0.29 | $ | 33.95 | $ | 39.24 | $ | 0.29 | ||||||

Third Quarter | 35.77 | 40.52 | 0.28 | 35.77 | 40.52 | 0.28 | ||||||||||||

Second Quarter | 33.23 | 37.46 | 0.28 | 33.23 | 37.46 | 0.28 | ||||||||||||

First Quarter | 34.95 | 38.39 | 0.28 | 34.95 | 38.39 | 0.28 | ||||||||||||

| 2004 | ||||||||||||||||||

Fourth Quarter | $ | 35.50 | $ | 38.60 | $ | 0.27 | ||||||||||||

Third Quarter | 31.18 | 36.90 | 0.27 | |||||||||||||||

Second Quarter | 27.85 | 32.14 | 0.27 | |||||||||||||||

First Quarter | 29.16 | 31.65 | 0.26 | |||||||||||||||

During 2005,2006, S&T repurchased 660,4001,031,700 shares of its common stock at an average price of $35.09$34.19 per share. The impact of the repurchased shares is insignificanta $0.02 increase to diluted earnings per share. The remaining shares authorized under this program expired at December 31, 2005. S&T reissued 330,735 shares primarily through the exercise of employee stock options. In December 2005, our Board of Directors previously authorized a planstock buyback program for our repurchase2006 of up to one million shares, or approximately 4 percent of shares outstandingoutstanding. During 2006, S&T repurchased 999,000 shares under this program at an average cost of $34.20 per share. On October 16, 2006, the S&T Board of Directors authorized a new stock buyback program until September 30, 2007 of an additional one million shares with 32,700 shares repurchased under this plan during the period January 1,fourth quarter of 2006 at an average cost of $33.63 per share. S&T reissued 122,244 shares during 2006 primarily through December 31, 2006.the exercise of employee stock options.

PAGE 13

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER REPURCHASES OF EQUITY SECURITIES — continued

FIVE-YEAR CUMULATIVE TOTAL RETURN

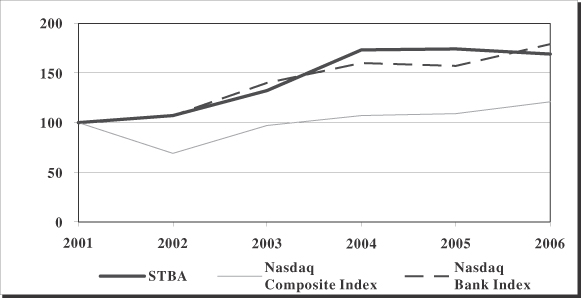

The following chart compares the cumulative total shareholder return on S&T Common Stock with the cumulative total shareholder return of the NASDAQ Composite Index and1NASDAQ Bank Index assuming a $100 investment in each on December 31, 2001.

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |||||||||||||

STBA | $ | 100 | $ | 107 | $ | 132 | $ | 173 | $ | 174 | $ | 169 | ||||||

Nasdaq Composite Index | 100 | 69 | 97 | 107 | 109 | 121 | ||||||||||||

Nasdaq Bank Index | 100 | 107 | 140 | 160 | 157 | 179 | ||||||||||||

| 1 | The NASDAQ Bank Index contains securities of NASDAQ-listed companies classified according to the Industry Classification Benchmark as Banks. They include banks providing a broad range of financial services, including retail banking, loans and money transmissions. |

PAGE 14

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER REPURCHASES OF EQUITY SECURITIES — continued

The following information describes the activity that has taken place during 20052006 with respect to S&T’s share repurchase plan:

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Maximum Number of Shares that Can be Purchased Under the Plan | |||||

01/01/2005 – 01/31/2005(1)(2)(3) | — | — | — | 1,000,000 | |||||

02/01/2005 – 02/28/2005 | — | — | — | 1,000,000 | |||||

03/01/2005 – 03/31/2005 | 115,000 | $ | 36.21 | 115,000 | 885,000 | ||||

04/01/2005 – 04/30/2005 | 129,100 | 33.83 | 129,100 | 755,900 | |||||

05/01/2005 – 05/31/2005 | 194,500 | 34.90 | 194,500 | 561,400 | |||||

06/01/2005 – 06/30/2005 | 79,900 | 35.41 | 79,900 | 481,500 | |||||

07/01/2005 – 07/31/2005 | — | — | — | 481,500 | |||||

08/01/2005 – 08/31/2005 | — | — | — | 481,500 | |||||

09/01/2005 – 09/30/2005 | 4,000 | 36.96 | 4,000 | 477,500 | |||||

10/01/2005 – 10/31/2005 | 126,900 | 35.24 | 126,900 | 350,600 | |||||

11/01/2005 – 11/30/2005 | — | — | — | 350,600 | |||||

12/01/2005 – 12/31/2005 | 11,000 | 36.94 | 11,000 | 339,600 | |||||

Total | 660,400 | $ | 35.09 | 660,400 | 339,600 | ||||

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Maximum Number of Shares that Can Be Purchased Under the Plans | |||||

01/01/2006 – 01/31/2006(1)(2)(3) | 40,000 | $ | 36.30 | 40,000 | |||||

02/01/2006 – 02/28/2006 | 33,000 | 36.13 | 33,000 | ||||||

03/01/2006 – 03/31/2006 | 131,000 | 35.88 | 131,000 | ||||||

04/01/2006 – 04/30/2006 | 175,000 | 35.43 | 175,000 | ||||||

05/01/2006 – 05/31/2006 | 225,000 | 35.11 | 225,000 | ||||||

06/01/2006 – 06/30/2006 | — | — | — | ||||||

07/01/2006 – 07/31/2006 | 100,000 | 31.72 | 100,000 | ||||||

08/01/2006 – 08/31/2006 | — | — | — | ||||||

09/01/2006 – 09/30/2006 | 295,000 | 32.38 | 295,000 | ||||||

10/01/2006 – 10/31/2006 | — | — | — | ||||||

11/01/2006 – 11/30/2006 | — | — | — | ||||||

12/01/2006 – 12/31/2006 | 32,700 | 33.63 | 32,700 | ||||||

Total | 1,031,700 | $ | 34.19 | 1,031,700 | 2,000,000 | ||||

| (1) | The plan was announced on December 20, |

| (2) | The plan was approved by the S&T Board of Directors for the repurchase of up to one million shares. |

| (3) | The expiration date of the plan is December 31, |

Item 6. SELECTED FINANCIAL DATA

| Year Ended December 31: | 2005 | 2004 | 2003 | 2002 | 2001 | 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||||||

| (dollars in thousands, except per share data) | ||||||||||||||||||||||||||||||

INCOME STATEMENTS | ||||||||||||||||||||||||||||||

Interest income | $ | 172,122 | $ | 148,638 | $ | 151,460 | $ | 151,160 | $ | 166,702 | $ | 204,702 | $ | 172,122 | $ | 148,638 | $ | 151,460 | $ | 151,160 | ||||||||||

Interest expense | 59,514 | 40,890 | 47,066 | 56,300 | 76,713 | 91,584 | 59,514 | 40,890 | 47,066 | 56,300 | ||||||||||||||||||||

Provision for loan losses | 5,000 | 4,400 | 7,300 | 7,800 | 5,000 | 9,380 | 5,000 | 4,400 | 7,300 | 7,800 | ||||||||||||||||||||

Net interest income after provision for loan losses | 107,608 | 103,348 | 97,094 | 87,060 | 84,989 | 103,738 | 107,608 | 103,348 | 97,094 | 87,060 | ||||||||||||||||||||

Noninterest income | 37,568 | 34,202 | 36,204 | 32,680 | 31,230 | 40,390 | 37,386 | 34,401 | 36,204 | 32,680 | ||||||||||||||||||||

Noninterest expense | 62,646 | 60,191 | 60,658 | 51,766 | 49,875 | 69,279 | 62,464 | 60,390 | 60,658 | 51,766 | ||||||||||||||||||||

Income before taxes | 82,530 | 77,359 | 72,640 | 67,974 | 66,344 | 74,849 | 82,530 | 77,359 | 72,640 | 67,974 | ||||||||||||||||||||

Applicable income taxes | 24,287 | 23,001 | 20,863 | 19,370 | 19,046 | 21,513 | 24,287 | 23,001 | 20,863 | 19,370 | ||||||||||||||||||||

Net income | $ | 58,243 | $ | 54,358 | $ | 51,777 | $ | 48,604 | $ | 47,298 | $ | 53,336 | $ | 58,243 | $ | 54,358 | $ | 51,777 | $ | 48,604 | ||||||||||

PER SHARE DATA | ||||||||||||||||||||||||||||||

Net income—Basic | $ | 2.21 | $ | 2.05 | $ | 1.96 | $ | 1.83 | $ | 1.76 | $ | 2.07 | $ | 2.21 | $ | 2.05 | $ | 1.96 | $ | 1.83 | ||||||||||

Net income—Diluted | 2.18 | 2.03 | 1.94 | 1.81 | 1.75 | 2.06 | 2.18 | 2.03 | 1.94 | 1.81 | ||||||||||||||||||||

Dividends declared | $ | 1.13 | $ | 1.07 | $ | 1.02 | $ | 0.97 | $ | 0.92 | 1.17 | 1.13 | 1.07 | 1.02 | 0.97 | |||||||||||||||

Book Value | 13.41 | 13.12 | 12.48 | 11.51 | 11.01 | 13.37 | 13.41 | 13.12 | 12.48 | 11.51 | ||||||||||||||||||||

PAGE 1415

Item 6. SELECTED FINANCIAL DATA — continued

SELECTED FINANCIAL DATA

BALANCE SHEET TOTALS (PERIOD END):

| Year Ended December 31: | 2005 | 2004 | 2003 | 2002 | 2001 | 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||

Total assets | $ | 3,194,979 | $ | 2,989,034 | $ | 2,900,272 | $ | 2,823,867 | $ | 2,357,874 | $ | 3,338,543 | $ | 3,194,979 | $ | 2,989,034 | $ | 2,900,272 | $ | 2,823,867 | ||||||||||

Securities | 494,575 | 518,171 | 611,083 | 641,164 | 585,265 | |||||||||||||||||||||||||

Securities available for sale Other investments | | 432,045 10,562 | | 481,257 13,318 | | 503,218 14,953 | | 594,179 16,904 | | 624,971 16,193 | ||||||||||||||||||||

Net loans | 2,454,934 | 2,253,089 | 2,069,142 | 1,968,755 | 1,615,842 | 2,633,071 | 2,454,934 | 2,253,089 | 2,069,142 | 1,968,755 | ||||||||||||||||||||

Total deposits | 2,418,884 | 2,176,263 | 1,962,253 | 1,926,119 | 1,611,317 | 2,565,306 | 2,418,884 | 2,176,263 | 1,962,253 | 1,926,119 | ||||||||||||||||||||

Securities sold under repurchase agreements and federal funds purchased | 137,829 | 98,384 | 182,020 | 194,388 | 152,282 | 133,021 | 137,829 | 98,384 | 182,020 | 194,388 | ||||||||||||||||||||

Short-term borrowings | 150,000 | 225,000 | 250,000 | 125,000 | — | 55,000 | 150,000 | 225,000 | 250,000 | 125,000 | ||||||||||||||||||||

Long-term borrowings | 83,776 | 86,325 | 116,933 | 211,693 | 251,256 | 171,941 | 83,776 | 86,325 | 116,933 | 211,693 | ||||||||||||||||||||

Junior subordinated debt securities | 25,000 | — | — | — | — | |||||||||||||||||||||||||

Total shareholders’ equity | 352,421 | 349,129 | 332,718 | 306,114 | 293,327 | 339,051 | 352,421 | 349,129 | 332,718 | 306,114 | ||||||||||||||||||||

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

S&T is a financial holding company with its headquarters located in Indiana, Pennsylvania with assets of approximately $3.2$3.3 billion at December 31, 2005.2006. S&T provides a full range of financial services through a branch network of 5049 offices located in Allegheny, Armstrong, Blair, Butler, Cambria, Clarion, Clearfield, Indiana, Jefferson and Westmoreland counties of Pennsylvania. S&T provides full service retail and commercial banking products as well as cash management services; insurance; estate planning and administration; employee benefit investment management and administration; corporate services; and other fiduciary services. S&T earns revenue primarily from interest on loans, security investments and fees charged for financial services provided to our customers. Offsetting these revenues are the cost of deposits and other funding sources, provision for loan losses as well as other operating costs such as: salaries and employee benefits, occupancy, data processing expenses and tax expense. Balance sheet growth in 20052006 included a 107 percent increase in commercial lending activities, and with an 11a 9 percent increase in depositsconsumer and residential mortgage loans with funding for that growth provided primarily attributable to our Green Plan savings account.by a 6 percent increase in deposits. S&T’s strategic plan to deliver profitable growth to our shareholders includes: increasing loans and core deposits with sufficient interest rate spreads, controlling loan delinquency and loan losses, controlling operating expenses and to expandexpanding the business through new de novo branching, merger and acquisitions, introduction of new products and services, and expansion of our products and services provided to our existing customers.

There are many uncertainties regarding the economy as S&T enters 2007. S&T continually strives to be well positioned for changes in both the economy and interest rates, regardless of the timing or direction of these changes. Management continually assesses our balance sheet, capital, liquidity and operation infrastructures in order to be positioned to take advantage of internal or acquisition growth opportunities.

There are many factors that could influence our results, both positively and negatively, in 2007. Because the majority of our revenue comes from net interest income, internally generated loan and deposit growth and the mix of that growth are major factors on our operations and financial condition. S&T has directed a fair amount of focus and resources in planning for 2007 to improve our generation and retention of low cost core deposits. On the other hand, a slowing economy could cause

PAGE 1516

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

deterioration in the asset quality measurements. S&T recognizes that our shift to a greater dependence on commercial loans in recent years exposes us to larger credit risks and greater swings in nonperforming loans and loan charge-offs when problems do occur. However, because of our earnings strength and strong capitalization, as well as the strengths of other businesses in our market area, management does not expect a decline in our ability to satisfactorily perform if a further decline in our economy occurs.

FINANCIAL CONDITION

Average earning assets grewincreased by $89.5$166.6 million in 20052006 primarily as a result of growth in commercial lending, consumer and residential mortgage activities. During 2005,2006, average loan balances increased by $145.6$217.3 million, and average securities, other investments and federal funds sold decreased $56.0$50.7 million. The funding for this loan growth was primarily provided by a $217.7$249.1 million increase in average deposits, and an increase of $13.3 million in noninterest earning assets, offset by a $129.2decrease of $4.6 million in average earnings retained and a $68.6 million decrease in average borrowings.

| 2005 | 2004 | 2006 | 2005 | |||||||||||||||||||||

| Loans | Average Loan Balance | Average Loan Balance Percentage | Average Loan Balance | Average Loan Balance Percentage | Average Loan Balance | Average Loan Balance Percentage | Average Loan Balance | Average Loan Balance Percentage | ||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||||||

Commercial, mortgage and industrial | $ | 1,809.5 | 76 | % | $ | 1,664.1 | 75 | % | $ | 1,972.7 | 76 | % | $ | 1,809.5 | 76 | % | ||||||||

Residential real estate mortgage | 492.7 | 21 | % | 489.3 | 22 | % | 545.8 | 21 | % | 492.7 | 21 | % | ||||||||||||

Installment | 68.7 | 3 | % | 71.9 | 3 | % | 69.7 | 3 | % | 68.7 | 3 | % | ||||||||||||

Total | $ | 2,370.9 | 100 | % | $ | 2,225.3 | 100 | % | $ | 2,588.2 | 100 | % | $ | 2,370.9 | 100 | % | ||||||||

LENDING ACTIVITY

Average loans for the year ended December 31, 2005 (“2005”)2006 were $2.4$2.6 billion, a $145.6$217.3 million or 79 percent increase from the year ended December 31, 2004 (“2004”).2005. The increase in average loans for 20042005 compared to the year ended 2003 (“2003”)2004 was $190.6$145.5 million. Changes in the composition of the average loan portfolio during 2006 included increases of $163.2 million in commercial loans and $53.1 million in residential mortgage loans and an increase of $1.0 million in installment loans. Changes in the composition of the average loan portfolio during 2005 included increases of $145.4$145.3 million in commercial loans and $3.4 million in residential mortgage loans, offset by a decrease of $3.2 million in installment loans. Changes in the composition of the average loan portfolio during 2004 included increases of $229.8 million in commercial loans, offset by decreases of $25.7 million in residential mortgages and $13.5 million in installment loans. Total loans at December 31, 20052006 increased $204.1$174.8 million from December 31, 2004.2005. The increase is primarily attributable to $174.7 millionthe growth of loan growth within the commercial loan category, $34.7$124.1 million in home equitycommercial loans, offset by a $5.3$45.8 million decreasein residential mortgage loans and $4.9 million in consumer loan balances due to paydowns and sales into the secondary mortgage market. Total loans at December 31, 2004 increased $186.7 million from December 31, 2003. The increase is primarily attributable to $208.4 million of loan growth within the commercial loan category, offset by a $21.7 million decrease in consumer loan balances due to paydowns and sales into the secondary mortgage market.loans.

Average real estate construction and commercial loans, including mortgagecommercial and industrial, comprised 76 percent of the loan portfolio in 2005 compared to 75 percent in 2004.2006 and 2005. Commercial loans continued to be an area of strategic growth during 20052006 and 2004.2005. Although commercial loans can be an area ofhave a relatively higher risk profile, management believes these risks are mitigated by limiting concentrationsthrough active portfolio management, underwriting and applying rigorous underwriting review by loan administration.continuous review. At December 31, 2005,2006, variable-rate commercial loans were 5549 percent of the commercial loan portfolio as compared to 5755 percent at December 31, 2004.2005.

Average residential mortgage loans comprised 21 percent of the loan portfolio in 2005 compared to 22 percent in 2004.2006 and 2005. Residential mortgage lending continued to be a strategic focus during 20052006 through a centralized mortgage origination department, ongoing product redesign, secondary market activities and the utilization of commission compensated originators. Management believes that if a downturn in the local residential real estate market occurs, the impact of declining values on the real estate loan

PAGE 17

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

portfolio will be mitigated because of S&T’s conservative mortgage lending policies for portfolio loans, which generally require a maximum term of 20 years for fixed-rate mortgages, a maximum term of 30 years for adjustable-rate mortgages and private mortgage insurance for loans

PAGE 16

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

with less than a 20 percent down payment. Adjustable-rate mortgages with repricing terms of one, three and five years comprised 1310 percent of the residential mortgage portfolio in 20052006 and 1513 percent in 2004.2005. Home equity loans increased $42.4 million during 2006 and $34.7 million duringin 2005 and $11.3totaled $269.9 million in 2004at December 31, 2006 and totaled $227.5 million at December 31, 2005 and $192.8 million at December 31, 2004, respectively.2005. The increase in home equity loans is primarily attributable to successful marketing programs during 20052006 and 2004.2005.

Most of the decline in residential loans during 2005 was due to active participation in the secondary mortgage markets. S&T periodically designates specific loan originations, generally longer-term, lower-yielding 1–4 family mortgages as held for sale and sells them to Fannie Mae. The intent of these sales is to mitigate interest-rate risk associated with holding long-term residential mortgages in the loan portfolio, generate fee revenue from servicing, and maintain the primary customer relationship. During 2005,2006, S&T sold $36.4$18.8 million of 1–4 family mortgagesmortgage loans to Fannie Mae and currently services $185.1$180.8 million of secondary market mortgage loans. Fees and gains from mortgage servicing activities were $0.7 million in 2006 and $1.5 million in 2005 and 2004.2005. Management intends to continue to sell longer-term loans to Fannie Mae in the future on a selective basis, especially during periods of lower interest rates.

Average consumer installment loans comprised 3 percent of the loan portfolio in 20052006 and 2004.2005. Installment loan decreasesincreases during 20052006 were primarily the result of lower origination volumes.successful marketing programs during 2006. The balance of consumer installment loans at December 31, 20052006 was $68.2$73.1 million compared to $69.2$68.2 million at December 31, 2004.2005.

Loan underwriting standards for S&T are established by a formal policy administered by the S&T Bank CreditLoan Administration Department, and are subject to the periodic review and approval by our Board of Directors.

Rates and terms for commercial real estate, equipment loans and commercial lines of credit normally are negotiated, subject to such variables as financial condition of the borrower, economic conditions, marketability of collateral, credit history of the borrower and future cash flows. The loan to value policy guidelineguidelines for commercial real estate loans is generally 75–65–80 percent.

The loan to value policy guidelineguidelines for residential, first lien, mortgage loans is 80 percent. Higher loan to value loans may be approved with the appropriate private mortgage insurance coverage. Second lien positions are sometimes assumed with home equity loans, but normally only to the extent that the combined credit exposure for both first and second liens does not exceed 100 percent of the fair market value of the mortgage property.

We offer a variety of unsecured and secured installment loan and credit card products. Loan to value policy guidelines for direct loans are 90–100 percent of invoice for new automobiles and 80–90 percent of National Automobile Dealer Association (NADA) value for used automobiles.

The following table shows S&T’s loan distribution at the end of each of the last five years:

| December 31 | December 31 | |||||||||||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||||

| (dollars in thousands ) | ||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||

Domestic Loans: | ||||||||||||||||||||||||||||||

Commercial, mortgage and industrial | $ | 1,565,035 | $ | 1,455,932 | $ | 1,328,378 | $ | 1,169,138 | $ | 1,016,113 | $ | 1,675,848 | $ | 1,565,035 | $ | 1,455,932 | $ | 1,328,378 | $ | 1,169,138 | ||||||||||

Real estate—construction | 339,179 | 274,783 | 193,874 | 191,927 | 115,825 | 352,482 | 339,179 | 274,783 | 193,874 | 191,927 | ||||||||||||||||||||

Real estate—mortgage | 519,076 | 487,445 | 499,661 | 541,102 | 430,261 | 564,821 | 519,076 | 487,445 | 499,661 | 541,102 | ||||||||||||||||||||

Installment | 68,216 | 69,191 | 78,707 | 96,726 | 80,569 | 73,140 | 68,216 | 69,191 | 78,707 | 96,726 | ||||||||||||||||||||

TOTAL LOANS | $ | 2,491,506 | $ | 2,287,351 | $ | 2,100,620 | $ | 1,998,893 | $ | 1,642,768 | $ | 2,666,291 | $ | 2,491,506 | $ | 2,287,351 | $ | 2,100,620 | $ | 1,998,893 | ||||||||||

PAGE 1718

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

The following table shows the maturity of loans (excluding residential mortgages of 1-4 family residences and installment loans) outstanding as of December 31, 2005.2006. Also provided are the amounts due after one year classified according to the sensitivity to changes in interest rates.

| Maturing | Maturing | |||||||||||||||||||||||

| Within One Year | After One But Within Five Years | After Five Years | Total | Within One Year | After One But Within Five Years | After Five Years | Total | |||||||||||||||||

| (dollars in thousands ) | ||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

Commercial, mortgage and industrial | $ | 448,389 | $ | 471,318 | $ | 645,328 | $ | 1,565,035 | $ | 485,924 | $ | 502,447 | $ | 687,477 | $ | 1,675,848 | ||||||||

Real estate—construction | 109,243 | 148,487 | 81,449 | 339,179 | 148,968 | 130,178 | 73,336 | 352,482 | ||||||||||||||||

TOTAL | $ | 557,632 | $ | 619,805 | $ | 726,777 | $ | 1,904,214 | $ | 634,892 | $ | 632,625 | $ | 760,813 | $ | 2,028,330 | ||||||||

Fixed interest rates | $ | 120,783 | $ | 104,355 | $ | 200,335 | $ | 133,983 | ||||||||||||||||

Variable interest rates | 499,022 | 622,422 | 432,290 | 626,830 | ||||||||||||||||||||

TOTAL | $ | 619,805 | $ | 726,777 | $ | 632,625 | $ | 760,813 | ||||||||||||||||

SECURITIES ACTIVITY

Average securities and other investments decreased $49.8 million in 2006 and decreased $57.7 million in 2005 and decreased $72.72005. The largest components of the 2006 decrease included $24.6 million in 2004.U.S. government agency securities, $8.6 million in marketable equity securities, $7.7 million of mortgage-backed securities, $6.8 million of corporate securities and $2.9 million in treasury securities. Average other investments decreased $3.4 million in 2006 as compared to the 2005 full year average and is comprised of Federal Home Loan Bank (“FHLB”) stock that is a membership and borrowing requirement and is recorded at historical cost. The amount of S&T’s investment in FHLB stock depends upon S&T’s borrowing availability and level from the FHLB. Offsetting these decreases was an average increase of $4.2 million of states and political subdivisions. The largest components of the 2005 decrease included $67.5 million in U.S. government agency securities, $8.6 million of corporate securities $2.9 million in Federal Home Loan Bank (“FHLB”) stock and $2.1 million in treasury securities. The decreaseAverage other investments decreased $2.9 million in 2005 as compared to the 2004 full year average and is comprised of FHLB stock. Offsetting these decreases were average increases of $13.2 million of mortgage-backed securities and $10.2 million of states and political subdivisions. Both the decreases in securities isin 2006 and 2005 are partially attributable to ana S&T Asset Liability Committee (“ALCO”) strategy to reduce balances in both securities and borrowings to mitigate the interest rate risk of a flatteningflat or inverted yield curve. Offsetting these decreases were average increases of $13.2 million of mortgage backed securities and $10.2 million of states and political subdivisions. The FHLB capital stock is a membership and borrowing requirement and is acquired and sold at stated value. The amount of S&T’s investment in FHLB stock depends upon S&T’s borrowing availability and level from the FHLB. The largest components of the 2004 decrease included $45.7 million in U.S. government agency securities, $12.8 million of corporate securities, $26.8 million in mortgage-backed securities, $0.5 million in treasury securities and $0.4 million in corporate stocks. The decrease in securities is partially attributable to an ALCO strategy to reduce balances in both securities and borrowings to mitigate the interest rate risk of declining rates on a flattening yield curve. Offsetting these decreases were average increases of $11.9 million of states and political subdivisions and $1.6 million of FHLB stock.

OurThe equity securities portfolio is primarily comprised of bank holding companies. At December 31, 2005, our2006, the equity securities portfolio had a total market value of $65.1$55.3 million and net unrealized gains of $19.7$16.1 million. The equity securitysecurities portfolio consists of securities traded on the various stock markets and is subject to changes in market value.

S&T’s policy for security classification includes U.S. treasury securities, U.S. government corporations and agencies, mortgage-backed securities, collateralized mortgage obligations, states and political subdivisions, corporate securities, and marketable equity securities and other securities as available for sale. On a quarterly basis, management evaluates the securitysecurities portfolios for other-than-temporary declines in market value in accordance with Emerging Issues Task Force No. 03-1.FSP 115-1 and FAS 124-1, “The Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments”. During 2005,2006, there were $0.3 million of realized losses taken for an other-than-temporary impairmentimpairments on onethree equity investment security.securities. The performance of the equities and debt securities markets could generate further impairment in future periods. At December 31, 2005,2006, net unrealized gains on securities classified as available for sale, including equity securities, were approximately $13.5$9.8 million as compared to $31.7$13.5 million at December 31, 2004.2005. S&T has the intent and ability to hold these debt and equity securities until maturity or until market value recovers above cost.

PAGE 1819

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

S&T invests in various securities in order to provide a source of liquidity, increase net interest income and as a tool of ALCO to quickly reposition the balance sheet for interest rate risk purposes. Securities are subject to similar interest rate and credit risks as loans. In addition, by their nature, securities classified as available for sale are also subject to market value risks that could negatively affect the level of liquidity available to S&T, as well as equity.

Risks associated with various securities portfolios are managed and monitored by investment policies annually approved by the S&T Board of Directors, and administered through ALCO and the Treasury function of S&T Bank. As of December 31, 2005,2006, management is not aware of any risk associated with securities that would be expected to have a significant, negative effect on S&T’s statement of condition or statement of operations.

The following table sets forth the carrying amount of securities at the dates indicated:

| December 31 | December 31 | |||||||||||||||||

| 2005 | 2004 | 2003 | 2006 | 2005 | 2004 | |||||||||||||

| (dollars in thousands ) | ||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||

Available for Sale | ||||||||||||||||||

Marketable equity securities | $ | 65,114 | $ | 74,555 | $ | 72,591 | $ | 55,349 | $ | 65,114 | $ | 74,555 | ||||||

Obligations of U.S. government corporations and agencies | 221,037 | 237,514 | 325,903 | 180,003 | 221,037 | 237,514 | ||||||||||||

Collateralized mortgage obligations of U.S. government corporations and agencies | 63,638 | 46,528 | 44,251 | 60,090 | 63,639 | 46,528 | ||||||||||||

Mortgage-backed securities | 38,417 | 48,373 | 45,769 | 31,793 | 38,416 | 48,373 | ||||||||||||

U.S. treasury securities | 499 | 5,248 | 5,744 | — | 499 | 5,248 | ||||||||||||

Obligations of states and political subdivisions | 83,811 | 71,198 | 67,539 | 81,672 | 83,811 | 71,198 | ||||||||||||

Corporate securities | — | 16,493 | 21,464 | — | — | 16,493 | ||||||||||||

Other securities | 22,059 | 17,997 | 27,557 | 23,138 | 8,741 | 3,044 | ||||||||||||

TOTAL | $ | 494,575 | $ | 517,906 | $ | 610,818 | $ | 432,045 | $ | 481,257 | $ | 502,953 | ||||||

Held to Maturity | ||||||||||||||||||

Obligations of states and political subdivisions | $ | — | $ | 265 | $ | 265 | $ | — | $ | — | $ | 265 | ||||||

TOTAL | $ | — | $ | 265 | $ | 265 | $ | — | $ | — | $ | 265 | ||||||

PAGE 1920

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

The following table sets forth the maturities of securities at December 31, 2005,2006, and the weighted average yields of such securities (calculated on the basis of the amortized cost and effective yields weighted for the scheduled maturity of debt securities and estimated prepayment rates on most mortgage-backed securities). Tax-equivalent adjustments (using a 35 percent federal income tax rate) for 20052006 have been made in calculating yields on obligations of states and political subdivisions.

| Maturing | Maturing | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Within One Year | After One But Within Five Years | After Five But Within Ten Years | After Ten Years | No Fixed Maturity | Within One Year | After One But Within Five Years | After Five But Within Ten Years | After Ten Years | No Fixed Maturity | |||||||||||||||||||||||||||||||||||||||||||||

| Amount | Yield | Amount | Yield | Amount | Yield | Amount | Yield | Amount | Amount | Yield | Amount | Yield | Amount | Yield | Amount | Yield | Amount | |||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Available for Sale | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Marketable equity securities | $ | — | — | $ | — | — | $ | — | — | $ | — | — | $ | 65,114 | $ | — | — | $ | — | — | $ | — | — | $ | — | — | $ | 55,349 | ||||||||||||||||||||||||||

Obligations of U.S. government corporations and agencies | 40,328 | 6.18 | % | 170,658 | 3.93 | % | 10,051 | 4.44 | % | — | — | — | 37,677 | 3.48 | % | 142,327 | 4.08 | % | — | — | — | — | — | |||||||||||||||||||||||||||||||

Collateralized mortgage obligations of U.S. government corporations and agencies | 8,563 | 4.43 | % | 39,197 | 4.67 | % | 15,878 | 4.65 | % | — | — | — | 7,443 | 4.44 | % | 44,144 | 4.75 | % | 8,503 | 4.67 | % | — | — | — | ||||||||||||||||||||||||||||||

Mortgage-backed securities | 6,599 | 4.83 | % | 16,888 | 4.63 | % | 11,259 | 4.53 | % | 3,671 | 4.72 | % | — | 5,097 | 4.71 | % | 16,048 | 4.57 | % | 8,197 | 4.49 | % | 2,451 | 4.83 | % | — | ||||||||||||||||||||||||||||

U.S. treasury securities | 499 | 3.57 | % | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

Obligations of states and political subdivisions | 5,247 | 5.12 | % | 48,890 | 4.76 | % | 29,393 | 5.15 | % | 281 | 5.86 | % | — | 5,840 | 5.31 | % | 54,392 | 4.73 | % | 21,155 | 5.34 | % | 284 | 5.86 | % | — | ||||||||||||||||||||||||||||

Other securities | — | — | — | — | — | — | — | — | 22,059 | — | — | — | — | — | — | — | — | 23,138 | ||||||||||||||||||||||||||||||||||||

TOTAL | $ | 61,236 | $ | 275,633 | $ | 66,581 | $ | 3,952 | $ | 87,173 | $ | 56,057 | $ | 256,911 | $ | 37,855 | $ | 2,735 | �� | $ | 78,487 | |||||||||||||||||||||||||||||||||

Weighted Average Rate | 5.67 | % | 4.22 | % | 4.82 | % | 4.80 | % | 3.91 | % | 4.36 | % | 5.01 | % | 4.93 | % | ||||||||||||||||||||||||||||||||||||||

NONEARNINGNONINTEREST EARNING ASSETS

Average noninterest earning assets increased $13.3$20.9 million in 20052006 and $1.8$11.1 million in 2004.2005. The 20052006 increase was primarily attributable to increases in cash and due from banks, premises and equipment due to the addition of fivenew branches and administrative facilities during 2006 and accrued interest receivable on a higher earning asset balance. The 2005 increase of $11.1 million was primarily attributable to increases in cash and due from banks, premises and equipment due to the addition of new branches during 2005 and accrued interest receivable on a higher earning asset balance. The 2004 increase of $1.8 million was primarily due to an increase in premises and equipment related to the addition of three new branches during 2004.

ALLOWANCE FOR LOAN LOSSES

The balance in the allowance for loan losses increaseddecreased to $33.2 million or 1.25 percent of total loans at December 31, 2006 as compared to $36.6 million or 1.47 percent of total loans at December 31, 2005 as compared2005. The decrease in the allowance for loan losses is primarily attributable to $34.3 million or 1.50 percent of totalthree commercial loans at December 31, 2004.that were charged-off during 2006 totaling $11.4 million. During the second quarter of 2005,

PAGE 21

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

S&T split its allowance for credit losses into an allowance for loan losses and an allowance for lending-related commitments such as unfunded commercial real

PAGE 20

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

estate and commercial &and industrial term loan commitments. The allowance for lending-related commitments is included in other liabilities. This resulted in a decrease in the allowance for loan losses of $1.0 million and reduction in the allowance for loan losses to total loans from 1.44 percent to 1.40 percent at June 30, 2005. The allowance for lending-related commitments is computed using a methodology similar to that used to determine the allowance for loan losses. Amounts are added to the allowance for lending-related commitments through a charge to current earnings through noninterest expense. The balance in the allowance for lending-related commitments increased to $1.2 million at December 31, 2006 as compared to $0.8 million at December 31, 2005.

Management evaluates the degree of loss exposure for loans on a continuous basis through a formal allowance for loan loss policy as administered by theS&T Bank’s Loan Administration Department of S&T Bank and various management and director committees. Problem loans are identified and continually monitored through detailed reviews of specific commercial loans, and the analysis of delinquency and charge-off levels of consumer loan portfolios. Charged-off and recovered loan amounts are applied to the allowance for loan losses. Monthly updates are presented to the S&T Board of Directors as to the status of loan quality.

Amounts are added to the allowance for loan losses through a charge to current earnings through the provision for loan losses, based upon management’s assessment of the adequacy of the allowance for loan losses for probable loan losses. A quantitative analysis is utilized to support the adequacy of the allowance for loan losses. This analysis includes review of the historical charge-off rates for all loan categories, fluctuations and trends in various risk factors. Factors consider the level of S&T’s historical charge-offs that have occurred within the creditscredits’ economic life cycle. Management also assesses qualitative factors such as portfolio credit trends, unemployment trends, vacancy trends, loan growth and variable interest rate factors.

Significant to this analysis and assessment is the shift in loan portfolio composition to an increased mix of commercial loans. These loans are generally larger in size and, due to our continuing growth, many are not well seasoned and could be more vulnerable to an economic slowdown. Management relies on its risk rating process to monitor trends, which may be occurring relative to commercial loans to assess potential weaknesses within specific credits. Current risk factors, trends in risk ratings and historical charge-off experiences are considered in the determination of the allowance for loan losses. During 2005,2006, the risk rating profile of the portfolio remained relatively stable. Management believes its quantitativewas impacted by three commercial loans. Two of these loan relationships have combined remaining loan balances of $7.5 million, and qualitative analysiswe believe that the problem loans have been adequately reserved at December 31, 2006 and risk-rating process is sufficient and enables it to conclude that the total allowance for loan losses is adequate to absorb probable loan losses.losses as determined by the quarterly impairment analysis and risk-rating processes. The third credit has no remaining exposure and future collateral recovery is expected to be insignificant. The remaining risk rating profile of the portfolio has shown overall improvement absent the aforementioned loan relationships.

The allowance for loan losses is established based on management’s assessment of the factors noted above along with the growth in the loan portfolio. The additions to the allowance charged to operating expense has maintained the allowance as a percent of loans at the following levels at the end of each year presented below:

| Year Ended December 31 | ||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||

| 1.47% | 1.50 | % | 1.50 | % | 1.51 | % | 1.64 | % | ||||

| Year Ended December 31 | ||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||

| 1.25% | 1.47 | % | 1.50 | % | 1.50 | % | 1.51 | % | ||||

We have considered impaired loans in our determination of the allowance for loan losses. The allowance for loan losses for all impaired loans was $9,937,000$2,627,000 and $5,712,000$9,937,000 at December 31, 20052006 and 2004,2005, respectively.

PAGE 2122

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

This table summarizes our loan loss experience for each of the five years presented below:

| Year Ended December 31 | Year Ended December 31 | |||||||||||||||||||||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||

Balance at January 1: | $ | 34,262 | $ | 31,478 | $ | 30,138 | $ | 26,926 | $ | 27,395 | $ | 36,572 | $ | 34,262 | $ | 31,478 | $ | 30,138 | $ | 26,926 | ||||||||||||||||||||

Charge-offs: | ||||||||||||||||||||||||||||||||||||||||

Commercial, mortgage and industrial | 2,260 | 5,616 | 5,208 | 6,131 | 4,728 | 12,575 | 2,260 | 5,616 | 5,208 | 6,131 | ||||||||||||||||||||||||||||||

Real estate—mortgage | 529 | 484 | 905 | 588 | 912 | 394 | 529 | 484 | 905 | 588 | ||||||||||||||||||||||||||||||

Installment | 1,140 | 1,075 | 1,193 | 1,102 | 1,299 | 1,069 | 1,140 | 1,075 | 1,193 | 1,102 | ||||||||||||||||||||||||||||||

Total | 3,929 | 7,175 | 7,306 | 7,821 | 6,939 | 14,038 | 3,929 | 7,175 | 7,306 | 7,821 | ||||||||||||||||||||||||||||||

Recoveries: | ||||||||||||||||||||||||||||||||||||||||

Commercial, mortgage and industrial | 1,699 | 4,835 | 624 | 1,118 | 643 | 640 | 1,699 | 4,835 | 624 | 1,118 | ||||||||||||||||||||||||||||||

Real estate—mortgage | 235 | 408 | 384 | 349 | 404 | 201 | 235 | 408 | 384 | 349 | ||||||||||||||||||||||||||||||

Installment | 274 | 316 | 338 | 345 | 423 | 465 | 274 | 316 | 338 | 345 | ||||||||||||||||||||||||||||||

Total | 2,208 | 5,559 | 1,346 | 1,812 | 1,470 | 1,306 | 2,208 | 5,559 | 1,346 | 1,812 | ||||||||||||||||||||||||||||||

Net charge-offs | 1,721 | 1,616 | 5,960 | 6,009 | 5,469 | 12,732 | 1,721 | 1,616 | 5,960 | 6,009 | ||||||||||||||||||||||||||||||

Provision for loan losses | 5,000 | 4,400 | 7,300 | 7,800 | 5,000 | 9,380 | 5,000 | 4,400 | 7,300 | 7,800 | ||||||||||||||||||||||||||||||

Reserve for unfunded commitments | (969 | ) | — | — | — | — | ||||||||||||||||||||||||||||||||||

Allowance for lending-related commitments | — | (969 | ) | — | — | — | ||||||||||||||||||||||||||||||||||

Loan loss reserve from acquisition | — | — | — | 1,421 | — | — | — | — | — | 1,421 | ||||||||||||||||||||||||||||||

Balance at December 31: | $ | 36,572 | $ | 34,262 | $ | 31,478 | $ | 30,138 | $ | 26,926 | $ | 33,220 | $ | 36,572 | $ | 34,262 | $ | 31,478 | $ | 30,138 | ||||||||||||||||||||

Ratio of net charge-offs to average loans outstanding | 0.07 | % | 0.07 | % | 0.29 | % | 0.34 | % | 0.33 | % | 0.49 | % | 0.07 | % | 0.07 | % | 0.29 | % | 0.34 | % | ||||||||||||||||||||

This table shows allocation of the allowance for loan losses as of the end of each of the last five years:

| December 31 | December 31 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount | Percent of Loans in Each Category to Total Loans | Amount | Percent of Loans in Each Category to Total Loans | Amount | Percent of Loans in Each Category to Total Loans | Amount | Percent of Loans in Each Category to Total Loans | Amount | Percent of Loans in Each Category to Total Loans | Amount | Percent of Loans | Amount | Percent of Loans | Amount | Percent of Loans in Each Category to Total Loans | Amount | Percent of Loans | Amount | Percent of Loans | |||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Commercial, mortgage and industrial | $ | 32,053 | 63 | % | $ | 29,594 | 64 | % | $ | 26,947 | 63 | % | $ | 26,002 | 58 | % | $ | 22,628 | 62 | % | $ | 28,540 | 63 | % | $ | 32,053 | 63 | % | $ | 29,594 | 64 | % | $ | 26,947 | 63 | % | $ | 26,002 | 58 | % | ||||||||||||||||||||

Real estate—construction | 532 | 14 | % | 852 | 12 | % | 843 | 9 | % | 664 | 10 | % | 329 | 7 | % | 379 | 13 | % | 532 | 14 | % | 852 | 12 | % | 843 | 9 | % | 664 | 10 | % | ||||||||||||||||||||||||||||||

Real estate—mortgage | 613 | 21 | % | 585 | 21 | % | 558 | 24 | % | 685 | 27 | % | 744 | 26 | % | 536 | 21 | % | 613 | 21 | % | 585 | 21 | % | 558 | 24 | % | 685 | 27 | % | ||||||||||||||||||||||||||||||

Installment | 3,374 | 2 | % | 3,231 | 3 | % | 3,009 | 4 | % | 2,671 | 5 | % | 3,121 | 5 | % | 3,765 | 3 | % | 3,374 | 2 | % | 3,231 | 3 | % | 3,009 | 4 | % | 2,671 | 5 | % | ||||||||||||||||||||||||||||||

Unallocated | — | 0 | % | — | 0 | % | 121 | 0 | % | 116 | 0 | % | 104 | 0 | % | — | — | — | 0 | % | — | 0 | % | 121 | 0 | % | 116 | 0 | % | |||||||||||||||||||||||||||||||

TOTAL | $ | 36,572 | 100 | % | $ | 34,262 | 100 | % | $ | 31,478 | 100 | % | $ | 30,138 | 100 | % | $ | 26,926 | 100 | % | $ | 33,220 | 100 | % | $ | 36,572 | 100 | % | $ | 34,262 | 100 | % | $ | 31,478 | 100 | % | $ | 30,138 | 100 | % | ||||||||||||||||||||

Net loan charge-offs totaled $12.7 million in 2006 and $1.7 million in 2005. Net loan charge-offs increased during 2006 due to three commercial loan relationships that were charged-off during the period. The first relationship is a commercial construction company that was charged-down by $7.2 million during the third quarter of 2006. The relationship had a specific reserve assigned of $7.1 million at the time it was charged down. S&T had previously provided $5.1 million in 2005 and $1.6provided an additional $2.0 million in 2004.the second quarter of 2006. The balance of nonperforming loans, which include nonaccrual loans past due 90 days or more, at December 31, 2005, was $11.2 million or 0.45 percent of total loans. This comparesborrower continues to nonperforming loans of $6.3 million or 0.28 percent of total loans at December 31, 2004. The majority of the increase in nonperforming loans primarily relates to a $4.6 million commercial real estate loan classified asoperate,

PAGE 2223

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

nonperforming. but has experienced significant cash flow problems. The borrower has restricted ability to obtain new contracts and may be at-risk to continue as a going concern. The remaining $5.6 million loan balance on this relationship is believed to be adequately collateralized which includes receivables, equipment and personal guarantees. The second relationship is a $4.6 million mixed-use, commercial real estate loan participation with another financial institution, previously classified as nonaccrual, which was charged-down by $2.7 million during the second quarter of 2006. The commercial real estate company filed a voluntary chapter eleven bankruptcy petition during the second quarter of 2006. The remaining $1.8 million exposure is the estimated fair market value S&T expects to receive in sale proceeds based upon our percentage participation in the loan. The credit is on nonaccrual status at December 31, 2006. The third relationship is a wholesale distributor that filed a voluntary chapter eleven bankruptcy petition during the second quarter of 2006 after failing to obtain expected and significant new contracts and was previously classified as nonaccrual. A charge-off of $1.5 million was recorded during the second quarter of 2006 for this loan. No further exposure remains for this credit and future collateral recovery is expected to be insignificant.

The balance of nonaccrual loans past due 90 days or more, at December 31, 2006, was $19.9 million or 0.74 percent of total loans. This compares to nonaccrual loans of $11.2 million or 0.45 percent of total loans at December 31, 2005. Nonperforming assets totaled $20.4 million or 0.61 percent of total assets at December 31, 2006 as compared to $14.9 million or 0.47 percent at December 31, 2005. The most significant credits in nonperforming status at December 31, 2006 is a $5.6 million residual balance of the aforementioned commercial construction company and the $1.8 million residual balance related to the aforementioned mixed-use commercial real estate credit. Also affecting nonaccrual loans at December 31, 2006 was a $1.0 million loan relationship with an energy-related company. Two other $3.1 million loan relationships were classified as nonaccrual at December 31, 2006, but were fully resolved in January 2007. Also affecting nonperforming assets is a $3.2 million reduction in property acquired through foreclosure during 2006. The reduction is primarily attributable to a $2.4 million residential development property acquired in the fourth quarter of 2005, charged down to $1.5 million in the second quarter of 2006 that was sold for $1.6 million during the fourth quarter of 2006.

The provision for loans losses was $9.4 million for 2006, as compared to $5.0 million for 2005, as compared to $4.4 million for 2004.2005. The provision is based onwas the result of management’s detailed quarterlyfourth quarter analysis of the adequacy of the allowance for loan losses and is consistent with the significant increase in nonaccrual loans losses. During 2005, S&T recorded a specific allowance for one impaired commercial loan relationship, which accounted for the majoritythat occurred as result of the provision foraforementioned loan losses in 2005. S&T’s exposure with respect to this one commercial loan has been appropriately considered in determining the adequacy of its allowance for loan losses based on S&T’s value of the underlying collateral and the expectation of future cash flows.

relationships.

The following table summarizes our nonaccrual and past due loans:

| December 31 | December 31 | |||||||||||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||||||||||

| (dollars in thousands ) | ||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||

Nonaccrual loans | $ | 11,166 | $ | 6,309 | $ | 9,120 | $ | 5,831 | $ | 8,253 | $ | 19,852 | $ | 11,166 | $ | 6,309 | $ | 9,120 | $ | 5,831 | ||||||||||

Accruing loans past due 90 days or more | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

It is S&T’s policy to place loans in all categories on nonaccrual status when collection of interest or principal is doubtful, or generally when interest or principal payments are 90 days or more past due. There are no loans 90 days or more past due and still accruing. At December 31, 20052006 and 2004, nonaccrual2005, interest that was notwould have been recorded amounted to $565,000 and $535,000, respectively. At December 31, 2005 and 2004, nonaccrual interest that was recorded on paid currenthad the nonaccrual loans amounted to $660,000performed in accordance with the original loan terms would have been $1,642,000 and $825,000,$565,000, respectively. The accrual of interest on impaired loans is discontinued when the loan is 60 days past due or, in management’s opinion, the account should be placed on nonaccrual status. At December 31, 20052006 and 2004,2005, there was $5,507,000$8,617,000 and $2,138,000,$5,507,000, respectively, of impaired loans that were on nonaccrual. There are no foreign loan amounts required to be included in this table. There were no restructured loans in the periods presented.

PAGE 24

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

DEPOSITS

Average total deposits increased by $261.6 million in 2006 and $217.7 million in 2005 and $100.9 million in 2004.2005. The mix of average deposits changed in 20052006 with average time deposits increasing $31.7$25.4 million and average savings accounts increasing $266.7$327.1 million. Partially offsetting these increases is a decrease of $100.1$103.4 million in average money market and NOW accounts. Average noninterest-bearing deposits increased by $19.4$12.5 million or 53 percent in 20052006 and were approximately 1817 percent and 1918 percent of average total deposits during 20052006 and 2004,2005, respectively. The increase in savings accounts is primarily attributable to the success of the Green Plan savings account, which hashad grown to $494.7$641.9 million at December 31, 20052006 since its introduction in August 2004. The Green Plan account iswas indexed to the Federal Funds Target Rate. DepositDuring the first quarter of 2006, S&T introduced another high yield savings account to replace the Green Plan account called the Plan B account. After the introduction of the Plan B account, no further Green Plan accounts were opened. Plan B accounts were non-indexed and were expected to allow S&T to continue core deposit growth that better compliments shifting interest rate sensitivity. The S&T Cash Management account is similar to the Plan B account and was introduced in November 2006; both are non-indexed, but the S&T Cash Management account has the added feature of tiering, or the payment of higher rates on higher balances. At December 31, 2006, S&T Cash Management accounts, Green Plan and Plan B balances outstanding were $743.5 million. As of January 2, 2007, Green Plan and Plan B account balances were transferred to the new S&T Cash Management account. Core deposit growth has been an important strategic initiative for S&T, through the expansion of retail facilities, promotions and new products. Other important strategies include providing cash management services to commercial customers to increase transaction related deposits, and delivery services such as electronic banking. Total deposits at December 31, 20052006 increased $242.6$146.4 million compared to December 31, 2004.

PAGE 23

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

2005.

The daily average amount of deposits and rates paid on such deposits is summarized for the periods indicated in the following table:

| Year Ended December 31 | Year Ended December 31 | |||||||||||||||||||||||||||||||||||

| 2005 | 2004 | 2003 | 2006 | 2005 | 2004 | |||||||||||||||||||||||||||||||

| Amount | Rate | Amount | Rate | Amount | Rate | Amount | Rate | Amount | Rate | Amount | Rate | |||||||||||||||||||||||||

| (dollars in thousands ) | ||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||

Noninterest-bearing demand deposits | $ | 411,236 | $ | 391,885 | $ | 347,042 | $ | 423,808 | $ | 411,236 | $ | 391,885 | ||||||||||||||||||||||||

NOW/Money market accounts | 438,356 | 0.87 | % | 538,471 | 0.61 | % | 568,869 | 0.66 | % | 334,987 | 1.13 | % | 438,356 | 0.87 | % | 538,471 | 0.61 | % | ||||||||||||||||||

Savings deposits | 502,641 | 2.24 | % | 235,926 | 0.63 | % | 203,633 | 0.46 | % | 829,700 | 3.95 | % | 502,641 | 2.24 | % | 235,926 | 0.63 | % | ||||||||||||||||||

Time deposits | 889,261 | 3.34 | % | 857,534 | 3.02 | % | 803,323 | 3.30 | % | 914,621 | 4.04 | % | 889,261 | 3.34 | % | 857,534 | 3.02 | % | ||||||||||||||||||

TOTAL | $ | 2,241,494 | $ | 2,023,816 | $ | 1,922,867 | $ | 2,503,116 | $ | 2,241,494 | $ | 2,023,816 | ||||||||||||||||||||||||

Maturities of time certificates of deposit of $100,000 or more outstanding at December 31, 2005, are summarized as follows:

| (dollars in thousands ) | ||||||

| 2006 | ||||||

| (dollars in thousands) | ||||||

Three months or less | $ | 83,205 | $ | 86,464 | ||

Over three through six months | 19,101 | 80,028 | ||||

Over six through twelve months | 36,464 | 45,622 | ||||

Over twelve months | 67,896 | 49,532 | ||||

TOTAL | $ | 206,666 | $ | 261,646 | ||

We believe ourPAGE 25

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

Management believes that the S&T deposit base is stable and we havethat S&T has the ability to attract new deposits, mitigating a funding dependency on other more volatile sources. Special rate deposits of $100,000 and over were 10 percent and 9 percent of total deposits at December 31, 2006 and 2005, and 2004,respectively, and primarily represent deposit relationships with local customers in our market area. In addition, management believes that S&T has the ability to access both public and private markets to raise long-term funding if necessary. At December 31, 2005,2006, S&T had $57.2$2.8 million of brokered retail certificates of deposit outstanding compared to $37.3$57.2 million at December 31, 2004.2005. The purchase of brokered retail certificates of deposits in 20052006 and 20042005 was an ALCO strategy to increase liquidity for commercial loan demand, as an alternative to increased borrowings.

BORROWINGS

Average borrowings by S&T decreased $129.2$68.6 million in 20052006 as a result of increased deposit growth and lower levels of investment securities. Borrowings were comprised of retail repurchase agreements (“REPOs”), wholesale REPOs, federal funds purchased, FHLB advances and long-term borrowings. S&T defines REPOs with our retail customers as retail REPOs; wholesale REPOs are those transacted with other banks and brokerage firms with terms normally ranging from one to 365 days.

The average balance in retail REPOs decreasedincreased by $1.5 million in 2006 and $7.7 million in 2005 and increased by $11.4 million in 2004.2005. S&T views retail REPOs as a relatively stable source of funds because most of these accounts are with local, long-term customers.

Wholesale REPOs, federal funds purchased and FHLB advances averaged $293.3$140.3 million in 2005,2006, a decrease of $96.0$153.0 million from the 20042005 averages. The decrease is attributable to the increase in deposits in 2005,2006, which decreased our need for additional funds.

During 2005,2006, average fixed ratelong-term borrowings decreased $25.5 million. The decrease is attributableincreased $82.8 million as compared to the increase in deposits in 2005, which decreased our need for additional borrowings.December 31, 2005. At December 31, 2005,2006, S&T had long-term borrowings outstanding of $83.8$168.8 million at a fixed-rate and $3.1 million at a variable rate with the FHLB. The increase in long-term borrowings is part of an ALCO strategy to limit interest rate risk as customer preferences have shifted to short-term and variable rate deposits, and to take advantage of lower cost funds through the FHLB’s Community Investment Program.

During the third quarter of 2006, S&T Bank issued $25.0 million of junior subordinated debentures through a pooled transaction at an initial fixed rate of 6.78 percent. On September 15, 2011 and quarterly thereafter, S&T Bank has the option to redeem the subordinated debt, subject to a 30 day written notice and prior approval by the FDIC. If S&T Bank chooses not to exercise the option for early redemption on September 15, 2011 or subsequent quarters, the subordinated debt will convert to a variable rate of 3-month LIBOR plus 160 basis points. The subordinated debt qualifies as Tier 2 capital under regulatory guidelines and will mature on December 15, 2036.

PAGE 2426

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

the FHLB. The purpose of these borrowings was to provide matched fundings for newly originated loans, to mitigate the risk associated with volatile liability fundings, to take advantage of lower-cost funds through the FHLB’s Community Investment Program and to fund stock buy-backs.

During the fourth quarter of 2003, S&T prepaid $89.3 million of fixed-rate borrowings, with average maturities of approximately nine months and an average cost of 6.56 percent, resulting in a pretax prepayment charge of $3.6 million. The prepayment penalties are reflected in S&T’s Consolidated Statements of Income as noninterest expense. The funds were replaced with short-term borrowings having an average cost of 1.25 percent. The expense savings approximated $3.0 million in 2004 and $0.5 million in 2003. The reduction in higher-cost long-term debt was an ALCO strategy intended to mitigate the asset sensitivity position of S&T’s balance sheet and exposure to declining interest rates or a flattening yield curve.

The following table shows the distribution of our short-term borrowings and the weighted average interest rates thereon at the end of each of the last three years. Also provided are the maximum amount of borrowings and the average amounts of borrowings as well as weighted average interest rates for the last three years.

| Securities Sold under Repurchase Agreements and Federal Funds Purchased | 2005 | 2004 | 2003 | 2006 | 2005 | 2004 | ||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

Balance at December 31 | $ | 137,829 | $ | 98,384 | $ | 182,020 | $ | 133,021 | $ | 137,829 | $ | 98,384 | ||||||||||||

Average balance during the year | 132,406 | 164,645 | 185,214 | 114,544 | 132,406 | 164,645 | ||||||||||||||||||

Average interest rate during the year | 2.98 | % | 1.16 | % | 1.13 | % | 4.51 | % | 2.98 | % | 1.16 | % | ||||||||||||

Maximum month-end balance during the year | $ | 174,467 | $ | 199,538 | $ | 230,774 | $ | 156,471 | $ | 174,467 | $ | 199,538 | ||||||||||||

Average interest rate at year-end | 3.80 | % | 1.77 | % | 0.95 | % | 4.83 | % | 3.80 | % | 1.77 | % | ||||||||||||

| Federal Home Loan Bank (FHLB) Advances | 2005 | 2004 | 2003 | 2006 | 2005 | 2004 | ||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||

Balance at December 31 | $ | 150,000 | $ | 225,000 | $ | 250,000 | $ | 55,000 | $ | 150,000 | $ | 225,000 | ||||||||||||

Average balance during the year | 221,918 | 293,391 | 142,136 | 88,342 | 221,918 | 293,391 | ||||||||||||||||||

Average interest rate during the year | 3.21 | % | 1.47 | % | 1.28 | % | 5.01 | % | 3.21 | % | 1.47 | % | ||||||||||||

Maximum month-end balance during the year | $ | 315,000 | $ | 380,000 | $ | 250,000 | $ | 150,000 | $ | 315,000 | $ | 380,000 | ||||||||||||

Average interest rate at year-end | 4.34 | % | 2.20 | % | 1.20 | % | 5.44 | % | 4.34 | % | 2.20 | % | ||||||||||||

WEALTH MANAGEMENT ASSETS

The year-end 20052006 market value balance of the S&T Bank Wealth Managementwealth management assets under management, which are not accounted for as part of the assets of S&T, increased 512 percent in 20052006 to $1.2$1.4 billion, with $912.8$959.8 million in Wealth Management Serviceswealth management services and $311.5$416.6 million in Brokerage Services.brokerage services. The 20052006 increase is attributable to increased performance in the stock markets and newly developed business relationships.

EXPLANATION OF USE OF NON-GAAP FINANCIAL MEASURES

In addition to the results of operations presented in accordance with generally accepted accounting principles (“GAAP”), S&T management uses, and this annual report contains or references, certain non-GAAP financial measures, such as net interest income on a fully tax-equivalent basis and operating revenue. S&T believes these non-GAAP financial measures provide information useful to investors in understanding our underlying operational performance and our business and performance trends as they facilitate comparisons with the performance of others in the financial

PAGE 25

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

services industry. Although S&T believes that these non-GAAP financial measures enhance investors’ understanding of S&T’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP.

We believe the presentation of net interest income on a fully tax-equivalent basis ensures comparability of net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. Interest income per the consolidated statements of income is reconciled to net interest income adjusted to a fully tax-equivalent basis on page 27.29.

Operating revenue is the sum of net interest income and noninterest income less security gains. In order to understand the significance of net interest income to S&T business and operating results, S&T management believes it is appropriate to evaluate the significance of net interest income as a component of operating revenue.

PAGE 27

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — continued

RESULTS OF OPERATIONS

Year Ended December 31, 2006

NET INCOME

Net income was $53.3 million or $2.06 per diluted earnings per share in 2006, an 8 percent decrease from the $58.2 million or $2.18 per diluted earnings per share in 2005. The decrease in earnings was primarily the result of a higher provision for loan losses due to the deterioration in the credit quality of three large commercial loan relationships, the $0.9 million charge-down for properties previously acquired through foreclosure and other increases to noninterest expense. The return on average assets was 1.64 percent for 2006, as compared to 1.90 percent for 2005. The return on average equity was 15.37 percent for 2006 compared to 16.57 percent for 2005.

RETURN ON EQUITY AND ASSETS

The table below shows consolidated operating and capital ratios of S&T for each of the last three years:

| Year Ended December 31 | |||||||||

| 2006 | 2005 | 2004 | |||||||

Return on average assets | 1.64 | % | 1.90 | % | 1.83 | % | |||

Return on average equity | 15.37 | % | 16.57 | % | 16.07 | % | |||

Dividend payout ratio | 56.34 | % | 50.38 | % | 51.70 | % | |||

Equity to asset ratio | 10.16 | % | 11.03 | % | 11.68 | % | |||

NET INTEREST INCOME

On a fully tax-equivalent basis, net interest income increased $1.0 million or 1 percent in 2006 compared to 2005. The net yield on interest earning assets decreased to 3.86 percent in 2006 as compared to 4.05 percent in 2005. The decrease in the net yield on earning assets is primarily attributable to the effect of rising short-term interest rates in combination with a flat and inverted yield curve during the period. S&T’s balance sheet is liability sensitive, with funding costs rising faster than asset yields in today’s interest rate environment.

In 2006, average loans increased $217.3 million and average securities, other investments and federal funds sold decreased $50.7 million. The yields on average loans increased by 80 basis points, and the yields on average securities increased 15 basis points. Overall funding costs increased 75 basis points.

Average interest-bearing deposits provided $249.1 million of the funds for the growth in average earning assets, at a cost of 3.54 percent in 2006 as compared to 2.45 percent in 2005. The cost of repurchase agreements and other borrowed funds increased 157 basis points to 4.96 percent.

Negatively affecting net interest income was a $13.8 million decrease in average net free funds during 2006 compared to 2005. Average net free funds are the excess of demand deposits, other noninterest-bearing liabilities and shareholders’ equity over nonearning assets. The decrease is primarily due to a successful stock buy-back program in 2006, higher levels of cash and due from banks, defined benefit pension plan fundings and an increase in premises and equipment due to new branches and administrative facilities during 2006.