shortages or delays in the availability of drilling rigs or crews and the delivery of equipment.

Our future drilling activities may not be successful and, if unsuccessful, such failure will have an adverse effect on our future results of operations and financial condition. Our overall drilling success rate or our drilling success rate for activity within a particular geographic area may decline. We may ultimately not be able to lease or drill identified or budgeted prospects within our expected time frame, or at all. We may not be able to lease or drill a particular prospect because, in some cases, we identify a prospect or drilling location before seeking an option or lease rights in the prospect or location. Similarly, our drilling schedule may vary from our capital budget. The final determination with respect to the drilling of any scheduled or budgeted wells will be dependent on a number of factors, including:

the results of exploration efforts and the acquisition, review and analysis of the seismic data;

the availability of sufficient capital resources to us and the other participants for the drilling of the prospects;

the approval of the prospects by other participants after additional data has been compiled;

economic and industry conditions at the time of drilling, including prevailing and anticipated prices for natural gas and oil and the availability of drilling rigs and crews;

our financial resources and results; and

the availability of leases and permits on reasonable terms for the prospects.

These projects may not be successfully developed and the wells, if drilled, may not encounter reservoirs of commercially productive natural gas or oil.

Index to Financial Statements

Reserve estimates depend on many assumptions that may prove to be inaccurate.Our proved reserves are estimates. Any material inaccuracies in our reserve estimates or underlying assumptions could cause the quantities and net present value of our reserves to be overstated.overstated or understated.

Reserve engineering is a subjective process of estimating underground accumulations of natural gas and crude oil that cannot be measured in an exact manner. The process of estimating quantities of proved reserves is complex and inherently uncertain,imprecise, and the reserve data included in this document are only estimates. The process relies on interpretations of available geologic, geophysic,geophysical, engineering and production data. As a result, estimates of different engineers may vary. In addition, theThe extent, quality and reliability of this technical data can vary. The degree of uncertainty varies among the three regions in which we operate. The estimation of reserves in the Gulf Coast region requires more estimates than the East and West regions and inherently has more uncertainty surrounding reserve estimation. The differences in the reserve estimation process are substantially due to the geological conditions in which the wells are drilled. The process also requires certain economic assumptions, some of which are mandated by the SEC, such as natural gas and oil prices. Additional assumptions include drilling and operating expenses, capital expenditures, taxes and availability of funds. The accuracy of a reserve estimate is a function of:

Results of drilling, testing and production subsequent to the date of an estimate may justify revising the original

estimate. Accordingly, initial reserve estimates often vary from the quantities of natural gas and crude oil that are ultimately recovered, and such variances may be material. Any significant variance could reduce the estimated quantities and present value of our reserves.

You should not assume that the present value of future net cash flows from our proved reserves is the current market value of our estimated natural gas and oil reserves. In accordance with SEC requirements, we base the estimated discounted future net cash flows from our proved reserves on prices and costs in effect on the date of the estimate, holding the prices and costs constant throughout the life of the properties. Actual future prices and costs may differ materially from those used in the net present value estimate, and future net present value estimates using then current prices and costs may be significantly less than the current estimate. In addition, the 10% discount factor we use when calculating discounted future net cash flows for reporting requirements in compliance with the Financial Accounting Standards Board in Statement of Financial Accounting Standards No. 69 may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the natural gas and oil industry in general.

Our future performance depends on our ability to find or acquire additional natural gas and oil reserves that are economically recoverable.

In general, the production rate of natural gas and oil properties declines as reserves are depleted, with the rate of decline depending on reservoir characteristics. Unless we successfully replace the reserves that we produce, our reserves will decline, eventually resulting in a decrease in natural gas and oil production and lower revenues and cash flow from operations. Our future natural gas and oil production is, therefore, highly dependent on our level of success in finding or acquiring additional reserves. We may not be able to replace reserves through our exploration, development and exploitation activities or by acquiring properties at acceptable costs. Low natural gas and oil prices may further limit the kinds of reserves that we can develop economically. Lower prices also decrease our cash flow and may cause us to decrease capital expenditures.

Our reserve report estimates that production from our proved developed producing reserves as of December 31, 2008 will decline at estimated rates of 21%, 17%, 12% and 11% during 2009, 2010, 2011 and 2012, respectively. Future development of proved undeveloped and other reserves currently not classified as proved developed producing will impact these rates of decline. Because of higher initial decline rates from newly developed reserves, we consider this pattern fairly typical.

Exploration, development and exploitation activities involve numerous risks that may result in dry holes, the failure to produce natural gas and oil in commercial quantities and the inability to fully produce discovered reserves.

We are continually identifyingAcquired properties may not be worth what we pay due to uncertainties in evaluating recoverable reserves and evaluating opportunities to acquireother expected benefits, as well as potential liabilities.

Successful property acquisitions require an assessment of a number of factors beyond our control. These factors include exploration potential, future natural gas and oil prices, operating costs, and potential

Index to Financial Statements

environmental and other liabilities. These assessments are complex and inherently imprecise. Our review of the properties we acquire may not reveal all existing or potential problems. In addition, our review may not allow us to fully assess the potential deficiencies of the properties. We do not inspect every well, and even when we inspect a well we may not discover structural, subsurface, or environmental problems that may exist or arise. We may not be entitled to contractual indemnification for pre-closing liabilities, including environmental liabilities, and our contractual indemnification may not be effective. Often, we acquire interests in properties on an “as is” basis with limited remedies for breaches of representations and warranties.

The integration of the properties we acquire could be difficult, and may divert management’s attention away from our existing operations.

The integration of the properties we acquire could be difficult, and may divert management’s attention and financial resources away from our existing operations. These difficulties include:

the challenge of integrating the acquired properties while carrying on the ongoing operations of our business; and

the possibility of faulty assumptions underlying our expectations.

The process of integrating our operations could cause an interruption of, or loss of momentum in, the activities of our business. Members of our management may be required to devote considerable amounts of time to this integration process, which will decrease the time they will have to manage our existing business. If management is not able to successfully consummateeffectively manage the integration process, or if any acquisition, to acquire producing natural gas and oil properties that contain economically recoverable reserves, or to integratesignificant business activities are interrupted as a result of the properties intointegration process, our operations profitably.business could suffer.

We face a variety of hazards and risks that could cause substantial financial losses.

Our business involves a variety of operating risks, including:

well site blowouts, cratering and explosions;

equipment failures;

uncontrolled flows of natural gas, oil or well fluids;

fires;

formations with abnormal pressures;

pollution and other environmental risks; and

natural disasters.

In addition, we conduct operations in shallow offshore areas (largely coastal waters), which are subject to additional hazards of marine operations, such as capsizing, collision and damage from severe weather. Any of these events could result in injury or loss of human life, loss of hydrocarbons, significant damage to or destruction of property, environmental pollution, regulatory investigations and penalties, impairment of our operations and substantial losses to us.

Our operation of natural gas gathering and pipeline systems also involves various risks, including the risk of explosions and environmental hazards caused by pipeline leaks and ruptures. The location of pipelines near populated areas, including residential areas, commercial business centers and industrial sites, could increase these risks. As of December 31, 2005,2008, we owned or operated approximately 3,4003,500 miles of natural gas gathering and pipeline systems. As part of our normal maintenance program, we have identified certain segments of our pipelines that we believe periodically require repair, replacement or additional maintenance.

In accordance with customary industry practice,

Index to Financial Statements

We may not be insured against all of the operating risks to which we are exposed.

We maintain insurance against some, but not all, of these risks and losses. We do not carry business interruption insurance. In addition, pollution and environmental risks generally are not fully insurable. The occurrence of an event not fully covered by insurance could have a material adverse effect on our financial position and results of operations.

We have limited control over the activities on properties we do not operate.

Other companies operate some of the properties in which we have an interest. Non-operated wells represented approximately 15% of our total owned gross wells, or approximately 4.8% of our owned net wells, as of December 31, 2008. We have limited ability to influence or control the operation or future development of these non-operated properties or the amount of capital expenditures that we are required to fund with respect to them. The failure of an operator of our wells to adequately perform operations, an operator’s breach of the applicable agreements or an operator’s failure to act in ways that are in our best interest could reduce our production and revenues. Our dependence on the operator and other working interest owners for these projects and our limited ability to influence or control the operation and future development of these properties could materially adversely affect the realization of our targeted returns on capital in drilling or acquisition activities and lead to unexpected future costs.

Terrorist activities and the potential for military and other actions could adversely affect our business.

The threat of terrorism and the impact of military and other action have caused instability in world financial markets and could lead to increased volatility in prices for natural gas and oil, all of which could adversely affect the markets for our operations. Future acts of terrorism could be directed against companies operating in the United States. The U.S. government has issued public warnings that indicate that energy assets might be specific targets of terrorist organizations. These developments have subjected our operations to increased risk and, depending on their ultimate magnitude, could have a material adverse effect on our business.

Our ability to sell our natural gas and oil production could be materially harmed if we fail to obtain adequate services such as transportation and processing.

The sale of our natural gas and oil production depends on a number of factors beyond our control, including the availability and capacity of transportation and processing facilities. Our failure to obtain these services on acceptable terms could materially harm our business.

Competition in our industry is intense, and many of our competitors have substantially greater financial and technological resources than we do, which could adversely affect our competitive position.

Competition in the natural gas and oil industry is intense. Major and independent natural gas and oil companies actively bid for desirable natural gas and oil properties, as well as for the equipment and labor required to operate and develop these properties. Our competitive position is affected by price, contract terms and quality of service, including pipeline connection times, distribution efficiencies and reliable delivery record. Many of our competitors have financial and technological resources and exploration and development budgets that are substantially greater than ours, particularly in the Rocky Mountains, Mid-Continent and Gulf Coast areas.ours. These companies may be able to pay more for exploratory projects and productive natural gas and oil properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may be able to expend greater resources on the existing and changing technologies that we believe are and will be increasingly important to attaining success in the industry.

Index to Financial Statements

We may have hedging arrangements that expose us to risk of financial loss and limit the benefit to us of increases in prices for natural gas and oil.

From time to time, when we believe that market conditions are favorable, we use certain derivative financial instruments to manage price risks associated with our production in all of our regions. While there are many different types of derivatives available, in 20052008 we primarily employed natural gas and crude oil price collar and swap agreements covering portions of our 2008 production and collar agreementsanticipated 2009 and 2010 production to attempt to manage price risk. The price swaps call for payments to, or receipts from, counterparties based on whether the market price of natural gas or crude oil for the period is greater or less than the fixed price established for that period when the swap is put in place.risk more effectively. The collar arrangements are put and call options used to establish floor and ceiling commodity prices for a fixed volume of production during a certain time period. They provide for payments to counterparties if the index price exceeds the ceiling and payments from the counterparties if the index price isfalls below the floor.

The price swaps call for payments to, or receipts from, counterparties based on whether the market price of natural gas or crude oil for the period is greater or less than the fixed price established for that period when the swap is put in place. These hedging arrangements limit the benefit to us of increases in prices. In addition, these arrangements expose us to risks of financial loss in a variety of circumstances, including when:

a counterparty is unable to satisfy its obligations;

production is less than expected; or

there is an adverse change in the expected differential between the underlying price in the derivative instrument and actual prices received for our production.

We will continue to evaluate the benefit of employing derivatives in the future. Please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and “Quantitative and Qualitative Disclosures about Market Risk” in Item 7A for further discussion concerning our use of derivatives.

The loss of key personnel could adversely affect our ability to operate.

Our operations are dependent upon a relatively small group of key management and technical personnel, and one or more of these individuals could leave our employment. The unexpected loss of the services of one or more of these individuals could have a detrimental effect on us. In addition, our drilling success and the success of other activities integral to our operations will depend, in part, on our ability to attract and retain experienced geologists, engineers and other professionals. Competition for experienced geologists, engineers and some other professionals is extremely intense. If we cannot retain our technical personnel or attract additional experienced technical personnel, our ability to compete could be harmed.

We are subject to complex laws and regulations, including environmental regulations, which can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to extensive federal, state and local laws and regulations, including tax laws and regulations and those relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. These laws and regulations can adversely affect the cost, manner or feasibility of doing business. Many laws and regulations require permits for the operation of various facilities, and these permits are subject to revocation, modification and renewal. Governmental authorities have the power to enforce compliance with their regulations, and violations could subject us to fines, injunctions or both. These laws and regulations have increased the costs of planning, designing, drilling, installing and operating natural gas and oil facilities. In addition, we may be liable for environmental damages caused by previous owners of property we purchase or lease. Risks of substantial costs and liabilities related to environmental compliance issues are inherent in natural gas and oil operations. It is possible that other developments, such as stricter environmental laws and regulations, and claims for damages to property or persons resulting from natural gas and oil production, would result in substantial costs and liabilities.

Index to Financial Statements

Provisions of Delaware law and our bylaws and charter could discourage change in control transactions and prevent stockholders from receiving a premium on their investment.

Our bylaws provide for a classified boardBoard of directorsDirectors with staggered terms, and our charter authorizes our boardBoard of directorsDirectors to set the terms of preferred stock. In addition, Delaware law contains provisions that impose restrictions on business combinations with interested parties. Our bylaws prohibit stockholder action by written consent and limit stockholder proposals at meetings of stockholders. We also have adopted a stockholder rights plan. Because of our stockholder rights plan and these provisions of our charter, bylaws and Delaware law, persons considering unsolicited tender offers or other unilateral takeover proposals may be more likely to negotiate with our boardBoard of directorsDirectors rather than pursue non-negotiated takeover attempts. As a result, these provisions may make it more difficult for our stockholders to benefit from transactions that are opposed by an incumbent boardBoard of directors.Directors.

The personal liability of our directors for monetary damages for breach of their fiduciary duty of care is limited by the Delaware General Corporation Law and by our certificate of incorporation.

The Delaware General Corporation Law allows corporations to limit available relief for the breach of directors’ duty of care to equitable remedies such as injunction or rescission. Our certificate of incorporation limits the liability of our directors to the fullest extent permitted by Delaware law. Specifically, our directors will not be personally liable for monetary damages for any breach of their fiduciary duty as a director, except for liabilityliability:

for any breach of their duty of loyalty to the company or our stockholders;

for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

under provisions relating to unlawful payments of dividends or unlawful stock repurchases or redemptions; and

for any transaction from which the director derived an improper personal benefit.

This limitation may have the effect of reducing the likelihood of derivative litigation against directors, and may discourage or deter stockholders or management from bringing a lawsuit against directors for breach of their duty of care, even though such an action, if successful, might otherwise have benefited our stockholders.

The global financial crisis may have impacts on our business and financial condition that we currently cannot predict.

The continued credit crisis and related turmoil in the global financial system may have an impact on our business and our financial condition, and we may face challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise financing, which could have an impact on our flexibility to react to changing economic and business conditions. The economic situation could have an impact on our lenders or customers, causing them to fail to meet their obligations to us. Additionally, market conditions could have an impact on our commodity hedging arrangements if our counterparties are unable to perform their obligations or seek bankruptcy protection. Additionally, the current economic situation could lead to further reduced demand for oil and natural gas, or lower prices for oil and natural gas, or both, which could have a negative impact on our revenues.

ITEM 1B. UNRESOLVED STAFF COMMENTS

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

See Item 1. Business.“Business.”

Index to Financial Statements

| ITEM 3. | LEGAL PROCEEDINGS |

We are a defendant in various legal proceedings arising in the normal course of our business. All known liabilities are accrued based on management’s best estimate of the potential loss. While the outcome and impact of such legal proceedings on us cannot be predicted with certainty, management believes that the resolution of these proceedings through settlement or adverse judgment will not have a material adverse effect on our consolidated financial position or cash flow. Operating results, however, could be significantly impacted in the reporting periods in which such matters are resolved.

Wyoming Royalty Litigation

In January 2002, we were sued by 13 overriding royalty owners in Wyoming federal district court, as reported in previous filings. The plaintiffs made claims pertaining to deductions from their overriding royalty and claims concerning penalties for improper reporting. As a result of several decisions by the Court favorable to us, the case was settled in September 2005 with no payment from us and a dismissal with prejudice of all claims by plaintiffs. The settlement included provisions for reporting and payment going forward. In the third quarter of 2005, management reversed the reserve we had recorded regarding this case, which did not have a material impact on our consolidated financial statements.

West Virginia Royalty Litigation

In December 2001, we were sued by two royalty owners in West Virginia state court for an unspecified amount of damages. The plaintiffs have requested class certification and allege that we failed to pay royalty based upon the wholesale market value of the gas, that we had taken improper deductions from the royalty and failed to properly inform royalty owners of the deductions. The plaintiffs also claimed that they are entitled to a 1/8th royalty share of the gas sales contract settlement that we reached with Columbia Gas Transmission Corporation in 1995 bankruptcy proceedings.

Discovery and pleadings necessary to place the class certification issue before the state court have been ongoing. The Court entered an order on June 1, 2005 granting the motion for class certification. The parties have negotiated a modification to the order which will result in the dismissal of the claims related to the gas sales contract settlement in connection with the Columbia Gas Transmission bankruptcy proceedings and that will limit the claims to those arising on and after December 17, 1991. The Court has postponed the trial date from April 17, 2006, in light of a case pending before the West Virginia Supreme Court of Appeals which may decide issues of law that may apply to the issue of deductibility of post-production expenses. We intend to challenge the class certification order by filing a Petition for Writ of Prohibition with the West Virginia Supreme Court of Appeals.

We are vigorously defending the case. We have established a reserve that management believes is adequate based on their estimate of the probable outcome of this case.

Texas Title Litigation

On January 6, 2003, we were served with Plaintiffs’ Second Amended Original Petition in Romeo Longoria, et al. v. Exxon Mobil Corporation, et al. in the 79th Judicial District Court of Brooks County, Texas. Plaintiffs filed their Second Supplemental Original Petition on November 12, 2004 and their Third Supplemental Original Petition on February 22, 2005 (which added Wynn-Crosby 1996, Ltd. and Dominion Oklahoma Texas Exploration & Production, Inc.). Plaintiffs allege that they are the owners of a one-half undivided mineral interest in and to certain lands in Brooks County, Texas. Cody Energy, LLC, our subsidiary, acquired certain leases and wells in 1997 and 1998.

The plaintiffs allege that they are entitled to be declared the rightful owners of an undivided interest in minerals and all improvements on the lands on which we acquired these leases. The plaintiffs also assert claims for trespass to try title, action to remove a cloud on the title, failure to properly account for royalty, fraud, trespass, conversion, all for unspecified actual and exemplary damages. Plaintiffs claim that they acquired title to the property by adverse possession. Plaintiffs also assert the discovery rule and a claim of fraudulent concealment to avoid the affirmative defense of limitations. In August 2005, the case was abated until late February 2006, during which time the parties are allowed to amend pleadings or add additional parties to the litigation. Due to the abatement of the case, we have

not had the opportunity to conduct discovery in this matter. We estimate that production revenue from this field since Cody Energy, LLC acquired title is approximately $15.7 million, and that the carrying value of this property is approximately $33.6 million.

Although the investigation into this claim continues, we intend to vigorously defend the case. Should we receive an adverse ruling in this case, an impairment review would be assessed to determine whether the carrying value of the property is recoverable. Management cannot currently determine the likelihood of an unfavorable outcome or range of any potential loss should the outcome be unfavorable. Accordingly, we have not established a reserve for this matter.

Raymondville Area

In April 2004, our wholly owned subsidiary, Cody Energy, LLC, filed suit in state court in Willacy County, Texas against certain of its co-working interest owners in the Raymondville Area, located in Kenedy and Willacy Counties. In early 2003, Cody had proposed a new prospect under the terms of the Joint Operating Agreement. Some of the co-working interest owners elected not to participate. The initial well was successful and subsequent wells have been drilled to exploit the discovery made in the first well.

The working interest owners who elected not to participate notified Cody that they believed that they had the right to participate in wells drilled after the initial well. Cody contends that the working interest owners that elected not to participate are required to assign their interest in the prospect to those who elected to participate. The defendants have filed a counter claim against the Company, and one of the defendants has filed a lien against Cody’s interest in the leases in the Raymondville area.

Cody has signed a settlement agreement with certain of the defendants representing approximately 3% of the interest in the area. Cody and the remaining defendant filed cross motions for summary judgment. In August 2005, the trial judge entered an order granting Cody’s Motion for Summary Judgment requiring the remaining defendant to assign to Cody all of its interest in the prospect and to remove the lien filed against Cody’s interest. The defendant has filed a Motion for Reconsideration and Opposition to Proposed Order. The Court has not yet made a decision on these two motions.

Commitment and Contingency Reserves

We have establishedWhen deemed necessary, we establish reserves for certain legal proceedings. The establishment of a reserve involves an estimation process that includes the advice of legal counsel and subjective judgment of management. While management believes these reserves to be adequate, it is reasonably possible that we could incur approximately $10.2$2.1 million of additional loss with respect to those matters in which reserves have been established. Future changes in the facts and circumstances could result in the actual liability exceeding the estimated ranges of loss and amounts accrued.

While the outcome and impact on us cannot be predicted with certainty, management believes that the resolution of these proceedings through settlement or adverse judgment will not have a material adverse effect on our consolidated financial position or cash flow. Operating results, however, could be significantly impacted in the reporting periods in which such matters are resolved.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of 2005.2008.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table shows certain information as of February 15, 2009 about our executive officers, as of February 17, 2006, as such term is defined in Rule 3b-7 of the Securities Exchange Act of 1934, and certain of our other officers.

Name | Age | Position | Officer Since | Age | Position | Officer Since | ||||||

Dan O. Dinges | 52 | Chairman, President and Chief Executive Officer | 2001 | 55 | Chairman, President and Chief Executive Officer | 2001 | ||||||

Michael B. Walen | 57 | Senior Vice President, Exploration and Production | 1998 | 60 | Senior Vice President, Chief Operating Officer | 1998 | ||||||

Scott C. Schroeder | 43 | Vice President and Chief Financial Officer | 1997 | 46 | Vice President and Chief Financial Officer | 1997 | ||||||

J. Scott Arnold | 52 | Vice President, Land and Associate General Counsel | 1998 | 55 | Vice President, Land and General Counsel | 1998 | ||||||

Robert G. Drake | 58 | Vice President, Information Services and Operational Accounting | 1998 | 61 | Vice President, Information Services and Operational Accounting | 1998 | ||||||

Abraham D. Garza | 59 | Vice President, Human Resources | 1998 | 62 | Vice President, Human Resources | 1998 | ||||||

Jeffrey W. Hutton | 50 | Vice President, Marketing | 1995 | 53 | Vice President, Marketing | 1995 | ||||||

Thomas S. Liberatore | 49 | Vice President, Regional Manager, East Region | 2003 | 52 | Vice President, Regional Manager, East Region | 2003 | ||||||

Lisa A. Machesney | 50 | Vice President, Managing Counsel and Corporate Secretary | 1995 | 53 | Vice President, Managing Counsel and Corporate Secretary | 1995 | ||||||

Henry C. Smyth | 59 | Vice President, Controller and Treasurer | 1998 | 62 | Vice President, Controller and Treasurer | 1998 |

All officers are elected annually by our Board of Directors. Except for the following, allAll of the executive officers have been employed by Cabot Oil & Gas Corporation for at least the last five years.

Dan O. Dinges joined Cabot Oil & Gas Corporation as President and Chief Operating Officer and as a member of the Board of Directors in September 2001. He was promotedIndex to

his current position of Chairman, President and Chief Executive Officer in May 2002. Mr. Dinges came to Cabot after a 20-year career with Samedan Oil Corporation, a subsidiary of Noble Affiliates, Inc. The last three years, Mr. Dinges served as Samedan’s Senior Vice President, as well as Division General Manager for the Offshore Division, a position he held since August 1996. He also served as a member of the Executive Operating Committee for Samedan. Mr. Dinges started his career as a Landman for Mobil Oil Corporation covering Louisiana, Arkansas and the central Gulf of Mexico. After four years of expanding responsibilities at Mobil, he joined Samedan as a Division Landman – Offshore. Over the years, Mr. Dinges held positions of increasing responsibility at Samedan including Division Manager, Vice President and ultimately Senior Vice President. Mr. Dinges received his B.B.A. degree in Petroleum Land Management from The University of Texas.

Thomas S. Liberatorejoined Cabot in January 2002 as Regional Manager, East and was promoted to his current position in July 2003. Prior to joining the Company, Mr. Liberatore served as Vice President, Exploration and Production for North Coast Energy. He began his career as a geologist and has held various positions of increasing responsibility for Presidio Oil Company and Belden & Blake Corporation. Mr. Liberatore received his B.S. in Geology from West Virginia University.

Financial Statements

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

TheOur common stock is listed and principally traded on the New York Stock Exchange under the ticker symbol “COG.” The following table presents the high and low closing sales prices per share of theour common stock during certain periods, as reported in the consolidated transaction reporting system. Cash dividends paid per share of the common stock are also shown. A regular dividend has been declared each quarter since we became a public company in 1990.

On February 28, 2005, we announced that23, 2007, our Board of Directors had declared a 3-for-22-for-1 split of our common stock in the form of a stock distribution. The stock dividend was distributed on March 31, 200530, 2007 to stockholders of record on March 18, 2005. In lieu of issuing fractional shares, we paid cash based on the closing price of the common stock on the record date.16, 2007. All common stock accounts and per share data, including cash dividends per share, have been retroactively adjusted to give effect to the 3-for-22-for-1 split of our common stock. After the stock split, the dividend was increased to $0.03 per share per quarter, or a 50% increase from pre-split levels.

| High | Low | Cash Dividends | High | Low | Dividends | |||||||||||||

2005 | ||||||||||||||||||

2008 | ||||||||||||||||||

First Quarter | $ | 38.04 | $ | 27.78 | $ | 0.027 | $ | 53.41 | $ | 37.67 | $ | 0.03 | ||||||

Second Quarter | 38.13 | 28.29 | 0.040 | $ | 71.11 | $ | 51.48 | $ | 0.03 | |||||||||

Third Quarter | 50.81 | 36.05 | 0.040 | $ | 68.58 | $ | 33.58 | $ | 0.03 | |||||||||

Fourth Quarter | 51.54 | 40.48 | 0.040 | $ | 33.83 | $ | 21.31 | $ | 0.03 | |||||||||

2004 | ||||||||||||||||||

2007 | ||||||||||||||||||

First Quarter | $ | 21.93 | $ | 19.17 | $ | 0.027 | $ | 35.29 | $ | 28.06 | $ | 0.02 | ||||||

Second Quarter | 28.20 | 20.09 | 0.027 | $ | 41.88 | $ | 34.55 | $ | 0.03 | |||||||||

Third Quarter | 30.05 | 25.87 | 0.027 | $ | 38.39 | $ | 31.55 | $ | 0.03 | |||||||||

Fourth Quarter | 32.25 | 27.27 | 0.027 | $ | 40.90 | $ | 33.59 | $ | 0.03 | |||||||||

As of January 31, 2006,2009, there were 632544 registered holders of the common stock. Shareholders include individuals, brokers, nominees, custodians, trustees, and institutions such as banks, insurance companies and pension funds. Many of these hold large blocks of stock on behalf of other individuals or firms.

Issuer Purchases of Equity SecuritiesISSUER PURCHASES OF EQUITY SECURITIES

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum of Shares that | |||||

October 2005 | — | $ | — | — | 1,918,750 | ||||

November 2005 | 207,400 | $ | 43.10 | 207,400 | 1,711,350 | ||||

December 2005 | 225,200 | $ | 42.95 | 225,200 | 1,486,150 | ||||

Total | 432,600 | $ | 43.02 | ||||||

On August 13, 1998, we announced that ourOur Board of Directors has authorized thea share repurchase of two millionprogram under which we may purchase shares of our common stock in the open market or in negotiated transactions. As a result of the 3-for-2 stock split effected in March 2005, this figure has been adjusted to three million shares. All purchases executed have been through open market transactions. There is no expiration date associated with the authorizationauthorization. During 2008, we did not repurchase any shares of common stock. All purchases executed to repurchasedate have been through open market transactions. The maximum number of shares that may yet be purchased under the plan as of December 31, 2008 was 4,795,300.

Index to Financial Statements

PERFORMANCE GRAPH

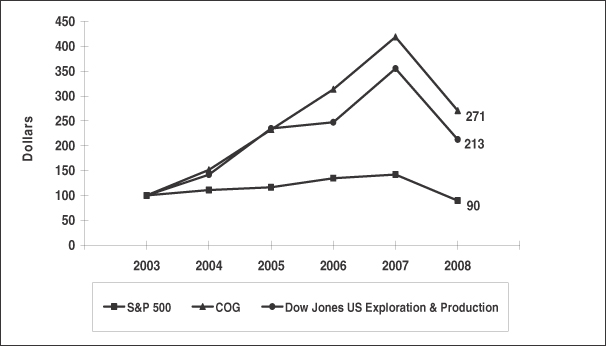

The following graph compares our securities.common stock performance (“COG”) with the performance of the Standard & Poors’ 500 Stock Index and the Dow Jones US Exploration & Production Index for the period December 2003 through December 2008. The graph assumes that the value of the investment in our common stock and in each index was $100 on December 31, 2003 and that all dividends were reinvested.

Calculated Values | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | ||||||

S&P 500 | 100.0 | 110.9 | 116.3 | 134.7 | 142.1 | 89.5 | ||||||

COG | 100.0 | 151.4 | 232.4 | 313.5 | 418.7 | 270.5 | ||||||

Dow Jones US Exploration & Production | 100.0 | 141.9 | 234.5 | 247.1 | 355.1 | 212.6 |

The performance graph above is furnished and not filed for purposes of Section 18 of the Securities Exchange Act of 1934 and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933 unless specifically identified therein as being incorporated therein by reference. The performance graph is not soliciting material subject to Regulation 14A.

Index to Financial Statements

ITEM 6. SELECTED FINANCIAL DATA

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table summarizes our selected consolidated financial data for the periods indicated. This information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7, and the Consolidated Financial Statements and related Notes.Notes in Item 8.

| Year Ended December 31, | |||||||||||||||

| (In thousands, except per share amounts) | 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||

Statement of Operations Data | |||||||||||||||

Operating Revenues | $ | 682,797 | $ | 530,408 | $ | 509,391 | $ | 353,756 | $ | 447,042 | |||||

Impairment of Oil and Gas Properties (1) | — | 3,458 | 93,796 | 2,720 | 6,852 | ||||||||||

Income from Operations | 258,731 | 160,653 | 66,587 | 49,088 | 95,366 | ||||||||||

Net Income | 148,445 | 88,378 | 21,132 | 16,103 | 47,084 | ||||||||||

Basic Earnings per Share(2)(3) | $ | 3.04 | $ | 1.81 | $ | 0.44 | $ | 0.34 | $ | 1.04 | |||||

Dividends per Common Share(2) | $ | 0.147 | $ | 0.107 | $ | 0.107 | $ | 0.107 | $ | 0.107 | |||||

Balance Sheet Data | |||||||||||||||

Properties and Equipment, Net | $ | 1,238,055 | $ | 994,081 | $ | 895,955 | $ | 971,754 | $ | 981,338 | |||||

Total Assets | 1,495,370 | 1,210,956 | 1,055,056 | 1,100,947 | 1,092,810 | ||||||||||

Current Portion of Long-Term Debt | 20,000 | 20,000 | — | — | — | ||||||||||

Long-Term Debt | 320,000 | 250,000 | 270,000 | 365,000 | 393,000 | ||||||||||

Stockholders’ Equity | 600,211 | 455,662 | 365,197 | 350,657 | 346,552 | ||||||||||

| Year Ended December 31, | ||||||||||||||||

| 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||

| (In thousands, except per share amounts) | ||||||||||||||||

Statement of Operations Data | ||||||||||||||||

Operating Revenues | $ | 945,791 | $ | 732,170 | $ | 761,988 | $ | 682,797 | $ | 530,408 | ||||||

Impairment of Oil & Gas Properties and Other Assets(1) | 35,700 | 4,614 | 3,886 | — | 3,458 | |||||||||||

Gain / (Loss) on Sale of Assets(2) | 1,143 | 13,448 | 232,017 | 74 | (124 | ) | ||||||||||

Gain on Settlement of Dispute(3) | 51,906 | — | — | — | — | |||||||||||

Income from Operations | 372,012 | 274,693 | 528,946 | 258,731 | 160,653 | |||||||||||

Net Income | 211,290 | 167,423 | 321,175 | 148,445 | 88,378 | |||||||||||

Basic Earnings per Share(4) | $ | 2.10 | $ | 1.73 | $ | 3.32 | $ | 1.52 | $ | 0.91 | ||||||

Diluted Earnings per Share(4) | $ | 2.08 | $ | 1.71 | $ | 3.26 | $ | 1.49 | $ | 0.90 | ||||||

Dividends per Common Share(4) | $ | 0.120 | $ | 0.110 | $ | 0.080 | $ | 0.074 | $ | 0.054 | ||||||

Balance Sheet Data | ||||||||||||||||

Properties and Equipment, Net | $ | 3,135,828 | $ | 1,908,117 | $ | 1,480,201 | $ | 1,238,055 | $ | 994,081 | ||||||

Total Assets | 3,701,664 | 2,208,594 | 1,834,491 | 1,495,370 | 1,210,956 | |||||||||||

Current Portion of Long-Term Debt | 35,857 | 20,000 | 20,000 | 20,000 | 20,000 | |||||||||||

Long-Term Debt | 831,143 | 330,000 | 220,000 | 320,000 | 250,000 | |||||||||||

Stockholders’ Equity | 1,790,562 | 1,070,257 | 945,198 | 600,211 | 455,662 | |||||||||||

(1) | For discussion of impairment of oil and gas properties and other assets, refer to Note 2 of the Notes to the Consolidated Financial Statements. |

(2) | Gain on Sale of Assets for 2007 and 2006 reflects $12.3 million and $231.2 million, respectively, related to disposition of our offshore portfolio and certain south Louisiana properties (the “2006 south Louisiana and offshore properties sale”), which was substantially completed in the third quarter of 2006. |

(3) | Gain on Settlement of Dispute is associated with the Company’s settlement of a dispute in the fourth quarter of 2008. The dispute settlement includes the value of cash and properties received. See Note 7 of the Notes to the Consolidated Financial Statements. |

(4) | All Earnings per Share and Dividends per Common Share figures have been retroactively adjusted for the 2-for-1 split of our common stock effective March 31, 2007 as well as the 3-for-2 split of our common stock effective March 31, 2005. |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion is intended to assist you in understanding our results of operations and our present financial condition. Our Consolidated Financial Statements and the accompanying Notes to the Consolidated Financial Statements included elsewhere in this Form 10-K contain additional information that should be referred to when reviewing this material.

Statements in this discussion may be forward-looking. These forward-looking statements involve risks and uncertainties, including those discussed below, which could cause actual results to differ from those expressed. Please read “Forward-Looking Information” for further details.

We operate in one segment, natural gas and oil explorationdevelopment, exploitation and exploitation,exploration, exclusively within the United States and Canada.

Index to Financial Statements

OVERVIEW

Cabot Oil & Gas and its subsidiaries are a leading independent oil and gas company engaged in the exploration, development, acquisition, exploitation, exploration, production and marketing of natural gas, and to a lesser extent, crude oil and natural gas liquids from its properties in North America. We also transport, store, gather and produce natural gas for resale. Our exploitation and exploration activities are concentrated in areas with known hydrocarbon resources, which are conducive to multi-well, repeatable drilling programs. Our program is designed to be disciplined and balanced, with a focus on achieving strong financial returns.

At Cabot, there are three types of investment alternatives that constantly compete for available capital: drilling opportunities, acquisition opportunities and financial opportunities such as debt repayment or repurchase of common stock.stock and acquisition opportunities. Depending on circumstances, we allocate capital among the alternatives based on a rate-of-return approach. Our goal is to invest capital in the highest return opportunities available at any given time. At any one time, one or more of these may not be economically feasible.

Our financial results depend upon many factors, particularly the price of natural gas and crude oil and our ability to market our production on economically attractive terms. Price volatility in the commodity markets has remained prevalent in the last few years. Throughout 20042007 and 2005,most of 2008, the futures market reported unprecedentedstrong natural gas and crude oil contract prices. During the fourth quarter of 2008, commodity prices experienced a sharp decline. Our realized natural gas and crude oil price was $6.74$8.39 per Mcf and $44.19$89.11 per Bbl, respectively, in 2005.2008. These realized prices include the realized impact of derivative instruments. In an effort to manage commodity price risk, we entered into a series of crude oil and natural gas price collarsswaps and swaps.collars. These financial instruments are an important element of our risk management strategy but prevented usand assisted in the increase in our realized natural gas price from realizing the full impact of the price environment.2007 to 2008.

Commodity prices are impacted by many factors that are outside of our control. Historically, commodity prices have been volatile and we expect them to remain volatile. Commodity prices are affected by changes in market demands,supply and demand, which are impacted by overall economic activity, weather, pipeline capacity constraints, inventory storage levels, basis differentials and other factors. As a result, we cannot accurately predict future natural gas, natural gas liquidsNGL and crude oil prices and, therefore, we cannot determine with any degree of certainty what effect increases or decreases will have on our capital program, production volumes and future revenues. In addition to production volumes and commodity prices, finding and developing sufficient amounts of crude oil and natural gas reserves at economical costs are critical to our long-term success. See “Risk Factors—Natural gas and oil prices fluctuate widely, and low prices for an extended period of time are likely to have a material adverse impact on our business” and “Risk Factors—Our future performance depends on our ability to find or acquire additional natural gas and oil reserves that are economically recoverable” in Item 1A.

The tables below illustrate how natural gas prices have fluctuated by month over 20042007 and 2005.2008. “Index” represents the first of the month Henry Hub index price per Mmbtu. The “2004”“2007” and “2005”“2008” price is the natural gas price per Mcf realized by us and includes the realized impact of our natural gas price collar and swap arrangements, as applicable:

| (in $ per Mcf) | Natural Gas Prices by Month - 2005 | |||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 6.21 | $ | 6.29 | $ | 6.30 | $ | 7.33 | $ | 6.77 | $ | 6.13 | $ | 6.98 | $ | 7.65 | $ | 10.97 | $ | 13.93 | $ | 13.85 | $ | 11.21 | ||||||||||||

2005 | $ | 5.78 | $ | 5.84 | $ | 5.52 | $ | 6.28 | $ | 6.19 | $ | 5.55 | $ | 6.05 | $ | 6.58 | $ | 7.76 | $ | 8.94 | $ | 8.53 | $ | 7.78 | ||||||||||||

| (in $ per Mcf) | Natural Gas Prices by Month - 2004 | |||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 6.15 | $ | 5.77 | $ | 5.15 | $ | 5.37 | $ | 5.94 | $ | 6.68 | $ | 6.14 | $ | 6.04 | $ | 5.08 | $ | 5.79 | $ | 7.63 | $ | 7.78 | ||||||||||||

2004 | $ | 5.23 | $ | 5.23 | $ | 5.17 | $ | 4.88 | $ | 4.96 | $ | 5.23 | $ | 5.39 | $ | 5.21 | $ | 4.54 | $ | 5.29 | $ | 5.63 | $ | 5.55 | ||||||||||||

| Natural Gas Prices by Month - 2008 | ||||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 7.13 | $ | 8.01 | $ | 8.96 | $ | 9.59 | $ | 11.29 | $ | 11.93 | $ | 13.11 | $ | 9.23 | $ | 8.40 | $ | 7.48 | $ | 6.47 | $ | 6.90 | ||||||||||||

2008 | $ | 7.46 | $ | 7.82 | $ | 8.45 | $ | 9.03 | $ | 9.38 | $ | 9.50 | $ | 9.36 | $ | 8.61 | $ | 8.05 | $ | 7.89 | $ | 7.70 | $ | 7.54 | ||||||||||||

| Natural Gas Prices by Month - 2007 | ||||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 5.84 | $ | 6.93 | $ | 7.55 | $ | 7.56 | $ | 7.51 | $ | 7.59 | $ | 6.93 | $ | 6.11 | $ | 5.43 | $ | 6.43 | $ | 7.27 | $ | 7.21 | ||||||||||||

2007 | $ | 7.05 | $ | 7.61 | $ | 7.63 | $ | 7.04 | $ | 7.30 | $ | 7.38 | $ | 7.05 | $ | 6.94 | $ | 6.41 | $ | 7.06 | $ | 7.44 | $ | 7.87 | ||||||||||||

Index to Financial Statements

Prices for crude oil have followed a similar path as the commodity price continued to maintainmaintained strength in 20042007 and rose furtherto record high levels in 2005.2008, but experienced significant declines in the fourth quarter of 2008. The tables below contain the NYMEX monthly average crude oil price (Index) and our realized per barrel (Bbl) crude oil prices by month for 20042007 and 2005.2008. The “2004”“2007” and “2005”“2008” price is the crude oil price per Bbl realized by us and includes the realized impact of our crude oil derivative arrangements:

| (in $ per Bbl) | Crude Oil Prices by Month - 2005 | |||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 46.85 | $ | 48.05 | $ | 54.63 | $ | 53.22 | $ | 49.87 | $ | 56.42 | $ | 59.03 | $ | 64.99 | $ | 65.55 | $ | 62.27 | $ | 58.34 | $ | 59.45 | ||||||||||||

2005 | $ | 38.18 | $ | 40.57 | $ | 47.30 | $ | 44.95 | $ | 41.88 | $ | 44.58 | $ | 46.24 | $ | 46.62 | $ | 45.05 | $ | 45.92 | $ | 45.59 | $ | 43.70 | ||||||||||||

| (in $ per Bbl) | Crude Oil Prices by Month - 2004 | |||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 34.23 | $ | 34.50 | $ | 36.72 | $ | 36.62 | $ | 40.28 | $ | 38.05 | $ | 40.81 | $ | 44.88 | $ | 45.94 | $ | 53.09 | $ | 48.48 | $ | 43.26 | ||||||||||||

2004 | $ | 30.62 | $ | 30.66 | $ | 31.62 | $ | 30.97 | $ | 30.80 | $ | 31.51 | $ | 31.43 | $ | 33.00 | $ | 31.61 | $ | 32.87 | $ | 33.15 | $ | 30.46 | ||||||||||||

| Crude Oil Prices by Month - 2008 | ||||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 92.93 | $ | 95.35 | $ | 105.42 | $ | 112.46 | $ | 125.46 | $ | 134.02 | $ | 133.48 | $ | 116.69 | $ | 103.76 | $ | 76.72 | $ | 57.44 | $ | 42.04 | ||||||||||||

2008 | $ | 83.71 | $ | 85.02 | $ | 90.85 | $ | 92.56 | $ | 99.79 | $ | 103.83 | $ | 102.76 | $ | 101.16 | $ | 93.51 | $ | 87.10 | $ | 69.16 | $ | 62.45 | ||||||||||||

| Crude Oil Prices by Month - 2007 | ||||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

Index | $ | 54.67 | $ | 59.39 | $ | 60.74 | $ | 64.04 | $ | 63.53 | $ | 67.53 | $ | 74.15 | $ | 72.36 | $ | 79.63 | $ | 85.66 | $ | 94.63 | $ | 91.74 | ||||||||||||

2007 | $ | 51.59 | $ | 53.17 | �� | $ | 55.54 | $ | 61.31 | $ | 63.35 | $ | 61.42 | $ | 70.68 | $ | 70.03 | $ | 71.90 | $ | 83.97 | $ | 84.38 | $ | 82.65 | |||||||||||

We reported earnings of $3.04$2.10 per share, or $148.4$211.3 million, for 2005. This is up2008, an increase from the $1.81$1.73 per share, or $88.4$167.4 million, reported in 2004. The stronger price environment was2007. Natural gas revenues increased from 2007 to 2008 as a primary contributorresult of favorable natural gas hedge settlements, increased commodity market prices and increased natural gas production. Crude oil revenues increased from 2007 to the earnings increase2008 primarily due to the increaseincreased realized prices, partially offset by a reduction in natural gas andcrude oil revenues.production. Prices, including the realized impact of derivative instruments, rose 30%increased by 16% for natural gas and 40%33% for oil.

We drilled 316432 gross wells with a success rate of 95%97% in 20052008 compared to 256461 gross wells with a 95% success rate of 96% in 2004.2007. Total capital and exploration expenditures increased by $166.1$844.8 million to $425.6$1,481.0 million of which $73.1 million was for property acquisitions,(including the east Texas acquisition) in 20052008 compared to $259.5$636.2 million for 2004.in 2007. We believe our cash on hand and operating cash flow in 20062009 will be sufficient to fund our budgeted capital and exploration budgeted spending of approximately $396 million$475 million. Any additional needs will be funded by borrowings from our credit facility. We have reduced, and again provide excess cash flow. Any excess cash flow may be used for acquisitions,continue to pay current debt due, repurchase common stock, expandreduce, our budgeted capital program or other opportunities.and exploration spending to maintain sufficient liquidity.

Our 20062009 strategy will remain consistent with 2005.2008. We will remain focused on our strategies of balancing our capital investments between higher risk projects with the potential for higher returns andpursuing lower risk projects withdrilling opportunities that provide more stable returns, along with balancing longer life investments with impact exploration opportunities.predictable results on our accumulated acreage position. Additionally, we intend to manage our balance sheet in an effort to ensure that we have sufficient liquidity, and we intend to maintain spending discipline. In the current year we have allocated our planned program for capital and exploration expenditures among our various operatingprimarily to the East and Gulf Coast regions. We believe these strategies are appropriate infor our portfolio of projects and the current industry environment and that this activity will continue to add shareholder value over the long term.long-term.

The preceding paragraphs, discussing our strategic pursuits and goals, contain forward-looking information. Please read “Forward-Looking Information” for further details.

FINANCIAL CONDITION

Capital Resources and Liquidity

Our primary sourcesources of cash in 2005 was2008 were from funds generated from operations, as well asthe sale of natural gas and crude oil production, the private placements of debt completed in July and December 2008, the sale of common stock and, to a lesser extent, borrowings onunder our revolving credit facility and asset sales. Cash flows provided by operating activities, borrowings, the sale of common stock and proceeds from asset sales were primarily used to fund our development (including acquisitions) and, to a lesser extent, proceeds from the exerciseexploratory expenditures, in addition to paying dividends and debt issuance costs. See below for additional discussion and analysis of stock options under our stock plans. cash flow.

Index to Financial Statements

We generate cash from the sale of natural gas and crude oil. Operating cash flow fluctuations are substantially driven by commodity prices and changes in our production volumes. Prices for crude oil and natural gas have historically been subject tovolatile, including seasonal influences characterized by peak demand and higher prices in the winter heating season; however, the impact of other risks and uncertainties have also influenced prices throughout the recent years. Working capital is also substantially influenced by these variables. During 2005, approximately 1.4 Bcfe of expected productionCommodity prices have recently experienced increased volatility due to adverse market conditions in our Gulf Coast region was deferred due to the impacts of Hurricanes Katrina and Rita. These hurricanes did not have a material adverse impact on our capital resources nor liquidity. Fluctuationeconomy. In addition, fluctuations in cash flow may result in an increase or decrease in our capital and exploration expenditures. See “Results of Operations” for a review of the impact of prices and volumes on sales. Cash flows provided

Our working capital is also substantially influenced by operating activities were primarily usedvariables discussed above. From time to fund explorationtime, our working capital will reflect a surplus, while at other times it will reflect a deficit. This fluctuation is not unusual. The recent financial and development expenditures, purchase treasury stockcredit crisis has reduced credit availability and pay dividends. Proceeds from the exercise of stock options under stock option plans during 2005 partially offsetliquidity for some companies; however, we believe we have adequate liquidity available to meet our repurchase of 452,300 treasury shares of common stock at a weighted average purchase price of $42.41. See below for additional discussion and analysis of cash flow.working capital requirements.

| Year-Ended December 31, | ||||||||||||

| (In thousands) | 2005 | 2004 | 2003 | |||||||||

Cash Flows Provided by Operating Activities | $ | 364,560 | $ | 273,022 | $ | 241,638 | ||||||

Cash Flows Used by Investing Activities | (412,150 | ) | (255,357 | ) | (151,856 | ) | ||||||

Cash Flows Provided / (Used) by Financing Activities | 48,190 | (8,363 | ) | (90,660 | ) | |||||||

Net Increase / (Decrease) in Cash and Cash Equivalents | $ | 600 | $ | 9,302 | $ | (878 | ) | |||||

| Year Ended December 31, | ||||||||||||

| 2008 | 2007 | 2006 | ||||||||||

| (In thousands) | ||||||||||||

Cash Flows Provided by Operating Activities | $ | 634,447 | $ | 462,137 | $ | 357,104 | ||||||

Cash Flows Used in Investing Activities | (1,452,289 | ) | (589,922 | ) | (187,353 | ) | ||||||

Cash Flows Provided by / (Used in) Financing Activities | 827,445 | 104,429 | (138,523 | ) | ||||||||

Net Increase / (Decrease) in Cash and Cash Equivalents | $ | 9,603 | $ | (23,356 | ) | $ | 31,228 | |||||

Operating Activities. Net cash provided by operating activities in 2005 increased $91.5 million over 2004. This increase is primarily due to higher commodity prices. Key components impacting net operating cash flows are commodity prices, production volumes and operating costs. Net cash provided by operating activities in 2008 increased by $172.3 million over 2007. This increase was mainly due to an increase in net income, the receipt of cash of $20.2 million in 2008 in connection with the settlement of a dispute and an increase of $13.7 million in cash received for income tax refunds. In addition, cash flows from operating activities increased as a result of other working capital changes. Average realized natural gas prices increased 30%by 16% in 2008 over 2004, while2007 and average realized crude oil realized prices increased 40%by 33% over the same period. ProductionEquivalent production volumes declined slightly, with a less than one percent reduction of equivalent productionincreased by 11% in 20052008 compared to 2004. While we believe 2006 commodity production may exceed 2005 levels, we2007 as a result of higher natural gas production. We are unable to predict future commodity prices and, as a result, cannot provide any assurance about future levels of net cash provided by operating activities. Realized prices may be lower in 2009.

Net cash provided by operating activities in 20042007 increased $31.4by $105.0 million over 2003.2006. This increase iswas mainly due to a decrease in cash paid for current income taxes from 2006 to 2007 primarily due to higher commodity prices. Key componentsthe 2006 payment of approximately $102 million related to the 2006 south Louisiana and offshore properties sale, as well as our 2007 tax net operating cash flows are commodity prices, production volumesloss position and operating costs.the receipt in 2007 of $29.6 million in federal tax refunds relating to our 2006 tax return. Average realized natural gas prices increased 15%by one percent in 2007 over 2003, while2006 and average realized crude oil realized prices increased 7%by three percent over the same period. Production volumes declined, with a 5% reduction of equivalentEquivalent production decreased by three percent in 20042007 compared to 2003. 2006 as a result of a decrease in crude oil production, offset in part by an increase in natural gas production.

See “Results of Operations” for a discussion on commodity prices and a review of the impact of prices and volumes on sales revenue.

Investing Activities. The primary uses of cash byin investing activities arewere capital spending (including the east Texas acquisition and new leases in both Pennsylvania and east Texas) and exploration expense.expenses. We establishestablished the budget for these amounts based on our current estimate of future commodity prices. Due to the volatility of commodity prices and new opportunities which may arise, our capital expenditures may be periodically adjusted during any given year. Cash flows used in investing activities increased for the years ended December 31, 2005by $862.4 million from 2007 to 2008 and 2004 in the amounts of $156.8increased by $402.6 million and $103.5 million, respectively.from 2006 to 2007. The increase from 20042007 to 2005 is2008 was due

Index to Financial Statements

to an increase of $866.0 million in capital expenditures, including an increase of approximately $601.8 million primarily due to the $604.0 million east Texas acquisition and an increase of $130.5 million related to unproved leasehold acquisitions primarily in northeast Pennsylvania. In addition, there were $5.0 million of lower proceeds from the sale of assets in 2008 compared to 2007. Partially offsetting these increases to cash used in investing activities were decreased exploration expenditures of $8.6 million in 2008 compared to 2007.

The increase in cash flows used in investing activities from 2006 to 2007 was due to a decrease of $322.4 million in 2007 in proceeds from the sale of assets and an increase of $89.8 million in 2007 in capital expenditures, partially offset by reduced exploration expenses of $9.6 million.

Financing Activities. Cash flows provided by financing activities increased by $723.0 million from 2007 to 2008. This was primarily due to an increase in drilling activity in the East region and the Rocky Mountains areadebt consisting of our West region in response to higher commodity prices. Our continued drilling activity in Canada also contributed to the increase. In addition, we spent $73.1July 2008 and December 2008 private placements of debt ($492 million) and an increase of $45 million in proved property acquisitions, primarily inborrowings under our revolving credit facility. Additionally, net proceeds from the Gulf Coast. The increase from 2003 to 2004 was alsosale of common stock increased by $311.1 million primarily due to the June 2008 issuance of common stock. The tax benefit for stock-based compensation increased by $10.7 million from 2007 to 2008, but was partially offset by an increase in drilling activity in response to higher commodity prices. This increase largely occurred in our East regiondividends and the Rocky Mountains area of our West region. Our initial drilling activity in Canada also contributed to the increase.capitalized debt issuance costs paid.

Financing Activities.Cash flows provided by financing activities were $48.2increased by $243.0 million for the year ended December 31, 2005, resulting from 2006 to 2007 primarily due to a $210.0 million increase in debt, principally related to higher borrowings under theour revolving credit facility, partially offset by the purchasefacility. In addition, $46.5 million of treasury stock and dividend payments. Cash flows usedwas purchased in 2006 compared with none in 2007. Partially offsetting these increases in cash provided by financing activities were a $9.5 million reduction in the tax benefit for the year ended December 31, 2004 were $8.4 million. This is the result ofstock-based compensation, lower proceeds from the exercise of stock options offset by the purchase of treasury shares and higher dividend payments. Cash flows used by financing activities for the year ended December 31, 2003 were $90.7 million. This is substantially due to a net repayment on our revolving credit facility in the amount of $95.0 million. Cash utilized for the repayments was generated from operating cash flows.

At December 31, 2005,2008, we had $90$185 million of debtborrowings outstanding under our credit facility. Theunsecured credit facility providesat a weighted-average interest rate of 3.7%. In December 2008, the revolving credit facility was amended to extend the commitment period for lenders holding approximately 90% of the aggregate commitments from December 2009 to October 2010. The December amendment added an available credit line of $250 million, which can be expanded upaccordion feature to $350 million, either withallow us, if the existing banks or new banks.banks agree, to increase the available credit line from $350 million to $450 million. The available credit line is subject to adjustment on the basis of the present value of estimated future net cash flows from proved oil and gas reserves (as determined by the banks’ petroleum engineer) and other assets. The revolving term of the credit facility ends in December 2009. We strive to manage our debt at a level below the available credit line in order to maintain excess borrowing capacity. Our revolving credit facility includes a covenant limiting our total debt. Management believes that we have the abilitycapacity to finance through new debt or equity offerings, if necessary, our spending plans and maintain our liquidity. At the same time, we will closely monitor the capital requirements, including potential acquisitions.

In August 1998, we announced that our Board of Directors authorized the repurchase of two million shares of our common stock in the open market or in negotiated transactions.markets. As a result of market conditions and our increased level of borrowings, we may experience increased costs associated with future debt.

In July 2008, we completed a private placement of $425 million aggregate principal amount of senior unsecured fixed-rate notes with a weighted-average interest rate of 6.51%, consisting of amounts due in July 2018, 2020 and 2023. In December 2008, we completed a private placement of $67 million aggregate principal amount of senior unsecured 9.78% fixed-rate notes due in December 2018. Please refer to Note 4 of the 3-for-2 stock split effected in March 2005, this figure has been adjustedNotes to three million shares. During 2005,the Consolidated Financial Statements for further details.

In June 2008, we repurchased 452,300entered into an underwriting agreement pursuant to which we sold an aggregate of 5,002,500 shares of our common stock at a weighted averageprice to us of $62.66 per share. This aggregate share amount included 652,500 shares of common stock that were issued as a result of the exercise of the underwriters’ option to purchase additional shares. We received $313.5 million in net proceeds, after deducting underwriting discounts and commissions. These net proceeds were used temporarily to reduce outstanding borrowings under our revolving credit facility prior to funding a portion of the purchase price of $42.41. All purchases executedour east Texas acquisition, which closed in the third quarter of 2008. Immediately prior to date have been through open market transactions. There is no expiration date associated with the authorization(and in connection with) this issuance, we retired 5,002,500 shares of treasury stock, which had a weighted-average purchase price of $16.46.

Index to repurchase our securities. The maximum number of shares that may yet be purchased under the plan as of December 31, 2005 was 1,486,150. See Item 5 “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” for additional information.Financial Statements

Capitalization

Information about our capitalization is as follows:

| December 31, | ||||||||

| (In millions) | 2005 | 2004 | ||||||

Debt (1) | $ | 340.0 | $ | 270.0 | ||||

Stockholders’ Equity | 600.2 | 455.7 | ||||||

Total Capitalization | $ | 940.2 | $ | 725.7 | ||||

Debt to Capitalization | 36 | % | 37 | % | ||||

Cash and Cash Equivalents | $ | 10.6 | $ | 10.0 | ||||

| December 31, | ||||||||

| 2008 | 2007 | |||||||

| (Dollars in millions) | ||||||||

Debt(1) | $ | 867.0 | $ | 350.0 | ||||

Stockholders’ Equity | 1,790.6 | 1,070.3 | ||||||

Total Capitalization | $ | 2,657.6 | $ | 1,420.3 | ||||

Debt to Capitalization | 33 | % | 25 | % | ||||

Cash and Cash Equivalents | $ | 28.1 | $ | 18.5 | ||||

(1) | Includes $35.9 million and $20.0 million of current portion of long-term debt at |

For the year ended December 31, 2005,2008, we paid dividends of $7.2$12.1 million on our common stock. A regular dividend of $0.04 per share of common stock, or $0.027 per share for dividends prior to the 3-for-2 stock split as adjusted for the split, has been declared for each quarter since we became a public company.company in 1990. After the March 2007 2-for-1 stock split, the dividend was increased to $0.03 per share per quarter, or a 50% increase from pre-split levels.

Capital and Exploration Expenditures

On an annual basis, we generally fund most of our capital and exploration activities, excluding any significant oil and gas property acquisitions, with cash generated from operations and, when necessary, our revolving credit facility. We budget these capital expenditures based on our projected cash flows for the year.

The following table presents major components of our capital and exploration expenditures for the three years ended December 31, 2005.2008.

| (In millions) | 2005 | 2004 | 2003 | |||||||||||||||

| 2008 | 2007 | 2006 | ||||||||||||||||

| (In millions) | ||||||||||||||||||

Capital Expenditures | ||||||||||||||||||

Drilling and Facilities | $ | 249.3 | $ | 174.0 | $ | 102.0 | ||||||||||||

Drilling and Facilities(1) | $ | 624.3 | $ | 539.7 | $ | 405.5 | ||||||||||||

Leasehold Acquisitions | 22.1 | 18.3 | 14.1 | 152.7 | 22.2 | 42.6 | ||||||||||||

Acquisitions | 625.0 | 4.0 | 6.7 | |||||||||||||||

Pipeline and Gathering | 17.9 | 13.5 | 10.6 | 36.9 | 28.2 | 24.2 | ||||||||||||

Other | 1.4 | 1.6 | 1.8 | 10.9 | 2.3 | 9.1 | ||||||||||||

| 290.7 | 207.4 | 128.5 | 1,449.8 | 596.4 | 488.1 | |||||||||||||

Proved Property Acquisitions | 73.1 | 4.0 | 1.5 | |||||||||||||||

Exploration Expense | 61.8 | 48.1 | 58.2 | 31.2 | 39.8 | 49.4 | ||||||||||||

Total | $ | 425.6 | $ | 259.5 | $ | 188.2 | $ | 1,481.0 | $ | 636.2 | $ | 537.5 | ||||||

(1) | Includes Canadian currency translation effects of $(27.7) million, $15.0 million and $(1.4) million in 2008, 2007 and 2006, respectively. |

We plan to drill about 391approximately 148 gross wells (122.3 net) in 20062009 compared with 316432 gross wells (355 net) drilled in 2005.2008. The number of wells we plan to drill in 2009 is down from 2008 in each of our operating regions due to the underlying economic fundamentals, which have significantly reduced commodity prices. This 20062009 drilling program includes approximately $396$475 million in total capital and exploration expenditures, down from $425.6$1,481 million in 2005. Capital and exploration expenditures in 2005 included a layer of $73.1 million in proved property acquisitions as shown in the table above.2008. We will continue to assess the natural gas and crude oil price environment and our liquidity position and may increase or decrease the capital and exploration expenditures accordingly.

Index to Financial Statements

There are many factors that impact our depreciation, depletion and amortization (DD&A) rate. These include reserve additions and revisions, development costs, impairments and changes in anticipated production in a future period.periods. In 20062009, management expects an increase in our depreciation, depletion and amortizationDD&A rate due to negative reserve revisions and higher capital costs.costs, partially as a result of inflationary cost pressures in the industry over the last four years. This change may result in an increase of depreciation, depletion and amortization of 10%is currently estimated to 15%be approximately 13% greater than 20052008 levels. This increase will not have an impact on our cash flows.

Contractual Obligations

Our known material contractual obligations include long-term debt, interest on long-term debt, firm gas transportation agreements, drilling rig commitments and operating leases. We have no off-balance sheet debt or other similar unrecorded obligations, and we have not guaranteed the debt of any other party.obligations.

A summary of our known contractual obligations as of December 31, 20052008 are set forth in the following table:

| Payments Due by Year | |||||||||||||||

| 2007 | 2009 | 2011 & | |||||||||||||

| (In thousands) | Total | 2006 | to 2008 | to 2010 | Beyond | ||||||||||

Long-Term Debt(1) | $ | 340,000 | $ | 20,000 | $ | 40,000 | $ | 110,000 | $ | 170,000 | |||||

Interest on Long-Term Debt (2) | 132,960 | 24,632 | 44,950 | 32,673 | 30,705 | ||||||||||

Firm Gas Transportation Agreements(3) | 93,766 | 11,661 | 19,839 | 6,762 | 55,504 | ||||||||||

Drilling Rig Commitments (3) | 104,315 | 26,055 | 68,585 | 9,675 | — | ||||||||||

Operating Leases | 17,746 | 4,876 | 9,174 | 3,696 | — | ||||||||||

Total Contractual Cash Obligations | $ | 688,787 | $ | 87,224 | $ | 182,548 | $ | 162,806 | $ | 256,209 | |||||

| Total | Payments Due by Year | ||||||||||||||

| 2009 | 2010 to 2011 | 2012 to 2013 | 2014 & Beyond | ||||||||||||

| (In thousands) | |||||||||||||||

Long-Term Debt(1) | $ | 867,000 | $ | 35,857 | $ | 244,143 | $ | 75,000 | $ | 512,000 | |||||

Interest on Long-Term Debt(2) | 460,624 | 63,124 | 99,602 | 82,469 | 215,429 | ||||||||||

Firm Gas Transportation Agreements(3) | 94,670 | 13,218 | 23,935 | 13,374 | 44,143 | ||||||||||

Drilling Rig Commitments(3) | 44,271 | 42,021 | 2,250 | — | — | ||||||||||

Operating Leases(3) | 28,686 | 6,335 | 9,028 | 7,397 | 5,926 | ||||||||||

Total Contractual Cash Obligations | $ | 1,495,251 | $ | 160,555 | $ | 378,958 | $ | 178,240 | $ | 777,498 | |||||

(1) | Including current portion. At December 31, |

(2) | Interest payments have been calculated utilizing the fixed rates of our |

(3) | For further information on our obligations under firm gas transportation agreements, |

Amounts related to our asset retirement obligations are not included in the above table given the uncertainty regarding the actual timing of such expenditures. The total amount of asset retirement obligations at December 31, 2005 is $43.0 million.

Subsequent to2008 was $28.0 million, up from $24.7 million at December 31, 2005, we entered into an agreement for one additional drilling rig in the Gulf Coast. The total commitment over the next four years is $27.42007, primarily due to $1.2 million of which $0.8accretion expense during 2008 as well as $2.2 million $9.1 million, $9.1 million and $8.4 million will be paid out during the years 2006, 2007, 2008 and 2009, respectively.of drilling additions.

Potential Impact of Our Critical Accounting Policies

Readers of this document and users of the information contained in it should be aware of how certain events may impact our financial results based on the accounting policies in place. The most significant policies are discussed below.

Oil and Gas Reserves

The process of estimating quantities of proved reserves is inherently uncertain,imprecise, and the reserve data included in this document are only estimates. The process relies on interpretations of available geologic, geophysic,

Index to Financial Statements