UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 OR 15(d) of the Securities and Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 20052008

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934 |

For the transition period from to

Commission File Number:

000-51515

CORE-MARK HOLDING COMPANY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-1489747 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

395 Oyster Point Boulevard, Suite 415 South San Francisco, California 94080 | (650) 589-9445 | |

| (Address of Principal Executive Offices, including Zip Code) | (Registrant’s Telephone Number, Including Area Code) | |

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange | |

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01 per share

(Title of class) None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ CHECK IF APPLICABLE

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a non-accelerated filer.smaller reporting company. See definitionthe definitions of “large accelerated filer,” “accelerated filerfiler” and large accelerated filer”“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ |

| |

Non-accelerated filer ¨ | Smaller reporting company ¨ | |

(Do not check if a smaller reporting company). | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨No x

State the aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the closing price of the common stock as of June 30, 2005,2008, the last day of the registrant’s most recently completed second quarter: $265,996,663$277,773,841.

Indicate by check mark whether the registrant has filed all reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by the court. Yes x No¨

As of March 31, 2006,February 27, 2009, the Registrant had 9,841,97610,809,692 shares of its common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE(

See Parts III and IV. Registrant’s Proxy Statement for the 2009 Annual Meeting of Stockholders is incorporated by reference to Part III)III in this Form 10-K.

i

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

ThisExcept for historical information, the statements made in this Annual Report on Form 10-K contains disclosures which are forward-looking statements made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on certain assumptions or estimates, discuss future expectations, describe future plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain.

Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking statements. Forward-looking statements include all statements that do not relate solely to historical or current facts, andin some cases can generally be identified by the use of words such as may, believe, will, expect, project, estimate, anticipate, plan“may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “would,” “project,” “predict,” “continue,” “plan,” “propose” or continue.other similar words or expressions. These forward-looking statements are based on the current plans and expectations of our management and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated. These factorsdiscussed in such forward looking statements.

Factors that might cause or contribute to such differences include, but are not limited to: economic conditions affecting the cigarette and consumable goods industry; the adverse effect of legislation and other matters affecting the cigarette industry; financial risks associated with purchasing cigarettes and other tobacco products from certain product manufacturers; increases in excise and other taxes on cigarettes and other tobacco products; increased competition in the distribution industry; our reliance on income from rebates, allowances and other incentive programs;to our dependence on the convenience store industry;retail industry for our revenues; uncertain and recent economic conditions; competition; price increases; our dependence on relatively few suppliers; the low-margin nature of cigarette and consumable goods distribution; certain distribution centers’ dependence on a few relatively large customers; competition in the risk that we may not be able to retainlabor market and attract customers;collective bargaining agreements; product liability claims and manufacturer recalls of products; fuel price increases; our inabilitydependence on our senior management and key personnel; integration of acquired businesses; currency exchange rate fluctuations; our ability to borrow additional capital; governmental regulations and changes thereto; earthquake and natural disaster damage; failure or disruptions to our information systems; a general decline in cigarette sales volume; competition from sales of our suppliersdeep-discount brands and illicit and other low priced sales of cigarettes. Refer to provide products; the negative affectsPart I, Item 1A, “Risk Factors” of product liability claims; the loss of key personnel, our inability to attract and retain new qualified personnel or the failure to renew collective bargaining agreements covering certain of our employees; currency exchange rate fluctuations; government regulation; and the residual effects of the Fleming bankruptcy on our customer, supplier and employee relationships, and our results of operations.

this Form 10-K. Except as provided by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should also read, among other things, the risks and uncertainties described in the section of this Annual Report on Form 10-K entitled Risk Factors.

Restatements of Previously Issued Financial Statements

On March 23, 2006 the Audit Committee of the Board of Directors of the Company (as defined below) and management concluded that our audited consolidated financial statements as of December 31, 2004 and for the period from August 23, 2004 to December 31, 2004 and our unaudited condensed consolidated financial statements as of and for the six months ended June 30, 2005, each included in our registration statement on Form 10, and our unaudited condensed consolidated financial statements as of and for the three and nine months ended September 30, 2005 included in our Form 10-Q for the third quarter of 2005, should no longer be relied upon because of errors in those financial statements relating to the accounting for foreign currency translation adjustments related to intercompany balances. Accordingly, the Company is restating its financial statements for such periods to correct such error, and to correct inventory valuation errors, and other errors in estimation and balance sheet classifications. Such restatements are reflected herein and we intend to also reflect these restatements in amendments to our Form 10 registration statement and our Form 10-Q for the third quarter of 2005.

For further information concerning the restatements and the specific adjustments made seeItem 7 Management Discussion and Analysis of Financial Condition and Results of Operations—Restatements of Financial Information and Note 2 of the Notes to the Consolidated Financial Statements elsewhere herein.

ii

| ITEM 1. | BUSINESS |

Unless the context indicates otherwise, all references in this Annual Report on Form 10-K to Core-Mark, the Company, we, us, or our refer to Core-Mark Holding Company, Inc. and its direct and indirect subsidiaries.

Company Overview

Core-Mark is one of the largestleading wholesale distributors to the convenience retail industry in North America in terms of annual sales, providingand provides sales and marketing, distribution and logistics services to customer locations across the United States and Canada.

Although Core-Mark Holding Company, Inc. was incorporated in Delaware in August 2004, the business conducted by Core-Mark dates back to 1888 when Glaser Bros., a family-owned-and-operated candy and tobacco distribution business, was founded in San Francisco. In June 2002, Fleming Companies, Inc. acquired Core-Mark International. At the time of the acquisition, Core-Mark International distributed products to convenience stores and other retailers in the Western United States and Canada from a network of 20 distribution centers. In addition to Fleming’s other national retail and wholesale grocery operations, Fleming owned and operated seven convenience store distribution centers in the Eastern and Midwestern United States. After the acquisition of Core-Mark International by Fleming, Core-Mark International’s management continued to operate Core-Mark International’s distribution business and began integrating Fleming’s convenience store distribution centers into Core-Mark International’s operations. In connection with Fleming’s bankruptcy three of Fleming’s convenience distribution centers were fully integrated into Core-Mark International’s operations.

Core-Mark operates a network of 24 distribution centers in the United States and Canada, including two distribution centers that we operate as a third party logistics provider. One of these third party distribution centers is located in Phoenix, Arizona, which we refer to as the Arizona Distribution Center (ADC), and is dedicated solely to supporting the logistics and management requirements of one of our major customers, Circle K. In April 2005, we began operating a second third party logistics distribution facility located in San Antonio, Texas, which we refer to as the Retail Distribution Center (RDC), and is dedicated solely to supporting Valero.

We distribute a diverse line of national and private label convenience store products to over 19,000 customer locations. The products we distribute include cigarettes, tobacco, candy, snacks, fast food, grocery products, non-alcoholic beverages, general merchandise and health and beauty care products. For the twelve months ended December 31, 2005, approximately 72% of our net sales came from the cigarette category and approximately 28% of our net sales came from the remaining non-cigarette categories. During the same twelve month period, approximately 35% of our gross profit was generated from cigarette categories while approximately 65% of our gross profit was generated from the non-cigarette categories.

We also provide sales and marketing, distribution and logistics services to our customer locations which include a variety of store formats, including traditional convenience retail stores, grocery stores, drug stores, liquor stores, gift shops, specialty stores and other stores that carry convenience products. We distribute approximately 38,000 SKUs of packaged consumable goods to our customers, and also provide an array of information and data services that enable our customers to better manage retail product sales and marketing functions.

Our management team is led by J. Michael Walsh, our President and Chief Executive Officer, who has been with Core-Mark since April 1991. He leads a team of 14 senior managers who have largely overseen the operations of Core-Mark since 1991. Our management has expertise in all of the critical functional areas including logistics, sales and marketing, purchasing, information technology, finance, human resources and retail store support.

Company Background

Our origins date back to 1888, when Glaser Bros., a family-owned-and-operated candy and tobacco distribution business, was founded in San Francisco. In June 2002, Fleming Companies, Inc., or Fleming,

acquired Core-Mark International, Inc., or CMI, our operating subsidiary. On April 1, 2003, Fleming filed for protection under Chapter 11 of the United States Bankruptcy Code. The debtor-in-possession entities comprising Core-Mark were included in the Chapter 11 proceedings. Fleming’s plan of reorganization, or the Plan, which became effective on August 23, 2004, provided for the reorganization of certain of Fleming’s convenience operations and subsidiaries around Core-Mark International. Fleming’s other assets and liabilities were transferred to two special-purpose trusts and are being liquidated.

On August 23, 2004, pursuant to the Plan, we emerged from the Fleming bankruptcy and undertook the following actions:

(1) We issued an aggregate of 9.8 million shares of our common stock to Fleming in exchange for the stock of Core-Mark International, Inc. and its subsidiaries. Further to the Plan, warrants to purchase an aggregate of 990,616 shares of our common stock were issued to Fleming and distributed by Fleming to its Class 6(B) creditors in March 2005. We refer to these warrants as the Class 6(B) warrants. The Class 6(B) warrants have an exercise price of $20.925 per share, a 35% premium to the fair value of a share of our common stock as determined pursuant to the Plan, are immediately exercisable, and expire in 2011. As of December 31, 2005, all of the Class 6(B) warrants allocated to the Class 6(B) creditors under the Plan had been distributed. We also issued warrants to purchase an aggregate of 247,654 shares of our common stock to the holders of our Tranche B Notes. We entered into a registration rights agreement with the holders of the Tranche B Warrants pursuant to which we registered under the Securities Act of 1933 the shares of our common stock issuable upon exercise of the Tranche B Warrants. The Tranche B Warrants have an exercise price of $15.50 per share.

Subsequent to the initial capitalization, we established four stock-based compensation plans. (See—Note 13, Stock-Based Compensation Plans.)

(2) We guaranteed certain obligations of two trusts set up pursuant to the Plan for the benefit of Fleming’s former creditors.

(3) We assumed the remaining workers compensation, general liabilities, auto liabilities and pension liabilities of the Fleming grocery divisions totaling approximately $33 million.

(4) Core-Mark reflected the terms of the Plan in its consolidated financial statements applying the terms of the American Institute of Certified Public Accountants (AICPA) Statement of Position 90-7,Financial Reporting by Entities in Reorganization under the Bankruptcy Code (SOP 90-7) with respect to financial reporting upon emergence from bankruptcy (See Note 8—Reorganization Items, Net to the consolidated financial statements).

Corporate Information

Our corporate headquarters are located at 395 Oyster Point Boulevard, Suite 415, South San Francisco, California 94080. The telephone number of our corporate headquarters is (650) 589-9445. Our website address is http://www.core-mark.com. The information included on our website is not included as a part of, or incorporated by reference into, this Annual Report on Form 10-K.

Industry Overview

Wholesale distributors provide valuable services to both manufacturers of consumer products and convenience retailers. Manufacturers benefit from wholesale distributors’ broad retail coverage, inventory management and efficient processing of small orders. Wholesale distributors provide convenience retailers access to a broad product line, the ability to place small quantity orders, inventory management and access to trade credit. In addition, large full-service wholesale distributors, such as Core-Mark, offer retailers the ability to participate in manufacturer and Company sponsored marketing programs, merchandising and product category

management services, as well as the use of information systems that are focused on minimizing retailers’ investment in inventory, while seeking to maximize their sales.

We operate in an industry where, in 2007, based on the Association for Convenience and Petroleum Retailing [formerly known as the National Association of Convenience Stores (NACS)], 2008 State of the Industry (SOI) Report, total in-store sales at convenience retail locations approximated $169 billion and were generated through an estimated 146,000 stores across the United States. We estimate that 45% to 55% of the products that these stores sell are supplied by wholesale distributors such as Core-Mark. The convenience retail industry gross profit for in-store sales was approximately $45 billion in 2007 and $44 billion in 2006. Over the ten years from 1997 through 2007, convenience in-store sales increased by a compounded annual growth rate of 7.6%. Two of the factors influencing this growth were a 9.1% compounded annual growth rate in average cigarette sales for convenience retail locations and a 3.0% compounded annual growth rate in the number of stores.

We distribute a diverse line of national and private label convenience store products to approximately 24,000 customer locations in all 50 states of the Unites States and 5 Canadian provinces. The products we distribute include cigarettes, tobacco, candy, snacks, fast food, groceries, fresh products, dairy, non-alcoholic beverages, general merchandise, and health and beauty care products. We service traditional convenience stores as well as alternative outlets selling convenience products. Our traditional convenience store customers include many of the major national and super-regional convenience store operators as well as thousands of multi and single-store customers. Our alternative outlet customers comprise a variety of store formats, including drug stores, grocery stores, liquor stores, cigarette and tobacco shops, hotel gift shops, correctional facilities, military exchanges, college bookstores, casinos, video rental stores, hardware stores and airport concessions.

We operate a network of 26 distribution centers in 14 states and Canada, including two distribution centers that we operate as a third-party logistics provider. We distribute approximately 42,000 SKUs (Stock Keeping Units) of packaged consumable goods to our customers, and also provide an array of information and data services that enable our customers to better manage retail product sales and marketing functions.

In 2008, our consolidated net sales increased 8.7% to $6,044.9 million from $5,560.9 million in 2007. Cigarettes comprised approximately 68.2% of total net sales in 2008, while approximately 71.0% of our gross profit was generated from food/non-food products.

Competitive Strengths

We believe we have the following fundamental competitive strengths which are the foundation of our business strategy:

Experience in the Industry. Our origins date back to 1888, when Glaser Bros., a family-owned-and-operated candy and tobacco distribution business, was founded in San Francisco. The executive management team comprised of our CEO and 14 senior managers has largely overseen the operations of Core-Mark for more than a decade, bringing their expertise to critical functional areas including logistics, sales and marketing, purchasing, information technology, finance, human resources and retail store support.

Innovative & Flexible.Wholesale distributors typically provide convenience retailers access to a broad product line, the ability to place small quantity orders, inventory management and access to trade credit. As a large full-service wholesale distributor we offer retailers the ability to participate in manufacturer and Company sponsored sales and marketing programs, merchandising and product category management services, as well as the use of information systems that are focused on minimizing retailers’ investment in inventory, while seeking to maximize their sales.

Distribution Capabilities.The wholesale distribution industry is highly fragmented and historically has consisted of a large number of small, privately-owned businesses and a small number of large, full-service wholesale distributors serving multiple geographic regions. Relative to smaller competitors, large distributors such as Core-Mark benefit from several competitive advantages including: increased purchasing power, the ability to service large national chain accounts, economies of scale in sales and operations, the ability to spread fixed corporate costs over a larger revenue base, and the resources to invest in information technology and other productivity enhancing technology.

Convenience in-storeBusiness Strategy

Our objective is to increase overall return to shareholders by growing market share, revenues, profitability and cash flow. To achieve that objective, we have become one of the largest marketers of fresh and broad-line supply solutions in North America. In order to further enhance our value to the retailer, we plan to:

Drive our Vendor Consolidation Initiative (VCI).We expect our VCI program will allow us to grow by capitalizing on the highly fragmented nature of the distribution channel that services the convenience retail industry. A convenience retailer generally receives their store merchandise includes candy, snacks, fastthrough a large number of unique deliveries. This represents a highly inefficient and costly process for the individual stores. Our VCI program offers convenience retailers the ability to receive one delivery for the bulk of their products, including dairy and other perishable items, thus simplifying the supply chain and eliminating operational costs.

Deliver Fresh Products. We believe there is an increasing trend among consumers to purchase fresh food and dairy products beer, non-alcoholic packaged beverages, frozenfrom convenience stores. We have modified and upgraded our refrigerated capacity, including investing in chill docks, state-of-the-art ordering devices and tri-temperature trailers, which enables us to deliver a significant range of chilled items general merchandise, health and beauty care products, other grocery products, cigarettes, cigarsincluding milk, produce and other tobacco products. Aggregate U.S. wholesale salesfresh foods to retail outlets. We now have the in-house expertise and experience to properly source, handle and market this highly perishable product line. We intend on expanding the delivery of convenience store merchandise include wholesalefresh food and dairy products through the development of unique and comprehensive marketing programs. In addition, we have launched a rebranding program to properly reflect the role this new fresh product salesline will play in the Company’s and the industry’s future.

Expand our Presence Eastward. We believe there is significant opportunity for us to traditional convenience stores and sales to a varietyincrease our market share by expanding our presence east of alternative convenience retailers, which we refer to as alternative outlets. Alternative outlets include drug stores, grocery stores, liquor stores, cigarette and tobacco shops, hotel gift shops, correctional facilities, military exchanges, college bookstores, casinos, video rental stores, hardware stores, airport concessions and movie theatres, and others.

the Mississippi. According to the 2005 National Association offor Convenience Stores (NACS) State of the Industryand Petroleum Retailing 2008 SOI Report, during 2004,2007, aggregate U.S.United States traditional convenience retail in-store sales were approximately $132$169 billion through approximately 138,000 stores. We estimate that146,000 stores with most of those stores

located east of the products that these stores sell, 45%Mississippi. We believe our expansion eastward will be accomplished by acquiring new customers, both national and regional, through a combination of exemplary service, VCI programs, fresh product deliveries, innovative marketing strategies, and competitive pricing. In addition, we intend to 55%explore select acquisitions of other wholesale distributors which complement our business. In June 2006, we acquired the Klein Candy Company, L.P. (“Pennsylvania division”) to further our eastern expansion. In January 2008, we opened a new distribution facility near Toronto, Ontario. This new facility expanded our existing market geography in Canada. In June 2008, we acquired Auburn Merchandise Distributors, Inc., (“AMD” or “New England division”), to further expand our presence and infrastructure in the Northeastern region of the productsUnited States(See Note 3—Acquisitions).

Continue Building Sustainable Competitive Advantage. We believe our ability to increase sales and profitability with existing and new customers is highly dependent upon us being able to deliver consistently high levels of service, innovative marketing programs, and information technology and logistics support. To that fundamental end, we are supplied by wholesale distributorscommitted to further improving our operational efficiencies in our distribution centers while containing our costs in order to enhance profitability. To further enhance our competitive advantage, we have been the first to recognize emerging trends and to offer to the retailer our unique marketing programs such as Core-Mark. The convenience store retail industry gross profit for in-store sales wasVCI and Fresh. We believe this innovation has established us as the market leader in providing valuable marketing and supply chain solutions in the industry.

Customers, Products and Suppliers

We service approximately $39 billion24,000 customer locations in 2004 which represents an increase of 9.5% over 2003. Over the ten years from 1994 through 2004, convenience in-store sales increased by a compounded annual growth rate of 6.9%. Twoall 50 states of the factors influencing this growth were a 9.9% compounded annual growth rate in cigarette salesUnited States and a 3.5% compounded annual growth rate in the number of stores.

The traditional convenience store sector is divided into two principal categories: (1) corporates, defined as corporate-owned and operated chains with a national or multi-region footprint, such as Circle K, Petro-Canada and Valero; and (2) independents and smaller chains, including franchisees, dealers and individually operated locations. Based on the 2005 NACS State5 Canadian provinces. Our customers represent many of the Industry Report, we estimate independentslarge national and smaller chains, those comprising 50 stores or less, represent approximately 76% of traditionalregional convenience store salesretailers in the United States while corporates represented 24%. Conversely, Canadian convenience store sales are dominated by corporates.

Customers and Marketing

We service over 19,000 customer locations in 38 U.S. statesCanada and five Canadian provinces. Our top fifteen customers as of December 31, 2005 included Alimentation Couche-Tard (the parent company of Circle K stores in the U.S. and Mac’s stores in Canada), Arco am/pm franchisees, ConocoPhillips, Esso Convenience, Kroger (convenience), Maverik Country Stores, Petro-Canada, RaceTrac and Valero. We service traditional convenience stores as well as alternative outlets selling convenience store products. Our traditional convenience store customers include many of the major national and super-regional convenience store operators as well as thousands of multi- and single-store customers. Ourleading alternative outlet customers comprise a variety of store formats, including drug stores, grocery stores, liquor stores, cigarette and tobacco shops, hotel gift shops, correctional facilities, military exchanges, college bookstores, casinos, video rental stores, hardware stores and airport concessions. Some of our other alternative outlet customers include Hudson News, London Drugs, MGM Grand Hotel and Shoppers Drug Mart.customers. Our top ten customers accounted for approximately 31%30.1% of our sales in 2005,2008, while our largest customer accounted for less than 6%approximately 7.5% of our total sales in 2005.2008.

Sales, Products and Suppliers

The financial information set forth below reflects the restatement of our financial statements for the first three quarters of fiscal year 2005 and for the period from August 23 through December 31, 2004, as discussed

underManagement’s Discussion and Analysis of Financial Condition and Results of Operations—Restatements of Financial Information and Note 2 of the Notes to the Consolidated Financial Statements.

For the purpose of comparing our results of operations by product category in the table below the results for fiscal year 2004 have been combined for the Successor and Predecessor Companies as discussedunder Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following table summarizes our cigarette and other product sales over the past five years asBelow is a percentcomparison of our net sales:sales mix by primary product category for the last three years (in millions):

| 2005(1) | 2004(1) (Restated) | 2003(1) | 2002(1) | 2001(1) | ||||||||||||||||

Cigarettes | ||||||||||||||||||||

Net sales (in millions)(4) | $ | 3,505.2 | $ | 3,048.2 | $ | 3,049.8 | $ | 3,368.4 | $ | 2,473.1 | ||||||||||

Gross Profit (in millions) (2)(3) | $ | 93.5 | $ | 87.4 | $ | 106.7 | $ | 129.3 | $ | 82.6 | ||||||||||

% of Total Sales | 72 | % | 72 | % | 71 | % | 72 | % | 72 | % | ||||||||||

% of Gross Profit | 35 | % | 36 | % | 40 | % | 42 | % | 39 | % | ||||||||||

All other products | ||||||||||||||||||||

Net sales (in millions)(5) | $ | 1,385.9 | $ | 1,174.2 | $ | 1,274.5 | $ | 1,293.7 | $ | 951.9 | ||||||||||

Gross Profit (in millions) | $ | 177.5 | $ | 153.3 | $ | 162.7 | $ | 179.0 | $ | 131.3 | ||||||||||

% of Total Sales | 28 | % | 28 | % | 29 | % | 28 | % | 28 | % | ||||||||||

% of Gross Profit | 65 | % | 64 | % | 60 | % | 58 | % | 61 | % | ||||||||||

Total Net Sales (in millions) | $ | 4,891.1 | $ | 4,222.4 | $ | 4,324.3 | $ | 4,662.1 | $ | 3,425.0 | ||||||||||

Gross Profit (in millions) | $ | 271.0 | $ | 240.7 | $ | 269.4 | $ | 308.3 | $ | 213.9 | ||||||||||

| 2008 | 2007 | 2006 | ||||||||||||||||

| Net Sales | % of Net Sales | Net Sales | % of Net Sales | Net Sales | % of Net Sales | |||||||||||||

Cigarettes | $ | 4,124.8 | 68.2 | % | $ | 3,863.1 | 69.5 | % | $ | 3,783.8 | 71.2 | % | ||||||

Food | 710.1 | 11.7 | % | 596.7 | 10.7 | % | 522.4 | 9.8 | % | |||||||||

Candy | 401.3 | 6.7 | % | 349.8 | 6.3 | % | 318.3 | 6.0 | % | |||||||||

Other Tobacco Products | 402.7 | 6.7 | % | 353.4 | 6.4 | % | 322.6 | 6.1 | % | |||||||||

Health, Beauty & General | 220.1 | 3.6 | % | 206.2 | 3.7 | % | 187.7 | 3.5 | % | |||||||||

Non-alcoholic Beverages | 180.9 | 3.0 | % | 186.4 | 3.4 | % | 174.3 | 3.3 | % | |||||||||

Equipment / Other | 5.0 | 0.1 | % | 5.3 | 0.1 | % | 5.3 | 0.1 | % | |||||||||

Total Food/Non-Food Products | 1,920.1 | 31.8 | % | 1,697.8 | 30.5 | % | 1,530.6 | 28.8 | % | |||||||||

Total Net Sales | $ | 6,044.9 | 100.0 | % | $ | 5,560.9 | 100.0 | % | $ | 5,314.4 | 100.0 | % | ||||||

Cigarette Products. We purchase cigarette products from all the major U.S.United States and Canadian manufacturers. With cigarettes accounting for approximately $3,505.2$4,124.8 million or 72%68.2% of our total net sales revenueand 29.0% of our total gross profit in 2005,2008, we control major purchases of cigarettes centrally in order to minimize routineoptimize inventory levels and to maximize cigarette purchasing opportunities. The daily replenishment of inventory and brand selection is controlled by our distribution centers.

Although U.S.United States cigarette consumption has generally declined since 1980,1980. Based on 2007 statistics provided by the Tobacco Merchants Association (TMA) published in early 2008 and compiled from the United States

Department of Agriculture-Economic Research Service, total cigarette consumption in the United States declined from 480 billion cigarettes in 1997 to 362 billion cigarettes in 2007, or a 25% reduction in consumption. Prior to 2007, we have benefitedhad benefitted from a shift in cigarette and tobacco sales to the convenience storeretail segment. According to the 2005 NACS Statemost recent statistic available on the growth of the Industry Report,cigarette sales in the convenience storeretail segment in the NACS 2007 SOI Report (which includes data through December 31, 2006), the convenience retail portion of aggregate U.S.United States cigarette sales increased from approximately 38%54% in 19931999 to 62%64% in 2004. Total

Total cigarette consumption also declined in Canada as illustrated byfrom 45.5 billion cigarettes in 1997 to 14.1 billion cigarettes in 2007, or a 69% reduction in consumption, according to consumption statistics availablepublished in 2008 by Canada’s central statistical agency, Statistics Canada.

Our overall cigarette carton sales declined 1.0% in 2008 and 1.4% in 2007, excluding carton sales made by the new divisions, Toronto and New England. The shift in cigarette carton sales from other channels to the convenience retail segment may no longer be adequate to compensate for the years 1995 through 2005.

The following table illustrates U.S. cigarette consumption since 1950 and Canadian cigarette consumption since 1995.declines.

Year | Total U.S. Consumption(1) (in billions of cigarettes) | Total Canadian Consumption(2) (in billions of cigarettes) | ||

1950 | 375.8 | — | ||

1960 | 484.4 | — | ||

1970 | 536.4 | — | ||

1980 | 631.5 | — | ||

1990 | 525.0 | — | ||

1995 | 487.0 | 45.4 | ||

2000 | 430.0 | 42.8 | ||

2001 | 425.0 | 41.2 | ||

2002 | 415.0 | 36.1 | ||

2003 | 400.0 | 33.7 | ||

2004 | 390.0 | 32.3 | ||

2005 | 378.0 | 30.8 |

We have no long-term cigarette purchase agreements and buy substantially all of our products on an as needed basis. Cigarette manufacturers historically have offered structured incentive programs to wholesalers based on maintaining market share and executing promotional programs. These programs have been significantly decreased by several major manufacturers, including Philip Morris and R.J. Reynolds, and are subject to change by the manufacturermanufacturers without notice.

Excise taxes on cigarettes and other tobacco products are imposed by the various states, localities and provincesprovinces. We collect these taxes from our customers and remit these amounts to the appropriate authorities. Excise taxes are a significant component of our revenue and cost of sales. During 2005,2008, we paidincluded in net sales approximately $1,195.0$1,474.4 million of state and provincial excise taxes in the U.S. and Canada.taxes. As of December 31, 2005,2008, state cigarette excise taxes in the U.S.United States jurisdictions we serve ranged from $0.07 per pack of 20 cigarettes in South Carolina to $2.03$2.75 per pack of 20 cigarettes in Washington.the state of New York. In the Canadian jurisdictions we serve, provincial excise taxes ranged from C$2.302.47 per pack of 20 cigarettes in Ontario to C$4.20 per pack of 20 cigarettes in the Northwest Territories.

In the United States, legislation was introduced in 2008 to fund the State Children’s Health Insurance Program (SCHIP) by raising the federal cigarette excise tax from 39¢ to $1.01 per pack. Federal excise tax is included as a component of our product cost charged by the manufacturer. The legislation, which was signed into law in February 2009, becomes effective on April 1, 2009.

Food and Non-Food ProductsProducts.. The food product category includes candy, snacks, fast food, grocerysnacks, groceries, fresh products, dairy and non-alcoholic beverages. The non-food product category includes general merchandise, health and beauty care products and tobacco products other than cigarettes.bread. Food and non-foodNon-food product categories were $1,385.9$1,920.1 million of net sales for the year ended December 31, 2005in 2008 and account for approximately 28%31.8% of our sales, buthowever, these categories represented approximately 65%71.0% of our gross profit. We structure our marketing and merchandising programs around these higher margin products.

Our Suppliers. We purchase products for resale from approximately 3,800 trade suppliers and manufacturers located across the United States and Canada. In 2005,2008, we purchased approximately 51%61% of our products from our top 20 suppliers, with our top two suppliers, Philip Morris and R.J. Reynolds, representing approximately 26%27% and 15%14% of our purchases, respectively. We coordinate our purchasing from suppliers by negotiating, on a corporate-wide basis, special arrangements to obtain volume discounts and additional allowances and rebates,incentives, while also taking advantage of promotional and advertising allowancesincentives offered to us as a wholesale distributor. In

addition, buyers in each of our distribution facilities purchase products, particularly food, directly from the manufacturers, improving product mix and availability for individual markets and reducing our inventory investment.

We have historically operated without purchase contracts with our major vendors, instead relying on relationships based on industry trade practices. Immediately following the Fleming bankruptcy, the trade credit terms that we had been enjoying were substantially reduced or eliminated by our vendors. We have restored credit terms with nearly all of our vendors, but some of these credit terms are less favorable than those provided to us prior to Fleming’s bankruptcy due primarily to changes in industry credit terms.

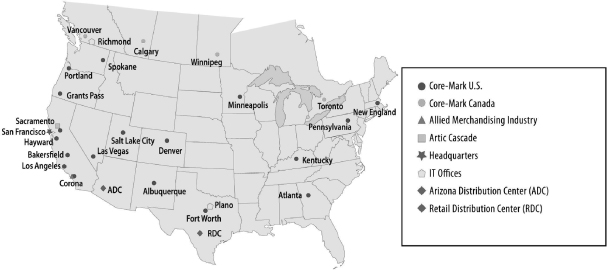

Operations

We operate a total of 2426 distribution centers. We have operationscenters consisting of 22 in the Western United States consistingand four in Canada as of 15December 31, 2008. The map below describes the scope of our operations and distribution centers located in California, Colorado, Nevada, New Mexico, Oregon, Texas, Utah and Washington; the Southeastern and Midwestern United States consistingcenters.

Map of three distribution centers located in Georgia, Kentucky and Minnesota; and Canada consisting of four distribution centers located in Alberta, British Columbia and Manitoba. Operations

Two of our 24 distribution centers,the facilities we operate in the United States, Artic Cascade and Allied Merchandising Industry, are consolidating warehouses which buy products from our suppliers in bulk quantities and then distribute the products to many of our other Western distribution centers. By using Artic Cascade, located in Sacramento, California, to obtain products at lower cost from frozen product vendors, we are able to offer a broader selection of quality products to retailers at more competitive prices. Allied Merchandising Industry located in Corona, California purchases the majority of our non-food products, other than cigarettes and tobacco products, for our Western distribution centers, enabling us to reduce our overall general merchandise and health and beauty care product inventory. Two of theWe operate two additional facilities that we operate are in our role as a third party logistics provider. One distribution facility located in Phoenix, Arizona, referred to as the Arizona Distribution Center (ADC), is dedicated solely to supporting the logistics and management requirements of one of our major customers, Circle K. In April 2005, we began operating aAlimentation Couche-Tard. The second third party logistics distribution facility located in San Antonio, Texas, referred to as the Valero Retail Distribution FacilityCenter (RDC), which is dedicated solely to supporting another major customer, Valero.

Map of Operations

We purchase a variety of brand name and private label products, totaling approximately 38,00042,000 SKUs, including approximately 2,6004,900 SKUs of cigarette and other tobacco products, from our suppliers and manufacturers. We offer customers a variety of food and non-food products, including candy, snacks, fast food, groceries, fresh products, dairy, non-alcoholic beverages, general merchandise and health and beauty care products.

A typical convenience store order is comprised of a mix of dry, frozen and chilled products. Receivers,Our receivers, stockers, order selectors, stampers, forklift drivers and loaders received, stored and picked nearly 390435 million, 407 million and 300405 million items (a carton of 10 packs of cigarettes is one item) or 5466 million, 64 million and 4359 million cubic feet of product, during the years ended December 31, 20052008, 2007 and December 31, 2004,2006, respectively, while limiting the order-itemservice error rate to about twoapproximately three errors per thousand items shipped.shipped(Note—these performance metrics do not include those of the Pennsylvania division prior to Core-Mark integrating them into our distribution system on October 1, 2006, and those of our New England division—See Note 3—Acquisitions).

Our proprietary Distribution Center Management System, or DCMS, platform provides our distribution centers with the flexibility to adapt to our customers’ information technology requirements in an industry that does not have a standard information technology platform. Actively integrating our customers into our platform is a priority which enables fast, efficient and reliable service.

Distribution

At December 31, 2005,2008, we had approximately 650908 transportation department personnel, including delivery drivers, shuttle drivers, routers, training supervisors and managers who focus on achieving safe, on-time deliveries. Our daily orders are picked and loaded nightly in reverse order of scheduled delivery. At December 31, 2005,2008, our trucking systemfleet consisted of approximately 380671 tractors, trucks and vans, of which nearly all were leased. Our trailers are typically owned byWe have made a significant investment over the past few years in upgrading our trailer fleet to tri-temperature (“tri-temp”) which gives us and many have refrigerated compartments that allow usthe capability to deliver frozen, chilled, and chillednon-refrigerated goods in one delivery. As of December 31, 2008, over 40% of our fleet consisted of tri-temp trailers with the remainder capable of delivering refrigerated and non-refrigerated foods. This provides us the multiple temperature zone capability needed to support our focus on delivering fresh products alongside non-refrigerated goods. Grossto our customers. Our fuel consumption costs for the year ended December 31, 20052008 totaled approximately $9.9$9.4 million, net of fuel surcharges passed on to customers, which represented an increase of approximately $3.2$2.4 million, from 2004, or 48%,$7.0 million in 2007 due to increased fuel prices, miles driven and increased sales volume. A significant portionthe additions of the fuel costs are offset by fuel surcharges of $4.6 million which are included in our customer pricing. In 2004, gross fuel costs were $6.7 million which were offset by fuel surcharges of $3.2 million.two new divisions.

Competition

We estimate that, as of December 31, 2005,2008, there were over 400approximately 350 wholesale distributors to traditional convenience store retailers in the United States, approximately 30 of which are broad-line distributors similar to Core-Mark.States. We believe that Core-Mark and McLane Company, Inc., a subsidiary of Berkshire Hathaway, Inc., are second largest and the two largest convenience wholesale companies,distributors, measured by annual sales, in North America. There are also companies that provide products to specific regions of the country, such as The H.T. Hackney Company in the Southeast, Eby-Brown Company in the Midwest, Mid-Atlantic and Southeast and GSC Enterprises, Inc. in Texas and surrounding states, and several hundred local distributors serving small regional chains and independent convenience stores.retailers. In Canada, there are fewer wholesale suppliers asdistributors compared to the United States. In addition, we also compete withcertain manufacturers who deliver their products directly to convenience stores, such as Coca-Cola bottlers, Frito Lay, and Interstate Bakeries.Bakeries deliver their products directly to convenience retailers.

Competition within the industry is based primarily based on service, price and variety of products offered, schedules and reliability of deliveries, and the range and quality of the services provided.provided, price, variety of products offered and the reliability of deliveries. We operate from a perspective that focuses heavily on providing competitive pricing as well as outstanding customer service as evidenced bythrough our decentralized distribution centers, order fulfillment rates, on time deliveries, innovative marketing solutions, and merchandising support.support as well as competitive pricing. At least one of our major competitors currently operates on a logistics model that concentrates on competitive pricing, using large distribution centers and providing competitive order fulfillment rates. This logistics model, however, couldmay result in uncertainless certain delivery times and leavescould leave the customer to perform all of the merchandising functions. Many of our small competitors focus on customer service from small distribution facilities and concentrate on long-standing customer relationships. We believe that our unique combination of priceservice, marketing solutions and serviceprice is a compelling combination that is highly attractive to customers and results in our increasing growth.may enhance their growth and profitability.

SinceWe purchase cigarettes primarily from manufacturers covered by the tobacco industry’s master settlement agreementMaster Settlement Agreement (MSA), which was signed in November 1998,1998. Since then, we have experienced increased wholesale competition for cigarette sales. Competition amongst cigarette wholesalers is based primarily on the basis of service, price and variety. Competition amongvariety, whereas competition amongst manufacturers for cigarette sales is based primarily based on brand positioning, price, product attributes, consumer loyalty, promotions, advertising and

retail presence. Cigarette brands produced by the major tobacco product manufacturers generally require competitive pricing, substantial marketing support, retail programs and other financial incentives to maintain or improve a brand’s market position. Increased selling prices and higher cigarette taxes have resulted in the growth of deep-discount brands. Deep-discount brands are brands manufactured by companies that are not original participants to the MSA, and accordingly, do not have cost structures burdened with MSA-related payments to the same extent as the original participating manufacturers. Historically, major tobacco product manufacturers have had a competitive advantage in the United States because significant cigarette marketing restrictions and the scale of investment required to compete made gaining consumer awareness and trial of new brands difficult. However, since the MSA was signed in November 1998, the category of deep-discount brands manufactured by smaller manufacturers or supplied by importers has grown substantially.

As a result of purchasing cigarettes for sale in MSA states exclusively from manufacturers that are parties to the MSA, we are adversely impacted by increases in deep-discount brand growth. We believe that non-MSA manufacturers that sell deep-discount brands have steadily increased their combined market share of cigarette sales. The premium and discount cigarettes subject to the MSA that we sell have been negatively impacted by widening price gaps in the prices between those brands and the deep-discount brands for the past several years. As a result, our operations may be negatively impacted as sales of premium cigarettes and other tobacco products that we sell decline. Non-MSA cigarettes sold in MSA states also may be subject to additional legal liabilities.

We also face competition duefrom the sale of cigarettes by third parties over the internet and by other means designed to avoid collection of applicable taxes, including the sale of cigarettes in non-taxable jurisdictions, imports of foreign low priced brands, and the diversion into the United States market of cigarettes intended for sale outside the United States, the sale of counterfeit cigarettes by third parties, the sale of cigarettes in non-taxable jurisdictions, inter-state and international smuggling of cigarettes, the sale of cigarettes by third parties over the Internet and by other means designed to avoid collection of applicable taxes and increased imports of foreign low priced brands.States. The competitive environment has been characterizedimpacted by a continued influx of cheapalternative smoking products, such as snus and snuff, and higher prices due to higher state excise taxes and list price increases for cigarettes manufacturesmanufactured by parties to the MSA. As a result, the lowest priced products of manufacturers of numerous small share brands manufactured by companies that are not parties to the MSA have increasedheld their market share, putting pressure on the profitability of the premium cigarettes that we sell.cigarettes.

Working Capital Practices

We sell products on credit terms to our customers that averaged, as measured by days sales outstanding, about 9 days for 2008 and 10 days for the year ended December 31, 2005 and about 11 days for the year ended December 31, 2004.2007. Credit terms may impact pricing and are competitive within our industry. An increasing number of our customers remit payment electronically.electronically which facilitates efficient and timely monitoring of payment risk. Canadian days sales outstanding in receivables tend to be lower as Canadian industry practice is for shorter credit terms than those in the United States.

We maintain our inventory of products based on the level of sales of the particular product and manufacturer replenishment cycles. The number of days a particular item of inventory remains in our distribution centers varies by product and is principally driven by the turnover of that product and economic order quantities. We typically order and carry in inventory additional amounts of certain critical products to assure high order fulfillment levels.levels for these items. The number of days of cost of sales in inventory averaged about 1315 days during 20042008 and 2005.2007.

We obtain terms from our vendors withinbased on industry termspractices and consistent with our credit standing. Vendor terms vary depending on individual vendor policies and also may vary between product categories. We take advantage of the full complement of vendor offerings, including early payment terms. During 2005,Our days purchasespayable outstanding during 2008 averaged approximately 912 days, including cigarette and tobacco taxes payable, as compared to 11 days for 2007, with a range of twothree days prepaid to 30 days credit and was significantly affected by the cigarette industry where the leading vendors provide incentives for prepayment. This average includes the impact of tobacco taxes payable.credit.

The days outstanding averages presented in this Working Capital Practices section are calculated using month-end averages.

Employees

As of December 31, 2005,2008, we had approximately 3,430 employees. Four4,181 employees, including 578 in administration, finance and purchasing, 1,026 in sales and marketing, and 2,577 in warehousing and distribution functions. Of these employees, 457 employees are located in Canada and the remainder in the United States. Three of our distribution centers, Hayward, Las Vegas Victoria and Calgary, employ people who are covered by collective bargaining agreements with local affiliates of The International Brotherhood of Teamsters (Hayward and Las Vegas), and United Food and Commercial Workers (Calgary) and United Steelworkers of America (Victoria). Approximately 220199 employees, or approximately 6%,4.8% of our workforce, are unionized. There have been no disruptions in customer service, strikes, work stoppages or slowdowns as a result of union activities, and we believe we have satisfactory relations with our employees.

FacilitiesTOTAL EMPLOYEES BY BUSINESS FUNCTIONS

Our headquarters are located in South San Francisco, California, and we operate distribution centers throughout the United States and Canada. We have operations in the Western United States consisting of 15 distribution centers located in California, Colorado, Nevada, New Mexico, Oregon, Texas, Utah and Washington; the Eastern and Midwestern United States consisting of three distribution centers located in Georgia, Kentucky and Minnesota; and Canada consisting of four distribution centers located in Alberta, British Columbia and Manitoba. Two of our 24 distribution centers, Artic Cascade and Allied Merchandising Industry, are consolidating warehouses which buy products from our suppliers in bulk quantities and then distribute the products to our other Western distribution centers. By using Artic Cascade, located in Sacramento, California, to obtain products at lower cost from frozen product vendors, we are able to offer a broader selection of quality products to retailers at more competitive prices. Allied Merchandising Industry, located in Corona, California, purchases the majority of our non-food products, other than cigarettes, for our Western distribution centers enabling us to reduce our overall general merchandise and health and beauty care product inventory. Each facility is equipped for receiving, stocking, order selection and loading customer orders on trucks for delivery. Each facility provides warehouse, distribution, sales and support functions for its geographic area under the supervision of a division president and operates under a common set of performance metrics.

| December 31, 2008 | ||||||

| United States | Canada | Total Core-Mark Employees | ||||

Administration, Finance, and Purchasing | 478 | 100 | 578 | |||

Sales and Marketing | 974 | 52 | 1,026 | |||

Warehousing and Distribution | 2,272 | 305 | 2,577 | |||

Total Categories | 3,724 | 457 | 4,181 | |||

Of the 24 distribution centers we operate, two are operated as third party logistics providers. One distribution facility located in Phoenix, Arizona, referred to as the Arizona Distribution Center, or the ADC, is dedicated solely to supporting the logistics and management requirements of one of our major customers, Circle K. In April 2005, we began operating a second third party logistics distribution facility, located in San Antonio, Texas, referred to as the Valero Retail Distribution Center (RDC), which is dedicated solely to supporting Valero.

Regulation

As a distributor of food products, we are subject to the Federal Food, Drug and Cosmetic Act and regulations promulgated by the U.S.United States Food and Drug Administration (FDA). The FDA regulates the holding requirements for foods through its current good manufacturing practice regulations, specifies the standards of identity for certain foods and prescribes the format and content of certain information required to appear on food product labels. A limited number of the over-the-counter medications that we distribute are subject to the regulations of the U.S.United States Drug Enforcement Administration. In Canada, similar standards related to food and over-the-counter medications are governed by Health Canada. The products we distribute are also subject to federal, state, provincial and local regulation through such measures as the licensing of our facilities, enforcement by state, provincial and local health agencies of state and localrelevant standards for the products we distribute and regulation of the our trade practices in connection with the sale of our products. Our facilities are inspected periodically by federal, state, provincial and local authorities including the Occupational Safety and Health Administration under the U.S.United States Department of Labor which require us to comply with certain health and safety standards to protect our employees.

We are also subject to regulation by numerous other federal, state, provincial and local regulatory agencies, including but not limited to the U.S.United States Department of Labor, which sets employment practice standards for workers, and the U.S. DepartmentUnited States and Canadian Departments of Transportation, which regulatesregulate transportation of perishable goods, and similar state, provincial and

local agencies. Compliance with these laws has not had and is not anticipated to have a material effect on our results of operations.

We voluntarily participate in random quality inspections of all of our distribution centers, conducted by the American Institute of Baking (AIB). The AIB publishes standards as a tool to permit operators of distribution centers to evaluate the food safety risks within their operations and determine the levels of compliance with the standards. AIB conducts an inspection which is composed of food safety and quality criteria. AIB conducts its inspections based on five categories: adequacy of the company’s food safety program, pest control, operational methods and personnel practices, maintenance of food safety and cleaning practices. Within these five categories, the AIB evaluates over 100 criteria items. AIB’s independent evaluation is summarized and posted on its website for our customer’scustomers’ review. In 2005,2008, nearly 90%87% of our distribution centers received the highest rating from the AIB and the remaining distribution centers received the second highest rating.

Registered Trademarks

We have registered trademarks including the following: Arcadia Bay®, Arcadia Bay Coffee Company®, Boonaritos™, Boondoggles®, Cable Car®, Core-Mark®, Core-Mark International®, EMERALD®, Feastona®, Java Street®, QUICKEATS®, Richland ValleyTM, SmartStock®, Starmark®and SmartStockTastefully Yours®.

Segment and Geographic Information

We operate in two reportable geographic segments—the United States and Canada.SeeNote 16—Segment and Geographic Information to our consolidated financial statements.

Corporate and Available Information

You may readThe office of our corporate headquarters is located at 395 Oyster Point Boulevard, Suite 415, South San Francisco, California 94080 and copy any materialsthe telephone number is (650) 589-9445.

Our internet website address iswww.core-mark.com. We provide free access to various reports that we file with or furnish to the United States Securities and Exchange Commission through our website, as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q, and any amendments to those reports. Our SEC at

reports can be accessed through the SEC’s Public Reference room at 100 F Street, NE, Washington, DC 20549. The public“Investor Relations” section of our website, or throughwww.sec.gov. Also available on our website are printable versions of Core-Mark’s Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter, and Code of Business Conduct and Ethics. Copies of these documents may obtain informationbe requested from:

Core-Mark International

395 Oyster Point Blvd, Suite 415

South San Francisco, CA 94080

Attention: Investor Relations

Corporate Governance—Code of Business Conduct and Ethics and Whistle Blower Policy:

Our Code of Business Conduct and Ethics is designed to promote honest, ethical and lawful conduct by all employees, officers and directors and is posted on the operation“Investor Relations” section of our website at www.core-mark.com under “Corporate Governance.”

Additionally, the Audit Committee (“Audit Committee”) of the Public Reference Room by callingBoard of Directors of Core-Mark has established procedures to receive, retain, investigate and act on complaints and concerns of employees, shareholders and others regarding accounting, internal accounting controls and auditing matters, including complaints regarding attempted or actual circumvention of internal accounting controls or complaints regarding violations of the SECCompany’s accounting policies. The procedures are also described in our website address at 1-800-SEC-0330. The Company is an electronic filer andwww.core-mark.com under Corporate Governance in the SEC maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.“Investor Relations” section.

| ITEM 1.A. | RISK FACTORS |

You should carefully consider the following risks together with all of the other information contained in this Annual Report on Form 10-K. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us or those we currently view as immaterial may also materially adversely affect our business, financial condition or results of operations.

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such differences include, but are not limited to, the risk factors set forth below (See—Special Note Regarding Forward Looking Statements)Statements prior to Item 1. Business).

FACTORS THAT MAY AFFECT FUTURE OPERATING RESULTS

Risks RelatingRelated to the Economy and Market Conditions

Current difficult economic conditions and market turmoil may reduce demand for our products and increase credit risks.

Current market turmoil and difficult economic conditions, including actual and potential job losses among many sectors of the economy, significant declines in real estate values, large losses to consumer retirement and investment accounts, increases in food and fuel prices and uncertainty regarding federal tax and economic policies have resulted in reduced consumer confidence and curtailed consumer spending. If these economic conditions persist or deteriorate further, we expect that convenience retail operators will experience continued weakness and further reductions in same store sales, which will adversely affect demand for our products and will result in reduced sales and pressures on margins. This may have a material adverse effect on our business and operating results. These economic and market conditions, combined with continuing difficulties in the credit markets and the resulting pressures on liquidity may also place a number of our convenience retail customers under financial stress, which would increase our credit risk and potential bad debt exposure.

Our business is sensitive to general economic conditions and, in particular, to gasoline prices and the labor market.

Our operating results are also sensitive to, and may be adversely affected by, other factors, including inflation, competitive price pressures, severe weather conditions and unexpected increases in fuel or other transportation-related costs. Due to the low margins on the products we distribute, changes in general economic conditions could materially adversely affect our operating results.

Two particular economic factors may have a significant impact on our sales, margins and costs. First, our retailers have reported to us that when gasoline prices increased they have experienced a decrease in the proportion of their customers’ expenditures on food/non-food products compared to customers’ expenditures on cigarettes. When gasoline prices undergo sustained increases and a similar shift in expenditures results, we experience pressure on our sales and gross margins since sales of food/non-food products result in higher margins than sales of cigarettes do. Second, our results are sensitive to the labor market. For example, the strength of the employment market in the transportation sector has led to a shortage of qualified drivers in some areas, increasing our costs as we are required to use more temporary drivers and increase wages for permanent drivers in the affected areas. Shortages of qualified warehouse and other employees could similarly increase our costs.

Historically, we have been able to pass on a substantial portion of increases in our own fuel costs to our customers in the form of fuel surcharges, but our ability to continue to pass through price increases, either from manufacturers or costs incurred in the business, including labor and fuel costs, is not assured.

As a result of recent recessionary economic conditions and financial market turmoil, our pension plan is currently underfunded and we will be required to make cash payments to the plan, reducing the cash available for our business.

We sponsored a qualified defined-benefit pension plan and a post-retirement benefit plan for employees hired before September 1986. We record a liability associated with these plans equal to the excess of the benefit obligation over the fair value of plan assets. The benefit liability recorded under the provisions of Statement of Financial Accounting Standards No. 158 “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans,” at December 31, 2008 was $34.9 million for the pension plan. Our pension plan’s underfunded status increased from approximately $4.0 million in 2007 to approximately $12.8 million in 2008. The primary reason for this increase in the underfunding status of the plan from 2007 to 2008 is due to a lower return than expected on invested plan assets as of December 31, 2008 compared to December 31, 2007 as a result of the recent economic downturn and financial market turmoil. The amount of the estimated contributions is expected to increase in 2010 due, in part, to the underperformance of the plan assets relative to our expectations given the overall market downturn during 2008. If the performance of the assets in the plan does not meet our expectations, or if other actuarial assumptions are modified, our future cash payments to the plan could be substantially higher than we expect. The pension plan is subject to the Employee Retirement Income Security Act of 1974, or ERISA. Under ERISA, the Pension Benefit Guaranty Corporation, or PBGC, has the authority to terminate an underfunded pension plan under limited circumstances. In the event our pension plan is terminated for any reason while it is underfunded, we will incur a liability to the PBGC that may be equal to the entire amount of the underfunding in the pension plan.

Risks Related to Our Business and Industry

We are dependent on the convenience retail industry for our revenues, and our results of operations would suffer if there is an overall decline in the convenience retail industry.

The majority of our sales are made under purchase orders and short-term contracts with convenience retail which inherently involve significant risks. These risks include the uncertainty of general economic conditions in the convenience retail industry, credit exposure from our customers, termination of customer relationships without notice, consolidation of our customer base and consumer movement toward purchasing from club stores. Any of these factors could negatively affect the convenience retail industry which would negatively affect our results of operations.

We face competition in our distribution markets and if we are unable to compete effectively in any distribution market, we may lose market share and suffer a decline in sales.

Our distribution centers operate in highly competitive markets. We face competition from local, regional and national tobacco and consumable products distributors on the basis of service, price and variety of products offered, schedules and reliability of deliveries, and the range and quality of services provided. Some of our competitors, including a subsidiary of Berkshire Hathaway Inc., McLane Company, Inc., the largest convenience wholesale distributor in the United States, have substantial financial resources and long standing customer relationships. In addition, heightened competition among our existing competitors or by new entrants into the distribution market could create additional competitive pressures that may reduce our margins and adversely affect our business. If we fail to successfully respond to these competitive pressures or to implement our strategies effectively, we may lose market share and our results of operations could suffer.

If we are not able to retain existing customers and attract new customers, our results of operations could suffer.

Increasing the growth and profitability of our distribution business is particularly dependent upon our ability to retain existing customers and attract additional distribution customers. The ability to attract additional customers through our existing network of distribution centers is especially important because it enables us to

leverage our distribution centers and other fixed assets. Our ability to retain existing customers and attract new customers is dependent upon our ability to provide industry-leading customer service, offer competitive products at low prices, maintain high levels of productivity and efficiency in distributing products to our customers while integrating new customers into our distribution system, and offer marketing, merchandising and ancillary services that provide value to our customers. If we are unable to execute these tasks effectively, we may not be able to attract a significant number of new customers and our existing customer base could decrease, either or both of which could have an adverse impact on our results of operations.

If the costs to us of the products we distribute increase and we cannot pass the increase on to our customers, our results of operations could be adversely affected.

Our industry is characterized by a high volume of sales with relatively low profit margins. We experience increases in our cost of goods sold when manufacturers increase prices or reduce or eliminate discounts and incentive programs. If we cannot pass along such cost increases to our customers due to resistance to higher prices, our relatively narrow profit margins and earnings could be negatively affected.

We rely on funding from manufacturer discount and incentive programs and cigarette excise stamping allowances, any material changes in these programs could adversely affect our results of operations.

We receive payments from the manufacturers of the products we distribute for allowances, discounts, volume rebates, and other merchandising and incentive programs. These payments are a substantial benefit to us. The amount and timing of these payments are affected by changes in the programs by the manufacturers, our ability to sell specified volumes of a particular product, attaining specified levels of purchases by our customers, and the duration of carrying a specified product. In addition, we receive discounts from states in connection with the purchase of excise stamps for cigarettes. If the manufacturers or states change or discontinue these programs or change the timing of payments, or if we are unable to maintain the volume of our sales, our results of operations could be negatively affected.

We depend on relatively few suppliers for a large portion of our products, and any interruptions in the supply of the products that we distribute could adversely affect our results of operations.

We obtain the products we distribute from third party suppliers. At December 31, 2008, we had approximately 3,800 vendors, and during 2008 we purchased approximately 61% of our products from our top 20 suppliers, with our top two suppliers, Philip Morris and R. J. Reynolds, representing approximately 27% and 14% of our purchases, respectively. We do not have any long-term contracts with our suppliers committing them to provide products to us. Although our purchasing volume can provide leverage when dealing with suppliers, suppliers may not provide the products we distribute in the quantities we request or on favorable terms. Since we do not control the actual production of the products we distribute, we are also subject to delays caused by interruption in production based on conditions outside our control. These conditions include job actions or strikes by employees of suppliers, inclement weather, transportation interruptions, and natural disasters or other catastrophic events. Our inability to obtain adequate supplies of the products we distribute as a result of any of the foregoing factors or otherwise, could cause us to fail to meet our obligations to our customers and reduce the volume of our sales.

We may lose business if cigarette or other manufacturers decide to engage in direct distribution of their products.

In the past certain large manufacturers have elected to engage in direct distribution of their products and eliminate distributors such as Core-Mark. If other manufacturers make similar decisions in the future our revenues and profits would be adversely affected, and there can be no assurance that we will be able to take action to compensate for such losses.

Cigarette and consumable goods distribution is a low-margin business sensitive to economic conditions.

We derive most of our revenues from the distribution of cigarettes, other tobacco products, candy, snacks, fast food, grocerygroceries, fresh products, dairy, non-alcoholic beverages, general merchandise and health and beauty care products.

Our industry is characterized by a high volume of sales with relatively low profit margins. Our non-cigarettefood/non-food sales are at prices that are based on the cost of the product plus a percentage markup. As a result, our profit levels may be negatively impacted during periods of cost deflation for these products, even though our gross profit as a percentage of the price of goods sold may remain relatively constant. PeriodsAlternatively, periods of product cost inflation may also have a negative impact on our profit margins and earnings with respect to sales of cigarettes. Gross profit on cigarette sales are generally fixed on a cents per carton basis. Therefore, as cigarette prices increase, gross profit generally decreases as a percent of sales. In addition, if the cost of the cigarettes that we purchase increase due to manufacturer price increases or increases in applicable excise tax rates, our inventory costs and accounts receivable could rise. To the extent that product cost increases are not passed on to our customers due to their resistance to higher prices, our profit margins and earnings could be negatively impacted.

The consumable goodsSome of our distribution industry is sensitivecenters are dependent on a few relatively large customers, and our failure to nationalmaintain our relationships with these customers could substantially harm our business and regional economic conditions. Inflation, fuel costsprospects.

Some of our distribution centers are dependent on relationships with a single customer or a few customers, and other factors affecting consumer confidence generally may negatively impactwe expect our sales. Ourreliance on these relationships to continue for the foreseeable future. Any termination or non-renewal of customer relationships could severely and adversely affect the revenues generated by certain of our distribution centers. Any future termination, non-renewal or reduction in services that we provide to these select customers would cause our revenues to decline and our operating results are also sensitive to, andwould be harmed.

We may be adversely affected by, other factors, including difficulties with the collectability of accounts receivable, competitive price pressures, severe weather conditions and unexpected increases in fuel or other transportation-related costs. Duesubject to the low- margins on the products we distribute, changes in general economic conditionsproduct liability claims which could materially adversely affect our business, and our operations could be subject to disruptions as a result of manufacturer recalls of products.