Contract drilling companies compete primarily on a regional basis, and the intensity of competition may vary significantly from region to region at any particular time. If demand for drilling services improves in a region where we operate, our competitors might respond by moving in suitable rigs from other regions. An influx of rigs from other regions could rapidly intensify competition and make any improvement in demand for drilling rigs in a particular region short-lived.

Many of our competitors have greater financial, technical and other resources than we do. Their greater capabilities in these areas may enable them to:

better withstand industry downturns;

compete more effectively on the basis of price and technology;

better retain skilled rig personnel; and

build new rigs or acquire and refurbish existing rigs so as to be able to place rigs into service more quickly than us in periods of high drilling demand.

Production Services Division

The market for production services is highly competitive. Competition is influenced by such factors as price, capacity, availability of work crews, type and condition of equipment and reputation and experience of the service provider. We believe that an important competitive factor in establishing and maintaining long-term customer relationships is having an experienced, skilled and well-trained work force. In recent years, many of our larger customers have placed increased emphasis on the safety performance and quality of the crews, equipment and services provided by their contractors. We have devoted, and will continue to devote, substantial resources toward employee safety and training programs. Although we believe customers consider all of these factors, price is generally the primary factor in determining which service provider is awarded the work. However, we believe that most customers are willing to pay a slight premium for the quality and efficient service we provide.

The largest well service providers that we compete with are Key Energy Services, Basic Energy Services, Nabors Industries, Complete Production Services and CC Forbes. In addition, there are numerous smaller companies that compete in our well service markets.

The wireline market is dominated by Schlumberger Ltd. and Halliburton Company. These companies have a substantially larger asset base than Pioneer and operate in all major U.S. oil and natural gas producing basins. Other competitors include Weatherford International, Baker Atlas, Superior Energy Services, Basic Energy Services, and Key Energy Services. The market for wireline services is very competitive, but historically we have competed effectively with our competitors based on performance and strong customer service.

The fishing and rental tools market is fragmented compared to our other product lines. Companies which provide fishing services generally compete based on the reputation of their fishing tool operators and their relationships with customers. Competition for rental tools is sometimes based on price; however, in most cases, when a customer chooses a specific fishing tool operator for a particular job, then the necessary rental equipment will be part of that job as well. Our primary competitors include: Baker Oil Tools, Weatherford International, Basic Energy Services, Key Energy Services, Quail Tools (owned by Parker Drilling) and Knight Oil Tools.

The need for well servicing, wireline, and fishing and rental services fluctuates, primarily, in relation to the price (or anticipated price) of oil and natural gas, which, in turn, is driven by the supply of and demand for oil and natural gas. Generally, as supply of those commodities decreases and demand increases, service and maintenance requirements increase as oil and natural gas producers attempt to maximize the productivity of their wells in a higher priced environment.

The level of our revenues, earnings and cash flows are substantially dependent upon, and affected by, the level of domestic and international oil and gas exploration and development activity, as well as the equipment capacity in any particular region. For a more detailed discussion, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Raw Materials

The materials and supplies we use in our drilling and production services operations include fuels to operate our drilling and well service equipment, drilling mud, drill pipe, drill collars, drill bits and cement. We do not rely on a single source of supply for any of these items. While we are not currently experiencing any shortages, from time to time there have been shortages of drilling equipment and supplies during periods of high demand. Shortages could result in increased prices for drilling equipment or supplies that we may be unable to pass on to customers. In addition, during periods of shortages, the delivery times for equipment and supplies can be substantially longer. Any significant delays in our obtaining drilling equipment or supplies could limit drilling operations and jeopardize our relations with customers. In addition, shortages of drilling equipment or supplies could delay and adversely affect our ability to obtain new contracts for our rigs, which could have a material adverse effect on our financial condition and results of operations.

Operating Risks and Insurance

Our operations are subject to the many hazards inherent in the contract land drilling business, including the risks of:

blowouts;

fires and explosions;

loss of well control;

collapse of the borehole;

lost or stuck drill strings; and

damage or loss from natural disasters.

Any of these hazards can result in substantial liabilities or losses to us from, among other things:

suspension of drilling operations;

damage to, or destruction of, our property and equipment and that of others;

personal injury and loss of life;

damage to producing or potentially productive oil and gas formations through which we drill; and

environmental damage.

We seek to protect ourselves from some but not all operating hazards through insurance coverage. However, some risks are either not insurable or insurance is available only at rates that we consider uneconomical. Those risks include pollution liability in excess of relatively low limits. Depending on competitive conditions and other factors, we attempt to obtain contractual protection against uninsured operating risks from our customers. However, customers who provide contractual indemnification protection may not in all cases maintain adequate insurance to support their indemnification obligations. We can offer no assurance that our insurance or indemnification arrangements will adequately protect us against liability or loss from all the hazards of our operations. The occurrence of a significant event that we have not fully insured or indemnified against or the failure of a customer to meet its indemnification obligations to us could materially and adversely affect our results of operations and financial condition. Furthermore, we may not be able to maintain adequate insurance in the future at rates we consider reasonable.

Our current insurance coverage includes property insurance on our rigs, drilling equipment and real property. Our insurance coverage for property damage to our rigs and to our drilling equipment is based on our estimate, as of October 2006,estimates of the cost of comparable used equipment to replace the insured property. The policy provides for a deductible on rigs of $250,000 per occurrence.occurrence ($500,000 deductible for rigs with an insured value greater than $10 million). Our third-party liability insurance coverage is $51 million per occurrence and in the aggregate, with a deductible of $260,000 per occurrence. We believe that we are adequately insured for public liability and property damage to others with respect to our operations. However, such insurance may not be sufficient to protect us against liability for all consequences of well disasters, extensive fire damage or damage to the environment.

In addition, we generally carry insurance coverage to protect against certain hazards inherent in our turnkey contract drilling operations. This insurance covers “control-of-well,” including blowouts above and below the surface, redrilling, seepage and pollution. This policy provides coverage of $3 million, $5 million, $10 million, $15 million or $10$20 million depending on the area in which the well is drilled and its target depth, subject to a deductible of the greater of 15% of the well’s anticipated dry hole cost or $150,000. This policy also provides care, custody and control insurance, with a limit of $1,000,000,$1 million, subject to a $50,000$100,000 deductible.

Employees

We currently have approximately 1,5401,952 employees. Approximately 190247 of these employees are salaried administrative or supervisory employees. The rest of our employees are hourly employees who operate or maintainworking in operations for our drilling rigsDrilling Services Division and rig-hauling trucks.Production Services Division. The number of hourly employees fluctuates depending on the numberutilization of our drilling projects we are engaged inrigs, workover rigs and wireline units at any particular time. None of our employment arrangements are subject to collective bargaining arrangements.

Our operations require the services of employees having the technical training and experience necessary to obtain proper operational standards. As a result, our operations depend, to a considerable extent, on the continuing availability of such personnel. Although we have not encountered material difficulty in hiring and retaining qualified rig crews,employees in our operations, shortages of qualified personnel are occurringhave occurred in our industry. If we should suffer any material loss of personnel to competitors or be unable to employ additional or replacement personnel with the requisite level of training and experience to adequately operate our equipment, our operations could be materially and adversely affected. While we believe our wage rates are competitive and our relationships with our employees are satisfactory, a significant increase in the wages paid by other employers could result in a reduction in our workforce, increases in wage rates, or both. The occurrence of either of these events for a significant period of time could have a material and adverse effect on our financial condition and results of operations.

Facilities

Our corporate office facilities are located at 1250 N.E. Loop 410, Suite 1000 San Antonio, Texas 78209 and are leased with costs escalating from $26,809 per month to $29,316 per month with a non-cancelable lease term expiring in December 2013. We own:

We lease:

April 2013.

Governmental Regulation

Our operations are subject to stringent laws and regulations relating to containment, disposal and controlling the discharge of hazardous oilfield waste and other non-hazardous waste material into the environment, requiring removal and cleanup under certain circumstances, or otherwise relating to the protection of the environment. In addition, our operations are often conducted in or near ecologically sensitive areas, such as wetlands, which are

subject to special protective measures and which may expose us to additional operating costs and liabilities for accidental discharges of oil, natural gas, drilling fluids or contaminated water, or for noncompliance with other aspects of applicable laws. We are also subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state statutes. The OSHA hazard communication standard, the Environmental Protection Agency “community right-to-know” regulations under Title III of the Federal Superfund Amendment and Reauthorization Act and comparable state statutes require us to organize and report information about the hazardous materials we use in our operations to employees, state and local government authorities and local citizens.

Environmental laws and regulations are complex and subject to frequent change. In some cases, they can impose liability for the entire cost of cleanup on any responsible party, without regard to negligence or fault, and can impose liability on us for the conduct of others or conditions others have caused, or for our acts that complied with all applicable requirements when we performed them. We may also be exposed to environmental or other liabilities originating from businesses and assets that we purchased from others. Compliance with applicable environmental laws and regulations has not, to date, materially affected our capital expenditures, earnings or competitive position, although compliance measures have added to our costs of operating drilling equipment in some instances. We do not expect to incur material capital expenditures in our next fiscal year in order to comply with current environment control regulations. However, our compliance with amended, new or more stringent requirements, stricter interpretations of existing requirements or the future discovery of contamination may require us to make material expenditures or subject us to liabilities that we currently do not anticipate.

In addition, our business depends on the demand for land drilling services from the oil and gas industry and, therefore, is affected by tax, environmental and other laws relating to the oil and gas industry generally, by changes in those laws and by changes in related administrative regulations. It is possible that these laws and regulations may in the future add significantly to our operating costs or those of our customers, or otherwise directly or indirectly affect our operations.

Our wireline operations involve the use of radioactive isotopes along with other nuclear, electrical, acoustic, and mechanical devices. Our activities involving the use of isotopes are regulated by the U.S. Nuclear Regulatory Commission and specified agencies of certain states. Additionally, we use high explosive charges for perforating casing and formations, and we use various explosive cutters to assist in wellbore cleanout. Such operations are regulated by the U.S. Department of Justice, Bureau of Alcohol, Tobacco, Firearms, and Explosives and require us to obtain licenses or other approvals for the use of densitometers as well as explosive charges. We have obtained these licenses and approvals when necessary and believe that we are in substantial compliance with these federal requirements.

Among the services we provide, we operate as a motor carrier and therefore are subject to regulation by the U.S. Department of Transportation and by various state agencies. These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations and regulatory safety. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment and product handling requirements. The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand for common or contract carrier services or the cost of providing truckload services. Some of these possible changes include increasingly stringent environmental regulations, changes in the hours of service regulations which govern the amount of time a driver may drive in any specific period, onboard black box recorder devices or limits on vehicle weight and size.

Interstate motor carrier operations are subject to safety requirements prescribed by the U.S. Department of Transportation. To a large degree, intrastate motor carrier operations are subject to state safety regulations that mirror federal regulations. Such matters as weight and dimension of equipment are also subject to federal and state regulations.

From time to time, various legislative proposals are introduced, including proposals to increase federal, state, or local taxes, including taxes on motor fuels, which may increase our costs or adversely impact the recruitment of drivers. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted.

Available Information

Our websiteWeb site address iswww.pioneerdrlg.com. We make available on this website under “Investor Relations-SEC Filings,” free of charge, ourOur annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, are available free of charge through our Website as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the SEC.Securities and Exchange Commission. The public may read and copy these materials at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. For additional information on the Securities and Exchange Commission’s Public Reference Room, please call 1-800-SEC-0330. In addition, the Securities and Exchange Commission maintains an Internet site atwww.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically. We have also posted on our websiteWeb site our: Charters for the Audit, Compensation, and Nominating and Corporate Governance Committees of our Board; Code of Ethical Conduct for our Chief Executive Officer and other Officers;Ethics; Rules of Conduct; and Company Contact Information.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

We are including

| Item 1A. | Risk Factors |

The information set forth in this Item 1A should be read in conjunction with the following discussion to inform our existing and potential security holders generally of somerest of the risks and uncertainties that can affect our company and to take advantage of the “safe harbor” protection for forward-looking statements that applicable federal securities law affords.

From time to time, our management or persons acting on our behalf make forward-looking statements to inform existing and potential security holders about our company. These statements may include projections and estimates concerning the timing and success of specific projects and our future backlog, revenues, income and capital spending. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “plan,” “intend,” “seek,” “will,” “should,” “goal” or other words that convey the uncertainty of future events or outcomes. These forward-looking statements speak only as of the date on which they are first made, which in the case of forward-looking statements madeinformation included in this report, is the date of this report. Sometimes we will specifically describe a statement as being a forward-looking statement and refer to this cautionary statement.

In addition, various statements that this Annual Report on Form 10-K contains, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. Those forward-looking statements appear in Item 1 – “Business” and Item 3 – “Legal Proceedings” in Part I of this report and in Item 5 – “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities,” and in Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” Item 7A – “Quantitative and Qualitative Disclosures About Market Risk” and in the Notes to Consolidated Financial Statements we have includedOperations” in Item 8 of Part II of7 the historical financial statements and related notes this report contains. While we attempt to identify, manage and elsewhere in this report. These forward-looking statements speak only as of the date of this report. We disclaim any obligation to update these statements, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and othermitigate risks contingencies and uncertainties mostassociated with our business to the extent practical under the circumstances, some level of which are difficult to predictrisk and many of which are beyond our control. Theseuncertainty will always be present. Additional risks contingencies and uncertainties relatenot presently known to among other matters, the following:

We believe the items we have outlined above are important factors that could cause our actual results to differ materially from those expressed in a forward-looking statement contained in this report or elsewhere. We have discussed many of these factors in more detail elsewhere in this report. These factors are not necessarily all the important factors that could affect us. Unpredictable or unknown factors we

have not discussed in this report could also have material adverse effects on actual results of matters that are the subject of our forward-looking statements. We do not intend to update our description of important factors each time a potential important factor arises, except as required by applicable securities laws and regulations. We advise our security holders that they should (1) be aware that important factors not referred to above could affect the accuracy of our forward-looking statements and (2) use caution and common sense when considering our forward-looking statements. Also, please read the risk factors set forth below.

Item 1A. Risk Factorsoperating results.

Set forth below are various risks and uncertainties that could adversely impact our business, financial condition, results of operations and cash flows.

Risks Relating to the Oil and Gas Industry

We derive all our revenues from companies in the oil and gas exploration and production industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and gas prices.

As a provider of contract land drilling services and oil and gas production services, our business depends on the level of drillingexploration and production activity by oil and gas exploration and production companies operating in the geographic markets where we operate. The oil and gas exploration and production industry is a historically cyclical industry characterized by significant changes in the levels of exploration and development activities. Oil and gas prices, and market expectations of potential changes in those prices, significantly affect the levels of those activities. Worldwide political, economic, and military events as well as natural disasters have contributed to oil and gas price volatility and are likely to continue to do so in the future. Any prolonged reduction in the overall level of exploration and development activities, whether resulting from changes in oil and gas prices or otherwise, cancould materially and adversely affect us in many ways by negatively impacting:

our revenues, cash flows and profitability;

the fair market value of our drilling rig fleet;fleet and production service assets;

our ability to maintain or increase our borrowing capacity;

our ability to obtain additional capital to finance our business and make acquisitions, and the cost of that capital; and

our ability to retain skilled rig personnel whom we would need in the event of an upturn in the demand for our services.

Depending on the market prices of oil and gas, oil and gas exploration and production companies may cancel or curtail their drilling programs and may lower production spending on existing wells, thereby reducing demand for our services. Oil and gas prices have been volatile historically and, we believe, will continue to be so in the future. Many factors beyond our control affect oil and gas prices, including:

the United Statescost of exploring for, producing and elsewhere;delivering oil and gas;

the discovery rate of new oil and gas reserves;

the rate of decline of existing and new oil and gas reserves;

available pipeline and other oil and gas transportation capacity;

the ability of oil and gas companies to raise capital;

economic conditions in the United States and elsewhere;

actions by OPEC, the Organization of Petroleum Exporting Countries;

political instability in the Middle East and other major oil and gas producing regions;

governmental regulations, both domestic and foreign;

domestic and foreign tax policy;

weather conditions in the United States and elsewhere;

the pace adopted by foreign governments for the exploration, development and production of their national reserves;

the price of foreign imports of oil and gas; and

As a result of recent declines in oil and natural gas prices and substantial uncertainty in the capital markets due to the deteriorating global economic environment, our customers have reduced spending on exploration and production and this has resulted in a decrease in demand for our services. We are unable to determine whether customers and/or vendors and suppliers will be able to access financing necessary to sustain their current level of operations, fulfill their commitments and/or fund future operations and obligations. The deteriorating global economic environment may impact industry fundamentals, and the potential resulting decrease in demand for drilling and production services could adversely affect our business.

Oil and natural gas prices, and market expectations of potential changes in these prices, significantly impact the level of worldwide drilling and production services activities. Oil and natural gas prices have declined significantly during recent months in a deteriorating global economic environment. This decline in oil and natural gas prices, as well as the current crisis in the global credit markets, have caused exploration and production companies to reduce their overall level of drilling and production services activity and spending. When drilling and production activity and spending declines, both day rates and utilization have historically declined. As a result, the recent declines in oil and natural gas prices and the global economic crisis could materially and adversely affect our business and financial results.

Moreover, the deteriorating global economic environment may impact fundamentals that are critical to our industry, such as the global demand for, and consumption of, oil and natural gas. Reduced demand for oil and natural gas generally results in lower prices for these commodities and may impact the economics of planned drilling projects and ongoing production projects, resulting in the curtailment, reduction, delay or postponement of such projects for an indeterminate period of time. Companies that planned to finance exploration, development or production projects through the capital markets may be forced to curtail, reduce, postpone or delay drilling or production services activities, and also may experience inability to pay suppliers. The deteriorating global economic environment could also impact our vendors and suppliers’ ability to meet obligations to provide materials and services in general. If any of the foregoing were to occur, it could have a material adverse effect on our business and financial results.

Risks Relating to Our Business

We have a historyReduced demand for or excess capacity of losses and may experience losses in the future.drilling services or production services could adversely affect our profitability.

We have a history of losses during periods of reduced demand for drilling rigs. We incurred net losses of $1.8 million, $5.1 million and $0.4 million in the fiscal years ended March 31, 2004, 2003 and 2000, respectively. Our profitability in the future will depend on many factors, but largely on pricing and utilization rates and dayrates for our drilling rigs. Our currentand production services. A reduction in the demand for drilling rigs or an increase in the supply of drilling rigs, whether through new construction or refurbishment, could decrease the dayrates and utilization rates and dayrates may decline and we may experience losses in the future.

Our acquisition strategy involves various risks.

As a key component offor our business strategy, we have pursued and intend to continue to pursue acquisitions of complementary assets and businesses. For example, since March 31, 2003, our rig fleet has increased from 24 to 57 drilling rigs, primarily as a result of acquisitions. Certain risks are inherent in an acquisition strategy, such as increasing leverage and debt service requirements and combining disparate company cultures and facilities,services, which couldwould adversely affect our operating results. The success of any completed acquisition will dependrevenues and profitability. An increase in part on our ability to integrate effectively the acquired business into our operations. The process of integrating an acquired business may involve unforeseen difficulties and may require a disproportionate amount of management attention and financial and other resources. Possible future acquisitions may be for purchase prices significantly higher than those we paid for previous acquisitions. We may be unable to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms, obtain financing for acquisitions on satisfactory terms or successfully acquire identified targets. Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our financial condition and results of operations.

Our strategy of constructing drilling rigs during periods of peak demand requires that we maintain an adequate supply of drilling rig components to complete our rig building program. Our suppliers may be unable to continue providing uswell service rigs, wireline units and fishing and rental tools equipment, without a corresponding increase in demand, could similarly decrease the needed drilling rig components if their manufacturing sources are unable to fulfill their commitments.

In addition, we may not have sufficient capital resources to complete additional acquisitions. Historically, we have funded the growthpricing and utilization rates of our rig fleet through a combination of debtproduction services, which would adversely affect our revenues and equity financing. We may incur substantial additional indebtedness to finance future acquisitions and also may issue equity securities or convertible securities in connection with such acquisitions. Debt service requirements could represent a significant burden on our results of operations and financial condition and the issuance of additional equity could be dilutive to our existing stockholders. Furthermore, we may not be able to obtain additional financing on satisfactory terms.profitability.

We operate in a highly competitive, fragmented industry in which price competition is intense.could reduce our profitability.

We encounter substantial competition from other drilling contractors.contractors and other oilfield service companies. Our primary market areas are highly fragmented and competitive. The fact that drilling, workover and well-servicing rigs are mobile and can be moved from one market to another in response to market conditions heightens the competition in the industry.

The drilling contracts we compete for are usually awarded on the basis of competitive bids. In addition to pricingindustry and rig availability, we believe the following factors are also important to our customersmay result in determining which drilling contractor to select:

While we must be competitive in our pricing, our competitive strategy generally emphasizes the quality of our equipment, the safety record of our rigs and the quality of service and experience of our rig crews to differentiate us from our competitors. This strategy is less effective as lower demand for drilling services intensifies price competition and makes it more difficult for us to compete on the basis of factors other than price. In all of the markets in which we compete, an over-supplyoversupply of rigs can cause greater price competition.

in an area. Contract drilling companies and other oilfield service companies compete primarily on a regional basis, and the intensity of competition may vary significantly from region to region at any particular time. If demand for drilling or production services improves in a region where we operate, our competitors might respond by moving in suitable rigs from other regions. An influx of rigs from other regions could rapidly intensify competition, and reduce profitability and make any improvement in demand for drilling or production services short-lived.

Most drilling services contracts and production services contracts are awarded on the basis of competitive bids, which also results in price competition. In addition to pricing and rig availability, we believe the following factors are also important to our customers in determining which drilling services or production services provider to select:

the type and condition of each of the competing drilling, workover and well-servicing rigs;

the mobility and efficiency of the rigs;

the quality of service and experience of the rig crews;

the safety records of the rigs;

the offering of ancillary services; and

the ability to provide drilling and production equipment adaptable to, and personnel familiar with, new technologies and drilling and production techniques.

While we must be competitive in our pricing, our competitive strategy generally emphasizes the quality of our equipment, the safety record of our rigs, short-lived.our ability to offer ancillary services and the quality of service and experience of our rig crews to differentiate us from our competitors. This strategy is less effective as lower demand for drilling and production services or an oversupply of drilling, workover and well-servicing rigs intensifies price competition and makes it more difficult for us to compete on the basis of factors other than price. In all of the markets in which we compete, an oversupply of rigs can cause greater price competition, which can reduce our profitability.

We face competition from many competitors with greater resources.

Many of our competitors have greater financial, technical and other resources than we do. Their greater capabilities in these areas may enable them to:

better withstand industry downturns;

compete more effectively on the basis of price and technology;

retain skilled rig personnel; and

build new rigs or acquire and refurbish existing rigs so as to be able to place rigs into service more quickly than us in periods of high drilling demand.

Unexpected cost overruns on our turnkey drilling jobs and our footage contracts could adversely affect our financial position and our results of operations.

We have historically derived a significant portion of our revenues from turnkey drilling contracts, and we expect that they willturnkey contracts may represent a significant component of our future revenues. The occurrence of uninsured or under-insured losses or operating cost overruns on our turnkey jobs could have a material adverse effect on our financial position and

results of operations. Under a typical turnkey drilling contract, we agree to drill a well for our customer to a specified depth and under specified conditions for a fixed price. We provide technical expertise and engineering services, as well as most of the equipment and drilling supplies required to drill the well. We often subcontract for related services, such as the provision of casing crews, cementing and well logging. Underlogging.Under typical turnkey drilling arrangements, we do not receive progress payments and are paid by our customer only after we have performed the terms of the drilling contract in full. For these reasons, the risk to us under a turnkey drilling contract is substantially greater than for a well drilled on a daywork basis because we must assume most of the risks associated with drilling operations that the operator generally assumes under a daywork contract, including the risks of blowout, loss of hole, stuck drill pipe, machinery breakdowns, abnormal drilling conditions and risks associated with subcontractors’ services, supplies, cost escalations and personnel. Similar to our turnkey contracts, under a footage contract we assume most of the risks associated with drilling operations that the operator generally assumes under a daywork contract.

Although we attempt to obtain insurance coverage to reduce certain of the risks inherent in our turnkey drilling operations, adequate coverage may be unavailable in the future and we might have to bear the full cost of such risks, which could have an adverse effect on our financial condition and results of operations.

Our operations involve operating hazards, which, if not insured or indemnified against, could adversely affect our results of operations and financial condition.

Our operations are subject to the many hazards inherent in the contract land drilling, business,workover and well-servicing industries, including the risks of:

blowouts;

cratering;

fires and explosions;

loss of well control;

collapse of the borehole;

damaged or lost or stuck drill strings;drilling equipment; and

damage or loss from natural disasters.

Any of these hazards can result in substantial liabilities or losses to us from, among other things:

suspension of drilling operations;

damage to, or destruction of, our property and equipment and that of others;

personal injury and loss of life;

damage to producing or potentially productive oil and gas formations through which we drill; and

environmental damage.

We seek to protect ourselves from some but not all operating hazards through insurance coverage. However, some risks are either not insurable or insurance is available only at rates that we consider uneconomical. Those risks include pollution liability in excess of relatively low limits. Depending on competitive conditions and other factors, we attempt to obtain contractual protection against uninsured operating risks from our customers. However, customers who provide contractual indemnification protection may not in all cases maintain adequate insurance to support their indemnification obligations. Our insurance or indemnification arrangements may not adequately protect us against liability or loss from all the hazards of our operations. The occurrence of a significant event that we have not fully insured or indemnified against or the failure of a customer to meet its indemnification obligations to us could materially and adversely affect our results of operations and financial condition. Furthermore, we may be unable to maintain adequate insurance in the future at rates we consider reasonable.

We face increased exposure to operating difficulties because we primarily focus on providing drilling and production services for natural gas.

Most of our drilling and production contracts are with exploration and production companies in search of natural gas. Drilling on land for natural gas generally occurs at deeper drilling depths than drilling for oil. Although deep-depth drilling exposesand production services expose us to risks similar to risks encountered in shallow-depth drilling and production services, the magnitude of the risk for deep-depth drilling and production services is greater because of the higher costs and greater complexities involved in providing drilling and production services for deep wells. We generally do not insure risks related to operating difficulties other than blowouts. If we do not adequately insure the increased risk from blowouts or if our contractual indemnification rights are insufficient or unfulfilled, our profitability and other results of operationoperations and our financial condition could be adversely affected in the event we encounter blowouts or other significant operating difficulties while providing drilling or production services at deeper depths.

Our current primary focus on drilling for customers in search of natural gas could place us at a competitive disadvantage if we changedwere to change our primary focus to drilling for customers in search of oil.

Our drilling rig fleet consists of rigs capable of drilling on land at drilling depths of 6,000 to 18,000 feet because most of our contracts are with customers drilling in search of natural gas, which generally occurs at deeper drilling depths than drilling in search of oil, which often occurs at drilling depths less than 6,000 feet. Generally, larger drilling rigs capable of deep drilling generally incur higher mobilization costs than smaller drilling rigs drilling at shallower depths. If our primary focus shifts from drilling for customers in search of natural gas to drilling for customers in search of oil, the majority of our rig fleet would be disadvantaged in competing for new oil drilling projects as compared to competitors that primarily use shallower drilling depth rigs when drilling in search of oil.

Our operations are subject to various laws and governmental regulations that could restrict our future operations and increase our operating costs.

Many aspects of our operations are subject to various federal, state and local laws and governmental regulations, including laws and regulations governing:

Our operations are subject to stringent laws and regulations relating to containment, disposal and controlling the discharge of hazardous oilfield waste and other nonhazardous waste material into the environment, requiring removal and cleanup under certain circumstances, or otherwise relating to the protection of the environment. In addition, our operations are often conducted in or near ecologically sensitive areas, such as wetlands, which are subject to special protective measures and which may expose us to additional operating costs and liabilities for accidental discharges of oil, gas, drilling fluids or contaminated water or for noncompliance with other aspects of applicable laws. We are also subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state statutes. The OSHA hazard communication standard, the Environmental Protection Agency “community right-to-know” regulations under Title III of the Federal Superfund Amendment and Reauthorization Act and comparable state statutes require us to organize and report information about the hazardous materials we use in our operations to employees, state and local government authorities and local citizens.

Environmental laws and regulations are complex and subject to frequent change. In some cases, they can impose liability for the entire cost of cleanup on any responsible party without regard to negligence or fault and can impose liability on us for the conduct of others or conditions others have caused, or for our acts that complied with all applicable requirements when we performed them. We may also be exposed to environmental or other liabilities originating from businesses and assets which we purchased from others. Our compliance with amended, new or more stringent requirements, stricter interpretations of existing requirements or the future discovery of contamination may require us to make material expenditures or subject us to liabilities that we currently do not anticipate.

In addition, our business depends on the demand for land drilling services from the oil and gas industry and, therefore, is affected by tax, environmental and other laws relating to the oil and gas industry generally, by changes in those laws and by changes in related administrative regulations. It is also possible that these laws and regulations may in the future add significantly to our operating costs or those of our customers or otherwise directly or indirectly affect our operations.

We could be adversely affected if shortages of equipment, supplies or personnel occur.

From time to time there have been shortages of drilling and production services equipment and supplies during periods of high demand which we believe could reoccur.recur. Shortages could result in increased prices for drilling and production services equipment or supplies that we may be unable to pass on to customers. In addition, during periods of shortages, the delivery times for equipment and supplies can be substantially longer. Any significant delays in our obtaining drilling and production services equipment or supplies could limit drilling and production services operations and jeopardize our relations with customers. In addition, shortages of drilling and production services equipment or supplies could delay and adversely affect our ability to obtain new contracts for our rigs, which could have a material adverse effect on our financial condition and results of operations.

Our strategy of constructing drilling rigs during periods of peak demand requires that we maintain an adequate supply of drilling rig components to complete our rig building program. Our suppliers may be unable to continue providing us the needed drilling rig components if their manufacturing sources are unable to fulfill their commitments.

Our operations require the services of employees having the technical training and experience necessary to obtain the proper operational results. As a result, our operations depend, to a considerable extent, on the continuing availability of such personnel. Shortages of qualified personnel are occurring in our industry. If we should suffer any material loss of personnel to competitors or be unable to employ additional or replacement personnel with the requisite level of training and experience to adequately operate our equipment, our operations could be materially and adversely affected. A significant increase in the wages paid by other employers could result in a reduction in our workforce, increases in wage rates, or both. The occurrence of either of these events for a significant period of time could have a material and adverse effect on our financial condition and results of operations.

Our acquisition strategy exposes us to various risks, including those relating to difficulties in identifying suitable acquisition opportunities and integrating businesses, assets and personnel, as well as difficulties in obtaining financing for targeted acquisitions and the potential for increased leverage or debt service requirements.

As a key component of our business strategy, we have pursued and intend to continue to pursue acquisitions of complementary assets and businesses. For example, since March 31, 2003, our drilling rig fleet has increased from 24 to 70 drilling rigs, as a result of acquisitions and rig construction. In addition, during the first quarter of 2008, we completed the acquisition of the production services businesses of WEDGE and Competition.

Our acquisition strategy in general, and our recent acquisitions in particular, involve numerous inherent risks, including:

unanticipated costs and assumption of liabilities and exposure to unforeseen liabilities of acquired businesses, including environmental liabilities;

difficulties in integrating the operations and assets of the acquired business and the acquired personnel;

limitations on our ability to properly assess and maintain an effective internal control environment over an acquired business in order to comply with applicable periodic reporting requirements;

potential losses of key employees and customers of the acquired businesses;

risks of entering markets in which we have limited prior experience; and

increases in our expenses and working capital requirements.

The process of integrating an acquired business may involve unforeseen costs and delays or other operational, technical and financial difficulties that may require a disproportionate amount of management attention and financial and other resources. Possible future acquisitions may be for purchase prices significantly higher than those we paid for previous acquisitions. Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our financial condition and results of operations.

In addition, we may not have sufficient capital resources to complete additional acquisitions. Historically, we have funded the growth of our rig fleet through a combination of debt and equity financing. We may incur substantial additional indebtedness to finance future acquisitions and also may issue equity securities or convertible securities in connection with such acquisitions. Debt service requirements could represent a significant burden on our results of operations and financial condition and the issuance of additional equity or convertible securities could be dilutive to our existing shareholders. Furthermore, we may not be able to obtain additional financing on satisfactory terms.

Even if we have access to the necessary capital, we may be unable to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms or successfully acquire identified targets.

Our indebtedness could restrict our operations and make us more vulnerable to adverse economic conditions.

For several years we have had little or no long-term debt. In connection with the acquisition of the production services businesses of WEDGE and Competition, we entered into a new $400 million, five-year, senior secured revolving credit facility. As of December 31, 2008, our total debt was approximately $272.5 million.

Our current and future indebtedness could have important consequences, including:

impairing our ability to make investments and obtain additional financing for working capital, capital expenditures, acquisitions or other general corporate purposes;

limiting our ability to use operating cash flow in other areas of our business because we must dedicate a substantial portion of these funds to make principal and interest payments on our indebtedness;

making us more vulnerable to a downturn in our business, our industry or the economy in general as a substantial portion of our operating cash flow could be required to make principal and interest payments on our indebtedness, making it more difficult to react to changes in our business and in industry and market conditions;

limiting our ability to obtain additional financing that may be necessary to operate or expand our business;

putting us at a competitive disadvantage to competitors that have less debt; and

increasing our vulnerability to rising interest rates.

We anticipate that our cash generated by operations and our ability to borrow under the currently unused portion of our senior secured revolving credit facility should allow us to meet our routine financial obligations for the foreseeable future. However, our ability to make payments on our indebtedness, and to fund planned capital expenditures, will depend on our ability to generate cash in the future. This, to a certain extent, is subject to conditions in the oil and gas industry, general economic and financial conditions, competition in the markets where we operate, the impact of legislative and regulatory actions on how we conduct our business and other factors, all of which are beyond our control. If our business does not generate sufficient cash flow from operations to service our outstanding indebtedness, we may have to undertake alternative financing plans, such as:

refinancing or restructuring our debt;

selling assets;

reducing or delaying acquisitions or capital investments, such as refurbishments of our rigs and related equipment; or

seeking to raise additional capital.

However, we may be unable to implement alternative financing plans, if necessary, on commercially reasonable terms or at all, and any such alternative financing plans might be insufficient to allow us to meet our debt obligations. If we are unable to generate sufficient cash flow or are otherwise unable to obtain the funds required to make principal and interest payments on our indebtedness, or if we otherwise fail to comply with the various covenants in our senior secured revolving credit facility or other instruments governing any future indebtedness, we could be in default under the terms of our senior secured revolving credit facility or such instruments. In the event of a default, the Lenders under our senior secured revolving credit facility could elect to declare all the loans made under such facility to be due and payable together with accrued and unpaid interest and terminate their commitments thereunder and we or one or more of our subsidiaries could be forced into bankruptcy or liquidation. Any of the foregoing consequences could materially and adversely affect our business, financial condition, results of operations and prospects.

Our senior secured revolving credit facility imposes restrictions on us that may affect our ability to successfully operate our business.

Our senior secured revolving credit facility limits our ability to take various actions, such as:

limitations on the incurrence of additional indebtedness;

restrictions on investments, mergers or consolidations, asset dispositions, acquisitions, transactions with affiliates and other transactions without the lenders’ consent; and

limitation on dividends and distributions.

In addition, our senior secured revolving credit facility requires us to maintain certain financial ratios and to satisfy certain financial conditions, which may require us to reduce our debt or take some other action in order to comply with them. The failure to comply with any of these financial conditions, such as financial ratios or

covenants, would cause an event of default under our senior secured revolving credit facility. An event of default, if not waived, could result in acceleration of the outstanding indebtedness under our senior secured revolving credit facility, in which case the debt would become immediately due and payable. If this occurs, we may not be able to pay our debt or borrow sufficient funds to refinance it. Even if new financing is available, it may not be available on terms that are acceptable to us. These restrictions could also limit our ability to obtain future financings, make needed capital expenditures, withstand a downturn in our business or the economy in general, or otherwise conduct necessary corporate activities. We also may be prevented from taking advantage of business opportunities that arise because of the limitations imposed on us by the restrictive covenants under our senior secured revolving credit facility.

Our international operations are subject to political, economic and other uncertainties not encountered in our domestic operations.

As we continue to implement our strategy of expanding into areas outside the United States, our international operations will be subject to political, economic and other uncertainties not generally encountered in our U.S. operations. These will include, among potential others:

risks of war, terrorism, civil unrest and kidnapping of employees;

expropriation, confiscation or nationalization of our assets;

renegotiation or nullification of contracts;

foreign taxation;

the inability to repatriate earnings or capital due to laws limiting the right and ability of foreign subsidiaries to pay dividends and remit earnings to affiliated companies;

changing political conditions and changing laws and policies affecting trade and investment;

regional economic downturns;

the overlap of different tax structures;

the burden of complying with multiple and potentially conflicting laws;

the risks associated with the assertion of foreign sovereignty over areas in which our operations are conducted;

difficulty in collecting international accounts receivable; and

potentially longer payment cycles.

Our international operations may also face the additional risks of fluctuating currency values, hard currency shortages and controls of foreign currency exchange. Additionally, in some jurisdictions, we may be subject to foreign governmental regulations favoring or requiring the awarding of contracts to local contractors or requiring foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. These regulations could adversely affect our ability to compete.

Our operations are subject to various laws and governmental regulations that could restrict our future operations and increase our operating costs.

Many aspects of our operations are subject to various federal, state and local laws and governmental regulations, including laws and regulations governing:

environmental quality;

pollution control;

remediation of contamination;

preservation of natural resources;

transportation, and

worker safety.

Our operations are subject to stringent federal, state and local laws, rules and regulations governing the protection of the environment and human health and safety. Some of those laws, rules and regulations relate to the disposal of hazardous substances, oilfield waste and other waste materials and restrict the types, quantities and concentrations of those substances that can be released into the environment. Several of those laws also require removal and remedial action and other cleanup under certain circumstances, commonly regardless of fault. Our operations routinely involve the handling of significant amounts of waste materials, some of which are classified as hazardous substances. Planning, implementation and maintenance of protective measures are required to prevent accidental discharges. Spills of oil, natural gas liquids, drilling fluids and other substances may subject us to penalties and cleanup requirements. Handling, storage and disposal of both hazardous and non-hazardous wastes are also subject to these regulatory requirements. In addition, our operations are often conducted in or near ecologically sensitive areas, such as wetlands, which are subject to special protective measures and which may expose us to additional operating costs and liabilities for accidental discharges of oil, gas, drilling fluids, contaminated water or other substances, or for noncompliance with other aspects of applicable laws and regulations.

The federal Clean Water Act, as amended by the Oil Pollution Act, the federal Clean Air Act, the federal Resource Conservation and Recovery Act, the federal Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, the Safe Drinking Water Act, the Occupational Safety and Health Act, or OSHA, and their state counterparts and similar statutes are the primary statutes that impose the requirements described above and provide for civil, criminal and administrative penalties and other sanctions for violation of their requirements. The OSHA hazard communication standard, the Environmental Protection Agency “community right-to-know” regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require us to organize and report information about the hazardous materials we use in our operations to employees, state and local government authorities and local citizens. In addition, CERCLA, also known as the “Superfund” law, and similar state statutes impose strict liability, without regard to fault or the legality of the original conduct, on certain classes of persons who are considered responsible for the release or threatened release of hazardous substances into the environment. These persons include the current owner or operator of a facility where a release has occurred, the owner or operator of a facility at the time a release occurred, and companies that disposed of or arranged for the disposal of hazardous substances found at a particular site. This liability may be joint and several. Such liability, which may be imposed for the conduct of others and for conditions others have caused, includes the cost of removal and remedial action as well as damages to natural resources. Few defenses exist to the liability imposed by environmental laws and regulations. It is also common for third parties to file claims for personal injury and property damage caused by substances released into the environment.

Environmental laws and regulations are complex and subject to frequent change. Failure to comply with governmental requirements or inadequate cooperation with governmental authorities could subject a responsible party to administrative, civil or criminal action. We may also be exposed to environmental or other liabilities originating from businesses and assets which we acquired from others. Our compliance with amended, new or more stringent requirements, stricter interpretations of existing requirements or the future discovery of contamination or regulatory noncompliance may require us to make material expenditures or subject us to liabilities that we currently do not anticipate.

In addition, our business depends on the demand for land drilling and production services from the oil and gas industry and, therefore, is affected by tax, environmental and other laws relating to the oil and gas industry generally, by changes in those laws and by changes in related administrative regulations. It is possible that these laws and regulations may in the future add significantly to our operating costs or those of our customers, or otherwise directly or indirectly affect our operations.

Among the services we provide, we operate as a motor carrier and therefore are subject to regulation by the U.S. Department of Transportation and by various state agencies. These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations and regulatory safety. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment and product handling requirements. The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand for common or contract carrier services or the cost of providing truckload services. Some of these possible changes include increasingly stringent environmental regulations, changes in the hours of service regulations which govern the amount of time a driver may drive in any specific period, onboard black box recorder devices or limits on vehicle weight and size.

Interstate motor carrier operations are subject to safety requirements prescribed by the U.S. Department of Transportation. To a large degree, intrastate motor carrier operations are subject to state safety regulations that mirror federal regulations. Such matters as weight and dimension of equipment are also subject to federal and state regulations.

From time to time, various legislative proposals are introduced, including proposals to increase federal, state, or local taxes, including taxes on motor fuels, which may increase our costs or adversely impact the recruitment of drivers. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted.

Our combined operating history may not be sufficient for investors to evaluate our business and prospects.

The acquisition of the production services businesses of WEDGE and Competition significantly expanded our operations and assets. Our historical combined financial statements include financial information based on the separate production services businesses of WEDGE and Competition. As a result, the historical and pro forma information presented may not provide an accurate indication of what our actual results would have been if the acquisition of the production services businesses of WEDGE and Competition had been completed at the beginning of the periods presented or of what our future results of operations are likely to be. Our future results will depend on our ability to efficiently manage our combined operations and execute our business strategy.

Risk Relating to Our Capitalization and Organizational Documents

Under our existing dividend policy, weWe do not intend to pay dividends on our common stock.stock in the foreseeable future, and therefore only appreciation of the price of our common stock will provide a return to our shareholders.

We have not paid or declared any dividends on our common stock and currently intend to retain any earnings to fund our working capital needs and growth opportunities. Any future dividends will be at the discretion of our board of directors after taking into account various factors it deems relevant, including our financial condition and performance, cash needs, income tax consequences and the restrictions imposed by the Texas Business Corporation Act and other applicable laws and by our credit facilities. Our debt arrangements include provisions that generally prohibit us from paying dividends on our capital stock, including our common stock.

We may issue preferred stock whose terms could adversely affect the voting power or value of our common stock.

Our articles of incorporation authorize us to issue, without the approval of our shareholders, one or more classes or series of preferred stock having such designations, preferences, limitations and relative rights, including preferences over our common stock respecting dividends and distributions, as our board of directors may determine. The terms of one or more classes or series of preferred stock could adversely impact the voting power or value of our common stock. For example, we might grant holders of preferred stock the right to elect some number of our directors in all events or on the happening of specified events or the right to veto specified transactions. Similarly, the repurchase or redemption rights or liquidation preferences we might assign to holders of preferred stock could affect the residual value of the common stock.

Provisions in our organizational documents could delay or prevent a change in control of our company even if that change would be beneficial to our shareholders.

The existence of some provisions in our organizational documents could delay or prevent a change in control of our company even if that change would be beneficial to our shareholders. Our articles of incorporation and bylaws contain provisions that may make acquiring control of our company difficult, including:

provisions regulating the ability of our shareholders to nominate candidates for election as directors or to bring matters for action at annual meetings of our shareholders;

limitations on the ability of our shareholders to call a special meeting and act by written consent;

provisions dividing our board of directors into three classes elected for staggered terms; and

the authorization given to our board of directors to issue and set the terms of preferred stock.

Item 1BWe may continue to experience market conditions that could adversely affect the liquidity of our auction rate preferred security investment.. Unresolved Staff Comments

None.At December 31, 2008, we held $15.9 million (par value) of investments comprised of tax exempt, auction rate preferred securities (“ARPSs”), which are variable-rate preferred securities and have a long-term maturity with the interest rate being reset through “Dutch auctions” that are held every 7 days. The ARPSs have historically traded at par because of the frequent interest rate resets and because they are callable at par at the option of the issuer. Interest is paid at the end of each auction period. Our ARPSs are AAA/Aaa rated securities, collateralized by municipal bonds and backed by assets that are equal to or greater than 200% of the liquidation preference. Until February 2008, the auction rate securities market was highly liquid. Beginning mid-February 2008, we experienced several “failed” auctions, meaning that there was not enough demand to sell all of the securities that holders desired to sell at auction. The immediate effect of a failed auction is that such holders cannot sell the securities at auction and the interest rate on the security resets to a maximum auction rate. We have continued to receive interest payments on our ARPSs in accordance with their terms. Unless a future auction is successful or the issuer calls the security pursuant to redemption prior to maturity, we may not be able to access the funds we invested in our ARPSs without a loss of principal. We have no reason to believe that any of the underlying municipal securities that collateralize our ARPSs are presently at risk of default. We believe we will ultimately be able to liquidate our investments without material loss primarily due to the collateral securing the ARPSs. We do not currently intend to attempt to sell our ARPSs at a discount since our liquidity needs are expected to be met with cash flows from operating activities and our senior secured revolving credit facility. Our ARPSs are designated as available-for-sale and are reported at fair market value with the related unrealized gains or losses, included in accumulated other comprehensive income (loss), net of tax, a component of shareholders’ equity. The estimated fair value of our ARPSs at December 31, 2008 was $13.9 million compared with a par value of $15.9 million. The $2.0 million difference represents a fair value discount due to the current lack of liquidity which is considered temporary and is recorded as an unrealized loss. We would recognize an impairment charge if the fair value of our investments falls below the cost basis and is judged to be other-than-temporary. Our ARPSs are classified with other long-term assets on our consolidated balance sheet as of December 31, 2008 because of our inability to the determine recovery period of our investments.

| Item 1B. | Unresolved Staff Comments |

Not applicable.

| Item 2. | Properties |

For a description of our significant properties, see “Business – Drilling Equipment”“Business—Overview of Our Segments and “Business – Services” and “Business—Facilities” in Item 1 of this report. We consider each of our significant properties to be suitable for its intended use.

| Item 3. | Legal Proceedings |

Due to the nature of our business, we are, from time to time, involved in routine litigation or subject to disputes or claims related to our business activities, including workers’ compensation claims and employment-related disputes. In the opinion of our management, none of the pending litigation, disputes or claims against us will have a material adverse effect on our financial condition or results of operations.

Item 4. Submission of Matters to a Vote of Security Holders

| Item 4. | Submission of Matters to a Vote of Security Holders |

We did not submit any matter to a vote of our stockholdersshareholders during the fourth quarter of fiscal 2006.ended December 31, 2008.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

| Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

As of May 12, 2006, 49,591,978February 6, 2009, 49,997,578 shares of our common stock were outstanding, held by 512560 shareholders of record. The number of record holders does not necessarily bear any relationship to the number of beneficial owners of our common stock.

Our common stock trades on the American Stock Exchange (NYSE Alternext US) under the symbol “PDC.” The following table sets forth, for each of the periods indicated, the high and low sales prices per share on the American Stock Exchange:Exchange (NYSE Alternext US):

| Low | High | Low | High | |||||||||

| Fiscal Year Ended March 31, 2006: | ||||||||||||

Fiscal Year Ended December 31, 2008: | ||||||||||||

First Quarter | $ | 10.57 | $ | 16.30 | $ | 10.59 | $ | 16.70 | ||||

Second Quarter | 14.00 | 19.93 | 15.29 | 20.64 | ||||||||

Third Quarter | 14.25 | 19.98 | 12.49 | 18.82 | ||||||||

Fourth Quarter | 13.10 | 23.06 | 4.85 | 13.09 | ||||||||

| Fiscal Year Ended March 31, 2005: | ||||||||||||

Nine Months Ended December 31, 2007: | ||||||||||||

First Quarter | $ | 12.69 | $ | 16.00 | ||||||||

Second Quarter | 11.81 | 14.88 | ||||||||||

Third Quarter | 11.49 | 12.49 | ||||||||||

Fiscal Year Ended March 31, 2007: | ||||||||||||

First Quarter | $ | 5.60 | $ | 7.99 | $ | 12.60 | $ | 18.00 | ||||

Second Quarter | 6.75 | 8.90 | 10.79 | 15.70 | ||||||||

Third Quarter | 7.63 | 10.50 | 11.57 | 14.65 | ||||||||

Fourth Quarter | 9.05 | 14.21 | 11.46 | 13.47 | ||||||||

| Fiscal Year Ended March 31, 2004: | ||||||||||||

First Quarter | $ | 3.57 | $ | 5.24 | ||||||||

Second Quarter | 3.65 | 4.99 | ||||||||||

Third Quarter | 3.30 | 5.20 | ||||||||||

Fourth Quarter | 4.75 | 7.35 | ||||||||||

The last reported sales price for our common stock on the American Stock Exchange (NYSE Alternext US) on May 12, 2006February 6, 2009 was $15.39$5.08 per share.

We have not paid or declared any dividends on our common stock and currently intend to retain earnings to fund our working capital needs and growth opportunities. Any future dividends will be at the discretion of our board of directors after taking into account various factors it deems relevant, including our financial condition and performance, cash needs, income tax consequences and the restrictions Texas and other applicable laws and our credit facilities then impose. Our debt arrangements include provisions that generally prohibit us from paying dividends, other than dividends on our preferred stock. We currently have no preferred stock outstanding.

No shares of our common stock were purchased by or on behalf of our company or any affiliated purchaser during the fiscal year ended December 31, 2008.

Performance Graph

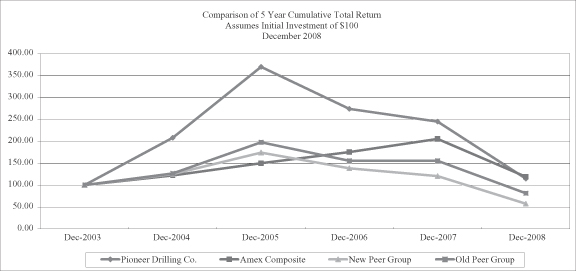

The following graph compares, for the periods from December 31, 2003 to December 31, 2008, the cumulative total shareholder return on our common stock with the (1) cumulative total return on the companies that comprise the AMEX Composite Index, (2) an old peer group index that includes the five companies that primarily provide contract drilling services, and (3) a new peer group index that includes five companies that provide contract drilling services and / or production services. With the acquisition of WEDGE and Competition on March 1, 2008, we expanded our operations beyond providing only contract drilling services and began providing production services. We believe the companies included in the new peer group index better reflect our peers with similar service offerings. The comparison assumes that $100 was invested on December 31, 2003 in our common stock, the companies that compose the AMEX Composite Index and the companies that compose the old and new peer group indexes, and further assumes all dividends were reinvested.

The companies that comprise the old peer group index are Helmerich & Payne, Inc., Grey Wolf, Inc., Patterson-UTI Energy, Inc., Nabors Industries Ltd. and Unit Corp. The companies that comprise the new peer group index are Patterson-UTI Energy, Inc., Nabors Industries Ltd., Bronco Drilling Company, Precision Drilling Trust and Key Energy Services.

Equity Compensation Plan Information

The following table provides information on our equity compensation plans as of MarchDecember 31, 2006:2008:

Plan category | Number of securities to be (a) | Weighted-average (b) | Number of securities (c) | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price per share of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (1) | ||||||||

Equity compensation plans approved by security holders | 1,592,833 | $ | 7.71 | 1,618,500 | 3,769,695 | $ | 12.85 | 2,035,073 | ||||||

Equity compensation plans not approved by security holders | — | — | — | — | — | — | ||||||||

Total | 1,592,833 | $ | 7.71 | 1,618,500 | 3,769,695 | $ | 12.85 | 2,035,073 | ||||||

Item 6. Selected Financial Data

| (1) | Includes 822,489 shares that may be issued in the form of restricted stock or restricted stock units under the Amended and Restated Pioneer Drilling Company 2007 Incentive Plan. |

| Item 6. | Selected Financial Data |

The following information derives from our audited financial statements. You should review this information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of this report and the historical financial statements and related notes this report contains.

| Years Ended March 31, | |||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||||

| (In thousands, except per share amounts) | |||||||||||||||||

Contract drilling revenues | $ | 284,148 | $ | 185,246 | $ | 107,876 | $ | 80,183 | $ | 68,627 | |||||||

Income (loss) from operations | 77,909 | 18,774 | 438 | (4,943 | ) | 11,201 | |||||||||||

Income (loss) before income taxes | 79,813 | 17,161 | (2,216 | ) | (7,305 | ) | 9,737 | ||||||||||

Preferred dividends | — | — | — | — | 93 | ||||||||||||

Net earnings (loss) applicable to common stockholders | 50,567 | 10,812 | (1,790 | ) | (5,086 | ) | 6,225 | ||||||||||

Earnings (loss) per common share-basic | 1.08 | 0.31 | (0.08 | ) | (0.31 | ) | 0.41 | ||||||||||

Earnings (loss) per common share-diluted | 1.06 | 0.30 | (0.08 | ) | (0.31 | ) | 0.35 | ||||||||||

Long-term debt and capital lease obligations, excluding current installments | — | 13,445 | 44,892 | 45,855 | 26,119 | ||||||||||||

Shareholders’ equity | 340,676 | 221,615 | 70,836 | 47,672 | 33,343 | ||||||||||||

Total assets | 400,678 | 276,009 | 143,731 | 119,694 | 83,450 | ||||||||||||