UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10–KForm 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 20062009

ORor

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-8399

WORTHINGTON INDUSTRIES, INC.

(Exact nameName of Registrant as specifiedSpecified in its charter)Charter)

Ohio | 31-1189815 | |||

| (State or | Organization) | (I.R.S. Employer Identification No.) | ||

200 Old Wilson Bridge Road, Columbus, Ohio | 43085 | |||

| (Address of | Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area | (614) 438-3210 | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of Common Shares, Without Par Value | Name of New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes x No ¨ |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES x NO ¨

Indicate by check mark if the Registrantregistrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x |

YES ¨ NO x

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES Yes x NO No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrantregistrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a non-accelerated filer.smaller reporting company. See definitionthe definitions of “large accelerated filer,” “accelerated filerfiler” and large accelerated filer”“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filerx Accelerated filer¨ Non-accelerated filer¨ Smaller reporting company ¨

�� (Do not check if a smaller reporting company)

Indicate by check mark whether the Registrantregistrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES Yes ¨ NO No x

The aggregate market value of the Common Shares (the only common equity) of the Registrant held by non-affiliates of the Registrant, based oncomputed by reference to the closing price on the New York Stock Exchange on November 30, 200528, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1,757,447,872.$1,423,212,576.

TheIndicate the number of Registrant’sshares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. On July 24, 2009, the number of Common Shares issued and outstanding as of August 1, 2006, was 88,807,354.79,092,675.

DOCUMENT INCORPORATED BY REFERENCEREFERENCE:

Selected portions of the Registrant’s definitive Proxy Statement to be furnished to shareholders of the Registrant in connection with the Annual Meeting of Shareholders to be held on September 27, 2006,30, 2009, are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent provided herein.

| ii | ||||||

Item 1. | 1 | |||||

Item 1A. | ||||||

Item 1B. | ||||||

Item 2. | ||||||

Item 3. | ||||||

Item 4. | ||||||

Supplemental | ||||||

Item. | ||||||

Item 5. | ||||||

Item 6. | ||||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||

Item 7A. | Quantitative and Qualitative Disclosures | |||||

Item 8. | ||||||

Item 9. | Changes in and Disagreements | |||||

Item 9A. | ||||||

Item 9B. | ||||||

Item 10. | Directors, | |||||

Item 11. | ||||||

Item 12. | ||||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||

Item 14. | ||||||

Item 15. | ||||||

| 95 | ||||||

| E-1 | ||||||

i

Selected statements contained in this Annual Report on Form 10-K, including, without limitation, in “PART I – Item 1. – Business” and “PART II – Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations,” constitute “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). These forward-looking statements include, without limitation, statements relating to:

• | business plans or future or expected performance, |

• | projected capacity and working capital needs; |

• | demand trends for the Company or its markets; |

| • | pricing trends for raw materials and finished goods; |

• | anticipated capital expenditures and asset sales; |

• | anticipated improvements and efficiencies in operations, sales and sourcing and the results thereof; |

| • | anticipated impacts of transformation efforts; |

| • | projected timing, results, benefits, costs, charges and expenditures related to |

• | the alignment of operations with demand; |

| • | the ability to develop or take advantage of future opportunities, new products and markets; |

• | expectations for Company and customer inventories, jobs and orders; |

• | expectations for the economy and |

• | expected benefits from transformation plans, cost reduction efforts and other new |

• | expectations for improving earnings, margins or shareholder value; |

| • | effects of judicial rulings; and |

• | other non-historical matters. |

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation:limitation, those that follow:

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| the effect of national, regional and worldwide economic conditions generally and within major product markets, including a prolonged or substantial economic downturn; |

• | the effect of |

| • | product demand and pricing; |

| • | changes in product mix, product substitution and market acceptance of the Company’s products; |

| • | fluctuations in pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities and other items required by operations; |

| • | effects of facility closures and the consolidation of operations; |

| • | the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; |

| • | failure to maintain appropriate levels of inventories; |

| • | financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; |

| • | failure to maintain, or any adverse changes in, our existing committed credit facilities, or our credit ratings; |

| • | the ability to realize targeted expense reductions from head count reductions, facility closures and other cost reduction efforts; |

| • | the ability to realize other cost savings and operational, sales and sourcing improvement and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; |

| • | the overall success of, and the ability to integrate, newly-acquired businesses and achieve synergies therefrom; |

ii

| • | capacity levels and efficiencies, and other expected benefits from transformation initiatives within facilities and within the industry as a whole; |

| • | the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment |

• | changes in customer demand, inventories, spending patterns, product choices, and supplier choices; |

• | risks associated with doing business internationally, including economic, political and social instability, and foreign currency |

• | the ability to improve and maintain processes and business practices |

• |

|

• | deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; |

• | level of imports and import prices in the Company’s markets; |

| • | the impact of judicial rulings and governmental regulations, both in the United States and abroad; and |

• | other risks described from time to time in |

We note these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, you should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Any forward-looking statements in this Annual Report on Form 10-K are based on current information as of the date of this Annual Report on Form 10-K, and we assume no obligation to correct or update any such statements in the future, except as required by applicable law.

iiiii

General Overview

Worthington Industries, Inc., an is a corporation formed under the laws of the State of Ohio corporation (individually, the “Registrant” or “Worthington Industries” or, together with its subsidiaries, “Worthington”collectively, “we,” “our,” “Worthington,” or “Company”),. Founded in 1955, Worthington is primarily a diversified metal processing company, focused on value-added steel processing and manufactured metal products, such as metal framing, pressure cylinders, automotive past-modelpast- and current-model year service stampings and, through joint ventures, metal ceiling grid systems and laser-welded blanks.

Worthington was founded in 1955 and as of August 1, 2006, operates 46 manufacturing facilities worldwide and holds equity positions in seven joint ventures, which operate an additional 15 manufacturing facilities worldwide.

Worthington is headquartered at 200 Old Wilson Bridge Road, Columbus, Ohio 43085, telephone (614) 438-3210. The common shares of Worthington Industries are traded on the New York Stock Exchange under the symbol WOR.

Worthington made changes during the second quarter of the fiscal year ended May 31, 2006 (“fiscal 2006”) to the internal organizational and reporting structure, affecting the composition of its business segments. The Automotive Body Panels reporting segment, consisting of The Gerstenslager Company, which was previously combined with Steel Processing in the Processed Steel Products reportable segment, was moved to the “Other” category and the Processed Steel Products reportable segment was renamed Steel Processing. Dietrich Construction Group was formed and includes Dietrich Building Systems, which was previously included in the Metal Framing reportable segment, Dietrich Residential Construction, and a research and development project in China. Dietrich Construction Group is now included in the Construction Services reporting segment, and is reported in the “Other” category. All segment financial information for the prior periods has been reclassified to reflect these changes.

Operations are currently reported in three principal reportable segments: Steel Processing, Metal Framing and Pressure Cylinders. All financial information included in this Annual Report on Form 10-K for periods prior to the second quarter of fiscal 2006 has been reclassified to reflect the segment changes discussed in the immediately preceding paragraph. The Steel Processing segment consists of the Worthington Steel business unit (“Worthington Steel”). The Metal Framing segment consists of the Dietrich Metal Framing business unit (“Dietrich”). The Pressure Cylinders segment consists of the Worthington Cylinder business unit (“Worthington Cylinders”). The “Other” category includes the Automotive Body Panels, Construction Services and Steel Packaging operating segments and also includes income and expense items not allocated to the reportable segments.

Worthington holds equity positions in seven joint ventures, further discussed below under the subheading “Joint Ventures.” One joint venture is consolidated while the remaining six joint ventures are unconsolidated.

During fiscal 2006, the Steel Processing, Metal Framing and Pressure Cylinders segments served approximately 1,050, 2,075 and 2,325 customers, respectively, located primarily in the United States. Foreign sales account for less than 10% of consolidated net sales and are comprised primarily of sales to customers in Canada and Europe. No single customer accounts for over 5% of consolidated net sales.

Worthington Industries maintains an Internet web site at www.worthingtonindustries.com. This uniform resource locator, or URL, is an inactive textual reference only and is not intended to incorporate Worthington Industries’ web site into this Annual Report on Form 10-K. Annual reportsReports on Form 10-K, quarterly reportsQuarterly Reports on Form 10-Q, current reportsCurrent Reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available free of charge, on or through the Worthington Industries web site, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”).

Business Segments

At the end of the fiscal year ended May 31, 2009 (“fiscal 2009”), the Company had 41 manufacturing facilities worldwide and held equity positions in six joint ventures, which operated an additional 19 manufacturing facilities worldwide.

The Company has three principal reportable business segments: Steel Processing, Metal Framing and Pressure Cylinders. The Steel Processing business segment consists of the Worthington Steel business unit (“Worthington Steel”). The Metal Framing business segment consists of the Dietrich Metal Framing business unit (“Dietrich”). The Pressure Cylinders business segment consists of the Worthington Cylinder business unit (“Worthington Cylinders”). All other business units not included in these three reportable business segments are combined and disclosed in the ‘Other’ category, which also includes income and expense items not allocated to the business segments. The Other category includes the Automotive Body Panels, Construction Services and Steel Packaging business units.

Worthington holds equity positions in six joint ventures, which are further discussed below under the subheading “Joint Ventures.” Only one of the six joint ventures is consolidated and its operating results are reported in the Steel Processing business segment.

During fiscal 2009, the Steel Processing, Metal Framing and Pressure Cylinders business segments served approximately 1,100, 3,900 and 2,000 customers, respectively, located primarily in the United States. Foreign sales accounted for approximately 9% of consolidated net sales and were comprised primarily of sales to customers in Canada and Europe. No single customer accounted for over 5% of consolidated net sales. Further reportable business segment data is provided in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note H – Segment Data” of this Annual Report on Form 10-K. That data is incorporated herein by reference.

Transformation Plan

In fiscal 2008, we initiated a Transformation Plan (the "Plan") with the overall goal to improve the Company's sustainable earnings potential, asset utilization and operational performance. The Plan is being implemented over a three-year period and focuses on cost reduction, margin expansion and organizational capability improvements, and in the process seeks to drive excellence in three core competencies: sales, operations and supply chain management. The Plan is comprehensive in scope and includes aggressive diagnostic and implementation phases in the Steel Processing and Metal Framing business segments.

We retained a consulting firm to assist in the development and implementation of the Plan. The services provided by this firm included diagnostic tools, performance improvement technologies, project management techniques, benchmarking information, and insights that directly relate to the Plan. Internal transformation teams have also been formed and are dedicated to the Plan efforts. As of May 31, 2009, responsibility for executing the Plan has been successfully transitioned to our internal transformation teams.

Plan initiatives executed to date include facility closings, head count reductions, other cost reductions, an enhanced and more focused commercial sales effort, improved operating efficiencies, a consolidated sourcing and supply chain strategy, and a continued emphasis on safety. The positive results of these efforts, however, have been over-shadowed by the negative impact of the recessionary business conditions.

Pre-tax restructuring charges associated with the Plan totaled $43,041,000 for fiscal 2009. See “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note N – Restructuring,” of this Annual Report on Form 10-K for further information on restructuring charges. We anticipate that we will incur an additional $6,000,000 in restructuring charges during the fiscal year ending May 31, 2010.

Recent Developments

On June 13, 2005,2, 2008, Worthington Industries announced that its board of directors had authorized the repurchase of up to 10.0 millionpurchased substantially all of the outstanding common sharesassets of The Sharon Companies Ltd. (“Worthington Industries.Stairs”) for $37,150,000. Worthington Stairs designs and manufactures steel egress stair systems for the commercial construction market, and operates one manufacturing facility in Akron, Ohio. It operates as part of the Construction Services segment, Worthington Integrated Building Systems, LLC (“WIBS”). The purchases may be made from time to time, on the open market or in private transactions, with consideration givenpurchase price was allocated to the market priceacquired assets and assumed liabilities based on their estimated fair values at the date of acquisition, with goodwill representing the excess of the common shares,purchase price over the naturefair value allocated to the net assets. The purchase price allocated to intangible assets will be amortized over a weighted average life of other investment opportunities, cash flows from operations and general economic conditions. No repurchases of common shares pursuant to this authorization occurred during fiscal 2006.13 years.

On September 27, 2005, Dietrich entered intoJuly 31, 2008, our Worthington Steelpac Systems, LLC (“Steelpac”) subsidiary purchased the assets of Laser Products (“Laser”) for $3,425,000. Laser is a joint development agreement with NOVA Chemicals Corporationsteel rack fabricator primarily serving the auto industry. The purchase price was allocated to evaluateworking capital, fixed assets, and commercialize novel construction products that combine the structural benefits of light-gauge steel framing with the thermalcustomer list. The purchase price allocated to customer list will be amortized over ten years.

On October 1, 2008, Worthington expanded and moisture retardant properties of expandable polystyrene. On July 20, 2006,modified Worthington announced that Dietrich had formed a 50:50Specialty Processing (“WSP”), our joint venture with NOVA ChemicalsUnited States Steel Corporation (“U.S. Steel”). U.S. Steel contributed ProCoil Company L.L.C., its steel processing facility in Canton, Michigan that is intendedslits, cuts-to-length and presses blanks from steel coils to developdesired specifications, and manufacture durable, energy-saving composite construction productsalso provides laser welding services and systems.warehouses material for automotive customers. Worthington contributed its steel processing subsidiary in Taylor, Michigan that slits, cuts-to-length and tension levels steel coils, plus $2,500,000 in cash. After the contributions, Worthington owns 51% and U.S. Steel owns 49% of WSP. The joint venture’s current focusventure will continue to be accounted for using the equity method as both parties have equal control. WSP is on developing cost-effective insulated metal framing panels intendedexpected to remove significant obstacles to using steel framing products for exterior walls in areas where interior/exterior temperature variations may cause condensation.

On September 29, 2005, Worthington Industries amended and restated its $435,000,000 long-term unsecured revolving credit facility. The amended and restated facility provides for an extensionbetter serve the changing needs of the revolving credit commitmentsautomotive and flat-rolled customers by allowing each of the three entities to September 2010; replacesmaximize their individual processing specialties with this expansion of the leverage ratio (debt-to-EBITDA) financial covenant with an interest coverage ratio (EBITDA-to-interest expense) financial covenant; and reduces the facility fees payable. Borrowings under the amended and restated facility may be used to fund general corporate purposes including working capital, capital expenditures, acquisitions and dividends. The facility was unused at May 31, 2006.joint venture.

On

During October 17, 2005, Worthington acquired the remaining 50%2008, we sold our 49% equity interest in Dietrich Residential Construction, LLC from its partner, Pacific Steel Construction,Canessa Worthington Slovakia s.r.o. for $3,773,000 cash and debt assumptionapproximately $3,700,000 to the Magnetto Group, the other member of $4,153,000. This acquisition provides panelizing capabilities and further opens the door to United States military housing and residential housing markets.joint venture. The gain on the transaction was immaterial.

In November 2005, Dietrich launched the “UltraSTEEL™” drywall metal framing line in Florida. As of May 31, 2006, the “UltraSTEEL™” product line had been introduced into markets in the Southeast and Northeast and machinery conversions were underway to make “UltraSTEEL™” products in the Midwest and Southwest. A license from Hadley Industries PLC (“Hadley”) grants Dietrich the exclusive rights to manufacture and sell metal framing using Hadley’s patented “UltraSTEEL™” technology in North America. In February 2006, Dietrich entered into an exclusive sublicensing arrangement with Clark-Western, which will become the only other producer of “UltraSTEEL™” metal framing products for the North American market.

On November 30, 2005, Worthington acquired the remaining 40%During January 2009, we sold our 60% equity interest in DietrichAegis Metal Framing, Canada,LLC for approximately $24,000,000 to MiTek Industries, Inc. from, the minority shareholder, Encore Coils Holdings Ltd., for $3,003,000 cash.other member of the joint venture. This resulted in a pre-tax gain of $8,331,000.

On April 25, 2006, Worthington SteelDuring May 2009, we sold itsour 50% equity interest in Acerex, S.A. de C.V.Accelerated Building Technologies, LLC to NOVA Chemicals Corporation, the other member of the joint venture. The sales price and loss on the transaction were immaterial.

On June 1, 2009, we purchased the assets related to the business of Piper Metal Forming Corporation (“Piper”), U.S. Respiratory, Inc. and Pacific Cylinders, Inc., for approximately $10,000,000, subject to closing adjustments. Piper is a joint venture operating amanufacturer of aluminum high pressure cylinders, and impact extruded steel processing facilityand aluminum parts, serving the medical, automotive, defense, oil services and other commercial markets, with one manufacturing location in Monterrey, Mexico, to its partner Ternium, S.A.New Albany, Mississippi. U.S. Respiratory provides value-added assembly and distribution of Piper’s medical cylinder products. Pacific Cylinders provides West Coast distribution from Diamond Springs, California. The revenues of this group were approximately $30,000,000 for $44,604,000 cash.the 2008 calendar year. These assets will be included in our Pressure Cylinders business segment.

Steel Processing

The Steel Processing reportablebusiness segment consists of the Worthington Steel business unit.unit, and includes Precision Specialty Metals, Inc., a specialty stainless processor located in Los Angeles, California (“PSM”), and Spartan Steel Coating, LLC (“Spartan”), a consolidated joint venture which operates a cold-rolled hot dipped galvanizing line. For fiscal 2006,2009, the fiscal year ended May 31, 20052008 (“fiscal 2005”2008”), and the fiscal year ended May 31, 20042007 (“fiscal 2004”2007”), the percentage of consolidated net sales generated by the Steel Processing segment was 51.3%45%, 58.8%48%, and 53.2%49%, respectively.

Worthington Steel is one of America’s largest independent intermediate processors of flat-rolled steel. It occupies a niche in the steel industry by focusing on products requiring exact specifications. These products cannot typically cannot be supplied as efficiently by steel mills or steel end-users.end-users of these products.

The Steel Processing business segment, including Spartan, owns and operates eightnine manufacturing facilities – one each located in Alabama,California, Indiana, Kentucky, Maryland, and Michigan, and South Carolina and three located in Ohio. The consolidated joint venture, Spartan Steel Coating, LLC (“Spartan”), ownsOhio – and operates aleases one manufacturing facility in Michigan.Alabama.

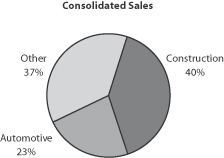

Worthington Steel serves approximately 1,0501,100 customers from these facilities, principally in the automotive, construction, lawn and garden, hardware, furniture, office equipment, electrical control, tubing, leisure and recreation, appliance, farm implements,agricultural, HVAC, container, and aerospace markets. Automotive-related customers have historically represented approximately half of this business segment’s net sales. No single customer represented greater than 8%6% of net sales for the Steel Processing business segment during fiscal 2006.2009.

Worthington Steel buys coils of steel from major integrated steel mills and mini-mills and processes them to the precise type, thickness, length, width, shape, temper and surface quality required by customer specifications. Computer-aided processing capabilities include, among others:

pickling, a chemical process using an acidic solution to remove surface oxide which develops on hot-rolled steel;

slitting, which cuts steel to specific widths;

cold reduction,reducing, which achieves close tolerances of thickness and temper by rolling;

hot-dipped galvanizing, which coats steel with zinc and zinc alloys through a hot-dipped process;

hydrogen annealing, a thermal process that changes the hardness and certain metallurgical characteristics of steel;

cutting-to-length, which cuts flattened steel to exact lengths;

tension leveling, a method of applying pressure to achieve precise flatness tolerances for steel;

edging, which conditions the edges of the steel by imparting round, smooth or knurled edges;

non-metallic coatingscoating including dry lube,lubrication, acrylic and paint; and

configured blanking, which stamps steel into specific shapes.

Worthington Steel also toll processes steel for steel mills, large end-users, service centers, and other processors. Toll processing is different from typical steel processing becausein that the mill, end-user, or other party retains title to the steel and has the responsibility for selling the end product. Toll processing enhances Worthington Steel’s participation in the market for wide sheet steel and large standard orders, which is a market generally served by steel mills rather than by intermediate steel processors.

The steel processing industry is fragmented and highly competitive. There are many competitors, including other independent intermediate processors. Competition is primarily on the basis of price, product quality, and the ability to meet delivery requirements, and price.requirements. Technical service and support for material testing and customer-specific applications enhance the quality of products (See “Item 1. – Business – Technical Services”). However, the extent to which technical service capability has improved Worthington Steel’s competitive position has not been quantified. Worthington Steel’s ability to meet tight delivery schedules is, in part, based on the proximity of our facilities to customers, suppliers and one another. The extent to which plant location has impacted Worthington Steel’s competitive position has not been quantified. Processed steel products are priced competitively, primarily based on market factors, including, among other things, competitive market pricing, the cost and availability of raw materials, transportation and shipping costs, and overall economic conditions in the United States and abroad.

Metal Framing

The Metal Framing reportablebusiness segment, consisting of the Dietrich Metal Framing business unit, designs and produces metal framing components and systems and related accessories for the commercial and residential construction markets within the United States and Canada. For fiscal 2006,2009, fiscal 2005,2008, and fiscal 2004,2007, the percentage of consolidated net sales generated by the Metal Framing segment was 27.5%25%, 27.4%26%, and 27.4%26%, respectively.

Metal Framing products include steel studs and track, floor and wall system components, roof trusses and other building product accessories, such as metal corner bead, lath, lath accessories, clips, fasteners and vinyl beadsbead and trim.

In November 2005, Dietrich successfully launched its “UltraSTEEL™” drywall metal framing product line in Florida. The “UltraSTEEL™” product line is being readily accepted by architects, engineers and material specifiers for its performance capabilities and by contractors for its ease of use. As of May 31, 2006, “UltraSTEEL™” had also been introduced into additional markets in the Southeast and Northeast and machinery conversions were underway to make “UltraSTEEL™” products in the Midwest and Southwest for sales in those markets. In February 2006, Dietrich entered into an exclusive sublicensing agreement with Clark-Western, which will become the only other producer of “UltraSTEEL™” metal framing products for the North American market.

The Metal Framing business segment has 2315 operating facilities located throughout the United States: one each in Colorado, Florida, Georgia, Hawaii, Illinois, Indiana, Kansas, Maryland, Massachusetts,and New Jersey, South Carolina and Washington; two each in Arizona, California, Indiana, Ohio, and Texas; and three in Florida.Texas. This business segment also has threetwo operating facilities in Canada: one each in British Columbia Ontario and Quebec.Ontario.

Dietrich is the largest metal framing manufacturer in the United States, supplying between 40% and 45%approximately one-third of the metal framing products and accessories sold in the United States. Dietrich is the second largest metal framing manufacturer in Canada with a market share of between 15%25% and 20%30%. Dietrich serves approximately 2,0753,900 customers, primarily consisting of wholesale distributors, commercial and residential building contractors, and mass merchandisers. During fiscal 2006,2009, Dietrich’s twothree largest customers represented approximately 15%17%, 10% and 12%10%, respectively, of the net sales for the business segment, while no other customer represented more than 5%3% of net sales for the business segment.

The light-gauge metal framing industry is very competitive. Dietrich competes with seven large regional or national competitors and numerous small, more localized competitors, primarily on the basis of quality,price, service, breadth of product line and price.quality. As is the case in the Steel Processing business segment, the proximity of facilities to customers and their project sites provides a service advantage and impacts freight and shipping costs. TheDietrich’s products sold are transported by both common and dedicated carriers. The extent to which facility location has impacted Dietrich’s competitive position has not been quantified.

Dietrich uses numerous trademarks and patents in its business. Dietrich licenses from Hadley Industries the “UltraSTEEL™“UltraSTEEL®” registered trademark and the United States and Canadian patents to manufacture “UltraSTEEL™“UltraSTEEL®” metal framing and accessory products. The “Spazzer®“Spazzer®” trademark is used in connection with wall component products that are the subject of four United States patents, onetwo foreign patent,patents, one pending United States patent application, and several pending foreign patent applications. The trademark “TradeReady®“TradeReady®” is used in connection with floor-system products that are the subject of four United States patents, seventeennumerous foreign patents, one pending United States patent application, and fiveseveral pending foreign patent applications. The “Clinch-On®“Clinch-On®” trademark is used east of the RockiesRocky Mountains in connection with corner bead and metal trim products for gypsum wallboard. Dietrich licenses the “SLP-TRK®“PRO X®” trademarkand the “SLP-TRK®" trademarks as well as the patent to manufacture “SLP-TRK®”"SLP-TRK®" slotted track in the United States and “Pro XR” header system from Brady Construction Innovations, Inc. Aegis Metal Framing, LLC, an unconsolidated joint venture, uses the “Ultra-Span®” registered trademark in connection with certain patents for proprietary roof trusses. Dietrich intends to continue to use and renew these registered trademarks. Dietrich also has a number of other patents, trademarks and trade names relating to specialized products. The Metal Framing business segment intends to continue to use these trademarks and renew its registered trademarks.

Pressure Cylinders

The Pressure Cylinders segment consists of the Worthington Cylinders business unit. For fiscal 2006,2009, fiscal 2005,2008, and fiscal 2004,2007, the percentage of consolidated net sales generated by Worthington Cylinders was 15.9%20%, 13.3%19%, and 13.8%18%, respectively.

Worthington Cylinders operates eight manufacturing facilities:facilities with three in Ohio one in Wisconsin, and one each in Wisconsin, Austria, Canada, the Czech Republic and Portugal.

The Pressure Cylinders business segment produces a diversified line of pressure cylinders, including low-pressure liquefied petroleum gas (“LPG”) and refrigerant gas cylinders andcylinders; high-pressure and industrial/specialty gas cylinders.cylinders; airbrake tanks; and certain consumer products. LPG cylinders are sold to manufacturers, distributors and mass merchandisers and are used to hold fuel for gas barbecue grills, recreational vehicle equipment, residential and light commercial heating systems, industrial forklifts, propane-fueled camping equipment, hand held torches, and commercial/residential cooking (the latter, generally outside North America).

Refrigerant gas cylinders are sold primarily to major refrigerant gas producers and distributors and are used to hold refrigerant gases for commercial, residential, and residentialautomotive air conditioning and refrigeration systems and for automotive air conditioning systems. High-pressure and industrial/specialty gas cylinders are sold primarily to gas producers and distributors as containers for gases used in: cutting and welding metals; breathing (medical, diving and firefighting); semiconductor production; beverage delivery; and compressed natural gas systems. Worthington Cylinders also produces recovery tanks for refrigerant gases, air reservoirs for truck and trailer original equipment manufacturers, and “Balloon Time®” helium kits which include non-refillable cylinders. While a large percentage of cylinder sales are made to major accounts, Worthington Cylinders has approximately 2,3252,000 customers. During fiscal 2006,2009, no single customer represented more than 9%10% of net sales for the business segment.

Worthington Cylinders produces low-pressure steel cylinders with refrigerant capacities of 15 to 1,000 lbs.pounds and steel and aluminum cylinders with LPG capacities of 14.1 oz.ounces to 420 lbs.pounds. Low-pressure cylinders are produced by precision stamping, drawing, welding and/or brazing component parts to customer specifications. They are then tested, painted and packaged, as required. High-pressure steel cylinders are manufactured by several processes, including deep drawing, tube spinning and billet piercing.

In the United States and Canada, high-pressure and low-pressure cylinders are primarily manufactured in accordance with U.S. Department of Transportation and Transport Canada specifications. Outside the United States and Canada, cylinders are manufactured according to European norm specifications, as well as various other international standards.

In the United States and Canada, Worthington Cylinders has one principal domestic competitor in the low-pressure non-refillable refrigerant market, one principal domestic competitor in the low-pressure LPG cylinder market, and two principal domestic competitors in the high-pressure cylinder market. There are also several smaller foreign competitors in these markets. Worthington Cylinders believes that it has the largest domestic market share in both low-pressure cylinder markets. In the European high-pressure cylinder market, there are several competitors. Worthington Cylinders believes that it is a leading producer in both the high-pressure cylinder and low-pressure non-refillable cylinder markets in Europe. As with Worthington’s other business segments, competition is on the basis ofbased upon price, service price and quality.

The Pressure Cylinders business segment uses the trade name “Worthington Cylinders” to conduct business and the registered trademark “Balloon Time®” to market low-pressure helium balloon kitskits; the trademark “FLAMESAVER™” to market certain LP gas cylinders; the trademark “WORTHINGTON PRO GRADE™” to market certain LPG cylinders, hand torch cylinders and camping fuel cylinders; and the trademark “MAP-PRO™” to market certain hand torch cylinders. The Pressure Cylinders business segment intends to continue to use these trademarks and renew thisits registered trademark. This intellectual property is important totrademarks.

As noted under “Recent Developments”, the recently acquired Piper business will be included in the Pressure Cylinders segment but is not considered material.business segment.

Other

The “Other” category consists of reporting segments that do not meet the materiality tests for purposes of separate disclosure and other corporate related entities. These reportingbusiness segments are Automotive Body Panels, Construction Services and Steel Packaging, which includes the Worthington Steelpac business unit (“Steelpac”).Packaging.

The Automotive Body Panels reportingbusiness segment consistingconsists of theThe Gerstenslager business unit,Company (“Gerstenslager”), which is ISO/TS 16949:2002 and ISO14001 certified. Gerstenslager provides stamping, blanking, assembly, painting, packaging, die management, warehousing, distribution management and other services to customers, primarily in the automotive industry. Gerstenslager operates two facilities in Ohio. Gerstenslager is a major supplier to the automotive past-model year market and manages more than 3,0003,600 finished good part numbers and more than 11,00012,500 stamping dies/fixture sets for the past- and current-model year automotive and truck manufacturers, both domestic and transplant.

The Construction Services reportingbusiness segment operates out of three facilities, one each in Tennessee, Washington, and Ohio. This business segment consists of Dietrich Building Systems,the WIBS business unit which includes Worthington Mid-Rise Construction, Inc., which designs and builds mid-rise light-gauge steel framed commercial structures and multi-family housing units; Dietrich ResidentialWorthington Military Construction, Inc., which is involved in the supply and construction of metal framing products for, and in the framing of, single family housing, with a focus on military; and Worthington Stairs, a mid-rise light-gaugemanufacturer of pre-engineered steel framed construction project in China entered into primarily for research and development purposes.egress stair solutions.

The Steel Packaging business segment consists of Steelpac, which is an ISO-9001: 2000 certified manufacturer of engineered, recyclable steel shipping solutions,solutions. Steelpac operates three facilities, one each in Indiana, Ohio and Pennsylvania. Steelpac designs and manufactures reusable custom crates,platforms, racks, and pallets made of steel for supporting, protecting and handling products throughout the shipping process for industries such as automotive, lawn and garden and recreational vehicles.

Segment Financial Data

Financial information for the reportable business segments is provided in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note H – Industry Segment Data.”Data” of this Annual Report on Form 10-K. That financial information is incorporated herein by reference.

Financial Information About Geographic Areas

Foreign operations represented 9%, 9%, and exports represent less than 10%8% of production and consolidated net sales.sales for fiscal 2009, fiscal 2008, and fiscal 2007, respectively. Summary information about ourWorthington’s foreign operations is set forth in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note A – Summary of Significant Accounting Policies – Risks and Uncertainties.”Uncertainties” of this Annual Report on Form 10-K. That summary information is incorporated herein by reference. For fiscal 20062009, fiscal 2008, and fiscal 2005,2007, Worthington had operations in North America and Europe, while prior years included operations in South America.Europe. Net sales by geographic region are provided in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note H – Industry Segment Data.”–Segment Data” of this Annual Report on Form 10-K. That information is incorporated herein by reference.

Suppliers

The primary raw material purchased by Worthington is steel. We purchase steel from major primary producers of steel, both domestic and foreign. The amount purchased from any particular supplier varies from year-to-year depending on a number of factors including market conditions, then current relationships and prices and terms offered. In nearly all market conditions, particularly now, steel is available from a number of suppliers and generally any supplier relationship or contract can and has been replaced with little or no significant interruption to our business. In fiscal 2006,2009, Worthington purchased approximately four1.7 million tons of steel (58% hot-rolled, 30% galvanized, and 12% cold-rolled) on a consolidated basis. Steel is purchased in large quantities at regular intervals from major primary producers, both domestic and foreign. In the Steel Processing business segment, steel is primarily purchased and processed based on specific customer orders. The Metal Framing and Pressure Cylinders business segments purchase steel to meet production schedules. For certain raw materials, there are more limited suppliers, for example, hydrogen and zinc, which are generally purchased at market prices. Since there are a limited number of suppliers in the hydrogen and zinc markets, if delivery from a major supplier is disrupted due to a force majeure type occurrence, it may be difficult to obtain an alternative supply. Raw materials are generally purchased in the open market on a negotiated spot-market basis at prevailing market prices. Supply contracts are also entered into, some of which have fixed pricing. During fiscal 2006,2009, the Company purchased steel from the following major suppliers, of steel were, in alphabetical order: AK Steel Corporation; ArcelorMittal; California Steel Industries, Inc; Gallatin Steel Company; Mittal Steel; North Star BlueScope Steel LLC; Nucor Corporation; SeverStalSeverstal North America, USInc.; Steel Dynamics, Inc.; Stemcor Holdings Limited; United States Steel Corporation; and WCI Steel, Inc.USS-POSCO Industries. Alcoa, Inc. was the primary aluminum supplier for the Pressure Cylinders business segment in fiscal 2006.2009. Major suppliers of zinc to the Steel Processing business segment were, in alphabetical order: Considar Metal Marketing (a/k/a HudBay); Industrias Peñoles; Teck Cominco Limited; U. S. Zinc; and Xstrata Zinc Canada. Approximately 20.5 million pounds of zinc were purchased in fiscal 2009. Worthington believes its supplier relationships are good.

Technical Services

Worthington employs a staff of engineers and other technical personnel and maintains fully-equipped modernfully equipped laboratories to support operations. These facilities enable verification, analysis and documentation of the physical, chemical, metallurgical and mechanical properties of raw materials and products. Technical service personnel also work in conjunction with the sales force to determine the types of flat-rolled steel required for customer needs. Additionally, technical service personnel design and engineer metal framing structures and provide sealed shop drawings to the building construction markets. To provide these services, Worthington

maintains a continuing program of developmental engineering with respect to product characteristics and performance under varying conditions. Laboratory facilities also perform metallurgical and chemical testing as dictated by the regulations of the U.S. Department of Transportation, Transport Canada, and other associated agencies, along with International Organization for Standardization (ISO) and customer requirements. All design work complies with applicable current local and national building code requirements. An IAS (International Accreditations Service, Incorporated) accredited product-testing laboratory supports these design efforts.

Seasonality and Backlog

Our financial resultsSales are generally lowerweaker in the third quarter of ourthe fiscal year, primarily due to reduced activity in the building and construction industry as a result of the weather, as well as customer plant shutdowns in the automotive industry due to holidays. Sales are generally strongest in the fourth quarter of the fiscal year when all of the segments are normally operating at seasonal peaks.

We do not believe backlog is a significant indicator of our business.

Employees

As of May 31, 2006,2009, Worthington employed approximately 8,2006,400 employees in its operations, excluding theincluding unconsolidated joint ventures, approximately 11%ventures. Approximately 13% of whomthese employees were coveredrepresented by collective bargaining agreements, including those at the Hammond facility as discussed below.units. Worthington believes it has good relationships with its employees in general, including those covered by collective bargaining agreements. However, the union employees at the Dietrich facility in Hammond, Indiana have been on strike since May 5, 2006, as the parties have not reached

agreement on a new contract covering the facility. The Hammond facility has continued to operate during this time period at approximately 90% of pre-strike production levels.units.

Joint Ventures

As part of a strategy to selectively develop new products, markets, and technological capabilities and to expand an international presence, while mitigating the risks and costs associated with those activities, Worthington participates in one consolidated and sixfive unconsolidated joint ventures.

Consolidated

Spartan Steel Coating, LLC, (“Spartan”)is a 52%-owned consolidated joint venture with Severstal North America, Inc. (“Severstal”), located in Monroe, Michigan. It operates a cold-rolled, hot-dipped galvanizing facilityline for toll processing steel coils into galvanized and galvannealed products intended primarily for the automotive industry. Spartan's financial results are fully consolidated into the Steel Processing segment. The equity ownership of Severstal is shown as minority interest on the Company’s consolidated balance sheets and its portion of operating income is eliminated in Monroe, Michigan.miscellaneous expense on the Company’s consolidated statements of earnings.

Unconsolidated

Aegis Metal Framing,LEFCO Worthington, LLC ("LEFCO Worthington"), a 60%49%-owned joint venture with MiTekLEFCO Industries, Inc., headquarteredLLC, is a minority business enterprise which offers engineered wooden crates, specialty pallets, and steel rack systems for a variety of industries. LEFCO Worthington operates one manufacturing facility in Chesterfield, Missouri, offers design, estimating and management software, a full line of metal framing products, and integrated professional engineering services to light-gauge metal component manufacturers and contractors.Cleveland, Ohio.

Dietrich/NOVA, LLC,Serviacero Planos, S.A. de C.V. ("Serviacero Worthington"), a 50%-owned joint venture with NOVA Chemicals Corporation, evaluates, develops, tests, manufactures, sellsInverzer, S.A. de C.V., operates three facilities in Mexico, one each in Leon, Queretaro, and otherwise commercializes construction products which combine or useMonterrey. The Monterrey facility, opened in combination light-gaugemid-July 2009, has not been included as part of our location count. Serviacero Worthington provides steel framing productsprocessing services such as slitting, multi-blanking and styreniccutting-to-length to customers in a variety of industries including automotive, appliance, electronics and copolymer resin products.heavy equipment.

TWB Company, LLCL.L.C. (“TWB”), a 50%45%-owned joint venture with ThyssenKrupp Steel North America, Inc., is a leading North American supplier of tailor welded blanks. TWB produces laser-welded blanks for use in the automotive industry for products such as inner-door panels.panels, bodysides, rails and pillars. TWB operates facilities in Prattville, Alabama; Monroe, Michigan; Columbus, Indiana; and SaltilloPuebla, Ramos Arizpe (Saltillo) and Hermosillo, Mexico.

Viking & Worthington Steel Enterprise, LLC, a 49%-owned joint venture with Bainbridge Steel, LLC, an affiliate of Viking Industries, LLC, operates a steel processing TWB closed its Columbus, Indiana facility in Valley City, Ohio, and is a qualified minority business enterprise.during fiscal 2009.

Worthington Armstrong Venture (“WAVE”), a 50%-owned joint venture with Armstrong Ventures, Inc., a subsidiary of Armstrong World Industries, Inc., is one of the three leading global manufacturers and multiple smaller international manufacturers of suspended ceilingsuspension grid systems for concealed and lay-in panel ceilings.ceilings used in commercial and residential ceiling markets. WAVE operates seven facilities in five countries: Aberdeen, Maryland; Benton Harbor, Michigan; and North Las Vegas, Nevada;Nevada, within the United States; Shanghai, the Peoples Republic of China; Team Valley, United Kingdom; Valenciennes, France; and Madrid, Spain.

Worthington Specialty Processing,WSP, a 50%51%-owned joint venture with U.S. Steel, Corporation (“U.S. Steel”)operates three steel processing facilities located in Canton, Jackson and Taylor, Michigan, operateswhich are managed by Worthington Steel. WSP serves primarily as a toll processor for U.S. Steel.Steel and others. Its services include slitting, blanking, cutting-to-length, laser welding, tension leveling and warehousing.

See “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note J – Investments in Unconsolidated Affiliates” for further information about Worthington’s participation in unconsolidated joint ventures.

Environmental Regulation

Worthington’s manufacturing facilities, generally in common with those of similar industries making similar products, are subject to many federal, state and local requirements relating to the protection of the environment. Worthington continually examines ways to reduce emissions and waste and to decrease costs related to environmental compliance. The cost of compliance or capital expenditures for environmental control facilities required to meet environmental requirements are not anticipated to be material when compared with overall costs and capital expenditures and, accordingly, are not anticipated to have a material effect on ourthe financial position, results of operations, or cash flows, or the competitive position of the Company.

Future results and the market price for Worthington Industries’ common shares are subject to numerous risks, many of which are driven by factors that cannot be controlled or predicted. The following discussion, as well as other sections of this Annual Report on Form 10-K, including “Item 7. – Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations,” describe certain business risks. Consideration should be given to the risk factors described below as well as those in the Safe Harbor Statement at the beginning of this Annual Report on Form 10-K, in conjunction with reviewing the forward-looking statements and other information contained in this Annual Report on Form 10-K.

Raw Material Prices

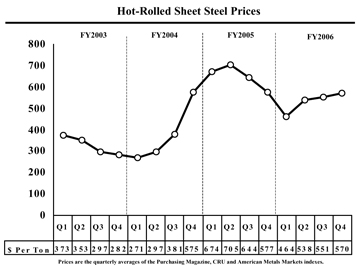

Our future operating results may be affected by fluctuations in raw material prices.Our principal raw material is flat-rolled steel, which we purchase from multiple primary steel producers. The steel industry as a whole is very cyclical, and at times availability and pricing can be volatile due to a number of factors beyond our control. These factors include general economic conditions, domestic and worldwide demand, curtailed production at major mills due to factors such as equipment breakdowns, repairs or catastrophic events, labor costs or problems, competition, import duties, tariffs, energy costs, availability and cost of steel inputs (e.g. ore, scrap, coke, energy, etc.), currency exchange rates and those other factors described under “Raw Material Availability.” This volatility can significantly affect our steel costs. In an environment of increasing prices for steel and other raw materials, competitive conditions may impact how much of the price increases we can pass on to our customers and to the extent we are unable to pass on future price increases in our raw materials to our customers, our financial results could be adversely affected. Also, if steel prices in general decrease, competitive conditions may impact how quickly we must reduce our prices to our customers and we could be forced to use higher-priced raw materials to complete orders for which the sales prices have decreased.

Raw Material Availability

The costs of manufacturing our products and the ability to supply our customers could be negatively impacted if we experience interruptions in deliveries of needed raw materials or supplies.If for any reason our supply of flat-rolled steel or other key raw materials, such as aluminum and zinc, is curtailed or we are otherwise unable to obtain the quantities we need at competitive prices, our business could suffer and our financial results could be adversely affected. Such interruptions might result from a number of factors including events such as a shortage of capacity in the supplier base or of the raw materials, energy or the inputs needed to make steel or other supplies, financial difficulties of suppliers, significant events affecting their facilities, significant weather events, those factors listed under “Raw Material Prices” or other factors beyond our control. Further, the number of suppliers has decreased in recent years due to industry consolidation and the financial difficulties of certain suppliers, and consolidation may continue. Accordingly, if delivery from a major supplier is disrupted, it may be more difficult to obtain an alternative supply than in the past.

Inventories

Our business could be harmed if we fail to maintain proper inventory levels.We are required to maintain substantial inventories to accommodate the needs of our customers, including in many cases, short lead times and just-in-time delivery requirements. Although we typically have customer orders in hand prior to placement of our raw material orders for Steel Processing, we anticipate and forecast customer demand for all business segments. We purchase raw materials on a regular basis in an effort to maintain our inventory at levels that we believe are sufficient to satisfy the anticipated needs of our customers based upon orders, customers volume expectations, historic buying practices and market conditions. Inventory levels in excess of customer demand may result in the use of higher-priced inventory to fill orders reflecting lower sales prices, if steel prices have significantly decreased. These events could adversely affect our financial results. Conversely, if we underestimate demand for our products or if our suppliers fail to supply quality products in a timely manner, we may experience inventory shortages. Inventory shortages might result in unfilled orders, negatively impact customer relationships, and result in lost revenues, any of which could harm our business and adversely affect our financial results.

Economic or Industry Downturns

Downturns or weaknessThe current global recession has adversely affected and is likely to continue to adversely affect our business and our industries, as well as the industries of many of our customers and suppliers. The volatile domestic and global recessionary climate is having significant negative impacts on our business. The global recession has resulted in a significant decrease in customer demand throughout nearly all of our markets, including our two largest markets – construction and automotive. The impacts of government approved and proposed measures to aid economic recovery, including economic stimulus legislation and assistance to automotive manufacturers and others, are currently unknown. Overall, operating levels across our businesses have fallen and may remain at depressed levels until economic conditions improve and demand increases.

Continued volatility in the United States and worldwide capital and credit markets has impacted and is likely to continue to significantly impact our end markets and result in continued negative impacts on demand, increased credit and collection risks and other adverse effects on our business. The domestic and worldwide capital and credit markets have experienced and are experiencing significant volatility, disruptions and dislocations with respect to price and credit availability. These have caused diminished availability of credit and other capital in our end markets, including automotive and construction, and for participants in, and the customers of, those markets. There is continued uncertainty as to when and if the capital and credit markets will improve and the impact this period of volatility will have on our end markets and business in general.

The construction and automotive industries account for a significant portion of our net sales, and reductions in demand from these industries have adversely impacted and are likely to continue to adversely affect our business. The overall downturn in the economy, the disruption in capital and credit markets, declining real estate values and reduced consumer spending have caused significant reductions in demand from our end markets in general, and in particular, the construction and automotive end markets.

Demand in the commercial and residential construction markets has weakened as it has become more difficult for companies and consumers to obtain credit for construction projects and the economic slowdown has caused delays in or cancellations of construction projects.

The domestic auto industry is currently experiencing a very difficult operating environment, which has resulted in keyand will likely continue to result in lower levels of vehicle production and an associated decrease in demand for products sold to the automotive industry. Many automotive manufacturers and their suppliers have reduced production levels and eliminated manufacturing capacity, through the closure of facilities, extension of temporary shutdowns, reduction in operations, and other cost reduction actions. The difficulties faced by these industries such as commercial construction or automotive, mayare likely to continue to adversely affect our business.

Financial difficulties and bankruptcy filings by the Company’s customers which may cause the demand forcould have an adverse impact on our products and services to decline and adversely affect our financial results.business. Many of our customers are in industriesexperiencing extremely challenging financial conditions. General Motors and businesses thatChrysler have gone through bankruptcy proceedings and both companies have implemented plans to significantly reduce production capacity and their dealership networks. Certain other customers have filed or are cyclical in nature and affected by changes in general economic conditions or conditions specific to their respective markets, such as the commercial construction and automotive industries. Product demand in our customer’s end markets is based on numerous factors such as interest rates, general economic conditions, consumer confidence,contemplating filing bankruptcy petitions. These and other factors beyond our control. Downturnscustomers may be in demand from the commercial construction industry, the automotive industryneed of additional capital or any of the other industries we serve, or a decrease in the margins that we can realize from sales of our productscredit to customers in any of these industries, could adversely affect our financial results.

Reduced commercial construction activity, especially office building, could negatively impact our financial results.continue operations. The commercial construction market is a key end market with approximately 41% of our net sales going to that market in fiscal 2006. If commercial construction activity in the United States, in general, or by one or more of our major customers, in particular, were to be reduced significantly, it could negatively affect our salesbankruptcies and financial results.

Reduced automotive/truck production and the financial difficulties of customers in this market could negatively impact our financial results. The automotive and truck market remains a key customer group with approximately 33% of our net sales derived from that market in fiscal 2006. Total domestic automotive production in fiscal 2006 was at a relatively high level on an historical basis. If domestic automotive production, in general, or by one or more of our major domestic customers, in particular, were to be reduced significantly, it could negatively affect our sales and financial results.

The financial difficulties and internal strategies of customers could adversely affect us.A portion of our business is highly dependent on automotive manufacturers, many of which have publicly announced plans to reduce production levels and eliminate excess manufacturing capacity including plans to eliminate jobs and reduce costs. The financial difficulties of certain customers and theand/or failure in their efforts under way by our customers to obtain credit or otherwise improve their overall financial condition could result in numerous changes that are beyond our control,within the markets we serve, including additional unannounced customer plant closings, decreased production, reduced demand, changes in product mix, or distribution patterns, volume reductions, labor disruptions, changes or disruptions in our accounts receivable, mandatory reductions or other unfavorable changes in our pricing,the prices, terms or service conditions or market share losses, as well aswe are able to obtain, and other changes wethat may not accurately anticipate. These events could adverselyresult in decreased purchases from us and otherwise negatively impact our business. These conditions also increase the risk that our customers may default on their payment obligations to us, particularly customers in hard hit industries such as automotive and construction.

The overall weakness among automotive manufacturers and their suppliers has increased the risk that at least some of the Company's customers, which are suppliers to the automotive industry, could have further financial results.difficulties. The same is true of the Company's customers in other industries, including construction, which are also experiencing significant financial weakness. Should the economy or any applicable market not improve, the risk of bankruptcy filings by the Company's customers will continue to increase. Such filings may result in not only in a reduction in sales, but also in a loss associated with the potential inability to collection outstanding accounts receivables. While the Company takes steps intended to mitigate the impact of financial difficulties and potential bankruptcy filings by its customers, these matters could have a negative impact on the Company's business.

The loss of significant volume from key customers could adversely affect us.us. In fiscal 2006,2009, our largest customer accounted for approximately 5%4% of our consolidated gross sales, and our ten largest customers

accounted for approximately 25%22% of our consolidated gross sales. A significant loss of, or decrease in, business from any of these customers could have an adverse effect on our sales and financial results if we cannot obtain replacement business. Also, due to consolidation in the industries we serve, including the commercial construction, automotive and retail industries, our gross sales may be increasingly sensitive to deterioration in the financial condition of, or other adverse developments with respect to, one or more of our top customers.

Raw Material Pricing and Availability

The costs of manufacturing our products and the ability to supply our customers could be negatively impacted if we experience interruptions in deliveries of needed raw materials or supplies. If, for any reason, our supply of flat-rolled steel or other key raw materials, such as aluminum and zinc, is curtailed or we are otherwise unable to obtain the quantities we need at competitive prices, our business could suffer and our financial results could be adversely affected. Such interruptions might result from a number of factors including events such as a shortage of capacity in the supplier base or of the raw materials, energy or the inputs needed to make steel or other supplies, failure of suppliers to fulfill their supply obligations, financial difficulties of suppliers, significant events affecting supplier facilities, significant weather events, those factors listed in the immediately following paragraphs or other factors beyond our control. Further, the number of suppliers has decreased in recent years due to industry consolidation and the financial difficulties of certain suppliers, and consolidation may continue. Accordingly, if delivery from a major supplier is disrupted, it may be more difficult to obtain an alternative supply than in the past.

Our future operating results may be affected by fluctuations in raw material prices. Our principal raw material is flat-rolled steel, which we purchase from multiple primary steel producers. The steel industry as a whole has been cyclical, and at times availability and pricing can be volatile due to a number of factors beyond our control. These factors include general economic conditions, domestic and worldwide demand, curtailed production at major mills due to factors such as equipment breakdowns, repairs or catastrophic events, labor costs or problems, competition, import duties, tariffs, energy costs, availability and cost of steel inputs (e.g. ore, scrap, coke, energy, etc.), currency exchange rates, and other factors described immediately in the preceding paragraph. This volatility can significantly affect our steel costs.

In an environment of increasing prices for steel and other raw materials, competitive conditions may impact how much of the price increases we can pass on to our customers. To the extent we are unable to pass on future price increases in our raw materials to our customers, our financial results could be adversely affected. Also, if steel prices decrease, in general, competitive conditions may impact how quickly we must reduce our prices to our customers and we could be forced to use higher-priced raw materials to complete orders for which the selling prices have decreased. Decreasing steel prices may also require the Company to write-down the value of its inventory to reflect current market pricing, as was the case during fiscal 2009. These write-downs are discussed further in "Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations."

Inventories

Our business could be harmed if we fail to maintain proper inventory levels. We are required to maintain sufficient inventories to accommodate the needs of our customers including, in many cases, short lead times and just-in-time delivery requirements. Although we typically have customer orders in hand prior to placement of our raw material orders for Steel Processing, we anticipate and forecast customer demand for all business segments. We purchase raw materials on a regular basis in an effort to maintain our inventory at levels that we believe are sufficient to satisfy the anticipated needs of our customers based upon orders, customer volume expectations, historic buying practices and market conditions. Inventory levels in excess of customer demand may result in the use of higher-priced inventory to fill orders reflecting lower selling prices, if steel prices have significantly decreased. These events could adversely affect our financial results. Conversely, if we underestimate demand for our products or if our suppliers fail to supply quality products in

a timely manner, we may experience inventory shortages. Inventory shortages might result in unfilled orders, negatively impacting our customer relationships, and resulting in lost revenues, any of which could harm our business and adversely affect our financial results.

Competition

Our business is highly competitive, and increased competition could negatively impact our financial results. Generally, the markets in which we conduct business are highly competitive. Competition for most of our products is primarily on the basis of price, product quality, and our ability to meet delivery requirements, and price.requirements. The current economic recession has also resulted in significant open capacity which could increase competitive presence. Increased competition could cause us to lose market share, increase expenditures, lower our margins or offer additional services at a higher cost to us, which could adversely impact our financial results.

Material Substitution

In certain applications, steel competes with other materials, such as aluminum (particularly in the automobile industry), cement and wood (particularly in the construction industry), composites, glass and plastic.Prices of all of these materials fluctuate widely and differences between them and steel prices may adversely affect

demand for our products and/or encourage substitution, which could adversely affect prices and demand for steel products. The high cost of steel relative to other materials can make material substitution more attractive for certain uses.

Freight and Energy

The availability and cost of freight and energy, such as electricity, natural gas and diesel fuel, is important in the manufacture and transport of our products.Our operating costs increase when energy costs rise. During periods of increasing freight and energy costs, we might not be able to fully recover our operating cost increases through price increases without reducing demand for our products. Our financial results could be adversely affected if we are unable to pass all of the increases on to our customers or if we are unable to obtain the necessary freight and energy. Also, increasing energy costs could put a strain on the transportation of materials and products if it forces certain transporters to close.

Information Systems

We are subject to information system security risks and systems integration issues that could disrupt our internal operations.We are dependent upon information technology for the distribution of information internally and also to our customers and suppliers. This information technology is subject to damage or interruption from a variety of sources, including but not limited to computer viruses, security breaches and defects in design. There also could be system or network disruptions if new or upgraded business management systems are defective or are not installed properly.properly, or are not properly integrated into operations. We are currently in the process of implementingrecently implemented a new software-based enterprise resource planning system (“ERP”). For more information related to the new ERP, see “Part II – Item 9A. – Controls and Procedures – New ERP System.” system. Various measures have been implemented to manage our risks related to information system and network disruptions, but a system failure or failure to implement new systems properly could negatively impact our operations and financial results.

Business Disruptions

Disruptions to our business or the business of our customers or suppliers, could adversely impact our operations and financial results.Business disruptions, including increased costs for or interruptions in the supply of energy or raw materials, resulting from shortages of supply or transportation, from severe weather events such(such as hurricanes, floods blizzards,and blizzards), from casualty events such(such as explosions, fires or material equipment breakdown,breakdown), from acts of terrorism, from pandemic disease, from labor disruptions, or from other

events such(such as required maintenance shutdowns, canshutdowns), could cause interruptions to our businesses as well as the operations of our customers and suppliers. Such interruptionsWhile we maintain insurance coverage that can offset some losses relating to certain types of these events, some could have an adverse effect on our operations and financial results.results and we can be adversely impacted to the extent any such losses are not covered by insurance or cause some other adverse impact to the Company.

Foreign

Economic, political and other risks associated with foreign operations could adversely affect our international financial results.Although the substantial majority of our business activity takes place in the United States, we derive a portion of our revenues and earnings from operations in foreign countries, and are subject to risks associated with doing business internationally. Our sales originating outside the United States represented approximately 10% of our consolidated net sales in fiscal 2006. We have wholly-owned facilities in Austria, Canada, the Czech Republic and Portugal and joint venture facilities in China, France, Mexico, Spain and the United Kingdom. The risks of doing business in foreign countries include the potential for adverse changes in the local political climate, in diplomatic relations between foreign countries and the United States or in government policies, laws or regulations,regulations; terrorist activity that may cause social disruption,disruption; logistical and communications challenges,challenges; costs of complying with a variety of laws and regulations,regulations; difficulty in staffing and managing geographically diverse operations,operations; deterioration of foreign economic conditions,conditions; currency rate fluctuations,fluctuations; foreign exchange restrictions,restrictions; differing local business practices and cultural considerations,considerations; restrictions on imports and exports or sources of supplysupply; and changes in duties or taxes. We believe that our business activities outside of the United States involve a higher degree of risk than our domestic activities.

The global recession and the volatility of worldwide capital and credit markets have impacted and will likely continue to significantly impact our foreign customers and markets. This has decreased demand in our foreign operations and is having significant negative impacts on our business. See in general the discussion under“Economic or Industry Downturns”.

Joint Ventures