UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED DECEMBER 31, |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number | Registrant | State of Incorporation | IRS Employer Identification Number | |||

| 1-7810 | Energen Corporation | Alabama | 63-0757759 | |||

| 2-38960 | Alabama Gas Corporation | Alabama | 63-0022000 |

605 Richard Arrington Jr. Boulevard North, Birmingham, Alabama 35203-2707

Telephone Number 205/326-2700

http://www.energen.com

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Exchange on Which Registered | |

| Energen Corporation Common Stock, $0.01 par value | New York Stock Exchange | |

| Energen Corporation Preferred Stock Purchase Rights | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrants are a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by a check mark whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by a check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, (as definedor a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act).Exchange Act.

Energen Corporation |

| Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | ||||

Alabama Gas Corporation | Large accelerated filer ¨ | Accelerated filer ¨ |

| Smaller reporting company ¨ | ||||

Indicate by check mark whether the registrants are a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

Aggregate market value of the voting stock held by non-affiliates of the registrants as of June 30, 2006:29, 2007:

Energen Corporation | $ | 2,727,928,993 |

Energen Corporation | $3,886,440,012 |

Indicate number of shares outstanding of each of the registrant’s classes of common stock as of February 5, 2007:2008:

Energen Corporation | ||||

Alabama Gas Corporation | 1,972,052 shares | |||

Alabama Gas Corporation meets the conditions set forth in General Instruction I(1) (a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format pursuant to General Instruction I(2).

DOCUMENTS INCORPORATED BY REFERENCE

Energen Corporation Proxy Statement to be filed on or about March 26, 200724, 2008 (Part III, Item 10-14)

INDUSTRY GLOSSARY

For a more complete definition of certain terms defined below, as well as other terms and concepts applicable to successful efforts accounting, please refer to Rule 4-10(a) of Regulation S-X,

promulgated pursuant to the Securities Act of 1933 and the Securities Exchange Act of 1934, each as amended.

Basis | The difference between the futures price for a commodity and the corresponding cash spot price. | |

Basin-Specific | A type of derivative contract whereby the contract’s settlement price is based on specific geographic basin indices. | |

Behind Pipe Reserves | Oil or gas reserves located above or below the currently producing zone(s) that cannot be extracted until a recompletion or pay-add occurs. | |

Call Option | A contract that gives the investor the right, but not the obligation, to buy the underlying commodity at a certain price on an agreed upon date. | |

Carried Interest | An agreement under which one party agrees to pay for a specified portion or for all of the development and operating costs of another party on a property in which both own a portion of the working interest. | |

Cash Flow Hedge | The designation of a derivative instrument to reduce exposure to variability in cash flows from the forecasted sale of oil, gas or natural gas liquids production whereby the gains (losses) on the derivative transaction are anticipated to offset the losses (gains) on the forecasted sale. | |

Collar | A financial arrangement that effectively establishes a price range between a floor and a ceiling for the underlying commodity. The purchaser bears the risk of fluctuation between the minimum (or floor) price and the maximum (or ceiling) price. | |

Development Costs | Costs necessary to gain access to, prepare and equip development wells in areas of proved reserves. | |

Development Well | A well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive. | |

Downspacing | An increase in the number of available drilling locations as a result of a regulatory commission order. | |

Dry Well | An exploratory or a development well found to be incapable of producing either oil or gas in sufficient quantities to justify completion as an oil or gas well. | |

Exploration Expenses | Costs primarily associated with drilling unsuccessful exploratory wells in undeveloped properties, exploratory geological and geophysical activities, and costs of impaired and expired leaseholds. | |

Exploratory Well | A well drilled to find and produce oil or gas in an unproved area, to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir, or to extend a known reservoir. | |

Futures Contract | An exchange-traded legal contract to buy or sell a standard quantity and quality of a commodity at a specified future date and price. Such contracts offer liquidity and minimal credit risk exposure but lack the flexibility of swap contracts. | |

Hedging | The use of derivative commodity instruments such as futures, swaps and collars to help reduce financial exposure to commodity price volatility. | |

Gross Revenues | Revenues reported after deduction of royalty interest payments. | |

Gross Well or Acre | A well or acre in which a working interest is owned. | |

Liquified Natural Gas (LNG) | Natural gas that is liquified by reducing the temperature to negative 260 degrees Fahrenheit. LNG typically is used to supplement traditional natural gas supplies during periods of peak demand. | |

Long-Lived Reserves | Reserves generally considered to have a productive life of approximately 10 years or more, as measured by the reserves-to-production ratio. | |

Natural Gas Liquids (NGL) | Liquid hydrocarbons that are extracted and separated from the natural gas stream. NGL products include ethane, propane, butane, natural gasoline and other hydrocarbons. | |

Net Well or Acre | A net well or acre is deemed to exist when the sum of fractional ownership working interests in gross wells or acres equals one. | |

Odorization | The adding of odorant to natural gas which is a characteristic odor so that leaks can be readily detected by smell. | ||

Operational Enhancement | Any action undertaken to improve production efficiency of oil and gas wells and/or reduce well costs. | ||

Operator | The company responsible for exploration, development and production activities for a specific project. | ||

Pay-Add | An operation within a currently producing wellbore that attempts to access and complete an additional pay zone(s) while maintaining production from the existing completed zone(s). | ||

Pay Zone | The formation from which oil and gas is produced. | ||

Production (Lifting) Costs | Costs incurred to operate and maintain wells. | ||

Productive Well | An exploratory or a development well that is not a dry well. | ||

Proved Developed Reserves | The portion of proved reserves which can be expected to be recovered through existing wells with existing equipment and operating methods. | ||

Proved Reserves | Estimated quantities of crude oil, natural gas and natural gas liquids that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. | ||

Proved Undeveloped Reserves (PUD) | The portion of proved reserves which can be expected to be recovered from new wells on undrilled proved acreage or from existing wells where a relatively major expenditure is required for completion. | ||

Put Option | A contract that gives the purchaser the right, but not the obligation, to sell the underlying commodity at a certain price on an agreed date. | ||

Recompletion | An operation within an existing wellbore whereby a completion in one pay zone is abandoned in order to attempt a completion in a different pay zone. | ||

| Ratio expressing years of supply determined by dividing the remaining recoverable reserves at year end by actual annual production volumes. The reserve-to-production ratio is a statistical indicator with certain limitations, including predictive value. The ratio varies over time as changes occur in production levels and remaining recoverable reserves. | ||

Secondary Recovery | The process of injecting water, gas, etc., into a formation in order to produce additional oil otherwise unobtainable by initial recovery efforts. | ||

Service Well | A well employed for the introduction into an underground stratum of water, gas or other fluid under pressure or disposal of salt water produced with oil or other waste. | ||

Sidetrack Well | A new section of wellbore drilled from an existing well. | ||

Swap | A contractual arrangement in which two parties, called counterparties, effectively agree to exchange or “swap” variable and fixed rate payment streams based on a specified commodity volume. The contracts allow for flexible terms such as specific quantities, settlement dates and location but also expose the parties to counterparty credit risk. | |

Transportation | Moving gas through pipelines on a contract basis for others. | |

Throughput | Total volumes of natural gas sold or transported by the gas utility. | |

Working Interest | Ownership interest in the oil and gas properties that is burdened with the cost of development and operation of the property. | |

Workover | A major remedial operation on a completed well to restore, maintain, or improve the well’s production such as deepening the well or plugging back to produce from a shallow formation. | |

-e | Following a unit of measure denotes that the oil and natural gas liquids components have been converted to cubic feet equivalents at a rate of 6 thousand cubic feet per barrel. | |

20062007 FORM 10-K ANNUAL REPORT

| Page | ||||||

| PART I | ||||||

Item 1. | 4 | |||||

Item 1A. | 11 | |||||

Item 1B. | 12 | |||||

Item 2. | 13 | |||||

Item 3. | ||||||

Item 4. | ||||||

Item 5. | ||||||

Item 6. | ||||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||

Item 7A. | ||||||

Item 8. | ||||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |||||

Item 9A. | ||||||

Item 10. | ||||||

Item 11. | ||||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||

Item 14. | ||||||

Item 15. | ||||||

(This page intentionally left blank.)blank)

This Form 10-K is filed on behalf of Energen Corporation (Energen or the Company)

and Alabama Gas Corporation (Alagasco).

Forward-Looking Statements:Certain statements in this report express expectations of future plans, objectives and performance of the Company and its subsidiaries and constitute forward-looking statements made pursuant to the Safe Harbor provision of the Private Securities Litigation Reform Act of 1995. Except as otherwise disclosed, the forward-looking statements do not reflect the impact of possible or pending acquisition,acquisitions, investments, divestitures or restructurings. The absence of errors in input data, calculations and formulas used in estimates, assumptions and forecasts cannot be guaranteed. Neither the Company nor Alagasco undertakes any obligation to correct or update any forward-looking statements whether as a result of new information, future events or otherwise.

All statements based on future expectations rather than on historical facts are forward-looking statements that are dependent on certain events, risks and uncertainties that could cause actual results to differ materially from those anticipated. Some of these include, but are not limited to, economic and competitive conditions, inflation rates, legislative and regulatory changes, financial market conditions, our ability to access the capital markets, future business decisions, utility customer growth and retention and usage per customer, litigation results and other uncertainties, all of which are difficult to predict.

Third Party Facilities: The forward-looking statements also assume generally uninterrupted access to third party oil and gas gathering, transportation, processing and storage facilities. Energen Resources Corporation, the Company’s oil and gas subsidiary, relies upon such facilities for access to markets for its production. Alagasco relies upon such facilities for access to natural gas supplies. Such facilities are typically limited in number and geographically concentrated. An extended interruption of access to or service from these facilities, whether caused by weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could result in material adverse financial consequences to Alagasco, Energen Resources and/or the Company.

Energen Resources’ Production:Production and Drilling: There are numerous uncertainties inherent in estimating quantities of proved oil and gas reserves and in projecting future rates of production and timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserve and production estimates. In the event Energen Resources is unable to fully invest its planned acquisition, development and exploratory expenditures, future operating revenues, production, and proved reserves could be negatively affected. The drilling of development and exploratory wells can involve significant risks, including those related to timing, success rates and cost overruns, and these risks can be affected by lease and rig availability, complex geology and other factors. Anticipated drilling plans and capital expenditures may also change due to weather, manpower and equipment availability, changing emphasis by management and a variety of other factors which could result in actual drilling and capital expenditures being substantially different than currently planned.

Energen Resources’ Hedging: Although Energen Resources makes use of futures, swaps, options and fixed-price contracts to mitigate price risk, fluctuations in future oil, gas and natural gas liquids prices could materially affect the Company’s financial position, results of operations and cash flows; furthermore, such risk mitigation activities may cause the Company’s financial position and results of operations to be materially different from results that would have been obtained had such risk mitigation activities not occurred. The effectiveness of such risk mitigation assumes that counterparties maintain satisfactory credit quality. The effectiveness of such risk mitigation also assumes that actual sales volumes will generally meet or exceed the volumes subject to the futures, swaps, options and fixed-price contracts. A substantial failure to meet sales volume targets, whether caused by miscalculations, weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could leave Energen Resources financially exposed to its counterparties and result in material adverse financial consequences to Energen Resources and the Company. The adverse effect could be increased if the adverse event was widespread enough to move market prices against Energen Resources’ position.

Alagasco’s Hedging: Similarly, although Alagasco makes use of futures, swaps and fixed-price contracts to mitigate gas supply cost risk, fluctuations in future gas supply costs could materially affect its financial position and rates to customers. The effectiveness of Alagasco’s risk mitigation assumes that its counterparties in such activities maintain satisfactory credit quality. The effectiveness of such risk mitigation also assumes that Alagasco’s actual gas supply needs will generally meet or exceed the volumes subject to the futures, swaps and

fixed-price contracts. A substantial failure to experience projected gas supply needs, whether caused by miscalculations, weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could leave Alagasco financially exposed to its counterparties and result in material adverse financial consequences to Alagasco and the Company. The adverse effect could be increased if the adverse event was widespread enough to move market prices against Alagasco’s position.

Operations: Inherent in the gas distribution activities of Alagasco and the oil and gas production activities of Energen Resources and the gas distribution activities of Alagasco are a variety of hazards and operation risks, such as leaks, explosions and mechanical problems that could cause substantial financial losses. In addition, these risks could result in loss of human life, significant damage to property, environmental pollution, impairment of our operations and substantial losses to the Company. In accordance with customary industry practices, the Company maintains insurance against some, but not all, of these risks and losses. The location of pipeline and storage facilities near populated areas, including residential areas, commercial business centers and industrial sites, could increase the level of damages resulting from these risks. The occurrence of any of these events could adversely affect Alagasco’s, Energen Resources’ and/or the Company’s financial position, results of operations and cash flows.

Alagasco’s Service Territory: Alagasco’s utility customers are geographically concentrated in central and north Alabama. Significant economic, weather, natural disaster, criminal act or other events that adversely affect this region could adversely affect Alagasco and the Company.

| BUSINESS |

General

Energen Corporation, based in Birmingham, Alabama, is a diversified energy holding company engaged primarily in the development, acquisition, exploration and production of oil, natural gas and natural gas liquids in the continental United States and in the purchase, distribution and sale of natural gas principally in central and north Alabama. Its two principal subsidiaries are Energen Resources Corporation and Alabama Gas Corporation (Alagasco).

Energen was incorporated in Alabama in 1978. Alagasco was formed in 1948 by the merger of Alabama Gas Company into Birmingham Gas Company, the predecessors of which had been in existence since the mid-1800s. Alagasco became a public companypublicly traded in 1953. Energen Resources was formed in 1971 as a subsidiary of Alagasco. Energen was incorporated in 1978 in preparation for the 1979 corporate reorganization in which Alagasco and Energen Resources became a subsidiarysubsidiaries of Energen in a 1979 reorganization.Energen.

The Company maintains a Web site with the addresswww.energen.com. The Company does not include the information contained on its Web site as part of this report nor is the information incorporated by reference into this report. The Company makes available free of charge through its Web site the annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to these reports. Also, these reports are available in print upon shareholder request. These reports are available as soon as reasonably practicable after being electronically filed with or furnished to the Securities and Exchange Commission. The Company’s Web site also includes its Code of Ethics, Corporate Governance Guidelines, Audit Committee Charter, Officers’ Review Committee Charter, Governance and Nominations Committee Charter and Finance Committee Charter, each of which is available in print upon shareholder request.

Financial Information About Industry Segments

The information required by this item is provided in Note 20,19, Industry Segment Information, in the Notes to Financial Statements.

Narrative Description of Business

Oil and Gas Operations

General: Energen’s oil and gas operations focus on increasing production and adding proved reserves through the development and acquisition of oil and gas properties. To a lesser extent,In addition, Energen Resources explores for and develops new reservoirs, primarily in areas in which it has an operating presence. All gas, oil and natural gas liquids production is sold to third parties. Energen Resources also provides operating services in the Black Warrior, San Juan and Permian basins for its joint interest and third parties. These services include overall project management and day-to-day decision-making relative to project operations.

At the end of 2006,2007, Energen Resources’ proved oil and gas reserves totaled 1,7231,754 billion cubic feet equivalent (Bcfe). Substantially all of these reserves are located in the San Juan Basin in New Mexico and Colorado, the Permian Basin in west Texas and the Black Warrior Basin in Alabama. Approximately 7982 percent of Energen Resources’ year-end reserves are proved developed reserves. Energen Resources’ reserves are long-lived, with a year-end reserves-to-production ratio of 18 years. Natural gas represents approximately 64 percent of Energen Resources’ proved reserves, with oil representing approximately 26 percent and natural gas liquids comprising the balance.

Growth Strategy: Energen has operated for more than ten years under a strategy to grow its oil and gas operations. Since the end of fiscal year 1995, Energen Resources has invested approximately $1.2 billion in property acquisitions, $1$1.3 billion in related development, and $168$209 million in exploration and related development. Energen Resources’ capital investment over the three-year period ending December 31,in 2008 and 2009 is currently expected to approximate $660 million.$579 million primarily for existing properties. The Company also may allocate additional capital during this three-yeartwo-year period for other oil and gas activities such as property acquisitions and the exploration and development of potential shale plays primarily in Alabama. The estimates above do not include amounts for capital related to potential acquisitions or development of these shale plays discussed below.

Energen Resources will considerseeks to acquire onshore North American property acquisitionsproperties which offer proved undeveloped and/or behind-pipe reserves as well as operational enhancement potential. Energen Resources prefers properties with long-lived reserves and multiple pay-zone opportunities; however, Energen Resources will consider acquisitions of other types of properties which meet its investment requirements, including acquisitions with limited unproved properties. In addition, Energen Resources may conduct limitedconducts exploration activities primarily in areas in which it has operations and remains open to considering exploration activities which complement its core expertise and meet its investment requirements. Following an acquisition, Energen Resources focuses on increasing production and reserves through development of the properties’ proved undeveloped reserves and behind-pipe reserve potential as well as engaging in other activities. These activities include development well drilling, limited exploration, behind-pipe recompletions, pay-adds, workovers, secondary recovery and operational enhancements. Energen Resources prefers to operate its properties in order to better control the nature and pace of development activities. Energen Resources operated approximately 91 percent of its proved reserves at December 31, 2007.

In October 2006, Energen Resources sold to Chesapeake Energy Corporation (Chesapeake) a 50 percent interest in its unproved lease position of approximately 200,000 acres in various shale plays in Alabama for $75 million.million and a $15 million carried drilling interest. In addition, the two companies signed an agreement to form an area of mutual interest (AMI) through which they will pursue new leases, exploration, development and operations on a 50-50 basis, for at least the next 10 years. Energen Resources and Chesapeake will also pay forcontinue to lease shared acreage in the AMI, which encompasses Alabama and some of Georgia, in advance of drilling. As of February 25, 2008, Energen Resources’ first $15 million of future drilling costs.net acreage position in Alabama shale totaled approximately 287,500 acres and represents multiple shale opportunities.

Energen Resources’ development activities can result in the addition of new proved reserves and can serve to reclassify proved undeveloped reserves to proved developed reserves. Proved reserve disclosures are provided annually, although changes to reserve classifications occur throughout the year. Accordingly, additions of new reserves from development activities can occur throughout the year and may result from numerous factors including, but not limited to, regulatory approvals for drilling unit downspacing that increase the number of

5

available drilling locations; changes in the economic or operating environments that allow previously uneconomic locations to be added; technological advances that make reserve locations available for development; successful development of existing proved undeveloped reserve locations that reclassify adjacent

probable locations to proved undeveloped reserve locations; increased knowledge of field geology and engineering parameters relative to oil and gas reservoirs; and changes in management’s intent to develop certain opportunities.

During the three years ended December 31, 2006,2007, the Company’s development efforts have added 307364 Bcfe of proved reserves from the drilling of 891975 gross development wells (including 27 sidetrack wells) and 227150 well recompletions and pay-adds. In 2006,2007, Energen Resources’ successful development wells and other activities added approximately 147127 Bcfe of proved reserves; the company drilled 309367 gross development wells (including 22 sidetrack wells), performed some 3934 well recompletions and pay-adds, and conducted other operational enhancements. Energen Resources’ production from continuing operations totaled 95.698.6 Bcfe in 20062007 and is estimated to total 95102 Bcfe in 2007,2008, including 93.5100 Bcfe of estimated production from proved reserves owned at December 31, 2006.2007. In 2009, production is estimated to be 108 Bcfe, including approximately 100 Bcfe produced from proved reserves currently owned.

Drilling Activity:The following table sets forth the total number of net productive and dry exploratory and development wells drilled:

Years ended December 31, | 2006 | 2005 | 2004 | 2007 | 2006 | 2005 | ||||||

Development: | ||||||||||||

Productive | 151.7 | 153.9 | 145.5 | 135.5 | 151.7 | 153.9 | ||||||

Dry | — | 1.7 | 1.0 | 1.0 | - | 1.7 | ||||||

Total | 151.7 | 155.6 | 146.5 | 136.5 | 151.7 | 155.6 | ||||||

Exploratory: | ||||||||||||

Productive | 40.1 | 4.1 | 7.5 | 21.7 | 40.1 | 4.1 | ||||||

Dry | 3.0 | — | 0.4 | 0.3 | 3.0 | - | ||||||

Total | 43.1 | 4.1 | 7.9 | 22.0 | 43.1 | 4.1 | ||||||

As of December 31, 2006,2007, the Company was participating in the drilling of 79 gross development wells, with the Company’s interest equivalent to 4.45 wells. In addition to the development wells drilled, the Company drilled 99.8, 35.9 33 and 45.933 net service wells during 2007, 2006 2005 and 2004,2005, respectively. As of December 31, 2006,2007, the Company was participating in the drilling of 21 gross service wells,well, with the Company’s interest equivalent to 1.9 wells.0.9 well.

Productive Wells and Acreage: The following table sets forth the total gross and net productive gas and oil wells as of December 31, 2006,2007, and developed and undeveloped acreage as of the latest practicable date prior to year-end:

| Gross | Net | Gross | Net | |||||

Gas wells | 3,943 | 2,228 | 4,101 | 2,333 | ||||

Oil wells | 2,828 | 1,502 | 3,161 | 1,587 | ||||

Developed acreage | 817,804 | 573,049 | 820,732 | 564,748 | ||||

Undeveloped acreage | 126,781 | 114,433 | 324,395 | 287,852 | ||||

There were 2717 wells with multiple completions in 2006.2007. All wells and acreage are located onshore in the United States, with the majority of the net undeveloped acreage located in Alabama.

Risk Management:Energen Resources attempts to lower the riskscommodity price risk associated with its oil and natural gas business.business through the use of futures, swaps and options. Energen Resources does not hedge more than 80 percent of its estimated annual production and generally does not hedge more than two fiscal years forward. Statement of Financial Accounting Standards (SFAS) No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended requires all derivatives to be recognized on the balance sheet and measured at fair value. If a derivative is designated as a cash flow hedge, the effectiveness of the hedge, or the

6

degree that the gain (loss) for the hedging instrument offsets the loss (gain) on the hedged item, is measured at each reporting period. The effective portion of the gain or loss on the derivative instrument is recognized in other comprehensive income as a component of equity and subsequently reclassified into earnings when the forecasted transaction affects earnings. The ineffective portion of a derivative’s change in fair value is required to be recognized in earnings immediately. Derivatives that do not qualify for hedge treatment under SFAS No. 133 must be recorded at fair value with gains or losses recognized in operating revenues in the period of change.

The Company from time to time entersmay also enter into derivative transactions that do not qualify for cash flow hedge accounting but are considered by management to represent valid economic hedges and are accounted for as mark-to-market transactions. These economic hedges may include, but are not limited to, put options and swaps on non-operated or other properties for which all of the necessary information to qualify for cash flow hedge accounting is either not readily available or subject to change.

In the case of an acquisition, Energen Resources may hedge more than two years forward to protect targeted returns. Energen Resources prefers long-lived reserves and primarily uses the then-current oil and gas futures prices in its evaluation models, the prevailing swap curve and, for the longer-term, its own pricing assumptions.

See the Forward-Looking Statements in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 1A, Risk Factors, for further discussion with respect to price and other risks.

Natural Gas Distribution

General: Alagasco is the largest natural gas distribution utility in the state of Alabama. Alagasco purchases natural gas through interstate and intrastate marketers and suppliers and distributes the purchased gas through its distribution facilities for sale to residential, commercial and industrial customers and other end-users of natural gas. Alagasco also provides transportation services to industrial and commercial customers located on its distribution system. These transportation customers, using Alagasco as their agent or acting on their own, purchase gas directly from producers, marketers or suppliers and arrange for delivery of the gas into the Alagasco distribution system. Alagasco charges a fee to transport such customer-owned gas through its distribution system to the customers’ facilities.

Alagasco’s service territory is located in central and parts of north Alabama and includes 178177 cities and communities in 28 counties. The aggregate population of the counties served by Alagasco is estimated to be 2.4 million. Among the cities served by Alagasco are Birmingham, the center of the largest metropolitan area in Alabama, and Montgomery, the state capital. During 2006,2007, Alagasco served an average of 420,558416,967 residential customers and 34,45634,200 commercial, industrial and transportation customers. The Alagasco distribution system includes approximately 10,10010,200 miles of main and more than 11,80011,900 miles of service lines, odorization and regulation facilities, and customer meters.

APSC Regulation:As an Alabama utility, Alagasco is subject to regulation by the Alabama Public Service Commission (APSC) which established the Rate Stabilization and Equalization (RSE) rate-setting process in 1983. RSE was extended in 2007, 2002, 1996, 1990, 1987 and 1985. On June 10, 2002,December 21, 2007, the APSC extended RSE for a six-yearseven-year period through January 1, 2008.December 31, 2014. Under the terms of the extension, RSE will continue after December 31, 2014, unless, after notice to the Company and a hearing, the APSC order,votes to modify or discontinue the RSE methodology. Alagasco’s allowed range of return on average equity remains 13.15 percent to 13.65 percent throughout the term of the order, subject to change in the event that the Commission, following a generic rate of return hearing, adjusts the returns on equity of all major energy utilities operating under a similar methodology.order. Alagasco is on a September 30 fiscal year for rate-setting purposes (rate year).

Under RSE, the APSC conducts quarterly reviews to determine, based on Alagasco’s projections and year-to-date performance, whether Alagasco’s return on average equity at the end of the rate year will be within the allowed range.range of return. Reductions in rates can be made quarterly to bring the projected return within the allowed range; increases, however, are allowed only once each rate year, effective December 1, and cannot exceed 4 percent of prior-year revenues. Prior to the December 21, 2007 extension, RSE limitslimited the utility’s equity upon which a return is permitted to 60 percent of total capitalization and providesprovided for certain cost control

7

measures designed to monitor Alagasco’s operations and maintenance (O&M) expense. Under the inflation-based cost control measurement established by the APSC, if the percentage change in O&M expense per customer fallsfell within a range of 1.25 points above or below the percentage change in the Consumer Price Index For All Urban Consumers (index range), no adjustment iswas required. If the change in O&M expense per customer exceedsexceeded the index range, three-quarters of the difference iswas returned to customers. To the extent the change iswas less than the index range, the utility benefitsbenefited by one-half of the difference through future rate adjustments.

The temperature adjustment rider to Alagasco’s rate tariff, approved by the APSC in 1990, was designed to mitigate the earnings impact of variances from normal temperatures. Alagasco calculates a temperature adjustment to customers’ monthly bills to substantially removemoderate the effectimpact of departures from normal temperatures on Alagasco’s earnings. This adjustment, however, is subject to certain limitations including regulatory limits on adjustments to increase customers’ bills. Other non-temperature weather conditions that may affect customer usage are not included such as the impact of wind velocity or cloud cover and the impact of any elasticity of demand as a result of high commodity prices. Adjustments to customers’ bills are made in the same billing cycle in which the weather variation occurs. Substantially all the customers to whom the temperature adjustment applies are residential, small commercial and small industrial. Alagasco’s rate schedules for natural gas distribution charges contain a Gas Supply Adjustment (GSA) rider that permits the pass-through to customers of changes in the cost of gas supply.

The APSC approved an Enhanced Stability Reserve (ESR) beginning October 1997, with an approved maximum funding level of $4 million, to which Alagasco may charge the full amount of: (1) extraordinary O&M expenses resulting fromforce majeure events such as storms, severe weather, and outages, when one or a combination of two such events results in more than $200,000 of additional O&M expense during a rate year; or (2) individual industrial and commercial customer revenue losses that exceed $250,000 during the rate year, if such losses cause Alagasco’s return on equity to fall below 13.15 percent. Following a year in which a charge against the ESR is made, the APSC provides for accretions to the ESR in an amount of no more than $40,000 monthly until the maximum funding level is achieved. Subsequent to the 2007 extension, Alagasco will not have accretions against the ESR until December 31, 2010 unless the Company incurs a significant natural disaster during the three-year period ended December 31, 2010 and receives approval from the APSC to resume accretions under the ESR.

Gas Supply: Alagasco’s distribution system is connected to two major interstate natural gas pipeline systems, Southern Natural Gas Company (Southern) and Transcontinental Gas Pipe Line Company (Transco). It is also connected to several intrastate natural gas pipeline systems and to Alagasco’s two liquified natural gas (LNG) facilities.

Alagasco purchases natural gas from various natural gas producers and marketers. Certain volumes are purchased under firm contractual commitments with other volumes purchased on a spot market basis. The purchased volumes are delivered to Alagasco’s system using a variety of firm transportation, interruptible transportation and storage capacity arrangements designed to meet the system’s varying levels of demand. Alagasco’s LNG facilities can provide the system with up to an additional 200,000 additional thousand cubic feet per day (Mcfd) of natural gas to meet peak day demand.

8

As of December 31, 2006,2007, Alagasco had the following contracts in place for firm natural gas pipeline transportation and storage services:

| December 31, | ||||

| (Mcfd) | ||||

Southern firm transportation | 152,933 | |||

Southern storage and no notice transportation | 251,679 | |||

Transco firm transportation | 70,000 | |||

Various intrastate transportation | 20,240 |

Competition and Rate Flexibility:The price of natural gas is a significant competitive factor in Alagasco’s service territory, particularly among large commercial and industrial transportation customers. Propane, coal and fuel oil are readily available, and many industrial customers have the capability to switch to alternate fuels and/or alternate sources of gas. In the residential and small commercial and industrial markets, electricity is the principal competitor. With the support of the APSC, Alagasco has implemented a variety of flexible rate strategies to help it compete for the large customer gas load in the marketplace. Rate flexibility remains critical as the utility faces competition for this load. To date, the utility has been effective in utilizing its flexible rate strategies to minimize bypass and price-based switching to alternate fuels and alternate sources of gas.

In 1994 Alagasco implemented the P Rate in response to the competitive challenge of interstate pipeline capacity release. Under this tariff provision, Alagasco releases much of its excess pipeline capacity and repurchases it as agent for its transportation customers under 12 month contracts. The transportation customers benefit from lower pipeline costs; Alagasco’s core market customers benefit, as well, since the utility uses the revenues received from the P Rate to decrease gas costs for its residential and its small commercial and industrial customers. In 2006,2007, approximately 300 of Alagasco’s transportation customers utilized the P Rate, and the resulting reduction in core market gas costs totaled more than $7.8 million.

The Competitive Fuel Clause (CFC) and Transportation Tariff also have been important to Alagasco’s ability to compete effectively for customer load in its service territory. The CFC allows Alagasco to adjust large customer rates on a case-by-case basis to compete with alternate fuels and alternate sources of gas. The GSA rider to Alagasco’s tariff allows the Company to recover a reduction in charges allowed under the CFC because the retention of any customer, particularly large commercial and industrial transportation customers, benefits all customers by recovering a portion of the system’s fixed costs. The Transportation Tariff allows Alagasco to transport gas for customers, rather than buy and resell it to them, and is based on Alagasco’s sales profit margin so that operating margins are unaffected. During 20062007 substantially all of Alagasco’s large commercial and industrial customer deliveries wereinvolved the transportation of customer-owned gas. In addition, Alagasco served as gas purchasing agent for more than 99 percent of its transportation customers. Alagasco also uses long-term special contracts as a vehicle for retaining large customer load. At the end of 2006, 662007, 65 of the utility’s largest commercial and industrial transportation customers were under special contracts of varying lengths.

Natural gas service available to Alagasco customers falls into two broad categories: interruptible and firm. Interruptible service contractually is subject to interruption by Alagasco for various reasons; the most common occurrence is curtailment of industrial customers during periods of peak core market heating demand. Interruptible service typically is provided to large commercial and industrial transportation customers who can reduce their gas consumption by adjusting production schedules or by switching to alternate fuels for the duration of the service interruption. More expensive firm service, on the other hand, generally is not subject to interruption and is provided to residential and to small commercial and industrial customers; these core market customers depend on natural gas primarily for space heating.

Growth: Customer growth presents a major challenge for Alagasco, given its mature, slow-growth service area. In 2006,2007 Alagasco’s average number of customers decreased 1 percent. Alagasco will continue to concentrate on maintaining its current penetration levels in the residential new construction market and generating additional revenue in the small and large commercial and industrial market segments.

9

Seasonality:Alagasco’s gas distribution business is highly seasonal since a material portion of the utility’s total sales and delivery volumes is to space heating customers. Alagasco’s rate tariff includes a temperature adjustment rider primarily for residential, small commercial and small industrial customers that substantially mitigatesmoderates the effectimpact of departures from normal temperatures on Alagasco’s earnings. The calculation is performed monthly, and adjustments are made to customers’ bills in the actual month the weather variation occurs.

Environmental Matters

Various environmental laws and regulations apply to the operations of Energen Resources and Alagasco. Historically, the cost of environmental compliance has not materially affected the Company’s financial position, results of operations or cash flows and is not expected to do so in the future; however, new regulations, enforcement policies, claims for damages or other events could result in significant unanticipated costs.

A discussion of certain litigation against Energen Resources in the state of Louisiana related to the restoration of oil fieldoilfield properties is included in Item 3.3, Legal Proceedings of Part I in this Form 10-K.

Alagasco is in the chain of title of nine former manufactured gas plant sites (four of which it still owns) and five manufactured gas distribution sites (one of which it still owns). An investigation of the sites does not indicate the present need for remediation activities. Management expects that, should remediation of any such sites be required in the future, Alagasco’s share, if any, of such costs will not materially affect the Company’s financial position.

Employees

The Company has approximately 1,5301,542 employees, of which Alagasco employs 1,1901,169 and Energen Resources employs 340.373. The Company believes that its relations with employees are good.

| RISK FACTORS |

Third Party Facilities: Energen Resources delivers to and Alagasco is served by third party facilities. These facilities include third party oil and gas gathering, transportation, processing and storage facilities. Energen Resources relies upon such facilities for access to markets for its production. Alagasco relies upon such facilities for access to natural gas supplies. Such facilities are typically limited in number and geographically concentrated. An extended interruption of access to or service from these facilities, whether caused by weather events, natural disaster, accident, mechanical failure, criminal act or otherwise could result in material adverse financial consequences to Alagasco, Energen Resources and/or the Company.

Energen Resources’ Production:Production and Drilling: There are numerous uncertainties inherent in estimating quantities of proved oil and gas reserves and in projecting future rates of production and timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserve and production estimates. In the event Energen Resources is unable to fully invest its planned development, acquisition and exploratory expenditures, future operating revenues, production, and proved reserves could be negatively affected. The drilling of development and exploratory wells can involve significant risks, including those related to timing, success rates and cost overruns, and these risks can be affected by lease and rig availability, complex geology and other factors. Anticipated drilling plans and capital expenditures may also change due to weather, manpower and equipment availability, changing emphasis by management and a variety of other factors which could result in actual drilling and capital expenditures being substantially different than currently planned.

Energen Resources’ Hedging:Although Energen Resources makes use of futures, swaps, options and fixed-price contracts to mitigate price risk, fluctuations in future oil, gas and natural gas liquids prices could materially affect the Company’s financial position, results of operations and cash flows; furthermore, such risk mitigation activities may cause the Company’s financial position and results of operations to be materially different from results that would have been obtained had such risk mitigation activities not occurred. The effectiveness of such risk mitigation assumes that counterparties maintain satisfactory credit quality. The effectiveness of such risk mitigation also assumes that actual sales volumes will generally meet or exceed the volumes subject to the futures, swaps, options and fixed-price contracts. A substantial failure to meet sales volume targets, whether caused by miscalculations, weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could leave Energen Resources financially exposed to its counterparties and result in material adverse financial consequences to Energen Resources and the Company. The adverse effect could be increased if the adverse event was widespread enough to move market prices against Energen Resources’ position.

Alagasco’s Hedging:Similarly, although Alagasco makes use of futures, swaps and fixed-price contracts to mitigate gas supply cost risk, fluctuations in future gas supply costs could materially affect its financial position and rates to customers. The effectiveness of Alagasco’s risk mitigation assumes that its counterparties in such activities maintain satisfactory credit quality. The effectiveness of such risk mitigation also assumes that Alagasco’s actual gas supply needs will generally meet or exceed the volumes subject to the futures, swaps and fixed-price contracts. A substantial failure to experience projected gas supply needs, whether caused by miscalculations, weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could leave Alagasco financially exposed to its counterparties and result in material adverse financial consequences to Alagasco and the Company. The adverse effect could be increased if the adverse event was widespread enough to move market prices against Alagasco’s position.

Operations: Inherent in the gas distribution activities of Alagasco and the oil and gas production activities of Energen Resources are a variety of hazards and operation risks, such as leaks, explosions and mechanical problems that could cause substantial financial losses. In addition, these risks could result in loss of human life, significant damage to property, environmental pollution, impairment of operations and substantial losses to the Company. In accordance with customary industry practices, the Company maintains insurance against some, but not all, of these risks and losses. The location of pipeline and storage facilities near populated areas, including residential areas, commercial business centers and industrial sites, could increase the level of damages resulting from these risks. The occurrence of any of these events could adversely affect Alagasco’s, Energen Resources’ and/or the Company’s financial position, results of operations and cash flows.

Energen Resources Customer Concentration: Revenues and related accounts receivable from oil and gas operations primarily are generated from the sale of produced oil, natural gas and oilnatural gas liquids to energy marketing companies. Such sales are typically made on an unsecured credit basis with payment due the month following delivery. This concentration of sales to the energy marketing industry has the potential to affect the Company’s overall exposure to credit risk, either positively or negatively, in that the Company’s oil and gas purchasers may be affected similarly by changes in economic, industry or other conditions. Energen Resources considers the credit quality of its customers and, in certain instances, may require credit assurances such as a deposit, letter of credit or parent guarantee. The threefour largest oil, natural gas and natural gas liquids purchasers account for approximately 3422 percent, 1314 percent, 11 percent and 1110 percent, respectively, of Energen Resources’ estimated 20072008 production. Energen Resources’ other purchasers each bought less than 98 percent of production.

Alagasco’s Service Territory: Alagasco’s utility customers are geographically concentrated in central and north Alabama. Significant economic, weather, natural disaster, criminal act or other events that adversely affect this region could adversely affect Alagasco and the Company.

Access to Credit Markets: The Company and its subsidiaries rely on access to credit markets. The availability and cost of credit market access is significantly influenced by rating agency evaluations of the Company and of Alagasco. Events affecting credit market liquidity could increase borrowing costs or limit availability of funds.

| UNRESOLVED STAFF COMMENTS |

None

| PROPERTIES |

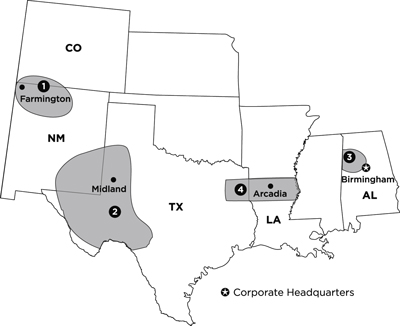

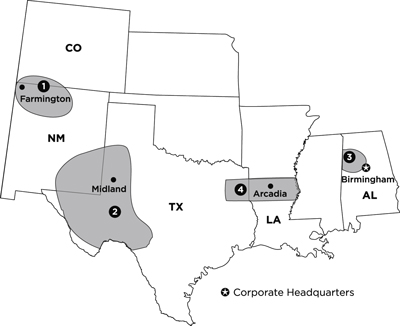

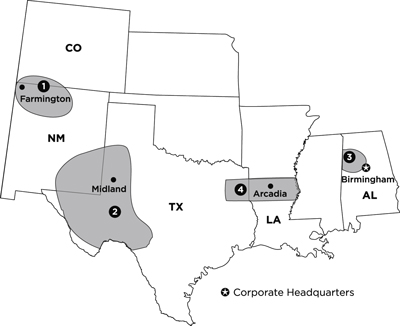

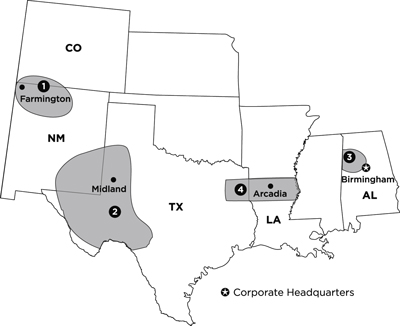

The corporate headquarters of Energen, Alagasco and Energen Resources are located in leased office space in Birmingham, Alabama. Energen Resources maintains offices in Midland, Lehman, Seminole, Westbrook and Penwell, Texas; in Farmington, New Mexico; in Brookwood and Tuscaloosa, Alabama; and in Arcadia, Louisiana. For a description of Energen Resources’ oil and gas properties, seeSee the discussion under Item 1-Business.1-Business for further information related to Energen Resources’ and Alagasco’s business operations. Information concerning Energen Resources’ production and reserves is summarized in the table below and included in Note 19,18, Oil and Gas Operations (Unaudited), in the Notes to Financial Statements. See Item 7 -Management’s Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the future outlook and expectations for Energen Resources and Alagasco.

Oil and Gas Operations

Energen Resources focuses on increasing its production and proved reserves through the acquisition and development of onshore North American producing oil and gas properties. Energen Resources maintains offices in Arcadia, Louisiana; in Farmington, New Mexico; and in Midland, Texas. The Company also maintains offices in Lehman, Seminole, Westbrook and Penwell, Texas; and in Brookwood and Tuscaloosa, Alabama.

The major areas of operations include (1) the San Juan Basin, (2) the Permian Basin, (3) the Black Warrior Basin and (4) North Louisiana/East Texas as highlighted on the above map.

The following table sets forth the production volumes for the year ended December 31, 2007, and proved reserves and reserves-to-production ratio by area as of December 31, 2007:

Year Ended December 31, 2006 | December 31, 2006 | Year Ended December 31, 2007 | December 31, 2007 | December 31, 2007 | ||||||

Production Volumes (MMcfe) | Proved Reserves (MMcfe) | Production Volumes (MMcfe) | Proved Reserves (MMcfe) | Reserves-to- Production Ratio | ||||||

San Juan Basin | 44,845 | 919,862 | 47,517 | 943,423 | 19.85 years | |||||

Permian Basin | 27,181 | 496,959 | 28,655 | 501,920 | 17.52 years | |||||

Black Warrior Basin | 15,010 | 231,314 | 14,813 | 234,253 | 15.81 years | |||||

North Louisiana/East Texas | 8,094 | 69,464 | 7,187 | 68,653 | 9.55 years | |||||

Other | 465 | 5,212 | 433 | 5,403 | 12.48 years | |||||

Total | 95,595 | 1,722,811 | 98,605 | 1,753,652 | 17.78 years | |||||

13

The following table sets forth proved reserves by area as of December 31, 2007:

| Gas MMcf | Oil MBbl | NGL MBbl | ||||

San Juan Basin | 762,091 | 1,326 | 28,896 | |||

Permian Basin | 47,648 | 72,944 | 2,768 | |||

Black Warrior Basin | 234,253 | - | - | |||

North Louisiana/East Texas | 67,573 | 180 | - | |||

Other | 4,353 | 175 | - | |||

Total | 1,115,918 | 74,625 | 31,664 |

The following table sets forth proved developed reserves by area as of December 31, 2007:

| Gas MMcf | Oil MBbl | NGL MBbl | ||||

San Juan Basin | 569,800 | 1,320 | 25,805 | |||

Permian Basin | 44,042 | 59,553 | 2,543 | |||

Black Warrior Basin | 231,791 | - | - | |||

North Louisiana/East Texas | 53,526 | 161 | - | |||

Other | 4,351 | 175 | - | |||

Total | 903,510 | 61,209 | 28,348 |

Energen Resources files Form EIA-23 with the Department of Energy which reports gross proved reserves, including the working interest share of other owners, for properties operated by the Company. The proved reserves reported in the table above represent our share of proved reserves for all properties, based on our ownership interest in each property. For properties operated by Energen Resources, the difference between the proved reserves reported on Form EIA-23 and the gross reserves associated with the Company-owned proved reserves reported in the table above does not exceed five percent. Estimated proved reserves as of December 31, 2007 are based upon studies for each of our properties prepared by Company engineers and reviewed by Ryder Scott Company, L.P. and T. Scott Hickman and Associates, Inc., independent oil and gas reservoir engineers. Calculations were prepared using standard geological and engineering methods generally accepted by the petroleum industry and in accordance with SEC guidelines.

The following table sets forth the total net productive gas and oil wells by area as of December 31, 2007, and developed and undeveloped acreage as of the latest practicable date prior to year-end:

| Net Wells | Net Developed Acreage | Net Undeveloped Acreage | ||||

San Juan Basin | 1,390 | 302,202 | 1,413 | |||

Permian Basin | 1,579 | 87,851 | 3,309 | |||

Black Warrior Basin | 782 | 147,190 | 1,187 | |||

North Louisiana/East Texas | 159 | 20,675 | 55 | |||

Alabama Shale and Other | 10 | 6,830 | 281,888 | |||

Total | 3,920 | 564,748 | 287,852 |

Natural Gas Distribution

The properties of Alagasco consist primarily of its gas distribution system, which includes approximately 10,10010,200 miles of main and more than 11,80011,900 miles of service lines, odorization and regulation facilities, and customer meters. Alagasco also has two LNG facilities, four division commercial offices, three division business centers, two payment centers, three district offices, seven service centers, and other related property and equipment, some of which are leased by Alagasco.

| LEGAL PROCEEDINGS |

Energen and its affiliates are, from time to time, parties to various pending or threatened legal proceedings. Certain of these lawsuits include claims for punitive damages in addition to other specific relief. Based upon information presently available, and in light of available legal and other defenses, contingent liabilities arising from threatened and pending litigation are not considered material in relation to the respective financial positions of Energen and its

14

affiliates. It should be noted, however, that Energen and its affiliates conduct business in Alabama and other jurisdictions in which the magnitude and frequency of punitive or other damage awards may bear little or no relation to culpability or actual damages, thus making it difficult to predict litigation results.

Jefferson County, Alabama

In January 2006, RGGS Land and Minerals LTD, L.P. (RGGS) filed a lawsuit in Jefferson County, Alabama, alleging breach of contract with respect to Energen Resources’ calculation of certain allowed costs and failure to pay in a timely manner certain amounts due RGGS under a mineral lease. RGGS seeks a declaratory judgment with respect to the parties’ rights under the lease, reformation of the lease, monetary damages and termination of Energen Resources’ rights under the lease. The Occluded Gas Lease dated January 1, 1986 was originally between Energen Resources and United States Steel Corporation (U.S. Steel) as lessor. RGGS became the lessor under the lease as a result of a 2004 conveyance from U.S. Steel to RGGS. Approximately 120,000 acres in Jefferson and Tuscaloosa counties, Alabama, are subject to the lease. Separately on February 6, 2006, Energen Resources received notice of immediate lease termination from RGGS. During 2006,2007, Energen Resources’ production associated with the lease was approximately 1010.5 Bcf.

RGGS has adopted positions contrary to the seventeen years of course of dealing between Energen Resources and its original contracting partner, U.S. Steel. The Company believes that RGGS’ assertions are without merit and that the notice of lease termination is ineffective. Energen Resources intends to vigorously defend its rights under the lease. The Company remains in possession of the lease, believes that the likelihood of a judgment in favor of RGGS is remote, and has made no material accrual with respect to the litigation or purported lease termination.

Enron Corporation

Enron and Enron North America Corporation (ENA) have settled with Energen Resources and Alagasco related to the Enron and ENA bankruptcy proceedings. Under the settlement, Energen Resources was allowed claims in the bankruptcy cases against Enron and ENA of $12.5 million each. In December 2006, Energen Resources sold its claims against Enron and ENA for a gain of $6.7 million after-tax. All other claims have been released.

Legacy Litigation

During recent years, numerous lawsuits have been filed against oil production companies in Louisiana for restoration of oilfield properties. These suits are referred to in the industry as “legacy litigation” because they usually involve operations that were conducted on the affected properties many years earlier. Energen Resources is or has been a party to several legacy litigation lawsuits, most of which result from the operations of predecessor companies. Based upon information presently available, and in light of available legal and other defenses, contingent liabilities arising from legacy litigation in excess of the Company’s accrued provision for estimated liability are not considered material to the Company’s financial position.

Other

Various other pending or threatened legal proceedings are in progress currently, and the Company has accrued a provision for the estimated liability.

| SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of 2006.

15

EXECUTIVE OFFICERS OF THE REGISTRANTS

Energen Corporation

Name | Age | Position (1) | ||

James T. McManus, II | 49 | Chairman, Chief Executive Officer and President of Energen and Chairman and Chief Executive Officer of Alagasco (2) | ||

Wm. Michael Warren, Jr. | 60 | (3) | ||

Charles W. Porter, Jr. | 43 | Vice President, Chief Financial Officer and Treasurer of Energen and Alagasco (4) | ||

John S. Richardson | 50 | President and Chief Operating Officer of Energen Resources (5) | ||

Dudley C. Reynolds | 55 | President and Chief Operating Officer of Alagasco (6) | ||

J. David Woodruff, Jr. | 51 | General Counsel and Secretary of Energen and Alagasco and Vice President-Corporate Development of Energen (7) | ||

Grace B. Carr | 52 | Vice President and Controller of Energen (8) | ||

| Notes: |

|

|

| |||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||||

|

| |||

(2) |

| |||

(3) | Mr. Warren retired from the Company at the end of 2007. He had been employed by the Company in various capacities since 1983 and served as Chairman of the Board and Chief Executive Officer of Energen and each of its subsidiaries since 1998. Mr. Warren was succeeded by Mr. McManus as Chief Executive officer effective July 1, 2007 and as Chairman of the Board of Energen and each of its subsidiaries effective January 1, 2008. Mr. Warren continues to serve as a Director of Energen and each of its subsidiaries. | |||

(4) | Mr. Porter has been employed by the Company in various financial capacities since 1989. He was elected Controller of Energen Resources in 1998. In 2001, he was elected Vice President – Finance of Energen Resources. He was elected Vice President, Chief Financial Officer and Treasurer of Energen and each of its subsidiaries effective January 1, 2007. | |||

(5) | Mr. Richardson has been employed by the Company in various capacities since 1985. He was elected Vice President – Acquisitions and Engineering of Energen Resources in 1997. He was elected Executive Vice President and Chief Operating Officer of Energen Resources effective January 1, 2006. He was elected President and Chief Operating Officer of Energen Resources effective January 23, 2008. |

16

(6) | Mr. Reynolds has been employed by the Company in various capacities since 1980. He was elected General Counsel and Secretary of Energen and each of its subsidiaries in April 1991. He was elected President and Chief Operating Officer of Alagasco effective January 1, 2003.

|

(7) |

| |||

(8) | Ms. Carr was employed by the Company in various capacities from January 1985 to April 1989. She was not employed from May 1989 through December 1997. She was elected Controller of Energen in January 1998 and elected Vice President and Controller of Energen in October 2001. |

| MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Quarterly Market Prices and Dividends Paid Per Share

Quarter ended(in dollars) | High | Low | Close | Dividends Paid | ||||

March 31, 2004 | 22.36 | 19.94 | 20.63 | .0925 | ||||

June 30, 2004 | 24.28 | 20.06 | 24.00 | .0925 | ||||

September 30, 2004 | 25.98 | 22.93 | 25.78 | .09625 | ||||

December 31, 2004 | 30.04 | 25.44 | 29.48 | .09625 | ||||

March 31, 2005 | 34.09 | 27.06 | 33.30 | .10 | ||||

June 30, 2005 | 35.64 | 28.65 | 35.05 | .10 | ||||

September 30, 2005 | 43.56 | 33.85 | 43.26 | .10 | ||||

December 31, 2005 | 44.31 | 34.50 | 36.32 | .10 | ||||

March 31, 2006 | 39.49 | 32.71 | 35.00 | .11 | ||||

June 30, 2006 | 38.42 | 32.16 | 38.41 | .11 | ||||

September 30, 2006 | 44.48 | 36.95 | 41.87 | .11 | ||||

December 31, 2006 | 47.60 | 38.50 | 46.94 | .11 |

Quarter ended(in dollars) | High | Low | Close | Dividends Paid | ||||

March 31, 2006 | 39.49 | 32.71 | 35.00 | .11 | ||||

June 30, 2006 | 38.42 | 32.16 | 38.41 | .11 | ||||

September 30, 2006 | 44.48 | 36.95 | 41.87 | .11 | ||||

December 31, 2006 | 47.60 | 38.50 | 46.94 | .11 | ||||

March 31, 2007 | 51.43 | 43.78 | 50.89 | .115 | ||||

June 30, 2007 | 60.49 | 51.05 | 54.94 | .115 | ||||

September 30, 2007 | 58.90 | 48.24 | 57.12 | .115 | ||||

December 31, 2007 | 70.41 | 56.81 | 64.23 | .115 |

Energen’s common stock is listed on the New York Stock Exchange under the symbol EGN. On January 23, 2007,February 8, 2008, there were 7,3907,135 holders of record of Energen’s common stock. At the date of this filing, Energen Corporation owned all the issued and outstanding common stock of Alabama Gas Corporation. Energen expects to pay annual cash dividends of $0.48 per share on the Company’s common stock in 2008. The amount and timing of all dividend payments is subject to the discretion of the Board of Directors and is based upon business conditions, results of operations, financial conditions and other factors.

The following table summarizes information concerning securities authorized for issuance under equity compensation plans:

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options | Weighted Average Exercise Price | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | Number of Securities to be Issued for Outstanding Options and Performance Share Awards | Weighted Average Exercise Price | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | |||||||

Equity compensation plans approved by security holders | 428,078 | $ | 15.35 | 2,223,336 | |||||||||

Equity compensation plans | 466,339 | $30.79 | 1,953,996 | ||||||||||

Equity compensation plans not approved by security holders | — | — | — | - | - | - | |||||||

Total | 428,078 | $ | 15.35 | 2,223,336 | 466,339 | $30.79 | 1,953,996 | ||||||

| * | These plans include the Company’s 1997 Stock Incentive Plan and the 1992 Energen Corporation Directors Stock Plan |

The following table summarizes information concerning purchases of equity securities by the issuer:

Period | Total Number of Shares Purchased* | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Maximum Number of Shares that May Yet Be Purchased Under the Plans** | ||||||

October 1, 2006 through October 31, 2006 | 78 | * | $ | 40.52 | — | 9,992,700 | ||||

November 1, 2006 through November 30, 2006 | 1,218 1,000,000 | * | $ $ | 45.51 43.44 | — | 8,992,700 | ||||

December 1, 2006 through December 31, 2006 | 3,901 | * | $ | 47.02 | — | 8,992,700 | ||||

Total | 1,005,197 | $ | 43.46 | — | 8,992,700 | |||||

| Period | Total Number of Shares Purchased | | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Maximum Number of Shares that May Yet Be Purchased Under the Plans** | ||||

October 1, 2007 through | - | - | - | 8,992,700 | |||||

November 1, 2007 through | - | - | - | 8,992,700 | |||||

December 1, 2007 through | 1,857 | * | $ 64.43 | - | 8,992,700 | ||||

Total | 1,857 | $ 64.43 | - | 8,992,700 |

* | Acquired in connection with tax withholdings and payment of exercise price on stock compensation plans. |

** | By resolution adopted May 24, 1994, and supplemented by a resolution adopted April 26, 2000 and June 24, 2006, the Board of Directors authorized the Company to repurchase up to 12,564,400 shares of the Company’s common stock. The resolutions do not have an expiration date. |

Share and per share data have been restated to reflect a 2-for-1 stock split effective June 1, 2005.

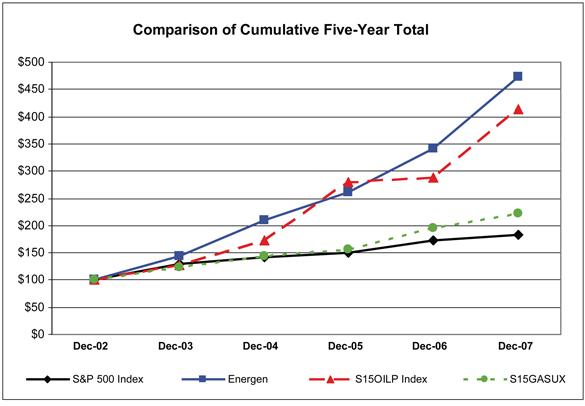

PERFORMANCE GRAPHOil and Gas Operations

General: Energen’s oil and gas operations focus on increasing production and adding proved reserves through the development and acquisition of oil and gas properties. In addition, Energen Resources explores for and develops new reservoirs, primarily in areas in which it has an operating presence. All gas, oil and natural gas liquids production is sold to third parties. Energen Resources also provides operating services in the Black Warrior, San Juan and Permian basins for its joint interest and third parties. These services include overall project management and day-to-day decision-making relative to project operations.

At the end of 2007, Energen Resources’ proved oil and gas reserves totaled 1,754 billion cubic feet equivalent (Bcfe). Substantially all of these reserves are located in the San Juan Basin in New Mexico and Colorado, the Permian Basin in west Texas and the Black Warrior Basin in Alabama. Approximately 82 percent of Energen Resources’ year-end reserves are proved developed reserves. Energen Resources’ reserves are long-lived, with a year-end reserves-to-production ratio of 18 years. Natural gas represents approximately 64 percent of Energen Resources’ proved reserves, with oil representing approximately 26 percent and natural gas liquids comprising the balance.

Growth Strategy: Energen has operated for more than ten years under a strategy to grow its oil and gas operations. Since the end of fiscal year 1995, Energen Resources has invested approximately $1.2 billion in property acquisitions, $1.3 billion in related development, and $209 million in exploration and related development. Energen Resources’ capital investment in 2008 and 2009 is currently expected to approximate $579 million primarily for existing properties. The Company also may allocate additional capital during this two-year period for other oil and gas activities such as property acquisitions and the exploration and development of potential shale plays primarily in Alabama. The estimates above do not include amounts for capital related to potential acquisitions or development of these shale plays discussed below.

Energen Resources seeks to acquire onshore North American properties which offer proved undeveloped and/or behind-pipe reserves as well as operational enhancement potential. Energen Resources prefers properties with long-lived reserves and multiple pay-zone opportunities; however, Energen Resources will consider acquisitions of other types of properties which meet its investment requirements, including acquisitions with unproved properties. In addition, Energen Resources conducts exploration activities primarily in areas in which it has operations and remains open to exploration activities which complement its core expertise and meet its investment requirements. Following an acquisition, Energen Resources focuses on increasing production and reserves through development of the properties’ undeveloped reserves and behind-pipe reserve potential as well as engaging in other activities. These activities include development well drilling, exploration, behind-pipe recompletions, pay-adds, workovers, secondary recovery and operational enhancements. Energen Resources prefers to operate its properties in order to better control the nature and pace of development activities. Energen Resources operated approximately 91 percent of its proved reserves at December 31, 2007.

In October 2006, Energen Resources sold to Chesapeake Energy Corporation (Chesapeake) a 50 percent interest in its unproved lease position of approximately 200,000 acres in various shale plays in Alabama for $75 million and a $15 million carried drilling interest. In addition, the two companies signed an agreement to form an area of mutual interest (AMI) through which they will pursue new leases, exploration, development and operations on a 50-50 basis, for at least the next 10 years. Energen Resources and Chesapeake continue to lease shared acreage in the AMI, which encompasses Alabama and some of Georgia, in advance of drilling. As of February 25, 2008, Energen Resources’ net acreage position in Alabama shale totaled approximately 287,500 acres and represents multiple shale opportunities.

Energen Resources’ development activities can result in the addition of new proved reserves and can serve to reclassify proved undeveloped reserves to proved developed reserves. Proved reserve disclosures are provided annually, although changes to reserve classifications occur throughout the year. Accordingly, additions of new reserves from development activities can occur throughout the year and may result from numerous factors including, but not limited to, regulatory approvals for drilling unit downspacing that increase the number of

5

available drilling locations; changes in the economic or operating environments that allow previously uneconomic locations to be added; technological advances that make reserve locations available for development; successful development of existing proved undeveloped reserve locations that reclassify adjacent probable locations to proved undeveloped reserve locations; increased knowledge of field geology and engineering parameters relative to oil and gas reservoirs; and changes in management’s intent to develop certain opportunities.

During the three years ended December 31, 2007, the Company’s development efforts have added 364 Bcfe of proved reserves from the drilling of 975 gross development wells (including 27 sidetrack wells) and 150 well recompletions and pay-adds. In 2007, Energen Resources’ successful development wells and other activities added approximately 127 Bcfe of proved reserves; the company drilled 367 gross development wells (including 22 sidetrack wells), performed some 34 well recompletions and pay-adds, and conducted other operational enhancements. Energen Resources’ production from continuing operations totaled 98.6 Bcfe in 2007 and is estimated to total 102 Bcfe in 2008, including 100 Bcfe of estimated production from proved reserves owned at December 31, 2007. In 2009, production is estimated to be 108 Bcfe, including approximately 100 Bcfe produced from proved reserves currently owned.

Drilling Activity:The following table sets forth the total number of net productive and dry exploratory and development wells drilled:

Years ended December 31, | 2007 | 2006 | 2005 | |||

Development: | ||||||

Productive | 135.5 | 151.7 | 153.9 | |||

Dry | 1.0 | - | 1.7 | |||

Total | 136.5 | 151.7 | 155.6 | |||

Exploratory: | ||||||

Productive | 21.7 | 40.1 | 4.1 | |||

Dry | 0.3 | 3.0 | - | |||

Total | 22.0 | 43.1 | 4.1 |

As of December 31, 2007, the Company was participating in the drilling of 9 gross development wells, with the Company’s interest equivalent to 5 wells. In addition to the development wells drilled, the Company drilled 99.8, 35.9 and 33 net service wells during 2007, 2006 and 2005, respectively. As of December 31, 2007, the Company was participating in the drilling of 1 gross service well, with the Company’s interest equivalent to 0.9 well.

Productive Wells and Acreage: The following table sets forth the total gross and net productive gas and oil wells as of December 31, 2007, and developed and undeveloped acreage as of the latest practicable date prior to year-end:

| Gross | Net | |||

Gas wells | 4,101 | 2,333 | ||

Oil wells | 3,161 | 1,587 | ||

Developed acreage | 820,732 | 564,748 | ||

Undeveloped acreage | 324,395 | 287,852 |

There were 17 wells with multiple completions in 2007. All wells and acreage are located onshore in the United States, with the majority of the net undeveloped acreage located in Alabama.

Risk Management:Energen Resources attempts to lower the commodity price risk associated with its oil and natural gas business through the use of futures, swaps and options. Energen Resources does not hedge more than 80 percent of its estimated annual production and generally does not hedge more than two fiscal years forward. Statement of Financial Accounting Standards (SFAS) No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended requires all derivatives to be recognized on the balance sheet and measured at fair value. If a derivative is designated as a cash flow hedge, the effectiveness of the hedge, or the

6