UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(MARK ONE)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 20062008

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROMTO.

COMMISSION FILE NUMBER 1-14037

MOODY’S CORPORATION

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| DELAWARE | 13-3998945 | |

| (STATE OF INCORPORATION) | (I.R.S. EMPLOYER IDENTIFICATION NO.) |

99 CHURCH STREET,7 World Trade Center at 250 Greenwich Street, NEW YORK, NEW YORK 10007

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(ZIP CODE)

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (212) 553-0300.

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

TITLE OF EACH CLASS | NAME OF EACH EXCHANGE ON WHICH REGISTERED | |

COMMON STOCK, PAR VALUE $.01 PER SHARE PREFERRED SHARE PURCHASE RIGHTS | NEW YORK STOCK EXCHANGE | |

NEW YORK STOCK EXCHANGE |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant: (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer (see definition of “accelerated filer and large accelerated filer” in Exchange Act Rule 12b-2).

Large Accelerated Filer x Accelerated Filer ¨ Non-accelerated Filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of Moody’s Corporation Common Stock held by nonaffiliates* on June 30, 20062008 (based upon its closing transaction price on the Composite Tape on such date) was approximately $15.3$8.3 billion.

As of January 31, 2007, 278.52009, 235.2 million shares of Common Stock of Moody’s Corporation were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for use in connection with its annual meeting of stockholders scheduled to be held on April 24, 2007,28, 2009, are incorporated by reference into Part III of this Form 10-K.

The Index to Exhibits is included as Part IV, Item 15(3) of this Form 10-K.

| * | Calculated by excluding all shares held by executive officers and directors of the Registrant without conceding that all such persons are “affiliates” of the Registrant for purposes of federal securities laws. |

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 1 |

| 2 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

| Page | ||||

Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 98 | ||

Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 98 | ||

Item 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 98 | ||

Item 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 99 | ||

| 100 | ||||

| 101-106 | ||||

Exhibits | ||||

21 | SUBSIDIARIES OF THE REGISTRANT | |||

23.1 | CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM – 2008 | |||

23.2 | CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM – 2007 | |||

31.1 | Chief Executive Officer Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |||

31.2 | Chief Financial Officer Certification Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |||

32.1 | Chief Executive Officer Certification Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |||

32.2 | Chief Financial Officer Certification Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |||

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 3 |

GLOSSARY OF TERMS AND ABBREVIATIONS

The following terms, abbreviations and acronyms are used to identify frequently used terms in this report:

| TERM | DEFINITION | |

| ACNielsen | ACNielsen Corporation – a former affiliate of Old D&B | |

| Analytics | Moody’s Analytics – reportable segment of MCO formed in January 2008 which combines MKMV, the sales of MIS research and other MCO non-rating commercial activities | |

| AOCI | Accumulated other comprehensive income (loss); a separate component of shareholders’ equity (deficit) | |

| Basel II | Capital adequacy framework published in June 2004 by the Basel Committee on Banking Supervision | |

| Board | The board of directors of the Company | |

| Bps | Basis points | |

| BQuotes | BQuotes , Inc.; an acquisition completed in January 2008; part of the MA segment; a global provider of price discovery tools and end-of-day pricing services. | |

| Canary Wharf Lease | Operating lease agreement entered into on February 6, 2008 for office space in London, England, to be occupied by the Company in the second half of 2009 | |

| CDOs | Collateralized debt obligations | |

| CFG | Corporate finance group; an LOB of MIS | |

| CMBS | Commercial mortgage-backed securities; part of CREF | |

| Cognizant | Cognizant Corporation – a former affiliate of Old D&B, which comprised the IMS Health and NMR businesses | |

| Commission | European Commission | |

| Common Stock | the Company’s common stock | |

| Company | Moody’s Corporation and its subsidiaries; MCO; Moody’s | |

| COSO | Committee of Sponsoring Organizations of the Treadway Commission | |

| CP | Commercial paper | |

| CP Notes | Unsecured commercial paper notes | |

| CP Program | The Company’s commercial paper program entered into on October 3, 2007 | |

| CRAs | Credit rating agencies | |

| CREF | Commercial real estate finance which includes REITs, commercial real estate CDOs and CMBS; part of SFG | |

| D&B Business | Old D&B’s Dun & Bradstreet operating company | |

| DBPPs | Defined benefit pension plans | |

| Debt/EBITDA | Ratio of Total Debt to EBITDA | |

| Directors’ Plan | The 1998 Moody’s Corporation Non-Employee Directors’ Stock Incentive Plan | |

| Distribution Date | September 30, 2000; the date which Old D&B separated into two publicly traded companies – Moody’s Corporation and New D&B | |

| EBITDA | Earnings before interest, taxes, depreciation, amortization and extraordinary gains or losses | |

| 4 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

| TERM | DEFINITION | |

| ECAIs | External Credit Assessment Institutions | |

| ECB | European Central Bank | |

| EITF | Emerging Issues Task Force; a task force established by the FASB to improve financial reporting through the timely identification, discussion, and resolution of financial accounting issues within the framework of existing authoritative literature. | |

| EMEA | Represents countries within Europe, the Middle East and Africa | |

| Enb | Enb Consulting; an acquisition completed in December 2008; part of the MA segment; a provider of credit and capital markets training services; | |

| EPS | Earnings per share | |

| ESPP | The 1999 Moody’s Corporation Employee Stock Purchase Plan | |

| ETR | Effective Tax Rate | |

| EU | European Union | |

| EUR | Euros | |

| Excess Tax Benefit | The difference between the tax benefit realized at exercise of an option or delivery of a restricted share and the benefit recorded at the time that the option or restricted share is expensed under GAAP | |

| Exchange Act | The Securities Exchange Act of 1934, as amended | |

| FASB | Financial Accounting Standards Board | |

| Fermat | Fermat International; an acquisition completed in October 2008; part of the MA segment; a provider of risk and performance management software to the global banking industry | |

| FIG | Financial institutions group; an LOB of MIS | |

| FIN 48 | FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” | |

| FSF | Financial Stability Forum | |

| FX | Foreign exchange | |

| GAAP | U.S. Generally Accepted Accounting Principles | |

| GBP | British pounds | |

| G-7 | The finance ministers and central bank governors of the group of seven countries consisting of Canada, France, Germany, Italy, Japan, U.S. and U.K., that meet annually | |

| G-20 | The G-20 is an informal forum that promotes open and constructive discussion between industrial and emerging-market countries on key issues related to global economic stability. By contributing to the strengthening of the international financial architecture and providing opportunities for dialogue on national policies, international co-operation, and international financial institutions, the G-20 helps to support growth and development across the globe. The G-20 is comprised of: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the U.K. and the U.S. and The EU who is represented by the rotating Council presidency and the ECB. | |

| HFSC | House Financial Services Committee | |

| IMS Health | A spin-off of Cognizant, which provides services to the pharmaceutical and healthcare industries | |

| IOSCO | International Organization of Securities Commissions | |

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 5 |

| TERM | DEFINITION | |

| IOSCO Code | Code of Conduct Fundamentals for Credit Rating Agencies issued by IOSCO | |

| IRS | Internal Revenue Service | |

| Legacy Tax Matter(s) | Exposures to certain potential tax liabilities assumed in connection with the 2000 Distribution | |

| LIBOR | London Interbank Offered Rate | |

| LOB | Line of Business | |

| MA | Moody’s Analytics – a reportable segment of MCO formed in January 2008 which combines the operations of MKMV, the sales of MIS research and other MCO non-rating commercial activities | |

| Make Whole Amount | The prepayment penalty amount relating to the Series 2005-1 Notes and Series 2007-1 Notes, which is a premium based on the excess, if any, of the discounted value of the remaining scheduled payments over the prepaid principal | |

| MCO | Moody’s Corporation and its subsidiaries; the Company; Moody’s | |

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| MIS | Moody’s Investors Service – a reportable segment of MCO | |

| MIS Code | Moody’s Investors Service Code of Professional Conduct | |

| MKMV | Moody’s KMV – a reportable segment of MCO prior to January 2008 | |

| Moody’s | Moody’s Corporation and its subsidiaries; MCO; the Company | |

| New D&B | The New D&B Corporation – which comprises the D&B business | |

| NM | Percentage change is not-meaningful after 400% | |

| NMR | Nielsen Media Research, Inc.; a spin-off of Cognizant, which is a leading source of television audience measurement services | |

| Notices | IRS Notices of Deficiency for 1997-2002 | |

| NRSRO | Nationally Recognized Statistical Rating Organizations | |

| Old D&B | The former Dun and Bradstreet Company which distributed New D&B shares on September 30, 2000, and was renamed Moody’s Corporation | |

| Post-Retirement Plans | Moody’s funded and unfunded pension plans, the post-retirement healthcare plans and the post-retirement life insurance plans | |

| PPIF | Public, project and infrastructure finance; an LOB of MIS | |

| Profit Participation Plan | Defined contribution profit participation retirement plan that covers substantially all U.S. employees of the Company | |

| PWG | President’s Working Group on Financial Markets | |

| Reform Act | Credit Rating Agency Reform Act of 2006 | |

| REITs | Real estate investment trusts | |

| Reorganization | The Company’s business reorganization announced in August 2007 which resulted in two new reportable segments (MIS and MA) beginning in January 2008 | |

| 6 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

| TERM | DEFINITION | |

| Restructuring Plan | The Company’s 2007 restructuring plan | |

| RMBS | Residential mortgage-backed security; part of SFG | |

| S&P | Standard & Poor’s Ratings Services, a division of The McGraw-Hill Companies, Inc. | |

| SEC | Securities and Exchange Commission | |

| Series 2005-1 Notes | Principal amount of $300.0 million, 4.98% senior unsecured notes due in September 2015 pursuant to the 2005 Agreement | |

| Series 2007-1 Notes | Principal amount of $300.0 million, 6.06% senior unsecured notes due in September 2017 pursuant to the 2007 Agreement | |

| SFAS | Statement of Financial Accounting Standards | |

| SFAS No. 87 | SFAS No. 87, “Employers’ Accounting for Pensions” | |

| SFAS No. 88 | SFAS No. 88, “Employers’ Accounting for Settlements and Curtailments of Defined Benefits Pension Plans and for Termination Benefits” | |

| SFAS No. 109 | SFAS No. 109, “Accounting for Income Taxes” | |

| SFAS No. 112 | SFAS No. 112, “Employers’ Accounting for Postemployment Benefits” | |

| SFAS No. 123 | SFAS No. 123 “Accounting for Stock-Based Compensation” | |

| SFAS No. 123R | SFAS No. 123R, “Share-Based Payment” (Revised 2004) | |

| SFAS No. 132R | SFAS No. 132R, “Employers’ Disclosures about Pensions and Other Postretirement Benefits – an amendment of FASB Statements No. 87, 88, and 106” (Revised 2003) | |

| SFAS No. 133 | SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” | |

| SFAS No. 141 | SFAS No. 141, “Business Combinations” | |

| SFAS No. 141R | SFAS No. 141R, “Business Combinations” (Revised 2007) | |

| SFAS No. 142 | SFAS No. 142, “Goodwill and Other Intangible Assets” | |

| SFAS No. 144 | SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” | |

| SFAS No. 146 | SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities” | |

| SFAS No. 157 | SFAS No. 157, “Fair Value Measurements” | |

| SFAS No. 158 | SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106, and 132(R)” | |

| SFAS No. 159 | SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities – including an amendment of FASB Statement No. 115” | |

| SFAS No. 162 | SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” | |

| SFG | Structured finance group; an LOB of MIS | |

| SG&A | Selling, general and administrative expenses | |

| Stock Plans | The 1998 Plan and the 2001 Plan | |

| T&E | Travel and entertainment expenses | |

| Total Debt | All indebtedness of the Company as reflected on the consolidated balance sheets, excluding current accounts payable incurred in the ordinary course of business | |

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 7 |

| TERM | DEFINITION | |

| U.K. | United Kingdom | |

| U.S. | United States | |

| USD | U.S. dollar | |

| UTBs | Unrecognized tax benefits | |

| UTPs | Uncertain tax positions | |

| 1998 Plan | Old D&B’s 1998 Key Employees’ Stock Incentive Plan | |

| 2000 Distribution | The distribution by Old D&B to its shareholders of all of the outstanding shares of New D&B common stock on September 30, 2000 | |

| 2000 Distribution Agreement | Agreement governing certain ongoing relationships between the Company and New D&B after the 2000 Distribution including the sharing of any liabilities for the payment of taxes, penalties and interest resulting from unfavorable IRS determinations on certain tax matters and certain other potential tax liabilities | |

| 2001 Plan | The Amended and Restated 2001 Moody’s Corporation Key Employees’ Stock Incentive Plan | |

| 2005 Agreement | Note purchase agreement dated September 30, 2005 relating to the Series 2005-1 Notes | |

| 2007 Agreement | Note purchase agreement dated September 7, 2007 relating to the Series 2007-1 Notes | |

| 2007 Facility | Revolving credit facility of $1 billion entered into on September 28, 2007, expiring in 2012 | |

| 2008 Term Loan | Five-year $150.0 million senior unsecured term loan entered into by the Company on May 7, 2008 | |

| 7WTC | The Company’s headquarters located at 7 World Trade Center | |

| 7WTC Lease | Operating lease agreement entered into on October 20, 2006 | |

| 8 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

| ITEM 1. | BUSINESS |

As used in this report, except where the context indicates otherwise, the terms “Moody’s” or the “Company” refer to Moody’s Corporation, a Delaware corporation, and its subsidiaries. The Company’s executive offices are located at 99 Church7 World Trade Center at 250 Greenwich Street, New York, NY 10007 and its telephone number is (212) 553-0300.

Prior to September 30, 2000, the Company operated as part of The Dun & Bradstreet Corporation (“OldCorporation.

Moody’s is a provider of (i) credit ratings and related research, data and analytical tools, (ii) quantitative credit risk measures, risk scoring software, and credit portfolio management solutions and (iii) securities pricing software and valuation models. In 2007 and prior years, Moody’s operated in two reportable segments: Moody’s Investors Service and Moody’s KMV. Beginning in January 2008, Moody’s segments were changed to reflect the Reorganization announced in August 2007. As a result of the Reorganization, the rating agency remains in the MIS operating segment and several ratings business lines have been realigned. All of Moody’s other non-rating commercial activities, including MKMV and sales of MIS research, are now combined under a new operating segment known as Moody’s Analytics. Moody’s now reports in two new reportable segments: MIS and MA. Financial information and operating results of these segments, including revenue, expenses, operating income and total assets, are included in Part II, Item 8. Financial Statements of this annual report, and are herein incorporated by reference.

The MIS segment publishes credit ratings on a wide range of debt obligations and the entities that issue such obligations in markets worldwide, including various corporate and governmental obligations, structured finance securities and commercial paper programs. Revenue is derived from the originators and issuers of such transactions who use MIS’s ratings to support the distribution of their debt issues to investors. MIS provides ratings in more than 110 countries. Ratings are disseminated via press releases to the public through a variety of print and electronic media, including the Internet and real-time information systems widely used by securities traders and investors. As of December 31, 2008, MIS had ratings relationships with approximately 13,000 corporate issuers and approximately 26,000 public finance issuers. Additionally, the Company has rated and currently monitors ratings on approximately 109,000 structured finance obligations.

The MA segment develops a wide range of products and services that support the credit risk management activities of institutional participants in global financial markets. These offerings include quantitative credit risk scores, credit processing software, economic research, analytical models, financial data, securities pricing software and valuation models, and specialized consulting services. MA also distributes investor-oriented research and data developed by MIS as part of its rating process, including in-depth research on major debt issuers, industry studies, and commentary on topical events. MA clients represent more than 5,000 institutions worldwide operating in approximately 120 countries. Over 30,000 client users and more than 200,000 individuals accessed Moody’s research web site.

The Company operated as part of “Old D&B”). On until September 8,30, 2000, the Board of Directors ofwhen Old D&B approved a plan to separateseparated into two publicly traded companies – the CompanyMoody’s Corporation and The New D&B Corporation (“New D&B”). On September 30, 2000 (“the Distribution Date”),&B. At that time, Old D&B distributed to its shareholders all of the outstanding shares of New D&B common stock (the “2000 Distribution”).stock. New D&B comprised the business of Old D&B’s Dun & Bradstreet operating company (the “D&B Business”).company. The remaining business of Old D&B consisted solely of the business of providing ratings and related research and credit risk management services (the “Moody’s Business”) and was renamed “Moody’s Corporation”.

New D&B is the accounting successor to Old D&B, which was incorporated under the laws of the State of Delaware on April 8, 1998. Old D&B began operating as an independent publicly-owned corporation on July 1, 1998 as a result of its June 30, 1998 spin-off (the “1998 Distribution”) from the corporation now known as “R.H. Donnelley Corporation” and previously known as “The Dun & Bradstreet Corporation” (“Donnelley”). Old D&B became the accounting successor to Donnelley at the time of the 1998 Distribution.

Prior to the 1998 Distribution, Donnelley was the parent holding company for subsidiaries then engaged in the businesses currently conducted by New D&B, Moody’s and Donnelley. Prior to November 1, 1996, it also was the parent holding company of subsidiaries conducting business under the names Cognizant Corporation (“Cognizant”) and ACNielsen Corporation (“ACNielsen”). On that date Donnelley effected a spin-off of the capital stock of Cognizant and ACNielsen to its stockholders (the “1996 Distribution”). Cognizant subsequently changed its name to Nielsen Media Research, Inc. in connection with its 1998 spin-off of the capital stock of IMS Health Incorporated (“IMS Health”).

Corporation. For purposes of governing certain ongoing relationships between the Company and New D&B after the 2000 Distribution and to provide for an orderly transition, the Company and New D&B entered into various agreements including a Distribution Agreement, Tax Allocation Agreement, Employee Benefits Agreement, Shared Transaction Services Agreement, Insurancedistribution agreement, tax allocation agreement and Risk Management Services Agreement, Data Services Agreement and Transition Services Agreement.

Detailed descriptions of the 1996, 1998 and 2000 Distributions are contained in the Company’s 2000 annual report on Form 10-K, filed on March 15, 2001.employee benefits agreement.

The Company

Moody’s is a provider of (i) credit ratings, research and analysis covering fixed-income securities, other debt instruments and the entities that issue such instruments in the global capital markets, and credit training services and (ii) quantitative credit risk assessment products and services and credit processing software for banks, corporations and investors in credit-sensitive assets. Founded in 1900, Moody’s employs approximately 3,400 people worldwide. Moody’s maintains offices in 22 countries and has expanded into developing markets through joint ventures or affiliation agreements with local rating agencies. Moody’s customers include a wide range of corporate and governmental issuers of securities as well as institutional investors, depositors, creditors, investment banks, commercial banks and other financial intermediaries. Moody’s is not dependent on a single customer or a few customers, such that a loss of any one would have a material adverse effect on its business.

Moody’s operates in two reportable segments: Moody’s Investors Service and Moody’s KMV. For additional financial information on these segments, see Part II, Item 8. “Financial Statements – Note 17 – Segment Information”.

Moody’s Investors Service publishes rating opinions on a broad range of credit obligors and credit obligations issued in domestic and international markets, including various corporate and governmental obligations, structured finance securities and commercial paper programs. It also publishes investor-oriented credit information, research and economic commentary, including in-depth research on major debt issuers, industry studies, special comments and credit opinion handbooks. Moody’s credit ratings and research help investors analyze the credit risks associated with fixed-income securities. Such independent credit ratings and research also contribute to efficiencies in markets for other obligations, such as insurance policies and derivative transactions, by providing credible and independent assessments of credit risk. Moody’s provides ratings and

2

credit research on governmental and commercial entities in more than 100 countries. Moody’s global and increasingly diverse services are designed to increase market efficiency and may reduce transaction costs. As of December 31, 2006, Moody’s had ratings relationships with more than 12,000 corporate issuers and approximately 29,000 public finance issuers. Additionally, the Company has rated more than 96,000 structured finance obligations. Ratings are disseminated via press releases to the public through a variety of print and electronic media, including the Internet and real-time information systems widely used by securities traders and investors.

Beyond credit rating services for issuers, Moody’s Investors Service provides research services, data and analytic tools that are utilized by institutional investors and other credit and capital markets professionals. These services cover various segments of the loan and debt capital markets, and are sold to more than 9,300 customer accounts worldwide. Within these accounts, more than 29,000 users accessed Moody’s research website (www.moodys.com) during calendar year 2006. In addition to these clients, more than 148,000 other individuals visited Moody’s website to retrieve current ratings and other information made freely available to the public.

The Moody’s KMV business develops and distributes quantitative credit risk assessment products and services and credit processing software for banks, corporations and investors in credit-sensitive assets. Moody’s KMV serves more than 1,700 clients operating in approximately 85 countries, including most of the world’s largest financial institutions. Moody’s KMV’s quantitative credit analysis tools include models that estimate the probability of default for approximately 29,000 publicly traded firms globally, updated daily. In addition, Moody’s KMV’s RiskCalc™ models extend the availability of these probabilities to privately held firms in many of the world’s economies. Moody’s KMV also offers services to value and improve the performance of credit-sensitive portfolios.

Prospects for GrowthPROSPECTS FOR GROWTH

Over recent decades, global public and private fixed-income markets have grown significantly in terms of outstanding principal amount and types of securities. While there is potentialsecurities or other obligations. Despite the recent market disruption and significant declines in issuance activity for periodic cyclical disruptionmany classes of securities in these developments,the U.S. and internationally, Moody’s believes that the overall trend andlong-term outlook remainremains favorable for continued secular growth of fixed-income markets worldwide. However, Moody’s expects that, in the near-term, growth drivers such as financial innovation and disintermediation will slow as capital market activity worldwide. In addition,participants adjust to the securities being issuedrecent poor performance of some structured finance asset classes, such as U.S. RMBS and credit derivatives. Restoring investor confidence in structured products may require further enhancements to MIS’s rating processes and may be facilitated by greater transparency from issuers of

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 9 |

structured (or securitized) debt. MIS has developed updated rating methodologies, volatility measures, and pricing and valuation services to aid the global fixed-income markets are becoming more complex.return of investor trust. Moody’s expects that these trendsinitiatives will providesupport continued long-term demand for high-quality, independent credit opinions. These phenomena are especially apparent internationally, where economic expansion and integration are driving increased use of public

Growth in global fixed-income markets for corporate financing activities,is attributable to a number of forces and factors such as enabling regulation and increased acceptance of new financial technologies by debt issuers and investors have driven growthtrends. Advances in structured finance issuance.

Communicationinformation technology, such as the Internet, makesmake information about investment alternatives widely available throughout the world. This technology facilitates issuers’ ability to place securities outside their national markets and investors’ capacity to obtain information about securities issued outside their national markets. Issuers and investors are also more readily able to obtain information about new financing techniques and new types of securities that they may wish to purchase or sell, many of which may be unfamiliar to them. This availability of information promotes the ongoing integration and development of worldwide financial markets and a greater need for credible, and globally comparable opinions about credit risk. As a result, existing capital markets have expanded and a number of new capital markets have emerged. In addition, more issuers and investors are accessing developed capital markets.

Another trend that is increasing the size ofin the world’s capital markets is the ongoing disintermediation of financial systems. Issuers are increasingly financingraise capital in the global public capital markets, in addition to, or in substitution for, traditional financial intermediaries. Moreover, financial intermediaries are sellinghave sold assets in the global public capital markets, in addition to or instead of retaining those assets. Structured finance securitiesRecent credit market disruptions have slowed the trend of disintermediation globally, but Moody’s believes that debt capital markets for many types of assets have developedoffer advantages in many countriescapacity and are contributingefficiency compared to these trends.the traditional banking systems. Thus, disintermediation is expected to expand in the longer-term.

The complexity of capital market instruments is also growing. Consequently, assessingstrong growth trend seen in the credit risk of such instruments becomes more of a challenge for financial intermediaries and asset managers. In the credit markets, reliable third-party ratings and research increasingly supplement or substitute for traditional in-house research as the scale, geographic scope and complexity of financial markets grow.

Growth in issuance of structured finance securities has generally been stronger than growthreversed dramatically in straight corporate and financial institutions debt issuance,2008 due to the market turmoil. The market disruptions that escalated in 2008 are expected to continue in the immediate term, and Moody’s expects that trend to continue. Growthsee a continued decline in revenue from this market in 2009. However, although the extent and scale are unclear, Moody’s believes that structured finance has reflected increased acceptancesecurities will continue to play a role in global credit markets, and provide opportunities for longer term growth. Moody’s will continue to monitor and support the progress of structured finance as a financingthis market and refinancing mechanism, regulatory changes that facilitateadapt to meet the use of structured finance, and increases in the scope of asset types, including for example consumer debt, that form the underlying asset pools for structured finance securities.changing needs.

Rating fees paid by debt issuers account for most of the revenue of Moody’s Investors Service.MIS. Therefore, a substantial portion of Moody’sMIS’s revenue is dependent upon the volume and number of debt securities issued in the global capital markets that Moody’sit rates. Moody’s is therefore affected by, for example, the performance, of, and the prospects for growth, of the major world economies,

3

and by the fiscal and monetary policies pursued by their governments.governments, and the decisions of issuers to request MIS ratings to aid investors in their investment decision process. However, annual fee arrangements with frequent debt issuers, annual debt monitoring fees and annual fees from commercial paper and medium-term note programs, bank and insurance company financial strength ratings, mutual fund ratings, subscription-based research and other areas are less dependent on, or independent of, the volume or number of debt securities issued in the global capital markets.

Moody’s operations are also subject to various risks inherent in carrying on business internationally. Such risks include currency fluctuations and possible nationalization, expropriation, exchange and price controls, changes in the availability of data from public sector sources, limits on providing information across borders and other restrictive governmental actions. Management believes that the risks of nationalization or expropriation are reduced because the Company’s basic service is the creation and dissemination of information, rather than the production of products that require manufacturing facilities or the use of natural resources. However, the formation of, for example, a new government-sponsored regional or global rating agency would pose a risk to Moody’s growth prospects. Management believes that this risk, compared to other regulatory changes under consideration for the credit rating industry, is relatively low because of the likelihood that substantial investments over a sustained period would be required, with uncertainty about the likelihood of financial success.

Legislative bodies and regulators in both the United StatesU.S., Europe and Europeselective other jurisdictions continue to conduct regulatory reviews of credit rating agencies,CRAs, which may result in, for example, an increased number of competitors, changes to the business model or restrictions on certain business expansion activities by Moody’s Investors Serviceof MIS, or increased costs of doing business for Moody’s. Therefore, in order to broaden the potential for expansion of non-ratings services, Moody’s reorganized in January 2008 into two distinct businesses: MIS, consisting solely of the ratings business, and MA. Moody’s Analytics conducts all non-ratings activities, and includes the MKMV and Fermat businesses, the sale of credit research produced by MIS and the production and sale of other credit related products and services. The reorganization broadens the opportunities for expansion by MA into activities which were previously restricted, due to the potential for conflicts of interest with the ratings business. At present, Moody’s is unable to assess the nature and effect that any regulatory changes may have on future growth opportunities. See “Regulation” below.

| 10 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

MA expects to benefit from the growing demand among credit market participants for information that enables them to make sound investment and risk management decisions. These customers require advanced qualitative and quantitative tools to support their management of increasingly complex capital market instruments. Such complexity creates analytical challenges for market participants, including financial intermediaries, asset managers and other investors. In recent years, reliable third-party ratings and research served to supplement or substitute for traditional in-house research as the scale, geographic scope and complexity of financial markets grew. Recent disruptions in credit markets threaten to slow this trend, but Moody’s expects to sustain reliance on its offerings as enhancements to credit rating methodologies and other changes in securities origination processes restore investor confidence and more orderly market operations.

Growth in Moody’s KMVMA is also expected from increased awareness and adoption byas financial institutions ofadopt active credit portfolio management practices and the estimation of economic capital, for which MKMV provides products and services. In addition, Moody’s KMV will continue to see revenue growth from the implementation ofimplement internal ratingcredit assessment tools for compliance with Basel II compliance and credit analysis best practices.regulations. MA offers products that respond to these needs. This growth will be realized by, for example, the development of new private firm default probability models for specific countries and by expanding analysis capabilities of new asset classes.

The Moody’s Investors ServiceMIS business competes with other credit rating agenciesCredit Rating Agencies and with investment banks and brokerage firms that offer credit opinions and research. Institutional investorsMany of Moody’s customers also have in-house credit research capabilities. Moody’s largest competitor in the global credit rating business is Standard & Poor’s Ratings Services, (“S&P”), a division of The McGraw-Hill Companies, Inc. There are some rating markets, based on industry, geography and/or instrument type, in which Moody’s has made investments and obtained market positions superior to S&P’s. In other markets, the reverse is true.

In addition to S&P, Moody’s competitors include Fitch, a subsidiary of Fimalac S.A., Dominion Bond Rating Service Ltd. of Canada (“DBRS”) and, A.M. Best Company Inc, Japan Credit Rating Agency Ltd., Rating and Investment Information Inc. of Japan (R&I) and Egan-Jones Ratings Company. In 2008 two more firms were granted the Nationally Recognized Statistical Rating Organizations status; LACE Financial Corp., in February, and Realpoint LLC, in June. One or more significantadditional rating agencies may emerge in the United StatesU.S. as the Securities and Exchange Commission (“SEC”) maySEC continues to expand the number of Nationally Recognized Statistical Rating Organizations (“NRSRO”).NRSROs. Competition may also emergeincrease in developed or developing markets outside the United StatesU.S. over the next few years as the number of rating agencies increase.increases.

Financial regulators are reviewing their approach to supervision and have sought or are seeking comments on changes to the global regulatory framework that could affect Moody’s. Bank regulators, under the oversight of the Basel Committee on Banking Supervision, have proposed using refined risk assessments as the basis for minimum capital requirements. The proposed Standardized Approach relies on rating agency opinions, while the proposed Internal Ratings Based Approach relies on systems and processes maintained by the regulated bank. The increased regulatory focus on credit risk presents both opportunities and challenges for Moody’s. Global demand for credit ratings and risk management services may rise, but regulatory actions may result in a greater number of rating agencies and/or additional regulation of Moody’s and its competitors. Alternatively, banking or securities market regulators could seek to reduce the use of ratings in regulations, thereby reducing certain elements of demand for ratings, or otherwise seek to control the analysis or business of rating agencies.

Credit rating agencies such as Moody’sMIS also compete with other means of managing credit risk, such as credit insurance. Competitors that develop quantitative methodologies for assessing credit risk also may pose a competitive threat to Moody’s.

Moody’s KMV’sMA competes broadly in the financial information space against diversified competitors such as Thomson-Reuters, Bloomberg, RiskMetrics, S&P, Fitch, Dun & Bradstreet, and Markit Group among others. MA’ main competitors for quantitative measures of defaultwithin credit risk management include theFitch Algorithmics, SunGard, SAS, i-Flex, and RiskMetrics Group S&P, CreditSights, R&I’s Financial Technology Institute (in Japan), Fitch Algorithmics, Dunas well as a host of smaller vendors and Bradstreet, models developed internally by customersin-house solutions. In economic analysis, data and othermodeling services, MA faces competition from IHS Global Insight, Oxford Economics, Haver Analytics and a number of smaller vendors. Other firms may compete inaround the future. Baker Hill, acquired by Experian, and Bureau van Dijk Electronic Publishing areworld. Within Credit Services, Moody’s KMV’s main competitors in the software market to assist banks in their commercial lending activities.competes with Mercer Oliver Wyman competes with the professional services group at Moody’s KMV for certain credit risk consulting, serviceswith Omega Performance, DC Gardner, and a host of boutique providers for financial training, and CreditSights, Gimme Credit and other smaller providers for independent credit research. In Securities Analytics and Valuation, Moody’s competes against Interactive Data Corporation, Thomson-Reuters, S&P, Fitch, Markit Group, CME, Intex, and many other smaller providers.

Moody’s continues to follow growth strategies that adapt to market conditions and capitalize on emerging opportunities:

Given recent market turmoil Moody’s immediate focus is on making effective business decisions to adjust for the expected reduction in revenue while positioning the Company to benefit from an eventual recovery in global credit market activity.

In a world of renewed attention to risk analysis and risk management, Moody’s is committed to further encouraging the informed use of credit ratings, research and related analytics products.

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 11 |

Moody’s seeks to differentiate itself from incumbent and potential competitors with uniquely thoughtful, forward-looking and accurate opinions about credit and the credit industry.

Adapting to market change is a key factor in maintaining market relevance. Moody’s continuously monitors opportunities to selectively diversify its revenue base through organic growth and acquisitions, in order to replace lost revenue and position Moody’s for new sources of business.

4

Moody’s Strategy

In support of those goals Moody’s intends to continue its focus onin the following opportunities:areas:

Expansion in Financial Centers

Moody’s serves its customers through its global network of offices and business affiliations. Moody’s currently maintains comprehensive rating and marketing operations in financial centers including Dubai, Frankfurt, Hong Kong, London, Madrid, Milan, Moscow, New York, Paris, Singapore, Sydney and Tokyo. Moody’s expects that its global network will position it to benefit from the expansion of worldwide capital markets and thereby increase revenue. Moody’s also expects that the growth of its Moody’s Investors ServiceMIS business as a consequence of financial market integration in Europe will continue.return. Additionally, Moody’s expects to continue its expansion into developing markets either directly or through joint ventures. This will allow Moody’s to extend its credit opinion franchise to local and regional obligors, through domestic currency ratings and national scale ratings. These developing market efforts have been supported in 2006 by the acquisition of 100% of CRA Rating Agency in the Czech Republic to form Moody’s Central Europe and the acquisition of a 49% stake in China Cheng Xin International Credit Rating Co. Ltd. in China, and in January 2007 by the acquisition of 99% of PT Kasnic Credit Rating in Indonesia to form Moody’s Indonesia. Moody’s expects to continue its expansion into developing markets either directly or through joint ventures.

New Rating Products

Moody’s is pursuing numerous initiatives to expand credit ratings, including from public fixed-income securities markets to other sectors with credit risk exposures. Within established capital markets, Moody’s continues to expand its rating coverage of bank loansrespond to investor demand for new products and project finance loansenhancements. In the recent market turmoil attention to core strengths has been crucial and securities. In globalenhancements have and local counterparty markets, Moody’s offers distinct sets of rating productscontinue to addressbe focused on quality and transparency. Given the creditworthiness of financial firms, including bank financial strength and deposit ratings, and insurance financial strength ratings. Moody’s has also introduced issuer ratings for corporations not activeparticular disruption in the debt markets. As the structured finance markets continueMIS has been developing enhanced structured finance offerings to grow worldwide and secondary markets continue to develop, demandmeet investor demands for more information content. Leveraging the diversity of its research data and analytics Moody’s has introduced cross-sector analysis supporting these markets has heightened. In orderto better illustrate the broader impacts of recent market events. This is further enhanced by the incorporation of macroeconomics to frame conditions and assumptions. MIS continues to capitalize on market developments and to enhance ratings surveillance efficiency, Moody’s has created a new products group within structured finance to focusfocusing on new ratings products, such as hedge fund operations quality ratings, and to identify, design, develop and maintain value-added research, analytics and data products serving the structured finance market. The acquisition of Wall Street Analytics in December 2006 broadens Moody’s capabilities in the analysis and monitoring of complex debt securities and provides a deeper pool of dedicated analytic and product development staff to create new software analytic tools for the structured finance market.

In response to growing investor demand for expanded credit opinion in the high yield market, Moody’s has introduced a number of new products, including joint default analysis, corporate financial metrics, and both loss-given-default and probability-of-default ratings.capital markets.

Additional Opportunities in Structured Finance

The repackaging of financial assets has had a profound effect on the fixed-income markets. New patterns of securitization are expected to emerge in the next decade. Although the bulk of assets securitized in the past five years have been consumer assets owned by banks, commercial assets — principally commercial mortgages, term receivables and corporate obligations — are now increasingly being securitized. Securitization has evolved into a strategic corporate finance tool in North America, Europe and Japan, and is evolving elsewhere internationally. Ongoing global development of non-traditional financial instruments, especially credit derivatives, has accelerated in recent years. Increasingly complex collateralized debt obligations (“CDO”s) have been introduced, which should continue to support growth. Moody’s has introduced new services enabling investors to monitor the performance of their investments in structured finance, covering asset-backed finance, commercial mortgage finance, residential mortgage finance and credit derivatives.

Internet-Enhanced Products and Services

Moody’s is expanding its use of the Internet and other electronic media to enhance client service. Moody’s website provides the public with instant access to ratings and provides the public and subscribers with credit research. Internet delivery also enables Moody’s to provide services to more individuals within a client organization than were available with paper-based products and to offer higher-value services because of more timely delivery. Moody’s expects that access to these applications will increase client use of Moody’s services. Moody’s expects to continue to invest in electronic media to capitalize on these and other opportunities.

5

Expansion of Credit Research Products and Investment Analytic Tools

Moody’s plans to expand its research and analytic services through internal development and by acquisition. To respond to client demand,through acquisitions. Most new product initiatives are generallytend to be more analytical and data-intensive than traditional narrative research offerings. Such services address investor interest in replicating the monitoring activities conducted by, for example, Moody’s securitization analysts and provide the means for customers to gain access to raw data and adjusted financial statistics and ratios used by Moody’s analysts in the rating process for municipalities, companies and financial institutions. These products represent important sources of growth for the research business unit.business. MA is developing products in the fixed-income valuations and pricing arena that facilitate price transparency in global fixed income markets, especially for complex structured securities and derivative instruments. Moreover, Moody’s continues to explore opportunities to extend its research relevance in new domestic or regional markets (e.g., China) as well as new functional markets (e.g., hedge funds).

New Quantitative Credit Risk Assessment Services

Moody’s will continue to provide banks and other institutions with quantitative credit risk assessment services. Moody’s believes that there will be increased demand for such services because they assist customers trading or holding credit-sensitive assets to producebetter manage risk and deliver better performance. Also, recent proposals by international bank regulatory authorities to recognizeare assessing the

| 12 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

adequacy of banks’ internal credit risk management systems for the purpose of determining regulatory capital are expected tocapital. The acquisition of Fermat accelerates Moody’s developments in this area. Such regulatory initiatives create demand for, and encourage adoption of, suchrelated services by banks from third-party providers. Moody’s also expects to provide extensions to existing services and new services, such as valuations of credit-sensitive assets.

In the United States, Moody’s Investors ServiceU.S., since 1975, MIS has been designated as aan NRSRO by the SEC. The SEC first applied the NRSRO designation in 1975that year to companies whose credit ratings could be used by broker-dealers for purposes of determining their net capital requirements. Since that time, Congress, (including in certain mortgage-related legislation), the SEC (including in certain of its regulations under the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended and the Investment Company Act of 1940, as amended) and other governmental and private bodies have used the ratings of NRSROs to distinguish between, among other things, “investment grade”“investment-grade” and “non-investment grade”“non-investment-grade” securities. Moody’s Investors Service has also voluntarily registered with the SEC as a NRSRO under the Investment Advisers Act of 1940, as amended. Once SEC rules under

In September 2006, the Credit Rating Agency Reform Act of 2006 discussed below, are promulgated and become effective, approved NRSROs will be required to register pursuant to the Securities Exchange Act of 1934.

Over the past several years, U.S. regulatory and congressional authorities have reviewed the suitability of continuing to use ratings in federal securities laws and, if such use is continued, the potential needwas passed, which created a voluntary registration process for altering the regulatory framework under which rating agencies operate. This review ultimately resulted in the passage of the Credit Rating Agencywishing to be designated as NRSROs. The Reform Act of 2006 (“Reform Act”) in September 2006. The stated objectives of the Reform Act are to foster competition, transparency and accountability in the credit rating industry. It makes changes to the SEC’s processes for designating rating agencies as NRSROs, and formalizes the framework through whichprovides the SEC oversees them. However, the legislation provides thatwith authority to oversee NRSROs, while prohibiting the SEC shall not regulatefrom regulating the substance of credit ratings or the procedures and methodologies by which any NRSRO determines credit ratings. The Reform Act requires the SEC to issue final implementing rules byIn June 26, 2007. On February 5, 2007, the SEC published for comment its proposedfirst set of rules addressingunder the Reform Act. These rules address the NRSRO application and registration process, as well as oversight rules related to recordkeeping, financial reporting, policies for handlingprevention of misuse of material non-public information, conflicts of interest, and prohibited acts and practices. In June 2007, MIS filed its application for registration as an NRSRO with the SEC. In September 2007, the SEC registered MIS as an NRSRO under the Securities Exchange Act of 1934, and as of that time MIS has been subject to the SEC’s oversight rules described above. As required by the rules, MIS has made its Form NRSRO Initial Application, its Annual Certification of Form NRSRO, and any associated updates publicly available by posting it on the Regulatory Affairs page of the Company’s website.

In July 2008, the SEC released a report on its examination of CRAs. The SEC began its review of the ratings processes and procedures of the three leading rating agencies — MIS, S&P and Fitch — in August 2007, focusing on sub-prime RMBS and CDOs. While the Commission’s Staff noted that most of the period under review pre-dated the implementation of SEC rules for the industry, the report identified areas that were either of concern to the SEC or that the SEC believed could be enhanced going-forward. The concerns identified by the Commission’s Staff generally fall into three categories: policies addressing potential conflicts of interest; resources and resource allocation; documentation around policies and procedures and enhancing transparency. The SEC also summarized the various steps that are already being put in place by the rating agencies, as well as those that are under consideration in the SEC’s current rule-making process.

In February 2009, the SEC published a second set of final rules applicable to NRSROs as well as additional proposed rules. These final rules and rule proposals were approved by the Commission in early December 2008. The majority of the final rules address managing conflicts of interest, enhancing record keeping requirements, and certain prohibitions against unfair, coercive or abusive practices. Interested parties have untilimproving transparency of ratings performance and methodologies. The deadline for market comment on the new proposed rules is March 12, 2007 to26, 2009. MIS will submit comments to the SEC. Moody’s isSEC by this deadline.

Finally, both chambers of the Congress are reviewing the proposed rulesbroader U.S. regulatory infrastructure and intendsas part of this review, the role and function of CRAs will continue to submit comments tobe studied. For example, as part of a series of hearings focusing on the SEC.existing market turmoil, on October 22, 2008, the House Committee on Oversight and Government Reform held a hearing on the Role of Credit Rating Agencies. MIS has participated in this and other hearings and the written testimonies can be found on the Regulatory Affairs page of the Company’s website.

Internationally, several regulatory developments have occurred:

The Group of 7 and the Group of 20— The G-7 Finance Ministers and Central Bank Governors formally asked the FSF to analyze the underlying causes of the recent financial market turbulence. One area for analysis was the role and use of credit rating in the structured finance market. To encourage the adoption of a unified regulatory approach, the FSF has coordinated the work of other international organizations on these subjects. The FSF’s recommendations on the CRA industry are as follows: improve the quality of the rating process and management of conflicts of interest in rating structured finance securities; differentiate ratings on structured finance products from those on corporate and government bonds and expand the initial and ongoing information provided on the risk characteristics of structured products; and enhance their review of the quality of the data input and due diligence performed on underlying assets by originators, arrangers and issuers.

In November 2008, the Heads of State of the G-20 reached agreement on a wide-ranging set of proposals to better regulate financial systems. Among other things, the G-20 committed to implement oversight of the CRAs, consistent with the strength-

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 13 |

ened international code of conduct (see below) and agreed that, in the medium term, the countries should implement a registration system for CRAs. The G-20 also committed to formulate their regulations and other measures in a consistent manner and recommended that, the international organization of securities regulators should review CRAs’ adoption of the standards and mechanisms for monitoring compliance.

IOSCO—In December 2004, the Technical Committee of the International Organization of Securities Commissions (“IOSCO”)IOSCO published theits Code of Conduct Fundamentals for Credit Rating Agencies (the “IOSCO Code”). TheAgencies. In March 2008, IOSCO Code ispublished for public consultation a report on the productrole of approximately two years of collaboration among IOSCO, rating agencies and market participants, and incorporates provisions that address three broad areas:

the quality and integrity of the rating process;

credit rating agency independence and the avoidance of conflicts of interest; and

credit rating agency responsibilitiesCRAs in structured finance, as well as a proposal to the investing public and issuers.

The IOSCO Code is not binding on credit rating agencies. It relies on voluntary compliance and public disclosure of areas of non-compliance by credit rating agencies so that users of credit ratings can better assess rating agency behavior and performance.

6

Moody’s Investors Service endorsedamend the IOSCO Code of Conduct Fundamentals for CRAs. Working with four other globally active CRAs, MIS submitted a joint response to IOSCO’s consultation report. This joint response can be found on the Regulatory Affairs webpage of the Company’s website. In May 2008, IOSCO finalized its report and published the revised IOSCO Code at its annual meeting in June 2005May, 2008. The changes made to the IOSCO Code broadly address greater transparency of methodologies and processes by CRAs. On July 2008, IOSCO also announced that it will monitor the CRAs implementation of the IOSCO Code changes and it will explore the means by which IOSCO members might work together to verify the proper and complete disclosure by CRAs of information required by the IOSCO Code. Finally, in September IOSCO announced that it would discuss at its next technical committee meeting, held in January 2009, measures that would aim to bring about more globally consistent oversight of CRAs.

MIS initially published its Code of Professional Conduct (the “Moody’s Code”) pursuant to the IOSCO Code in June 2005 and published an updated version in October 2007. In November 2008, MIS revised its Code to reflect the changes made to the IOSCO Code. In AprilBeginning in 2006, Moody’s Investors ServiceMIS has annually published its first annuala report on thethat describes its implementation of Moody’sthe Code. The report discusses policies, procedures and processes that implement the Moody’s Code. The report also describes differences between the Moody’sMIS Code and the IOSCO Code and how Moody’s believesthree annual reports that the objectives of the IOSCO Code are otherwise addressed. Both Moody’s Code and the reporthave been published thus far can be found on theRegulatory Affairspage of the Company’s website.

European UnionEU—The European Commission (“Commission”) issued a Communication on rating agencies in January 2006. The Commission noted that recent European Union (“EU”) financial services legislative measures that are relevant to credit rating agencies, combined with a self-regulatory framework for rating agencies based onpresently is re-examining the IOSCO Code, provided a suitable framework for the oversight of rating agencies and that no legislative actions were required at the time. The Commission indicated that it would monitor developments related to rating agencies and asked the Committee of European Securities Regulators (“CESR”) to monitor rating agencies’ compliance with the IOSCO Code and report back regularly.

CESR completed a process to assess such compliance and published a report in January 2007. The CESR process focused on four internationally active rating agencies that operate in the European Union, including Moody’s, and involved discussions with the individual rating agencies as well as a survey of market participants. CESR concluded that the four rating agencies are largely compliant with the IOSCO Code and identified a few areas where it believed rating agencies could improve their processes and disclosures and where the IOSCO Code could be improved. CESR indicated that for its 2007 report, it will look into these areas in particular as well as the impact of the Reform Act and the SEC’s implementing rules on the rating business in the European Union. As a result of the CESR report, in January 2007 the Commission reiterated its stance that the self-regulatory approach was, at present, the appropriate regulatory framework for rating agencies in Europe. On July 31, 2008 the Commission published a consultation document seeking comments on proposals with respect to regulating rating agencies that operate in the EU. Specifically, the Commission sought comments on the authorization, supervision and enforcement rules for rating agencies that operate within the EU. Over 90 respondents provided the Commission with their views on the suggested framework. MIS’s comments on the proposal are posted on the Regulatory Affairs page of the Company’s website.

In November 2008, the Commission introduced proposed regulation for the oversight of CRAs (“Proposed Regulation”). The document is primarily based on the IOSCO Code, but with important differences. Particularly, the Commission has introduced additional conduct and governance regulation. The Proposed Regulation is now being considered by EU Member States — under the leadership of the Presidency of the Council of the EU — and by the European Parliament. Both bodies have the ability to introduce significant modifications to the Commission’s original proposed text.

It is as yet too early to assess the form and content of this re-evaluation process.

The Basel Committee—In June 2004, the Basel Committee on Banking Supervision published a new bank capital adequacy framework, (“called Basel II”)II, to replace its initial 1988 framework. Under Basel II, ratings assigned by recognized credit rating agencies (called External Credit Assessment Institutions,CRAs or “ECAIs”) couldECAIs, can be used by banks in determining credit risk weights for many of their institutional credit exposures. National authorities will begin implementing these aspects of Basel II during 2007. Recognized ECAIs could be subject to a broader range of oversight.

In the EU, Basel II has been adopted through the Capital Requirements Directive (“CRD”), which, among other things, sets out criteria for recognizing ECAIs within the EU. The Commission created the Committee of European Banking Supervisors (“CEBS”), comprised of European banking regulators, to advise it on banking policy issues that include implementing the CRD. In January 2006, CEBS published guidelines that provide the basis for a consistent approach by EU Member States to the implementation of the CRD’s ECAI recognition and supervision criteria. Moody’s completed an application process pursuant to the CEBS guidelines and in August 2006, CEBS announced a shared view among EU banking National authorities that Moody’s should be recognized as an ECAI. However, as each Member State must formally recognize ECAIs for use in its jurisdiction, the recognition process is ongoing.

Bank regulators in other jurisdictions globally have begun the ECAI recognition process, and Moody’sprocess. MIS has been recognized as an ECAI in several jurisdictions. At this time Moody’s cannot predictjurisdictions and the long-term impact of Basel II on the mannerrecognition process is ongoing in which the Company conducts its business. However, Moody’smany others. MIS does not currently believe that Basel II will materially affect its financial position or results of operations. As a result of the recent regulatory activity, the banking authorities of the Basel Committee are reconsidering the overall Basel II framework. It is as yet too early to assess the form and content of this re-evaluation.

Other legislation and regulation relating to credit rating and research services has beenis being considered from time to time by local, national and multinational bodies and this type of activity is likely to be consideredcontinue in the future. In addition, in certain countries, governments may provide financial or other support to locally-based rating agencies. In addition,For example, governments may from time to time establish official rating agencies or credit ratings criteria or procedures for evaluating local issuers. If enacted, any such legislation and regulation could significantly change the competitive landscape in which Moody’sMIS operates. In addition, theThe legal status of rating agencies has been addressed by courts in various decisions and is likely to be considered and addressed in legal proceedings from time to time in the future. Management of Moody’sMIS cannot predict whether these or any other proposals will be enacted, the outcome of any pending or possible future legal proceedings, or regulatory or legislative actions, or the ultimate impact of any such matters on the competitive position, financial position or results of operations of Moody’s.

| 14 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

Intellectual PropertyINTELLECTUAL PROPERTY

Moody’s and its affiliates own and control a variety of trade secrets, confidential information, trademarks, trade names, copyrights, patents, databases and other intellectual property rights that, in the aggregate, are of material importance to Moody’s business. Management of Moody’s believes that each of the “Moody’s”, “Moody’s KMV” and the “M Circle Logo” trademarks and related corporate names, marks and logos containing the term “Moody’s” are of material importance to Moody’s.the Company. Moody’s is licensed to use certain technology and other intellectual property rights owned and controlled by others, and, similarly, other companies are licensed to use certain technology and other intellectual property rights owned and controlled by Moody’s. Moody’sThe Company considers its trademarks, service marks, databases, software and other intellectual property to be proprietary, and Moody’s relies on a combination of copyright, trademark, trade secret, patent, non-disclosure and contractual safeguards for protection.

7

In 2002, Moody’s formed two subsidiaries that hold some of its intellectual property. The first, MIS Quality Management Corp., was formed to own, manage, protect, enforce and license the trademarks of Moody’s and its affiliates. The second, Moody’s Assurance Company, Inc., is a New York State “captive” insurance company that self-insures Moody’s against certain risks and owns Moody’s ratings databases, methodologies and related software and processes in addition to other assets in support of its insurance program.

The names of Moody’s products and services referred to herein are trademarks, service marks or registered trademarks or service marks owned by or licensed to Moody’s or one or more of its subsidiaries.

As of December 31, 2006,2008, the number of full-time equivalent employees of Moody’s was approximately 3,400.3,900.

Available InformationAVAILABLE INFORMATION

Moody’s investor relations Internet website is http://ir.moodys.com/. Under the “SEC Filings” tab at this website, the Company makes available free of charge its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after they are filed with, or furnished to, the SEC.

The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and other information statements that the Company files electronically with the SEC. The SEC’s internet site is http://www.sec.gov/.

EXECUTIVE OFFICERS OF THE REGISTRANT

|

| |

| ||

| ||

Richard Cantor, 51 Chief Risk Officer – Moody’s Corporation and Chief Credit Officer – Moody’s Investors Service | Mr. Cantor has served as Chief Risk Officer of Moody’s Corporation since December 2008 and as Chief Credit Officer of Moody’s Investors Service, Inc. since November 2008. Mr. Cantor has also served as the Chairman of the Credit Policy Committee since November 2008. From July 2008 to November 2008 Mr. Cantor served as Acting Chief Credit Officer and Acting Chairman of the Credit Policy Committee. Prior thereto, Mr. Cantor was Managing Director of Moody’s Credit Policy Research Group from June 2001 to July 2008 and Senior Vice President in the Financial Guarantors Rating Group. Mr. Cantor joined Moody’s in 1997 from the Federal Reserve Bank of New York, where he served as Assistant Vice President in the Research Group and was Staff Director at the Discount Window. Prior to the Federal Reserve, Mr. Cantor taught Economics at UCLA and Ohio State and has taught on an adjunct basis at the business schools of Columbia University and NYU. | |

John J. Goggins, Senior Vice President and General Counsel | Mr. Goggins has served as the Company’s Senior Vice President and General Counsel since October 1, 2000. Mr. Goggins joined Moody’s Investors Service, Inc. in February 1999 as Vice President and Associate General Counsel and became General Counsel in 2000. | |

8

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 15 |

NAME, AGE AND POSITION | BIOGRAPHICAL DATA | |||

Linda S. Huber, Executive Vice President and Chief Financial Officer | Ms. Huber has served as the Company’s Executive Vice President and Chief Financial Officer since May 2005. Prior thereto, she served as Executive Vice President and Chief Financial Officer at U.S. Trust Company, a subsidiary of Charles Schwab & Company, Inc., from 2003 to 2005. Prior to U.S. Trust, she was Managing Director at Freeman & Co. from 1998 through 2002. She served PepsiCo as Vice President of Corporate Strategy and Development from 1997 until 1998 and as Vice President and Assistant Treasurer from 1994 until 1997. She served as Vice President in the Energy Investment Banking Group at Bankers Trust Company from 1991 until 1994 and as an Associate in the Energy Group at First Boston Corporation from 1986 through 1990. She also held the rank of Captain in the U.S. Army where she served from 1980 to 1984. | |||

Michel Madelain, 52 Chief Operating Officer – Moody’s Investors Service | Mr. Madelain has served as Chief Operating Officer of Moody’s Investors Service Inc., since May 2008. Prior to this position, Mr. Madelain served as Executive Vice President, Fundamental Ratings from September 2007 to May 2008, with responsibility for all Global Fundamental Ratings, including Corporate Finance, Financial Institutions, Public Finance and Infrastructure Finance. He managed the Financial Institutions group from March 2007 until September 2007. Mr. Madelain served as Group Managing Director, EMEA Corporate Ratings from January 2004 to March 2007 and prior thereto held several Managing Director positions in the U.S. and U.K. Fundamental Rating Groups. Prior to joining Moody’s in 1994, Mr. Madelain served as a Partner of Ernst & Young, Auditing Practice. Mr. Madelain is qualified as a Chartered Accountant in France. | |||

Joseph (Jay) McCabe, Senior Vice | Mr. McCabe has served as the Company’s Senior Vice President | |||

Raymond W. McDaniel, Jr., Chairman and Chief Executive Officer | Raymond W. McDaniel, Jr., has served as the Chairman and Chief Executive Officer | |||

| 16 | MOODY’S 2008 ANNUAL REPORT FINANCIALS |

NAME, AGE AND POSITION | BIOGRAPHICAL DATA | |

Perry Rotella, Senior Vice President and Chief Information Officer | Mr. Rotella has served as the Company’s Senior Vice President and Chief Information Officer since December 2006. Prior | |

Lisa S. Westlake, 47 Senior Vice President and Chief Human Resource Officer | Ms. Westlake has served as the Company’s Senior Vice President and Chief Human Resources Officer since December 2008. Prior to this position, Ms. Westlake served as Vice President — Investor Relations from December 2006 to December 2008 and Managing Director — Finance from September 2004 to December 2006. Prior to joining the Company, Ms. Westlake was a senior consultant with the Schiff Consulting Group from 2003 to 2004. From 1996 to 2003 Ms. Westlake worked at American Express Company where she held several different positions such as Vice President and Chief Financial Officer for the OPEN Business, Vice President and Chief Financial Officer for Establishment Services and Vice President and Chief Financial Officer for Relationship Services. From 1989 to 1995 Ms. Westlake held a range of financial management positions at Dun & Bradstreet Corporation and it subsidiary at the time, IMS International. From 1984 to 1987 Ms. Westlake served at Lehman Brothers in both the investment banking and municipal trading areas. | |

9

| MOODY’S 2008 ANNUAL REPORT FINANCIALS | 17 |

| ITEM 1A. | RISK FACTORS |

The following risk factors and other information included in this annual report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones the Company faces. Additional risks and uncertainties not presently known to the Company or that the Company’s management currently deems minor or insignificant also may impair its business operations. If any of the following risks occur, Moody’s business, financial condition, operating results and cash flows could be materially adversely affected.

Changes in the Volume of Debt Securities Issued in Domestic and/or Global Capital Markets and Changes in Interest Rates and Other Volatility in the Financial Markets

Approximately 80%49% of Moody’sMIS’ revenue for 2008 was transaction-based, compared to 68% of MIS’ revenue in 2006 was derived2007. Revenue from ratings, a significant portion of which was related to the issuance of credit-sensitive securitiesrating transactions, in the global capital markets. The Company anticipates that a substantial part of its business will continue to beturn, is dependent on the number and dollar volume of debt securities issued in the capital markets. Therefore, the Company’s results could be adversely affected by a reduction in the level of debt issuance.

Unfavorable financial or economicAccordingly, any conditions that either reduce investor demand for debt securities or reduce issuers’ willingness or ability to issue such securities could reduce the number and dollar volume of debt issuanceissuances for which Moody’s provides ratings services. In addition,services, and thereby, have an adverse effect on the fees derived from the issuance of ratings.

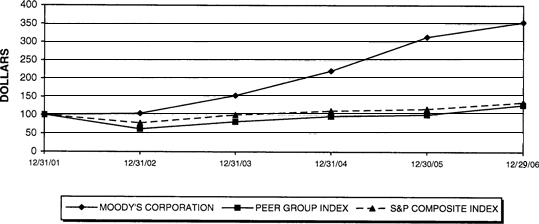

A significant disruption in world financial markets, particularly in the credit markets, that began in mid-2007 worsened materially in the second half of 2008, particularly in the latter portion of the year when many credit markets experienced a severe lack of liquidity. These credit market disruptions together with the current economic slowdown have negatively impacted the volume of debt securities issued in global capital markets and the demand for credit ratings. Consequently, the Company has experienced a substantial reduction in the demand for rating newly issued debt securities resulting in a 32% decrease in MIS revenue for 2008 compared to 2007. The timing and nature of any recovery in the credit and other financial markets remains uncertain, and there can be no assurance that market conditions will improve in the future or that financial results will not continue to be adversely affected. A sustained period of market decline or weakness, especially if it relates to credit sensitive securities, for which there is typically a high level of demand for ratings, could have a material adverse effect on Moody’s business and financial results. Initiatives that the Company has undertaken to reduce costs may not be sufficient to offset the results of a prolonged or more severe downturn, and further cost reductions may be difficult or impossible to obtain in the near term, due in part to rent, technology and other fixed costs associated with some of the Company’s operations as well as the need to monitor outstanding ratings. Further, the cost-reduction initiatives undertaken to date could result in strains in the Company’s operations if the credit markets and demand for ratings return to levels that prevailed prior to mid-2007 or otherwise unexpectedly surge.