UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 20062008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period fromto

COMMISSION FILE NUMBER 001-12307

ZIONS BANCORPORATION

(Exact name of Registrant as specified in its charter)

UTAH | 87-0227400 | |

(State or other jurisdiction of

| (Internal Revenue Service Employer Identification Number) | |

|

| |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (801) 524-4787

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Guarantee related to 8.00% Capital Securities of Zions Capital Trust B | New York Stock Exchange | |

6% Subordinated Notes due September 15, 2015 | New York Stock Exchange | |

Depositary Shares each representing a 1/40th ownership interest in a share of Series A Floating-Rate Non-Cumulative Perpetual Preferred Stock | New York Stock Exchange | |

Depositary Shares each representing a 1/40th ownership interest in a share of Series C 9.5% Non-Cumulative Perpetual Preferred Stock | New York Stock Exchange | |

Common Stock, without par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a non-accelerated filer.smaller reporting company. See definitionthe definitions of “large accelerated filer,” “accelerated filer,” and large accelerated filer”“smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Aggregate Market Value of Common Stock Held by Non-affiliates at June 30, 2006 | $ | 7,939,764,713 | |

Number of Common Shares Outstanding at February 16, 2007 | 109,997,378 shares | ||

Aggregate Market Value of Common Stock Held by Non-affiliates at June 30, 2008 | $ | 3,226,459,704 | |

Number of Common Shares Outstanding at February 20, 2009 | 115,337,627 shares |

Documents Incorporated by Reference:

Portions of the Company’s Proxy Statement (to be dated approximately March 16, 2007) for the Annual Meeting of Shareholders to be held May 4, 2007 – Incorporated into Part III

| Page | ||||

| Item 1. | ||||

| Item 1A. | ||||

| Item 1B. | ||||

| Item 2. | ||||

| Item 3. | ||||

| Item 4. | Submission of Matters to a Vote of Security | |||

| PART II | ||||

| Item 5. | ||||

| Item 6. | ||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |||

| Item 7A. | ||||

| Item 8. | ||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | |||

| Item 9A. | ||||

| Item 9B. | ||||

| PART III | ||||

| Item 10. | ||||

| Item 11. | ||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | |||

| Item 14. | ||||

| PART IV | ||||

| Item 15. | ||||

FORWARD-LOOKING INFORMATION

Statements in this Annual Report on Form 10-K that are based on other than historical data are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and include, among others:

statements with respect to the beliefs, plans, objectives, goals, guidelines, expectations, anticipations, and future financial condition, results of operations and performance of Zions Bancorporation (“the parent”) and its subsidiaries (collectively “the Company”Company,” “Zions,” “we,” “our,” “us”);

statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” or similar expressions.

These forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties and actual results may differ materially from those presented, either expressed or implied, in this Annual Report on Form 10-K, including, but not limited to, those presented in the Management’s Discussion and Analysis. Factors that might cause such differences include, but are not limited to:

the Company’s ability to successfully execute its business plans, manage its risks, and achieve its objectives;

changes in political and economic conditions, including the political and economic effects of the current economic crisis and other major developments, including wars, military actions and terrorist attacks against the United States and related events;attacks;

changes in financial market conditions, either internationally, nationally or locally in areas in which the Company conducts its operations, including without limitation, reduced rates of business formation and growth, commercial and residential real estate development and real estate prices;

fluctuations in themarkets for equity, fixed-income, commercial paper and fixed-income markets;other securities, including availability, market liquidity levels, and pricing;

changes in interest rates, the quality and composition of the loan and securities portfolios, demand for loan products, deposit flows and competition;

acquisitions and integration of acquired businesses;

increases in the levels of losses, customer bankruptcies, claims and assessments;

changes in fiscal, monetary, regulatory, trade and tax policies and laws, including policies of the U.S. Department of Treasury and the Federal Reserve Board;

the Company’s participation or lack of participation in governmental programs implemented under the Emergency Economic Stabilization Act (“EESA”) and the American Recovery and Reinvestment Act (“ARRA”), including without limitation the Troubled Asset Relief Program (“TARP”), the Capital Purchase Program (“CPP”), and the Temporary Liquidity Guarantee Program (“TLGP”) and the impact of such programs and related regulations on the Company and on international, national, and local economic and financial markets and conditions;

the impact of the EESA and the ARRA and related rules and regulations on the business operations and competitiveness of the Company and other participating American financial institutions, including the impact of the executive compensation limits of these acts, which may impact the ability of the Company and other American financial institutions to retain and recruit executives and other personnel necessary for their businesses and competitiveness;

the impact of certain provisions of the EESA and ARRA and related rules and regulations on the attractiveness of governmental programs to mitigate the effects of the current economic crisis, including the risks that certain financial institutions may elect not to participate in such programs, thereby decreasing the effectiveness of such programs;

continuing consolidation in the financial services industry;

new litigation or changes in existing litigation;

success in gaining regulatory approvals, when required;

changes in consumer spending and savings habits;

increased competitive challenges and expanding product and pricing pressures among financial institutions;

demand for financial services in the Company’s market areas;

inflation and deflation;

technological changes and the Company’s implementation of new technologies;

the Company’s ability to develop and maintain secure and reliable information technology systems;

legislation or regulatory changes which adversely affect the Company’s operations or business;

the Company’s ability to comply with applicable laws and regulations; and

changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or regulatory agencies.agencies; and

increased costs of deposit insurance and changes with respect to Federal Deposit Insurance Corporation (“FDIC”) insurance coverage levels.

The Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

AVAILABILITY OF INFORMATION

We also make available free of charge on our website,www.zionsbancorporation.com, annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission.

GLOSSARY OF ACRONYMS

ABS – Asset-Backed Security

AFS – Available-for-Sale

ALCO – Asset/Liability Committee

ALM – Asset-Liability Management

AML – Anti-Money Laundering

ARM – Adjustable Rate Mortgage

ARRA – American Recovery and Reinvestment Act

ATM – Automated Teller Machine

BCBS – Basel Committee on Banking Supervision

BSA – Bank Secrecy Act

CDARS – Certificate of Deposit Account Registry System

CDO – Collateralized Debt Obligation

CMC – Capital Management Committee

COSO – Committee of Sponsoring Organizations of the Treadway Commission

CPFF – Commercial Paper Funding Facility

CPP – Capital Purchase Program

CRA – Community Reinvestment Act

CRE – Commercial Real Estate

EESA – Emergency Economic Stabilization Act

EITF – Emerging Issues Task Force

ESOARS – Employee Stock Option Appreciation Rights Securities

FAMC – Federal Agricultural Mortgage Corporation

FASB – Financial Accounting Standards Board

FDIC – Federal Deposit Insurance Corporation

FHLB – Federal Home Loan Bank

FHLMC – Federal Home Loan Mortgage Corporation

FIN – FASB Interpretation

FINRA – Financial Industry Regulatory Authority

FNMA – Federal National Mortgage Association

FRB – Federal Reserve Board

FSP – FASB Staff Position

FTE – Full-Time Equivalent

GNMA – Government National Mortgage Association

HTM – Held-to-Maturity

ISDA – International Swap Dealer Association

LIBOR – London Inter-Bank Offering Rate

LTV – Loan-to-Value

MD&A – Management’s Discussion and Analysis

NPR – Notice of Proposed Rulemaking

NRSRO – Nationally Recognized Statistical Rating Organization

OCC – Office of the Comptroller of the Currency

OCI – Other Comprehensive Income

OREO – Other Real Estate Owned

OTC – Over-the-Counter

OTTI – Other-Than-Temporary-Impairment

PCAOB – Public Company Accounting Oversight Board

PDs – Probabilities of Default

QSPE – Qualifying Special-Purpose Entity

REIT – Real Estate Investment Trust

SBA – Small Business Administration

SBIC – Small Business Investment Company

SEC – Securities and Exchange Commission

SFAS – Statement of Financial Accounting Standards

TAF – Term Auction Facility

TARP – Troubled Asset Relief Program

TLGP – Temporary Liquidity Guarantee Program

VIE – Variable Interest Entity

| ITEM 1. | BUSINESS |

DESCRIPTION OF BUSINESS

Zions Bancorporation (“the Parent”) is a financial holding company organized under the laws of the State of Utah in 1955, and registered under the Bank Holding Company Act of 1956, as amended (the “BHC Act”). The Parent and its subsidiaries (collectively “the Company”) own and operate eight commercial banks with a total of 470 offices513 domestic branches at year-end 2006.2008. The Company provides a full range of banking and related services through its banking and other subsidiaries, primarily in Utah, California, Texas, Arizona, Nevada, Colorado, Idaho, Washington, and Oregon. Full-time equivalent employees totaled 10,61811,011 at year-end 2006.2008. For further information about the Company’s industry segments, see “Business Segment Results” on page 60 in Management’s Discussion and Analysis (“MD&A”) and Note 22 of the Notes to Consolidated Financial Statements. For information about the Company’s foreign operations, see “Foreign Operations” on page 58 in MD&A. The “Executive Summary” on page 18 in MD&A provides further information about the Company.

PRODUCTS AND SERVICES

The Company focuses on maintaining community-mindedproviding community banking services by continuously strengthening its core business lines of 1) small, medium-sized business and corporate banking; 2) commercial and residential development, construction and term lending; 3) retail banking; 4) treasury cash management and related products and services; 5) residential mortgage; 6) trust and 6)wealth management; and 7) investment activities. It operates eight different banks in ten Western and Southwestern states with each bank operating under a different name and each having its own board of directors, chief executive officer, and management team. The banks provide a wide variety of commercial and retail banking and mortgage lending products and services. They also provide a wide range of personal banking services to individuals, including home mortgages, bankcard, student and other installment loans, home equity lines of credit, checking accounts, savings accounts, time certificates of various types and maturities, trust services, safe deposit facilities, direct deposit, and 24-hour ATM access. In addition, certain banking subsidiaries provide services to key market segments through their Women’s Financial, Private Client Services, and Executive Banking Groups. We also offer wealth management services through a subsidiary, Contango Capital Advisors, Inc., (“Contango”) that was launched in 2004., and online brokerage services through Zions Direct.

In addition to these core businesses, the Company has built specialized lines of business in capital markets, public finance, and certain financial technologies, and is also a leader in U.S. Small Business Administration (“SBA”) lending. Through its eight banking subsidiaries, the Company provides SBA 7(a) loans to small businesses throughout the United States and is also one of the largest providers of SBA 504 financing in the nation. The Company owns an equity interest in the Federal Agricultural Mortgage Corporation (“Farmer Mac”) and is one of the nation’s top originatororiginators of secondary market agricultural real estate mortgage loans through Farmer Mac. The Company is a leader in municipal finance advisory and underwriting services. The Company also controls four venture capital funds that provide early-stage capital primarily for start-up companies located in the Western United States. Finally, the Company’s NetDeposit Inc. (“NetDeposit”) and P5, Inc. (“P5”) subsidiaries are national leaderssubsidiary is a leader in the provision of check imaging and clearing software and of web-based medical claims tracking and cash management services, respectively.

software.

COMPETITION

The Company operates in a highly competitive environment. The Company’s most direct competition for loans and deposits comes from other commercial banks, thrifts, and credit unions, including institutions that do not have a physical presence in our market footprint but solicit via the Internet and other means. In addition, the Company competes with finance companies, mutual funds, brokerage firms, securities dealers, investment banking companies, financial technology firms, and a variety of other types of companies. Many of these companies have fewer regulatory constraints and some have lower cost structures.

structures or tax burdens.

The primary factors in competing for business include pricing, convenience of office locations and other delivery methods, range of products offered, and the level of service delivered. The Company must compete effectively along all of these parameters to remain successful.

SUPERVISION AND REGULATION

The Parent is a bank holding company that has elected to become a financial holding company under the BHC Act. The Gramm-Leach-Bliley Act of 1999 (“the GLB Act”) provides a regulatory framework for financial holding companies, which have as their umbrella regulator the Federal Reserve Board (“FRB”). The functional regulation of the separately regulated subsidiaries of a holding company is conducted by each subsidiary’s primary functional regulator. To qualify for and maintain status as a financial holding company, a companythe Parent must satisfy certain ongoing criteria.

The GLB Act also provides federal regulations dealing with privacy for nonpublic personal information of individual customers, with which the Company must comply. In addition, the Company is subject to various other federal and state laws that deal with the use and disclosure of nonpublic personal information.

The Parent is a financial holding company and, as such, is subject to the BHC Act. The BHC Act requires the prior approval of the FRB for a financial holding company to acquire or hold more than 5% voting interest in any bank. The BHC Act allows, subject to certain limitations, interstate bank acquisitions and interstate branching by acquisition anywhere in the country.

The BHC Act restricts the Company’s nonbanking activities to those that are permitted for financial holding companies or that have been determined by the FRB to be financial in nature, incidental to financial activities, or complementary to a financial activity. The BHC Act does not place territorial restrictions on the activities of nonbank subsidiaries of financial holding companies.

The Company’s banking subsidiaries are also subject to various requirements and restrictions contained in both the laws of the United States and the states in which the banks operate. These include restrictions on:

transactions with affiliates;

the amount of loans to a borrower and its affiliates;

the nature and amount of any investments;

their ability to act as an underwriter of securities;

the opening of branches; and

the acquisition of other financial entities.

In addition, the Company’s subsidiary banks are subject to the provisions of the National Bank Act or the banking laws of their respective states, as well as the rules and regulations of the Office of the Comptroller of the Currency (“OCC”), the FRB, and the Federal Deposit Insurance Corporation (“FDIC”).FDIC. They are also under the supervision of, and are continually subject to periodic examination by, the OCC or their respective state banking departments, the FRB, and the FDIC. Many of our nonbank subsidiaries are also subject to regulation by the FRB and other applicable federal and state agencies. Our brokerage and investment advisory subsidiaries are regulated by the Securities and Exchange Commission (“SEC”), Financial Industry Regulatory Authority (“FINRA”) and/or state securities regulators. Our other nonbank subsidiaries may be subject to the laws and regulations of the federal government and/or the various states in which they conduct business.

The Company is subject to various requirements and restrictions contained in both the laws of the United States and the states in which its banks and other subsidiaries operate. These regulations include but are not limited to the following:

Laws and regulations regarding the availability, requirements and restrictions of a number of recently enacted governmental programs in which the Company participates, including the TARP and its associated CPP, the TLGP, the Term Auction Facility (“TAF”) and the Commercial Paper Funding Facility (“CPFF”), as well as certain conditions imposed by the EESA and ARRA and programs thereunder, including limitations on dividends on common stock in the CPP, and on executive compensation contained in the ARRA. Some of these programs, including specifically the CPP, contain provisions that allow the U.S. Government to unilaterally modify any term or provision of contracts executed under the program.

Requirements for approval of acquisitions and activities. The prior approval is required, in accordance with the BHC Act of the FRB, for a financial holding company to acquire or hold more than 5% voting interest in any bank. The BHC Act allows, subject to certain limitations, interstate bank acquisitions and interstate branching by acquisition anywhere in the country. The BHC Act also requires approval for certain nonbanking acquisitions and restricts the Company’s nonbanking activities to those that are permitted for financial holding companies or that have been determined by the FRB to be financial in nature, incidental to financial activities, or complementary to a financial activity.

��

Capital requirements. The FRB has established capital guidelines for financial holding companies. The OCC, the FDIC, and the FRB have also issued regulations establishing capital requirements for banks. Additional capital requirements, including taking additional capital from the U.S. Treasury in amounts and on terms yet to be defined, to be determined by “stress tests” not yet designed, may be required by the U.S. Treasury for banks larger than the Company, and could become required of the Company. There also is a risk that regional bank companies like Zions which are not deemed to be systemically important will be disadvantaged by not being allowed to participate in future government capital programs. The federal bank regulatory agencies have adopted and are proposing risk-based capital rules described below. Failure to meet capital requirements could subject the CompanyParent and its subsidiary banks to a variety of restrictions and enforcement remedies. See Note 19 of the Notes to Consolidated Financial Statements for information regarding capital requirements.

The U.S. federal bank regulatory agencies’ risk-based capital guidelines are based upon the 1988 capital accord (“Basel I”) of the Basel Committee on Banking Supervision (the “BCBS”). The BCBS is a committee of central banks and bank supervisors/regulators from the major industrialized countries that develops broad policy guidelines that each country’s supervisors can use to determine the

supervisory policies they apply. The BCBS has been working for a number of years on revisions to Basel I and in June 2004 releasedI. In December 2007, U.S. banking regulators published the final versionrule for Basel II implementation, requiring banks with over $250 billion in consolidated total assets or on-balance sheet foreign exposure of its proposed new capital framework with an update in November 2005 (“$10 billion (core banks) to adopt the Advanced Approach of Basel II”). II while allowing other banks to elect to “opt in.”

Basel II provides two approaches for setting capital standards for credit risk – an internal ratings-based approach tailored to individual institutions’ circumstances (which for many asset classes is itself broken into a “foundation” approach and an “advanced” or “A-IRB” approach, the availability of which is subject to additional restrictions) and a standardized approach that bases risk weightings on external credit assessments to a much greater extent than permitted in existing risk-based capital guidelines. Basel II also would setsets capital requirements for operational risk and refinerefines the existing capital requirements for market risk exposures. However, U.S. regulatory authorities consistently have taken the position that U.S. banks would not be permitted to utilize the “foundation” approach. Operational risk is defined by the proposal to mean the risk of direct or indirect loss resulting from inadequate or failed internal processes, people and systems, or from external events. Basel I does not include separate capital requirements for operational risk.

In September 2006, the U.S. banking and thrift agencies issued an interagency Advance Notice of Proposed Rulemaking (“NPR”) setting forth a definitive proposal for implementing Basel II in the United States that would apply only to internationally active banking organizations – defined as those with consolidated total assets of $250 billion or more or consolidated on-balance sheet

foreign exposures of $10 billion or more – but that other U.S. banking organizations could elect, but would not be required to apply. We doare not currently expect to be an early “opt in” bank holding company, as the Company does not have in place the data collection and analytical capabilities necessary to adopt Basel II.the Advanced Approach. However, we believe that the competitive advantages afforded to companies that do adopt the framework willAdvanced Approach may make it necessary for the Company to elect to “opt in” at some point,point. Whether or not this scenario emerges, our risk management will be well served by our continuing investment in more sophisticated analytical capabilities and we have begun investing in an enhanced data environment.

In July 2008, the required capabilities.U.S. banking regulators issued a proposed rule that would provide “non-core” banks with the option to adopt the Standardized Approach proposed in Basel II, replacing the previously proposed Basel 1A framework. While the Advanced Approach uses sophisticated mathematical models to measure and assign capital to specific risks, the Standardized Approach categorizes risks by type and then assigns capital requirements. We are evaluating the benefit of adopting the Standardized Approach and will make a decision following publication of the final rule.

Additional modifications of the Basel II regime continue to be proposed or adopted, but the requirements of the CPP and the ARRA appear to be “overriding” for the time being on any Basel II issues as they might apply to the Company.

Also, in December 2006,Requirements that the agencies issued another NPRParent serve as a source of strength for modificationsits banking subsidiaries. The FRB has a policy that a bank holding company is expected to act as a source of financial and managerial strength to each of its bank subsidiaries and, under appropriate circumstances, to commit resources to support each subsidiary bank. In addition, the Basel I framework for those banks not adopting Basel II, called Basel IA. The Basel IA NPR will allow non-Basel II banking organizations the choice of adopting allOCC may order an assessment of the revisions suggested inParent if the proposed NPR or continuingcapital of one of its national bank subsidiaries were to fall below capital levels required by the use of existing risk-based capital rules. The agencies have indicated their intent to have the A-IRB provisions for internationally active U.S. banking organizations first become effective in March 2009 and that those provisions and the Basel IA provisions for others will be implementedregulators.

Limitations on similar time frames.

Dividendsdividends payable by subsidiaries. A substantial portion of the Parent’s cash, which is used to pay dividends on our common and preferred stock and to pay principal and interest on our debt obligations, is derived from dividends paid by the Parent’s subsidiary banks to the Parentbanks. These dividends are subject to various legal and regulatory restrictions. These restrictions and the amount available for the payment of dividends at year-end areas summarized in Note 19 of the Notes to Consolidated Financial Statements.

The Financial Institutions Reform, Recovery, and Enforcement ActCross-guarantee requirements. All of 1989 provides that the Company’sParent’s subsidiary banks are insured by the FDIC. Each commonly controlled FDIC-insured bank subsidiaries arecan be held liable for any losslosses incurred, or reasonably expected to be incurred, by the FDIC due to another commonly controlled FDIC-insured bank being placed into receivership, and for any assistance provided by the FDIC to another commonly controlled FDIC-insured bank that is subject to certain conditions indicating that receivership is likely to occur in connection with the failureabsence of an affiliated insured bank.regulatory assistance.

TheSafety and soundness requirements. Federal and state laws require that our banks be operated in a safe and sound manner. We are subject to additional safety and soundness standards prescribed in the Federal Deposit Insurance CorporationCorporate Improvement Act of 1991, prescribesincluding standards for the safety and soundness of insured banks. These standards relaterelated to internal controls, information systems, internal audit, systems, loan documentation, credit underwriting, interest rate exposure, asset growth and compensation, as well as other operational and management standards deemed appropriate by the federal banking regulatory agencies.

Limitations on the amount of loans to a borrower and its affiliates.

The Limitations on transactions with affiliates.

Restrictions on the nature and amount of any investments and ability to underwrite certain securities.

Requirements for opening of branches and the acquisition of other financial entities.

Fair lending and truth in lending requirements to provide equal access to credit and to protect consumers in credit transactions.

Provisions of the GLB Act and other federal and state laws dealing with privacy for nonpublic personal information of individual customers.

Community Reinvestment Act (“CRA”) requirements. The CRA requires banks to help serve the credit needs in their communities, including credit to low and moderate income individuals. Should the Company or its subsidiaries fail to adequately serve their communities, penalties may be imposed including denials of applications to add branches, relocate, add subsidiaries and affiliates, and merge with or purchase other financial institutions.

Anti-money laundering regulations. The GLBBank Secrecy Act (“BSA”) and other federal laws require financial institutions to assist U.S. Government agencies to detect and prevent money laundering. Specifically, the BSA requires “satisfactory”financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or higher CRA compliance for insured depository institutions and their financial holding companies for them to engage in new financialother criminal activities. If one of the Company’s banks should receive a CRA rating of less than satisfactory, the Company could lose its status as a financial holding company.

On October 26, 2001, the President signed into law comprehensive anti-terrorism legislation known as the USA PATRIOT Act of 2001 (the “USA Patriot Act”). Title III of the Uniting and Strengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (“USA Patriot ActAct”) substantially broadens the scope of U.S. anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, defining new crimes and related penalties, and expanding the extra-territorial jurisdiction of the United States. The U.S. Treasury Department has issued a number of implementing regulations, which apply various requirements of the USA Patriot Act to financial institutions. The Company’s bank and broker-dealer subsidiaries and mutual funds and private investment companies advised or sponsored by the Company’s subsidiaries must comply with these regulations. These regulations also impose new obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing.

The Parent is subject to the disclosure and regulatory requirements of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, both as administered by the SEC. As a company quoted on the NASDAQ Stock Market LLC (“Nasdaq”) Global Select Market, the Parent is subject to Nasdaq listing standards for quoted companies.

The Company has adopted appropriate policies, procedures and controlsis subject to address compliance with the requirements of these acts and will continue to make appropriate revisions to reflect any changes required.

Regulators, Congress, and state legislatures continue to enact rules, laws, and policies to regulate the financial services industry and to protect consumers. The nature of these laws and regulations and the effect of such policies on future business and earnings of the Company cannot be predicted.

On July 30, 2002, the Senate and the House of Representatives of the United States (Congress) enacted the Sarbanes-Oxley Act of 2002, a law thatwhich addresses, among other issues, corporate governance, auditing and accounting, executive compensation, and enhanced and timely disclosure of corporate information. The Nasdaq has also adopted corporate governance rules, which are intended to allow shareholders and investors to more easily and efficiently monitor the performance of companies and their directors.

The Board of Directors of the Parent has implemented a comprehensive system of strong corporate governance practices. This system includes Corporate Governance Guidelines, a Code of Business Conduct and Ethics for Employees, a Directors Code of Conduct, and charters for the Audit, Credit Review, Executive Compensation, and Nominating and Corporate Governance Committees. More information on the Company’s corporate governance practices is available on the Company’s website atwww.zionsbancorporation.com. (The Company’s website is not part of this Annual Report on Form 10-K.)

The Company has adopted policies, procedures and controls to address compliance with the requirements of the banking, securities and other laws and regulations described above or otherwise applicable to the Company. The Company intends to make appropriate revisions to reflect any changes required.

Regulators, Congress, and state legislatures continue to enact rules, laws, and policies to regulate the financial services industry and public companies and to protect consumers and investors. The nature of these laws and regulations and the effect of such policies on future business and earnings of the Company cannot be predicted.

GOVERNMENT MONETARY POLICIES

The earnings and business of the Company are affected not only by general economic conditions, but also by fiscal and other policies adopted by various governmental authorities. The Company is particularly affected by the monetary policies of the FRB, which affect short-term interest rates and the national supply of bank credit. The methods of monetary policytools available to the FRB which may be used to implement monetary policy include:

open-market operations in U.S. governmentGovernment securities;

adjustment of the discount rates or cost of bank borrowings from the FRB; and

imposing or changing reserve requirements against bank deposits.deposits;

term auction facilities collateralized by bank loans; and

other programs to purchase assets and inject liquidity directly in various segments of the economy.

These methods are used in varying combinations to influence the overall growth or contraction of bank loans, investments and deposits, and the interest rates charged on loans or paid for deposits.

In view of the changing conditions in the economy and the effect of the FRB’s monetary policies, it is difficult to predict future changes in loan demand, deposit levels and interest rates, or their effect on the business and earnings of the Company. FRB monetary policies have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future.

| ITEM 1A. | RISK FACTORS |

The following list describes several risk factors which are significant to the Company:Company including but not limited to:

The United States and other countries are facing a severe economic crisis. In response the United States and other governments have established a variety of programs and policies designed to mitigate the effects of the crisis. Many of these programs and policies are unprecedented and untested and may not be effective or may have adverse consequences, whether anticipated or unanticipated. If these programs and policies are ineffective or result in substantial adverse developments, the economic crisis may become more severe or may continue for a substantial period of time. Any increase in the severity or duration of the economic crisis would adversely affect the Company.

The Company has chosen to participate in a number of new programs sponsored by the U.S. Government during the current financial and economic crisis, and in the future may elect to or be required to participate in these or other, as not yet enacted, programs. The company is therefore subject to the risk that these programs may not be available in the future, or that it will be forced to participate in programs that it does not believe to be in its best interest or that of its shareholders. These programs, including the TARP and its associated CPP, the TLGP, the TAF, and the CPFF, as well as the ARRA and EESA, contain important limitations on the Company’s conduct of its business, including limitations on dividends, repurchases of common stock, acquisitions, and executive compensation contained in the CPP and the ARRA. These limitations may adversely impact the Company’s ability to attract nongovernmental capital and to recruit and retain executive management and other personnel and its ability to compete with other American and foreign financial institutions. One of these programs, the CPP, contains provisions that allow the U.S. Government to unilaterally modify any term or provision of contracts executed under the program.

Certain provisions of the ESSA and ARRA and related rules and regulations may lead certain financial institutions to elect not to participate in governmental programs designed to mitigate the current economic crisis, thereby decreasing the effectiveness of such programs and creating additional stresses on employees and customers of and investors in American financial institutions.

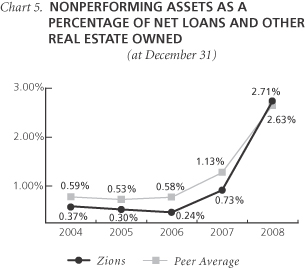

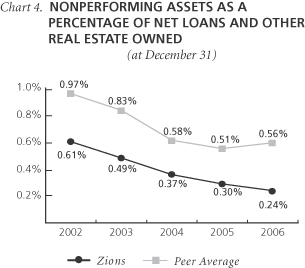

Credit risk is one of our most significant risks. OverThe Company’s level of credit quality continued to weaken during 2008. The deterioration in credit quality is mainly related to the weakness in residential development and construction activity in the Southwest that started in the latter half of 2007. Although not to the degree experienced in the Southwestern states (generally Arizona, Nevada and California), some signs of deterioration began to surface in Utah and Idaho during the first quarter of 2008 and in the Texas market in the fourth quarter of 2008. Residential construction and land development loans in Arizona and Nevada remain the most troubled segments of the portfolio and account for the most meaningful declines in commercial real estate credit quality during the last three years we have experienced historically high levelshalf of 2008. We expect continued credit quality. We do not see any indicationsquality deterioration over the next few quarters. With the economy continuing to weaken, there is a risk that credit quality will deteriorate significantly, but it is unlikely that we willcould be able to maintain credit quality at these levels indefinitely. Economic conditions in the high growth geographical areas in whichadversely impacted throughout our banks operate have been strong, but events could result in weaker economic conditions including deterioration of property values that could significantly increase the Company’s credit risk.geographic footprint and for other loan types.

Net interest income is the largest component of the Company’s revenue. The management of interest rate risk for the Company and all bank subsidiaries is centralized and overseen by an Asset Liability Management Committee appointed by the Company’s Board of Directors. The Company has been successful in its interest rate risk management as evidenced by its achieving a relatively stable net interest rate margin over the last several years when interest rates have been volatile and the rate environment challenging. Factors beyond the Company’s control can significantly influence the interest rate environment and increase the Company’s risk. These factors include competitive pricing pressures for our loans and deposits, adverse shifts in the mix of deposits and other funding sources, and volatile market interest rates subject to general economic conditions and the policespolicies of governmental and regulatory agencies, in particular the FRB.

Funding availability, as opposed to funding cost, became a more important risk factor in the latter half of 2007 and in 2008, as a global liquidity crisis affected financial institutions generally, including the Company, and is expected to remain an issue in 2009. However, this global liquidity crisis was partially mitigated as the Company strengthened its capital and liquidity during the latter half of 2008, including raising approximately $300 million of common and preferred equity, a capital investment of $1.4 billion from the U.S. Treasury as part of the Treasury’s CPP, as well as its participation in the TAF, and the TLGP. See “Capital Management” on page 119 in MD&A and Notes 11 and 14 of the Notes to Consolidated Financial Statements for further information on funding availability.

It is expected that liquidity stresses will continue to be a risk factor in 2009 for the Company, the Parent and its affiliate banks, and for Lockhart Funding, LLC (“Lockhart”). Lockhart’s participation in the CPFF has mitigated these stresses for it; however, this program is currently scheduled to expire in October 2009.

Zions Bank sponsors an off-balance sheet qualifying special-purpose entity (“QSPE”), Lockhart, which funds its assets by issuing asset-backed commercial paper. Its assets include securities which are rated AAA and AA or guaranteed by the U.S. Government. Factors beyond the Company’s control can significantly influence whether Lockhart will remain as an off-balance sheet QSPE and whether the Company will be required to purchase, and possibly incur losses, on securities from Lockhart under the provisions of a Liquidity Agreement the Company provides to Lockhart. These factors include Lockhart’s inability to issue asset-backed commercial paper, expiration of the Federal Reserve’s CPFF without sufficient offsetting market demand for Lockhart’s commercial paper, rating agency downgrades of securities, and instability in the credit markets.

The Company’s on-balance sheet asset-backed securities investment portfolio includes collateralized debt obligations (“CDOs”) collateralized by trust preferred securities issued by banks, insurance companies, and real estate investment trusts (“REITs”) that may have some exposure to the subprime market and/or to other categories of distressed assets. In addition, asset-backed securities also include structured asset-backed collateralized debt obligations (“ABS CDOs”) (also known as diversified structured finance CDOs) purchased from Lockhart which have minimal exposure to subprime and home equity mortgage securitizations. Factors beyond the Company’s control can significantly influence the fair value of these securities and potential adverse changes to the fair value of these securities. These factors include but are not limited to rating agency downgrades of securities, defaults of debt issuers, lack of market pricing of securities, rating agency downgrades of monoline insurers that insure certain asset-backed securities, and continued instability in the credit markets. See “Investment Securities Portfolio” on page 85 for further details.

The Company is exposed to accounting, financial reporting, and regulatory/compliance risk. The Company provides to its customers a number of complex financial products and services. Estimates, judgments and interpretations of complex and changing accounting and regulatory policies are required in order to provide and account for these products and services. Identification, interpretation and implementation of complex and changing accounting standards as well as compliance with regulatory requirements, including the BSA and various Know Your Customer, Identity Theft Red Flag, and Anti-Money Laundering regulations, therefore pose an ongoing risk.

The Company is subject to risks associated with legal claims and litigation. The Company’s exposure to claims and litigation may increase as a result of stresses on customers, counterparties and others arising from the current economic crisis.

A failure in our internal controls could have a significant negative impact not only on our earnings, but also on the perception that customers, regulators and investors may have of the Company. We continue to devote a significant amount of effort, time and resources to improving our controls and ensuring compliance with complex accounting standards and regulations.

We have a number of business initiatives that, while we believe they will ultimately produce profits for our shareholders, currently generate expenses in excess of revenues. Two significant initiatives are Contango, a wealth management business started in 2004, and NetDeposit, a subsidiary that provides electronic check processing systems. Our management of these businesses takes into account the development of revenues and control of expenses so that results of operations are not adverse to an extent that is not warranted by the expected opportunities these businesses provide.

As noted previously, U.S. and international regulators have proposedadopted new capital standards commonly known as Basel II. These standards would apply toAs a number of our largest competitors and potentially give them a significant competitive advantage overbank holding company with less than $250 billion in consolidated total assets

and on-balance sheet foreign exposure of less than $10 billion, we can but are not required to adopt the Advanced Approach of Basel II. We have not as yet chosen to adopt it. However, these standards would apply to a number of our largest competitors and potentially give them a competitive advantage over banks that do not adopt these standards. |

From time to time the Company makes acquisitions. The success of any acquisition depends, in part, on our ability to realize the projected cost savings from the merger and on the continued growth and profitability of the acquisition target. We have been successful with most prior mergers, but it is possible that the merger and integration process with an acquisition target could result in the loss of key employees, disruptions in controls, procedures and policies, or other factors that could affect our ability to realize the projected savings and successfully retain and grow the target’s customer base.

The Company’s Board of Directors has established an Enterprise-Wide Risk Management policy and appointed an Enterprise Risk Management Committee in 2005 to oversee and implement the policy. In addition to credit and interest rate risk, the Committee also oversees and monitors the following risk areas: market risk, liquidity risk, operational risk, compliance risk, information technology risk, strategic risk, and reputation risk.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

At year-end 2006,December 31, 2008, the Company operated 470513 domestic branches, of which 225269 are owned and 245244 are on leased premises.leased. The Company also leases its headquarter offices in Salt Lake City, Utah. Other operationsoperation facilities are either owned or leased. The annual rentals under long-term leases for leased premises are determined under various formulas and factors, including operating costs, maintenance, and taxes. For additional information regarding leases and rental payments, see Note 18 of the Notes to Consolidated Financial Statements.

| ITEM 3. | LEGAL PROCEEDINGS |

The information contained in Note 18 of the Notes to Consolidated Financial Statements is incorporated by reference herein.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None.

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

MARKET INFORMATION

The Company’s common stock is traded on the Nasdaq Global Select Market under the symbol “ZION.” The last reported sale price of the common stock on Nasdaq on February 16, 200720, 2009 was $87.56$9.00 per share.

The following table sets forth, for the periods indicated, the high and low sale prices of the Company’s common stock, as quoted on Nasdaq:

| 2006 | 2005 | 2008 | 2007 | ||||||||||||||||

| High | Low | High | Low | High | Low | High | Low | ||||||||||||

1st Quarter | $ | 85.25 | 75.13 | 70.45 | 63.33 | $ | 57.05 | 39.31 | 88.56 | 81.18 | |||||||||

2nd Quarter | 84.18 | 76.28 | 75.17 | 66.25 | 51.15 | 29.46 | 86.00 | 76.59 | |||||||||||

3rd Quarter | 84.09 | 75.25 | 74.00 | 68.45 | 107.21 | 1 | 17.53 | 81.43 | 67.51 | ||||||||||

4th Quarter | 83.15 | 77.37 | 77.67 | 66.67 | 47.94 | 21.07 | 73.00 | 45.70 | |||||||||||

1 | This trading price was an anomaly resulting from electronic orders at the opening of the market on September 19, 2008 in response to the SEC’s announcement (prior to the market opening that day) of its temporary emergency action suspending short selling in financial companies. The closing price on September 19, 2008 was $52.83. |

During September 8-11, 2008, the Company issued $250 million of new common stock consisting of 7,194,079 shares at an average price of $34.75 per share. Net of issuance costs and fees, this issuance added $244.9 million to common stock.

As of February 16, 2007,20, 2009, there were 6,9826,224 holders of record of the Company’s common stock.

DIVIDENDS

The frequency and amount of common stock dividends paid during the last two years are as follows:

1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||

2006 | $ | 0.36 | 0.36 | 0.36 | 0.39 | ||||

2005 | 0.36 | 0.36 | 0.36 | 0.36 | |||||

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||

2008 | $ | 0.43 | 0.43 | 0.43 | 0.32 | ||||

2007 | 0.39 | 0.43 | 0.43 | 0.43 | |||||

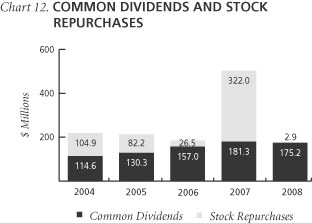

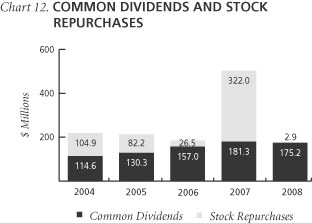

On January 26, 2007,2009, the Company’s Board of Directors approved a dividend of $0.39$0.04 per common share payable on February 21, 200725, 2009 to shareholders of record on February 7, 2007.11, 2009. This is a reduction from prior dividend levels in response to the deteriorating outlook for the Company and generally for the industry and the economy as a whole. The Company expects to continue its policy of paying regular cash dividends on a quarterly basis, although there is no assurance as to future dividends because they depend on future earnings, capital requirements, and financial condition.

On December 7, 2006, we issued 240,000We have 3,000,000 authorized shares of our Series A Floating-Rate Non-Cumulative Perpetual Preferred Stockpreferred stock without par value and with an aggregatea liquidation preference of $240 million, or $1,000 per share. TheAs of December 31, 2008, 240,000, 46,949, and 1,400,000 of preferred stock was offered in the form of 9,600,000 depositary shares with each depositary share representing a 1/40th ownership interest in a share of the preferred stock.series A, C, and D, respectively, have been issued. In general, preferred shareholders are entitled tomay receive asset distributions before common shareholders; however, preferred shareholders have no preemptive or conversion rights, and only limited voting rights pertaining generally with respect to amendments to the termscertain provisions of the preferred stock, or the issuance of senior preferred stock, as well asand the rightelection of directors. Preferred stock dividends reduce earnings available to elect two directorscommon shareholders and are paid quarterly in the event of certain defaults.arrears. The preferred stockredemption amount is not redeemable prior to December 15, 2011, but will be redeemable subsequent to that datecomputed at the Company’s option at theper share liquidation preference value plus any declared but unpaid dividends. The preferred stock dividend reduces earnings availableseries A and C shares are registered with the SEC.

to common shareholders and is computed at an annual rate equalThe Series D Fixed-Rate Cumulative Perpetual Preferred Stock was issued on November 14, 2008 to the greaterU.S. Department of three-month LIBOR plus 0.52%, or 4.0%the Treasury for $1.4 billion in a private placement exempt from registration. The EESA authorized the U.S. Treasury to appropriate funds to eligible financial institutions participating in the TARP Capital Purchase Program. The capital investment includes the issuance of preferred shares of the Company and a warrant to purchase common shares pursuant to a Letter Agreement and a Securities Purchase agreement (collectively “the Agreement”). The preferred shares are rankedpari passu with the Series A and C preferred shares. The dividend rate of 5% increases to 9% after the first five years. Dividend payments are made quarterly in arrears on the 15th day of March, June, September,February, May, August, and December, commencing on March 15, 2007.November. The warrant allows the U.S. Treasury to purchase up to 5,789,909 shares of the Company’s common stock exercisable over a 10-year period at a price per share of $36.27. The preferred shares and the warrant qualify for Tier 1 regulatory capital. The Agreement subjects the Company to certain restrictions and conditions including those related to common dividends, share repurchases, executive compensation, and corporate governance.

UnderWe recorded the termstotal $1.4 billion of the preferred stock agreements, in December 2006shares and the Company was required to declare the full quarterly dividendwarrant at their relative fair values of $3.8$1,292.2 million and set aside$107.8 million, respectively. The difference from the funds before it could resumepar amount of the repurchasepreferred shares is accreted to preferred stock over five years using the interest method with a corresponding adjustment to preferred dividends.

The Company cannot increase the common stock dividend above $0.32 per share without the consent of its common shares.

the U.S. Treasury until the third anniversary of the date of the investment, or November 14, 2011, unless prior to such third anniversary the senior preferred stock series D is redeemed in whole or the U.S. Treasury has transferred all of the senior preferred stock series D to third parties.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The information contained in Item 12 of this Form 10-K is incorporated by reference herein.

SHARE REPURCHASES

The following table summarizes the Company’s share repurchases for the fourth quarter of 2006:2008:

Period | Total number of shares | Average price paid per share | Total number of shares purchased | Approximate dollar value of shares that may yet be purchased | Total number of shares repurchased1 | Average price paid per share | Total number of shares purchased as part of publicly announced plans or programs | Approximate dollar value of shares that may yet be purchased under the plan | ||||||||||||

October | 1,057 | $ | 80.68 | – | $ | 59,253,657 | 100 | $ | 34.99 | – | $ | 56,250,315 | ||||||||

November | 365 | 79.27 | – | 59,253,657 | 387 | 29.50 | – | 56,250,315 | ||||||||||||

December | 311,987 | 81.06 | 308,359 | 375,006,404 | 8,918 | 25.97 | – | 56,250,315 | ||||||||||||

Fourth quarter | 313,409 | 81.05 | 308,359 | 9,405 | 26.21 | – | ||||||||||||||

1 | All share repurchases during the fourth quarter of 2008 were made to pay for |

The Company has not repurchased any shares under the Common Stock Repurchase Plan since August 16, 2007. It is prohibited from repurchasing any common shares by terms of the CPP until the Company’s CPP capital has been repaid.

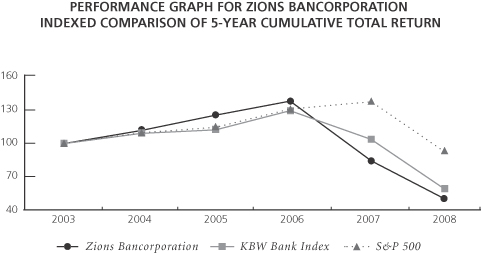

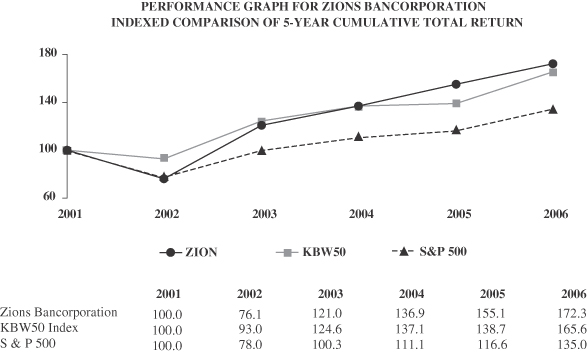

PERFORMANCE GRAPH

The following stock performance graph compares the five-year cumulative total return of Zions Bancorporation’s common stock with the Standard & Poor’s 500 Index and the KBW50 Index.KBW Bank Index which includes Zions Bancorporation. The KBW50KBW Bank Index is a market-capitalization weightedmarket capitalization-weighted bank stock index developed and published by Keefe, Bruyette & Woods, Inc., a nationalnationally recognized brokerage and investment banking firm specializing in bank stocks. The index is composed of 50 of the nation’s largest banking companies.24 geographically diverse stocks representing national money center banks and leading regional financial institutions. The stock performance graph is based upon an initial investment of $100 on December 31, 20012003 and assumes reinvestment of dividends.

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | |||||||

Zions Bancorporation | 100.0 | 113.3 | 128.4 | 142.7 | 82.7 | 45.1 | ||||||

KBW Bank Index | 100.0 | 110.3 | 113.7 | 133.0 | 104.1 | 54.9 | ||||||

S&P 500 | 100.0 | 110.8 | 116.3 | 134.6 | 142.0 | 89.5 |

| ITEM 6. | SELECTED FINANCIAL DATA |

FINANCIAL HIGHLIGHTSFinancial Highlights

| (In millions, except per share amounts) | 2006/2005 CHANGE | 2006 | 2005 (3) | 2004 | 2003 | 2002 | 2008/2007 Change | 2008 | 2007 | 2006 | 20054 | 2004 | ||||||||||||||||||||

FOR THE YEAR | ||||||||||||||||||||||||||||||||

For the Year | ||||||||||||||||||||||||||||||||

Net interest income | +30% | $ | 1,764.7 | 1,361.4 | 1,160.8 | 1,084.9 | 1,025.7 | +5 | % | $ | 1,971.6 | 1,882.0 | 1,764.7 | 1,361.4 | 1,160.8 | |||||||||||||||||

Noninterest income | +26% | 551.2 | 436.9 | 431.5 | 500.7 | 386.2 | -54 | % | 190.7 | 412.3 | 551.2 | 436.9 | 431.5 | |||||||||||||||||||

Total revenue | +29% | 2,315.9 | 1,798.3 | 1,592.3 | 1,585.6 | 1,411.9 | -6 | % | 2,162.3 | 2,294.3 | 2,315.9 | 1,798.3 | 1,592.3 | |||||||||||||||||||

Provision for loan losses | +69% | 72.6 | 43.0 | 44.1 | 69.9 | 71.9 | +326 | % | 648.3 | 152.2 | 72.6 | 43.0 | 44.1 | |||||||||||||||||||

Noninterest expense | +31% | 1,330.4 | 1,012.8 | 923.2 | 893.9 | 858.9 | +5 | % | 1,475.0 | 1,404.6 | 1,330.4 | 1,012.8 | 923.2 | |||||||||||||||||||

Impairment loss on goodwill | -100% | – | 0.6 | 0.6 | 75.6 | – | 353.8 | – | – | 0.6 | 0.6 | |||||||||||||||||||||

Income from continuing operations before income taxes and minority interest | +23% | 912.9 | 741.9 | 624.4 | 546.2 | 481.1 | ||||||||||||||||||||||||||

Income taxes | +21% | 318.0 | 263.4 | 220.1 | 213.8 | 167.7 | ||||||||||||||||||||||||||

Income (loss) before income taxes and minority interest | -143 | % | (314.8 | ) | 737.5 | 912.9 | 741.9 | 624.4 | ||||||||||||||||||||||||

Income taxes (benefit) | -118 | % | (43.4 | ) | 235.8 | 318.0 | 263.4 | 220.1 | ||||||||||||||||||||||||

Minority interest | +817% | 11.8 | (1.6) | (1.7) | (7.2) | (3.7) | -163 | % | (5.1 | ) | 8.0 | 11.8 | (1.6 | ) | (1.7 | ) | ||||||||||||||||

Income from continuing operations | +21% | 583.1 | 480.1 | 406.0 | 339.6 | 317.1 | ||||||||||||||||||||||||||

Loss on discontinued operations | – | – | – | – | (1.8) | (28.4) | ||||||||||||||||||||||||||

Cumulative effect adjustment | – | – | – | – | – | (32.4) | ||||||||||||||||||||||||||

Net income | +21% | 583.1 | 480.1 | 406.0 | 337.8 | 256.3 | ||||||||||||||||||||||||||

Net earnings applicable to common shareholders | +21% | 579.3 | 480.1 | 406.0 | 337.8 | 256.3 | ||||||||||||||||||||||||||

Net income (loss) | -154 | % | (266.3 | ) | 493.7 | 583.1 | 480.1 | 406.0 | ||||||||||||||||||||||||

Net earnings (loss) applicable to common shareholders | -161 | % | (290.7 | ) | 479.4 | 579.3 | 480.1 | 406.0 | ||||||||||||||||||||||||

PER COMMON SHARE | ||||||||||||||||||||||||||||||||

Earnings from continuing operations – diluted | +4% | 5.36 | 5.16 | 4.47 | 3.74 | 3.44 | ||||||||||||||||||||||||||

Net earnings – diluted | +4% | 5.36 | 5.16 | 4.47 | 3.72 | 2.78 | ||||||||||||||||||||||||||

Net earnings – basic | +4% | 5.46 | 5.27 | 4.53 | 3.75 | 2.80 | ||||||||||||||||||||||||||

Per Common Share | ||||||||||||||||||||||||||||||||

Net earnings (loss) – diluted | -160 | % | (2.66 | ) | 4.42 | 5.36 | 5.16 | 4.47 | ||||||||||||||||||||||||

Net earnings (loss) – basic | -160 | % | (2.67 | ) | 4.47 | 5.46 | 5.27 | 4.53 | ||||||||||||||||||||||||

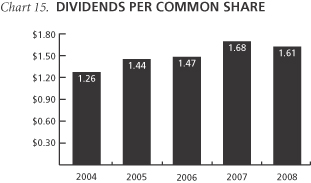

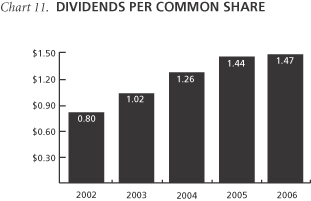

Dividends declared | +2% | 1.47 | 1.44 | 1.26 | 1.02 | 0.80 | -4 | % | 1.61 | 1.68 | 1.47 | 1.44 | 1.26 | |||||||||||||||||||

Book value (1) | +10% | 44.48 | 40.30 | 31.06 | 28.27 | 26.17 | ||||||||||||||||||||||||||

Book value1 | -10 | % | 42.65 | 47.17 | 44.48 | 40.30 | 31.06 | |||||||||||||||||||||||||

Market price – end | 82.44 | 75.56 | 68.03 | 61.34 | 39.35 | 24.51 | 46.69 | 82.44 | 75.56 | 68.03 | ||||||||||||||||||||||

Market price – high | 85.25 | 77.67 | 69.29 | 63.86 | 59.65 | |||||||||||||||||||||||||||

Market price – high2 | 57.05 | 88.56 | 85.25 | 77.67 | 69.29 | |||||||||||||||||||||||||||

Market price – low | 75.13 | 63.33 | 54.08 | 39.31 | 34.14 | 17.53 | 45.70 | 75.13 | 63.33 | 54.08 | ||||||||||||||||||||||

AT YEAR-END | ||||||||||||||||||||||||||||||||

At Year-End | ||||||||||||||||||||||||||||||||

Assets | +10% | 46,970 | 42,780 | 31,470 | 28,558 | 26,566 | +4 | % | 55,093 | 52,947 | 46,970 | 42,780 | 31,470 | |||||||||||||||||||

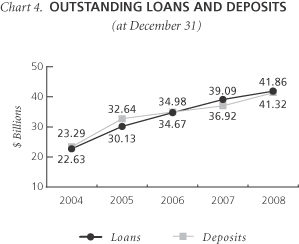

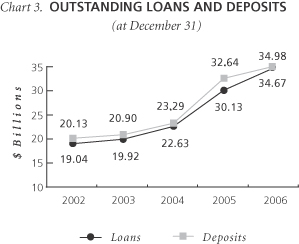

Net loans and leases | +15% | 34,668 | 30,127 | 22,627 | 19,920 | 19,040 | +7 | % | 41,859 | 39,088 | 34,668 | 30,127 | 22,627 | |||||||||||||||||||

Loans sold being serviced (2) | -24% | 2,586 | 3,383 | 3,066 | 2,782 | 2,476 | ||||||||||||||||||||||||||

Sold loans being serviced3 | -69 | % | 578 | 1,885 | 2,586 | 3,383 | 3,066 | |||||||||||||||||||||||||

Deposits | +7% | 34,982 | 32,642 | 23,292 | 20,897 | 20,132 | +12 | % | 41,316 | 36,923 | 34,982 | 32,642 | 23,292 | |||||||||||||||||||

Long-term borrowings | -9% | 2,495 | 2,746 | 1,919 | 1,843 | 1,310 | +1 | % | 2,622 | 2,591 | 2,495 | 2,746 | 1,919 | |||||||||||||||||||

Shareholders’ equity | +18% | 4,987 | 4,237 | 2,790 | 2,540 | 2,374 | ||||||||||||||||||||||||||

Shareholders’ equity: | ||||||||||||||||||||||||||||||||

Preferred equity | +559 | % | 1,582 | 240 | 240 | – | – | |||||||||||||||||||||||||

Common equity | -3 | % | 4,920 | 5,053 | 4,747 | 4,237 | 2,790 | |||||||||||||||||||||||||

PERFORMANCE RATIOS | ||||||||||||||||||||||||||||||||

Performance Ratios | ||||||||||||||||||||||||||||||||

Return on average assets | 1.32% | 1.43% | 1.31% | 1.20% | 0.97% | (0.50 | )% | 1.01 | % | 1.32 | % | 1.43 | % | 1.31 | % | |||||||||||||||||

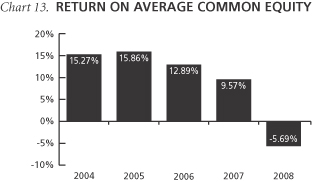

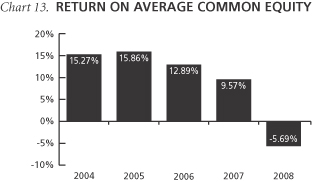

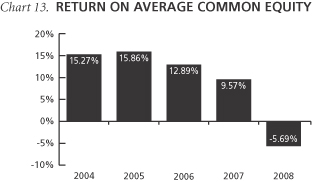

Return on average common equity | 12.89% | 15.86% | 15.27% | 13.69% | 10.95% | (5.69 | )% | 9.57 | % | 12.89 | % | 15.86 | % | 15.27 | % | |||||||||||||||||

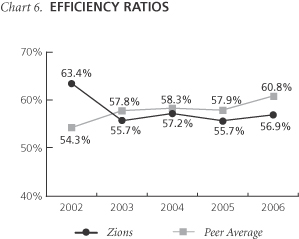

Efficiency ratio | 56.85% | 55.67% | 57.22% | 55.65% | 63.40% | 67.47 | % | 60.53 | % | 56.85 | % | 55.67 | % | 57.22 | % | |||||||||||||||||

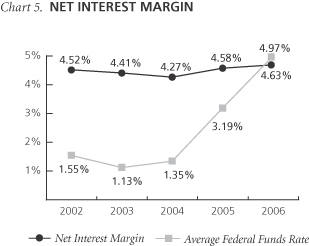

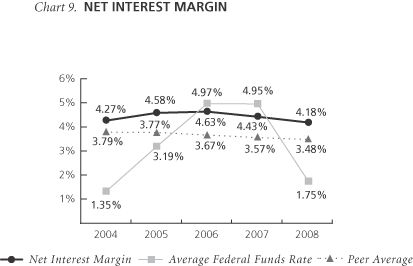

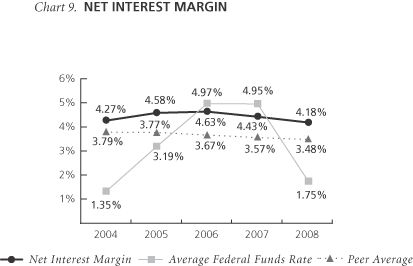

Net interest margin | 4.63% | 4.58% | 4.27% | 4.41% | 4.52% | 4.18 | % | 4.43 | % | 4.63 | % | 4.58 | % | 4.27 | % | |||||||||||||||||

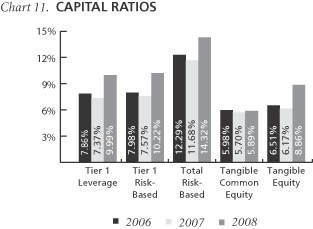

CAPITAL RATIOS (1) | ||||||||||||||||||||||||||||||||

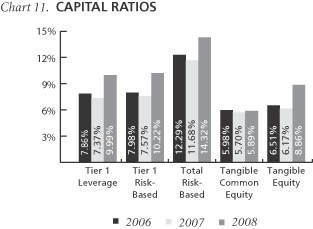

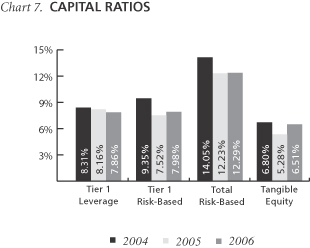

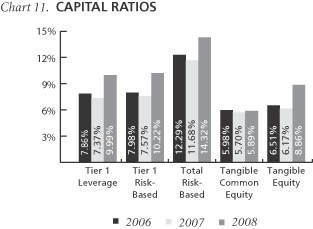

Capital Ratios1 | ||||||||||||||||||||||||||||||||

Equity to assets | 10.62% | 9.90% | 8.87% | 8.89% | 8.94% | 11.80 | % | 10.00 | % | 10.62 | % | 9.90 | % | 8.87 | % | |||||||||||||||||

Tier 1 leverage | 7.86% | 8.16% | 8.31% | 8.06% | 7.56% | 9.99 | % | 7.37 | % | 7.86 | % | 8.16 | % | 8.31 | % | |||||||||||||||||

Tier 1 risk-based capital | 7.98% | 7.52% | 9.35% | 9.42% | 9.26% | 10.22 | % | 7.57 | % | 7.98 | % | 7.52 | % | 9.35 | % | |||||||||||||||||

Total risk-based capital | 12.29% | 12.23% | 14.05% | 13.52% | 12.94% | 14.32 | % | 11.68 | % | 12.29 | % | 12.23 | % | 14.05 | % | |||||||||||||||||

Tangible common equity | 5.89 | % | 5.70 | % | 5.98 | % | 5.28 | % | 6.80 | % | ||||||||||||||||||||||

Tangible equity | 8.86 | % | 6.17 | % | 6.51 | % | 5.28 | % | 6.80 | % | ||||||||||||||||||||||

SELECTED INFORMATION | ||||||||||||||||||||||||||||||||

Selected Information | ||||||||||||||||||||||||||||||||

Average common and common-equivalent shares (in thousands) | 108,028 | 92,994 | 90,882 | 90,734 | 92,079 | 109,145 | 108,523 | 108,028 | 92,994 | 90,882 | ||||||||||||||||||||||

Common dividend payout ratio | 27.10% | 27.14% | 28.23% | 27.20% | 28.58% | na | 37.82 | % | 27.10 | % | 27.14 | % | 28.23 | % | ||||||||||||||||||

Full-time equivalent employees | 10,618 | 10,102 | 8,026 | 7,896 | 8,073 | 11,011 | 10,933 | 10,618 | 10,102 | 8,026 | ||||||||||||||||||||||

Commercial banking offices | 470 | 473 | 386 | 412 | 415 | 513 | 508 | 470 | 473 | 386 | ||||||||||||||||||||||

ATMs | 578 | 600 | 475 | 553 | 588 | 625 | 627 | 578 | 600 | 475 | ||||||||||||||||||||||

1 | At year-end. |

2 | The actual high price was $107.21. However, this trading price was an anomaly resulting from electronic orders at the opening of the market on September 19, 2008 in response to the SEC’s announcement (prior to the market opening that day) of its temporary emergency action suspending short selling in financial companies. The closing price on September 19, 2008 was $52.83. |

3 | Amount represents the outstanding balance of loans sold and being serviced by the Company, excluding conforming first mortgage residential real estate loans. |

4 | Amounts for 2005 include Amegy Corporation at December 31, 2005 and for the month of December 2005. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

MANAGEMENT’S DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

Company Overview

Zions Bancorporation (“the Parent”) and subsidiaries (collectively “the Company,” “Zions,” “we,” “our,” “us”) together comprise a $47$55 billion financial holding company headquartered in Salt Lake City, Utah. TheAs of September 30, 2008, the Company iswas the twenty-second19th largest domestic bank holding company in terms of deposits, operatingdeposits. At December 31, 2008, the Company operated banking businesses through 470 offices513 domestic branches and 578625 ATMs in ten Western and Southwestern states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, and Washington. Our banking businesses include: Zions First National Bank (“Zions Bank”), in Utah and Idaho; California Bank & Trust (“CB&T”); Amegy Corporation (“Amegy”) and its subsidiary, Amegy Bank, in Texas; National Bank of Arizona (“NBA”); Nevada State Bank (“NSB”); Vectra Bank Colorado (“Vectra”), in Colorado and New Mexico; The Commerce Bank of Washington (“TCBW”); and The Commerce Bank of Oregon (“TCBO”).

The Company also operates a number of specialty financial services and financial technology businesses that conduct business on a regional or national scale. The Company is a national leader in Small Business Administration (“SBA”) lending, public finance advisory services, and software sales and cash management services related to “Check 21 Act” electronic imaging and clearing of checks. In addition, Zions is included in the Standard and Poor’s 500 (“S&P 500500”) and NASDAQ Financial 100 indices.

In operating its banking businesses, the Company seeks to combine the front office or customer facing advantages that it believes can result from decentralized organization and branding, with those that can come from centralized risk management, capital management and operations. In its specialty financial services and technology businesses, the Company seeks to develop a competitive advantage in a particular product, customer, or technology niche.

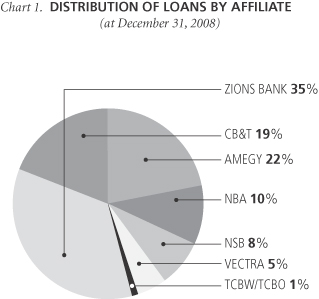

Banking BusinessesDistribution of Loans and Deposits

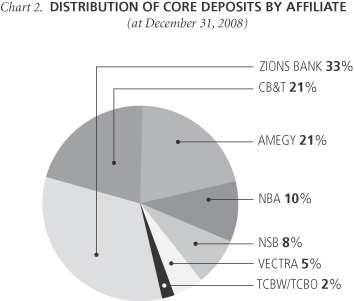

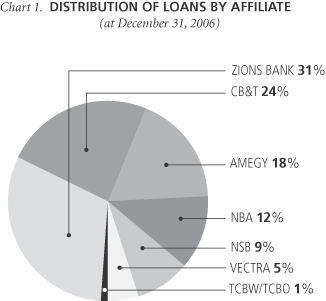

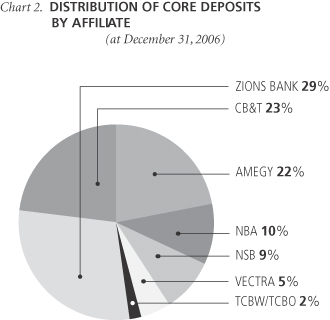

As shown in Charts 1 and 2 the Company’s loans and core deposits are widely diversified among the banking franchises the Company operates.

Note: Core deposits are defined as total deposits excluding

brokered deposits and time deposits $100,000 and over.

Business Strategies

We believe that the Company distinguishes itself by having a strategy for growth in its banking businesses that is unique for a bank holding company of its size. This growth strategy is driven by threefour key factors: (1) focus on high growth markets; (2) keep decisions aboutthat affect customers local; and (3) centralize technology and operations to achieve economies of scale.

Focus on High Growth Markets

Each of the states in which the Company conducts its banking businesses has experienced relatively high levels of historical economic growth and each ranks among the top one-third of the fastest growing states as ranked by population and household income growth projected by the U.S. Census Bureau. In addition,Despite slowdowns in population, employment, and key indicators of economic growth in some of these markets in 2008, which is expected to persist through much of 2009, the Company believes that over the medium to longer term all of these markets will continue to be among the fastest growing in the recent past these states have experienced relatively high levels of population growth compared to the rest of the country.

Schedule 1

DEMOGRAPHIC PROFILE

BY STATE

SCHEDULE 1

DEMOGRAPHIC PROFILE

BY STATE

(Dollar amounts in thousands)

| Number of branches | Deposits in market at 12/31/2006 (1) | Percent of Zions’ deposit base | Estimated 2006 total population (2) | Estimated population % change 2000-2006 (2) | Projected population % change 2006-2011 (2) | Estimated median household income 2006 (2) | Estimated % change | Projected % change | Number of branches 12/31/2008 | Deposits at 12/31/20081 | Percent of Zions’ deposit base | Estimated 2008 total population2 | Estimated population % change 2000-20082 | Projected population % change 2008-20132 | Estimated median household income 20082 | Estimated household income % change 2000-20082 | Projected household income % change 2008-20132 | |||||||||||||||||||||||||||

Utah | 112 | $ | 9,531,472 | 27.25% | 2,551,534 | 14.26% | 12.43% | $ | 56.4 | 23.38% | 18.39% | 116 | $ | 13,825,330 | 33.46 | % | 2,677,229 | 19.23 | % | 12.57 | % | $ | 60.3 | 30.76 | % | 16.05 | % | ||||||||||||||||||

California | 91 | 8,351,369 | 23.87 | 37,236,136 | 9.93 | 8.00 | 57.8 | 21.32 | 16.95 | 90 | 7,933,186 | 19.20 | 37,873,407 | 11.44 | 6.84 | 61.8 | 28.71 | 16.17 | |||||||||||||||||||||||||||

Texas | 77 | 7,329,258 | 20.95 | 23,786,899 | 14.08 | 10.96 | 49.3 | 23.35 | 17.56 | 83 | 8,625,056 | 20.88 | 24,627,546 | 17.51 | 11.32 | 52.4 | 30.15 | 18.32 | |||||||||||||||||||||||||||

Arizona | 53 | 3,675,458 | 10.51 | 6,135,872 | 19.59 | 16.09 | 51.3 | 26.44 | 21.27 | 79 | 3,896,531 | 9.43 | 6,630,722 | 28.24 | 17.47 | 55.3 | 34.92 | 20.13 | |||||||||||||||||||||||||||

Nevada | 72 | 3,378,945 | 9.66 | 2,575,444 | 28.88 | 22.95 | 55.1 | 23.42 | 18.06 | 77 | 3,512,195 | 8.50 | 2,730,425 | 35.35 | 20.00 | 58.1 | 29.19 | 16.17 | |||||||||||||||||||||||||||

Colorado | 38 | 1,665,988 | 4.76 | 4,821,136 | 12.09 | 9.08 | 58.5 | 23.82 | 18.03 | 40 | 2,071,894 | 5.01 | 4,962,478 | 14.87 | 9.04 | 62.5 | 31.06 | 16.75 | |||||||||||||||||||||||||||

Idaho | 24 | 519,211 | 1.48 | 1,475,700 | 14.05 | 11.75 | 46.6 | 23.59 | 17.88 | 25 | 781,523 | 1.89 | 1,549,062 | 19.06 | 12.67 | 50.4 | 32.55 | 20.34 | |||||||||||||||||||||||||||

Washington | 1 | 504,918 | 1.44 | 6,396,653 | 8.53 | 6.36 | 56.5 | 23.38 | 18.35 | 1 | 602,731 | 1.46 | 6,628,203 | 12.06 | 7.98 | 60.8 | 31.75 | 15.96 | |||||||||||||||||||||||||||

New Mexico | 1 | 16,385 | 0.05 | 1,956,417 | 7.55 | 6.07 | 41.5 | 21.56 | 16.62 | 1 | 32,647 | 0.08 | 2,029,633 | 11.21 | 7.66 | 44.7 | 29.69 | 18.71 | |||||||||||||||||||||||||||

Oregon | 1 | 8,742 | 0.03 | 3,694,335 | 7.98 | 6.28 | 50.1 | 22.23 | 17.56 | 1 | 35,403 | 0.09 | 3,814,725 | 11.13 | 7.61 | 53.5 | 29.54 | 17.71 | |||||||||||||||||||||||||||

Zions’ weighted average | 15.12 | 12.33 | 54.7 | 23.28 | 18.21 | 16.56 | 10.33 | 61.8 | 32.14 | 18.41 | |||||||||||||||||||||||||||||||||||

Aggregate national | 303,582,361 | 7.87 | 6.66 | 51.5 | 22.25 | 17.77 | 309,299,265 | 9.59 | 6.30 | 54.7 | 28.82 | 16.97 | |||||||||||||||||||||||||||||||||

1 | Excludes intercompany deposits. |

2 | Data Source: SNL Financial Database |

The Company seeks to grow both organically and through acquisitions in these banking markets. In 2005 we acquired Amegy Bank in Texas, which continued to enjoy very strong organic growth through 2006. In September 2006, we announced the pending acquisition of The Stockmen’s Bancorp, Inc. (“Stockmen’s”), a bank holding company with $1.2 billion in assets headquartered in Kingman, Arizona. On January 17, 2007, this acquisition was completed and Stockmen’s banking subsidiary, The Stockmen’s Bank, was merged into our NBA affiliate bank.

Within each of the states thatwhere the Company operates, we focus on the market segments that we believe present the best opportunities for us. We believe that these states over time have experienced higher rates of growth, business formation, and expansion than other states. We also believe that over the long term these states will continue to experience higher rates of commercial real estate development as local businesses strive to provide housing, shopping, business facilities and other amenities for their growing populations. As a result, aHowever, in the near term growth in many of our geographies and market segments has slowed markedly due to weakening economic conditions and loan demand. We have recently experienced net portfolio shrinkage in distressed residential real estate markets in the Southwest.

A common focus of all of Zions’ subsidiary banks is small and middle market business banking (including the personal banking needs of the executives and employees of those businesses) and commercial real estate development. In many cases, the Company’s relationship with its customers is primarily driven by the goal to satisfy their needs for credit to finance their expanding business opportunities. In addition to our commercial business, we also provide a broad base of consumer financial products in selected markets, including home mortgages, home equity credit lines, auto loans, and credit cards. This mix of business often leads to loan balances growing faster than internally generated deposits.deposits; this was particularly true in much of 2008 as loan growth significantly outpaced low cost core deposit growth. In addition, it has important implications for the Company’s management of certain risks, including interest rate and liquidity risks, which are discussed further in later sections of this document.

Keep Decisions AboutThat Affect Customers Local

The Company operates eight different community/regional banks, each under a different name, and each with its own charter, and each with its own chief executive officer and management team. This structure helps to ensure that decisions related to customers are made at a local level. In addition, each bank controls, among other things, allmost decisions related to its branding, market strategies, customer relationships, product pricing, and credit decisions (within the limits of established corporate policy). In this way we are able to differentiate our banks from much larger, “mass market” banking competitors that operate regional or national franchises under a common brand and often

around “vertical” product silos. We believe that this approach allows us to attract and retain exceptional management, and that it also results in providing service of the highest quality to our targeted customers. In addition, we believe that over time this strategy generates superior growth in our banking businesses.

Centralize Technology and Operations to Achieve Economies of Scale

We seek to differentiate the Company from smaller banks in two ways. First, we use the combined scale of all of the banking operations to create a broad product offering without the fragmentation of systems and operations that would typically drive up costs. Second, for certain products for which economies of scale are believed to be important, the Company “manufactures” the product centrally or outsources it from a third party. Examples include cash management, credit card administration, mortgage servicing, and deposit operations. In this way the Company seeks to create and maintain efficiencies while generating superior growth.

Specialty Financial ServicesCentralize and Technology BusinessesStandardize Policies and Management Controlling Key Risks