20072008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 20072008

Commission file number 1-16811

(Exact name of registrant as specified in its charter)

| Delaware | 25-1897152 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

600 Grant Street, Pittsburgh, PA 15219-2800

(Address of principal executive offices)

Tel. No. (412) 433-1121

Securities registered pursuant to Section 12 (b) of the Act:

| Title of Each Class | Name of Exchange on which Registered | |

United States Steel Corporation Common Stock, par value $1.00 |

New York Stock Exchange, Chicago Stock Exchange |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ü No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for at least the past 90 days. Yes ü No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ü

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ü | Accelerated filer | |

Non-accelerated filer (Do not check if a smaller reporting company) | Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes No ü

Aggregate market value of Common Stock held by non-affiliates as of June 30, 20072008 (the last business day of the registrant’s most recently completed second fiscal quarter): $12.8$21.6 billion. The amount shown is based on the closing price of the registrant’s Common Stock on the New York Stock Exchange composite tape on that date. Shares of Common Stock held by executive officers and directors of the registrant are not included in the computation. However, the registrant has made no determination that such individuals are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

There were 117,798,740116,198,090 shares of United States Steel Corporation Common Stock outstanding as of February 26, 2008.20, 2009.

Documents Incorporated By Reference:

Portions of the Proxy Statement for the 20082009 Annual Meeting of Stockholders are incorporated into Part III.

| 3 | ||||||

PART I | ||||||

Item 1. | 4 | |||||

Item 1A. | ||||||

Item 1B. | ||||||

Item 2. | ||||||

Item 3. | ||||||

Item 4. | ||||||

PART II | ||||||

Item 5. | ||||||

Item 6. | ||||||

Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |||||

Item 7A. | ||||||

Item 8. | F-1 | |||||

Item 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |||||

Item 9A. | ||||||

Item 9B. | ||||||

PART III | ||||||

Item 10. | DIRECTORS, | |||||

Item 11. | ||||||

Item 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |||||

Item 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |||||

Item 14. | ||||||

PART IV | ||||||

Item 15. | ||||||

SUPPLEMENTARY DATA | 95 | |||||

TOTAL NUMBER OF PAGES | ||||||

Certain sections of the Annual Report of United States Steel Corporation (U. S. Steel) on Form 10-K, particularly Item 1. Business, Item 3. Legal Proceedings, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 7A. Quantitative and Qualitative Disclosures About Market Risk, include forward-looking statements concerning trends or events potentially affecting U. S. Steel. These statements typically contain words such as “anticipates,” “believes,” “estimates,” “expects” or similar words indicating that future outcomes are uncertain. In accordance with “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, these statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in forward-looking statements. For additional factors affecting the businesses of U. S. Steel, see “Item 1A. Risk Factors” and “Supplementary Data – Disclosures About Forward-Looking Statements.” References in this Annual Report on Form 10-K to “U. S. Steel”,Steel,” “the Company”, “we”,Company,” “we,” “us” and “our” refer to U. S. Steel and its consolidated subsidiaries, unless otherwise indicated by the context.

PART I

U. S. Steel is an integrated steel producer with major production operations in North America and Central Europe. An integrated producer uses iron ore and coke as primary raw materials for steel production. U. S. Steel has annual raw steel production capability of 31.7 million net tons (tons) (24.3 million tons in North America and 7.4 million tons in Central Europe) and is. We believe that we are currently the fiftheighth largest steel producer in the world. U. S. Steel is also engaged in several other business activities most of which are related to steel manufacturing. These includeincluding the production of coke in both North America and Central Europe;Europe and the production of iron ore pellets from taconite,in North America, and transportation services (railroad and barge operations), real estate operations, and engineering and consulting services in North America.

The global economic recession has affected many of the markets that we serve and is having significant negative effects on our business. For further discussion, see “Business Strategy,” “Item 1A. Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity” and “Supplementary Data – Disclosures About Forward-Looking Statements.”

On February 6, 2009, U. S. Steel announced that approximately 500 employees have elected to retire under a Voluntary Early Retirement Program (VERP) offered to certain non-represented Headquarters and Operations employees in the United States who met age and years-of-service criteria. In connection with this program, U. S. Steel will record a pre-tax charge of approximately $70 million in the first quarter of 2009. See Note 28 to the Financial Statements.

On January 31, 2009, we completed the sale of a majority of the operating assets of Elgin, Joliet and Eastern Railway Company (EJ&E) to a subsidiary of Canadian National Railway Company. After-tax proceeds from the sale were approximately $210 million and U. S. Steel will record a net gain of approximately $60 million in the first quarter of 2009. The retained portion of EJ&E has been renamed Gary Railway Company. See Note 5 to the Financial Statements.

On October 31, 2008, U. S. Steel acquired the interests in the Clairton 1314B Partnership, L.P. (1314B) held by unrelated parties for $104 million, and 1314B was terminated. 1314B’s financial results had been consolidated in U. S. Steel’s financial statements prior to October 31, 2008. There was no change in the operations at the Clairton Plant as a result of the transaction.

On August 29, 2008, U. S. Steel Canada Inc. (USSC) paid C$38 million (approximately $36 million) to acquire three pickle lines in Nanticoke, Ontario from Nelson Steel, a division of Samuel Manu-Tech Inc. The acquisition of the pickle lines strengthens USSC’s position as a premier supplier of flat-rolled steel products to the North American market. The results of operations for these facilities are included in our Flat-rolled segment as of the date of the acquisition.

We completed two significant acquisitions in 2007 aimed at strengthening our presence in the North American flat-rolled and tubular markets.

On June 14, 2007, U. S. Steel acquired all of the outstanding shares of Lone Star Technologies, Inc. (Lone Star), a domestic manufacturer of welded oil country tubular goods (OCTG), standard and line pipe and tubular couplings, and a provider of finishing services. See Note 4 to the Financial Statements for information regarding the acquisition. The facilities that were acquired in the Lone Star transaction included the Lone Star Steel Company facility, located in Lone Star, Texas, that manufactures OCTG products and standard and line pipe and specialty tubing products (renamed Texas Operations); the Wheeling Machine Products, Inc. and Wheeling Machine Products of Texas, Inc. facilities, located in Pine Bluff, Arkansas, and Hughes Springs and Houston, Texas, that supply couplings used to connect individual sections of oilfield casing and tubing (renamed Wheeling Machine Products); the Delta Tubular Processing, Inc. facility, located in Houston Texas, that provides thermal treating and end-finishing services for oilfield production tubing (renamed Tubular Processing Services); the Delta Tubular International, Inc. facility, located in Houston, Texas, that provides threading, inspection and storage services to the OCTG market (renamed Tubular Threading and Inspection Services); the Bellville Tube Company, L.P. facility,

located in Bellville, Texas, that manufactures OCTG products (renamed Bellville Operations); and several Fintube Technologies, Inc. facilities that manufacture specialty tubular products used in heat recovery technology applications (Fintube Technologies). We also acquired the Texas & Northern Railroad Company (the T(T&N Railroad) and a 50 percent ownership interest in Apolo Tubulars S.A., a Brazilian supplier of welded casing, tubing, line pipe and other tubular products. Effective June 14, 2007, the Tubular segment includes the operating results of the facilities and the equity investee acquired from Lone Star, except for the results of the T&N Railroad, which are included in Other Businesses as of such date.

On October 31, 2007, U. S. Steel acquired all of the outstanding shares of Stelco Inc. (Stelco), and renamed it U. S. Steel Canada Inc. (USSC).USSC. The facilities that were acquired included Lake Erie Works, an integrated steelmaking facility in Nanticoke, Ontario; Hamilton Works, an integrated steelmaking facility in Hamilton, Ontario; and several joint venture interests including iron ore operations in the United States and Canada and a 60 percent interest in Z-Line Company, which owns and operates an automotive-quality hot dip galvanizing line. We also acquired approximately 4,000 acres of land in Ontario, Canada, which could potentially be sold or developed. Effective October 31, 2007, the Flat-rolled segment includes the operating results of USSC, except for the results of its iron ore and real estate interests, which are included in Other Businesses as of such date.

On September 26, 2007, U. S. Steel and Canadian National Railway Company (CN) announced that they had entered into an agreement under which CN will acquireSee Note 4 to the majority of the operating assets of Elgin, Joliet and Eastern Railway CompanyFinancial Statements for $300 million. Under the agreement, U. S. Steel will retain railroad assets, equipment, and employees that support Gary Works in northwest Indiana. The transaction is subject to regulatory approval by the U.S. Surface Transportation Board.further information regarding these acquisitions.

Segments

During 2007, U. S. Steel hadhas three reportable operating segments: Flat-rolled Products (Flat-rolled), U. S. Steel Europe (USSE) and Tubular Products (Tubular). The results of several operating segments that do not constitute reportable segments are combined and disclosed in the Other Businesses category.

Effective with the fourth quarter of 2008, the operating results of our iron ore operations, which were previously included in Other Businesses, are included in the Flat-rolled segment. The iron ore operations are managed as part of our Flat-rolled segment, which consumes almost all of our iron ore production. Prior periods have been restated to reflect this change.

The Flat-rolled segment includes the operating results of U. S. Steel’s North American integrated steel mills and equity investees involved in the production of slabs, sheets, tin mill products, strip mill plates and rounds for Tubular, as well as all iron ore and coke production facilities in North America. These operations are principally located in the United States and Canada andCanada. These operations primarily serve North American customers in the service center, conversion, transportation (including automotive), construction, container, and appliance and electrical markets. Effective October 31, 2007, the Flat-rolled segment includes the operating results of USSC, excluding the results of its iron ore and real estate interests.

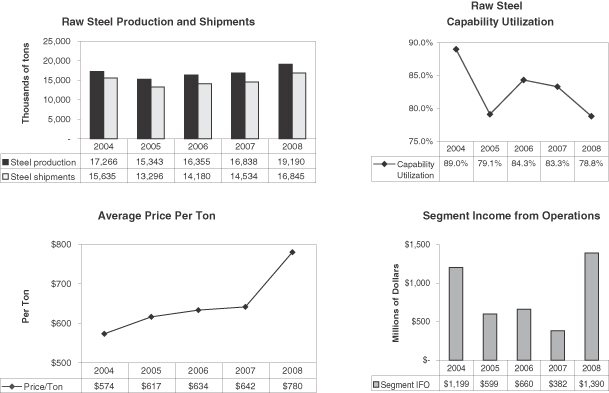

The acquisition of USSC increased Flat-rolled’sFlat-rolled has annual raw steel production capability by 4.9 million tons, or 25 percent, toof 24.3 million tons. Raw steel production was 19.2 million tons in 2008, 16.8 million tons in 2007 including production from USSC following the acquisition,and 16.4 million tons in 2006 and 15.3 million tons in 2005.2006. Raw steel production averaged 79 percent of capability in 2008, 83 percent of capability in 2007 including results from USSC following the acquisition,and 84 percent of capability in 2006 and 79 percent of capability in 2005.2006.

The USSE segment includes the operating results of U. S. Steel KosiceKošice (USSK), U. S. Steel’s integrated steel mill and coke production facilities in Slovakia; and U. S. Steel Serbia (USSS), U. S. Steel’s integrated steel mill and other facilities in Serbia.Serbia; and equity investees located in Europe. USSE primarily serves customers in the central, western and southern European construction, service center, conversion, container, transportation (including automotive), appliance and electrical, and oil, gas and petrochemical markets. USSE produces and sells sheet, strip mill plate, tin mill and tubular products, as well as heating radiators and refractories.

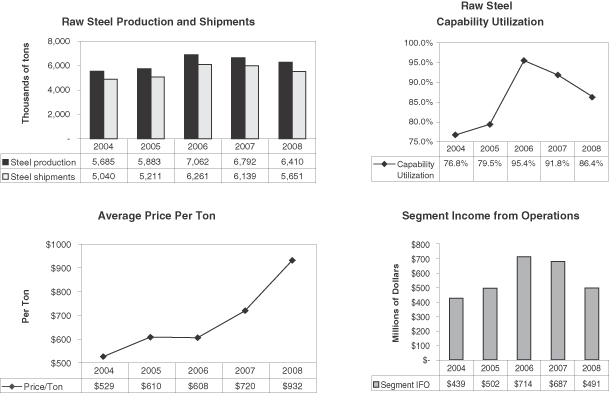

USSE has annual raw steel production capability of 7.4 million tons. USSE’s raw steel production was 6.4 million tons in 2008, 6.8 million tons in 2007 and 7.1 million tons in 2006 and 5.9 million tons in 2005.2006. USSE’s raw steel production averaged 86 percent of capability in 2008, 92 percent of capability in 2007 and 95 percent of capability in 2006 and 80 percent of capability in 2005.2006.

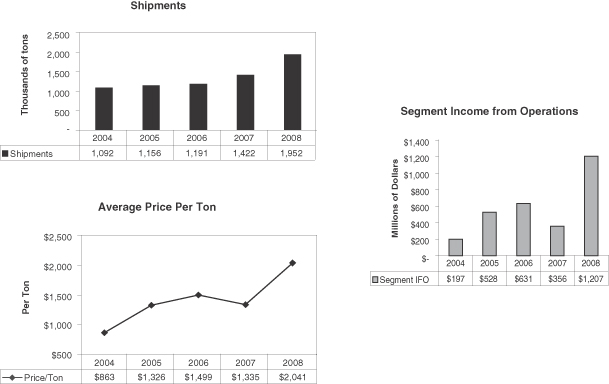

The Tubular segment includes the operating results of U. S. Steel’s tubular production facilities.facilities, primarily in the United States, and equity investees in the United States and Brazil. These operations which produce and sell both seamless and electric resistance welded (ERW) tubular products are principally located in the United States and primarily serve customers in the oil, gas and petrochemical markets. Effective June 14, 2007, the Tubular segment includes the operating results of the facilities acquired from Lone Star, excluding the results of the T&N Railroad. The acquisition increased Tubular’s annual production capability by 1.0 million tons tois 2.8 million tons.

All other U. S. Steel businesses not included in reportable segments are reflected in Other Businesses. These businesses include the production and sale of iron ore pellets, transportation services, the management and development of real estate, and engineering and consulting services. Effective June 14, 2007, Other Businesses includes the operating results of the T&N Railroad. Effective October 31, 2007, Other Businesses includes the operating results of USSC’s iron ore and real estate interests.

For further information, see Note 3 to the Financial Statements.

Financial and Operational Highlights

Net Sales by Segment

| (a) | Includes |

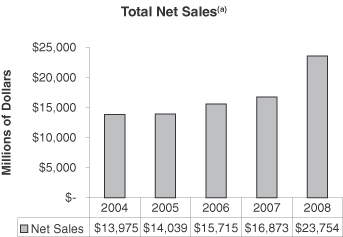

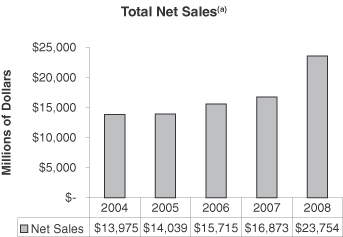

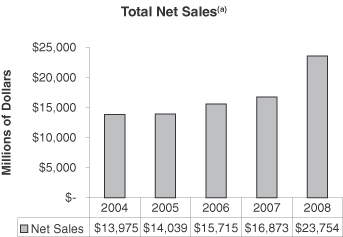

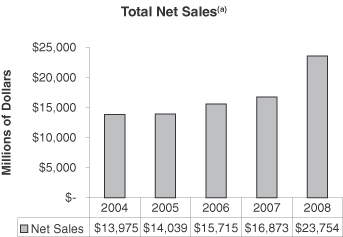

The following table sets forth the total net sales of U. S. SteelNet Sales by segment for each of the last three years.Segment

| (Dollars in millions, excluding intersegment sales) | 2007 | 2006 | 2005 | 2008 | 2007 | 2006 | ||||||||||||||||||||

Flat-rolled | $ | 9,884 | $ | 9,607 | $ | 8,813 | $ | 13,789 | $ | 9,986 | $ | 9,693 | ||||||||||||||

USSE | 4,667 | 3,968 | 3,336 | 5,487 | 4,667 | 3,968 | ||||||||||||||||||||

Tubular | 1,985 | 1,798 | 1,546 | 4,251 | 1,985 | 1,798 | ||||||||||||||||||||

Total sales from reportable segments | 16,536 | 15,373 | 13,695 | 23,527 | 16,638 | 15,459 | ||||||||||||||||||||

Other Businesses | 337 | 342 | 344 | 227 | 235 | 256 | ||||||||||||||||||||

Net sales | $ | 16,873 | $ | 15,715 | $ | 14,039 | $ | 23,754 | $ | 16,873 | $ | 15,715 | ||||||||||||||

| (a) | Certain amounts have been restated versus prior years’ disclosures. See Note 3 to the Financial Statements. |

Income (Loss) from Operations (IFO)

| (a) | Includes |

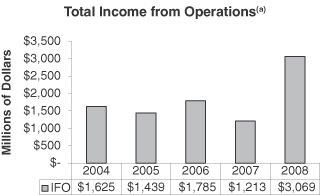

Income from Operations by Segment(a)

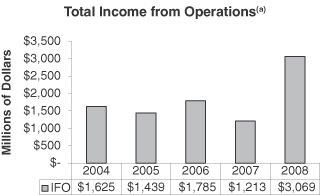

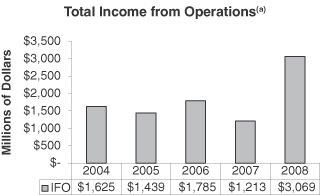

The following table sets forth income from operations by segment for each of the last three years.

| Year Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||||||||

| (Dollars in Millions) | 2007 | 2006 | 2005 | 2008 | 2007 | 2006 | ||||||||||||||||||||||||||

Flat-rolled | $ | 390 | $ | 600 | $ | 602 | $ | 1,390 | $ | 382 | $ | 660 | ||||||||||||||||||||

USSE | 687 | 714 | 502 | 491 | 687 | 714 | ||||||||||||||||||||||||||

Tubular | 356 | 631 | 528 | 1,207 | 356 | 631 | ||||||||||||||||||||||||||

Total income from reportable segments | 1,433 | 1,945 | 1,632 | 3,088 | 1,425 | 2,005 | ||||||||||||||||||||||||||

Other Businesses | 76 | 129 | 43 | 77 | 84 | 69 | ||||||||||||||||||||||||||

Segment income from operations | 1,509 | 2,074 | 1,675 | 3,165 | 1,509 | 2,074 | ||||||||||||||||||||||||||

Retiree benefit expenses | (143 | ) | (243 | ) | (267 | ) | (22 | ) | (143 | ) | (243 | ) | ||||||||||||||||||||

Other items not allocated to segments: | ||||||||||||||||||||||||||||||||

Contingent funding liability reversal | 150 | – | – | |||||||||||||||||||||||||||||

Labor agreement signing bonuses | (105 | ) | – | – | ||||||||||||||||||||||||||||

Litigation reserve | (45 | ) | – | – | ||||||||||||||||||||||||||||

Drawn-over-mandrel charge | (28 | ) | – | – | ||||||||||||||||||||||||||||

Environmental remediation charge | (23 | ) | – | – | ||||||||||||||||||||||||||||

Flat-rolled inventory transition effects | (58 | ) | – | – | (23 | ) | (58 | ) | – | |||||||||||||||||||||||

Tubular inventory transition effects | (38 | ) | – | – | – | (38 | ) | – | ||||||||||||||||||||||||

Workforce reduction charges | (57 | ) | (21 | ) | (20 | ) | – | (57 | ) | (21 | ) | |||||||||||||||||||||

Out of period adjustments | – | (15 | ) | – | – | – | (15 | ) | ||||||||||||||||||||||||

Asset impairment charge | – | (5 | ) | – | – | – | (5 | ) | ||||||||||||||||||||||||

Loss from sale of certain assets | – | (5 | ) | – | – | – | (5 | ) | ||||||||||||||||||||||||

Environmental remediation at previously sold facility | – | – | (20 | ) | ||||||||||||||||||||||||||||

Stock appreciation rights | – | – | 1 | |||||||||||||||||||||||||||||

Property tax settlement gain | – | – | 70 | |||||||||||||||||||||||||||||

Total income from operations | $ | 1,213 | $ | 1,785 | $ | 1,439 | $ | 3,069 | $ | 1,213 | $ | 1,785 | ||||||||||||||||||||

| (a) | See Note 3 to the Financial Statements for reconciliations and other disclosures required by Statement of Financial Accounting Standards No. 131. |

| (b) | Certain amounts have been restated versus prior years’ disclosures. |

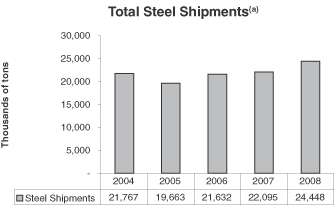

Steel Shipments

| (a) | Includes |

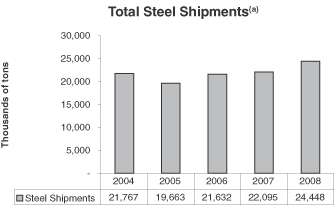

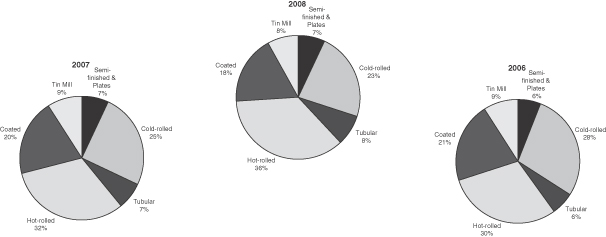

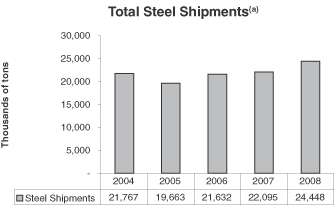

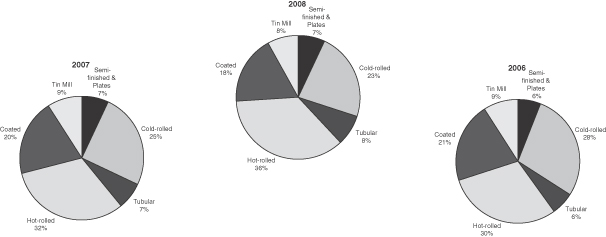

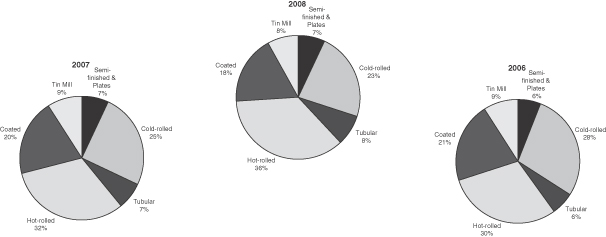

Steel Shipments by Product

Steel Shipments by Product and Segment

The following table displays steel shipment data for U. S. Steel by product and segment for 2007, 2006 and 2005. Such data does not include shipments by joint ventures and other equity investees of U. S. Steel.

(Thousands of Tons)

| Flat-rolled | USSE | Tubular | Total | Flat-rolled | USSE | Tubular | Total | |||||||||||||||||||||

Product – 2008 | ||||||||||||||||||||||||||||

Hot-rolled Sheets | 6,474 | 2,142 | – | 8,616 | ||||||||||||||||||||||||

Cold-rolled Sheets | 4,489 | 1,195 | – | 5,684 | ||||||||||||||||||||||||

Coated Sheets | 3,554 | 733 | – | 4,287 | ||||||||||||||||||||||||

Tin Mill Products | 1,387 | 605 | – | 1,992 | ||||||||||||||||||||||||

Tubular | – | 109 | 1,952 | 2,061 | ||||||||||||||||||||||||

Semi-finished, Bars and Plates | 941 | 867 | – | 1,808 | ||||||||||||||||||||||||

TOTAL | 16,845 | 5,651 | 1,952 | 24,448 | ||||||||||||||||||||||||

Memo: Intersegment Shipments from | ||||||||||||||||||||||||||||

Flat-rolled to Tubular | ||||||||||||||||||||||||||||

Hot-rolled sheets | 1,108 | |||||||||||||||||||||||||||

Rounds | 768 | |||||||||||||||||||||||||||

Product – 2007 | ||||||||||||||||||||||||||||

Hot-rolled Sheets | 4,887 | 2,346 | 13 | 7,246 | 4,887 | 2,346 | – | 7,233 | ||||||||||||||||||||

Cold-rolled Sheets | 4,238 | 1,402 | – | 5,640 | 4,238 | 1,402 | – | 5,640 | ||||||||||||||||||||

Coated Sheets | 3,743 | 595 | – | 4,338 | 3,743 | 595 | – | 4,338 | ||||||||||||||||||||

Tin Mill Products | 1,288 | 618 | – | 1,906 | 1,288 | 618 | – | 1,906 | ||||||||||||||||||||

Tubular | – | 91 | 1,422 | 1,513 | – | 91 | 1,422 | 1,513 | ||||||||||||||||||||

Semi-finished, Bars and Plates | 378 | 1,087 | – | 1,465 | 378 | 1,087 | – | 1,465 | ||||||||||||||||||||

TOTAL | 14,534 | 6,139 | 1,435 | 22,108 | 14,534 | 6,139 | 1,422 | 22,095 | ||||||||||||||||||||

Memo: Intersegment Shipments | ||||||||||||||||||||||||||||

Memo: Intersegment Shipments from | ||||||||||||||||||||||||||||

Flat-rolled to Tubular | 305 | |||||||||||||||||||||||||||

Rounds to Tubular | 608 | |||||||||||||||||||||||||||

Hot-rolled sheets | 305 | |||||||||||||||||||||||||||

Rounds | 608 | |||||||||||||||||||||||||||

Product – 2006 | ||||||||||||||||||||||||||||

Hot-rolled Sheets | 4,195 | 2,327 | – | 6,522 | 4,195 | 2,327 | – | 6,522 | ||||||||||||||||||||

Cold-rolled Sheets | 4,479 | 1,535 | – | 6,014 | 4,479 | 1,535 | – | 6,014 | ||||||||||||||||||||

Coated Sheets | 4,083 | 415 | – | 4,498 | 4,083 | 415 | – | 4,498 | ||||||||||||||||||||

Tin Mill Products | 1,318 | 587 | – | 1,905 | 1,318 | 587 | – | 1,905 | ||||||||||||||||||||

Tubular | – | 150 | 1,191 | 1,341 | – | 150 | 1,191 | 1,341 | ||||||||||||||||||||

Semi-finished and Plates | 105 | 1,247 | – | 1,352 | 105 | 1,247 | – | 1,352 | ||||||||||||||||||||

TOTAL | 14,180 | 6,261 | 1,191 | 21,632 | 14,180 | 6,261 | 1,191 | 21,632 | ||||||||||||||||||||

Memo: Intersegment Shipments | ||||||||||||||||||||||||||||

Memo: Intersegment Shipments from | ||||||||||||||||||||||||||||

Flat-rolled to Tubular | 167 | |||||||||||||||||||||||||||

Rounds to Tubular | 691 | |||||||||||||||||||||||||||

Product – 2005 | ||||||||||||||||||||||||||||

Hot-rolled Sheets | 3,779 | 1,960 | – | 5,739 | ||||||||||||||||||||||||

Cold-rolled Sheets | 4,343 | 1,383 | – | 5,726 | ||||||||||||||||||||||||

Coated Sheets | 3,657 | 405 | – | 4,062 | ||||||||||||||||||||||||

Tin Mill Products | 1,388 | 561 | – | 1,949 | ||||||||||||||||||||||||

Tubular | – | 140 | 1,156 | 1,296 | ||||||||||||||||||||||||

Semi-finished and Plates | 129 | 762 | – | 891 | ||||||||||||||||||||||||

TOTAL | 13,296 | 5,211 | 1,156 | 19,663 | ||||||||||||||||||||||||

Memo: Intersegment Shipments | ||||||||||||||||||||||||||||

Flat-rolled to Tubular | 134 | |||||||||||||||||||||||||||

Rounds to Tubular | 773 | |||||||||||||||||||||||||||

Hot-rolled sheets | 167 | |||||||||||||||||||||||||||

Rounds | 691 | |||||||||||||||||||||||||||

Steel Shipments by Market

Steel Shipments by Market and Segment

The following table displays steel shipment data for U. S. Steel by major market and segment for 2007, 2006 and 2005. Such data does not include shipments by joint ventures and other equity investees of U. S. Steel. No single customer accounted for more than 10 percent of gross annual revenues; however, Tubular has one customer that accounted for more than 10 percent of segment revenues.

(Thousands of Tons)

| Flat-rolled | USSE | Tubular | Total | Flat-rolled | USSE | Tubular | Total | |||||||||||||||||||||

Major Market – 2008 | ||||||||||||||||||||||||||||

Steel Service Centers | 3,871 | 1,239 | 16 | 5,126 | ||||||||||||||||||||||||

Further Conversion – Trade Customers | 3,368 | 546 | 34 | 3,080 | ||||||||||||||||||||||||

– Joint Ventures | 1,770 | – | – | 1,770 | ||||||||||||||||||||||||

Transportation (Including Automotive) | 2,550 | 590 | 8 | 3,148 | ||||||||||||||||||||||||

Construction and Construction Products | 1,333 | 1,745 | – | 3,078 | ||||||||||||||||||||||||

Containers | 1,421 | 615 | – | 2,036 | ||||||||||||||||||||||||

Appliances and Electrical Equipment | 1,115 | 503 | – | 1,618 | ||||||||||||||||||||||||

Oil, Gas and Petrochemicals | – | 9 | 1,737 | 2,614 | ||||||||||||||||||||||||

Exports from the United States | 808 | – | 118 | 926 | ||||||||||||||||||||||||

All Other | 609 | 404 | 39 | 1,052 | ||||||||||||||||||||||||

TOTAL | 16,845 | 5,651 | 1,952 | 24,448 | ||||||||||||||||||||||||

Major Market – 2007 | ||||||||||||||||||||||||||||

Steel Service Centers | 3,151 | 1,264 | – | 4,415 | 3,151 | 1,264 | – | 4,415 | ||||||||||||||||||||

Further Conversion – Trade Customers | 2,160 | 897 | 1 | 3,058 | 2,277 | 897 | 1 | 3,058 | ||||||||||||||||||||

– Joint Ventures | 2,037 | – | – | 2,037 | 2,037 | – | – | 2,037 | ||||||||||||||||||||

Transportation (Including Automotive) | 2,629 | 493 | 1 | 3,123 | 2,629 | 493 | 1 | 3,123 | ||||||||||||||||||||

Construction and Construction Products | 1,045 | 1,847 | – | 2,892 | 1,045 | 1,847 | – | 2,892 | ||||||||||||||||||||

Containers | 1,301 | 563 | – | 1,864 | 1,301 | 563 | – | 1,864 | ||||||||||||||||||||

Appliances and Electrical Equipment | 1,055 | 489 | – | 1,544 | 1,055 | 489 | – | 1,544 | ||||||||||||||||||||

Oil, Gas and Petrochemicals | 117 | 10 | 1,343 | 1,470 | – | 10 | 1,330 | 1,457 | ||||||||||||||||||||

Exports from the United States | 566 | – | 90 | 656 | 566 | – | 90 | 656 | ||||||||||||||||||||

All Other | 473 | 576 | – | 1,049 | 473 | 576 | – | 1,049 | ||||||||||||||||||||

TOTAL | 14,534 | 6,139 | 1,435 | 22,108 | 14,534 | 6,139 | 1,422 | 22,095 | ||||||||||||||||||||

Major Market – 2006 | ||||||||||||||||||||||||||||

Steel Service Centers | 3,241 | 1,367 | 1 | 4,609 | 3,241 | 1,367 | 1 | 4,609 | ||||||||||||||||||||

Further Conversion – Trade Customers | 1,820 | 1,267 | 1 | 3,088 | 1,820 | 1,267 | 1 | 3,088 | ||||||||||||||||||||

– Joint Ventures | 1,808 | – | – | 1,808 | 1,808 | – | – | 1,808 | ||||||||||||||||||||

Transportation (Including Automotive) | 2,517 | 439 | 1 | 2,957 | 2,517 | 439 | 1 | 2,957 | ||||||||||||||||||||

Construction and Construction Products | 1,263 | 1,526 | – | 2,789 | 1,263 | 1,526 | – | 2,789 | ||||||||||||||||||||

Containers | 1,317 | 566 | – | 1,883 | 1,317 | 566 | – | 1,883 | ||||||||||||||||||||

Appliances and Electrical Equipment | 1,198 | 512 | – | 1,710 | 1,198 | 512 | – | 1,710 | ||||||||||||||||||||

Oil, Gas and Petrochemicals | – | 41 | 1,073 | 1,114 | – | 41 | 1,073 | 1,114 | ||||||||||||||||||||

Exports from the United States | 628 | – | 115 | 743 | 628 | – | 115 | 743 | ||||||||||||||||||||

All Other | 388 | 543 | – | 931 | 388 | 543 | – | 931 | ||||||||||||||||||||

TOTAL | 14,180 | 6,261 | 1,191 | 21,632 | 14,180 | 6,261 | 1,191 | 21,632 | ||||||||||||||||||||

Major Market – 2005 | ||||||||||||||||||||||||||||

Steel Service Centers | 3,172 | 807 | 4 | 3,983 | ||||||||||||||||||||||||

Further Conversion – Trade Customers | 1,638 | 1,302 | 1 | 2,941 | ||||||||||||||||||||||||

– Joint Ventures | 1,744 | – | – | 1,744 | ||||||||||||||||||||||||

Transportation (Including Automotive) | 2,449 | 372 | 2 | 2,823 | ||||||||||||||||||||||||

Construction and Construction Products | 1,079 | 1,109 | – | 2,188 | ||||||||||||||||||||||||

Containers | 1,297 | 531 | – | 1,828 | ||||||||||||||||||||||||

Appliances and Electrical Equipment | 1,031 | 402 | – | 1,433 | ||||||||||||||||||||||||

Oil, Gas and Petrochemicals | – | 33 | 1,055 | 1,088 | ||||||||||||||||||||||||

Exports from the United States | 515 | – | 94 | 609 | ||||||||||||||||||||||||

All Other | 371 | 655 | – | 1,026 | ||||||||||||||||||||||||

TOTAL | 13,296 | 5,211 | 1,156 | 19,663 | ||||||||||||||||||||||||

Business Strategy

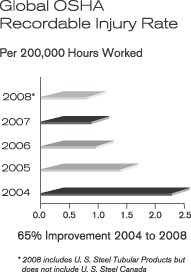

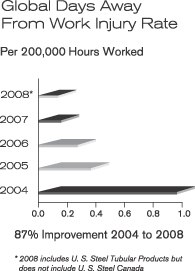

U. S. Steel strives to be forward-looking, to grow responsibly, to generate a competitive return on capital and to meet our financial and stakeholder obligations. Within this value framework, our business strategy is to becomebe a world leader in safety and environmental performance; to continue to increase our value-added product mix; to further expand our global business platform; to maintain a strong capital structure, balance sheet and balance sheet;liquidity position; to improve our reliability and cost competitiveness; and to attract and retain a diverse workforce with the talent and skills needed for our long-term success.

Commercially,In the near term, our strategy is to carefully monitor the impact of the current economic situation on our customers and to adjust our operations to efficiently meet their requirements. In late 2008 and early 2009, we have reduced production levels to correspond with customer order rates by temporarily idling certain facilities and cutting back production at others. We also have significantly reduced planned capital expenditures, reduced our inventory levels, placed a temporary freeze on salaries and hiring, offered a VERP which has been accepted by approximately 500 non-represented Headquarters and Operations employees in the United States, suspended the company match on employees’ 401(k) plan contributions, suspended our common stock buyback program and discontinued all non-essential spending for travel and entertainment and outside services in an effort to maximize liquidity and lower costs. We do not know when conditions may improve, but we are well positioned to fully participate in a market recovery when it occurs. In the meantime, we continue aggressive efforts to maximize liquidity and reduce costs and will take additional actions as market conditions warrant.

Over the longer term, commercially we are focused on providing value-added steel products including advanced high strength steel and coated sheets for the automotive and appliance industries, electrical steel sheets for the manufacture of motors and electrical equipment, galvanized and Galvalume® sheets for the construction industry, tin mill products for the container industry and oil country tubular goods for the oil and gas industry. In addition, our European operations have concentratedconcentrate on meetingbeing a dependable source of high-quality steel to meet the needs of the rapidly expanding central European markets for a dependable source of high-quality steel.markets.

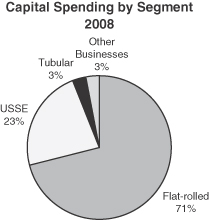

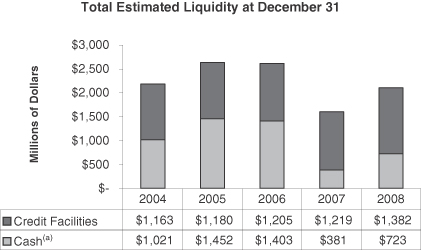

Our balanced approach to the allocation of our capital resources and free cash flow has produced significant returns. Since our separation from Marathon Oil Company at the end of 2001,2001: we have completed four major acquisitions (National Steel Corporation (National Steel) and USSS in 2003, and Lone Star and USSC in 2007), which increased our annual raw steel production capability by almost 80 percent to 31.7 million tons and increased our tubular production capability by more than 50 percent to 2.8 million tons; we have made capital investments in excess of $3 billion, including the construction of an automotive-quality galvanizing line in Slovakia and the reconstruction of our largest blast furnace at Gary Works;almost $4 billion; we have made voluntary contributions in excess of $900 million$1 billion to our main defined benefit pension plan and to our trusts for retiree health care and life insurance; we have repurchased over 1416 million common shares for over $800 million;$1 billion; we have increased the annual common stock dividend by 500 percent;from $0.20 to $1.20 per share; and we have increased our liquidity by almost $900 million.$1.4 billion.

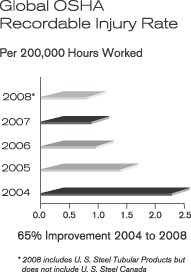

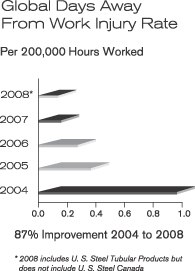

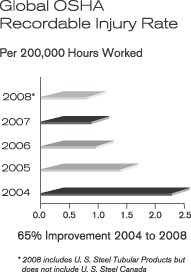

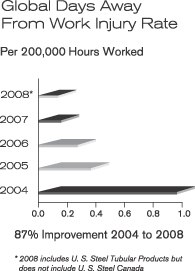

We have also made significant improvements in our safety performance as shown in the following graphs.

|  |

We will continue to assess North American and international expansion opportunities, including raw material operations, and carefully weigh them in light of changing global steel and financial market conditions and long-term value considerations. We may consider 100 percent acquisition opportunities, joint ventures and other arrangements.

We also continue to assess and make capital investments in our existing facilities with particular emphasis on our raw materials and blast furnace operations. We have recently completed blast furnace reline projects at USSK and USSS. In November, we announced thatresponse to the current economic conditions, we are considering investing $1 billionfocusing our capital spending on non-discretionary and key strategic projects. We are continuing with our plans for a significant capital investment over a period of years for new

coke oven batteries at our Clairton Plant, in part replacing existing batteries that are nearing the end of their useful lives and rehabilitating several other existing batteries. We are also pursuing an opportunity withcurrently in the first phase of this investment, which includes construction of a technologically and environmentally advanced coke battery that will replace the current capacity of three older units, and rehabilitation of several existing coke batteries. Also, Gateway Energy & Coke Company, LLC (Gateway), an affiliate of SunCoke Energy, Inc. to construct, is in the process of constructing a coke plant to supply Granite City Works, while we are constructing a cogeneration facility that is contingent upon obtaining the necessary permits. Also, in February 2008,will utilize by-products and that we will own and operate. A previously announced a capital investment program in excess of $300 million at our iron ore pellet operations in Keewatin, Minnesota to increase production by modernizing and improving a pellet indurating line that has been idle since 1980.1980 is currently in the permitting process, but we expect this project to be deferred beyond 2009.

We are currently implementingalso continuing our efforts to implement an enterprise resource planning (ERP) system to help us operate more efficiently. Minor portions of the project were implemented in 2008; however, we have extended the overall implementation schedule. The implementationcompletion of the ERP systemproject is expected to provide further opportunities to streamline, standardize and centralize business processes in order to maximize cost effectiveness, efficiency and control across our global operations.

The foregoing statements of belief are forward-looking statements. Predictions regarding capital investments and benefits resulting from the implementation of the ERP systemproject are subject to uncertainties. Factors that may affect our ability to construct new facilities include levels of cash flow from operations, general economic conditions, business conditions, availability of capital, whether or not assets are purchased or financed by operating leases, receipt of necessary permits and unforeseen hazards such as contractor performance, material shortages, weather conditions, explosions or fires, which could delay the timing of completion of particular capital projects. We may not be able to successfully implement the ERP programproject without experiencing difficulties. In addition, the

expected benefits of implementing the ERP systemproject might not be realized or the costs of implementation might outweigh the realized benefits. The acquisitions of USSC and the former Lone Star facilities have made this process more complex.benefits realized. Actual results could differ materially from those expressed in these forward-looking statements.

Given the largerecent VERP and the number of remaining employees eligible for retirement in the near future (see “Risk Factors – Other Risk Factors applicable to U. S. Steel”), recruiting, developing and retaining a diverse workforce and a world-class leadership team are crucial to the long-term success of our company. However, in light of current business conditions, we have revised our near-term recruiting plans.

Steel Industry Background and Competition

The global steel industry is cyclical, highly competitive and has historically been characterized by overcapacity.

We believe that U. S. Steel is currently the fiftheighth largest steel producer in the world, the largest integrated steel producer headquartered in North America, and one of the largest integrated flat-rolled producers in Central Europe. U. S. Steel competes with many North American and international steel producers. Competitors include integrated producers which, like U. S. Steel, use iron ore and coke as primary raw materials for steel production, and mini-mills, which primarily use steel scrap and, increasingly, iron-bearing feedstocks as raw materials.

Mini-mills typically require lower capital expenditures for construction of facilities and may have lower total employment costs; however, these competitive advantages may be more than offset by the cost of scrap when scrap prices are high. Some mini-mills utilize thin slab casting technology to produce flat-rolled products and are increasingly able to compete directly with integrated producers of flat-rolled products, who are able to manufacture a broader range of products. U. S. Steel provides defined benefit pension and/or other postretirement benefits to approximately 134,000130,000 retirees and beneficiaries (including certain former employees of National Steel).beneficiaries. Mini-mills and most of our other competitors do not have comparable retiree obligations.

Also, international competitors may have lower labor costs than U.S. producers and some are owned, controlled or subsidized by their governments, allowing their production and pricing decisions to be influenced by political, social and economic policy considerations, as well as prevailing market conditions. We also face competition in many markets from producers of materials such as aluminum, cement, composites, glass, plastics and wood.

Due primarily to growthThe recent significant reduction in worldwideglobal steel production especially in China,late 2008 and into 2009 has resulted in decreases in many raw materials prices. We expect that such prices will rebound when global steel production returns to more customary levels. In contrast, prices for steelmaking commodities such as steel scrap, coal, coke, iron ore, zinc, tin and other metallic additions havehad escalated significantly over the last several years.years due primarily to growth in worldwide steel production, especially in China. Historically, we have had adequate iron ore pellet production in the United States to meet our needs. With the acquisition of USSC and indirectly with the acquisition of Lone Star, at high levels of steelmaking

production we could be one to two million tons short in our iron ore pellet supply position in North America. Once our recently announcedAmerica, although we expect to be self-sufficient for 2009. If the proposed expansion at our iron ore pellet operations in Keewatin, Minnesota begins production, we will return to a position of being able to fully satisfy our North American pellet requirements.requirements at normal levels of capability utilization. The operations in Keewatin were temporarily idled in December 2008, and we expect the expansion project to be deferred beyond 2009. We are about 75 to 80 percent self sufficient for coke in North America.America at normal operating levels. Our relatively balanced raw materials position in North America and limited dependence on purchased steel scrap have helped mitigate the competitive positionvolatility of our North American operations.production costs.

Demand for flat-rolled products is influenced by a wide variety of factors, including but not limited to macro-economic drivers, the supply-demand balance, inventories, imports and exports, currency fluctuations, and the demand from flat-rolled consuming markets. The largest drivers of domestic consumption have historically been the automotive and construction markets which make up more than 50 percent of total sheet consumption. Other sheet consuming industries include appliance, converter, container, tin, energy, electrical equipment, agricultural, domestic and commercial equipment and industrial machinery.

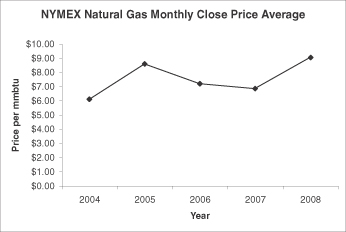

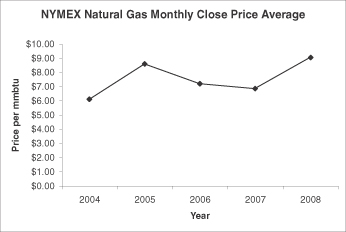

Demand for oil country tubular goods depends on several factors, most notably the number of oil and natural gas wells being drilled, completed and re-worked, the depth and drilling conditions of these wells and the drilling techniques utilized. The level of these activities depends primarily on the demand for natural gas and oil and the

expectation of future prices of these commodities.

Demand for our flat-rolled and tubular products is also affected by the level of inventories maintained by manufacturers, distributors, and end users and by the level of imports in the markets we serve.

Steel imports to the United States which reached all-time highs in 2006, accounted for an estimated 2628 percent of the U.S. steel market in 2008, 26 percent in 2007 and 31 percent in 2006 and 25 percent in 2005.2006. Increases in future levels of imported steel could reduce future market prices and demand levels for steel produced in our North American facilities.

SteelImports of tubular products increased significantly in 2008. Oil country tubular goods (OCTG) accounted for a large share of the growth as they have more than doubled over 2007 levels. Imports of OCTG from China registered the most dramatic increase as they grew from 900,000 tons in 2007 to nearly 2.3 million tons in 2008. The U.S. market experienced a surge in tubular imports in the second half of 2008 that resulted in record OCTG inventories by the end of the year, which are expected to affect demand in 2009.

Imports of flat-rolled steel to Canada have accounted for over halfan estimated 25 percent of the Canadian market for flat-rolled steel products since 2005, representing 52 percent of the flat-rolled steel market in the first nine months of 2007, 532008, 27 percent in 20062007 and 5134 percent in 2005.2006.

Many of these imports have violated U.S. or Canadian trade laws. Under these laws, duties can be imposed against dumped products, which are products sold at a price that is below that producer’s sales price in its home market or at a price that is lower than its cost of production. Countervailing duties can be imposed against products that benefited from foreign government financial assistance for the benefit of the production, manufacture, or exportation of the product. For many years, U. S. Steel, other producers, customers and the United Steelworkers (USW) have sought the imposition of duties and in many cases have been successful. Such duties are generally subject to review every five years and we actively participate in such review proceedings.

The flat-rolled steel market in Europe has become extremely attractive for imports in the last two years. Total imports of flat-rolled carbon steel products (excluding quarto plates and wide flats) to the EU27 (the 27 countries currently comprising the European Union) rose by 72Union (EU)) were 15 percent of the EU market in 2006 compared to 2005, and by 212008, 17 percent in 2007 compared to 2006. Imports of galvanized sheets to the EU27 increased by 74and 14 percent in 2007 compared to 2006, while imports of galvanized sheets from China to the EU27 increased by 136 percent during the same period. The increases in imported2006. Imported steel to the EuropeanEU market have had a detrimental effect oncoupled with declining demand starting late in 2008 contributed to record levels of inventory, all of which resulted in weakening market prices in late 2008 and demand for steel made by European producers.early 2009.

On October 29, 2007, the European Confederation of Iron and Steel Industries (Eurofer), the European trade association of steel producers of which USSK is a member, filed an anti-dumping complaint against imports into the European UnionEU of hot-dipped metallic coated sheet and strip products originating in China. TheIn December 2008, Eurofer withdrew its complaint, saying that the case was based on historical data that no longer fully reflected turbulent current market conditions, and the European Commission has initiated anthereafter terminated its investigation.

We expect to continue to experience competition from imports and will continue to closely monitor imports of products in which we have an interest. Additional complaints may be filed if unfairly traded imports adversely impact, or threaten to adversely impact, financial results.

U. S. Steel’s businesses are subject to numerous federal, state and local laws and regulations relating to the storage, handling, emission and discharge of environmentally sensitive materials. U. S. Steel believes that our major North American and many European integrated steel competitors are confronted by substantially similar environmental conditions and thus does not believe that our relative position with regard to such competitors is materially affected by the impact of environmental laws and regulations. However, the costs and operating restrictions necessary for compliance with environmental laws and regulations may have an adverse effect on U. S. Steel’s competitive position with regard to domestic mini-mills, some foreign steel producers (particularly in developing economies such as China) and producers of materials which compete with steel, all of which may not

be required to undertake equivalent costs in their operations. In addition, the specific impact on each competitor may vary depending on a number of factors, including the age and location of its operating facilities and its production methods. U. S. Steel is also responsible for remediation costs related to our prior disposal of environmentally sensitive materials. MostMany of our competitors have fewer historichistorical liabilities. For further information, see “Item 3. Legal Proceedings – Environmental Proceedings” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental Matters, Litigation and Contingencies.”

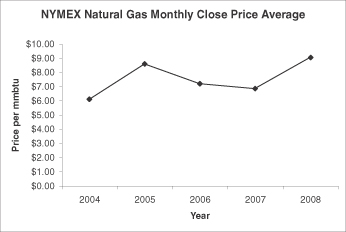

USSE conducts business primarily in central, western and southern Europe and USSC conducts business primarily in Canada. TheyWe are subject to market conditions in those areas which are influenced by many of the same factors that affect U.S. markets, as well as matters specific to international markets such as quotas and tariffs. TheyLike our domestic operations, USSE and USSC are affected by worldwide overcapacity in the steel industry, the cyclical nature of demand for steel products and the sensitivity of that demand to worldwide general economic conditions. In particular, USSE and USSC are subject to economic conditions,different environmental regulations and politicalother factors in Europe and Canada, respectively, which if changedthat could negatively affect results of operations and cash flow. These economic conditions, environmental regulations and politicalother factors include, but are not limited to, taxation, nationalization, inflation, currency fluctuations, increased regulation, limits on emissions (see “Environmental Matters” for discussions regarding carbon dioxide emissions limits which are applicable to European Union member countries, and carbon dioxide emissions limitations which are expected to come into effect in Canada), limits on production, and quotas, tariffs and other protectionist measures. USSE and USSC are affected by the volatility ofvolatile raw materials prices, and USSSUSSE has been affected by curtailments of natural gas available to Europe from the one pipeline that supplies Serbia.Russia through Ukraine. USSS experienced natural gas curtailments during periods of peak demand in Eastern Europe and Russia in 2006, and both USSK and USSS experienced a curtailment for more than ten days in January 2009 related to Russia’s suspension of gas shipments to Europe.

U. S. Steel is subject to foreign currency exchange risks as a result of its European and Canadian operations. USSE’s revenues are primarily in euros and its costs are primarily in U.S. dollars, Slovak koruna, Serbian dinars and euros. USSC’s revenues are primarilydenominated in Canadian dollars although the markets served are heavily influenced by the interaction between theboth Canadian and U.S. dollar.dollars. While the majoritymost of USSC’s costs are in Canadian dollars, there arewe make significant raw material purchases that are in U.S. dollars. In addition, the Stelco acquisition of USSC was funded from the United States and through the reinvestment of undistributed foreign earnings from USSE, creating intercompany monetary assets and liabilities in differentcurrencies other than the functional currencies of the entities involved, which can impact income when they are remeasured at the end of each quarter. A $1.2 billionAn $815 million U.S. dollar-denominated intercompany loan to a European affiliate was the primary exposure at December 31, 2007.2008.

Facilities and Locations

Flat-rolled

With the exception ofExcept for the Fairfield pipe mill, the operating results of all the facilities within U. S. Steel’s integrated steel mills in North America are included in Flat-rolled. These facilities include Gary Works, Great Lakes Works, Mon Valley Works, Granite City Works, Lake Erie Works, Fairfield Works and Hamilton Works. The operating results of U. S. Steel’s iron ore pellet operations and many equity investees in North America are also included in Flat-rolled.

Gary Works, located in Gary, Indiana, has annual raw steel production capability of 7.5 million tons. Gary Works has three coke batteries, four blast furnaces, six steelmaking vessels, a vacuum degassing unit and four continuous slab casters. In January 2006, we completed a major reconstruction of our largest blast furnace, which is located at Gary Works. Gary Works generally consumes all the coke it produces and sells several coke by-products. Finishing facilities include a hot strip mill, two pickling lines, two cold reduction mills, three temper mills, a double cold reduction line, two tin coating lines an electrolytic galvanizing line and a hot dip galvanizing line. Principal products include hot-rolled, cold-rolled and coated sheets and tin mill products. Gary Works also produces strip mill plate. The Midwest Plant and East Chicago Tin are operated as part of Gary Works.

The Midwest Plant, located in Portage, Indiana, finishes primarilyprocesses hot-rolled bands.bands and produces tin mill products and hot dip galvanized, cold-rolled and electrical lamination sheets. Midwest facilities include a pickling line, two cold reduction mills, two temper mills, a double cold reduction mill, two hot dip galvanizing lines, a tin coating line and a tin-free steel line. Principal products include tin mill products and hot dip galvanized, cold-rolled and electrical lamination sheets.

East Chicago Tin is located in East Chicago, Indiana.Indiana and produces tin mill products. Facilities include a pickling line, a cold reduction mill, a temper mill, a tin coating line and a tin-free steel line.

Great Lakes Works, located in Ecorse and River Rouge, Michigan, has annual raw steel production capability of 3.8 million tons. Great Lakes facilities include three blast furnaces, two steelmaking vessels, a vacuum degassing unit, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, a temper mill, an electrolytic galvanizing line and a hot dip galvanizing line. Principal products include hot-rolled, cold-rolled and coated sheets. Great Lake Works was temporarily idled in December 2008.

Mon Valley Works consists of the Edgar Thomson Plant, located in Braddock, Pennsylvania; the Irvin Plant, located in West Mifflin, Pennsylvania; the Fairless Plant, located in Fairless Hills, Pennsylvania; and the Clairton Plant, located in Clairton, Pennsylvania. Mon Valley Works has annual raw steel production capability of 2.9 million tons. Facilities at the Edgar Thomson Plant include two blast furnaces, two steelmaking vessels, a vacuum degassing unit and a slab caster. Irvin Plant facilities include a hot strip mill, two pickling lines, a cold reduction mill, a temper mill, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. The Fairless Plant operates a hot dip galvanizing line. Principal products from Mon Valley Works include hot-rolled, cold-rolled and coated sheets, as well as coke and coke by-products produced at the Clairton Plant.

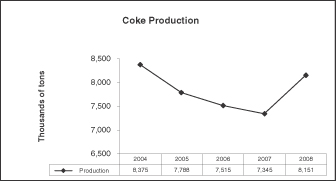

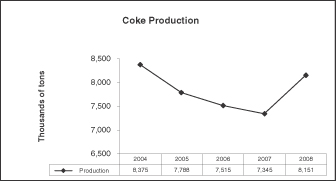

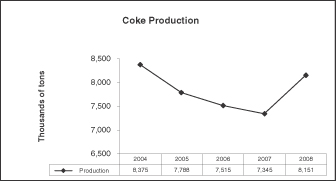

The Clairton Plant is comprised of twelve coke batteries, two of which arewere operated for the Clairton 1314B Partnership, L.P. (1314B Partnership), which is discussed below.(1314B). On October 31, 2008, U. S. Steel acquired the interests in 1314B held by unrelated parties, and 1314B was terminated. There was no change in the operations at the Clairton Plant as a result of the transaction. Approximately 7683 percent of 20072008 coke production (including the 1314B Partnership)1314B) was consumed by U. S. Steel facilities and the remainder was sold to or swapped with other domestic steel producers. Several coke by-products are sold to the chemicals and raw materials industries.

U. S. Steel is the sole general partner of and owns an equity interest in the 1314B Partnership. As general partner, U. S. Steel is responsible for operating and selling coke and coke by-products from the partnership’s two coke batteries. U. S. Steel’s share of profits during 2007 was 45.75 percent. The results of the 1314B Partnership are consolidated in our financial statements.

Granite City Works, located in Granite City, Illinois, has annual raw steel production capability of 2.8 million tons. Granite City’s facilities include two coke batteries, two blast furnaces, two steelmaking vessels, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Granite City Works generally consumes all the coke it produces and sells several coke by-products. Principal products include hot-rolled and coated sheets. We are pursuing an opportunity with an affiliateGateway is in the process of SunCoke Energy, Inc. to constructconstructing a coke plant to supply Granite City Works and we are constructing a cogeneration facility that is contingent upon obtaining the necessary permits.will utilize by-products and that we will own and operate. Steel production and finishing at Granite City Works was temporarily idled in December 2008.

Lake Erie Works, located in Nanticoke, Ontario, has annual raw steel production capability of 2.6 million tons. Lake Erie Works facilities include a coke battery, a blast furnace, two steelmaking vessels, a slab caster, and a hot strip mill.mill and three pickling lines. The pickling lines were acquired on August 29, 2008 and are included in Flat-rolled results as of that date. Principal products include slabs and hot-rolled sheets.

Fairfield Works, located in Fairfield, Alabama, has annual raw steel production capability of 2.4 million tons. Fairfield Works facilities included in Flat-rolled are a blast furnace, three steelmaking vessels, a vacuum degassing unit, a slab caster, a rounds caster, a hot strip mill, a pickling line, a cold reduction mill, two temper/skin pass mills, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Principal products include hot-rolled, cold-rolled and coated sheets, and steel rounds for Tubular.

Hamilton Works, located in Hamilton, Ontario, has annual raw steel production capability of 2.3 million tons. Hamilton Works facilities include a coke battery, a blast furnace, three steelmaking vessels, a slab caster, a combination slab/bloom caster, a bar mill, a pickling line, a cold reduction mill and two hot dip galvanizing lines. Principal products include slabs and cold-rolled and coated sheets, and bars.sheets. Steel production at Hamilton Works was temporarily idled in November 2008.

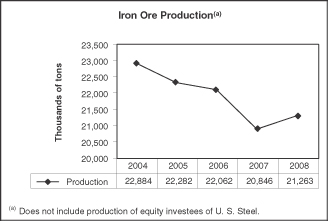

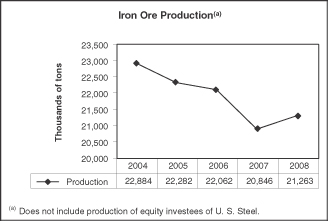

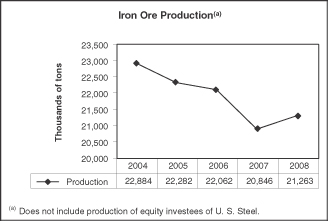

ProCoil Company LLC (Procoil)We have iron ore pellet operations located at Mt. Iron (Minntac) and Keewatin (Keetac), a wholly owned subsidiary located in Canton, Michigan, slits, cuts to length and presses blanks from steel coils to desired specifications, provides laser welding services and warehouses material to service automotive customers. Procoil’sMinnesota with annual iron ore pellet production capability is approximately 300,000of 22.4 million tons. During 2008, 2007 and 2006, these operations produced 21.3 million, 20.8 million and 22.1 million net tons of iron ore pellets, respectively. We previously announced a capital investment program at Keetac to increase production by modernizing and improving a pellet indurating line that has been idle since 1980. This expansion would increase Keetac’s iron pellet production capability by 3.6 million tons to a total annual capability of 9.6 million tons. We are currently involved in the permitting process, but Keetac was temporarily idled in December 2008 and we expect the expansion project to be deferred beyond 2009.

USSC owns 60 percent of the Z-Line Company (Z-Line), a partnership with Metal One Canada Corporation, which is consolidated in our financial results. Z-Line owns and operates a galvanizing/galvannealing line located within Hamilton Works with annual production capability of approximately 430,000 tons.

Lake Erie Works, Hamilton Works, Z-Line, Baycoat Limited Partnership (discussed below) and DC Chrome Limited (discussed below) were acquired in the Stelco acquisition and are included in Flat-rolled’s results effective October 31, 2007.

U. S. Steel participates in a number of additional joint ventures that are included in Flat-rolled, most of which are conducted through subsidiaries or other separate legal entities. All of these joint ventures are accounted for under the equity method. The significant joint ventures and other investments are described below. For information regarding joint ventures and other investments, see Note 10 to the Financial Statements.

U. S. Steel and Pohang Iron & Steel Co., Ltd. (POSCO)POSCO of South Korea participate in a 50-50 joint venture, USS-POSCO Industries (USS-POSCO), located in Pittsburg, California. The joint venture markets high quality sheet and tin mill products, principally in the western United States. USS-POSCO produces cold-rolled sheets, galvanized sheets, tin plate and tin-free steel from hot bands principally provided by U. S. Steel and POSCO, which each provide about 50 percent of its requirements. USS-POSCO’s annual production capability is approximately 1.5 million tons.

U. S. Steel and Kobe Steel, Ltd. of Japan participate in a 50-50 joint venture, PRO-TEC Coating Company (PRO-TEC). PRO-TEC owns and operates two hot dip galvanizing lines in Leipsic, Ohio, which primarily serve the automotive industry. PRO-TEC’s annual production capability is approximately 1.2 million tons. U. S. Steel supplies PRO-TEC with all of its requirements of cold-rolled sheets and markets all of its products.

U. S. Steel and Severstal North America, Inc. participate in Double Eagle Steel Coating Company (DESCO), a 50-50 joint venture which operates an electrogalvanizing facility located in Dearborn, Michigan. The facility coats sheet steel with free zinc or zinc alloy coatings, primarily for use in the automotive industry. DESCO processes steel supplied by each partner and each partner markets the steel it has processed by DESCO. DESCO’s annual production capability is approximately 870,000 tons.

U. S. Steel and ArcelorMittal participate in the Double G Coatings Company, L.P. 50-50 joint venture (Double G), a hot dip galvanizing and Galvalume® facility located near Jackson, Mississippi, which primarily serves the construction industry. Double G processes steel supplied by each partner and each partner markets the steel it has processed by Double G. Double G’s annual production capability is approximately 315,000 tons.

U. S. Steel and Worthington Industries, Inc. (Worthington Industries) participate in Worthington Specialty Processing (Worthington), which consisted of a 50-50 joint venture steel processing facility located in Jackson, Michigan. The plant is operatedMichigan until October 1, 2008, when the joint venture was expanded by the partners. U. S. Steel contributed ProCoil Company LLC, its steel processing subsidiary in Canton, Michigan, and Worthington Industries Inc.contributed Worthington Steel Taylor, its steel processing subsidiary in Taylor, Michigan, to the joint venture. As part of this transaction, U. S. Steel received a cash payout of $2.5 million and our ownership interest decreased from 50 percent to 49 percent. The facility is capable of processing masterfacilities slit, cut to length and press blanks from steel coils into both slit coils and sheared first operation blanks including rectangles, trapezoids, parallelograms and chevrons. It is designed to meet specifications for the automotive, appliance, furniture and metal door industries.desired specifications. Worthington’s annual production capability is approximately 510,000890,000 tons.

USSC and ArcelorMittal Dofasco, Inc. participate in Baycoat Limited Partnership (Baycoat), a 50-50 joint venture located in Hamilton, Ontario. Baycoat applies a variety of paint finishes to flat-rolled steel coils. Baycoat’s annual production capability is approximately 280,000 tons.

D.C. Chrome Limited, a 50-50 joint venture between USSC and The Court Group of Companies Limited, operates a plant in Stony Creek, Ontario which textures and chromium plates work rolls for Hamilton Works and for other customers, and grinds and chromes steel shafts used in manlifts.

Chrome Deposit Corporation (CDC), a 50-50 joint venture between U. S. Steel and Court Holdings, reconditions finishing work rolls, which require grinding, chrome plating, and/or texturing. The rolls are used on rolling mills to provide superior finishes on steel sheets. CDC has seven locations across the United States, with all locations near major steel mills.

Feralloy Processing Company (FPC), a joint venture between U. S. Steel and Feralloy Corporation, converts coiled hot strip mill plate into sheared and flattened plates for shipment to customers. U. S. Steel has a 49 percent interest. The plant, located in Portage, Indiana, has a temper mill linked to a cut-to-length leveling line. The line provides stress-free, leveled product with a superior surface finish. FPC provides processing services to the joint venture partners and other steel consumers and service centers. FPC’s annual production capability is approximately 275,000 tons.

U. S. Steel, along with Feralloy Mexico, S.R.L. de C.V. and Mitsui & Co. (USA), Inc., participates in a joint venture, Acero Prime.Prime, S.R.L. de CV (Acero Prime). U. S. Steel has a 40 percent interest. Acero Prime operates in Mexico with facilities in San Luis Potosi and Ramos Arizpe, and a leased warehouse in Toluca. Acero Prime provides slitting, warehousing and logistical services. Acero Prime’s annual slitting capability is approximately 385,000 tons.

We have a 44.6 percent ownership interest in Wabush Mines (Wabush), which has a mine and concentrator in Wabush, Labrador and a pellet plant in Pointe Noire, Quebec. Wabush’s rated annual production capability is 6.4 million tons of iron ore pellets, of which our share is about 2.8 million tons, reflecting our ownership interest. Our share of 2008 production was 2.0 million tons.

U. S. Steel has a 14.7 percent ownership interest in Hibbing Taconite Company (Hibbing), which is based in Hibbing, Minnesota. Hibbing’s rated annual production capability is 9.1 million tons of iron ore pellets, of which our share is about 1.3 million tons, reflecting our ownership interest. Our share of 2008 production was 1.4 million tons.

We have a 15 percent ownership interest in Tilden Mining Company (Tilden), which is based in Ishpeming, Michigan. Tilden’s rated annual production capability is 8.7 million tons of iron ore pellets, of which our share is about 1.3 million tons, reflecting our ownership interest. Our share of 2008 production was 1.2 million tons.

U. S. Steel owns a Research and Technology Center located in Munhall, Pennsylvania where we carry out a wide range of applied research, development and technical support functions.

U. S. Steel also owns an automotive technical center in Troy, Michigan. This facility brings automotive sales, service, distribution and logistics services, product technology and applications research into one location. Much of U. S. Steel’s work in developing new grades of steel to meet the demands of automakers for high-strength, light-weight and formable materials is carried out at this location.

USSE

USSE consists of USSK and its subsidiaries and USSS.

USSK is headquartered at its integrated facility in Kosice,Košice, Slovakia, which has annual raw steel production capability of 5.0 million tons. This facility has two coke batteries, three blast furnaces, four steelmaking vessels, a vacuum degassing unit, two dual strand casters, a hot strip mill, two pickling lines, two cold reduction mills, a temper mill, a temper/double cold reduction mill, three hot dip galvanizing lines, two tin coating lines, three dynamo lines and a color coating line. Construction of anThe final acceptance test for the new automotive-quality hot dip galvanizing line was completed in February 2007August 2008. Principal products include hot-rolled, cold-rolled and commissioning progressed throughout the year. We expect the final acceptance test to be completed by the end of the first quarter.coated sheets and tin mill products. USSK also has facilities for manufacturing heating radiators, spiral welded pipe and refractories.

In addition, USSK has a full service research laboratory. In conjunction with our research facility in Munhall, Pennsylvania, the USSK lab supports efforts in cokemaking, electrical steels, design and instrumentation, and ecology.

USSS has an integrated plant in Smederevo, Serbia which has annual raw steel production capability of 2.4 million tons. Facilities at this plant include two blast furnaces, three steelmaking vessels, two slab casters, a hot strip mill, a pickling line, a cold reduction mill, a temper mill and a temper/double cold reduction mill. Other facilities include a tin mill in Sabac with one tin coating line, a limestone mine in Kucevo and a river port in Smederevo, all located in Serbia. Principal products include hot-rolled and cold-rolled sheets and tin mill products.

Serbian Roll Service Company, d.o.o. is a 50-50 joint venture between USSS and Court Holdings (Europe) Ltd. Currently under construction, the operation will recondition finishing work rolls which require grinding and chrome plating. Anticipated start-up is late 2009.

Tubular

Tubular manufactures seamless and welded oil country tubular goods (OCTG) and other tubular products.

Seamless products are produced on a mill located at Fairfield Works in Fairfield, Alabama, and on two mills located in Lorain, Ohio. The Fairfield mill has annual production capability of 750,000 tons and is supplied with steel rounds exclusively from Fairfield Works. The Fairfield mill has the capability to produce outer diameter (O.D.)

sizes from 4.5 to 9.625 inches and has quench and temper, hydrotester, threading and coupling, and inspection capabilities. The Lorain mills have combined annual production capability of 780,000 tons and use steel rounds primarily from external sources, supplementedsupplied by Fairfield Works. Works and external sources. Lorain #3 Mill has the capability to produce O.D. sizes from 10.125 to 26 inches and has quench and temper, hydrotester, cutoff, and inspection capabilities. Lorain #4 Mill has the capability to produce O.D. sizes from 1.9 to 4.5 inches and has cut to length capabilities and uses Tubular Services in Houston for finishing.

Texas Operations manufactures welded OCTG, standard and line pipe and specialtymechanical tubing products. Texas Operations #1 Mill has the capability to produce O.D. sizes from 7 to 16 inches. Texas Operations #2 Mill has the capability to produce O.D. sizes from 1.088 to 7.15 inches. Both mills have quench and temper, hydrotester, threading and coupling, and inspection capabilities. Bellville Operations manufactures welded tubular products primarily for OCTG. Bellville Operations has the capability to produce O.D. sizes from 2.375 to 4.5 inches and has limited hydrotester and cutoff capabilities. Texas Operations and Bellville Operations have combined annual production capability of 1.0 million tons and use hot-rolled products from Flat-rolled’s facilities. Wheeling Machine Products supplies couplings usedBellville Operations was temporarily idled in January 2009 and we intend to connect individual sectionstemporarily idle Texas Operations at the end of oilfield casing and tubing. Tubular Processing Services provides thermal treating and end-finishing services for oilfield production tubing. Tubular Threading and Inspection Services provides threading, inspection and storage services to the OCTG market. Fintube Technologies (Fintube) manufactures specialty tubular products used in heat recovery technology applications. February.

Welded products are also produced on a mill located in McKeesport, Pennsylvania, which is operated by Camp-Hill Corporation. The McKeesport mill has annual production capability of 315,000 tons and purchases flat-rolled productsprocesses hot-rolled bands from Mon Valley Works and other U. S. Steel locations. This mill has the capability to produce, hydrotest, cut to length, and inspect O.D. sizes from 8.625 to 20 inches.

Wheeling Machine Products supplies couplings used to connect individual sections of oilfield casing and tubing. It produces sizes ranging from 2.375 to 20 inches at three locations: Pine Bluff, Arkansas, Hughes Springs, Texas and Houston, Texas.

Tubular Processing Services, located in Houston, Texas, provides thermal treating and end-finishing services for oilfield production tubing. Tubular Threading and Inspection Services, also located in Houston, Texas, provides threading, inspection and storage services to the OCTG market.

Fintube Technologies (Fintube), located in Tulsa, Oklahoma and Monterey, Mexico, manufactures specialty tubular products used in heat recovery technology applications. Fintube has a welded tube production mill, finning operations and an engineered products division.

U. S. Steel also has a 50 percent ownership interest in Apolo Tubulars S.A. (Apolo), a Brazilian supplier of welded casing, tubing, line pipe and other tubular products.

Effective June 14, 2007, Tubular’s results include Texas Operations, Bellville Operations, Wheeling Machine Products, Tubular Processing Services, Tubular Threading and Inspection Services, Fintube and Apolo, which were acquired in the Lone Star acquisition. Apolo’s annual production capability is approximately 150,000 tons.

In April 2007, U. S. Steel, POSCO and SeAH Steel Corporation, a Korean manufacturer of tubular products, formed United Spiral Pipe LLC to design, engineer and construct a manufacturing facility with annual production capability of 300,000 tons of spiral welded tubular products. EngineeringU. S. Steel and permitting work is ongoing,POSCO each hold a 35-percent ownership interest in the joint venture, with construction commencingthe remaining 30-percent ownership interest being held by SeAH. Construction commenced in February 2008.2008 and we expect start-up to occur in 2009.

Other Businesses

U. S. Steel’s Other Businesses are involved in the production and sale of iron-bearing taconite pellets,include transportation services, the management and development of real estate and engineering and consulting services.

On January 31, 2009, we completed the sale of a majority of the operating assets of EJ&E to a subsidiary of Canadian National Railway Company. After-tax proceeds from the sale were approximately $210 million and U. S. Steel has iron ore pellet operations located at Mt. Iron (Minntac) and Keewatin (Keetac), Minnesota. During 2007, 2006 and 2005, these operations produced 20.8will record a net gain of approximately $60 million 22.1 million and 22.3 million net tons of iron ore pellets, respectively. U. S. Steel has a 14.7 percent ownership interest in Hibbing Taconite Company (Hibbing), which is based in Hibbing, Minnesota. Hibbing’s rated annual production capacity is 9.1 million tons of iron ore pellets, of which our share is about 1.3 million tons, reflecting our ownership interest. We also have a 15 percent ownership interest in Tilden Mining Company (Tilden), which is based in Ishpeming, Michigan. Tilden’s rated annual production capacity is 8.7 million tons of iron ore pellets, of which our share is about 1.3 million tons reflecting our ownership interest. In February 2008, we announced a capital investment program in excess of $300 million at Keetac to increase production by modernizing and improving a pellet indurating line that has been idle since 1980. The expansion, if implemented, would increase Keetac’s iron pellet production capability by 3.6 million tons to a total annual capability of 9.6 million tons. The program is expected to take approximately 36 months after the permitting process to complete.

Through USSC, we also have a 44.6 percent ownership interest in Wabush Mines (Wabush), which has a mine and concentrator in Wabush, Labrador and a pellet plant in Pointe Noire, Quebec. ArcelorMittal Dofasco, Inc. is in the process of purchasing our interest in Wabush. The transaction is subject to various regulatory approvals and is currently expected to close in the first halfquarter of 2008. We expect2009. The retained portion of EJ&E has been renamed Gary Railway Company. See Note 5 to enter into a pellet supply arrangement in conjunction with the sale.Financial Statements.

In addition to Gary Railway Company in Indiana, U. S. Steel owns the Elgin, Joliet and Eastern Railway Company in Illinois and Indiana; the Lake Terminal Railroad Company in Ohio; Union Railroad Company and McKeesport Connecting Railroad Company in Pennsylvania; the Birmingham Southern

Railroad Company, Fairfield Southern Company, Inc., Mobile River Terminal Company, and Warrior and Gulf Navigation Company, all located in Alabama; Delray Connecting Railroad Company in Michigan and the Texas & Northern Railroad Company in Texas,Texas; all of which comprise U. S. Steel’s transportation business.

On September 26, 2007, U. S. Steel and Canadian National Railway Company (CN) announced that they had entered into an agreement under which CN will acquire the majority of the operating assets of Elgin, Joliet and Eastern Railway Company for $300 million. Under the agreement, U. S. Steel will retain railroad assets, equipment, and employees that support Gary Works in northwest Indiana. The transaction is subject to regulatory approval by the U.S. Surface Transportation Board and closing is anticipated in the second half of 2008.

U. S. Steel owns, develops and manages various real estate assets, which include approximately 200,000 acres of surface rights primarily in Alabama, Illinois, Maryland, Michigan, Minnesota and Pennsylvania. In addition, U. S. Steel participates in joint ventures that are developing real estate projects in Alabama Illinois and Maryland. U. S. Steel also owns approximately 4,000 acres of land in Ontario, Canada, which could potentially be sold or developed.

Met-Chem Canada Inc., a wholly owned subsidiary of U. S. Steel, is a consulting engineering company providing engineering services in the mining and mineral processing sectors. Technical services provided include the preparation of studies (conceptual, feasibility, bankable feasibility and detailed reports), mine and process audits, basic and detailed engineering, project and construction management, procurement, start-up and commissioning, training and operations assistance.

Raw Materials and Energy