UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 20072009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period fromto

COMMISSION FILE NUMBER 001-12307

ZIONS BANCORPORATION

(Exact name of Registrant as specified in its charter)

UTAH | 87-0227400 | |

(State or other jurisdiction of

| (Internal Revenue Service Employer Identification Number) | |

|

| |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (801) 524-4787

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Guarantee related to 8.00% Capital Securities of Zions Capital Trust B | New York Stock Exchange | |

Convertible 6% Subordinated Notes due September 15, 2015 | New York Stock Exchange | |

Depositary Shares each representing a 1/40th ownership interest in a share of Series A Floating-Rate Non-Cumulative Perpetual Preferred Stock | New York Stock Exchange | |

Depositary Shares each representing a 1/40th ownership interest in a share of Series C 9.5% Non-Cumulative Perpetual Preferred Stock | New York Stock Exchange | |

Common Stock, without par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Aggregate Market Value of Common Stock Held by Non-affiliates at June 30, 2007 | $ | 7,974,285,987 | |

Number of Common Shares Outstanding at February 15, 2008 | 107,139,628 shares | ||

Aggregate Market Value of Common Stock Held by Non-affiliates at June 30, 2009 | $ | 1,376,411,491 | |

Number of Common Shares Outstanding at February 16, 2010 | 150,401,679 shares |

Documents Incorporated by Reference:

Portions of the Company’s Proxy Statement (to be dated approximately March 10, 2008) for the Annual Meeting of Shareholders to be held April 24, 2008 – Incorporated into Part III

| Page | ||||

| PART I | ||||

| Item 1. | ||||

| Item 1A. | ||||

| Item 1B. | ||||

| Item 2. | ||||

| Item 3. | ||||

| Item 4. |

| |||

| PART II | ||||

| Item 5. | ||||

| Item 6. | ||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |||

| Item 7A. | ||||

| Item 8. | ||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | |||

| Item 9A. | ||||

| Item 9B. | ||||

| PART III | ||||

| Item 10. | ||||

| Item 11. | ||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | |||

| Item 14. | ||||

| PART IV | ||||

| Item 15. | ||||

FORWARD-LOOKING INFORMATION

Statements in this Annual Report on Form 10-K that are based on other than historical data are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and include, among others:

statements with respect to the beliefs, plans, objectives, goals, guidelines, expectations, anticipations, and future financial condition, results of operations and performance of Zions Bancorporation (“the parent”) and its subsidiaries (collectively “the Company”Company,” “Zions,” “we,” “our,” “us”);

statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “projects,” or similar expressions.

These forward-looking statements are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties and actual results may differ materially from those presented, either expressed or implied, in this Annual Report on Form 10-K, including, but not limited to, those presented in the Management’s Discussion and Analysis. Factors that might cause such differences include, but are not limited to:

the Company’s ability to successfully execute its business plans, manage its risks, and achieve its objectives;

changes in political and economic conditions, including without limitation the political and economic effects of the current economic crisis, delay of recovery from the current economic crisis, and other major wars, military actions, terrorist attacks against the United States and related events;attacks;

changes in financial market conditions, either internationally, nationally or locally in areas in which the Company conducts its operations, including without limitation reduced rates of business formation and growth, commercial and residential real estate development and real estate prices;

fluctuations in markets for equity, fixed-income, commercial paper and other securities, including availability, market liquidity levels, and pricing;

changes in interest rates, the quality and composition of the loan and securities portfolios, demand for loan products, deposit flows and competition;

acquisitions and integration of acquired businesses;

increases in the levels of losses, customer bankruptcies, bank failures, claims, and assessments;

changes in fiscal, monetary, regulatory, trade and tax policies and laws, and regulatory assessments and fees, including policies of the U.S. Department of Treasury, the Board of Governors of the Federal Reserve Board System (the “FRB” or the Federal Reserve Board), and the Federal Reserve Board;Deposit Insurance Corporation (“FDIC”);

the Company’s participation or lack of participation in governmental programs implemented under the Emergency Economic Stabilization Act (“EESA”) and the American Recovery and Reinvestment Act (“ARRA”), including without limitation the Troubled Asset Relief Program (“TARP”) and the Capital Purchase Program (“CPP”) and the impact of such programs and related regulations on the Company and on international, national, and local economic and financial markets and conditions;

the impact of the EESA and the ARRA and related rules and regulations, and changes in those rules and regulations, on the business operations and competitiveness of the Company and other participating American financial institutions, including the impact of the executive compensation limits of these acts, which may impact the ability of the Company and other American financial institutions to retain and recruit executives and other personnel necessary for their businesses and competitiveness;

continuing consolidation in the financial services industry;

new litigation or changes in existing litigation;

success in gaining regulatory approvals, when required;

changes in consumer spending and savings habits;

increased competitive challenges and expanding product and pricing pressures among financial institutions;

demand for financial services in the Company’s market areas;

inflation and deflation;

technological changes and the Company’s implementation of new technologies;

the Company’s ability to develop and maintain secure and reliable information technology systems;

legislation or regulatory changes which adversely affect the Company’s operations or business;

the Company’s ability to comply with applicable laws and regulations; and

changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or regulatory agencies.agencies; and

Theincreased costs of deposit insurance and changes with respect to FDIC insurance coverage levels.

Except to the extent required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments.

AVAILABILITY OF INFORMATION

We also make available free of charge on our website,www.zionsbancorporation.com, annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission.

GLOSSARY OF ACRONYMS

ABS – Asset-Backed Security

ACL – Allowance for Credit Losses

AFS – Available-for-Sale

ALCO – Asset/Liability Committee

ALLL – Allowance for Loan and Lease Losses

ALM – Asset-Liability Management

ARM – Adjustable Rate Mortgage

ARRA – American Recovery and Reinvestment Act

ASC – Accounting Standards Codification

ASU – Accounting Standards Update

ATM – Automated Teller Machine

BCBS – Basel Committee on Banking Supervision

BSA – Bank Secrecy Act

CB&T – California Bank & Trust

CDARS – Certificate of Deposit Account Registry System

CDO – Collateralized Debt Obligation

CMC – Capital Management Committee

COSO – Committee of Sponsoring Organizations of the Treadway Commission

CPP – Capital Purchase Program

CRA – Community Reinvestment Act

CRE – Commercial Real Estate

DTA – Deferred Tax Asset

DTL – Deferred Tax Liability

EESA – Emergency Economic Stabilization Act

ESOARS – Employee Stock Option Appreciation Rights Securities

FAMC – Federal Agricultural Mortgage Corporation

FASB – Financial Accounting Standards Board

FDIC – Federal Deposit Insurance Corporation

FHLB – Federal Home Loan Bank

FHLMC – Federal Home Loan Mortgage Corporation

FINRA – Financial Industry Regulatory Authority

FNMA – Federal National Mortgage Association

FRB – Federal Reserve Board

FTE – Full-Time Equivalent

GAAP – Generally Accepted Accounting Principles

GLB – Gramm-Leach-Bliley Act of 1999

GNMA – Government National Mortgage Association

HTM – Held-to-Maturity

ISDA – International Swap Dealer Association

LIBOR – London Inter-Bank Offering Rate

LTV – Loan-to-Value (on an “as completed” basis)

MD&A – Management’s Discussion and Analysis

MSA – Metropolitan Statistical Area

NBA – National Bank of Arizona

NPR – Notice of Proposed Rulemaking

NRSRO – Nationally Recognized Statistical Rating Organization

NSB – Nevada State Bank

OCC – Office of the Comptroller of the Currency

OCI – Other Comprehensive Income

OREO – Other Real Estate Owned

OTC – Over-the-Counter

OTTI – Other-Than-Temporary-Impairment

PCAOB – Public Company Accounting Oversight Board

PDs – Probabilities of Default

PIK – Payment in Kind

QSPE – Qualifying Special-Purpose Entity

REIT – Real Estate Investment Trust

SBA – Small Business Administration

SBIC – Small Business Investment Company

SEC – Securities and Exchange Commission

SFAS – Statement of Financial Accounting Standards

TAF – Term Auction Facility

TARP – Troubled Asset Relief Program

TCBO – The Commerce Bank of Oregon

TCBW – The Commerce Bank of Washington

TLGP – Temporary Liquidity Guarantee Program

VIE – Variable Interest Entity

ZCTB – Zions Capital Trust B

ZFNB – Zions First National Bank

ZMSC – Zions Management Services Company

| ITEM 1. | BUSINESS |

DESCRIPTION OF BUSINESS

Zions Bancorporation (“the Parent”) is a financial holding company organized under the laws of the State of Utah in 1955, and registered under the Bank Holding Company Act of 1956, as amended (the “BHC Act”). The Parent and its subsidiaries (collectively “the Company”) own and operate eight commercial banks with a total of 508491 domestic branches at year-end 2007.2009. The Company provides a full range of banking and related services through its banking and other subsidiaries, primarily in Utah, California, Texas, Arizona, Nevada, Colorado, Idaho, Washington, and Oregon. Full-time equivalent employees totaled 10,93310,529 at year-end 2007.2009. For further information about the Company’s industry segments, see “Business Segment Results” on page 64 in Management’s Discussion and Analysis (“MD&A”) and Note 22 of the Notes to Consolidated Financial Statements. For information about the Company’s foreign operations, see “Foreign Operations” on page 63 in MD&A. The “Executive Summary” on page 20 in MD&A provides further information about the Company.

PRODUCTS AND SERVICES

The Company focuses on providing community-mindedcommunity banking services by continuously strengthening its core business lines of 1) small, medium-sized business and corporate banking; 2) commercial and residential development, construction and term lending; 3) retail banking; 4) treasury cash management and related products and services; 5) residential mortgage; 6) trust and wealth management; and 7) investment activities. It operates eight different banks in ten Western and Southwestern states with each bank operating under a different name and each having its own board of directors, chief executive officer, and management team. The banks provide a wide variety of commercial and retail banking and mortgage lending products and services. They also provide a wide range of personal banking services to individuals, including home mortgages, bankcard, other installment loans, home equity lines of credit, checking accounts, savings accounts, time certificates of various types and maturities, trust services, safe deposit facilities, direct deposit, and 24-hour ATMAutomated Teller Machine (“ATM”) access. In addition, certain banking subsidiaries provide services to key market segments through their Women’s Financial, Private Client Services, and Executive Banking Groups. We also offer wealth management services through a subsidiary, Contango Capital Advisors, Inc., (“Contango”) that was launched in 2004, and online brokerage services through Zions Direct.

In addition to these core businesses, the Company has built specialized lines of business in capital markets, public finance, and certain financial technologies, and is also a leader in U.S. Small Business Administration (“SBA”) lending. Through its eight banking subsidiaries, the Company provides SBA 7(a) loans to small businesses throughout the United States and is also one of the largest providers of SBA 504 financing in the nation. The Company owns an equity interest in the Federal Agricultural Mortgage Corporation (“Farmer Mac”) and is one of the nation’s top originatororiginators of secondary market agricultural real estate mortgage loans through Farmer Mac. The Company is a leader in municipal finance advisory and underwriting services. The Company also controls four venture capital funds that provide early-stage capital primarily for start-up companies located in the Western United States. Finally, the Company’s NetDeposit Inc. (“NetDeposit”) and P5, Inc. (“P5”) subsidiaries are leaderssubsidiary is a leader in the provision of check imaging and clearing software and of web-based medical claims tracking and cash management services, respectively.

software.

COMPETITION

The Company operates in a highly competitive environment. The Company’s most direct competition for loans and deposits comes from other commercial banks, thrifts, and credit unions, including institutions that do not have a physical presence in our market footprint but solicit via the Internet and other means. In addition, the Company competes with finance companies, mutual funds, brokerage firms, securities dealers, investment banking companies, financial technology firms, and a variety of other types of companies. Many of these companies have fewer regulatory constraints and some have lower cost structures or tax burdens.

The primary factors in competing for business include pricing, convenience of office locations and other delivery methods, range of products offered, and the level of service delivered. The Company must compete effectively along all of these parameters to remain successful.

SUPERVISION AND REGULATION

The Parent is a bank holding company that has elected to become a financial holding company underas provided by the BHC Act. The Gramm-Leach-Bliley Act of 1999 (“the GLB Act”) provides a. The BHC Act, and other federal statutes as modified by the GLB Act, provide the regulatory framework for bank holding companies and financial holding companies which have as their umbrella regulator the Federal Reserve Board (“FRB”).Board. The functional regulation of the separately regulated subsidiaries of a holding company is conducted by each subsidiary’s primary functional regulator. To qualify for and maintain status as a financial holding company, the Parent must satisfy certain ongoing criteria. The Company currently engages in only limited activities for which financial holding company status is required.

In addition, the Company’sThe Parent’s subsidiary banks are subject to the provisions of the National Bank Act or other statutes governing national banks and the banking laws of their respectivevarious states, as well as the rules and regulations of the Office of the Comptroller of the Currency (“OCC”), the FRB, and the Federal Deposit Insurance Corporation (“FDIC”).FDIC. They are also under the supervision of, and are continually subject to periodic examination by, the OCC or their respective state banking departments, the FRB, and the FDIC. Many of our nonbank subsidiaries are also subject to regulation by the FRB and other applicable federal and state agencies. Our brokerage and investment advisory subsidiaries are regulated by the Securities and Exchange Commission (“SEC”), Financial Industry Regulatory Authority (“FINRA”) and/or state securities regulators. Our other nonbank subsidiaries may be subject to the laws and regulations of the federal government and/or the various states in which they conduct business.

The Company is subject to various requirements and restrictions contained in both the laws of the United States and the states in which its banks and other subsidiaries operate. These regulations include but are not limited to the following:

Laws and regulations regarding the availability, requirements and restrictions of a number of recently enacted governmental programs in which the Company participates, including without limitation the TARP and its associated CPP, as well as certain requirements and limitations imposed by the EESA and ARRA and programs and regulations thereunder, including without limitation limitations on dividends on common stock in the CPP, and on executive compensation contained in the EESA and ARRA. One of these programs, the CPP, contains provisions that allow the U.S. Government to unilaterally modify any term or provision of contracts executed under the program.

Requirements for approval of acquisitions and activities. The priorPrior approval is required, in accordance with the BHC Act of the FRB, for a financial holding company to acquire or hold more than 5% voting interest in any bank. The BHC Act allows, subject to certain limitations, interstate bank acquisitions and interstate branching by acquisition anywhere in the country. The BHC Act also requires approval for certain nonbanking acquisitions and restricts the Company’s nonbanking activities to those that are permitted for financial holding companies or that have been determined by the FRB to be financial in nature, incidental to financial activities, or complementary to a financial activity.

Capital requirements. The FRB has established capital guidelines for financial holding companies. The OCC, the FDIC, and the FRB have also issued regulations establishing capital requirements for banks. The federalU.S. regulatory bodies are expected to issue new capital guidelines for banking organizations. Numerous “white papers,” speeches, and similar documents have been published by both U.S. and international regulatory bodies, which consistently point toward unspecified, but increased, levels of bank regulatory agencies have adopted and are proposing risk-basedholding company capital rules described below.and liquidity. Accordingly, additional capital requirements could be required by new regulations in the future and could become required of the Company. In addition, there is a risk that the Company may be pressured by regulators to raise capital to enable it to repay the preferred stock issued to the U.S. Treasury under TARP at a time or in amounts that management would not consider optimal. Failure to meet capital requirements could subject the Parent and its subsidiary banks to a variety of restrictions and enforcement remedies. See Note 19 of the Notes to Consolidated Financial Statements for information regarding capital requirements.

The U.S. federal bank regulatory agencies’ risk-based capital guidelines are based upon the 1988 capital accord (“Basel I”) of the Basel Committee on Banking Supervision (the “BCBS”). The BCBS is

a committee of central banks and bank supervisors/regulators from the major industrialized countries that develops broad policy guidelines that each country’s supervisors can use to determine the supervisory policies they apply. The BCBS has been working for a number of years on revisions to Basel I and in June 2004 released the final version of its proposed new capital framework (“Basel II”) with an update in November 2005. Basel II provides two approaches for setting capital standards for credit risk – an internal ratings-based approach tailored to individual institutions’ circumstances (which for many asset classes is itself broken into a “foundation” approach and an “advanced” or “A-IRB” approach, the availability of which is subject to additional restrictions) and a standardized approach that bases risk weightings on external credit assessments to a much greater extent than permitted in existing risk-based capital guidelines. Basel II also sets capital requirements for operational risk and refines the existing capital requirements for market risk exposures. However, U.S. regulatory authorities consistently have taken the position that U.S. banks would not be permitted to utilize the “foundation” approach. Operational risk is defined to mean the risk of direct or indirect loss resulting from inadequate or failed internal processes, people and systems, or from external events. Basel I does not include separate capital requirements for operational risk.

I. In December 2007, U.S. banking regulators published the final rule for Basel II implementation, requiring banks with over $250 billion in consolidated total assets or on balanceon-balance sheet foreign exposure of $10 billion (core banks) to adopt the Advanced Approach of Basel II while allowing other banks to elect to “opt in.” We do not currently expect

Modifications to the Basel II regime (“Basel III”) continue to be an early “opt in”proposed. Additionally, regulators may subjectively require banking organizations to maintain capital, reserves, or liquidity at levels higher than those codified by regulation or those prior to the recent economic crisis. Adoption of new Basel III requirements and/or regulatory actions may have a significant impact on bank holding company, as the Company does not have in place the data collectioncapital and analytical capabilities necessary to adopt the Advanced Approach. However, we believe that the competitive advantages afforded to companies that do adopt the Advanced Approach may make it necessary for the Company to elect to “opt in” at some point, and we have begun investing in the required capabilities and required data.liquidity levels going forward.

Also, in July 2007, the U.S. banking regulators agreed to issue a proposed rule that would provide “non-core” banks with the option of adopting the Standardized Approach proposed in Basel II, replacing the previously proposed Basel 1A framework. While the Advanced Approach uses sophisticated mathematical models to measure and assign capital to specific risks, the Standardized Approach categorizes risks by type and then assigns capital requirements. Following the publication of the proposed rule, the Company will evaluate the benefit of adopting the Standardized Approach.

Requirements that the Parent serve as a source of strength for its banking subsidiaries. The FRB has a policy that a bank holding company is expected to act as a source of financial and managerial strength to each of its bank subsidiaries and, under appropriate circumstances, to commit resources to support each subsidiary bank. In addition, the OCC may order an assessment of the Parent if the capital of one of its national bank subsidiaries were to become impaired.fall below capital levels required by the regulators.

Limitations on dividends payable by subsidiaries. A substantial portion of the Parent’s cash, which is used to pay dividends on our common and preferred stock and to pay principal and interest on our debt obligations, is derived from dividends paid by the Parent’s subsidiary banks. These dividends are subject to various legal and regulatory restrictions as summarized inrestrictions. See Note 19 of the Notes to Consolidated Financial Statements.

Limitations on dividends payable to shareholders. The Parent’s ability to pay dividends on both its common and preferred stock may be subject to regulatory restrictions. See discussion under “Liquidity Management Actions” starting on page 123.

Cross-guarantee requirements. All of the Parent’s subsidiary banks are insured by the FDIC. Each commonly controlled FDIC-insured bank can be held liable for any losses incurred, or reasonably expected to be incurred, by the FDIC due to another commonly controlled FDIC-insured bank being placed into receivership, and for any assistance provided by the FDIC to another commonly controlled FDIC-insured bank that is subject to certain conditions indicating that receivership is likely to occur in the absence of regulatory assistance.

Safety and soundness requirements. Federal and state laws require that our banks be operated in a safe and sound manner. We are subject to additional safety and soundness standards prescribed in the Federal Deposit Insurance Corporate Improvement Act of 1991, including standards related to internal controls, information systems, internal audit, systems, loan documentation, credit underwriting, interest rate exposure, asset growth and compensation, as well as other operational and management standards deemed appropriate by the federal banking agencies.

Limitations on the amount of loans to a borrower and its affiliates.

Limitations on transactions with affiliates.

Restrictions on the nature and amount of any investments and ability to underwrite certain securities.

Requirements for opening of branches and the acquisition of other financial entities.

Fair lending and truth in lending requirements to provide equal access to credit and to protect consumers in credit transactions.

Provisions of the GLB Act and other federal and state laws dealing with privacy for nonpublic personal information of individual customers.

Community Reinvestment Act (“CRA”) requirements. The CRA requires banks to help serve the credit needs in their communities, including credit to low and moderate income individuals. Should the Company or its subsidiaries fail to adequately serve their communities, penalties may be imposed including denials of applications to add branches, relocate, add subsidiaries and affiliates, and merge with or purchase other financial institutions.

Anti-money laundering regulations. The Bank Secrecy Act (“BSA”) and other federal laws require financial institutions to assist U.S. governmentGovernment agencies to detect and prevent money laundering. Specifically, the BSA requires financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities. Title III of the Uniting and StrengthingStrengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (“USA Patriot Act”) substantially broadens the scope of U.S. anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations, defining new crimes and related penalties, and expanding the extra-territorial jurisdiction of the United States. The U.S. Treasury Department has issued a number of implementing regulations, which apply various requirements of the USA Patriot Act to financial institutions. The Company’s bank and broker-dealer subsidiaries and private investment companies advised or sponsored by the Company’s subsidiaries must comply with these regulations. These regulations also impose new obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing.

The Parent is subject to the disclosure and regulatory requirements of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, both as administered by the SEC. As a company quotedlisted on the NASDAQ Stock Market LLC (“Nasdaq”) Global Select Market, the Parent is subject to Nasdaq listing standards for quoted companies.

The Company is subject to the Sarbanes-Oxley Act of 2002, which addresses, among other issues, corporate governance, auditing and accounting, executive compensation, and enhanced and timely disclosure of corporate information. Nasdaq has also adopted corporate governance rules, which are intended to allow shareholders and investors to more easily and efficiently monitor the performance of companies and their directors.

The Board of Directors of the Parent has implemented a comprehensive system of strong corporate governance practices. This system includes Corporate Governance Guidelines, a Code of Business Conduct and Ethics for Employees, a Directors Code of Conduct, and charters for the Audit, Credit Review, Compensation, and Nominating and Corporate Governance Committees. More information on the Company’s corporate governance practices is available on the Company’s website atwww.zionsbancorporation.com. (The Company’s website is not part of this Annual Report on Form 10-K.)

The Company has adopted policies, procedures and controls to address compliance with the requirements of the banking, securities and other laws and regulations described above or otherwise applicable to the Company. The Company intends to make appropriate revisions to reflect any changes required.

Regulators, Congress, and state legislatures and international consultative bodies continue to enact rules, laws, and policies to regulate the financial services industry and public companies and to protect consumers and investors. The nature of these laws and regulations and the effect of such policies on future business and earnings of the Company cannot be predicted.

GOVERNMENT MONETARY POLICIES

The earnings and business of the Company are affected not only by general economic conditions, but also by fiscal and other policies adopted by various governmental authorities. The Company is particularly affected by the monetary policies of the FRB, which affect both short-term and long-term interest rates and the national supply of bank credit. The methods of monetary policytools available to the FRB which may be used to implement monetary policy include:

open-market operations in U.S. governmentGovernment and other securities;

adjustment of the discount rates or cost of bank borrowings from the FRB; and

imposing or changing reserve requirements against bank deposits.deposits;

term auction facilities collateralized by bank loansloans; and

other programs to purchase assets and inject liquidity directly in various segments of the economy.

These methods are used in varying combinations to influence the overall growth or contraction of bank loans, investments and deposits, and the interest rates charged on loans or paid for deposits.

In view of the changing conditions in the economy and the effect of the FRB’s monetary policies, it is difficult to predict future changes in loan demand, deposit levels and interest rates, or their effect on the business and earnings of the Company. FRB monetary policies have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future.

| ITEM 1A. | RISK FACTORS |

The following list describes several risk factors which are significant to the Company including but not limited to:

The Company has been and could continue to be negatively affected by recent adverse economic conditions.

The United States and many other countries recently faced a severe economic crisis, including a major recession which has not yet been resolved. These adverse economic conditions have negatively affected, and are likely to continue for some time to adversely affect, the Company’s assets, including its loans and securities portfolios, capital levels, results of operations, and financial condition. In response to the economic crisis, the United States and other governments established a variety of programs and policies designed to mitigate the effects of the crisis. These programs and policies appear to have stabilized the severe financial crisis that occurred in the second half of 2008, but the extent to which these programs and policies will assist in an economic recovery or may lead to adverse consequences, whether anticipated or unanticipated, is still unclear. If these programs and policies are ineffective in bringing about an economic recovery or result in substantial adverse developments, the economic conditions may again become more severe, or adverse economic conditions may continue for a substantial period of time. Any increase in the severity or duration of adverse economic conditions or delay in the recovery from them would adversely affect the Company.

Our participation in the CPP and other government programs imposes restrictions and obligations on us that limit our ability to increase dividends, repurchase shares of our stock, and access the equity capital markets.

The Company has chosen to participate in a number of new programs sponsored by the U.S. Government during the current financial and economic crisis. These programs, including without limitation the TARP and its associated CPP, as well as the ARRA and EESA and regulations thereunder, contain important limitations on the Company’s conduct of its business, including limitations on dividends, repurchases of common stock, acquisitions, and executive compensation. These limitations may adversely impact the Company’s ability to attract nongovernmental capital and to recruit and retain executive management and other personnel and its ability to compete with other American and foreign financial institutions. One of these programs, the CPP, contains provisions that allow the U.S. Government to unilaterally modify any term or provision of contracts executed under the program.

Legislative and regulatory actions taken now or in the future may have a significant adverse effect on our operations.

In response to the recent economic crisis, various legislative proposals that would materially restructure the regulatory framework governing the financial services industry have been introduced or are being considered for introduction in Congress. These proposals include, but are not limited to:

the establishment of new regulatory bodies with authority over consumer protection and systemic risk;

the elimination or modification of responsibilities and independence of certain existing regulatory agencies;

the grant of authority to state agencies to enforce state and federal laws against national banks;

the imposition of substantial new fees or taxes on banking organizations or classes of banking organizations;

limitations on the size of banking organizations or the imposition of heightened costs or burdens associated with asset size; and

the introduction of new resolution authority and processes for entities in the financial services industry.

Also in response to the recent economic crisis, bank regulatory agencies and international regulatory consultative bodies have proposed or appear to be considering new regulations and requirements, some of which may be imposed without formal promulgation. These include, but are not limited to:

new capital and liquidity standards imposing higher levels and different mixes of capital and having new liquidity requirements than those contained in current regulations;

new capital planning actions, including stress testing or similar actions and timing expectations for capital-raising;

new and accelerated FDIC insurance premiums;

limitations on the amount and manner of compensation paid to executive officers and employees generally; and

restrictions on the types of products and services offered by banking organizations.

Some of these proposals could adversely affect the Company by, among other things: impacting after tax returns earned by financial services firms in general; limiting the Company’s ability to grow; increasing taxes or fees on some of the Company’s funding or activities; limiting the range of products and services that the Company could offer; exposing the Company to costly litigation and regulatory actions and increasing the cost of regulatory compliance; requiring the Company to raise capital at inopportune times; and making it difficult for the Company to compete with other banking and nonbanking companies to recruit and retain executives and other employees. Others of these proposals may actually favorably impact the Company by affecting some of its competitors more adversely than the Company. The ultimate impact of these proposals cannot be predicted, as it is unclear which, if any, may eventually be enacted into law or regulation.

Economic and other circumstances, including pressure to repay TARP preferred stock, may require us to raise capital at times or in amounts that are unfavorable to the Company.

The Company’s subsidiary banks must maintain certain risk-based and leverage capital ratios as required by their banking regulators and which can change depending upon general economic conditions and their particular condition, risk profile and growth plans. Compliance with capital requirements may limit the Company’s ability to expand and has required, and may require, capital investment from the Parent. In 2008, we issued shares of preferred stock for $1.4 billion and a warrant to purchase shares of the Company’s common stock to the U.S. Treasury under TARP. There may be increasing market, regulatory or political pressure on the Company to raise capital to enable it to repay the preferred stock issued to the U.S. Treasury under TARP at a time or in amounts that may be unfavorable to the Company’s shareholders. These uncertainties and risks created by the legislative and regulatory uncertainties discussed above may themselves increase the Company’s cost of capital and other financing costs.

Negative perceptions associated with our continued participation in the U.S. Treasury’s TARP may adversely affect our ability to retain customers, attract investors, and compete for new business opportunities.

Several financial institutions which also participated in the CPP have repurchased their TARP preferred stock. There can be no assurance as to the timing or manner in which the Company may repurchase its TARP preferred stock from the U.S. Treasury. Our customers, employees and counterparties in our current and future business relationships could draw negative implications regarding the strength of the Company as a financial institution based on our continued participation in the TARP following the exit of one or more of our competitors or other financial institutions. Any such negative perceptions could impair our ability to effectively compete with other financial institutions for business or to retain high performing employees. If this were to occur, our business, financial condition, and results of operations may be adversely affected, perhaps materially.

Credit quality has adversely affected us and may continue to adversely affect us.

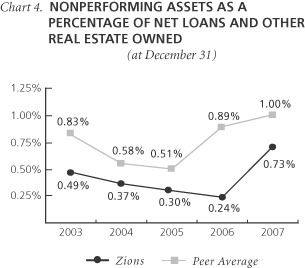

Credit risk is one of our most significant risks. The Company’s level of credit quality weakenedcontinued to weaken during 2009 in most loan types and markets in which the latter half of 2007 although it remained relatively strong compared to historical company and industry standards. The deterioration inCompany operates. We expect continued credit quality was mainly relatedweakness over the next few quarters.

Failure to weakness in loans related to residential land acquisition, development and construction in Arizona, California, and Nevada andeffectively manage our interest rate risk could weaken further in 2008. We have not seen any evidence of significant deterioration in other components of our lending portfolio, but worsening economic conditions including further declines in property values could result in deterioration in other components of the portfolio. Economic conditions in the high growth Southwestern geographical areas in which our banks operate have been weakening and continued economic weakness could result in further deterioration of property values that could significantly increase the Company’s credit risk.adversely affect us.

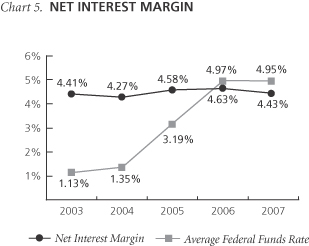

Net interest income is the largest component of the Company’s revenue. The management of interest rate risk for the Company and all bank subsidiaries is centralized and overseen by an Asset Liability Management Committee appointed by the Company’s Board of Directors. The Company has been successful in its interest rate

risk management as evidenced by its achieving a relatively stable net interest rate margin over the last several years when interest rates have been volatile and the rate environment challenging. Factors beyond the Company’s control can significantly influence the interest rate environment and increase the Company’s risk. These factors include competitive pricing pressures for our loans and deposits, adverse shifts in the mix of deposits and other funding sources, and volatile market interest rates subject to general economic conditions and the policespolicies of governmental and regulatory agencies, in particular the FRB.

Our ability to maintain adequate sources of funding and liquidity has been and may continue to be adversely affected by market conditions.

Funding availability, as opposed to funding cost, becameremained a more important risk factor in the latter half of 2007, as what has been describedduring 2009, as a “globalglobal liquidity crisis” affectedcrisis continued to affect financial institutions generally, including the Company. However, the Company was able to take a number of actions during the year to augment its capital and liquidity (See “Capital Management” on page 126 in MD&A and Notes 11, 13 and 14 of the Notes to Consolidated Financial Statements for further information on funding availability). It is expected that liquidity stresses will continue to be a risk factor in 20082010 for the Company, the Parent and its affiliate banks,banks.

The quality and for Lockhart Funding, LLC (“Lockhart”).

Zions Bank sponsors an off-balance sheet qualifying special-purpose entity (“QSPE”), Lockhart, which funds its assets by issuingliquidity of our asset-backed commercial paper. Its assets include AAA-rated securities that are collateralized by small business loans, U.S. Government, agencyinvestment portfolio has adversely affected us and other AA-rated securities. Factors beyond the Company’s control can significantly influence whether Lockhart will remain as an off-balance sheet QSPE and whether the Company will be requiredmay continue to purchase securities and possibly incur losses on the securities from Lockhart under the provisions of a Liquidity Agreement the Company provides to Lockhart. These factors include Lockhart’s inability to issue asset-backed commercial paper, rating agency downgrades of securities, and instability in the credit markets.adversely affect us.

The Company’s on-balance sheet asset-backed securities investment portfolio includes collateralized debt obligations (“CDOs”) collateralized by trust preferred securities issued by banks, insurance companies, and real estate investment trusts (“REITs”) that may have some exposure to construction loan, commercial real estate, and the subprime market.markets and/or to other categories of distressed assets. In addition, asset-backed securities also include structured asset-backed collateralized debt obligations (“ABS CDOs”) (also known as diversified structured finance CDOs) purchased from Lockhart which have minimal exposure to subprime and home equity mortgage securitizations. Factors beyond the Company’s control can significantly influence the fair value of these securities and potential adverse changes to the fair valueimpairment status of these securities. These factors include but are not limited to defaults and deferrals by debt issuers, rating agency downgrades of securities, defaults of collateralized debt issuers, lack of market pricing of securities or the return of market pricing that varies from the Company’s current model valuations, rating agency downgrades of monoline insurers that insure certain asset-backed securities, and continued instability in the credit markets.markets, and changes in prepayment rates and future interest rates. See “Investment Securities Portfolio” on page 7791 for further details.

We have been unprofitable and may continue to be unprofitable, and such lack of profitability could have particular adverse effects on us, such as restricting our ability to pay dividends or requiring a valuation allowance against our deferred tax asset.

The Parent and certain of its subsidiary banks have been unprofitable in each of the most recent five quarters. The ability of banks and bank holding companies to pay dividends is restricted by regulatory requirements, including profitability and the need to maintain required levels of capital. Continuing lack of profitability exposes the Company to the risk that regulators could restrict the ability of our subsidiary banks to pay dividends to the Parent and/or of the Parent to declare and pay dividends on its common stock, preferred stock or trust preferred securities. It also increases the risk that the Company may have to establish a “valuation allowance” against its net deferred tax asset (“DTA”). The Parent and some of its subsidiary banks already have some disallowed DTA for regulatory capital purposes.

We and/or the holders of our securities could be adversely affected by unfavorable rating actions from rating agencies.

Our ability to access the capital markets is important to our overall funding profile. This access is affected by the ratings assigned by rating agencies to us, certain of our affiliates and particular classes of securities that we and our affiliates issue. The interest rates we pay on our securities are also influenced by, among other things, the credit ratings that we, our affiliates, and/or our securities receive from recognized rating agencies. The rating agencies have in the past downgraded our ratings. Further downgrades could increase our costs or otherwise have a negative effect on the market price of our securities, our ability to access capital markets, or our results of operations or financial condition.

We could be adversely affected by accounting, financial reporting, and regulatory and compliance risk.

The Company is exposed to accounting, financial reporting, and regulatory/compliance risk. The Company provides to its customers, and uses for its own capital, funding and risk management needs, a number of complex financial products and services. Estimates, judgments and interpretations of complex and changing accounting and regulatory policies are required in order to provide and account for these products and services. Identification, interpretation and implementation of complex and changing accounting standards as well as compliance with regulatory requirements, therefore pose an ongoing risk.

We could be adversely affected by litigation and legal claims.

The Company is subject to risks associated with legal claims and litigation. The Company’s exposure to claims and litigation has increased and may further increase as a result of stresses on customers, counterparties and others arising from the current economic crisis or otherwise.

We could be adversely affected by failure in our internal controls.

A failure in our internal controls could have a significant negative impact not only on our earnings, but also on the perception that customers, regulators and investors may have of the Company. We continue to devote a significant amount of effort, time and resources to improving our controls and ensuring compliance with complex accounting standards and regulations.

As noted previously, U.S. and international regulators have adopted new capital standards commonly knownWe could be adversely affected as Basel II. These standards would apply to a numberresult of our largest competitors and potentially give them a significant competitive advantage over banks that do not adopt these standards. Sophisticated systems and data are required to adopt Basel II standards; the Company does not yet have these systems and data. While the Company is developing some of the systems, data, and analytical capabilities required to adopt Basel II, adoption is difficult and the Company has not yet decided that it will or can adopt Basel II.acquisitions.

More recently, U.S. banking regulators issued the final rule which requires banks with over $250 billion in consolidated total assets or on-balance sheet foreign exposure of $10 billion (core banks) to adopt the Advanced Approach of Basel II while allowing other banks to elect to “opt in.” We do not currently expect to be an early “opt in” bank holding company. However, our initial analysis indicates that a significant risk of competitive inequity may exist between banks operating under Basel II and those not using Basel II by potentially allowing Basel II banks to operate with lower levels of capital for certain lines of business.

From time to time the Company makes acquisitions.acquisitions including the acquisition of assets and liabilities of failed banks from the FDIC acting as a receiver. The FDIC-supported transactions are subject to loan loss sharing agreements. Failure to comply with the terms of the agreements could result in the loss of indemnification from the FDIC. The success of any acquisition depends, in part, on our ability to realize the projected cost savings from the mergeracquisition and on the continued growth and profitability of the acquisition target. We have been successful with most prior mergers,acquisitions, but it is possible that the merger and integration process with an acquisition target could result in the loss of key employees, disruptions in controls, procedures and policies, or other factors that could affect our ability to realize the projected savings and successfully retain and grow the target’s customer base.

The Company’s Board of Directors has established an Enterprise-WideEnterprise Risk Management policy and has appointed an Enterprise Risk Management Committee in late 2005 to oversee and implement the policy. In addition to credit and interest rate risk, the Committee also monitors the following risk areas: market risk, liquidity risk, operational risk, compliance risk, information technology risk, strategic risk, compensation-related risk, and reputation risk.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.There are no unresolved written comments that were received from the SEC’s staff 180 days or more before the end of the Company’s fiscal year relating to our periodic or current reports filed under the Securities Exchange Act of 1934.

| ITEM 2. | PROPERTIES |

At December 31, 2007,2009, the Company operated 508491 domestic branches, of which 263283 are owned and 245208 are leased premises.leased. The Company also leases its headquarterheadquarters offices in Salt Lake City, Utah. Other operations facilities are either owned or leased. The annual rentals under long-term leases for leased premises are determined under various formulas and factors, including operating costs, maintenance, and taxes. For additional information regarding leases and rental payments, see Note 18 of the Notes to Consolidated Financial Statements.

| ITEM 3. | LEGAL PROCEEDINGS |

The information contained in Note 18 of the Notes to Consolidated Financial Statements is incorporated by reference herein.

None.

| ITEM 5. | MARKET FOR |

MARKET INFORMATION

The Company’s common stock is traded on the Nasdaq Global Select Market under the symbol “ZION.” The last reported sale price of the common stock on Nasdaq on February 15, 200816, 2010 was $51.80$18.26 per share.

The following table sets forth, for the periods indicated, the high and low sale prices of the Company’s common stock, as quoted on Nasdaq:

| 2007 | 2006 | ||||||||||||||||||

| High | Low | High | Low | 2009 | 2008 | ||||||||||||||

| High | Low | High | Low | ||||||||||||||||

1st Quarter | $ | 88.56 | 81.18 | 85.25 | 75.13 | $ | 25.52 | 5.90 | 57.05 | 39.31 | |||||||||

2nd Quarter | 86.00 | 76.59 | 84.18 | 76.28 | 20.97 | 8.88 | 51.15 | 29.46 | |||||||||||

3rd Quarter | 81.43 | 67.51 | 84.09 | 75.25 | 20.36 | 10.25 | 107.21 | 1 | 17.53 | ||||||||||

4th Quarter | 73.00 | 45.70 | 83.15 | 77.37 | 19.03 | 12.50 | 47.94 | 21.07 | |||||||||||

| 1 | This trading price was an anomaly resulting from electronic orders at the opening of the market on September 19, 2008 in response to the SEC’s announcement (prior to the market opening that day) of its temporary emergency action suspending short selling in financial companies. The closing price on September 19, 2008 was $52.83. |

During 2009 the Company issued $472.7 million of new common stock consisting of 31,741,425 shares at an average price of $14.89 per share. Net of issuance costs and fees, the issuances added $464.1 million to common stock.

As of February 15, 2008,16, 2010, there were 6,4376,303 holders of record of the Company’s common stock.

EQUITY CAPITAL AND DIVIDENDS

We have 3,000,000 authorized shares of preferred stock without par value and with a liquidation preference of $1,000 per share. As of December 31, 2009, 67,952, 110,388, and 1,400,000 of preferred shares series A, C, and D, respectively, have been issued and are outstanding. In addition, holders of $1.1 billion of the Company’s subordinated debt have the right to convert that debt into either Series A or C preferred stock, and that therefore the Company has reserved for possible future issuance approximately 1.1 million shares of authorized preferred stock. In general, preferred shareholders may receive asset distributions before common shareholders; however, preferred shareholders have only limited voting rights generally with respect to certain provisions of the preferred stock, the issuance of senior preferred stock, and the election of directors. Preferred stock dividends reduce earnings available to common shareholders and are paid quarterly in arrears. The redemption amount is computed at the per share liquidation preference plus any declared but unpaid dividends. The series A and C shares are registered with the SEC.

The Series D Fixed-Rate Cumulative Perpetual Preferred Stock was issued on November 14, 2008 to the U.S. Department of the Treasury for $1.4 billion in a private placement exempt from registration. The EESA authorized the U.S. Treasury to provide funds to eligible financial institutions participating in the TARP Capital Purchase Program. The capital investment includes the issuance of preferred shares of the Company and a warrant to purchase common shares pursuant to a Letter Agreement and a Securities Purchase agreement (collectively “the Agreement”). The preferred shares are rankedpari passu with the Series A and C preferred shares. The dividend rate of 5% increases to 9% after the first five years. Dividend payments are made on the 15th day of February, May, August, and November. The warrant allows the U.S. Treasury to purchase up to 5,789,909 shares of the Company’s common stock exercisable over a 10-year period at a price per share of $36.27. The

preferred shares and the warrant qualify for Tier 1 regulatory capital. The Agreement subjects the Company to certain restrictions and conditions including those related to common dividends, share repurchases, executive compensation, and corporate governance.

We recorded the total $1.4 billion of the preferred shares and the warrant at their relative fair values of $1,292.2 million and $107.8 million, respectively. The difference from the par amount of the preferred shares is accreted to preferred stock over five years using the interest method with a corresponding adjustment to preferred dividends.

The frequency and amount of common stock dividends paid during the last two years are as follows:

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||

2007 | $ | 0.39 | 0.43 | 0.43 | 0.43 | ||||

2006 | 0.36 | 0.36 | 0.36 | 0.39 | |||||

| 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||

2009 | $ | 0.04 | 0.04 | 0.01 | 0.01 | ||||

2008 | 0.43 | 0.43 | 0.43 | 0.32 | |||||

OnIn January 24, 2008,2010, the Company’s Board of Directors approved a dividend of $0.43$0.01 per common share payable on February 20, 200824, 2010 to shareholders of record on February 6, 2008.10, 2010. The Company expects to continue its policy of paying regular cash dividends on a quarterly basis, although there is no assurance as to future dividends because they depend on future earnings, capital requirements, and financial condition.

In December 2006, we issued 240,000 shares of our Series A Floating-Rate Non-Cumulative Perpetual Preferred Stock with an aggregate liquidation preference of $240 million, or $1,000The Company cannot increase the common stock dividend above $0.32 per share. The preferred stock was offered inshare without the form of 9,600,000 depositary shares with each depositary share representing a 1/40th ownership interest in a shareconsent of the preferred stock. In general, preferred shareholders are entitled to receive asset distributions before common shareholders; however, preferred shareholders have no preemptive or conversion rights, and only limited voting rights pertaining generally to amendments toU.S. Treasury until the termsthird anniversary of the preferred stockdate of the investment, or November 14, 2011, unless prior to such third anniversary the issuance of senior preferred stock as well asseries D is redeemed in whole or the right to elect two directors inU.S. Treasury has transferred all of the event of certain defaults. Thesenior preferred stock is not redeemable priorseries D to December 15, 2011, but will be redeemable subsequent to that date at the Company’s option at the liquidation preference value plus any declared but unpaid dividends. The preferred stock dividend reduces earnings available to common shareholders and is computed at an annual rate equal to the greater of three-month LIBOR plus 0.52%, or 4.0%. Dividend payments are made quarterly in arrears on the 15th day of March, June, September, and December.third parties.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The information contained in Item 12 of this Form 10-K is incorporated by reference herein.

SHARE REPURCHASES

The following table summarizes the Company’s share repurchases for the fourth quarter of 2007:2009:

Period | Total number of shares repurchased(1) | Average price paid per share | Total number of shares purchased as part of publicly announced plans or programs | Approximate dollar value of shares that may yet be purchased under the plan(2) | Total number of shares repurchased1 | Average price paid per share | Total number of shares purchased as part of publicly announced plans or programs | Approximate dollar value of shares that may yet be purchased under the plan | ||||||||||||

October | 490 | $ | 66.76 | – | $ | 56,250,315 | 341 | $ | 16.85 | – | $ | 56,250,315 | ||||||||

November | 229 | 50.71 | – | 56,250,315 | 404 | 13.11 | – | 56,250,315 | ||||||||||||

December | 143 | 48.22 | – | 56,250,315 | 8,944 | 13.12 | – | 56,250,315 | ||||||||||||

Fourth quarter | 862 | 59.42 | – | 9,689 | 13.25 | – | ||||||||||||||

All share repurchases |

The Company has not repurchased any shares under the Common Stock Repurchase Plan since August 16, 2007. It currently does not anticipate making additionalis prohibited from repurchasing any common shares through an authorized share repurchase program by terms of the CPP until the Company’s Series D preferred stock repurchases underhas been fully repaid or the plan during most or all of 2008.U.S. Treasury otherwise ceases to own any such preferred stock.

PERFORMANCE GRAPH

The following stock performance graph compares the five-year cumulative total return of Zions Bancorporation’s common stock with the Standard & Poor’s 500 Index and the KBW50KBW Bank Index which includesinclude Zions Bancorporation. The KBW50KBW Bank Index is a market-capitalization weightedmarket capitalization-weighted bank stock index developed and published by Keefe, Bruyette & Woods, Inc., a nationalnationally recognized brokerage and investment banking firm specializing in bank stocks. The index is composed of 50 of the nation’s largest banking companies.24 geographically diverse stocks representing national money center banks and leading regional financial institutions. The stock performance graph is based upon an initial investment of $100 on December 31, 20022004 and assumes reinvestment of dividends.

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||

Zions Bancorporation | 100.0 | 113.3 | 125.9 | 73.1 | 40.2 | 21.3 | ||||||

KBW Bank Index | 100.0 | 103.2 | 120.7 | 94.5 | 49.8 | 48.9 | ||||||

S&P 500 | 100.0 | 104.9 | 121.4 | 128.1 | 80.8 | 102.1 |

| ITEM 6. | SELECTED FINANCIAL DATA |

FINANCIAL HIGHLIGHTSFinancial Highlights

(In millions, except per share amounts)

| 2007/2006 CHANGE | 2007 | 2006 | 2005 (3) | 2004 | 2003 | 2009/2008 Change | 2009 | 2008 | 2007 | 2006 | 20053 | ||||||||||||||||||||

FOR THE YEAR | ||||||||||||||||||||||||||||||||

For the Year | ||||||||||||||||||||||||||||||||

Net interest income | +7% | $ | 1,882.0 | 1,764.7 | 1,361.4 | 1,160.8 | 1,084.9 | -4 | % | $ | 1,897.5 | 1,971.6 | 1,882.0 | 1,764.7 | 1,361.4 | |||||||||||||||||

Noninterest income | -25% | 412.3 | 551.2 | 436.9 | 431.5 | 500.7 | +322 | % | 804.1 | 190.7 | 412.3 | 551.2 | 436.9 | |||||||||||||||||||

Total revenue | -1% | 2,294.3 | 2,315.9 | 1,798.3 | 1,592.3 | 1,585.6 | +25 | % | 2,701.6 | 2,162.3 | 2,294.3 | 2,315.9 | 1,798.3 | |||||||||||||||||||

Provision for loan losses | +110% | 152.2 | 72.6 | 43.0 | 44.1 | 69.9 | +211 | % | 2,016.9 | 648.3 | 152.2 | 72.6 | 43.0 | |||||||||||||||||||

Noninterest expense | +6% | 1,404.6 | 1,330.4 | 1,012.8 | 923.2 | 893.9 | +13 | % | 1,671.5 | 1,475.0 | 1,404.6 | 1,330.4 | 1,012.8 | |||||||||||||||||||

Impairment loss on goodwill | – | – | – | 0.6 | 0.6 | 75.6 | +80 | % | 636.2 | 353.8 | – | – | 0.6 | |||||||||||||||||||

Income from continuing operations before income taxes and minority interest | -19% | 737.5 | 912.9 | 741.9 | 624.4 | 546.2 | ||||||||||||||||||||||||||

Income taxes | -26% | 235.8 | 318.0 | 263.4 | 220.1 | 213.8 | ||||||||||||||||||||||||||

Minority interest | -32% | 8.0 | 11.8 | (1.6) | (1.7) | (7.2) | ||||||||||||||||||||||||||

Income from continuing operations | -15% | 493.7 | 583.1 | 480.1 | 406.0 | 339.6 | ||||||||||||||||||||||||||

Loss on discontinued operations | – | – | – | – | – | (1.8) | ||||||||||||||||||||||||||

Net income | -15% | 493.7 | 583.1 | 480.1 | 406.0 | 337.8 | ||||||||||||||||||||||||||

Net earnings applicable to common shareholders | -17% | 479.4 | 579.3 | 480.1 | 406.0 | 337.8 | ||||||||||||||||||||||||||

Income (loss) before income taxes | -416 | % | (1,623.0 | ) | (314.8 | ) | 737.5 | 912.9 | 741.9 | |||||||||||||||||||||||

Income taxes (benefit) | -825 | % | (401.3 | ) | (43.4 | ) | 235.8 | 318.0 | 263.4 | |||||||||||||||||||||||

Net income (loss) | -350 | % | (1,221.7 | ) | (271.4 | ) | 501.7 | 594.9 | 478.5 | |||||||||||||||||||||||

Net income (loss) applicable to noncontrolling interests | -10 | % | (5.6 | ) | (5.1 | ) | 8.0 | 11.8 | (1.6 | ) | ||||||||||||||||||||||

Net income (loss) applicable to controlling interest | -357 | % | (1,216.1 | ) | (266.3 | ) | 493.7 | 583.1 | 480.1 | |||||||||||||||||||||||

Net earnings (loss) applicable to common shareholders | -325 | % | (1,234.4 | ) | (290.7 | ) | 479.4 | 579.3 | 480.1 | |||||||||||||||||||||||

PER COMMON SHARE | ||||||||||||||||||||||||||||||||

Earnings from continuing operations – diluted | -18% | 4.42 | 5.36 | 5.16 | 4.47 | 3.74 | ||||||||||||||||||||||||||

Net earnings – diluted | -18% | 4.42 | 5.36 | 5.16 | 4.47 | 3.72 | ||||||||||||||||||||||||||

Net earnings – basic | -18% | 4.47 | 5.46 | 5.27 | 4.53 | 3.75 | ||||||||||||||||||||||||||

Per Common Share | ||||||||||||||||||||||||||||||||

Net earnings (loss) – diluted | -270 | % | (9.92 | ) | (2.68 | ) | 4.40 | 5.35 | 5.16 | |||||||||||||||||||||||

Net earnings (loss) – basic | -270 | % | (9.92 | ) | (2.68 | ) | 4.45 | 5.45 | 5.26 | |||||||||||||||||||||||

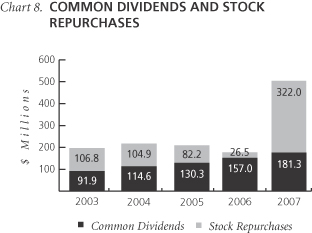

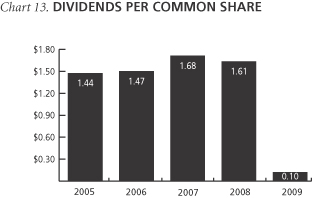

Dividends declared | +14% | 1.68 | 1.47 | 1.44 | 1.26 | 1.02 | -94 | % | 0.10 | 1.61 | 1.68 | 1.47 | 1.44 | |||||||||||||||||||

Book value (1) | +6% | 47.17 | 44.48 | 40.30 | 31.06 | 28.27 | ||||||||||||||||||||||||||

Book value1 | -35 | % | 27.85 | 42.65 | 47.17 | 44.48 | 40.30 | |||||||||||||||||||||||||

Market price – end | 46.69 | 82.44 | 75.56 | 68.03 | 61.34 | 12.83 | 24.51 | 46.69 | 82.44 | 75.56 | ||||||||||||||||||||||

Market price – high | 88.56 | 85.25 | 77.67 | 69.29 | 63.86 | |||||||||||||||||||||||||||

Market price – high2 | 25.52 | 57.05 | 88.56 | 85.25 | 77.67 | |||||||||||||||||||||||||||

Market price – low | 45.70 | 75.13 | 63.33 | 54.08 | 39.31 | 5.90 | 17.53 | 45.70 | 75.13 | 63.33 | ||||||||||||||||||||||

AT YEAR-END | ||||||||||||||||||||||||||||||||

At Year-End | ||||||||||||||||||||||||||||||||

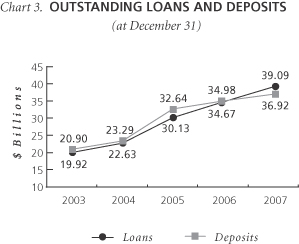

Assets | +13% | 52,947 | 46,970 | 42,780 | 31,470 | 28,558 | -7 | % | 51,123 | 55,093 | 52,947 | 46,970 | 42,780 | |||||||||||||||||||

Net loans and leases | +13% | 39,088 | 34,668 | 30,127 | 22,627 | 19,920 | -4 | % | 40,189 | 41,659 | 38,880 | 34,415 | 29,871 | |||||||||||||||||||

Sold loans being serviced (2) | -27% | 1,885 | 2,586 | 3,383 | 3,066 | 2,782 | ||||||||||||||||||||||||||

Deposits | +6% | 36,923 | 34,982 | 32,642 | 23,292 | 20,897 | +1 | % | 41,841 | 41,316 | 36,923 | 34,982 | 32,642 | |||||||||||||||||||

Long-term borrowings | +4% | 2,591 | 2,495 | 2,746 | 1,919 | 1,843 | -22 | % | 2,033 | 2,622 | 2,591 | 2,495 | 2,746 | |||||||||||||||||||

Shareholders’ equity | +6% | 5,293 | 4,987 | 4,237 | 2,790 | 2,540 | ||||||||||||||||||||||||||

Shareholders’ equity: | ||||||||||||||||||||||||||||||||

Preferred equity | -5 | % | 1,503 | 1,582 | 240 | 240 | – | |||||||||||||||||||||||||

Common equity | -15 | % | 4,190 | 4,920 | 5,053 | 4,747 | 4,237 | |||||||||||||||||||||||||

Noncontrolling interests | -37 | % | 17 | 27 | 31 | 43 | 28 | |||||||||||||||||||||||||

PERFORMANCE RATIOS | ||||||||||||||||||||||||||||||||

Performance Ratios | ||||||||||||||||||||||||||||||||

Return on average assets | 1.01% | 1.32% | 1.43% | 1.31% | 1.20% | (2.25 | )% | (0.50 | )% | 1.01 | % | 1.32 | % | 1.43 | % | |||||||||||||||||

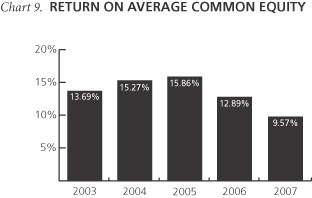

Return on average common equity | 9.57% | 12.89% | 15.86% | 15.27% | 13.69% | (28.35 | )% | (5.69 | )% | 9.57 | % | 12.89 | % | 15.86 | % | |||||||||||||||||

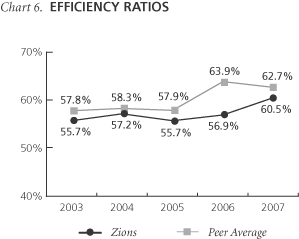

Efficiency ratio | 60.53% | 56.85% | 55.67% | 57.22% | 55.65% | 61.34 | % | 67.47 | % | 60.53 | % | 56.85 | % | 55.67 | % | |||||||||||||||||

Net interest margin | 4.43% | 4.63% | 4.58% | 4.27% | 4.41% | 3.94 | % | 4.18 | % | 4.43 | % | 4.63 | % | 4.58 | % | |||||||||||||||||

CAPITAL RATIOS(1) | ||||||||||||||||||||||||||||||||

Capital Ratios1 | ||||||||||||||||||||||||||||||||

Equity to assets | 10.00% | 10.62% | 9.90% | 8.87% | 8.89% | 11.17 | % | 11.85 | % | 10.06 | % | 10.71 | % | 9.97 | % | |||||||||||||||||

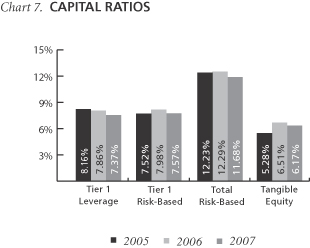

Tier 1 leverage | 7.37% | 7.86% | 8.16% | 8.31% | 8.06% | 10.38 | % | 9.99 | % | 7.37 | % | 7.86 | % | 8.16 | % | |||||||||||||||||

Tier 1 risk-based capital | 7.57% | 7.98% | 7.52% | 9.35% | 9.42% | 10.53 | % | 10.22 | % | 7.57 | % | 7.98 | % | 7.52 | % | |||||||||||||||||

Total risk-based capital | 11.68% | 12.29% | 12.23% | 14.05% | 13.52% | 13.28 | % | 14.32 | % | 11.68 | % | 12.29 | % | 12.23 | % | |||||||||||||||||

Tangible common equity | 6.12 | % | 5.89 | % | 5.70 | % | 5.98 | % | 5.28 | % | ||||||||||||||||||||||

Tangible equity | 6.17% | 6.51% | 5.28% | 6.80% | 6.53% | 9.16 | % | 8.91 | % | 6.23 | % | 6.61 | % | 5.35 | % | |||||||||||||||||

SELECTED INFORMATION | ||||||||||||||||||||||||||||||||

Selected Information | ||||||||||||||||||||||||||||||||

Average common and common-equivalent | 108,523 | 108,028 | 92,994 | 90,882 | 90,734 | 124,443 | 108,908 | 108,408 | 107,957 | 92,994 | ||||||||||||||||||||||

Common dividend payout ratio | 37.82% | 27.10% | 27.14% | 28.23% | 27.20% | na | na | 37.82 | % | 27.10 | % | 27.14 | % | |||||||||||||||||||

Full-time equivalent employees | 10,933 | 10,618 | 10,102 | 8,026 | 7,896 | 10,529 | 11,011 | 10,933 | 10,618 | 10,102 | ||||||||||||||||||||||

Commercial banking offices | 508 | 470 | 473 | 386 | 412 | 491 | 513 | 508 | 470 | 473 | ||||||||||||||||||||||

ATMs | 627 | 578 | 600 | 475 | 553 | 602 | 625 | 627 | 578 | 600 | ||||||||||||||||||||||

At year-end. |

The actual high price for 2008 was $107.21. However, this trading price was an anomaly resulting from electronic orders at the |

Amounts for 2005 include Amegy Corporation at December 31, 2005 and for the month of December 2005. Amegy was acquired on December 3, 2005. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

MANAGEMENT’S DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

Company Overview

Zions Bancorporation (“the Parent”) and subsidiaries (collectively “the Company,” “Zions,” “we,” “our,” “us”) together comprise a $53$51 billion financial holding company headquartered in Salt Lake City, Utah. TheAs of September 30, 2009, the Company iswas the twenty-third17th largest domestic bank holding company in terms of deposits, operatingdeposits. At December 31, 2009, the Company operated banking businesses through 508491 domestic branches and 627602 ATMs in ten Western and Southwestern states: Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, and Washington. Our banking businesses include: Zions First National Bank (“Zions Bank”), in Utah and Idaho; California Bank & Trust (“CB&T”); Amegy Corporation (“Amegy”) and its subsidiary, Amegy Bank, in Texas; National Bank of Arizona (“NBA”); Nevada State Bank (“NSB”); Vectra Bank Colorado (“Vectra”), in Colorado and New Mexico; The Commerce Bank of Washington (“TCBW”); and The Commerce Bank of Oregon (“TCBO”).

The Company also operates a number ofseveral specialty financial services and financial technology businesses that conduct business on a regional or national scale. The Company is a national leader in Small Business Administration (“SBA”) lending, public finance advisory services, and software sales and cash management services related to “Check 21 Act” electronic imaging and clearing of checks. In addition, Zions is included in the Standard and Poor’s 500 (“S&P 500500”) and NASDAQ Financial 100 indices.

In operating its banking businesses, the Company seeks to combine the front office or customer facing advantages that it believes can result from decentralized organization and branding, with those that can come from centralized risk management, capital management and operations. In its specialty financial services and technology businesses, the Company seeks to develop a competitive advantage in a particular product, customer, or technology niche.

Banking BusinessesDistribution of Loans and Deposits

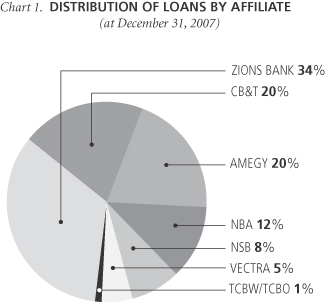

As shown in Charts 1 and 2 the Company’s loans and core deposits are widely diversified among the banking franchises the Company operates.

Note: Core deposits are defined as total deposits excluding

brokered deposits and time deposits $100,000 and over.

Business Strategies

We believe that the Company distinguishes itself by having a long-term strategy for growth in its banking businesses that is unique for a bank holding company of its size. This growth strategy is driven by four key factors: (1) focus on high growth markets; (2) keep decisions that affect customers local; (3) centralize technology and operations to achieve economies of scale; and (4) centralize and standardize policies and management controlling key risks.

These strategies are more fully set forth as follows:Focus on High Growth Markets

Each of the states in which the Company conducts its banking businesses has experienced relatively high levels of historical economic growth and each ranks among the top one-third of states as ranked by population and household income growth projected by the U.S. Census Bureau. Despite slowdowns in population,weaker employment and key indicators of economic growth in some of these markets in 2007,2009, which is expected tomay persist through much of 2008,2010, the Company believes that over the medium to longer term all of these markets will continue to be among the fastest growing in the country.

SCHEDULE

Schedule 1

DEMOGRAPHIC PROFILE

BY STATE

DEMOGRAPHIC PROFILE

BY STATE

(Dollar amounts in

| Number of branches 12/31/2007 | Deposits at 12/31/2007(1) | Percent of Zions’ deposit base | Estimated 2007 total population(2) | Estimated population % change 2000-2007(2) | Projected population % change 2007-2012(2) | Estimated median household income 2007(2) | Estimated household income % change 2000-2007(2) | Projected household income % change 2007-2012(2) | Number of branches 12/31/2009 | Deposits at 12/31/20091 | Percent of Zions’ deposit base | Estimated 2009 total population2 | Estimated population % change 2000-20092 | Projected population % change 2009-20142 | Estimated median household income 20092 | Estimated household income % change 2000-20092 | Projected household income % change 2009-20142 | |||||||||||||||||||||||||||

Utah | 114 | $ | 10,674,230 | 28.91% | 2,610,198 | 16.88% | 12.02% | $ | 58.4 | 27.70% | 18.39% | 103 | $ | 12,514,145 | 29.91 | % | 2,748,395 | 23.07 | % | 11.17 | % | $ | 60.3 | 31.88 | % | 4.29 | % | ||||||||||||||||||

California | 90 | 8,081,319 | 21.89 | 37,483,448 | 10.66 | 6.75 | 60.3 | 26.55 | 16.59 | 106 | 9,329,215 | 22.30 | 37,933,734 | 11.99 | 5.14 | 61.6 | 29.38 | 4.02 | |||||||||||||||||||||||||||

Texas | 87 | 8,057,997 | 21.82 | 23,986,432 | 15.03 | 9.89 | 51.1 | 27.96 | 18.02 | 82 | 8,880,228 | 21.22 | 24,896,267 | 19.40 | 9.25 | 52.4 | 31.19 | 4.03 | |||||||||||||||||||||||||||

Arizona | 76 | 3,851,422 | 10.43 | 6,363,799 | 24.04 | 16.96 | 53.3 | 31.34 | 21.43 | 76 | 3,784,170 | 9.04 | 6,664,707 | 29.90 | 12.84 | 55.3 | 36.21 | 5.46 | |||||||||||||||||||||||||||

Nevada | 74 | 3,279,288 | 8.88 | 2,645,277 | 32.38 | 19.90 | 56.3 | 26.21 | 17.07 | 58 | 3,523,708 | 8.42 | 2,746,331 | 37.44 | 14.61 | 58.1 | 30.29 | 4.63 | |||||||||||||||||||||||||||

Colorado | 40 | 1,697,382 | 4.60 | 4,883,413 | 13.53 | 8.53 | 61.0 | 29.01 | 19.49 | 37 | 1,964,909 | 4.70 | 5,026,916 | 16.87 | 7.75 | 62.6 | 32.44 | 5.14 | |||||||||||||||||||||||||||