UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 200731, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33164

Domtar Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 20-5901152 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

395 de Maisonneuve Blvd. West

Montreal, Quebec H3A 1L6 Canada

(Address of Principal Executive Offices)(Zip Code)

Registrant’s telephone number, including area code: (514) 848-5555

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨x No x¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”,filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨x Accelerated Filer ¨ Non-Accelerated Filer x¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of July 1, 2007,June 30, 2009, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $5,145,844,440.$689,235,723.

Number of shares of common stock outstanding as of March 17, 2008: 471,964,399February 24, 2010: 42,083,664

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement forfiled within 120 days of the close of the registrant’s fiscal year in connection with its 2010 Annual Meeting of Stockholders to be held on May 6, 2008 are incorporated by reference into Part III of this Annual Report on Form 10-K.

DOMTAR CORPORATION

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2009

TABLE OF CONTENTS

| PART I | ||||

ITEM 1 | 4 | |||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

ITEM 1A | 20 | |||

ITEM 1B | ||||

ITEM 2 | ||||

ITEM 3 | ||||

ITEM 4 | ||||

| PART II | ||||

ITEM 5 | ||||

ITEM 6 | ||||

ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |||

| 37 | ||||

Consolidated Results and | ||||

| 54 | ||||

| 57 | ||||

| 63 | ||||

ITEM 7A | ||||

ITEM 8 | ||||

| 79 | ||||

Report of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm | ||||

| ||||

ITEM 9 | CHANGES IN AND | |||

ITEM 9A | ||||

ITEM 9B | ||||

| PART III | ||||

ITEM 10 | ||||

ITEM 11 | ||||

ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |||

ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |||

ITEM 14 | ||||

ITEM 15 | ||||

Report of Independent Registered Public Accounting Firm on Financial Statement Schedule | ||||

PART I

| ITEM 1. | BUSINESS |

We are the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity. We are also a manufacturer of papergrade, fluff and specialty pulp. Through our subsidiaries, weWe design, manufacture, market and distribute a wide range of paper products for a variety of customers, including merchants, retail outlets, stationers, printers, publishers, converters and end-users. We own and operate Domtar Distribution Group, an extensive network of strategically located paper distribution facilities. We also produce lumber and other specialty and industrial wood products. We have three business segments: Papers, Paper Merchants and Wood. We had revenues of $5.9$5.5 billion in 2007,2009, of which approximately 82%81% was from the Papers segment, approximately 14%16% was from the Paper Merchants segment and approximately 4%3% was from the Wood segment.

Throughout this Annual Report on Form 10-K, unless otherwise specified, “Domtar Corporation,” “the Company,” “Domtar,” “we,” “us” and “our” refer to Domtar Corporation, its subsidiaries, as well as its investments. Unless otherwise specified, “Domtar Inc.” refers to Domtar Inc., a wholly-owned100% owned Canadian subsidiary. Information regarding our recent developments is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K, under the caption “Recent Developments.”

Domtar Corporation was incorporated on August 16, 2006, for the sole purpose of holding the Weyerhaeuser Fine Paper Business (the “Predecessor”) and consummating the combination of the Weyerhaeuser Fine Paper Business with Domtar Inc. (the “Transaction”). The Predecessor was owned by Weyerhaeuser Company (“Weyerhaeuser”) prior to the completion of the Transaction on March 7, 2007. Domtar Corporation had no operations prior to March 7, 2007 when, upon the completion of the Transaction, we became an independent public holding company. Information regarding the Transaction is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Conditions and Results of Operations of this Annual Report on Form 10-K, under the caption “The Transaction” and “Accounting for the Transaction.”

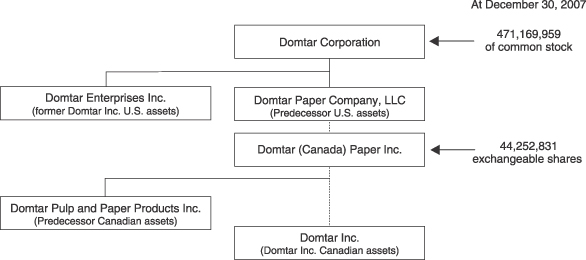

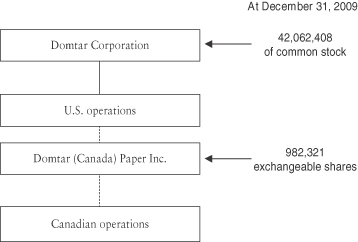

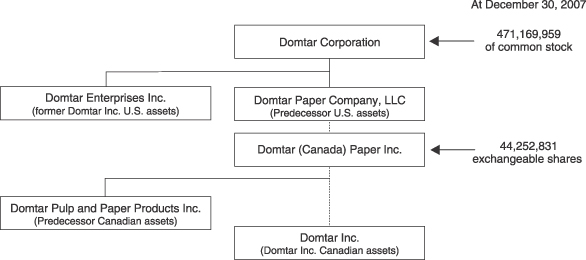

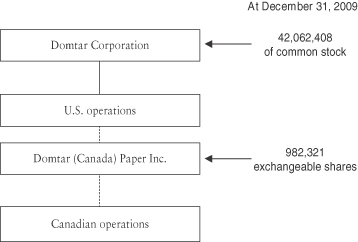

At December 30, 2007,31, 2009, Domtar Corporation had a total of 471,169,95942,062,408 shares of common stock issued and outstanding, and Domtar (Canada) Paper Inc., an indirectly 100% owned subsidiary, had a total of 44,252,831982,321 exchangeable shares issued and outstanding. These exchangeable shares are intended to be substantially the economic equivalent to shares of our common stock and are currently exchangeable at the option of the holder on a one-for-one basis for shares of our common stock. As such, the total combined number of shares of common stock and exchangeable shares issued and outstanding was 515,422,79043,044,729 at December 30, 2007.31, 2009. Our common shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol “UFS” and our exchangeable shares are traded on the Toronto Stock Exchange under the symbol “UFX.” Information regarding our common stock and the exchangeable shares is included in Part II, Item 8, Financial Statements and Supplementary Data of this Annual Report on Form 10-K, under Note 2022 “Shareholders’ Equity.”

4

The following chart summarizes our corporate structure.

We operate in the three reportable segments described below. Each reportable segment offers different products and services and requires different manufacturing processes, technology andand/or marketing strategies. The following summary briefly describes the operations included in each of our reportable segments:

Papers – represents the aggregation of the manufacturing and distribution of business, commercial printing and publication,publishing, and converting and specialty papers, as well as market pulp.

Paper Merchants – involves the purchasing, warehousing, sale and distribution of our paper products and those of other paper manufacturers. These products include business and printing papers and certain industrial products.

Wood – comprises the manufacturing and marketing of lumber and wood-based value-addedother specialty and industrial wood products and the management of forest resources.

5

| Fifty-two weeks ended | Fifty-three weeks ended | Fifty-two weeks ended | ||||||||||

FINANCIAL HIGHLIGHTS PER SEGMENT | December 30, 2007 | December 31, 2006 | December 25, 2005 | |||||||||

| (In millions of U.S. dollars, unless otherwise noted) | ||||||||||||

Sales: | ||||||||||||

Papers | $ | 5,116 | $ | 3,143 | $ | 3,074 | ||||||

Paper Merchants | 813 | — | — | |||||||||

Wood | 304 | 234 | 338 | |||||||||

Total for reportable segments | 6,233 | 3,377 | 3,412 | |||||||||

Intersegment sales—Papers | (235 | ) | — | (2 | ) | |||||||

Intersegment sales—Paper Merchants | (1 | ) | — | — | ||||||||

Intersegment sales—Wood | (50 | ) | (71 | ) | (143 | ) | ||||||

Consolidated sales | $ | 5,947 | $ | 3,306 | $ | 3,267 | ||||||

Operating income (loss): | ||||||||||||

Papers | $ | 321 | $ | (608 | ) | $ | (492 | ) | ||||

Paper Merchants | 13 | — | — | |||||||||

Wood | (63 | ) | 52 | (86 | ) | |||||||

Corporate | (1 | ) | — | — | ||||||||

Total | $ | 270 | $ | (556 | ) | $ | (578 | ) | ||||

Segmented assets: | ||||||||||||

Papers | $ | 6,888 | $ | 3,933 | ||||||||

Paper Merchants | 108 | — | ||||||||||

Wood | 320 | 65 | ||||||||||

Corporate | 432 | — | ||||||||||

Total | $ | 7,748 | $ | 3,998 | ||||||||

Information regarding our reportable segments is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations as well as Item 8, Financial Statements and Supplementary Data, under Note 24,25, of this Annual Report on Form 10-K. Geographic information is also included under Note 2425 of the Financial Statements.Statements and Supplementary Data.

5

FINANCIAL HIGHLIGHTS PER SEGMENT | Year ended December 31, 2009 | Year ended December 31, 2008 | Year ended December 30, 2007 (1) | |||||||||

| (In millions of dollars, unless otherwise noted) | ||||||||||||

Sales: | ||||||||||||

Papers | $ | 4,632 | $ | 5,440 | $ | 5,116 | ||||||

Paper Merchants | 873 | 990 | 813 | |||||||||

Wood | 211 | 268 | 304 | |||||||||

Total for reportable segments | 5,716 | 6,698 | 6,233 | |||||||||

Intersegment sales—Papers | (231 | ) | (276 | ) | (235 | ) | ||||||

Intersegment sales—Paper Merchants | — | — | (1 | ) | ||||||||

Intersegment sales—Wood | (20 | ) | (28 | ) | (50 | ) | ||||||

Consolidated sales | $ | 5,465 | $ | 6,394 | $ | 5,947 | ||||||

Operating income (loss): | ||||||||||||

Papers(2) | $ | 650 | $ | (369 | ) | $ | 321 | |||||

Paper Merchants | 7 | 8 | 13 | |||||||||

Wood(2) | (42 | ) | (73 | ) | (63 | ) | ||||||

Corporate | — | (3 | ) | (1 | ) | |||||||

Total | $ | 615 | $ | (437 | ) | $ | 270 | |||||

Segment assets: | ||||||||||||

Papers | $ | 5,538 | $ | 5,399 | ||||||||

Paper Merchants | 101 | 120 | ||||||||||

Wood | 250 | 247 | ||||||||||

Corporate | 630 | 338 | ||||||||||

Total | $ | 6,519 | $ | 6,104 | ||||||||

| (1) | The year 2007 consists of 52 weeks ended December 30, 2007 and includes the consolidated financial results of the Weyerhaeuser Fine Paper Business, on a carve-out basis, from January 1, 2007 to March 6, 2007 and of the Successor for the period from March 7, 2007 to December 30, 2007. Information regarding the Transaction is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Conditions and Results of Operations of this Annual Report on Form 10-K. |

| (2) | Factors that affected the year-over-year comparison of financial results are discussed in the year-over-year and segment analysis included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation of this Annual Report on Form 10-K. |

6

Our Operations

We are the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity. In uncoated freesheet, weWe have 1210 pulp and paper mills in operation (nine(eight in the United States and threetwo in Canada) with an annual paper production capacity of approximately 4.63.9 million tons of uncoated freesheet paper.paper, after giving effect to the conversion of our Plymouth facility to 100% fluff pulp production in 2010. In addition, we have an annual production capacity of 238,000 tons of coated groundwood at our Columbus paper mill. Approximately 81% of our paper production capacity is domestic and the remaining 19% is located in Canada. Our paper manufacturing operations are supported by 1715 converting and distribution operations, including a network of 1112 plants located offsite of our paper making operations. Also, we have forms manufacturing operations at twothree of the offsite converting and distribution operations and threetwo stand-alone forms manufacturing operations.

We alsoIn addition, we manufacture and sell pulp in excess of our internal requirements, and we purchase papergrade pulp from third parties allowing us to optimize the logistics of our pulp capacity while reducing transportation costs. We have the capacity to sell approximately 1.51.9 million metric tonnes of pulp per year depending on market conditions.conditions, after giving effect to the conversion of our Plymouth facility to 100% fluff pulp production in 2010. Approximately 45%51% of our trade pulp production capacity is domestic, and the remaining 55%49% is located in Canada. Our net pulp position, the amount of pulp produced and sold net of purchases from third

6

parties, was approximately 1.1 million metric tonnes of pulp in 2007. We produce market pulp at our twothree non-integrated pulp mills in Kamloops, Woodland and Woodland,Dryden, as well as at our pulp and paper mills in Dryden, Espanola, Ashdown, Hawesville, and Windsor. Also, weWe also produce fluff pulp at our Plymouth mill. We also have pulping operations in Prince Albert and Lebel-sur-Quévillon that are not in operation.

7

The table below lists our operating pulp and paper mills and their annual production capacity.

| Saleable | Saleable | |||||||||||||||||||

Production Facility | Fiberline Pulp Capacity | Paper Capacity | Trade Pulp (1) | Fiberline Pulp Capacity | Paper Capacity | Trade Pulp (1) | ||||||||||||||

| # lines | (‘000 ADMT) | # machines | (‘000 ST) | (‘000 ADMT) | # lines | (‘000 ADMT) | # machines | (‘000 ST) | (‘000 ADMT) | |||||||||||

Uncoated freesheet | Uncoated freesheet | |||||||||||||||||||

Ashdown, Arkansas | 3 | 810 | 4 | 933 | 86 | 3 | 810 | 4 | 933 | 86 | ||||||||||

Windsor, Quebec | 1 | 454 | 2 | 670 | 33 | 1 | 454 | 2 | 670 | 33 | ||||||||||

Hawesville, Kentucky | 1 | 455 | 2 | 634 | 47 | 1 | 455 | 2 | 634 | 47 | ||||||||||

Plymouth, North Carolina | 2 | 486 | 2 | 489 | 153 | |||||||||||||||

Kingsport, Tennessee | 1 | 272 | 1 | 425 | 1 | 272 | 1 | 425 | ||||||||||||

Marlboro, South Carolina | 1 | 356 | 1 | 391 | 1 | 356 | 1 | 391 | ||||||||||||

Johnsonburg, Pennsylvania | 1 | 231 | 2 | 374 | 1 | 231 | 2 | 374 | ||||||||||||

Dryden, Ontario | 1 | 319 | 1 | 151 | 197 | |||||||||||||||

Nekoosa, Wisconsin | 1 | 162 | 3 | 167 | 1 | 162 | 3 | 167 | ||||||||||||

Rothschild, Wisconsin | 1 | 60 | 1 | 147 | 1 | 60 | 1 | 147 | ||||||||||||

Port Huron, Michigan | — | — | 4 | 116 | — | — | 4 | 116 | ||||||||||||

Espanola, Ontario | 2 | 351 | 2 | 77 | 114 | 2 | 351 | 2 | 77 | 114 | ||||||||||

Total uncoated freesheet | 15 | 3,956 | 25 | 4,574 | 630 | |||||||||||||||

Total Uncoated freesheet | 12 | 3,151 | 22 | 3,934 | 280 | |||||||||||||||

Coated groundwood | ||||||||||||||||||||

Columbus, Mississippi | 1 | 70 | 1 | 238 | — | 1 | 70 | 1 | 238 | — | ||||||||||

Total coated grandwood | 1 | 70 | 1 | 238 | — | |||||||||||||||

Total Coated groundwood | 1 | 70 | 1 | 238 | — | |||||||||||||||

Pulp | ||||||||||||||||||||

Kamloops, British Columbia | 2 | 477 | — | — | 477 | 2 | 477 | — | — | 477 | ||||||||||

Woodland, Maine | 1 | 398 | — | — | 398 | 1 | 398 | — | — | 398 | ||||||||||

Dryden, Ontario | 1 | 319 | — | — | 319 | |||||||||||||||

Plymouth, North Carolina | 2 | 444 | — | — | 444 | |||||||||||||||

Total pulp | 3 | 875 | — | — | 875 | |||||||||||||||

Total Pulp | 6 | 1,638 | — | — | 1,638 | |||||||||||||||

Total | 19 | 4,901 | 26 | 4,812 | 1,505 | 19 | 4,859 | 23 | 4,172 | 1,918 | ||||||||||

Pulp purchases | 288 | 171 | ||||||||||||||||||

Net pulp | 1,217 | 1,747 | ||||||||||||||||||

| (1) | Estimated third-party shipments dependent upon market conditions. |

8

Our Raw Materials

The manufacturing of pulp and paper requires wood fiber, chemicals and energy. We outlinediscuss below details of these three major raw materials used in our manufacturing operations.

Wood Fiber

United States pulp and paper mills

The fiber used by our pulp and paper mills in the United States is primarily hardwood and secondarily softwood, both arebeing readily available in the market from multiple third-party sources. The mills obtain fiber from a variety of sources, depending on their location. These sources include a combination of long-term supply contracts, wood lot management arrangements, advance stumpage purchases and spot market purchases.

7

Canadian pulp and paper mills

The fiber used at our Windsor pulp and paper mill is hardwood originating from a variety of sources, including purchases on the open market in Canada and the United States, contracts with Quebec wood producers’ marketing boards, public land where we have wood fiber harvesting rights and Domtar’s private lands. Our Espanola pulp and paper mill and Dryden pulp and paper mills,mill, which consume both hardwood and softwood, obtain fiber from third parties, or directly or indirectly from public lands, either through designated wood harvesting rights for the pulp mills or from our Ontario sawmills. The fiber used at our Kamloops pulp mill is all softwood, originating mostly from third-party sawmilling operations in the southern part of the British Columbia interior.

Cutting rights on public lands related to our pulp and paper mills in Canada represent about 0.80.7 million cubic meters of softwood and 1.31.2 million cubic meters of hardwood, for a total of 2.11.9 million cubic meters of wood per year. Access to harvesting of fiber on public lands in Ontario and Quebec is subject to licenses and review by the respective governmental authorities.

During 2007,2009, the cost of wood fiber relating to our Papers businesssegment comprised approximately 19%24% of the aggregate amount of coststotal cost of sales.

Chemicals

We use various chemical compounds in our pulp and paper manufacturing facilities that are purchasedwe purchase, primarily on a central basis, through contracts varying in general between one toand twelve years in length to ensure product availability. Most of the contracts have pricing that fluctuates based on prevailing market conditions. For pulp manufacturing, we use numerous chemicals including caustic soda, sodium chlorate, sulfuric acid, lime peroxide and liquid oxygen.peroxide. For paper manufacturing, we also use several chemical products including starch, precipitated calcium carbonate, optical brighteners, dyes and aluminum sulfate.

During 2007,2009, the cost of chemicals relating to our Papers segment comprised approximately 12% of the aggregate amount of coststotal cost of sales.

Energy

Our operations consume substantial amounts of fossil fuel including natural gas, fuel oil, coal and hog fuel as well as electricity. We purchase substantial portions of the fuel we consume under supply contracts. Under most of these contracts, suppliers are committed to provide quantities within pre-determined ranges that provide us with our needs for a particular type of fuel at a specific facility. Most of thethese contracts have pricing that fluctuates based on prevailing market conditions. Natural gas, fuel oil, coal and hog fuel are consumed primarily to produce steam that is used in the manufacturing process and, to a lesser extent, to provide direct heat to be used in the chemical recovery process. We provide about 68%About 78% of the total energy required to manufacture our products comes from renewable fuels such as bark and spent cooking liquor. The remainder of the energy required to produce steam internally through our recovery boilers and cogeneration assets with the remaining fuelcomes from purchased in the form of bark,fossil fuels such as natural gas, oil and coal.

We own power generating assets, including steam turbines, at thirteen locations: Ashdown, Dryden, Espanola, Hawesville, Johnsonburg, Kamloops, Kingsport, Nekoosa, Plymouth, Port Huron, Rothschild, Windsor

9

and Woodland, as well as hydro assets at five locations: Espanola, Gatineau, Nekoosa, Woodland and Rothschild. Electricity is primarily used to drive motors and other equipment, as well as provide lighting. Approximately 69%66% of our electric power requirements are produced internally. We purchase the balance of our power requirements from local utilities.

During 2007,2009, energy costs relating to our Papers businesssegment comprised approximately 8%7% of the aggregate amount of coststotal cost of sales.

Our Product Offering and Go-to-Market Strategy

Our uncoated freesheet papers and coated groundwood papers are used for business, commercial printing and publication,publishing, and converting and specialty applications.

8

Business papers include copy and electronic imaging papers, which are used with ink jet and laser printers, photocopiers and plain-paper fax machines, as well as computer papers, preprinted forms and digital papers. These products are primarily for office and home use. Business papers accounted for approximately 43%47% of our shipments of paper products in 2007.2009.

Our commercial printing and publicationpublishing papers include uncoated freesheet papers, such as offset papers and opaques and coated groundwood. These uncoated freesheet grades are used in sheet and roll fed offset presses across the spectrum of commercial printing end-uses, including digital printing. Our publicationpublishing papers include tradebook and lightweight uncoated papers used primarily in book publishing applications such as textbooks, dictionaries, catalogs, magazines, hard cover novels and financial documents. Design papers, a sub-group of commercial printing and publicationpublishing papers, have distinct features of color, brightness and texture and are targeted towards graphic artists, design and advertising agencies, primarily for special brochures and annual reports. Coated groundwood papers are used primarily in magazines, catalogs and inserts. Commercial printing and publicationpublishing papers accounted for approximately 35%29% of our shipments of paper products in 2007.2009.

We also produce paper for several converting and specialty markets. These converting and specialty papers consist primarily of base papers that are converted into finished products, such as envelopes, tablets, business forms and data processing/computer forms and base stock used by the flexible packaging industry in the production of food and medical packaging and other specialty papers for various other industrial applications, including base stock for sandpaper, base stock for medical gowns, drapes and packaging, as well as transfer paper for printing processes. We also participate in several converting grades for specialty and security applications. These converting and specialty papers accounted for approximately 22%24% of our shipments of paper products in 2007.2009.

The chart below illustrates our main paper products and their applications.

Category | Business Papers | Commercial Printing and | Converting and

| |||||||||

Type | Uncoated Freesheet | Coated | Uncoated Freesheet | |||||||||

Grade | Copy | Premium imaging / technology papers | Offset Colors Index Tag Bristol | Opaques Premium opaques

Lightweight Tradebook |

| Business converting Flexible packaging Abrasive papers Decorative papers Imaging papers Label papers Medical disposables | ||||||

Application | Photocopies Office documents Presentations | Commercial

Direct mail Pamphlets Brochures |

Brochures Annual reports Books Catalogs | Catalogs Magazines Direct mail Cards Posters Packaging | Forms & envelopes Food & candy packaging Surgical gowns Repositionable note pads Check and Security | |||||||

10

Our customer service personnel work closely with sales, marketing and production staff to provide service and support to merchants, converters, end-users, stationers, printers and retailers. We promote our products directly to end-users and others who influence paper purchasing decisions in order to enhance brand recognition and increase product demand. In addition, our sales representatives work closely with mill-based new product development personnel and undertake joint marketing initiatives with customers in order to better understand their businesses and needs and to support their future requirements.

We sell business papers primarily to paper merchants, office equipment manufacturers, stationers and retail outlets. We distribute uncoated commercial printing and publicationpublishing papers to end-users and commercial printers, mainly through paper merchants, as well as selling directly to converters. We sell our converting and specialty

9

products mainly to converters, who apply a further production process such as coating, laminating, folding or waxing to our papers before selling them to a variety of specialized end-users. We distributed approximately 49%41% of our paper products in 20072009 through a large network of paper merchants operating throughout North America, one of which we own (see “—Paper Merchants”). Paper merchants, who sell our products to their own customers, represent our largest group of customers. Our ten largest paper customers represented approximately 55%

The chart below illustrates our channels of our 2007 Paper business sales or 46% of our total sales in 2007. The sales to our largest customer, Office Depot, amounted to 10% of our total sales in 2007. The majority of our customers purchase products through individual purchase orders. In 2007, approximately 84% ofdistribution for our paper sales were domestic, 9% were in Canada, and 7% were in other countries.products.

Category | Business Papers | Commercial Printing and Publishing Papers | Converting and Specialty Papers | |||||||||||

Domtar sells to: | Merchants i | Office Equipment Manufacturers / Stationers i | Retailers i | Merchants i | Converters i | End-Users | Converters i | |||||||

Customer sells to: | Printers / Retailers / End-users | Retailers / Stationers / End-users | Printers / End-users | Printers / Converters / End-users | Merchants / Retailers | End-users | ||||||||

We sell market pulp to customers in North America mainly through a North American sales force while sales to most overseas customers are made directly or through commission agents. We maintain pulp supplies at strategically located warehouses, which allow us to respond to orders on short notice. In 2007,2009, approximately 33%26% of our sales of market pulp were domestic, 4%11% were in Canada 4%and 63% were in Mexicoother countries.

Our ten largest customers represented approximately 52% of our 2009 Papers segment sales or 44% of our total sales in 2009. In 2009, none of our customers represented more than 10% of our total sales. The majority of our customers purchase products through individual purchase orders. In 2009, approximately 79% of our Papers segment sales were domestic, 9% were in Canada, and 59%12% were overseas.in other countries.

Transportation

Transportation of raw materials, wood fiber, chemicals and pulp to our mills is mostly done by rail although trucks are used in certain circumstances. We rely strictly on third parties for the transportation of our pulp and paper products between our mills, converting operations, distribution centers and customers. Our paper products are shipped mostly by truck, and logistics are managed centrally in collaboration with each location. Our pulp is either shipped by vessel, rail or truck. We work with all major railroads and truck companies in the U.S. and Canada. The chart below illustrateslength of our channelscarrier contracts are generally from one to three years. We pay diesel fuel surcharges which vary depending on market conditions, but are mostly tied to the cost of distribution fordiesel fuel.

During 2009, outbound transportation costs relating to our paper products.Papers segment comprised approximately 9% of the total cost of sales.

|

|

|

| |||||||||||

|

|

|

|

|

| |||||||||

|

|

|

|

|

| |||||||||

11

Our Operations

Our Paper Merchants business involves the purchasing, warehousing, sale and distribution of our products and those of other manufacturers. Products include business, printing and publishing papers and certain industrial products. These products are sold to a wide and diverse customer base, which includes small, medium and large commercial printers, publishers, quick copy firms, catalog and retail companies and institutional entities.

Our paper merchantsPaper Merchants operate in the United States and Canada under a single banner and umbrella name, the Domtar Distribution Group. Ris Paper, part of the Domtar Distribution Group, operates throughout the Northeast, Mid-Atlantic and Midwest areas from 20 locations in the United States, including 16 distribution centers serving customers in over 18 states.across North America. The Canadian business operates as Buntin Reid in three locations in Ontario; JBR/La Maison du Papier in two locations in Quebec; and The Paper House from two locations in Atlantic Canada.

Sales are executed by our sales force, based at branches strategically located in served markets. We distribute about 53%50% of our paper sales from our own warehouse distribution system and about 47%50% of our paper sales through mill-direct deliveries (i.e., deliveries directly from manufacturers, including ourselves, to our customers).

10

The table below lists all of our Domtar Distribution Group locations.

RIS Paper | Buntin Reid | JBR / La Maison du

| The Paper House | |||||

Eastern Region | MidWest Region | Ontario, Canada | Quebec, Canada | Atlantic Canada | ||||

Albany, New York | London, Ontario | Montreal, Quebec | ||||||

Boston, Massachusetts | Cincinnati, Ohio | Ottawa, Ontario | Quebec City, Quebec | |||||

| Cincinnati, Ohio (I.T.) Cleveland, Ohio | Toronto, Ontario | ||||||

| Columbus, Ohio | |||||||

| Covington, Kentucky | |||||||

| Dayton, Ohio | |||||||

| Uniontown, Ohio | |||||||

Southport, Connecticut | Dallas/Forth Worth, Texas | |||||||

| Fort Wayne, Indiana

| |||||||

|

| |||||||

| Indianapolis, Indiana | |||||||

Our Raw Materials

The distribution business sells annually over 0.8approximately 0.7 million tons of paper, forms and industrial/packaging products from over 60 suppliers located around the world. Domtar products represent approximately 39%33% of the total.

Our Product Offering and Go-to-Market Strategy

Our product offerings addressesaddress a broad range of printing, publishing, imaging, advertising, consumer and industrial needs and are comprised of uncoated, coated and specialized papers and industrial products. Our go-to-market strategy is to serve numerous segments of the commercial printing, publishing, retail, wholesale, catalog and industrial markets with logistics and services tailored to the needs of our customers. In 2007,2009, approximately 69%68% of our sales were made in the United States and 31%32% were made in Canada.

12

Our Operations

Our Wood business comprises the manufacturing, marketing and distribution of lumber and wood-based value-added products, and the management of forest resources. We operate fiveseven sawmills with a production capacity of approximately 660890 million board feet of lumber and one remanufacturing facility. In addition, we own six sawmills that are currently not in operation but have an aggregate production capacity of approximately 796 million board feet of lumber. We also have investments in five companies, one of which is not in operation.two companies. We seek to optimize the 2831 million acres of forestland we directly license or own in Canada and the United States and Canada through efficient management and the application of certified sustainable forest management practices to help ensure that a continuous supply of wood is available for future needs. Additional information regarding our Wood business is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual report on Form 10-K, under the caption “Recent Developments.”

11

The table below lists all of our sawmills and their annual production capacity.

Production facilities | Province | Annual Wood Capacity (MFBM) | ||

Operating sawmills: | ||||

Ear Falls | Ontario | 190 | ||

Val d’Or | Quebec | 160 | ||

Timmins | Ontario | 140 | ||

Nairn Centre | Ontario | 130 | ||

Matagami | Quebec | 100 | ||

Gogama | Ontario | 100 | ||

Ste-Marie | Quebec | 70 | ||

Total capacity of operating sawmills | ||||

Remanufacturing | ||||

Sullivan | Quebec | 75 | ||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

The following table lists our investments.

Investments | Province | Ownership | |||

Elk Lake | Ontario | 66 | % | ||

| |||||

| |||||

Anthony Domtar | Ontario | 50 | % | ||

|

Our Raw Materials

Wood Fiber

Fiber costs, net of revenues from wood chip sales, representsrepresent approximately 50%38% of our total manufacturing costs in the wood businessour Wood segment, or approximately 1% of the aggregate amount oftotal cost of sales. In Quebec, our annual allowable softwood harvesting amounts to approximately 1.71.0 million cubic meters and is granted by the Ministry of Natural Resources (Quebec). We obtain most of the wood fiber required for our northern Quebec sawmilling operations either directly or indirectly from these harvesting rights. Additional information regarding wood fiber availability in Quebec is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K, under the caption “Fiber Supply.”

In Ontario, our annual allowable softwood harvesting on public lands amounts to approximately 2.8 million cubic meters pursuant to Sustainable Forest Licenses that have been granted by the Ontario Ministry of Natural Resources. We obtain most of the wood fiber required for our northern Ontario sawmilling operations either directly or indirectly from these harvesting rights. The remaining required fiber is either harvested from our private lands, or purchased under various contractual arrangements and on the open market.

1213

All wood fiber received by Domtar mills must conform to Domtar’s Fiber Use and Sourcing Policy, which forbids the inclusion of fiber that is illegally harvested, derived from improperly managed High Conservation Value Forests, harvested without respect for aboriginal communities, or is genetically engineered. Further, 67%58% of Domtar’s Ontario and Quebec timber supply area is currently third-party certified, with 53% of the total supply area certified to the Forestry Stewardship Council (“FSC”) standards. Domtar’s goal is to reach 100% certification of all lands under its control by the FSC and to have all of its wood suppliers conform to the FSC Controlled Wood Standard.

Energy

Our wood operations require the use of two types of energy: electric energy is used to operate our manufacturing machinery and fossil fuel is used for the drying of wood. The type of fossil fuel used to dry the wood varies among our sawmills and depends on the technology available. Some of our assets operate with energy produced with biomass through residual products such as bark, sawdust and shavings. The use of our own productsbiomass in the production of energy results in lower energy costs. In other sawmills, we use fuel oil and natural gas and propane.gas.

Our Product Offering and Go-to-Market Strategy

We produce primarily dimensional lumber used in the construction industry and our offerings include a variety of grades of kiln-dried softwood lumber, produced mainly from black spruce and jack pine which are known for their strength, stability, light weight and good workability. Most of our production capacity is used to produce studs and random length lumber in dimensions of 2 inches by 3 inches through 2 inches by 10 inches in lengths of 86 feet to 16 feet. We also manufacture quality #1 and #2 wood, utility quality #3 wood, economic wood as well as “rough” wood that we sell green and dried. We also manufacture a wide variety of value-added products including MSR 2100, MSR 1650, Premium, Select and Mid-line. Our remanufacturing facility produces specialty products mainly for the bed frame industry and home centers and can produce a large variety of products in most dimensions, in lengths of 4 inches to 16 feet.

We sell substantially all of our softwood lumber through our sales office in Montreal to a wide range of retailers, distributors, manufacturers and wholesalers in the United States and Canada who sell to end-users. These wood products are consumed in the home construction, renovation and industrial markets. Our marketing efforts for lumber products are focused on providing our customers with efficient value-added supply chain integration, in order to achieve a high level of customer satisfaction and a balanced and diversified customer base for our products. In 2007,2009, approximately 70%47% of our lumber sales were made in the United States and 30%53% were made in Canada.

Our ten biggest clientscustomers represented approximately 48%45% of our Wood segment sales in 2007.2009. None of these clientscustomers represented 10% or more of our total sales in 2007.2009.

We believe that our competitive strengths provide a solid foundation for the execution of our business strategy:

Leading market position. We are the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity. This leading market position provides us with key competitive advantages, including economies of scale, wider sales and marketing coverage and a broad product offering such asof business, printing and publishing and converting and specialty paper grades.

Efficient and cost-competitive assets. Our papers business is comprisedwide network of a mix ofworld-class assets which allowallows us to be a low-cost producer of high volume papers and an efficient producer of value-added specialty papers. Our sixfive largest mills focus on the production of high volume copy and offset papers while the others focusproduction at our other mills focuses on the production of

14

value-added paper products where quality, flexibility and service are key determinants.factors. Most of our paper production is produced at mills with integrated pulp production and cogeneration facilities, reducing their exposure to price volatility for purchased pulp and energy.

13

Proximity to customers. We have a broad distribution and manufacturing footprint completedsupported by a network of converting and distribution operations located across North America. This proximity to customers provides opportunities for direct and enhanced customer service and the minimization ofminimizes freight distance,distances, response time and delivery cost, whichcost. These constitute key competitive advantages, particularly in the high volume copy and offset paper grades market segment. Customer proximity also allows for just-in-time delivery of high demand paper products in less than 48 hours to most major North American cities.markets.

Strong franchise with attractive service solutions. We sell paper to multiple market segments through a variety of channels, including paper merchants, converters, retail companies and publishers throughout North America. In addition, we maintain a strong market presence through our ownership of the Domtar Distribution Group. We will continue to build on those positions by maximizing our strengths with centralized planning capability and supply-chain management solutions.

High quality products with strong brand recognition. We enjoy a strong reputation for producing high quality paper products and market some of the most recognized and preferred papers in North America, including a wide range of business and commercial printing paper brands, such as Cougar®, Lynx® Opaque, Husky® Offset, First Choice®, and Domtar EarthChoice® Office Paper, part of a family of environmentally and socially responsible paper.

Experienced management team with proven integration expertise. Our management team has significant experience and a record of success in the North Americanpulp and paper industry, including with respect to business integration issues. To support the management team, weindustry. We believe our employees’ expertise and know-how not only support the management team but help create operational efficiencies and enable us to deliver improved profitability from our manufacturing operations.

OUR STRATEGIC INITIATIVES AND FINANCIAL PRIORITIES

Our goal isWe strive to be recognized as the supplier of choice of branded and private branded paper products for consumer channels, stationers, merchants, printers and converters in North America. WeTo achieve this goal and to generate cash flow and create shareholder value, we have implementedestablished the following business strategies in order to enhance cash flow and generate shareholder value:strategies:

build customer loyalty and balance supply with demand;

successfully integrate the combined businesses and optimize the operating platform;

increase depth of product offerings including our offering of environmentally and ethically responsible line of papers;

deliver on synergies;

focus on free cash flow generation and maintain financial discipline; and

conduct operations in a sustainable way.

Build customer loyalty and balance supply andour production with our customer demand. We are building on the successful relationships that the Predecessor and Domtar Inc.we have developed with key customers to support their businesses and to provide inventory reduction solutions through just-in-time delivery for the most-demanded products. We believe that we are a supplier of choice for customers who seek competitively-priced paper products and services.

Successfully integrate the combined businesses and optimize the operating platform. We believe that the combination of the Predecessor and Domtar Inc. represents a strategic fit because of the similarity of both their fine paper offerings in uncoated freesheet grades and their geographic presence. Our integration efforts have been focused on providing a single faceContinue to grow our customers, utilizing our greater sales and marketing coverage to enhance customer service, and achieving synergies. The combination provides an opportunity to combine the operational strengths and best practices of two of the industry’s leading manufacturers. We are implementing plans to improve our operating efficiency and cost structure and to achieve synergies within two years through a combination of process optimization resulting in lower operating costs, reductions in transportation, logistics and

14

purchasing costs, implementation of best-in-class business practices and reductions in sales and administrative costs. We are also optimizing our distribution network, reviewing our organizational structure and consolidating our regional centers and back-office functions where appropriate.

Increase depth of product offering including our offeringline of environmentally and ethically responsible line of papers. We believe that we are delivering improved service to customers through increased deptha broad range of product offerings and greater access to volume. We believe the development of EarthChoice®, our line of environmentally and socially responsible paper, is providing a platform upon which to expand our offerings to customers. The EarthChoice® line of papers, a product line endorsed and supported by leading environmental groups, offers customers solutions and peace of mind through the use of a combination of Forest Stewardship Council (FSC) virgin fiber and recycled fiber. FSC is the certification recognized by environmental groups as the most stringent and is third-party audited.

DeliverFocus on synergies.We have targeted $200 million of synergies from the Transaction to be achieved by the end of March 2009. There are more than 650 synergy projects covering best-in-class practices, selling, general and administration, transportation and logistics, process optimization, procurement and maintenance. Given the success to date, we are optimistic that we will exceed our synergy goal of $200 million run rate by the end of fiscal year 2008.

Focus ongenerating free cash flow generation and maintainmaintaining financial discipline.We believe that value creation is achieved by operating ourefficiently operated assets efficiently and reducingcarefully managed manufacturing costs while managingare key to creating shareholder value. To generate free cash flow, we are focused on assigning our capital expenditures effectively and minimizing working capital requirements to generate free cash flow.by reducing discretionary spending, reviewing procurement costs and pursuing the balancing of production and inventory control.

15

Conduct operationsOperate in a sustainable way. Customers and end-users as well as all stakeholders in communities where we operate seek assurances from the pulp and paper industry that resources are managed in a sustainable manner. We strive to provide these assurances by certifying our forest, manufacturing and distribution operations and we intend to subscribe to internationally recognized environmental management systems, namely ISO 14001.

The markets in which our businesses operate are highly competitive with well-established domestic and foreign manufacturers.

In the Paperspaper business, our paper production does not rely on proprietary processes or formulas, except in highly specialized papers or customized products. In order to gain market share in uncoated freesheet, we compete primarily on the basis of product quality, breadth of offering, service solutions and competitively priced paper products. We seek product differentiation through an extensive offering of high quality FSC-certified paper products. While we have a leading position in the North American uncoated freesheet market, we also compete with other paper grades, including coated freesheet and uncoated groundwood, and with electronic transmission and document storage alternatives. As the use of these alternative products continues to grow, we maycontinue to see a decrease in the overall demand for paper products or shifts from one type of paper to another. All of our pulp and paper manufacturing facilities are located in the United States or in Canada where we sell 93%88% of our papers.products. The five largest manufacturers of uncoated freesheet papers in North America ownrepresent approximately 80% of the total production capacity. On a global basis, there are hundreds of manufacturers that produce and sell uncoated freesheet papers, ten of which have an annual production capacity of over 1 million tons. The level of competitive pressures from foreign producers in the North American market is highly dependent upon exchange rates, including the rate between the U.S. dollar and the Euro.Euro as well as the U.S. dollar and the Brazilian real.

The market pulp we sell is either hardwood or softwood and, to a lesser extent, fluff pulp. The pulp market is highly fragmented with many manufacturers competing worldwide, some of whom have lower operating costs than we do. Competition is primarily on the basis of access to low-cost wood fiber, product quality and prices.

15

The pulp we sell is primarily slow growth northern bleached hardwood and softwood kraft, and we produce speciallyspecialty engineered pulp grades with a pre-determined mix of wood species that go into the makingspecies. Our pulps are sold to a combination of all kinds“paper grade” customers who make printing and writing grades, and “non-paper grade” customers who make a variety of papers, from business toproducts for specialty papers.paper, packaging, tissue and industrial applications. We also seek product differentiation through the certification of our pulp mills to the FSC chain-of-custody standard and the procurement of FSC-certified virgin fiber. All of our market pulp production capacity is located in the United States or in Canada, and we sell 59%63% of our pulp overseas.to other countries.

In Wood, we sell primarily kiln-dried softwood lumber and other value added products. We are the 10th largest producer of lumber in North America with a production capacity of 1.5 MFBM and ourOur competitors include other major lumber producers, most of which are located in Eastern Canada. Competition is primarily on the basis of access to low-cost fiber, service and prices. All of our lumber production capacity is located in Canada, and we sell 70%47% of our lumberwood products to the United States, resulting in anStates. As a result, we have exposure to currency fluctuations and are potentially subject to softwood lumber export taxes.taxes and duties.

We have approximately 13,000over 10,000 employees, of which approximately 56%62% are employed in the United States and 44%38% in Canada. Approximately 69%60% of our employees are covered by collective bargaining agreements, generally on a facility-by-facility basis, which will expire between 2010 and 2015.

In 2008, we signed a four year umbrella agreement with the United Steelworkers Union, affecting approximately 4,000 employees at our U.S. locations. This agreement only covers certain economic elements, and all other contract issues will be negotiated at each operating location, as the related collective bargaining

16

agreements become subject to renewal. The parties have agreed not to strike or lock-out during the terms of the respective local agreements.

OUR APPROACH TO SUSTAINABILITY

We adopted our Statement on Sustainable Growth to govern our pathway to sustainability, from excellence in corporate and ethical standards to product stewardship. Derived fromConsistently with our Statement, we define our actions under our Code of Ethics, policies addressing health and safety, environment, forestry fiber procurement and others.

Our business is subject to a wide range of general and industry-specific laws and regulations in the United States and Canada relating to the protection of the environment, including those governing harvesting, air emissions, wastewatergreenhouse gases and climate change, waste water discharges, the storage, management and disposal of hazardous substances and wastes, contaminated sites, landfill operation and closure obligations and health and safety matters. Compliance with these laws and regulations is a significant factor in the operation of our business. We may encounter situations in which our operations fail to maintain full compliance with applicable environmental requirements, possibly leading to civil or criminal fines, penalties or enforcement actions, including those that could result in governmental or judicial orders that stop or interrupt our operations or require us to take corrective measures at substantial costs, such as the installation of additional pollution control equipment or other remedial actions.

Compliance with U.S. federal, state and local and Canadian federal and provincial environmental laws and regulations involves capital expenditures as well as additional operating costs. For example, the United States Environmental Protection Agency has promulgated regulations dealing with air emissions from pulp and paper mills, including regulations on hazardous air pollutants that require use of maximum achievable control technology and controls for pollutants that contribute to smog and haze. Additional information regarding Environmental Mattersenvironmental matters is included in Item 3, Legal Proceedings, under the caption “Climate change regulation” and in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K, under the section of Critical accounting policies, caption “Environmental Mattersmatters and Other Asset Retirement Obligations.other asset retirement obligations.”

Many of our brand name paper products are protected by registered trademarks. Our key trademarks include Cougar®, Lynx® Opaque, Husky® Offset, First Choice® and Domtar EarthChoice®. These brand names and trademarks are important to the business. Our numerous trademarks have been registered in the United States and/or in other countries where our products are sold. The current registrations of these trademarks are effective for various periods of time. These trademarks may be renewed periodically, provided that we, as the registered owner, and/or licenseeslicensee comply with all applicable renewal requirements, including the continued use of the trademarks in connection with similar goods.

16

We own U.S. and foreign patents, some of which have expired or been abandoned, and have several pending patent applications. Our management regards these patents and patent applications as important but does not consider any single patent or group of patents to be materially important to our business as a whole.

In connection with the Transaction, we entered into a contribution and distribution agreement with Weyerhaeuser and Domtar Paper Company, LLC, dated as of January 25, 2007 (as amended from time to time, the “Contribution and Distribution Agreement”). Under the terms of the Contribution and Distribution Agreement and the intellectual property license agreement, we received a fully paid-up, royalty free, non-exclusive license to use certain intellectual property and technology that is retained by Weyerhaeuser.

INTERNET AVAILABILITY OF INFORMATION

In this Annual Report on Form 10-K, we incorporate by reference certain information contained in other documents filed with the Securities and Exchange Commission (“SEC”) and we refer you to such information. We file annual, quarterly and current reports and other information with the SEC. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100F Street, NE, Washington DC, 20549.

17

You may obtain information on the operation of the Public Reference Room by calling 1-800-SEC-0330. The SEC maintains a website at www.sec.gov that contains our quarterly and current reports, proxy and information statements, and other information we file electronically with the SEC. You may also access, free of charge, our reportreports filed with the SEC through our website. Reports filed or furnished to the SEC will be available through our website as soon as reasonably practicable after they are filed or furnished to the SEC. The information contained on our website, www.domtar.com, is not, and should in no way be construed as, a part of this or any other report that we filed with or furnished to the SEC.

Raymond RoyerJohn D. Williams,, age 69, is the55, has been president, chief executive officer and a director of the Company.Company since January 1, 2009. Previously, Mr. Royer wasWilliams served as president of SCA Packaging Europe between 2005 and chief executive officer2008. Prior to assuming his leadership position with SCA Packaging Europe, Mr. Williams held increasingly senior management and director of Domtar Inc. since joining Domtar Inc.operational roles in 1996. Hethe packaging business and related industries.

Melissa Anderson, age 45, is also a director of Power Financial Corporation. Mr. Royer is an Officerthe senior vice-president, human resources of the Order of Canada, a Commander of the Order of Léopold II of Belgium and an Officer of the Ordre national du Quebec.

Marvin D. Cooper, age 64, has been executive vice-president and chief operating officer of the Company since March 2007. Mr. CooperCompany. Ms. Anderson joined Domtar in January 2010. Previously, she was senior vice-president, cellulose fiber, white papershuman resources and containerboard manufacturing and engineering of Weyerhaeuser from 2002 to 2006 when he stepped down to work full-time ongovernment relations, at The Pantry, Inc., an independently operated convenience store chain in the Transaction.southeastern United States. Prior to joining Weyerhaeuser in 2002, hethis, she held a number of executivesenior management positions with Willamette Industries, Inc., including executive vice-president, pulp and paper mills from 1998 to 2002. His career inInternational Business Machine (“IBM”) over the pulp and paper industry spans over 36span of 17 years.

Daniel Buron, age 44,46, is the senior vice-president and chief financial officer of the Company. Mr. Buron was senior vice-president and chief financial officer of Domtar Inc. since May 2004. He joined Domtar Inc. in 1999. Prior to May 2004 he was vice-president, finance, pulp and paper sales division and, prior to September 2002, he was vice-president and controller. He has over 1921 years of experience in finance.

Steven A. Barker, age 54, is the senior vice-president, pulp and paper marketing of the Company. Mr. Barker was senior vice-president pulp and paper sales and marketing of Domtar Inc. since December 2004. He joined Domtar Inc. in 2000 following the acquisition of Ris Paper Company, Inc. (a wholly-owned subsidiary of Domtar Inc. since 2000) where he held a number of executive positions. His career in the paper industry spans over 25 years.

Roger H. Brear, age 60, is the senior vice-president, southern region mills of the Company. Mr. Brear was senior vice-president, paper manufacturing of Domtar Inc. since 2001 when he joined following the acquisition of four U.S. paper mills from Georgia-Pacific Corporation, where he held various senior manufacturing positions. His career in the paper industry spans over 35 years.

17

Michel Dagenais, age 58, is the senior vice-president, human resources of the Company. Mr. Dagenais was vice-president, human resources of Domtar Inc. since 2005. Previously, he was director, human resources of the Forest Products Group since joining Domtar Inc. in 2001. During his career that spans over 36 years, he has held various management and consulting positions in human resources and labor relations.

Ghislain Dinel, age 59, is the senior vice-president, northern region mills of the Company. Mr. Dinel was vice-president, operations, optimization and technology of Domtar Inc. since 2004. Since joining Domtar Inc. in 1970, he has held various management positions in the pulp and paper operations. His career in the pulp and paper industry spans over 37 years.

Michael Edwards, age 60,62, is the group senior vice-president, pulp and paper manufacturing of the Company. Mr. Edwards was vice-president, fine paper manufacturing of Weyerhaeuser since 2002. Since joining Weyerhaeuser in 1994, he has held various management positions in the pulp and paper operations. Prior to Weyerhaeuser, Mr. Edwards worked at Domtar Inc. for 11 years. His career in the pulp and paper industry spans over 4446 years.

James F. Lenhoff,Zygmunt Jablonski, age 57,56, is the senior vice-president, Distributionlaw and corporate affairs of the Company. Mr. Lenhoff was the senior vice-president, Domtar Distribution Group of Domtar Inc. since 2004. HeJablonski joined Domtar Inc. in 2000 following the acquisition of Ris Paper Company Inc. where he was vice president, sales2008, after serving in various in-house counsel positions for major manufacturing and marketing. His careerdistribution companies in the paper industry spansfor 13 years – most recently, as executive vice-president, general counsel and secretary. From 1985 to 1994, he practiced law in Washington, DC.

Mark Ushpol, age 46, is the senior vice-president, distribution of the Company. Mr. Ushpol joined Domtar in January 2010. Previously, he was sales and marketing director of Mondi Europe & International Uncoated Fine Paper, where he was in charge of global uncoated fine paper sales. He has over 2620 years experience in senior marketing and sales management with the last 13 years in the pulp and paper sector. Prior to that, he was involved in the plastics industry in South Africa for 8 years.

Patrick Loulou, age 39,41, is the senior vice-president, corporate development since he joined the Company in March 2007. Previously, he held a number of positions in the telecommunications sector as well as in management consulting. He has over 1011 years experience in corporate strategy and business development.

Jean-François Mérette, age 41,43, is the senior vice-president, forest products of the Company. Mr. Mérette was the vice-president, sawmills since he joined Domtar Inc. in 2005. Previously, he has held various management positions with a major forest products company. His career in the forest products industry spans over 1618 years.

Bart Nicholson, age 48, is the senior vice-president, specialty mills and converting operations of the Company. Mr. Nicholson was vice-president, fine paper converting operations since he joined Weyerhaeuser in 2002. Previously, he held various technical and management positions in the pulp and paper operations of Willamette Industries, Inc. since 1981. His career in the pulp and paper industry spans over 26 years.

Yves L. Parent, age 54, is the senior vice-president, information technology of the Company since March 2007. He joined Domtar Inc. in 2005 as vice-president, information technology. He has over 25 years of experience in IT management, including 15 years in the pulp and paper industry and 10 years as senior director, IT in an international manufacturing organization.18

Gilles Pharand, age 63, is the senior vice-president, law and corporate affairs of the Company. Mr. Pharand joined Domtar Inc. in 1970; and has been senior vice-president, corporate affairs since 1994 and general counsel since 1986, being responsible for secretariat, environmental and legal affairs, communications and government relations, internal audit and head office operations. His career in the pulp and paper industry spans over 37 years.

Richard L. Thomas, age 54,56, is the senior vice-president, sales and marketing of the Company. Mr. Thomas was vice-president of fine papers of Weyerhaeuser since 2005. Prior to 2005, he was vice-president, business papers of Weyerhaeuser. Mr. Thomas joined Weyerhaeuser in 2002 when Willamette Industries, Inc. was acquired by Weyerhaeuser. At Willamette, he held various management positions in operations since joining in 1992. Previously, he was with Champion International Corporation for 12 years.

18

The information included in this Annual Report on Form 10-K may contain forward-looking statements relating to trends in, or representing management’s beliefs about, Domtar Corporation’s future growth, results of operations, performance and business prospects and opportunities. These forward-looking statements are generally denoted by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “aim,” “target,” “plan,” “continue,” “estimate,” “project,” “may,” “will,” “should” and similar expressions. These statements reflect management’s current beliefs and are based on information currently available to management. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to known and unknown risks and uncertainties and other factors that could cause actual results to differ materially from historical results or those anticipated. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will occur, or if any occurs, what effect they will have on Domtar Corporation’s results of operations or financial condition. These factors include, but are not limited to:

conditions in the effect of general economic conditions,global capital and credit markets, and the economy generally, particularly in the U.S. and Canada;

market demand for Domtar Corporation’s products, which may be tied to the relative strength of various U.S. and/or Canadian business segments;

product selling prices;

raw material prices, including wood fiber, energychemical and chemical;energy;

performance of Domtar Corporation’s manufacturing operations, including unexpected maintenance requirements;

the successful integration of the Weyerhaeuser Fine Paper Business with Domtar Inc. and the ability to realize anticipated cost savings;

the level of competition from domestic and foreign producers;

the effect of, or change in, forestry, land use, environmental and other governmental regulations (including tax), and changes in accounting regulations;

the effect of weather and the risk of loss from fires, floods, windstorms, hurricanes and other natural disasters;

transportation costs;

the loss of current customers or the inability to obtain new customers;

legal proceedings;

changes in asset valuations, including write downs of property, plant and equipment, inventory, accounts receivable or other assets for impairment or other reasons;

changes in currency exchange rates, particularly the relative value of the U.S. dollar to the Canadian dollar;

the effect of timing of retirements and changes in the market price of Domtar Corporation’s common stock on charges for stock-based compensation;

performance of pension fund investments and related derivatives; and

the other factors described under “Risk Factors,” in item 1A of this Annual Report on Form 10-K.

19

You are cautioned not to unduly rely on such forward-looking statements, which speak only as of the date made, when evaluating the information presented in this Annual Report on Form 10-K. Unless specifically required by law, Domtar Corporation assumes no obligation to update or revise these forward-looking statements to reflect new events or circumstances.

19

| ITEM 1A. | RISK FACTORS |

You should carefully consider the risks described below in addition to the other information presented in this Annual Report on Form 10-K. Some of the following risks relate principally to the Company’s business and the industry in which it operates, while others relate principally to the Transaction.

RISKS RELATING TO THE INDUSTRIES AND BUSINESSES OF THE COMPANY

The pulp, paper and wood product industries are highly cyclical. Fluctuations in the prices of and the demand for the Company’s products could result in lower sales volumes and smaller profit margins and lower sales volumes.margins.

The pulp, paper and wood product industries are highly cyclical. Historically, economic and market shifts, fluctuations in capacity and changes in foreign currency exchange rates have created cyclical changes in prices, sales volume and margins for the Company’s products. The length and magnitude of industry cycles have varied over time and by product, but generally reflect changes in macroeconomic conditions and levels of industry capacity. Most of the Company’s paper products are commodities that are widely available from other producers. Even the Company’s non-commodity products, such as value-added papers, are susceptible to commodity dynamics. Because commodity products have few distinguishing qualities from producer to producer, competition for these products is based primarily on price, which is determined by supply relative to demand.

The overall levels of demand for the products the Company manufactures and distributes, and consequently its sales and profitability, reflect fluctuations in levels of end-user demand, which depend in part on general macroeconomic conditions in North America and worldwide, as well as competition from electronic substitution. See—“SomeConditions in the global capital and credit markets, and the economy generally, can adversely affect the Company business, results of operations and financial position” and “Some of the Company’s products are vulnerable to long-term declines in demand due to competing technologies or materials.” For example, demand for cut-size office paper may fluctuate with levels of white-collar employment. Demand for many such products was materially and negatively impacted by the global economic downturn among other things, in the early part of this decade, and the Company expects that it will be susceptible to such downturns in the future.2009.

Industry supply of pulp, paper and wood products is also subject to fluctuation, as changing industry conditions can influence producers to idle or permanently close individual machines or entire mills. Such closures can result in significant cash and/or non-cash charges. In addition, to avoid substantial cash costs in connection with idling or closing a mill, some producers will choose to continue to operate at a loss, sometimes even a cash loss, which could prolong weak pricing environments due to oversupply. Oversupply can also result from producers introducing new capacity in response to favorable short-term pricing trends.

Industry supply of pulp, paper and wood products is also influenced by overseas production capacity, which has grown in recent years and is expected to continue to grow. While the weakness of the U.S. dollar has mitigated the levels of imports in recent years, imports of pulp, paper and wood products from overseas may increase, putting downward pressure on prices.

As a result, prices for all of the Company’s products are driven by many factors outside of its control, and itthe Company has little influence over the timing and extent of price changes, which are often volatile. Because market conditions beyond the Company’s control determine the prices for its commodity products, the price for any one or more of these products may fall below its cash production costs, requiring the Company to either incur cash losses on product sales or cease production at one or more of its manufacturing facilities. The Company continues to evaluatecontinuously evaluates potential adjustments to its production capacity, which may include additional closures of machines or entire mills, and the Company could recognize significant cash and/or non-cash charges relating to any such closures in future periods. See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, under “Restructuring activities.” Therefore, the Company’s

20

profitability with respect to these products depends on managing its cost structure, particularly wood fiber, chemical and energy costs, which represent the largest components of its operating costs and can fluctuate based upon factors beyond its control, as described below. If the prices of or demand for its products decline, or if its wood fiber, chemical or energy costs increase, or both, its sales and profitability could be materially and adversely affected.

Conditions in the global capital and credit markets, and the economy generally, can adversely affect the Company business, results of operations and financial position.

20A significant or prolonged downturn in general economic condition may affect the Company’s sales and profitability. The Company has exposure to counterparties with which we routinely execute transactions. Such counterparties include commercial banks, insurance companies and other financial institutions, some of which may be exposed to bankruptcy or liquidity risks. While the Company has not realized any significant losses to date, a bankruptcy or illiquidity event by one of its significant counterparties may materially and adversely affect the Company access to capital, future business and results of operations.

Some of the Company’s products are vulnerable to long-term declines in demand due to competing technologies or materials.

The Company’s business competes with electronic transmission and document storage alternatives, as well as with paper grades it does not produce, such as uncoated groundwood. As a result of such competition, the Company has experienced decreased demand for some of its existing pulp and paper products. As the use of these alternatives grows, demand for pulp and paper products is likely to further decline. Moreover, demand for some of the Company’s wood products may decline if customers purchase alternativesalternative products.

The Company faces intense competition in its markets, and the failure to compete effectively would have a material adverse effect on its business and results of operations.

The Company competes with both U.S. and Canadian paper producers and, for many of its product lines, global producers, some of which may have greater financial resources and lower production costs than the Company. The principal basis for competition is selling price. The Company’s ability to maintain satisfactory margins depends in large part on its ability to control its costs. The Company cannot assure youprovide assurance that it canwill compete effectively and maintain current levels of sales and profitability. If the Company cannot compete effectively, such failure will have a material adverse effect on its business and results of operations.

The Company’s intellectual property rights are valuable, and any inability to protect them could reduce the value of its products and its brands.

The Company relies on patent, trademark, and other intellectual property laws of the United States and other countries to protect its intellectual property rights. However, the Company may be unable to prevent third parties from using its respective intellectual property without its authorization, which may reduce any competitive advantage it has developed. If the Company had to litigate to protect these rights, any proceedings could be costly, and it may not prevail. The Company cannot guarantee that any United States or foreign patents, issued or pending, will provide it with any competitive advantage or will not be challenged by third parties. Additionally, the Company has obtained and applied for United States and foreign trademark registrations, and will continue to evaluate the registration of additional service marks and trademarks, as appropriate. The Company cannot guarantee that any of its pending patent or trademark applications will be approved by the applicable governmental authorities and, even if the applications are approved, third parties may seek to oppose or otherwise challenge these registrations. The failure to secure any pending patent or trademark applications may limit the Company’s ability to protect the intellectual property rights that these applications were intended to cover.

The Company’s manufacturing businesses may have difficulty obtaining wood fiber at favorable prices, or at all.