UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10–KForm 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 20082010

ORor

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-8399

WORTHINGTON INDUSTRIES, INC.

(Exact nameName of registrantRegistrant as specifiedSpecified in its charter)Charter)

Ohio | 31-1189815 | |

| (State or | (I.R.S. Employer Identification No.) | |

200 Old Wilson Bridge Road, Columbus, Ohio | 43085 | |

| (Address of | (Zip Code) |

Registrant’s telephone number, including area | (614) 438-3210 | |

Securities registered pursuant to Section 12(b) of the Act:

Title of | Name of Each Exchange on Which Registered | |

Common Shares, Without Par Value |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x YES

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes þ No ¨

|

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes ¨ No þ |

Indicate by check mark whether the registrantRegistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrantRegistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xþ YESNo ¨ NO

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’sRegistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrantRegistrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:Act.

Large accelerated filer xþ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨��

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrantRegistrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ YESNo xþ NO

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. The aggregate market value of the Common Shares (the only common equity)equity of the Registrant) held by non-affiliates based oncomputed by reference to the closing price on the New York Stock Exchange on November 30, 2007,2009, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $1,385,500,000.$717,342,269. For this purpose, executive officers and directors of the Registrant are considered affiliates.

Indicate the number of shares outstanding of each of the registrant’sRegistrant’s classes of common stock, as of the latest practicable date. On July 24, 2008,23, 2010, the Registrant had 78,769,498number of Common Shares issued and outstanding.outstanding was 77,892,544.

DOCUMENT INCORPORATED BY REFERENCEREFERENCE:

Selected portions of the Registrant’s definitive Proxy Statement to be furnished to shareholders of the Registrant in connection with the Annual Meeting of Shareholders to be held on September 24, 2008,30, 2010, are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent provided herein.

| ii | ||||

PART I | ||||

Item 1. | 1 | |||

Item 1A. | ||||

Item 1B. | ||||

Item 2. | ||||

Item 3. | ||||

Item 4. | ||||

Supplemental Item. | ||||

PART II | ||||

Item 5. | ||||

Item 6. | ||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||

Item 7A. | ||||

Item 8. | ||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |||

Item 9A. | ||||

Item 9B. | ||||

PART III | ||||

Item 10. | ||||

Item 11. | ||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||

Item 14. | ||||

PART IV | ||||

Item 15. | ||||

| E-1 | ||||

i

Selected statements contained in this Annual Report on Form 10-K, including, without limitation, in “PART I – Item 1. – Business” and “PART II – Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations,” constitute “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements reflect our current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “intend,” “estimate,” “plan,” “foresee,” “likely,” “will,” “should” or other similar words or phrases. These forward-looking statements include, without limitation, statements relating to:

| • | business plans or future or expected growth, |

| • | the sustainability of earnings; |

| • | projected profitability potential, capacity and working capital needs; |

| • | demand trends for the Company or its markets; |

| • | pricing trends for raw materials and finished goods and the impact of pricing changes; |

| • | anticipated capital expenditures and asset sales; |

| • | anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain and the results thereof; |

| • | projected timing, results, benefits, costs, charges and expenditures related to acquisitions, |

| • | the alignment of operations with demand; |

| • | the ability to capture and maintain margins and market share and to develop or take advantage of future opportunities, new products |

| • | expectations for Company and customer inventories, jobs and orders; |

| • | expectations for the economy and markets or improvements in the economy or markets; |

| • | expected benefits from |

| • | expectations for |

|

| • | effects of judicial |

| • | other non-historical matters. |

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow:

| • | the effect of national, regional and worldwide economic conditions generally and within major product markets, including a prolonged or substantial economic downturn; |

| • | the effect of conditions in national and worldwide financial markets; |

| • | product demand and pricing; |

| • | changes in product mix, product substitution and market acceptance of the Company’s products; |

| • | fluctuations in pricing, quality or availability of raw materials (particularly steel),supplies, transportation, utilities and other items required by operations; |

| • | effects of facility closures and the consolidation of operations; |

| • | the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and |

| • | failure to maintain appropriate levels of inventories; |

| • | financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; |

| • | the ability to realize targeted expense reductions |

| • | the ability to realize other cost savings and operational, sales and sourcing improvements and efficiencies, and |

ii

| • | the overall success of, and the ability to integrate, newly-acquired businesses and achieve synergies |

| • | capacity levels and efficiencies, within facilities and within the industry as a whole; |

| • |

|

the effect of |

|

| • | changes in customer demand, inventories, spending patterns, product choices, and supplier choices; |

| • | risks associated with doing business internationally, including economic, political and social instability, and foreign currency |

| • | the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; |

| • | adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; |

| • | deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; |

| • |

|

| • | the impact of judicial rulings and governmental regulations, including those adopted by the SEC and other governmental agencies as contemplated by the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, both in the United States and abroad; and |

| • | other risks described from time to time in the filings of Worthington Industries, Inc. with the United States Securities and Exchange Commission, including those described in “PART I – Item 1A. – Risk Factors” of this Annual Report on Form 10-K. |

We note these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, you should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Any forward-looking statements in this Annual Report on Form 10-K are based on current information as of the date of this Annual Report on Form 10-K, and we assume no obligation to correct or update any such statements in the future, except as required by applicable law.

iiiii

PART I

General Overview

Worthington Industries, Inc. is a corporation formed under the laws of the State of Ohio (individually, the “Registrant” or “Worthington Industries” or, collectively with the subsidiaries of Worthington Industries, Inc., “we,” “our,” “Worthington,” or the “Company”). Founded in 1955, Worthington is primarily a diversified metalmetals processing company, focused on value-added steel processing and manufactured metal products. Our manufactured metal products include: pressure cylinder products such as metalpropane, refrigerant, oxygen, hand torch and camping cylinders, scuba tanks and helium balloon kits; light gauge steel framing pressure cylinders,for commercial and residential construction; framing systems and stairs for mid-rise buildings; current and past model automotive past-model service stampingsstampings; and, through joint ventures, metal ceilingsuspension grid systems for concealed and laser-weldedlay-in panel ceilings and laser welded blanks.

Worthington is headquartered at 200 Old Wilson Bridge Road, Columbus, Ohio 43085, telephone (614) 438-3210. The common shares of Worthington Industries are traded on the New York Stock Exchange under the symbol WOR.

Worthington Industries maintains an Internet web site at www.worthingtonindustries.com. This uniform resource locator, or URL, is an inactive textual reference only and is not intended to incorporate Worthington Industries’ web site into this Annual Report on Form 10-K. Annual reportsReports on Form 10-K, quarterly reportsQuarterly Reports on Form 10-Q, current reportsCurrent Reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as Worthington Industries’ definitive annual meeting proxy materials filed pursuant to Section 14 of the Exchange Act, are available free of charge, on or through the Worthington Industries web site, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”).

Business Segments

At the end of the fiscal year ended May 31, 20082010 (“fiscal 2008”2010”), the Company had 4441 manufacturing facilities worldwide and held equity positions in teneight joint ventures, which operated an additional 2224 manufacturing facilities worldwide.

The Company has three principal reportable operatingbusiness segments: Steel Processing, Pressure Cylinders and Metal Framing and Pressure Cylinders.Framing. The Steel Processing reportable business segment consists of the Worthington Steel business unit (“Worthington Steel”). The Pressure Cylinders reportable business segment consists of the Worthington Cylinders business unit (“Worthington Cylinders”). The Metal Framing reportable business segment consists of the Dietrich Metal Framing business unit (“Dietrich”). The Steel processing, Pressure Cylinders segment consists ofand Metal Framing operating segments are the Worthington Cylinderonly operating segments within the Company that met the applicable criteria for separate disclosure as reportable business unit (“Worthington Cylinders”).segments. All other business units not included in these three reportable operating segments are combined and disclosed in the Other category, which also includes income and expense items not allocated to the operatingreportable business segments. The Other category includes the Automotive Body Panels, Steel Packaging, Mid-Rise Construction, Military Construction and Commercial Stairs operating segments.

During the Company’s third quarter ended February 28, 2010, we made certain organizational changes that impacted the internal reporting and management structure of our previously reported Construction Services operating segment which had been reported in the Other category. This operating segment consisted of the Worthington Integrated Building Systems (“WIBS”) business unit, which included the Mid-Rise Construction, Military Construction and Steel Packaging segments.Commercial Stairs businesses. As a result of continued

challenges facing those businesses, the interaction between those businesses and other operations within the Company and other industry factors, management responsibilities and internal reporting were re-aligned and separated for those entities within WIBS. The composition of the Company’s reportable business segments is unchanged from this development (see description within “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note H – Segment Data” of this Annual Report on Form 10-K for fiscal 2010 of Worthington Industries for a full description of the reportable business segments), but the level of aggregation within the Other category for segment reporting purposes is impacted, as are the identified reporting units used for testing of potential goodwill impairment. Subsequent to this change, and as of February 28, 2010, the Other category, for purposes of reporting segment financial information, continues to include Mid-Rise Construction, Military Construction and Commercial Stairs. However, those operating units are no longer combined together as the Construction Services operating segment, but are each separate and distinct operating segments, as well as separate reporting units.

Worthington holds equity positions in teneight joint ventures, which are further discussed below under the subheading “Joint Ventures.” Only one of the teneight joint ventures is consolidated and its operating results are reported in the Steel Processing reportable business segment.

During fiscal 2008,2010, the Steel Processing, Pressure Cylinders and Metal Framing and Pressure Cylindersoperating segments served approximately 1,200, 3,8001,100, 2,400 and 2,4003,100 customers, respectively, located primarily in the United States. Foreign salesoperations accounted for approximately 9%6% of consolidated net sales for fiscal 2010 and were comprised primarily of sales to customers in Canada and Europe. No single customer accounted for over 5%10% of consolidated net sales.sales during fiscal 2010. Further reportable operatingbusiness segment data is provided in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note H – Segment Data” of this Annual Report on Form 10-K. That data is incorporated herein by reference.

Transformation Plan

In our fiscal year ended May 31, 2008 (“fiscal 2008”), we initiated a Transformation Plan (the “Transformation Plan”) with the overall goal to improve the Company’s sustainable earnings potential, asset utilization and operational performance. The Transformation Plan focuses on cost reduction, margin expansion and organizational capability improvements and, in the process, seeks to drive excellence in three core competencies: sales; operations; and supply chain management. The Transformation Plan is comprehensive in scope and includes aggressive diagnostic and implementation phases in the Steel Processing and Metal Framing operating segments.

We retained a consulting firm to assist in the development and implementation of the Transformation Plan. The services provided by this firm included assistance through diagnostic tools, performance improvement technologies, project management techniques, benchmarking information and insights that directly related to the Transformation Plan. We also formed internal teams dedicated to the Transformation Plan efforts. These internal teams assumed full responsibility for executing the Transformation Plan starting in the fourth quarter of the fiscal year ended May 31, 2009 (“fiscal 2009”).

We continued to execute our Transformation Plan through fiscal 2010. In our Steel Processing operating segment, we have completed the diagnostic and implementation phases at each of our core facilities. Additionally, we have initiated the diagnostic process at our west coast stainless steel operation and our newly acquired facility in Cleveland, as well as in our Mexican joint venture, Serviacero. We anticipate that we will have substantially completed the Transformation Plan process at these facilities and one additional Steel Processing facility by December 31, 2010. In our Metal Framing operating segment, we have substantially completed the Transformation Plan process at eight facilities and anticipate completing the process at four additional facilities by December 31, 2010.

Transformation Plan initiatives executed to date include facility closings, headcount reductions, other cost reductions, an enhanced and more focused commercial sales effort, improved operating efficiencies, a

consolidated sourcing and supply chain strategy and a continued emphasis on safety. We have seen positive results from these efforts; however, their impact has been dampened by the negative impact of the economic recession.

As of May 31, 2010, we had recorded a total of $65.4 million of restructuring charges associated with the Transformation Plan: $18.1 million was incurred during fiscal 2008; $43.0 million was incurred during fiscal 2009; and $4.2 million was incurred during fiscal 2010. We expect to incur additional restructuring charges relating to the Transformation Plan as we progress through the remaining Metal Framing and Steel Processing facilities, although these charges should decline over the coming quarters. The need for other restructuring charges will depend largely on recommendations developed from the Transformation Plan. See “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note M – Restructuring” of this Annual Report on Form 10-K for further information on restructuring charges. That information is incorporated herein by reference.

Recent Developments

On September 14, 2007, the Company segment acquired certain cylinder production assets of Wolfedale Engineering, the largest Canadian manufacturer of portable propane gas steel cylinders for use with

barbeque gas grills, recreational vehicles, campers and trailers. These assets and production were integrated into existing facilities.

On September 17, 2007, the Company acquired a 50% interest in Serviacero Planos which operates two steel processing facilities in central Mexico. This joint venture is known as Serviacero Planos, S.A. de C.V. (“Serviacero Worthington”). On March 5, 2008, Serviacero Worthington announced plans to add a greenfield site in the Monterrey, Mexico region. This will be the third facility in Mexico for the Serviacero Worthington joint venture.

On September 25, 2007, a steel processing joint venture was formed with The Magnetto Group to construct and operate a Class One steel processing facility in Slovakia. This 49%-owned joint venture started operations in February 2008 as Canessa Worthington Slovakia s.r.o. (“Canessa Worthington”) and services customers throughout central Europe.

On September 25, 2007, Worthington announced the closure or downsizing of five production facilities in the Metal Framing segment. The affected facilities were: East Chicago, Indiana; Rock Hill, South Carolina; Goodyear, Arizona; Wildwood, Florida; and Montreal, Canada which is being downsized. The Rock Hill facility continues to operate as a steel processing operation and will also produce product for the Aegis joint venture. In addition to the plant closures, the Metal Framing executive and administrative offices will be relocated from Pittsburg, Pennsylvania, to our corporate offices in Columbus, OH. Annual net sales generated by the closed facilities totaled approximately $125.0 million, the majority of which are expected to be transferred to other nearby Metal Framing locations. As of May 31, 2008, all five of the Metal Framing operating facilities have been closed or downsized. Of the $9.0 million in annual savings expected from these actions, $2.1 million was realized in fiscal 2008. The balance will be realized in fiscal 2009. Restructuring charges related to these closures totaled $8.1 million in fiscal 2008 with an additional $4.6 million expected in fiscal 2009.

On September 26, 2007, Worthington Industries announced that the Board of Directors had approved the repurchase of ten million of its outstanding common shares. A prior authorization to repurchase up to ten million common shares, originally approved by the Board of Directors on June 13, 2005, had 1,370,800 common shares remaining under it, making a total of 11,370,800 common shares available for repurchase at the time of the announcement. During fiscal 2008, the Company repurchased 6,451,500 common shares, and at year-end, there were 9,099,500 common shares authorized for repurchase.

On October 25, 2007, Worthington acquired a 49% interest in crate and pallet maker LEFCO Industries, LLC, a minority business enterprise. The resulting joint venture, called LEFCO Worthington, LLC, will manufacture steel rack systems for the automotive and trucking industries, in addition to continuing LEFCO’s existing products.

On March 1, 2008 TWB Company, L.L.C. (“TWB”), our joint venture with ThyssenKrupp Steel North America, Inc. (“ThyssenKrupp”), acquired ThyssenKrupp Tailored Blanks, S.A. de C.V., the Mexican subsidiary of ThyssenKrupp, to expand TWB’s presence in Mexico. As a result, ThyssenKrupp now owns 55% of TWB and Worthington now owns 45%.

On June 2, 2008, Worthington made an additional capital contribution of $392,000 to Viking & Worthington Steel Enterprise, LLC. The other member in the joint venture did not make its contribution as required by the operating agreement. As a result, Worthington became the majority owner of the joint venture, and the joint venture will be consolidated in Worthington’s financial statements starting in fiscal 2009.

On June 2, 2008, the Company acquired2009, we purchased substantially all of the assets related to the business of The Sharon Companies Ltd. (“Sharon Stairs”). The Sharon Stairs business designsPiper Metal Forming Corporation, U.S. Respiratory, Inc. and manufacturesPacific Cylinders, Inc. (collectively, “Piper”) for cash of $9,713,000. Piper is a manufacturer of aluminum high pressure cylinders and impact extruded steel egress stair systems forand aluminum parts, serving the medical, automotive, defense, oil services and other commercial construction market and operatesmarkets, with one manufacturing facilitylocation in Akron, Ohio. It will operateNew Albany, Mississippi. Piper operates as part of Worthington Integratedour Pressure Cylinders operating segment. Piper’s aluminum products increase our line of industrial gas product offerings and present an opportunity to increase our participation in the medical cylinder market.

On August 12, 2009, we joined with ClarkWestern Building Systems, Inc., to create DMFCWBS, LLC (the “Clark JV”). We contributed certain intangible assets and committed to pay a portion of certain costs and expenses in return for 50% of the equity units and voting power of the joint venture. The purpose of the Clark JV is to develop, test and obtain approvals for metal framing stud designs, as well as to develop, own and license intellectual property related to such designs. The Clark JV does not manufacture or sell any products, but will license its designs to its members and possibly to third parties. The Clark JV is accounted for using the equity method of accounting, as both parties have equal voting rights and control.

On September 3, 2009, we acquired the membership interests of Structural Composites Industries, LLC (“Worthington-IBS”SCI”). for cash of $24,221,000. SCI is a manufacturer of lightweight, aluminum-lined, composite-wrapped high pressure cylinders used in commercial, military, marine and aerospace applications. Product lines include cylinders for alternative fuel vehicles using compressed natural gas or hydrogen, self-contained breathing apparatuses, aviation oxygen and escape slides, military applications, home oxygen therapy and advanced and cryogenic structures. SCI operates as part of our Pressure Cylinders operating segment. The acquisition of SCI allows us to continue to grow the Pressure Cylinders business and provides an entry into weight critical applications, further broadening the portfolio beyond the operating segment’s original, core markets.

On November 2, 2009, our Metal Framing operating segment announced the formation of a strategic alliance with Bailey Metal Products Limited (“Bailey”) that included the sale of our Metal Framing operations in Canada to Bailey. The sale included two manufacturing facilities located in Burnaby, British Columbia, and Mississauga, Ontario, and two sales and distribution centers located in LaSalle, Quebec, and Edmonton, Alberta. The alliance provides for Bailey to be the exclusive distributor of Metal Framing’s proprietary and vinyl products in Canada. Bailey has licensed its paper-faced metal corner bead product to Metal Framing to manufacture and sell in most of the United States.

On February 1, 2010, we acquired the steel processing assets of Gibraltar Industries, Inc. and its subsidiaries (collectively, “Gibraltar”) for cash of $29,164,000. Those assets are now operated within our Steel Processing operating segment. The acquisition expanded the capabilities of Worthington Steel’s cold-rolled

strip business and its ability to service the needs of new and existing customers. The assets acquired were Gibraltar’s inventories, its Cleveland, Ohio, facility, the equipment of Gibraltar’s Buffalo, New York, facility and a warehouse in Detroit, Michigan. Also acquired was the stock of Cleveland Pickling, Inc., whose only asset is a 31.25% interest in Samuel Steel Pickling Company, a joint venture which operates a steel pickling facility in Twinsburg, Ohio, and one in Cleveland, Ohio.

On June 21, 2010, our Pressure Cylinders operating segment acquired the assets of Hy-Mark Cylinders, Inc. (“Hy-Mark”) for cash of $12,125,000. Hy-Mark manufactures extruded aluminum cylinders for medical oxygen, scuba, beverage service, industrial specialty and professional racing applications and was based in Hampton, Virginia. The assets acquired included Hy-Mark’s manufacturing equipment and inventories, which will be relocated to the Worthington Cylinders Mississippi manufacturing location, complementing the medical cylinder lines and adding a range of new products.

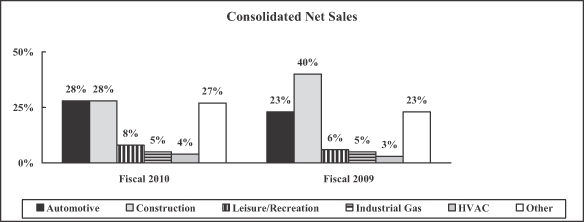

Steel Processing

The Steel Processing operating segment consists of the Worthington Steel business unit, and includes Precision Specialty Metals, Inc., a specialty stainless processor located in Los Angeles, California (“PSM”), and Spartan Steel Coating LLC (“Spartan”), a consolidated joint venture.venture which operates a cold-rolled hot dipped galvanizing line. For fiscal 2008, the2010, fiscal year ended May 31, 2007 (“2009 and fiscal 2007”), and the fiscal year ended May 31, 2006 (“fiscal 2006”),2008, the percentage of consolidated net sales generated by the Steel Processing operating segment was 48%approximately 51%, 49%,45% and 51%48%, respectively.

Worthington Steel is one of America’sthe largest independent intermediate processors of flat-rolled steel.steel in the United States. It occupies a niche in the steel industry by focusing on products requiring exact specifications. These products cannot typically be supplied as efficiently by steel mills or end-users of these products.

The Steel Processing operating segment, including Spartan, owns and operates tennine manufacturing facilities – one each in California, Indiana, Kentucky and Maryland, two facilities in Michigan, and threefour facilities in Ohio – and leases one manufacturing facility in Alabama.

Worthington Steel serves approximately 1,2001,100 customers from these facilities, principally in the automotive, construction, lawn and garden, hardware, furniture, office equipment, electrical control, tubing, leisure and recreation, appliance, agricultural, HVAC, container and aerospace markets. Automotive-related customers have historically represented approximately half of itsthis operating segment’s net sales. No single customer represented greater than 7%10% of net sales for the Steel Processing operating segment during fiscal 2008.2010.

Worthington Steel buys coils of steel from integrated steel mills and mini-mills and processes them to the precise type, thickness, length, width, shape, temper and surface quality required by customer specifications. Computer-aided processing capabilities include, among others:

pickling, a chemical process using an acidic solution to remove surface oxide which develops on hot-rolled steel;

slitting, which cuts steel to specific widths;

cold reducing, which achieves close tolerances of thickness and temper by rolling;

hot-dipped galvanizing, which coats steel with zinc and zinc alloys through a hot-dipped process;

hydrogen annealing, a thermal process that changes the hardness and certain metallurgical characteristics of steel;

cutting-to-length, which cuts flattened steel to exact lengths;

tension leveling, a method of applying pressure to achieve precise flatness tolerances for steel;

edging, which conditions the edges of the steel by imparting round, smooth or knurled edges;

non-metallic coating, including dry lubrication, acrylic and paint; and

configured blanking, which stamps steel into specific shapes.

Worthington Steel also toll processes steel for steel mills, large end-users, service centers and other processors. Toll processing is different from typical steel processing in that the mill, end-user or other party retains title to the steel and has the responsibility for selling the end product. Toll processing enhances Worthington Steel’s participation in the market for wide sheet steel and large standard orders, which is a market generally served by steel mills rather than by intermediate steel processors.

The steel processing industry is fragmented and highly competitive. There are many competitors, including other independent intermediate processors. Competition is primarily on the basis of price, product quality and the ability to meet delivery requirements. Technical service and support for material testing and customer-specific applications enhance the quality of products (See “Item 1. – Business – Technical Services”). However, the extent to which technical service capability has improved Worthington Steel’s competitive

position has not been quantified. Worthington Steel’s ability to meet tight delivery schedules is, in part, based on the proximity of our facilities to customers, suppliers and one another. The extent to which plant location has impacted Worthington Steel’s competitive position has not been quantified. Processed steel products are priced competitively, primarily based on market factors, including, among other things, competitivemarket pricing, the cost and availability of raw materials, transportation and shipping costs, and overall economic conditions in the United States and abroad.

Metal Framing

The Metal Framing segment, consisting ofAs noted under “Recent Developments”, the Dietrich Metal Framingrecently acquired Gibraltar steel processing business unit, designs and produces metal framing components, systems and related accessories for the commercial and residential construction markets within the United States and Canada. For fiscal 2008, fiscal 2007, and fiscal 2006, the percentage of consolidated net sales generated by the Metal Framing segment was 26%, 26%, and 28%, respectively.

Metal Framing products include steel studs and track, floor and wall system components, roof trusses and other building product accessories, such as metal corner bead, lath, lath accessories, clips, fasteners and vinyl bead and trim.

The Metal Framing segment has 20 operating facilities located throughout the United States: one each in Arizona, Colorado, Georgia, Hawaii, Illinois, Indiana, Kansas, Maryland, Massachusetts, New Jersey, South Carolina and Washington; two each in California, Florida, Ohio and Texas. This segment also has 2 operating facilities in Canada: one each in British Columbia and Ontario.

Dietrich is the largest metal framing manufacturer in the United States, supplying approximately 35% of the metal framing products sold in the United States. Dietrich is the second largest metal framing manufacturer in Canada with a market share of between 20% and 25%. Dietrich serves approximately 3,800 customers, primarily consisting of wholesale distributors, commercial and residential building contractors, and mass merchandisers. During fiscal 2008, Dietrich’s three largest customers represented approximately 16%, 10% and 10%, respectively, of the net sales for the segment, while no other customer represented more than 2% of net sales for the segment.

The light-gauge metal framing industry is very competitive. Dietrich competes with seven large regional or national competitors and numerous small, more localized competitors, primarily on the basis of price, service and quality. As is the caseincluded in the Steel Processing segment, the proximity of facilities to customers and their project sites provides a service advantage and impacts freight and shipping costs. Dietrich’s products are transported by both common and dedicated carriers. The extent to which facility location has impacted Dietrich’s competitive position has not been quantified.operating segment.

Dietrich uses numerous trademarks and patents in its business. Dietrich licenses from Hadley Industries the “UltraSTEEL®” registered trademark and the United States and Canadian patents to manufacture “UltraSTEEL®” metal framing and accessory products. The “Spazzer®” trademark is used in connection with wall component products that are the subject of four United States patents, two foreign patents, one pending United States patent application, and several pending foreign patent applications. The trademark “TradeReady®” is used in connection with floor-system products that are the subject of four United States patents, numerous foreign patents, one pending United States patent application, and several pending foreign patent applications. The “Clinch-On®” trademark is used east of the Rockies in connection with corner bead and metal trim products for gypsum wallboard. Dietrich licenses the “SLP-TRK®” trademark as well as the patent to manufacture “SLP-TRK®” slotted track in the United States from Brady Construction Innovations, Inc. Aegis Metal Framing, LLC, an unconsolidated joint venture, uses the “Ultra-Span®” registered trademark in connection with certain patents for proprietary roof trusses. Dietrich intends to continue to use and renew its registered trademarks. Dietrich also has a number of other patents, trademarks and trade names relating to specialized products.

Pressure Cylinders

The Pressure Cylinders operating segment consists of the Worthington Cylinders business unit. For fiscal 2008,2010, fiscal 2007,2009 and fiscal 2006,2008, the percentage of consolidated net sales generated by Worthington Cylinders was 20%approximately 24%, 18%,20% and 16%19%, respectively.

Worthington Cylinders operates eightten manufacturing facilities with three facilities in Ohio and one facility in each inof California, Mississippi, Wisconsin, Austria, Canada, the Czech Republic and Portugal.

The Pressure Cylinders operating segment produces a diversified line of pressure cylinders, including low-pressure liquefied petroleum gas (“LPG”) and refrigerant gas cylinders; high-pressure and industrial/specialty gas cylinders; aluminum-lined, composite-wrapped high-pressure cylinders; airbrake tanks; and certain consumer products. LPG cylinders are sold to manufacturers, distributors and mass merchandisers and are used to hold fuel for gas barbecue grills, recreational vehicle equipment, residential and light commercial heating systems, industrial forklifts, propane-fueled camping equipment, hand held torches and commercial/residential cooking (the latter, generally outside North America). Refrigerant gas cylinders are sold primarily to major refrigerant gas producers and distributors and are used to hold refrigerant gases for commercial, residential and automotive air conditioning and refrigeration systems. High-pressure and industrial/specialty gas cylinders are sold primarily to gas producers and distributors as containers for gases used in:in cutting and welding metals;metals, breathing (medical, diving and firefighting);, semiconductor production;production, beverage delivery;delivery and compressed natural gas systems. Worthington Cylinders also produces recovery tanks for refrigerant gases, air reservoirs for truck and trailer original equipment manufacturers and “Balloon Time®” helium kits which include non-refillable cylinders. While a large percentage of cylinder sales are made to major accounts, Worthington Cylinders has approximately 2,400 customers. During fiscal 2008,2010, no single customer represented more than 6%11% of net sales for the Pressure Cylinders operating segment.

Worthington Cylinders produces low-pressure steel cylinders with refrigerant capacities of 15 to 1,000 pounds and steel and aluminum cylinders with LPG capacities of 14.1 ounces to 420 pounds. Low-pressure cylinders are produced by precision stamping, drawing, welding and/or brazing component parts to customer specifications. They are then tested, painted and packaged, as required. High-pressure steel cylinders are manufactured by several processes, including deep drawing, tube spinning and billet piercing.

In the United States and Canada, high-pressure and low-pressure cylinders are primarily manufactured in accordance with U.S.United States Department of Transportation and Transport Canada specifications. Outside the United States and Canada, cylinders are manufactured according to European norm specifications, as well as various other international standards.

In the United States and Canada, Worthington Cylinders has one principal domestic competitor in the low-pressure non-refillable refrigerant market, one principal domestic competitor in the low-pressure LPG cylinder market and twoone principal domestic competitorscompetitor in the high-pressure cylinder market. There are also several foreign competitors in these markets. Worthington Cylinders believes that it has the largest domestic market share in both low-pressure cylinder markets. In the European high-pressure cylinder market, there are several competitors. Worthington Cylinders believes that it is a leading producer in both the high-pressure cylinder and low-pressure non-refillable cylinder markets in Europe. As with Worthington’s other operating segments, competition is based upon price, service and quality.

The Pressure Cylinders operating segment uses the trade name “Worthington Cylinders” to conduct business and the registered trademark “Balloon Time®” to market low-pressure helium balloon kits; the trademark “FLAMESAVER™“FLAMESAVER®” to market certain LPlow-pressure gas cylinders; the trademark “WORTHINGTON PRO GRADE™GRADE®” to market certain LPG cylinders, hand torch cylinderstorches and camping fuel cylinders; and the trademark “MAP-PRO™“MAP-PRO®”. to market certain hand torch cylinders; and uses the registered trademark SCI® to market certain cylinders for transportation of compressed gases for inflation of flotation bags and escape slides, Self Contained Breathing Cylinders (SCBA) for fire fighting and cylinders to contain compressed natural gas. The Pressure Cylinders operating segment intends to continue to use these trademarks and renew its registered trademarks. This intellectual property is important to

As noted under “Recent Developments”, the recently acquired Piper and SCI businesses are included in the Pressure Cylinders operating segment butfor fiscal 2010. The Hy-Mark business will be included in the Pressure Cylinders operating segment beginning in the fiscal year ending May 31, 2011.

Metal Framing

The Metal Framing operating segment, consisting of the Dietrich Metal Framing business unit, designs and produces metal framing components and systems and related accessories for the commercial and residential construction markets within the United States. For fiscal 2010, fiscal 2009 and fiscal 2008, the percentage of consolidated net sales generated by the Metal Framing operating segment was approximately 17%, 25% and 26%, respectively.

Metal Framing products include steel studs and track, floor and wall system components, roof trusses and other building product accessories, such as metal corner bead, lath, lath accessories, clips, fasteners and vinyl bead and trim.

The Metal Framing operating segment has 14 operating facilities located throughout the United States: one facility in each of Colorado, Florida, Georgia, Hawaii, Indiana, Kansas, Maryland and New Jersey, and two facilities in each of California, Ohio and Texas.

Dietrich is not considered material.the largest metal framing manufacturer in the United States, supplying approximately one-third of the metal framing products sold in the United States. Dietrich serves approximately 3,100

customers, primarily consisting of wholesale distributors, commercial and residential building contractors and mass merchandisers. During fiscal 2010, Dietrich’s three largest customers represented approximately 17%, 8% and 8%, respectively, of the net sales for the operating segment, while no other customer represented more than 3% of net sales for the Metal Framing operating segment.

The light gauge metal framing industry is very competitive. Dietrich competes with seven large regional or national competitors and numerous small, more localized competitors, primarily on the basis of price, service, breadth of product line and quality. As is the case in the Steel Processing operating segment, the proximity of facilities to customers and their project sites provides a service advantage and impacts freight and shipping costs. Dietrich’s products are transported by both common and dedicated carriers. Our Metal Framing business has been an industry leader in driving code compliance for light gauge metal framing.

Dietrich uses numerous trademarks and patents in its business. Dietrich licenses from Hadley Industries the “UltraSTEEL®” registered trademark and the United States patents to manufacture “UltraSTEEL®” metal framing which is sold as an additional line to Dietrich’s standard metal framing products. Dietrich licenses from the Clark JV the patent pending nonstructural framing product under the trademarks of “ProSTUD™” and “ProTRAK™.” “FastClip™” is a trademarked line of structural connectors that are protected under various United States patents.

The “Spazzer®” registered trademark is used in connection with wall component products that are the subject of four United States patents, two foreign patents and several pending foreign patent applications. The registered trademark “TradeReady®” is used in connection with floor-system products that are the subject of five United States patents and several foreign patents. The “Clinch-On®” registered trademark is used east of the Rocky Mountains in the United States in connection with corner bead and metal trim products for gypsum wallboard. Dietrich licenses from Brady Construction Innovations, Inc. the “PROX™” and the “SLP-TRK®” registered trademarks as well as the patents to manufacture “Pro XR™” header system. Dietrich also has a number of other patents, trademarks and trade names relating to specialized products. The Metal Framing operating segment intends to continue to use these trademarks and renew its registered trademarks.

Other

The “Other”Other category consists of operating segments that do not meet the applicable aggregation criteria and materiality tests for purposes of separate disclosure as reportable business segments, and other corporate related entities. These operating segments are Automotive Body Panels, Steel Packaging, Mid-Rise Construction, ServicesMilitary Construction and Steel Packaging.Commercial Stairs.

The Automotive Body Panels operating segment consists of The Gerstenslager Company (“Gerstenslager”), which is ISO/TS 16949:2002 and ISO14001 certified. Gerstenslager provides stamping, blanking, assembly, painting, packaging, die management, warehousing, distribution management and other services to customers, primarily in the automotive industry. Gerstenslager operates two facilities in Ohio. Gerstenslager is a major supplier to the automotive past-model year market and manages more than 3,3003,800 finished good part numbers and more than 12,60013,400 stamping dies/fixture sets for the past- and current-model year automotive and truck manufacturers, both domestic and transplant.

The Construction Services segment consists of the Worthington-IBS business unit which includes Worthington Mid-Rise Construction, Inc., which designs and builds mid-rise light-gauge steel framed commercial structures and multi-family housing units; Worthington Military Construction, Inc., which is involved in the supply and construction of metal framing products for, and in the framing of, single family housing, with a focus on military; a 36 unit mid-rise light-gauge steel framed apartment project in China entered into primarily for research and development purposes; and recently acquired Sharon Stairs, a manufacturer of pre-engineered egress stair solutions.

The Steel Packaging operating segment consists of Worthington Steelpac Systems LLC (“Steelpac”), which is an ISO-9001: 2000 certified manufacturer of engineered, recyclable steel shippingpackaging solutions. Steelpac operates three facilities, with one facility in each of Indiana, Ohio and Pennsylvania. Steelpac designs and manufactures reusable custom platforms, racks and pallets made of steel for supporting, protecting and handling products throughout the shipping process for industries such as automotive, lawn and garden and recreational vehicles.

The Mid-Rise Construction operating segment, consisting of Worthington Mid-Rise Construction located in Cleveland, Ohio, designs, supplies and builds mid-rise light gauge steel framed commercial structures and multi-family housing units.

The Military Construction operating segment, consisting of Worthington Military Construction located in Franklin, Tennessee, is involved in the supply and construction of metal framing products for, and in the framing of, single family housing, with a focus on military housing.

The Commercial Stairs operating segment, consisting of Worthington Stairs located in Akron, Ohio, is a manufacturer of pre-engineered steel egress stair solutions.

Segment Financial Data

Financial information for the reportable business segments is provided in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note H – Segment Data” of this Annual Report on Form 10-K. That financial information is incorporated herein by reference.

Financial Information About Geographic Areas

ForeignIn fiscal 2010, our foreign operations represented 9%, 8%, and 6% of consolidated net sales, for fiscal 2008, fiscal 2007,7% of earnings attributable to controlling interest, pre-tax, and fiscal 2006, respectively.28% of consolidated net assets. Summary information about Worthington’s foreign operations is set forth in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note A – Summary of Significant Accounting Policies –Risks and Uncertainties”Uncertainties” of this Annual Report on Form 10-K. That summary information is incorporated herein by reference. For fiscal 2008,2010, fiscal 2007,2009 and fiscal 2006,2008, Worthington had operations in North America and Europe. Net sales and net fixed assets by geographic region are provided in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note H – Segment Data” of this Annual Report on Form 10-K. That information is incorporated herein by reference.

Suppliers

The primary raw material purchased by Worthington is steel. We purchase steel from major primary producers of steel, both domestic and foreign. The amount purchased from any particular supplier varies from year to year depending on a number of factors including market conditions, then current relationships and prices and terms offered. In nearly all market conditions, steel is available from a number of suppliers and generally any supplier relationship or contract can and has been replaced with little or no significant interruption to our business. In fiscal 2008,2010, Worthington purchased approximately three1.8 million tons of steel (58%(65% hot-rolled, 29%21% galvanized and 13%14% cold-rolled) on a consolidated basis. Steel is purchased in large quantities at regular intervals from major primary producers, both domestic and foreign. In the Steel Processing operating segment, steel is primarily purchased and processed based on specific customer orders. The Pressure Cylinders and Metal Framing and Pressure Cylindersoperating segments purchase steel to meet production schedules. For certain raw materials, there are more limited suppliers – for example, hydrogen and zinc, which are generally purchased at market prices. Since there is a limited number of suppliers in the hydrogen and zinc markets, if delivery from a major supplier is disrupted due to a force majeure type occurrence, it may be difficult to obtain an alternative supply. Raw materials are generally purchased in the open market on a negotiated spot-market basis at prevailing market prices. Supply contracts are also entered into, some of which have fixed pricing. During fiscal 2008,2010, the Company purchased steel from the following major suppliers, of steel were, in

alphabetical order: AK Steel Corporation; ArcelorMittal; California Steel Industries, Inc.;Inc; Duferco Farrell Corp; Gallatin Steel Company; North Star BlueScope Steel LLC; Nucor Corporation; SeverCorr, LLC; Severstal North America, Inc.; Steel Dynamics, Inc.; Stemcor Holdings Limited; United States Steel Corporation;Corporation (“U.S. Steel”); and USS-POSCO Industries; and WCI Steel, Inc.Industries. Alcoa, Inc. was the primary aluminum supplier for the Pressure Cylinders operating segment in fiscal 2008.2010. Major suppliers of zinc to the Steel Processing operating segment were, in

alphabetical order: Considar Metal Marketing Inc. (a/k/a HudBay),; Industrias Peñoles,oles; Teck Cominco LimitedLimited; U.S. Zinc; and Xstrata Zinc Canada. Approximately 3529 million pounds of zinc were purchased in fiscal 2008.2010. Worthington believes its supplier relationships are good.

Technical Services

Worthington employs a staff of engineers and other technical personnel and maintains fully equipped laboratories to support operations. These facilities enable verification, analysis and documentation of the physical, chemical, metallurgical and mechanical properties of raw materials and products. Technical service personnel also work in conjunction with the sales force to determine the types of flat-rolled steel required for customer needs. Additionally, technical service personnel design and engineer metal framing structures and provide sealed shop drawings to the building construction markets. To provide these services, Worthington maintains a continuing program of developmental engineering with respect to product characteristics and performance under varying conditions. Laboratory facilities also perform metallurgical and chemical testing as dictated by the regulations of the U.S.United States Department of Transportation, Transport Canada, and other associated agencies, along with International Organization for Standardization (ISO) and customer requirements. All design work complies with applicable current local and national building code requirements. An IAS (International Accreditations Service, Incorporated) accredited product-testing laboratory supports these design efforts.

Seasonality and Backlog

Sales are generally weaker in the third quarter of the fiscal year, primarily due to reduced activity in the building and construction industry as a result of the weather, as well as customer plant shutdowns in the automotive industry due to holidays. Sales are generally strongest in the fourth quarter of the fiscal year when all of the segments are normally operating at seasonal peaks.

We do not believe backlog is a significant indicator of our business.

Employees

As of May 31, 2008,2010, Worthington employed approximately 6,9006,400 employees in its operations, excluding theincluding unconsolidated joint ventures. Approximately 14%13% of these employees were represented by collective bargaining units. Worthington believes it has good relationships with its employees in general, including those covered by collective bargaining units.

Joint Ventures

As part of a strategy to selectively develop new products, markets and technological capabilities and to expand an international presence, while mitigating the risks and costs associated with those activities, Worthington participates in one consolidated and nineseven unconsolidated joint ventures.

Consolidated

Spartan Steel Coating, LLC (“Spartan”) is a 52%-owned consolidated joint venture with a subsidiary of Severstal North America, Inc. (“Severstal”), located in Monroe, Michigan. It operates a cold-rolled, hot-dipped galvanizing line for toll processing steel coils into galvanized and galvannealed products intended primarily for the automotive industry. Spartan’s financial results are fully consolidated into the Steel Processing reportable business segment. The equity ownership ofowned by Severstal is shown as minoritynoncontrolling interest on the Company’s consolidated balance sheets and itsSeverstal’s portion of operating incomenet earnings is eliminatedincluded as net earnings attributable to noncontrolling interest in miscellaneous expense on the Company’s consolidated statements of earnings.

Unconsolidated

| The Clark JV is a 50% |

|

|

Canessa Worthington Slovakia s.r.o. (“Canessa Worthington”), a 49%-owned joint venture with ClarkWestern Building Systems, Inc. The Magnetto Group, operates one manufacturing facility in Kosice, Slovakia. Canessa Worthington offers Class One steel processing servicespurpose of the Clark JV is to develop, test and obtain approvals for metal framing stud designs and to develop, own and license intellectual property related to such as slitting, blankingdesigns. The Clark JV does not manufacture or sell any products, but will license its designs to its members and cutting-to-length for customers throughout central Europe.possibly to third parties.

LEFCO Worthington, LLC (“LEFCO Worthington”), a 49%-owned joint venture with LEFCO Industries, LLC, is a minority business enterprise which offers engineered wooden crates, specialty pallets and steel rack systems for a variety of industries, including defense and automotive. LEFCO Worthington also mass produces the first light-weight, flame-resistant steel pallet designed to meet the Grocery Manufacturers Association’s capacity and compatibility standards.industries. LEFCO Worthington operates one manufacturing facility in Cleveland, Ohio.

Samuel Steel Pickling Company (“Samuel”), a 31.25%-owned joint venture with Samuel Manu-Tech Pickling, operates a steel pickling facility in Twinsburg, Ohio, and one in Cleveland, Ohio. Samuel specializes in in-line slitting, side trimming, pickle dry, under winding and the application of dry lube coatings during the pickling process.

Serviacero Planos, S.A. de C.V. (“Serviacero Worthington”), a 50%-owned joint venture with Inverzer, S.A. de C.V., operates twothree facilities in Mexico, one each in Leon, Queretaro and one in Queretaro.Monterrey. Serviacero Worthington provides steel processing services such as slitting, multi-blanking and cutting-to-length forto customers in a variety of industries including automotive, appliance, electronics and electronics related customers.heavy equipment.

TWB Company, L.L.C. (“TWB”), a 45%-owned joint venture with ThyssenKrupp Steel North America, Inc., is a leading North American supplier of tailor welded blanks, manufacturing 13 million per year.blanks. TWB produces laser-welded blanks for use in the automotive industry for products such as inner-door panels, bodysides,body sides, rails and pillars. TWB operates facilities inin: Prattville, Alabama; Monroe, Michigan; Columbus, Indiana; and in Puebla, Ramos Arizpe (Saltillo) and Hermosillo, Mexico.

Viking & Worthington Steel Enterprise, LLC (“VWSE”), a joint venture with Bainbridge Steel, LLC, an affiliate of Viking Industries, LLC, operates a steel processing facility in Valley City, Ohio. VWSE closed its manufacturing operations in June 2008 and its business will be reorganized or wound down.

Worthington Armstrong Venture (“WAVE”), a 50%-owned joint venture with Armstrong Ventures, Inc., a subsidiary of Armstrong World Industries, Inc., is one of fourthe three largest global manufacturers and multiple smaller international manufacturers of suspension grid systems for concealed and lay-in panel ceilings used in commercial and residential ceiling markets. It competes with the two other global manufacturers and numerous smaller manufacturers. WAVE operates seveneight facilities in fivesix countries: Aberdeen, Maryland; Benton Harbor, Michigan; and North Las Vegas, Nevada, within the United States; Shanghai, the Peoples Republic of China; Team Valley, United Kingdom; Valenciennes,Prouvy, France; Marval, Pune, India; and Madrid, Spain.

Worthington Specialty Processing (“WSP”), a 50%51%-owned joint venture with United StatesU.S. Steel, Corporation (“U.S. Steel”), operates athree steel processing facilityfacilities located in Canton, Jackson Michigan. The facility isand Taylor, Michigan, which are managed by Worthington Steel andSteel. WSP serves primarily as a toll processor for U.S. Steel.Steel and others. Its services include slitting, blanking, cutting-to-length, laser welding, tension leveling and warehousing. WSP processesis considered to be jointly controlled and not consolidated due to substantive participating rights of the minority partner.

|

See “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note J – Investments in Unconsolidated Affiliates” for further information about Worthington’s participation in unconsolidated joint ventures.

Environmental Regulation

Worthington’s manufacturing facilities, generally in common with those of similar industries making similar products, are subject to many federal, state and local requirements relating to the protection of the environment. Worthington continually examines ways to reduce emissions and waste and to decrease costs related to environmental compliance. The cost of compliance or capital expenditures for environmental control facilities required to meet environmental requirements are not anticipated to be material when compared with overall costs and capital expenditures and, accordingly, are not anticipated to have a material effect on the financial position, results of operations, or cash flows, or the competitive position of the Company.

Future results and the market price for Worthington Industries’ common shares are subject to numerous risks, many of which are driven by factors that cannot be controlled or predicted. The following discussion, as well as other sections of this Annual Report on Form 10-K, including “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations,” describe certain business risks. Consideration should be given to the risk factors described below as well as those in the Safe Harbor Statement at the beginning of this Annual Report on Form 10-K, in conjunction with reviewing the forward-looking statements and other information contained in this Annual Report on Form 10-K. These risks are not the only risks we face. Our business operations could also be affected by additional factors that are not presently known to us or that we currently consider to be immaterial in our operations.

Economic or Industry Downturns

The current global recession has adversely affected and is likely to continue to adversely affect our business and our industries, as well as the industries of many of our customers and suppliers. The volatile domestic and global recessionary climate is having significant negative impacts on our business. The global recession has resulted in a significant decrease in customer demand throughout nearly all of our markets, including our two largest markets – construction and automotive. The impacts of recent government approved and proposed measures, including various measures intended to provide stimulus to the economy in general or to certain industries, are currently unknown. Overall, operating levels across our businesses have fallen and may remain at depressed levels until economic conditions improve and demand increases.

Continued volatility in the United States and worldwide capital and credit markets has impacted and is likely to continue to significantly impact our end markets and result in continued negative impacts on demand, increased credit and collection risks and other adverse effects on our business. The domestic and worldwide capital and credit markets have experienced and are experiencing significant volatility, disruptions and dislocations with respect to price and credit availability. These have caused diminished availability of credit and other capital in our end markets, including automotive and construction, and for participants in, and the customers of, those markets. There is continued uncertainty as to when and if the capital and credit markets will improve and the impact this period of volatility will have on our end markets and business in general.

The construction and automotive industries account for a significant portion of our net sales, and reductions in demand from these industries have adversely impacted and are likely to continue to adversely affect our business. The overall downturn in the economy, the disruption in capital and credit markets, declining real estate values and reduced consumer spending have caused significant reductions in demand from our end markets in general and, in particular, the construction and automotive end markets.

Demand in the commercial and residential construction markets has weakened as it has become more difficult for companies and consumers to obtain credit for construction projects and the economic slowdown has caused delays in or cancellations of construction projects.

The domestic auto industry is currently experiencing a very difficult operating environment, which has resulted in and will likely continue to result in lower levels of vehicle production and an associated decrease in demand for products sold to the automotive industry. Many automotive manufacturers and their suppliers have reduced production levels and eliminated manufacturing capacity, through the closure of facilities, extension of temporary shutdowns, reduction in operations and other cost reduction actions. The difficulties faced by these industries are likely to continue to adversely affect our business.

Financial difficulties and bankruptcy filings by customers could have an adverse impact on our business. Many of our customers are experiencing extremely challenging financial conditions. General Motors and Chrysler have gone through bankruptcy proceedings and both companies have implemented

plans to significantly reduce production capacity and their dealership networks. Certain other customers have filed or are contemplating filing bankruptcy petitions. These and other customers may be in need of additional capital or credit to continue operations. The bankruptcies and financial difficulties of certain customers and/or failure in their efforts to obtain credit or otherwise improve their overall financial condition could result in numerous changes within the markets we serve, including additional plant closings, decreased production, reduced demand, changes in product mix, unfavorable changes in the prices, terms or conditions we are able to obtain and other changes that may result in decreased purchases from us and otherwise negatively impact our business. These conditions also increase the risk that our customers may default on their payment obligations to us, particularly customers in hard hit industries such as automotive and construction.

The overall weakness among automotive manufacturers and their suppliers has increased the risk that at least some of our customers, which are suppliers to the automotive industry, could have further financial difficulties. The same is true of our customers in other industries, including construction, which are also experiencing significant financial weakness. Should the economy or any applicable market not improve, the risk of bankruptcy filings by our customers will continue to increase. Such filings may result not only in a reduction in sales, but also in a loss associated with the potential inability to collect outstanding accounts receivable. While we take steps intended to mitigate the impact of financial difficulties and potential bankruptcy filings by our customers, these matters could have a negative impact on our business.

Raw Material PricesPricing and Availability

The costs of manufacturing our products and the ability to supply our customers could be negatively impacted if we experience interruptions in deliveries of needed raw materials or supplies. If, for any reason, our supply of flat-rolled steel or other key raw materials, such as aluminum and zinc, is curtailed or we are otherwise unable to obtain the quantities we need at competitive prices, our business could suffer and our financial results could be adversely affected. Such interruptions might result from a number of factors, including events such as a shortage of capacity in the supplier base or of the raw materials, energy or the inputs needed to make steel or other supplies, failure of suppliers to fulfill their supply obligations, financial difficulties of suppliers resulting in the closing or idling of supplier facilities, other significant events affecting supplier facilities, significant weather events, those factors listed in the immediately following paragraph or other factors beyond our control. Further, the number of suppliers has decreased in recent years due to industry consolidation and the financial difficulties of certain suppliers, and consolidation may continue. Accordingly, if delivery from a major supplier is disrupted, it may be more difficult to obtain an alternative supply than in the past.

Our future operating results may be affected by fluctuations in raw material prices. Our principal raw material is flat-rolled steel, which we purchase from multiple primary steel producers. The steel industry as a whole has been cyclical, and at times availability and pricing can be volatile due to a number of factors beyond our control. Thesecontrol.These factors include general economic conditions, domestic and worldwide demand, curtailed production atfrom major millssuppliers due to factors such as the closing or idling of facilities, equipment breakdowns, repairs or catastrophic events, labor costs or problems, competition, import duties, tariffs, energy costs, availability and cost of steel inputs (e.g. ore, scrap, coke energy, etc.)and energy), currency exchange rates and other factors described below under “Raw Material Availability.”immediately in the preceding paragraph. This volatility can significantly affect our steel costs.

In an environment of increasing prices for steel and other raw materials, competitive conditions may impact how much of the price increases we can pass on to our customers. To the extent we are unable to pass on future price increases in our raw materials to our customers, our financial results could be adversely affected. Also, if steel prices decrease, in general, competitive conditions may impact how quickly we must reduce our prices to our customers and we could be forced to use higher-priced raw materials to complete orders for which the selling prices have decreased.

Raw Material Availability

The costs of manufacturing our products and the ability Decreasing steel prices may also require us to supply our customers could be negatively impacted if we experience interruptions in deliveries of needed raw materials or supplies. If, for any reason, our supply of flat-rolled steel or other key raw materials, such as aluminum and zinc, is curtailed or we arewrite-down

otherwise unablethe value of our inventory to obtainreflect current market pricing, as was the quantities we need at competitive prices, our business could suffercase during fiscal 2009. These write- downs are discussed further in “Item 7. – Management’s Discussion and our financial results could be adversely affected. Such interruptions might result from a numberAnalysis of factors including events such as a shortageFinancial Condition and Results of capacity in the supplier base or of the raw materials, energy or the inputs needed to make steel or other supplies, failure of suppliers to fulfill their supply obligations, financial difficulties of suppliers, significant events affecting supplier facilities, significant weather events, those factors listed above under “Raw Material Prices” or other factors beyond our control. Further, the number of suppliers has decreased in recent years due to industry consolidation and the financial difficulties of certain suppliers, and consolidation may continue. Accordingly, if delivery from a major supplier is disrupted, it may be more difficult to obtain an alternative supply than in the past.Operations.”

Inventories

Our business could be harmed if we fail to maintain proper inventory levels. We are required to maintain sufficient inventories to accommodate the needs of our customers including, in many cases, short lead times and just-in-time delivery requirements. Although we typically have customer orders in hand prior to placement of our raw material orders for Steel Processing, we anticipate and forecast customer demand for all operating segments. We purchase raw materials on a regular basis in an effort to maintain our inventory at levels that we believe are sufficient to satisfy the anticipated needs of our customers based upon orders, customer volume expectations, historic buying practices and market conditions. Inventory levels in excess of customer demand may result in the use of higher-priced inventory to fill orders reflecting lower selling prices, if steel prices have significantly decreased. These events could adversely affect our financial results. Conversely, if we underestimate demand for our products or if our suppliers fail to supply quality products in a timely manner, we may experience inventory shortages. Inventory shortages might result in unfilled orders, negatively impacting our customer relationships, and resulting in lost revenues, any of which could harm our business and adversely affect our financial results.

Economic or Industry DownturnsSuppliers and Customers

Downturns or weakness in the economy in general or in key industries, such as construction or automotive, may adversely affect our customers, which may cause the demand for our products and services to decline and adversely affect our financial results. Many of our customers are in industries and businesses that are cyclical in nature and affected by changes in general economic conditions or conditions specific to their respective markets, such as the construction and automotive industries. Product demand in our customer’s end markets is based on numerous factors such as interest rates, general economic conditions, consumer confidence, and other factors beyond our control. Downturns in demand from the construction industry, the automotive industry or any of the other industries we serve, or a decrease in the margins that we can realize from sales of our products to customers in any of these industries, could adversely affect our financial results.

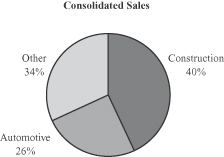

Reduced construction activity, especially in office buildings, could negatively impact our financial results. The construction market is a key end market with approximately 40% of our net sales going to that market in fiscal 2008. If construction activity in the United States, in general, or by one or more of our major customers, in particular, were to be reduced significantly, it could negatively affect our sales and financial results.

Reduced automotive/truck production and the financial difficulties of customers in this market could negatively impact our financial results. The automotive and truck market remains a key customer group with approximately 26% of the Company’s net sales derived from that market in fiscal 2008. If domestic automotive production, in general, or by one or more of our major domestic customers, in particular, were to be reduced significantly, it could negatively affect our sales and financial results.

The financial difficulties and internal strategies of customers could adversely affect us. A portion of our business is highly dependent on automotive manufacturers, many of which have publicly announced plans to

reduce production levels and eliminate excess manufacturing capacity including plans to eliminate jobs and reduce costs. These actions are impacting automotive suppliers who are also taking similar actions. Some customers in the construction and other industries are also experiencing cutbacks. The financial difficulties of certain customers and the efforts under way by our customers to improve their overall financial condition could result in numerous changes that are beyond our control, including additional unannounced customer plant closings, decreased production, changes in product mix or distribution patterns, volume reductions, labor disruptions, collectibility of our accounts receivable, mandatory reductions or other unfavorable changes in our pricing, terms or service conditions or market share losses, as well as other changes we may not accurately anticipate. These events could adversely impact our financial results.

The loss of significant volume from key customers could adversely affect us. us. In fiscal 2008,2010, our largest customer accounted for approximately 4%6% of our grossconsolidated net sales, and our ten largest customers accounted for approximately 24%27% of our grossconsolidated net sales. A significant loss of, or decrease in, business from any of these customers could have an adverse effect on our sales and financial results if we cannot obtain replacement business. Also, due to consolidation in the industries we serve, including the construction, automotive and retail industries, our gross sales may be increasingly sensitive to deterioration in the financial condition of, or other adverse developments with respect to, one or more of our top customers.