| x | Annual Report Pursuant to Section 13 OR 15(d) of the Securities |

| o | Transition Report Pursuant to Section 13 or 15(d) of the Securities |

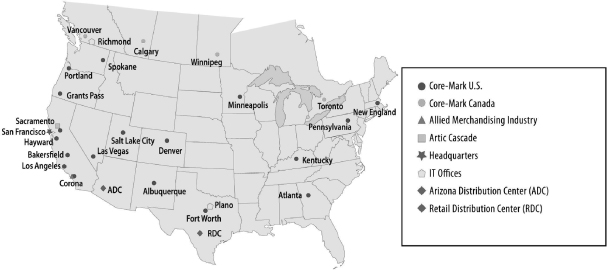

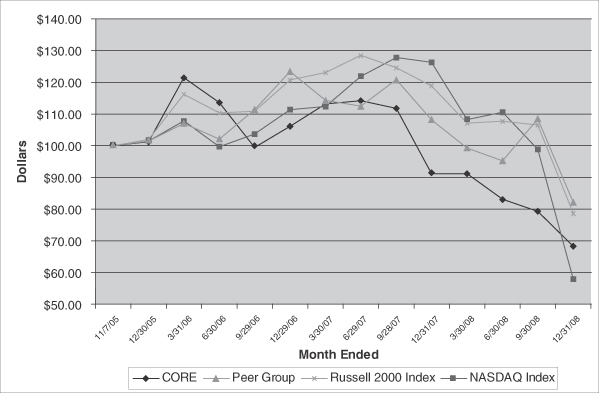

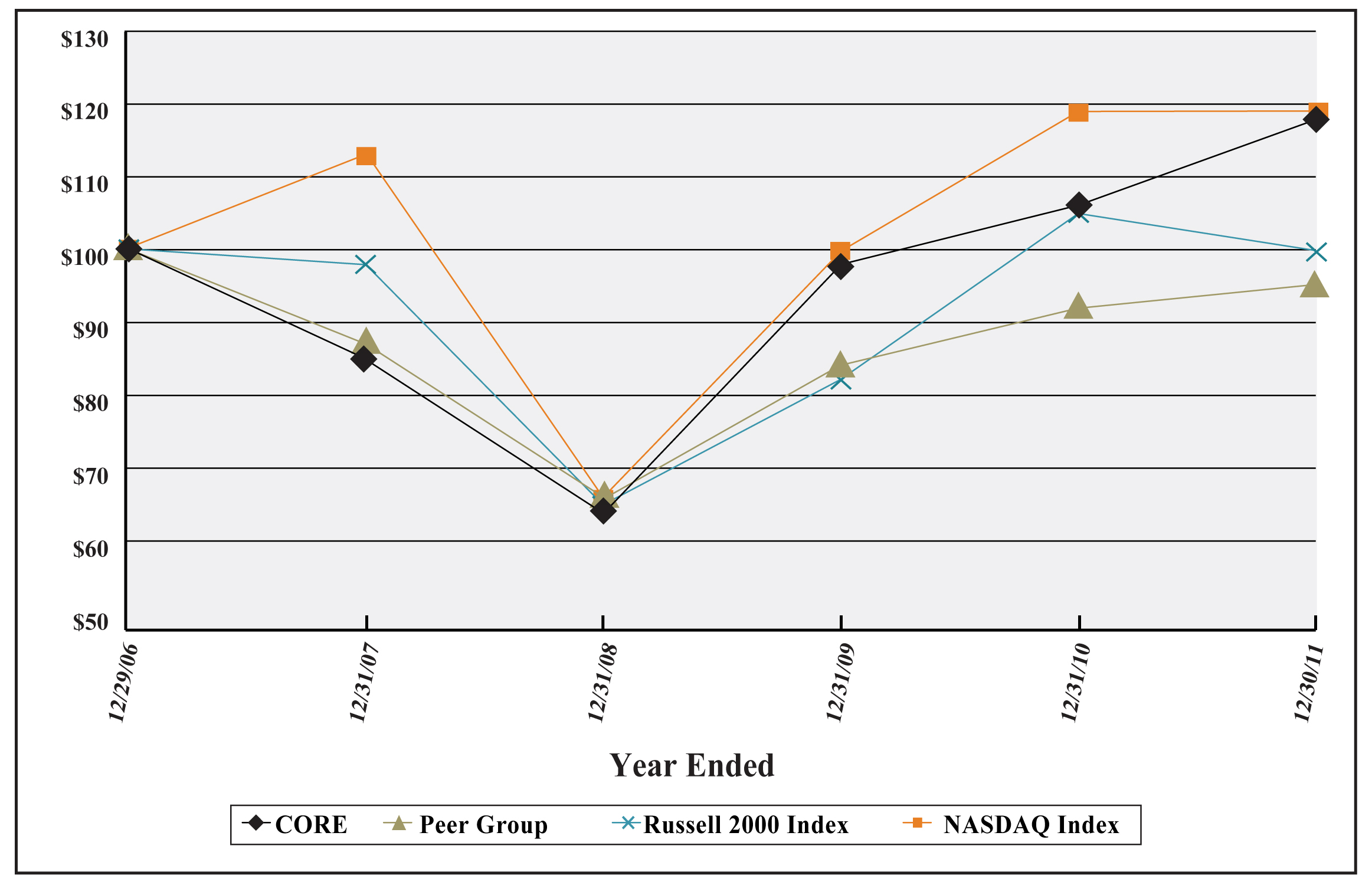

x No o $ the registrant's 2012 definitive proxy statement to be filed pursuant to Regulation 14A. ITEM 1.B. ITEM 5. ITEM 12. In addition, our wholesale distributing capabilities provide valuable services to both manufacturers of consumer products and convenience retailers. Manufacturers benefit from our broad retail coverage, inventory management and efficient processing of small orders. Convenience retailers benefit from our distribution capabilities by gaining access to a broad product line, optimizing inventory management and accessing trade credit. other specialty and small format stores that carry convenience products. located east of the Mississippi. We believe our expansion eastward will be accomplished by Cigarettes Food Candy Other Tobacco Products Health, Beauty & General Non-alcoholic Beverages Equipment / Other Total Food/Non-Food Products Total Net Sales U.S. Department of 32%. Total cigarette consumption also declined in Canada from the U.S. Our carton sales in Canada increased 0.9% in 2011 on a comparative basis to last year. Although we anticipate overall cigarette consumption will continue to decline, we expect to offset the majority of the impact from these declines through market share expansion, growth in our non-cigarette categories and incremental gross profit maintain or enhance their overall profitability. excise taxes. We believe this drive toward more healthy and fresh foods being sold in the convenience markets is a recognized major trend in the industry. We have invested a significant amount of capital to position our Company to have the proper infrastructure to successfully deliver these highly perishable items. Our objective is to consolidate the current fragmented nature of convenience store vendor distribution by consolidating such items as dairy and bread and to grow “fresh food” market share for the customers we service as they fight for consumer “share of stomach” for fresh foods with other retailers. Ultimately we believe the defragmentation of vendor deliveries coupled with market share gains in fresh foods for the stores we service will increase our customers' sales and profits and in turn improve our sales and profits. We operate a Valero Energy Corporation. At December 31, the Tampa, Florida division. Secondly, club wholesalers such as Costco and Sam's Club provide a limited selection of products at generally competitive prices, however, they often have limited delivery options and often no services. Finally, some large convenience retail chains have chosen self-distribution due to the geographic density of their stores and their belief that they can economically service such locations. MSA products. U.S. Days payable outstanding for both categories, excluding the impact of prepayments, during 2011, 2010 and 2009 averaged about 11 days. Administration, Finance, and Purchasing Sales and Marketing Warehousing and Distribution Total Categories a score of 900 or greater (on a possible 1,000 point scale). reports can be accessed through the “Investor Relations” section of our website, or throughwww.sec.gov. Also available on our website are printable versions of operating results. sales and profitability. leverage our distribution centers and other fixed assets. Our ability to retain existing customers and attract new customers is dependent upon our ability to provide industry-leading customer service, offer competitive products at low prices, maintain high levels of productivity and efficiency in distributing products to our customers while integrating new customers into our distribution system, and offer marketing, merchandising and ancillary services that provide value to our customers. If we are unable to execute these tasks effectively, we may not be able to attract a significant number of new customers and our existing customer base could decrease, either customers and reduce the volume of our sales and profitability. Successful integration of new operations will depend on our ability to manage those operations, fully assimilate the operations into our distribution network, realize opportunities for revenue growth presented by strengthened product offerings and expanded geographic market coverage, maintain the customer base, and eliminate redundant and excess costs. We may not realize the anticipated benefits or savings from an acquisition to the extent or in the time frame anticipated, if at all, or such benefits and savings may include higher costs than anticipated. In addition, we may assume both known and unknown liabilities as part of an acquisition which may increase the costs and risks associated with assimilating such operations. management. profitability. times. We cannot assure you that we will be able to renew our respective collective bargaining agreements on favorable terms, that employees at other facilities will not unionize and that our labor costs will not and Other Tobacco Products declining generally. suffer. liabilities. stock price. Our operations are also subject to regulation by the Occupational Safety and Health Administration, the Drug Enforcement Agency and other federal, state, provincial and local agencies. Each of these regulatory authorities has broad administrative powers with respect to our operations. Regulations, and the costs of complying with those regulations, have been increasing in recent years. If we fail to adequately comply with government regulations, Albuquerque, New Mexico Spokane, Washington Wilkes-Barre, Pennsylvania As of December 31, Our common stock trades on the NASDAQ Global Market under the symbol “CORE.” According to the records of our transfer agent, we had 29, 2012. Fiscal 2008 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter Fiscal 2007 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter CORE NASDAQ Index Russell 2000 Index Performance Peer Group CORE NASDAQ Index Russell 2000 Index Performance Peer Group Calendar Month/Period in which purchases were made: Mar 12, 2008—approval of share repurchase Mar 20, 2008 to Mar 31, 2008 May 1, 2008 to May 31, 2008 Jun 1, 2008 to Jun 30, 2008 Jul 1, 2008 to Jul 31, 2008 Aug 1, 2008 to Aug 31, 2008 Sept 1, 2008 to Sept 30, 2008 Oct 1, 2008 to Oct 31, 2008 Nov 1, 2008 to Nov 30, 2008 Dec 1, 2008 to Dec 31, 2008 Total Repurchases The selected consolidated financial data for the five years The following financial data should be read in conjunction with the consolidated financial statements and notes thereto and withItem 7, (in millions, except per share amounts) Statement of Operations Data: Net sales Gross profit Warehousing and distribution expenses Selling, general and administrative expenses Income from operations Interest expense, net(c) Reorganization items, net(d) Net income Per Share Data(e): Basic income per common share Diluted income per common share Shares used to compute net income per share: Basic Diluted Other Financial Data: Excise taxes(f) Cigarette inventory holding profits(g) LIFO expense Depreciation and amortization(h) Stock-based compensation Capital expenditures Balance Sheet Data: Total assets Total debt, including current maturities Canada. pricing. We continue to monitor the current macroeconomic conditions, including consumer confidence, spending, cigarette consumption, employment, inflation/deflation levels and operating results. On anticipated increase in federal excise taxes mandated by the SCHIP legislation. Net sales Net sales—Cigarettes Net sales—Food/Non-food Net sales, less excise taxes(2) Gross profit Warehousing and distribution expenses(3) Selling, general and administrative expenses Income from operations Interest expense Interest income Foreign currency transaction losses (gains), net Income before income taxes Net income average sales price per carton due primarily to were 70.4% in 2010, despite the addition of FCGC which has a lower percentage of food/non-food net sales. 2010. The increase in gross profit for 2011 was driven primarily by a $42.3 million increase in remaining gross profit, incremental cigarette inventory holding gains of $2.1 million and candy inventory holding gains of $5.9 million, both resulting from manufacturer price increases, which also contributed to a $1.7 million increase in LIFO expense. The increase in remaining gross profit was due primarily to the addition of FCGC, the new Couche-Tard business and sales increases in our food/non-food category. Net sales Net sales, less excise taxes(2) Components of gross profit: OTP tax refunds(3) LIFO expense Cigarette inventory holding profits Remaining gross profit Gross profit VCI and Fresh, to its customers. 2010. 2011 compared with 2.0%, for 2010. Net sales Net sales—Cigarettes Net sales—Food/Non-food Net sales, less excise taxes(2) Gross profit Warehousing and distribution expenses(3) Selling, general and administrative expenses Income from operations Interest expense Interest income Foreign currency transaction (gains) losses, net Income before income taxes Net income Net sales Net sales, less excise taxes(2) Components of gross profit: State of Washington OTP tax refund LIFO expense Cigarette inventory holding profits Remaining gross profit Gross profit Cigarettes Net sales Excise Taxes in Net Sales Net Sales, less excise taxes(2) LIFO expense Remaining Gross Profit(3) Remaining Gross Profit % Gross Profit(4) Gross Profit % Gross Profit % less excise taxes Food/Non-Food Products Net sales Excise Taxes in Net Sales Net sales, less excise taxes(2) LIFO expense Remaining Gross Profit(3) Remaining Gross Profit % Gross Profit(5) Gross Profit % Gross Profit % less excise taxes Totals Total Net Sales Total Excise Taxes in Net Sales Total Net Sales, less excise taxes(2) LIFO expense Remaining Gross Profit(3) Remaining Gross Profit % Gross Profit(4) (5) Gross Profit % Gross Profit % less excise taxes scheduled maturity of our debt, we expect that our current liquidity 2011 manufacturer price increases. 2011 2011 2011. 2010 Net available borrowings Amounts borrowed Outstanding letters of credit Credit Facility. $ Long-term debt(1) Purchase obligations(2) Letters of credit Operating leases Capitalized leases(3) Total contractual obligations(4)(5)(6) amount. policies currently include a deductible of $500,000 per occurrence and we maintain excess loss insurance that covers any health and welfare costs in excess of $200,000 per person per year. Gross Claims Liabilities: Workers’ Compensation Liability Auto & General Liability Health & Welfare Liability Total Gross Claims Liabilities Insurance Recoverables Reserves (net): Workers’ Compensation Liability Auto & General Liability Health & Welfare Liability Reserves (net) A 10% change in our incurred but not reported estimates would increase or decrease the estimated reserves for our plan effective December 2007. rate of compensation increases. Actual results in any given year will often differ from actuarial assumptions because of economic and other factors. In accordance with U.S. GAAP, actual results that differ from the actuarial assumptions are accumulated and amortized over future periods and, therefore, affect recognized expense and the recorded obligation in such future periods. While we believe our assumptions are appropriate, significant differences in actual results or changes in our assumptions may materially affect our pension and other assets was 7.35% for 2011 and 2010. Expected return on plan assets Discount Discount Presentation of Comprehensive Income. ASU 2011-05 requires an entity to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In full retrospective application is required. In avoid collection of applicable taxes. The competitive environment has been characterized by a continued influx of cheap products that challenge sales of higher priced and fully taxed cigarettes. Increased sales of illicit or other low priced alternatives by third parties, or sales by means to avoid the collection of applicable taxes, could have an adverse effect on our results of operations. negative impact on our liquidity. Accordingly, we may be required to obtain additional debt financing, which we may not be able to obtain on satisfactory terms or at all. Gains our gross profit, for 2010. consolidated financial statements). transactions during 2011, 2010 or 2009. (a) Financial Statements filed as part of this Annual Report on Form 10-K 1. Financial Statements A. Audited Financial Statements 2. Financial Statement Schedule Current assets: Cash and cash equivalents Restricted cash Accounts receivable, net of allowance for doubtful accounts of $8.8 million and $9.3 million, respectively (Note 5) Other receivables, net (Note 5) Inventories, net (Note 6) Deposits and prepayments (Note 5) Deferred income taxes (Note 10) Total current assets Property and equipment, net (Note 7) Deferred income taxes (Note 10) Goodwill Other non-current assets, net (Note 5) Total assets Current liabilities: Accounts payable Book overdrafts Cigarette and tobacco taxes payable Accrued liabilities (Note 5) Deferred income taxes (Note 10) Total current liabilities Long-term debt, net (Note 8) Other long-term liabilities Claims liabilities, net of current portion Pension liabilities Total liabilities Commitments and contingencies (Note 9) Stockholders’ equity: Common stock; $0.01 par value (50,000,000 shares authorized, 10,746,416 and 10,445,886 shares issued and outstanding at December 31, 2008 and December 31, 2007, respectively) Additional paid-in capital Treasury stock at cost, 396,716 shares of common stock (Note 14) Retained earnings Accumulated other comprehensive loss Total stockholders’ equity Total liabilities and stockholders’ equity Net sales Cost of goods sold Gross profit Warehousing and distribution expenses Selling, general and administrative expenses Amortization of intangible assets Total operating expenses Income from operations Interest expense Interest income Foreign currency transaction losses (gains), net Income before income taxes Provision for income taxes (Note 10) Net income Basic income per common share (Note 11) Diluted income per common share (Note 11) Basic weighted average shares (Note 11) Diluted weighted average shares (Note 11) Balance, December 31, 2005 Net income Amortization of stock-based compensation Cash proceeds from exercise of common stock Minimum pension liability adjustment, net of taxes of $0.9 SFAS No. 158 adoption adjustment, net of taxes of $0.3 Excess tax deductions associated with common stock Issuance of stock-based instruments Foreign currency translation adjustment Total comprehensive income Balance, December 31, 2006 Net income Amortization of stock-based compensation Cash proceeds from exercise of common stock FIN 48 adoption adjustments Pension plan funded status adjustment, net of taxes of $0.7 Excess tax deductions associated with common stock Issuance of stock-based instruments Foreign currency translation adjustment Total comprehensive income Balance, December 31, 2007 Net income Amortization of stock-based compensation Cash proceeds from exercise of common stock Pension plan funded status adjustment, net of taxes of $3.8 Excess tax deductions associated with common stock Issuance of stock-based instruments Repurchases of common stock Foreign currency translation adjustment Total comprehensive income Balance, December 31, 2008 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: LIFO and inventory provisions Amortization of debt issuance costs Amortization of stock-based compensation expense Bad debt expense, net Depreciation and amortization Foreign currency transaction losses (gains), net Deferred income taxes Changes in operating assets and liabilities: Accounts receivable Other receivables Inventories Deposits, prepayments and other non-current assets Accounts payable Cigarette and tobacco taxes payable Pension, claims and other accrued liabilities Income taxes payable Net cash provided by operating activities Cash flows from investing activities: Restricted cash Acquisition of business, net of cash acquired Additions to property and equipment, net Capitalization of software Proceeds from sale of fixed assets Net cash used in investing activities Cash flows from financing activities: Borrowings (repayments) under revolving credit facility, net Repurchases of common stock shares (treasury stock) Proceeds from exercise of common stock options Excess tax deductions associated with stock-based compensation (Decrease) increase in book overdrafts Net cash (used in) provided by financing activities Effects of changes in foreign exchange rates (Decrease) increase in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Supplemental disclosures: Cash paid during the period for: Income taxes, includes interest paid, net of refunds Interest Balance, beginning of period Net additions charged to operations Less: Write-offs and adjustments Balance, end of period Vendor receivables, net Insurance recoverables, current Other Total Deposits Prepayments Total Internally developed and other purchased software, net Insurance recoverables, net of current portion Debt issuance costs, net Insurance deposits, net of current portion Amortizable intangibles Other customer receivables Other assets Total Accrued payroll, retirement, and other benefits Claims liabilities, current Other accrued expenses Accrued customer incentives payable Total Inventories at FIFO, net of reserves Less: LIFO reserve Inventories at LIFO Delivery, warehouse and office equipment Equipment under Capital Leases Leasehold improvements Land and buildings Accumulated depreciation and amortization Total Amounts borrowed (Credit Facility) Obligations under Capital Leases Total Long-term debt Net available borrowings Amounts borrowed Outstanding letters of credit Year Ending December 31, 2009 2010 2011 2012 2013 Thereafter Current: Federal State Foreign Total current tax provision Deferred: Federal State Foreign Total deferred tax (benefit) provision Income tax provision Federal income tax provision at the statutory rate Increase (decrease) resulting from: State income taxes, net of federal benefit Decrease in unrecognized tax benefits Effect of foreign operations Change in valuation allowances Other, net Income tax provision Deferred tax assets: Employee benefits, including post-retirement benefits Trade and other receivables Inventories Goodwill and intangibles Self-insurance reserves State taxes Other Subtotal Less: valuation allowance Net deferred tax assets Deferred tax liabilities: Property and equipment Deferred income Other Total deferred tax liabilities Total net deferred tax assets Net current deferred tax assets Net non-current deferred tax assets Balance at beginning of year Lapse of statute of limitations Other Balance at end of year Net Income Weighted Average Shares Outstanding Net Income Common Share Net Income Weighted Average Shares Outstanding Net Income Common Share Net Income Weighted Average Shares Outstanding Net Income Common Share Basic EPS 2004 Long-Term Incentive Plan—Restricted Stock Units and Options 2005 Long-Term Incentive Plan—Restricted Stock Units 2004 Directors Equity Incentive Plan 2005 Directors Equity Incentive Plan 2007 Long-Term Incentive Plan(1) Expected life (years) Risk-free interest rate Volatility Dividend yield Weighted-average fair value per share of grants: Stock options Restricted stock units Performance shares Directors’ Directors’ Expected to Vest(2) Change in Benefit Obligation: Obligation at beginning of period Interest cost Actuarial loss (gain) Benefit payments Benefit obligation at end of period Change in Pension Plan Assets: Fair value of pension plan assets at beginning of period Actual return on plan assets Employer contributions Benefit payments Fair value of pension plan assets at end of period Funded Status: Funded status Projected benefit obligation Accumulated benefit obligation Fair value of pension plan assets Interest cost Expected return on plan assets Net periodic benefit cost Interest cost Amortization of net actuarial loss Net periodic other benefit cost Benefit Obligations: Discount rate Net Periodic Benefit Costs: Discount rate Expected return on assets Assumed current trend rate for next year Ultimate year trend rate Year that ultimate trend rate is reached Effect on total of service and interest cost components of net periodic postretirement health care benefit cost Effect on the health care component of the accumulated postretirement benefit obligation Asset Category Equity securities Debt securities Insurance contracts Other Year ended December 31, 2009 2010 2011 2012 2013 2014 through 2018 Net loss during 2007 Net loss during 2008 Year ended December 31, 2007 Current liabilities Non-current liabilities Accumulated other comprehensive loss Year ended December 31, 2008 Current liabilities Non-current liabilities Accumulated other comprehensive loss Expected amortization of net loss Net sales(8) Net sales—Cigarettes Net sales—Food/Non-food Cigarette inventory holding profits(1) Gross profit Warehousing and distribution expenses(7) Selling, general and administrative expenses Income from operations Interest expense(5) Interest income Foreign currency transaction losses, net Net income Basic net income per share(6) Diluted net income per share(6) Shares used in computing basic net income per share Shares used in computing diluted net income per share Depreciation and amortization Stock-based compensation Excise taxes(8) Net sales(9) Net sales—Cigarettes Net sales—Food/Non-food Cigarette inventory holding profits(1) Gross profit Warehousing and distribution expenses(8) Selling, general and administrative expenses Income from operations Interest expense(6) Interest income Foreign currency transaction (gains) losses, net Net income Basic net income per share(7) Diluted net income per share(7) Shares used in computing basic net income per share Shares used in computing diluted net income per share Depreciation and amortization Stock-based compensation Excise taxes(9) Net sales: United States Canada Corporate adjustments and eliminations Total Income before income taxes: United States Canada Corporate adjustments and eliminations Total Interest expense: United States Canada Corporate adjustments and eliminations Total Interest income: United States Canada Corporate adjustments and eliminations Total Depreciation and amortization: United States Canada Corporate adjustments and eliminations Total Identifiable assets: United States Canada Total Cigarettes Food Candy Other Tobacco Products Health, Beauty & General Non-Alcoholic Beverages Equipment / Other Total Food/Non-Food Products Total Net Sales opinions. The information required by this item is included in our Proxy Statement for the The information required by this item is included in our Proxy Statement for the The information required by this item is included (i) in our Proxy Statement for the Delaware 20-1489747 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) (650) 589-9445 (Address of Principal Executive Offices, including Zip Code) ( Registrant’sRegistrant's Telephone Number, Includingincluding Area Code)registered:registeredCommon Stock, par value $0.01 per share NASDAQ Global Market ¨o No x¨o No x¨oregistrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨o(Check one):¨o¨o ¨o(Do not check if a smaller reporting company).¨o No xstockequity held by non-affiliates computed by reference to the closingprice at which the common equity was last sold, or the average bid and asked price of thesuch common stockequity, as of June 30, 2008,2011, the last business day of the registrant’sregistrant's most recently completed second fiscal quarter: $277,773,841.Indicate by check mark whether397,712,744.has filed all reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by the court. Yes x No ¨As of February 27, 2009, the Registrant had 10,809,69211,398,254 shares of its common stock issued and outstanding.See Partsand IV. Registrant’s Proxy Statement for the 2009 Annual Meeting of Stockholders isthis Form 10-K will be included in an amendment to this Form 10-K or incorporated by reference to Part III in this Form 10-K. Page PagePART I ITEM 1.1ITEM 1.A.RISK FACTORS10 19ITEM 2. 20ITEM 3. LEGAL PROCEEDINGS20ITEM 4.20PART II 21 24 27 47 48 82 82ITEM 9.B. 84PART III ITEM 10.85ITEM 11.EXECUTIVE COMPENSATION85 85 85 85PART IV 86 FORWARD LOOKINGFORWARD-LOOKING STATEMENTSExcept for historical information, the statements madePrivate Securities Litigation ReformExchange Act of 1995. Forward-looking statements are based on certain assumptions or estimates, discuss future expectations, describe future plans1934 and strategies, contain projectionsthe Securities Act of results of operations or of financial condition or state other forward-looking information. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain.Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking statements. 1933.These forward-lookingForward-looking statements are made only as of the date of this Form 10-K and are based on theour current intent, beliefs, plans and expectations of our management and are subject to certainexpectations. They involve risks and uncertainties that could cause actual results to differ materially from historical results or those discusseddescribed in or implied by such forward lookingforward-looking statements.Factorsmightcould cause or contributeactual results and events to differ materially from such differences include, but are not limited to our dependence on the convenience retail industry for our revenues; uncertain and recent economic conditions; competition; price increases; our dependence on relatively few suppliers; the low-margin nature of cigarette and consumable goods distribution; certain distribution centers’ dependence on a few relatively large customers; competitionforward-looking statements is included in the labor market and collective bargaining agreements; product liability claims and manufacturer recalls of products; fuel price increases; our dependence on our senior management and key personnel; integration of acquired businesses; currency exchange rate fluctuations; our ability to borrow additional capital; governmental regulations and changes thereto; earthquake and natural disaster damage; failure or disruptions to our information systems; a general decline in cigarette sales volume; competition from sales of deep-discount brands and illicit and other low priced sales of cigarettes. Refer to Part I, Item 1A, “Risk Factors” of this Form 10-K. Except as providedrequired by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.ITEM 1.BUSINESSleading wholesale distributorslargest marketers of fresh and broad-line supply solutions to the convenience retail industry in North America in terms of annual sales, and providesproviding sales and marketing, distribution and logistics services to customer locations across the United StatesU.S. and Canada. Our origins date back to 1888, when Glaser Bros., a family-owned-and-operated candy and tobacco distribution business, was founded in San Francisco.Wholesale distributors provide valuable services to both manufacturers of consumer products and convenience retailers. Manufacturers benefit from wholesale distributors’ broad retail coverage, inventory management and efficient processing of small orders. Wholesale distributors provide convenience retailers access to a broad product line, the ability to place small quantity orders, inventory management and access to trade credit. In addition, large full-service wholesale distributors, such as Francisco, California.offeroffers retailers the ability to participate in manufacturer and Company sponsoredCompany-sponsored sales and marketing programs, merchandising and product category management services, as well as the use of information systems that are focused on minimizing retailers’retailers' investment in inventory, while seeking to maximize their sales.2007,2010, based on the NACS Association for Convenience and PetroleumFuel Retailing [formerly known as the National Association of Convenience Stores (NACS)], 20082011 State of the Industry (SOI)(“SOI”) Report, total in-store sales at convenience retail locations approximated $169increased 4.4% to approximately $190.4 billion and were generated through an estimated 146,000 stores across the United States.U.S. According to a more recent report from NACS, the number of convenience stores in the U.S. grew 1.2% in 2011 to approximately 148,000 stores. We estimate that 45% to 55%approximately 50% of the products that these stores sell are supplied by wholesale distributors such as Core-Mark. The convenience retail industry gross profit for in-store sales was approximately $45$60.1 billion in 20072010 and $44$58.6 billion in 2006.2009. Over the ten years from 19972000 through 2007,2010, convenience in-store sales increased by a compounded annual growth rate of 7.6%6.2%. Two of the factors influencing this growth were a 9.1% compounded annual growth rate in average cigarette sales for convenience retail locations and a 3.0% compounded annual growth rate in the number of stores.approximately 24,000over 28,000 customer locations in all 50 states of the Unites StatesU.S. and 5five Canadian provinces. The products we distribute include cigarettes, other tobacco products, candy, snacks, fast food, groceries, fresh products, dairy, non-alcoholicbread, beverages, general merchandise and health and beauty care products. We service traditional convenience stores as well as alternative outlets selling convenience products. Our traditional convenience store customers include many of the major national and super-regional convenience store operators, as well as thousands of multimulti- and single-store customers. Our alternative outlet customers comprise a variety of store formats, including druggrocery stores, grocerydrug stores, liquor stores, cigarette and tobacco shops, hotel gift shops, correctional facilities, military exchanges, college bookstores, casinos, video rental stores,movie theaters, hardware stores, airport concessions and airport concessions.in 14 states and Canada, including (excluding two distribution centers thatfacilities we operate as a third-partythird party logistics provider.provider) in the U.S. and Canada. We distribute approximately 42,000 SKUs (Stockin excess of 45,000 Stock Keeping Units)Units ("SKUs") of packaged consumable goods to our customers and also provide an array of information and data services that enable our customers to better manage retail product sales and marketing functions.2008,2011, our consolidated net sales increased 8.7%11.7% to $6,044.9 million$8.1 billion from $5,560.9 million$7.3 billion in 2007.2010. Cigarettes comprised approximately 68.2%70.4% of total net sales in 2008,2011, while approximately 71.0%68.3% of our gross profit was generated from food/non-food products.Francisco.Francisco, California. The executive management team, comprised of our CEO and 14 senior managers, has largely overseen the operationsan average tenure of Core-Mark for more than a decade, bringing theirover 16 years and applies its expertise to critical functional areas including logistics, sales and marketing, purchasing, information technology, finance, business development, human resources and retail store support.InnovativeInnovation & Flexible.Flexibility. Wholesale distributors typically provide convenience retailers access to a broad product line, the ability to place small quantity orders, inventory management and access to trade credit. As a large, full-service wholesale distributor we offer retailers the ability to participate in manufacturer and Company sponsoredCompany-sponsored sales and marketing programs, merchandisingretailers’retailers' investment in inventory, while seeking to maximize their sales.profitability and cash flow.profitability. To achieve that objective, we have become one of the largest marketers of fresh and broad-line supply solutions to the convenience retail industry in North America. In order to further enhance our value to the retailer, we plan to:(VCI)(“VCI”).We expect our VCI program will allow us to grow by capitalizing on the highly fragmented nature of the distribution channel that services the convenience retail industry. A convenience retailer generally receives their store merchandise through a large number of unique deliveries. This represents a highly inefficient and costly process for the individual stores. Today, we estimate that Core-Mark sells about 50% of what a convenience retailer purchases from their vendors. Our VCI program offers convenience retailersthe retailer the ability to receive one deliverymultiple weekly deliveries for the bulk of their products, including dairy and other perishable items, thus simplifyingmerchandise they would historically purchase from direct-store-delivery companies. This simplifies the supply chain and eliminatingas a by-product, retailers will improve inventory turns and working capital, eliminate operational costs.and transaction costs, and they will also greatly diminish their out-of-stocks on best-selling items.WeTo meet this expected demand, we have modified and upgraded our refrigerated capacity, including investing in chill docks state-of-the-art ordering devices and tri-temperature trailers, which enables us to deliver a significant range of chilled items including milk, produce and other fresh foods to retail outlets. We now have established partnerships with strategically located bakeries and commissaries to further enable us to deliver the in-house expertisefreshest product possible, with premium consumer items such as sandwiches, wraps, cut-fruit, parfaits, pastry, doughnuts, bread and experiencesome home meal replacement entrées (“HMR”). We continue to properly source, handle and market this highly perishable product line. We intend on expandingexpand the deliveryarray of fresh food and dairy products through the development of unique and comprehensive marketing programs. In addition, we have launchedprograms, including equipment programs that assist the retailer in obtaining the proper equipment to showcase their “fresh” product offering. We believe our investments in infrastructure, combined with our strategically located suppliers and in-house expertise, position us as the leader in providing fresh products and programs to convenience stores. Proper execution of VCI, with the cornerstone being dairy distribution, affords Core-Mark the critical mass necessary to offer retailers a rebranding program to properly reflectmultiple weekly delivery platform, which ensures the role this new fresh product line will play in the Company’sproper handling and the industry’s future.dating of "Fresh" products.expandingcontinuing to expand our presence east of the Mississippi. According to theThe Association for Convenience and Petroleum& Fuel Retailing 20082011 SOI Report, during 2007,2010, aggregate United StatesU.S. traditional convenience retail in-store sales were approximately $169$190.4 billion through approximately 146,000 stores with mostthe majority of those storesacquiringgaining new customers, both national and regional, through a combination of exemplary service, VCI programs, fresh product deliveries, innovative marketing strategies, and competitive pricing. In addition, we intend to explore selectpricing and acquisitions of other wholesale distributors which complementsmaller distributors.business. eastward expansion include:June 2006,September 2011, we signed a distribution agreement with Alimentation Couche-Tard, Inc. ("Couche-Tard") to service approximately 970 additional Couche-Tard corporate stores within Couche-Tard's Southeast, Gulf Coast and Florida markets. This distribution agreement led to the addition of our newest distribution facility located in Tampa, Florida.Klein Candy Company, L.P. (“Pennsylvania division”) surrounding states, which has provided Core-Mark with additional infrastructure and market share in the Southeastern region of the U.S. (See Note 3 --Acquisitions to further our eastern expansion. consolidated financial statements).January 2008, we opened a new distribution facility near Toronto, Ontario. This new facility expanded our existing market geography in Canada. In June 2008,August 2010, we acquired Auburn MerchandiseFinkle Distributors, Inc., (“AMD” or “New England division”FDI”), a convenience wholesaler servicing customers in New York, Pennsylvania and the surrounding states, to furthercontinue to expand our presence and infrastructuremarket share in the Northeastern region of the United StatesU.S. (See Note 3—Acquisitions)3 --Acquisitions to our consolidated financial statements).us being ableour ability to deliver consistently high levels of service, innovative marketing programs and information technology and logistics support. To that fundamental end, we are committed to further improving our operational efficiencies in our distribution centers while containing our costs in order to enhance profitability. To further enhance our competitive advantage, we have been one of the first to recognize emerging trends and to offer to the retailerretailers our unique marketing programs such as VCI and Fresh. In addition, we continue to roll out our Focused Marketing Initiative (“FMI”). This program is designed to drive deeper entrenchment with our customer base and to further differentiate ourselves in the market place. The FMI program is centered on increasing the profitability of the independent store through improved category insights and store management, maximizing geographic specific consumer preferences and habits as well as other available data resources. We believe this innovationour innovative approach which focuses on building a trusted partnership with our customers has established us as the market leader in providing valuable marketing and supply chain solutions into the convenience retail industry.approximately 24,000over 28,000 customer locations in all 50 states of the United StatesU.S. and 5five Canadian provinces. Our customers represent many of the large national and regional convenience retailers in the United StatesU.S. and Canada and leading alternative outlet customers. Our top ten customers accounted for approximately 30.1%31.5% of our net sales in 2008, while our largest2011. While no single customer accounted for approximately 7.5%10% or more of our total net sales in 2008.2011, Couche-Tard grew to approximately 13% of our net sales in the fourth quarter of 2011 due largely to sales under the new distribution agreement.(in(dollars in millions): Year ended December 31, 2011 2010 2009 Net Sales % of Net Sales Net Sales % of Net Sales Net Sales % of Net Sales Cigarettes $ 5,710.6 70.4 % $ 5,119.7 70.5 % $ 4,589.1 70.3 % Food 995.7 12.3 % 840.9 11.6 % 738.0 11.3 % Candy 459.8 5.7 % 426.0 5.8 % 405.0 6.2 % Other tobacco products 607.9 7.5 % 503.6 6.9 % 434.0 6.6 % Health, beauty & general 237.5 2.9 % 220.6 3.0 % 209.5 3.2 % Beverages 100.9 1.2 % 152.0 2.1 % 151.7 2.3 % Equipment/other 2.5 — % 4.0 0.1 % 4.3 0.1 % Total food/non-food products 2,404.3 29.6 % 2,147.1 29.5 % 1,942.5 29.7 % Total net sales $ 8,114.9 100.0 % $ 7,266.8 100.0 % $ 6,531.6 100.0 % 2008 2007 2006 Net Sales % of Net

Sales Net Sales % of Net

Sales Net Sales % of Net

Sales $ 4,124.8 68.2 % $ 3,863.1 69.5 % $ 3,783.8 71.2 % 710.1 11.7 % 596.7 10.7 % 522.4 9.8 % 401.3 6.7 % 349.8 6.3 % 318.3 6.0 % 402.7 6.7 % 353.4 6.4 % 322.6 6.1 % 220.1 3.6 % 206.2 3.7 % 187.7 3.5 % 180.9 3.0 % 186.4 3.4 % 174.3 3.3 % 5.0 0.1 % 5.3 0.1 % 5.3 0.1 % 1,920.1 31.8 % 1,697.8 30.5 % 1,530.6 28.8 % $ 6,044.9 100.0 % $ 5,560.9 100.0 % $ 5,314.4 100.0 % United StatesU.S. and Canadian manufacturers. With cigarettes accounting for approximately $4,124.8$5,710.6 million or 68.2%70.4% of our total net sales and 29.0%31.7% of our total gross profit in 2008,2011, we control major purchases of cigarettes centrally in order to optimize inventory levels and purchasing opportunities. The daily replenishment of inventory and brand selection is controlled by our distribution centers.United Statessince 1980.over the last ten years. Based on 20072011 statistics provided by the Tobacco Merchants Association (TMA)(“TMA”) published in early 20082012 and compiled from the United StatesAgriculture-EconomicAgriculture - Economic Research Service, total cigarette consumption in the United StatesU.S. declined from 480444 billion cigarettes in 19972001 to 362300 billion cigarettes in 2007,2011, or a 25% reduction in consumption. Prior to 2007, we had benefitted from a shift in cigarette and tobacco sales to the convenience retail segment. According to the most recent statistic available on the growth of cigarette sales in the convenience retail segment in the NACS 2007 SOI Report (which includes data through December 31, 2006), the convenience retail portion of aggregate United States cigarette sales increased from approximately 54% in 1999 to 64% in 2006. In 2007, convenience retailers were the largest trade class for cigarette sales accounting for approximately 69% of total industry volume according to the R.J. Reynolds’ 2007 Industry Report.45.541 billion cigarettes in 19972001 to 14.125 billion cigarettes in 2007,2011, or a 69%39% reduction in consumption, accordingbased on the 2011 statistics provided by TMA. In 2011 our carton sales increased 9.2% due to consumption statistics publishedthe incremental sales attributable to the FCGC and FDI acquisitions, the new distribution agreement with Couche-Tard and one additional selling day this year compared to 2010. Excluding these items, carton sales decreased 1.9% in 2008 by Canada’s central statistical agency, Statistics Canada.declined 1.0%decline in 2008 and 1.4% in 2007, excluding carton sales made by the new divisions, Toronto and New England. The shift in cigarette carton sales from other channelsorder to the convenience retail segment may no longer be adequate to compensate for consumption declines.thesestate, local and provincial excise taxes from our customers and remit these amounts to the appropriate authorities. Excise taxes are a significant component of our revenuenet sales and cost of sales. During 2008,2011, we included in net sales approximately $1,474.4$1,951.5 million of state, local and provincial excise taxes. As of December 31, 2008,2011, state cigarette excise taxes in the United StatesU.S. jurisdictions we serve ranged from $0.07$0.17 per pack of 20 cigarettes in South Carolinathe state of Missouri to $2.75$4.35 per pack of 20 cigarettes in the state of New York. In the Canadian jurisdictions we serve, provincial excise taxes ranged from C$2.47 per pack of 20 cigarettes in Ontario to C$4.205.72 per pack of 20 cigarettes in the Northwest Territories.In the United States, legislation was introduced in 2008 to fund the State Children’s Health Insurance Program (SCHIP) by raising the federal cigarette excise tax from 39¢ to $1.01 per pack. Federal excise taxes are levied on the manufacturers who pass the tax is includedon to us as part of the product cost and thus are not a component of our product cost charged by the manufacturer. The legislation, which was signed into law in February 2009, becomes effective on April 1, 2009.Food and Non-FoodFood/Non-food Products.TheOur food category includesproducts include fast food, candy, snacks, groceries, beverages, fresh products such as sandwiches, juices, salads, produce, dairy and bread. FoodOur non-food products include cigars, tobacco, health and Non-foodbeauty care products, general merchandise and equipment. Net sales of the combined food/non-food product categories were $1,920.1grew 12.0% in 2011 to $2,404.3 million, which was 29.6%of our total net sales. Excluding a reduction in our beverage product category resulting from the movement of Gatorade to a direct-store-delivery format during the first quarter of 2011, net sales in 2008 and account for approximately 31.8% of our sales, however, thesefood/non-food category increased 15.6% in 2011 compared to 2010. Gross profits for food/non-food categories represented approximately 71.0%grew $30.8 million, or 11.6%, to $296.7 million, which was 68.3% of our total gross profit. We structureFood/non-food products generated gross margins of 13.40% excluding excise taxes in 2011, while the cigarette category generated gross margins of 3.48% excluding excise taxes.marketingkey business strategies, VCI and merchandising programs around theseour fresh initiative, focus primarily on the higher margin categories in the food group. These categories include milk, fresh bread, fresh sandwiches, fresh fruit, fresh produce, fresh baked goods, home replacement meals and other fresh and natural products.3,8004,300 trade suppliers and manufacturers located across the United StatesU.S. and Canada. In 2008,2011, we purchased approximately 61%63% of our products from our top 20 suppliers, with our top two suppliers, Philip Morris and R.J. Reynolds, representing approximately 27% and 14% of our purchases, respectively. We coordinate our purchasing from suppliers by negotiating, on a corporate-wide basis, special arrangements to obtain volume discounts and additional incentives, while also taking advantage of promotional and advertisingmarketing incentives offered to us as a wholesale distributor. In addition, buyers in each of our distribution facilities purchase products, particularly food, directly from the manufacturers, improving product mix and availability for individual marketsmarkets.reducinghigher gross profits during the warm weather months (May through September) than in other times throughout the year. We believe this occurs because the convenience store industry which we serve tends to be busier during this period due to vacations and travel by consumers. During the second and third quarters of 2011, 2010 and 2009, we generated approximately 53% of our inventory investment.net sales for each fiscal year.Operationstotalnetwork of 26 distribution centers consisting(excluding two distribution facilities we operate as a third party logistics provider). In 2011, we acquired FCGC in Arkansas and we added a distribution center in Tampa, Florida initially to support a new distribution agreement with Couche-Tard by servicing their Southeast, Gulf Coast and Florida regions. Twenty-two of 22our distribution centers are located in the United StatesU.S. and four are located in Canada as of December 31, 2008.Canada. The map below describesdepicts the scope of our operations and distribution centers.

United States,U.S., Artic Cascade and Allied Merchandising Industry, are consolidating warehouses which buy products from our suppliers in bulk quantities and then distribute the products to many of our other distribution centers. By using Artic Cascade, located in Sacramento, California, to obtain products at lower cost from frozen product vendors, we are able to offer a broader selection of quality products to retailers at more competitive prices. Allied Merchandising Industry, located in Corona, California, purchases the majoritya portion of our non-foodnon-cigarette products, other than cigarettesprimarily health and tobacco products,beauty care and general merchandise items, for our distribution centers enabling us to reduceoptimize our overall general merchandise and health and beauty care product inventory.inventory to meet the needs of our customers. We operate two additional facilities as a third party logistics provider. One distribution facility located in Phoenix, Arizona, referred to as the Arizona Distribution Center (ADC)(“ADC”), is dedicated solely to supporting the logistics and management requirements of one of our major customers, Alimentation Couche-Tard.Couche-Tard, Inc. The second distribution facility located in San Antonio, Texas, referred to as the Valero Retail Distribution Center (RDC)(“RDC”), is dedicated solely to supporting another major customer, Valero.totaling approximately 42,000in excess of 45,000 SKUs, including approximately 4,900 SKUs ofover 2,000 cigarette and other tobacco products, from our suppliers and manufacturers. We offer customers a variety of food and food/non-food products, including fast food, candy, snacks, fast food, groceries, fresh products, dairy, non-alcoholicbread, beverages, other tobacco products, general merchandise and health and beauty care products.is comprisedconsists of a mix of dry, frozen and chilled products. Our receivers, stockers, order selectors, stampers, forklift drivers and loaders received, stored and picked nearly 435approximately 476 million, 407454 million and 405426 million items (a carton of 10 packs of cigarettes is one item) or 6671 million, 6471 million and 5965 million cubic feet of product, during the years ended December 31, 2008, 20072011, 2010 and 2006,2009, respectively, while limiting the service error rate to approximately threetwo errors per thousand items shipped(Note—these performance metrics do not include those of the Pennsylvania division prior to Core-Mark integrating them into our distribution system on October 1, 2006, and those of our New England division—See Note 3—Acquisitions). in 2011.or DCMS,("DCMS") platform provides our distribution centers with the flexibility to adapt to our customers’customers' information technology requirements in an industry that does not have a standard information technology platform. Actively integrating our customers intoonto our platform is a priority which enables fast, efficient and reliable service.Distribution2008,2011, we had approximately 9081,128 transportation department personnel, including delivery drivers, shuttle drivers, routers, training supervisors and managers who focus on achieving safe, on-time deliveries. Our daily orders are picked and loaded nightly in reverse order of scheduled delivery. At December 31, 2008,2011, our trucking fleet consisted of approximately 671700 tractors, trucks and vans, of which nearly all were leased. We have made a significant investment over the past few years in upgrading our trailer fleet to tri-temperature (“tri-temp”) which gives us the capability to deliver frozen, chilled and non-refrigerated goods in one delivery. As of December 31, 2008, over 40%2011, approximately 70% of our fleet consisted oftrailers were tri-temp, trailers with the remainder capable of delivering refrigerated and non-refrigerated foods. This provides us the multiple temperature zone capability needed to support our focus on delivering fresh products to our customers. Our fuel consumption costs for 20082011 totaled approximately $9.4$13.0 million, net of fuel surcharges passed on to customers, which represented an increase of approximately $2.4$3.5 million, from $7.0$9.5 million in 20072010, due to increasedhigher fuel prices, a 5.9% increase in miles driven, the acquisition of FCGC and the additionsaddition of two new divisions.2008,2011, there were approximately 350300 wholesale distributors toserving traditional convenience retailers in the United States.U.S. We believe that Core-Mark and McLane Company, Inc., a subsidiary of Berkshire Hathaway, Inc., and Core-Mark are the two largest convenience wholesale distributors measured(measured by annual sales,sales) in North America. There are alsotwo other large regional companies that provide products to specific regionsareas of the country, such as The H.T. Hackney Company in the Southeast and Eby-Brown Company in the Midwest and Mid-Atlantic and Southeast and GSC Enterprises, Inc. in Texas and surrounding states, andregions. In addition there are several hundred local distributors serving small regional chains and independent convenience retailers. In Canada, there are fewertwo large regional players, aside from Core-Mark, that make up the competitive landscape, Karrys Wholesale Distributors and Wallace and Carey, Inc.distributors compared to the United States. In addition,supply channels, we face potential competition from at least three other supply avenues. First, certain manufacturers such as Budweiser, Miller-Coors, Coca-Cola, bottlers, Frito Lay,Frito-Lay and Interstate BakeriesPepsiCo deliver their products directly to convenience retailers.decentralized distribution centers, order fulfillment rates, on time deliveries,on-time delivery performance using delivery equipment sized for the small format store, innovative marketing solutions and merchandising support, as well as competitive pricing. At least oneWe believe this represents a contrast to some large competitors who offer a standardized logistics approach, with emphasis on uniformity of our major competitors currently operatesproduct lines, and company determined delivery schedules using large delivery equipment designed for large format stores. We believe this emphasis on a standardized logistics model that concentrates onapproach, while it allows for competitive pricing, using large distribution centersis not best suited for retailers looking for more customized solutions and providingsupport from their supply partners in addition to competitive order fulfillment rates. This logistics model, however, may result in less certain delivery times and could leave the customer to perform all of the merchandising functions. Many of ourpricing. Alternatively, some small competitors focus on customer service from small distribution facilities and concentrate on long-standing customer relationships.relationships but often lack the range of offerings of the larger distributor. We believe that our unique combination of service, marketing solutions and price is a compelling combination that is highly attractive to customersretailers and mayhelps to enhance their growth and profitability.industry’sindustry's Master Settlement Agreement (MSA)(“MSA”), which was signed in November 1998. Since then, we have experienced increased wholesale competition for cigarette sales. Competition amongst cigarette wholesalers is based primarily on service, price and variety, whereas competition amongst manufacturers for cigarette sales is based primarily on brand positioning, price, product attributes, consumer loyalty, promotions, advertisingmarketing and retail presence. Cigarette brands produced by the major tobacco product manufacturers generally require competitive pricing, substantial marketing support, retail programs and other financial incentives to maintain or improve a brand’sbrand's market position. Historically, major tobacco product manufacturers have had a competitive advantage in the United StatesU.S. because significant cigarette marketing restrictions and the scale of investment required to compete made gaining consumer awareness and trial of new brands difficult. also face competition from the diversion into the U.S. and Canadian markets of cigarettes intended for sale outside of such markets, the sale of cigarettes in non-taxable jurisdictions, inter-state/provincial and international smuggling of cigarettes, the sale of counterfeit cigarettes by third parties, increased imports of foreign low priced brands, the sale of cigarettes by third parties over the internet and by other means designed to avoid collection of applicable taxes, includingtaxes. The competitive environment has been characterized by a continued influx of cheap products that challenge sales of higher priced and fully taxed cigarettes. sale of cigarettes in non-taxable jurisdictions, imports of foreign low priced brands, and the diversion into the United States market of cigarettes intended for sale outside the United States. The competitive environment has been impacted by alternative smoking products, such as snus and snuff, and highersnuff. In addition, cigarette prices continue to rise due to higher statecontinuing pressure on taxing jurisdictions to raise revenues through excise taxes andtaxes. Further, cigarette list price increasesprices have historically increased for cigarettes manufactured bythose manufacturers who are parties to the MSA. As a result, the lowest of manufacturers of numerous small share brands manufactured by companies that are not parties to the MSAnon-MSA participants have held their market share, putting profitability pressure on the profitability of premium cigarettes.9nine days for 20082011, 2010 and 10 days for 2007.2009. Credit terms may impact pricing and are competitive within our industry. An increasing number of our customers remit payment electronically, which facilitates efficient and timely monitoring of payment risk. Canadian days sales outstanding in receivables tend to be lower as Canadian industry practice is for shorter credit terms than those in the United States.items.items and periodically we may carry higher levels of inventory to take advantage of manufacturer price increases. The number of days of cost of sales in inventory averaged about 16 days during 2011 and about 15 days during 20082010 and 2007.2009. The increase of one day cost of sales in 2011 compared to 2010 was driven primarily by speculative purchases to take advantage of expected price increases by manufacturers. and consistent with our credit standing. We take advantage of the full complement of vendorterm offerings, including early payment terms. Our dayswhich may include enhanced cash discounts for earlier payment. Terms for our accounts payable outstanding during 2008 averaged 12 days, includingand cigarette and tobacco taxes payable as compared to 11 days for 2007, with a range ofanywhere from three days prepaid to 3060 days credit.EmployeesAsThe following chart provides a breakdown of our employees by function and geographic region (including employees at our third party logistic facilities) as of December 31, 2008, we had 4,181 employees, including 578 in administration, finance and purchasing, 1,026 in sales and marketing, and 2,577 in warehousing and distribution functions. Of these employees, 457 employees are located in Canada and the remainder in the United States. 2011: U.S. Canada Total Sales and Marketing 1,095 47 1,142 Warehousing and Distribution 2,792 248 3,040 Management, Administration, Finance and Purchasing 569 101 670 Total Categories 4,456 396 4,852 employ peoplehave employees who are covered by collective bargaining agreements with local affiliates of The International Brotherhood of Teamsters (Hayward and Las Vegas) and United Food and Commercial Workers (Calgary). Approximately 199188 employees, or 4.8%3.9% of our workforce, are unionized. There have been no disruptions in customer service, strikes, work stoppages or slowdowns as a result of union activities, and we believe we have satisfactory relations with our employees.TOTAL EMPLOYEES BY BUSINESS FUNCTIONS December 31, 2008 United States Canada Total