UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 20092012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-8399

WORTHINGTON INDUSTRIES, INC.

(Exact Name of Registrant as Specified in its Charter)

Ohio | 31-1189815 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

200 Old Wilson Bridge Road, Columbus, Ohio | 43085 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: | (614) 438-3210 | |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Shares, Without Par Value |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the | Yes |

Indicate by check mark if the registrant

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the Indicate by check mark whether the Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Indicate by check mark whether the Large accelerated filer Indicate by check mark whether the The aggregate market value of the Common Shares (the only common Indicate the number of shares outstanding of each of the DOCUMENT INCORPORATED BY REFERENCE: Selected portions of the Registrant’s definitive Proxy Statement to be furnished to shareholders of the Registrant in connection with the Annual Meeting of Shareholders to be held on September

i Selected statements contained in this Annual Report on Form 10-K, including, without limitation, in “PART I – Item 1. – Business” and “PART II – Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations,” constitute “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements reflect our current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “intend,” “estimate,” “plan,” “foresee,” “likely,” “will,” “should” or other similar words or phrases. These forward-looking statements include, without limitation, statements relating to:

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow:

ii

We note these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, you should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Any forward-looking statements in this Annual Report on Form 10-K are based on current information as of the date of this Annual Report on Form 10-K, and we assume no obligation to correct or update any such statements in the future, except as required by applicable law.

iii PART I General Overview Worthington Industries, Inc. is a corporation formed under the laws of the State of Ohio (individually, the “Registrant” or “Worthington Industries” or, collectively with the subsidiaries of Worthington Industries, Inc., “we,” “our,” Worthington is headquartered at 200 Old Wilson Bridge Road, Columbus, Ohio 43085, telephone (614) 438-3210. The common shares of Worthington Industries are traded on the New York Stock Exchange under the symbol WOR. Worthington Industries maintains an Internet web site at www.worthingtonindustries.com. This uniform resource locator, or URL, is an inactive textual reference only and is not intended to incorporate Worthington Industries’ web site into this Annual Report on Form 10-K. Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as Worthington Industries’ definitive annual meeting proxy materials filed pursuant to Section 14 of the Exchange Act, are available free of charge, on or through the Worthington Industries web site, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”).

At the end of the fiscal year ended May 31,

the joint venture. As of August 31, 2011, all of the retained facilities had ceased operations. Accordingly, the financial results and operating performance of the retained facilities have been reported within Metal Framing through August 31, 2011. The contributed net assets, which were deconsolidated effective March 1, 2011, have been reported within Metal Framing on a historical basis. All other operating segments are combined and disclosed in the Other category, which also includes income and expense items not allocated to our reportable business segments. The Other category includes the Worthington Steelpac Systems, LLC (“Steel Packaging”) and Worthington Global Group, LLC (the “Global Group”) operating segments as well as the former Automotive Body Panels operating segment, on a historical basis, through May 9, 2011. On May 9, 2011, we closed an agreement to combine certain assets of The Gerstenslager Company (“Gerstenslager”) and International Tooling Solutions, LLC in a new joint venture, ArtiFlex Manufacturing, LLC (“ArtiFlex”). In exchange for the contributed net assets, we received a 50% noncontrolling ownership interest in the new joint venture in addition to certain cash and other consideration. We hold equity positions in 12 joint ventures, which are further discussed in theJoint Ventures section herein. The PSI Energy Solutions, LLC, Spartan, and WNCL joint ventures are consolidated with their operating results reported within the Other, Steel Processing and Pressure Cylinders reportable business segments, respectively. During fiscal 2012, the Steel Processing, Pressure Cylinders and Engineered Cabs operating segments served approximately 1,100, 4,100 and 100 customers, respectively, located primarily in the United States. Foreign operations accounted for approximately 8% of consolidated net sales during fiscal 2012 and were comprised primarily of sales to customers in Europe. No single customer accounted for over 10% of consolidated net sales during fiscal 2012. Refer to “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note M – Segment Data” of this Annual Report on Form Recent Developments On March 22, 2012, we acquired a 75% ownership interest in PSI Energy Solutions, LLC (“PSI”). PSI is On January 10, 2012, we announced a voluntary recall of our MAP-PRO®, propylene and MAAP® cylinders and related hand torch kits. The recall was a precautionary step and involved a valve supplied by On December 29, 2011, we acquired the outstanding economic interests of Angus Industries, Inc. (“Angus”). Angus designs and manufactures high-quality, custom-engineered open and closed cabs and operator stations for a wide range of heavy mobile equipment. In connection with this acquisition, we established a new operating segment, Engineered Cabs, which is comprised of the operations of Angus and is considered a separate reportable segment. On December 1, 2011, we acquired the propane fuel cylinders business of The Coleman Company, Inc. (“Coleman Cylinders”). The acquired net assets became part of our Pressure Cylinders operating segment upon closing of the transaction. Subsequent to closing, we received a request from the Federal Trade Commission, asking us to provide, on a voluntary basis, certain information related to the acquisition and the industry as it conducts a preliminary investigation into the transaction. The acquisition fell below the threshold for pre-merger notification under the Hart-Scott-Rodino Act. On September 30, 2011, we completed the acquisition of Poland-based STAKO sp.Z o.o. (“STAKO”). STAKO manufactures liquefied natural gas, propane and butane fuel tanks for use in passenger cars, buses and trucks. The acquired business became part of our Pressure Cylinders operating segment upon closing of this transaction. On July 1, 2011, we purchased substantially all of the net assets (excluding accounts receivable) of the BernzOmatic business (“Bernz”) of Irwin Industrial Tool Company, a subsidiary of Newell Rubbermaid, Inc. Bernz is a leading manufacturer of hand held torches and accessories. The acquired net assets became part of our Pressure Cylinders operating segment upon closing of the transaction. Transformation Plan In our fiscal year ended May 31, 2008 (“fiscal 2008”), we initiated a We completed the transformation phases in each of the core facilities within our Steel Processing operating segment in fiscal 2011, and

As of May 31,

Steel Processing

Worthington Steel is one of

Worthington Steel buys coils of steel from integrated steel mills and mini-mills and processes them to the precise type, thickness, length, width, shape

pickling, a chemical process using an acidic solution to remove surface oxide which develops on hot-rolled steel;

slitting, which cuts steel to specific widths;

cold reducing, which achieves close tolerances of hot-dipped galvanizing, which coats steel with zinc and zinc alloys through a

hydrogen annealing, a thermal process that changes the hardness and certain metallurgical characteristics of steel;

cutting-to-length, which cuts flattened steel to exact lengths;

tension leveling, a method of applying pressure to achieve precise flatness tolerances for steel;

edging, which conditions the edges of the steel by imparting round, smooth or knurled edges;

non-metallic coating, including dry lubrication, acrylic and

configured blanking, which stamps steel into specific shapes. Worthington Steel also toll processes steel for steel mills, large end-users, service centers and other processors. Toll processing is different from typical steel processing in that the mill, end-user or other party retains title to the steel and has the responsibility for selling the end product. Toll processing enhances Worthington Steel’s participation in the market for wide sheet steel and large standard orders, which is a market generally served by steel mills rather than by intermediate steel processors. The steel processing industry is fragmented and highly competitive. There are many competitors, including other independent intermediate processors. Competition is primarily on the basis of price, product quality and the ability to meet delivery requirements. Technical service and support for material testing and customer-specific applications enhance the quality of products (See “Item 1. – Business – Technical Services”). However, the extent to which technical service capability has improved Worthington Steel’s competitive position has not been quantified. Worthington Steel’s ability to meet tight delivery schedules is, in part, based on the proximity of our facilities to customers, suppliers and one another. The extent to which plant location has impacted Worthington Steel’s competitive position has not been quantified. Processed steel products are priced competitively, primarily based on market factors, including, among other things,

Our Pressure Cylinders operating segment manufactures and

Alternative fuels: The sector includes Type I, II, and

Industrial and

While a large percentage of

In the United States and Canada, high-pressure and low-pressure cylinders are primarily manufactured in accordance with In the United States and Canada, Worthington Cylinders has one principal domestic competitor in the low-pressure non-refillable refrigerant market, one principal domestic competitor in the low-pressure LPG cylinder market and The Pressure Cylinders In connection with the acquisition of the propane fuel cylinders business of The Coleman Company, Inc. (“Coleman Cylinders”), we executed a trademark license agreement whereby we are required to make minimum annual royalty payments of $2,000,000 in exchange for the exclusive right to use certain Coleman trademarks within the United States and Canada in connection with our operation of the acquired business. As noted Engineered Cabs The Engineered Cabs operating segment consists of the Angus Industries business unit, which was acquired on December 29, 2011, and includes the Angus-Palm, Angus Engineering and ACT® brands. Angus is headquartered in Watertown, South Dakota and has additional operations in Iowa, South Carolina and Tennessee. In fiscal 2012, approximately 4% of consolidated net sales were generated by our Engineered Cabs operating segment. On an annualized basis, Engineered Cabs would have represented approximately 10% of net sales. Angus is North America’s leading non-captive designer and manufacturer of high-quality, custom-engineered operator cabs, operator stations and custom fabrications of mobile equipment used primarily in the agricultural, construction, mining and various other industries. Angus cabs are used in products ranging from small utility equipment to the largest earthmovers. Angus produces products for over 150 different equipment platforms for approximately 100 customers, although six customers have historically represented approximately 75% of this operating segment’s net sales. In addition to its cab products, Angus has the capability to provide a full suite of complementary products such as machine structural components, painted weldments, engine doors, boom components and complete frames, as well as a complete range of vacuum-formed plastic/acoustical trim components and assemblies under the ACT brand. Angus has the manufacturing capability for: Steel laser cutting; Steel bending and forming; Roll-form tube curving and bending; Machining; Welding – robotic and manual; Automated steel product cleaning and E-coating; Top coat painting; and Assembly. Key supplies include steel sheet and plate, steel tubing, hardware, controls, wiper systems, glazing materials (glass, polycarbonate), perishables (paint, urethane, caulk), electrical materials, HVAC systems and aesthetic materials (acoustical trim, plastics, foam) which are available from a variety of sources. Other The

Steel Packaging. The Steel Packaging operating segment consists of

Global Group. The purpose of the Global Group operating segment is to identify and develop potential growth platforms by applying our core competencies in metals manufacturing and construction methods. The Global Group operates a business platform that includes high density mid-rise residential construction in emerging and developed international markets and includes the Mid-Rise Construction, Military Construction and Commercial Stairs business units as well as the recently-formed Global Development Group and Worthington Energy Group business units. The Worthington Energy Group business unit includes our recently-acquired and 75%-owned joint venture, PSI, a services firm that develops cost-effective energy solutions for public and private entities throughout North America. Other operating activities of the Global Group include the design, supply and building/construction of mid-rise light gauge steel framed commercial structures and multi-family housing units; and the supply and construction of metal framing products for, and used in the framing of, single and multi-family housing, with a focus on domestic military bases. During the fourth quarter of fiscal 2012, we formalized plans to close the Commercial Stairs business unit. Segment Financial Data Financial information for the reportable business segments is provided in “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note Financial Information About Geographic Areas

Suppliers The primary raw material purchased by Worthington is steel. We purchase steel from major primary producers of steel, both domestic and foreign. The amount purchased from any particular supplier varies from Technical Services

Seasonality and Backlog Sales are generally strongest in the fourth quarter of our fiscal year as our operating segments are generally operating at seasonal peaks. Historically, sales have generally been weaker in the third quarter of We do not believe backlog is a significant indicator of our business. Employees As of May 31, Joint Ventures As part of Consolidated

PSI is a 75%-owned consolidated joint venture with a subsidiary of Professional Supply, Inc. (20%) and Stonehenge Structured Finance Partners, LLC (5%) (together referred to as “PSI Partners”), located in Fremont, Ohio. PSI is a professional services company that develops cost-effective energy solutions for entities in North America. PSI designs solutions to minimize energy consumption, manages the energy solution installation, monitors and verifies energy usage, guarantees future energy savings and shares in these savings. Additionally, PSI utilizes certain patented products to further enhance energy savings. PSI’s financial results are reported within the Other category for reporting purposes. The equity owned by the PSI Partners is shown as non-controlling interest on our consolidated balance sheets and the PSI Partners’ portion of net earnings is included as net earnings attributable to non-controlling interest in our consolidated statements of earnings. Spartan is a 52%-owned consolidated joint venture with a subsidiary of Severstal North America, Inc. (“Severstal”), located in Monroe, Michigan. It operates a cold-rolled, hot-dipped galvanizing line for toll processing steel coils into galvanized and galvannealed products intended primarily for the automotive industry. WNCL is a 60%-owned consolidated joint venture with India-based Nitin Cylinders Limited (“Nitin”). WNCL manufactures high-pressure, seamless steel cylinders for compressed natural gas storage in motor vehicles, and produces cylinders for compressed industrial gases. WNCL’s financial results are fully consolidated within our Pressure Cylinders reportable business segment. The equity owned by Nitin is shown as non-controlling interest on Unconsolidated

ClarkDietrich, a 25%-owned joint venture with ClarkWestern Building Systems, LLC, is the industry leader in the manufacture and supply of light gauge steel framing products in the United States. ClarkDietrich manufactures a Gestamp Worthington Wind Steel, LLC (the “Gestamp JV”) is a 50%-owned joint venture with Gestamp Wind Steel U.S., Inc., that was formed with a focus on producing towers for wind turbines being constructed in the North American market. The Gestamp JV announced plans to construct its initial production facility in Cheyenne, Wyoming; however, due to the volatile political environment in the United States, particularly in regards to the Federal Production Tax Credit, construction of this facility has been placed on hold. Samuel Steel Pickling Company (“Samuel”), a

Serviacero Planos, TWB Company, L.L.C. (“TWB”), a 45%-owned joint venture with ThyssenKrupp Steel North America, Inc., is a leading North American supplier of tailor welded

Worthington Armstrong Venture (“WAVE”), a 50%-owned joint venture with Armstrong Ventures, Inc., a subsidiary of Armstrong World Industries, Inc., is one of the three largest global manufacturers

Worthington Specialty Processing (“WSP”), a 51%-owned joint venture with U.S. Steel, operates three steel processing facilities located in Canton, Jackson and Taylor, Michigan, which are managed by Worthington Steel. WSP serves primarily as a toll processor for U.S. Steel and others. Its services include slitting, blanking, cutting-to-length, laser welding, tension leveling and warehousing. WSP is considered to be jointly controlled and not consolidated due to substantive participating rights of the minority partner. See “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note Environmental Regulation

Future results and the market price for Worthington Industries’ common shares are subject to numerous risks, many of which are driven by factors that cannot be controlled or predicted. The following discussion, as well as other sections of this Annual Report on Form 10-K, including Economic or Industry Downturns The The impacts of

The

The domestic auto industry Financial difficulties and bankruptcy filings by The

There is continued uncertainty particularly in Europe as to the sustainability of the recovery of the capital and credit markets. Further volatility in the United States or Raw Material Pricing and Availability The costs of manufacturing our products and Our future operating results may be affected by fluctuations in raw material at times availability and pricing can be volatile due to a number of factors beyond our costs and adversely impact our financial results. If our suppliers increase the prices of our critical raw materials, we may not have alternative sources of supply. In addition, in an environment of increasing prices for steel and other raw materials, competitive conditions may impact how much of the price increases we can pass on to our customers. To the extent we are unable to pass on future price increases in our raw materials to our customers, our financial results could be adversely affected. Also, if steel prices decrease, Inventories Our business could be harmed if we fail to maintain proper inventory levels. We are required to maintain sufficient inventories to accommodate the needs of our customers including, in many cases, short lead times and just-in-time delivery requirements. Although we typically have customer orders in hand prior to placement of our raw material orders for Steel Processing, we anticipate and forecast customer demand for a timely manner, we may experience inventory shortages. Inventory shortages Suppliers and Customers The loss of significant volume from our key customers could adversely affect us. In fiscal 2012, our largest customer accounted for approximately 5% of our consolidated net sales, and our ten largest customers accounted for approximately 24% of our consolidated net sales. A significant loss of, or decrease in, business from any of our key customers could have an adverse effect on our sales and financial results if we cannot obtain replacement business. Also, due to consolidation in the industries we serve, including the construction, automotive and retail industries, our sales may be increasingly sensitive to deterioration in the financial condition of, or other adverse developments with respect to, one or more of our top customers. In addition, certain of our top customers may be able to exert pricing and other influences on us, requiring us to market, deliver and promote our products in a manner that may be more costly to us. Moreover, we generally do not have long-term contracts with our customers. As a result, although our customers periodically provide indications of their product needs and purchases, they generally purchase our products on an order-by-order basis, and the relationship, as well as particular orders, can be terminated at any time. Many of our key industries, such as construction and automotive, are cyclical in nature. Many of our key industries, such as automotive and construction, are cyclical and can be impacted by both market demand and raw material supply, particularly with respect to steel. The demand for our products is directly related to, and quickly impacted by, customer demand in our industries, which can change as the result of changes in the general United States or worldwide economy and other factors beyond our control. Adverse changes in demand or pricing can have a negative effect on our business. Significant sales reductions for any of the Detroit Three automakers could have a negative impact on our business. Approximately half of the net sales of our Steel Processing operating segment and a significant amount of the net sales of certain joint ventures are to automotive-related customers. Although we do sell to the domestic operations of foreign automakers and their suppliers, a significant portion of our automotive sales are to Ford, General Motors, and Chrysler (the “Detroit Three automakers”) and their suppliers. A reduction in sales for any of the Detroit Three automakers could negatively impact our business. In addition, in 2011, automobile producers began taking steps toward complying with new Corporate Average Fuel Economy mileage requirements for new cars and light trucks that they produce. As automakers work to produce vehicles that comply with these new standards, they may reduce the amount of steel used in cars and trucks to improve fuel economy, thereby reducing demand for steel and resulting in further over-supply of steel in North America. The closing or relocation of customer facilities could adversely affect us. Our ability to meet delivery requirements and the overall cost of our products as delivered to customer facilities are important competitive factors. If customers close or move their production facilities further away from our manufacturing facilities which can supply them, it could have an adverse effect on our ability to meet competitive conditions, which could result in the loss of sales. Likewise, if customers move their production facilities overseas, it could result in the loss of potential sales for us. Sales conflicts with our customers and/or suppliers may adversely impact us. In some instances, we may compete with one or more of our customers and/or suppliers in pursuing the same business. Such conflicts may strain our relationships with those parties, which could adversely affect our future business with them. The closing or idling of steel manufacturing facilities could have a negative impact on us. As steel makers have reduced their production capacities by closing or idling production lines in light of the challenging economic conditions, the number of facilities from which we can purchase steel, in particular certain specialty steels, has decreased. Accordingly, if delivery from a supplier is disrupted, particularly with respect to certain types of specialty steel, it may be more difficult to obtain an alternate supply than in the past. These closures and disruptions could also have an adverse effect on our suppliers’ on-time delivery performance, which could have an adverse effect on our ability to meet our own delivery commitments and may have other adverse effects on our business. The loss of key supplier relationships could adversely affect us. Over the years, our various manufacturing operations have developed relationships with certain steel and other suppliers which have been beneficial to us by providing more assured delivery and a more favorable all-in cost, which includes price and shipping costs. If any of those relationships were disrupted, it could have an adverse effect on delivery times and the overall cost and quality of our raw materials, which could have a negative impact on our business. In addition, we do not have long-term contracts with any of our suppliers. If, in the future, we are unable to obtain sufficient amounts of steel and other products at competitive prices and on a timely basis from our traditional suppliers, we may be unable to obtain these products from alternative sources at competitive prices to meet our delivery schedule, which could have a material adverse affect on our results of operations. Competition Our business is highly competitive, and increased competition could negatively impact our financial results. Generally, the markets in which we conduct business are highly competitive. Our competitors include a variety of both domestic and foreign companies in all major markets. Competition for most of our products is primarily on the basis of price, product quality and our ability to meet delivery requirements. Depending on a variety of factors, including raw material, energy, labor and capital costs, government control of currency exchange rates and government subsidies of foreign steel producers, our business may be materially adversely affected by competitive forces. The Sales by competitors of light gauge metal framing products which are not code compliant could adversely affect us. Our unconsolidated metal framing joint venture, ClarkDietrich, is an industry leader in driving code compliance for light gauge metal framing. If our competitors offer cheaper products which are not code compliant, and certain customers are willing to purchase such non-compliant products, it may be difficult for ClarkDietrich to be cost competitive on these sales. Material Substitution If steel prices increase compared to certain substitute materials, the demand for our products could be negatively impacted, which could have an adverse effect on our financial results.In certain applications, steel competes with other materials, such as aluminum (particularly in the automobile industry), cement and wood (particularly in the construction industry), composites, glass and Freight and Energy Increasing energy and freight costs could increase our operating costs, which could have an adverse effect on our financial results. The availability and cost of freight and energy, such as electricity, natural gas and diesel fuel, is important in the manufacture and transport of our Information Systems We are subject to information system security risks and systems integration issues that could disrupt our internal operations. We are dependent upon information technology for the distribution of information internally and also to our customers and suppliers. This information technology is subject to damage or interruption from a variety of sources, including, Business Disruptions Disruptions to our business or the business of our customers or suppliers could adversely impact our operations and financial results. Business disruptions, including increased costs for, or interruptions in, the supply of energy or raw materials, resulting from shortages of supply or transportation, events (such as required maintenance shutdowns), could cause interruptions to our businesses as well as the operations of our customers and suppliers. While we maintain insurance coverage that can offset some losses relating to certain types of these events, Foreign Operations Economic, political and other risks associated with foreign operations could adversely affect our international financial results. Although the substantial majority of our business activity takes place in the United States, we derive a portion of our revenues and earnings from operations in foreign countries, and we are subject to risks associated with doing business internationally. We have wholly-owned facilities in Austria, Canada, the Czech Republic, Poland and Portugal and joint venture facilities in China, France, India, Mexico, Spain and the United

Joint Ventures A change in the relationship between the members of any of our joint ventures may have an adverse effect on that joint venture. Acquisitions We may Capital Expenditures Our business requires capital investment and maintenance expenditures, and our capital resources may not be adequate to provide for all of our cash requirements. Many of our operations are capital intensive. For the five-year period ended May 31, 2012, our total capital expenditures, including acquisitions and investment activity, were approximately $637.3 million. Additionally, at May 31, 2012, we were obligated to make aggregate lease payments of $27.5 million under operating lease agreements. Our business also requires expenditures for maintenance of our facilities. We currently believe that we have adequate resources (including cash and cash equivalents, cash provided by operating activities, availability under existing credit facilities and unused lines of credit) to meet our cash needs for normal operating costs, capital expenditures, debt repayments, dividend payments, future acquisitions and working capital for our existing business. However, given the current challenges, uncertainty and volatility in the domestic and global economies and financial markets, there can be no assurance that our capital resources will be adequate to provide for all of our cash requirements. Litigation We may be subject to legal proceedings or investigations, the resolution of which could negatively affect our results of operations and liquidity in a particular period. Our results of operations or liquidity in a particular period could be affected by an adverse ruling in any legal proceedings or investigations which may be pending against us or filed against us in the future. We are also subject to a variety of legal compliance risks, including, without limitation, potential claims relating to product liability, health and safety, environmental matters, intellectual property rights, taxes and compliance with U.S. and foreign export laws, anti-bribery laws, competition laws and sales and trading practices. While we believe that we have adopted appropriate risk management and compliance programs to address and reduce these risks, the global and diverse nature of our operations means that these risks will continue to exist and additional legal proceedings and contingencies may arise from time to time. A future adverse ruling or settlement or an unfavorable change in laws, rules or regulations could have a material adverse effect on our results of operations or liquidity in a particular period. For additional information regarding our pending legal proceedings and contingencies, refer to “Part I—Item 3.—Legal Proceedings” within this Annual Report on Form 10-K and “Note E – Contingent Liabilities and Commitments” to the Consolidated Financial Statements included in “Part II – Item 8. – Financial Statements and Supplementary Data” of this Annual Report on Form 10-K. Accounting We are required to make accounting and tax-related estimates, assumptions and judgments in preparing our consolidated financial judgments that we use. In preparing our consolidated financial statements in accordance with accounting principles generally accepted in the United States, we are required to make certain estimates and assumptions that affect the accounting for and recognition of assets, liabilities, revenues and expenses. These estimates and assumptions must be made because certain information that is used in the preparation of our consolidated financial statements is dependent on future events, or cannot be calculated with a high degree of precision from data Tax Laws and Regulations Tax increases or changes in tax laws could adversely affect our financial results. We are subject to tax and related obligations in the jurisdictions in which we operate or do business, including state, local, federal and foreign taxes. The taxing rules of the various jurisdictions in which we operate or do business often are complex and subject to varying interpretations. Tax authorities may challenge tax positions that we take or historically have taken, and may assess taxes where we have not made tax filings or may audit the tax filings we have made and assess additional taxes. Some of these assessments may be substantial, and also may involve the imposition of penalties and interest. In addition, governments could impose new taxes on us or increase the rates at which we are taxed in the future. The payment of substantial additional taxes, penalties or interest resulting from tax assessments, or the imposition of any new taxes, could materially and adversely impact our results of operations, financial condition and cash flows. In addition, our provision for income taxes and cash tax liability in the future could be adversely affected by changes in U.S. tax laws. Potential changes that may adversely affect our financial results include, without limitation, decreasing the ability of U.S. companies to receive a tax credit for foreign taxes paid or to defer the U.S. deduction of expenses in connection with investments made in other countries. Claims and Insurance Adverse claims experience, to the extent not covered by insurance, may have an adverse effect on our financial results. We self-insure a significant portion of our potential liability for Principal Shareholder Our principal shareholder may have the ability to exert significant influence in matters requiring a shareholder vote and could delay, deter or prevent a change in control of Worthington Industries. Pursuant to our charter documents, certain matters such as those in which a person would attempt to acquire or take control of the Company, must be approved by the vote of the holders of common shares representing at least 75% of Worthington Industries’ outstanding voting power. Approximately Key Employees If we lose our senior management or other key employees, our business may be adversely affected. Our ability to successfully operate, grow our business and implement our business strategies is largely dependent on the efforts, abilities and services of our senior management and other key employees. The loss of any of these individuals or our inability to attract, train and retain additional personnel could reduce the competitiveness of our business or otherwise impair our operations or prospects. Our future success will also depend, in part, on our ability to attract and retain qualified personnel, such as engineers and other skilled technicians, who have experience in the application of our products and are knowledgeable about our business, markets and products. We cannot assure that we will be able to retain our existing senior management personnel or other key employees or attract additional qualified personnel when needed. We have not entered into any formal employment agreements or change in control agreements with our executive officers, and the loss of any member of our management team could adversely impact our business and operations. Additionally, we may modify our management structure from time to time or reduce our overall workforce as we did in certain operating segments during the recent economic downturn, which may create marketing, operational and other business risks. Credit Ratings

Difficult Financial Markets Should we be required to raise capital in the Environmental, Health and Safety We may incur additional costs related to environmental and health and safety matters. Our operations and facilities are subject to a variety of federal, state, local and foreign laws and regulations relating to the environmental laws, we may be held liable for all remediation costs at a particular site, even with respect to contamination for which we are not responsible. Changes in environmental and human health and safety laws, rules, regulations or enforcement policies could have a material adverse effect on our business, financial condition or results of operations. Legislation and Regulation Certain proposed legislation and regulations may have an adverse impact on the economy in general and in our markets specifically, which may adversely affect our business. Our business may be negatively impacted by a variety of new or proposed legislation or regulations. For example, legislation and regulations proposing increases in taxation on, or heightened regulation of, carbon or other greenhouse gas emissions may result in higher prices for steel, higher prices for utilities required to run our facilities, higher fuel costs for us and our suppliers and distributors and other adverse impacts. See the immediately following risk factor for additional information regarding legislation and regulations concerning climate change and greenhouse gas emissions. To the extent that new legislation or regulations increase our costs, we may not be able to fully pass these costs on to our customers without a resulting decline in sales and adverse impact to our profits. Likewise, to the extent new legislation or regulations would have an adverse effect on the economy, our markets or the ability of domestic businesses to compete against foreign operations, it could also have an adverse impact on us. Legislation or regulations concerning climate change and greenhouse gas emissions may negatively affect our results of operations. Energy is a significant input in a number of our operations and products, and many believe that consumption of energy derived from fossil fuels is a contributor to global warming. A number of governments and governmental bodies have introduced or are contemplating legislative and regulatory changes in response to the potential impacts of climate change and greenhouse gas emissions. The European Union has established greenhouse gas regulations, and Canada has published details of a regulatory framework for greenhouse gas emissions. The U.S. Environmental Protection Agency has issued and proposed regulations addressing greenhouse gas emissions, including regulations which will require reporting of greenhouse gas emissions from large sources and suppliers in the United States. Legislation previously has been introduced in the U.S. Congress aimed at limiting carbon emissions from companies that conduct business that is carbon-intensive. Among other potential items, such bills could include a system of carbon emission credits issued to certain companies, similar to the European Union’s existing cap-and-trade system. Several U.S. states have also adopted, and other states may in the future adopt, legislation or regulations implementing state-wide or regional cap-and-trade systems that apply to some or all industries that emit greenhouse gases. It is impossible at this time to forecast what the final regulations and legislation, if any, will look like and the resulting effects on our business and operations. Depending upon the terms of any such regulations or legislation, however, we could suffer a negative financial impact as a result of increased energy, environmental and other costs necessary to comply with limitations on greenhouse gas emissions, and we may see changes in the margins of our greenhouse gas-intensive and energy-intensive assets. In addition, depending upon whether similar limitations are imposed globally, the regulations and legislation could negatively impact our ability to compete with foreign companies situated in areas not subject to such limitations. Many of our customers in the United States, Canada and Europe may experience similar impacts, which could result in decreased demand for our products. Seasonality Our operations have been subject to seasonal fluctuations that may impact our cash flows for a particular period. Sales are generally strongest in the fourth quarter of the fiscal year when all of our business segments are normally operating at seasonal peaks. Historically, our sales are generally weaker in the third quarter of the fiscal year, primarily due to reduced activity in the building and construction industry as a result of the colder, more inclement weather, as well as customer plant shutdowns in the automotive industry due to holidays. Our quarterly results may also be affected by the timing of large customer orders. Consequently, our cash flow from operations may fluctuate significantly from quarter to quarter. If, as a result of any such fluctuation, our quarterly cash flows were significantly reduced, we may be unable to service our indebtedness or maintain compliance with certain covenants under our credit facilities. A default under any of the documents governing our indebtedness could prevent us from borrowing additional funds, limit our ability to pay interest or principal and allow our lenders to declare the amounts outstanding to be immediately due and payable and to exercise certain other remedies. Impairment Charges Continued or enhanced weakness or instability in the economy, our markets Item 1B. — Unresolved Staff Comments None. General

Financial Condition and Results of Operations –Contractual Cash Obligations and Other Commercial Commitments” as well as “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – Note Excluding joint ventures, Steel Processing

Engineered Cabs Our Engineered Cabs operating segment operates four owned manufacturing facilities containing a total of approximately 600,000 square feet. These facilities are located in Iowa, South Carolina, South Dakota, and Tennessee. This operating segment also operates one Other

Joint Ventures The Spartan consolidated joint venture owns and operates one manufacturing facility in Michigan, consolidated joint venture owns and operates a manufacturing facility in India. The unconsolidated joint ventures operate a total of

Notwithstanding the Item 4. —

Supplemental Item — Executive Officers of the Registrant Effective August 1, 2012, George P. Stoe will be retiring from his position as President and Chief Operating Officer of Worthington Industries and will continue serving the Company as Director of International Business Development and Non-Executive Chairman of Angus–Palm. Mark A. Russell, currently President of The Worthington Steel Company, will succeed Mr. Stoe as President and Chief Operating Officer of Worthington Industries effective August 1, 2012; and Geoffrey G. Gilmore, currently Vice President-Purchasing of Worthington Industries, will succeed Mr. Russell as President of The Worthington Steel Company effective August 1, 2012. The following table lists the names, positions held and ages of the

John P. McConnell has served as Worthington Industries’ Chief Executive Officer since June 1993, as a director of Worthington Industries continuously since 1990, and as Chairman of the Board of Worthington Industries since September 1996. Mr. McConnell serves as the Chair of the Executive Committee of Worthington Industries’ Board of Directors. He George P. Stoe has served as President and Chief Operating Officer of Worthington Industries since October

B. Andrew ‘Andy’ Rose has served as Vice President and Chief Dale T. Brinkman has served as Worthington Industries’ Vice President-Administration since December 1998 and as Worthington Industries’ General Counsel since September 1982. He has been Secretary of

Andrew J. Billman has served as President of Worthington Cylinder Corporation since August 2011. From February 2010 to August 2011, he served as Vice President-Purchasing for Worthington Industries. He served in various other positions with the Company from 1991 to February 2010. Geoffrey G. Gilmore was appointed to the position of President of The Worthington Steel Company effective August 1, 2012. Since July 2011, he has served as Vice President-Purchasing for Worthington Industries responsible for all purchasing efforts across the Company including steel, commodity and OEM purchasing, logistics and outside processing. From March 2010 to July 2011, he served as General Manager of The Worthington Steel Company’s Delta, Ohio facility, responsible for overseeing its manufacturing and sales operations; and from June 2006 to March 2010, he served as Director of automotive sales for The Worthington Steel Company. Mr. Gilmore served in various other positions with the Company from 1998 to June 2006. Matthew A. Lockard has served as Treasurer of Worthington Industries since February 2009 and as Vice President-Corporate Development of Worthington Industries since July 2005. From April 2001 to July 2005, Mr. Lockard served as Vice President-Global Business Development for Worthington Cylinder Corporation. Mr. Lockard served in various other positions with the Company from January 1994 to April 2001. Cathy M. Lyttle has served as Vice President of Communications and Investor Relations since April 2009. Ms. Lyttle has served as Vice President of Communications since January Eric M. Smolenski was appointed to the position of Chief Information Officer of Worthington Industries effective June, 2012. Mr. Smolenski served as Vice President-Human Resources of Worthington Industries from December 2005 through June 2012. From January 2001 to Richard G. Welch has served as the Corporate Controller of Worthington Industries since March 2000 and prior thereto, he served as Assistant Controller of Worthington Industries from August 1999 to March 2000. He served as Principal Financial Officer of Worthington Industries on an interim basis from Virgil L. Winland has served as Senior Vice President-Manufacturing of Worthington Industries since January 2001. He served in various other positions with Executive officers serve at the pleasure of the directors of the Registrant. There are no family relationships among any of the PART II Item 5.—Market for Common Shares Information The common shares of Worthington Industries, Inc. (“Worthington Industries”) trade on the New York Stock Exchange (“NYSE”) under the symbol

Dividends are declared at the discretion of Worthington Industries’ Board of Directors. Worthington Industries’ Board of Directors declared quarterly dividends of The Board of Directors reviews the dividend on a quarterly basis and establishes the dividend rate based upon Worthington Industries’ financial condition, results of operations, capital requirements, current and projected cash flows, business prospects and other factors which the directors may deem relevant. While Worthington Industries has paid a dividend every quarter since becoming a public company in 1968, there is no guarantee Shareholder Return Performance The following information in this Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or Regulation 14C under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or to the liabilities of Section 18 of the Exchange Act, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent we specifically incorporate such information into such a filing. The following graph compares the five-year cumulative return on Worthington Industries’ common shares, the S&P Midcap 400 Index and the S&P 1500 Steel Composite Index. The graph assumes that $100 was invested at May 31,

Data and graph provided by Zacks Investment Research, Inc. Copyright© Worthington Industries Issuer Purchases of Equity Securities

The common shares available for repurchase under the June 29, 2011 authorization may be purchased from time to time, with consideration given to the market price of the common shares, the nature of other investment opportunities, cash flows from operations, general economic conditions and other appropriate factors. Repurchases may be made on the open market or through privately negotiated transactions. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Item 6. — Selected Financial Data

| Fiscal Year Ended May 31, | ||||||||||||||||||||

| In thousands, except per share | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||

Net sales | $ | 2,631,267 | $ | 3,067,161 | $ | 2,971,808 | $ | 2,897,179 | $ | 3,078,884 | ||||||||||

Cost of goods sold | 2,456,533 | 2,711,414 | 2,610,176 | 2,525,545 | 2,580,011 | |||||||||||||||

Gross margin | 174,734 | 355,747 | 361,632 | 371,634 | 498,873 | |||||||||||||||

Selling, general and administrative expense | 210,046 | 231,602 | 232,487 | 214,030 | 225,915 | |||||||||||||||

Goodwill impairment | 96,943 | - | - | - | - | |||||||||||||||

Restructuring charges and other | 43,041 | 18,111 | - | - | 5,608 | |||||||||||||||

Operating income (loss) | (175,296 | ) | 106,034 | 129,145 | 157,604 | 267,350 | ||||||||||||||

Miscellaneous income (expense) | (6,858 | ) | (6,348 | ) | (4,446 | ) | (1,524 | ) | (7,991 | ) | ||||||||||

Nonrecurring losses | - | - | - | - | - | |||||||||||||||

Gain on sale of unconsolidated affiliates | 8,331 | - | - | 26,609 | - | |||||||||||||||

Interest expense | (20,734 | ) | (21,452 | ) | (21,895 | ) | (26,279 | ) | (24,761 | ) | ||||||||||

Equity in net income of unconsolidated affiliates | 48,589 | 67,459 | 63,213 | 56,339 | 53,871 | |||||||||||||||

Earnings (loss) from continuing operations before income taxes | (145,968 | ) | 145,693 | 166,017 | 212,749 | 288,469 | ||||||||||||||

Income tax expense (benefit) | (37,754 | ) | 38,616 | 52,112 | 66,759 | 109,057 | ||||||||||||||

Earnings (loss) from continuing operations | (108,214 | ) | 107,077 | 113,905 | 145,990 | 179,412 | ||||||||||||||

Net earnings (loss) | $ | (108,214 | ) | $ | 107,077 | $ | 113,905 | $ | 145,990 | $ | 179,412 | |||||||||

Earnings (loss) per share – diluted: | ||||||||||||||||||||

Continuing operations | $ | (1.37 | ) | $ | 1.31 | $ | 1.31 | $ | 1.64 | $ | 2.03 | |||||||||

Net earnings (loss) per share | $ | (1.37 | ) | $ | 1.31 | $ | 1.31 | $ | 1.64 | $ | 2.03 | |||||||||

Continuing operations: | ||||||||||||||||||||

Depreciation and amortization | $ | 64,073 | $ | 63,413 | $ | 61,469 | $ | 59,116 | $ | 57,874 | ||||||||||

Capital expenditures (including acquisitions and investments) | 109,491 | 97,343 | 90,418 | 66,904 | 112,937 | |||||||||||||||

Cash dividends declared | 48,115 | 54,640 | 58,380 | 60,110 | 57,942 | |||||||||||||||

Per share | $ | 0.61 | $ | 0.68 | $ | 0.68 | $ | 0.68 | $ | 0.66 | ||||||||||

Average common shares outstanding – diluted | 78,903 | 81,898 | 87,002 | 88,976 | 88,503 | |||||||||||||||

FINANCIAL POSITION | ||||||||||||||||||||

Current assets | $ | 598,935 | $ | 1,104,970 | $ | 969,383 | $ | 996,241 | $ | 938,333 | ||||||||||

Current liabilities | 372,080 | 664,895 | 420,494 | 490,786 | 545,443 | |||||||||||||||

Working capital | $ | 226,855 | $ | 440,075 | $ | 548,889 | $ | 505,455 | $ | 392,890 | ||||||||||

Net fixed assets | $ | 521,505 | $ | 549,944 | $ | 564,265 | $ | 546,904 | $ | 552,956 | ||||||||||

Total assets | 1,363,829 | 1,988,031 | 1,814,182 | 1,900,397 | 1,830,005 | |||||||||||||||

Total debt | 239,393 | 380,450 | 276,650 | 252,684 | 388,432 | |||||||||||||||

Shareholders’ equity | 706,069 | 885,377 | 936,001 | 945,306 | 820,836 | |||||||||||||||

Per share | $ | 8.94 | $ | 11.16 | $ | 11.02 | $ | 10.66 | $ | 9.33 | ||||||||||

Common shares outstanding | 78,998 | 79,308 | 84,908 | 88,691 | 87,933 | |||||||||||||||

| Fiscal Year Ended May 31, | ||||||||||||||||||||

| (in thousands, except per share amounts) | 2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||

Net sales | $ | 2,534,701 | $ | 2,442,624 | $ | 1,943,034 | $ | 2,631,267 | $ | 3,067,161 | ||||||||||

Cost of goods sold | 2,201,833 | 2,086,467 | 1,663,104 | 2,456,533 | 2,711,414 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross margin | 332,868 | 356,157 | 279,930 | 174,734 | 355,747 | |||||||||||||||

Selling, general and administrative expense | 225,069 | 235,198 | 218,315 | 210,046 | 231,602 | |||||||||||||||

Impairment of long-lived assets | 355 | 4,386 | 35,409 | 96,943 | - | |||||||||||||||

Restructuring and other expense | 5,984 | 2,653 | 4,243 | 43,041 | 18,111 | |||||||||||||||

Joint venture transactions | (150 | ) | (10,436 | ) | - | - | - | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating income (loss) | 101,610 | 124,356 | 21,963 | (175,296 | ) | 106,034 | ||||||||||||||

Miscellaneous income (expense) | 2,319 | 597 | 1,127 | (2,329 | ) | 620 | ||||||||||||||

Gain on sale of investment in Aegis | - | - | - | 8,331 | - | |||||||||||||||

Interest expense | (19,497 | ) | (18,756 | ) | (9,534 | ) | (20,734 | ) | (21,452 | ) | ||||||||||

Equity in net income of unconsolidated affiliates | 92,825 | 76,333 | 64,601 | 48,589 | 67,459 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Earnings (loss) before income taxes | 177,257 | 182,530 | 78,157 | (141,439 | ) | 152,661 | ||||||||||||||

Income tax expense (benefit) | 51,904 | 58,496 | 26,650 | (37,754 | ) | 38,616 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net earnings (loss) | 125,353 | 124,034 | 51,507 | (103,685 | ) | 114,045 | ||||||||||||||

Net earnings attributable to noncontrolling interest | 9,758 | 8,968 | 6,266 | 4,529 | 6,968 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net earnings (loss) attributable to controlling interest | $ | 115,595 | $ | 115,066 | $ | 45,241 | $ | (108,214 | ) | $ | 107,077 | |||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Earnings (loss) per share—diluted: | ||||||||||||||||||||

Net earnings (loss) per share attributable to controlling interest | $ | 1.65 | $ | 1.53 | $ | 0.57 | $ | (1.37 | ) | $ | 1.31 | |||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Depreciation and amortization | $ | 55,873 | $ | 61,058 | $ | 64,653 | $ | 64,073 | $ | 63,413 | ||||||||||

Capital expenditures (including acquisitions and investments) | 272,349 | 59,891 | 98,275 | 109,491 | 97,343 | |||||||||||||||

Cash dividends declared | 33,441 | 29,411 | 31,676 | 48,115 | 54,640 | |||||||||||||||

Per common share | $ | 0.48 | $ | 0.40 | $ | 0.40 | $ | 0.61 | $ | 0.68 | ||||||||||

Average common shares outstanding—diluted | 70,252 | 75,409 | 79,143 | 78,903 | 81,898 | |||||||||||||||

FINANCIAL POSITION | ||||||||||||||||||||

Total current assets | $ | 914,239 | $ | 891,635 | $ | 782,285 | $ | 598,935 | $ | 1,104,970 | ||||||||||

Total current liabilities | 658,263 | 525,002 | 379,802 | 372,080 | 664,895 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Working capital | $ | 255,976 | $ | 366,633 | $ | 402,483 | $ | 226,855 | $ | 440,075 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total property, plant and equipment, net | $ | 443,077 | $ | 405,334 | $ | 506,163 | $ | 521,505 | $ | 549,944 | ||||||||||

Total assets | 1,877,797 | 1,667,249 | 1,520,347 | 1,363,829 | 1,988,031 | |||||||||||||||

Total debt | 533,714 | 383,210 | 250,238 | 239,393 | 380,450 | |||||||||||||||

Total shareholders’ equity—controlling interest | 697,174 | 689,910 | 711,413 | 706,069 | 885,377 | |||||||||||||||

Per share | $ | 10.27 | $ | 9.62 | $ | 8.98 | $ | 8.94 | $ | 11.16 | ||||||||||

Common shares outstanding | 67,906 | 71,684 | 79,217 | 78,998 | 79,308 | |||||||||||||||

The acquisition of our 75% ownership interest in PSI Energy Solutions, LLC has been reflected since March 2012. The acquisition of the outstanding voting interests of Angus Industries, Inc. has been reflected since December 2011. The acquisition of the propane fuel cylinders business of The Coleman Company, Inc. has been reflected since December 2011. The acquisition of the outstanding voting interests of STAKO sp. Z o.o.

has been reflected since September 2011. The acquisition of substantially all of the net assets of the BernzOmatic business of Irwin Industrial Tool Company has been reflected since July 2011. Our Automotive Body Panels operations have been excluded from consolidated operating results since their deconsolidation in May 2011. Our Metal Framing operations have been excluded from consolidated operating results since their deconsolidation in March 2011, except for our Metal Framing operations in Canada, which have been excluded since their disposition in November 2009. The acquisition of the net assets of three MISA Metals, Inc. steel processing locations has been reflected since March 2011. The acquisition of our 60% ownership interest in Nitin Cylinders Limited has been reflected since December 2010. The acquisition of the net assets of Hy-Mark Cylinders, Inc. has been reflected since June 2010. The acquisition of the steel processing assets of Gibraltar Industries, Inc. and its subsidiaries has been reflected since February 2010. The acquisition of the membership interests of Structural Composites Industries, LLC has been reflected since September 2009. The acquisition of the net assets related to the businesses of Piper Metal Forming Corporation, U.S. Respiratory, Inc. and Pacific Cylinders, Inc. has been reflected since June 2009. The acquisition of the net assets of Laser Products has been reflected since July 2008. The acquisition of the net assets of The Sharon Companies Ltd. assets has been reflected since June 2008. The acquisition of the capital stock of Precision Specialty Metals, Inc. has been reflected since August 2006. The acquisition of Western Industries, Inc. assets has been reflected since September 2004. The disposition of certain assets related to the Decatur, Alabama steel processing facility has been reflected since August 2004.

Item 7. — Management’s Discussion and Analysis of Financial Condition and Results of Operations

Selected statements contained in this “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations” constitute “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based, in whole or in part, on management’s beliefs, estimates, assumptions and currently available information. For a more detailed discussion of what constitutes a forward-looking statement and of some of the factors that could cause actual results to differ materially from such forward-looking statements, please refer to the “Safe Harbor Statement” in the beginning of this Annual Report on Form 10-K and “Part I – I—Item 1A. – —Risk Factors” of this Annual Report on Form 10-K.

Introduction

Worthington Industries, Inc., together with its subsidiaries (collectively, “we,” “our,” “Worthington,” or the “Company”), is primarily a diversified metal processingmetals manufacturing company, focused on value-added steel processing and manufactured metal products. Our manufactured metal products include: pressure cylinder products such as metalpropane, refrigerant, oxygen, compressed natural gas and industrial cylinders, scuba tanks, hand torches, and helium balloon kits; custom-engineered open and closed cabs and operator stations, weldments, kits accessories and cab components for a wide range of heavy mobile equipment; framing pressure cylinders, automotive past-systems and current-model year service stampingsstairs for mid-rise buildings; steel pallets and racks; and, through joint ventures, metal ceilingsuspension grid systems for concealed and lay-in panel ceilings; laser-welded blanks.blanks; light gauge steel framing for commercial and residential construction; and current and past model automotive service stampings. Our number one goal is to increase shareholder value, which we seek to accomplish by optimizing existing operations, developing and commercializing new products and applications, and pursuing strategic acquisitions and joint ventures.

As of May 31, 2009,2012, excluding our joint ventures, we operated 4135 manufacturing facilities worldwide, principally in threefour reportable business segments: Steel Processing, Pressure Cylinders, Engineered Cabs and, on an historical basis, Metal Framing and Pressure Cylinders.Framing. Other businessoperating segments, which are immaterial for purposes of separate disclosure, include Automotive Body Panels, Construction Services,Steel Packaging and Steel Packaging.the Worthington Global Group (the “Global Group”). We also held equity positions in six12 joint ventures, which operated 1944 manufacturing facilities worldwide, as of May 31, 2009.2012. For additional information regarding the formation of Engineered Cabs, refer to theRecent Business Developments section below.

Overview

During fiscal 2012, we benefited from the continued strengthening of the automotive market. Additionally, recent acquisitions by the Company, as discussed in theRecent Business Developments section below, have proven complementary to our existing businesses and contributed to earnings. ClarkWestern Dietrich Building Systems LLC (“ClarkDietrich”) and ArtiFlex Manufacturing LLC (“ArtiFlex”), joint ventures formed during the fourth quarter of fiscal 2011, also performed well, as did our joint ventures in general. ClarkDietrich and ArtiFlex are discussed in more detail below:

On March 1, 2011, we closed an agreement with Marubeni-Itochu Steel America, Inc. (“MISA”) to combine certain assets of Dietrich Metal Framing (“Dietrich”) and ClarkWestern Building Systems Inc. in a new joint venture, ClarkDietrich. We contributed our metal framing business, excluding the Vinyl division, to ClarkDietrich, including all of the related working capital and six of the 13 facilities. In exchange for the contributed net assets, we received the assets of certain MISA Metals, Inc. steel processing locations (the “MMI acquisition”) and a 25% noncontrolling ownership interest in ClarkDietrich. We retained and continued to operate the remaining metal framing facilities (the “retained facilities”), on a short-term basis, to support the transition of the business into the new joint venture. As of August 31, 2011, all of the retained facilities had ceased operations. In a separate transaction, the Vinyl division was sold to ClarkDietrich on October 31, 2011.

On May 9, 2011, we closed an agreement to combine certain assets of The Gerstenslager Company (“Gerstenslager”) and International Tooling Solutions, LLC in a new joint venture, ArtiFlex. In exchange for the contributed net assets, we received a 50% noncontrolling ownership interest in the new joint venture in addition to certain cash and other consideration.

As a result of these transactions (collectively, the “Joint Venture Transactions”), the contributed net assets of Dietrich (excluding the Vinyl division) and Gerstenslager were deconsolidated effective March 1, 2011 and May 9, 2011, respectively. Accordingly, the financial results and operating performance of these businesses are reported on a historical basis through the respective dates of deconsolidation, with our portion of the net earnings of ClarkDietrich and ArtiFlex reported within the equity in net income of unconsolidated affiliates (“equity income”) line item in our consolidated statements of earnings since the dates of deconsolidation.

For additional information on our business segments, pleaseregarding the Joint Venture Transactions, refer to “Item 1.8. – Business”Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – NOTE A – Summary of Part ISignificant Accounting Policies” of this Annual Report on Form 10-K.

OverviewRecent Business Developments

During

On March 22, 2012, we acquired a 75% ownership interest in PSI Energy Solutions, LLC (“PSI”) for cash consideration of $7.0 million. PSI is a professional services firm that develops cost-effective energy solutions for public and private entities throughout North America. The acquired net assets became part of our fiscal year ended May 31, 2009Global Group operating segment upon closing and will be reported in the “Other” category for segment reporting purposes.

| • | On January 10, 2012, we announced a voluntary recall of our MAP-PRO®, propylene and MAAP® cylinders and related hand torch kits. The recall was a precautionary step and involved a valve supplied by a third party that may leak when a torch or hose is disconnected from the cylinder. We are unaware of any incidence of fire or injury caused by this situation. For additional information regarding the recall, refer to “Item 8. – Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements – NOTE E – Contingent Liabilities and Commitments” of this Annual Report on Form 10-K. |

On December 29, 2011, we acquired 100% of the outstanding economic interests of Angus Industries, Inc. (“fiscal 2009”Angus”), for cash consideration of approximately $132.9 million and the assumption of approximately $47.3 million of debt. Additionally, we experienced challenges and rapidly changing business conditions unlike any we have ever experienced. Record earnings in our first quarter, dueissued 382,749 restricted common shares to record high pricescertain former employees of hot-rolled steel, were erased by a large loss in our second quarter dueAngus who became employees of Worthington upon closing. Approximately $1.1 million of the $6.3 million fair value of these restricted common shares was attributed to the global financial crisispurchase price and recession. Demand in mostrecognized as goodwill. Angus designs and manufactures high-quality, custom-engineered open and closed cabs and operator stations for a wide range of heavy mobile equipment. In connection with this acquisition, we established a new operating segment, Engineered Cabs, which is considered a separate reportable segment.

On December 1, 2011, we acquired the propane fuel cylinders business of The Coleman Company, Inc. (“Coleman Cylinders”). The purchase price consisted of cash consideration of approximately $22.7 million. The acquired net assets became part of our markets plummeted, and steel prices underwentPressure Cylinders operating segment upon closing of the transaction. Subsequent to closing, we received a severe and rapid decline, producing an environment of selling high priced inventory into a declining price market. This requiredrequest from the Federal Trade Commission, asking us to write-down our steel inventoriesprovide, on a voluntary basis, certain information related to the lower-of-cost-or-market, an impactacquisition and the industry as it conducts a preliminary investigation into the transaction. The acquisition fell below the threshold for pre-merger notification under the Hart-Scott-Rodino Act.

On September 30, 2011, we completed the acquisition of $105.0 million, $4.4 millionPoland-based STAKO sp.Z o.o. (“STAKO”). STAKO manufactures liquefied natural gas, propane and butane fuel tanks for use in passenger cars, buses and trucks. The acquired business became part of which related to our Serviacero joint venture. In addition, the declining economy and construction market deterioration resulted in a $96.9 million write-offPressure Cylinders operating segment upon closing of this transaction.

On July 1, 2011, we purchased substantially all of the goodwill associated with our Metal Framing segment. Our third and fourth fiscal quarters saw a continued decline in steel prices and demand in mostnet assets (excluding accounts receivable) of the marketsBernzOmatic business (“Bernz”) of Irwin Industrial Tool Company, a subsidiary of Newell Rubbermaid, Inc. for cash consideration of approximately $41.0 million. In connection with this transaction, we serve.agreed to settle our ongoing dispute with Bernz, which was valued at $10.0 million. Bernz is a leading manufacturer of hand held torches and accessories. The acquired net assets became part of our Pressure Cylinders operating segment upon closing of the transaction.

Market & Industry Overview

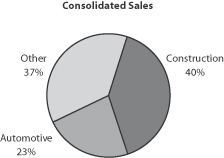

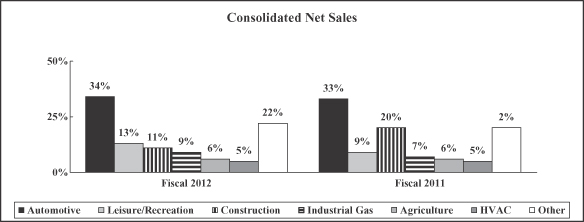

For fiscal 2009,We sell our products and services to a diverse customer base and a broad range of end markets. The breakdown of our net sales breakdown by end user market for fiscal 2012 and fiscal 2011 is illustrated byin the chart below. Substantially allfollowing chart:

The automotive industry is one of the largest consumers of flat-rolled steel, and thus the largest end market for our Steel Processing operating segment. Approximately 52% of the net sales of our Metal Framing business segment and the Construction Services business segment, as well as approximately 25% of the sales for the Steel Processing businessoperating segment are to the construction market, both residentialautomotive market. North American vehicle production, primarily by Chrysler, Ford and non-residential. We estimate that approximately 10%General Motors (the “Detroit Three automakers”), has a considerable impact on the activity within this operating segment. The majority of the net sales of five of our consolidatedunconsolidated affiliates, including the recently-formed ArtiFlex joint venture, were also to the automotive end market.

Approximately 44% and 11% of the net sales or one-fourth of our construction marketEngineered Cabs and Steel Processing operating segments, respectively, and substantially all of the net sales of our Global Group operating segment are to the residentialconstruction market. While the market price of steel significantly impacts this business,these businesses, there are other key indicators that are meaningful in analyzing construction market demand, including U.S. gross domestic product (“U.S. GDP”), the Dodge Index of construction contracts, and trends in the relative price of framing lumber and steel. ConstructionThe construction market is also the predominant end market for our largest joint venture, Worthington Armstrong Venture (“WAVE”). The sales of WAVE are not consolidated in our results; however, adding our ownership percentage of WAVE’s construction market sales to our reported sales would not materially change the sales breakdown in the chart.

The automotive industry is the largest consumer of flat-rolled steel and thus the largest end market for our Steel Processing operations. Approximately half of the sales of our Steel Processing business segment, and substantially all of the sales of the Automotive Body Panels business segment, are to the automotive market. North American vehicle production, primarily by Chrysler, Ford and General Motors (the “Big Three automakers”), has a considerable impact on the customers within these two segments. These segments are also impacted by the market price of steel and, to a lesser extent, the market price of commodities used in their operations, such as zinc, natural gas and diesel fuel. The majority of the sales of two of our unconsolidated joint ventures, also goWorthington Armstrong Venture (“WAVE”) and ClarkDietrich. The decrease in the portion of our total net sales to the automotive end market. These sales are not consolidated in our results; however, adding our ownership percentageconstruction market versus fiscal 2011 was primarily driven by the deconsolidation of joint venture automotive market sales to our reported sales would not materially changesubstantially all of the sales breakdown in the previous chart.net assets of Dietrich Metal Framing (“Dietrich”) on March 1, 2011, as more fully described herein.

The net sales of our Pressure Cylinders and Steel Packaging businessoperating segments, and approximately 30%56% and 37% of the net sales of our Engineered Cabs and Steel Processing business segment,operating segments, respectively, are to other markets such as appliance, leisure and recreation, distribution and transportation,industrial gas, HVAC, lawn and garden, agriculture, mining, forestry and consumer specialty products.appliance. Given the many different product linesproducts that make up these net sales and the wide variety of end markets, it is very difficult to listdetail the key market indicators that drive this portion of our business. However, we believe that the trend in U.S. GDP growth is a good economic indicator for analyzing these operating segments.

We use the following information to monitor our costs and demand in our major end markets:

| Fiscal Year Ended May 31, | Inc / (Dec) | |||||||||||||||||||

| 2009 | 2008 | 2007 | 2009 vs. 2008 | 2008 vs. 2007 | ||||||||||||||||

U.S. GDP (% growth year-over-year) | -1.0 | % | 2.4 | % | 2.1 | % | -3.4 | % | 0.3 | % | ||||||||||

Hot-Rolled Steel ($ per ton)1 | $ | 726 | $ | 636 | $ | 571 | $ | 90 | $ | 65 | ||||||||||

Big Three Auto Build (000s vehicles)2 | 5,606 | 8,643 | 9,509 | (3,037 | ) | (866 | ) | |||||||||||||

No. America Auto Build (000s vehicles)2 | 9,880 | 14,662 | 15,068 | (4,782 | ) | (406 | ) | |||||||||||||

Dodge Index | 98 | 130 | 139 | (32 | ) | (9 | ) | |||||||||||||

Framing Lumber ($ per 1,000 board ft)3 | $ | 230 | $ | 269 | $ | 286 | $ | (39 | ) | $ | (17 | ) | ||||||||

Zinc ($ per pound)4 | $ | 0.65 | $ | 1.24 | $ | 1.65 | $ | (0.59 | ) | $ | (0.41 | ) | ||||||||

Natural Gas ($ per mcf)5 | $ | 7.02 | $ | 7.66 | $ | 6.73 | $ | (0.64 | ) | $ | 0.93 | |||||||||

Retail Diesel Prices, All types ($ per gallon)6 | $ | 3.17 | $ | 3.41 | $ | 2.77 | $ | (0.24 | ) | $ | 0.64 | |||||||||

U.S. GDP (% growth year-over-year)1 Hot-Rolled Steel ($ per ton)2 Detroit Three Auto Build (000’s vehicles)3 No. America Auto Build (000’s vehicles)3 Zinc ($ per pound)4 Natural Gas ($ per mcf)5 On-Highway Diesel Fuel Prices ($ per gallon)6 Fiscal Year Ended May 31, Increase /

(Decrease) 2012 2011 2010 2012 vs.

2011 2011 vs.

2010 0.5 % 2.4 % 0.1 % -1.9 % 2.3 % $ 693 $ 680 $ 549 $ 13 $ 131 8,084 7,251 5,650 833 1,601 14,242 12,756 10,643 1,486 2,113 $ 0.96 $ 1.00 $ 0.94 ($ 0.04 ) $ 0.06 $ 3.61 $ 4.14 $ 4.35 ($ 0.53 ) ($ 0.21 ) $ 3.93 $ 3.35 $ 2.77 $ 0.58 $ 0.58