For the fiscal year ended December 31, 2009 Commission file number 0-1402

| For the fiscal year ended December 31, 2012 | Commission file number 0-1402 | |

| Ohio | 34-1860551 | |||||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| 22801 St. Clair Avenue, Cleveland, Ohio | 44117 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

| (216) 481-8100 |

| (Registrant's telephone number, including area code) |

(216) 481-8100

(Registrant’s telephone number, including area code)

| Common Shares, without par value | The NASDAQ Stock Market LLC | |||||||

| (Title of each class) | (Name of each exchange on which registered) | |||||||

þLarge accelerated filer | ¨Accelerated filer | ¨Non-accelerated filer | ||||

(Do not check if a smaller reporting company) | ¨ Smaller reporting company | |||||

information, which is incorporated herein by reference. general metal fabrication, power generation and process industry, structural steel construction (buildings and bridges), heavy equipment fabrication (farming, mining and rail), shipbuilding, automotive,ITEM 1.BUSINESSreport,Annual Report on Form 10-K, the term “Company,”"Company," except as otherwise indicated by the context, means Lincoln Electric Holdings, Inc., and its wholly-owned and majority-owned subsidiaries for which it has a controlling interest. The Lincoln Electric Company began operations in 1895 and was incorporated under the laws of the State of Ohio in 1906. During 1998, The Lincoln Electric Company reorganized into a holding company structure, and Lincoln Electric Holdings, Inc. became the publicly-held parent of Lincoln Electric subsidiaries worldwide, including The Lincoln Electric Company.manufacturer and resellermanufacturers of welding, cutting and cuttingbrazing products. Welding products include arc welding power sources, wire feeding systems, robotic welding packages, fume extraction equipment, consumable electrodes and fluxes. The Company’s weldingCompany's product offering also includes computer numeric controlled ("CNC") plasma and oxy-fuel cutting systems and regulators and torches used in oxy-fuel welding, cutting and cutting.brazing. In addition, the Company has a leading global position in the brazing and soldering alloys market.electrodes,electrodes; (2) solid electrodes produced in coil, reel or drum forms for continuous feeding in mechanized welding,welding; and (3) cored electrodes produced in coil form for continuous feeding in mechanized welding.ventureventures, manufacturing facilities located in the United States, Australia, Brazil, Canada, China, Colombia, France, Germany, India, Indonesia, Italy, Mexico, the Netherlands, People’s Republic of China, Poland, Portugal, Russia, Turkey, the United Kingdom and Venezuela. Nearly allVenezuela, of the above facilitieswhich 34 are ISO 9001 certified.During the fourth quarter of 2009, therealignedhas aligned its business units into five operating segments to enhance the utilization of the Company’sCompany's worldwide resources and global end user and sourcing initiatives. The operating segments consist of North America Welding, Europe Welding, Asia Pacific Welding, South America Welding and The Harris Products Group. The North America Welding segment includes welding operations in the United States, Canada and Mexico. The Europe Welding segment includes welding operations in Europe, Russia and Africa. The other threetwo welding segments include welding operations in Europe, Asia Pacific and South America, respectively. The fifth segment, The Harris Products Group, includes the Company’sCompany's global cutting, soldering and brazing businesses as well as the retail business in the United States. See Note 35 to the Company’s Consolidated Financial StatementsCompany's consolidated financial statements for segment and geographic area information.Company’sCompany's products are sold in both domestic and international markets. In North America, products are sold principally through industrial distributors, retailers and also directly to users of welding products. Outside of North America, the Company has an international sales organization comprised of Company employees and agents who sell products from the Company’sCompany's various manufacturing sites to distributors and product users.Company’sCompany's major end-user markets include:2

pipe mills and pipelines, and

offshore oil and gas exploration and extraction.

generally a mature industry in developed markets such as North America and Western Europe, and is cyclical in nature. Overall demand for arc welding and cutting products is largely determined by economic cycles and the level of capital spending in manufacturing and other industrial sectors. The Company experiences some variability in reported period-to-period results as demand for the Company's products are mildly seasonal with generally higher demand in the second and

3

development, which is incorporated herein by reference.

The number of persons employed by the Company worldwide at December 31, 20092012 was 8,950.approximately 10,000. See "Part I, Item 10 of Part III1C" for information regarding the Company’sCompany's executive officers, which is incorporated herein by reference.

4

The risksrisk factors and uncertainties described below, and all of the othertogether with information incorporated by reference or otherwise included elsewhere in this Annual Report on Form 10-K, should be carefully considered. These risks and uncertainties are not the only ones we face. Additional risks and uncertainties of which we are currently unaware or that we currently believe to be immaterial may also adversely affect our business.

distribution of our products and the loss of sales and customers. Insurance proceeds may not adequately compensate the Company for the losses.

components, our inability to timely or otherwise obtain substitutes for such items, or any deterioration in our relationships with or the financial viability of our suppliers could adversely affect our business.

Since January 1, 1995, we have been a co-defendant in manganese cases that have been resolved as follows: 13,471 of those claims were dismissed, 20 were tried to defense verdicts in favor of us and five were tried to plaintiff verdicts (four of which are being or will be appealed). In addition, 13 claims were resolved by agreement for immaterial amounts and one was decided in favor of us following a motion for summary judgment.

5

Defense costs remain significant.

Manganese is an essential element of steel and cannot be eliminated from welding consumables.

6

acquisitions, we may be required to raise additional financing, which may not be available to us on acceptable terms. Our current operational cash flow is sufficient to fund our current acquisition plans, but a significant acquisition could require access to the capital markets. Further, we may not be able to successfully integrate any acquired business with our existing businesses or recognize the expected benefits from any completed acquisition.

Moreover, social unrest, the absence of trained labor pools and the uncertainties associated with entering into joint ventures or similar arrangements in foreign countries have slowed our business expansion into some

7

developing economies. Our presence in emerging markets has been facilitated in part through joint venture agreements with local organizations. While this strategy has allowed us to gain a footprint in emerging markets while leveraging the experience of local organizations, it also presents corporate governance and management challenges.

Our foreign operations also subject us to the risks of international terrorism and hostilities and to foreign currency risks, including exchange rate fluctuations and limits on the repatriation of funds.

For example, during

2012, approximately 8% of our net sales were generated from China and approximately 19% of our property, plant and equipment were located there. If the Chinese economy were to experience a significant slowdown, it could adversely affect our financial condition, results of operations and cash flows.We are dependent

standards. Furthermore, the potential physical impacts of theorized climate change on the Company’sCompany's customers, and therefore on the Company’sCompany's operations, are speculative and highly uncertain, and would be particular to the circumstances developing in various geographical regions. These may include changes in weather patterns

8

(including (including drought and rainfall levels), water availability, storm patterns and intensities, and temperature levels. These potential physical effects may adversely impact the cost, production, sales and financial performance of the Company’s operations.

Company's operations which we are unable, at this time, to predict.

| Name | Age | Position | |||

| John M. Stropki, Jr. | 62 | Executive Chairman of the Board effective December 31, 2012; Chairman of the Board since October 13, 2004 to December 31, 2012; Director since 1998; Chief Executive Officer and President since June 3, 2004 to December 31, 2012; Chief Operating Officer from May 1, 2003 to June 3, 2004; Executive Vice President from 1995 to June 3, 2004; and President, North America from 1996 to 2003. | |||

| Christopher L. Mapes | 51 | President and Chief Executive Officer effective December 31, 2012; Chief Operating Officer from September 1, 2011 to December 31, 2012; Director since February 2010. Prior to his service with the Company, Mr. Mapes was Executive Vice President of A.O. Smith Corporation (a global manufacturer with a water heating and water treatment technologies business and an electric motor and motor solutions business) a position he held from 2006 through August 2011, and the President of its Electrical Products unit, a position he held from September 2004 through August 2011. | |||

| Vincent K. Petrella | 52 | Senior Vice President, Chief Financial Officer and Treasurer since October 7, 2005; Vice President, Chief Financial Officer and Treasurer from February 4, 2004 to October 7, 2005; and Vice President, Corporate Controller from 2001 to 2003. | |||

| Frederick G. Stueber | 59 | Senior Vice President, General Counsel and Secretary since 1996. | |||

| George D. Blankenship | 50 | Senior Vice President; President, Lincoln Electric North America since July 30, 2009; Senior Vice President, Global Engineering from October 7, 2005 to July 30, 2009; Vice President, Global Engineering from May 5, 2005 to October 7, 2005; President, Lincoln Electric North America of The Lincoln Electric Company since July 30, 2009; Senior Vice President; President, Lincoln Cleveland of The Lincoln Electric Company from January 8, 2008 to July 30, 2009; Senior Vice President, U.S. Operations of The Lincoln Electric Company from October 7, 2005 to January 8, 2008; Vice President, Cleveland Operations of The Lincoln Electric Company from June 6, 2005 to October 7, 2005; and Vice President, Engineering and Quality Assurance of The Lincoln Electric Company from 2000 to June 6, 2005. | |||

| Gabriel Bruno | 45 | Vice President, Chief Information Officer since May 1, 2012; Vice President, Corporate Controller from 2005 to May 1, 2012. | |||

| Gretchen A. Farrell | 50 | Senior Vice President, Human Resources and Compliance since July 30, 2009; Vice President, Human Resources from May 5, 2005 to July 30, 2009; and Vice President, Human Resources of The Lincoln Electric Company since March 5, 2003. | |||

| Thomas A. Flohn | 52 | Vice President; President, Lincoln Electric Europe, Middle East & Africa (EMEA) since July 1, 2010; Vice President; President, Lincoln Asia Pacific from January 1, 2005 to June 30, 2010; and Vice President of Sales and Marketing, Lincoln Electric Asia Pacific from May 1, 1999 to December 31, 2004. | |||

| Steven B. Hedlund | 46 | Vice President, Strategy and Business Development since September 15, 2008. Prior to his service with the Company, Mr. Hedlund was the Vice President, Growth and Innovations with Master Lock, LLC (a security products company) from June 1, 2005 to July 1, 2008. | |||

| David M. LeBlanc | 48 | Senior Vice President; President, Lincoln Electric International since July 30, 2009; Vice President; President, Lincoln Electric Europe and Russia from March 10, 2008 to July 30, 2009; Vice President; President, Lincoln Electric Europe from September 1, 2005 to March 10, 2008; and Vice President; President, Lincoln Electric Latin America from January 1, 2002 to August 31, 2005. | |||

None.

North | ||

United States | Cleveland and Fort Loramie, Ohio; | |

Canada | Toronto; Mississauga. | |

Mexico | Mexico City; Torreon. | |

| Port Talbot, Wales. | |

Europe Welding: | ||

| France | Grand-Quevilly. | |

Germany | Essen. | |

Italy | Genoa; Corsalone. | |

Netherlands | Nijmegen. | |

Poland | Bielawa; | |

Portugal | Lisbon. | |

Russia | Mtsensk. | |

| Turkey | Istanbul. | |

United Kingdom | ||

Asia Pacific Welding: | ||

| ||

India | Chennai. | |

Indonesia | Cikarang. | |

| ||

| ||

Brazil | Sao Paulo. | |

Colombia | Bogota. | |

Venezuela | Maracay. | |

The Harris Products Group: | ||

United States | Mason, Ohio; Gainesville, Georgia; Santa Fe Springs, California. | |

Brazil | Guarulhos. | |

Mexico | Tijuana. | |

Poland | Dzierzoniow. | |

9

At December 31, 2009,

On December 13, 2006, the Company filed a complainttax and interest assessment was made in U.S. District Court (Northern District of Ohio) against Illinois Tool Works, Inc. seeking a declaratory judgment that eight patents owned by the defendant relating to certain inverter power sources have not and are not being infringed and that the subject patents are invalid. Illinois Tool Works filed a motion to dismiss this action, which the Court denied on June 21, 2007. On September 7, 2007, the Court stayed the litigation, referencing pending reexaminations before the U.S. Patent and Trademark Office. On June 17, 2008, the Company filed a motion to amend its pleadings in the foregoing matter to include several additional counts, including specific allegations of fraud on the U.S. Patent and Trademark Office with respect to portable professional welding machines and resulting monopoly power in that market.

No matters were submitted to a vote of security holders during the quarter ended December 31, 2009.

10

2012. Any Canadian tax ultimately due will be creditable in the parent company's U.S. federal tax return. The Company expects to be able to utilize the full amount of foreign tax credits generated in the statutorily allowed carry-back and carry-forward periods. Accordingly, should the Company not prevail in this dispute, the income statement charge will approximate the deficiency interest, net of tax. The Company believes it will prevail on the merits of the tax position. In accordance with prescribed recognition and measurement thresholds, no income tax accrual has been made for any uncertain tax positions related to the CRA reassessment. An unfavorable resolution of this matter could have a material effect on the Company's financial statements in the period in which a judgment is reached.

The Company’sCompany's common shares are traded on The NASDAQ StockGlobal Select Market under the symbol “LECO.”"LECO." The number of record holders of common shares at December 31, 20092012 was 1,758.

1,699.

The December dividend that the Company would normally pay in January 2013 was paid on December 28, 2012.

| 2009 | 2008 | |||||||||||||||||

| Stock Price | Dividends Declared | Stock Price | Dividends Declared | |||||||||||||||

| High | Low | High | Low | |||||||||||||||

First quarter | $ | 56.22 | $ | 26.32 | $ | 0.27 | $ | 71.48 | $ | 53.32 | $ | 0.25 | ||||||

Second quarter | 45.96 | 30.88 | 0.27 | 86.97 | 64.07 | 0.25 | ||||||||||||

Third quarter | 52.81 | 32.97 | 0.27 | 86.47 | 59.78 | 0.25 | ||||||||||||

Fourth quarter | 56.71 | 42.90 | 0.28 | 65.11 | 34.27 | 0.27 | ||||||||||||

Source: The NASDAQ Stock Market

| 2012 | 2011 | |||||||||||||||||||||||

| Stock Price | Dividends Declared | Stock Price | Dividends Declared | |||||||||||||||||||||

| High | Low | High | Low | |||||||||||||||||||||

| First quarter | $ | 47.87 | $ | 38.96 | $ | 0.170 | $ | 38.50 | $ | 32.69 | $ | 0.155 | ||||||||||||

| Second quarter | 50.36 | 41.42 | 0.170 | 39.62 | 32.30 | 0.155 | ||||||||||||||||||

| Third quarter | 46.11 | 37.83 | 0.170 | 39.18 | 27.47 | 0.155 | ||||||||||||||||||

| Fourth quarter | 49.00 | 37.63 | 0.200 | 40.10 | 26.84 | 0.170 | ||||||||||||||||||

Period | Total Number of Shares Repurchased (1) | Average Price Paid Per Share | Total Number of Shares Repurchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs (2) | |||||

February 1-28, 2009 | 8,407 | $ | 40.85 | 8,407 | 3,784,610 | ||||

| Period | Total Number of Shares Repurchased | Average Price Paid Per Share | Total Number of Shares Repurchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs (2) | |||||||||

| October 1-31, 2012 | — | $ | — | — | 3,779,773 | ||||||||

| November 1-30, 2012 | 271,518 | (1) | 44.74 | 253,400 | 3,526,373 | ||||||||

| December 1-31, 2012 | 184,000 | 47.36 | 184,000 | 3,342,373 | |||||||||

| Total | 455,518 | 45.80 | 437,400 | ||||||||||

| (1) | The above |

| (2) | The |

11

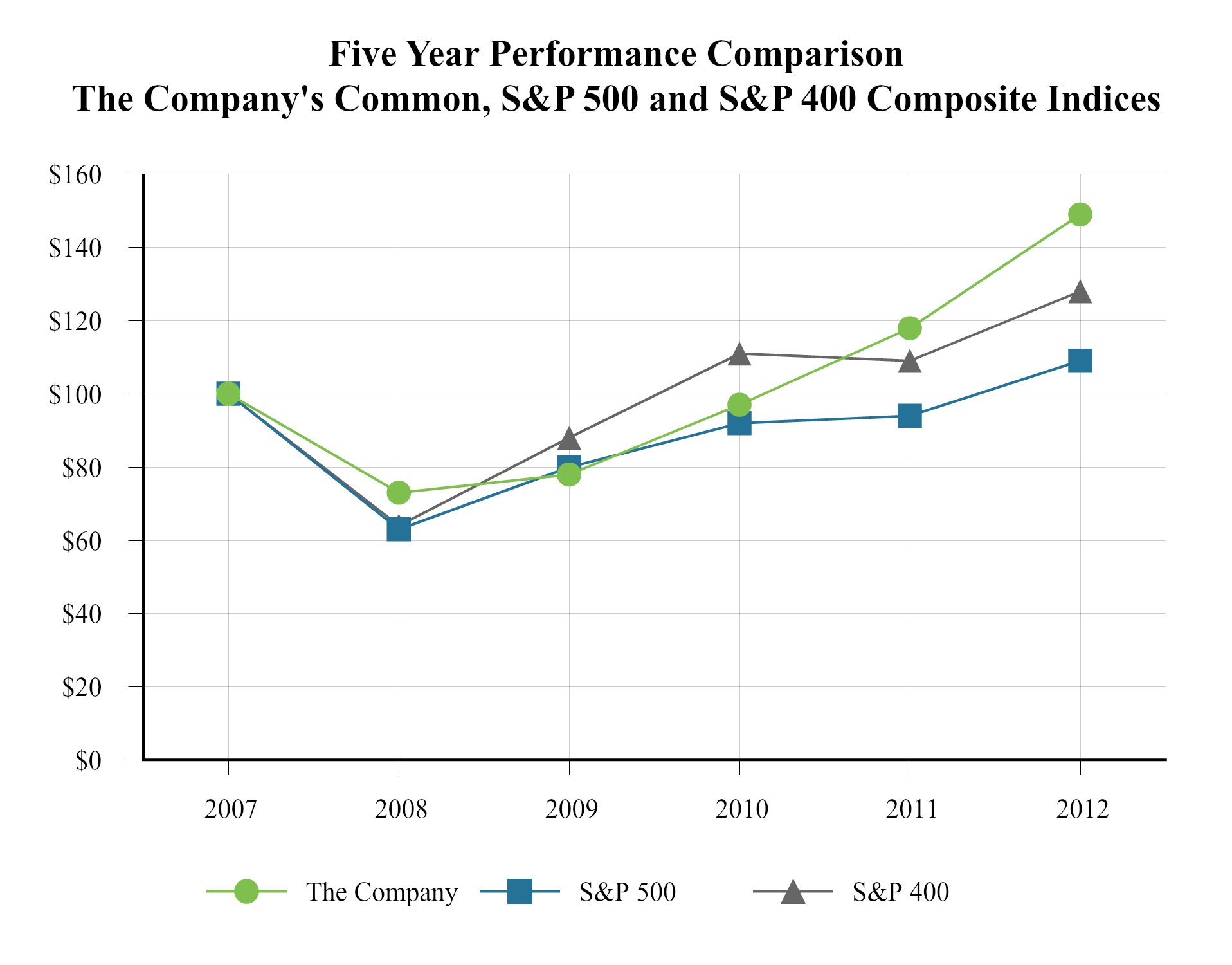

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

| The Company | 100 | 73 | 78 | 97 | 118 | 149 |

| S&P 500 | 100 | 63 | 80 | 92 | 94 | 109 |

| S&P 400 | 100 | 64 | 88 | 111 | 109 | 128 |

| Year Ended December 31, | ||||||||||||||||||||

2012 (1) | 2011 (2) | 2010 (3) | 2009 (4) | 2008 (5) | ||||||||||||||||

| Net sales | $ | 2,853,367 | $ | 2,694,609 | $ | 2,070,172 | $ | 1,729,285 | $ | 2,479,131 | ||||||||||

| Net income | 257,411 | 217,186 | 130,244 | 48,576 | 212,286 | |||||||||||||||

| Basic earnings per share | 3.10 | 2.60 | 1.54 | 0.57 | 2.49 | |||||||||||||||

| Diluted earnings per share | 3.06 | 2.56 | 1.53 | 0.57 | 2.47 | |||||||||||||||

| Cash dividends declared per share | 0.710 | 0.635 | 0.575 | 0.545 | 0.510 | |||||||||||||||

| Total assets | 2,089,863 | 1,976,776 | 1,783,788 | 1,705,292 | 1,718,805 | |||||||||||||||

| Long-term debt | 1,599 | 1,960 | 84,627 | 87,850 | 91,537 | |||||||||||||||

| (1) |

| (2) | Results for 2011 include rationalization and asset impairment net charges of |

| Year Ended December 31, | |||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

Net sales | $ | 1,729,285 | $ | 2,479,131 | $ | 2,280,784 | $ | 1,971,915 | $ | 1,601,190 | |||||

Net income | 48,576 | 212,286 | 202,736 | 175,008 | 122,306 | ||||||||||

Basic earnings per share | $ | 1.15 | $ | 4.98 | $ | 4.73 | $ | 4.11 | $ | 2.93 | |||||

Diluted earnings per share | 1.14 | 4.93 | 4.67 | 4.07 | 2.90 | ||||||||||

Cash dividends declared | 1.09 | 1.02 | 0.91 | 0.79 | 0.73 | ||||||||||

Total assets | $ | 1,705,292 | $ | 1,718,805 | $ | 1,645,296 | $ | 1,394,579 | $ | 1,161,161 | |||||

Long-term debt | 87,850 | 91,537 | 117,329 | 113,965 | 157,853 | ||||||||||

12

Results for 2009 include rationalization and asset impairment charges of $29,897 ($23,789 after-tax). The Company’s rationalization activities to align the business to current market conditions resulted in charges of $29,018 ($23,193 after-tax) and impairment charges of $879 ($596 after-tax) were recognized for certain indefinite-lived intangible assets. Results also include a loss of $7,943 ($7,943 after-tax) associated with the acquisition of a business in China and the related disposal of an interest in Taiwan, a pension settlement gain of $1,543 ($1,543 after-tax) and a gain on the sale of a property by the Company’s joint venture in Turkey of $5,667 ($5,667 after-tax).

Results for 2008 include a charge of $2,447 ($1,698 after-tax) relating to the Company’s rationalization programs that began in the fourth quarter of 2008 designed to align the business to current market conditions. Results for 2008 also include $16,924 ($16,615 after-tax) in asset impairment charges including $13,194 of goodwill and $2,388 of long-lived assets related to two businesses in China (with no tax benefit) as well as an impairment charge of $1,342 ($1,033 after-tax) for intangible assets in North America and Europe.

Results for 2007 include a net gain of $188 ($107 after-tax) relating to the Company’s rationalization programs.

Results for 2006 include a charge of $3,478 ($3,478 after-tax) relating to the Company’s rationalization programs and a gain of $9,006 ($7,204 after-tax) on the sale of a facility in Ireland.

Results for 2005 include a charge of $1,761 ($1,303 after-tax) relating to the Company’s rationalization programs, a one-time state income tax benefit of $1,807 (net of federal benefit) relating to changes in Ohio tax laws, a favorable adjustment of $8,711 related to the resolution of prior years’ tax liabilities, a net favorable tax benefit of $1,146 associated with the repatriation of foreign earnings and a gain of $1,418 ($876 after-tax) on the settlement of legal disputes.

| (3) | Results for 2010 include rationalization and asset impairment net gains of |

The following discussions

| (4) | Results for 2009 include rationalization and asset impairment net charges of $29,897 ($23,789 after-tax). The net charges include rationalization charges of $26,957 ($21,529 after-tax) and impairment charges of $2,940 ($2,260 after-tax) for certain indefinite-lived intangible assets. Results also include a loss of $7,943 ($7,943 after-tax) associated with the acquisition of a business in China and the related disposal of an interest in Taiwan, a pension settlement gain of $2,144 ($2,144 after-tax), a charge of $601 after-tax in non-controlling interests associated with the pension settlement gain for a majority-owned consolidated subsidiary and a gain on the sale of a property by the Company's joint venture in Turkey of $5,667 ($5,667 after-tax). |

| (5) | Results for 2008 include a charge of $2,447 ($1,698 after-tax) relating to the Company's rationalization programs that began in the fourth quarter 2008. Results for 2008 also include $16,924 ($16,615 after-tax) in asset impairment charges including $13,194 of goodwill and $2,388 of long-lived assets related to two businesses in China (with no tax benefit) as well as an impairment charge of $1,342 ($1,033 after-tax) for intangible assets. |

13

general metal fabrication,

power generation and process industry,

structural steel construction (buildings and bridges),

heavy equipment fabrication (farming, mining and rail),

shipbuilding,

automotive,

pipe mills and pipelines, and

offshore oil and gas exploration and extraction.

During the fourth quarter of 2009, the

and geographic area information, which is incorporated herein by reference.

14

| Year Ended December 31, | |||||||||||||||||||||

| 2009 | 2008 | 2007 | |||||||||||||||||||

| Amount | % of Sales | Amount | % of Sales | Amount | % of Sales | ||||||||||||||||

Net sales | $ | 1,729,285 | 100.0 | % | $ | 2,479,131 | 100.0 | % | $ | 2,280,784 | 100.0 | % | |||||||||

Cost of goods sold | 1,273,017 | 73.6 | % | 1,758,980 | 71.0 | % | 1,633,218 | 71.6 | % | ||||||||||||

Gross profit | 456,268 | 26.4 | % | 720,151 | 29.0 | % | 647,566 | 28.4 | % | ||||||||||||

Selling, general & administrative expenses | 333,395 | 19.3 | % | 405,376 | 16.4 | % | 370,122 | 16.2 | % | ||||||||||||

Rationalization and asset impairment charges (gain) | 29,897 | 1.7 | % | 19,371 | 0.8 | % | (188 | ) | (0.0 | )% | |||||||||||

Operating income | 92,976 | 5.4 | % | 295,404 | 11.9 | % | 277,632 | 12.2 | % | ||||||||||||

Interest income | 3,462 | 0.2 | % | 8,845 | 0.4 | % | 8,294 | 0.4 | % | ||||||||||||

Equity (loss) earnings in affiliates | (5,025 | ) | (0.3 | )% | 6,034 | 0.2 | % | 9,838 | 0.4 | % | |||||||||||

Other income | 3,589 | 0.2 | % | 1,681 | 0.1 | % | 2,823 | 0.1 | % | ||||||||||||

Interest expense | (8,521 | ) | (0.5 | )% | (12,155 | ) | (0.5 | )% | (11,430 | ) | (0.5 | )% | |||||||||

Income before income taxes | 86,481 | 5.0 | % | 299,809 | 12.1 | % | 287,157 | 12.6 | % | ||||||||||||

Income taxes | 37,905 | 2.2 | % | 87,523 | 3.5 | % | 84,421 | 3.7 | % | ||||||||||||

Net income | $ | 48,576 | 2.8 | % | $ | 212,286 | 8.6 | % | $ | 202,736 | 8.9 | % | |||||||||

| Year Ended December 31, | |||||||||||||||||||||

| 2012 | 2011 | 2010 | |||||||||||||||||||

| Amount | % of Sales | Amount | % of Sales | Amount | % of Sales | ||||||||||||||||

| Net sales | $ | 2,853,367 | 100.0 | % | $ | 2,694,609 | 100.0 | % | $ | 2,070,172 | 100.0 | % | |||||||||

| Cost of goods sold | 1,986,711 | 69.6 | % | 1,957,872 | 72.7 | % | 1,506,353 | 72.8 | % | ||||||||||||

| Gross profit | 866,656 | 30.4 | % | 736,737 | 27.3 | % | 563,819 | 27.2 | % | ||||||||||||

Selling, general & administrative expenses | 495,221 | 17.4 | % | 439,775 | 16.3 | % | 377,773 | 18.2 | % | ||||||||||||

Rationalization and asset impairment charges (gains) | 9,354 | 0.3 | % | 282 | — | (384 | ) | — | |||||||||||||

| Operating income | 362,081 | 12.7 | % | 296,680 | 11.0 | % | 186,430 | 9.0 | % | ||||||||||||

| Interest income | 3,988 | 0.1 | % | 3,121 | 0.1 | % | 2,381 | 0.1 | % | ||||||||||||

| Equity earnings in affiliates | 5,007 | 0.2 | % | 5,385 | 0.2 | % | 3,171 | 0.2 | % | ||||||||||||

| Other income | 2,685 | 0.1 | % | 2,849 | 0.1 | % | 1,817 | 0.1 | % | ||||||||||||

| Interest expense | (4,191 | ) | (0.1 | %) | (6,704 | ) | (0.2 | %) | (6,691 | ) | (0.3 | %) | |||||||||

| Income before income taxes | 369,570 | 13.0 | % | 301,331 | 11.2 | % | 187,108 | 9.0 | % | ||||||||||||

| Income taxes | 112,354 | 3.9 | % | 84,318 | 3.1 | % | 54,898 | 2.7 | % | ||||||||||||

Net income including non-controlling interests | 257,216 | 9.0 | % | 217,013 | 8.1 | % | 132,210 | 6.4 | % | ||||||||||||

Non-controlling interests in subsidiaries' (loss) earnings | (195 | ) | — | (173 | ) | — | 1,966 | 0.1 | % | ||||||||||||

| Net income | $ | 257,411 | 9.0 | % | $ | 217,186 | 8.1 | % | $ | 130,244 | 6.3 | % | |||||||||

2011

Net sales for the North America Welding segment decreased 34.7%

Net sales for the Europe Welding segment decreased 35.7% to $346,383 in 2009 compared with $538,570 in 2008. This decrease reflects a decrease of $130,235 (24.2%) due to volume, a $22,510 (4.2%) decrease due to price, a $5,242 (1.0%) increase from acquisitions and a $44,684 (8.3%) unfavorable impact as a result of changes in foreign currency exchange rates.

Net sales for the Asia Pacific Welding segment decreased 9.7% to $208,280 in 2009 compared with $230,661 in 2008. This decrease reflects a decrease of $68,447 (29.7%) due to volume, a $5,471 (2.4%) decrease due to price, a $54,638, (23.7%) increase from acquisitions and a $3,101 (1.3%) unfavorable impact as a result of changes in foreign currency exchange rates.

Net sales for the South America Welding segment decreased 14.6% to $99,171 in 2009 compared with $116,061 in 2008. This decrease reflects a decrease of $23,831 (20.5%) due to volume, a $13,117 (11.3%) increase due to price and a $6,176 (5.3%) unfavorable impact as a result of changes in foreign currency exchange rates.

15

Net sales for The Harris Products Group segment decreased 22.4% to $217,271 in 2009 compared with $279,958 in 2008. This decrease reflects a decrease of $59,196 (21.1%) due to volume, a $14,178 (5.1%) decrease due to price, a $13,570, (4.8%) increase from acquisitions and a $2,883 (1.0%) unfavorable impact as a result of changes in foreign currency exchange rates.

2012.

$8,821.

Equity (Loss) Earnings in Affiliates: Equity loss in affiliates was $5,025 in 2009 compared with earnings of $6,034$542 in 2008. The equity lossChile being partially offset by an increase in 2009 includes a lossearnings of $7,943 associated with the acquisition of Jinzhou Jin Tai Welding and Metal Co, Ltd. (“Jin Tai”) and the related disposal of an interest$164 in Kuang Tai Metal Industrial Co., Ltd. (“Kuang Tai”), the Company’s Taiwanese joint venture, and income of $5,667 as the Company’s share of a gain realized on the sale of a property by the Company’s joint ventureTurkey.

Income Taxes:The Company recorded $37,905$112,354 of tax expense on pre-tax income of $86,481,$369,570, resulting in an effective tax rate of 43.8%30.4% for 2009.2012. The effective income tax rate exceedsis lower than the Company’sCompany's statutory rate primarily due to losses at certain non-U.S. entities, including the loss associated with the acquisition of Jin Taiincome earned in lower tax rate jurisdictions and related disposal of Kuang Tai of $7,943, with no tax benefit, partially offset by a benefit for the utilization of foreign tax credits.loss carry-forwards for which valuation allowances had been previously provided.

| Change in Net Sales due to: | ||||||||||||||||||||||||

Net Sales 2011 | Volume | Acquisitions | Price | Foreign Exchange | Net Sales 2012 | |||||||||||||||||||

| Operating Segments | ||||||||||||||||||||||||

| North America Welding | $ | 1,309,499 | $ | 112,898 | $ | 124,830 | $ | 37,124 | $ | (3,533 | ) | $ | 1,580,818 | |||||||||||

| Europe Welding | 508,692 | (36,199 | ) | 8,322 | 4,874 | (33,462 | ) | 452,227 | ||||||||||||||||

| Asia Pacific Welding | 376,276 | (54,289 | ) | — | 1,646 | 849 | 324,482 | |||||||||||||||||

| South America Welding | 156,684 | (1,284 | ) | — | 15,584 | (9,501 | ) | 161,483 | ||||||||||||||||

| The Harris Products Group | 343,458 | 13,683 | — | (13,427 | ) | (9,357 | ) | 334,357 | ||||||||||||||||

| Consolidated | $ | 2,694,609 | $ | 34,809 | $ | 133,152 | $ | 45,801 | $ | (55,004 | ) | $ | 2,853,367 | |||||||||||

| % Change | ||||||||||||||||||||||||

| North America Welding | 8.6 | % | 9.5 | % | 2.8 | % | (0.3 | %) | 20.7 | % | ||||||||||||||

| Europe Welding | (7.1 | %) | 1.6 | % | 1.0 | % | (6.6 | %) | (11.1 | %) | ||||||||||||||

| Asia Pacific Welding | (14.4 | %) | — | 0.4 | % | 0.2 | % | (13.8 | %) | |||||||||||||||

| South America Welding | (0.8 | %) | — | 9.9 | % | (6.1 | %) | 3.1 | % | |||||||||||||||

| The Harris Products Group | 4.0 | % | — | (3.9 | %) | (2.7 | %) | (2.6 | %) | |||||||||||||||

| Consolidated | 1.3 | % | 4.9 | % | 1.7 | % | (2.0 | %) | 5.9 | % | ||||||||||||||

| Twelve Months Ended | ||||||||||||||

| December 31, | ||||||||||||||

| 2012 | 2011 | $ Change | % Change | |||||||||||

| North America Welding: | ||||||||||||||

| Net sales | $ | 1,580,818 | $ | 1,309,499 | 271,319 | 20.7 | % | |||||||

| Inter-segment sales | 131,062 | 136,314 | (5,252 | ) | (3.9 | %) | ||||||||

| Total Sales | $ | 1,711,880 | $ | 1,445,813 | 266,067 | 18.4 | % | |||||||

| EBIT, as adjusted | $ | 293,070 | $ | 227,924 | 65,146 | 28.6 | % | |||||||

| As a percent of total sales | 17.1 | % | 15.8 | % | 1.3 | % | ||||||||

| Europe Welding: | ||||||||||||||

| Net sales | $ | 452,227 | $ | 508,692 | (56,465 | ) | (11.1 | %) | ||||||

| Inter-segment sales | 16,048 | 17,422 | (1,374 | ) | (7.9 | %) | ||||||||

| Total Sales | $ | 468,275 | $ | 526,114 | (57,839 | ) | (11.0 | %) | ||||||

| EBIT, as adjusted | $ | 37,299 | $ | 36,171 | 1,128 | 3.1 | % | |||||||

| As a percent of total sales | 8.0 | % | 6.9 | % | 1.1 | % | ||||||||

| Asia Pacific Welding: | ||||||||||||||

| Net sales | $ | 324,482 | $ | 376,276 | (51,794 | ) | (13.8 | %) | ||||||

| Inter-segment sales | 14,829 | 15,614 | (785 | ) | (5.0 | %) | ||||||||

| Total Sales | $ | 339,311 | $ | 391,890 | (52,579 | ) | (13.4 | %) | ||||||

| EBIT, as adjusted | $ | 7,247 | $ | 2,629 | 4,618 | 175.7 | % | |||||||

| As a percent of total sales | 2.1 | % | 0.7 | % | 1.4 | % | ||||||||

| South America Welding: | ||||||||||||||

| Net sales | $ | 161,483 | $ | 156,684 | 4,799 | 3.1 | % | |||||||

| Inter-segment sales | 38 | 494 | (456 | ) | (92.3 | %) | ||||||||

| Total Sales | $ | 161,521 | $ | 157,178 | 4,343 | 2.8 | % | |||||||

| EBIT, as adjusted | $ | 18,301 | $ | 12,895 | 5,406 | 41.9 | % | |||||||

| As a percent of total sales | 11.3 | % | 8.2 | % | 3.1 | % | ||||||||

| The Harris Products Group: | ||||||||||||||

| Net sales | $ | 334,357 | $ | 343,458 | (9,101 | ) | (2.6 | %) | ||||||

| Inter-segment sales | 8,549 | 8,496 | 53 | 0.6 | % | |||||||||

| Total Sales | $ | 342,906 | $ | 351,954 | (9,048 | ) | (2.6 | %) | ||||||

| EBIT, as adjusted | $ | 29,477 | $ | 25,151 | 4,326 | 17.2 | % | |||||||

| As a percent of total sales | 8.6 | % | 7.1 | % | 1.5 | % | ||||||||

16

| Change in Net Sales due to: | ||||||||||||||||||||||||

Net Sales 2010 | Volume | Acquisitions | Price | Foreign Exchange | Net Sales 2011 | |||||||||||||||||||

| Operating Segments | ||||||||||||||||||||||||

| North America Welding | $ | 1,013,193 | $ | 194,618 | $ | 54,452 | $ | 41,839 | $ | 5,397 | $ | 1,309,499 | ||||||||||||

| Europe Welding | 359,925 | 42,376 | 66,425 | 20,390 | 19,576 | 508,692 | ||||||||||||||||||

| Asia Pacific Welding | 324,092 | 26,198 | — | 3,305 | 22,681 | 376,276 | ||||||||||||||||||

| South America Welding | 117,419 | 24,209 | — | 11,618 | 3,438 | 156,684 | ||||||||||||||||||

| The Harris Products Group | 255,543 | 18,625 | — | 65,753 | 3,537 | 343,458 | ||||||||||||||||||

| Consolidated | $ | 2,070,172 | $ | 306,026 | $ | 120,877 | $ | 142,905 | $ | 54,629 | $ | 2,694,609 | ||||||||||||

| % Change | ||||||||||||||||||||||||

| North America Welding | 19.2 | % | 5.4 | % | 4.1 | % | 0.5 | % | 29.2 | % | ||||||||||||||

| Europe Welding | 11.8 | % | 18.5 | % | 5.7 | % | 5.4 | % | 41.3 | % | ||||||||||||||

| Asia Pacific Welding | 8.1 | % | — | 1.0 | % | 7.0 | % | 16.1 | % | |||||||||||||||

| South America Welding | 20.6 | % | — | 9.9 | % | 2.9 | % | 33.4 | % | |||||||||||||||

| The Harris Products Group | 7.3 | % | — | 25.7 | % | 1.4 | % | 34.4 | % | |||||||||||||||

| Consolidated | 14.8 | % | 5.8 | % | 6.9 | % | 2.6 | % | 30.2 | % | ||||||||||||||

| Twelve Months Ended | ||||||||||||||

| December 31, | ||||||||||||||

| 2011 | 2010 | $ Change | % Change | |||||||||||

| North America Welding: | ||||||||||||||

| Net sales | $ | 1,309,499 | $ | 1,013,193 | 296,306 | 29.2 | % | |||||||

| Inter-segment sales | 136,314 | 108,849 | 27,465 | 25.2 | % | |||||||||

| Total Sales | $ | 1,445,813 | $ | 1,122,042 | 323,771 | 28.9 | % | |||||||

| EBIT, as adjusted | $ | 227,924 | $ | 162,192 | 65,732 | 40.5 | % | |||||||

| As a percent of total sales | 15.8 | % | 14.5 | % | 1.3 | % | ||||||||

| Europe Welding: | ||||||||||||||

| Net sales | $ | 508,692 | $ | 359,925 | 148,767 | 41.3 | % | |||||||

| Inter-segment sales | 17,422 | 13,330 | 4,092 | 30.7 | % | |||||||||

| Total Sales | $ | 526,114 | $ | 373,255 | 152,859 | 41.0 | % | |||||||

| EBIT, as adjusted | $ | 36,171 | $ | 17,023 | 19,148 | 112.5 | % | |||||||

| As a percent of total sales | 6.9 | % | 4.6 | % | 2.3 | % | ||||||||

| Asia Pacific Welding: | ||||||||||||||

| Net sales | $ | 376,276 | $ | 324,092 | 52,184 | 16.1 | % | |||||||

| Inter-segment sales | 15,614 | 12,546 | 3,068 | 24.5 | % | |||||||||

| Total Sales | $ | 391,890 | $ | 336,638 | 55,252 | 16.4 | % | |||||||

| EBIT, as adjusted | $ | 2,629 | $ | 1,752 | 877 | 50.1 | % | |||||||

| As a percent of total sales | 0.7 | % | 0.5 | % | 0.2 | % | ||||||||

| South America Welding: | ||||||||||||||

| Net sales | $ | 156,684 | $ | 117,419 | 39,265 | 33.4 | % | |||||||

| Inter-segment sales | 494 | 1,216 | (722 | ) | (59.4 | %) | ||||||||

| Total Sales | $ | 157,178 | $ | 118,635 | 38,543 | 32.5 | % | |||||||

| EBIT, as adjusted | $ | 12,895 | $ | 7,554 | 5,341 | 70.7 | % | |||||||

| As a percent of total sales | 8.2 | % | 6.4 | % | 1.8 | % | ||||||||

| The Harris Products Group: | ||||||||||||||

| Net sales | $ | 343,458 | $ | 255,543 | 87,915 | 34.4 | % | |||||||

| Inter-segment sales | 8,496 | 6,641 | 1,855 | 27.9 | % | |||||||||

| Total Sales | $ | 351,954 | $ | 262,184 | 89,770 | 34.2 | % | |||||||

| EBIT, as adjusted | $ | 25,151 | $ | 12,311 | 12,840 | 104.3 | % | |||||||

| As a percent of total sales | 7.1 | % | 4.7 | % | 2.4 | % | ||||||||

| Year Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Operating income as reported | $ | 362,081 | $ | 296,680 | $ | 186,430 | ||||||

| Special items (pre-tax): | ||||||||||||

| Rationalization charges (gains) | 7,512 | 282 | (1,267 | ) | ||||||||

| Impairment charges | 1,842 | — | 883 | |||||||||

| Venezuela statutory severance obligation | 1,381 | — | — | |||||||||

| Venezuela – functional currency change and devaluation | — | — | 3,123 | |||||||||

| Adjusted operating income | $ | 372,816 | $ | 296,962 | $ | 189,169 | ||||||

| Year Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Net income as reported | $ | 257,411 | $ | 217,186 | $ | 130,244 | ||||||

| Special items (after-tax): | ||||||||||||

| Rationalization charges (gains) | 6,153 | 237 | (1,695 | ) | ||||||||

| Impairment charges | 1,289 | — | 801 | |||||||||

| Venezuela statutory severance obligation | 906 | — | — | |||||||||

| Venezuela – functional currency change and devaluation | — | — | 3,560 | |||||||||

Income from tax adjustment resulting from change in applicable tax regulations | — | — | (5,092 | ) | ||||||||

| Adjustment for tax audit settlements | — | (4,844 | ) | — | ||||||||

Non-controlling interests charges associated with special items | — | — | 1,782 | |||||||||

| Adjusted net income | $ | 265,759 | $ | 212,579 | $ | 129,600 | ||||||

| Diluted earnings per share as reported | $ | 3.06 | $ | 2.56 | $ | 1.53 | ||||||

| Special items per share | 0.10 | (0.05 | ) | (0.01 | ) | |||||||

| Adjusted diluted earnings per share | $ | 3.16 | $ | 2.51 | $ | 1.52 | ||||||

| Year Ended December 31, | |||||||

| 2009 | 2008 | ||||||

Operating income as reported | $ | 92,976 | $ | 295,404 | |||

Special items: | |||||||

Rationalization charges | 29,018 | 2,447 | |||||

Impairment charges | 879 | 16,924 | |||||

Pension settlement gain | (1,543 | ) | — | ||||

Adjusted Operating income excluding special items | $ | 121,330 | $ | 314,775 | |||

| Year Ended December 31, | |||||||

| 2009 | 2008 | ||||||

Net income as reported | $ | 48,576 | $ | 212,286 | |||

Special items (after-tax): | |||||||

Rationalization charges | 23,193 | 1,698 | |||||

Impairment charges | 596 | 16,615 | |||||

Pension settlement gain | (1,543 | ) | — | ||||

Loss associated with the acquisition of Jin Tai | 7,943 | — | |||||

Gain on sale of property | (5,667 | ) | — | ||||

Adjusted Net income excluding special items | $ | 73,098 | $ | 230,599 | |||

Diluted EPS | $ | 1.14 | $ | 4.93 | |||

Special items | 0.57 | 0.43 | |||||

Adjusted Diluted EPS excluding special items | $ | 1.71 | $ | 5.36 | |||

2008 Compared to 2007

Net Sales: Net sales for 2008 increased 8.7% to $2,479,131 from $2,280,784 initiated in 2007. The increase in Net sales reflects an $88,436 (3.9%) decrease due to volume, a $176,045 (7.7%) increase due to price, a $67,538 (3.0%) increase from acquisitions and a $43,200 (1.9%) favorable impact as a result of changes in foreign currency exchange rates.

Net sales for the North America Welding segment increased 5.2% to $1,313,881 in 2008 compared with $1,248,382 in 2007. This increase reflects a decrease of $57,607 (4.6%) due to volume, a $113,883 (9.1%) increase due to price and a $9,425 (0.8%) increase from acquisitions.

Net sales for the Europe Welding segment increased 13.5% to $538,570 in 2008 compared with $474,388 in 2007. This increase reflects a decrease of $1,592 (0.3%) due to volume, a $6,458 (1.4%) increase due to price, a $29,827 (6.3%) increase from acquisitions and a $29,489 (6.2%) favorable impact as a result of changes in foreign currency exchange rates.

17

Net sales for the Asia Pacific Welding segment increased 29.5% to $230,661 in 2008 compared with $178,120 in 2007. This increase reflects a $21,752 (12.2%) increase due to price, a $23,159 (13.0%) increase from acquisitions and a $7,699 (4.3%) favorable impact as a result of changes in foreign currency exchange rates.

Net sales for the South America Welding segment increased 14.4% to $116,061 in 2008 compared with $101,426 in 2007. This increase reflects a decrease of $10,444 (10.3%) due to volume, a $20,883 (20.6%) increase due to price and a $4,196 (4.1%) favorable impact as a result of changes in foreign currency exchange rates.

Net sales for The Harris Products Group segment increased 0.5% to $279,958 in 2008 compared with $278,468 in 2007. This increase reflects a decrease of $18,724 (6.7%) due to volume, a $13,069 (4.7%) increase due to price, a $5,127 (1.8%) increase from acquisitions and a $2,018 (0.7%) favorable impact as a result of changes in foreign currency exchange rates.

Gross Profit: Gross profit increased 11.2% to $720,151 during 2008 compared with $647,566 in 2007. As a percentage of Net sales, Gross profit increased to 29.0% in 2008 from 28.4% in 2007. This increase was primarily a result of favorable pricing leverage and improved operational effectiveness2012 partially offset by volume decreasesgains on the disposal of assets at rationalized operations, asset impairment charges of $1,289 and a net charge of $906 related to the continuing shiftchange in sales mix to traditionally lower margin geographies and businesses. Foreign currency exchange rates had a $10,621 favorable impact in 2008.

Selling, General & Administrative Expenses: SG&A expensesVenezuelan labor law, which provides for increased $35,254 (9.5%) in 2008 compared with 2007. The increase was primarily due to higher selling expenses of $10,543 resulting from increased sales activity, incremental selling, general and administrative expenses from acquisitions totaling $9,222, higher bonus expense of $5,706 and higher foreign currency transaction losses of $4,381. Foreign currency exchange rates had a $5,587 unfavorable impact.employee severance obligations.

In 2007, the Company recorded$801. Net income also includes a net gaincharge of $188 ($107 after-tax) to rationalization charges due to a gain of $816 ($735 after-tax)$3,560 related to the terminationchange in functional currency and devaluation of the Harris Ireland Pension Plan offsetting other chargesVenezuelan currency, income of $5,092 due to an adjustment in tax liabilities for a change in applicable tax regulations, a gain of $108 in non-controlling interests related to severance costs covering 66 employees at the Company’s facility in Ireland.

Interest Income: Interest income increased to $8,845 in 2008 from $8,294 in 2007. The increase wasimpairment of assets for a result of higher cash balances partially offset by lower interest rate investments in 2008 when compared with 2007.

Equity Earnings in Affiliates: Equity earnings in affiliates decreased to $6,034 in 2008 from $9,838 in 2007 as a result of lower earnings at the Company’s joint venture investments in Turkey and Taiwan.

Interest Expense: Interest expense increased to $12,155 in 2008 from $11,430 in 2007 as a result of a lower level of amortization of the gain associated with previously terminated interest rate swap agreements and higher debt levels.

Income Taxes: Income taxes for 2008 were $87,523 on income before income taxes of $299,809, an effective rate of 29.2%, compared with income taxes of $84,421 on income before income taxes of $287,157, or an effective rate of 29.4% for 2007. The decrease in the effective tax rate for 2008 from 2007 was a result of additional utilization of foreign tax credits from the repatriation of higher-taxed earnings partially offset by non-deductible asset impairment charges in China. The effective rate for 2008 and 2007 was lower than the Company’s statutory rate primarily because of the utilization of foreign tax credits, lower taxes on non-U.S. earnings and the utilization of foreign tax loss carryforwards, for which valuation allowances had been previously provided.

18

Net Income: Net income for 2008 was $212,286 compared with $202,736 in the prior year. Diluted EPS for 2008 was $4.93 compared with $4.67 per share in 2007. Foreign currency exchange rate movements had a $2,508majority-owned consolidated subsidiary and a $3,419 favorable effect on net incomecharge of $1,890 in non-controlling interests related to the disposal of assets for 2008 and 2007, respectively.a majority-owned consolidated subsidiary.

Non-GAAP Financial Measures: The Company reviews Operating income, Net income and Diluted EPS excluding special items, non-GAAP financial measures, in assessing and evaluating the Company’s underlying operating performance. The following tables present reconciliations of Operating income, Net income and Diluted EPS as reported to Operating income, Net income and Diluted EPS excluding special items.

| Year Ended December 31, | |||||||

| 2008 | 2007 | ||||||

Operating income as reported | $ | 295,404 | $ | 277,632 | |||

Special items: | |||||||

Rationalization charges (gain) | 2,447 | (188 | ) | ||||

Impairment charges | 16,924 | — | |||||

Adjusted Operating income excluding special items | $ | 314,775 | $ | 277,444 | |||

| Year Ended December 31, | |||||||

| 2008 | 2007 | ||||||

Net income as reported | $ | 212,286 | $ | 202,736 | |||

Special items (after-tax): | |||||||

Rationalization charges (gain) | 1,698 | (107 | ) | ||||

Impairment charges | 16,615 | — | |||||

Adjusted Net income excluding special items | $ | 230,599 | $ | 202,629 | |||

Diluted EPS | $ | 4.93 | $ | 4.67 | |||

Special items | 0.43 | — | |||||

Adjusted Diluted EPS excluding special items | $ | 5.36 | $ | 4.67 | |||

19

| Year Ended December 31, | $ Change | |||||||||||||||||||

| 2009 | 2008 | 2007 | 2009 vs. 2008 | 2008 vs. 2007 | ||||||||||||||||

Cash provided by operating activities: | $ | 250,350 | $ | 257,449 | $ | 249,832 | $ | (7,099 | ) | $ | 7,617 | |||||||||

Cash used by investing activities: | (63,581 | ) | (115,800 | ) | (79,705 | ) | 52,219 | (36,095 | ) | |||||||||||

Capital expenditures | (38,201 | ) | (72,426 | ) | (61,633 | ) | 34,225 | (10,793 | ) | |||||||||||

Acquisition of businesses, net of cash acquired | (25,449 | ) | (44,036 | ) | (18,773 | ) | 18,587 | (25,263 | ) | |||||||||||

Cash used by financing activities: | (89,072 | ) | (67,741 | ) | (77,586 | ) | (21,331 | ) | 9,845 | |||||||||||

(Payments) proceeds on short-term borrowings, net | (12,954 | ) | 6,104 | 2,826 | (19,058 | ) | 3,278 | |||||||||||||

(Payments) proceeds on long-term borrowings, net | (30,874 | ) | 319 | (40,142 | ) | (31,193 | ) | 40,461 | ||||||||||||

Proceeds from exercise of stock options | 705 | 7,201 | 8,644 | (6,496 | ) | (1,443 | ) | |||||||||||||

Tax benefit from exercise of stock options | 195 | 3,728 | 4,289 | (3,533 | ) | (561 | ) | |||||||||||||

Purchase of shares for treasury | (343 | ) | (42,337 | ) | (15,459 | ) | 41,994 | (26,878 | ) | |||||||||||

Cash dividends paid to shareholders | (45,801 | ) | (42,756 | ) | (37,744 | ) | (3,045 | ) | (5,012 | ) | ||||||||||

Increase in Cash and cash equivalents | 103,804 | 66,950 | 97,170 | 36,854 | (30,220 | ) | ||||||||||||||

| Year Ended December 31, | $ Change | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 vs. 2011 | 2011 vs. 2010 | ||||||||||||||||

| Cash provided by operating activities | $ | 327,484 | $ | 193,518 | $ | 156,978 | $ | 133,966 | $ | 36,540 | ||||||||||

| Cash used by investing activities: | (187,471 | ) | (130,796 | ) | (69,400 | ) | (56,675 | ) | (61,396 | ) | ||||||||||

| Capital expenditures | (52,715 | ) | (65,813 | ) | (60,565 | ) | 13,098 | (5,248 | ) | |||||||||||

| Acquisition of businesses, net of cash acquired | (134,602 | ) | (66,229 | ) | (18,856 | ) | (68,373 | ) | (47,373 | ) | ||||||||||

| Proceeds from the sale of property, plant and equipment | 1,387 | 1,246 | 10,021 | 141 | (8,775 | ) | ||||||||||||||

| Other investing activities | (1,541 | ) | — | — | (1,541 | ) | — | |||||||||||||

| Cash used by financing activities: | (216,838 | ) | (63,370 | ) | (109,507 | ) | (153,468 | ) | 46,137 | |||||||||||

| (Payments) proceeds on short-term borrowings, net | (4,533 | ) | 8,981 | (18,599 | ) | (13,514 | ) | 27,580 | ||||||||||||

| Payments on long-term borrowings, net | (84,770 | ) | (1,032 | ) | (8,580 | ) | (83,738 | ) | 7,548 | |||||||||||

| Proceeds from exercise of stock options | 18,776 | 11,351 | 3,508 | 7,425 | 7,843 | |||||||||||||||

| Tax benefit from exercise of stock options | 7,819 | 2,916 | 1,210 | 4,903 | 1,706 | |||||||||||||||

| Purchase of shares for treasury | (81,018 | ) | (36,997 | ) | (39,682 | ) | (44,021 | ) | 2,685 | |||||||||||

| Cash dividends paid to shareholders | (73,112 | ) | (51,935 | ) | (47,364 | ) | (21,177 | ) | (4,571 | ) | ||||||||||

| Other financing activities | — | 3,346 | — | (3,346 | ) | 3,346 | ||||||||||||||

| Decrease in Cash and cash equivalents | (74,637 | ) | (5,092 | ) | (21,943 | ) | ||||||||||||||

2011

.The Company’s debt levels decreased from $142,230 at December 31, 2008, to $123,717 at December 31, 2009. Debt to total capitalization decreased to 10.2% at December 31, 2009 from 12.3% at December 31, 2008.

A total of $45,801 in

20

The Company has investments in Venezuela which currently require the approval of a government agency to convert local currency to U.S. dollars at official government rates. Government approval for currency conversion to satisfy U.S. dollar liabilities to foreign suppliers, including payables to Lincoln affiliates, has lagged payment due dates from time to time in the past, resulting in higher cash balances and higher past due U.S. dollar payables within our Venezuelan subsidiary. If the Company had settled its Venezuelan subsidiary’s U.S. dollar liabilities using unofficial parallel currency exchange mechanisms as of December 31, 2009, it would have resulted in a currency exchange gain of approximately $437.

Cumulative inflation in Venezuela over the preceding three year period reached 100% during the fourth quarter of 2009. As a result, the Company changed the functional currency of its Venezuelan subsidiary to the U.S. dollar as of January 1, 2010. During January 2010, the Venezuelan government announced the devaluation of the official exchange rate used for most foreign currency transactions common to the Company’s Venezuelan subsidiary from 2.15 to 4.30 Bolivars to the U.S. dollar.

The Company’s Venezuelan subsidiary’s net Bolivar denominated monetary liability position is expected to result in a gain of approximately $2,500 during the first quarter of 2010. The Company also expects that its Venezuelan subsidiary’s results of operations will decrease significantly in 2010 due to the new exchange rate. The impact of selling inventories carried at the previous exchange rate is expected to decrease gross profit by approximately $5,000.

Rationalization and Asset Impairments

The Company recorded rationalization and asset impairment charges of $29,897 for the year ended December 31, 2009. These charges include $27,142 primarily related to employee severance costs, $2,061 in long-lived asset impairment charges, $879 in indefinite-lived intangible asset impairment charges and a gain of $185 recognized in connection with the partial settlement of a pension plan.

In the fourth quarter of 2009, the Company determined that the carrying value of certain long-lived assets exceeded fair value at operations affected by rationalization activities initiated in the second and third quarters of 2009. As a result, asset impairment charges totaling $2,061 were recognized in “Rationalization and asset impairment charges (gain).” Of the total asset impairment charges, $253 were recognized in the Europe Welding segment, $1,515 in the Asia Pacific Welding segment and $293 in The Harris Products Group segment. Fair values of impaired long-lived assets were determined primarily by third party appraisal.

During the third quarter of 2009, the Company initiated various rationalization actions, including the closureDecember dividend payment of a manufacturing facility in Europe and the consolidation of certain manufacturing operations in the Europe Welding and Asia Pacific Welding segments. These actions impacted 80 employees in the Europe Welding segment, 175 employees in the Asia Pacific Welding segment and nine employees in the South America Welding segment. These actions are expected to cost approximately $12,000, of which the Company recorded rationalization charges of $8,333 for the year ended December 31, 2009. At December 31, 2009, a liability related to these actions of $3,912 was recorded in “Other current liabilities.” Costs related to these actions relate primarily to employee severance actions$16,533 that are expected to be substantially completed and paid over the next year.

During the second quarter of 2009, the Company initiated various rationalization actions including the closure of a manufacturing facility in The Harris Products Group segment. These actions affected eight employees in the North America Welding segment, 61 employees in the Europe Welding segment, 81 employees in the Asia Pacific Welding segment, 23 employees in the South America Welding segment and 58 employees in The Harris Products Group segment. The Company recorded rationalization charges of $6,684 for the year ended December 31, 2009 related to these actions. A liability related to these actions of $2,445 was recorded in “Other current liabilities” at December 31, 2009. These costs relate primarily to employee severance actions that are essentially complete and are expected towould generally be paid over the next year.

21

Rationalization actions taken during the first quarter of 2009 included a voluntary separation incentive program covering certain U.S.-based employees. These actions affected 408 employees in the North America Welding segment, 48 employees in the Europe Welding segment, 44 employees in the Asia Pacific Welding segment, 22 employees in the South America Welding segment and 46 employees in The Harris Products Group segment. The Company recorded rationalization charges of $12,092 for the year ended December 31, 2009 related to these actions. At December 31, 2009, all activities associated with these actions were completed.

Rationalization actions taken during the fourth quarter of 2008 affected 67 and 65 employees in The Harris Products Group and Europe Welding segments, respectively. The Company recorded rationalization charges of $2,447 at December 31, 2008 and $33 for the year ended December 31, 2009 related to these actions. At December 31, 2009, all activities associated with these actions were completed.

The Company continues evaluating its cost structure and additional rationalization actions may result in charges in subsequent quarters.

In the fourth quarter of 2008, the Company recorded asset impairment charges totaling $16,924 in “Rationalization and asset impairment charges (gain).”

In the fourth quarter of 2008, the Company determined that poor operating results and a dampened economic outlook indicated the potential for impairment at two of its businesses in China. Impairment testing determined that the carrying value of long-lived assets exceeded fair value at one of these businesses and the Company recorded a charge of $2,388. In addition, the carrying value of goodwill at both of these businesses exceeded the implied value of goodwill and the Company recorded a charge of $13,194.

The Company also tested indefinite-lived intangible assets and determined that the carrying value of certain intangible assets in the Europe Welding and North America Welding segments exceeded fair value. As a result, the Company recorded charges of $524 and $818, respectively.

Fair values of impaired assets were determined using projected discounted cash flows.

In 2005, the Company committed to a plan to rationalize manufacturing operations at Harris Calorific Limited (“Harris Ireland”). The Company incurred a total of $3,920 in charges related to this plan of which a gain of $188 was recorded in 2007. During 2009, the Company received cash of $1,740 related to the termination of the Harris Ireland pension plan and recognized a gain of $185.

AcquisitionsJanuary 2013.

On July 29, 2009, the Company completed the acquisition of 100% of Jin Tai, based in Jinzhou, China. This transaction expanded the Company’s customer base and gave the Company control of significant cost-competitive solid wire manufacturing capacity.

The Company previously held a 21% direct interest in Jin Tai and a further 27% indirect interest via its 35% interest in Kuang Tai. Under the terms of the agreement, the Company exchanged its 35% interest in Kuang Tai with a fair value of $22,723, paid cash of $35,531 and will pay an additional $4,181 in cash over a three-year period after close.

The fair value of the Company’s previous non-controlling direct interest in Jin Tai was $8,675. The carrying values of the Company’s interests in Kuang Tai and Jin Tai were $29,368 and $9,973, respectively. The excess carrying value over fair value of these interests resulted in a loss on the transaction of $7,943 recorded in “Equity (loss) earnings in affiliates.”

The Company previously reported its proportional share of Jin Tai’s net income under the equity method in “Equity (loss) earnings in affiliates.” Jin Tai’s sales were $186,774 in 2008 and $74,834 in 2009 prior to the acquisition. Jin Tai’s sales of $53,956 after the acquisition were included in “Net sales” for 2009. The pro forma impact on the results of operations if the acquisition had been completed as of the beginning of both 2009 and 2008 would not have been significant.

22

The identifiable assets acquired and liabilities assumed upon the acquisition of Jin Tai were as follows:

| July 29, 2009 | |||

Cash and cash equivalents | $ | 16,032 | |

Accounts receivable | 23,306 | ||

Inventory | 17,037 | ||

Other current assets | 18,932 | ||

Property, plant and equipment | 29,275 | ||

Intangibles | 15,201 | ||

Goodwill | 1,429 | ||

Other non-current assets | 5,585 | ||

Total assets acquired | 126,797 | ||

Amounts due banks | 28,833 | ||

Trade accounts payable | 2,306 | ||

Current liabilities | 7,839 | ||

Long-term liabilities | 15,459 | ||

Total liabilities assumed | 54,437 | ||

Net assets acquired | $ | 72,360 | |

All assets acquired and liabilities assumed were recorded at estimated fair value. Goodwill of $1,429 was allocated to the Asia Pacific Welding segment and is not deductible for income tax purposes under current tax law. Net assets acquired included a non-controlling interest in one of Jin Tai’s operations valued at $1,250. This non-controlling interest was subsequently acquired and accounted for as an equity transaction.

On October 1, 2008, the Company acquired a 90% interest in a leading Brazilian manufacturer of brazing products for approximately $24,000 in cash and assumed debt. The newly acquired company, based in Sao Paulo, is being operated as Harris Soldas Especiais S.A. This acquisition expanded the Company’s brazing product line and increased the Company’s presence in the South American market. Annual sales at the time of the acquisition were approximately $30,000.

On April 7, 2008, the Company acquired all of the outstanding stock of Electro-Arco S.A. (“Electro-Arco”), a privately held manufacturer of welding consumables headquartered near Lisbon, Portugal, for approximately $24,000 in cash and assumed debt. This acquisition added to the Company’s European consumables manufacturing capacity and widened the Company’s commercial presence in Western Europe. Annual sales at the time of the acquisition were approximately $40,000.

On November 30, 2007, the Company acquired the assets and business of Vernon Tool Company Ltd. (“Vernon Tool”), a privately held manufacturer of computer-controlled pipe cutting equipment used for precision fabrication purposes headquartered near San Diego, California, for approximately $12,434 in cash. This acquisition added to the Company’s ability to support its customers in the market for infrastructure development. Annual sales at the time of the acquisition were approximately $9,000.

On November 29, 2007, the Company announced that it had entered into a majority-owned joint venture with Zhengzhou Heli Welding Materials Company Ltd. (“Zhengzhou Heli”), a privately held manufacturer of subarc flux based in Zhengzhou, China. The Company has contributed $16,400 to Zhengzhou Heli. Annual sales at the time of the acquisition were approximately $8,000.

23

On July 20, 2007, the Company acquired Nanjing Kuang Tai Welding Materials Company, Ltd. (“Nanjing”), a manufacturer of stick electrode products based in Nanjing, China, for approximately $4,245 in cash and assumed debt. The Company previously owned 35% of Nanjing indirectly through its investment in Kuang Tai. Annual sales at the time of the acquisition were approximately $10,000.

On March 30, 2007, the Company acquired all of the outstanding stock of Spawmet Sp. z o.o. (“Spawmet”), a privately held manufacturer of welding consumables headquartered near Katowice, Poland, for approximately $5,000 in cash. This acquisition provided the Company with a portfolio of stick electrode products and broadened its distributor network in Poland and Eastern Europe. Annual sales at the time of the acquisition were approximately $5,000.

Acquired companies are included in the Company’s consolidated financial statements as of the date of acquisition.

decreased to 1.5% at December 31, 2012 from 8.0% at December 31, 2011. The decrease was predominantly due to the repayment of the Company's $80,000 senior unsecured note on March 12, 2012.

During March 2002, the Company entered into floating rate interest rate swap agreements totaling $80,000 to convert a portion of the Notes outstanding from fixed to floating rates. These swaps were designated as fair value hedges and, as such, the gains or losses on the derivative instrument, as well as the offsetting gains or losses on the hedged item attributable to the hedged risk, were recognized in earnings. Net payments or receipts under these agreements were recognized as adjustments to “Interest expense.” In May 2003, these swap agreements were terminated. The gain of $10,613 on the termination of these swaps was deferred and is being amortized as an offset to “Interest expense” over the remaining life of the Notes. The amortization of this gain reduced “Interest expense” by $313 in 2009, $958 in 2008 and $1,121 in 2007, and is expected to reduce annual “Interest expense” by $206 in 2010. At December 31, 2009, $442 remains to be amortized and is recorded in “Long-term debt, less current portion.”

During July 2003 and April 2004, the Company entered into various floating rate interest rate swap agreements totaling $110,000 to convert a portion of the Notes outstanding from fixed to floating rates based on the London Inter-Bank Offered Rate (“LIBOR”). These swaps were designated and qualified as fair value hedges and, as such, the gains or losses on the derivative instrument, as well as the offsetting gains or losses on the hedged item, were recognized in earnings. Net payments or receipts under these agreements were recognized as adjustments to “Interest expense.”

During February 2009, the Company terminated swaps with a notional value of $80,000 and realized a gain of $5,079. This gain was deferred and is being amortized over the remaining life of the Notes. The amortization of

24

this gain reduced “Interest expense” by $1,429 in 2009 and is expected to reduce annual “Interest expense” by $1,661the

During

2012.

On November 18, 2009, the

The Credit Agreement contains customary affirmative, negative and financial covenants for credit facilities of this type, including limitations on the Company with respect to liens, investments, distributions, mergers and acquisitions, dispositions of assets, transactions with affiliates and a fixed charges coverage ratio and total leverage ratio. As of December 31, 2009, there were no borrowings under the Credit Agreement.

25

| Payments Due By Period | ||||||||||||||||||||

| Total | 2013 | 2014 to 2015 | 2016 to 2017 | 2018 and Beyond | ||||||||||||||||

| Long-term debt, including current portion | $ | 1,788 | $ | 366 | $ | 622 | $ | 188 | $ | 612 | ||||||||||

| Interest on long-term debt | 160 | 38 | 49 | 30 | 43 | |||||||||||||||

| Capital lease obligations | 267 | 93 | 95 | 79 | — | |||||||||||||||

| Short-term debt | 18,220 | 18,220 | — | — | — | |||||||||||||||

| Interest on short-term debt | 844 | 844 | — | — | — | |||||||||||||||

| Operating leases | 46,219 | 12,624 | 16,257 | 10,256 | 7,082 | |||||||||||||||

Purchase commitments(1) | 155,480 | 154,823 | 482 | 158 | 17 | |||||||||||||||

| Total | $ | 222,978 | $ | 187,008 | $ | 17,505 | $ | 10,711 | $ | 7,754 | ||||||||||

| Payments Due By Period | |||||||||||||||

| Total | 2010 | 2011 to 2012 | 2013 to 2014 | 2015 and Beyond | |||||||||||

Long-term debt | $ | 82,209 | $ | 326 | $ | 80,457 | $ | 303 | $ | 1,123 | |||||

Interest on long-term debt | 13,209 | 5,235 | 7,828 | 53 | 93 | ||||||||||

Capital lease obligations | 2,839 | 964 | 1,652 | 83 | 140 | ||||||||||

Short-term debt | 34,577 | 34,577 | — | — | — | ||||||||||

Interest on short-term debt | 904 | 904 | — | — | — | ||||||||||

Operating leases | 34,709 | 9,923 | 12,559 | 4,995 | 7,232 | ||||||||||

Total contractual cash obligations | $ | 168,447 | $ | 51,929 | $ | 102,496 | $ | 5,434 | $ | 8,588 | |||||

| (1) | Purchase commitments include contractual obligations for raw materials and services. |

At

December 31, 2012, there were 2,517,228 common shares available for future grant under all plans.26

awards been exercised on that dateat

Costs

reduced trial activity.

claims.

Arrangements

In May 2009,face of the FASB issued ASC 855 (formerly SFAS 165, “Subsequent Events”). ASC 855 established general standards of accounting for disclosure of events that occur after the balance sheet date but before financial statements are issuedstatement where net income is presented or are available to be issued. In particular, ASC 855 sets forth the period after the balance sheet date during which management should evaluate events or transactions that may occur for potential recognition or disclosure in the financial statements, the circumstances under which an entity should recognize events or transactions occurring after the balance sheet date in its financial statements and the disclosures that an entity should make about events or transactions that occurred after the balance sheet date. ASC 855 was adopted in 2009 and did not have a significant impact on the Company’s financial statements.

In December 2008, the FASB issued ASC 715 (formerly FSP FAS 132(R)-1, “Employers’ Disclosures about Postretirement Benefit Plan Assets”). ASC 715 requires disclosure about an entity’s investment policies and

27

strategies, the categories of plan assets, concentrations of credit risk and fair value measurements of plan assets. The standard, effective for fiscal years ending after December 15, 2009, resulted in increased disclosures in the notes, tosignificant amounts reclassified out of accumulated other comprehensive income by the Company’s financial statements related torespective line items of net income but only if the assets of the Company’s defined benefit pension plans.

In November 2008, the FASB issued ASC 323-10 (formerly Emerging Issues Task Force (“EITF’) Issue 08-6, “Equity Method Investment Accounting Considerations”). ASC 323-10 addresses the impact that ASC 805 (formerly SFAS 141(R)), and ASC 810 (formerly SFAS 160), might have on the accounting for equity method investments including how the initial carrying value of an equity method investment should be determined, how it should be tested for impairment and how changes in classification from equity method to cost method should be treated. ASC 323-10amount reclassified is required under U.S. GAAP to be implemented prospectively and is effective for fiscal years beginning after December 15, 2008. The adoption of ASC 323-10 did not have a significant impact on the Company’s financial statements.

In June 2008, the FASB issued ASC 260-10 (formerly FSP EITF 03-6-1, “Determining Whether Instruments Grantedreclassified to net income in Share-Based Payment Transactions Are Participating Securities”). ASC 260-10 determined that unvested share-based payment awards that contain rights to receive nonforfeitable dividends or dividend equivalents (whether paid or unpaid) are participating securities, and thus, should be includedits entirety in the two-class method of computing earnings per share. This standard did not have a significant impact on the Company’s disclosure of earnings per share.

In April 2008, the FASB issued ASC 275-10 and ASC 350-30 (formerly FSP 142-3, “Determination of the Useful Life of Intangible Assets”). These standards amend the factorssame reporting period. For other amounts, an entity is required to cross-reference to other disclosures required under U.S. GAAP that should be considered in developing renewal or extension assumptions used to determine the useful life of a recognized intangible asset under ASC 350 (formerly SFAS 142, “Goodwill and Other Intangible Assets”). ASC 275-10 and ASC 350-30provide additional detail about those amounts. The amendments are effective for financial statements issued for fiscal years beginning after December 15, 2008 and interim periods within those fiscal years. ASC 275-10 and ASC 350-30 apply prospectively to intangible assets acquired after adoption. The adoption of ASC 275-10 and ASC 350-30 did not have a significant impact on the Company’s financial statements.

In March 2008, the FASB issued ASC 815 (formerly SFAS 161, “Disclosures about Derivative Instruments and Hedging Activities”). ASC 815 requires disclosures of how and why an entity uses derivative instruments, how derivative instruments and related hedged items are accounted for and how derivative instruments and related hedged items affect an entity’s financial position, financial performance and cash flows. ASC 815 is effective for fiscal years beginning after November 15, 2008 with early adoption permitted. The Company adopted these provisions as of January 1, 2009. See Note 10 for the Company’s disclosures pursuant to adoption.

In December 2007, the FASB issued ASC 810 (formerly SFAS 160, “Noncontrolling Interests in Consolidated Financial Statements”). ASC 810 clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. ASC 810 changes the way the consolidated statement of income is presented thus requiring consolidated net income to be reported at amounts that include the amounts attributable to both parent and the noncontrolling interest. This pronouncement is effective for fiscal years and interim periods within those fiscal years beginning on or after December 15, 2008. The Company adopted these provisions as of January 1, 2009, applying the presentation and disclosure requirements retrospectively resulting in reclassification of noncontrolling interests from “Other non-current liabilities” to “Total equity.” Income attributable to noncontrolling interests is included in “Selling, general and administrative expenses” in the Consolidated Statements of Income and is not material to the Company. Therefore, the Company did not present income attributable to non-controlling interests separately in the Consolidated Statements of Income.

In December 2007, the FASB issued ASC 805 (formerly SFAS 141 (revised 2007), “Business Combinations” which replaced SFAS 141, “Business Combinations”). ASC 805 retains the fundamental requirements in SFAS 141 that the acquisition method of accounting (which SFAS 141 called the purchase method) be used for all business combinations and for an acquirer to be identified for each business combination. ASC 805 defines the acquirer as the entity that obtains control of one or more businesses in the business combination and establishes

28

the acquisition date as the date that the acquirer achieves control. ASC 805 requires an acquirer to recognize the assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree at the acquisition date measured at their fair values as of that date with limited exceptions specified in the statement. ASC 805 applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008.

New Accounting Standards to be Adopted:

In January 2010, the FASB issued Accounting Standards Update (“ASU”) No. 2010-06,“Fair Value Measurements and Disclosures (Topic 820) Improving Disclosures about Fair Value Measurements.”ASU 2010-06 amends ASC 820-10-50 to require additional information to be disclosed principally with respect to Level 3 fair value measurements and transfers to and from Level 1 and Level 2 measurements; in addition, enhanced disclosure is required concerning inputs and valuation techniques used to determine Level 2 and Level 3 fair value measurements. The new disclosures and clarifications of existing disclosures, as required by ASU 2010-06, are effective for interim and annual reporting periods beginning after December 15, 2009, except for the disclosures about purchases, sales, issuances and settlements in the roll forward of activity in Level 3 fair value measurements. Those disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. Earlier application is permitted. ASU No. 2010-06 is not expected to have a significant impact on the Company’s financial statements.

In December 2009, the FASB issued ASU No. 2009-17,“Consolidations (Topic 810) Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities an Amendment of the FASB Accounting Standards Codification.”In June 2009, the FASB issued ASC 810 (formerly SFAS 167,“Amendments to FASB Interpretation No. 46(R)”). The objective of ASC 810 is to amend certain requirements of FASB Interpretation 46 (R) (revised December 2003), “Consolidation of Variable Interest Entities,”to improve financial reporting by enterprises involved with variable interest entities and to provide more relevant and reliable information to users of financial statements. ASC 810 will be effective as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter. Earlier application is prohibited. ASU No. 2009-17 is not expected to have a significant impact on the Company’s financial statements.

In December 2009, the FASB issued ASU No. 2009-16, “Transfers and Servicing (Topic 860) Accounting for Transfers of Financial Assets an Amendment of the FASB Accounting Standards Codification.”In June 2009, the FASB issued ASC 860,“Transfers and Servicing,” (formerly SFAS 166,“Accounting for Transfers of Financial Assets, an amendment of FASB Statement No. 140”). The objective of ASC 860 is to improve the relevance, representational faithfulness and comparability of the information that a reporting entity provides in its financial reports about a transfer of financial assets; the effects of a transfer on its financial position, financial performance and cash flows; and a transferor’s continuing involvement in transferred financial assets. ASC 860 must be applied as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period and for interim and annual reporting periods thereafter. Earlier application is prohibited. ASU No. 2009-16 must be applied to transfers occurring on or after the effective date. ASU No. 2009-16 is not expected to have a significant impact on the Company’s financial statements.