SECURITIES AND EXCHANGE COMMISSION

x

|

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31,

20092011

¨

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period fromto Commission File Number 000-30975

(Exact Name of Registrant as Specified in its Charter)

|

| | |

| Delaware | | 91-1789357 |

(State or Other Jurisdiction of Incorporation or Organization) | | Identification Number) |

| |

Omaha, NE 68164

| | 68164 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange On Which Registered |

None | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form10-K

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer¨ Accelerated Filerý Non-Accelerated Filer ¨ Non-Accelerated Filer¨ Smaller Reporting Company

x¨ (Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based on the last reported closing price per share of Common Stock as reported on the OTC Bulletin Board on the last business day of the registrant’s most recently completed second quarter was approximately

$14.5$86.2 million.

At

February 25, 2010,March 13, 2012, the registrant had

49,189,67271,625,725 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions

Index to Form 10-K for the Fiscal Year Ended December 31, 20092011 | | |

| | | |

PART I | | | |

| PART I | | | | |

| | Item 1. | Business | | | K-2 |

| | Item 1A. | | Risk Factors | | K-6 |

| | Item 1B. | | Unresolved Staff Comments | | K-12 |

| | Item 2. | Properties | | | K-12 |

| | Item 3. | | Legal Proceedings | | K-13 |

| | Item 4. | Mine Safety Disclosures | |

| PART II | | K-13 |

PART II | | | | | | |

| | Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | K-14 |

| | Item 6. | | Selected Consolidated Financial Data | | K-15 |

| | Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | K-16 |

| | Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | K-25 |

| | Item 8. | | Financial Statements and Supplementary Data | |

| | |

| | | | Report of Independent Registered Public Accounting Firm | |

| | K-26 |

| | | | Consolidated Balance Sheets as of December 31, 20092011 and 20082010 | |

| | K-27 |

| | | | Consolidated Statements of Operations for the Years Ended December 31, 20092011, 2010 and 20082009 | |

| | K-28 |

| | | | Consolidated Statements of Stockholders’ Equity for the Years Ended December 31, 20092011, 2010 and 20082009 | |

| | K-29 |

| | | | Consolidated Statements of Cash Flows for the Years Ended December 31, 20092011, 2010 and 20082009 | |

| | K-30 |

| | | | Notes to the Consolidated Financial Statements for the Years Ended December 31, 20092011, 2010 and 20082009 | | K-31 |

| | Item 9 | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | | K-50 |

| | Item 9A(T).9A. | | Controls and Procedures | | K-50 |

| | Item 9B. | | Other Information | |

| PART III | | K-51 |

PART III | | | | | | |

| | Item 10. | | Directors, Executive Officers and Corporate Governance | | K-52 |

| | Item 11. | | Executive Compensation | | K-53 |

| | Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | K-53 |

| | Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | K-53 |

| | Item 14. | | Principal Accounting Fees and Services | |

| PART IV | | K-53 |

PART IV | | | | | | |

| | Item 15. | | Exhibits, Financial Statement Schedules | |

| | K-53 |

| SIGNATURES | |

| | K-58 |

This Annual Report on Form 10-K references the following registered trademarks which are the property of Transgenomic, Inc.: DNASEP® Columns, Cartridges, WAVE® System, WAVEMAKER® Software, TRANSFORMING THE WORLDTRANSGENOMIC® for Laboratory Equipment, TRANSGENOMIC® and the Globe Logo

®; MutationDiscovery.com® Website, OLIGOSEP® Cartridges for Systems and Reagents, OPTIMASE® Polymerase, RNASEP® Columns, SURVEYOR Cartridges, WAVE OPTIMIZED® reagents, WAVE OPTIMIZED® reagents, and WAVE MD Systems, MitoScreen®TM MD Systems. Additionally, this Annual Report on Form 10-K references the following trademarks which are the property of Transgenomic, Inc.: MitoScreen™ Kits, ProtocolWriter™ProtocolWriterTM Software, Navigator™NavigatorTM Software, THE POWER OF DISCOVERY® for Lab Reagents and Educational Programs, and SURVEYOR Nuclease® Nuclease, and FAMILION®. All other trademarks or trade names referred to in this Annual Report on Form 10-K are the property of their respective owners.

FORWARD-LOOKING STATEMENTS

This report, including Management’s Discussion & Analysis, contains forward-looking statements. These statements are based on management’s current views, assumptions or beliefs of future events and financial performance and are subject to uncertainty and changes in circumstances. Readers of this report should understand that these statements are not guarantees of performance or results. Many factors could affect our actual financial results and cause them to vary materially from the expectations contained in the forward-looking statements. These factors include, among other things: our expected revenue,

income(loss)income (loss), receivables, operating expenses, supplier pricing, availability and prices of raw materials, Medicare/Medicaid/Insurance reimbursements, product pricing, foreign currency exchange rates, sources of funding operations and acquisitions, our ability to raise funds, sufficiency of available liquidity, future interest costs, future economic circumstances,

business strategy, industry conditions

and key trends, our ability to execute our operating plans, the success of our cost savings initiatives, competitive environment and related market conditions,

expected financial and other benefits from our organizational restructuring activities, actions of governments and regulatory factors affecting our business and other risks as described in our reports filed with the Securities and Exchange

Commission.Commission (the "SEC"). In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would” and similar expressions.

You are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. Actual results may differ materially from those suggested by the forward-looking statements that we make for a number of reasons including those described in Item 1A, “Risk Factors,” and other factors identified by cautionary language used elsewhere in this report.

We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

The following discussion should be read together with our financial statements and related notes contained in this report. Results for the year ended December 31, 20092011 are not necessarily indicative of results that may be attained in the future.

Transgenomic, Inc. (together with its Affiliates, the “Company” or “Transgenomic”) provides innovative products for the purification and analysis of nucleic acids usedis a global biotechnology company advancing personalized medicine in the life sciences industry for research focused ondetection and treatment of cancer and inherited diseases through its proprietary molecular geneticstechnologies and diagnostics. We also provide genetic variation analytical services to the medical research,world-class clinical and research services. We have three complementary business segments.

Clinical Laboratories. Our clinical laboratories specialize in genetic testing for cardiology, neurology, mitochondrial disorders, and oncology. Located in New Haven, Connecticut and Omaha, Nebraska the molecular clinical reference laboratories are certified under the Clinical Laboratory Improvement Amendment (CLIA) as high complexity labs and our Omaha facility is also accredited by the College of American Pathologists (CAP).

Pharmacogenomics Services. Our Contract Research Organization located in Omaha, Nebraska provides pharmacogenomics research services supporting Phase II and Phase III clinical trials conducted by our pharmaceutical

markets. Net sales are categorized as Instrument Related Businesscustomers. This lab specializes in pharmacogenomic, biomarker and

Laboratory Services.Instrument Related Business:

mutation discovery research serving the pharmaceutical and biomedical industries worldwide for disease research, drug and diagnostic development and clinical trial support. | ·

|

| • | | Bioinstruments.Diagnostic Tools. Our flagshipproprietary product is the WAVE® System which has broad applicability to genetic variation detection in both molecular genetic research and molecular diagnostics. There is a worldwide installed base of over 1,4751,500 WAVE Systems

|

| as of December 31, 2009.2011. We also distribute bioinstruments produced by other manufacturers (“OEM Equipment”) through our sales and distribution network. Service contracts to maintain installed systems are sold and supported by our technical support personnel. |

| ·

| | Bioconsumables. The installed WAVE base and some third-party installedOEM Equipment platforms generate a demand for consumables that are required for the continued operation of the bioinstruments. We develop, manufacture and sell these consumable products. In addition, we manufacture and sell consumable products that can be used on multiple, independent platforms. These products include SURVEYOR® Nuclease and a range of HPLC separationchromatography columns.

|

Laboratory Services:

| ·

| | Molecular Clinical Reference Laboratory. The molecular clinical reference laboratory specializes in mitochondrial and molecular diagnostic testing including genetic testing for oncology, hematology and inherited disorders. Located in Omaha, Nebraska the molecular clinical reference laboratory operates in a Good Laboratory Practices compliant environment, is certified under the Clinical Laboratory Improvement Amendment (CLIA) as a high complexity lab and is accredited by CAP (College of American Pathologists).

|

| ·

| | Pharmacogenomics Research Services. Pharmacogenomics research services are provided by our Contract Research Organization located in Omaha, Nebraska. It specializes in pharmacogenomic, biomarker and mutation discovery research serving the pharmaceutical and biomedical industries world-wide for disease research, drug and diagnostic development and clinical trial support.

|

Our business strategyprimary goal is to provide products and services to biomedical researchers, physicians, medical institutions, and diagnostic and pharmaceutical companies that are tied to advancements in the field of genomics and, increasingly, personalized medicine. Advances in genomics have fueled our efforts to understand individual differences in disease susceptibility, disease progression, and response to therapy. Accordingly,

The markets in which we compete require a principal componentwide variety of technologies, products, and capabilities. The combination of technological complexity and rapid change within our markets makes it difficult for a single company to develop all of the technological solutions that it desires to offer within its family of products and services. We work to broaden the range of products and services we deliver to customers in target markets through acquisitions, investments, and alliances. We employ the following strategies to address the need for new or enhanced products and services:

Developing new technologies and products internally

Acquire all or parts of other companies

Entering into joint-development efforts with other companies

Reselling other companies' products

Our strategy is to leverage the synergies of our strategy hasthree divisions, capitalizing on discoveries in our R&D and continuesPharmacogenomic Services labs to becreate “kits” or assays to establishdistribute through our WAVE SystemTools division, as an industry standardwell as tests to conduct in the biomedical research market andour Clinical Laboratories.

We will continue to develop

additional markets for the WAVE Systemnew technologies, such as

clinicalour ICECOLD-PCR, and capitalize on our expertise and intellectual properties to develop new ground-breaking tests, such as our PGxPredict®:CLOPIDOGREL Panel. We also continue to cultivate new and expanded relationships with industry leaders across the globe, such as A. Menarini in our Tools business, and a list of medical research

and diagnostics. For continued high quality support for our WAVE System and associated bioconsumables, we attained ISO90001:2000 certification for our Omaha manufacturing site in the fourth quarter of 2008 and have since been certified to the ISO9001:2008 standard in 2009.Over the last few years our strategy has grown to include increasing concentration offacilities working with our two Laboratorylaboratory divisions.

We continue to evaluate a range of acquisition targets, including smaller single-test labs as well as larger private and public entities, as well as divisions of entities. We acquired the Familion business in December, 2010, and quickly integrated it into our existing business, and believe we are skilled at such acquisition integrations.

Products

Our highly specialized genetics service and expertise are delivered by our Pharmacogenomic Services businesses. We have gained exposure to the translational and clinical research markets, laying the foundation for increasing our participation in the full value chain associated with activities ranging from basic biomedical research to development of diagnostic and therapeutic products to increasing opportunities for developing and manufacturing companion diagnostics. During the fourth quarter of 2005, our laboratoryLaboratory in Omaha, Nebraska was certified under theNE and in our Clinical Laboratory Improvement AmendmentsAct (CLIA)-certified Clinical Laboratories in Omaha and New Haven, CT. Our Pharmacogenomics Lab supports pharmaceutical companies in their clinical trials, primarily phase II and phase III trials. Our Clinical Laboratories division support medical professionals in the diagnosis and treatment of patients, primarily in the specialties of Cardiology, Neurology and Oncology with a range of tests within each medical specialty.

In cardiology, our FAMILION® family of tests focuses on detecting mutations that can cause cardiac channelopathies, cardiomyopathies and other rare, potentially lethal heart conditions. The specific diseases include Long QT Syndrome (LQTS), Familial Atrial Fibrillation (AF), Hypertrophic Cardiomyopathy (HCM), and Dilated Cardiomyopathy (DCM) . By reducing uncertainty and finding the specific genetic causes of cardiac channelopathies and cardiomyopathies, the FAMILION tests can:

Help diagnose a patient's disease

Guide treatment options

Determine whether family members are at risk

Also in cardiology, our PGxPredict®:CLOPIDOGREL Panel seeks to identify the approximately 50% of patients with a genetic deficiency that prevents them from receiving the expected pharmacological benefit from clopidogrel (Plavix®). Information from the PGxPredict®:CLOPIDOGREL Panel can be used by the health care provider to ensure the most appropriate anti-platelet therapy is being used in an effort to reduce adverse cardiac events.

In Neurology, we receivedhave a focus on mitochondrial disorders and epilepsy and epilepsy-like diseases. We employ a wide variety of technologies, including proprietary technologies such as the WAVE, and industry standards such as Sanger sequencing. In 2011 we introduced the NuclearMitome test, which is based on next-generation sequencing, currently run in a partner lab at Seattle Children's Hospital.

Our oncology tests are focused heavily on genetic mutations commonly associated with the major cancer types - Lung, Colorectal, Breast, and Prostate. We primarily test for mutations in the K-RAS, N-RAS, BRAF, and PIK3CA genes, all associated with the most common cancers. We also offer tests for hereditary cancer-predisposing syndromes.

Our lab expertise is leveraged into our first patient samplesDiagnostic Tools division, which focuses on assembly and delivery of highly sensitive mutation detection equipment, primarily our WAVE, WAVEmce, and Hanabi instruments, as well as the

bioconsumables used in these instruments for molecular-basedmolecular testing and cytogenetics. Transgenomic equipment systems offer discovery and detection of genetic variation at close to 100% sensitivity, making them among the most sensitive and accurate technologies for hematology, oncologydetection of known and certain inherited diseasesunknown mutations and single nucleotide polymorphisms (SNPs). These equipment systems are used throughout the world to screen for physicians and third-party laboratories to aida large variety of diseases. More than 350 human genes have been screened entirely or partly by Direct High Pressure Liquid Chromatography (DHPLC), the underlying technology used by our equipment systems. A multitude of other applications are being used with WAVE Systems in patient diagnoses or pharmaceutical drug developmentsuch diverse areas as plant genomics, microbial analysis, and drug clinical trials. In December of 2008 we were awarded an accreditation bysensitivity.

We continue to leverage the

Commission on Laboratory Accreditationsynergies of the

College of American Pathologists (CAP) basedthree divisions, capitalizing on

the results of an onsite inspection. We believethere is a significant opportunity for us to continue growing the demand for molecular-based personalized medicine by leveraging our technologies and experience gained from the genomic biomarker analysis that our Laboratory Services business has and will continue to provide to pharmaceutical and biopharmaceutical companies. In addition, we continue to seek out and evaluate new technologies and genomic based laboratory tests which will further extend our offeringsdiscoveries in our Molecular Diagnostics LaboratoryR&D and Pharmacogenomic Services labs to create “kits” or test assays to distribute through our Pharmacogenomics Services Lab.

Tools division, as well as tests to conduct in our Clinical Laboratories.

Our Sales and Support team consists of regionally based sales people, service engineers and applications scientists to support our sales and marketing activities worldwide. We have sold our products to customers in over 50 countries. We use a direct sales and support staff for sales in the U.S. and Europe. Our sales and support team consists of regionally-based sales people, engineers and applications scientists to support our sales and marketing activities throughout the U.S. and Europe. For the rest of the world, we sell our products through dealers and distributors within local markets. We have over 35 dealers and distributors.

Customers

Physicians requesting genetic tests for their patients are our primary source of laboratory services. Fees for laboratory testing services rendered for these physicians are billed either to the physician, the patient or the patient’s third-party payer such as an insurance company, Medicare or Medicaid. Billings are typically on a fee-for-service basis. The naturepatient or third-party payer is billed at our patient fee schedule. Commercial insurance providers are billed at contracted rates or other generally accepted market reimbursement rates. Revenues received from Medicare and Medicaid billings are based on government established fee schedules and reimbursement rules.

Our customers include a number of

our business does not generally lend itself to trackinglarge, established pharmaceutical, biotech and

reporting sales backlog.Customers

Customers include numerouscommercial companies as well as leading academic and medical institutions in the U.S. and abroad.institutions. In addition, our customers also include a number of large, established pharmaceutical, biotech and commercial companies both in the U.S. and abroad. No customer accounted for more than 10% of our consolidated net sales for the years ended December 31, 20092011, 2010 or 2009. Information regarding the revenues attributable to U.S. and 2008. Forinternational markets is set forth in Note P to the year ended December 31, 2009 one customer made up 20% of the Laboratory Services net sales. For the year ended December 31, 2008 four customers each made up more than 10% of the Laboratory Services net sales and combined they represent 56% of the Laboratory Services net sales.

footnotes to our consolidated financial statements.

We continue to invest in research and development in order to remain competitive and to take advantage of new business opportunities as they arise. We maintain a program of research and development with respect to instruments and services, engaging existing and new technologies to create scientific and medical applications that will haveadd value to patient care as well as significant commercial value. Major areas of focus include ultra-high(i) development of SURVEYOR® Nuclease based oncology mutation detection kits utilizing multiple instrument platforms for aid in therapeutic treatment decisions for cancers such as colorectal, melanoma, non small cell lung; (ii) a new discovery in high sensitivity DNA mutation detection buildingfor Sanger Sequencing; (iii) development of ICE COLD-PCR applications for ultra-high sensitivity mutation detection in our WAVEany tissue samples (fresh, frozen, FNA, FFPE, etc.) and SURVEYOR products;body fluids (plasma, serum, ascites); (iv) a “toolbox” of mitochondrial DNA assays to assess damage, copy number, deletion and mutation for applications ranging from toxicology to diabetes to aging; clinicaland (v) development of in-licensed diagnosticsa biomarker for FC Gamma receptor to aid in neurodegenerative diseases, including Alzheimer’s and Parkinson’s diseases; and development of oncology mutation kits using WAVE/SURVEYOR forthe selection of anti-cancer therapies.therapeutic options for monoclonal antibody cancer drugs. For the years ended December 31, 20092011, 2010 and 2008,2009, our research and development expenses were $3.2

$2.2 million, $2.3 million and $2.5$3.2 million, respectively. We manufacture bioconsumable products including our separation columns, liquid reagents, and enzymes. The major components of our WAVE Systems are manufactured for us by a third party. We integrate our

own hardware and software with these third party manufactured components. Our manufacturing facilities for

our WAVE Systems and bioconsumables are located in Omaha, Nebraska and San Jose, California.

To establish and protect our proprietary technologies and products, we rely on a combination of patent, copyright, trademark and trade-secret laws, as well aslicense agreements' contractual provisions and confidentiality provisions in our contracts.agreements. Our WAVE SystemSystems and related consumables are protected by patents and in-licensed technologies that expire in various periods beginning in 20132012 through 2027. 2030. As part of the FAMILION Acquisition, we acquired exclusive rights to the FAMILION family of

genetic tests for inherited disease, including the patents protecting this technology. As we expand our product offerings, we also extend our patent development efforts to protect such product offerings. Established competitors, as well as companies that purchase and enforce patents and other intellectual property, may already have patents covering similar products. There is no assurance that we will be able to obtain patents covering our products, or that we will be able to obtain licenses from such companies on favorable terms or at all. However, while patents are an important element of our success, our business as a whole is not significantly dependent on any one patent.

We will continue to file patent applications, and seek new licenses, as warrantedtake advantage of available copyright and trademark protections and implement appropriate trade-secret protocols to protect our intellectual property. Despite these precautions, there can be no assurance that misappropriation of our products and develop newproprietary technologies will not occur.

In addition to own products, we distribute or act as a sales agent for OEM Equipment developed by third parties. Our rights to those third-party products and the associated intellectual property rights are limited by the terms of interest tothe contractual agreement between us and the respective third-party.

Although we believe that our customer basedeveloped and licensed intellectual property rights do not infringe upon the proprietary rights of third parties, there can be no assurance that third parties will not assert infringement claims against us. Further, there can be no assurance that intellectual property protection will be available for our products in all foreign countries.

Like many companies in the

coming years.biotechnology and other high-tech industries, third parties have in the past and may in the future assert claims or initiate litigation related to patent, copyright, trademark or other intellectual property rights to business processes, technologies and related standards that are relevant to us and our customers. These assertions have increased over time as a result of the general increase in patent claims assertions, particularly in the United States. Third parties may also claim that their intellectual property rights are being infringed by our customers' use of a business process method that utilizes products in conjunction with other products, which could result in indemnification claims against us by our customers. Any claim against us, with or without merit, could be time-consuming, result in costly litigation, cause product delivery delays, require us to enter into royalty or licensing agreements or pay amounts in settlement, or require us to develop alternative non-infringing technology. We could also be required to defend or indemnify our customers against such claims. A successful claim by a third-party of intellectual property infringement by us or one of our customers could compel us to enter into costly royalty or license agreements, pay significant damages or even stop selling certain products and incur additional costs to develop alternative non-infringing technology.

Government Regulation

We are subject to a variety of federal, state and municipal environmental and safety laws based on our use of hazardous materials in both manufacturing and research and development operations. We believe that we are in material compliance with applicable environmental laws and regulations. If we cause contamination to the environment, intentionally or unintentionally, we could be responsible for damages related to the clean-up of such contamination or individual injury caused by such contamination. We cannot predict how changes in laws and regulations will impact how we conduct our business operations in the future or whether the costs of compliance will increase in the future.

Regulation by governmental authorities in the United States and other countries is not expected to be a significant factor in the manufacturing, labeling, distribution and marketing of our products and systems

The markets in which we operate are highly competitive and characterized by rapidly changing technological advances. A number of our competitors possess

substantially greater resources than us and

aremay be able to develop and offer a

much greater breadth of products and/or services, coupled with significant marketing and distribution capabilities. We compete principally on the basis of uniquely enabling

scientific technical advantages in specific but significant market segments.

Our Laboratory Services division faces competition from a number of companies offering contract DNA sequencing and other genomic analysis services, including Genzyme, SeqWright and others. In addition, several clinical diagnostics service providers, such as Labcorp, Quest, GeneDx and Baylor College of Medicine, also offer related laboratory services. Finally, additional competition arises from academic core laboratory facilities. Competition for our WAVE SystemsSystem arises primarily from DNA sequencing and genotyping technologies. Competitors in these areas include Applied Biosystems, Idaho Technologies,Qiagen, Roche, Sequenom, and others. Competition for some of our non-WAVE consumable products comes from numerous well-diversified life sciences reagents providers, including, among others, Invitrogen, Qiagen, Roche, Stratagene, and Promega. Our Laboratory Services division faces competition from a number

As of December 31,

20092011 and

2008,2010, we had employees focused in the following areas of

our operation:

| | | | |

| | | December 31, |

| | | 2009 | | 2008 |

Manufacturing and Laboratory | | 36 | | 42 |

Sales, Marketing and Administration | | 53 | | 65 |

Research and Development | | 14 | | 12 |

| | | | |

| | 103 | | 119 |

| | | | |

|

| | | | | | |

| | | December 31, |

| | | 2011 | | 2010 |

| Manufacturing and Laboratory | | 68 |

| | 62 |

|

| Sales, Marketing and Administration | | 92 |

| | 88 |

|

| Research and Development | | 9 |

| | 12 |

|

| | | 169 |

| | 162 |

|

Our employees were employed in the following geographical locations:

| | | | |

| | | December 31, |

| | | 2009 | | 2008 |

United States | | 78 | | 89 |

Europe (other than the United Kingdom) | | 12 | | 13 |

United Kingdom | | 13 | | 17 |

| | | | |

| | 103 | | 119 |

| | | | |

|

| | | | | | |

| | | December 31, |

| | | 2011 | | 2010 |

| United States | | 148 |

| | 136 |

|

| Europe (other than the United Kingdom) | | 10 |

| | 15 |

|

| United Kingdom | | 11 |

| | 10 |

|

| Canada | | — |

| | 1 |

|

| | | 169 |

| | 162 |

|

We were incorporated in Delaware on March 6, 1997. Our principal office is located at 12325 Emmet Street, Omaha, Nebraska 68164 (telephone: 402-452-5400). This facility

officeshouses our administrative staff and laboratories. We maintain manufacturing facilities in Omaha, Nebraska and San Jose, California. We maintain research and development offices in

Gaithersburg, MarylandOmaha, Nebraska. We maintain laboratories in Omaha, Nebraska and

Omaha, Nebraska.New Haven, Connecticut that have been certified under the Clinical Laboratory Improvement Amendments of 1988 ("CLIA").

Our Internet website is located at http://www.transgenomic.com. The information on our website is not a part of this annual report. We make reports filed by us with the SEC available free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after thesewe electronically file such material with, or furnish it to, the Unite States Securities and Exchange Commission ("SEC"). Our SEC reports are filed. The addresscan be accessed through the investor relations section of our Internet website.

The public may also read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The SEC's Internet website iswww.transgenomic.com. Information located at http://www.sec.gov.

Executive Officers of the Registrant

Craig J. Tuttle. Mr. Tuttle, age 59, has served as our President and Chief Executive Officer since 2006. From 2004 to 2005, Mr. Tuttle was President and Chief Operating Officer of Duke Scientific. From 1999 to 2003, Mr. Tuttle served as President and Chief Executive Officer of Applied Biotech, Inc. The Board selected Mr. Tuttle to serve as a director because he is the Company's Chief Executive Officer. He has expansive knowledge and experience in the biotech industry, as well as relationships with chief executives and other senior management at biotechnology companies and leading research institutions.

Chad M. Richards. Mr. Richards, age 42, joined the Company in October 2007 as Senior Vice President, Sales and Marketing and was promoted to Chief Commercial Officer in January 2011. Before joining the Company, Mr. Richards was the National Sales Director for Anatomic Pathology with Quest Diagnostics. During his career with Quest Diagnostics, Mr. Richards held a variety of sales management roles in both their physician and hospital business segments. Before joining Quest Diagnostics, Mr. Richards held different marketing and sales management roles with Roche Diagnostics Ventana Medical Systems Division, one of the world’s leading developers and manufacturers of immunohistochemistry and in-situ hybridization instruments and

reagent systems. Before embarking on a career in diagnostics, Mr. Richards served in the United States Marine Corps.

Brett L. Frevert. Mr. Frevert, age 49, was appointed as our website,Chief Financial Officer by the Board of Directors on June 28, 2010. Mr. Frevert serves as Chief Financial Officer pursuant to the terms a letter agreement with CFO Systems, LLC (“CFO Systems”) and Brett L. Frevert. Under the letter agreement CFO Systems provides financial and consulting services to us. Since 2004 Mr. Frevert has been Managing Director of CFO Systems, which he founded. During that time he has served as CFO of several Midwestern companies, including any SEC report, is not partregistrants and private companies. Prior to founding CFO Systems, Mr. Frevert was Chief Financial Officer of this Annual Report on Form 10-K.a regional real estate firm and also served as Interim Chief Financial Officer of First Data Europe. Mr. Frevert began his career with Deloitte & Touche, serving primarily SEC-registered clients in the food and insurance industries.

Item 1A. Risk Factors

We may not have adequate financial resources to execute our business plan.

We have historically operated at a loss and have not consistently generated sufficient cash from operating activities to cover our operating and other cash expenses. While we have been able to historically finance our operating losses through borrowings or from the issuance of additional equity, we currently have no plans to borrow additional funds or to issue additional equity securities for this purpose. At December 31, 2009, we had cash and cash equivalents of $5.6 million. While we believe that existing sources of liquidity are sufficient to meet expected cash needs through 2010, we will need to increase our net sales or further reduce our operating expenses in order to be assured of meeting our liquidity needs on a long-term basis. However, we cannot assure you that we will be able to increase our net sales, further reduce our expenses, or raise further capital or equity and, accordingly, we may not have sufficient sources of liquidity to continue the operations of the Company indefinitely.

We have a history of operating losses and may incur losses in the future.

We have experienced annual losses from continuing operations since inception of our operations. Our netoperating loss for the yearyears ended December 31, 2011, 2010 and 2009 was $1.9 million. Our loss from continuing operations for the year ended December 31, 2008 was $0.5 million.were $3.0 million, $3.6 million and $1.9 million, respectively. These historical losses have been due principally to the high levels of research and development expenses and sales and marketing expenses that we have incurred in order to develop and market our products, the fixed nature of our manufacturing costs, restructuring charges, impairment charges and merger and acquisition costs.

We might enter into new acquisitions that are difficult to integrate, disrupt our business, dilute stockholder value or divert management attention.

Our success will depend in part on our ability to continually enhance and broaden our product offerings in response to changing technologies, customer demands and competitive pressures. We expect to seek to acquire businesses, technologies or products that will complement or expand our existing business, including acquisitions that could be material in size and scope. Any acquisition we might make in the future might not provide us with the benefits we anticipated upon entering into the transaction. Any future acquisitions involve various risks, including:

Difficulties in integrating the operations, technologies, products and personnel of the acquired entities;

The risk of diverting management’s attention from normal daily operations of the business;

Potential difficulties in completing projects associated with in-process research and development;

Risks of entering markets in which we have no or limited direct prior experience and where competitors in such markets have stronger market positions;

Initial dependence on unfamiliar supply chains or relatively small supply partners;

Unexpected expenses resulting from the acquisition;

Potential unknown liabilities associated with acquired businesses;

Insufficient revenues to offset increased expenses associated with the acquisition; and

The potential loss of key employees of the acquired entities.

An acquisition could result in the incurrence of debt, restructuring charges or large one-time write-offs. Acquisitions also could result in goodwill and other intangible assets that are subject to impairment tests, which might result in future impairment charges. In addition, marketsFurthermore, if we finance acquisitions by issuing convertible debt or equity securities, our existing stockholders may be diluted.

From time to time, we might enter into negotiations for acquisitions that are not ultimately consummated. Those negotiations could result in diversion of management time and potentially significant out-of-pocket costs. If we fail to evaluate and execute acquisitions accurately, we could fail to achieve our productsanticipated level of growth and servicesour business and operating results could be adversely affected.

Continued weakness in U.S. or global economic conditions could have developed more slowly than expectedan adverse effect on our businesses.

The economies of the United States and other regions of the world in

many cases and may continue towhich we do

so. As a result, we may incur operating lossesbusiness have experienced significant weakness, which, in the

future.Market demand is outsidecase of our control.

There are many factors thatthe U.S., has resulted in significant unemployment and slower growth in economic activity. A continued decline in economic conditions may adversely affect the market demand for our services and products, and services thatthus reducing our revenue. These conditions could also impair the ability of those with whom we cannot control. Demand for our WAVE System is affected by the needs and budgetary resources of research institutions, universities, hospitals and others who use the WAVE System for genetic-variation research. The WAVE System represents a significant expenditure by these types of customers and often requires a long sales cycle. Similarly, the sales cycle for the OEM equipment that we sell can also be lengthy. If net sales from the sales of our products and services continue at current levels, we may needdo business to take stepssatisfy their obligations to further reduce operating expenses or raise additional working capital. We cannot assure you that sales will increase or that we will be able to reduce operating expenses or raise additional working capital.

The current economy may decrease sales.

Demand for our instruments is affected by the budgetary resources of institutions that use our products. Potential customers may be unable to obtain the financing that they need to make such significant capital expenditures during these troubled economic times. In addition, potential customers may be under budgetary restrictions which do not allow for such capital expenditures in the foreseeable future.

us.

Sales

of our Laboratory Services have been variable.

Laboratory Services include services performed by both our Molecular Clinical Reference Laboratory and our Pharmacogenomics Research Services.

Testing volumes at the Molecularin our Clinical Reference Laboratory isare dependent on patient visits to doctors’ offices and other providers of

health care and tends to fluctuate on a seasonal basis. Volume of testingTesting volume generally declines during the year endyear-end holiday periods, other major holidays and the summer. The

Our Pharmacogenomics

Research Services depends on

project basedproject-based work

which will changethat changes from quarter to quarter. Therefore, comparison of the results of successive quarters may not accurately reflect trends or results for the full year.

Changes in payer mix could have a material adverse impact on our net sales and profitability.

Testing services are billed to physicians, patients, Medicare, Medicaid and insurance companies. Tests may be billed to different payers depending on a particular patient’s medical insurance coverage. Increases in the percentage of services billed to government payors could have an adverse impact on our net sales.

Governmental payers and health care plans have taken steps to control costs.

Medicare, Medicaid and private insurers have increased their efforts to control the costs of health care services, including clinical testing services. They may reduce fee schedules or limit/exclude coverage for types of tests that we perform. Medicaid reimbursement varies by state and is subject to administrative and billing requirements and budget pressures. We expect efforts to reduce reimbursements, impose more stringent cost controls and reduce utilization of testing services will continue. These efforts, including changes in law or regulations, may have a material adverse impact on our business.

Our Laboratory requires ongoing CLIA certification.

The Clinical Laboratory Improvement Amendments of 1988 (“CLIA”)

CLIA extended federal oversight to virtually all clinical laboratories by requiring that they be certified by the federal government or by a

federally-approvedfederally approved accreditation agency. CLIA requires that all clinical laboratories meet quality assurance, quality control and personnel standards. Laboratories

must also

must undergo proficiency testing and are subject to inspections.

The sanctions for failure to comply with CLIA requirements include suspension, revocation or limitation of a laboratory’s CLIA certificate, which is necessary to conduct business, cancellation or suspension of the laboratory’s approval to receive Medicare and/or Medicaid reimbursement, as well as significant fines and/or criminal penalties. The loss or suspension of a CLIA certification, imposition of a fine or other penalties, or future changes in the CLIA law or regulations (or interpretation of the law or regulations) could have a material adverse effect on us.

We believe that we are in compliance with all applicable laboratory requirements, but no assurances can be given that our laboratories will pass all future certification inspections.

Failure to comply with HIPAA could be costly.

The Health Insurance Portability and Accountability Act (HIPAA) and associated regulations protect the privacy and security of certain

protectedpatient health information and establish standards for electronic

healthcarehealth care transactions in the United States. These privacy regulations establish federal standards regarding the uses and disclosures of protected health information. Our Molecular

Clinical Reference Laboratory isLabs are subject to HIPAA and its associated regulations. If we fail to comply with these laws and regulations we could suffer civil and criminal penalties, fines, exclusion from participation in governmental

healthcarehealth care programs and the loss of various licenses, certificates and authorizations necessary to operate our Laboratory Services business. We could also incur liabilities from third party claims.

Our business could be adversely impacted by

healthcarehealth care reform.

Government attention to the healthcarehealth care industry in the United States is significant and may increase. There has been extensive public discussionThe Patient Protection and Affordable Care Act passed by Congress and signed into law by the President in March 2010 could adversely impact our business. While the ultimate impact of the legislation on healthcare reform. Whilethe health care industry is unknown, it is not possiblelikely to predict what changesbe extensive and could result in U.S. government regulationsignificant change.

We may be subject to client lawsuits.

Providers of healthcareclinical testing services may be subject to lawsuits alleging negligence or other legal claims. Potential suits could involve claims for substantial damages. Litigation could also have an adverse impact on our client base and reputation. We maintain liability insurance coverage for certain claims that could result from providing or failing to provide clinical testing services, including inaccurate testing results and other exposures. Our insurance coverage limits our maximum recovery on individual claims and, therefore, there is no assurance that such coverage will occur, orbe adequate.

Market demand is outside of our control.

There are many factors that affect the nature or impactmarket demand for our products and services that we cannot control. Demand

for our

business could be adversely impactedWAVE System is affected by the needs and budgetary resources of research institutions, universities, hospitals and others who use the WAVE System for genetic-variation research. The WAVE System represents a significant expenditure by these

changes.types of customers and often requires a long sales cycle. Similarly, the sales cycle for the OEM Equipment that we sell can be lengthy.

The sale of our products and business operations in international markets subjects us to additional risks.

During the past several years, international sales have represented

approximately 60%a significant portion of our total net sales. As a result, a major portion of our net sales are subject to risks associated with international sales and operations. These risks include:

payment cycles in foreign markets are typically longer than in the U.S., and capital spending budgets for research agencies can vary over time with foreign governments;

changes in foreign currency exchange rates can make our products more costly in local currencies since our foreign sales are typically paid for in British Pounds or the Euro;

the potential for changes in U.S. and foreign laws or regulations that result in additional import or export restrictions, higher tariffs or other taxes, more burdensome licensing requirements or similar impediments to our ability to sell products and services profitably in these markets; and

the fluctuation of foreign currency to the US Dollar and the Euro to the British Pound can cause our net sales and expenses to increase or decrease, which adds risk to our financial statements.

Our WAVE System includes hardware components and instrumentation manufactured by a single supplier and if we are no longer able to obtain these components and instrumentation our ability to manufacture our products could be impaired.

We rely on a single supplier, Hitachi High Technologies America, to provide the basic instrument modules used in our WAVE Systems. While other suppliers of instrumentation are available, we believe that our arrangement with Hitachi offers strategic advantages. We have successfully converted the latest model of WAVE Systems to utilize Hitachi’s newest instrument line. If we were required to seek alternative sources of supply, it could be

more time consuming

or expensive orand may require significant and costly modification of our WAVE System. Also, if we were unable to obtain instruments from Hitachi in sufficient quantities or in a timely manner, our ability to manufacture our products could be impaired, which could limit our future net sales.

The current economy may cause suppliers of products to not be able to perform.

We rely on various suppliers for products and materials needed to produce our products. In the event that they would be unable to deliver those items due to product shortage or business closure, we

wouldmay be unable to deliver our products

to our customers timely or may need to increase our prices. The current economy poses additional risk of our suppliers’ ability to continue their businesses as usual.

We may not have adequate top executive talent to execute our business plan.

In order to reduce our operating costs, we have reduced the number of employees in most areas of our business. In addition, we may lose key management, scientific, technical, sales and manufacturing personnel from time to time. It may be very difficult to recruit and retain executive management if they are needed in the future, and the loss of top executive talent could harm our business and operating results. We cannot assure you that our employee reductions will not impair our ability to continue to develop new products and refine existing products in order to remain competitive. In addition, these reductions could prevent us from successfully marketing our products and developing our customer base.

Our markets are very competitive.

Many of our competitors have greater resources than we do and may enjoy other competitive advantages. This may allow them to more effectively market their products to our customers or potential customers, to develop products that make our products obsolete or to produce and sell products less expensively than us. As a result of these competitive factors, demand for and pricing of our products and services could be negatively affected.

Our patents may not protect us from others using our technology

thatwhich could harm our business and competitive position.

Patent law relating to the scope of claims in the technology fields in which we operate is still evolving. The degree of future protection for our proprietary rights is uncertain. Furthermore, we cannot be certain that others will not independently develop similar or alternative products or technology, duplicate any of our products, or, if patents are issued to us, design around the patented products developed by us. Our patents or licenses could be challenged by litigation and, if the outcome of such litigation were adverse to us, our competitors could be free to use our technology. We may not be able to obtain additional patents for our technology, or if we are able to do so, patents may not provide us with adequate protection or be commercially beneficial. In addition, we could incur substantial costs in litigation if we are required to defend ourselves in patent suits brought by third parties or if we initiate such suits.

We cannot be certain that other measures taken to protect our intellectual property will be effective.

We rely upon trade secret protection,secrets, copyright and trademark laws, non-disclosure agreements and other contractual provisions for some of our confidential and proprietary information that is not subject matter for which patent protection is being sought. Such measures, however, may not provide adequate protection for our trade secrets or other proprietary information. If such measures do not protect our rights, third parties could use our technology and our ability to compete in the market would be

We are dependent upon

our licensed technologies and may need to obtain additional licenses in the future to offer our products and remain competitive.

We have licensed key components of our technologies from third parties. If these agreements were to terminate prematurely due to our breach of the terms of these licenses or we otherwise fail to maintain our rights to such technology, we may lose the right to manufacture or sell a substantial portion of our products. In addition, we may need to obtain licenses to additional technologies in the

future in order to keep our products competitive. If we fail to license or otherwise acquire necessary technologies, we may not be able to develop new products that we need to remain competitive.

The protection of intellectual property in foreign countries is uncertain.

A significant percentage of our sales are to customers located outside the U.S.

The patentPatent and other intellectual property laws of some foreign countries may not protect our intellectual property rights to the same extent as U.S. laws. We may need to bring proceedings to defend our patent rights or to determine the validity of our competitors’ foreign patents. These proceedings could result in substantial cost and diversion of our efforts. Finally, some of our patent protection in the U.S. is not available to us in foreign countries due to the laws of those countries.

Our products could infringe on the intellectual property rights of others.

There are a significant number of U.S. and foreign patents and patent applications submitted for technologies in, or related to, our area of business. As a result, any application or exploitation of our technology

by us could infringe patents or proprietary rights of others and any licenses that we might need as a result of such infringement might not be available to us on commercially reasonable terms, if at all. This may lead others to assert patent infringement or other intellectual property claims against us.

Our failure to comply with any applicable government regulations or otherwise respond to claims relating to improper handling, storage or disposal of hazardous chemicals that we use may adversely affect our results of operations.

Our research and development and manufacturing activities involve the controlled use of hazardous materials and chemicals. We are subject to federal, state, local and international laws and regulations governing the use, storage, handling and disposal of hazardous materials and waste products. If we fail to comply with applicable laws or regulations, we could be required to pay penalties or be held liable for any damages that result and this liability could exceed our financial resources. We cannot assure you that accidental contamination or injury will not occur. Any such accident could damage our research and manufacturing facilities and operations, resulting in delays and increased costs.

The price for our common stock is volatile and may drop.

The trading price for our common stock has fluctuated significantly over recent years. The volatility in the price of our stock is attributable to a number of factors, not all of which relate to our operating results and financial position. Our stock is traded on the OTC Bulletin Board (OTCBB). Continued volatility in the market price for our stock should be expected and we cannot assure you that the price of our stock will not decrease in the future. Fluctuations or further declines in the price of our stock may affect our ability to sell shares of our stock and to raise capital through future equity financing.

Our stock has been delisted from the Nasdaq Capital Market and is now trading on the OTC Bulletin Board (OTCBB).

On February 1, 2007, we received a staff determination letter from Nasdaq’s Listing Qualifications Department indicating that we no longer met the minimum bid price requirement for continued listing on the Nasdaq Capital Market. As a result, our common stock on the Nasdaq Capital

Market was ended on February 22, 2007. Trading information about our common stock became available on the OTC Bulletin Board beginning on February 26, 2007.

Our common stock is deemed to be “penny stock”

, which may make it more difficult for investors to sell their shares due to suitability requirements.

Our common stock is classified as a “penny stock” under the rules of the SEC. The

Securities and Exchange CommissionSEC has adopted Rule 3a51-1

whichthat establishes the definition of a “penny stock”

, for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9

requires:requires that:a broker or dealer approve a person’s account for transactions in penny stocks; and

that the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

obtain financial information and investment experience objectives of the person; and

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which

is in highlight form:

sets forth the basis on which the broker or dealer made the suitability determination; and

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to

the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We may issue a substantial amount of our common stock to holders of options and warrants and this could reduce the market price for our stock.

At December 31,

2009,2011, we had obligations to issue

11,309,88717,648,273 shares of common stock upon exercise of outstanding stock options,

representing 3,331,731 shares and warrants

representing7,978,156 shares.or conversion rights. The issuance of these additional shares of common stock may be dilutive to our current shareholders and could negatively impact the market price of our common stock.

Our common stock is thinly traded and a large percentage of our shares are held by a small group of unrelated, institutional owners.

At December 31,

2009,2011, we had

49,189,67249,625,725 shares of common stock outstanding.

Fewer than ten unrelated, institutional holders own more than 50% of these shares. The sale of

a significant

number of shares into the public market has

the potential to cause significant downward pressure on the price of our common stock. This is particularly the case if the shares being placed into the market exceed the market’s ability to absorb the

stock. Such an event could place further downward pressure on the price of our common stock. This presents an opportunity for short sellers to contribute to the further decline of our stock price. If there are significant short sales of our stock, the price decline that would result from this activity will cause the share price to decline more so, which, in turn, may cause long holders of the stock to sell their shares thereby contributing to sales of stock in the market.

|

| |

| Item 1B. | Unresolved Staff Comments |

We currently lease

a total of six facilities throughout the world under

non-cancelablenon-cancellable leases with various terms. The following table summarizes certain information regarding

theour leased facilities. Annual rent amounts presented in the table are reflected in thousands.

| | | | | | | | | |

Location | | Function | | Square

Footage | | 2010

Scheduled

Rent | | Lease Term

Expires |

Omaha, Nebraska | | WAVE and Consumable Manufacturing | | 25,000 | | $ | 138 | | July 2011 |

San Jose, California | | Consumable Manufacturing | | 14,360 | | $ | 165 | | October 2010 |

Glasgow, Scotland | | Multi Functional(1) | | 5,059 | | $ | 33 | | March 2012 |

Omaha, Nebraska | | Multi Functional(1) | | 18,265 | | $ | 196 | | July 2012 |

Paris, France | | Multi Functional(1) | | 4,753 | | $ | 102 | | February 2011(2) |

Gaithersburg, Maryland | | Multi Functional(1) | | 8,404 | | $ | 154 | | May 2012 |

|

| | | | | | | | | | | |

| Location | | Function | | Square Footage | | 2012 Scheduled Rent | | Lease Term Expires |

| Omaha, Nebraska | | WAVE and Consumable Manufacturing | | 25,000 |

| | $ | 139 |

| | July 2016 |

| San Jose, California | | Consumable Manufacturing | | 9,110 |

| | $ | 57 |

| | February 2016 |

| Glasgow, Scotland | | Multi Functional (1) | | 5,059 |

| | $ | 36 |

| | March 2017 |

| Omaha, Nebraska | | Multi Functional (1) | | 18,265 |

| | $ | 204 |

| | July 2022 |

| New Haven, Connecticut | | Laboratory | | 22,459 |

| | $ | 472 |

| | March 2018 |

| |

| (1) | Multi Functional facilities include functions related to manufacturing, services, sales and marketing, research and development and/or administration. |

(2) | This lease expiration assumes that we exercise the early termination clause which allows the lease to terminate in February 2011. The original lease expiration is February 2014. |

We occupy the leased facilities, with the exception of the Paris, France facility which we have vacated and are in the process of finding a tenant to sublease this facility. In the event we are unable to sublease the Paris, France facility, we will exercise the early termination clause which allows for the lease to terminate in February 2011. The original term of the lease expires on February 1, 2014. We have a reserve of $0.1 million in other accrued expenses for the remaining lease liability.

We believe that

ourthese facilities are

suitable and adequate

forto meet our current

level of operations.and planned needs. We believe that if additional space is needed in the future, we could find alternate space at competitive market rates without substantial increase in cost.

|

| |

| Item 3. | Legal Proceedings. |

The Company is

We are subject to a number of claims of various amounts which arise out of the normal course of our business. In our opinion, the disposition of pending claims will not

a party to any pending legal proceedings which, if decided adversely to the Company, will have a material adverse effect on our financial position, results of operations or cash flows.

|

| |

| Item 4. | Submission of Matters to a Vote of Security Holders.

Mine Safety Disclosures |

We did not submit any matters to our stockholders for a vote or other approval during the fourth quarter

Not applicable.

|

| |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information. Share price information for our common stock is available on the OTC Bulletin Board under the symbol TBIO.OB. Prior to February 22, 2007, our common stock was listed for trading on the Nasdaq Capital Market under the symbol TBIO. The following table sets forth the high and low closing prices for our common stock during each of the quarters of 20082011 and 2009. | | | | | | |

| | | High | | Low |

Year Ended December 31, 2008 | | | | | | |

First Quarter | | $ | 0.54 | | $ | 0.42 |

Second Quarter | | $ | 0.86 | | $ | 0.47 |

Third Quarter | | $ | 0.85 | | $ | 0.52 |

Fourth Quarter | | $ | 0.56 | | $ | 0.25 |

| | |

Year Ended December 31, 2009 | | | | | | |

First Quarter | | $ | 0.42 | | $ | 0.21 |

Second Quarter | | $ | 0.58 | | $ | 0.32 |

Third Quarter | | $ | 0.70 | | $ | 0.35 |

Fourth Quarter | | $ | 0.74 | | $ | 0.58 |

Holders. At2010. These prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

| | | | | | | | |

| | | High | | Low |

| Year Ended December 31, 2011 | | | | |

| First Quarter | | $ | 0.90 |

| | $ | 0.61 |

|

| Second Quarter | | $ | 1.75 |

| | $ | 0.82 |

|

| Third Quarter | | $ | 1.77 |

| | $ | 1.00 |

|

| Fourth Quarter | | $ | 1.44 |

| | $ | 1.07 |

|

| Year Ended December 31, 2010 | | | | |

| First Quarter | | $ | 0.88 |

| | $ | 0.61 |

|

| Second Quarter | | $ | 0.86 |

| | $ | 0.49 |

|

| Third Quarter | | $ | 0.59 |

| | $ | 0.33 |

|

| Fourth Quarter | | $ | 0.71 |

| | $ | 0.32 |

|

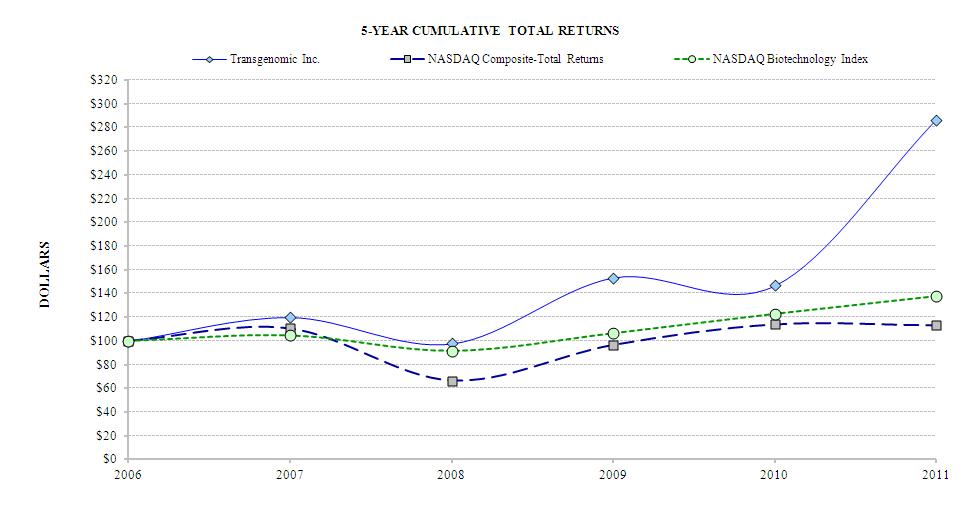

Company Stock Price Performance Graph.The following graph compares five-year cumulative total returns of the Company, the NASDAQ Composite Index and the NASDAQ Biotechnology Stock Index. The graph assumes $100 was invested in the common stock of Transgenomic, Inc. and each index as of December 31, 2009,2006 and that all dividends were re-invested.

The information contained in this Stock Performance Graph section shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into a document filed under

the Securities Act of 1933 (the "Securities Act") or the Securities Exchange Act of 1934.

Holders. At December 31, 2011, there are 49,189,67249,625,725 shares of our common stock outstanding and approximately 2,800 holders of record. Dividends. We have never declared or paid any cash dividends on our common stock and we do not anticipate paying any cash dividends on our common stock in the foreseeable future. We expect to retain all earnings, if any, for investment in our business. Dividends on our common stock will be paid only if and when declared by our Board of Directors. The Board’s ability to declare a dividend is subject to limits imposed by Delaware corporate law. In determining whether to declare dividends, the Board may consider our financial condition, results of operations, working capital requirements, future prospects and other relevant factors. The holders of our Series A Convertible Preferred Stock (the "Series A Preferred Stock") are entitled to receive quarterly dividends. Sale of Unregistered Securities.On December 29, 2010, the Company issued 2,586,205 shares of Series A Preferred Stock pursuant to applicable exemptions from the registration requirements of the Securities Act of 1933. The issuance of such Series A Preferred Stock was in connection with the FAMILION Acquisition. Please refer to the Series A Convertible Preferred Stock Purchase Agreement among the Company made no salesand Third Security Senior Staff 2008 LLC, Third Security Staff 2010 LLC and Third Security Incentive 2010, LLC ("Third Security Investors") dated December 29, 2010.

On November 8, 2011, the Company entered into an Amendment Agreement with the Third Security Investors, which are the holders of all of the outstanding shares of the Company's Series A Preferred Stock. Pursuant to the Amendment Agreement, the Third Security Investors and the Company agreed to amend the Certificate of Designation to eliminate certain features of the Series A Preferred Stock relating to (i) an anti-dilution adjustment to the conversion rate upon which the Series A Preferred Stock is convertible into the Company's common stock and (ii) an optional redemption of the Series A Preferred Stock by the Third Security Investors (the “Certificate Amendment”); subject to the requisite stockholder approval of the Certificate Amendment at the Company's next annual meeting of its stockholders. Pursuant to the Amendment Agreement, the Third Security Investors agreed to vote the Series A Preferred Stock and their common stock duringin favor of the years endedCertificate Amendment and agreed to waive their rights to the features of the Series A Preferred Stock being eliminated by the Certificate Amendment. In exchange for the Third Security Investors entering into the Amendment Agreement, the Company agreed to issue to the holders an aggregate of 245,903 shares of common stock having a market value of $0.3 million.

On December 30, 2011, the Company entered into a Convertible Promissory Note Purchase Agreement (the “Note Purchase Agreement”) with the Third Security Investors in the aggregate amount of $3.0 million. Under the Note Purchase Agreement, the Company sold to the Third Security Investors convertible notes that mature on March 31, 20092012. The Note Purchase Agreement and 2008 that werenotes provide for conversion of any amount remaining due to the Third Security Investors under the notes into equity securities of the Company of the same class(es) or series and at the same price as the equity securities of the Company sold in the Company's first sale or issuance of its equity securities after December 30, 2011, in the aggregate amount of at least $3.0 million. The notes and the equity securities into which the notes are convertible have not been registered under the Securities Act and applicable state securities laws, but have been offered and sold in the United States pursuant to applicable exemptions from registration requirements under the Securities Act and applicable state securities laws.

On February 2, 2012, the Company entered into a Securities Purchase Agreement with certain institutional and other accredited investors pursuant to which the Company: (i) sold to the investors an aggregate of 1933 (the “Securities Act”). 19,000,000 shares of the Company's common stock at a price per share of $1.00 for aggregate gross proceeds of approximately $19.0 million; and (ii) issued to the investors warrants to purchase up to an aggregate of 9,500,000 shares of common stock with an exercise price of $1.25 per share. The warrants may be exercised, in whole or in part, at any time from February 7, 2012 until February 7, 2017 and contain both cash and “cashless exercise” features. The warrants also impose penalties on the Company for failure to deliver the shares of common stock issuable upon exercise. The Securities Purchase Agreement also requires the filing by the Company of a registration statement with the SEC covering all shares issued and issuable under such Securities Purchase Agreement and imposes significant penalties for the failure to file such registration statement by March 23, 2012. The Company currently intends to use the net proceeds from the offering for general corporate and working capital purposes, primarily to accelerate development of several of the company's key initiatives. The common stock and warrants were issued pursuant to applicable exemptions from registration requirements under the Securities Act and applicable securities law.

As part of the offering and, in connection with the conversion of certain convertible promissory notes in the aggregate amount of $3.0 million issued by the Company on December 30, 2011 to the Third Security Investors, the Third Security Investors collectively received 3,000,000 shares of common stock and warrants to purchase up to 1,500,000 shares of common stock upon the same terms as the investors.

Information regarding saleswith respect to the securities of equity securitiesthe Company as described above sold by the Company during the year ended December 31, 2005period covered by this Annual Report and thereafter through the date of the filing of this Annual Report with the SEC that were not

registered under the Securities Act

of 1933 havehas previously been

previously reported byprovided in the

CompanyCompany's Current Reports on Form

8-Ks8-K filed

with the SEC on

March 18, 2005, March 30, 2005January 6, 2012, February 3, 2012 and

October 31, 2005.February 7, 2012.

Issuer Purchase of Equity Securities. The Company made no purchases of its common stock during the quarteryear ended December 31, 2008.2011. Therefore, tabular disclosure is not presented. |

| |

| Item 6. | Selected Consolidated Financial Data. |

The selected consolidated balance sheet data as of December 31, 20092011 and 20082010 and the selected consolidated statements of operations data for each year ended December 31, 20092011, 2010 and 20082009 have been derived from our audited consolidated financial statements that are included elsewhere in this Annual Report on Form 10-K. The selected consolidated balance sheet data as of December 31, 2007, 20062009, 2008 and 20052007 and the selected consolidated statements of operations data for each year ended December 31, 2007, 20062008 and 20052007 have been derived from our audited consolidated financial statements that are not included in this Annual Report on Form 10-K. Dollar amounts, except per share data, are presented in thousands. | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 22,023 | | | $ | 23,993 | | | $ | 23,176 | | | $ | 23,415 | | | $ | 25,828 | |

Cost of good sold | | | 10,418 | | | | 10,345 | | | | 10,483 | | | | 12,046 | | | | 13,497 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 11,605 | | | | 13,648 | | | | 12,693 | | | | 11,369 | | | | 12,331 | |

Selling, general and administrative | | | 10,319 | | | | 10,795 | | | | 11,466 | | | | 12,138 | | | | 12,218 | |

Research and development | | | 3,182 | | | | 2,465 | | | | 3,033 | | | | 2,362 | | | | 2,199 | |

Restructuring charges(1) | | | — | | | | 118 | | | | 1,516 | | | | — | | | | — | |

Impairment charges(2) | | | — | | | | 638 | | | | — | | | | — | | | | 425 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 13,501 | | | | 14,016 | | | | 16,015 | | | | 14,500 | | | | 14,842 | |

Other income (expense)(3) | | | 18 | | | | 86 | | | | 1,391 | | | | 198 | | | | (2,447 | ) |

| | | | | | | | | | | | | | | | | | | | |