UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20102012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33164

Domtar Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 20-5901152 | |

(State or Other Jurisdiction of

| (I.R.S. Employer

|

395 de Maisonneuve Blvd. West

Montreal, Quebec, H3A 1L6, Canada

(Address of Principal Executive Offices)(Zip Code)

Registrant’s telephone number, including area code:(514) 848-5555

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer x Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2010,2012, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $2,073,567,134.2,707,214,110.

Number of shares of common stock outstanding as of February 23, 2011: 41,105,30519, 2013: 34,168,276

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement, to be filed within 120 days of the close of the registrant’s fiscal year, in connection with its 20112013 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

DOMTAR CORPORATION

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 20102012

| PAGE | ||||||

| PART I | ||||||

ITEM 1 | 4 | |||||

| 4 | ||||||

| 5 | ||||||

| 11 | ||||||

| 12 | ||||||

| 14 | ||||||

| 14 | ||||||

ITEM 1A | ||||||

ITEM 1B | 26 | |||||

ITEM 2 | 26 | |||||

ITEM 3 | 28 | |||||

ITEM 4 | 30 | |||||

| PART II | ||||||

ITEM 5 | 31 | |||||

| 31 | ||||||

| 31 | ||||||

| 31 | ||||||

| 33 | ||||||

ITEM 6 | 34 | |||||

ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 35 | ||||

| 35 | ||||||

| 37 | ||||||

| 52 | ||||||

| PAGE | ||||||

| 56 | ||||||

| 57 | |||||

| 57 | ||||||

| 58 | ||||||

| 58 | ||||||

ITEM 7A | ||||||

ITEM 8 | ||||||

Report of PricewaterhouseCoopers LLP, Independent Registered Public | ||||||

Consolidated Statements of Earnings | ||||||

ITEM 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |||||

ITEM 9A | ||||||

ITEM 9B | ||||||

| PART III | ||||||

ITEM 10 | ||||||

ITEM 11 | ||||||

ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |||||

ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |||||

ITEM 14 | ||||||

| PART IV | ||||||

ITEM 15 | ||||||

| ||||||

| ITEM 1. | BUSINESS |

We design, manufacture, market and distribute a wide variety of fiber-based products including communication papers, specialty and packaging papers and adult incontinence products. The foundation of our business is a network of world class wood fiber converting assets that produce paper grade, fluff and specialty pulps. The majority of our pulp production is consumed internally to manufacture paper and consumer products. We are the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity. We are also a manufacturer of papergrade, fluff and specialty pulp. We design, manufacture, market and distribute a wide range of paper products forserving a variety of customers, including merchants, retail outlets, stationers, printers, publishers, converters and end-users. We are also a leading marketer and producer of a complete line of incontinence care products marketed primarily under the Attends® brand name. We own and operate Ariva (previously the Domtar Distribution Group)®, an extensivea network of strategically located paper and printing supplies distribution facilities. To learn more, visitwww.Domtar.com.

We also produced lumber and other specialty and industrial wood products up untiloperate the sale of our Wood business on June 30, 2010. Prior to June 30, 2010, we had threefollowing business segments: Papers, Paper Merchants and Wood. We now have two business segments: PapersPulp and Paper, Merchants.Distribution and Personal Care. We had revenues of $5.9$5.5 billion in 2010,2012, of which approximately 83%80% was from the PapersPulp and Paper segment, approximately 15%13% was from the Paper MerchantsDistribution segment and approximately 2%7% was from the WoodPersonal Care segment. Our Personal Care segment was formed on September 1, 2011, upon completion of the acquisition of Attends Healthcare Inc. (“Attends US”). On March 1, 2012, we completed the acquisition of Attends Healthcare Ltd. (“Attends Europe”), a manufacturer and supplier of adult incontinence care products in Northern Europe. In addition, on May 10, 2012, we completed the acquisition of EAM Corporation (“EAM”), a manufacturer of high quality airlaid and ultrathin laminated cores used in feminine hygiene, adult incontinence, baby diapers and other medical healthcare and performance packaging solutions. The acquired businesses are presented under our Personal Care reportable segment. Information regarding these business acquisitions is included in Part II, Item 8, Financial Statements and Supplementary Data of this Annual Report on Form 10-K, under Note 3 “Acquisition of Businesses.”

Throughout this Annual Report on Form 10-K, unless otherwise specified, “Domtar Corporation,” “the Company,” “Domtar,” “we,” “us” and “our” refer to Domtar Corporation, its subsidiaries, as well as its investments. Unless otherwise specified, “Domtar Inc.” refers to Domtar Inc., a 100% owned Canadian subsidiary.

Domtar Corporation was incorporated on August 16, 2006, for the sole purpose of holding the Weyerhaeuser Fine Paper Business and consummating the combination of the Weyerhaeuser Fine Paper Business with Domtar Inc. (the “Transaction”). The Weyerhaeuser Fine Paper Business was owned by Weyerhaeuser Company (“Weyerhaeuser”) prior to the completion of the Transaction on March 7, 2007. Domtar Corporation had no operations prior to March 7, 2007 when, upon the completion of the Transaction, we became an independent public holding company.

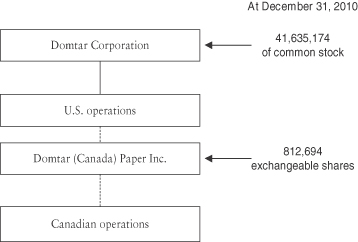

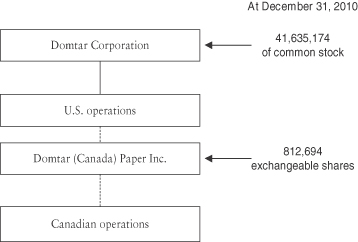

At December 31, 2010,2012, Domtar Corporation had a total of 41,635,17434,238,604 shares of common stock issued and outstanding, and Domtar (Canada) Paper Inc., an indirectly 100% owned subsidiary, had a total of 812,694607,814 exchangeable shares issued and outstanding. These exchangeable shares are intended to be substantially the economic equivalent to shares of our common stock and are currently exchangeable at the option of the holder on a one-for-one basis for shares of our common stock. As such, the total combined number of shares of common stock and exchangeable shares issued and outstanding was 42,447,86834,846,418 at December 31, 2010.2012. Our common shares are traded on the New York Stock Exchange and the Toronto Stock Exchange under the symbol “UFS” and our exchangeable shares are traded on the Toronto Stock Exchange under the symbol “UFX.” Information regarding our common stock and the exchangeable shares is included in Part II, Item 8, Financial Statements and Supplementary Data of this Annual Report on Form 10-K, under Note 1920 “Shareholders’ Equity.”

The following chart summarizes our corporate structure.

On June 30, 2010, we exited our Wood business, which comprised the manufacturing and marketing of lumber and other specialty and industrial wood products and the management of forest resources. As of July 1, 2010, weWe operate in the twothree reportable segments described below. Each reportable segment offers different products and services and requires different manufacturing processes, technology and/or marketing strategies.

The following summary briefly describes the operations included in each of our reportable segments:

PapersPulp and Paper – represents—Our Pulp and Paper segment comprises the aggregation of thedesign, manufacturing, sale and distribution of business, commercial printingcommunication and publishing,specialty and converting and specialtypackaging papers, as well as market softwood, fluff and hardwood market pulp.

Paper MerchantsDistribution –—Our Distribution segment involves the purchasing, warehousing, sale and distribution of our paper products and those of other paper manufacturers. These products include business and printing papers, and certain industrial products and printing supplies.

Personal Care—Our Personal Care segment, which we formed in September 2011, consists of the design, manufacturing, sale and distribution of adult incontinence products.

Information regarding our reportable segments is included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations as well as Item 8, Financial Statements and Supplementary Data, under Note 22,23, of this Annual Report on Form 10-K. Geographic information is also included under Note 2223 of the Financial Statements and Supplementary Data.

FINANCIAL HIGHLIGHTS PER SEGMENT | Year ended December 31, 2010 | Year ended December 31, 2009 | Year ended December 31, 2008 | Year ended December 31, 2012 | Year ended December 31, 2011 | Year ended December 30, 2010 | ||||||||||||||||||

| (In millions of dollars, unless otherwise noted) | ||||||||||||||||||||||||

Sales: | ||||||||||||||||||||||||

Papers | $ | 5,070 | $ | 4,632 | $ | 5,440 | ||||||||||||||||||

Paper Merchants | 870 | 873 | 990 | |||||||||||||||||||||

Wood | 150 | 211 | 268 | |||||||||||||||||||||

Pulp and Paper | $ | 4,575 | $ | 4,953 | $ | 5,070 | ||||||||||||||||||

Distribution | 685 | 781 | 870 | |||||||||||||||||||||

Personal Care(2) | 399 | 71 | — | |||||||||||||||||||||

Wood(3) | — | — | 150 | |||||||||||||||||||||

|

|

| ||||||||||||||||||||||

Total for reportable segments | 6,090 | 5,716 | 6,698 | 5,659 | 5,805 | 6,090 | ||||||||||||||||||

Intersegment sales—Papers | (229 | ) | (231 | ) | (276 | ) | ||||||||||||||||||

Intersegment sales—Pulp and Paper | (177 | ) | (193 | ) | (229 | ) | ||||||||||||||||||

Intersegment sales—Wood | (11 | ) | (20 | ) | (28 | ) | — | — | (11 | ) | ||||||||||||||

|

|

| ||||||||||||||||||||||

Consolidated sales | $ | 5,850 | $ | 5,465 | $ | 6,394 | $ | 5,482 | $ | 5,612 | $ | 5,850 | ||||||||||||

Operating income (loss): | ||||||||||||||||||||||||

Papers(1) | $ | 667 | $ | 650 | ($ | 369 | ) | |||||||||||||||||

Paper Merchants | (3 | ) | 7 | 8 | ||||||||||||||||||||

Wood(1) | (54 | ) | (42 | ) | (73 | ) | ||||||||||||||||||

Operating income (loss):(1) | ||||||||||||||||||||||||

Pulp and Paper | $ | 346 | $ | 581 | $ | 667 | ||||||||||||||||||

Distribution | (16 | ) | — | (3 | ) | |||||||||||||||||||

Personal Care(2) | 45 | 7 | — | |||||||||||||||||||||

Wood(3) | — | — | (54 | ) | ||||||||||||||||||||

Corporate | (7 | ) | — | (3 | ) | (8 | ) | 4 | (7 | ) | ||||||||||||||

|

|

| ||||||||||||||||||||||

Total | $ | 603 | $ | 615 | ($ | 437 | ) | $ | 367 | $ | 592 | $ | 603 | |||||||||||

Segment assets: | ||||||||||||||||||||||||

Papers | $ | 5,088 | $ | 5,538 | $ | 5,399 | ||||||||||||||||||

Paper Merchants | 99 | 101 | 120 | |||||||||||||||||||||

Wood | — | 250 | 247 | |||||||||||||||||||||

Pulp and Paper | $ | 4,564 | $ | 4,874 | $ | 5,088 | ||||||||||||||||||

Distribution | 73 | 84 | 99 | |||||||||||||||||||||

Personal Care(2) | 841 | 458 | — | |||||||||||||||||||||

Wood(3) | — | — | — | |||||||||||||||||||||

Corporate | 839 | 630 | 338 | 645 | 453 | 839 | ||||||||||||||||||

|

|

| ||||||||||||||||||||||

Total | $ | 6,026 | $ | 6,519 | $ | 6,104 | $ | 6,123 | $ | 5,869 | $ | 6,026 | ||||||||||||

|

|

| ||||||||||||||||||||||

| (1) | Factors that affected the year-over-year comparison of financial results are discussed in the year-over-year and segment analysis included in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation of this Annual Report on Form 10-K. |

| (2) | On September 1, 2011, we acquired Attends US and formed a new reportable segment entitled Personal Care. Results of Attends US are included in the consolidated financial statements starting September 1, 2011. On March 1, and May 10, 2012, we grew our Personal Care segment with the acquisition of Attends Europe and EAM, respectively. Results of Attends Europe and EAM are included in the consolidated financial statements starting on March 1, 2012 and May 1, 2012, respectively. |

| (3) | We sold our Wood Products business on June 30, 2010. |

Our Operations

We are the largest integrated manufacturer and marketer of uncoated freesheet paper in North America and the second largest in the world based on production capacity. We have 10 pulp and paper mills in operation (eight in the United States and two in Canada) with an annual paper production capacity of approximately 3.8produce 4.2 million metric tons of uncoated freesheet paper. Approximately 81%hardwood, softwood and fluff pulp at 12 of our 13 mills (Port Huron being a non-integrated paper production capacity is domestic and the remaining 19% is located in Canada. Our paper manufacturing operations are supported by 15 converting and distribution operations, including a network of 11 plants located offsitemill). The majority of our pulp is consumed internally to manufacture paper making operations.and

In addition, we manufacture and sell pulp in excess of our internal requirements, and we

consumer products, with the balance being sold as market pulp. We also purchase papergrade pulp from third parties allowing us to optimize the logistics of our pulp capacity while reducing transportation costs.

We are the largest integrated marketer and manufacturer of uncoated freesheet paper in North America. We have 10 pulp and paper mills (eight in the United States and two in Canada), with an annual paper production capacity to sellof approximately 1.53.4 million metric tons of pulp per year depending on market conditions. Approximately 38%uncoated freesheet paper. Our paper manufacturing operations are supported by 15 converting and distribution operations including a network of 12 plants located offsite of our trade pulppaper making operations. Also, we have forms manufacturing operations at three offsite converting and distribution operations. Approximately 81% of our paper production capacity is domestic,in the U.S. and the remaining 62%19% is located in Canada.

We produce market pulp in excess of our internal requirements at our three non-integrated pulp mills in Kamloops, Dryden, and Plymouth as well as at our pulp and paper mills in Ashdown, Espanola, Ashdown, Hawesville, Windsor, Marlboro and Windsor.Nekoosa. We sell approximately 1.6 million metric tons of pulp per year depending on market conditions. Approximately 50% of our trade pulp production capacity is in the U.S., and the remaining 50% is located in Canada.

The table below lists our operating pulp and paper mills and their annual production capacity.

| Fiberline Pulp Capacity | Paper Capacity (1) | Trade Pulp (2) | Saleable | |||||||||||||||||||||||||||||||||||

Production Facility | # lines | (’000 ADMT) | # machines | (’000 ST) | (’000 ADMT) | Fiberline Pulp Capacity | Paper(1) | |||||||||||||||||||||||||||||||

| # lines | (‘000 ADMT) (2) | # machines | Category(3) | (‘000 ST) (2) | ||||||||||||||||||||||||||||||||||

Uncoated freesheet | Uncoated freesheet |

| Uncoated freesheet | |||||||||||||||||||||||||||||||||||

Ashdown, Arkansas | 3 | 810 | 4 | 906 | 86 | 3 | 747 | 3 | Communication | 703 | ||||||||||||||||||||||||||||

Windsor, Quebec | 1 | 454 | 2 | 655 | 40 | 1 | 447 | 2 | Communication | 641 | ||||||||||||||||||||||||||||

Hawesville, Kentucky | 1 | 455 | 2 | 593 | 47 | 1 | 430 | 2 | Communication | 578 | ||||||||||||||||||||||||||||

Kingsport, Tennessee | 1 | 275 | 1 | 432 | — | 1 | 282 | 1 | Communication | 414 | ||||||||||||||||||||||||||||

Johnsonburg, Pennsylvania | 1 | 238 | 2 | Communication | 369 | |||||||||||||||||||||||||||||||||

Marlboro, South Carolina | 1 | 338 | 1 | 389 | — | 1 | 325 | 1 | Specialty & Packaging | 278 | ||||||||||||||||||||||||||||

Johnsonburg, Pennsylvania | 1 | 231 | 2 | 362 | — | |||||||||||||||||||||||||||||||||

Nekoosa, Wisconsin | 1 | 166 | 3 | 151 | — | 1 | 155 | 3 | Specialty & Packaging | 118 | ||||||||||||||||||||||||||||

Rothschild, Wisconsin | 1 | 60 | 1 | 140 | — | 1 | 66 | 1 | Communication | 138 | ||||||||||||||||||||||||||||

Port Huron, Michigan | — | — | 4 | 113 | — | — | — | 4 | Specialty & Packaging | 114 | ||||||||||||||||||||||||||||

Espanola, Ontario | 2 | 351 | 2 | 76 | 114 | 2 | 352 | 2 | Specialty & Packaging | 77 | ||||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||||||||

Total Uncoated freesheet | 12 | 3,140 | 22 | 3,817 | 287 | 12 | 3,042 | 21 | 3,430 | |||||||||||||||||||||||||||||

Pulp | Pulp |

| ||||||||||||||||||||||||||||||||||||

Kamloops, British Columbia | 2 | 477 | — | — | 477 | 1 | 380 | — | — | |||||||||||||||||||||||||||||

Dryden, Ontario | 1 | 327 | — | — | 327 | 1 | 328 | — | — | |||||||||||||||||||||||||||||

Plymouth, North Carolina | 2 | 444 | — | — | 444 | 2 | 438 | — | — | |||||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||||||||

Total Pulp | 5 | 1,248 | — | — | 1,248 | 4 | 1,146 | — | — | |||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||

Total | 17 | 4,388 | 22 | 3,817 | 1,535 | 16 | 4,188 | 21 | 3,430 | |||||||||||||||||||||||||||||

Total Trade Pulp(4) | 1,625 | |||||||||||||||||||||||||||||||||||||

Pulp purchases | 117 | 129 | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

Net pulp | 1,418 | 1,496 | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

| (1) | Paper capacity is based on an operating schedule of 360 days and the production at the winder. |

| (2) | ADMT refers to an air dry metric ton and ST refers to short ton. |

| (3) | Represents the majority of the capacity at each of these facilities. |

| (4) | Estimated third-party shipments dependent upon market |

Our Raw Materials

The manufacturing of pulp and paper requires wood fiber, chemicals and energy. We discuss these three major raw materials used in our manufacturing operations below.

Wood Fiber

United States pulp and paper mills

The fiber used by our pulp and paper mills in the United States is primarily hardwood and secondarily softwood, both being readily available in the market from multiple third-party sources. The mills obtain fiber from a variety of sources, depending on their location. These sources include a combination of long-term supply contracts, wood lot management arrangements, advance stumpage purchases and spot market purchases.

Canadian pulp and paper mills

The fiber used at our Windsor pulp and paper mill is hardwood originating from a variety of sources, including purchases on the open market in Canada and the United States, contracts with Quebec wood producers’ marketing boards, public land where we have wood supply allocations and from Domtar’s private lands. The softwood and hardwood fiber for our Espanola pulp and paper mill and the softwood fiber for our Dryden pulp mill, is obtained from third parties, directly or indirectly from public lands and through designated wood supply allocations for the pulp mills or from business-to-business arrangements from the Ontario sawmills sold to EACOM Timber Corporation.mills. The fiber used at our Kamloops pulp mill is all softwood, originating mostly from third-party sawmilling operations in the southern interiorsouthern-interior part of British Columbia.

Cutting rights on public lands related to our pulp and paper mills in Canada represent about 0.9 million cubic meters of softwood and 1.0 million cubic meters of hardwood, for a total of 1.9 million cubic meters of wood per year. Access to harvesting of fiber on public lands in Ontario and Quebec is subject to licenses and review by the respective governmental authorities.

During 2010,2012, the cost of wood fiber relating to our PapersPulp and Paper segment comprised approximately 20% of the total consolidated cost of sales.

Chemicals

We use various chemical compounds in our pulp and paper manufacturing facilitiesoperations that we purchase, primarily on a central basis, through contracts varying between one and twelveten years in length to ensure product availability. Most of the contracts have pricing that fluctuates based on prevailing market conditions. For pulp manufacturing, we use numerous chemicals including caustic soda, sodium chlorate, sulfuric acid, lime and peroxide. For paper manufacturing, we also use several chemical products including starch, precipitated calcium carbonate, optical brighteners, dyes and aluminum sulfate.

During 2010,2012, the cost of chemicals relating to our PapersPulp and Paper segment comprised approximately 11%13% of the total consolidated cost of sales.

Energy

Our operations consume substantial amounts of fuel including natural gas, fuel oil, coal and biomass, as well as electricity. We purchase substantial portions of the fuel we consume under supply contracts. Under most of these contracts, suppliers are committed to provide quantities within pre-determined ranges that provide us with our needs for a particular type of fuel at a specific facility. Most of these contracts have pricing that fluctuates based on prevailing market conditions. Natural gas, fuel oil, coal and biomass are consumed primarily to produce steam that is used in the manufacturing process and, to a lesser extent, to provide direct heat to be used in the chemical recovery process. About 75%76% of the total energy required to manufacture our products comes from renewable fuels such as bark and spent cooking liquor. The remainder of the energy comes from purchased fossil fuels such as natural gas, oil and coal.

We own power generating assets, including steam turbines, at all of our integrated pulp and paper mills, as well as hydro assets at fourthree locations: Espanola, our former Ottawa-Hull site, Nekoosa and Rothschild. Electricity is primarily used to drive motors and other equipment, as well as provide lighting. Approximately 71%72% of our electric power requirements are produced internally. We purchase the balance of our power requirements from local utilities.

During 2010,2012, energy costs relating to our PapersPulp and Paper segment comprised approximately 7%6% of the total consolidated cost of sales.

Our Transportation

Transportation of raw materials, wood fiber, chemicals and pulp into our mills is mostly done by rail and trucks although barges are used in certain circumstances. We rely strictly on third parties for the transportation of our pulp and paper products between our mills, converting operations, distribution centers and customers. Our paper products are shipped mostly by truck, and logistics are managed centrally in collaboration with each location. Our pulp is either shipped by vessel, rail or truck. We work with all the major railroads and approximately 300 trucking companies in the United States and Canada. The length of our carrier contracts are generally from one to three years. We pay diesel fuel surcharges which vary depending on market conditions, and the cost of diesel fuel.

During 2012, outbound transportation costs relating to our Pulp and Paper segment comprised approximately 11% of the total consolidated cost of sales.

Our Product Offering and Go-to-Market Strategy

Our uncoated freesheet papers are used for communication and specialty and packaging papers. Communication papers are further categorized into business and commercial printing and publishing and converting and specialty applications.

BusinessOurbusiness papers include copy and electronic imaging papers, which are used with ink jet and laser printers, photocopiers and plain-paper fax machines, as well as computer papers, preprinted forms and digital papers. These products are primarily for office and home use. Business papers accounted for approximately 46%45% of our shipments of paper products in 2010.2012.

Ourcommercial printing and publishing papers include uncoated freesheet papers, such as offset papers and opaques. These uncoated freesheet grades are used in sheet and roll fed offset presses across the spectrum of commercial printing end-uses, including digital printing. Our publishing papers include tradebook and lightweight uncoated papers used primarily in book publishing applications such as textbooks, dictionaries, catalogs, magazines, hard cover novels and financial documents. Design papers, a sub-group of commercial printing and publishing papers, have distinct features of color, brightness and texture and are targeted towards graphic artists, design and advertising agencies, primarily for special brochures and annual reports. Commercial printing and publishing papers accounted for approximately 27% of our shipments of paperThese products in 2010.

We also produce paper for several converting and specialty markets. These converting and specialty papers consist primarily ofinclude base papers that are converted into finished products, such as envelopes, tablets, business forms and data processing/computer formsforms. Commercial printing and base stock used by the flexible packaging industry in the production of food and medical packaging and other specialty papers for various other industrial applications, including base stock for sandpaper, base stock for medical gowns, drapes and packaging, as well as transfer paper for printing processes. We also participate in several converting grades for specialty and security applications. These converting and specialtypublishing papers accounted for approximately 27%40% of our shipments of paper products in 2010.2012.

We also produce paper for severalspecialty and packaging markets. These products consist primarily of base stock for thermal printing, flexible packaging, food packaging, medical gowns and drapes, sandpapers backing, carbonless printing, labels and other coating and laminating applications. We also manufacture papers for industrial and specialty applications including carrier papers, treated papers, security papers and specialized printing and converting applications. These specialty and packaging papers accounted for approximately 15% of our shipments of paper products in 2012. These grades of papers require a certain amount of innovation and agility in the manufacturing system.

The chart below illustrates our main paper products and their applications.

| Communication Papers | Specialty and Packaging Papers | |||||||||

Category | Business Papers | Commercial Printing and |

| |||||||

Type | Uncoated Freesheet | Uncoated Freesheet | ||||||||

Grade | Copy | Premium imaging Technology papers | Offset Colors Index Tag Bristol | Opaques Premium opaques Lightweight Tradebook |

Imaging papers Label papers Medical disposables | |||||

Application | Photocopies Office documents Presentations | Presentations Reports | Commercial

Direct mail Pamphlets Brochures Cards Posters | Stationery Brochures Annual reports Books Catalogs, Forms & Envelopes |

Food & candy packaging

Check and security papers Surgical gowns | |||||

Our customer service personnel work closely with sales, marketing and production staff to provide service and support to merchants, converters, end-users, stationers, printers and retailers. We promote our products directly to end-users and others who influence paper purchasing decisions in order to enhance brand recognition and increase product demand. In addition, our sales representatives work closely with mill-based new product development personnel and undertake joint marketing initiatives with customers in order to better understand their businesses and needs and to support their future requirements.

We sell business papers primarily to paper stationers, merchants, office equipment manufacturers stationers and retail outlets. We distribute uncoated commercial printing and publishing papers to end-users and commercial printers, mainly through paper merchants, as well as selling directly to converters. We sell our convertingspecialty and specialty productspackaging papers mainly to converters, who apply a further production process such as coating, laminating, folding or waxing to our papers before selling them to a variety of specialized end-users. We distributed approximately 37%33% of our paper products in 20102012 through a large network of paper merchants operating throughout North America, one of which we own (see “—Paper Merchants”“Distribution”). Paper merchants,Distributors, who sell our products to their own customers, representrepresents our largest group of customers.

The chart below illustrates our channels of distribution for our paper products.

| Communication Papers | Specialty and Packaging Papers | |||||||||||||

Category | Business Papers | Commercial Printing and Publishing Papers | ||||||||||||

Domtar sells to: | Merchants i | Office Equipment Manufacturers /Stationers i | Retailers i | Merchants i | Converters i | End-Users | Converters i | |||||||

Customer sells to: |

End-users |

End-users | End-users | Converters/ End-users | Merchants/ Retailers | End-users | ||||||||

We sell market pulp to customers in North America mainly through a North American sales force while sales to most overseas customers are made directly or through commission agents. We maintain pulp supplies at strategically located warehouses, which allow us to respond to orders on short notice. In 2010,2012, approximately 32% of our sales of market pulp were domestic, 6%11% were in Canada and 62%57% were in other countries.

Our ten largest customers represented approximately 50%39% of our 2010 Papers2012 Pulp and Paper segment sales or 42%32% of our total sales in 2010.2012. In 2010, none2012, Staples, one of our customers of our Pulp and Paper segment represented more than 10%approximately 11% of our total sales. The majority of our customers purchase products through individual purchase orders. In 2010,2012, approximately 74%79% of our PapersPulp and Paper segment sales were domestic, 10% were in Canada, and 16%11% were in other countries.

Transportation

Transportation of raw materials, wood fiber, chemicals and pulp to our mills is mostly done by rail although trucks are used in certain circumstances. We rely strictly on third parties for the transportation of our pulp and paper products between our mills, converting operations, distribution centers and customers. Our paper products are shipped mostly by truck, and logistics are managed centrally in collaboration with each location. Our pulp is either shipped by vessel, rail or truck. We work with all major railroads and truck companies in the U.S. and Canada. The length of our carrier contracts are generally from one to three years. We pay diesel fuel surcharges which vary depending on market conditions, but are mostly tied to the cost of diesel fuel.

During 2010, outbound transportation costs relating to our Papers segment comprised approximately 10% of the total cost of sales.

Our Operations

Our Paper MerchantsDistribution business involves the purchasing, warehousing, sale and distribution of our various products and those of other manufacturers. ProductsThese products include business, printing and publishing papers and certain industrialpackaging products. These products are sold to a wide and diverse customer base, which includes small, medium and large commercial printers, publishers, quick copy firms, catalog and retail companies and institutional entities.

Our Paper Merchants operateDistribution business operates in the United States and Canada under a single banner and umbrella name, Ariva.Ariva®. Ariva operates throughout the Northeast, Mid-Atlantic and Midwest areas from 1816 locations in the United States, including 1412 distribution centers serving customers across North America. The Canadian business operates in threetwo locations in Ontario; inOntario, two locations in Quebec; and from two locations in Atlantic Canada.

Sales are executed by our sales force, based at branches strategically located in served markets. We distribute about 52% of our paper sales from our own warehouse distribution system and about 48% of our paper sales through mill-direct deliveries (i.e., deliveries directly from manufacturers, including ourselves, to our customers).

The table below lists all of our Ariva locations.

Eastern Region |

| Ontario, Canada | Quebec, Canada | Atlantic Canada | ||||

Albany, New York | Cincinnati, Ohio | Montreal, Quebec | Halifax, Nova Scotia | |||||

Boston, Massachusetts | Cleveland, Ohio | Quebec City, Quebec | Mount Pearl, Newfoundland | |||||

Harrisburg, Pennsylvania | Columbus, Ohio | |||||||

Hartford, Connecticut | Covington, Kentucky | |||||||

Lancaster, Pennsylvania | Dayton, Ohio | |||||||

New York, New York | ||||||||

Philadelphia, Pennsylvania | ||||||||

Southport, Connecticut | ||||||||

Washington, |

Our Raw Materials

The distributionDistribution business sells annually approximately 0.70.5 million tons of paper, forms and industrial/packaging products from over 60 suppliers located around the world. Domtar products represent approximately 31%30% of the total.

Our Product Offering and Go-to-Market Strategy

Our product offerings address a broad range of printing, publishing, imaging, advertising, consumer and industrial needs and are comprised of uncoated, coated and specialized papers and industrialpackaging products. Our go-to-market strategy is to serve numerous segments of the commercial printing, publishing, retail, wholesale, catalog and industrial markets with logistics and services tailored to the needs of our customers. In 2010,2012, approximately 68%61% of our sales were made in the United States and 32%39% were made in Canada.

OUR COMPETITIVE STRENGTHSPERSONAL CARE

We believe that

Our Operations

Our Personal Care business sells and manufactures adult incontinence products and distributes disposable washcloths marketed primarily under the Attends® brand name. During 2012, we acquired Attends Europe, a manufacturer and supplier of adult incontinence care products in Northern Europe, consolidating our competitive strengths provide a solid foundation forownership of the executionAttends brand on both sides of our business strategy:

Leading market position.the Atlantic. We are one of the largest integrated manufacturer and marketerleading suppliers of uncoated freesheet paper inadult incontinence products sold into North America and the second largestNorthern Europe, selling to hospitals (acute care) and nursing homes (long-term care) and we have a growing presence in the homecare and retail channels.

We operate two manufacturing facilities, with each having the ability to produce multiple product categories. We also have a research and development facility and production lines which manufacture high quality airlaid and ultrathin laminated absorbent cores.

Attends operates in the United States and in Europe:

Greenville, North Carolina: R&D, manufacturing and distribution

Aneby, Sweden: R&D, manufacturing and distribution

Jesup, Georgia: R&D, manufacturing and distribution

Our Industry Dynamics

Aging population

We compete in an industry with fundamental drivers for long-term growth. The aging population suggests that adult incontinence will become much more prevalent over the next several decades, as baby boomers enter their senior years and medical advances continue to extend the average lifespan. As an example, the National Association for Continence (“NAFC”) estimates that 10,000 Americans are turning 65 years old every day, or 3.65 million people per year. By the year 2030, approximately 71 million Americans are estimated to be 65 years old or older, representing over 20% of the U.S. population. It is estimated that approximately 5% of the world population, or 340 million individuals, is incontinent. After age 65, nearly one in three people are estimated to suffer from incontinence.

Increased healthcare spending

We are expected to benefit from the overall increase in national healthcare spending, which is due to an aging population and is aided by the recent federal legislative expansion of health insurance coverage, in the United States. Spending will likely increase at an even faster rate as health insurance coverage is expanded and the number of insured patients with the improved ability to access healthcare products and services increases. Growing healthcare expenditures are expected to spur an increase in spending within each of the channels served by Attends.

Our Raw Materials

The primary raw materials used in our manufacturing process are nonwovens, fluff pulp, super absorbent polymers, polypropylene film, elastics, adhesives and packaging materials that are purchased on a central basis with contracts varying between one and five years. Most contracts have prices that fluctuate based on production capacity. This leadingprevailing market position provides us with key competitive advantages, including economies of scale, wider salesconditions.

Our Product Offering and marketing coverageGo-to-Market Strategy

Our products, which include branded and a broad product offering of business, printingprivate label briefs, protective underwear, underpads, pads and publishing and converting and specialty paper grades.

Efficient and cost-competitive assets. Our network of world-class assets allows us to be a low-cost producer of high volume papers and an efficient producer of value-added specialty papers. Our five largest mills focus on the production of high volume copy and offset papers while production at our other mills focuses on value-added paper products where quality, flexibility and servicewashcloths, are key factors. Most of our paper is produced at mills with integrated pulp production and cogeneration facilities, reducing our exposure to price volatility for purchased pulp and energy.

Proximity to customers. We have a broad manufacturing footprint supported by a network of converting and distribution operations located across North America. This proximity to customers provides opportunities for direct and enhanced customer service and minimizes freight distances, response time and delivery cost. These constitute key competitive advantages, particularlyavailable in the high volume copy and offset paper grades market segment. Customer proximity also allows for just-in-time delivery of high demand paper products in less than 48 hours to most major North American markets.

Strong franchise with customer-focused solutions. We sell paper to multiple market segments through a variety of channels, including paper merchants, converters, retail companiessizes, as well as with differing performance levels and publishers throughout North America. In addition,product attributes. Our broad product portfolio covers most price points across each product category.

We serve four channels: acute care, long-term care, homecare, and retail. Through the utilization of our flexible production platform, manufacturing expertise and efficient supply chain management, we are able to provide a complete and high-quality line of branded and unbranded products to customers across all channels. We maintain a strong market presence through our ownershipdirect sales organization in the United States, Canada and nine Northern European countries.

Our Product Development

We currently offer a comprehensive, full suite of Ariva. We willproducts, and we continue to buildfocus on product development to produce even more effective products for our positions by maximizing our strengths with centralized planning capabilitycustomers. We continue to explore materials and supply-chain management solutions.

High quality products with strong brand recognition. We enjoy a strong reputation for producing high quality paper products and market some of the most recognized and preferred papers in North America, including a wide range of business and commercial printing paper brands, such as Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice®, and Domtar EarthChoice® Office Paper, part of a family of Forest Stewardship Council™ (FSC®) certified, environmentally and socially responsible paper.

Experienced management team. Our management team has significant experience and a record of success in the pulp and paper industry. We believe our employees’ expertise and know-how not only support the management team but help create operational efficiencies and enableprocesses that will allow us to deliver improved profitability from our manufacturing operations.manufacture products that absorb wetness quickly, while providing industry leading skin-dryness and superior containment.

OUR STRATEGIC INITIATIVES AND FINANCIAL PRIORITIES

WeAs a leading innovative fiber-based technology company, we strive to be recognized as the supplier of choice for branded and customer branded pulp and paper products in North Americaour customers, to be a core investment for our shareholders and to be recognized as leadersan industry leader in sustainabilitysustainability. We have three unwavering business objectives: (1) to grow and find ways to become less vulnerable to the manufacturesecular decline in communication paper demand, (2) to reduce volatility in our earnings profile by increasing the visibility and predictability of fiber-based products. our cash flows, and (3) to create value over time by ensuring that we maximize the strategic and operational use of our capital.

To achieve this goal and to create shareholder value,these goals, we have established the following business strategies:

Build customer loyaltyPerform: Drive performance in everything we do, focusing on customers, costs and cash. We are determined to operate our assets efficiently and to ensure we balance our production with our customer demand. We are building on the successful relationships that we have developed with key customers to support their businesses and to provide inventory reduction solutions through just-in-time delivery for the most-demanded products. We believe that we are a supplier of choice for customers who seek competitively-priced pulp and paper products and services.

Focus on generating free cash flow and maintaining financial discipline.We believe efficiently operated assets and carefully managed manufacturing costs are key to creating shareholder value.demand in papers. To generate free cash flow, we are focused on assigning our capital expenditures effectively and minimizing working capital requirements by reducing discretionary spending, reviewing procurement costs and pursuingrequirements. We apply prudent financial management policies to retain the balancing of production and inventory control.flexibility needed to successfully execute on our strategic roadmap.

LeverageGrow: To counteract the secular demand decline in our expertise to tap into growth opportunities. In order tocommunication paper products and sustain the success of our company, we believe that we must leverage our core competencies and expertise as operators of large scale operations in fiber sourcing and our expertise in the manufacturemarketing, manufacturing and distribution of fiber-based products and fiber sourcing.products. We are focused on optimizing and expanding our operations in markets with positive demand dynamics through the repurposing of assets, through investments to helporganically grow our business and counteract secular demand decline in our core North American fine paper business.or through strategic acquisitions.

Operate inBreak Out: Through agility and innovation, move from a responsible way. Customers, end-users, and all stakeholders in communities where we operate seek assurancespaper to a fiber-centric organization by seeking opportunities to break out from thetraditional pulp and paper industry that resources are managedmaking. We continue to explore opportunities to invest in a sustainable manner. We striveinnovative fiber-based technologies to provide these assurances by certifyingbring our manufacturingbusiness in new directions and distribution operations, namely with FSC chain-of-custody standards,leverage our expertise and our assets to extract the maximum value for the wood fiber we intend to haveconsume in our environmental management systems third-party verified against internationally recognized standards.operations.

Continue to growGrow our line of environmentally and ethically responsible papers.products: We believe we are delivering improvedbest-in-class service to customers through a broad range of product offerings and greater access to volume.certified products. The development of EarthChoice®, our line of environmentally and socially responsible paper, is providing a platform upon which to expand our offering to customers. The EarthChoice®This product line of papers, a product lineis supported by leading environmental groups and offers customers the solutions and peace of mind through the use of a combination of FSCForest Stewardship Council® (FSC®) virgin fiber and recycled fiber. FSC is

Operate in a responsible way: We try to make a positive difference every day by pursuing sustainable growth, valuing relationships, and responsibly managing our resources. We care for our customers, end-users and stakeholders in the communities where we operate, all seeking assurances that resources are managed in a sustainable manner. We strive to provide these assurances by certifying our distribution and manufacturing operations and measuring our performance against internationally recognized benchmarks. We are committed to the responsible use of forest resources across our operations and we are enrolled in programs and initiatives to encourage landowners engaged towards certification recognized by environmental groups as the most stringentto improve their market access and is third-party audited.increase their revenue opportunities.

The markets in which our businesses operate are highly competitive with well-established domestic and foreign manufacturers.

In the paper business, our paper production does not rely on proprietary processes or formulas, except in highly specialized papers or customized products. In order to gain market share in uncoated freesheet, we compete primarily on the basis of product quality, breadth of offering, service solutions and competitively priced paper products. We seek product differentiation through an extensive offering of high quality FSC-certified paper products. While we have a leading position in the North American uncoated freesheet market, we also compete with other paper grades, including coated freesheet, and with electronic transmission and document storage alternatives. As the use of these alternative products continues to grow, we continue to see a decrease in the overall demand for paper products or shifts from one type of paper to another. All of our pulp and paper manufacturing facilities are located in the United States or in Canada where we sell 84%89% of our products. The five largest manufacturers of uncoated freesheet papers in North America represent approximately 80% of the total production capacity. On a global basis, there are hundreds of manufacturers that produce and sell uncoated freesheet papers, eight of which have annual production capacities of over 1 million tons.papers. The level of competitive pressures from foreign producers in the North American market is highly dependent upon exchange rates, including the rate between the U.S. dollar and the Euro as well as the U.S. dollar and the Brazilian real.

The market pulp we sell is either fluff, softwood fluff pulp, or hardwood.hardwood pulp. The pulp market is highly fragmented with many manufacturers competing worldwide, some of whom have lower operating costs than we do.worldwide. Competition is primarily on the basis of access to low-cost wood fiber, product quality and competitively priced pulp products. The fluff pulp we sell is used in absorbent products, incontinence products, diapers and feminine hygiene products. The softwood and hardwood pulp we sell is primarily slow growth northern bleached softwood and hardwood kraft, and we produce specialty engineered pulp grades with a pre-determined mix of wood species. Our hardwood and softwood pulps are sold to a combination of “paper grade” customers who make printing and writing grades, and “non-paper grade”

customers who make a variety of products for specialty paper, packaging, tissue and industrial applications.applications, and customers who make printing and writing grades. We also seek product differentiation through the certification of our pulp mills to the FSC chain-of-custody standard and the procurement of FSC-certified virgin fiber. All of our market pulp production capacity is located in the United States or in Canada, and we sell 62%57% of our pulp to other countries.

In the adult incontinence business in North America, the top 5 manufacturers supply approximately 90% of the market share and have done so for at least the last 10 years. Competition is along the line of four major product categories—protective underwear, light pads, briefs and underpads with customers split between retail and institutional channels. The retail channel has the majority of sales concentrated in mass marketers and drug stores. The institutional channel includes extended care (long term care and homecare) and acute care facilities. In the adult incontinence business in Europe, we compete in the Western, Northern and Central Europe markets where the top 5 manufacturers supply approximately 80% to the healthcare channel and 99% of the retail channel. Competition is along the line of four major product categories: pads, pull-ons, briefs and underpads, with customers mostly split between mass retail, prescription and closed contract. The mass retail market is more fragmented than in North American markets with a mix of larger chains and smaller players. Approximately 70% of institutional and homecare expenditures are funded by local governments in Western Europe. In the adult incontinence business, the principal methods and elements of competition include brand recognition and loyalty, product innovation, quality and performance, price and marketing and distribution capabilities.

We have over 8,5009,300 employees, of which approximately 66%63% are employed in the United States, 31% in Canada, 5% in Europe and 34%1% in Canada.Asia. Approximately 59%53% of our employees are covered by collective bargaining agreements, generally on a facility-by-facility basis, certain of which expiredbasis. Certain agreements covering approximately 674 employees will expire in 20102013 and someothers will expire between 20112014 and 2015.

In 2008, we signed a four year umbrella agreement with the United Steelworkers Union, affecting approximately 3,000 employees at our U.S. locations. This agreement only covers certain economic elements, and all other contract issues will be negotiated at each operating location, as the related collective bargaining agreements become subject to renewal. The parties have agreed not to strike or lock-out during the terms of the respective local agreements.2017.

OUR APPROACH TO SUSTAINABILITY

Domtar delivers a higher, lasting value to our customers, employees, shareholders and communities by viewing our business decisions within the larger context of sustainability. As a renewable fiber-based company,

we take the long-term view on managing natural resources for the future. We adopted our Statement on Sustainable Growthprize efficiency in everything we do. We strive to govern our pathway to sustainability, from excellence in corporateminimize waste and encourage recycling. We have the highest standards for ethical standards to product stewardship. Consistently with our Statement, we define our actions under our Code of Ethics, policies addressingconduct, for caring about the health and safety environment, forestryof each other, and for maintaining the environmental quality in the communities where we live and work. We value the partnerships we have formed with non-governmental organizations and believe they make us a better company, even if we do not always agree on every issue. We pay attention to being agile to respond to new opportunities, and we are focused in order to turn innovation into value creation. By embracing sustainability as our operating philosophy, we seek to internalize the fact that the choices we have and the impact of the decisions we make on our stakeholders are all interconnected. Further, we believe that our business and the people and communities who depend upon us are better served as we weave this focus on sustainability into the things we do.

Domtar effects this commitment to sustainability at every level and every location across the company. With the support of the Board of Directors, our Management Committee empowers senior managers from manufacturing, technology, finance, sales and marketing and corporate staff functions to regularly come together and establish key sustainability performance metrics, and to routinely assess and report on progress. In 2011, Domtar decided to establish a new, vice-president position to help lead this effort, allowing the company’s organizational structure to better reflect the priority focus the company places on sustainable performance. At the same time, recognizing that the promise of sustainability is only achieved if it is woven into the fiber procurementof an organization, Domtar is committed to establishing EarthChoice Ambassadors—sustainability leaders and others.advocates—in every one of the company’s locations. We believe that weaving sustainability into our business positions Domtar for the future.

Our business is subject to a wide range of general and industry-specific laws and regulations in the United States and Canadaother countries were we have operations, relating to the protection of the environment, including those governing harvesting, air emissions, climate change, waste water discharges, the storage, management and disposal of hazardous substances and wastes, contaminated sites, landfill operation and closure obligations and health and safety matters. Compliance with these laws and regulations is a significant factor in the operation of our business. We may encounter situations in which our operations fail to maintain full compliance with applicable environmental requirements, possibly leading to civil or criminal fines, penalties or enforcement actions, including those that could result in governmental or judicial orders that stop or interrupt our operations or require us to take corrective measures at substantial costs, such as the installation of additional pollution control equipment or other remedial actions.

Compliance with U.S. federal, state and local and Canadian federal and provincial environmental laws and regulations involves capital expenditures as well as additional operating costs. For example, in December 2012, the United States Environmental Protection Agency will be promulgating regulations addressing the emissionsproposed a new set of hazardous air pollutants fromstandards related to all industrial boilers, including those present at pulp and paper mills, which will require the use of maximum achievable control technology.mills. Additional information regarding environmental matters is included in Part I, Item 3, Legal Proceedings, under the caption “Climate change regulation” and in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K, under the section of Critical accounting policies, caption “Environmental matters and other asset retirement obligations.”

Many of our brand name paper products are protected by registered trademarks. Our key trademarks include Cougar®, Lynx® Opaque Ultra, Husky® Opaque Offset, First Choice®, Domtar EarthChoice®, Attends®, NovaThin®, NovaZorb® and Domtar EarthChoiceAriva®. These brand names and trademarks are important to the business. Our numerous trademarks have been registered in the

United States and/or in other countries where our products are sold. The current registrations of these trademarks are effective for various periods of time. These trademarks may be renewed periodically, provided that we, as the registered owner, and/or licensee comply with all applicable renewal requirements, including the continued use of the trademarks in connection with similar goods.

We own U.S. and foreign patents, some of which have expired or been abandoned, and have several pending patent applications. Our management regards these patents and patent applications as important but does not consider any single patent or group of patents to be materially important to our business as a whole.

INTERNET AVAILABILITY OF INFORMATION

In this Annual Report on Form 10-K, we incorporate by reference certain information contained in other documents filed with the Securities and Exchange Commission (“SEC”) and we refer you to such information. We file annual, quarterly and current reports and other information with the SEC. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100F Street, NE, Washington DC, 20549. You may obtain information on the operation of the Public Reference Room by calling 1-800-SEC-0330. The SEC maintains a website at www.sec.gov that contains our quarterly and current reports, proxy and information statements, and other information we file electronically with the SEC. You may also access, free of charge, our reports filed with the SEC through our website. Reports filed or furnished to the SEC will be available through our website as soon as reasonably practicable after they are filed or furnished to the SEC. The information contained on our website, www.domtar.com, is not, and should in no way be construed as, a part of this or any other report that we filed with or furnished to the SEC.

John D. Williams,age 56,58, has been president, chief executive officer and a director of the Company since January 1, 2009. Previously, Mr. Williams served as president of SCA Packaging Europe between 2005 and 2008. Prior to assuming his leadership position with SCA Packaging Europe, Mr. Williams held increasingly senior management and operational roles in the packaging business and related industries.

Melissa Anderson, age 46,48, is the senior vice-president, human resources of the Company. Ms. Anderson joined Domtar in January 2010. Previously, she was senior vice-president, human resources and government relations, at The Pantry, Inc., an independently operated convenience store chain in the southeastern United States. Prior to this, she held senior management positions with International Business Machine (“IBM”) over the span of 1719 years.

Daniel Buron, age 47,49, is the senior vice-president and chief financial officer of the Company. Mr. Buron was senior vice-president and chief financial officer of Domtar Inc. since May 2004. He joined Domtar Inc. in 1999. Prior to May 2004, he was vice-president, finance, pulp and paper sales division and, prior to September 2002, he was vice-president and controller. He has over 2224 years of experience in finance.

Michael Edwards, age 63,65, is the senior vice-president, pulp and paper manufacturing of the Company. Mr. Edwards was vice-president, fine paper manufacturing of Weyerhaeuser since 2002. Since joining Weyerhaeuser in 1994, he has held various management positions in the pulp and paper operations. Prior to Weyerhaeuser, Mr. Edwards worked at Domtar Inc. for 11 years. His career in the pulp and paper industry spans over 4749 years.

Michael Fagan, age 51, is the senior vice-president, personal care of the Company. Mr. Fagan joined Domtar in 2011, following the acquisition of Attends Healthcare Products, Inc. Mr. Fagan has been with Attends since 1999, when he was hired as Senior Vice President of Sales and Marketing. He was promoted to President and CEO in 2006. Prior to joining Attends, Mr. Fagan held a variety of sales development roles with Procter & Gamble, the previous owners of the Attends line of products.

Zygmunt Jablonski, age 57,59, is the senior vice-president, law and corporate affairs of the Company. Mr. Jablonski joined Domtar in 2008, after serving in various in-house counsel positions for major manufacturing and distribution companies in the paper industry for 13 years—most recently, as executive vice-president, general counsel and secretary.years. From 1985 to 1994, he practiced law in Washington, DC.

Patrick Loulou, age 44, is the senior vice-president, corporate development since he joined the Company in March 2007. Previously, he held a number of positions in the telecommunications sector as well as in management consulting. He has over 14 years of experience in corporate strategy and business development.

Mark Ushpol, age 47,49, is the senior vice-president, distribution of the Company. Mr. Ushpol joined Domtar in January 2010. Previously, he was sales and marketing director of Mondi Europe & International Uncoated Fine Paper, where he was in charge of global uncoated fine paper sales. He has over 2123 years of experience in senior marketing and sales management with the last 1416 years in the pulp and paper sector. Prior to that, he was involved in the plastics industry in South Africa for 8 years.

Patrick Loulou, age 42, is the senior vice-president, corporate development since he joined the Company in March 2007. Previously, he held a number of positions in the telecommunications sector as well as in management consulting. He has over 12 years experience in corporate strategy and business development.

Richard L. Thomas, age 57,59, is the senior vice-president, sales and marketing of the Company. Mr. Thomas was vice-president of fine papers of Weyerhaeuser since 2005. Prior to 2005, he was vice-president, business papers of Weyerhaeuser. Mr. Thomas joined Weyerhaeuser in 2002 when Willamette Industries, Inc. was acquired by Weyerhaeuser. At Willamette, he held various management positions in operations since joining in 1992. Previously, he was with Champion International Corporation for 12 years.

The information included in this Annual Report on Form 10-K may contain forward-looking statements relating to trends in, or representing management’s beliefs about, Domtar Corporation’s future growth, results of operations, performance and business prospects and opportunities. These forward-looking statements are generally denoted by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “aim,” “target,” “plan,” “continue,” “estimate,” “project,” “may,” “will,” “should” and similar expressions. These statements reflect management’s current beliefs and are based on information currently available to management. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to known and unknown risks and uncertainties and other factors that could cause actual results to differ materially from historical results or those anticipated. Accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will occur, or if any occurs, what effect they will have on Domtar Corporation’s results of operations or financial condition. These factors include, but are not limited to:

conditionscontinued decline in the global capital and credit markets, and the economy generally, particularlyusage of fine paper products in the U.S. and Canada;our core North American market;

market demand for Domtar Corporation’s products;our ability to implement our business diversification initiatives, including strategic acquisitions;

product selling prices;

raw material prices, including wood fiber, chemical and energy;

conditions in the global capital and credit markets, and the economy generally, particularly in the U.S. and Canada;

performance of Domtar Corporation’s manufacturing operations, including unexpected maintenance requirements;

the level of competition from domestic and foreign producers;

the effect of, or change in, forestry, land use, environmental and other governmental regulations (including tax), and accounting regulations;

the effect of weather and the risk of loss from fires, floods, windstorms, hurricanes and other natural disasters;

transportation costs;

the loss of current customers or the inability to obtain new customers;

legal proceedings;

changes in asset valuations, including write downs of property, plant and equipment, inventory, accounts receivable or other assets for impairment or other reasons;

changes in currency exchange rates, particularly the relative value of the U.S. dollar to the Canadian dollar;

the effect of timing of retirements and changes in the market price of Domtar Corporation’s common stock on charges for stock-based compensation;

performance of pension fund investments and related derivatives, if any; and

the other factors described under “Risk Factors,” in itemPart I, Item 1A of this Annual Report on Form 10-K.

You are cautioned not to unduly rely on such forward-looking statements, which speak only as of the date made, when evaluating the information presented in this Annual Report on Form 10-K. Unless specifically required by law, Domtar Corporation assumes no obligation to update or revise these forward-looking statements to reflect new events or circumstances.

| ITEM 1A. | RISK FACTORS |

You should carefully consider the risks described below in addition to the other information presented in this Annual Report on Form 10-K.

RISKS RELATING TO THE INDUSTRYINDUSTRIES AND BUSINESSES OF THE COMPANY

Some of theThe Company’s paper products are vulnerable to long-term declines in demand due to competing technologies or materials.

The Company’s paper business competes with electronic transmission and document storage alternatives, as well as with paper grades it does not produce, such as uncoated groundwood. As a result of such competition, the Company is experiencing on-going decreasing demand for most of its existing paper products. As the use of these alternatives grows, demand for paper products is likely to further decline. Declines in demand for our paper products may adversely affect the Company’s business, results of operations and financial position.

Failure to successfully implement ourthe Company business diversification initiatives could have a material adverse affect on ourits business, financial results or conditioncondition.

We areThe Company is pursuing strategic initiatives that management considers important to our long-term success including,success. The most recent initiatives include, but are not limited to, optimizingthe acquisitions in adult incontinence business and expanding our operations in markets with positive demand dynamicsthe conversion of a commodity paper mill to produce lighter basis weight specialty paper. The intent of these initiatives is to help grow ourthe business and counteract the secular demand decline in our core North American paper business. These initiatives may involve organic growth, select joint ventures and strategic acquisitions. The success of these initiatives will depend, among other things, on our ability to identify potential strategic initiatives, understand the key trends and principal drivers affecting businesses to be acquired and to execute the initiatives in a cost effective manner. There are significant risks involved with the execution of these initiatives, including significant business, economic and competitive uncertainties, many of which are outside of our control.

Strategic acquisitions may expose us to additional risks. We may have to compete for acquisition targets and any acquisitions we make may fail to accomplish our strategic objectives or may not perform as expected. In addition, the costs of integrating an acquired business may exceed our estimates and may take significant time and attention from senior management. Accordingly, we cannot predict whether we will succeed in implementing these strategic initiatives. If we fail to successfully diversify our business, it may have a material adverse effect on our competitive position, financial condition and operating results.

The pulp and paper industry is highly cyclical. Fluctuations in the prices of and the demand for the Company’s pulp and paper products could result in lower sales volumes and smaller profit margins.

The pulp and paper industry is highly cyclical. Historically, economic and market shifts, fluctuations in capacity and changes in foreign currency exchange rates have created cyclical changes in prices, sales volume and margins for the Company’s pulp and paper products. The length and magnitude of industry cycles have

varied over time and by product, but generally reflect changes in macroeconomic conditions and levels of industry capacity. Most of the Company’s paper products are commodities that are widely available from other producers. Even the Company’s non-commodity products, such as value-added papers, are susceptible to commodity dynamics. Because commodity products have few distinguishing qualities from producer to producer, competition for these products is based primarily on price, which is determined by supply relative to demand.

The overall levels of demand for the products the Company manufactures and distributes, and consequently its sales and profitability, reflect fluctuations in levels of end-user demand, which depend in part on general macroeconomic conditions in North America and worldwide, the continuation of the current level of service and cost of postal services, as well as competition from electronic substitution. See—“ConditionsSee “Conditions in the global capital and credit markets, and the economy generally, can adversely affect the Company business, results of operations and financial position” and “Some of the“The Company’s paper products are vulnerable to long-term declines in demand due to competing technologies or materials.” For example, demand for cut-size office paper may fluctuate with levels of white-collar employment.

Industry supply of pulp and paper products is also subject to fluctuation, as changing industry conditions can influence producers to idle or permanently close individual machines or entire mills. Such closures can result in significant cash and/or non-cash charges. In addition, to avoid substantial cash costs in connection with idling or closing a mill, some producers will choose to continue to operate at a loss, sometimes even a cash loss, which could prolong weak pricing environments due to oversupply. Oversupply can also result from producers introducing new capacity in response to favorable short-term pricing trends.

Industry supply of pulp and paper products is also influenced by overseas production capacity, which has grown in recent years and is expected to continue to grow.

As a result, prices for all of the Company’s pulp and paper products are driven by many factors outside of its control, and the Company has little influence over the timing and extent of price changes, which are often volatile. Because market conditions beyond the Company’s control determine the prices for its commodity products, the price for any one or more of these products may fall below its cash production costs, requiring the Company to either incur cash losses on product sales or cease production at one or more of its pulp and paper manufacturing facilities. The Company continuously evaluates potential adjustments to its production capacity, which may include additional closures of machines or entire mills, and the Company could recognize significant cash and/or non-cash charges relating to any such closures in future periods. See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operation, under “Restructuring“Closure and restructuring activities.” Therefore, the Company’s profitability with respect to these products depends on managing its cost structure, particularly wood fiber, chemical and energy costs, which represent the largest components of its operating costs and can fluctuate based upon factors beyond its control, as described below. If the prices of or demand for its pulp and paper products decline, or if its wood fiber, chemical or energy costs increase, or both, its sales and profitability could be materially and adversely affected.

Conditions in the global capital and credit markets and the economy generally, can adversely affect the CompanyCompany’s business, results of operations and financial position.

A significant or prolonged downturn in general economic condition may affect the Company’s sales and profitability. The Company has exposure to counterparties with which we routinely execute transactions. Such counterparties include commercial banks, insurance companies and other financial institutions, some of which may be exposed to bankruptcy or liquidity risks. While the Company has not realized any significant losses to date, a bankruptcy or illiquidity event by one of its significant counterparties may materially and adversely affect the Company’s access to capital, future business and results of operations.

In addition, our customers and suppliers may be adversely affected by severe economic conditions. This could result in reduced demand for our products or our inability to obtain necessary supplies at reasonable costs or at all.

The Company faces intense competition in its markets, and the failure to compete effectively would have a material adverse effect on its business and results of operations.

The Company competes with both U.S. and Canadian producers and, for many of its product lines, global producers, some of which may have greater financial resources and lower production costs than the Company. The principal basis for competition is selling price. The Company’s ability to maintain satisfactory margins depends in large part on its ability to control its costs. The Company cannot provide assurance that it will compete effectively and maintain current levels of sales and profitability. If the Company cannot compete effectively, such failure will have a material adverse effect on its business and results of operations.

The Company’s manufacturingpulp and paper businesses may have difficulty obtaining wood fiber at favorable prices, or at all.