SECURITIES AND EXCHANGE COMMISSION

Annual report pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 for the fiscal year ended December 31, 20102013 Commission File Number 001-15811

(Exact name of registrant as specified in its charter)

IRS Employer Identification No. 54-1959284

4521 Highwoods Parkway, Glen Allen, Virginia 23060-6148

(Address of principal executive offices) (Zip code)

Registrant’s

Registrant's telephone number, including area code: (804) 747-0136

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, no par value

7.50% Senior Debentures due 2046

New York Stock Exchange, Inc.

(title of each class and name of the exchange on which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of

“large"large accelerated filer,

” “accelerated filer”" "accelerated filer" and

“smaller"smaller reporting

company”company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x The aggregate market value of the shares of the registrant’sregistrant's Common Stock held by non-affiliates as of June 30, 20102013 was approximately $3,020,713,353.$7,085,000,000. The number of shares of the registrant’sregistrant's Common Stock outstanding at February 16, 2011: 9,718,932.10, 2014

: 13,985,396. Documents Incorporated By Reference

The portions of the

registrant’sregistrant's Proxy Statement for the Annual Meeting of Shareholders scheduled to be held on May

9, 2011,12, 2014, referred to in Part III.

Index and Cross References-Form 10-K Annual Report

| | | | | | |

Item No. | | | | Page | |

| | |

Part I | | | | | | |

1. | | Business | | | 12-33, 129-131 | |

1A. | | Risk Factors | | | 30-33 | |

1B. | | Unresolved Staff Comments | | | NONE | |

2. | | Properties (note 5) | | | 53 | |

3. | | Legal Proceedings (note 14) | | | 69 | |

4. | | [Reserved] | | | | |

4A. | | Executive Officers of the Registrant | | | 132 | |

| | |

Part II | | | | | | |

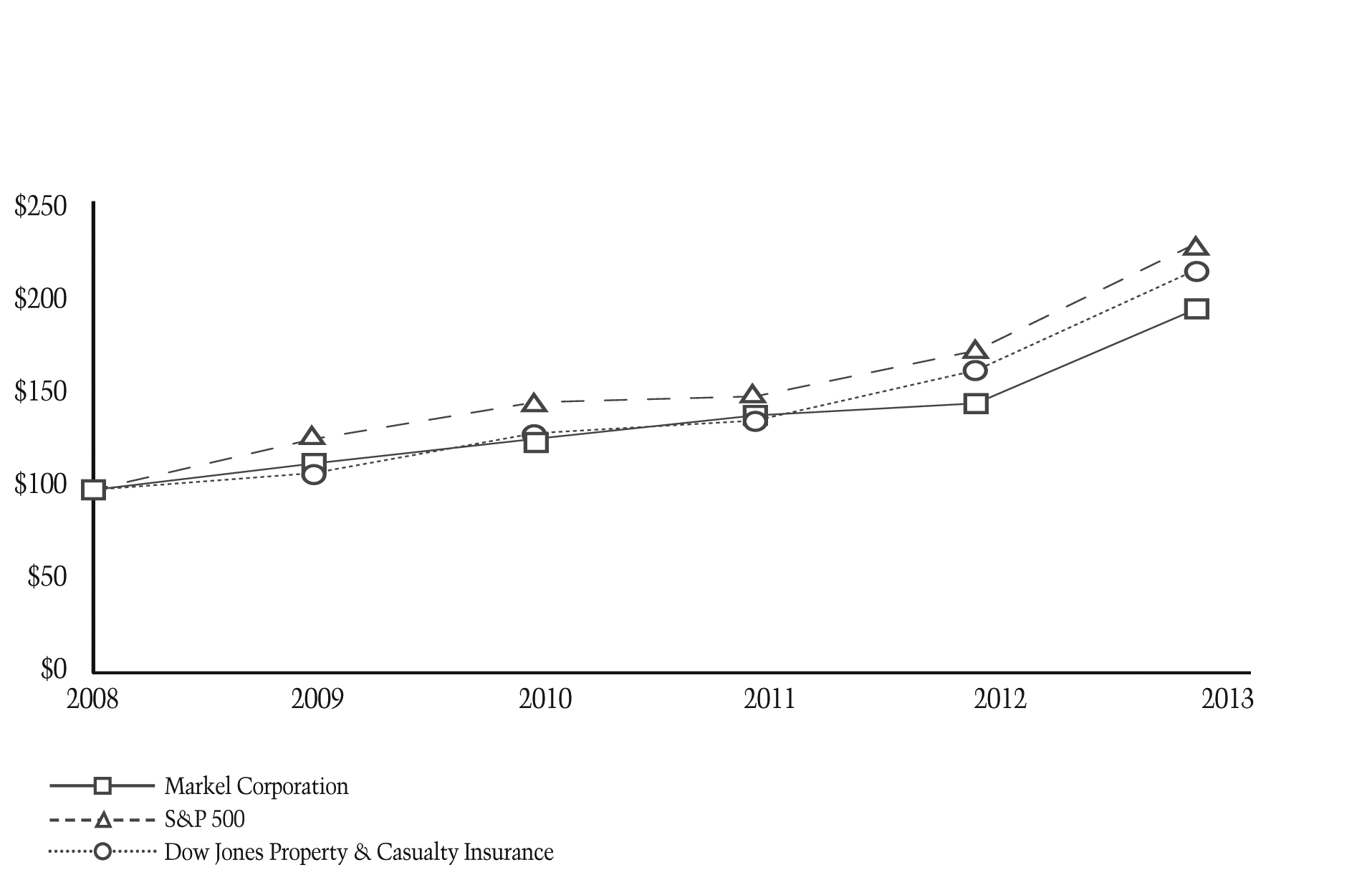

5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 83, 129-130 | |

6. | | Selected Financial Data | | | 34-35 | |

7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 88-128 | |

7A. | | Quantitative and Qualitative Disclosures About Market Risk | | | 120-125 | |

8. | | Financial Statements and Supplementary Data The response to this item is submitted in Item 15 and on page 83. | | | | |

9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | | NONE | |

9A. | | Controls and Procedures | | | 85-87, 126 | |

9B. | | Other Information | | | NONE | |

| | |

Part III | | | | | | |

10. | | Directors, Executive Officers and Corporate Governance* | | | 132 | |

| | Code of Conduct | | | 131 | |

11. | | Executive Compensation* | | | | |

12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters* | | | | |

13. | | Certain Relationships and Related Transactions, and Director Independence* | | | | |

14. | | Principal Accounting Fees and Services* | | | | |

*Portions of Item 10 and Items 11, 12, 13 and 14 will be incorporated by reference from the Registrant’s 2011 Proxy Statement pursuant to instructions G(1) and G(3) of the General Instructions to Form 10-K. | |

| | |

Part IV | | | | | | |

15. | | Exhibits, Financial Statement Schedules a. Documents filed as part of this Form 10-K (1) Financial Statements | | | | |

| | |

| | Consolidated Balance Sheets at December 31, 2010 and 2009 | | | 36 | |

| | |

| | Consolidated Statements of Operations and Comprehensive Income (Loss) for the Years Ended December 31, 2010, 2009 and 2008 | | | 37 | |

| | |

| | Consolidated Statements of Changes in Equity for the Years Ended December 31, 2010, 2009 and 2008 | | | 38 | |

| | |

| | Consolidated Statements of Cash Flows for the Years Ended December 31, 2010, 2009 and 2008 | | | 39 | |

| | |

| | Notes to Consolidated Financial Statements for the Years Ended December 31, 2010, 2009 and 2008 | | | 40-83 | |

| | |

| | Reports of Independent Registered Public Accounting Firm | | | 84-86 | |

| | |

| | (2) Schedules have been omitted since they either are not required or are not applicable, or the information called for is shown in the Consolidated Financial Statements and Notes thereto. | | | | |

| | |

| | (3) See Index to Exhibits for a list of Exhibits filed as part of this report b. See Index to Exhibits and Item 15a(3) c. See Index to Financial Statements and Item 15a(2) | | | | |

|

| | | | | |

| Item No. | | Page |

| Part I | | |

| 1. | Business | 2-25, 127-128 |

|

| 1A. | Risk Factors | 21-25 |

|

| 1B. | Unresolved Staff Comments | NONE |

|

| 2. | Properties (note 6) | 49 |

|

| 3. | Legal Proceedings (note 17) | 68-69 |

|

| 4. | Mine Safety Disclosures | NONE |

|

| Part II | | |

| 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 84, 127 |

|

| 6. | Selected Financial Data | 26-27 |

|

| 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 88-126 |

|

| 7A. | Quantitative and Qualitative Disclosures About Market Risk | 120-124 |

|

| 8. | Financial Statements and Supplementary Data The response to this item is submitted in Item 15 and on page 84. | |

| 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | NONE |

|

| 9A. | Controls and Procedures | 86-87, 124 |

|

| 9B. | Other Information | NONE |

|

| Part III | | |

| 10. | Directors, Executive Officers and Corporate Governance* | 129 |

|

| | Code of Conduct | 128 |

|

| 11. | Executive Compensation* | |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters* | |

| 13. | Certain Relationships and Related Transactions, and Director Independence* | |

| 14. | Principal Accounting Fees and Services* | |

| *Portions of Item 10 and Items 11, 12, 13 and 14 will be incorporated by reference from the Registrant's 2014 Proxy Statement pursuant to instructions G(1) and G(3) of the General Instructions to Form 10-K. | |

| Part IV | | | | |

| 15. | Exhibits, Financial Statement Schedules | |

| | a. | Documents filed as part of this Form 10-K | |

| | | (1) | Financial Statements | |

| | | | Consolidated Balance Sheets | 28 |

|

| | | | Consolidated Statements of Income and Comprehensive Income | 29 |

|

| | | | Consolidated Statements of Changes in Equity | 30 |

|

| | | | Consolidated Statements of Cash Flows | 31 |

|

| | | | Notes to Consolidated Financial Statements | 32-84 |

|

| | | | Reports of Independent Registered Public Accounting Firm | 85-86 |

|

| | | (2) | Schedules have been omitted since they either are not required or are not applicable, or the information called for is shown in the Consolidated Financial Statements and Notes thereto. | |

| | | (3) | See Index to Exhibits for a list of Exhibits filed as part of this report | |

| | b. | See Index to Exhibits and Item 15a(3) | |

| | c. | See Index to Financial Statements and Item 15a(2) | |

Markel Corporation & Subsidiaries

We are a diverse financial holding company serving a variety of niche markets. Our principal business markets and underwrites specialty insurance

products and programs.products. We believe that our specialty product focus and niche market strategy enable us to develop expertise and specialized market knowledge. We seek to differentiate ourselves from competitors by our expertise, service, continuity and other value-based considerations. We

compete in three segments of the specialty insurance marketplace: the Excess and Surplus Lines, the Specialty Admitted and the London markets. We also own interests in various

industrial and service businesses that operate outside of the specialty insurance marketplace. Our financial goals are to earn consistent underwriting and operating profits and superior investment returns to build shareholder value.

On May 1, 2013, we completed the acquisition of Alterra Capital Holdings Limited (Alterra), a Bermuda-headquartered global enterprise providing diversified specialty property and casualty insurance and reinsurance products to corporations, public entities and other property and casualty insurers. Total purchase consideration was $3.3 billion. The acquisition of Alterra creates additional size and scale, providing us with additional insurance and investment opportunities.

Specialty Insurance

and Reinsurance

The specialty insurance market differs significantly from the standard market. In the standard market, insurance rates and forms are highly regulated, products and coverages are largely uniform with relatively predictable exposures and companies tend to compete for customers on the basis of price. In contrast, the specialty market provides coverage for hard-to-place risks that generally do not fit the underwriting criteria of standard carriers.

For example, United States insurance regulations generally require an Excess and Surplus Lines (E&S) account to be declined by admitted carriers before an E&S company may write the business. Hard-to-place risks written in the Specialty Admitted market cover insureds engaged in similar, but highly specialized activities who require a total insurance program not otherwise available from standard insurers or insurance products that are overlooked by large admitted carriers. Hard-to-place risks in the London market are generally distinguishable from standard risks due to the complexity or significant size of the risk.

Competition in the specialty insurance market tends to focus less on price than in the standard insurance market and more on other value-based considerations, such as availability, service and expertise. While specialty market exposures may have higher perceived insurance risks than their standard market counterparts, we seek to manage these risks to achieve higher financial returns. To reach our financial and operational goals, we must have extensive knowledge and expertise in our chosen markets. Many of our accounts are considered on an individual basis where customized forms and tailored solutions are employed.

By focusing on the distinctive risk characteristics of our insureds, we have been able to identify a variety of niche markets where we can add value with our specialty product offerings. Examples of niche

insurance markets that we have targeted include wind and

earthquake exposedearthquake-exposed commercial properties, liability coverage for highly specialized professionals, equine-related risks,

workers’workers' compensation insurance for small businesses,

yachts and other watercraft, motorcyclesclassic cars and marine, energy and environmental-related activities. Our market strategy in each of these areas of specialization is tailored to the unique nature of the loss exposure, coverage and services required by insureds. In each of our niche markets, we assign teams of experienced underwriters and claims specialists who provide a full range of insurance services.

Markets

The E&S market focuses on hard-to-place risks and loss exposures that generally cannot be written

We also participate in the

standard market. E&S eligibility allowsreinsurance market in certain classes of reinsurance product offerings, which were expanded in 2013 through the acquisition of Alterra. In the reinsurance market, our

clients are other insurance

subsidiaries to underwrite unique loss exposures with more flexible policy forms and unregulated premium rates. Thiscompanies, or cedents. We typically

results in coverages that are more restrictive and more expensive than coverageswrite our reinsurance products in the

standard market.12 |

form of treaty reinsurance contracts, which are contractual arrangements that provide for automatic reinsuring of a type or category of risk underwritten by cedents. Generally, we participate on reinsurance treaties with a number of other reinsurers, each with an allocated portion of the treaty, with the terms and conditions of the treaty being substantially the same for each participating reinsurer. With treaty reinsurance contracts, we do not separately evaluate each of the individual risks assumed under the contracts and are largely dependent on the individual underwriting decisions made by the cedent. Accordingly, we review and analyze the cedent's risk management and underwriting practices in deciding whether to provide treaty reinsurance and in pricing of treaty reinsurance contracts.

Our reinsurance products are written on both a quota share and excess of loss basis. Quota share contracts require us to share the losses and expenses in an agreed proportion with the cedent. Excess of loss contracts require us to indemnify the cedent against all or a specified portion of losses and expenses in excess of a specified dollar or percentage amount. In both types of contracts, we may provide a ceding commission to the cedent.

We distinguish ourselves in the reinsurance market by the expertise of our underwriting teams, our access to global reinsurance markets, our ability to offer large lines and our ability to customize reinsurance solutions to fit our client's needs. Our specialty reinsurance product offerings include coverage for property, professional liability, automobile, general casualty and credit and surety risks.

Markets

In 2009,the United States, we write business in the excess and surplus lines (E&S) and specialty admitted insurance and reinsurance markets. In 2012, the E&S market represented approximately $33$35 billion, or 7%, of the approximately $475$523 billion United States property and casualty (P&C) industry.(1) We areIn 2012, our legacy Markel operations were the sixtheighth largest E&S writer in the United States as measured by direct premium writings.writings and Alterra's legacy operations were the twenty-ninth.(1) In 2010, we wrote $898 million

Our E&S insurance operations are conducted through Essex Insurance Company (Essex), domiciled in Delaware, and Evanston Insurance Company (Evanston), domiciled in Illinois. The majority of

business in our

Excess and Surplus Lines segment.We also write business in the Specialty Admitted market. Most of these risks, although unique and hard-to-place in the standard market, must remain with anspecialty admitted insurance company for marketingoperations are conducted through Markel Insurance Company (MIC), domiciled in Illinois; Markel American Insurance Company (MAIC), domiciled in Virginia; FirstComp Insurance Company (FCIC), domiciled in Nebraska; and regulatory reasons. The Specialty Admitted market is subject to more state regulation than the E&S market, particularly with regard to rate and form filing requirements, restrictions on the ability to exit lines of business, premium tax payments and membershipEssentia Insurance Company (Essentia), domiciled in various state associations, such as state guaranty funds and assigned risk plans. In late 2010, we acquired Aspen Holdings, Inc. and began writing workers’ compensation insurance within the Specialty Admitted market. In 2010, we wrote $375 million of business in our Specialty Admitted segment.

The London market, which produced approximately $50 billion of gross written premium in 2009, is the largest insurance market in Europe and third largest in the world.(2) The London market is known for its ability to provide innovative, tailored coverage and capacity for unique and hard-to-place risks. It is primarilyMissouri.

As a broker market, which means that insurance brokers bring mostresult of the business to the market. The London market is also largelyacquisition of Alterra, we have expanded our United States insurance and reinsurance operations, effective May 1, 2013. Our E&S insurance operations include Alterra Excess & Surplus Insurance Company (AESIC) and our specialty admitted operations include Alterra America Insurance Company (AAIC), both domiciled in Delaware. Our United States reinsurance operations are conducted through Alterra Reinsurance USA Inc. (Alterra Re USA), a subscription market, which means that loss exposures brought into the market are typically insured by more than one insurance company or Lloyd’s syndicate, often due to the high limits of insurance coverage required. We write business on both a direct and subscription basisConnecticut-domiciled reinsurance company.

In Europe, we participate in the London market. When we write business in the subscription market, we prefer to participate as lead underwriter in order to control underwriting terms, policy conditions and claims handling.In 2009, gross premium written through Lloyd’s syndicates generated approximately two-thirds of the London market’s international insurance business(2), making Lloyd’s the world’s second largest commercial surplus lines insurer(1) and fifth largest reinsurer.(3) Corporate capital providers often provide a majority of a syndicate’s capacity and also often own or control the syndicate’s managing agent. This structure permits the capital provider to exert greater influence on, and demand greater accountability for, underwriting results. In 2009, corporate capital providers accounted for approximately 95% of total underwriting capacity in Lloyd’s.(4)

We participate in the London market through Markel International, which includes Markel Capital Limited (Markel Capital) and Markel International Insurance Company Limited (MIICL). Markel Capital is the corporate capital provider for our syndicate at Lloyd’s, Markel Syndicate 3000, through which our Lloyd's of London (Lloyd's) operations are conducted. Markel Syndicate 3000 is managed by Markel Syndicate Management Limited.Limited (MSM). As a result of the acquisition of Alterra, our Lloyd's operations also include Alterra Corporate Capital 2 Limited and Alterra Corporate Capital 3 Limited, corporate capital providers to Lloyd's Syndicate 1400. Since October 1, 2013, MSM has also managed Lloyd's Syndicate 1400. Markel International is headquartered in London, England. In 2010,addition to regional offices in the United Kingdom, Markel International has offices in Canada, Spain, Germany, Sweden, Switzerland, the Netherlands, Hong Kong, China, Malaysia and Singapore. The London insurance market, which produced approximately $69 billion of gross written premium in 2012,(2) is the largest insurance market in Europe and third largest in the world.(3) In 2012, gross premium written through Lloyd's syndicates generated approximately half of the London market's international insurance business,(2) making Lloyd's the world's largest commercial surplus lines insurer(1) and fourth largest reinsurer.(4) Corporate capital providers often provide a majority of a syndicate's capacity and also generally own or control the syndicate's managing agent. This structure permits the capital provider to exert greater influence on, and demand greater accountability for, underwriting results. In 2012, corporate capital providers accounted for approximately 89% of total underwriting capacity in Lloyd's.(5) Our other European operations acquired through Alterra are conducted through Markel Europe plc (Markel Europe), which is headquartered in Dublin, Ireland. Markel Europe also operates branches in London, England and Zurich, Switzerland.

We also added insurance and reinsurance operations in Bermuda and Latin America through the acquisition of Alterra. In Bermuda, we

wrote $709 millionconduct our insurance and reinsurance operations through Markel Bermuda Limited (Markel Bermuda), which is registered as a Class 4 insurer and a Class C long term insurer under the insurance laws of

businessBermuda. In Latin America, we provide reinsurance through MSM in

our London Insurance Market segment.Rio de Janeiro, Brazil, using Lloyd's admitted status, through Markel Europe using a representative office in Bogota, Colombia and a service company in Buenos Aires, Argentina, and through Markel Resseguradora do Brasil S.A. (Markel Brazil), a reinsurance company in Rio de Janeiro. Additionally, MIICL, Markel Syndicate 3000 and Lloyd's Syndicate 1400 are able to offer reinsurance in a number of other Latin American countries from their offices outside of Latin America.

|

|

(1) U.S. Surplus Lines Segment Review Special Report, A.M. Best (September 23, 2013). |

(2) London Company Market Statistics Report, International Underwriting Association (October 2013). |

(3) UK Insurance Key Facts, Association of British Insurers (September 2013). |

(4) Global Reinsurance Segment Review Special Report, A.M. Best (August 26, 2013). |

(5) Lloyd's Annual Report 2012. |

In 2010, 28%2013, 25% of consolidated gross premium writings related to foreign risks (i.e., coverage for risks located outside of the United States), of which 25% were from the United Kingdom and 17%13% were from Canada. In 2009, 26%2012, 30% of our premium writings related to foreign risks, of which 28%20% were from the United Kingdom.Kingdom and 16% were from Canada. In 2008, 23%2011, 31% of our premium writings related to foreign risks, of which 32%20% were from the United Kingdom.Kingdom and 18% were from Canada. In each of these years, there were no other individual foreign countries from which premium writings were material. Premium writings are attributed to individual countries based upon location of risk.(1) | U.S. Surplus Lines – 2010 Market Review Special Report,A.M. Best Research(September 2010).

|

(2) | Insurance 2010, TheCityUK(December 2010).

|

(3) | Top Ten Global Reinsurers by Net Reinsurance Premiums Written 2009, Business Insurance(September 2010).

|

(4) | Lloyd’s Highlights, Lloyd’s(April 2010).

|

| 13

Most of our business is placed through insurance and reinsurance brokers. Some of our insurance business is also placed through managing general agents. We seek to develop and capitalize on relationships with insurance and reinsurance brokers, insurance and reinsurance companies, large global corporations and financial intermediaries to develop and underwrite business. As a result of the acquisition of Alterra, a significant volume of premium for the property and casualty insurance and reinsurance industry is produced through a small number of large insurance and reinsurance brokers. During the year ended December 31, 2013, the top three independent brokers accounted for approximately 19% of our gross premiums written.

Competition

Markel Corporation & Subsidiaries

BUSINESS OVERVIEW (continued)

Competition

We compete with numerous domestic and international insurance companies and reinsurers,

Lloyd’sLloyd's syndicates, risk retention groups, insurance buying groups, risk securitization programs and alternative self-insurance mechanisms. Competition may take the form of lower prices, broader coverages, greater product flexibility, higher quality services or higher ratings by independent rating agencies. In all of our markets, we compete by developing specialty products to satisfy well-defined market needs and by maintaining relationships with agents, brokers and insureds who rely on our expertise. This expertise is our principal means of competing. We offer

over 100 product lines. Eacha diverse portfolio of

these products,

haseach with its own distinct competitive

environment.environment, which enables us to be responsive to changes in market conditions for individual product lines. With each of our products, we seek to compete with innovative ideas, appropriate pricing, expense control and quality service to policyholders, agents and brokers.

Few barriers exist to prevent insurers

and reinsurers from entering our

segmentsmarkets of the

P&Cproperty and casualty industry. Market conditions and capital capacity influence the degree of competition at any point in time. Periods of intense competition, which typically include broader coverage terms, lower prices and excess underwriting capacity, are referred to as a

“soft"soft market.

”" A favorable insurance market is commonly referred to as a

“hard market”"hard market" and is characterized by stricter coverage terms, higher prices and lower underwriting capacity. During soft markets, unfavorable conditions exist due in part to what many perceive

to beas excessive amounts of capital in the industry. In an attempt to use their capital, many insurance companies seek to write additional premiums without appropriate regard for ultimate profitability, and standard insurance companies are more willing to write specialty coverages. The opposite is typically true during hard markets.

The Insurance Market Cycle

After a decade Historically, the performance of softthe property and casualty reinsurance and insurance industries has tended to fluctuate in cyclical periods of price competition and excess underwriting capacity, followed by periods of high premium rates and shortages of underwriting capacity. This cyclical market conditions,pattern can be more pronounced in the specialty insurance industryand reinsurance markets in which we compete than the standard insurance market.

We have experienced

favorable conditions beginning in late 2000, which continued through 2003 for most product lines. During 2004, the market began to soften and the industry began to show signs of increased competition. Since 2005, we have been in a soft insurance market

and have experienced intense competition. During the current soft market cycle, we have experiencedconditions including price deterioration in virtually all of our product

areas duelines since the mid-2000s. During 2011, unfavorable pricing trends continued for some of our product lines; however, price declines stabilized for most of our product lines, and we achieved moderate price increases in

partseveral lines. During 2012 and 2013, we have generally seen low to

an increased presence of standard insurance companiesmid-single digit favorable rate changes in

our markets. During 2008, given the rapid deterioration in underwriting capacity as a result of the disruptions in the financial markets and losses from catastrophes, the rate of decline in prices began to slow. However, the effects of the economic environment contributed to further declines in gross premium volume in 2009 and 2010. Premiums for many of our product lines

are based upon our insureds’as market conditions improved and revenues, gross receipts

or payroll, which have been negativelyand payrolls of our insureds were favorably impacted by

improving economic conditions; however, during the

depressed levelsfourth quarter of

business activity in recent years. In 2010,2013, we

continuedbegan to experience

pricing pressure due in part to intense competition, which resulted in further price deterioration across many ofsoftening prices on our

catastrophe exposed property product lines

most notablyand in our

professional and products liability programs within the Excess and Surplus Lines segment. However, we experienced moderate price increases in severalreinsurance book. Despite stabilization of prices on certain product lines during

2010,the most

notably those offered by Markel International.recent three years, we still consider the overall property and casualty insurance market to be soft. We routinely review the pricing of our major product lines and have pursuedwill continue to pursue price increases for most product lines in many product areas; however, as a result of continued soft insurance market conditions, our targeted price increases have been met with resistance in the marketplace, particularly within the Excess and Surplus Lines segment. In general, we believe prevailing rates within the property and casualty insurance marketplace are lower than our targeted pricing levels. When2014, when possible. However, when we believe the prevailing market price will not support our underwriting profit targets, the business is not written. As a result of our underwriting discipline, gross premium volume for many ofmay vary when we alter our product lines, most notably within the Excess and Surplus Lines segment, has declined and, if the competitive environment does notofferings to maintain or improve could decline further in the future.

14 |

underwriting profitability.

By focusing on market niches where we have underwriting expertise, we seek to earn consistent underwriting

profits. Underwriting profits,

which are a key component of our strategy. We believe that the ability to achieve consistent underwriting profits demonstrates knowledge and expertise, commitment to superior customer service and the ability to manage insurance risk. We use underwriting profit or loss as a basis for evaluating our underwriting performance.

To facilitate this strategy, we have a product line leadership group that has primary responsibility for both developing and maintaining underwriting and pricing guidelines on our existing products and new product development. The product line leadership group is under the direction of our Chief Underwriting Officer.

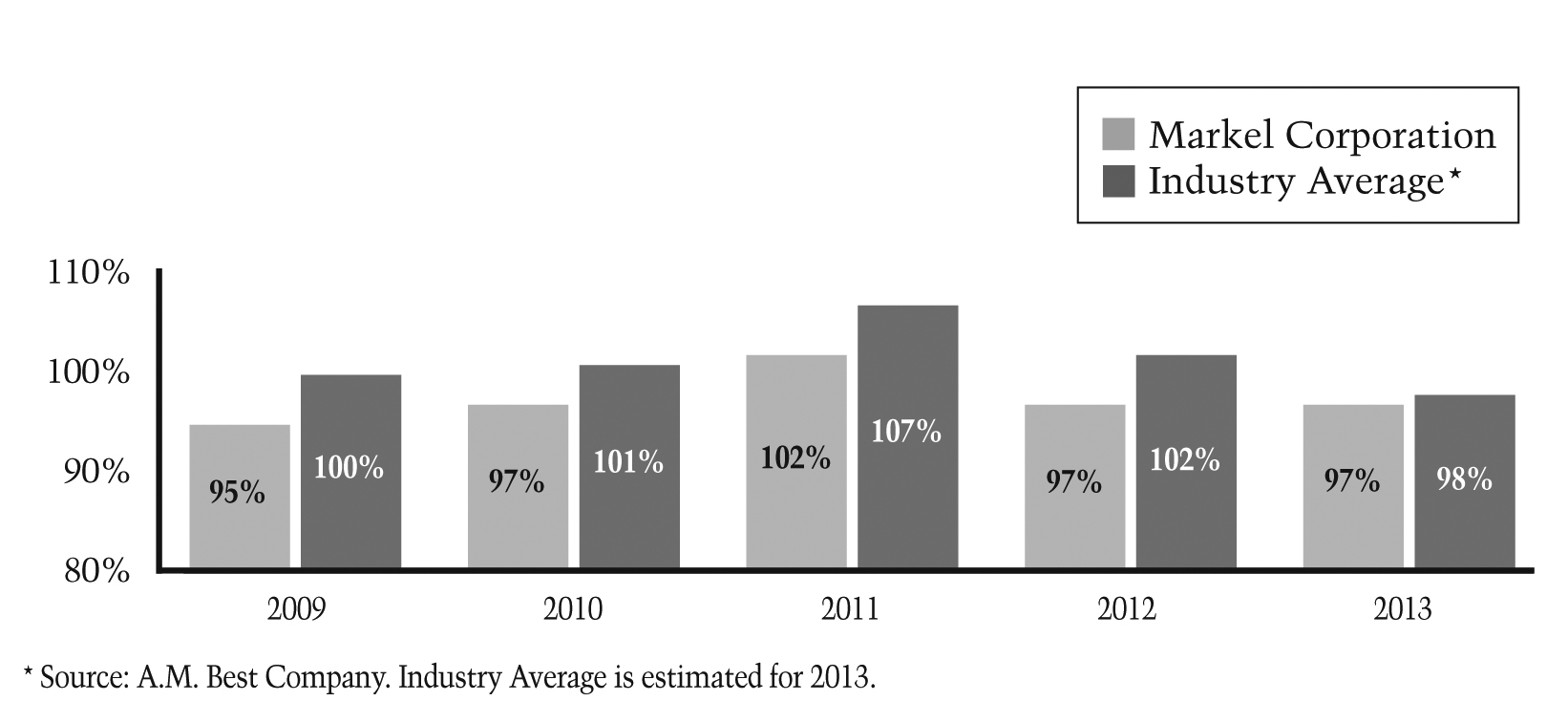

The combined ratio is a measure of underwriting performance and represents the relationship of incurred losses, loss adjustment expenses and underwriting, acquisition and insurance expenses to earned premiums. A combined ratio less than 100% indicates an underwriting profit, while a combined ratio greater than 100% reflects an underwriting loss. In 2010,2013, our combined ratio was 97%. See Management’sManagement's Discussion & Analysis of Financial Condition and Results of Operations for further discussion of our underwriting results.

The following graph compares our combined ratio to the

P&C industry’sproperty and casualty industry's combined ratio for the past five years.

Combined Ratios

We

definehistorically defined our underwriting segments based on the areas of the specialty insurance market in which we

compete,compete: the

Excess and Surplus Lines, Specialty AdmittedE&S, specialty admitted and London markets.

See note 17As a result of the

notesacquisition of Alterra, we formed a new operating segment, effective May 1, 2013. During 2013, results attributable to

consolidated financial statements for additionalAlterra were being separately evaluated by management. The Alterra segment

reporting disclosures.is comprised of all of the active property and casualty underwriting operations of the former Alterra companies.

For purposes of segment reporting, our Other Insurance (Discontinued Lines) segment includes lines of business that have been discontinued

prior to, or in conjunction with,

the acquisitions of insurance operations.acquisitions. The lines were discontinued because we believed some aspect of the product, such as risk profile or competitive environment, would not allow us to earn consistent underwriting profits.

| 15

Alterra previously offered life and annuity reinsurance products. In 2010, Alterra ceased writing life and annuity reinsurance contracts and placed this business into run-off. Results attributable to the run-off of life and annuity reinsurance business are included in our Other Insurance (Discontinued Lines) segment.

Beginning in 2014, we will monitor and report our ongoing underwriting operations in the following three segments: U.S. Insurance, International Insurance and Global Reinsurance. The U.S. Insurance segment will include all direct business and facultative placements written by our insurance subsidiaries domiciled in the United States. The International Insurance segment will include all direct business and facultative placements written by our insurance subsidiaries domiciled outside of the United States, including our syndicates at Lloyd's. The Global Reinsurance segment will include all treaty reinsurance written across the Company. Results for lines of business discontinued prior to, or in conjunction with, acquisitions will continue to be reported as the Other Insurance (Discontinued Lines) segment.

See note 20 of the notes to consolidated financial statements for additional segment reporting disclosures.

Markel Corporation

& SubsidiariesBUSINESS OVERVIEW (continued)

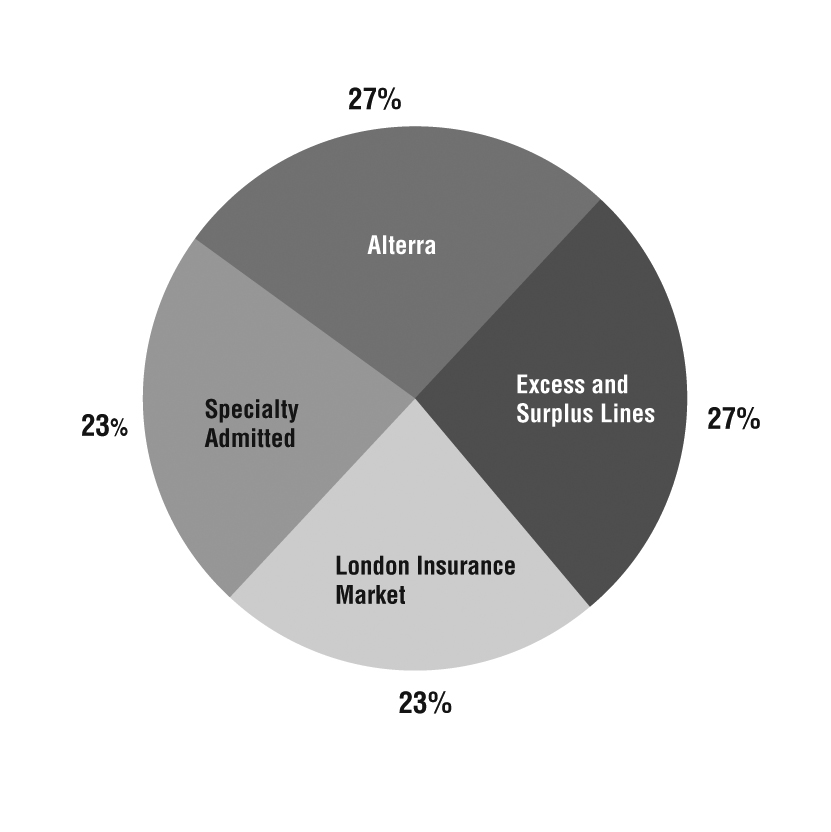

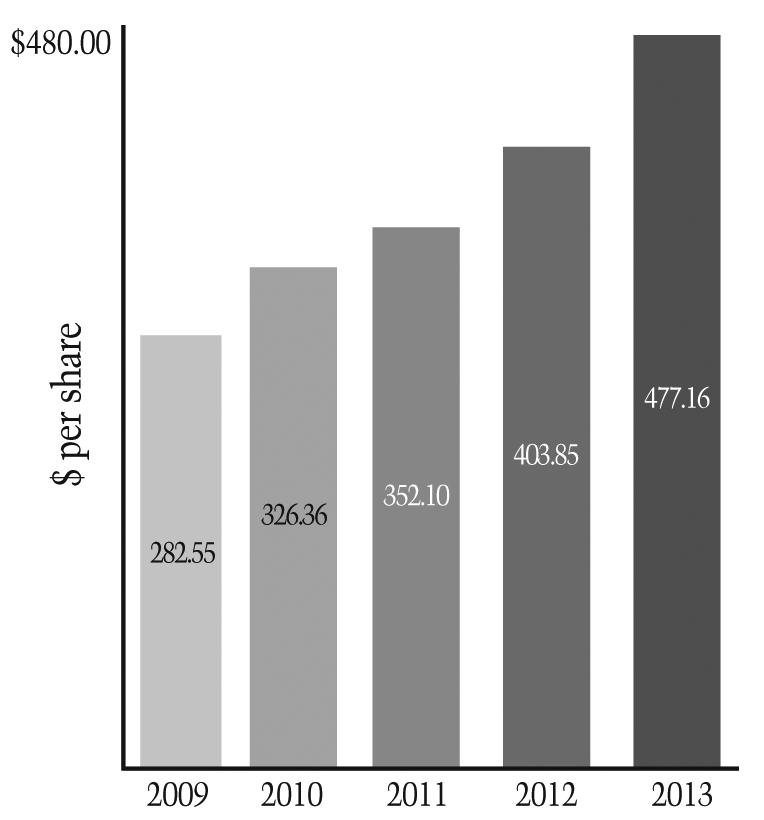

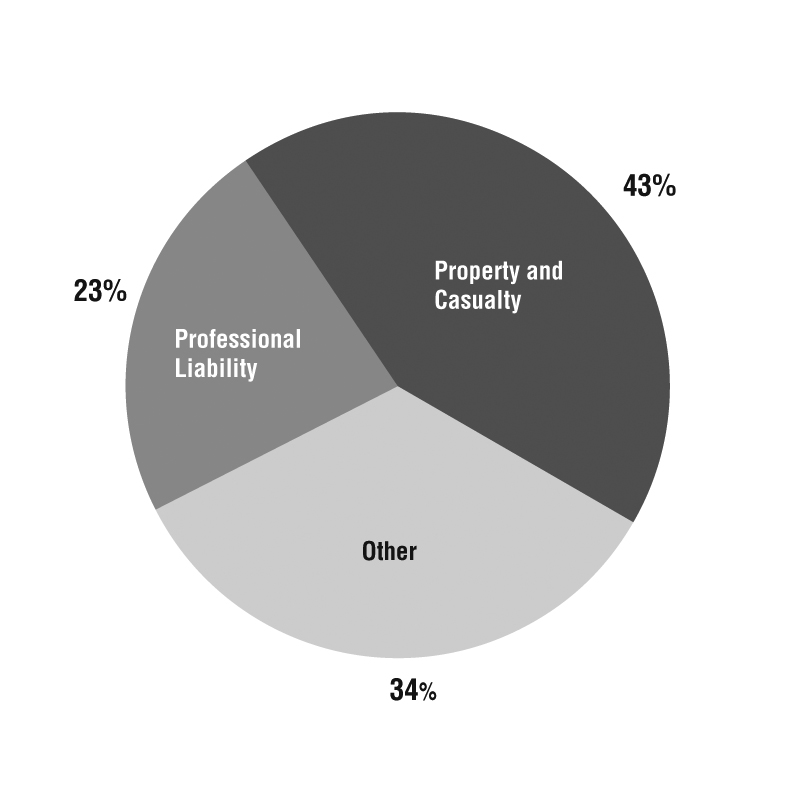

MARKEL CORPORATION20132010 CONSOLIDATED GROSS PREMIUM VOLUME ($2.0 billion) Consolidated Gross Premium Volume (

$3.9 billion)

Excess and Surplus Lines Segment

Our Excess

The E&S market focuses on hard-to-place risks and

Surplus Lines segment reported grossloss exposures that generally cannot be written in the standard market. United States insurance regulations generally require an E&S account to be declined by admitted carriers before an E&S company may write the business. E&S eligibility allows our insurance subsidiaries to underwrite unique loss exposures with more flexible policy forms and unregulated premium

volume of $898.4 million, earned premiums of $809.7 millionrates. This typically results in coverages that are more restrictive and

an underwriting profit of $35.6 millionmore expensive than coverages in

2010.the standard market.

Business in the Excess and Surplus Lines segment is written through two distribution channels, professional surplus lines general agents who have limited quoting and binding authority and wholesale brokers. The majority of the business produced by this segment is written on a surplus lines basis through either Essex

Insurance Company, which is domiciled in Delaware, or

Evanston Insurance Company, which is domiciled in Illinois.TheEvanston.

Our Excess and Surplus Lines segment is comprisedreported gross premium volume of five regions,$1.1 billion, earned premiums of $856.6 million and each regionalan underwriting office is responsible for serving the needsprofit of the wholesale producers located$171.5 million in its region. Our regional teams focus on customer service and marketing, underwriting and distributing our insurance solutions and provide customers easy access to the majority2013.

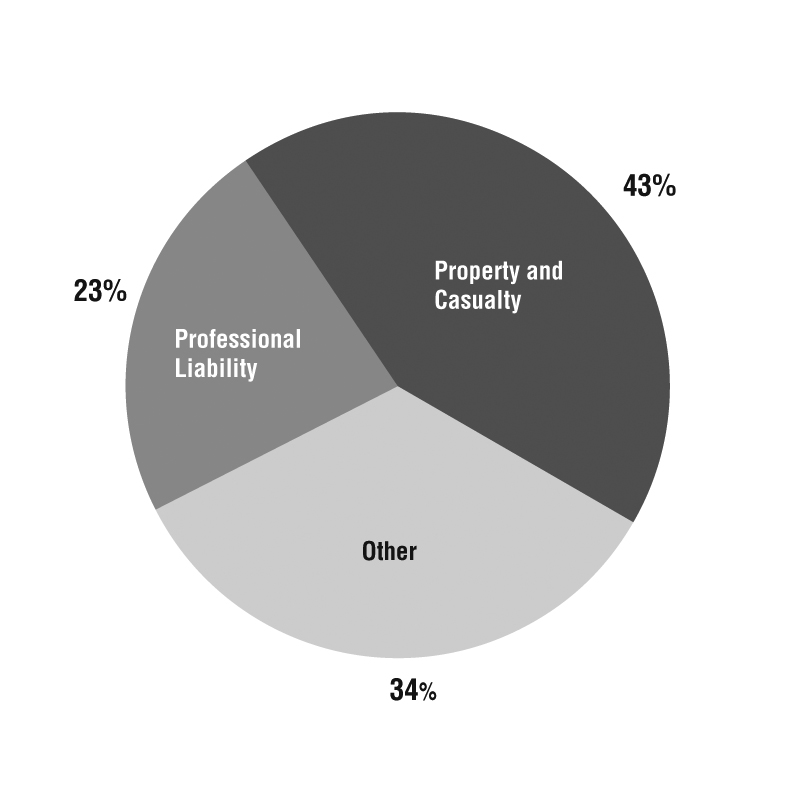

Excess and Surplus Lines

segment, we wrote business through the following regional underwriting offices during 2010:SegmentMarkel Northeast (Red Bank, NJ)

2013 Gross Premium Volume ($1.1 billion)Markel Southeast (Glen Allen, VA)

Markel Midwest (Deerfield, IL)

Markel Mid South (Plano, TX)

Markel West (Woodland Hills, CA and Scottsdale, AZ)

We also have a product line leadership group that has primary responsibility both for developing and maintaining underwriting and pricing guidelines on our existing products and for new product development. The product line leadership group also delegates underwriting authority to the regional underwriters to ensure that the products needed by our customers are available through the regional offices and provides underwriting training and development so that our regional underwriting teams have the expertise to underwrite the risk or to refer risks to our product line experts as needed. The product line leadership group is under the direction of our Chief Underwriting Officer, who also is ultimately responsible for the underwriting activities of our Specialty Admitted and London Insurance Market segments.

16 |

Product offerings within the Excess and Surplus Lines segment include:

fall within the following major product groupings:Excess and Umbrella

Other Product LinesThese product offerings are generally available in all of the regional offices included in the Excess and Surplus Lines segment.

EXCESSAND SURPLUS LINES SEGMENT

2010 GROSS PREMIUM VOLUME ($898MILLION)

Our property and casualty product offerings include a variety of liability coverages focusing on light-to-medium casualty exposures such as restaurants and bars, child and adult care facilities, vacant properties, builder’s risk, general or artisan contractors and office buildings. In addition, we offer third party protection on either an occurrence or claims-made basis to manufacturers, distributors, importers and re-packagers of manufactured products. We also provide property coverages for similar classes of business ranging from small, single-location accounts to large, multi-state, multi-location accounts. Property coverages consist principally of fire, allied lines (including windstorm, hail and water damage) and other specialized property coverages, including catastrophe-exposed property risks such as earthquake and wind on both a primary and excess basis. Catastrophe-exposed property risks are typically larger and are lower frequency and higher severity in nature than more standard property risks.

| 17

Markel Corporation & Subsidiaries

BUSINESS OVERVIEW (continued)

Our professional liabilityproperty risks range from small, single-location accounts to large, multi-state, multi-location accounts. Casualty product offerings include a variety of primary liability coverages targeting apartments and office buildings, retail stores, contractors and recreational and hospitality businesses. We also offer products liability coverages on either an occurrence or claims-made basis to manufacturers, distributors, importers and re-packagers of manufactured products.

Professional liability coverages include unique solutions for highly specialized professions, including architects and engineers, lawyers, agents and brokers, service technicians and computer consultants. We

also offer claims-made medical malpractice coverage for doctors, dentists

podiatrists and

other medical professionals;podiatrists; claims-made professional liability coverage to individual healthcare providers such as therapists, pharmacists, physician assistants and nurse anesthetists; and coverages for medical facilities and other allied healthcare risks such as clinics, laboratories, medical spas, home health agencies, small hospitals, pharmacies and nursing homes. This product line also includes

for-profit and not-for profit management liability coverage

forwhich can be bundled or written mono-line and include employment practices liability,

not-for-profitdirectors' and

for-profit directors’ and officers’ liability, fiduciaryofficers' liability and

tenant discriminationfiduciary liability coverages. Additionally, we offer a data privacy and security product, which provides coverage for data breach and privacy liability, data breach loss to insureds and electronic media coverage.

We offer

Other product lines within the Excess and Surplus Lines segment include:

excess and umbrella solutions, primarily to commercial businesses,products, which provide coverage over approved underlying insurance carriers. Coverage can be writtencarriers on either an occurrence or claims-made basis. Targeted classes of businessbasis;

environmental products, which include

commercial and residential construction contractors and subcontractors, manufacturers, wholesalers, retailers, service providers, municipalities and school districts.Our environmental product offerings target small to mid-sized environmental contractors and provide a complete array of environmental coverages, including environmental consultants’consultants' professional liability, contractors’contractors' pollution liability and site specific environmental impairment liability. The professional liability cover is offered on a claims-made basis and targets risks inherent in the businesses of environmental consultants and engineers. The contractors’ pollution liability cover is offered on either a claims-made or occurrence basis and protects environmental contractors, trade contractors and general contractors. Thesite-specific environmental impairment liability cover is offered on a claims-made basis and protects commercial, industrial, environmental, habitational and institutional facilities against pollution to their premises.

Our transportation product offerings includecoverages;

transportation-related products, which provide auto physical damage

coveragescoverage for high-value automobiles

such as race cars and antique vehicles, as well as all types of specialty commercial vehicles,

including dump trucks, coal haulers, logging trucks, bloodmobiles, mobile stores, public autos, couriers and house moving vehicles. We offer dealer’sdealers' open lot and

garagekeeper’sgaragekeeper legal liability coverages,

targeting used car and truck, motorcycle and mobile home and recreational vehicle dealers, as well as repair shops. We also offer vehicular liability and physical damage coverages for local and intermediate haul commercial

trucks. Additionally, we providetrucks and liability coverage to operators of

small to medium-sized owned and operated taxicab fleets, non-emergency ambulances and multi-line specialty products designed for the unique characteristics of the garage

industry.Our industry;

inland marine

product offerings includeproducts, which provide a number of specialty coverages for risks such as motor truck cargo

warehouseman’s legal liability and contractors’ equipment. In addition, this product line group includes builder’s risk coverage. Motor truck cargo coverage

is offered to haulers of commercial goods for damage to third party cargo while in

transit. Warehouseman’stransit, warehouseman's legal liability

provides coverage

to warehouse operators for damage to third party goods in

storage. Contractors’storage, contractor's equipment

cover provides protectioncoverage for first party property damage

to contractors’ equipment including tools and

machinery. Also included in this product line group is first party property coverage for miscellaneous property including slot machines, ATMs, medical equipment, musical instruments and amusement equipment.18 |

Our builder's risk coverage;

ocean marine

product offerings includeproducts, which provide general liability, professional liability, property and cargo

coverages for

many marine-related classes. Targeted marine classes include marine artisan contractors, boat dealers and marina

owners. Coverages offered include general liability and property coverages, as well asowners including hull physical damage, protection and indemnity and third party property

coveragecoverages for ocean

cargo.Miscellaneous coverages offered include cargo;

casualty facultative reinsurance railroad first and third party insurance, public entity insurance and reinsurance and specialized insurance programs for specific classes of business. Casualty facultative reinsurance is written for individual casualty risks focusing on general liability, products liability, automobile liability and certain classes of miscellaneous professional liability. Targetedliability and targeting classes which include low frequency, high severity, short-tail general liability risks. Casualty facultative placements offer coverages that possess favorable underwriting characteristics, such as control of individual risk selection and pricing. Our railroad product offersrisks;

railroad-related products, which provide first and third party coverages for short-line and regional railroads, scenic and tourist railroads, commuter and light rail trains and railroad equipment. Publicequipment; and

public entity insurance and reinsurance programs,

which provide coverage for government entities including counties, municipalities, schools and community colleges.

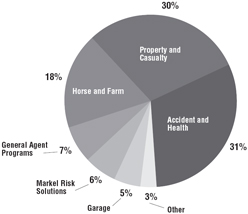

Specialty Admitted Segment

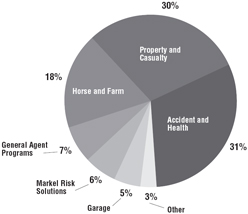

Our Specialty Admitted segment reported grosswrites risks that, although unique and hard-to-place in the standard market, must remain with an admitted insurance company for marketing and regulatory reasons. Hard-to-place risks written in the specialty admitted market cover insureds engaged in similar, but highly specialized activities who require a total insurance program not otherwise available from standard insurers or insurance products that are overlooked by large admitted carriers. The specialty admitted market is subject to more state regulation than the E&S market, particularly with regard to rate and form filing requirements, restrictions on the ability to exit lines of business, premium volumetax payments and membership in various state associations, such as state guaranty funds and assigned risk plans.

The majority of

$375.0 million, earned premiums of $343.6 million and an underwriting profit of $1.3 millionthe business in

2010.In the Specialty Admitted market, we wrote business through the following underwriting units during 2010:

Markel Specialty (Glen Allen, VA)

Markel American Specialty Personal and Commercial Lines (Pewaukee, WI)

SPECIALTY ADMITTED SEGMENT

2010 GROSS PREMIUM VOLUME ($375MILLION)

| 19

Markel Corporation & Subsidiaries

BUSINESS OVERVIEW (continued)

Markel Specialty.The Markel Specialty unit focuses on providing total insurance programs for businesses engaged in highly specialized activities. These activities typically do not fit the risk profiles of standard insurers and make complete coverage difficult to obtain from a single insurer.

The Markel Specialty unitsegment is organized into product areas that concentrate on particular markets and customer groups. The property and casualty division writes commercial coverages for youth and recreation oriented organizations, such as children’s camps, conference centers, YMCAs, YWCAs, Boys and Girls Clubs, child care centers, nursery schools, private and Montessori schools and gymnastics, martial arts and dance schools. This division also writes commercial coverages for social service organizations, museums and historic homes, performing arts organizations, bed and breakfast inns, outfitters and guides, hunting and fishing lodges, dude ranches and rod and gun clubs. The horse and farm operations specialize in insurance coverages for equine-related risks, such as horse mortality, theft, infertility, transit and specified perils. We also provide property and liability coverages for farms and boarding, breeding and training facilities. The accident and health division writes liability and accident insurance for amateur sports organizations, accident and medical insurance for colleges, universities, public schools and private schools, monoline accident and medical coverage for various niche markets, short-term medical insurance, pet health insurance, stop-loss insurance for self-insured medical plans and medical excess reinsurance coverage. The garage division provides commercial coverages for auto repair garages, gas stations and convenience stores and used car dealers. The general agent programs division develops partnerships with managing general agents to offer single source admitted and non-admitted programs for a specific class or line of business. We seek general agents who utilize retailers as their primary source of distribution. Underwriting, policy issuance and business development authority are delegated to the managing general agent. The Markel Risk Solutions facility works with select retail producers on a national basis to provide admitted market solutions to accounts having difficulty finding coverage in the standard marketplace. Accounts of various classes and sizes are written with emphasis placed on individual risk underwriting and pricing.

The majority of Markel Specialty business is produced by retail insurance agents. Management grantsagents who have very limited underwriting authority to a fewauthority. Agents are carefully selected agents and controls agency business is controlled through regular audits and pre-approvals.pre- approvals. Certain products and programs are also marketed directly to consumers or distributed through wholesale producers. Markel Specialty business is primarily written on Markel Insurance Company (MIC). MIC is domiciledPersonal lines coverages included in Illinois and is licensed to write P&C insurance in all 50 states and the District of Columbia.

MARKEL SPECIALTY

2010 GROSS PREMIUM VOLUME ($230MILLION)

20 |

Markel American Specialty Personal and Commercial Lines.The Markel American Specialty Personal and Commercial Lines unit offers its insurance products in niche markets and focuses its underwriting on marine, recreational vehicle, property and other personal and commercial line coverages. The marine division markets personal lines insurance coverage for watercraft, older boats, high performance boats and yachts. The marine division also provides coverage for small fishing ventures, charters, utility boats and boat rentals. The recreational vehicle division provides coverage for motorcycles, snowmobiles and ATVs. The property division provides coverage for mobile homes, dwellings and homeowners that do not qualify for standard homeowners coverage, as well as contents coverage for renters. Mobile home coverages include primary, seasonal and rental mobile homes. Coverage is offered for motor homes, as well as motor home rental operations. Commercial coverages include specialty insurance products, most notably professional liability coverages that we design and administer on behalf of other insurance carriers and ultimately assume on a reinsurance basis. Other products offered by this unit include special event protection, which provides for cancellation and/or liability coverage for weddings, anniversary celebrations and other personal events; supplemental natural disaster coverage, which offers additional living expense protection for loss due to specific named perils including flood; renters’ protection coverage, which provides tenant homeowner’s coverage on a broader form than the standard renter’s policy; excess flood coverage, which provides coverage above the National Flood Insurance Program limits; and collector vehicle coverage, which provides comprehensive coverage for a variety of collector vehicles including antique autos and motorcycles.

Markel American Specialty Personal and Commercial Lines products are characterized by high numbers of transactions, low average premiums and creative solutions for under-served and emerging markets. The unit distributes its marine, property and other products through wholesale or specialty retail producers. The recreational vehicle program and some marine productssegment are marketed directly to the consumer using direct mail, internet and telephone promotions, as well as relationships with various motorcycle and boat manufacturers, dealers and associations.

The

Markel American Specialty Personal and Commercial Lines unit writes the majority of

itsthe business

in Markel American Insurance Company (MAIC).produced by this segment is written on an admitted basis either through MIC, MAIC,

is domiciled in VirginiaFCIC or Essentia. MIC, MAIC and

isEssentia are licensed to write

P&C businessproperty and casualty insurance in all 50 states and the District of Columbia.

MARKEL AMERICAN SPECIALTY PERSONALAND COMMERCIAL LINES

2010 GROSS PREMIUM VOLUME ($104MILLION)

| 21

Markel Corporation & Subsidiaries

BUSINESS OVERVIEW (continued)

FirstComp.On October 15, 2010, we completed our acquisition of Aspen Holdings, Inc., a Nebraska-based privately held corporation whose FirstComp MAIC is also licensed to write property and casualty insurance group provides workers’in Puerto Rico. Essentia is also licensed in the U.S. Virgin Islands and specializes in coverage for classic cars and boats. FCIC is currently licensed in 28 states and specializes in workers' compensation insurance and related services, principally to small businesses, in 31 states. The majority of FirstComp business is produced by retail insurance agents. FirstComp business produced for our benefit is written on FirstComp Insurance Company, which is domiciled in Nebraska, or MIC. FirstComp also produces business for unaffiliated insurance companies through FirstComp Underwriters Group, Inc. and FirstComp Insurance Agency, Inc., which act as managing general agents. FirstComp has distribution relationships with more than 8,000 independent insurance agencies. These agencies are generally located in small towns and have been underserved by other market participants because of their size. For expense efficiency reasons, carriers often will not do business with agencies that do not have large books of business. Utilizing its proprietary technology platform, FirstComp is able to service these small agencies in a cost-efficient manner.

The FirstComp operations collectively produced approximately $290 million of gross written premiums in 2010. During 2010, thecoverage.

Our Specialty Admitted segment included $40.7 million of gross premium volume produced by FirstComp.London Insurance Market Segment

Our London Insurance Market segment reported gross premium volume of $709.0

$900.0 million, earned premiums of $577.5$745.0 million and an underwriting profit of $26.1$21.4 million in 2010.LONDON INSURANCE MARKET SEGMENT20132010 GROSS PREMIUM VOLUME ($709MILLION.

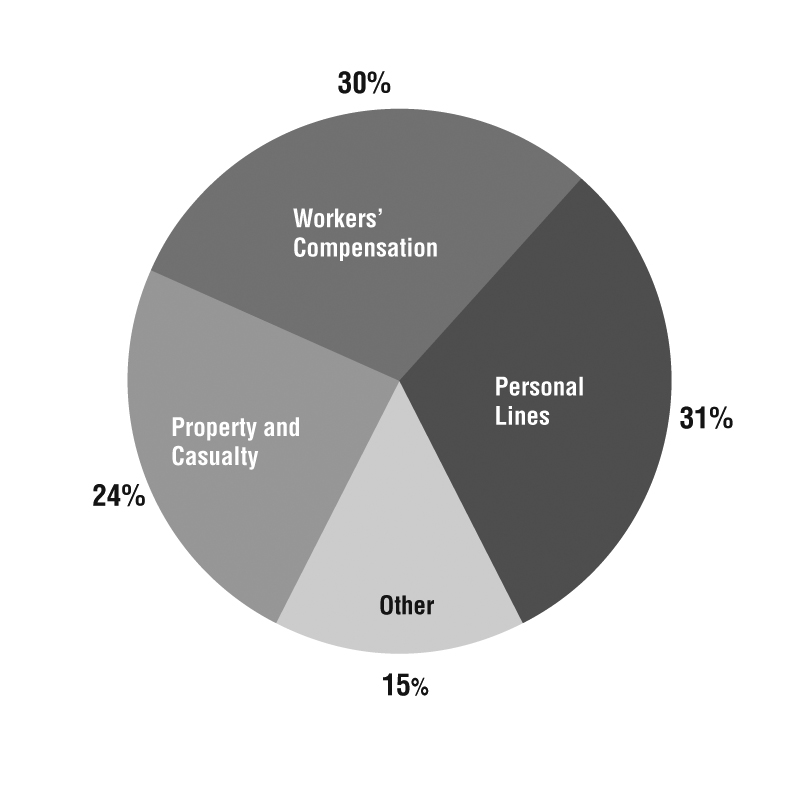

Specialty Admitted Segment

2013 Gross Premium Volume ($900 million)

This

Product offerings within the Specialty Admitted segment is comprised of Markel International, which is headquartered in London, England. In additionfall within the following major product groupings:

Workers' Compensation

Property and Casualty

Personal Lines

Other Product Lines

Workers' compensation products provide wage replacement and medical benefits to seven branch officesemployees injured in the course of employment and target main-street, service and artisan contractor businesses, retail stores and restaurants.

Property and casualty products included in this segment are offered on a monoline or package basis and generally target specialized commercial markets and customer groups. Targeted groups include youth and recreation oriented organizations, social service organizations, museums and historic homes, performing arts organizations, senior living facilities and wineries.

Personal lines products provide first and third party coverages for a variety of personal watercrafts including vintage boats, high performance boats and yachts and recreational vehicles, including motorcycles, snowmobiles and ATVs. Additionally, property coverages are offered for mobile homes, dwellings and homeowners that do not qualify for standard homeowner's coverage. Other products offered include special event protection, supplemental natural disaster coverage, renters' protection coverage, excess flood coverage. In January 2013, we expanded our personal lines products through the acquisition of Essentia, which underwrites insurance exclusively for Hagerty Insurance Agency and Hagerty Classic Marine Insurance Agency (collectively, Hagerty) throughout the United Kingdom,States. Hagerty offers insurance for classic cars, vintage boats, motorcycles and related automotive collectibles.

Other product lines within the Specialty Admitted segment include:

coverages for equine-related risks, such as horse mortality, theft, infertility, transit and specified perils, as well as property and liability coverages for farms and boarding, breeding and training facilities;

general agent programs that use managing general agents to offer single source admitted and non-admitted programs for a specific class or line of business;

first and third party coverages for small fishing ventures, charters, utility boats and boat rentals;

professional liability coverages that we design and administer on behalf of other insurance carriers and ultimately assume on a reinsurance basis; and

accident and health products offer liability and accident insurance for amateur sports organizations, monoline accident and medical coverage for various niche markets and short-term medical insurance.

London Insurance Market Segment

The London insurance market is known for its ability to provide innovative, tailored coverage and capacity for unique and hard-to-place risks. Hard-to-place risks in the London market are generally distinguishable from standard risks due to the complexity or significant size of the risk. It is primarily a broker market, which means that insurance brokers bring most of the business to the market. The London market is also largely a subscription market, which means that loss exposures brought into the market are typically insured by more than one insurance company or Lloyd's syndicate, often due to the high limits of insurance coverage required. We write business on both a direct and subscription basis in the London market. When we write business in the subscription market, we prefer to participate as lead underwriter in order to control underwriting terms, policy conditions and claims handling.

In this segment, we participate in the London market through Markel

International has offices in Canada, Spain, Singapore and Sweden.International. Markel International writes specialty property, casualty, professional liability, equine, marine, energy and trade credit insurance on a direct and reinsurance basis. Business is written worldwide

with approximately 23% of writings coming from the United States.22 |

Markel International.Markel International is comprised of the following underwriting divisions which, to better serve the needs of our customers, have the ability to write business through either MIICL or Markel Syndicate 3000:3000.

Our London Insurance Market segment reported gross premium volume of $914.5 million, earned premiums of $781.6 million and an underwriting profit of $95.5 million in 2013. In 2013, 82% of gross premium written in the London Insurance Market segment related to foreign risks, of which 25% was from the United Kingdom and 16% was from Canada. In 2012, 84% of gross premium written in the London Insurance Market segment related to foreign risks, of which 20% was from the United Kingdom and 16% was from Canada. In 2011, 85% of gross premium written in the London Insurance Market segment related to foreign risks, of which 20% was from the United Kingdom and 18% was from Canada. In each of these years, there were no other individual foreign countries from which premium writings were material.

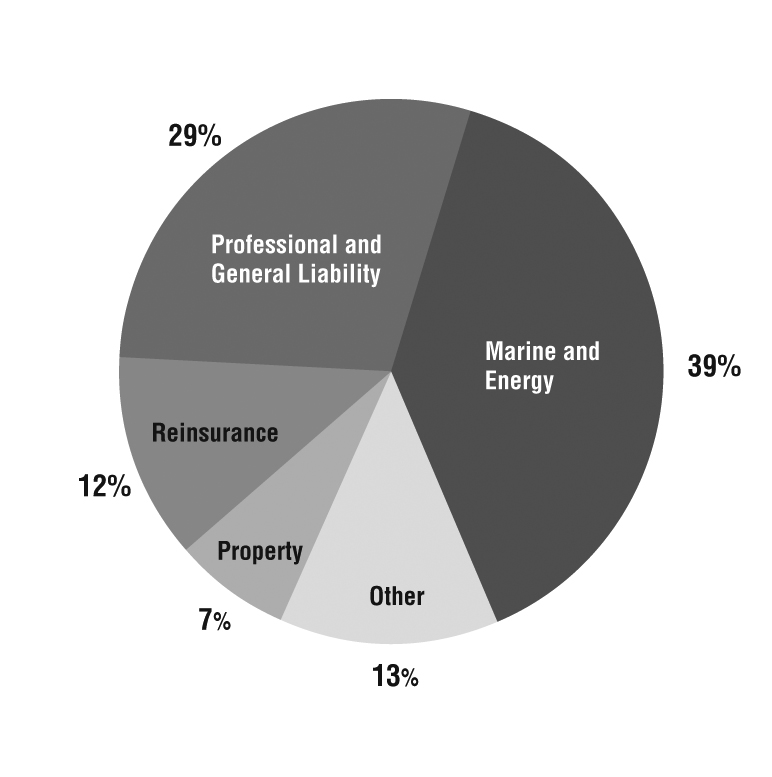

London Insurance Market Segment

2013 Gross Premium Volume ($914 million)

Product offerings within the London Insurance Market segment fall within the following major product groupings:

Marine and Energy

Professional and Financial Risks

General LiabilityEquine

Other Product Lines

Elliott Special Risks (ESR)

10

The

Marine and

Energy division underwritesenergy products include a portfolio of coverages for cargo, energy, hull, liability, war,

terrorism and specie risks. The cargo account is an international transit-based book covering many types of cargo.

The energy accountEnergy coverage includes all aspects of oil and gas activities. The hull account covers physical damage to ocean-going tonnage, yachts and

mortgagee’smortgagee's interest.

The liability accountLiability coverage provides

coverage for a broad range of energy liabilities, as well as traditional marine exposures including charterers, terminal operators and ship repairers. The war account covers the hulls of ships and aircraft, and other related interests, against war and associated perils.

Terrorism coverage provides for property damage and business interruption related to political violence including war and civil war. The specie account includes coverage for fine art on

exhibitexhibition and in private collections, securities, bullion, precious metals, cash in transit and jewelry.

The Non-Marine Property division writes

Professional and general liability products include professional indemnity, directors' and officers' liability, intellectual property, some miscellaneous defense costs, incidental commercial crime, general and products liability coverages targeting consultants, construction professionals, financial service professionals, professional practices, social welfare organizations and medical products. Professional and general liability products are written on a worldwide basis, limiting exposure in the United States.

Reinsurance products include property and casualty treaty reinsurance. Property treaty products are offered on an excess of loss and proportional basis for per risk and catastrophe exposures. A significant portion of the excess of loss catastrophe and per risk property treaty business comes from the United States with the remainder coming from international property treaties. Casualty treaty reinsurance is offered on an excess of loss basis and primarily targets specialist writers of motor products in the United Kingdom and Europe. Excess of loss casualty treaty reinsurance also is offered for select writers of employers' and products liability business forcoverages.

Property products target a wide range of insureds, providing coverage ranging from fire to catastrophe perils such as earthquake and windstorm. Business is written

in either theprimarily on an open market

or delegated authority accounts. The open market account writesbasis for direct and facultative risks

typically fortargeting Fortune 1000

companies. Open market business is written mainlycompanies on a worldwide basis by our underwriters to London brokers, with each risk being considered on its own merits.

The delegated authority account focuses mainly on small commercial insureds and is written through a network of coverholders. The delegated authority account is primarily written in the United States. Coverholders underwriting this business are closely monitored, subject to audit and must adhere to strict underwriting guidelines.The Professional and Financial Risks division underwrites professional indemnity, directors’ and officers’ liability, intellectualWe also provide property some miscellaneous defense costs, incidental commercial crime and general liability coverages. The professional indemnity account offers unique solutions in four main professional classes including miscellaneous professionals and consultants, construction professionals, financial service professionals and professional practices. The miscellaneous professionals and consultants class includes coverages for a wide range of professionals including management consultants, publishers, broadcasters, pension trustees and public officials. The construction class includes coverages for surveyors, engineers, architects and estate agents. The financial services class includes coverages for insurance brokers, insurance agents, financial consultants, stockbrokers, fund managers, venture capitalists and bankers. The professional practices class includes coverages for accountants and solicitors. The directors’ and officers’ liability account offers coverage to public, private and non-profit companies of all sizes on either an individual or blanket basis. The Professional and Financial Risks division writes business on a worldwide basis, limiting exposure in the United States.

The Retail division offers a full range of professional liability products, including professional indemnity, directors’ and officers’ liability and employment practices liability, through six branch offices in England and one branch office in Scotland. In addition, coverage is provided for small to

| 23

Markel Corporation & Subsidiaries

BUSINESS OVERVIEW (continued)

medium-sized commercial property risks on both a stand-alone and package basis. Thebasis through our branch offices provide insureds and brokers with direct access to decision-making underwriters who possess specialized knowledge of their local markets. The division also underwrites certain niche liability products such as coverages for social welfare organizations.

The Specialty division provides property treaty reinsurance on an excess of loss and proportional basis for per risk and catastrophe exposures. A significant portion ofoffices.

Other product lines within the division’s excess of loss catastrophe and per risk treaty business comes from the United States with the remainder coming from international property treaties. The Specialty division also offers directLondon Insurance Market segment include:

crime coverage for a number of specialist classes includingprimarily targeting financial institutions contingency and other special risks. Coverage includes bankersproviding protection for bankers' blanket bond, computer crime and commercial fidelity, professional sports liability,fidelity;

contingency coverage including event cancellation, non-appearance and prize

indemnity.The Equine division writes bloodstock, livestockindemnity;

accident and aquaculture-related products on a worldwide basis. The bloodstock account provides health coverage targeting affinity groups and schemes, high value and high risks accounts and sports groups;

coverage for equine-related risks ofsuch as horse mortality, theft, infertility, transit and specified perils for insureds ranging in size from large stud farms to private horse owners. The livestock account provides coverageperils;

specialty coverages include mortality risks for farms, zoos, animal theme parks and safari

parks. The aquaculture account provides comprehensive coverage for fish at onshore farms, offshore farms and in-transit risks.The Trade Credit division writes parks;

short-term trade credit coverage for commercial risks, including insolvency and protracted

default. Politicaldefault as well as political risks

are coveredcoverage in conjunction with commercial risks for currency inconvertibility, government action,

import/import and export license cancellation, public buyer default and

war. Products include coverages for captive reinsurance, trade receivables securitization, vendor financing, pre-credit/work in progress, anticipatory credit, factoringwar; and

contract replacement. Policy structures are on an excess of loss basis or ground up for specific or named buyer risks.ESR underwrites a diverse portfolio of property and casualty coverages for Canadian domiciled insureds. ESR provides primary general liability,

products liability, excess and umbrella and environmental liability coverages targeted at Canadian domiciled insureds.

Alterra Segment

The Alterra segment provides diversified specialty insurance and reinsurance products to corporations, public entities and other property coverages. ESR also writesand casualty insurers through offices in the United States, the United Kingdom, Ireland, Switzerland, Bermuda and Latin America.

The Alterra segment reported gross premium volume of $1.0 billion, earned premiums of $848.3 million and an underwriting loss of $154.9 million in 2013. In 2013, 23% of gross premium written in the Alterra segment related to foreign risks, of which 24% was from the United Kingdom. In 2013, there were no other individual foreign countries from which premium writings were material. In 2013, the top three independent brokers accounted for approximately 40% of gross premiums written in the Alterra segment.

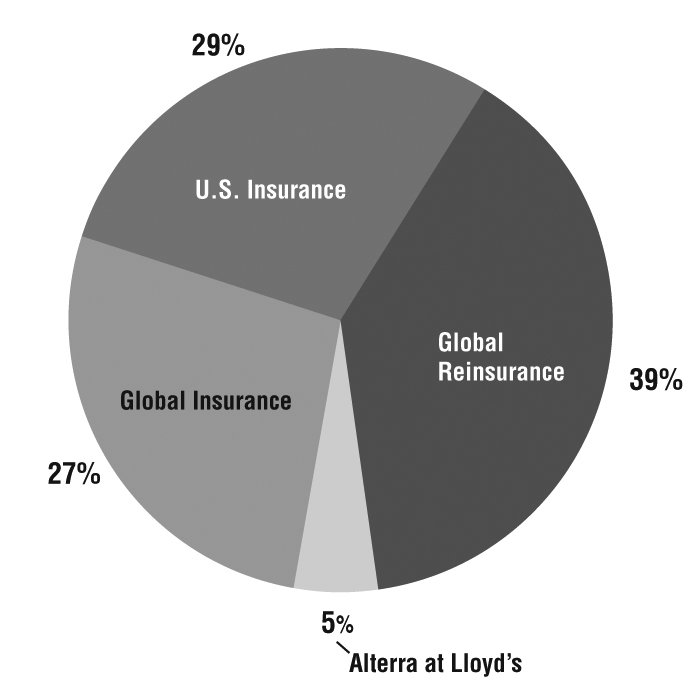

Alterra Segment

2013 Gross Premium Volume ($1.0 billion)

The Alterra segment is comprised of the following underwriting units:

U.S. Insurance

Global Insurance

Alterra at Lloyd's

Global Reinsurance

The U.S. Insurance unit offers property and casualty insurance coverage from offices in the United States. The Alterra segment participates in the excess and surplus lines market through AESIC and in the admitted insurance market through AAIC. AESIC is authorized to write business in 49 states and the District of Columbia, Puerto Rico and the U.S. Virgin Islands. AAIC is licensed to write business in all 50 states and the District of Columbia. Products offered within the U.S. Insurance unit include excess liability, marine, professional indemnity,liability and property.

The Global Insurance unit offers property and casualty excess of loss insurance through Markel Bermuda and Markel Europe from offices in Bermuda, Dublin, London and Zurich to Fortune 1000 companies. Products offered within the Global Insurance unit include excess liability, professional liability and property. Professional liability products include errors and omissions insurance, employment practices liability insurance and directors and officers

insurance. Excess liability products include excess umbrella liability insurance, excess product liability insurance, excess medical malpractice insurance and

equine products.excess product recall insurance. These products are underwritten on an individual risk basis.

Alterra at Lloyd's offers property and casualty quota share and excess of loss insurance and reinsurance through its Lloyd's Syndicate 1400 from its offices in London and Zurich, primarily to medium- to large-sized international clients. Products offered within the Lloyd's group include accident & health, agriculture, financial institutions, international casualty, marine, professional liability and property.

The Alterra segment's Global Reinsurance

unit offers property and casualty quota share and excess of loss reinsurance through Alterra Re USA, Alterra at Lloyd's, Markel Europe, Markel Bermuda and Markel Brazil to insurance and reinsurance companies worldwide. Alterra Re USA is licensed or accredited to provide reinsurance in all 50 states and the District of Columbia. We typically write our reinsurance products in the Alterra segment in the form of treaty reinsurance contracts, on both a quota share and excess of loss basis. Our reinsurance products may include features such as contractual provisions that require our cedent to share in a portion of losses resulting from ceded risks, may require payment of additional premium amounts if we incur greater losses than those projected at the time of the execution of the contract, may require reinstatement premium to restore the coverage after there has been a loss occurrence or may provide for experience refunds if the losses we incur are less than those projected at the time the contract is executed. Reinsurance products offered include agriculture, auto, credit and surety, general casualty, marine and energy, professional liability, property and workers' compensation.

Ceded Reinsurance

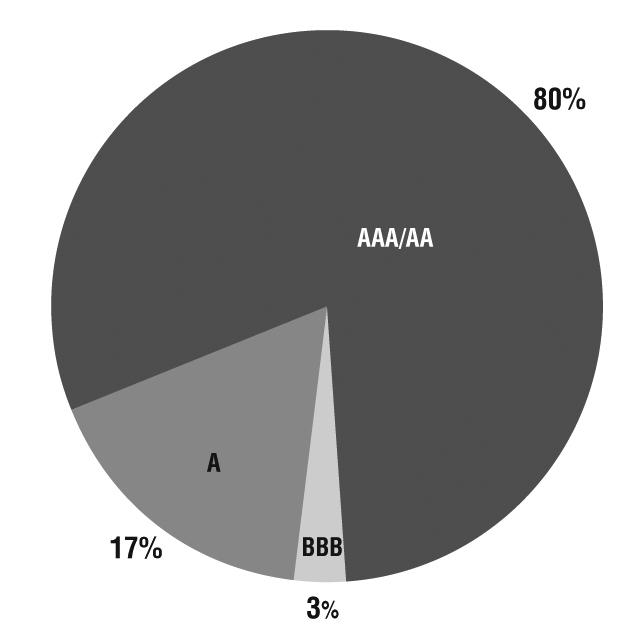

We purchase reinsurance in orderand retrocessional reinsurance to reducemanage our net retention on individual risks and overall exposure to havelosses, while providing us with the ability to underwriteoffer policies with sufficient limits to meet policyholder needs. In a reinsurance transaction, an insurance company transfers, or cedes, all or part of its exposure in return for a portion of the premium. In a retrocession transaction, a reinsurer transfers, or cedes, all or part of its exposure in return for a portion of the premium. As part of our underwriting philosophy, we seekhave historically sought to offer products with limits that dodid not require significant amountsreinsurance. Following the acquisition of Alterra, we now have certain insurance and reinsurance products that have typically required higher levels of reinsurance. We purchase catastrophe reinsurance coverage for our catastrophe-exposed policies, and we seek to manage our exposures under this coverage so that no exposure to any one reinsurer is material to our ongoing business. Net retention of gross premium volume was 89%83% in 20102013 and 90%88% in 2009.2012. We do not purchase or sell finite reinsurance products or use other structures that would have the effect of discounting loss reserves.The ceding of insurance does

Our ceded reinsurance and retrocessional contracts do not legally discharge us from our primary liability for the full amount of the policies, and we will be required to pay the loss and bear collection risk if the reinsurer fails to meet its obligations under the reinsurance agreement. We attempt to minimize credit exposure to reinsurers through adherence to internal

ceded reinsurance guidelines. To

becomeparticipate in our reinsurance

partner,program, prospective companies generally must: (i) maintain an A.M. Best Company (Best) or

24 |

Standard & Poor’sPoor's (S&P) rating of “A”"A" (excellent) or better; (ii) maintain minimum capital and surplus of $500 million and (iii) provide collateral for recoverables in excess of an individually established amount. In addition, certain foreign reinsurers for our United States insurance operations must provide collateral equal to 100% of recoverables, with the exception of reinsurers who have been granted authorized status by an insurance company’scompany's state of domicile. Lloyd’sLloyd's syndicates generally must have a minimum of a “B”"B" rating from Moody’sMoody's Investors Service (Moody’s)(Moody's) to be our reinsurers.

Over time, we will attempt to bring the reinsurance programs used within the Alterra segment into compliance with our internal ceded reinsurance guidelines.

When appropriate, we pursue reinsurance commutations that involve the termination of ceded reinsurance

and retrocessional contracts. Our commutation strategy related to ceded reinsurance

and retrocessional contracts is to reduce credit exposure and eliminate administrative expenses associated with the run-off of

ceded reinsurance placed with certain reinsurers.

The following table displays balances recoverable from our ten largest reinsurers by group at December 31,

2010.2013. The contractual obligations under reinsurance

agreementsand retrocessional contracts are typically with individual subsidiaries of the group or syndicates at

Lloyd’sLloyd's and are not typically guaranteed by other group members or syndicates at

Lloyd’s.Lloyd's. These ten reinsurance groups represent approximately

68%62% of our

$1.0$2.0 billion reinsurance recoverable balance before considering allowances for bad debts.

| | | | | | |

Reinsurers | | A.M. Best

Rating | | Reinsurance

Recoverable | |

| | | | | (dollars in

thousands) | |

Munich Re Group | | A+ | | $ | 167,148 | |

Lloyd’s of London | | A | | | 131,960 | |

Fairfax Financial Group | | A | | | 89,166 | |

XL Capital Group | | A | | | 60,484 | |

Swiss Re Group | | A | | | 55,292 | |

Ace Group | | A+ | | | 51,577 | |

W.R. Berkley Group | | A+ | | | 36,669 | |

HDI Group | | A | | | 35,299 | |

Aspen (Bermuda) Group | | A | | | 33,301 | |

White Mountains Insurance Group | | A- | | | 31,607 | |

| | | | | | |

Reinsurance recoverable on paid and unpaid losses for ten largest reinsurers | | | 692,503 | |

| | | | | | |

Total reinsurance recoverable on paid and unpaid losses | | $ | 1,023,848 | |

| | | | | | |

|

| | | | | |

| Reinsurers | A.M. Best Rating | | Reinsurance Recoverable |

| | | | (dollars in thousands) |

| Fairfax Financial Group | A | | $ | 212,591 |

|

| Munich Re Group | A+ | | 186,457 |

|

| Lloyd's of London | A | | 159,342 |

|

| AXIS Capital Holdings Limited | A | | 143,949 |

|

| Alleghany Corporation | A | | 117,729 |

|

| Platinum Underwriters Holdings Ltd | A | | 106,397 |

|

| Partner Re Group | A+ | | 105,627 |

|

| Swiss Re Group | A+ | | 83,562 |

|

| XL Capital Group | A | | 81,844 |

|

| Arch Insurance Group | A+ | | 72,320 |

|

| Reinsurance recoverable on paid and unpaid losses for ten largest reinsurers | | 1,269,818 |

|

| Total reinsurance recoverable on paid and unpaid losses | | $ | 2,032,626 |

|

Reinsurance recoverable balances in the

preceding table

above are shown before consideration of balances owed to reinsurers and any potential rights of offset, any collateral held by us and allowances for bad debts.

Reinsurance