United States

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2012 |

for the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-33433

KAISER VENTURES LLC

(Exact name of registrant as specified in its charter)

| DELAWARE | 33-0972983 | |

(State or Other Jurisdiction of

| (I.R.S. Employer

|

3633 E. Inland Empire Blvd. Suite 480337 N. Vineyard Ave., 4th Floor

Ontario, CA 91764

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (909) 483-8500

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class | Name of Each Exchange on which Registered | |

| Class A Units | Not Applicable |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not herein, and will not be contained to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨x No ¨ (The registrant is not yet required to submit Interactive Data)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | ||||||||

reporting company) | Smaller reporting company | x | ||||||

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The Class A Units are not publicly traded and thus, no public float exists and an aggregate market value of the Company’s Class A Units cannot be determined.

At March 15, 2011, 6,784,0231, 2013, 7,096,806 Class A Units were outstanding including 104,267 Class A Units outstanding but reserved for distribution to the general unsecured creditors in the Kaiser Steel Corporation bankruptcy and 113,250113,101 Class A Units deemed outstanding and reserved for issuance to holders of Kaiser Ventures Inc. stock that have to convert such stock into Kaiser Ventures LLC Class A Units.

Documents Incorporated by Reference: Certain exhibits as identified in the Exhibit List to this Annual Report on Form 10-K are incorporated by reference.

Transitional Small Business Disclosure Format (Check One):Yes ¨ No x

KAISER VENTURES LLC AND SUBSIDIARIES

TABLE OF CONTENTS TO FORM 10-K

i

KAISER VENTURES LLC AND SUBSIDIARIES

PART I

Except for the historical statements and discussions contained herein, statements contained in this 10-K Report constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any 10-K Report, 10-KSB Report, 10-Q Report, 10-QSB Report, 8-K Report, website posting or press release of the Company and any amendment thereof may include forward-looking statements. In addition, other written or oral statements, which constitute forward-looking statements, have been made and may be made in the future by the Company. You should not put undue reliance on forward-looking statements. When used or incorporated by reference in this 10-K Report or in other written or oral statements, the words “anticipate,” “estimate,” “project,” and similar expressions are intended to identify forward-looking statements. Such statements are subject to certain risks, uncertainties, and assumptions. We believe that our current assumptions are reasonable. Nonetheless, it is likely that at least some of these assumptions will not come true. Accordingly, should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected, or projected. For example, our actual results could materially differ from those projected as a result of factors such as, but not limited to: Kaiser’s inability to complete the anticipated sale of its Eagle Mountain landfill project; litigation, including, among others, the averse decisionconsequences of the U.S. 9th Circuit Court of Appeals in November 2009 impacting the viabilityadverse conclusion of the Eagle Mountain landfill project,final federal litigation involving a previously completed federal land exchange and the Company’s decision not to provide additional funds to Mine Reclamation, LLC for purposes of pursuing a “fix” of the land exchange; the bankruptcy of Mine Reclamation, LLC and the claims that may be made in or as result of such bankruptcy; pre-bankruptcy activities of Kaiser Steel Corporation, the predecessor of Kaiser, and asbestos and environmental claims; insurance coverage disputes; the impact of existing or proposed federal, state, and local laws and regulations on any of our current and future projects and subsidiaries, and their permitting and development activities; competition; the challenge, reduction or loss of any claimed tax benefits, including the taxation of the Company as a partnership; the impact of natural disasters on our assets; the amount and nature of the mineral resources at Eagle Mountain and theany inability to exploit such possible mineral and resource opportunities; the impacts and risks of the proposed dissolution and winding-up of the Company; and/or general economic conditions in the United States and Southern California. The Company disclaims any intention to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Unless otherwise noted: (1) the term “Kaiser LLC” refers to Kaiser Ventures LLC; (2) the term “Kaiser Inc.” refers to the former Kaiser Ventures Inc.; (3) the terms “Kaiser,” the “Company,” “we,” “us,” and “our,” refer to past and ongoing business operations conducted in the form of Kaiser Inc. or currently Kaiser LLC, and their respective subsidiaries. Kaiser Inc. merged with and into Kaiser LLC effective November 30, 2001; (4) the terms “Class A Units” and “members” refer to Kaiser LLC’s Class A Units and the beneficial owners thereof, respectively; and (5) the term the “merger” refers to the merger of Kaiser Inc. with and into Kaiser LLC effective November 30, 2001, in which Kaiser LLC was the surviving company. Kaiser is the reorganized successor tocompany Kaiser Steel Corporation, referred to as KSC, whichformerly was an integrated steel manufacturer.manufacturer that filed for Chapter 11 bankruptcy in 1987. Kaiser is the reorganized successor to a portion of the assets of the former KSC.

| Item 1. | BUSINESS |

Summary of Our Business

Overview.Our business is developinghas been to develop the remaining assets we received from the KSC bankruptcy and the possible opportunities related to such assets. Our currentIn 2000 Kaiser’s then Board of Directors approved a cash maximization strategy with the goal of seeking to reasonably maximize future

KAISER VENTURES LLC AND SUBSIDIARIES

distributions to our members. On January 15, 2013, our Board of Managers approved a Plan of Dissolution and Liquidation (the “Dissolution Plan”) and other documents that are necessary or appropriate to implement the Dissolution Plan as a final step in such cash maximization strategy. The Dissolution Plan and the attendant Second Amended and Restated Limited Liability Company Operating Agreement (“New Operating Agreement”), among other items, will require the approval of the Company’s Class A members. A meeting of the Company’s members will most likely will be held early in the second quarter of 2013. For additional information in this regard, see “Item 1. Business—Cash Maximization Strategy and Proposed Dissolution of the Company” below.

Currently, our remaining material projects and opportunities are summarized below.

We own an 83.13%84.247% ownership interest in Mine Reclamation, LLC, (referred to as MRC), which ownshas been seeking to develop a permitted rail-haul municipal solid waste landfill at a property called the Eagle Mountain Site located in the California desert (the “Landfill Project”). On October 30, 2011, MRC filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for Central District of California, Riverside Division, bankruptcy case number 6:11-bk-43596 (the “Bankruptcy Court”). MRC continues to operate its business as a “debtor in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code, Rules and orders of the Bankruptcy Court. MRC has currently established a $500,000 line of credit with us but we have approved providing up to a $1 million line of credit. Any proceeds from permitted draws on the line of credit are to be used to complete, if necessary, the MRC bankruptcy process. MRC may not be able to repay any amounts loaned to it by the Company if MRC is not able to complete a transaction for the sale of its remaining assets or if the net sales price of any transaction should be less than the amount owed to the Company.

The Landfill Project has been the subject of intense litigation in federal court over the course of more than ten years regarding the validity of a land exchange with the U.S. Bureau of Land Management (“BLM”). The land exchange is central to the development of the Landfill Project as permitted. On March 28, 2011, the U.S. Supreme Court denied the request of MRC for further review of the prior decision of the U.S. 9th Circuit Court of Appeals that had been adverse to the position of MRC and the BLM. Thus, the previous federal land exchange litigation is now final and concluded as there is no further right of appeal. Although the land exchange has been remanded to the BLM for further proceedings in accordance with the decision of the U.S. 9th Circuit Court of Appeals, there is no pending litigation and no current plan or process being undertaken by MRC to “fix” the land exchange since MRC does not have the funds or wherewithal to pursue such an objective. Additionally, Kaiser has decided that it will not make any further investment in MRC to fund a “fix” of the land exchange. However, other third parties may ultimately seek to “fix” the land exchange for purposes of the Landfill Project. For additional information on the nearly 20 years of administrative challenges and litigation involving the Landfill Project, see “Item 1. BUSINESS—Mine Reclamation and Eagle Mountain Landfill Project—Historical Landfill Project Litigation.”

As further background, MRC and the County Sanitation District No. 2 of Los Angeles County (the “District”) had entered into an Agreement for Purchase and Sale of Real Property and Related Personal Property in Regard to the Eagle Mountain Sanitary Landfill Project and Joint Escrow Instructions on August 9, 2000 (the “Landfill Project Sale Agreement”). The closing date under the Landfill Project Sale Agreement had been extended numerous times since December 31, 2000, pursuant to written extension agreements between MRC and the District. Under each of those extension agreements, the District had the right to either purchase the Landfill Project in its “as is” condition or to terminate its Landfill Project Sale Agreement with MRC. The last extension of the closing date under the Landfill Project Sale Agreement was set to expire on October 31, 2011. The then Chief Engineer and General Manager of the District had initially indicated that the District was not intending to proceed with the purchase of the Landfill Project;

KAISER VENTURES LLC AND SUBSIDIARIES

then he later communicated that the District would be purchasing the Landfill Project on October 31, 2011. Subsequent to the verbal communications from the then Chief Engineer and General Manager, the District repudiated in writing the terms of the last extension agreement, and threatened to sue MRC to, among other things, compel MRC, at MRC’s sole expense and risk, to further proceed with fully permitting the landfill which would have involved substantial additional financial resources and time, neither of which MRC had. Thus, MRC filed for bankruptcy protection on October 30, 2011, in federal bankruptcy court in Riverside County, California in order to preserve and protect its assets and options with respect to such assets. |

We own a 50% ownership interest in the West Valley Materials Recovery Facility and Transfer Station, a transfer station and materials recovery facility located on land acquired from Kaiser, which we refer to as the West Valley MRF. We are continuing to explore new projects for the West Valley MRF with the goal of ultimately increasing revenues or reducing costs. Possible projects include a waste to energy project, composting a significant portion of the green waste delivered to the West Valley MRF, an expansion of the construction and debris handling area and the possible installation of a small solar facility for the benefit of the West Valley MRF. For additional information on the West Valley MRF please see “Item 1. BUSINESS—West Valley Materials Recovery Facility and Transfer Station;”

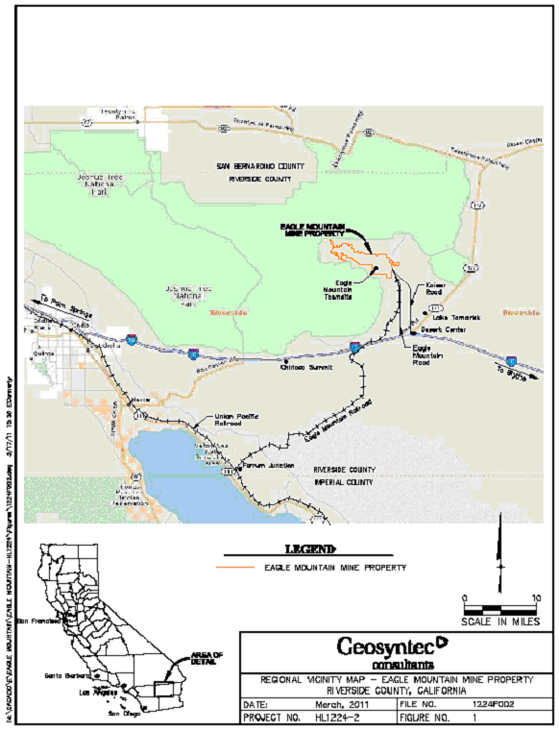

We owncontrol millions of tons of iron ore resources at the Eagle Mountain Site. With the large amount of iron ore reserves at Eagle Mountain and with the current high market prices for minerals, including for iron ore, we arecontinue to aggressively pursuingpursue possible opportunities with regard to the iron ore and other mineral resources. In this regard, the Company has retainedcontinues to work with an investment banking and advisory firm to assist it in exploring possible opportunities and transactions with regard to these resources. There may be a range of possible opportunities including some of which that may take several years to develop and implement. For additional information regarding the resources at Eagle Mountain please see “Item 2. Properties—PROPERTIES—Eagle Mountain;Mountain, California;”

As a result of previous mining operations there are millions of tons of rock stockpiled at the Eagle Mountain Site. We are continuing to explore available markets for such rock. For additional information regarding the resources at Eagle Mountain, please see “Item 2. PROPERTIES - Eagle Mountain;”

In addition to the mineral and rock opportunities at PROPERTIES—Eagle Mountain, we are exploring additional opportunities at Eagle Mountain, including the sale of up to 7,500 annual acre feet of water which is the approximate amount of water that was historically used in conjunction with the town and mining operations at Eagle Mountain to the extent such water is not necessary for the landfill project and any resumption of large-scale iron ore mining. Additionally, we continue to seek other possible uses for the approximate 5,400 acres we own or control at Eagle Mountain that are not a part of the landfill project;California;”

We are continuing to seek to sell the Company’s other miscellaneous assets, such as our Lake Tamarisk property. Lake Tamarisk is an unincorporated community located approximately 70 miles east of Palm Springs, California, and approximately 8 miles from the Eagle Mountain Site. Our Lake Tamarisk land consists of 72 residential lots and approximately 420 acres of other undeveloped property. For additional information on Lake Tamarisk, please see “Item 2. PROPERTIES—Lake Tamarisk, California”; and

KAISER VENTURES LLC AND SUBSIDIARIES

|

We are analyzing the issues created by the proposed hydro-electric pumped storage project at the Eagle Mountain Site including the threat of the taking of our property by eminent domain.

Sale of Ownership Interest In West Valley MRF, LLC.We no longer own an interest in the West Valley MRF, LLC (“WVMRF, LLC”). On April 2, 2012, Kaiser Recycling, LLC, a wholly-owned subsidiary of Kaiser LLC, sold its fifty percent (50%) ownership interest in the WVMRF, LLC which owns and operates the West Valley Materials Recovery Facility and Transfer Station, a transfer station and materials recovery facility near Fontana, California. The gross cash sales price for Kaiser Recycling’s 50% ownership interest was approximately $25,769,000 with the Company recording a gain on the sale of $20,588,000 in the second quarter of 2012.

CASH MAXIMIZATION STRATEGY AND PROPOSED LIQUIDATION OF THE COMPANY

Cash Maximization Strategy. In September 2000, Kaiser Inc.’s Board of Directors approved a strategy to maximize the cash ultimately to be distributed to Kaiser Inc.’s stockholders. Consistent with this strategy, Kaiser Inc. historically completed or entered into a number of transactions. For additional information on these transactions see “Item 1. BUSINESS - BUSINESS—Historical Operations and Completed Transactions” in this Annual Report on Form 10-K. These transactions resulted inPursuit of the cash maximization strategy over the past 13 years, the Company has made distributions totaling $13.50 per unit/share as of March 1, 2013. Specifically: (i) a $2.00 per share return of capital distribution was made to shareholders in 2000 and,2000; (ii) with the conversion of Kaiser Inc. to a limited liability company in November 2001, a distribution was made to shareholders of $10$10.00 per share plus one Class A Unit in Kaiser LLC upon surrender of their Kaiser Inc. stock. Westock; and (iii) with the sale of the ownership interest in the WVMRF, LLC in April 2012, a

KAISER VENTURES LLC AND SUBSIDIARIES

distribution of $1.50 per unit was made in May 2012. In addition, we have also taken steps to minimize any exposure we may have to liabilities resulting from the historical operations of the former KSC.

In furtherance of the cash maximization strategy, the Company has been seeking to sell its ownership interest in MRC, in Kaiser Eagle Mountain, LLC (“KEM”); the owner of the property at Eagle Mountain, and in Lake Tamarisk Development, LLC (“Lake Tamarisk”), the owner of property at Lake Tamarisk. Any possible sale of the Kaiser Eagle Mountain property was subject, in all instances, to the rights of the District to acquire the Landfill Project on or before October 31, 2011. For additional information on these efforts, see “Item 2. PROPERTIES—Eagle Mountain, California.” The final implementation of the cash maximization strategy will occur uponhas been negatively impacted by, among other things, the positive resolutionadverse final decision in the federal land exchange litigation which has halted MRC’s ability to continue to pursue the Landfill Project, the adverse actions of the current adverse federal litigation involvingDistrict, MRC’s bankruptcy and unsettled economic conditions. However, the landfill project andCompany’s Board of Managers has determined that the sale of such project and upon the completionproposed dissolution of the exploration and pursuitCompany is currently the best opportunity to achieve possible future distributions to its members. Additionally, if the dissolution of possible mineral resource opportunities at the Eagle Mountain Site. Accordingly,Company occurs, the final implementation of the cash maximization strategy could take ana significant additional significant period of time. As summarized above under “Item 1. BUSINESS - Summarytime depending upon the timing of the resolution of MRC’s bankruptcy and the sale of our Business - Overview”,remaining assets. We are continuing to evaluate all reasonable options with regard to the disposition of our remaining assets.

Proposed Dissolution of the Company. On January 15, 2013, the Company’s Board of Managers approved the dissolution and liquidation of the Company pursuant to the Plan of Dissolution and approved the New Operating Agreement for the Company, both of which remain subject to approval by the Company’s Class A members. The Board of Managers concluded that it is currently in the best interests of the Company and its members to dissolve and liquidate as the final step in implementing the Company’s previously approved cash maximization strategy. Assuming the Plan of Dissolution is approved by the Company’s members, the Company plans on selling its remaining assets, discharging or making adequate provision for all of its known and contingent liabilities and distributing the net liquidation proceeds, if any, in one or more future distributions to members. However, there could be no further distributions to members if our remaining assets are sold for substantially less than we continuecurrently anticipate and/or if liquidation expenses and actual and contingent liabilities are higher than we currently understand and estimate. Accordingly, we are not able to undertake activitiespredict with certainty the precise nature, amount or timing of any future distributions, primarily due to our inability to accurately predict (i) the amount of our remaining liabilities, (ii) the amount that we will expend during the course of the liquidation, or (iii) the net realizable value, if any, of our remaining non-cash assets. The Board has not established a firm timetable for any interim or final distributions to the Company’s members. If the Plan of Dissolution is approved by the Company’s members, the individuals serving on the Board of Managers will resign from the Board of Managers and the Board of Managers will be eliminated and replaced with a single Liquidation Manager with the power and authority to manage the liquidation and dissolution of the Company and the winding up of its affairs. The target date to complete dissolution is June 30, 2014, but that date could be extended to December 31, 2014, or beyond at the discretion of the Liquidation Manager.

Further details of the Plan of Dissolution and the New Operating Agreement will be provided in furtherancea proxy statement that will accompany the notice of the special members’ meeting that will be called to approve the Plan of Dissolution, the New Operating Agreement and a name change for the Company. The special members’ meeting would be the commencement of the final step in the Company’s cash maximization strategy.

KAISER VENTURES LLC AND SUBSIDIARIES

MEMBERS OF THE COMPANY ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY ALL RELEVANT MATERIALS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE, BECAUSE THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTIONS.

If the Plan of Dissolution is approved, we intend to immediately seek relief from the SEC to modify our reporting obligations under the Securities and Exchange Act of 1934, as amended, and in particular, to seek relief from the requirement to provide quarterly Form 10-Q Reports and audited annual financial statements. We anticipate that, if granted such relief, we would be required to continue filing current reports on Form 8-K to disclose material events relating to our dissolution and liquidation, along with any other reports that the SEC might require but we would no longer be filing audited financial statements. If the SEC does not grant us the requested relief, we will be required to continue filing all of our periodic and current reports as required by the Securities Exchange Act of 1934, as amended, and to provide

KAISER VENTURES LLC AND SUBSIDIARIES

audited financial statements, both of which would reduce the amount of funds available, if any, for distribution to members because of the costs associated therewith.

As will be more fully detailed in the proxy statement that will be furnished to the Company’s Class A members prior to the members’ meeting at which the approval of the Plan of Dissolution, the New Operating Agreement and a name change will be considered, there are a number of risks associated with dissolving the Company and winding-up its business. These risks include, but are not limited to:

We cannot assure members of any future distributions. The dissolution and liquidation process will be under the sole control of the Liquidation Manager and is subject to numerous uncertainties which may result in no, or less than anticipated, future distributions. The amount of any future distributions is impacted by the ability and price at which we are able to sell our remaining assets, the amount necessary to resolve or make reasonable provision for all known valid current and contingent obligations and claims, and the expenses of the dissolution and liquidation process;

We may not be able to resolve our current and contingent obligations. As a part of the winding up process, the Company will seek to identify, pay or make reasonable provision for the payment of all known valid current and contingent obligations and claims. If the Company cannot resolve such obligations and claims, the Company could be prevented from completing the Plan of Dissolution which would negatively impact the possibility of or the amount of future distributions;

We will continue to incur liabilities and expenses as we pursue the liquidation and winding up of the Company and such liabilities and expenses will reduce the amount available for any possible future distribution;

The governance of the dissolution and liquidation of the Company will be vested exclusively in one individual, the Liquidation Manager, which will be Richard E. Stoddard, our current President, Chief Executive Officer and Chairman of the Board of Managers. There will no longer be a Board of Managers and there will be no members’ meetings. Except for the covenants of good faith and fair dealing, all fiduciary duties of the Liquidation Manager will be eliminated upon approval of the New Operating Agreement; and

If a member knows that the Company has failed to create adequate reserves or to otherwise make reasonable adequate provision for its valid known and contingent obligations and claims, then any distribution received by such a member is subject to being repaid for a period of three years following the date of the distribution.

MINE RECLAMATION AND EAGLE MOUNTAIN LANDFILL PROJECT AND PENDING SALE

Description of the Eagle Mountain Site. Kaiser’s Eagle Mountain Site is located in the remote California desert approximately 200 miles east of Los Angeles, currently consistingconsists of approximately 10,800 acres, that contains three large open pit mines, the Eagle Mountain Townsite and a 52-mile private rail line that accesses the site. In 1988, Kaiser Eagle Mountain, Inc. (now Kaiser Eagle Mountain, LLC) leased what is now approximately 4,654 acres of the mine site and the rail line to MRC for development of a rail-haul solid-waste landfill. As discussed in more detail below,The lease between MRC and Kaiser Eagle Mountain, LLC, a wholly-owned subsidiary of Kaiser, as amended to date is often referred to as the amount and nature(“MRC Lease”). On October 30, 2011, MRC filed a voluntary petition for relief under Chapter 11 of the acreage owned and controlled atUnited States Bankruptcy Code. The MRC Lease may be assumed or rejected in the Eagle Mountain Site would change if the November 2009 U.S. 9th Circuit Court of Appeals decision affirming in part a 2005 U.S. District Court decision setting aside a land exchange completed between the Company and the BLM in October 1999 becomes the final decision and the land exchange is not successfully “fixed” through the BLM. We are seeking further review of the adverse U.S. 9th Circuit Court of Appeals decision by the U.S. Supreme Court and we are also evaluating a fix through the BLM of the three remaining issues identified by the U.S. 9th Circuit Court of Appeals.MRC bankruptcy.

In 1988, in anticipation of Southern California’s need for new environmentally safe landfill capacity, MRC began the planning and permitting for a 20,000 ton per day rail-haul, non-hazardous solid waste landfill at Kaiser’s Eagle Mountain Site. The landfill project received all the major permits and approvals required for siting, constructing, and operating the landfill project in 1999. We believe thatHowever, as discussed in

KAISER VENTURES LLC AND SUBSIDIARIES

more detail below, the Eagle Mountain SiteLandfill Project has many unique attributesbeen embroiled in extensive administrative challenges and state and federal litigation for over 20 years, with nearly $85 million having been spent by MRC in seeking to permit and defend the Landfill Project, of which make it particularly well-suited forapproximately $28.6 million has been spent since Kaiser became a rail-haul, solid waste landfill, including, among other attributes, its remote location, arid climate, available and suitable materials for the proposed liner system and daily cover, and rail access.member of MRC in 1995.

Acquisition of Our Ownership Interest in MRC. We initially acquired our interest in MRC in 1995, as a result of the withdrawal of MRC’s previous majority owner, a subsidiary of Browning Ferris Industries. Before and in connection with this withdrawal, Browning Ferris invested approximately $45 million in MRC. In 2000, Kaiser assigned all of the economic benefits of the MRC lease and granted an option to buy the landfill property to MRC in exchange for an increase in Kaiser’s ownership interest in MRC.MRC (the “MRC Option”). The MRC lease will terminate upon the sale of the landfill projectOption is currently scheduled to the District, assuming the sale is completed.

KAISER VENTURES LLC AND SUBSIDIARIES

expire March 29, 2013, if not extended by mutual agreement. We presently own 83.13%84.247% of MRC’s Class B Units and 100% of its Class A Units. See “Item 1. BUSINESS -BUSINESS—Mine Reclamation and Eagle Mountain Landfill Project and Pending Sale - Project—MRC Financing” below.

Pending SaleHistorical Landfill Project Litigation

State Litigation. After entering into the MRC Lease in 1988, MRC undertook activities including, but not limited to, negotiation and execution of a Memorandum of Understanding and Development Agreement with the County of Riverside (the “County”), preparation of an Environmental Impact Report (“EIR”)/Environmental Impact Study (“EIS”), numerous meetings and hearings with the Riverside County Planning Commission (the “Planning Commission”) and the Board of Supervisors of Riverside County (the “Board of Supervisors”), drilling and other field analysis to support environmental permit applications, and transportation and market development activities. On June 17, 1992, the Planning Commission recommended to the Board of Supervisors against approval of the Project. In September 1992, the Board of Supervisors held a series of public hearings regarding the Landfill Project and on October 6, 1992, the Board of Supervisors voted in favor of certain land use approvals required for the Landfill Project. On November 3, 1992, the Board of Supervisors officially adopted certain resolutions and ordinances certifying the EIR and the land use approvals for the Landfill Project.

Subsequent to the certification of the EIR in December 1992, three separate legal actions were commenced challenging the adequacy of the Project’s EIR as well as the review process leading to the Board of Supervisors’ approval of the EIR pursuant to the California Environmental Quality Act (“CEQA”). The legal actions were filed by local residents (Laurence R. and Donna J. Charpied), preservation groups and interested individuals (National Parks and Conservation Association, Eagle Mountain Landfill Opposition Coalition, City of Coachella, Steve W. Clute, Daniel S. Roman, and Richard M. Marsh), and the company that desires to use the Company’s property, a portion of which is covered by the MRC Lease, for a hydro-electric pump and storage project which company is now called Eagle Crest Energy Company (“ECEC”).

In June 1994, the San Diego County Superior Court issued a tentative ruling on the challenges to the EIR for the Eagle Mountain Landfill Project. Of the more than seventy areas of concerns initially raised by the plaintiffs in the cases, the Court announced that it had eight areas of concerns in which the EIR may be deficient and require future supplemental information and corrective action. After the Court’s tentative ruling, the Court held hearings on these legal challenges. On July 26, 1994, the Court issued its decisions in the cases which were adverse to the Landfill Project.

As a result of the San Diego Superior Court’s determinations, the Court set aside and declared void the Board of Supervisors’ certification of the EIR and all County approvals of the Project rendered in connection with the certification of the EIR, suspended permitting activities related to the development of the Landfill Project

Background.In August 2000, MRC entered into an agreement to sell and directed the landfill project to the District for $41 million. Under the termspreparation of that agreement, upon closing of the sale, $39 million of the total purchase price is to be deposited into an escrow account. This money would then be released to MRC on the resolution of certain litigation contingencies. Currently the only existing litigation contingency arises out of the federal litigation challenging the completed federal land exchange which is discussed below. Even though the closing has not taken placea new final environmental impact statement and these funds have not been deposited into an escrow account, interest began accruing on this portion of the purchase price on May 3, 2001. The remaining $2 million of the purchase price would also be placed into an escrow account upon closing and was originally to be released upon the later of (1) the release of the $39 million as described above or (2) the permitting approvals of the District’s Puente Hills landfill for its remaining 10 years of capacity which the District did receive. However, the District has received the necessary permits for the expansion of its Puente Hills landfill and thus, the full purchase price would be placed into escrow when the initial closing has occurred. As discussedreport in more detail in “Item 3. LEGAL PROCEEDINGS - Eagle Mountain Landfill Project Exchange Litigation,” on September 20, 2005, the U.S. District Court for the Central District of California, Eastern Division, issued an adverse decision in the federal land exchange litigation, which jeopardized the viability of the landfill project and its sale to the District. This decision was appealed to the U.S. 9th Circuit Court of Appeals. In November 2009 in a 2 to 1 decision, the panel majority upheld, in part, the U.S. District Court decision setting aside the land exchange. We are seeking further review of adverse U.S. 9th Circuit Court of Appeals decision by the U.S. Supreme Court but review by the Supreme Court is totally discretionary. This adverse decision, unless it is reversed by the U.S. Supreme Court or unless it is positively resolved by a fix through the BLM, will jeopardize the viability (i.e., the continued existence of) the current landfill project. Accordingly, receipt of the purchase price, in whole or in part, if at all, will continue to be delayed pending satisfactory resolution of these contingencies. At this time, we cannot estimate when or if ever the sale may be completed.

The sale of the landfill project is subject to the results of the District’s due diligence and satisfaction of numerous contingencies. The contingencies include, but are not limited to, obtaining the transfer of the landfill project’s permits to the District, obtaining all necessary consents to the transaction, resolving title matters, and negotiating mutually acceptable joint use agreements and resolution of the outstanding federal land exchange litigation. We have been working on resolving various title issues, obtaining necessary consents and otherwise working toward a closing. However, resolution of all remaining issues will not occur until and unless there is a positive decision at the U.S. Supreme Court level or positive resolution of the land exchange litigation by a fix through the BLM. Although the contractual expiration date is currently June 30, 2011, the date has already been extended numerous times. The conditions to closing are not expected to be met by the current expiration date,compliance with applicable law and the parties will individually determine whetherCourt’s conclusions.

MRC initially took steps to extendappeal the closing date one or more additional times. In addition, as discussedCourt’s 1994 adverse decision. However, in more detail below,late 1994 the adverse litigation involvingBoard of Supervisors voted not to appeal the federal land exchange, may impactCourt’s decisions. As a result, the sale ofCounty took the landfill project to the District. There is no assurance or requirement that either party will continue to extend the closing date for the proposed sale of the landfill project. See “Item 1. BUSINESS - Eagle Mountain Landfill Project and Pending Sale - Risks Factors” for a more detailed discussion of some of the material risk factors facing the landfill project and its sale.

Flood Damage to Railroad

The Company owns an approximate 52-mile private railroad that runs from Ferrum Junction near the Salton Sea to the Eagle Mountain mine. In late August and early September of 2003, portions of the railroad and related protective structures sustained considerable damage due to heavy rains and flash floods. This damage included having some rail sections being buried under silt while other areas hadsteps

KAISER VENTURES LLC AND SUBSIDIARIES

their rail bed undermined. In 2005 we conductednecessary to vacate the entitlements previously granted by the County to MRC in compliance with the Court’s decisions. Even though MRC initially took steps to appeal the Court’s decisions, MRC later determined that it would be in its best interest to focus its efforts on a more complete investigationnew EIR/EIS and permitting the Landfill Project. Accordingly, MRC dropped all of its appeals.

While MRC had dropped its appeals in favor of focusing on the re-permitting, three issues were appealed by the plaintiffs. After ECEC dropped its appeal of the damage anddenial of its attorney’s fees, the remaining issues that were appealed were resolved in favor of the costs to returnCompany. In early 1996, the railroadappeals court affirmed the trial court’s findings on the three issues that were favorable to the condition that it was in priorCompany.

Prior to the flood damage. Asadverse decisions of the San Diego Superior Court, MRC had received from a resultvariety of that investigation, we estimated thatfederal, state and local regulatory agencies 17 of the cost to repair the damage to be a minimum of $4.5 million for which an accrual has been made. Since the 2003 floods, work20 technical and environmental permits necessary to help preserveconstruct and protectoperate the existing railroad has been undertaken. However, the major repairs required to return the railroad to its condition prior to the flood damage will be deferred until a later date or until there is another project at Eagle Mountain that warrants such repairs.

MRC Financing

SinceProject. In 1995, MRC has been funded through a series of private placements to its existing equity holders. As a result of prior MRC private placements and in exchange for releasing the economic benefits of the lease with MRC and granting MRC the option to acquire the landfill project site for $1.00, we have increased our original 70% ownership interest in MRC acquired in 1995 to 83.13%. During the fourth quarter of 2010, MRC borrowed $500,000 from Kaiser Ventures to cover its ongoing expenses. The unsecured loan accrues interest at the rate of 6.0% per annum. The principal amount of such loan together with all accrued and unpaid interest is convertible into MRC units at the per unit price determined in the next private placement. MRC will likely undertake a private placement during the second quarter of 2011. The price and terms of such private placement have yet to be established by MRC. In addition to ongoing expenses, future funding would also be required for any fix through the BLM. Additionally, if the current federal land exchange litigation is resolved in a positive manner, additional future funding will be necessary to complete the sale to the District and to complete necessary railroad repairs.

Current Status

Approval by Riverside County of the Landfill Project; Development Agreement. Between 1992 and 1995, MRC faced legal challenges to its application and receipt of regulatory permits and consents required to operate the landfill project. In March 1995, MRC again initiatedre-initiated the necessary permitting process by filing its land use applications with Riversidethe County and working with the County and U.S. Bureau of Land Management, referred to as the BLM in securing the certification and approval of a new environmental impact report, or an EIR. After extensive public comment, the new EIR was released to the public in January 1997, and received final approval from the RiversideCounty Board of Supervisors in September 1997. In connection with the final approval of the landfill project by Riverside County, MRC agreed to indemnify the County from any lawsuit to which the County may become a party as a result of the approval of the landfill project. This indemnity agreement is secured by a $500,000 letter of credit. Riverside County is not currently a party to any landfill related litigation.

As a part of the process of considering the landfill project, Kaiser and MRC negotiated a Development Agreement with Riverside County. The Development Agreement provides the mechanism by which MRC acquires long-term vested land-use rights for a landfill and generally governs the relationship among the parties to the Agreement. The Development Agreement also addresses such items as the duties and indemnification obligations to Riverside County; the extensive financial assurances to be provided to Riverside County; the reservation and availability of landfill space for waste generated within Riverside County; and events of default and remedies, as well as a number of other items.

In addition, the financial payments to or for the benefit of Riverside County and others are detailed in the Development Agreement as well as in the Purchase and Sale Agreement, which forms a part of the Development Agreement. The Purchase and Sale Agreement requires a per ton payment on non-County waste determined from a base rate which is the greater of $2.70 per ton or ten percent (10%) of the landfill tip fee up to 12,000 tons of non-County waste. The 10% number increases to 12 1/2% for all non-County waste in excess of 12,000 tons per day. The per ton payment to the County also increases as

KAISER VENTURES LLC AND SUBSIDIARIES

volume increases. The per ton payments on non-County Waste to Riverside County are summarized as follows:

|

| |

| ||

| ||

| ||

| ||

|

Of the payments made to Riverside County by MRC on non-County municipal solid waste, $.90 of the per ton payment will be deposited into an environmental trust. In addition, MRC directly pays $.90 per ton into the environmental trust for in-County waste deposited into the landfill. Funds in the environmental trust are to be used within Riverside County for: (a) the protection, acquisition, preservation and restoration of parks, open space, biological habitat, scenic, cultural and scientific resources; (b) the support of environmental education and research; (c) the mitigation of the landfill project’s environmental impacts; and (d) the long term monitoring of the above mentioned items.

Finally, MRC has agreed to pay $.10 per ton of municipal solid waste deposited into the landfill to the National Parks Foundation for the benefit of the National Park Service.

Other major payments include: (i) partial funding for up to four rail crossings with $1 million due upon the occurrence of the earlier of: (a) the commencement of landfill construction; or (b) under certain circumstances, within 90-days of the execution of the Development Agreement between Riverside County and MRC; (ii) an additional $1 million for upgrading rail crossings is to be paid over the course of landfill operations; (iii) financial assistance of approximately $2 million for the host community, Lake Tamarisk, comprised of $500,000 due at the commencement of construction of the landfill plus approximately $1.5 million due over the course of landfill operations; and (iv) funding for the non-California Environmental Quality Act reduction air emission programs of $600,000 over the course of operations.

The initial term of the Development Agreement is fifty years, although it may be extended to November 30, 2088, under certain conditions. The Development Agreement allows the landfill project to receive up to 20,000 tons per day, 6 days a week, of non-hazardous municipal solid waste. However, during its first ten years of operation, the landfill owner is limited to 10,000 tons per day of non-County waste plus the waste generated from within the County. After ten years, the owner of the landfill may request an increase in its daily tonnage, and an independent scientific panel will review such request. The panel’s review is effectively limited to confirming substantial compliance with all developmental approvals, mitigation measures and permits.

The Development Agreement will be effective with the resolution of Kaiser’s ownership of the land which is the subject of the current federal land exchange litigation. We anticipate that the Development Agreement will be fully executed and recorded just prior to the anticipated closing of the sale of the landfill project. Riverside County has approved the assumption of the Development Agreement by the District as part of the sale of the landfill by MRC.

Successful Appeal of State EIR Litigation.After the September 1997 approval of the new EIR for the landfill project,Landfill Project by the Board of Supervisors, litigation with respect to MRC’s EIR certification resumed. In February 1998 the San Diego County Superior Court issued a final ruling with respect to this second round of EIR litigation, finding that the EIR certification did not adequately evaluate the landfill project’sLandfill Project’s impact on the Joshua Tree National Park and

KAISER VENTURES LLC AND SUBSIDIARIES

the threatened desert tortoise. KEM, MRC Kaiser and Riversidethe County appealed the Superior Court’s decision; opponents did not appeal.

On May 7, 1999, the Court of Appeal announced its decision to completely reverse the San Diego Superior Court’s prior adverse decision. The Court of Appeal’s decision, in effect, reinstated the EIR certification and reinstated the previous approval of the landfill projectLandfill Project by Riversidethe County. In June 1999, opponents to the landfill projectLandfill Project requested that the California Supreme Court review and overturn the Court of Appeal’s decision. In July 1999, the California Supreme Court declined to review the Court of Appeal’s decision.

Federal Land Exchange Litigation and Other Threatened Litigation. In October 1999, Kaiser’s wholly owned subsidiary, Kaiser Eagle Mountain, Inc. (now Kaiser Eagle Mountain, LLC),KEM completed a land exchange with the BLM. In this exchange, KaiserKEM transferred approximately 2,800 acres of Kaiser-ownedKEM-owned property along its railroad right-of-way to the BLM and a nominal cash equalization payment in exchange for approximately 3,500 acres of land within the landfill project area. The land exchanged by KaiserKEM was identified as prime desert tortoise habitat and was a prerequisite to completion of the permitting of the landfill project. With the land exchange completed, the Eagle Mountain Site consists of approximately 10,108 acres with 8,636 acres held in fee (which includes the Eagle Mountain Townsite) and approximately 1,472 acres held as various mining claims.Landfill Project. The land exchange also involved the grant of two rights-of-way by the BLM and the termination of a reversionary interest involving approximately 460 acres of the Eagle Mountain Townsite that was contained in the original grant of such property.

Following completion of the land exchange, two lawsuits were filed in the U.S. District Court for the Central District of California, Eastern Division challenging itthe land exchange and requesting its reversal. The plaintiffs argueargued that the land exchange should be reversed because the BLM failed to comply with the National Environmental Policy Act and the Federal Land Management Policy Act. Nearly three years after the final brief in the case was filed, on September 20, 2005, the U.S. District Court for the Central District of California, Eastern Division, issued its opinion in the case.opinion. The decision was adverse to the landfill projectLandfill Project in that it set aside“set aside” the land exchange completed between the CompanyKEM and BLM as well as two BLM rights-of-way. The Company along with the U.S. Department of Interior appealed the decision to the U.S. 9th Circuit Court of Appeals. The briefing for the appeal was completed in 2007 and oral argument was heard before a three judge panel on December 6, 2007.

On November 10, 2009, a three-judge panel of the U.S. 9th Circuit Court of Appeals issued its decision in the Company’s land exchange litigation and landfill project appeal. In a 2 to 1 decision the

KAISER VENTURES LLC AND SUBSIDIARIES

majority opinion was adverse to the Eagle Mountain landfill projectLandfill Project in that it upheld portions of the prior U. S. District Court decision setting aside the completed land exchange. The majority opinion found that: (i) the discussion of eutrophication (the introduction of nutrients, in this case primarily nitrogen, as a result of the landfill) was not adequately organized in the EIS; (ii) the statement of purpose and need for the project was unduly narrow resulting in an inadequate analysis of a reasonable range of alternatives to the proposed land exchange; and (iii) there was an inadequate appraisal of the lands in the land exchange due to the failure of the “highest and best use” analysis to take into account the probable use of the public lands as a landfill. Accordingly, subject to reversal on appeal, we may address these remaining issues by appropriate supplemental environmental and other documentation through the BLM. A 50-page dissenting opinion was filed. The dissenting judge found in the Company’s favor on all issues involving the land exchange and landfill project.

Both the panel majority and dissent concluded that the U.S. District Court was in error with regard to the bighorn sheep issue because there was substantial evidence in the record that bighorn sheep had been appropriately studied and analyzed. In addition, the majority and dissent also rejected a cross appeal of various environmental matters, finding that the agency’s analysis and explanation complied with applicable law for: (i) noise; (ii) night lighting; (iii) desert tortoise; (iv) groundwater; (v) air quality; and (vi) visual impacts relating to Joshua Tree National Park.

KAISER VENTURES LLC AND SUBSIDIARIES

Landfill Project.

We sought further review of the adverse U.S. 9th Circuit Court of Appeals decision by a broader panel of judges from the U.S. 9th Circuit Court of Appeals but the request for an en banc hearing by the U.S. 9th Circuit Court of Appeals was denied on July 30, 2010. In October 2010 we filed a petition with the U.S. Supreme Court asking the Court to review the decision of the U.S. 9th Circuit Court of Appeals. Whether such further review is granted is totally discretionary with the court. We anticipate an announcement of whetherOn March 28, 2011, the U.S. Supreme Court willdeclined to accept our appeal. On May 10, 2011, the U.S. District Court issued its order remanding the actions “to the BLM for proceedings consistent with the Ninth Circuit’s May 19, 2010 amended opinion.” With the decision of the U.S. Supreme Court not to hear the appeal will be made no later thanof the endadverse decision of May 2011. If the current U.S. 9th Circuit Court of Appeals, decisionthere is not reversed byno longer any pending litigation and the U.S. Supreme Court or if the land exchangeadverse federal litigation is not successfully fixed through the BLM, such decision would jeopardize the viabilityfinal and fully concluded as no further appeals are available.

Previously Anticipated Sale of the current landfill project. Landfill Project

In addition, such failure to positively resolve the land exchange litigation could adversely impact theAugust 2000 MRC entered into an agreement to sell the landfill projectLandfill Project to the District including terminationfor $41 million. The agreement for the sale of the Landfill Project was modified so that the purchase price began accruing interest in May 2001. The closing date under the Landfill Project Sale Agreement had been extended numerous times since December 31, 2000, pursuant to written extension agreements between MRC and the District. Under each of those extension agreements, the District had the right to either purchase the Landfill Project in its “as is” condition or to terminate its Landfill Project Sale Agreement with MRC. The last extension of the closing date under the Landfill Project Sale Agreement was set to expire on October 31, 2011. The then Chief Engineer and General Manager of the District in October 2011 had indicated that the District was not intending to proceed with the purchase of the Landfill Project. He later communicated that the District would be purchasing the Landfill Project on October 31, 2011. The District subsequently repudiated in writing the terms of the last extension agreement, and would likely result inthreatened to sue MRC to, among other things, compel MRC, at MRC’s sole expense and risk, to further impairmentproceed with the permitting of the Company’s investmentlandfill which would involve substantial additional financial resources and time, neither of which MRC had. Thus, MRC filed for bankruptcy protection on October 30, 2011, in federal bankruptcy court in Riverside County, California in order to preserve and protect its assets and options with respect to such assets.

Damage to Railroad

The Company owns an approximate 52-mile private railroad that runs from Ferrum Junction near the Salton Sea to the Eagle Mountain mine. The Eagle Mountain railroad is not abandoned. In late August and early September of 2003, portions of the railroad and related protective structures sustained considerable damage due to heavy rains and flash floods. This damage included having some rail sections being buried under silt while other areas had their rail bed undermined. In 2005 we conducted a more complete investigation of the damage and of the costs to return the railroad to the condition that it was in prior to the flood damage. As a result of that investigation, we estimated that the cost to repair such flood damage to be a minimum of $4.5 million for which an accrual has been made. Since the 2003 floods additional damage has been sustained by the railroad and in the landfill project. Iffall of 2011 the appealUnion Pacific Railroad removed the track and switching facilities at Ferrum Junction which is the location at which the Eagle Mountain railroad connects to the U.S. Supreme Courtmainline of the Union Pacific Railroad. There have also been attempts to steal portions of the railroad for scrap value. MRC is obligated to repair and maintain the railroad under the terms of the MRC Lease. Kaiser and MRC are evaluating what actions should be taken against Union Pacific Railroad as a result of Union Pacific’s actions. At this time, the major repairs required to return the railroad to its condition prior to the flood damage will be deferred until a later date or until there is another project at Eagle Mountain that warrants such repairs.

KAISER VENTURES LLC AND SUBSIDIARIES

MRC Financing

Since 1995 MRC has been funded through a series of private placements to its existing equity holders. As a result of prior MRC private placements and in exchange for releasing the economic benefits of the lease with MRC and granting MRC the option to acquire the landfill project site for $1.00, we have increased our original 70% ownership interest in MRC acquired in 1995 to 84.247%. A private placement for $1,300,000 was completed during the third quarter of 2011 in which Kaiser invested $1,146,344 increasing our ownership interest to the current 84.247%. Kaiser has made the determination that it will not successful, we may seek to resolvemake additional equity investments in MRC for the purpose of pursuing a “fix” of the federal land exchange litigation by pursuingexchange. While Kaiser will not be providing additional funding to MRC for the purpose of pursing a fix through“fix” of the BLM.

In addition to the federal land exchange, litigation,Kaiser is in the Company has been threatened from timeprocess to timeproviding MRC with additional litigationa line of credit currently in the amount of up to $500,000 (which could be increased up to $1,000,000) in order to fund certain activities to complete the MRC bankruptcy process. Draws under the line of credit would be completely in the discretion of Kaiser and bear interest at the rate of five percent (5%) per annum. Kaiser’s loan will not be secured but will be an administrative claim against the MRC bankruptcy estate meaning that it will have priority in payment over unsecured claims in the landfill project involving such matters as the federal Endangered Species Act. However, asbankruptcy. Without a sale of any assets that MRC may have, there is a substantial risk that this loan will not be fully repaid.

MRC Assets and Bankruptcy.As of the date of the filing of this Annual Report on Form 10-K, nonethe primary assets of MRC consist of the previous threats have resultedMRC Lease, the MRC Option and certain landfill related permits and approvals. MRC is in default of certain of its obligations under the MRC Lease such as maintaining and repairing the Eagle Mountain railroad. The MRC Option currently expires March 29, 2013.

As previously noted, MRC filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code in the commencementUnited States Bankruptcy Court for Central District of California, Riverside Division, bankruptcy case number 6:11-bk-43596 (the “Bankruptcy Court”). MRC will continue to operate its business as a legal action against“debtor in possession” under the Company.jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code, Rules and orders of the Bankruptcy Court. As part of the proceedings in Bankruptcy Court, MRC will need to develop a plan of reorganization which will include decisions regarding the status of the MRC Lease, the MRC Option and the Landfill Project Sale Agreement, among other things. It is possible that the Landfill Project will continue in some form as a result of the reorganization of MRC or the sale of certain of MRC’s assets.

Write-down of Investment in Eagle Mountain Landfill Project. In accordance with the requirements of generally accepted accounting principles (“GAAP”), we wrote down the carrying cost of the investment in the Landfill Project on our financial statements effective June 30, 2010, and again effective as of March 31, 2011. For additional information, see “Part II.—Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS—OPERATING RESULTS—Write-Down of Investment in Eagle Mountain Landfill.” With the write downs in 2010 and in 2011, the total investment associated with the Landfill Project has been written down to $13,843,000. As future events unfold with regard to MRC, the Company will continue to evaluate if further write-downs may be necessary or appropriate.

Eagle Crest Energy Company. Eagle Crest Energy Company, referred to as ECEC, one of the original opponents to the landfill project, is pursuing a license from the Federal Energy Regulatory Commission, referred to as FERC, for a proposed 1,300 mega-watt hydroelectric pumped storage project and ancillary facilities. The proposed ECEC project would utilize two of the mining pits and other property at the Eagle Mountain Site, that we own. The land on which the landfillproposed lower reservoir for ECEC’s proposed project is located ison land currently leased to MRC and is under contractthe subject of the MRC Option Agreement. We continue to be sold tobelieve that any landfill project and the District. The landfill projectresumption of large-scale mining would be adversely impacted by the ECEC project. ECEC has been pursuing this project off and on for nearlyover 20 years. The Company has not agreed to sell or lease this property to ECEC. We,ECEC and we, along with others, object to the ECEC project. The ECEC project is not compatible with the landfill project regardless of claims to the opposite by ECEC. Additionally, ECEC’s project would not be compatible with the resumption of large-scale mining at the Eagle Mountain Site. ECEC has filed for a necessary water quality certification from the State of California. In connection with ECEC seeking such water

KAISER VENTURES LLC AND SUBSIDIARIES

quality certification, a draft environmental impact report was released in July 2010.2010 and a draft final environmental impact report was released in January 2013. ECEC also filed its final license application with FERC in 2009. In January 2010 FERC determined that ECEC’s license application was ready for environmental review and in December 2010 a draft environmental impact statement was released by FERC evaluating the environmental impacts and the economics of the proposed project. Additionally, the draft environmental impact statement contained the recommendation of FERC’s staff that the project be licensed by FERC. Both the stateA final environmental impact report and the federal impact statement received extensive comments from Kaiser, the District, the U.S. Department of Interior and various environmental groups.was released by FERC on January 30, 2012.

If the project receives its water quality certification, it is likely that the grant of such certification will result in litigation. We understand that any grant of a water quality certification for ECEC’s project may occur in March or April 2013. Similarly, if the project is licensed by FERC, it is likely that litigation will be commenced over the issuance of the license. Finally, ifIf the project is licensed by FERC it is likely that additional and separate litigation will resultbe initiated by the Company over whether ECEC canactually has the authority to take our landproperty by eminent domain pursuantgiven the unique nature of ECEC’s project being located in the desert without any existing water way. Even if it is ultimately determined that ECEC would have the right to the Federal Power Act andeminent domain under applicable law, there will be litigation to determine the amount of damages payable to us and others as a result of ECEC’s actions for its private benefit. There may also be adversarial proceedings involving ECEC in MRC’s bankruptcy. ECEC has already filed a suit seeking a request for a declaratory judgment in MRC’s bankruptcy seeking a determination that MRC’s bankruptcy will not prevent ECEC from exercising any eminent domain authority it may have if it received a license from FERC. ECEC’s lawsuit was dismissed by the Bankruptcy Court, without prejudice.

If the completed land exchange is ultimately and permanently reversed, in accordance with the September 2005 U.S. District Court decision as affirmed in part by the U.S. 9th Circuit Court of Appeals and if the land exchange is not successfully “fixed” through the BLM, certain lands currently owned in fee by Kaiser will revert back to federal lands, although a substantial amount of such lands will then be controlled by Kaiser because of its federal mining claims. As a result of any final reversal to federal ownership, the federal land may be subject to a title encumbrance resulting from the issuance of the

KAISER VENTURES LLC AND SUBSIDIARIES

preliminary permit to ECEC by FERC but Kaiser would continue to own in fee the mining pits that are critical to ECEC’s project.

Risk Factors

As discussed in this Annual Report on Form 10-K, there are numerous risks associated with MRC and the landfill project.Landfill Project. The landfill projectLandfill Project has been and continues to be the subject of extensive litigation. MRC was ultimately successful in the state litigation which hasin defending the Land Project, its permits and will continuestate and local approvals. However, the federal litigation challenging a completed federal land exchange was ultimately resolved adverse to substantially delay the landfill project and which could ultimately leadLandfill Project with the U.S. Supreme Court’s denial in March 2011 of our petition to termination ofreview the landfill project. The adverse U.S. 9th Circuit Court of Appeals decisiondecision. With the adverse federal litigation involving the completed land exchange substantially increases the likelihood of these risks. If the current adverse land exchange litigation is not favorably resolved by an appeal that is heard by the U.S. Supreme Court or otherwise favorably resolved by a fix throughwith the BLM concluded, the landfill projectbankruptcy of MRC and the adverse actions of the District, the Company has determined that it would not invest further in MRC to pursue a “fix” of the land exchange. While the Company has determined that it will not be viable as currently permitted. Accordingly, ifinvest further money in MRC to “fix” the land exchange litigation is not ultimately favorably resolved and/for purposes of a landfill other third parties could fund or acquire the Company cannot otherwise cure various alleged title and other closing issues in a timely fashion, then the District’s purchase of the landfill project would not be completed and the Company might have to abandon Eagle Mountain and its investment in MRC. The adverse U.S. 9th Circuit Court of Appeals decision materially increases the possibility of such scenario. If this should occur, the Company may seekright to pursue other possible opportunities at the Eagle Mountain site or it may modify the existing proposed landfill project. There is also the risk that the District and MRC would not mutually agree to extend the closing date for the sale of the landfill project.Landfill Project.

In addition, to the litigation and other closing risks, there are risks of the loss of certain critical Landfill Project permits due to the passage of time. The landfill project is also subject to being impacted by natural disasters like the floods that caused significant damage to the rail line in 2003. Certain risks may be uninsurable or are not insurable on terms which we believe are economical.

The ECEC pumped storage project is also a risk to MRC and the successful completion of the landfill projectLandfill Project (as well as to other projects at the Eagle Mountain Site) and significant expenditures are anticipated to be incurred in opposition to this potential project.

As discussed above, MRC will need significant additional funding for ongoing operations, to complete any fix through the BLM and to close the sale of the landfill project to the District.funding. There is no assurance that MRC will be funded in the future.future although we are providing MRC a line of credit of up to $500,000 (which could be

The landfill project also faces competition from other landfills as well as

KAISER VENTURES LLC AND SUBSIDIARIES

increased to $1 million) to complete its bankruptcy but funding of any draw requests is at the Mesquite rail-haul landfill project which the District owns and is developing.

We are also dependent upon the continued services of our executive officers given the complex naturecomplete discretion of the landfill project, the challenges it faces, and the importance of historical information. The loss of the services of our executive officers, especially without advance notice, could materially and adversely impact this project and well as our other business.Company

WEST VALLEY MATERIALS RECOVERY FACILITY AND TRANSFER STATION

Background

West Valley MRF, LLC, referred to as “West Valley,” was formed in June 1997 by Kaiser Recycling, Inc. (now Kaiser Recycling, LLC), a wholly-owned subsidiary of Kaiser, and West Valley Recycling & Transfer, Inc., a wholly-owned subsidiary of Burrtec Waste Industries, Inc. This entity was formed to construct and operate thea materials recovery facility referred to as the West Valley MRF. Under the termsMRF located on property that was a part of the parties’ business arrangements, Kaiser Recycling and Kaiser remain responsible for any pre-existing environmental conditions and West Valley MRF is responsible for environmental issues that may

KAISER VENTURES LLC AND SUBSIDIARIES

arise related to any future deposit or release of hazardous substances. Kaiser and Burrtec have each separately guaranteed the prompt performance of their respective subsidiary’s obligations.

The West Valley MRF includes an approximate 140,000 square foot building, sorting equipment and related facilities for waste transfer and recycling services. The facility is permitted to handle 7,500 tons of municipal solid waste and recyclable materials per day. As part of its recyclable operations, the West Valley MRF processes for sale in the commodities markets certain materials, including paper, cardboard, aluminum, plastic and glass. West Valley MRF is currently processing, approximately 2,600 - 3,000 tons of municipal solid waste and recyclable materials per day. This processing level is significantly less than in previous years primarily due to the lingering adverse impacts of the worldwide economic recession. The West Valley MRF generates cash flow in excess of that necessary to fund its cost of operations and, therefore, has historically has been able to distribute cash to cover a portion of Kaiser LLC’s general and administrative costs.former KSC steel mill site. In 2010,2012, the West Valley MRF distributed a total of $1.25 million$750,000 in cash to Kaiser.

The Operating Agreement forKaiser prior to the West Valley MRF provides the opportunity for either Burrtec or Kaiser to buy the other party’ssale of Kaiser’s indirect ownership interest in the WVMRF in April 2012 which is discussed immediately below.

Sale of Ownership Interest.On April 2, 2012, Kaiser LLC, Kaiser Recycling, Burrtec Waste Industries (“Burrtec”) and West Valley MRF at fair market valueRecycling & Transfer, Inc. (“Buyer”), a wholly owned subsidiary of Burrtec, entered into that certain Purchase Agreement (the “Purchase Agreement”) whereby Kaiser Recycling sold its ownership interest in WVMRF, LLC to Buyer. The sale transaction closed on the same day as the Purchase Agreement was entered into by the parties to the agreement. Kaiser Recycling sold its ownership interest in WVMRF, LLC for a gross cash sales price of approximately $25,769,000. The Company recorded a gain of $20,588,000 in the event onesecond quarter of 2012. The Company’s guaranty of the parties desiresoutstanding California Pollution Control Finance Authority bonds used to accept an offer to buy its interest in the West Valley MRF; in the event of default by a party under the Agreement that is not cured within a specified time period or; in some circumstances, in the event there is a proposed transfer or deemed transfer. For example, a change in the control of Kaiser to a company that is in the waste management business could trigger Burrtec’s option to purchase our interest in the West Valley MRF.

Financing

Mostfinance many of the financing for theimprovements at West Valley MRF was obtained through California Pollution Control Financing Authority tax exempt bonds. Approximately $9.5 million in bonds were issued in June 1997. These bonds were for Phase 1terminated. However, existing environmental obligations and agreements of the West Valley MRF which consisted of a 62,000 square foot building, sorting equipmentCompany and ancillary facilities. Approximately $8.5 million in bonds were issued in May 2000 which was for Phase 2 of the West Valley MRF which consisted of an 80,000 square foot facility expansion and new sorting equipment. The interest rate for the bonds varies weekly. The rates for 2010 ranged from approximately 0.3% to 0.5%. Due to adverse economic conditions during 2010 the interest rates on the bonds were at historic low levels. Bonds issued for Phase 1 have a stated maturity date of June 1, 2012, and bonds issued for Phase 2 have a stated maturity date of June 1, 2030, although West Valley MRF is required, pursuant to an agreement with Union Bank, to periodically redeem a portion of the bonds.

The bonds are secured by a pledge and an assignment of the loan payments made by West Valley MRF and funds that may be drawn on an irrevocable direct pay letter of credit issued by Union Bank of California, N.A. The bonds are backed by a letters of credit issued by Union Bank. The letter of credit for the 1997 Phase 1 bonds is currently scheduled to expire June 30, 2011 and the letter of credit for the 2000 Phase 2 bonds is also currently scheduled to expire June 30, 2011. Union Bank has expressed that it currently intends to extend these letters of credit. In the event the letters of credit are not extended for any reason, payment of the bonds could be accelerated. Kaiser and Burrtec have each severally guaranteed fifty percent (50%) of the principal and interest on the bonds to Union Bank in the event of a default by West Valley MRF.

In 2007 West ValleyRecycling benefiting WVMRF, LLC, Buyer and Union Bank modified the bank’s repayment schedule for the bonds. Itremain in place and an escrow of $363,000 was agreed that the then required accelerated principal repaymentsestablished as a part of the indebtedness could be modified in accordance with the original issuance terms of the respective bond issues. As a result, the maturity date of the Phase 2 bonds has been extendedsale transaction to 2030.

As of December 31, 2010, the principal amount of bonds outstanding totaled approximately $6,450,000.

KAISER VENTURES LLC AND SUBSIDIARIES

West Valley MRF and Union Bank executed a Reimbursement Agreement in 2000 that, among other things, sets the terms and conditions whereby West Valley MRF:

is required to repay Union Bank in the event of a draw under the letter of credit;

grants Union Bank certain security interests in the income and property of West Valley MRF;

agrees to a schedule for the redemption of the Bonds; and

agrees to comply withprovide certain financial assurances that we estimate will be sufficient to cover any future environmental obligations, particularly with respect to the Tar Pits Parcel located next to the WVMRF. This amount was charged against the Company’s environmental reserve which provided for such specific environmental expenses. Subsequently, an insurance policy covering certain possible contingent environmental and other covenants.

Kaiserrelated events that could arise and impact the WVMRF, LLC and others was purchased by Kaiser Recycling have also provided environmental guaranty agreementsduring the second quarter to Union Bank. Undercover certain of these agreements, Kaiser and Kaiser Recycling are jointly and severally liable for any liability that may be imposed on Union Bank for pre-existing environmental conditions on the West Valley MRF’s property acquired from Kaiser Recycling that the West Valley MRF fails to timely address.

Competition

Burrtec operates a transfer and materials recovery facility in Agua Mansa, California. This facility is located approximately 15 milesexposures. The policy premium of $113,621 was paid from the West Valley MRFescrow account. (See also, “Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION—Section 2: Liquidity and competes for certain waste that might otherwise go to the West Valley MRF. West Valley MRF monitors such waste to ensure that it receives its appropriate share of such waste from the “territory” agreed upon between Burrtec and Kaiser. Burrtec also controls materials recovery facilities in Victorville, California and in the Coachella Valley of California, which are generally not considered to be competitors of the West Valley MRF. Other entities have from time to time proposed to develop materials recovery facilities that would serve the same broad geographic area as that served by West Valley. There is one small materials recovery facility operating in Colton and two other transfer and materials recovery facilities are currently being proposed that could, if built, be competitors for certain of the waste now processed by the West Valley MRF. One such new facility would be in the City of Pomona and the other facility would be in the City of San Bernardino. Such competition would likely adversely impact the volume and profitability of the waste processed at West Valley. Neither facility has been permitted or built as of December 31, 2010.