SECURITIES AND EXCHANGE COMMISSION

(Mark One)

x |

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20112014 |

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 1-8968

ANADARKO PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 76-0146568 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1201 Lake Robbins Drive, The Woodlands, Texas 77380-1046

(Address of principal executive offices)

Registrant’s telephone number, including area code(832) 636-1000 Securities registered pursuant to Section 12(b) of the Act:

| |

| | |

| Title of each class | | | | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | | | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes xý No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No xý Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xý No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site,website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes xý No ¨ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer x

| | Accelerated filer ¨ | | Non-accelerated filer ¨

| | Smaller reporting company ¨ |

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No xý The aggregate market value of the Company’s common stock held by non-affiliates of the registrant on June 30,

20112014, was

$38.1$55.3 billion based on the closing price as reported on the New York Stock Exchange.

The number of shares outstanding of the Company’s common stock at January 31, 2012,30, 2015, is shown below: |

| | |

| Title of Class | | Number of Shares Outstanding |

| Common Stock, par value $0.10 per share | | 498,427,854506,650,285 |

| | |

Part of

Form 10-K

| | Documents Incorporated By Reference |

Part III

| | Portions of the Proxy Statement for the Annual Meeting of Stockholders of Anadarko Petroleum Corporation to be held May 15, 2012 (to be filed with the Securities and Exchange Commission prior to April 5, 2012).

|

Documents Incorporated By Reference

Portions of the Proxy Statement for the Annual Meeting of Stockholders of Anadarko Petroleum Corporation to be held May 12, 2015 (to be filed with the Securities and Exchange Commission prior to April 2, 2015), are incorporated by reference into Part III of this Form 10-K.

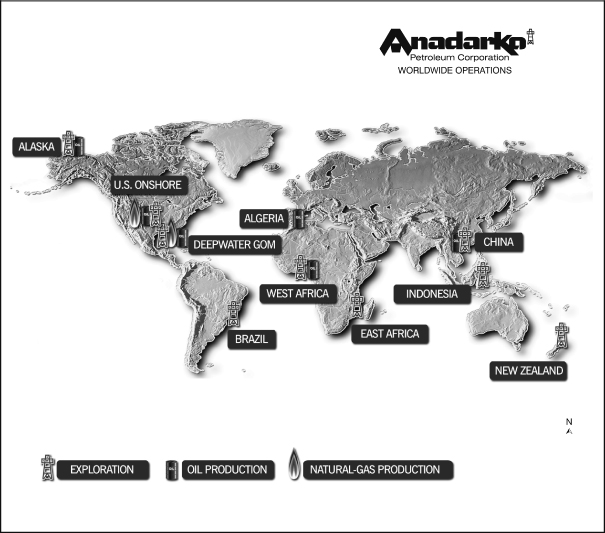

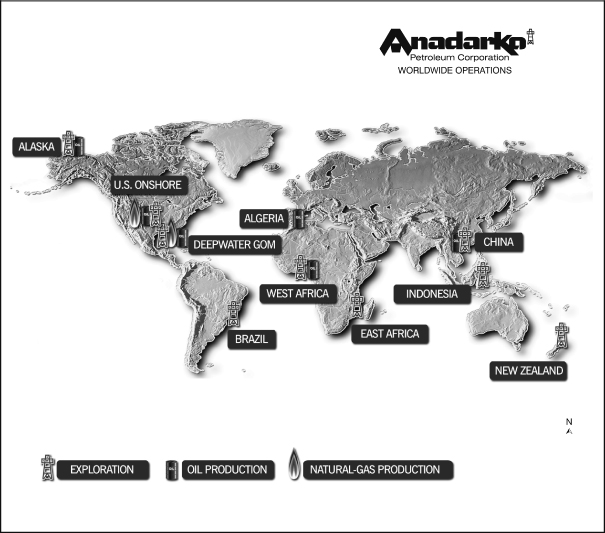

Items 1 and 2. Business and Properties

Anadarko Petroleum Corporation is among the world’s largest independent exploration and production companies, with over 2.5approximately 2.9 billion barrels of oil equivalent (BOE) of proved reserves at December 31, 2011.2014. Anadarko’s mission is to deliver a competitive and sustainable rate of return to shareholders by exploring for,developing, acquiring, and developingexploring for oil and natural-gas resources vital to the world’s health and welfare. Anadarko’s asset portfolio is aimed at delivering long-term value to stakeholders by combining a large inventory of development opportunities in the United StatesU.S. onshore with high-potential worldwide offshore exploration and development activities. Anadarko’s asset portfolio includes

positions inU.S. onshore resource plays in the Rocky Mountains

region,area, the southern United States,

and the Appalachian

basin.basin, and Alaska. The Company is also among the largest independent producers in the deepwater Gulf of Mexico, and has

productionexploration and

explorationproduction activities worldwide, including

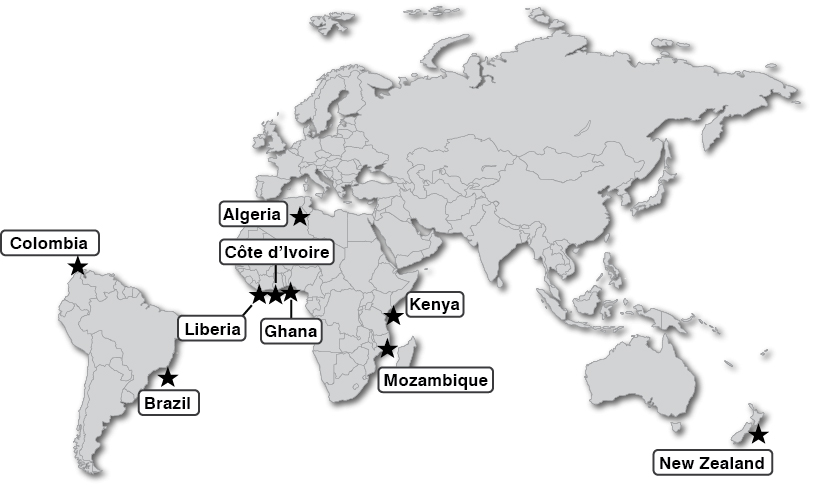

positionsactivities in

high-potential basins located in EastMozambique, Algeria, Ghana, Brazil, Colombia, Côte d’Ivoire, Kenya, Liberia, New Zealand, and

West Africa, Algeria, China, Alaska, and New Zealand.other countries.

Anadarko is committed to producing energy in a manner that protects the environment and public health. Anadarko’s focus is to deliver resources to the world while upholding the Company’s core values of integrity and trust, servant leadership,

commercial focus, people and passion,

commercial focus, and open communication in all business activities.

Anadarko’s

primary business segments are managed separately due to distinct operational differences and unique technology,

and distribution, and marketing requirements. The Company’s three reporting segments are as follows:

Oil and gas exploration and production—This segment explores for and produces natural gas, crude oil, condensate, and natural gas liquids (NGLs)., and plans for the development and operation of the Company’s liquefied natural gas (LNG) project.

Midstream—This segment providesengages in gathering, processing, treating, and transportation services totransporting Anadarko and third-party oil, natural-gas, and natural-gas producers.NGLs production. The Company owns and operates gathering, processing, treating, and transportation systems in the United States.States for natural gas, oil, and NGLs.

Marketing—This segment sells much of Anadarko’s oil, natural-gas, and NGLs production, as well as productionthird-party purchased from third parties.volumes. The Company actively markets oil, natural gas, and NGLs in the United States,States; oil and actively markets oilNGLs internationally; and the anticipated LNG production from Algeria, China, and Ghana.Mozambique.

Unless the context otherwise requires, the terms “Anadarko” or “Company” refer to Anadarko Petroleum Corporation and its consolidated subsidiaries. This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements based on expectations, estimates, and projections as of the date of this filing. These statements by their nature are subject to risks, uncertainties, and assumptions and are influenced by various factors. As a consequence, actual results may differ materially from those expressed in the forward-looking statements. See Risk Factors under Item 1A of this Form 10-K.

Available Information The Company’s corporate headquarters is located at 1201 Lake Robbins Drive, The Woodlands, Texas 77380-1046, and its telephone number is (832) 636-1000.Available Information The Company files or furnishes Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, registration statements, or any amendments thereto, and other itemsreports and filings with the Securities and Exchange Commission (SEC). Anadarko provides access free of charge to all of these SEC filings, as soon as reasonably practicable after filing or furnishing, by selecting SEC Filings on its website located at www.anadarko.com/Investor/Pages/SECFilings.aspx.www.anadarko.com. The Company will also make available to any stockholder, without charge, printed copies of its Annual Report on Form 10-K as filed with the SEC. For copies of this report or any other filing, please contact Anadarko Petroleum Corporation, Investor Relations, Department, P.O. Box 1330, Houston, Texas 77251-1330 or call (832) 636-1216.

In addition,investor@anadarko.com, or complete an information request on the Company’s website at www.anadarko.com, by selecting Investors/Shareholder Resources/Shareholder Services.

The public may read and copy any materials Anadarko files with the SEC at the SEC’s Public

ReferenceReading Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public

ReferenceReading Room by calling the SEC at 1-800-SEC-0330. The SEC maintains

an Internet site (www.sec.gov)a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, like Anadarko, that file electronically with the SEC.

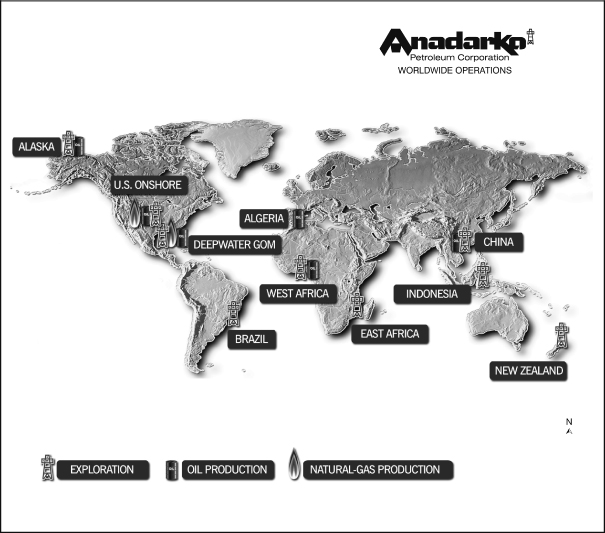

OIL AND GAS PROPERTIES AND ACTIVITIES

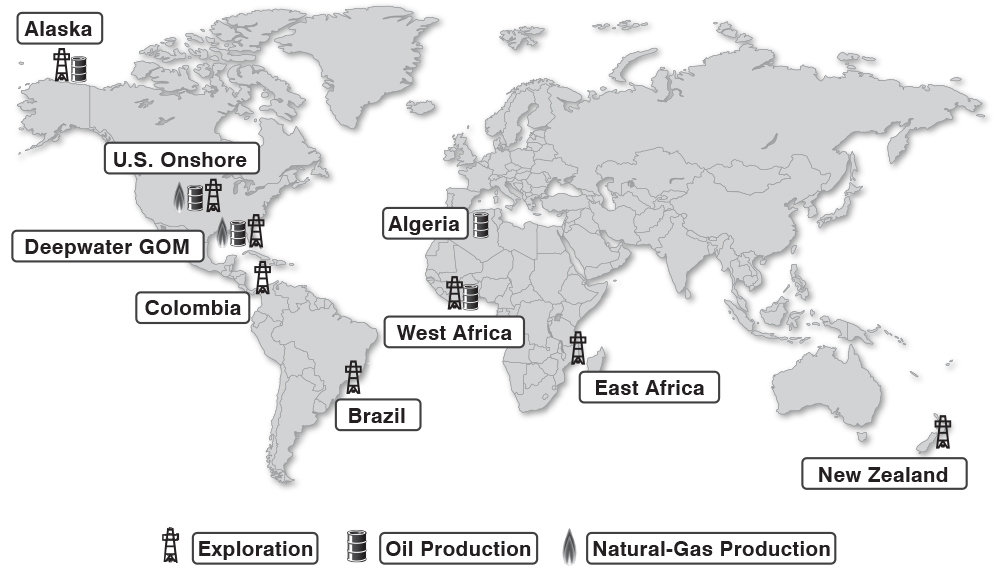

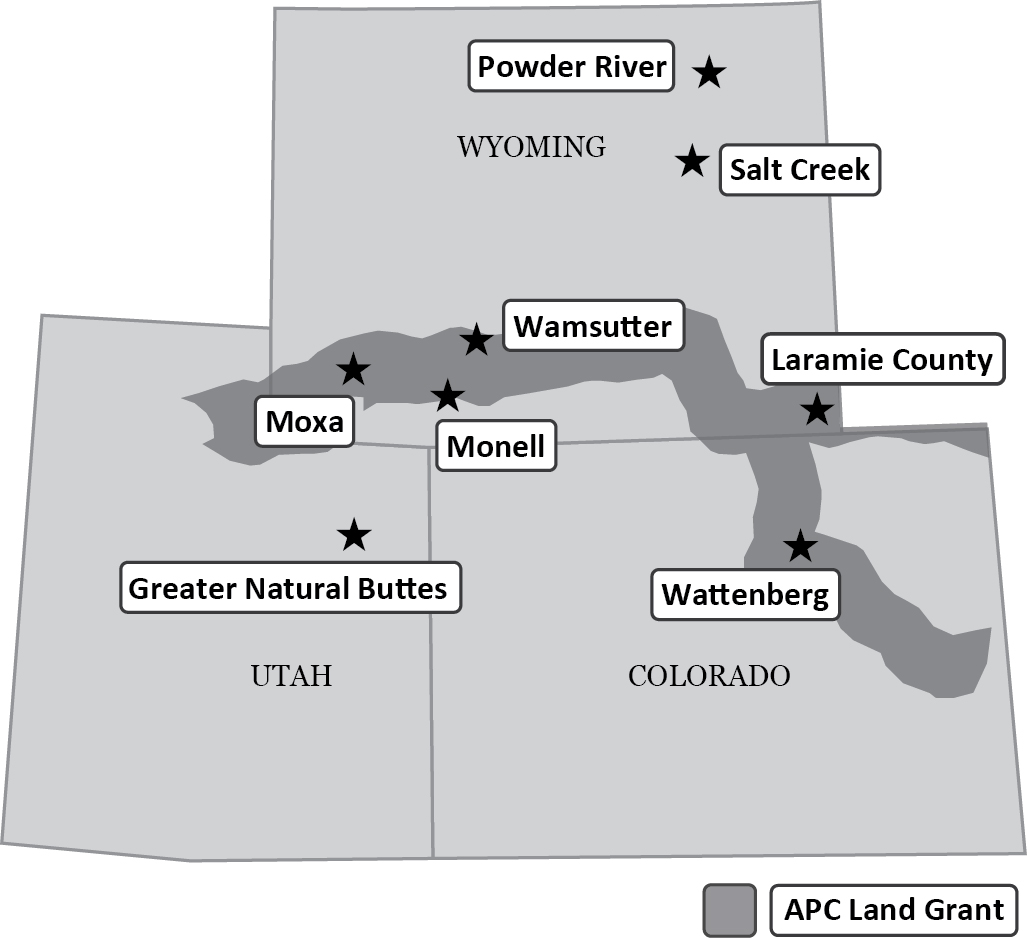

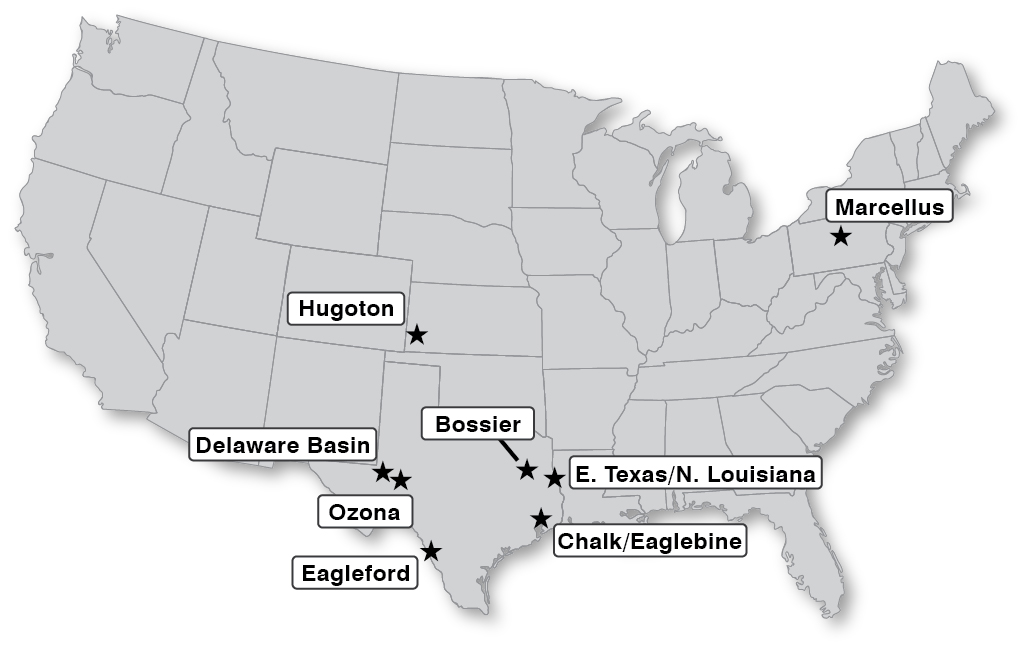

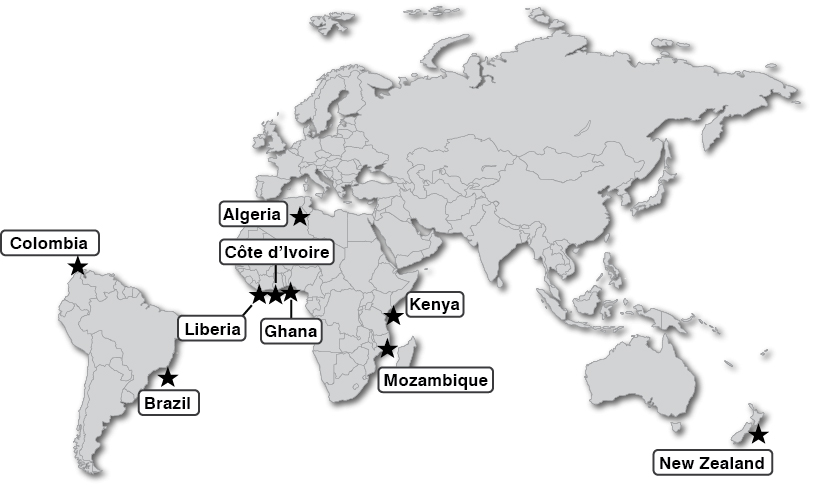

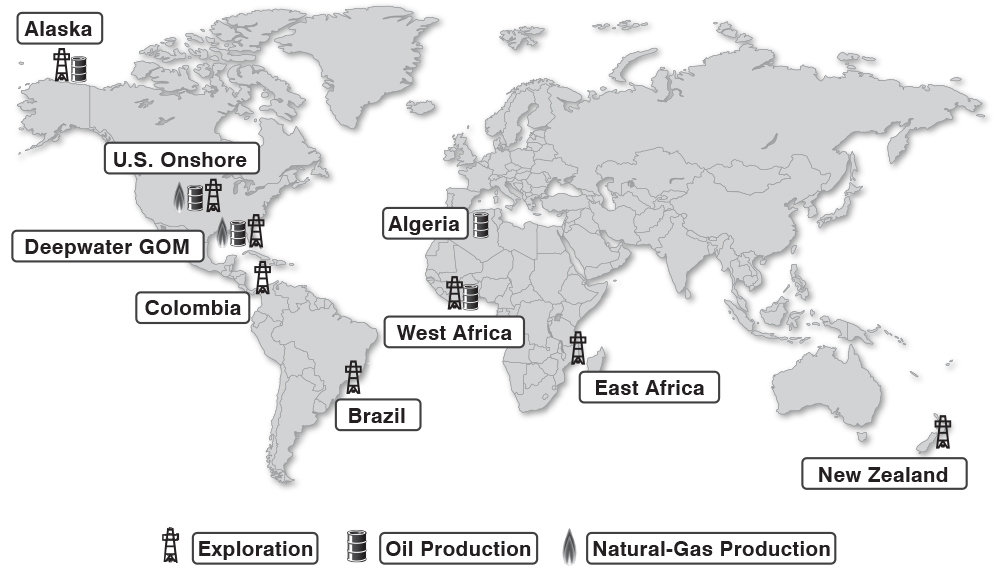

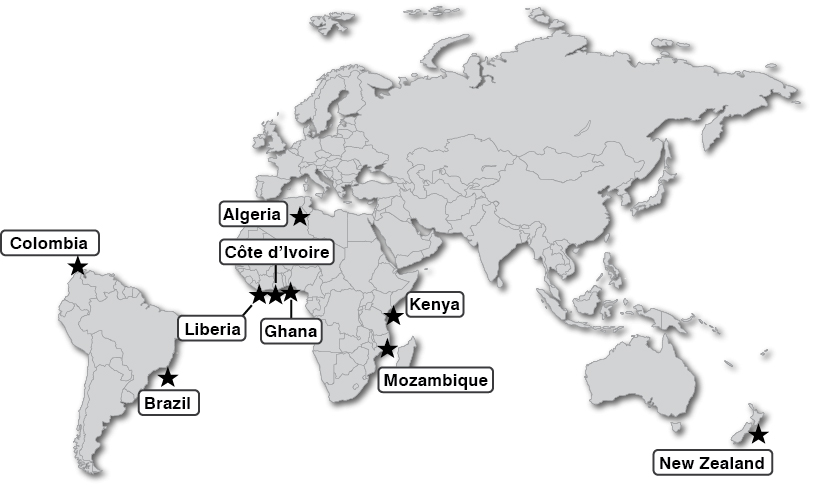

The map below illustrates the locations of Anadarko’s oil and natural-gas exploration and production operations.

United States

Overview OverviewAnadarko’s U.S. operations in the United States include oil and natural-gas exploration and production onshore in the Lower 48 states, onshore Alaska, and the deepwater Gulf of Mexico.Mexico, and onshore Alaska. The Company’s U.S. operations in the United States accounted for 87%89% of total sales volumes during 20112014 and 90%92% of total proved reserves at year-end 2011.

OnshoreIn 2011, the Company’s shale plays delivered a year-over-year sales-volume increase of almost 200%2014. Shale volumes now account for slightly more than 10% of the Company total sales volumes, which is up from less than one percent two years ago. Shales also represent about five percent of Anadarko’s total proved reserves.

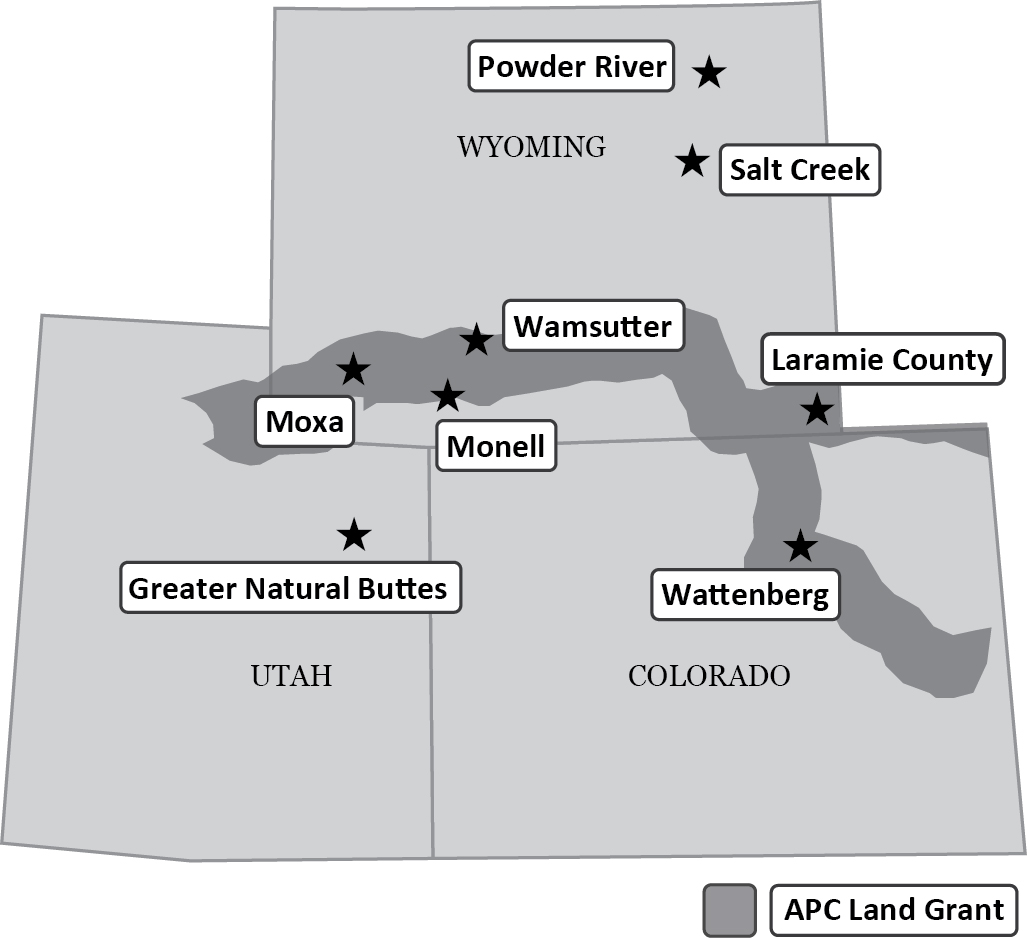

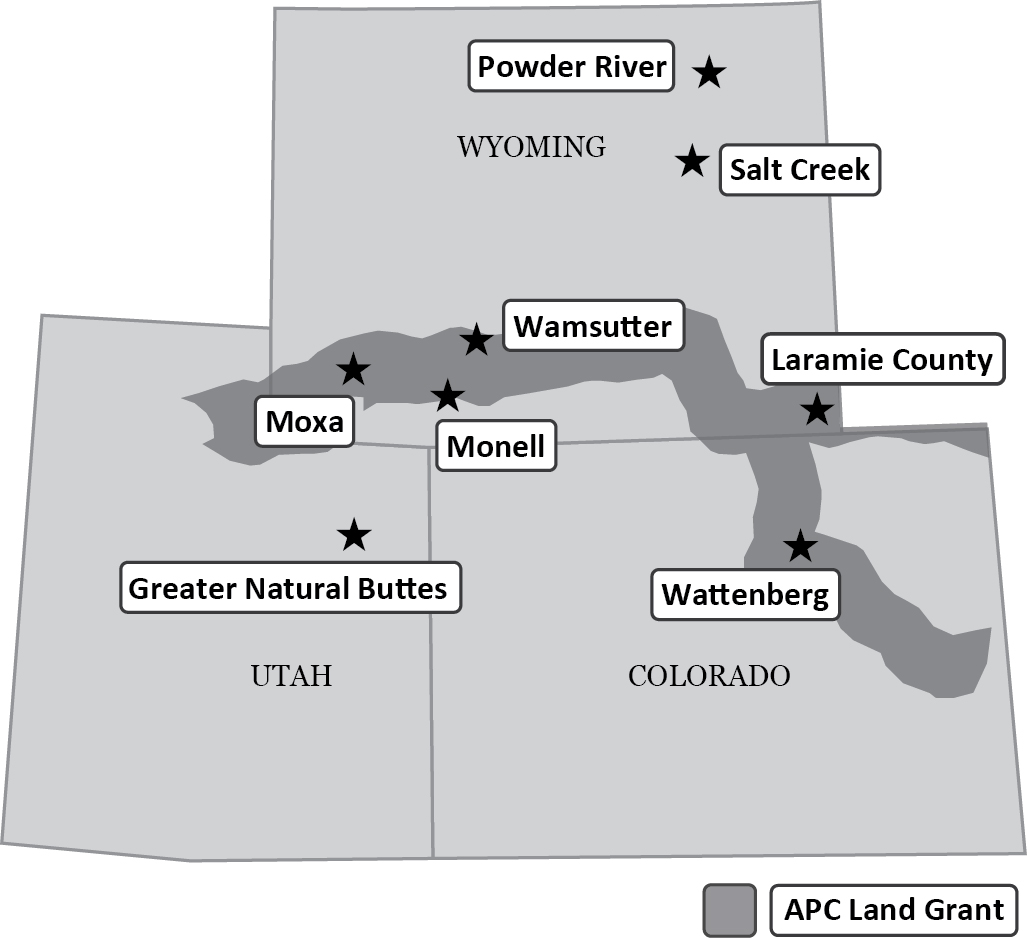

Rocky Mountains RegionAnadarko’s Rocky Mountains Region (Rockies) properties areinclude oil and natural-gas plays located in Colorado, Utah, and Wyoming and are a combination of oil and natural-gas plays, with significant growth and capital investment in areas that offer higher liquids yields (liquids-rich areas). Anadarkowhere the Company operates approximately 14,30014,500 wells and hasowns an interest in approximately 9,500 non-operated wells in the Rockies.8,000 nonoperated wells. Anadarko operates fractured carbonate/fractured-carbonate/shale reservoirs, tight gastight-gas assets, and coalbed methanecoalbed-methane (CBM) natural-gas assets, as well asand enhanced oil recovery (EOR) projects within the region. The Company also has fee ownership of mineral rights under approximately 8eight million acres that passespass through Colorado, and Wyoming, and into Utah (Land(known as the Land Grant). Management considers the Land Grant a significant competitive advantage tofor Anadarko becauseas it enhances the Company’s economic returns from production on Land Grant acreage, offers liquids-rich drilling opportunities for the Company without expiration, and allows the Company to capture incremental royalty revenue from third-party activity inon Land Grant acreage. The Company also believes its liquids-rich reservoirs, strong well performance, low development and operating costs, and large expandable midstream infrastructure each provide tangible benefits to the area. Company.

Activities in the Rockies continue toprimarily focus on expanding the existing fields to increase production and adding proved reserves through horizontal drilling, infill drilling, and down-spacing operations, re-completions, and re-fracture stimulations of existing wells. During 2011, totaloperations. The Company focused its 2014 capital investments in areas that offer high liquids yields (liquids-rich areas), which resulted in significant oil production growth. In 2014, total-year Rockies sales volumes in the Rockies increased 10% over 2010,2013, with an 18%a 45% or 49 thousand barrels of oil equivalent per day (MBOE/d) increase in liquids volumes. In 2011, theThe Company drilled 1,029569 wells and completed 487 wells in the Rockies andduring 2014. The Company plans to acceleratecontinue its drilling program in 2015, focusing on the regionWattenberg field.

Wattenberg Anadarko operates approximately 5,800 vertical wells and 750 horizontal wells in 2012.In 2011, the Company was dedicated to the development of new horizontal opportunities in the Niobrara and other formations in the Denver-Julesburg basin, which includes the Wattenberg field. The field contains the Niobrara is aand Codell formations, which are naturally fractured carbonate formationformations that holdshold liquids and natural gas. During 2011,2014, the Company drilled 33Company’s drilling program focused entirely on horizontal wellsdevelopment, drilling 369 horizontal wells. Sales volumes in the Wattenberg field focusing on liquids-rich areas in the Niobrara and Codell formations. The Company also drilled 17 horizontal wells in the Denver-Julesburg basin (outside the Wattenberg field) and the Powder River basin as part of the horizontal program.

The Wattenberg field is a liquids-rich area where Anadarko operates over 5,300 wells. During 2011, the Company drilled 433 vertical/directional wells in the Wattenberg field and increased sales volumes 19%55% compared to 2010,2013, with a year-over-year 32% increaseincreases of 69% in oil volumes and 79% in total liquids volumes. Horizontal drilling results in the Wattenberg field have showncontinue to be strong, initial production rates with average liquids yields of approximately 70%. The Company has also identified 1,200 to 2,700 future potential drilling locations in the Niobrara and Codell sandstoneeconomics that provide substantial opportunity for expanding Anadarko’s activity in these formations. The competitive advantage providedare enhanced by mineral ownership in the Land Grant mineral interest, a consolidated core acreage position, and recent enhancements in infrastructure and takeaway capacity.

Major facility and takeaway expansions occurred in 2014. The Lancaster cryogenic plant and Front Range Pipeline (FRP) were commissioned in 2014. The Lancaster cryogenic plant resulted in a field-wide increase in NGLs recoveries and the

liquids-rich reservoirs, strong well performance, low development costs, and expandable midstream infrastructure each provide tangible benefitsFRP resulted in access to the

Company and position itpremium Mt. Belvieu NGLs market. Gas processing capacity is expected to

accelerate its horizontal drilling programincrease in mid-2015 with the addition of Lancaster II, which is a second 300 million cubic feet per day (MMcf/d) cryogenic processing facility currently under construction. The White Cliffs pipeline expansion was completed in the

Wattenberg field. The Company plans to increasethird quarter of 2014, providing additional oil transportation capacity for the region. Management believes that Anadarko is well-positioned with its

activityoil and NGLs export capacity, which includes transport by

deploying seven horizontal rigspipeline, rail, and

drilling approximately 160 horizontal wells in 2012.truck.

Greater Natural ButtesThe Greater Natural Buttes area in eastern Utah is one of the Company’s major tight gas assets, where the Company is focusing on liquids-rich areas.tight-gas assets. The Company utilizes both refrigeration and cryogenic processing facilities in this area to extract natural-gas liquidsNGLs from the gasnatural-gas stream.

The Company operates over 2,200approximately 2,800 wells in the Greater Natural Buttes area and drilled 288133 wells in 2011, and increased year-over-year sales volumes from2014. The Company operated the area by 23%.field at a reduced activity level for the majority of 2014 due to capital allocation to higher-margin projects.

Powder River Deep The Company drilled 10 horizontal wells in the Powder River basin during 2014 as part of a multi-objective horizontal exploration program targeting oil opportunities. The Company has identified more than 6,000 potential locationsseen encouraging results in the Greater Natural Buttes area for future developmentNiobrara and Turner formations. Anadarko controls over 350,000 acres of deep mineral rights within the Powder River basin.

Coalbed Methane Properties Anadarko operates approximately 2,300 CBM wells and owns an interest in the Mesaverde formation. Many of these locations are infill drilling opportunities focused on down-spacing from 40-acre well density to 10-acre well density. Anadarko drilled and completed the lower Mesaverde Blackhawk interval in 56 new developmentapproximately 2,500 nonoperated CBM wells during 2011. This is a capital-efficient program with incremental development costs of approximately $0.50 per-Mcf equivalent. The Company’s other tight-gas assets in the Rockies, areprimarily located in the Greater GreenPowder River areabasin in Wyoming.Wyoming and the Helper and Clawson fields in Utah. Anadarko is expandingcontrols over 640,000 acres of shallow rights within the cryogenic facilities at its Chipeta plant to increase contracted cryogenic processing capacity to 500 MMcf/d by the third quarter of 2012. This expansion is expected to result in an incremental gross recovery of over 15,000 barrels of NGLs per day.Anadarko also operates multiple CBM properties in the Rockies.Powder River basin. CBM is natural gas that is generated and stored within coal seams. To produce CBM, water is extracted from the coal seam, resulting in reduced pressure and the release of natural gas, which flows to the wellhead. Anadarko’s primary CBM properties are locatedThe Company operated the field at a reduced activity level in the Powder River basin2014 due to capital allocation to higher-margin projects.

Salt Creek and Atlantic Rim areas in Wyoming and the Helper and Clawson fields in Utah. Anadarko operates approximately 4,000 low-cost CBM wells and has an interest in approximately 4,500 non-operated CBM wells in the Rockies. In 2011, Anadarko reduced development activity in its CBM program asMonell During 2014, the Company continued to allocatethe development of its capital spending toward its liquids-rich opportunities. A reductionRockies EOR assets in CBM development activity is expected to continuethe Salt Creek and Monell fields in 2012 as a result of low natural-gas prices.Wyoming. The Company’s EOR operations increase the amount ofuse carbon dioxide (CO

2) to stimulate oil that can be producedproduction from mature reservoirs after primary and water-flood recovery methods have been completed. During 2011,Significant gains in production were achieved in this area due to the Company continued to pursueCompany’s ongoing development of its Rockies EOR assets at the Monell and Salt Creek fieldsprograms, with oil production rising 10% in Wyoming. Monell field development is near completion with a small drilling program scheduled to finish edge-pattern development, and some minor infrastructure investments planned for 2012 to enhance carbon dioxide flooding operations. Throughout 2012,2014. In 2015, the Company plans to progresscontinue the tertiary recovery operations atmanagement of these fields to enhance CO2 flooding operations. In 2012, the Company entered into a carried-interest arrangement where a third party agreed to fund $400 million of development costs in exchange for a 23% interest in the Company’s EOR development in the Salt Creek whichfield in Wyoming. The funding commitment was completed in 2014.

Laramie County, Wyoming Anadarko holds ownership in more than 100,000 mineral-interest acres in this emerging liquids-rich play, targeting the Niobrara and Codell formations in the northern DJ Basin. In 2014, the Company has been continuously implementing since 2003.participated in more than 70 nonoperated wells testing the Niobrara and Codell formations. Early results from wells drilled in 2014 are encouraging, as results from the 19 nonoperated wells that are currently producing remain strong with initial 30-day net production averaging approximately 1,000 barrels of oil equivalent per day (BOE/d).

Greater Green River Basin Anadarko operates over 1,400 wells in the Wamsutter and Moxa fields, which are primarily dry-gas assets. The Company also carries a nonoperated position in 2,600 wells between the two fields. Much of this producing area is in the Land Grant, which improves the economics of projects in the area.

In late 2013, Anadarko acquired additional working interests and became the operator in the Moxa field, increasing the Company’s net production by approximately 6,500 BOE/d. In 2014, additional value was realized through reduction in the decline rates and decreasing operating costs.

In January 2014, Anadarko sold its interest in the Pinedale/Jonah assets in Wyoming for $581 million.

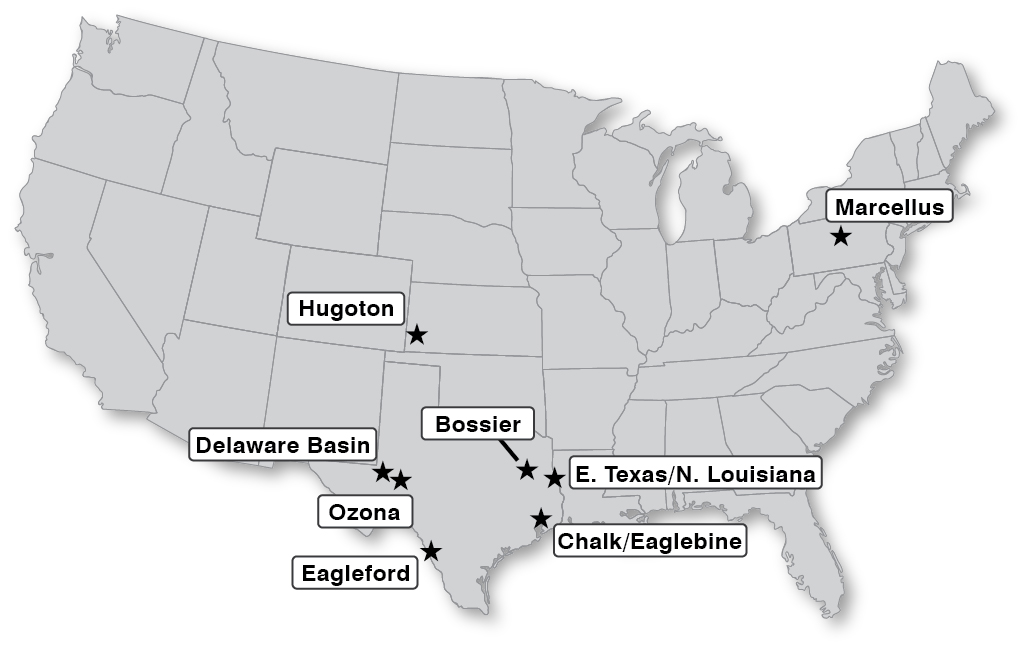

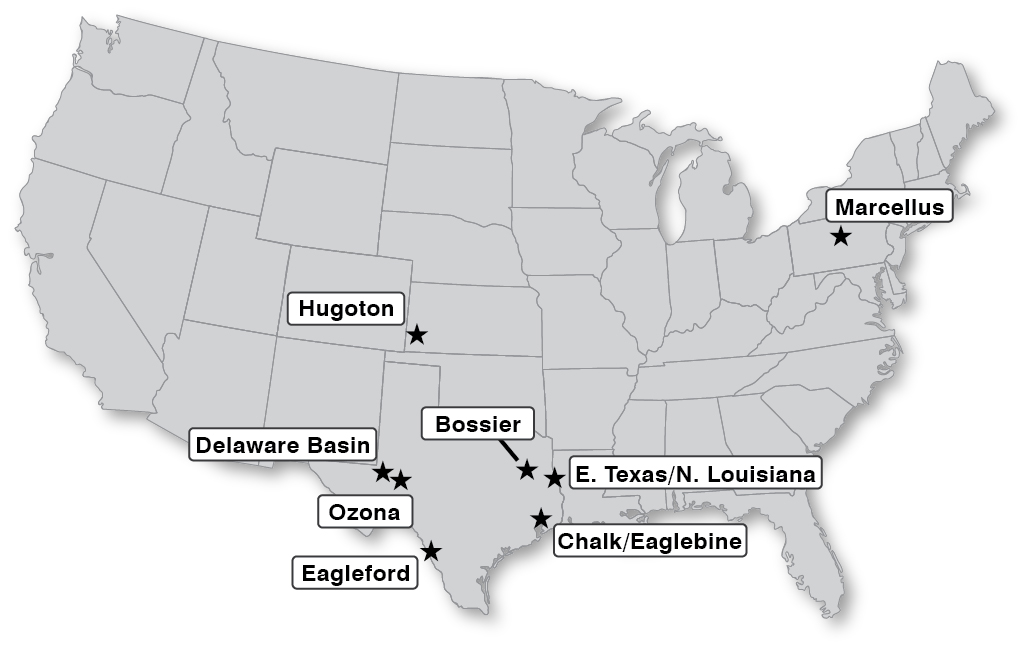

Southern and Appalachia Region Anadarko’s Southern and Appalachia Region properties are primarily located in Texas, Pennsylvania, Louisiana, Kansas, and Ohio.Kansas. The region includes the Eagleford shale in South Texas, the Delaware basin in West Texas, the Marcellus shale in north-central Pennsylvania, and the Haynesville shale in East Texas and Louisiana. Operations in these areas are focused on finding and developing both natural gas and liquids from shales, tight sands, and fractured-reservoir plays. During 2014, the Company continued to focus on liquids-rich opportunities across the region by expanding drilling activity in the emerging Wolfcamp shale play in the Delaware basin and other shale plays, while continuing its existing liquids-rich projects in the Eagleford shale, Delaware basin, and East Texas/North Louisiana plays. The Company has reduced costs and benefited from improved cycle-time efficiencies in both drilling and completion operations across all operating areas in the region.

In 2014, total-year sales volumes in the Southern and Appalachia Region increased 16% over 2013, with a 33% increase in liquids volumes. The Company drilled 589 operated horizontal wells and brought 730 wells online in 2014. In 2015, the Company expects to continue its horizontal drilling program, focusing on the Texas assets.

Eagleford The Eagleford shale development in South Texas consists of approximately 357,000 gross acres and over 1,100 producing wells. The Company drilled 393 wells, completed 388 wells, and brought 385 wells online generating 47% sales volume growth year over year.Anadarko entered 2014 with 10 drilling rigs and reduced the rig count to eight by the end of 2014 due to outstanding drilling performance. To facilitate additional completion activities, water infrastructure was expanded in 2014, increasing capacity by 75 thousand barrels per day (MBbls/d). The Company continues to test concepts for additional recovery across its acreage position and completed successful tests on two upper-Eagleford shale wells.

Delaware Basin Anadarko holds an interest in approximately 705,000 net acres in shale and other emerging-growth plays throughout the Southern and Appalachia Region. These plays include the Eagleford/Pearsall shales in southwest Texas, the Marcellus shale in north-central Pennsylvania, the Bone Spring formation and Avalon shale in the Delaware basin of West Texas, the Haynesville shale in East Texas and Louisiana, and the Utica shale in eastern Ohio. Anadarko also has tight gas and/or fractured-reservoir operations in the Bossier, Haley, Carthage, Chalk, South Texas and Ozona areas in Texas, and the Hugoton area in southern Kansas.In 2011, the Company drilled 442 wells and completed 364 wells in the Southern and Appalachia Region. Over 97% of the operated wells were drilled horizontally. By utilizing modernized drilling rigs and experienced crews, the region continued to experience improved drilling efficiencies in every area with respect to cycle times, while also drilling longer lateral lengths. Due to lower natural-gas prices, the Company is focusing its drilling activity in liquids-rich areas, such as the Eagleford shale and the Bone Spring and Avalon formations.

The Eagleford shale continues to be one of the Company’s most economic plays, capable of generating returns in excess of 100%. In the first quarter of 2011, Anadarko entered into a joint-venture agreement that conveyed 33.3% of the Company’s Eagleford and Pearsall shale assets to a third party. The third party acquired 96,000 net acres (80,000 acres within the Eagleford shale and the underlying Pearsall shale rights, and an additional 16,000 acres limited to Pearsall shale rights only) in exchange for funding $1.6 billion of Anadarko’s future drilling costs. The funding began in the second quarter of 2011 and covered $500 million of the Company’s 2011 development costs. The funding covers 90% of Anadarko’s development costs in subsequent years up to a $650 million annual limit. Based on expected activity, the third-party funding is expected to be fully utilized in the second half of 2013. Anadarko currently holds approximately 405,500 gross and 193,000 net acres with an average working interest of approximately 49% in this area. During 2011, the Company operated an average of nine rigs, which spud 228 horizontal wells and completed 197 wells. The Company began the year producing 14,300 net (27,000 gross) barrels of oil equivalent per day (BOE/d) and ended the year at over 27,400 net (77,000 gross) BOE/d, after completing over 3,200 fracturing stages during the year.

In the Appalachian basin, where the Marcellus shale is being developed, 134 operated horizontal wells were spud and 73 wells were completed utilizing a fleet that averaged seven rigs for the year. Anadarko also participated in 148 new horizontal wells and 135 completions as a non-operating partner in the area. Anadarko has a joint-venture agreement that permits a third party to participate with the Company as a 32.5% partner in the Company’s Marcellus shale assets in exchange for funding $1.4 billion of Anadarko’s drilling costs. The third party funded 100% of the Company’s 2010 development costs and 90% of these costs in 2011. The third party will continue to fund 90% of the development costs until the funding commitment is exhausted, which is anticipated to occur in 2012. Anadarko’s production in the area increased from a net 2010 year-end exit rate of 84 million cubic feet per day (MMcf/d) of natural gas to a net year-end exit rate of 230 MMcf/d.

During 2011, the Company accumulated over 370,000600,000 gross acres in the prospective liquids-rich area of the eastern Ohio Utica shale in the AppalachianDelaware basin. Two Utica horizontal pilot wells reached total depth in the fourth quarter of 2011 and Anadarko plans to accelerate the pilot and testing program in 2012.

Anadarko owns 330,000 net acres in the Delaware basin, which has seen significantAnadarko’s 2014 drilling activity primarily targetingtargeted the liquids-rich Bone Spring formation, the Avalon shale, and Avalon shale.the developing Wolfcamp shale play. In 2011,2014, Anadarko spud 50 operated wells, participated in 27 non-operated wells, and completed 54drilled 97 operated wells and 27 non-operated wellsparticipated in 43 nonoperated wells. Significant infrastructure was added, which increased NGLs sales volumes by 82% over 2013. In addition, in November 2014, Western Gas Partners, LP (WES), a consolidated subsidiary of the Company, acquired Nuevo Midstream, LLC (Nuevo), which has gathering and processing assets located in the area. Drilling and well performance continue to improve with well tests producing in excess of 2,000 BOE/d.Delaware basin. The Company had four rigsone operated rig drilling in the Bone Spring formation, and one operated rig drilling in the Avalon shale, and eight operated rigs drilling in the Wolfcamp shale at year-end 2011.

Alaska2014.

The successful Wolfcamp shale delineation program continues to deliver encouraging results across the majority of Anadarko’s oilacreage position. Anadarko is testing multiple zones within the Wolfcamp shale and natural-gas productionseveral development concepts including multi-well pads, extended laterals, and developmenthorizontal well spacing for increased efficiency. The Company has identified thousands of potential drilling locations in the Wolfcamp formations that are expected to provide substantial opportunity for Anadarko’s continued activity in Alaskathe basin.

Eaglebine Anadarko holds 156,000 gross acres in the Eaglebine shale in Southeast Texas, most of which is concentrated primarily on the North Slope. Development activityheld by existing Austin Chalk production. In 2014, Anadarko continued at the Colville River Unit through 2011to delineate and develop this acreage with eight wells drilled.a one-rig drilling program. In 2012,September 2014, the Company anticipates participatingentered into a carried-interest arrangement requiring a third party to fund $442 million of Anadarko’s capital costs in exchange for a 34% working interest in the Eaglebine development. Anadarko will remain the operator with an average post-transaction working interest of approximately 12 development wells51%. This transaction allows the Company to develop this oil opportunity while further enhancing Anadarko’s capital efficiency and the sanctioningflexibility. At December 31, 2014, $22 million of the Alpine West satellite development.total $442 million obligation had been funded.

East Texas/North Louisiana Anadarko holds 293,000 gross acres in East Texas/North Louisiana. Anadarko increased its capital program in the East Texas Carthage area in 2014, targeting a liquids-rich area in the Haynesville shale. In 2014, Anadarko operated six rigs and drilled 52 wells in the Haynesville and Cotton Valley formations. The Company increased sales volumes from the area by 10% year over year.

Marcellus The Company holds 654,000 gross acres in the Marcellus shale of the Appalachian basin. During the year, 24 operated horizontal wells were drilled using one rig. Anadarko also participated in drilling an additional 78 nonoperated horizontal wells in 2014. The Company’s production in Marcellus continued to improve with sales volumes increasing 12% over 2013.

Gulf of MexicoIn the Gulf of Mexico, Anadarko owns an average 64%61% working interest in 487394 blocks. The Company operates seven active floating platforms and holds interests in 3423 producing fields, and is infields. During 2014, the process of delineating and developing six additional fields in the area.Following a period of significantly reduced activity as a resultCompany advanced development of the drilling moratorium in 2010, during 2011, the Company resumedLucius and Heidelberg projects and continued an active deepwater explorationdevelopment and appraisal program in the Gulf of Mexico and is continuingas it continues to take advantage of its existing infrastructure to accelerate resource development activities at reduced costs. Anadarko made its

The following includes the significant development, exploration, and appraisal activity in the Gulf of Mexico during 2014.

Development

Lucius The Company realized first post-moratorium deepwater discoveryproduction at the Cheyenne East prospect, which is being developed as a tieback to the Independence Hub (IHUB)Anadarko-operated Lucius Spar in January 2015, bringing on three wells initially and isramping up production with an additional three wells expected to produce 60 MMcf/come online during the first quarter of 2015. The successful Lucius project was developed with production startup only three years from sanction and five years from discovery. The 80-MBbls/d spar resides in Keathley Canyon Block 875 with a water depth of natural gas. First production from this well is expected by March 2012. 7,100 feet.

A carried-interest arrangement with a third party, entered into in 2012, provided funding forthe substantial majority of Anadarko’s development capital commitment through first production. Following the carried-interest arrangement and 2014 equity re-determination, the Company holds a 23.8% working interest in Lucius.

Heidelberg The Company also completed a workover at the Spiderman IHUB well, resulting in natural-gas production at a rate in excess of 90 MMcf/d. In 4.5 years since first production, aggregate IHUB production surpassed one trillion cubic feet (Tcf) in early 2012. In Green Canyon Block 903, the Heidelberg appraisal well (44% operated working interest) began drilling in October 2011, and was declared successful in February 2012. The Company plans to sidetrack the well to evaluate the down-dip extent of the field.During 2011, Anadarko continuedcontinues to advance the Lucius field development. The unitization agreement for the Anadarko-operated Lucius fieldHeidelberg development project, which was signedsanctioned during the second quarter of 2011,2013. The construction of the 80-MBbls/d spar is progressing on schedule with anticipated start-up in 2016. At December 31, 2014, fabrication of the main topsides module was more than 70% complete and ahead of schedule.

In 2013, the Lucius project was sanctioned duringCompany entered into a carried-interest arrangement requiring a third party to fund $860 million of capital costs in exchange for a 12.75% working interest in the project. The carry obligation is expected to cover the substantial majority of the Company’s expected future capital costs through first production. At December 31, 2014, $386 million of the $860 million obligation had been funded. Anadarko holds a 31.5% working interest in Heidelberg. Development drilling commenced in late 2014 on two development wells.

Caesar/Tonga At Caesar/Tonga (33.75% working interest), the Company successfully completed a fourth development well (GC 727#2) in the first quarter of 2011 with first production expected in 2014. A production-handling agreement to process natural gas from the Hadrian South field at the Lucius facility was executed with the Hadrian South co-venturers,2014, and will add additional value to the Lucius development. The Company completed a successful well test at Lucius, which showed that the well is capableproducing 10 MBbls/d of flowing in excessoil. Anadarko is currently completing a fifth development well (GC 683#2), which is expected to come online during the first quarter of 15,000 barrels per day (Bbls/d)2015.

K2 At K2 (41.8% working interest), the GC 562 #5 infill well found 210 feet of oil pay in the Miocene, and that the main pay intervals are well connected. Lucius will be developed withis being sidetracked for a truss spar floating production facility withsubsequent completion. The well is expected to come online in the capacity to produce in excesssecond half of 80,000 Bbls/d of oil and 450 MMcf/d of natural gas. The spar is currently under construction and will be2015.

Constitution At Constitution (100% working interest), the largest of Anadarko’s operated spars. The Company plans to have an activeexecuted a successful platform drilling program in 2014, where the area beginning in 2012, with plans to drill its Spartacus prospect during the year.Anadarko continued advancing its development project at Caesar/Tonga. The CompanyA1 well was sidetracked, completed, and tested three wells that each demonstrated facility-constrained flow rates of approximately 15,000 Bbls/brought online producing 3 MBbls/d of oil. First production is expected by mid-2012.

During 2011,

Vito In 2014, Anadarko participatedsold its 18.67% working interest in the drillingnonoperated Vito deepwater development, along with several surrounding exploration blocks, for $500 million.

Exploration

Three exploration wells were drilled in the Gulf of the Coronado #1Mexico during 2014. The Deep Nansen exploration well (15%(35% working interest), located targeted Lower Tertiary-aged sediments in Walker Ridge Block 143.a large, four-way structure beneath Anadarko’s Nansen field and found non-commercial quantities of hydrocarbons and the well was plugged and abandoned. The evidence of a working petroleum system is being incorporated into potential future activity on the surrounding leasehold. The Bimini exploration well (50% working interest) was drilled in Garden Banks close to existing infrastructure at the Anadarko-operated Power Play field and near the Conger field and Baldpate Platform. The well spud in October 2011tested a subsalt Miocene prospect and was plugged and abandoned as a result of unanticipated geopressure inabandoned. The K2 development well was drilled deeper to test the shallow section. At year-end 2011, seismic was being reviewed to determine a new well location. In June 2011,Wilcox potential beneath the Kakuna #1 subsalt exploration well spud. Anadarko has an option to acquire a 6.25% interest or an overriding royalty interest in the well, which is locatedexisting field in Green Canyon Block 505, northand did not find commercial quantities of hydrocarbons in the Company’s Caesar/Tonga development. In addition,Wilcox objective. The K2 well will be sidetracked and completed in a field pay interval. Also, the Vito NEYeti exploration well (37.5% nonoperated working interest) was spud prior to year end. The well will test a Miocene sub-salt three-way closure in Walker Ridge.

Appraisal

Shenandoah Basin The Company spud the Shenandoah-3 well, its second appraisal well (20% non-operated working interest), locatedat the Shenandoah discovery, in Mississippi Canyon Block 940, spud in early 2012 and will test the northeast flank of the Vito discovery.Due to the drilling moratorium, Anadarko redeployed its deepwater rigs to other parts of the world but retained theEnsco 8500 under a long-term contract for operations in the Gulf of Mexico. The Gulf of Mexico has regained momentum and the Bureau of Safety and Environmental Enforcement (BSEE) is approving drilling permits, which has prompted Anadarko to execute contracts for theEnsco 8505 rig, with delivery scheduled for the second quarter of 20122014. The well finished drilling at the end of 2014 and found approximately 50% (1,470 feet) more of theEnsco 8506 rig, with delivery same reservoir sands 1,500 feet down-dip and 2.3 miles east of the Shenandoah-2 well, which encountered over 1,000 feet of net oil pay in excellent quality Lower Tertiary-aged sands. The Shenandoah-3 well confirmed the sand depositional environment, lateral sand continuity, excellent reservoir qualities, and down-dip thickening. The well also enabled the projection of oil-water contacts based on pressure data and reduced the uncertainty of the resource range. Planning is underway for the next appraisal well, which the Company expects to spud in the fourthsecond quarter of 2012. Both2015.

An appraisal well at theEnsco 8500 Coronado discovery (35% working interest) reached total depth during the second quarter of 2014 and did not find theEnsco 8505 are shared rig contracts between Anadarko Lower Miocene objective and other Gulfwas plugged and abandoned.

During the third quarter of Mexico operators. Also,2014, theTransocean Spirit rig, currently first appraisal well of the Yucatan discovery (25% working interest) was drilled down-dip of the original discovery, and found approximately 57 gross feet of pay in West Africa, will be mobilized toLower Tertiary oil-bearing sands. The Yucatan discovery is located approximately three miles south of the Gulf of Mexico in the latter part of 2012 to service the Company’sShenandoah discovery.

AlaskaAnadarko’s nonoperated oil development projects and exploration activities in the Gulf of Mexico. Anadarko expects exploration and appraisal activities to return to pre-moratorium levels in 2012. In addition, Anadarko signed long-term lease agreements for two new-build state-of-the-art drillships. TheOcean BlackHawk is expected to be delivered in late 2013 and theOcean BlackHornet is expected to be delivered in early 2014. These rigs are dual-activity and dual blowout-prevention rigs, reflecting Anadarko’s focus on continuing to enhance operational efficiency.International

Overview The Company’s international oil and natural-gas production and development activity in Alaska is concentrated on the North Slope. Infrastructure construction began in 2013 on the Alpine West satellite development, a 15-to-20-well extension of the Alpine field. Drilling at Alpine West is scheduled to commence in mid-2015 with production anticipated to come online in late 2015 or early 2016.

International

Overview Anadarko’s international operations are located primarilyinclude oil, natural-gas, and NGLs production and development in Mozambique, Algeria, Ghana, and China.Ghana. The Company also has exploration acreage in Brazil, Colombia, Côte d’Ivoire, Ghana, Mozambique, Brazil,Kenya, Liberia, Sierra Leone, Kenya, Cote d’Ivoire,Mozambique, New Zealand, Indonesia, and other countries. International locations accounted for 13%11% of Anadarko’s total sales volumes and 27%21% of sales revenues during 2011, as well as 10%2014, and 8% of total proved reserves at year-end 2011. Anadarko drilled 33 wells in international areas in 2011, which included natural-gas discoveries in Mozambique and oil discoveries in Ghana.2014. In 2012,2015, the Company expects to drillfocus its exploration and appraisal activity in East Africa, Côte d’Ivoire, and Colombia.

Mozambique Anadarko operates two blocks (one onshore and one offshore) totaling approximately 25 development5.3 million gross acres at December 31, 2014. From a construction, finance, and 25 exploration wells at various international locations.marketing perspective, the Company is positioned to commence project execution and deliver first cargoes in the expected 2019 timeframe; however, the pace of this project is dependent upon securing necessary approvals from the government of Mozambique.

Development In February 2014, the Company sold a 10% working interest in Offshore Area 1 in Mozambique for $2.64 billion. Anadarko remains the operator of Offshore Area 1 with a working interest of 26.5%.

During 2014, the Company obtained reserves certification from a third party indicating sufficient volumes to support an initial LNG development. The Environmental Impact Assessment was approved by the government of Mozambique. The Company completed front-end engineering and design (FEED) for the onshore liquefaction facilities and the offshore gathering infrastructure and is in the process of selecting the contractor groups for construction. Anadarko and its partners reached non-binding Heads of Agreements for long-term LNG sales to buyers in Asian markets covering in excess of eight million metric tonnes per annum. In December 2014, the Mozambique government published a Decree Law that is sufficient to continue progressing project finance, marketing, and construction and operation of an LNG project. This legislation marks a critical step toward establishing a project-wide legal and contractual framework that delivers a level of fiscal stability enabling continued equity investments by the Company and potential access to significant limited-recourse project finance capital.

Exploration In the Offshore Area 1, the Tubarão Tigre-1 exploration well was drilled approximately 37 miles south of the Orca-1 discovery well and encountered more than 92 feet of net gas pay in Paleocene sands. The Ouriço do Mar exploration well was drilled 22.5 miles south of the Orca-1 discovery well and tested the potential down-dip extent of the Paleocene reservoirs found in the Orca and Tubarão Tigre discoveries. The well was plugged and abandoned during the third quarter of 2014. Appraisal of the Orca discovery continued with the drilling of three appraisal wells. During the first quarter of 2014, the Orca-2 well encountered 151 feet of Paleocene reservoir sand with the top 26 feet being charged, establishing the gas/water contact for the discovery. The rig moved to the Orca-3 location and encountered 102 net feet of natural-gas pay in the Paleocene. The Orca-4 well reached total depth during the fourth quarter of 2014 encountering natural-gas pay in two reservoirs. At the end of 2014, the rig was located at Tubarão Tigre-2 drilling the first appraisal well associated with the Tubarão Tigre discovery. Data from these wells will be used to further delineate the size of the resource and determine future appraisal activity for the Orca and Tubarão Tigre discoveries.

In the Onshore Rovuma (35.7% working interest), the Anadarko-operated Tembo-1 well completed drilling at the end of the fourth quarter in 2014. The well encountered gas and condensate in one of the Cretaceous reservoirs and post-drill evaluations are underway to determine if additional exploration is warranted within the prospect area. A rig has been mobilized to the second well in the program, Kifaru, which will test Miocene, Oligocene, and Paleocene gas targets near the future LNG facility site.

Algeria Anadarko is engaged in production and development and production activitiesoperations in Algeria’s Sahara Desert in Blocks 404 and 208. Currently, all production is from fields located in Block 404,208, which produce through the Hassi Berkine South and Ourhoud Central Production Facilities (CPF). The El Merk project progressed to approximately 88% overall completion at December 31, 2011, and remains on target for initial production in 2012 with significant gross volumes expected at the facility near the end of 2012. The percentage of overall completion captures the progress of ongoing construction work at the El Merk CPF and associated infrastructure such as offsite facilities, export pipelines, and power transmission lines. During 2011, 16 development wells were drilled in Blocks 404 and 208. The Company expects 2012 development drilling activity to be similar to 2011 levels, with continued focus on El Merk drilling.Contracts and Partners Since October 1989, the Company’s operations in Algeria have beenare governed by a Production Sharing Agreement (PSA) between Anadarko, two thirdother parties, and Sonatrach, the national oil and gas company of Algeria. Anadarko’s interest in the PSA for Blocks 404 and 208 is 50% before participation at the exploitation stage by Sonatrach. The Company has two partners, each with a 25% interest, also prior to participation by Sonatrach. Under the terms of the PSA, oil reserves that are discovered, developed, and produced are shared by Sonatrach, Anadarko, and the remaining two partners. Sonatrach is responsible for 51%24.5% of the development and production costs Anadarko is responsible for 24.5%,these blocks. The Company produces oil through the Hassi Berkine South and its two partners are each responsible for 12.25%. Anadarko and its partners have completed the exploration program on BlocksOurhoud central processing facilities (CPF) in Block 404 and 208oil, condensate, and now participate onlyNGLs through the El Merk CPF in development activity onBlock 208. Gross production through these blocks. Anadarkofacilities averaged more than 383 MBbls/d in 2014, and its joint-venture partners funded Sonatrach’s sharea quarterly net production record of exploration costs and are entitled to recover these exploration costs from production during the development phase.

Exceptional Profits Tax In July 2006, the Algerian parliament approved legislation establishing an exceptional profits tax on foreign companies’ Algerian oil production. In December 2006, regulations regarding this legislation were issued. These regulations provide for an exceptional profits tax imposed on gross production at rates of taxation ranging from 5% to 50% based on average daily production volumes for each calendar month in which the price of Brent crude averages over $30 per barrel. Exceptional profits tax applies to the full value of production rather than to the amount in excess of $30 per barrel.

In response to the Algerian government’s impositionapproximately 75 MBOE/d was achieved as all of the exceptional profits tax,fields at the Company notified Sonatrach of its disagreement with the collection of the exceptional profits tax.El Merk CPF were increased to full oil production rates. The Company believes that the PSA provides fiscal stability through several provisions that require Sonatrach to pay all taxes and royalties. To facilitate discussions between the partiesdrilled nine development wells in an effort to resolve the dispute, in October 2007 the Company initiated a conciliation proceeding on the exceptional profits tax as provided in the PSA. The Conciliation Board issued its non-binding recommendation in November 2008. In February 2009, the Company initiated arbitration against Sonatrach with regard to the exceptional profits tax by submitting a notice of arbitration to Sonatrach. The arbitration hearing on the merits of the claims presented by Anadarko took place in June 2011 and the Company anticipates the issuance of the arbitration panel’s decision in the near term. Any decision issued by the arbitration panel is binding on the parties.

2014.

Ghana Anadarko’s explorationproduction and development activities in Ghana are located offshore in the West Cape Three Points Block and the Deepwater Tano Block.

The Jubilee field (27% nonoperated unit interest), which spans both the West Cape Three Points Block and the Deepwater Tano Block, averaged gross production of 102 MBbls/d of oil in 2014. In December 2010, 3.5 years following discovery, the Companyfourth quarter of 2014, a pipeline tie-in was completed and its partners achieved first oilnatural-gas exports commenced from the Jubilee field.field to an onshore gas processing plant. The natural-gas exports are being delivered to satisfy a commitment established in conjunction with the Jubilee development plan and are expected to allow increases in future oil production rates. The Company and its partners completed executionare evaluating options to further expand the oil throughput capacity of the Phase 1 development program and tied back 17 wells to the floating production, storage, and offloading vessel (FPSO) atand expect to submit a full-field development plan for the Jubilee field. field to the government of Ghana in 2015.

The gross oilJubilee J-24 development well was drilled deeper to evaluate the Mahogany sands below the Jubilee reservoirs. Additional appraisal work was completed in 2014 in the Mahogany and Akasa fields and the data is under evaluation.

In 2013, development commenced on the Tweneboa/Enyenra/Ntomme (TEN) project (19% nonoperated working interest). The project will use an 80-MBbls/d-capacity FPSO for production levelfrom subsea wells. Significant progress was made during 2014, including engineering design completion, the successful dry-docking of the FPSO, and drilling of the first nine wells. The project was approximately 70,000 Bbls/d50% complete at year-end 2011 from eight producing wells. Completion issues required a side-track2014 and remains on budget and on schedule for first production in 2016.

ChinaIn August 2014, the Company sold its Chinese subsidiary for $1.075 billion.

Index to Financial StatementsDuring 2011, the Company participated in 10 exploration and appraisal wells outside the Jubilee field, including the Akasa #1 discovery well in the West Cape Three Points Block (32% non-operated interest), two Teak discovery wells, and one Teak appraisal well to the Teak #1 discovery. The successful Teak appraisal well confirmed a northern extension of the discovery. The Company also participated in two successful Enyenra appraisal wells in the Deepwater Tano Block (18% non-operated working interest) and an additional appraisal of the Tweneboa discovery. A drillstem test (DST) conducted on the Tweneboa #2 well in the bottom oil leg of the reservoir and the DST performed at the Tweneboa #4 well confirmed the connectivity of the two wells. The Ntomme #2 was spud in late 2011 and reached total depth in 2012. This successful appraisal well tested the same targets discovered in the Tweneboa #3ST well and encountered oil pay in excellent-quality sandstone reservoirs. In 2012, the Company plans to participate in up to four exploration and appraisal wells in Ghana.

The Company and its partners anticipate declaration of commerciality for the Tweneboa/Enyenra/Ntomme field complex located in the Deepwater Tano Block during the second half of 2012 following completion of the appraisal program. In the West Cape Three Points Block, stand-alone FPSO and Jubilee tie-back development options are being evaluated to maximize the resource value from the Teak and Akasa discoveries.

Mozambique Anadarko operates two blocks (one onshore and one offshore) in Mozambique totaling approximately six million gross acres. In 2011, the Company drilled two natural-gas discoveries (Tubarão and Camarão) and two successful appraisal wells (Barquentine #2 and Barquentine #3) in the Offshore Area 1 of the Rovuma basin where Anadarko holds a 36.5% working interest. In 2012, the Lagosta #2 and Lagosta #3 appraisal wells successfully appraised discoveries at Lagosta and Camarão. To date, the Company has eight successful wells in the complex, including the Windjammer, Lagosta, Barquentine and Camarão discoveries. As a result, the Company and its partners are continuing to advance a liquefied natural gas (LNG) development, which is being designed to consist of an initial two 5-million-tonne-per-annum trains. Anadarko plans to construct a flexible offshore production system to collect gas from the wells located approximately 35 miles (56 kilometers) offshore, which will deliver gas to the liquefaction plant onshore. Pre-FEED (front-end engineering and design) activities are complete and the Company expects to begin FEED work around the middle of 2012. The Company expects to reach a final investment decision at approximately year-end 2013, with first cargo sales targeted for late 2018.BrazilAlso during 2011, Anadarko acquired two new 3D seismic datasets which have led to a growing number of high-potential prospects in other areas of the Offshore Area 1. Early in 2012, Anadarko mobilized a second deepwater drillship to Mozambique to accelerate the planned exploration and appraisal activities, which include an extensive reservoir testing program and up to seven exploration and appraisal wells in 2012.

ChinaAnadarko’s development and production activities in China are located offshore in Bohai Bay. Development drilling was ongoing throughout 2011, and Anadarko drilled 19 wells during the year including eight side-tracks of low oil-rate/high water-cut producers. The majority of the wells were drilled from the platform expansion decks, which were installed as part of an initiative to sustain continued plateau production. An exploration well in the South China Sea is expected to spud in mid-2012. Consistent with the terms of the Petroleum Contract, the Company is preparing to transfer operatorship of the Bohai Bay development to China National Offshore Oil Corporation at the end of 2012.

BrazilAnadarko holds exploration interests in approximately 750,000300,000 gross acres in sixtwo offshore blocks located offshore Brazil in the Campos basin. At the Wahoo discovery, the Company is evaluating commercialization options by performing pre-FEED and Espírito Santo basins. In these areas,FEED studies.

Colombia During 2014, Anadarko drilled two appraisal wells in 2011. In Block BM-C-32 (33% non-operatedwas the high bidder on the COL1, COL 6, and COL 7 blocks. At December 31, 2014, Anadarko controls the exclusive rights to explore or conduct technical evaluation activities on nine blocks, totaling 16 million acres. The COL 1, COL 2, COL 6, and COL 7 blocks are operated at 100% working interest)interest and the remaining blocks are operated at a 50% working interest.

Two initial prospects have been selected for the 2015 exploration drilling program. The Calasu prospect is a large four-way structure on the north end of the Fuerte Norte block. It has multiple targets and success would reduce the risk of several adjacent structures on the block. The Kronos prospect is located in the Campos basin,Fuerte Sur block and will test a large structure associated with the successful Itaipu #2 pre-saltfrontal area of a large thrust complex. As with Calasu, success would reduce the risk of multiple prospects. The two-well program commenced in early 2015.

Côte d’Ivoire Anadarko owns an operated working interest in five offshore blocks totaling approximately 1.3 million acres, including CI-515 and CI-516 each with a 45% working interest, CI-103 with a 65% working interest, and CI-528 and CI-529 each with a 90% working interest.

The Company continued appraisal of the Cretaceous Paon discovery in Block CI-103, where the discovery well encountered 100 feet of net pay. The Paon-3AR was drilled 3.7 miles down-dip to the discovery well and encountered more than 94 feet of pay. The well established a fluidan oil/water contact and appears to have successfully extendedbe in communication with the accumulation 394Paon-1X discovery. As a result of the success, the drilling of the Paon-4A was accelerated. The well, located six miles east of the Paon-3AR, penetrated over 37 feet downdip fromof pay in the Itaipu discovery well, which is located four miles totarget section and defined the northwest. The appraisal well significantly increases the arealeastern extent of the Itaipu field. Inreservoir. During 2014, Anadarko became operator of the block and farmed down a portion of the working interest for a carry on the appraisal activities. Based on the successful drilling program to date, the partnership and the government are currently discussing additional appraisal drilling activity for 2015, which would include a drillstem test.

The Morue prospect in Block BM-C-29 (50% working interest),CI-516 was drilled and encountered a small accumulation of oil in the Ituana appraisal wellwell-developed sands in the targeted interval, and was plugged and abandoned in 2012. as non-commercial.

The

Company is reviewing the results of the well as part of the evaluation of the Ituana post-salt discovery. Anadarko expects to drill up to four exploration and appraisal wells in Brazil during 2012, including the Wahoo #4 appraisal well in Block BM-C-30 (30% operated working interest).During 2011, the Company began marketing its Brazilian properties and a sale is possible in 2012 subject to receiving acceptable pricing and terms and obtaining regulatory approval.

Liberia The Company currently operates four blocks in offshore Liberia totaling approximately 3.3 million exploration acres in the Liberian basin. Multiple Cretaceous stratigraphic leads, similar to the Jubilee Mahogany fan, have been identified on these blocks. The Montserrado wellSaumon prospect was drilled in 2011 on Block LB-15CI-515 during 2014. The well reached total depth and encountered good-quality, water-bearing sands in the main objective and 27 net feet of pay in a secondary objective.did not find hydrocarbons. The well was plugged and abandonedabandoned.

Kenya Anadarko owns and operates a 45% working interest in five offshore deepwater blocks, encompassing approximately 5.6 million gross acres. An exploration well is currently planned to test a large four-way structure at the results are being incorporated intoMlima prospect in Block L-11B during 2015.

Liberia Two exploration wells were drilled in Block LB-10 (50% working interest) during 2014. The Anadarko-operated Iroko and Timbo wells both encountered non-commercial quantities of oil in their primary targets and were plugged and abandoned. Post-well evaluation is underway to determine the Company’s geologic data for future exploration inremaining prospectivity of the Liberian basin. Plans for 2012 include the incorporationblock. Anadarko completed a farm down prior to drilling, which covered a majority of the drilling results intocosts for these two wells.

New Zealand Anadarko controls the 3D seismicexclusive rights to explore or conduct technical evaluation activities on Blocks 15, 16, and 17, as well as the evaluationfour blocks totaling 42 million acres, of the newly acquired 3D seismicwhich 6.1 million acres are owned under exploration licenses. Anadarko operates a 45% working interest in the LB-10 Block.Sierra Leone Anadarko operatesCanterbury basin block and has a 55% participating100% working interest in Block SL-07B-11 in offshore Sierra Leone encompassing approximately 1.2two Pegasus basin blocks. In the 36 million gross acres. Multiple Upper Cretaceous fan-type prospects have been identifiedacre New Caledonia basin block, Anadarko controls a 25% nonoperated working interest. The Caravel prospect reached its total-depth objective in the lightly explored Liberian basin. The Jupiter #1 well, spudCanterbury basin block and was plugged and abandoned, having encountered natural gas shows and high-quality reservoir in the fourth quarter of 2011, targeted a large Cretaceous fan channel complex similar to the Enyenra and Tweneboa discoveries in Ghana. In 2012, the Jupiter #1 discovery well encountered hydrocarbon pay and has been preserved for possible re-entry, as the area will likely require additional evaluation. The Mercury #2 well, which will be drilled subsequent to Jupiter #1, will appraise the Mercury #1 discovery well that was announced as a discovery in 2010.

Kenya Anadarko operates and has a 50% participating interest in five deepwater blocks offshore Kenya encompassing approximately 7.5 million gross acres. The Company has completed 2D and 3Dprimary objective. A seismic programs and evaluationacquisition is currently taking place with potential drilling possible in late 2012 or early 2013.

Côte d’Ivoire During 2011, Anadarko and its partners began interpreting new 3D seismic data on two deepwater exploration blocks totaling approximately 850,000 gross acres offshore Côte d’Ivoire. Multiple Upper Cretaceous fan-type prospects have been identifiedplanned during 2015 on the 2D and 3D seismic. The Kosrou #1 well, spud in January 2012 on Block CI 105 (50% operated interest), has multiple targets within a large Cretaceous fan located south and east of the Company’s 2009 South Grand Lahou-1X well, which encountered thin sands with shows in the target. The Paon prospect located on Block CI 103 (40% non-operated interest) will be drilled following the Kosrou well. The geology on the block appears similar to that of the Jubilee, Enyenra, and Tweneboa discoveries in Ghana. In 2012, Anadarko purchased approximately 500,000 gross acres in Blocks CI 515 and CI 516 (45% operated interest).block.

New Zealand Anadarko operates approximately 11.5 million exploration acres in the Taranaki and Canterbury basins in New Zealand. A 3D seismic survey of approximately 1,100 square miles was completed on the Taranaki Block in 2011, and a 2D seismic survey of approximately 2,400 miles was acquired over the Canterbury Blocks. Two exploration wells, one on each block, are planned for late 2012 subject to rig availability.OtherIndonesia Anadarko has participating interests in approximately 3.4 million gross exploration acres in Indonesia through a combination of one operated and two non-operated Production Sharing Contracts. In 2012, the Company began marketing its Indonesian properties for sale.

Other Anadarko also has exploration projects in other overseas, new-venture areas including Morocco, Tunisia and South Africa.

Estimates of proved reserves volumes owned at year end, net of third-party royalty interests, are presented in

billionbillions of cubic feet (Bcf), at a pressure base of 14.73 pounds per square inch for natural gas and in millions of barrels (MMBbls) for oil, condensate, and NGLs. Total volumes are presented in millions of barrels of oil equivalent (MMBOE). For this computation, one barrel is the equivalent of 6,000 cubic feet of natural gas. Shrinkage associated with NGLs has been deducted from the natural-gas

reservereserves volumes.

Proved reserves are estimated based on the average beginning-of-month prices during the 12-month period for the respective year.

Disclosures by geographic area include

the United States and International. The International geographic area

includesconsists of proved reserves located in Algeria

Ghana, and

China,Ghana, which by country and in total represents less than 15% of the Company’s total proved reserves.

The Company sold its Chinese subsidiary during 2014.

Summary of Proved Reserves

|

| | | | | | | | | | | |

| | Natural Gas (Bcf) | | Oil and Condensate (MMBbls) | | NGLs (MMBbls) | | Total (MMBOE) |

| December 31, 2014 | | | | | | | |

| Proved | | | | | | | |

| Developed | | | | | | | |

| United States | 6,635 |

| | 352 |

| | 304 |

| | 1,762 |

|

| International | 27 |

| | 190 |

| | 13 |

| | 207 |

|

| Undeveloped | | | | | | | |

| United States | 2,033 |

| | 352 |

| | 162 |

| | 853 |

|

| International | 4 |

| | 35 |

| | — |

| | 36 |

|

| Total proved | 8,699 |

| | 929 |

| | 479 |

| | 2,858 |

|

| | | | | | | | |

| December 31, 2013 | | | | | | | |

| Proved | | | | | | | |

| Developed | | | | | | | |

| United States | 7,120 |

| | 347 |

| | 268 |

| | 1,801 |

|

| International | — |

| | 202 |

| | — |

| | 202 |

|

| Undeveloped | | | | | | | |

| United States | 2,085 |

| | 245 |

| | 127 |

| | 720 |

|

| International | — |

| | 57 |

| | 12 |

| | 69 |

|

| Total proved | 9,205 |

| | 851 |

| | 407 |

| | 2,792 |

|

| | | | | | | | |

| December 31, 2012 | | | | | | | |

| Proved | | | | | | | |

| Developed | | | | | | | |

| United States | 6,445 |

| | 318 |

| | 283 |

| | 1,675 |

|

| International | — |

| | 208 |

| | — |

| | 208 |

|

| Undeveloped | | | | | | | |

| United States | 1,884 |

| | 193 |

| | 110 |

| | 617 |

|

| International | — |

| | 48 |

| | 12 |

| | 60 |

|

| Total proved | 8,329 |

| | 767 |

| | 405 |

| | 2,560 |

|

The Company’s year-end | | | | | | | | | | | | | | | | |

| | | Natural Gas

(Bcf) | | | Oil and

Condensate

(MMBbls) | | | NGLs

(MMBbls) | | | Total

(MMBOE) | |

As of December 31, 2011 | | | | | | | | | | | | | | | | |

Proved | | | | | | | | | | | | | | | | |

Developed | | | | | | | | | | | | | | | | |

United States | | | 6,113 | | | | 352 | | | | 267 | | | | 1,638 | |

International | | | — | | | | 173 | | | | — | | | | 173 | |

Undeveloped | | | | | | | | | | | | | | | | |

United States | | | 2,252 | | | | 184 | | | | 94 | | | | 653 | |

International | | | — | | | | 62 | | | | 13 | | | | 75 | |

| | | | | | | | | | | | | | | | |

Total proved | | | 8,365 | | | | 771 | | | | 374 | | | | 2,539 | |

| | | | | | | | | | | | | | | | |

| | | | |

As of December 31, 2010 | | | | | | | | | | | | | | | | |

Proved | | | | | | | | | | | | | | | | |

Developed | | | | | | | | | | | | | | | | |

United States | | | 5,982 | | | | 303 | | | | 222 | | | | 1,523 | |

International | | | — | | | | 150 | | | | — | | | | 150 | |

Undeveloped | | | | | | | | | | | | | | | | |

United States | | | 2,135 | | | | 195 | | | | 85 | | | | 635 | |

International | | | — | | | | 101 | | | | 13 | | | | 114 | |

| | | | | | | | | | | | | | | | |

Total proved | | | 8,117 | | | | 749 | | | | 320 | | | | 2,422 | |

| | | | | | | | | | | | | | | | |

| | | | |

As of December 31, 2009 | | | | | | | | | | | | | | | | |

Proved | | | | | | | | | | | | | | | | |

Developed | | | | | | | | | | | | | | | | |

United States | | | 5,884 | | | | 300 | | | | 199 | | | | 1,480 | |

International | | | — | | | | 144 | | | | — | | | | 144 | |

Undeveloped | | | | | | | | | | | | | | | | |

United States | | | 1,880 | | | | 200 | | | | 61 | | | | 574 | |

International | | | — | | | | 89 | | | | 17 | | | | 106 | |

| | | | | | | | | | | | | | | | |

Total proved | | | 7,764 | | | | 733 | | | | 277 | | | | 2,304 | |

| | | | | | | | | | | | | | | | |

2014 proved reserves product mix was comparable to the last two years with 51% natural gas, 33% oil and condensate, and 16% NGLs.

Anadarko is focused on growth and profitability, and reserves was 55% natural gas, 30%replacement is a key to growth. Future profitability partially depends on commodity prices and the cost of finding and developing oil and condensate,gas reserves. Reserves growth can be achieved through successful exploration and 15% NGLs; compared to a year-end 2010 product mixdevelopment drilling, improved recovery, or acquisition of 56% natural gas, 31% oil and condensate, and 13% NGLs; and a year-end 2009 product mix of 56% natural gas, 32% oil and condensate, and 12% NGLs.producing properties.

|

| | | | | | | | |

| MMBOE | 2014 | | 2013 | | 2012 |

| Proved Reserves | | | | | |

| January 1 | 2,792 |

| | 2,560 |

| | 2,539 |

|

| Reserves additions and revisions | | | | | |

| Discoveries and extensions | 63 |

| | 145 |

| | 82 |

|

Infill-drilling additions (1) | 577 |

| | 410 |

| | 383 |

|

| Drilling-related reserves additions and revisions | 640 |

| | 555 |

| | 465 |

|

Other non-price-related revisions (1) | (137 | ) | | (40 | ) | | (31 | ) |

| Net organic reserves additions | 503 |

| | 515 |

| | 434 |

|

| Acquisition of proved reserves in place | — |

| | 36 |

| | 4 |

|

Price-related revisions (1) | (1 | ) | | (23 | ) | | (68 | ) |

| Total reserves additions and revisions | 502 |

| | 528 |

| | 370 |

|

| Sales in place | (124 | ) | | (12 | ) | | (81 | ) |

| Production | (312 | ) | | (284 | ) | | (268 | ) |

| December 31 | 2,858 |

| | 2,792 |

| | 2,560 |

|

| Proved Developed Reserves | | | | | |

| January 1 | 2,003 |

| | 1,883 |

| | 1,811 |

|

| December 31 | 1,969 |

| | 2,003 |

| | 1,883 |

|

| |

(1) | Combined and reported as revisions of prior estimates in the Company’s Supplemental Information under Item 8 of this Form 10-K. Reserves bookings related to infill drilling additions are treated as positive revisions. Other non-price-related revisions in 2014 are driven by a reduction of 116 MMBOE in the Wattenberg area primarily associated with the optimization of horizontal drilling locations and the discontinuation of vertical well workover plans. |

The Company’s estimates of proved developed reserves, proved undeveloped reserves (PUDs), and total proved reserves at December 31, 2011, 2010,2014, 2013, and 2009,2012, and changes in proved reserves during the last three years are presented in theSupplemental Information on Oil and Gas Exploration and Production Activities (Supplemental Information)under Item 8 of this Form 10-K.The Company has not filed information with a federal authority or agency with respect to its estimated total proved reserves at December 31, 2011. Annually, Anadarko reports gross proved reserves of operated properties in the United States to the U.S. Department of Energy; these reported reserves are derived from the same data used to estimate and report proved reserves in this Form 10-K.

Also presented in theSupplemental Information are the Company’s estimates of future net cash flows and discounted future net cash flows from proved reserves. SeeOperating Results andCritical Accounting Estimates under Item 7 of this Form 10-K for additional information on the Company’s proved reserves.

The Company has not yet filed information with a federal authority or agency with respect to its estimated total proved reserves at December 31, 2014. Annually, Anadarko reports gross proved reserves for U.S.-operated properties to the U.S. Department of Energy. These reported reserves are derived from the same database used to estimate and report proved reserves in this Form 10-K.

Changes in PUDs Significant changes Changes to PUDs occurring during 20112014 are summarized in the table below. Revisions of prior estimates reflect Anadarko’s ongoing evaluation of its asset portfolio and include updates to prior PUDs, the addition of new PUDs associated with current development plans, revisions to prior PUDs, revisions to infill drilling development plans, as well as the transfer of PUDs to unproved reserve categories due to development plan changes, and the impact of changes in development plans during the period. These PUDseconomic conditions, including changes reflect the ongoing evaluation of Anadarko’s asset portfolio and alignment with current-year changes to development plans.in commodity prices. The Company’s year-end development plans and associated PUDs are consistent with SEC guidelines for PUDs development within five years unless specific circumstances warrant a longer development time horizon. | |

| | |

MMBOE | | | | |

PUDs at December 31, 2010

| | | 749 | |

PUDs at January 1, 2014 | 789 |

|

| Revisions of prior estimates | 333 | | 60 |

|

Extensions, discoveries, and other additions | 32 | | 112 |

|

Conversion to developed | (210 | | (171 | ) |

Sales | (55 | | (22 | ) |

| | | | |

PUDs at December 31, 2011 2014 | 889 | | 728 | |

| | | |

|

Revisions In 2014, PUD revisions of 333 MMBOE were primarily related to successful infill drilling in large onshore areas such as Wattenberg in the Rockies and the Eagleford shale in the Southern and Appalachia Region, partially offset by decreases primarily due to development plan updates.

Extensions, Discoveries, and Other AdditionsDuring 2014, Anadarko added 32 MMBOE of PUDs Conversionthrough extensions, discoveries, and other additions, primarily as a result of successful drilling in the Marcellus and Wolfcamp shale plays in the Southern and Appalachia Region.

Conversions In 2011,2014, the Company converted 171210 MMBOE, or 23%27% of the total year-end 20102013 PUDs, to developed status. Approximately 58%73% of PUDsPUD conversions occurred in U.S. onshore U.S. assets, 26%16% in international assets, and the remaining 16%11% in Gulf of Mexico assets.The majority of PUDs conversions occurred as a result of ongoing development activities

Development activity in the

Rockies andU.S. onshore assets resulted in the

liquids-rich areasconversion of

80 MMBOE in the Southern and Appalachia

Region. Approximately 96Region and 72 MMBOE

of PUDs were converted to developed reserves in

these areas. Thethe Rockies. Ongoing development activity in the Company’s Algerian assets resulted in the conversion of

an additional 4534 MMBOE

of PUDs occurred in

the international areas, most of which are associated with completed production wells in the El Merk project of Algeria where the overall project was approximately 88% complete at December 31, 2011. Another 26 MMBOE of PUDs converted to developed reserves2014. The remaining PUD conversions were associated with

ongoing development

projects in

the Caesar/Tonga project in the U.S.various Gulf of Mexico

where three completed wells are awaiting tie-back to production facilities. The remaining converted PUDs were a result of development activity in Alaska.fields.

Anadarko spent $900 million associated with the development of$1.6 billion to develop PUDs in 2011.2014, of which approximately 74% related to U.S. onshore assets, 13% related to Gulf of Mexico assets, and 13% related to international assets.

In 2013, the Company converted 183 MMBOE, or 27% of the total year-end 2012 PUDs, to developed status. Approximately 68%85% of total 2011 PUDs conversion capitalPUD conversions occurred in U.S. onshore assets, 11% in international assets, and the remaining 4% in Gulf of Mexico assets. Anadarko spent $1.0 billion on PUD development in 2013, of which approximately 70% related to domestic development programs in the Rockies and the Southern and Appalachia Regions. Approximately 12% related to the development of the Caesar/Tonga and Lucius projects in the Gulf of Mexico, and 10%Regions, 25% related to development of international projects, and the El Merk project in Algeria. The remaining 10% of 2011 PUDs development spending was associated with5% related to Alaska and other internationalGulf of Mexico development projects.

Index to Financial StatementsIn 2010, the Company converted 103 MMBOE, or 15% of the total year-end 2009 PUDs to developed status. Approximately 65% of PUDs conversions occurred in onshore U.S. assets, 24% in international assets, and the remaining 11% in Gulf of Mexico assets. Anadarko spent $1.5 billion associated with the development of PUDs in 2010. Approximately 58% of total 2010 PUDs capital related to two major development projects, El Merk in Algeria and Jubilee in Ghana, and 29% related to domestic development programs in the Rockies and the Southern and Appalachia Regions. The remaining 13% of 2010 PUDs development spending was associated with Gulf of Mexico, Alaska, and other international development projects.

Development Plans The Company annually reviews all PUDs to ensure an appropriate plan for development exists. Typically, U.S. onshore U.S. PUDs are converted to developed reserves within five years of the initial proved reserves booking. Projectsbooking, but projects such as EOR, arctic development, deepwater development, and international programs may take longer than five years.longer. All of the Company’s U.S. onshore U.S. PUDs at December 31, 2014, were scheduled to be developed within five years, at December 31, 2011, with the exception of the Salt Creek EOR project, the annual development of which is limited by CO2 supply contract terms andCO2 supply.

At December 31, 2014, the