UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| FOR THE FISCAL YEAR ENDED DECEMBER 31, |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| FOR THE TRANSITION PERIOD FROM TO |

COMMISSION FILE NUMBER: 001-33776

ABITIBIBOWATERRESOLUTE FOREST PRODUCTS INC.

(Exact name of registrant as specified in its charter)

Delaware | 98-0526415 | |||

| (I.R.S. employer identification number) |

111 Duke Street, Suite 5000; Montreal, Quebec; Canada H3C 2MI

2M1

(Address of principal executive offices) (Zip Code)

(514) 875-2515

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $.001 per share | New York Stock Exchange Toronto Stock Exchange | |||

| (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.¨þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes¨ Noþ

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2011)29, 2012) was approximately $1.2 billion.$639 million. For purposes of the foregoing calculation only, all directors, executive officers and 5% beneficial owners have been deemed affiliates.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed pursuant toby Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes þ No ¨

As of January 31, 2012,2013, there were 97,092,38294,754,031 shares of AbitibiBowaterResolute Forest Products Inc. common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed within 120 days of December 31, 20112012 are incorporated by reference in this Annual Report on Form 10-K in response to Part III, Items 10, 11, 12, 13 and 14.

Item 1. | 1 | |||||||

Item 1A. | ||||||||

Item 1B. | ||||||||

Item 2. | ||||||||

Item 3. | ||||||||

Item 4. | ||||||||

Item 5. | ||||||||

Item 6. | ||||||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

Item 7A. | ||||||||

Item 8. | ||||||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |||||||

Item 9A. | ||||||||

Item 9B. | ||||||||

Item 10. | ||||||||

Item 11. | ||||||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||||

Item 14. | ||||||||

Item 15. | ||||||||

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION AND USE OF

THIRD-PARTY DATA

Statements in this Annual Report on Form 10-K (“Form 10-K”) that are not reported financial results or other historical information of AbitibiBowaterResolute Forest Products Inc. (with its subsidiaries and affiliates, either individually or collectively, unless otherwise indicated, referred to as “AbitibiBowater,“Resolute Forest Products,” “we,” “our,” “us” or the “Company”) are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. They include, for example, statements relating to our:to: our efforts to continue to reduce costs and increase revenues and profitability, including our cost reduction initiatives regarding selling, general and administrative (“SG&A”) expenses;initiatives; our business outlook; our assessment of market conditions; our liquidity outlook,outlook; our prospects, growth strategies and the industry in which we operate; and strategies for achieving our goals generally, including the strategies described in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Our Business, Strategy and Outlook,” of this Form 10-K.10-K; and the industry in which we operate. Forward-looking statements may be identified by the use of forward-looking terminology such as the words “should,” “would,” “could,” “will,” “may,” “expect,” “believe,” “anticipate,” “attempt,” “project” and other terms with similar meaning indicating possible future events or potential impact on our business or AbitibiBowater’s shareholders.

The reader is cautioned not to place undue reliance on these forward-looking statements, which are not guarantees of future performance. These statements are based on management’s current assumptions, beliefs and expectations, all of which involve a number of business risks and uncertainties that could cause actual results to differ materially. The potential risks and uncertainties that could cause our actual future financial condition, results of operations and performance to differ materially from those expressed or implied in this Form 10-K include those set forththe risks described in Part I, Item 1A, “Risk Factors.”

All forward-looking statements in this Form 10-K are expressly qualified by the cautionary statements contained or referred to in this section and in our other filings with the United States Securities and Exchange Commission (the “SEC”) and the Canadian securities regulatory authorities. We disclaim any obligation to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

Market and Industry Data

InformationCertain information about industry or general economic conditions contained in this Form 10-K is derived from third-party sources and certain trade publications (“Third-Party Data”) that we believe are widely accepted and accurate; however, we have not independently verified this information and cannot provide assurances of its accuracy.

We are a global leader in the forest products industry, with a diverse range of products, including newsprint, commercial printing papers, market pulp and wood products, which are marketed in close to 9080 countries. We own or operate 18over 40 pulp and paper mills and 23 wood products facilities in the United States, Canada and South Korea.Korea, and power generation assets in Quebec, Canada.

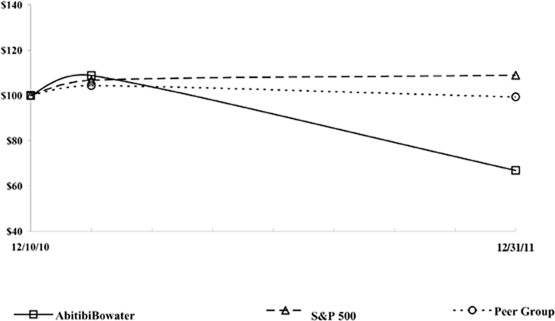

AbitibiBowater Inc. is a Delaware corporation incorporated on January 25, 2007. On October 29, 2007, Abitibi-Consolidated Inc. (“Abitibi”) and Bowater Incorporated (“Bowater”) combined in a merger of equals (the “Combination”) with each becoming a subsidiary of AbitibiBowater Inc., a Delaware corporation incorporated on January 25, 2007. On November 7, 2011, AbitibiBowater Inc. began doing business as Resolute Forest Products. We expect atAt the 2012 annual meeting of shareholders on May 23, 2012, the shareholders approved an amendment to seek shareholder approval to amend our certificate of incorporation to change our legalcorporate name from AbitibiBowater Inc. to Resolute Forest Products Inc. Our, effective May 24, 2012. The ticker symbol for our common stock began trading under the symbolwas changed from “ABH” to “RFP” on both the New York Stock Exchange (the “NYSE”) on May 24, 2012 and on the Toronto Stock Exchange (the “TSX”) on December 10, 2010.May 28, 2012.

Executive Officers

The following is information about our executive officers as of February 29, 2012:March 1, 2013:

| Name | Age | Position | Officer Since | Age | Position | Officer Since | ||||||||

Richard Garneau | 64 | President and Chief Executive Officer | 2011 | 65 | President and Chief Executive Officer | 2011 | ||||||||

Alain Boivin | 61 | Senior Vice President, Pulp and Paper Operations | 2011 | 62 | Senior Vice President, Pulp and Paper Operations | 2011 | ||||||||

Pierre Laberge | 55 | Senior Vice President, Human Resources and Public Affairs | 2011 | 56 | Senior Vice President, Human Resources | 2011 | ||||||||

John Lafave | 47 | Senior Vice President, Pulp and Paper Sales and Marketing | 2011 | 48 | Senior Vice President, Pulp and Paper Sales and Marketing | 2011 | ||||||||

Yves Laflamme | 55 | Senior Vice President, Wood Products, Global Supply Chain, Procurement and Information Technology | 2007 | 56 | Senior Vice President, Wood Products, Procurement and Information Technology | 2007 | ||||||||

Jo-Ann Longworth | 51 | Senior Vice President and Chief Financial Officer | 2011 | 52 | Senior Vice President and Chief Financial Officer | 2011 | ||||||||

Jacques P. Vachon | 52 | Senior Vice President and Chief Legal Officer | 2007 | 53 | Senior Vice President, Corporate Affairs and Chief Legal Officer | 2007 | ||||||||

Mr. Garneau joined the Board of Directors in June 2010. Previously, Mr. Garneau served as President and Chief Executive Officer of Catalyst Paper Corporation from March 2007 to May 2010. Prior to his tenure at Catalyst, Mr. Garneau served as Executive Vice President, Operations at Domtar Corporation. He also held a variety of roles at Norampac Inc. (a divisionjoint-venture of Domtar Inc. and Cascades Inc.), Copernic Inc., Future Electronics Inc., St. Laurent Paperboard Inc., Finlay Forest Industries Inc. and Donohue Inc. Mr. Garneau is a member of the Canadian Institute of Chartered Accountants.

Mr. Boivin previously served as Vice President of Mill Operations at Smurfit-Stone Container Corporation and as a Vice President at Smurfit-Stone since 2000. He was Senior Vice President, Containerboard Operations for St. Laurent Paperboard Inc. from 1999 to 2000 and was Mill Manager at a number of operations for Donohue Inc. and Avenor Inc.

Mr. Laberge previously served as Senior Vice President, Human Resources and Public Affairs from June 2011 to February 2012 and as Vice President, Human Resources for our Canadian operations.operations from January 2011 to May 2011. He joined a predecessor of the CompanyDonohue Inc. in 1988. As of March 1, 2012, Mr. Laberge will serve as Senior Vice President, Human Resources.

Mr. Lafave previously served as Vice President Sales, National Accounts – Paper Sales, and as Vice President Sales, National Accounts – Newsprint, and Vice President Sales, Commercial Printers of Abitibi from 2004 to 2009. He held progressive positions in sales with UPM-Kymmene and Repap Enterprises.

Mr. Laflamme previously served as Senior Vice President, Wood Products from October 2007 to January 2011, as Senior Vice President, Woodlands and Sawmills of Abitibi from 2006 to October 2007, and as Vice President, Sales, Marketing and Value-Added Wood Products Operations of Abitibi from 2004 to 2005.

Ms. Longworth previously served as Special Advisor to the President and Chief Executive Officer, focusing on special mandates, from July 4, 2011 to August 31, 2011. She served as Senior Vice President and Chief Accounting Officer with World Color Inc. (formerly Quebecor World Inc.) from 2008 to 2010, as Chief Financial Officer with Skyservice Inc. from 2007 to 2008, as Vice President and Controller with Novelis, Inc. from 2005 to 2006, and held a number of financial and operational roles over a 16-year career with Alcan Inc.

Mr. Vachon previously served as Senior Vice President and Chief Legal Officer from January 2011 to February 2012, as Senior Vice President, Corporate Affairs and Chief Legal Officer from October 2007 to January 2011, and as Senior Vice President, Corporate Affairs and Secretary of Abitibi from 1997 to October 2007. As of March 1, 2012, Mr. Vachon will serve as Senior Vice President, Corporate Affairs and Chief Legal Officer.

Our Products

We manage our business based on the products we manufacture. Accordingly, our reportable segments correspond to our primary product lines: newsprint, coated papers, specialty papers, market pulp and wood products. Certain segment and geographical financial information, including sales by segment and by geographic area, operating income (loss) by segment total assets by segment and long-lived assets by geographic area, can be found in Note 25,24, “Segment Information,” to our consolidated financial statements and related notes (“Consolidated Financial Statements”) appearing in Part II, Item 8, “Financial Statements and Supplementary Data,” of this Form 10-K.10-K (“Item 8”).

In accordance with our values, our environmental vision statement and forestry policies and in the interests of our customers and other stakeholders, we are committed to implementing and maintaining environmental management systems at our pulp, paper, woodlands and wood procurement operations to promote the conservation and sustainable use of forests and other natural resources. We and other member companies of the Forest Products Association of Canada, as well as a number of environmental organizations, are partners in the Canadian Boreal Forest Agreement. The group works to identify solutions to conservation issues that meet the goal of balancing equally the three pillars of sustainability linked to human activities: economic, social and environmental. We are also a member of the World Wildlife Fund’s Climate Savers program, in which businesses establish ambitious targets to voluntarily reduce greenhouse gas emissions and work aggressively toward achieving them.

Newsprint

We produce newsprint at 1110 facilities in North America and one facility in South Korea. We are the largest producer of newsprint in the world by capacity, with total capacity of approximately 3.1 million metric tons, or approximately 9% of total worldwide capacity. We are also the largest North American producer of newsprint, with total North American capacity of approximately 2.9 million metric tons, or approximately 36%39% of total North American capacity.

We distribute newsprint by rail, truck and ship; it is sold to North American customers directly by our regional sales offices. Export markets are serviced primarily through our international offices located in or near the markets we supply or through international agents. In 2011,2012, approximately 45%41% of our total newsprint shipments were to markets outside of North America.

We sell newsprint to various joint venture partners (partners with us in the ownership of certain mills we operate). During 2011,2012, these joint venture partners purchased approximately 400,000382,000 metric tons from our consolidated entities, which represented approximately 15% of the total newsprint metric tons we sold in 2011.2012.

Coated papers

We produce coated mechanical papers at our Catawba, South Carolina facility. We are one of the largest producers of coated mechanical papers in North America, with total capacity of approximately 616,000645,000 metric tons, or approximately 16%19% of total North American capacity. Our coated papers are used in magazines, catalogs, books, retail advertising, direct mail and coupons.

We sell coated papers to major commercial printers, publishers, catalogers and retailers. We distribute coated papers by truck, rail and ship. Most of our coated paper production is sold within North America and serviced directly by our regional sales offices. Export markets are serviced primarily through international agents.

Specialty papers

We produce specialty papers at eight facilities in North America. We are the largest producer of specialty papers in North America by capacity, including supercalendered, superbright, high bright, bulky book and directory papers, with total capacity of approximately 1.41.3 million metric tons, or approximately 31%29% of total North American capacity. Our specialty papers are used in books, retail advertising, direct mail, coupons and other commercial printing applications.

We sell specialty papers to major commercial printers, direct mailers, publishers, catalogers and retailers. We distribute specialty papers by truck, rail and ship. Most of our specialty paper production is sold within North America and serviced directly by our regional sales offices. Export markets are serviced primarily through international agents.

We sell specialty papers to various joint venture partners (partners with us in the ownership of certain mills we operate). During 2011,2012, these joint venture partners purchased approximately 25,00037,000 short tons from our consolidated entities, which represented approximately 1%3% of the total specialty papers short tons we sold in 2011.2012.

Market pulp

Wood pulp is the most commonly used material to make paper. Pulp shipped and sold as pulp, as opposed to being processednot converted into paper in one of our facilities, is referred tosold as market pulp. We produce market pulp at fiveeight facilities in North America, with total capacity of approximately 1.11.7 million metric tons, or approximately 6%10% of total North American capacity. Market pulp is used to make a range of consumer products including tissue, packaging, specialty paper products, diapers and other absorbent products.

North American market pulp sales are made through our regional sales offices, while export sales are made through international sales agents local to their markets. We distribute market pulp by truck, rail and ship.

On December 15, 2011,In 2012, we announced an offer to purchasepurchased all of the issued and outstanding shares of Fibrek Inc. (“Fibrek”), a producer and marketer of virgin and recycled kraft pulp, with a combined annual production capacity of approximately 760,000 metric tons.operating three mills. For additional information, see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” of this Form 10-K (“Item 7”) under “Business Strategy and Outlook – Strategic opportunities.”.

Wood products

We operate 1816 sawmills in Canada that produce construction-grade lumber sold in North America. In addition, our sawmills are a major source of wood chips for our pulp and paper mills. We also operate two engineered wood products facilities in Canada that produce I-joists and three remanufacturing wood products facilities in Canada that produce bed frame components, finger joints and furring strips.

For additional information on our corporate strategy, see “Our Business” under Item 7.

Pulp and paper manufacturing facilities

The following table provides a listing of the pulp and paper manufacturing facilities and the number of paper machines we owned or operated as of December 31, 20112012 (excluding facilities and paper machines which have been permanently closed as of December 31, 2011)2012) and production information by product line (which represents all of our reportable segments except wood products). The table below represents these facilities’ actual 20112012 production, which reflects the impact of any downtime taken in 2011,2012, and 2012expected 2013 capacity.

| Number | 2012 | 2011 | 2011 Production by Product Line | Number | 2013 | 2012 | 2012 Production by Product Line | |||||||||||||||||||||||||||||||||||||||||||||||||

| (In 000s of metric tons) | of Paper Machines | Total Capacity | Total Production | Newsprint | Coated Papers | Specialty Papers | Market Pulp | of Paper Machines | Total Capacity | Total Production | Newsprint | Coated Papers | Specialty Papers | Market Pulp | ||||||||||||||||||||||||||||||||||||||||||

Canada | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Alma, Quebec | 3 | 370 | 351 | – | – | 351 | – | 3 | 368 | 348 | – | – | 348 | – | ||||||||||||||||||||||||||||||||||||||||||

Amos, Quebec | 1 | 193 | 194 | 194 | – | – | – | 1 | 200 | 165 | 165 | – | – | – | ||||||||||||||||||||||||||||||||||||||||||

Baie-Comeau, Quebec | 3 | 443 | 432 | 432 | – | – | – | 3 | 461 | 435 | 435 | – | – | – | ||||||||||||||||||||||||||||||||||||||||||

Clermont, Quebec(1) | 2 | 345 | 298 | 298 | – | – | – | 2 | 345 | 305 | 305 | – | – | – | ||||||||||||||||||||||||||||||||||||||||||

Fort Frances, Ontario | 2 | 254 | 229 | – | – | 171 | 58 | |||||||||||||||||||||||||||||||||||||||||||||||||

Dolbeau, Quebec(2) | 1 | 138 | 26 | – | – | 26 | – | |||||||||||||||||||||||||||||||||||||||||||||||||

Fort Frances, Ontario(3) | 2 | 112 | 177 | – | – | 146 | 31 | |||||||||||||||||||||||||||||||||||||||||||||||||

Gatineau, Quebec(4) | 1 | 110 | – | – | – | – | – | |||||||||||||||||||||||||||||||||||||||||||||||||

Iroquois Falls, Ontario | 2 | 251 | 244 | 214 | – | 30 | – | 2 | 263 | 221 | 194 | – | 27 | – | ||||||||||||||||||||||||||||||||||||||||||

Kenogami, Quebec | 1 | 143 | 137 | – | – | 137 | – | 1 | 139 | 134 | – | – | 134 | – | ||||||||||||||||||||||||||||||||||||||||||

Laurentide, Quebec | 2 | 329 | 323 | – | – | 323 | – | 1 | 226 | 195 | – | – | 195 | – | ||||||||||||||||||||||||||||||||||||||||||

Liverpool, Nova Scotia(2) | 2 | 230 | 224 | 216 | – | 8 | – | |||||||||||||||||||||||||||||||||||||||||||||||||

Saint-Félicien, Quebec(5) | – | 356 | 170 | – | – | – | 170 | |||||||||||||||||||||||||||||||||||||||||||||||||

Thorold, Ontario | 1 | 199 | 196 | 196 | – | – | – | 1 | 202 | 145 | 145 | – | – | – | ||||||||||||||||||||||||||||||||||||||||||

Thunder Bay, Ontario | 1 | 574 | 514 | 216 | – | – | 298 | 1 | 566 | 523 | 213 | – | – | 310 | ||||||||||||||||||||||||||||||||||||||||||

United States | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Augusta, Georgia(3) | 2 | 401 | 390 | 390 | – | – | – | |||||||||||||||||||||||||||||||||||||||||||||||||

Calhoun, Tennessee(4) | 3 | 655 | 640 | 118 | – | 394 | 128 | |||||||||||||||||||||||||||||||||||||||||||||||||

Catawba, South Carolina | 3 | 865 | 845 | – | 610 | 22 | 213 | |||||||||||||||||||||||||||||||||||||||||||||||||

Augusta, Georgia | 2 | 401 | 369 | 369 | – | – | – | |||||||||||||||||||||||||||||||||||||||||||||||||

Calhoun, Tennessee (6) | 3 | 660 | 636 | 180 | – | 324 | 132 | |||||||||||||||||||||||||||||||||||||||||||||||||

Catawba, South Carolina(7) | 3 | 871 | 771 | – | 533 | 18 | 220 | |||||||||||||||||||||||||||||||||||||||||||||||||

Coosa Pines, Alabama | – | 272 | 250 | – | – | – | 250 | – | 273 | 203 | – | – | – | 203 | ||||||||||||||||||||||||||||||||||||||||||

Fairmont, West Virginia(5) | – | 218 | 109 | – | – | – | 109 | |||||||||||||||||||||||||||||||||||||||||||||||||

Grenada, Mississippi | 1 | 247 | 240 | 240 | – | – | – | 1 | 246 | 241 | 241 | – | – | – | ||||||||||||||||||||||||||||||||||||||||||

Usk, Washington(5) | 1 | 244 | 240 | 240 | – | – | – | |||||||||||||||||||||||||||||||||||||||||||||||||

Menominee, Michigan(5) | – | 178 | 101 | – | – | – | 101 | |||||||||||||||||||||||||||||||||||||||||||||||||

Usk, Washington(8) | 1 | 243 | 239 | 239 | – | – | – | |||||||||||||||||||||||||||||||||||||||||||||||||

South Korea | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Mokpo, South Korea | 1 | 200 | 219 | 219 | – | – | – | 1 | 200 | 198 | 198 | – | – | – | ||||||||||||||||||||||||||||||||||||||||||

| 31 | 6,215 | 5,966 | 2,973 | 610 | 1,436 | 947 | 30 | 6,776 | 5,711 | 2,684 | 533 | 1,218 | 1,276 | |||||||||||||||||||||||||||||||||||||||||||

| (1) | Donohue Malbaie Inc. (“DMI”), which owns one of Clermont’s paper machines, is owned 51% by us and 49% by NYT Capital Inc. We manage the facility and wholly own all of the other assets at the site. Manufacturing costs are transferred between us and DMI at agreed-upon transfer costs. DMI’s paper machine produced |

| (2) |

|

| (3) | On November 20, 2012, we announced the indefinite idling of the kraft mill and a paper machine at our Fort Frances facility, effective December 4, 2012 and December 10, 2012, respectively (representing approximately 200,000 metric tons of pulp capacity and approximately 105,000 metric tons of specialty papers capacity). The pulp production listed represents pulp sold to third parties. |

| (4) | Our Gatineau facility, which was closed in 2010, is |

| (5) | On May 2, 2012, we acquired Fibrek, which owns the Saint-Félicien, Fairmont and |

|

Calhoun Newsprint Company (“CNC”), which owns one of Calhoun’s paper machines, Calhoun’s recycled fiber plant and a portion of the thermomechanical pulp (“TMP”) mill, is owned 51% by us and 49% by Herald Company, Inc. We manage the facility and wholly own all of the other assets at the site, including the remaining portion of the TMP mill, a kraft pulp mill, a market pulp dryer, |

On June 23, 2012, we announced the indeterminate idling of a paper machine at our Catawba facility, effective June 30, 2012 (representing approximately 132,000 metric tons of capacity). |

| (8) | Ponderay Newsprint Company is located in Usk, Washington and is an unconsolidated partnership in which we have a 40% interest and, through a wholly-owned subsidiary, we are the managing partner. The balance of the partnership is held by |

Wood products facilities

The following table provides a listing of the sawmills we owned or operated as of December 31, 20112012 and their respective 2012expected 2013 capacity and 20112012 production. Our harvesting rights in Quebec are not sufficient to operate our sawmills at their total capacity. This table excludes facilities which have been permanently closed as of December 31, 2011.2012.

| (In million board feet) | 2012 Total Capacity | 2011 Total Production | 2013 Total Capacity | 2012 Total Production | ||||||||||||||

Comtois, Quebec | 145 | 50 | 145 | 28 | ||||||||||||||

Girardville-Normandin, Quebec | 208 | 189 | 218 | 178 | ||||||||||||||

La Dore, Quebec | 183 | 183 | ||||||||||||||||

La Doré, Quebec | 185 | 185 | ||||||||||||||||

La Tuque, Quebec (1) | 200 | 108 | 200 | 115 | ||||||||||||||

Maniwaki, Quebec | 160 | 125 | 160 | 59 | ||||||||||||||

Mistassini, Quebec | 175 | 167 | 175 | 166 | ||||||||||||||

Oakhill, Nova Scotia(2) | 152 | 97 | ||||||||||||||||

Obedjiwan, Quebec (3) | 30 | 20 | ||||||||||||||||

Petit Saguenay, Quebec(4) | 27 | – | ||||||||||||||||

Obedjiwan, Quebec (2) | 30 | 16 | ||||||||||||||||

Pointe-aux-Outardes, Quebec | 175 | 26 | 175 | 36 | ||||||||||||||

Roberval, Quebec | 143 | 21 | 143 | 9 | ||||||||||||||

Saint-Felicien, Quebec | 160 | 135 | ||||||||||||||||

Saint-Fulgence, Quebec(4) | 167 | 26 | ||||||||||||||||

Saint-Félicien, Quebec | 160 | 126 | ||||||||||||||||

Saint-Fulgence, Quebec | 167 | 26 | ||||||||||||||||

Saint-Hilarion, Quebec | 85 | 22 | 85 | 19 | ||||||||||||||

Saint-Ludger-de-Milot, Quebec (5) | 135 | 95 | ||||||||||||||||

Saint-Ludger-de-Milot, Quebec (3) | 135 | 97 | ||||||||||||||||

Saint-Thomas, Quebec | 110 | 78 | 110 | 74 | ||||||||||||||

Senneterre, Quebec | 155 | 104 | 155 | 118 | ||||||||||||||

Thunder Bay, Ontario | 300 | 237 | 300 | 256 | ||||||||||||||

| 2,710 | 1,683 | 2,543 | 1,508 | |||||||||||||||

| (1) | Forest Products Mauricie L.P. is located in La Tuque, Quebec and is a consolidated subsidiary in which we have a 93.2% interest. The amounts in the above table represent the mill’s total capacity and production. |

| (2) |

|

Societe en Commandite Scierie Opitciwan is located in Obedjiwan, Quebec and is an unconsolidated entity in which we have a 45% interest. The amounts in the above table represent the mill’s total capacity and production. |

|

Produits Forestiers Petit-Paris Inc. is located in Saint-Ludger-de-Milot, Quebec and is an unconsolidated entity in which we have a 50% interest. The amounts in the above table represent the mill’s total capacity and production. |

The following table provides a listing of the remanufacturing and engineered wood products facilities we owned or operated as of December 31, 20112012 and their respective 2012expected 2013 capacity and 20112012 production.

| (In million board feet, except where otherwise stated) | 2012 Total Capacity | 2011 Total Production | 2013 Total Capacity | 2012 Total Production | ||||||||||||||

Remanufacturing Wood Products Facilities | ||||||||||||||||||

Chateau-Richer, Quebec | 63 | 47 | 63 | 48 | ||||||||||||||

La Dore, Quebec | 15 | 20 | ||||||||||||||||

La Doré, Quebec | 15 | 22 | ||||||||||||||||

Manseau, Quebec | 20 | 7 | 20 | 12 | ||||||||||||||

Total Remanufacturing Wood Facilities | 98 | 74 | 98 | 82 | ||||||||||||||

Engineered Wood Products Facilities | ||||||||||||||||||

Larouche and Saint-Prime, Quebec (million linear feet) | 145 | 67 | 145 | 85 | ||||||||||||||

| (1) | Our Manseau facility will be permanently closed in the first quarter of 2013. |

| (2) | Abitibi-LP Engineered Wood Inc. and Abitibi-LP Engineered Wood II Inc. are located in Larouche, Quebec and Saint-Prime, Quebec, respectively, and are unconsolidated entities in which we have a 50% interest in each entity. We operate the facilities and our joint venture partners sell the products. The amounts in the above table represent the mills’ total capacity and production. |

On October 12, 2006, an agreement regarding Canada’s softwood lumber exports to the U.S. became effective (the “2006 Softwood Lumber Agreement”). The 2006 Softwood Lumber Agreement provides for, among other things, softwood lumber to be subject to one of two ongoing border restrictions, depending upon the province of first manufacture with several provinces including Nova Scotia, being exempt from these border restrictions. Volume quotas have been established for each company within the provinces of Ontario and Quebec based on historical production, and the volume quotas are not transferable between provinces. Quota volume restrictions are lifted if U.S. composite prices would have to rise above $355 composite per thousand board feet before the quota volume restrictions would be lifted, which had not occurred since the implementation of the 2006 Softwood Lumber Agreement.feet. On January 23, 2012, Canada and the U.S. announced a two-year extension to the 2006 Softwood Lumber Agreement, through October 2015. For information regarding lumber duties, see Note 20, “Commitments and Contingencies – Lumber duties,” to our Consolidated Financial Statements.

Other products

We also sell pulpwood, saw timber and wood chips to customers located in Canada and the United States. Sales of these other products are considered a recovery of the cost of manufacturing our primary products.

Raw Materials

Our operations consume substantial amounts of raw materials such as wood, recovered paper, chemicals and energy in the manufacturing of our paper, pulp and wood products. We purchase raw materials and energy sources (except internal generation) primarily on the open market.

Wood

Our sources of wood include property we own or lease, property on which we possess harvesting rights and purchases from local producers, including sawmills that supply residual wood chips. As of December 31, 2011,2012, we owned or leased approximately 0.70.1 million acres of timberlands, primarily in Canada, and have long-term harvesting rights for approximately 35.236.2 million acres of Crown-owned land in Canada. These sources provide approximately halfone third of ourthe wood fiber supplies to our paper, pulp and wood products operations. The harvesting rights contracts are approximately 20 – 25 years in length and automatically renew every five years, contingent upon our continual compliance with environmental performance and reforestation requirements. New legislation in the province of Quebec provides that a portion of the harvesting rights allocated to harvesters, including us, will be subject to an auction system that will be fully implemented in April 2013.

All of our managed forest lands are third-party certified to one or more globally recognized sustainable forest management standards, including those of the Sustainable Forestry Initiative (the “SFI”), Canadian Standards Association (the “CSA”) and Forest Stewardship Council (the “FSC”). We have implemented fiber tracking systems at our mills to ensure that our wood fiber supply comes from acceptable sources such as certified forests and legal harvesting operations. At several of our mills, theseThese systems are third-party certified at all of our mills to recognize chain of custody standards, with the exception of one mill, which is expected to be certified by the second quarter of 2013.

In Quebec and others areOntario, our volume allocated on Crown land is limited by the Annual Allowable Cut. This overall level of harvest is revised on a regular basis, typically every five years. In December 2006, the Chief Forester of the province of Quebec confirmed a reduction of 23.8% below 2004 levels for the period 2008 to 2013. In August 2011, the Quebec Chief Forester announced an interim estimate reduction of 10.3% in the process of being certified.Annual Allowable Cut for 2013 – 2014. A final assessment is expected in 2013.

We strive to improve our forest management and wood fiber procurement practices and we encourage our wood and fiber suppliers to demonstrate continual improvement in forest resource management, wood and fiber procurement and third-party certification.

Recovered paper

We are one of the largest recyclers of newspapers and magazines in North America and have a number of recycling plants that use advanced mechanical and chemical processes to manufacture high quality pulp from a mixture of old newspapers, old magazines and magazines,sorted office paper, or “recovered paper.” Using recovered paper, we produce, among other things, recycled fiber newsprint and uncoated specialty papers comparable in quality to paper produced with 100% virgin fiber pulp. The Thorold and Mokpo newsprint operations, and the Menominee and Fairmont pulp operations, produce products containing 100% recycled fiber. In 2011,2012, we used 0.9 million metric tons of recovered paper in our production processes and the recycled fiber content in the newsprint we produced averaged 20%17%.

In 2011,2012, we collected or purchased 1.2 million metric tons of recovered paper. Our Paper Retriever® and ecorewards® programs collect recovered fiber through a combination of community drop-off containers and recycling programs with businesses and commercial offices. The recovered paper that we physically purchase is from suppliers generally within the region of our recycling plants, primarily under long-term agreements.

Energy

Steam and electrical power constitute the primary forms of energy used in pulp and paper production. Process steam is produced in boilers using a variety of fuel sources, as well as heat recovery units in mechanical pulp facilities. All but two of our mills produced 100% of their own steam requirements. In 2011,2012, our Alma, Calhoun, Catawba, Coosa Pines, Dolbeau, Fort Frances, Kenogami, Saint-Félicien and Thunder Bay operations collectively consumed approximately 33%37% of their electrical requirements from internal sources, notably on-site cogeneration and hydroelectric stations.dams. The balance of our energy needs was purchased from third parties. We have sixseven sites that operate cogeneration facilities and all of these sites generate “green energy” from carbon-neutral biomass. In addition, we utilize alternative fuels such as methane from landfills, used oil, tire-derived fuel and black liquor to reduce consumption of virgin fossil fuels.

As of December 31, 2011,2012, we had one hydroelectric facility (Hydro Saguenay, Quebec), which consisted of seven installationsdams with capacity of 162170 MW and generation of 1,1221,120 GWh. The water rights agreements required to operate these installationsdams typically range from 10 to 50 years and are generally renewable, under certain conditions, for additional terms. In certain circumstances, water rights are granted without expiration dates. In some cases, the agreements are contingent on the continued operation of the related paper mill and a minimum level of capital spending in the region. The province of Quebec informed us on December 30, 2011 that it intended not to terminate one of these agreementsrenew our water rights associated with our Jim-Gray hydroelectric dam and to require us to transfer property of the associated installationproperty to the province for no consideration. The termination andOn February 6, 2013, the province of Quebec granted us an extension to transfer the property. As extended, an agreement on the terms of the transfer would need to be effective as of March 2, 2012.entered into at the latest on June 14, 2013. The province’s actions are not consistent withcontrary to our understanding of the agreementwater power lease in question. We continue to evaluate our legal options. For additional information, see the discussion under “Critical Accounting Estimates – Long-lived assets” in Item 7.

Competition

In general, our products are globally-traded commodities and are marketed in close to 9080 countries. The markets in which we compete are highly competitive and, aside from quality specifications to meet customer needs, the production of our products does not depend upon a proprietary process or formula. Pricing and the level of shipments of our products are influenced by the balance between supply and demand as affected by global economic conditions, changes in consumption and capacity, the level of customer and producer inventories and fluctuations in currency exchange rates. Any material decline in prices for our products or other adverse developments in the markets for our products could have a material adverse effect on our results of operations or financial condition. Prices for our products have been and are likely to continue to be highly volatile.

Newsprint, one of our principal products, is produced by numerous manufacturers worldwide. In 2011,2012, the five largest North American producers represented approximately 85%78% of North American newsprint capacity and the five largest global producers represented approximately 36%35% of global newsprint capacity. Our total newsprint capacity is approximately 9% of worldwide newsprint capacity. We face competition from both large global producers and numerous smaller regional producers. In recent years, a number of global producers of newsprint based in Asia, particularly China, have grown their production capacity. Price, quality and customer relationships are important competitive determinants.

We compete with seven other coated mechanical paper producers with operations in North America. In 2011,2012, the five largest North American producers represented approximately 84%85% of North American capacity for coated mechanical paper. In addition, several major offshore suppliers of coated mechanical paper compete for North American business. In 2011,2012, offshore imports represented approximately 11%12% of North American demand. As a major supplier to printers, end users (such as magazine publishers, catalogers and retailers) and brokers/merchants in North America, we compete with numerous worldwide suppliers of other grades of paper such as coated freesheet and supercalendered paper. We compete on the basis of price, quality and service.

In 2011,2012, we produced approximately 30%31% of North American uncoated mechanical paper demand, comprised mainly of supercalendered, superbright, high bright, bulky book and directory papers. We compete with numerous uncoated mechanical paper producers with operations in North America. In addition, imports from overseas represented approximately 10% of North American demand in 20112012 and were primarily concentrated in the supercalendered paper market where they represented approximately 19%20% of North American demand. We compete on the basis of price, quality, service and breadth of product line.

We compete with eightseven other major market pulp suppliersproducers with operations in North America along with other smaller competitors. Market pulp is a globally-traded commodity for which competition exists in all major markets. We produce five major grades of market pulp (northern and southern hardwood, northern and southern softwood and fluff) and compete with other producers from South America (eucalyptus hardwood and radiata pine softwood), Europe (northern hardwood and softwood) and Asia (mixed tropical hardwood). With the acquisition of Fibrek, we also produce recycled bleached kraft pulp. Price, quality, service and fiber sources are considered the main competitive determinants.

By the end of 2008, we had completed the certification of all of our managed forest lands to globally-recognized sustainable forest management standards, namely the SFI and the Z809 Standard of the CSA. In 2009, to better respond to market demands, we introduced the FSC standard in our certification portfolio by re-certifying two forest units in Quebec from CSA to FSC and by dual-certifying one forest in Ontario to FSC (already certified to SFI). In 2010, we further balanced our forest certification portfolio by re-certifying two additional forest units in Quebec from CSA to FSC and by dual-certifying one forest in Nova Scotia to FSC (already certified to SFI). We have committed to increasing FSC certification of our forest tenures from 18% in 2010 to 80% by 2015. We have certified approximately 65% of our forests to FSC standards, and in 2012, achieved the distinction of being the largest manager of FSC-certified forests in the world.

As with other global commodities, the competitive position of our products is significantly affected by the volatility of foreign currency exchange rates. See Item 7A, “Quantitative and Qualitative Disclosures About Market Risk – Foreign Currency Exchange Risk,” of this Form 10-K. We have operations in Canada, the United States and South Korea. In addition to the U.S., several of our primary competitors are located in Canada, Sweden, Finland and certain Asian countries. Accordingly, the relative rates of exchange between those countries’ currencies and the United States dollar can have a substantial effect on our ability to compete. In addition, the degree to which we compete with foreign producers depends in part on the level of demand abroad. Shipping costs and relative pricing generally cause producers to prefer to sell in local markets when the demand is sufficient in those markets.

Trends in advertising, electronic data transmission and storage and the Internet couldare expected to have further adverse effects on the demand for traditional print media, including our products and those of our customers, but neither the timing nor the extent of those trends can be predicted with certainty. Our newspaper, magazine, book and catalog publishing customers may increasingly use, and compete with businesses that use, other forms of media and advertising and electronic data transmission and storage, including television, electronic readers and the Internet, instead of newsprint, coated papers, uncoated specialty papers or other products made by us. The demand for newsprint declined significantly over the last several years as a result of continued declines in newspaper circulation and advertising volume and publishers’ conservation measures, which include increased usage of lighter basis-weight newsprint and web-width and page count reductions. Our newsprint, magazine and catalog publishing customers are also subject to the effects of competing media, including the Internet.

Emergence From Creditor Protection Proceedings

AbitibiBowater Inc.We and all but one of itsour debtor affiliates (as discussed below) successfully emerged from creditor protection proceedings under Chapter 11 of the United States Bankruptcy Code, as amended (“Chapter 11”) and theCompanies’ Creditors Arrangement Act (Canada) (the “CCAA”), as applicable (collectively, the “Creditor Protection Proceedings”) on December 9, 2010 (the “Emergence Date”). In the third quarter of 2010, the creditors under the Creditor Protection Proceedings, with one exception, voted in the requisite numbers to approve the respective Plan of Reorganization (as defined below). Creditors of Bowater Canada Finance Corporation (“BCFC”), an indirect, wholly-owned subsidiary of ours, did not vote in the requisite numbers to approve the Plans of Reorganization (as defined below). Accordingly, we did not seek sanction of theCCAA Plan of Reorganization and Compromise (the “CCAA Reorganization Plan”) or confirmation of theDebtors’ Second Amended Joint Plan of Reorganization under Chapter 11 of the Bankruptcy Code (the “Chapter 11 Reorganization Plan” and, together with the CCAA Reorganization Plan, the “Plans of Reorganization” and each, a “Plan of Reorganization”) with respect to BCFC. See Item 3, “Legal Proceedings, – BCFC Bankruptcy and Insolvency Act Filing,” for information regarding BCFC’s Bankruptcy and Insolvency Act filing on December 31, 2010. The Plans of Reorganization became effective on the Emergence Date.

From the 97,134,954 shares of Successor Company common stock issued for claims in the Creditor Protection Proceedings, we established a reserve of 23,382,073 shares for claims that remained in dispute as of the Emergence Date, from which we have made and will make supplemental interim distributions to unsecured creditors as disputed claims are resolved. As of December 31, 2011, there were 19,719,565 shares remaining in this reserve. The remaining claims are claims that we believe should be disallowed because they are duplicative, without merit, overstated or should be disallowed for other reasons. We have made significant progress in addressing the claims that remained in dispute at the time of our emergence from the substantial number and amount of claims filed during the Creditor Protection Proceedings. The majority of the remaining disputed claims will be disposed through ongoing litigation before the United States Bankruptcy Court for the District of Delaware (the “U.S. Court”) or a claims officer appointed by the Superior Court of Quebec in Canada (the “Canadian Court” and, together with the U.S. Court, the “Courts”). The ultimate completion of the claims resolution process could therefore take some time to complete. We may be required to settle certain disputed claims in cash under certain specific circumstances. As such, included in “Accounts payable and accrued liabilities” in our Consolidated Balance Sheets (as defined below) as of December 31, 2011 and 2010 is a liability of $11 million and $35 million, respectively, for the estimated cash settlement of such claims. To the extent there are shares remaining after all disputed claims have been resolved, these shares will be reallocated ratably among unsecured creditors with allowed claims in the Creditor Protection Proceedings pursuant to the Plans of Reorganization.

For additional information regarding the Creditor Protection Proceedings, see Note 3,4, “Creditor Protection Proceedings,” to our Consolidated Financial Statements.

Basis of Presentation

Effective upon the commencement of the Creditor Protection Proceedings on April 16 and 17,in 2009 and through the Convenience Date (as defined below), we applied the guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 852, “Reorganizations” (“FASB ASC 852”), in preparing our consolidated financial statements. The guidance in FASB ASC 852 does not change the manner in which financial statements are prepared. However, it requires that the financial statements distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Accordingly, during the Creditor Protection Proceedings, we: (i) recorded certain expenses, charges and credits incurred or realized that were directly associated with or resulting from the reorganization and restructuring of the business in “Reorganization items, net” in our Consolidated Statements of Operations included in our Consolidated Financial Statements (“Consolidated Statements of Operations”) and (ii) ceased recording interest expense on certain of our pre-petition debt obligations. For additional information, see Note 3,4, “Creditor Protection Proceedings,” and Note 16, “Liquidity and17, “Long-Term Debt,” to our Consolidated Financial Statements.

In accordance with FASB ASC 852, fresh start accounting (“fresh start accounting”) was required upon our emergence from the Creditor Protection Proceedings, which we applied effective December 31, 2010 (the “Convenience Date”). As such, adjustments related to the application of fresh start accounting was reflected in our Consolidated Balance Sheets included in our Consolidated Financial Statements (“Consolidated Balance Sheets”) as of December 31, 2010 and fresh start accounting adjustments related thereto were included in our Consolidated Statements of Operations for the year ended December 31, 2010.

The implementation of the Plans of Reorganization and the application of fresh start accounting materially changed the carrying amounts and classifications reported in our consolidated financial statements and resulted in the Company becoming a new entity for financial reporting purposes. Accordingly, our consolidated financial statements as of December 31, 2010 and for periods subsequent to December 31, 2010 are not comparable to our consolidated financial statements for periods prior to December 31, 2010. References to “Successor” or “Successor Company” refer to the Company on or after December 31, 2010, after giving effect to the implementation of the Plans of Reorganization and the application of fresh start accounting. References to “Predecessor” or “Predecessor Company” refer to the Company prior to December 31, 2010. Additionally, references to periods on or after December 31, 2010 refer to the Successor and references to periods prior to December 31, 2010 refer to the Predecessor.

Employees

As of December 31, 2011,2012, we employed approximately 10,4009,300 people, of whom approximately 7,9006,700 were represented by bargaining units. Our unionized employees are represented predominantly by the Communications, Energy and Paperworkers Union (the “CEP”) and the Confederation des syndicats nationauxof National Trade Unions (the “CSN”“CNTU”) in Canada and predominantly by the United Steelworkers International in the U.S.

We haveWhile we intend to negotiate to renew collective bargaining agreements, in place covering the majority of our unionized employees, many of which have been recently renewed and revised. However, there can be no assurance that we will be able to renew agreements on satisfactory terms, or that we will maintain continuously satisfactory agreements with all of our unionized employees or that we will finalize satisfactory agreements with the remaining unionized employees (which include approximately 200 wood workers in Quebec).employees. Should we be unable to do so, it could result in strikes or other work stoppages by affected employees, which could cause us to experience a disruption of operations and affect our business, financial condition or results of operations.

Trademarks

We registeredhave applied for registration of the marks “AbitibiBowater,” “Resolute,” “Resolutetrademarks “RESOLUTE” and “resolute Forest Products” “Resolu” and “Produits Forestiers Resolu” and the AbitibiBowater and Resolute logos & Design” in the countries of our principal markets.markets, as well as “RESOLUTE FOREST PRODUCTS” and “R Design” in Canada and the United States, and “RÉSOLU” and “Produits forestiers résolu & Design” in Canada. We consider our interest in the logosmarks and markslogos to be important and necessary to the conduct of our business.

Environmental Matters

We are subject to a variety of federal, state, provincial and local environmental laws and regulations in the jurisdictions in which we operate. We believe our operations are in material compliance with current applicable environmental laws and regulations. While it is impossible to predict future environmental regulations that may be established, we believe that we will not be at a competitive disadvantage with regard to meeting future Canadian, United States or South Korean standards. For additional information, see

Note 20, “Commitments and Contingencies – Environmental matters,” to our Consolidated Financial Statements.

Internet Availability of Information

We make our Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K, and any amendments to these reports, available free of charge on our website(www.resolutefp.com) as soon as reasonably practicable after we file or furnish such materials to the SEC. The SEC also maintains a website(www.sec.gov)that contains our reports and other information filed with the SEC. In addition, any materials we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C., 20549. Information on the operations of the Public Reference Room may be obtained by calling the SEC at

1-800-SEC-0330. Our reports are also available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) website(www.sedar.com).

In addition to the other information set forth in this Form 10-K, you should carefully consider the following factors, which could materially affect our business, financial condition or future results. In particular, the risks described below could cause actual events to differ materially from those contemplated in the forward-looking statements in this Form 10-K. The risks described below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially affect our business, financial condition or future results.

Developments in alternative media couldare expected to continue to adversely affect the demand for our products, especially in North America, and our responses to these developments may not be successful.

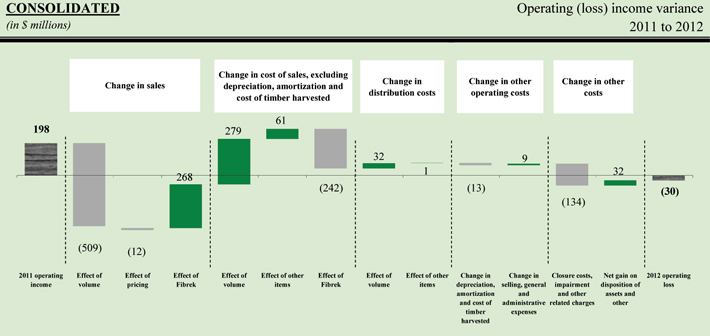

Trends in advertising, electronic data transmission and storage and the Internet couldare expected to have further adverse effects on the demand for traditional print media, including our products and those of our customers. Neither the timing nor the extent of those trends can be predicted with certainty. Our newspaper, magazine, book and catalog publishing customers may increasingly use, and compete with businesses that use, other forms of media and advertising and electronic data transmission and storage, including television, electronic readers and the Internet, instead of newsprint, coated papers, uncoated specialty papers or other products made by us. The demand for certain of our products weakened significantly over the last several years. For example, industry statistics indicate that North American newsprint demand has been in decline for several years and has experienced annual declines of 10.3% in 2007, 11.2% in 2008, 25.3% in 2009, 6.0% in 2010, and 7.4% in 2011.2011 and 1.2% in 2012. Third-party forecasters indicate that these declines may continue in the future due to reduced North American newspaper circulation, less advertising, substitution to other uncoated mechanical grades and conservation measures taken by publishers.

One of our responses to the declining demand for our products has been to curtail our production capacity. If demand for our products continues to decline, for our products, it may become necessary to curtail production even further or permanently shut down even more machines or facilities. Curtailments or shutdowns could result in asset impairments and additional cash costs at the affected facilities, including restructuring charges and exit or disposal costs, and could negatively impact our cash flows and materially affect our results of operations or financial condition.

Currency fluctuations may adversely affect our results of operations or financial condition, and changes in foreign currency exchange rates can affect our competitive position, selling prices and manufacturing costs.

We compete with North American, European and Asian producers in most of our product lines. Our products are sold and denominated in U.S. dollars, Canadian dollars and selected foreign currencies. A substantial portion of our manufacturing costs are denominated in Canadian dollars. In addition to the impact of product supply and demand, changes in the relative strength or weakness of such currencies, particularly the U.S. dollar, may also affect international trade flows of these products. A stronger U.S. dollar may attract imports into North America from foreign producers, increase supply and have a downward effect on prices, while a weaker U.S. dollar may encourage U.S. exports and increase manufacturing costs that are in Canadian dollars or other foreign currencies. Variations in the exchange rates between the U.S. dollar and other currencies, particularly the Euro and the currencies of Canada, Sweden and certain Asian countries, will significantly affect our competitive position compared to many of our competitors.

We are particularly sensitive to changes in the value of the Canadian dollar versus the U.S. dollar. The impact of these changes depends primarily on our production and sales volume, the proportion of our production and sales that occur in Canada, the proportion of our financial assets and liabilities denominated in Canadian dollars, our hedging levels and the magnitude, direction and duration of changes in the exchange rate. We expect exchange rate fluctuations to continue to impact costs and revenues; however, we cannot predict the magnitude or direction of this effect for any quarter, and there can be no assurance of any future effects. During the last two years, the relative value of the Canadian dollar ranged from a high of US$1.06 in July 2011 to a low of US$0.930.95 in May 2010October 2011 and was US$0.981.01 as of December 31, 2011.2012. Based on operating projections for 2012,2013, a one-cent increase in the Canadian-U.S. dollar exchange rate would decrease our annual operating income by approximately $16$14 million.

Certain of our assets and liabilities, including a substantial portion of our net pension and pension and other postretirement benefit (“OPEB”) obligations and our deferred income tax assets, are denominated in Canadian dollars, and are exposed to foreign currency movements. Our earnings are therefore affected by increases or decreases in the value of the Canadian dollar. Increases in the value of the Canadian dollar versus the U.S. dollar will tend to increase reported earnings, and decreases in the value of the Canadian dollar will tend to reduce reported earnings.

If the Canadian dollar continues to remain strong or appreciates as against the U.S. dollar, it could influence the foreign exchange rate assumptions that are used in our evaluation of long-lived assets for impairment and consequently, result in asset impairment charges.

We face intense competition in the forest products industry and the failure to compete effectively would have a material adverse effect on our business, financial condition or results of operations.

We compete with numerous forest products companies, many of which have greater financial resources than we do. There has been a continued trend toward consolidation in the forest products industry, leading to new global producers. These global producers are typically large, well-capitalized companies that may have greater flexibility in pricing and financial resources for marketing, investment and expansion than we do. The markets for our products are all highly competitive. Actions by competitors can affect our ability to sell our products and can affect the volatility of the prices at which our products are sold. While the principal basis for competition is price, we also compete on the basis of customer service, quality and product type. There has also been an increasing trend toward consolidation among our customers. With fewer customers in the market for our products, our negotiating position with these customers could be weakened.

In addition, our industry is capital intensive, which leads to high fixed costs. Some of our competitors may be lower-cost producers in some of the businesses in which we operate. Global newsprint capacity, particularly Chinese and European newsprint capacity, has been increasing, which may result in lower prices, volumes or both for our exported products. We believe that hardwood pulp capacity at South American pulp mills has unit costs that are significantly below those of our hardwood kraft pulp mills. Other actions by competitors, such as reducing costs or adding low-cost capacity, may adversely affect our competitive position in the products we manufacture and consequently, our sales, operating income and cash flows. We may not be able to compete effectively and achieve adequate levels of sales and product margins. Failure to compete effectively would have a material adverse effect on our business, financial condition or results of operations.

The forest products industry is highly cyclical. Fluctuations in the prices of, and the demand for, our products could result in small or negative profit margins, lower sales volumes and curtailment or closure of operations.

The forest products industry is highly cyclical. Historically, economic and market shifts, fluctuations in capacity and changes in foreign currency exchange rates have created cyclical changes in prices, sales volume and margins for our products. Most of our paper and wood products are commodities that are widely available from other producers and even our coated and specialty papers are susceptible to these fluctuations. Because our commodity products have few distinguishing qualities from producer to producer, competition for these products is based primarily on price, which is determined by supply relative to demand. The overall levels of demand for the products we manufacture and distribute and consequently, our sales and profitability, reflect fluctuations in levels of end-user demand, which depend in part on general economic conditions in North America and worldwide.

The effect of not meeting certain conditions under theWe could be required to make contributions to our Canadian pension funding relief regulationsplans at levels that could be significantly higher than expected, which could have a materialan adverse impact on our financial condition.

As ofa pre-condition to our emergence from the third quarter of 2011, bothcreditor protection proceedings, we entered into agreements with the provinces of Quebec and Ontario had adopted specific regulations to implementestablish parameters concerning the funding relief measures with respect toof the aggregate solvency deficits in our material Canadian registered pension plans, which we refer to as contemplated by an agreement between each province andthe “affected plans,” until 2020. These plans represented approximately 70% of our principal Canadian operating subsidiary, effectiveunfunded pension obligations as of December 31, 2012. In exchange for certain undertakings, the provinces confirmed their intention to adopt regulations specific to us, which we refer to as the “funding relief regulations,” to implement those parameters in respect of the affected plans. Because the aggregate solvency ratio in the affected plans was below the minimum solvency level prescribed in the funding relief regulations as of December 31, 2011, those regulations require that we propose, by March 2013, corrective measures designed to attain the target solvency ratio prescribed therein within five years. The portion of the solvency deficit that is subject to corrective measures amounted to approximately Cdn$500 million as of December 31, 2011 ($504 million, based on the exchange rate in effect on December 31, 2012). We continue to work with other plan stakeholders, including employees, retirees, unions, the provincial governments of Quebec and Ontario and the related pension regulators to address these corrective measures, but at this time we cannot estimate the additional contributions, if any, that may be made or required in future years in respect of the corrective measures, but they could be material, which would negatively impact our emergencecash flows and materially affect our results of operations or financial condition.

In light of a further decrease in yields on government securities in Canada, and certain changes to Canadian actuarial rules, when we file the actuarial report in respect of the affected plans in the second quarter of 2013, we expect that the aggregate solvency ratio as of December 31, 2012, will likely have further decreased from the Creditor Protection Proceedingslevel at December 31, 2011. This might therefore trigger the need for additional corrective measures, but at this time we cannot estimate the supplemental contributions, if any, that may be made or required in future years as a periodresult, but they could be material, which would negatively impact our cash flows and materially affect our results of 10 years. Thoseoperations or financial condition.

The agreements includewe reached with the provinces of Quebec and Ontario to implement the funding relief measures provide a number of undertakings by our principal Canadian operating subsidiary, which willincluding an obligation to make solvency deficit reduction contributions in the event of capacity reductions, subject to certain conditions. These undertakings apply for a minimum period of five years following the Emergence Date. Those undertakings and the basic funding parameters are described in Note 18, “Pension and Other Postretirement Benefit Plans – Canadian pension funding relief,” to our Consolidated Financial Statements. We could lose the benefit of the funding relief regulations if we fail to comply with them or fail to meet our undertakings in the related agreements, which, in either case, could have a material impact on our financial condition.

The regulations also provide that corrective measures would be required if the aggregate solvency ratio in the registered pension plans falls below For a prescribed level under the target provided by the regulations as of December 31 in any year through 2014. Such measures may include additional funding over five years to attain the target solvency ratio prescribed in the regulations. Thereafter, supplemental contributions, as described in Note 18, “Pension and Other Postretirement Benefit Plans – Canadian pension funding relief,” to our Consolidated Financial Statements, would be required if the aggregate solvency ratio in the registered pension plans falls below a prescribed level under the target provided by the regulations as of December 31 in any year on or after 2015 for the remainderfurther discussion of the period covered by the regulations. The aggregate solvency ratio in the Canadian registered pension plans covered by the Quebec and Ontario funding relief is determined annually as of December 31. The calculation is based on a number of factorsregulations, see “Liquidity and assumptions, including the accrued benefits to be provided by the plans, interest rate levels, membership data and demographic experience. In light of low yields on government securities in Canada, which are used to determine the applicable discount rate, when we file the actuarial report in respect of these plans later this year, we expect that the aggregate solvency ratio in these Canadian registered plans will have fallen below the minimum level prescribed by the regulations and that we will therefore be required to adopt corrective measures by March 2013. At this time, we cannot estimate the additional contributions, if any, that may be required in future years, but they could be material.Capital Resources – Employee Benefit Plans” under Item 7.

It is also possible that provinces other than Quebec and Ontarioprovincial pension regulators could attempt to assert jurisdiction and to compel additional funding of certain of our Canadian registered pension plans in respect of plan members associated with sites we formerly operated in their respective provinces. At this time,As more fully described under Item 3, “Legal Proceedings,” we cannot estimatefiled a motion for directives with the additional contributions,Quebec Superior Court in Canada, the court with jurisdiction in the Creditor Protection Proceedings (the “Canadian Court”), seeking an order to prevent pension regulators in each of Quebec, New Brunswick and Newfoundland and Labrador from declaring partial wind-ups of pension plans relating to employees of former operations in New Brunswick and Newfoundland and Labrador, or a declaration that any claim for accelerated reimbursements of deficits arising from a partial wind-up is a barred claim under the Creditor Protection Proceedings. A partial wind-up would likely shorten the period in which any deficit within those plans, which could exceed $150 million, would have to be funded if any, that may be required, but they could be material.we do not obtain the relief sought.

We may be required to record additional valuation allowances against our recorded deferred income tax assets.

We recorded significant tax attributes (deferred income tax assets) in our Consolidated Balance Sheet included in our Consolidated Financial Statements (“Consolidated Balance Sheet”) as of December 31, 2011,2012, which attributes would be available to offset any future taxable income. If, in the future, we determine that we are unable to use the full extent of these tax attributes as a result of sustained cumulative taxable losses, we could be required to record additional valuation allowances for the portion of the deferred income tax assets that are not recoverable. Such valuation allowances, if taken, would be recorded as a charge to income tax expense and would negatively impact our reported net income (loss).

We may not be able to generate sufficient cash to service allresults of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to service our debt obligations depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and certain financial, business, legislative, regulatory and other factors beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to fund our day-to-day operations or to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay capital expenditures or to sell assets or operations, seek additional capital or restructure or refinance our indebtedness. We may not be able to effect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, such alternative actions may not allow us to meet our scheduled debt service obligations. The credit agreement that governs our ABL Credit Facility (as defined and further discussed in Item 7 under “Liquidity and Capital Resources”) restricts our ability to dispose of assets and use the proceeds from any such dispositions and may also restrict our ability to raise debt or equity capital to be used to repay other indebtedness when it becomes due. We may not be able to consummate those dispositions or obtain proceeds in an amount sufficient to meet any debt service obligations when due.

If we are unable to generate sufficient cash flows to service our obligations under the 2018 Notes (as defined in Item 7 under “Liquidity and Capital Resources”) and the ABL Credit Facility, we would be in default. If the default is not cured, holders of the 2018 Notes could declare all outstanding principal and interest to be due and payable, the lenders under the ABL Credit Facility could terminate their commitments to loan money, our secured lenders could foreclose against the assets securing such borrowings and we could be forced into bankruptcy or liquidation.operations.

The credit agreement that governs the ABL Credit Facility and the 2018 Notes indenture may restrict our ability to respond to changes or to take certain actions.

The indenture with respect to our senior secured notes due in 2018 Notes indenture(the “2018 Notes”), and the credit agreement that governs our ABLsenior secured asset-based revolving credit facility (the “ABL Credit FacilityFacility”), contain a number of restrictive covenants that impose significant operating and financial restrictions on us and may limit our ability to engage in acts that may be in our long-term best interests, including, among other things, restrictions on our ability (subject to a number of exceptions and qualifications) to: incur, assume or guarantee additional indebtedness; issue redeemable stock and preferred stock; pay dividends or make distributions or redeem or repurchase capital stock; prepay, redeem or repurchase certain indebtedness; make loans and investments; incur liens; restrict dividends, loans or asset transfers from our subsidiaries; sell or otherwise dispose of assets, including capital stock of subsidiaries; consolidate or merge with or into, or sell substantially all of our assets to another person; enter into transactions with affiliates; and enter into new lines of business.

In addition, the restrictive covenants in the credit agreement that governs our ABL Credit Facility could require us to maintain a specified financial ratio if the availability under the facility falls below a certain threshold, as well as satisfy other financial condition tests. Our ability to meet those financial ratios and tests can be affected by events beyond our control, and there can be no assurance that we will meet them.

A breach of the covenants under the 2018 Notes indenture or under the credit agreement that governs the ABL Credit Facility could result in an event of default under the indenture or credit agreement governing the applicable indebtedness. Such default may allow the holders to accelerate the related debt and may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In addition, the occurrence of an event of default under the credit agreement that governs our ABL Credit Facility would permit the lenders thereunder to terminate all commitments to extend further credit under that facility. Furthermore, if we were unable to repay the amounts due and payable under our ABL Credit Facility or the 2018 Notes following an acceleration, those lenders could proceed against the collateral securing that indebtedness. In the event our lenders under the ABL Credit Facility or holders of the 2018 Notes accelerate the repayment of our borrowings, there can be no assurance that we and our subsidiaries would have sufficient assets to repay such indebtedness. As a result of these restrictions, we may be limited in how we conduct our business, unable to raise additional debt or equity financing to operate during general economic or business downturns or unable to compete effectively or to take advantage of new business opportunities. These restrictions may affect our ability to respond to changes or to pursue other business opportunities.

Our operations require substantial capital and we may be unable to maintain adequate capital resources to provide for all of our capital requirements.