Form

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

SECURITIES

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

__________

000-03134

Ohio | 34-1867219 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

6065 Parkland Boulevard, Cleveland, Ohio | 44124 | |

| (Address of principal executive offices) | (Zip Code) | |

Title of each class | Name of each exchange on which registered | |

| Common Stock, Par Value $1.00 Per Share | The NASDAQ Stock Market LLC | |

Large accelerated filer | ¨ | Accelerated filer | |||||||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||||

28, 2013.

28, 2014

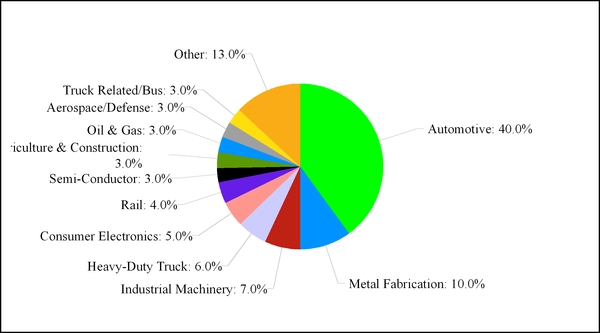

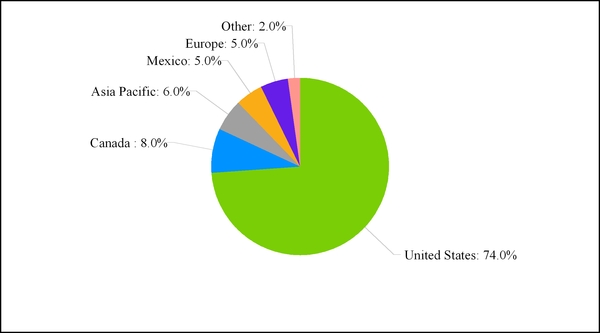

, 12,430,446 shares of the registrant’s common stock, $1 par value, were outstanding.December 31, 2013: Supply Technologies Rubber and thermoplastic hose manufacture fluid routing, injection molded rubber and thermoplastic and screw products. melting systems are engineered and built to customer specifications and are used primarily for melting, heating, and surface hardening of metals and curing of coatings. Approximately $13.0 million in cash, which payment was made in June 2012. the engineering staff of OEM customers in designing new products and improving existing products. 2014. growing product lines. the loss of any key customer, in whole or in part; the insolvency or bankruptcy of any key customer; a declining market in which customers reduce orders or demand reduced prices; or a strike or work stoppage at a key customer facility, which could affect both their suppliers and customers. of integrating operations could cause an interruption of, or loss of momentum in, our activities. Any delays or difficulties encountered in connection with any acquisition and the integration of our operations could have a material adverse effect on our business, results of operations, financial condition or prospects of our business. While we currently maintain what we believe to be suitable and adequate product liability insurance, we cannot assure you that we will be able to maintain our insurance on acceptable terms or that our insurance will provide adequate protection against potential liabilities. In the event of a claim against us, a lack of sufficient insurance coverage could have a material adverse effect on our financial condition, liquidity and results of operations. Moreover, even if we maintain adequate insurance, any successful claim could have a material adverse effect on our financial condition, liquidity and results of operations. fluctuations in currency exchange rates; limitations on ownership and on repatriation of earnings; transportation delays and interruptions; political, social and economic instability and disruptions; potential disruption that could be caused with the partial or complete reconfiguration of the European Union; the imposition of duties and tariffs and other trade barriers; import and export controls; labor unrest and current and changing regulatory environments; the potential for nationalization of enterprises; disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations including the U.S. Foreign Corrupt Practices Act (“FCPA”); difficulties in staffing and managing multinational operations; limitations on our ability to enforce legal rights and remedies; and potentially adverse tax consequences. may conflict with local customs and practices. We cannot assure you that our internal controls and procedures always will protect us from the reckless or criminal acts committed by our employees or agents. For example, in connection with responding to a subpoena from the staff of the SEC, regarding a third party, we disclosed to the staff that the third party participated in a payment on our behalf to a foreign tax official that implicates the FCPA. If we are found to be liable for FCPA violations (either due to our own acts or our inadvertence or due to the acts or inadvertence of others), we could suffer from criminal or civil penalties or other sanctions, which could have a material adverse effect on our business. and have sufficient productive capacity to meet our current needs. Related Industry Segment Location Owned or Leased Approximate Square Footage Use ALUMINUM PRODUCTS MANUFACTURED PRODUCTS(4) 2013 any injuries that they have incurred did in fact result from alleged exposure to asbestos; and (e) the complaints assert claims against multiple defendants and, in most cases, the damages alleged are not attributed to individual defendants. Additionally, we do not believe that the amounts claimed in any of the asbestos cases are meaningful indicators of our potential exposure because the amounts claimed typically bear no relation to the extent of the Contents Quarter 1st 2nd 3rd 4th 490. Period October 1 — October 31, 2011 November 1 — November 30, 2011(2) December 1 — December 31, 2011 TOTAL Selected Statement of Operations Data: Net sales Cost of products sold(a) Gross profit Selling, general and administrative expenses Goodwill impairment charge Gain on sale of assets held for sale Restructuring and impairment charges(a) Operating income (loss)(a) Gain on purchase of 8.375% senior subordinated notes Gain on acquisition of business Interest expense Income (loss) before income taxes Income tax (benefit) expense Net income (loss) Amounts per common share: Basic Diluted Other Financial Data: Net cash flows provided by operating activities Net cash flows used by investing activities Net cash flows provided (used) by financing activities Depreciation and amortization Capital expenditures, net Selected Balance Sheet Data (as of period end): Cash and cash equivalents Working capital Property, plant and equipment Total assets Total debt Shareholders’ equity Non-cash charges: Cost of products sold (inventory write-down) Asset impairment Restructuring and severance Total Charges reflected as restructuring and impairment charges on income statement 2013. 2012. 2013. Supply Technologies Aluminum Products Manufactured Products Consolidated Net Sales changes in segment revenues for 2012 compared to the prior year are contained within the “Segment Analysis” section. Consolidated cost of products sold Consolidated gross profit Gross Margin FRS acquisition. Consolidated SG&A expenses SG&A percent Consolidated SG&A expenses increased in cash, which payment was made in June 2012. Interest expense Debt extinguishment costs included in interest expense Amortization of deferred financing costs and bank service charges Average outstanding borrowings Average borrowing rate Income before income taxes Income tax (benefit) expense Effective income tax rate settlement costs and net interest expense and by adding the gain on acquisition of business. Supply Technologies Aluminum Products Manufactured Products Consolidated Net Sales Consolidated cost of products sold Consolidated gross profit Gross margin Consolidated SG&A expenses SG&A percent Interest expense Average outstanding borrowings Average borrowing rate Income before income taxes Income tax expense (benefit) Effective income tax rate balance due at maturity (April 7, 2016). liabilities and access the capital necessary to grow and maintain its business. Accordingly, (In thousands) Long-term debt obligations Interest obligations(1) Operating lease obligations Purchase obligations Postretirement obligations(2) Standby letters of credit and bank guarantees Total we cannot predict with reasonable reliability, the timing of potential cash settlements with the respective taxing authorities. Allowance for Obsolete and Slow Moving Inventory: Inventories are stated at the lower of cost or market value and have been reduced by an allowance for obsolete and slow-moving inventories. The estimated allowance is based on management’s review of inventories on hand with minimal sales activity, which is compared to estimated future usage and sales. Inventories identified by management as slow-moving or obsolete are reserved for based on estimated selling prices less disposal costs. Though we consider these allowances adequate and proper, changes in economic conditions in specific markets in which we operate could have a material effect on reserve allowances required. impairment indicators, we determined whether the carrying amount of our long-lived assets was recoverable by comparing the carrying value to the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the assets. We considered whether impairments existed at the lowest level of independent identifiable cash flows within a reporting unit (for example, plant location, program level or asset level). If the carrying value of the assets exceeded the expected cash flows, exists and must be recognized. In accordance with ASC 350, management tests goodwill for impairment at the reporting unit level. A reporting unit is Operational management, considering industry and company-specific historical and projected data, develops growth rates and cash flow projections. Terminal value rate determination follows common methodology of capturing the present value of perpetual cash flow estimates beyond the last projected period assuming a constant WACC and low long-term growth rates. There were no interim indicators of impairment and management concluded that the indefinite-lived intangibles were not impaired and that the two-step approach was not required to be performed through they become known. statements because it aligns with our current presentation. 2013 14, 2014 14, 2014 Current Assets Cash and cash equivalents Accounts receivable, less allowances for doubtful accounts of $5,483 in 2011 and $6,011 in 2010 Inventories, net Deferred tax assets Unbilled contract revenue Other current assets Total Current Assets Property, plant and equipment: Land and land improvements Buildings Machinery and equipment Less accumulated depreciation Other Assets: Goodwill Other Current Liabilities Trade accounts payable Accrued expenses Current portion of long-term debt Current portion of other postretirement benefits Total Current Liabilities Long-Term Liabilities, less current portion Senior Notes Credit facility Other long-term debt Deferred tax liability Other postretirement benefits and other long-term liabilities Shareholders’ Equity Capital stock, par value $1 per share Serial preferred stock: Authorized — 632,470 shares; Issued and outstanding — none Common stock: Authorized — 40,000,000 shares; Issued — 13,813,774 shares in 2011 and 13,396,674 in 2010 Additional paid-in capital Retained earnings (deficit) Treasury stock, at cost, 1,673,926 shares in 2011 and 1,558,996 shares in 2010 Accumulated other comprehensive (loss) income Net sales Cost of products sold Gross profit Selling, general and administrative expenses Restructuring and asset impairment charges Operating income Gain on purchase of 8.375% senior subordinated notes Gain on acquisition of business Interest expense Income (loss) before income taxes Income tax (benefit) expense Net income (loss) Amounts per common share: Basic Diluted Balance at January 1, 2009 Comprehensive (loss): Net loss Foreign currency translation adjustment Unrealized loss on marketable securities, net of income tax of $182 Pension and postretirement benefit adjustments, net of income tax of $1,179 Comprehensive income Restricted stock award, net of forfeiture Amortization of restricted stock Purchase of treasury stock (30,445 shares) Exercise of stock options (410,000 shares) Share-based compensation Balance at December 31, 2009 Comprehensive income (loss): Net income Foreign currency translation adjustment Pension and postretirement benefit adjustments, net of income tax of $1,143 Comprehensive income Amortization of restricted stock Restricted share units exchange for restricted stock Restricted stock awards Restricted stock cancelled Purchase of treasury stock (85,027 shares) Exercise of stock options (23,166 shares) Share-based compensation Balance at December 31, 2010 Comprehensive income (loss): Net income Foreign currency translation adjustment Pension and postretirement benefit adjustments, net of income tax of $5,571 Comprehensive income Amortization of restricted stock Restricted stock awards Purchase of treasury stock (114,930 shares) Exercise of stock options (223,300 shares) Share-based compensation Balance at December 31, 2011 OPERATING ACTIVITIES Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by operations: Depreciation and amortization Restructuring and asset impairment charges Debt extinguishment costs Gain on purchase of 8.375% senior subordinated notes Gain on acquisition of business Deferred income taxes Share-based compensation expense Changes in operating assets and liabilities excluding acquisitions of businesses: Accounts receivable Inventories and other current assets Accounts payable and accrued expenses Other Net cash provided by operating activities INVESTING ACTIVITIES Purchases of property, plant and equipment Business acquisitions, net of cash acquired Proceeds from the sale of property Purchases of marketable securities Sales of marketable securities Net cash used by investing activities FINANCING ACTIVITIES (Payments) on term loans and other debt Bank debt issue costs Proceeds from (payments on) revolving credit facility Issuance of 8.125% senior notes due 2021, net of deferred financing costs Redemption of 8.375% senior subordinated notes due 2014 Purchase of 8.375% senior subordinated notes Issuance of common stock under stock option plan Purchase of treasury stock Net cash provided (used) by financing activities Increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Income taxes paid Interest paid (includes $5,720 of senior subordinated notes redemption costs in 2011) Finished goods Work in process Raw materials and supplies Property, Plant and Equipment: Property, plant and equipment are carried at cost. Additions and associated interest costs are capitalized and expenditures for repairs and maintenance are charged to operations. Depreciation of fixed assets is computed principally by the straight-line method based on the estimated useful lives of the assets ranging from 15. events or changes in circumstances indicate that we may not be able to recover the assets’ carrying amount. We measure the recoverability of assets to be held and used by a comparison of the carrying amount of the asset to the expected net future undiscounted cash flows to be generated by that asset, or, for identifiable intangibles with finite useful lives, by determining whether the amortization of the intangible asset balance over its remaining life can be recovered through undiscounted future cash flows. The amount of impairment of identifiable intangible assets with finite useful lives, if any, to be recognized is measured based on projected discounted future cash flows. We measure the amount of impairment of other long-lived assets (excluding goodwill) as the amount by which the carrying value of the asset exceeds the fair market value of the asset, which is generally determined, based on projected discounted future cash flows or appraised values. We classify long-lived assets to be disposed of other than by sale as held and used until they are disposed. . an indication of fair value from a potential buyer or similar specific transactions, we believe that using this methodology provides reasonable estimates of a reporting unit’s fair value. The income approach is based on projected future debt-free cash flow that is discounted to present value using factors that consider the timing and risk of the future cash flows. We believe that this approach is appropriate because it provides a fair value estimate based upon the reporting 9) approximate fair value at December 31, 2013 and December 31, 2012. The fair values of long-term debt and pension plan assets are disclosed in Note 9 and Note 13, respectively. Concentration of Credit Risk: The Company sells its products to customers in diversified industries. The Company performs ongoing credit evaluations of its customers’ financial condition but does not require collateral to support customer receivables. The Company establishes an allowance for doubtful accounts based upon factors surrounding the credit risk of specific customers, historical trends and other information. As of December 31, statements because it aligns with our current presentation. December 31, 2013 are included in the Assembly Components operating/reportable segment. The business segment results for the prior years have been reclassified to reflect these changes. The following is a description of our three operating/reportable segments. Net sales: Supply Technologies Aluminum Products Manufactured Products Income (loss) before income taxes: Supply Technologies Aluminum Products Manufactured Products Corporate costs Gain on purchase of 8.375% senior subordinated notes Gain on acquisition of business Asset impairment charge Interest expense (includes $7,335 of debt extinguishment costs in 2011) Identifiable assets: Supply Technologies Aluminum Products Manufactured Products General corporate Depreciation and amortization expense: Supply Technologies Aluminum Products Manufactured Products General corporate Capital expenditures: Supply Technologies Aluminum Products Manufactured Products General corporate The percentage of net sales by product line included in each segment Manufactured Products: Capital equipment Forged and machined products Rubber products Supply Technologies: Supply Technologies Engineered specialty products Other United States Asia Canada Mexico Europe Other the acquisition method of accounting, the total Accounts receivable Inventories Prepaid expenses and other current assets Property, plant and equipment Customer relationships Accounts payable Accrued expenses Deferred tax liability Gain on acquisition Total purchase price Accounts receivable Inventories Property, plant and equipment Accounts payable Accrued expenses Goodwill Total purchase price Accounts receivable Inventories Prepaid expenses and other current assets Property, plant and equipment Customer relationships Technological know how Trade name and other intangible assets Accounts payable Accrued expenses Goodwill Total purchase price The following unaudited pro forma information is provided to present a summary of the combined results of the Company’s operations with Pro forma revenues Pro forma net income (loss) Earnings per share: Basic Diluted Balance at January 1, 2009 Foreign Currency Translation Balance at December 31, 2009 Foreign Currency Translation Acquisitions Balance at December 31, 2010 Foreign Currency Translation Finalization of Pillar Purchase Price Allocation Balance at December 31, 2011 ETM in the fourth quarter of 2012. Non-contractual customer relationships Other December 31, 2013 follows: Accrued salaries, wages and benefits Advance billings Warranty accrual Interest payable Taxes, income and other Other Totals business unit. Warranty liabilities are primarily associated with the Company’s industrial equipment business unit and the fluid routing solutions business. Balance at beginning of year Claims paid during the year Warranty expense Other Balance at end of year 2011: 8.125% senior notes due 2021 8.375% senior subordinated notes due 2014 Revolving credit Term Loan A Term Loan B Other Less current maturities Total 8.125% per annum, payable semi-annually in arrears on April 1 and October 1 of each 2021 at United States Outside the United States Current (benefit) expense: Federal State Foreign Deferred: Federal State Foreign Income tax (benefit) expense Rate Reconciliation Tax at statutory rate Effect of state income taxes, net Effect of foreign operations Valuation allowance, federal and foreign Non-deductable items Gain on asset purchase Other, net Total Deferred tax assets: Postretirement benefit obligation Inventory Net operating loss and credit carryforwards Goodwill Other Total deferred tax assets Deferred tax liabilities: Depreciation and amortization Pension Intangible assets and other Total deferred tax liabilities Net deferred tax assets prior to valuation allowances Valuation allowances Net deferred tax asset 2033. Unrecognized Tax Benefit — January 1, Gross Increases — Tax Positions in Prior Period Gross Decreases — Tax Positions in Prior Period Gross Increases — Tax Positions in Current Period Settlements Lapse of Statute of Limitations Unrecognized Tax Benefit — December 31, The Company has determined that it is not practicable to determine the unrecognized tax liability on such undistributed earnings. Stock-Based Compensation 2011. The compensation expense related to option awards was $0.1 million for 2011. Outstanding — beginning of year Granted Exercised Canceled or Expired Outstanding — end of year Options Exercisable 20% discount and recognized compensation expense of $0.1 million. Outstanding — beginning of year Granted Vested Canceled or expired Outstanding — end of year 267,953. Litigation Judgment Change in benefit obligation Benefit obligation at beginning of year Service cost Interest cost Actuarial losses Benefits and expenses paid, net of contributions Benefit obligation at end of year Change in plan assets Fair value of plan assets at beginning of year Actual (loss) return on plan assets Company contributions Cash transfer to fund postretirement benefit payments Benefits and expenses paid, net of contributions Fair value of plan assets at end of year Funded (underfunded) status of the plans 2012: Noncurrent assets Noncurrent liabilities Current liabilities Amounts recognized in accumulated other comprehensive (income) loss Net actuarial loss Net prior service cost Net transition (asset) Accumulated other comprehensive loss Asset Category Equity securities Debt securities Other Collective trust and pooled insurance funds: Common stock Equity Funds Foreign Stock Convertible Securities U.S. Government Obligations Fixed income funds Corporate Bonds Cash and Cash Equivalents Hedge funds Other Hedge Funds 2013 and 2012. Discount rate Expected return on plan assets Rate of compensation increase in the following year. Components of net periodic benefit cost Service costs Interest costs Expected return on plan assets Transition obligation Amortization of prior service cost Recognized net actuarial loss Benefit (income) costs Other changes in plan assets and benefit obligations recognized in accumulated other comprehensive (income) loss AOCI at beginning of year Net (gain)/loss Recognition of prior service cost/(credit) Recognition of (gain)/loss Total recognized in accumulated other comprehensive loss at end of year immaterial. 2012 2013 2014 2015 2016 2017 to 2021 Effect on total of service and interest cost components in 2011 Effect on postretirement benefit obligation as of December 31, 2011 2014. NUMERATOR Net income (loss) DENOMINATOR Denominator for basic earnings per share — weighted average shares Effect of dilutive securities: Employee stock options and restricted shares Denominator for diluted earnings per share — weighted average shares and assumed conversions Amounts per common share: Basic Diluted Foreign currency translation adjustment Pension and postretirement benefit adjustments, net of tax Total Selected Quarterly Financial Data (Unaudited) 2011 Net sales Gross profit Net income (loss) Amounts per common share: Basic Diluted 2010 Net sales Gross profit Net income Amounts per common share: Basic Diluted Note Note Note Description Year Ended December 31, 2011: Allowances deducted from assets: Trade receivable allowances Inventory obsolescence reserve Tax valuation allowances Product warranty liability Year Ended December 31, 2010: Allowances deducted from assets: Trade receivable allowances Inventory obsolescence reserve Tax valuation allowances Product warranty liability Year Ended December 31, 2009: Allowances deducted from assets: Trade receivable allowances Inventory obsolescence reserve Tax valuation allowances Product warranty liability There were no changes in or disagreements with the 2013 reference into this Item 9A. 2013. Plan Category Equity compensation plans approved by security holders(1) Equity compensation plans not approved by security holders Total The following consolidated financial statement schedule of Park-Ohio Holdings Corp. is included in Item 8: 14, 2014 ExhibitItem No. Page 1. 1A. 1B. 2. 3. 4. 5. 6. 7. 7A. 8. 9. 9A. 9B. 10. 11. 12 13. 14 15. Aluminum ProductsAssembly Components and ManufacturedEngineered Products.TM™ services for a broad range of high-volume, specialty production components. Our Aluminum Products businessTotal Supply Management™ manages the efficiencies of every aspect of supplying production parts and materials to our customers’ manufacturing floor, from strategic planning to program implementation, and includes such services as engineering and design support, part usage and cost analysis, supplier selection, quality assurance, bar coding, product packaging and tracking, just-in-time and point-of-use delivery, electronic billing services and ongoing technical support. The principal customers of Supply Technologies are in the heavy-duty truck; automotive, truck and vehicle parts; power sports and recreational equipment; bus and coaches; electrical distribution and controls; agricultural and construction equipment; consumer electronics; HVAC; lawn and garden; semiconductor equipment; aerospace and defense; and plumbing. Assembly Components manufactures cast and machined aluminum components, automotive and our Manufacturedindustrial rubber and thermoplastic products, fuel filler and hydraulic assemblies for automotive, agricultural equipment, construction equipment, heavy-duty truck and marine equipment industries. Assembly Components also provides value-added services such as design and engineering, machining and assembly. Engineered Products business isoperates a major manufacturerdiverse group of highly-engineered industrial products. Ourniche manufacturing businesses serve large, industrialthat design and manufacture a broad range of high quality products engineered for specific customer applications. The principal customers of Engineered Products are original equipment manufacturers (“OEMs”) and end users in a variety of industrial sectors, including the automotiveferrous and vehicle parts,non-ferrous metals, silicon, coatings, forging, foundry, heavy-duty truck, industrialconstruction equipment, steel,automotive, oil and gas, rail electrical distribution and controls,locomotive manufacturing and aerospace and defense oilindustries.gas, power sports/fitness equipment, HVAC, electrical components, appliancerepresentatives. Intersegment sales are immaterial and semiconductor equipment industries.eliminated in consolidation and are not included in the financial results presented. Intersegment sales are accounted for at values based on market prices. Income allocated to segments excludes certain corporate expenses, interest expense, and certain other infrequent or unusual charges or credits. Identifiable assets by industry segment include assets directly identified with those operations. As of December 31, 20112013, we employed approximately 3,2005,000 persons.

AluminumAssembly ComponentsEngineered Products Manufactured Products NET SALES FOR 20112013 493.0412.8 million51%34% of total) 127.0318.5 million13%27% of total)$346.6 million(36% of total)SELECTED PRODUCTS • Cooling modulesPinion housings • Injection molded rubber componentsSELECTED INDUSTRIES SERVED Power sports/fitnessAgricultural and construction equipmentElectrical components• Appliance• Semiconductor equipment• Recreational vehicles• Lawn and garden equipment • equipment TM™, a proactive solutions approach that manages the efficiencies of every aspect of supplying production parts and materials to our customers’ manufacturing floor, from strategic planning to program implementation. Total Supply ManagementTM™ includes such services as engineering and design support, part usage and cost analysis, supplier selection, quality assurance, bar coding, product packaging and tracking, just-in-time and point-of-use delivery, electronic billing services and ongoing technical support. We operate 4452 logistics service centers in the United States, Mexico, Canada, Puerto Rico, Scotland, Hungary, China, Taiwan, Singapore, India, United Kingdom and India,Ireland, as well as production sourcing and support centers in Asia. Through our supply chain management programs, we supply more than 190,000 globally-sourced production components, many of which are specialized and customized to meet individual customers’ needs.TM™ provides our customers with an expert partner in strategic planning, global sourcing, technical services, parts and materials, logistics, distribution and inventory management of production components. Some production components are characterized by low per unit supplier prices relative to the indirect costs of supplier management, quality assurance, inventory management and delivery to the production line. In addition, Supply Technologies delivers an increasingly broad range of higher-cost production components including valves, electro-mechanical hardware, fittings, steering components and many others. Applications engineering specialists and the direct sales force work closely with the engineering staff of OEM customers to recommend the appropriate production components for a new productrecently began providingalso provides spare parts and aftermarket products to end users of its customers’ products.TM™ services are typically provided to customers pursuant to sole-source arrangements. We believe our services distinguish us from traditional buy/sell distributors, as well as manufacturers who supply products directly to customers, because we outsource our customers’ high-volume production components supply chain management, providing processes customized to each customer’s needs and replacing numerous current suppliers with a sole-source relationship. Our highly-developed, customized, information systems provide transparency and flexibility through the complete supply chain. This enables our customers to: (1) significantly reduce the direct and indirect cost of production component processes by outsourcing internal purchasing, quality assurance and inventory fulfillment responsibilities; (2) reduce the amount of working capital invested in inventory and floor space; (3) reduce component costs through purchasing efficiencies, including bulk buying and supplier consolidation; and (4) receive technical expertise in production component selection and design and engineering. Our sole-source arrangements foster long-term, entrenched supply relationships with our customers and, as a result, the average tenure of service for our top 50 Supply Technologies clients exceeds six years. Supply Technologies’ remaining sales are generated through the wholesale supply of industrial products to other manufacturers and distributors pursuant to master or authorized distributor relationships.2011,2013, approximately 84%79% of Supply Technologies’ net sales were to domestic customers. Remaining sales were primarily to manufacturing facilities of large, multinational customers located in Canada, Mexico, Europe and Asia. Total Supply ManagementTM™ services and production components are used extensively in a variety of industries, and demand is generally related to the state of the economy and to the overall level of manufacturing activity.5,5006,500 customers domestically and internationally. The principal markets served by Supply Technologies are the heavy-duty truck; automotive, truck automotive and vehicle parts,parts; power sports and recreational equipment; bus and coaches; electrical distribution and controls, consumer electronics, power sports/fitness equipment, recreational vehicles, HVAC,controls; agricultural and construction equipment,equipment; consumer electronics; HVAC; lawn and garden; semiconductor equipment,equipment; aerospace and defense,defense; and appliance industries.plumbing. The five largest customers, within which Supply Technologies sells through sole-source contracts to multiple operating divisions or locations, accounted for approximately 27% and 26%31% of the sales of Supply Technologies for 2011both 2013 and 2010, respectively.2012. The loss of any two of its top five customers could have a material adverse effect on the results of operations and financial conditionscondition of this segment.The Company evaluated its long-lived assets to determine whether the carrying amount of such assets was recoverable in accordance with accounting guidance by comparing the carrying amount to the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the assets. If the carrying value of the assets exceeded the expected cash flows, the Company estimated the fair value of these assets to determine whether an impairment existed. The Company recorded restructuring and asset impairment charges of $4.0 million during the fourth quarter of 2009. See Note O to the consolidated financial statements included elsewhere herein.TM™ services, including engineering and design support, part usage and cost analysis, supplier selection, quality assurance, bar coding, product packaging and tracking, just-in-time and point-of-use delivery, electronic billing services and ongoing technical support, and its geographic reach, extensive product selection, price and reputation for high service levels. Numerous North American and foreign companies compete with Supply Technologies in manufacturing cold-formed and cold-extruded products. During In November 2013, we acquired all the third quarteroutstanding capital stock of 2010, Supply Technologies completed the acquisition of certain assets and assumed specific liabilities relating to the Assembly Components Systems (“ACS”QEF Global Limited ("QEF") business of Lawson Products, Inc. for $16.0 million in cash and a $2.2 million subordinated promissory note payable in equal quarterly installments over three years. ACS. QEF is a provider of supply chain management solutions with four locations throughout Ireland, Scotland and England. QEF's net sales for the year ended December 31, 2012 totaled approximately $14.0 million.broad rangeprovider of production components throughsupply chain management solutions throughout the United Kingdom and Ireland. For its service centers throughout North America. Thefiscal year ended March 31, 2013, Henry Halstead generated net sales of approximately $24.0 million.recordedsold all of the outstanding equity interests of a non-core business unit in the Supply Technologies segment, for $8.5 million in cash, which resulted in a net gain of $2.2approximately $3.8 million, representing the excessafter taxes of $1.5 million. The business unit sold is a provider of high-quality machine to machine information technology solutions, products and services. As a result of the aggregate fair valuesale, this business had been removed from the Supply Technologies segment and presented as a discontinued operation for all of purchased netthe periods presented. Additionally, the assets overand liabilities of the purchase price. See Note C tobusiness are classified as held for sale under the caption other current assets and accrued expenses and other, respectively, in the Company's consolidated financial statements included elsewhere herein.Aluminum ProductsWebalance sheet as of December 31, 2012.that we areis one of the few aluminum component suppliers that has the capability to provide a wide range of high-volume, high-quality products utilizing a broad range of processes including gravity and low pressure permanent mold, die-cast and lost-foam, as well as emerging alternative casting technologies. Our abilityIn 2012, we added machining capabilities to offer our customers this comprehensive range ofcapabilities at a low cost provides us with a competitive advantage. We produce our aluminum components at six manufacturing facilities in Ohio, Indianaproducts service offerings. We also design and Georgia. Our Aluminum Products business casts Assembly Components manufactures cast aluminum components, automotive and machines aluminum engine, transmission, brake, suspensionindustrial rubber and other componentsthermoplastic products, fuel filler and hydraulic assemblies for automotive, agricultural equipment, construction equipment, heavy-duty truck and marine equipment OEMs, primarily on a sole-source basis. Aluminum Products’industries. Assembly Components’ principal products include front engine covers, cooling modules, control arms, knuckles, pump housings, clutch retainers and pistons, master cylinders, pinion housings, oil pans and flywheel spacers.spacers, injected molded rubber and silicone products, including wire harnesses, shock and vibration mounts, spark plug boots and nipples and general sealing gaskets, rubber and thermoplastic hose and fuel filler assemblies. We produce our Assembly Components at twenty-four manufacturing facilities in Ohio, Michigan, Indiana, Tennessee, Florida, Georgia, Mexico, China and the Czech Republic. In addition, we also provide value-added services such as design engineering, machining and part assembly. Although these parts are lightweight, they possess high durability and integrity characteristics even under extreme pressure and temperature conditions.Demand by automotive OEMs for aluminum castings has increased in recent years as they have sought lighter alternatives to steel and iron, primarily to increase fuel efficiency without compromising structural integrity. We believe that this replacement trend will continue as end-users and the regulatory environment require greater fuel efficiency.withinto which Aluminum ProductsAssembly Components sells to multiple operating divisions through sole-source contracts, accounted for approximately 59% and 57%45% of Aluminum ProductsAssembly Components sales for 2011both 2013 and 2010, respectively.2012. The loss of any one of these customers could have a material adverse effect on the results of operations and financial condition of this segment. Aluminum Products Assembly Components competes principally on the basis of its ability to: (1) engineer and manufacture high-quality, cost-effective, machined castingsassemblies utilizing multiple casting technologies in large volumes; (2) provide timely delivery; and (3) retain the manufacturing flexibility necessary to quickly adjust to the needs of its customers. There are few domestic companies with aluminum casting capabilities able to meet the customers’ stringent quality and service standards and lean manufacturing techniques. As one of these suppliers, Aluminum ProductsAssembly Components is well-positioned to benefit as customers continue to consolidate their supplier base. Principal competitors in the Assembly Components segment are Chassix, Martinrea and Stant. On September 30, 2010, Effective April 26, 2013, the Company enteredacquired certain assets and assumed specific liabilities relating to Bates Acquisition, LLC and Bates Real Estate Acquisition, LLC (collectively, “Bates”) for a Billtotal purchase consideration of Sale with Rome Die Casting LLC (“Rome”),$20.8 million in cash. The acquisition was funded from borrowings under the revolving credit facility provided by the Credit Agreement (as defined herein). Bates is a producerleading manufacturer of aluminum high pressure die castings, pursuant to which Rome agreed to transfer toextruded, formed and molded products and assemblies for the Company substantially alltransportation and industrial markets. Bates’ production facilities are located in Tennessee. The financial results of its assetsBates are included in exchange for approximately $7.5the Company’s Assembly Components segment and contributed $30.4 million in revenues and $2.2 million of notes receivable duenet income from Rome held by the Company. See Note C todate acquired through December 31, 2013. The acquisition was accounted for under the consolidated financial statements included elsewhere herein.acquisition method of accounting.ManufacturedManufacturedEngineered Products segment operates a diverse group of niche manufacturing businesses that design and manufacture a broad range of highly-engineered products, including induction heating and melting systems, pipe threading systems rubber products and forged and machined products. We manufacture these products in twelveeleven domestic facilities and tennine international facilities in Canada, Mexico, the United Kingdom, Belgium, Germany, China and Japan.49%57% of our induction heating and melting systems’ revenues are derived from the sale of replacement parts and provision of field service, primarily for the installed base of our own products. Our pipe threading business serves the oil and gas industry. We also engineer and install mechanical forging presses, sell spare parts and provide field service for the large existing base of mechanical forging presses and hammers in North America. We machine, induction harden and surface finish crankshafts and camshafts, used primarily in locomotives. We forge aerospace and defense structural components such as landing gears and struts, as well as rail products such as railcar center plates and draft lugs. We manufacture injection mold rubber and silicone products, including wire harnesses, shock and vibration mounts, spark plug boots and nipples and general sealing gaskets. We sell rubber products primarily to sub-assemblers in the automotive, food processing and consumer appliance industries.small- tosmall-to medium-sized domestic and international equipment manufacturers on the basis of service capability, ability to meet customer specifications, delivery performance and engineering expertise. We compete domestically and internationally with small- tosmall-to medium-sized forging and machining businesses on the basis of product quality and precision. We compete with other domestic small- to medium-sized manufacturers of injection molded rubber and silicone products primarily on the basis of price and product quality. During the fourth quarter of 2009, the Company evaluated its long-lived assets at one of its forging units to determine whether the carrying amount of such assets was recoverable in accordance with accounting guidance by comparing the carrying amount to the sum of undiscounted cash flows expected to result from the use and eventual disposition of the assets and recorded restructuring and asset impairment charges of $3.0 million in 2009. See Note O to the consolidated financial statements included elsewhere herein. On December 31, 2010, the Company through its subsidiary, Ajax Tocco Magnethermic acquiredCorporation (“ATM”) was the defendant in a lawsuit in the United States District Court for the Eastern District of Arkansas. The plaintiff is IPSCO Tubulars Inc. d/b/a TMK IPSCO. The complaint alleged claims for breach of contract, gross negligence and constructive fraud, and TMK IPSCO sought approximately $6.0 million in direct and $4.0 million in consequential damages as well as an unspecified amount of punitive damages. ATM denied the allegations against it, believes it has a number of meritorious defenses and vigorously defended the lawsuit. A motion for partial summary judgment filed by ATM that, among other things, denied the plaintiff's fraud claims was granted by the district court. The remaining claims were the subject of a bench trial in May 2013. At the close of TMK IPSCO's case, the court entered partial judgment in favor of ATM, dismissing the gross negligence claim, dismissing a portion of the breach of contract claim, and dismissing any claim for punitive damages. The trial proceeded with respect to the remainder of TMK IPSCO's claim for damages and, in September 2013, the district court awarded TMK IPSCO damages of approximately $5.2 million. ATM is appealing the court's decision. TMK IPSCO is also appealing the decision and, additionally, it has asked the court for $3.8 million in attorney's fees.the related induction heating intellectual propertyliabilities of ABP Induction’s U.S. heatinga small business, operating as Pillar Induction (“Pillar”) for $10.3which resulted in a pre-tax gain of $0.6 million in cash. Pillar provides complete turnkey automated induction power systems and aftermarket parts and service to a worldwide market. See Note C to the consolidated financial statements included elsewhere herein.As a result of incurred losses induring the third quarter of 2011, projected losses2013. The small business is engaged in the business of designing, manufacturing, selling, distributing and installing various tube bending machines and related tooling, spare and replacement parts and ancillary services for fiscal year 2011 and planned restructuring,commercial applications. The small business is included in our Engineered Products segment from the date of acquisition. The purchase price was not significant to the results of operations, financial condition or liquidity.evaluated the long-lived assetsentered into an agreement to sell 25% of its rubber productsSouthwest Steel Processing LLC, ("SSP") business unitto Arkansas Steel Associates, LLC for impairment. Based on management’s analysis, certain long-lived assets were deemed abandoned$5.0 million in cash. SSP is included in our Engineered Products segment. This transaction facilitates the Company's capacity expansion in one of its growing product lines.were written down to their scrap or liquidation value andVanadium (“Evraz”) arbitration proceeding for the Company recorded a chargesum of $5.4 million.Aluminum ProductsAssembly Components primarily markets and sells its products in North America through internal sales personnel and independent sales representatives. ManufacturedEngineered Products primarily markets and sells its products in North America through both internal sales personnel and independent sales representatives. Induction heating and pipe threading equipment is also marketed and sold in Europe, Asia, Latin America and Africa through both internal sales personnel and independent sales representatives. In some instances, the internal engineering staff assists in the sales and marketing effort through joint design and applications-engineering efforts with major customers.We areSupply Technologies is dependent upon the ability of such suppliers to meet stringent quality and performance standards and to conform to delivery schedules. Aluminum ProductsAssembly Components and ManufacturedEngineered Products purchase substantially all of their raw materials, principally metals and certain component parts incorporated into their products, from third-party suppliers and manufacturers. Most raw materials required by Aluminum ProductsAssembly Components and ManufacturedEngineered Products are commodity products available from several domestic suppliers. Management believes that raw materials and component parts other than certain specialty products are available from alternative sources.Aluminum Products’Assembly Components’ backlog as of any particular date is not a meaningful measure of sales for any future period as a significant portion of sales are on a release or firm order basis. The backlog of ManufacturedEngineered Products’ orders believed to be firm as of December 31, 20112013 was $226.7$145.3 million compared with $174.4$180.0 million as of December 31, 2010. Approximately $1.9 million2012. Predominantly all of theEngineered Products’ backlog as of December 31, 2011 is scheduled to be shipped after 2012. The remainder2013 is scheduled to be shipped in 2012.B2 to the consolidated financial statements included elsewhere herein relating to (1) net sales, income before income taxes, identifiable assets and other information by industry segment and (2) net sales and assets by geographic region for the years ended December 31, 2011, 20102013, 2012 and 20092011 is incorporated herein by reference.containedtechnology solutions, products and services. As a result of the sale, this business had been removed from the Supply Technologies segment and presented as a discontinued operation for all of the periods presented. Additionally, the assets and liabilities of the business are classified as held for sale under the caption other current assets and accrued expenses and other, respectively, in Note C, Note D, Note Oour consolidated balance sheet as of December 31, 2012.Note Passumed specific liabilities relating to Bates for a total purchase consideration of $20.8 million in cash. The acquisition was funded from borrowings under the revolving credit facility provided by the Credit Agreement (as defined herein). Bates is a leading manufacturer of extruded, formed and molded products and assemblies for the transportation and industrial markets. Bates’ production facilities are located in Tennessee. The financial results of Bates are included in our Assembly Components segment and contributed $30.4 million in revenues and $2.2 million of net income from the date acquired through December 31, 2013. The acquisition was accounted for under the acquisition method of accounting.consolidated financial statements included elsewhere hereinremainder of TMK IPSCO's claim for damages and, in September 2013, the district court awarded TMK IPSCO damages of approximately $5.2 million. ATM is incorporated herein by reference.On March 5, 2012,appealing the Companycourt's decision. TMK IPSCO is also appealing the decision and, additionally, it has asked the court for $3.8 million in attorney's fees.acquire Fluid Routing Solutions Holding Corp. (“FRS”),purchase certain assets and liabilities of a leading manufacturersmall business, which resulted in a pre-tax gain of industrial hose products and fuel filler and hydraulic fluid assemblies, in an all cash transaction valued at $97.5 million. FRS products include fuel filler, hydraulic, and thermoplastic assemblies and several forms of manufactured hose including bulk and formed fuel, power steering, transmission oil cooling, hydraulic, and thermoplastic hose. FRS sells to automotive and industrial customers throughout North America, Europe and Asia. FRS has five production facilities located in Florida, Michigan, Ohio, Tennessee and the Czech Republic. The transaction is expected to close by March 30, 2012 subject to a number of customary conditions, including the expiration of waiting periods and the receipt of approvals under Hart-Scott-Rodino Antitrust Improvements Act.On April 7, 2011, the Company completed the sale of $250$0.6 million aggregate principal amount of 8.125% senior notes due 2021 (the “Notes”). The Notes bear an interest rate of 8.125% per annum, payable semi-annually in arrears on April 1 and October 1 of each year commencing on October 1, 2011. The Notes mature on April 1, 2021. In connection with the sale of the Notes, the Company also entered into a fourth amended and restated credit agreement (the “Amended Credit Agreement”). The Amended Credit Agreement, among other things, provides an increased credit facility up to $200 million, extends the maturity date of the borrowings under the facility to April 7, 2016 and amends fee and pricing terms. Furthermore, the Company has the option,pursuant to the Amended Credit Agreement, to increase the availability under the revolving credit facility by $50 million. The Company also purchased all of its outstanding $183.8 million aggregate principal amount of 8.375% senior subordinated notes due 2014 (the “Senior Subordinated Notes”) that were not held by its affiliates pursuant to a tender offer and subsequent redemption, repaid all of the term loan A and term loan B outstanding under its then existing credit facility and retired the Senior Subordinated Notes in the aggregate principal amount of $26.2 million that were held by an affiliate. The Company incurred debt extinguishment costs related to premiums and other transaction costs associated with the tender offer and subsequent redemption of the Senior Subordinated Notes and wrote off deferred financing costs totaling $7.3 million and recorded a provision for foreign income taxes of $2.1 million resulting from the retirement of the Senior Subordinated Notes that were held by an affiliate.Duringduring the third quarter of 2011,2013. The small business is engaged in the Company recordedbusiness of designing, manufacturing, selling, distributing and installing various tube bending machines and related tooling, spare and replacement parts and ancillary services for commercial applications. The small business is included in our Engineered Products segment from the date of acquisition. The purchase price was not significant to the results of operations, financial condition or liquidity.asset impairment chargeagreement to sell 25% of $5.4our SSP business to Arkansas Steel Associates, LLC for $5.0 million associated with the underperformance of the assetsin cash. SSP is included in our Engineered Products segment. This transaction facilitates our capacity expansion in one of its rubber products business unit.Name Age Position Edward F. Crawford 74 Chairman of the Board, Chief Executive Officer and Director Matthew V. Crawford 44 President and Chief Operating Officer and Director W. Scott Emerick 49 Vice President and Chief Financial Officer Robert D. Vilsack 53 Secretary and General Counsel Patrick W. Fogarty 52 Director of Corporate Development The recentfinancial crisiseconomic conditions may have significant effects on our customers and suppliers that wouldcould result in material adverse effects on our business and operating results.The recent global financial crisis, which included, among other things, significantthe recentunfavorable global financial crisiseconomic conditions may materially adversely affect our suppliers’ access to capital and liquidity with which tothey maintain their inventories, production levels and product quality, which could cause them to raise prices or lower production levels.the recentadverse global financial crisiseconomic conditions are difficult to forecast and mitigate. As a consequence, our operating results for a particular period are difficult to predict, and, therefore, prior results are not necessarily indicative of results to be expected in future periods. Any of the foregoing effects could have a material adverse effect on our business, results of operations and financial condition.The recentfinancial crisiseconomic conditions may have significant effects on our customers that would result in our inability to borrow or to meet our debt service coverage ratio in our revolving credit facility.2011,2013, we were in compliance with our debt service coverage ratio covenant and other covenants contained in our revolving credit facility. While we expect to remain in compliance throughout 2012,2014, declines in demand in the automotive industry and in sales volumes could adversely impact our ability to remain in compliance with certain of these financial covenants. Additionally, to the extent our customers are adversely affected by thea decline in the economy in general, they may not be able to pay their accounts payable to us on a timely basis or at all, which would make the accounts receivable ineligible for purposes of the revolving credit facility and could reduce our borrowing base and our ability to borrow.power sports/fitnessrecreational equipment, HVAC, electrical components, appliance and semiconductor equipment industries, are affected by consumer spending, general economic conditions and the impact of international trade. A downturn in any of the industries we serve could have a material adverse effect on our financial condition, liquidity and results of operations.heavy-dutyheavy-duty truck industries are highly cyclical and may be adversely affected by international competition. In addition, the automotive and heavy-duty truck industries are significantly unionized and subject to work slowdowns and stoppages resulting from labor disputes. We derived 19%40% and 7%6% of our net sales during the year ended December 31, 20112013 from the automobileautomotive and heavy-duty truck industries, respectively.2011,2013, our ten largest customers accounted for approximately 26%28% of our net sales. Many of our customers place orders for products on an as-needed basis and operate in cyclical industries and, as a result, their order levels have varied from period to period in the past and may vary significantly in the future. Due to competitive issues, we have lost key customers in the past and may again in the future. Customer orders are dependent upon their markets and may be subject to delays or cancellations. As a result of dependence on our key customers, we could experience a material adverse effect on our business and results of operations if any of the following were to occur:During 2009, Chrysler’s U.S. operations, General Motor’s U.S. operations and Metaldyne Corporation filed for bankruptcy protection under Chapter 11 of the United States Bankruptcy Code. We have collected substantially all amounts that were due from Chrysler and General Motors as of the dates of the respective bankruptcy filings and as such there was no charge to earnings as a result of these bankruptcies. The account receivable from Metaldyne at the time of the bankruptcy was $4.2 million. We recorded a $4.2 million charge to reserve for the collection ofthe account receivable when Metaldyne announced it had completed the sale of substantially all of its assets to MD Investors Corporation, effectively making no payments to its unsecured creditors, including us.Aluminum ProductsAssembly Components and ManufacturedEngineered Products segments are product quality andourHoldings’ outstanding common stock and if at such time neither Mr. E. Crawford nor Mr. M. Crawford holds the office of chairman, chief executive officer or president. The loss of the services of Messrs. E. Crawford and M. Crawford, senior and executive officers, and/or other key individuals could have a material adverse effect on our financial condition, liquidity and results of operations.IT technologies,information technology, services and products into our business, diversion of management’s attention, the assumption of unknown liabilities, increases in our indebtedness, the failure to achieve the strategic objectives of those acquisitions and other unanticipated problems, some or all of which could materially and adversely affect us. The processAluminum ProductsAssembly Components and ManufacturedEngineered Products businesses could be interrupted for a variety of reasons, including availability and pricing. Prices for raw materials necessary for production have fluctuated significantly in the past and significant increases could adversely affect our results of operations and profit margins. While we generally attempt to pass along increased raw materials prices to our customers in the form of price increases, there may be a time delay between the increased raw materials prices and our ability to increase the price of our products, or we may be unable to increase the prices of our products due to pricing pressure or other factors.2011,2013, we were a party to seveneight collective bargaining agreements with various labor unions that covered approximately 400650 full-time employees. Our inability to negotiate acceptable contracts with these unions could result in, among other things, strikes, work stoppages or other slowdowns by the affected workers and increased operating costs as a result of higher wages or benefits paid to union members. If the unionized workers were to engage in a strike, work stoppage or other slowdown, or other employees were to become unionized, we could experience a significant disruption of our operations and higher ongoing labor costs, which could have a material adverse effect on our business, financial condition and results of operations.for example out offrom, among other things, discovery of previously unknown conditions or more aggressive enforcement actions, could adversely affect our results of operations, and there is no assurance that they will not exceed our reserves or have a material adverse effect on our financial condition.willcould be materially affected.Aluminum ProductsAssembly Components and ManufacturedEngineered Products segments. We depend on our information systems to process orders, manage inventory and accounts receivable collections, purchase products, maintain cost-effective operations, route and re-route orders and provide superior service to our customers. We cannot assure you that a disruption in the operation of our information systems used by Supply Technologies, including the failure of the supply chain management software to function properly, or those used by Aluminum ProductsAssembly Components and ManufacturedEngineered Products will not occur. Any such disruption could have a material adverse effect on our financial condition, liquidity and results of operations.A1 to the consolidated financial statements included elsewhere herein.ourHoldings’ outstanding common stock and their interests may conflict with yours.February 29, 2012,December 31, 2013, Edward Crawford, our Chairman of the Board and Chief Executive Officer, and Matthew Crawford, our President and Chief Operating Officer, collectively beneficially owned approximately 27%26% of ourHoldings’ common stock. Mr. E. Crawford is Mr. M. Crawford’s father. Their interests could conflict with your interests. For example, if we encounter financial difficulties or are unable to pay our debts as they mature, the interests of Messrs. E. Crawford and M. Crawford may conflict with your interests as a shareholder.interests.2011,2013, our operations included numerous manufacturing and supply chain logistics services facilities located in 26 states in the United States and in Puerto Rico, as well as in Asia, Canada, Europe and Mexico. Approximately 88% of the available square footage wasWe lease our world headquarters located in Cleveland, Ohio, which includes the United States. Approximately 45%world headquarters for certain of the available square footage was owned. As of December 31, 2011, approximately 31% of the available domestic square footage was used by the Supply Technologies segment, 49% was used by the Manufactured Products segmentour businesses. We believe our manufacturing, logistics and 20% was used by the Aluminum Products segment. Approximately 50% of the available foreign square footage was used by the Supply Technologies segment and 50% was used by the Manufactured Products segment. In the opinion of management, ourcorporate office facilities are generally well maintainedwell-maintained and are suitable and adequate, for their intended uses.2011. SUPPLY TECHNOLOGIES(1) Cleveland, OH Leased 60,450 (2) Supply Technologies Corporate Office Dayton, OH Leased 70,600 Logistics Lawrence, PA Leased 116,000 Logistics and Manufacturing Minneapolis, MN Leased 87,100 Logistics Allentown, PA Leased 43,800 Logistics Atlanta, GA Leased 56,000 Logistics Memphis, TN Leased 48,750 Logistics Louisville, KY Leased 30,000 Logistics Chicago, IL Leased 51,000 Logistics Tulsa, OK Leased 40,000 Logistics Lenexa, KS Leased 67,400 Logistics Austin, TX Leased 30,000 Logistics Streetsboro, OH Leased 45,000 Logistics Mississauga, Ontario, Canada Leased 145,000 Manufacturing Solon, OH Leased 47,100 Logistics Dublin, VA Leased 40,000 Logistics Delaware, OH Owned 45,000 Manufacturing Conneaut, OH(3) Leased/Owned 258,300 Manufacturing Huntington, IN Leased 132,000 Manufacturing Fremont, IN Owned 112,000 Manufacturing Wapakoneta, OH Owned 188,000 Manufacturing Rootstown, OH Owned 209,300 Manufacturing Ravenna, OH Owned 70,000 Manufacturing Cuyahoga Hts., OH Owned 427,000 Manufacturing Cicero, IL Owned 450,000 Manufacturing Le Roeulx, Belgium Owned 120,000 Manufacturing Wickliffe, OH Owned 110,000 Manufacturing Brookfield, WI Leased 116,000 Manufacturing Warren, OH Owned 195,000 Manufacturing Canton, OH Leased 125,000 Manufacturing Madison Heights, MI Leased 128,000 Manufacturing Newport, AR Leased 200,000 Manufacturing Cleveland, OH Leased 150,000 Manufacturing Location Use SUPPLY Mississauga, Ontario, Canada Leased 145,000 Manufacturing TECHNOLOGIES (1) Lawrence, PA Leased 116,000 Logistics and Manufacturing Minneapolis, MN Leased 87,100 Logistics Dayton, OH Leased 70,600 Logistics Cleveland, OH (2) Leased 60,450 Supply Technologies Corporate Office Carol Stream, IL Leased 51,000 Logistics Memphis, TN Leased 48,750 Logistics Solon, OH Leased 47,100 Logistics Streetsboro, OH Leased 45,000 Manufacturing Allentown, PA Leased 43,800 Logistics Suwanee, GA Leased 42,500 Logistics Dublin, VA Leased 40,000 Logistics Tulsa, OK Leased 40,000 Logistics Lenexa, KS Leased 29,500 Logistics ASSEMBLY Ocala, FL Owned 433,000 Manufacturing COMPONENTS Conneaut, OH (4) Leased/Owned 283,800 Manufacturing Lexington, TN Owned 240,000 Manufacturing Lobelville, TN (5) Owned 208,700 Manufacturing Rootstown, OH Owned 208,000 Manufacturing Cleveland, OH (3) Leased/Owned 190,000 Manufacturing Wapakoneta, OH Owned 188,000 Manufacturing Huntington, IN Leased 124,500 Manufacturing Fremont, IN Owned 112,000 Manufacturing Big Rapids, MI Owned 97,000 Manufacturing Ravenna, OH Owned 69,000 Manufacturing Delaware, OH Owned 45,000 Manufacturing Bedford, OH Leased 43,300 Manufacturing ENGINEERED Cicero, IL Owned 450,000 Manufacturing PRODUCTS (6) Cuyahoga Heights, OH Owned 427,000 Manufacturing Newport, AR Owned 200,000 Manufacturing Warren, OH Owned 195,000 Manufacturing Madison Heights, MI Leased 128,000 Manufacturing Canton, OH Leased 124,000 Manufacturing La Roeulx, Belgium Owned 120,000 Manufacturing Brookfield, WI Leased 116,000 Manufacturing Wickliffe, OH Owned 110,000 Manufacturing Albertville, AL Leased 56,000 Office Cortland, OH Owned 30,000 Office and Manufacturing (1) Supply Technologies has other facilities, none of which is deemed to be a principal facility. (2) Includes 20,150 square feet used by Holdings’ and Park-Ohio’s corporate office. (3) Includes twoone leased property with 150,000 square feet and one owned property with 40,000 square feet.(4) Includes three leased properties with square footage of 91,800, 64,000 and 64,000, respectively,45,700 and twoone owned propertiesproperty with 82,300 and 20,200 square feet, respectively.feet.(4)Manufactured(5) Includes five facilities, which make up the total square footage of 208,700. (6) Engineered Products has other owned and leased facilities, none of which is deemed to be a principal facility. at as of December 31, 2011:260269 cases asserting claims on behalf of approximately 1,140609 plaintiffs alleging personal injury as a result of exposure to asbestos. These asbestos cases generally relate to production and sale of asbestos-containing products and allege various theories of liability, including negligence, gross negligence and strict liability, and seek compensatory and, in some cases, punitive damages.plaintiff’splaintiff's injury, if any.Oneour subsidiaries, Ajax Tocco Magnethermic (“ATM”),Arkansas. The plaintiff is IPSCO Tubulars Inc. d/b/a party to a binding arbitration proceeding pending in South Africa with one of its customers, Evraz Highveld Steel and Vanadium (“Evraz”).TMK IPSCO. The arbitration involves a dispute over the design and installation of a melting furnace. Evraz sought binding arbitration in September of 2011complaint alleged claims for breach of contract, gross negligence and seeks compensatoryconstructive fraud, and TMK IPSCO sought approximately $10.0 million in damages as well as an unspecified amount of$37.0$5.2 million as well as fees. ATM is appealing the court’s decision. TMK IPSCO is also appealing the decision and, expenses relatedadditionally, it has asked for $3.8 million in attorney's fees.arbitration. ATM intends to counterclaim arbitration, alleging breach of contract for non-payment in the amount of $2.7 million as well as fees and expenses relatedstaff’s subpoena, we disclosed to the arbitration. We believe we have meritorious defensesstaff of the SEC that, in November 2007, the third party participated in a payment on behalf of us to these claimsa foreign tax official that implicates the Foreign Corrupt Practices Act (“FCPA”).vigorously defend such allegations.cooperate fully with the SEC and the DOJ in connection with their investigations of the third party and with the SEC in light of our disclosure. We are unable to predict the outcome or impact of the special committee’s investigation or the length, scope or results of the SEC’s review or the impact, if any, on our results of operations.Item 4A. Executive Officersthe RegistrantInformation with respect to the executive officers of the Company as of March 15, 2012 is as follows:NameAgePositionEdward F. Crawford72Chairman of the Board, Chief Executive Officer and DirectorMatthew V. Crawford42President and Chief Operating Officer and DirectorJeffrey L. Rutherford51Vice President and Chief Financial OfficerRobert D. Vilsack51Secretary and General CounselPatrick W. Fogarty50Director of Corporate DevelopmentMr. E. Crawfordhas been a director and our Chairman of the Board and Chief Executive Officer since 1992. He has also served as the Chairman of Crawford Group, Inc., a management company for a group of manufacturing companies, since 1964.Mr. M. Crawfordhas been President and Chief Operating Officer since 2003 and joined us in 1995 as Assistant Secretary and Corporate Counsel. He was also our Senior Vice President from 2001 to 2003. Mr. M. Crawford became one of our directors in August 1997 and has served as President of Crawford Group, Inc. since 1995. Mr. E. Crawford is the father of Mr. M. Crawford.Mr. Rutherfordhas been Vice President and Chief Financial Officer since joining us in July 2008. From 2007 until his employment with us, Mr. Rutherford served as Senior Vice President, Chief Financial Officer of UAP Holding Corp., an independent distributor of agricultural inputs and professional non-crop products. Mr. Rutherford previously served as President and Chief Executive Officer of Lesco, Inc., a provider of professional turf care products and a divisionof John Deere & Co., from 2005 to 2007, and as Lesco’s Chief Financial Officer from 2002 to 2005. From 1998 to 2002, he was the Senior Vice President, Treasurer and Chief Financial Officer of OfficeMax, Inc., an office products company. Prior to joining Office Max, he spent fourteen years with the accounting firm Arthur Andersen & Co.Mr. Vilsackhas been Secretary and General Counsel since joining us in 2002. From 1999 until his employment with us, Mr. Vilsack was engaged in the private practice of law. From 1997 to 1999, Mr. Vilsack was Vice President, General Counsel and Secretary of Medusa Corporation, a manufacturer of Portland cement, and prior to that he was Vice President, General Counsel and Secretary of Figgie International Inc., a manufacturing conglomerate.Mr. Fogartyhas been Director of Corporate Development since 1997 and served as Director of Finance from 1995 to 1997.Item 5.Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity SecuritiesThe Company’s2011. There is no present intention to pay dividends.2013. Additionally, the terms of the Company’scredit agreement governing our revolving credit facility and the indenture governing the Notes restrict8.125% senior notes due 2021 provide some restrictions on the Company’s ability to payamounts of dividends.Quarterly Common Stock Price Ranges 2011 2010 High Low High Low $ 24.48 $ 16.95 $ 9.96 $ 5.69 24.40 17.46 16.40 8.80 23.27 10.95 15.66 10.01 20.29 10.59 23.70 12.77 Quarterly Common Stock Price Ranges 2013 2012 Quarter High Low High Low 1st $ 33.35 $ 19.96 $ 21.00 $ 16.13 2nd 39.00 30.61 22.61 16.85 3rd 38.75 31.29 22.88 16.42 4th 53.32 36.19 23.21 18.33 the Company’sour common stock as of February 29, 201228, 2014 was 561.the Company’srepurchases of our common stock repurchases during the fourth quarter of the fiscal year ended December 31, 2011. Total

Number

of Shares

Purchased Average

Price Paid

Per Share Total Number

of Shares

Purchased as

Part of Publicly

Announced Plans Maximum Number of Shares

That May Yet Be Purchased