SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended April 1, 2012

Commission File No. 0-7647

|

| | |

| | |

| Form 10-K |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended March 30, 2014 |

| Commission File No. 0-7647 |

| | |

(Exact Name of Registrant as specified in its Charter)

|

| | |

MINNESOTA | | 41-0771293 |

| MINNESOTA | | 41-0771293 |

| (State of Incorporation) | | Identification No.)

|

3100 East Hennepin Avenue, Minneapolis,

2381 Rosegate, Roseville, Minnesota

| | 5541355113 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(Registrant’s Telephone Number, Including Area Code)

|

| | | | |

| | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | COMMON STOCK, PAR VALUE $.05 PER SHARE |

Name of exchange on which registered: | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: | | NONE |

| | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | | | | |

| Large accelerated filer | | ¨ | | Non-accelerated filer | ¨ | | Accelerated filer | | þ |

| | | | |

Non-accelerated filer | | ¨ | | (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ The aggregate market value of voting stock held by non-affiliates of the Registrant on

October 2, 2011September 29, 2013 (the last business day of the Registrant’s most recently completed second fiscal quarter) was approximately

$285.4$358.3 million based upon the closing sale price for the Registrant’s common stock on that date as reported by The NASDAQ Stock Market, excluding all shares held by officers and directors of the Registrant and by the Trustees of the Registrant’s Employee Stock Ownership Plan and Trust.

As of May 25, 2012,23, 2014, the Registrant had 10,470,31510,612,640 shares of common stock outstanding. DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Proxy Statement for the annual meeting of shareholders to be held August

2, 2012,7, 2014, are incorporated by reference in Part III.

FORWARD-LOOKING STATEMENTS

The information presented in this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts, but rather are based on our current expectations, estimates and projections, and our beliefs and assumptions. We intend words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will” and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. These factors could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. These risks and uncertainties are described in the risk factors and elsewhere in this Annual Report on Form 10-K. We caution you not to place undue reliance on these forward-looking statements, which reflect our management’s view only as of the date of this Annual Report on Form 10-K. We are not obligated to update these statements or publicly release the result of any revisions to them to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events.

As used in this Annual Report on Form 10-K, except where otherwise stated or indicated by the context, “Hawkins,” “we,” “us,” “the Company,” “our,” or “the Registrant” means Hawkins, Inc. References to “fiscal

2015” means our fiscal year ending March 29, 2015, “fiscal 2014” means our fiscal year ending March 30, 2014, “fiscal 2013” means our fiscal year

endingended March 31, 2013, “fiscal 2012” means our fiscal year

endingended April 1, 2012

and “fiscal 2011” means our fiscal year ended April 3,

2011, “fiscal 2010” means our fiscal year ended March 28, 2010, and “fiscal 2009” means our fiscal year ended March 29, 2009.2011.

Annual Report on Form 10-K

For the Fiscal Year Ended

April 1, 2012March 30, 2014 | | | |

| | |

| | | | | Page | |

PART I | | | | |

ITEM 1.

| | Business | | | 4 | Page |

PART I |

| ITEM 1. | | |

| ITEM 1A. | | | | | 6 | |

ITEM 1B. | | | | | 11 | |

ITEM 2. | | | | | 11 | |

ITEM 3. | | | | | 13 | |

ITEM 4. | | | | | 13 | |

| PART II | | | | |

ITEM 5. | | | | | 14 | |

ITEM 6. | | | | | 15 | |

ITEM 7. | | | | | 16 | |

ITEM 7A. | | | | | 23 | |

ITEM 8. | | | | | 24 | |

ITEM 9. | | | | | 47 | |

ITEM 9A. | | | | | 47 | |

ITEM 9B. | | | | | 48 | |

| PART III | | | | |

ITEM 10. | | | | | 49 | |

ITEM 11. | | | | | 50 | |

ITEM 12. | | | | | 50 | |

ITEM 13. | | | | | 50 | |

ITEM 14. | | | | | 50 | |

| PART IV | | | | |

ITEM 15. | | | | | 51 | |

PART I

Hawkins, Inc. distributes,

bulk chemicalsblends and

blends, manufactures

and distributes specialty chemicals for our customers in a wide variety of industries. We began our operations primarily as a distributor of bulk chemicals with a strong customer focus. Over the years, we have maintained

theour strong customer focus and have expanded our business by increasing our sales of value-added

specialty chemical products, including repackaging, blending,

manufacturing and

manufacturingdiluting certain

products. In recent years, we significantly expanded the sales of our higher-margin blended and manufactured products. We believe that we create value for our customers through superb service and support, quality products, personalized applications and

our trustworthy, creative employees.

We currently conduct our business in two segments: Industrial and Water Treatment. Financial information regarding these segments is reported in

our Financial Statements and Notes to Financial Statements. See Items 7 and 8 of this Annual Report on Form 10-K.

Industrial Segment. Our Industrial Group operates this segment of our business, which specializes in providing industrial chemicals, products and services primarily to theindustries such as agriculture, energy, electronics, food, chemical processing, pulp and paper, pharmaceutical, medical device and plating industries.plating. The group’s principal products are acids, alkalis and industrial and food-grade salts.

Receives, stores and distributes various chemicals in bulk quantities, including liquid caustic soda, sulfuric acid, hydrochloric acid, phosphoric acid, potassium hydroxide and aqua ammonia;

| • | | Manufactures sodium hypochlorite (bleach), agricultural products and certain food-grade products, including our patented Cheese-Phos® liquid phosphate, lactates and other blended products;

|

Manufactures sodium hypochlorite (bleach), agricultural products and certain food-grade products, including liquid phosphates, lactates and other blended products;

Repackages water treatment chemicals for our Water Treatment Group and bulk industrial chemicals to sell in smaller quantities to our customers;

Performs custom blending of certain chemicals for customers according to customer formulas; and

Performs contract and private label packaging for household chemicals.bleach packaging.

The group’s sales are concentrated primarily in Illinois, Iowa, Minnesota, Missouri, North Dakota, South Dakota, Tennessee and Wisconsin while the group’s food-grade products are sold nationally. The Industrial Group relies on a specially trained sales staff that works directly with customers on their specific needs. The group conducts its business primarily through distribution centers and terminal operations.

During the third quarter of fiscal 2012, we purchased a 28-acre parcel of land in Rosemount, Minnesota and began construction of a new facility on the site, which is expected to be operational in late fiscal 2013. The site provides capacity for future business growth and lessens our dependence on our flood-prone sites on the Mississippi River. While we expect to transfer some blending and manufacturing activity to the Rosemount site, we do not intend to close any sites we currently operate.

In the fourth quarter of fiscal 2011, we completed the acquisition of substantially all of the assets of Vertex Chemical Corporation (“Vertex”), a manufacturer of sodium hypochlorite in the central Midwest. In addition to the manufacture of sodium hypochlorite bleaches, Vertex distributes and provides terminal services for bulk liquid inorganic chemicals, and contract and private label packaging for household chemicals. Its corporate headquarters are located in St. Louis, Missouri, with manufacturing sites in Dupo, Illinois, Camanche, Iowa, and Memphis, Tennessee. In connection with the acquisition we paid the sellers $27.2 million and assumed certain liabilities of Vertex. Vertex’s business is part of our Industrial Group.

In fiscal 2010, we completed two new facilities to expand our ability to service our customers and facilitate growth within our Industrial Group. Our facility in Centralia, Illinois began operations in July 2009 and primarily serves our food-grade and agriculture products businesses. We also opened a facility in Minneapolis, Minnesota, to handle bulk chemicals sold to pharmaceutical manufacturers.

Water Treatment Segment. Our Water Treatment Group operates this segment of our business, which specializes in providing chemicals, equipment and solutions for potable water, municipal and industrial wastewater, industrial process water and non-residential swimming pool water. The group has the resources and flexibility to treat systems ranging in size from a single small single well to a multi-million gallon-per-day treatmentmulti-million-gallon-per-day facility.

The group utilizes delivery routes operated by our employees who serve as route driver, salesperson and

highly trained technician to deliver our products and diagnose our customers’ water treatment needs. We believe that the high level of service provided by these individuals allows us to serve as the trusted water treatment expert for many of the municipalities and other customers that we serve. We also believe that we are able to obtain a competitive cost position on many of the chemicals sold by the Water Treatment Group due to the volumes of these chemicals purchased by our Industrial Group.

The group operates out of warehouses in

1820 cities supplying products and services to customers

primarily in Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, North Dakota, Oklahoma, South Dakota, Tennessee, Wisconsin and Wyoming. We opened one

new warehouse in each of

these warehouses in fiscal

2014, 2013 and 2012,

two in fiscal 2011, and expect to continue to invest in existing and new branches to expand the group’s geographic coverage. Our Water Treatment Group has historically experienced higher sales during April to September, primarily due to a seasonal increase in chemicals used by municipal water treatment facilities.

Discontinued Operations. In February 2009, we entered into two agreements whereby we agreed to sell our inventory and enter into a marketing relationship regarding the business of our Pharmaceutical segment, which provided pharmaceutical chemicals to retail pharmacies and small-scale pharmaceutical manufacturers. The transaction closed in May 2009 and we have no significant obligations to fulfill under the agreements. The results of the Pharmaceutical segment have been reported as discontinued operations in our consolidated financial statements for all periods presented in this Annual Report on Form 10-K.Raw Materials. We have numerous suppliers, including many of the major chemical producers in the United States. We typically have written distributorship agreements or supply contracts with our suppliers that are periodically renewed. We believe that most of the products we purchase can be obtained from alternative sources should existing relationships be terminated. We are dependent upon the availability of our raw materials. In the event that certain raw materials become generally unavailable, suppliers may

extend lead times or limit or cut off the supply of materials to us. As a result, we may not be able to supply or manufacture products for our customers. While we believe

that we have adequate sources of supply for our raw material and product requirements, we cannot be sure that supplies will be consistently available in the

future should shortages occur.future.

Intellectual Property. Our intellectual property portfolio is of economic importance to our business. When appropriate, we have pursued, and we will continue to pursue, patents covering our products. We also have obtained certain trademarks for our products to distinguish them from our competitors’ products. The patent for our Cheese-Phos® liquid phosphate product, which is manufactured by our Industrial group, is scheduled to expire in November 2013. We regard much of the formulae, information and processes that we generate and use in the conduct of our business as proprietary and protectable under applicable copyright, patent, trademark, trade secret and unfair competition laws.

Customer Concentration. No single In fiscal 2014, none of our customers accounted for 10.0% or more of our total sales. Sales to our largest customer represents more than 10%represented 6.9% of either our total sales or thein fiscal 2014, 7.4% of our total sales in fiscal 2013 and 7.2% of our total sales in fiscal 2012. Aggregate sales to our five largest customers, all of which are in our Industrial segment, represented 20.8% of our total sales in fiscal 2014, 21.8% of our total sales in fiscal 2013 and 24.8% of our total sales in fiscal 2012. No other customer represented more than 2.0% of our total sales in fiscal 2014. The loss of any of our segments, but the losslargest customers, or a substantial portion of our five largest customerstheir business, could have a material adverse effect on our results of operations. Total aggregate sales to our five largest customers were $55.6 million in fiscal 2010, $64.3 million in fiscal 2011 and $72.2 million in fiscal 2012.

Competition. We operate in a competitive industry and compete with many producers, distributors and sales agents offering chemicals equivalent to substantially all of the products we handle.offer. Many of our competitors are larger than we are and may have greater financial resources, although no one competitor is dominant in our industry. We compete by offering quality products at competitive prices coupled with outstanding customer service. Because of our long-standing relationships with many of our suppliers, we are often able to leverage those relationships to obtain products when supplies are scarce or to obtain competitive pricing.

Geographic Information. Substantially all of our revenues are generated in,by sales to customers within, and long-lived assets are located in, the United States.States, with only approximately 0.5% of our total revenues to customers outside of the U.S. in fiscal 2014.

Employees. We had 343361 employees as of April 1, 2012,March 30, 2014, including 4851 covered by a collective bargaining agreement.agreements.

About Us. Hawkins, Inc. was founded in 1938 and incorporated in Minnesota in 1955. We became a publicly-traded company in 1972. Our principal executive offices are located at 3100 East Hennepin Avenue, Minneapolis,2381 Rosegate, Roseville, Minnesota.

Available Information. We have made available, free of charge, through our Internet website (http://www.hawkinsinc.com), our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports, as soon as reasonably practicable after we electronically file these materials with, or furnish them to, the Securities and Exchange Commission. Reports of beneficial ownership filed by our directors and executive officers pursuant to Section 16(a) of the Exchange Act are also available on our website. We are not including the information contained on our website as part of, or incorporating it by reference into, this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

| RISK FACTORS |

You should consider carefully the following risks when reading the information,including the financial information, contained in this Annual Report onForm 10-K.

We operate in a highly competitive environment and face significant competition andprice pressure.

We operate in a highly competitive industry and compete with producers, manufacturers, distributors and sales agents offering chemicals equivalent to substantially all of the products we offer. Competition is based on several key criteria, including product price, product performance, product quality, product availability and security of supply, breadth of product offerings, geographic reach, responsiveness of product development in cooperation with customers, technical expertise and customer service. Many of our competitors are larger than we are and may have greater financial resources, more product offerings and a greater geographic reach. As a result, these competitors may be able to offer a broader array of products to a larger geographic area and may be better able than us to withstand changes in conditions within our industry, changes in the prices and availability of raw materials, changes in general economic conditions and be able to introduce innovative products that reduce demand for or the profit of our products. Additionally, competitors’ pricing decisions could compel us to decrease our prices, which could adversely affect our margins and profitability. Our ability to maintain or increase our profitability is dependent upon our ability to offset competitive decreases in the prices and margins of our products by improving production efficiency, investing in infrastructure to reduce freight costs, identifying and selling higher margin chemical products, providing higher levels of technical expertise and customer service, and improving existing products through innovation and research and development. If we are unable to maintain our profitability or competitive position, we could lose market share to our competitors and experience reduced profitability.

Fluctuations in the prices and availability of commodity chemicals,our chemical raw materials, which are may becyclical in nature, could have a material adverse effect on our operations and themargins we receive on sales of our products.Periodically, we

We experience

significantregular and

rapidrecurring fluctuations in the

commodity pricing of

our raw materials.

Those fluctuations can be significant and occur rapidly. The cyclicality of commodity chemical markets, such as caustic soda, primarily results from changes in the balance between supply and demand and the level of general economic activity. We cannot predict whether the markets for our

commodity chemicalschemical raw materials will favorably impact

our operations or

whethernegatively impact the margins we

will experience a negative impact due to oversupply and lower prices.can realize.

Our principal raw materials are generally purchased under supply contracts. The prices we pay under these contracts generally lag the market prices of the underlying raw material and the cost of inventory we have on hand generally will lag the current market pricing of such inventory. The pricing within our supply contracts generally adjusts quarterly or monthly. While we attempt to maintain competitive pricing and stable margin dollars, the

variabilitypotential variance in our cost of inventory from the current market pricing can cause significant volatility in our margins realized. In periods of rapidly increasing market prices,

theour inventory cost position will tend to be favorable,

to us, possibly by material amounts, which may positively impact our margins. Conversely, in periods of rapidly decreasing market prices,

theour inventory cost position will tend to be unfavorable,

to us, possibly by material amounts, which may negatively impact our margins. We do not engage in futures or other derivatives contracts to hedge against fluctuations in future prices. We may enter into sales contracts where the selling prices for our products are fixed for a period of time, exposing us to volatility in raw materials prices that we acquire on a spot market or short-term contractual basis. We attempt to pass commodity pricing changes to our customers, but we may be unable to or be delayed in doing so. Our inability to pass through price increases or any limitation or delay in our passing through price increases could adversely affect our profit margins.

We are also dependent upon the availability of our raw materials. In the event that raw materials are in short supply or unavailable, raw material suppliers may extend lead times or limit or cut off supplies. As a result, we may not be able to supply or manufacture products for some or all of our customers.

For example, in calendar 2008 a miners’ strike in Canada significantly limited supplies of potassium chloride, a key component of some of our products. Due to the resulting shortage, many chemical companies were unable to supply their customers. While we were able to obtain a supply of the product sufficient to meet our customers’ needs, we cannot be certain that such supplies would be available in the future should other similar shortages occur. Constraints on the supply or delivery of critical raw materials could disrupt our operations and adversely affect the performance of our business.

We operate in a highly competitive environment and face significant competition and price pressure.We operate in a highly competitive industry and compete with producers, manufacturers, distributors and sales agents offering chemicals equivalent to substantially all of the products we handle. Competition is based on several key criteria, including product price, product performance and quality, product availability and security of supply, responsiveness of product development in cooperation with customers, and customer service. Many of our competitors are larger than we are and may have greater financial resources. As a result, these competitors may be better able than us to withstand changes in conditions within our industry, changes in the prices and availability of raw materials, changes in general economic conditions and be able to introduce innovative products that reduce demand for or the profit of our products. Additionally, competitors’ pricing decisions could compel us to decrease our prices, which could adversely affect our margins and profitability. Our ability to maintain or increase our profitability is dependent upon our ability to offset competitive decreases in the prices and margins of our products by improving production efficiency and volume, identifying higher margin chemical products and improving existing products through innovation and research and development. If we are unable to maintain our profitability or competitive position, we could lose market share to our competitors and experience reduced profitability.

Demand for our products is affected by general economic conditions and by thecyclical nature of many of the industries we serve, which could cause significantfluctuations in our sales volumes and results.

Demand for our products is affected by general economic conditions. A decline in general economic or business conditions in the industries served by our customers could have a material adverse effect on our business. Although we sell to areas traditionally considered non-cyclical, such as water treatment and food products, many of our customers are in businesses that are cyclical in nature, such as the industrial manufacturing, surface finishing and energy industries which include the ethanol and agriculture industries. Downturns in these industries could adversely affect our sales and our financial results by affecting demand for and pricing of our products.

Changes in our customers’ productsneeds or failure of our products to meet customers’ quality specifications could adversely affect our sales and profitability.

Our chemicals are used for a broad range of applications by our customers. Changes in our customers’

productsproduct needs or processes may enable our customers to reduce or eliminate consumption of the chemicals that we provide. Customers may also find alternative materials or processes that no longer require our products. Consequently, it is important that we develop new products to replace the sales of products that mature and decline in use.

Our products provide important performance attributes to our customers’ products. If our products fail to

meet the customers’ specifications, perform in a manner consistent with quality specifications or have a shorter useful life than

guaranteed,required, a customer could seek replacement of the product or damages for costs incurred as a result of the product

failing to perform as expected.failure. A successful claim or series of claims against us could have a material adverse effect on our financial condition and results of operations and could result in a loss of one or more customers.

Our business is subject to hazards common to chemical businesses, any of which couldinterrupt our production and adversely affect our results of operations.

Our business is subject to hazards common to chemical manufacturing, storage, handling and transportation, including explosions, fires, severe weather, natural disasters, mechanical failure, unscheduled downtime, transportation interruptions,

traffic accidents involving our delivery vehicles, chemical spills, discharges or releases of toxic or hazardous substances or gases and other risks. These hazards could cause personal injury and loss of life, severe damage to or destruction of property and equipment, and environmental contamination. In addition, the occurrence of material operating problems at

any of our facilities due to any of these hazards may

diminishmake it impossible for us to make sales to our

ability to meet our output goalscustomers and

may result in a negative public or political reaction. Many of our facilities are

bordered bynear significant residential populations which

increaseincreases the risk of negative public or political reaction should an environmental issue occur and could lead to adverse zoning

or other regulatory actions that could limit our ability to operate our business in those locations. Accordingly, these hazards and their consequences could have a material adverse effect on our operations as a whole, including our results of operations and cash flows, both during and after the period of operational difficulties.

We are highly dependent upon transportation infrastructure to ship and receive our products and delays in these shipments could adversely affect our results of operations.

Although we maintain a number of owned trucks and trailers, we rely heavily upon transportation provided by third parties (including common carriers, barge companies and rail companies) to deliver products to us and to our customers. Our access to third-party transportation is not guaranteed, and we may be unable to transport our products in a timely manner, or at all, in certain circumstances, or at economically attractive rates. Disruptions in transportation are increasingly common, are often out of our control, and can happen suddenly and without warning. Rail limitations, such as limitations in rail capacity, availability of railcars and adverse weather conditions have disrupted or delayed rail shipments in the past and we expect they will continue into the future. Barge shipments are delayed or impossible under certain circumstances, including during times of high or low water levels and when waterways are frozen. Truck transportation has been negatively impacted by a number of factors, including limited availability of qualified drivers and equipment, and limitations on drivers’ hours of service, and we expect these conditions will continue into the future. Our failure to ship or receive products in a timely and efficient manner could have a material adverse effect on our financial condition and results of operations.

Environmental, health and safety, transportation and storage laws and regulations cause us to incur substantialcosts and may subject us to future liabilities.liabilities and risks.

We are subject to numerous federal, state and local environmental, health and safety laws and regulations in the jurisdictions in which we operate, including those governing the discharge of pollutants into the air and water, and the management,

storage and disposal of hazardous substances and wastes. The nature of our business exposes us to risks of liability under these laws and regulations due to the production, storage, use, transportation and sale of materials that can cause contamination or personal injury if released into the environment. Ongoing compliance with such laws and regulations is an important consideration for us and we invest substantial capital and incur significant operating costs in our compliance efforts. Governmental regulation has become increasingly strict in recent years. We expect this trend to continue and anticipate that compliance will continue to require increased capital expenditures and operating costs.

In addition, we operate a fleet of more than 100 vehicles, primarily in our Water Treatment Group, which are highly regulated, including by the U.S. Department of Transportation (“DOT”). The DOT governs transportation matters including authorization to engage in motor carrier service, including the necessary permits to conduct our business, equipment operation, and safety. We

are audited periodically by the DOT to ensure that we are in compliance with various safety, hours-of-service, and other rules and regulations. If we were found to be out of compliance, the DOT could severely restrict or otherwise impact our operations, which could have a material adverse effect on our operations as a whole, including our results of operations and cash flows.

If we violate environmental, health and safety,

transportation or storage laws or regulations, in addition to being required to correct such violations, we could be held liable in administrative, civil or criminal proceedings for substantial fines and other sanctions that could disrupt,

limit or

limithalt our

operations.operations, which could have a material adverse effect on our operations as a whole, including our results of operations and cash flows. Liabilities associated with the investigation and cleanup

of releases of hazardous substances, as well as personal injury, property damages or natural resource damages arising out of such

releases of hazardous substances, may be imposed in many situations without regard to violations of laws or regulations or other fault, and may also be imposed jointly and severally (so that a responsible party may be held liable for more than its share of the losses involved, or even the entire loss). Such liabilities can be difficult to identify and the extent of any such liabilities can be difficult to predict. We use, and in the past have used, hazardous substances at many of our facilities, and have generated, and continue to generate, hazardous wastes at a number of our facilities. We have in the past

been, and may in the future be, subject to claims relating to exposure to hazardous materials and the associated liabilities may be material.

Costs related to a multi-employer pension plan, which has liabilities in excess of plan assets, may have a material adverse effect on our financial condition and results of operations.We participate in the Central States Southeast and Southwest Areas Pension Fund (“CSS” or “the Fund” or “the plan”), a multi-employer pension plan. Our participation is pursuant to two collective bargaining agreements that expire in February 2013 (the “CBAs”). Our obligation to continue to participate in the plan does not automatically expire upon expiration of the CBAs.

CSS’s actuarial certification for the plan year beginning January 1, 2008 placed the Fund in “critical status,” a legal term that essentially means that the Fund’s assets were less than 65% of its liabilities. As a result, the plan adopted a rehabilitation plan. CSS’s 2011 Annual Funding Notice stated that, as of January 1, 2011, the Fund remained in critical status with a funded percentage of 58.9%, which was down from a funded percentage of

63.4% as of January 1, 2010. This decrease in the plan’s funded percentage was despite having adopted an “updated rehabilitation plan” that implemented additional measures to improve the funded level, including requiring higher employer contributions, establishing an increased minimum retirement age, and actuarially adjusting certain pre-age-65 benefits for participants who retire after July 1, 2011. We can make no assurances of whether or to what extent the updated rehabilitation plan will improve the funded status of the plan.

We continue to contribute cash to the Fund, as required by the CBAs. We record the required cash contributions to the Fund as an expense in the period incurred and recognize a liability for any contributions due and unpaid, consistent with the accounting rules for multi-employer defined benefit plans. In addition, we are responsible for our proportional share of any unfunded vested benefits related to the Fund as a whole. However, under applicable accounting rules, we do not record a liability for our portion of any unfunded vested benefit liability until withdrawal liability has been triggered by a partial or full withdrawal from the plan.

A partial or full withdrawal from the plan may be triggered by circumstances beyond our control, such as union members voting to decertify their union. Our withdrawal from the plan as the result of collective bargaining negotiations with the unions would also trigger withdrawal liability. If a withdrawal from the plan occurs, we will record our proportional share of any unfunded vested benefit liability in the period in which the withdrawal occurs. The ultimate amount of the withdrawal liability assessed by the plan is impacted by a number of factors, including but not limited to the plan’s investment returns and benefit levels, interest rates, financial difficulty of other participating employers in the plan such as bankruptcy, and the continued participation by our company and other employers in the plan.

Based upon the most recent information available from the trustees managing CSS, our share of the unfunded vested benefit liability for the plan was estimated to be approximately $7.9 million if the withdrawal had occurred in calendar year 2011, an increase from an estimate of approximately $5.1 million if the withdrawal had occurred in calendar year 2009. These estimates were calculated by the trustees managing CSS. Although we believe the most recent plan data available from CSS was used in computing this 2011 estimate, the actual withdrawal liability amount is subject to change based on, among other things, the plan’s investment returns and benefit levels, interest rates, financial difficulty of other participating employers in the plan such as bankruptcy, and continued participation by the company and other employers in the plan, each of which could impact the ultimate withdrawal liability. If withdrawal liability were to be triggered, we would have the option to make payments over a period of 20 years instead of paying the withdrawal liability in a lump sum.

If the collective bargaining process results in our withdrawal from the Fund, the withdrawal would likely take effect in the fourth quarter of fiscal 2013. We are currently unable to predict the ultimate outcome of those negotiations. However, if we are able to successfully withdraw from the plan, we anticipate it would trigger withdrawal liability in an amount that would have a material impact on our financial results.

A number of our employees are unionized, and our business and results of operations could be adversely affected if labor negotiations or contracts further restrict our ability to maximize the efficiency of our operations.

A significant portion of our production employees in the Twin Cities are unionized under two separate collective bargaining agreements that have expiration dates in February 2013. As a result, we are required to collectively bargain the wages, salaries, benefits, staffing levels and other terms with the bargaining representatives of those employees. Our results could be materially adversely affected if those labor negotiations further restrict our ability to maximize the efficiency of our operations, if we experience labor unrest (including but not limited to strikes, lockouts, slowdowns or other business interruptions or interferences) in connection with labor negotiations, or if we are unable to negotiate new collective bargaining agreements on reasonable terms acceptable to the affected parties.

Our business, particularly that of our Water Treatment Group and our agricultural product sales, is subject to seasonality andweather conditions, which could adversely affect our results of operations.

Our Water Treatment Group has historically experienced higher sales during April to September, primarily due to a seasonal increase in chemicals used by municipal water treatment facilities.

Our agricultural product sales are also seasonal, primarily corresponding with the planting and harvesting seasons. Demand

in both of these areas is also affected by weather conditions, as either higher or lower than normal precipitation or temperatures may affect water usage and the

timing and the amount of consumption of our products. We cannot assure you that seasonality or fluctuating weather conditions will not have a material adverse effect on our results of

operations and financial condition.operations.

The insurance that we maintain may not fully cover all potential exposures.

We maintain property, business interruption and casualty insurance, but such insurance may not cover all risks associated with the hazards of our business and is subject to limitations, including deductibles and limits on the liabilities covered. We may incur losses beyond the limits or outside the coverage of our insurance policies, including liabilities for environmental remediation. In addition, from time to time, various types of insurance for companies in the

specialty chemical industry have not been available on commercially acceptable terms or, in some cases, have not been available at all. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain.

If we are unable to retain key personnel or attract new skilled personnel, it couldhave an adverse impact on our business.

Because of the specialized and technical nature of our business, our future performance is dependent on the continued service of, and on our ability to attract and retain, qualified management, scientific, technical and support personnel. The unanticipated departure of key members of our management team could have an adverse impact on our business.

We may not be able to successfully consummate future acquisitions or integrateacquisitions into our business, which could result in unanticipated expenses andlosses.

As part of our business growth strategy, we have acquired businesses and may pursue acquisitions in the future. Our ability to pursue this strategy will be limited by our ability to identify appropriate acquisition candidates and our financial resources, including available cash and borrowing capacity. The expense incurred in consummating acquisitions, the time it takes to integrate an acquisition or our failure to integrate businesses successfully could result in unanticipated expenses and losses. Furthermore, we may not be able to realize the anticipated benefits from acquisitions.

The process of integrating acquired operations into our existing operations may result in unforeseen operating difficulties and may require significant financial resources that would otherwise be available for the ongoing development or expansion of existing operations. The risks associated with the integration of acquisitions include potential disruption of our ongoing business and distraction of management, unforeseen claims, liabilities, adjustments, charges and write-offs, difficulty in conforming the acquired business’ standards, processes, procedures and controls with our operations, and challenges arising from the increased scope, geographic diversity and complexity of the expanded operations.

Our business is subject to risks stemming from natural disasters or otherextraordinary events outside of our control, which could interrupt our production andadversely affect our results of operations.

Natural disasters have the potential of interrupting our operations and damaging our properties, which could adversely affect our business. Since 1963, flooding of the Mississippi River has required the Company’s terminal operations to be temporarily shifted out of its buildings seven times, including three times since the spring of 2010. We can give no assurance that flooding or other natural disasters will not recur or that there will not be material damage or interruption to our operations in the future from such disasters.

Chemical-related assets may be at greater risk of future terrorist attacks than other possible targets in the United States. Federal law imposes

new site security requirements, specifically on chemical facilities, which

requirehave increased

capital spending and increase our overhead expenses.

New federalFederal regulations have

alreadyalso been adopted to increase the security of the transportation of hazardous chemicals in the United States. We ship and receive materials that are classified as hazardous and we believe we have met these requirements, but additional federal and local regulations that limit the distribution of hazardous materials are being considered. Bans on movement of hazardous materials through certain cities could adversely affect the efficiency of our logistical operations. Broader restrictions on hazardous material movements could lead to additional investment and could change where and what products we provide.

The occurrence of extraordinary events, including future terrorist attacks and the outbreak or escalation of hostilities, cannot be predicted, but their occurrence can be expected to negatively affect the economy in general, and specifically the markets for our products. The resulting damage from a direct attack on our assets, or assets used by us, could include loss of life and property damage. In addition, available insurance coverage may not be sufficient to cover all of the damage incurred or, if available, may be prohibitively expensive.

We may not be able to renew our leases of land where four of our operationsfacilities reside.

We lease the land where our three main terminals are located and where

aanother significant manufacturing plant is located. We do not have guaranteed lease renewal options and may not be able to renew our leases in the future. Our current lease renewal periods extend out to

2014 (one lease), 2018 (two leases)

, 2023 (one lease) and 2029 (one lease). The failure to secure extended lease terms on any one of these facilities may have a material adverse impact on our business, as they are where a significant portion of our chemicals are manufactured and where the majority of our bulk chemicals are stored. While we can make no assurances, based on historical experience and anticipated future needs, we intend to extend these leases and believe that we will be able to renew our leases as the renewal periods expire. If we are unable to renew three of our leases (two relate to terminals and one to manufacturing) any property remaining on the land becomes the property of the lessor, and the lessor has the option to either maintain the property or remove the property at our expense. These asset retirement obligations and the cost to relocate our operations could have a material adverse effect on our results of operations and financial condition.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

ITEM 1B. UNRESOLVED STAFF COMMENTS

ITEM 2. PROPERTIES

Our corporate office is located in Roseville, Minnesota, where we lease approximately 40,000 square feet under a lease with an initial term through December 31, 2021. We own our principal

manufacturing, warehousing, and distribution location

in Minneapolis, Minnesota, which consists of approximately 11 acres of land,

in Minneapolis, Minnesota, with six buildings containing a total of 177,000 square feet of office and warehouse space primarily used by our Industrial Group.

Our principal office is located in one of these buildings, at 3100 East Hennepin Avenue. We have installed sprinkler systems in substantially all of our warehouse facilities for fire protection. We

believe that we carry customary levels of insurance covering the replacement of damaged property.

In addition to the facilities described previously, our other facilities are described below. We believe that these facilities, together with those described above, are adequate and suitable for the purposes they serve. Unless noted, each facility is owned by us and is primarily used as office and warehouse.

| |

| | | | |

Group

| | Location | | Approx.

Square Feet | |

Industrial

| Group | Location | | Approx. Square Feet |

| Industrial | St. Paul, MN(1) | | | 32,000 | |

| | Minneapolis, MN(2) | | | 29,000 | 9,000 |

| | Centralia, IL(3) | | | 77,000 | |

| | Camanche, IA(4) | IA | | 95,000 | |

| | St Louis, MO(4) | MO | | 6,000 | |

| | Dupo, IL(4) | | | 64,000 | |

| | Rosemount, MN(5) | | | 63,000 | |

| Water Treatment | | Fargo, ND | | | 20,000 | |

| | Fond du Lac, WI | | | 24,000 | |

| | Washburn, ND | | | 14,000 | |

| | Billings, MT | | | 9,000 | |

| | Sioux Falls, SD | | | 27,000 | |

| | Rapid City, SD | | | 9,000 | |

| | Peotone, IL(6) | | | 18,000 | |

| | Superior, WI | | | 17,000 | |

| | Slater, IA | | | 12,000 | |

| | Lincoln, NE(6) | | | 16,000 | |

| | Eldridge, IA | | | 6,000 | |

| | Columbia, MO(6) | | | 14,000 | |

| | Garnett, KS | | | 18,000 | |

| | Ft. Smith, AR(6) | | | 17,000 | |

| | Muncie, IN(7)IN | | 12,000 |

| | | 12,000 | |

| Centralia, IL | | Centralia, IL(7)39,000 |

| | | 39,000Havana, IL | | 16,000 |

| | Tulsa, OK | | 7,300 |

| Industrial and Water Treatment | | St. Paul, MN(8)MN(7) | | 59,000 |

| | | 59,000 | |

| | Memphis, TN(4) | TN | | 41,000 |

| (1) | Our terminal operations, located at two sites on opposite sides of the Mississippi River, are made up of three buildings, outside storage tanks for the storage of liquid bulk chemicals, including caustic soda, as well as numerous smaller tanks for storing and mixing chemicals. The land is leased from the Port Authority of the City of St. Paul, Minnesota. The applicable leases run until December 2013, at which time we have an option to renew the leases for an additional five-year period on the same terms and conditions subject to renegotiation of rent.2018. |

| |

| (2) | This facility is leased from a third party to serve our bulk pharmaceutical customers.and is warehouse space. |

| |

| (3) | This facility includes 10 acres of land located in Centralia, Illinois owned by the company. The facility became operational in July 2009includes manufacturing capacity and primarily serves our food-grade products business. Prior to fiscal 2011 this facility was shared with the Water Treatment Group. |

| |

| (4) | The acquisition of Vertex in fiscal 2011 included an office building located in St Louis, Missouri andland for this manufacturing and warehouse facilities located in Memphis, Tennessee; Camanche, Iowa; and Dupo, Illinois. All of the facilities and land are owned by the company with the exception of the land in Dupo, Illinois, whichpackaging facility is leased from a third party. Theparty, with the lease runs throughexpiring in May 2014. The2023. |

| |

| (5) | This facility in Memphis is shared betweenincludes 28 acres of land owned by the Industrialcompany. This manufacturing facility was constructed by us and Water Treatment Groups.has outside storage tanks for the storage of bulk chemicals, as well as numerous smaller tanks for storing and mixing chemicals. |

(5) | In October 2011 we acquired a 28-acre parcel of land located in Rosemount, MN. We began construction of a new facility on the site during the third quarter of fiscal 2012 and expect it to be operational in late fiscal 2013. |

| (6) | This facility is leased from a third party. |

(7) | This facility was purchased in fiscal 2011. |

(8)(7) | Our Red Rock facility, which consists of a 59,000 square-foot building located on approximately 10 acres of land, has outside storage capacity for liquid bulk chemicals, as well as numerous smaller tanks for storing and mixing chemicals. The land is leased from the Port Authority of the City of St. Paul, Minnesota and the lease runs until 2029. |

On November 3, 2009, ICL Performance Products, LP (“ICL”), a chemical supplier to us, filed a lawsuit in the United States District Court for the Eastern District of Missouri, asserting breach of a contract for the sale of 75% purified phosphoric acid in 2009 (the “2009 Contract”). ICL seeks to recover $7.3 million in damages and pre-judgment interest, and additionally seeks to recover its costs and attorneys’ fees. ICL also claimed that we breached a contract for the sale of 75% purified phosphoric acid in 2008 (the “2008 Contract”). ICL has since dropped its claim for breach of the 2008 Contract. We have counterclaimed against ICL alleging that ICL falsely claimed to have a shortage of raw materials that prevented it from supplying us with the contracted quantity of 75% purified phosphoric acid for 2008. We claim that ICL used this alleged shortage and the threat of discontinued shipments of 75% purified phosphoric acid to force us to pay increased prices for the remainder of 2008, and to sign the 2009 Contract. Based on this alleged conduct, we have brought four alternate causes of action including: (1) breach of contract, (2) breach of the implied covenant of good faith and fair dealing, (3) negligent misrepresentation, and (4) intentional misrepresentation. We seek to recover $1.5 million in damages, and additionally seek to recover punitive damages, pre- and post-judgment interest, and our costs and attorneys’ fees. After the completion of discovery, both parties moved for summary judgment in their favor. On February 7, 2012, the Court denied both parties’ motions for summary judgment. ICL moved for reconsideration of parts of its motion for summary judgment. On April 24, 2012, the Court granted ICL’s motion for reconsideration in part, and denied it in part. In its April 24, 2012 Memorandum and Order, the Court interpreted the meaning and effect of a specific phrase in the 2009 Contract, and concluded that, if the 2009 Contract is a legally enforceable contract, Hawkins remained obligated to purchase 50% of its requirements for 75% purified phosphoric acid from ICL in 2009. Trial is scheduled to begin on July 23, 2012. We

ITEM 3. LEGAL PROCEEDINGS

There are

not able to predict the ultimate outcome of this litigation, butno material pending legal proceedings,

such as this can result in substantial costs and divertother than ordinary routine litigation incidental to the business, to which we or any of our

management’s attention and resources, which may have a material adverse effect on our business and results of operations, including cash flows.Wesubsidiaries are a party from time to time in other legal proceedings arising in the ordinary courseor of which any of our business. To date, none ofproperty is the litigation has had a material effect on us.

ITEM 4. | MINE SAFETY DISCLOSURES |

subject.

ITEM 4. MINE SAFETY DISCLOSURES

PART II

ITEM 5. ITEM 5. | MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

| | | | | | | | |

Quarterly Stock Data | | High | | | Low | |

Fiscal 2012 | | | | | | | | |

4th Quarter | | $ | 42.93 | | | $ | 34.36 | |

3rd Quarter | | | 40.89 | | | | 29.05 | |

2nd Quarter | | | 38.66 | | | | 30.14 | |

1st Quarter | | | 47.48 | | | | 33.30 | |

Fiscal 2011 | | | | | | | | |

4th Quarter | | $ | 46.86 | | | $ | 36.00 | |

3rd Quarter | | | 50.18 | | | | 34.03 | |

2nd Quarter | | | 37.45 | | | | 24.21 | |

1st Quarter | | | 29.50 | | | | 23.14 | |

| | | | | | | | |

Cash Dividends | | Declared | | | Paid | |

Fiscal 2013 | | | | | | | | |

1st Quarter | | | | | | $ | 0.32 | |

Fiscal 2012 | | | | | | | | |

4th Quarter | | $ | 0.32 | | | | | |

3rd Quarter | | | | | | $ | 0.32 | |

2nd Quarter | | $ | 0.32 | | | | | |

1st Quarter | | | | | | $ | 0.30 | |

Fiscal 2011 | | | | | | | | |

4th Quarter | | $ | 0.30 | | | | | |

3rd Quarter | | | | | | $ | 0.40 | |

2nd Quarter | | $ | 0.40 | | | | | |

1st Quarter | | | | | | $ | 0.28 | |

MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

|

| | | | | | | | | |

| | Quarterly Stock Data | | High | | Low |

| | Fiscal 2014 | | | | |

| | 4th Quarter | | $ | 37.29 |

| | $ | 33.25 |

|

| | 3rd Quarter | | 38.21 |

| | 35.29 |

|

| | 2nd Quarter | | 44.00 |

| | 36.50 |

|

| | 1st Quarter | | 41.00 |

| | 35.92 |

|

| | Fiscal 2013 | | | | |

| | 4th Quarter | | $ | 40.96 |

| | $ | 37.25 |

|

| | 3rd Quarter | | 42.04 |

| | 36.18 |

|

| | 2nd Quarter | | 42.29 |

| | 35.77 |

|

| | 1st Quarter | | 38.53 |

| | 31.06 |

|

|

| | | | | | | | | |

| | Cash Dividends | | Declared | | Paid |

| | Fiscal 2015 | | | | |

| | 1st Quarter | | — |

| | $ | 0.36 |

|

| | Fiscal 2014 | | | | |

| | 4th Quarter | | $ | 0.36 |

| | — |

|

| | 3rd Quarter | | — |

| | $ | 0.36 |

|

| | 2nd Quarter | | $ | 0.36 |

| | — |

|

| | 1st Quarter | | — |

| | $ | 0.34 |

|

| | Fiscal 2013 | | | | |

| | 4th Quarter | | $ | 0.34 |

| | — |

|

| | 3rd Quarter | | — |

| | $ | 0.34 |

|

| | 2nd Quarter | | $ | 0.34 |

| | — |

|

| | 1st Quarter | | — |

| | $ | 0.32 |

|

Our common shares are traded on The NASDAQ Global Market under the symbol “HWKN.” The price information represents closing sale prices as reported by The NASDAQ Global Market. As of

April 1, 2012,May 23, 2014, shares of our common stock were held by approximately

501476 shareholders of record.

We first started paying cash dividends in 1985 and have continued to do so since.

In July 2010, in recognition of the Company’s strong financial performance in fiscal 2010, its strong cash position and no debt, the Board of Directors authorized a special dividend of $0.10 per share in addition to a regular semi-annual cash dividend of $0.30 per share for July 2010. Future dividend levels will be dependent upon our consolidated results of operations, financial position, cash flows and other factors, and

will be evaluatedare subject to approval by our Board of Directors.

We did not sell or repurchase any shares of our common stock during the fourth quarter of fiscal 2014.

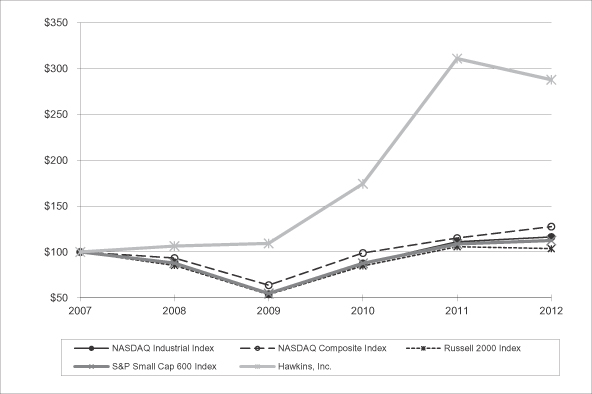

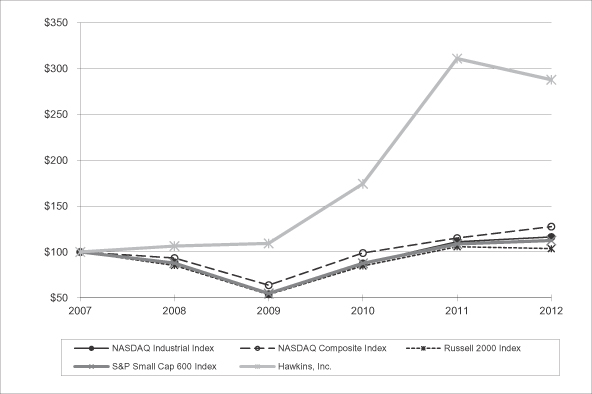

The following graph compares the cumulative total shareholder return on our common shares with the cumulative total returns of the NASDAQ Industrial Index, the NASDAQ Composite Index, the Russell 2000 Index and the Standard & Poor’s (“S&P”) Small Cap 600 Index for our last five completed fiscal years. The graph assumes the investment of $100 in our stock, the NASDAQ Industrial Index, the NASDAQ Composite Index, the Russell 2000 Index and the S&P Small Cap 600 Index on March 30,

2007,2009, and reinvestment of all dividends.

ITEM 6. | SELECTED FINANCIAL DATA |

ITEM 6. SELECTED FINANCIAL DATA

Selected financial data for the

CompanyCompany’s continuing operations is presented in the table below and should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations included in Item 7 and the Company’s consolidated financial statements and notes thereto included in Item 8 herein.

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Years | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (In thousands, except per share data) | |

Sales from continuing operations | | $ | 343,834 | | | $ | 297,641 | | | $ | 257,099 | | | $ | 284,356 | | | $ | 186,664 | |

Gross profit from continuing operations | | | 65,868 | | | | 61,902 | | | | 64,445 | | | | 62,420 | | | | 38,528 | |

Income from continuing operations | | | 21,628 | | | | 20,314 | | | | 23,738 | | | | 23,424 | | | | 8,488 | |

Basic earnings per common share from continuing operations | | | 2.09 | | | | 1.98 | | | | 2.32 | | | | 2.29 | | | | 0.83 | |

Diluted earnings per common share from continuing operations | | | 2.08 | | | | 1.96 | | | | 2.31 | | | | 2.29 | | | | 0.83 | |

Cash dividends declared per common share | | | 0.64 | | | | 0.70 | | | | 0.66 | | | | 0.52 | | | | 0.48 | |

Cash dividends paid per common share | | | 0.62 | | | | 0.68 | | | | 0.64 | | | | 0.50 | | | | 0.46 | |

Total assets | | $ | 204,081 | | | $ | 185,005 | | | $ | 160,293 | | | $ | 136,290 | | | $ | 108,943 | |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Total assets shown below are for the Company’s total operations.

|

| | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Years |

| | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 | |

| | | (In thousands, except per share data) |

| Sales | | $ | 348,263 |

| | $ | 350,387 |

| | $ | 343,834 |

| | $ | 297,641 |

| | $ | 257,099 |

| |

| Gross profit | | 61,600 |

| | 56,936 |

| | 65,868 |

| | 61,902 |

| | 64,445 |

| |

| Income from continuing operations | | 18,094 |

| | 17,108 |

| | 21,628 |

| | 20,314 |

| | 23,738 |

| |

| Basic earnings per common share | | 1.72 |

| | 1.64 |

| | 2.09 |

| | 1.98 |

| | 2.32 |

| |

| Diluted earnings per common share | | 1.71 |

| | 1.62 |

| | 2.08 |

| | 1.96 |

| | 2.31 |

| |

| Cash dividends declared per common share | | 0.72 |

| | 0.68 |

| | 0.64 |

| | 0.70 |

| | 0.66 |

| |

| Cash dividends paid per common share | | 0.70 |

| | 0.66 |

| | 0.62 |

| | 0.68 |

| | 0.64 |

| |

| Total assets | | $ | 237,193 |

| | $ | 222,148 |

| | $ | 204,081 |

| | $ | 185,005 |

| | $ | 160,293 |

| |

We acquired substantially all the assets of Vertex Chemical Corporation (“Vertex”) in late fiscal 2011. The results of its operations since the acquisition date are included in our consolidated results of operations.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following is a discussion and analysis of our financial condition and results of operations for fiscal

2012, 20112014, 2013 and

2010.2012. This discussion should be read in conjunction with the Financial Statements and Notes to Financial Statements included in Item 8 of this Annual Report on Form 10-K.

We derive substantially all of our revenues from the sale of

bulk and specialty chemicals to our customers in a wide variety of industries. We began our operations primarily as a distributor of bulk chemicals with a strong customer focus. Over the years, we have maintained the strong customer focus and have expanded our business by increasing our sales of value-added

specialty chemical products, including repackaging, blending,

manufacturing and

manufacturingdiluting certain products.

In recent years, we significantly expanded the sales of our higher-margin blended and manufactured products, including our food-grade products.

We have continued to invest in

growing ourinfrastructure to support increased business. During fiscal

2012,2013, we

purchased a 28-acre parcel of land in Rosemount, Minnesota and begancompleted construction of a new

Industrial manufacturing facility

on the site, which is expected to be operational in

late fiscal 2013.Rosemount, Minnesota. The site provides capacity for future business growth and lessens our dependence on our flood-prone sites on the Mississippi River.

While we expectWe incurred incremental costs to

transfer some blending and manufacturing activityoperate this new facility during fiscal 2014 as compared to

the Rosemount site, we do not intend to close any sites we currently operate.fiscal 2013 of approximately $1.7 million, which have been recorded in cost of sales in our Industrial segment.

In the fourthfirst quarter of fiscal 2011,2014, we completedmoved into a new corporate headquarters located in Roseville, Minnesota. The move was necessary because we had outgrown our former corporate headquarters that had been our home for over 60 years. As a result of this move, we incurred incremental costs during fiscal 2014 as compared to fiscal 2013 of approximately $1.0 million, recorded in selling, general and administrative expenses and allocated among both our Water Treatment and Industrial segments.

In fiscal 2014, we vacated the acquisitionleased facility used to serve our bulk pharmaceutical customers and transferred production of certain products to our other Industrial production facilities while discontinuing production of the remaining product lines. As a result, we recorded incremental costs in our Industrial segment during fiscal 2014 as compared to fiscal 2013 of approximately $0.4 million related to accelerated depreciation on leasehold improvements and manufacturing equipment related to this facility.

In the third quarter of fiscal 2014, we acquired substantially all

of the assets of

Vertex,Advance Chemical Solutions, Inc. (“ACS”), under the terms of an asset purchase agreement with ACS and its shareholders. We paid $2.4 million in cash, and may be obligated to pay an aggregate of $0.5 million in additional consideration to ACS over the next three years depending upon the achievement of certain financial performance targets. ACS had revenues of approximately $4.0 million for

approximately $27.2 million. In addition to the

manufacture12 months ended September 30, 2013. The results of

sodium hypochlorite bleaches, Vertex distributes and provides terminal services for bulk liquid inorganic chemicals, and contract and private label packaging for household chemicals. We believeits operations since the acquisition

strengthens our market position in the Midwest. Operating results of Vertexdate are included in our

consolidated results of operations from the date of acquisition in this Annual Report on Form 10-K as part of our IndustrialWater Treatment segment.

See Note 2 to the Consolidated Financial Statements for further information.In fiscal 2010, we completed two new facilities to expand our ability to service our customers and facilitate growth within our Industrial Group. Our facility in Centralia, Illinois began operations in July 2009 and primarily serves our food-grade and agriculture products businesses. We also opened a facility in Minneapolis, Minnesota, to handle bulk chemicals sold to pharmaceutical manufacturers.

We opened one new branch for our Water Treatment Group in fiscal

20122013 and

two new branchesone in fiscal

20112012 and expect to continue to invest in existing and new branches to expand our Water Treatment Group’s geographic coverage. The cost of these branch expansions is not expected to be material. In addition, we

have selectively addedcontinue to add route sales personnel to certain existing Water Treatment Group branch offices to spur growth within our existing geographic coverage area.

In February 2009,the third quarter of fiscal 2013, we agreed to sellrecorded a pre-tax charge of $7.2 million in our inventoryIndustrial segment (approximately $4.5 million after tax, or $0.43 per share, fully diluted). This charge represented the discounted value of our estimated withdrawal payment obligation from the Central States, Southeast and Southwest Areas Pension Fund (“CSS”), a collectively bargained multiemployer pension plan. The withdrawal liability will be paid over 20 years and our payments began in the third quarter of fiscal 2014.

In fiscal 2013, we entered into a

marketingsettlement agreement

regardingwith a chemical supplier to us, pursuant to which we mutually resolved the

businesspreviously disclosed litigation and all disputes among us. The settlement agreement provided for a cash payment by us to the supplier and provided that both parties enter into new contracts for the supply by the supplier of

our Pharmaceutical segment, which provided pharmaceuticalcertain chemicals to

retail pharmacies and small-scale pharmaceutical manufacturers. The transaction closed in May 2009 and we have no significantus. Our obligations

to fulfill under the

agreement. The resultssettlement agreement resulted in a $3.2 million charge to pre-tax income recorded in cost of

the Pharmaceutical segment have been reported as discontinued operationssales in our

Consolidated Financial Statements for all periods presentedIndustrial segment (approximately $2.0 million after tax, or $0.19 per share, fully diluted) in

this Annual Report on Form 10-K.Ourthe first quarter of fiscal 2013.

An overview of our financial performance in fiscal 2012 was highlighted by:2014 is provided below: Sales from continuing operations of $343.8$348.3 million, a 15.5% increase0.6%decrease from fiscal 2011;2013;

Gross profit from continuing operations of $65.9$61.6 million, or 19.2%17.7% of sales, a $4.0$4.7 millionincrease in gross profit dollars from fiscal 2011;2013. Fiscal 2013 gross profit was adversely impacted by non-recurring charges of $7.2 million related to our withdrawal from the CSS pension plan and $3.2 million related to the litigation settlement discussed above;

Net cash provided by operating activities of $33.7 million;$34.6 million; and

Cash and cash equivalents and investments available for sale were $45.9of $63.2 million as of the end of fiscal 2012.2014, an increase of $13.2 million from the end of fiscal 2013.

We seek to maintain relatively constant gross profit dollars

per unit sold on each of our products as the cost of our raw materials increase or

decrease.decrease, subject to competitive pricing pressures that may negatively impact our gross profit dollars per unit sold. Since we expect that we will continue to experience fluctuations in our raw material costs and resulting prices in the future, we believe that gross profit dollars is the best measure of our profitability from the sale of our

products. If we maintain relatively stableproducts, as opposed to gross profit

dollars on eachas a percentage of

our products, our reported gross profit percentage will decrease when the cost of the product increases and will increase when the cost of the product decreases.sales.

We use the last in, first out (“LIFO”) method of valuing the vast majority of Hawkins’our inventory, which causes the most recent product costs to be recognized in our income statement. The valuation of LIFO inventory for interim periods is based on our estimates of fiscal year-end inventory levels and costs. The LIFO inventory valuation method and the resulting cost of sales are consistent with our business practices of pricing to current commodity chemical raw material prices. Our LIFO reserve increaseddecreased by $1.6$1.9 million in fiscal 2012 primarily due to volumes2014 and mix of commodity chemicals$0.4 million in inventory at the end of the year. The increased reserve decreasedfiscal 2013, increasing our reported gross profit for both of these years. The reduction in the year. Our LIFO reserve increased by $3.9 million in fiscal 20112014 was primarily due to rising costs and higherlower levels of inventory volumes on hand at year-end, maintained to meet customer requirementsdriven by unusually cold and wintry weather that resulted in rail car and barge shipment delays during an anticipated flood. Thisthe fourth quarter of fiscal 2014. We anticipate our LIFO reserve will increase in fiscal 2015, decreasing our gross profit recorded, as we anticipate our inventory will return to levels consistent with historical levels at the end of fiscal 2015. The amount of the reserve decreasedincrease will depend on our reported gross profitactual fiscal year-end inventory levels and costs.

We disclose the sales of our bulk commodity products as a percentage of total sales dollars. We reviewed and revised the definition of bulk commodity products so that it now consists of products that we do not modify in

fiscal 2011.any way, but receive, store, and ship from our facilities, or direct ship to our customers in large quantities. This definition is more consistent with the business of a company primarily focused on bulk chemical distribution. The disclosures in this document referring to sales of bulk commodity products have been recalculated for all periods presented based on this revised definition.

The following table sets forth certain items from our statement of income as a percentage of sales from period to period: | | | | | | | | | | | | |

| | | Fiscal

2012 | | | Fiscal

2011 | | | Fiscal

2010 | |

Sales | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

Cost of sales | | | (80.8 | )% | | | (79.2 | )% | | | (74.9 | )% |

| | | | | | | | | | | | |

Gross profit | | | 19.2 | % | | | 20.8 | % | | | 25.1 | % |

Selling, general and administrative expenses | | | (9.0 | )% | | | (10.1 | )% | | | (10.0 | )% |

| | | | | | | | | | | | |

Operating income | | | 10.2 | % | | | 10.7 | % | | | 15.1 | % |

Investment income | | | 0.1 | % | | | 0.1 | % | | | 0.1 | % |

| | | | | | | | | | | | |

Income from continuing operations before income taxes | | | 10.3 | % | | | 10.8 | % | | | 15.2 | % |

Provision for income taxes | | | (4.0 | )% | | | (4.0 | )% | | | (6.1 | )% |

| | | | | | | | | | | | |

Income from continuing operations | | | 6.3 | % | | | 6.8 | % | | | 9.1 | % |

Income from discontinued operations, net of tax | | | 0.3 | % | | | 0.0 | % | | | 0.1 | % |

| | | | | | | | | | | | |

Net income | | | 6.6 | % | | | 6.8 | % | | | 9.2 | % |

| | | | | | | | | | | | |

|

| | | | | | | | | |

| | | Fiscal 2014 | | Fiscal 2013 | | Fiscal 2012 |

| Sales | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of sales | | (82.3 | )% | | (81.7 | )% | | (80.8 | )% |

| Pension withdrawal | | — | % | | (2.1 | )% | | — | % |

| Gross profit | | 17.7 | % | | 16.2 | % | | 19.2 | % |

| Selling, general and administrative expenses | | (9.6 | )% | | (9.0 | )% | | (9.0 | )% |

| Operating income | | 8.1 | % | | 7.2 | % | | 10.2 | % |

| Interest (expense) income, net | | — | % | | 0.1 | % | | 0.1 | % |

| Income from continuing operations before income taxes | | 8.1 | % | | 7.3 | % | | 10.3 | % |

| Income tax provision | | (2.9 | )% | | (2.4 | )% | | (4.0 | )% |

| Income from continuing operations | | 5.2 | % | | 4.9 | % | | 6.3 | % |

| Income from discontinued operations, net of tax | | — | % | | — | % | | 0.3 | % |

| Net income | | 5.2 | % | | 4.9 | % | | 6.6 | % |

Fiscal

20122014 Compared to Fiscal

20112013

Sales

SalesSales increased $46.2decreased$2.1 million, or 15.5%0.6%, to $343.8$348.3 million for fiscal 2012,2014, as compared to sales of $297.6$350.4 million for fiscal 2011. Vertex,2013. Sales of bulk commodity products, using the revised definition for these products discussed above, were approximately 21% of sales in fiscal 2014 and 23% in fiscal 2013.

Industrial Segment. Industrial segment sales decreased $3.7 million, or 1.5%, to $244.9 million for fiscal 2014. Overall volumes increased slightly year-over-year, with the increase driven by higher volumes of bulk commodity products sold, which generally carry lower per-unit selling prices and margins. In addition, competitive pricing pressures resulted in lower overall per-unit selling prices.

Water Treatment Segment. Water Treatment segment sales increased $1.5 million, or 1.5%, to $103.4 million for fiscal 2014. Sales volumes in this segment were largely unchanged as compared to the prior year. Sales growth in our newer branches, including the Oklahoma branch we acquired in connection with the ACS acquisition, together with increased sales of certain specialty chemical products and equipment, more than offset the negative impact of unfavorable weather conditions during the fourth quarter of 2011, contributed $32.9 millionmajority of the increase inspring and summer months and reduced sales volumes of bulk commodity products.

Gross Profit

Gross profit was $61.6 million, or 17.7% of sales, for fiscal 2012. We2014, as compared to $56.9 million, or 16.2% of sales, for fiscal 2013. The prior year’s gross profit was adversely impacted by the $7.2 million CSS pension withdrawal charge and the $3.2 million charge resulting from the litigation settlement, both of which were recorded in our Industrial segment. Together, these charges constituted 3.0% of sales for fiscal 2013. The LIFO method of valuing inventory increased gross profit by $1.9 million for fiscal 2014 and $0.4 million for fiscal 2013, primarily due to lower levels of inventory of many of our products at year-end.

Industrial Segment. Gross profit for the Industrial segment was $32.0 million, or 13.1% of sales, for fiscal 2014, as compared to $28.9 million, or 11.6% of sales, for fiscal 2013. The prior year’s gross profit for this segment was negatively impacted by the $7.2 million CSS pension withdrawal charge and the $3.2 million charge resulting from the litigation settlement, which charges together constituted 4.2% of Industrial segment sales for the fiscal year. Gross profit for fiscal 2014 was adversely impacted by $1.7 million in incremental costs to operate our new Rosemount manufacturing facility as compared to fiscal 2013, and a $0.4 million year-over-year difference in costs incurred to exit the leased facility used to serve our bulk pharmaceutical customers. Despite slightly higher overall sales volumes, gross profit was also experiencednegatively impacted by competitive pricing pressures and

higher volumes of lower margin products sold as compared to the prior year. The LIFO method of valuing inventory increased gross profit by $1.6 million in fiscal 2014 and increased gross profit by $0.4 million in fiscal 2013.