| • | | The Dynamic Polyconjugate® (DPC®) platform·

| ARC-LPA is an RNAi-based therapeutic designed to reduce production of apolipoprotein A (apo(a)), a small RNA delivery system that may be targeted to address multiple organ systems and cell types. It is a modular system that may be optimized on a target-by-target basis andkey component of lipoprotein(a) (Lp(a)), which has been demonstrated to promote multi-log gene knockdown in rodents and non-human primates, induce efficient endosomal escape, andgenetically linked with increased risk of cardiovascular diseases. ARC-LPA employs Arrowhead’s new hepatic delivery format being developed for subcutaneous administration. This program has wide safety margins using a variety of siRNA molecules.not yet been designated by Arrowhead as entering pre-IND development. |

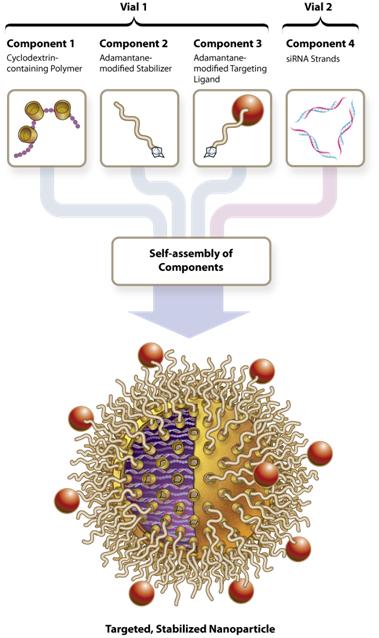

RONDEL is a small RNA delivery system that has demonstrated effective systemic siRNA delivery, RNAi-mediated mRNA and protein knockdown in human melanoma patients.

Arrowhead’s Homing Peptides platform is a vast, proprietary library of short peptides that have demonstrated rapid and specific internalization into a wide variety of cell types. This library is being mined for the potential development of peptide-drug conjugates (PDCs) and companion diagnostics. Arrowhead plans to develop the targeting peptides for use with its RNA delivery platforms as well as with traditional small molecule or peptide drugs.

Primary Strategic Opportunities

RNA interference (RNAi) is a naturally occurring mechanism that effects gene expression. Short interfering RNAs (siRNAs) have been shown to trigger RNAi and are thought to be a potentially powerful and specific way of silencing expression of disease-causing gene products. However, the lack of effective and safe delivery has impeded progress of the field. Arrowhead has multiple polymer-based, non-lipid delivery systems that enable development of RNAi therapeutics. Importantly, Arrowhead’s delivery systems have been validated in multiple species and have demonstrated high levels of efficiency and specificity with wide safety margins.

Examples of guided therapeutics producing positive patient outcomes are rapidly emerging. Arrowhead’s human-derived targeting library, comprised of over 42,000 peptides, is being mined to create PDCs designed to home specifically to target cells. PDCs have the potential to produce the advantages of antibody drug conjugates while bringing new benefits such as ease of manufacturing.

1

Recent EventsArrowhead made significant progress on product and platform development during fiscal year 2015 with an expanding pipeline of RNAi therapeutics based on the Dynamic Polyconjugate (DPC™) delivery system. The following are highlights of this progress: | • | | · | Strengthened management team and R&D staff with select key hires and expanded internal capabilities in manufacturing, RNA synthesis, toxicology, QA, program management, and clinical and regulatory operations |

| · | Presented data on ARC-520 and ARC-AAT at AASLD Liver Meeting® 2014 |

ARC-520 showed statistically significant reduction in HBsAg through day 43 after a single injection (p < 0.05) Repeat dosing of ARC-AAT in primates showed reduction of approximately 90% of serum alpha 1 antitrypsin (AAT) with long duration of effect suggesting that monthly or less frequent dosing may be sufficient for sustained suppression of hepatic AAT production ARC-AAT abstract highlighted in the AASLD President's Press Conference as a promising new treatment | · | Filed for regulatory approval to begin a Phase 1 clinical trial of ARC-AAT for the treatment of liver disease associated with alpha-1 antitrypsin deficiency |

| · | Submitted an Investigational New Drug (IND) application to the U.S. Food and Drug Administration and submitted additional clinical trial authorization applications with regulatory authorities in various jurisdictions in Europe, Asia, and Australia/New Zealand for ARC-520 |

| · | Initiated dosing in a Phase 1 clinical trial of ARC-AAT |

| · | Acquired Novartis Institutes for BioMedical Research, Inc (“Novartis”) entire RNAi research and development portfolio and associated assets, including: |

Multiple patent families covering RNAi-trigger design rules and modifications that fall outside of key patents controlled by competitors, which the Company believes provides freedom to operate for any target and indication Novel intracellular targeting ligands that enhance the activity of RNAi-triggers by targeting the RNA-induced silencing complex (RISC) more effectively and improving stability once RISC is loaded An assignment of Novartis' license from Alnylam Pharmaceuticals, Inc. (“Alnylam”) granting Arrowhead access to Alnylam intellectual property, excluding delivery, for 30 gene targets chosen by Novartis A pipeline of three candidates initiated by Novartis and for which Novartis has developed varying amounts of preclinical data | · | Initiated dosing in Heparc-2004, a multiple-dose Phase 2b clinical study of ARC-520 in the U.S. |

| · | Published new data in the Journal of Controlled Release, 209 (2015) 57-66, on a subcutaneously administered formulation of its DPC™ delivery system |

| · | Completed dosing of Part A of the ARC-AAT phase 1 study in healthy volunteers, and transitioned the study into Part B in patients with PiZZ genotype alpha-1 antitrypsin deficiency |

| · | Presented data at the TIDES Conference on the development of ARC-F12, an RNAi therapeutic for factor 12 (F12) mediated hereditary angioedema and thromboembolic diseases |

| · | Received Orphan Drug Designation from the United States Food and Drug Administration |

| · | Initiated multiple-dose Heparc-2002 and Heparc-2003 Phase 2b studies of ARC-520 in Europe and Asia |

2

| · | Patient Population Enrichment StrategiesExpanded Part B of the Phase 1 study of ARC-AAT to include additional treatment sites in Europe, Australia, and New Zealand

|

Arrowhead’s targeting library can be used for companion diagnostics that identify patient populations most likely to respond to a particular treatment, thus moving toward more personalized medicine.

| • | | Improving Generics·

| Nominated ARC-HIF2 against clear cell renal cell carcinoma as Arrowhead’s first therapeutic candidate delivered using a new DPC™ designed to target tissues outside of the liver |

| · | Hosted an analyst day to discuss top-line findings from the Heparc-2001 Phase 2a clinical study of ARC-520 and findings from a study of 9 chimpanzees that have been treated monthly with ARC-520 for between 6 and 11 months. Key messages included the following: |

Arrowhead’s targeting libraryArrowhead's proprietary DPC™ platform can be used to make PDCs with generics designed to have an improved efficacyeffectively and safety profile as compared to untargeted counterparts.consistently knock down target genes in humans

Arrowhead’s internal drug pipeline is intended to drive value directly through the development of novel therapeuticsARC-520 achieves significant HBV s-Antigen (HBsAg) reductions in humans, particularly in treatment naïve, HBeAg-positive patients

Arrowhead identifies a large target HBV population for ARC-520 and to provide proof of conceptdescribes a new paradigm for the platform technologies. We actively seek collaborationHBV lifecycle ARC-520 induces deep HBsAg reduction in chronically HBV infected chimps ARC-520 has been well tolerated Arrowhead expands its HBV portfolio by nominating an additional clinical candidate that is complementary to ARC-520 | · | Presented data on ARC-LPa against cardiovascular disease, which uses a new subcutaneous delivery construct that Arrowhead has developed |

| · | Presented data at the AASLD Liver Meeting 2015 including the following: |

ARC-520 led to robust, sustained anti-viral effects in chimpanzees with chronic HBV and licensing agreementsalso described an important new discovery that HBV DNA integrated into the host genome is likely an important source of HBV surface antigen (HBsAg) production In a Phase 2a clinical study, ARC-520 effectively reduced HBV viral antigens derived from cccDNA. HBV surface antigen (HBsAg) was reduced substantially with leading biopharmaceutical companies to augment their pipelines through the applicationa maximum reduction of our technologies1.9 logs (99%) and to advance the developmenta mean maximum reduction of 1.5 logs (96.8%) in treatment naïve e-antigen (HBeAg)-positive patients | · | Presented data at Hep DART 2015 showing that ARC-520 led to immune reactivation in 7 of 9 chimps with chronic hepatitis B infection |

Acquisition of Roche and commercialization of our own technology platformsNovartis RNAi business and drug candidates. Partnerships are intended to provide access to external expertise and capital to complement our internal development and create commercialization opportunities in areas outside of our core focus.assets RECENT EVENTS

Fiscal 2012The last four years have brought substantial change to Arrowhead. We have executed on our long-term strategy of transitioning from a nanotechnology holding company in multiple industries to a focused biotech model.Arrowhead’s research and development (R&D) capabilities and strategy. We are now a unifiedan integrated RNAi therapeutics company, developing actively guidednovel drugs that interact preferentially with target tissuessilence disease causing genes based on our broad RNAi and peptide targeting technology platforms.platform.

Arrowhead made two acquisitions in fiscal 2012. These acquisitions included new technology platforms, R&D infrastructure and expertise, and operating and business development management. We believe these acquisitions provide us with a solid foundation to discover and develop drug candidates and support partnerships that we expect will drive long-term value for our shareholders. Some of the key stepsThe most significant step in this transformation were:

Acquiredtransition was our 2011 acquisition of the RNAi therapeutics business assembledof Hoffmann-La Roche, Inc. and F. Hoffmann-La Roche Ltd. (collectively, “Roche”), which included the DPC™ delivery system that we have used for all our clinical drug candidates to date. Roche built this business unit in a manner that only a large pharmaceutical company is capable of: backed by expansive capital resources, Roche whichsystematically acquired technologies, licensed expansive intellectual property rights, attracted leading scientists, developed new technologies internally, and built state-of-the-art facilities. At a time when the markets were questioning whether RNAi could become a viable therapeutic modality, we saw great promise in the technology broadly and the quality of what Roche built specifically. The acquisition provided us with three primary sources of value:

| · | Broad freedom to operate with respect to key patents directed to the primary RNAi-trigger formats: canonical, UNA, meroduplex, and dicer substrate structures; |

| · | A best-in-class RNAi delivery system, which we believe to be the targetable DPC™ platform; and |

3

| · | A state-of-the-art R&D facility in Madison, Wisconsin, including a large team of scientists experienced in RNAi and oligonucleotide delivery. |

In addition, in March 2015 we acquired the entire RNAi research and development portfolio and associated assets of Novartis. Novartis had been working in the RNAi field for over a decade and made some very important advancements in their developments of proprietary oligonucleotide formatting and modifications. Key aspects of the acquisition include the following: | · | Multiple patent families covering RNAi-trigger design rules and modifications that fall outside of key patents controlled by competitors, which we believe provides freedom to operate for any target and indication; |

| · | Novel intracellular targeting ligands that enhance the activity of RNAi-triggers by targeting the RNA-induced silencing complex (RISC) more effectively and improving stability once RISC is loaded; |

| · | An assignment of Novartis' license from Alnylam Pharmaceuticals, Inc. (“Alnylam”) granting Arrowhead access to certain Alnylam intellectual property, excluding delivery, for 30 gene targets; and |

| · | A pipeline of three candidates initiated by Novartis for which Novartis has developed varying amounts of preclinical data. |

siRNAWe see the Roche and Novartis acquisitions as a powerful combination of intellectual property, R&D infrastructure, and RNAi delivery technologies,experts. We believe we are the only company with access to all primary RNAi-trigger structures now including additional novel structures discovered by Novartis. This enables us to optimize our drug candidates on a target-by-target basis and use the structure and modifications that yield the most advanced of which is Dynamic Polyconjugates (DPCs);

Licensepotent RNAi trigger. In addition, our DPC™ delivery system enables us to multiple siRNA structuresdeliver our drug candidates efficiently to hepatocytes and chemistriesto non-hepatic tissues in key therapeutic areas;

A state-of-the-art 24,000 square foota highly specific manner. Our R&D team and facility with complete small animal facilities;

R&D staffenable rapid innovation and drive to the clinic, as evidenced by the speed at which we have advanced our pipeline to now include six proprietary drug candidates in a very short period of 40 scientists; andtime.

Multiple pre-clinical drug development programs, including an siRNA therapeutic for chronic hepatitis B infection, which is approaching an IND filing as ARC-520.

Acquired Alvos Therapeutics, Inc. providing Arrowhead with a library of peptide targeting sequences used to create PDCs as well as intellectual property that can be used to generate novel targeting antibodies;

AugmentedWe have focused our management team by hiring accomplished biopharma executives Bruce Given, M.D. as Chief Operating Officer and Head of R&D, and Brendan Rae, Ph.D., J.D., as Chief Business Officer;

Created a centralized infrastructure for the management of clinical trials; and

Integrated and consolidated R&D operations in the Madison facility, including workresources primarily on the RONDEL siRNA delivery systemDPC™ platform and CALAA-01 candidate,on advancing our suite of obesity/metabolic disease compounds including the Adipotide candidate, and the Homing Peptide discovery and development programs;

These steps have created an integrated development operation that allows Arrowhead to advance multiple programs simultaneously. Sinceproprietary DPC™-enabled RNAi therapeutic candidates through clinical trials. Additionally, with our drug development strategy is unified around actively targeted delivery, ourincreased R&D operations are synergistic across drug candidates and platforms. Additionally,headcount, Arrowhead now has the infrastructure, expertise, IP portfolio, chemistry, manufacturing and control (CMC) capabilities, and management that we believe is necessary to attract and support a broad range ofpotential partnerships and research collaborations with large biopharma companies from discovery stage through commercialization.

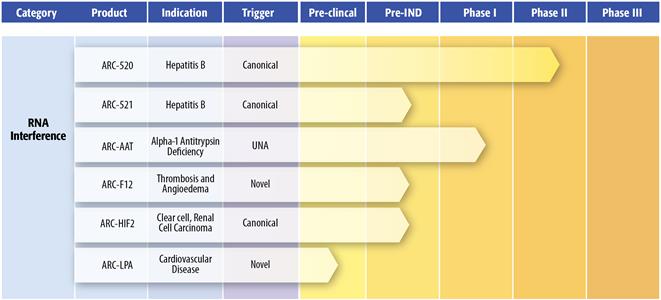

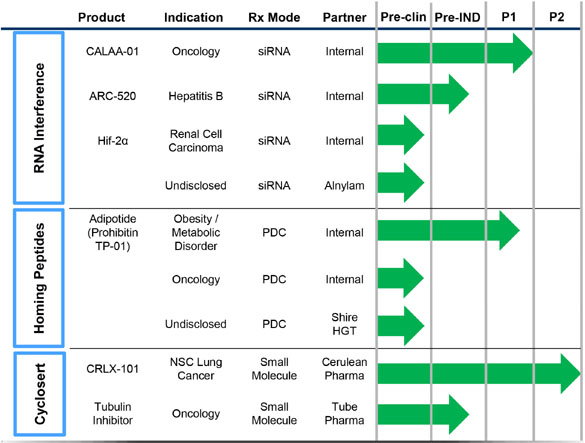

Pipeline Overview Our internal preclinical and clinical trials. PIPELINE OVERVIEW

Arrowhead is focused on delivering drugs preferentiallydevelopment programs are designed to their sitecreate value directly through our proprietary candidates. These programs also drive value to the technology platform as proof of action while avoiding non-specific uptake in off-target tissues. Our platform technologies are being developedconcept for the power of the programs to enable innovative new therapeutic modalities through targeted delivery and enhanced pharmacokinetics. In particular, our polymeric delivery systems, Dynamic Polyconjugates and RONDEL, have been formulated with small RNAs to develop drug candidates to address diseases such as cancer and HBV through the mechanism of RNAi. The ability to deliver the fragile siRNA molecules that induce RNAi is the key enabler of this important new field of medicine. Our Homing Peptide platform is being used in a clinical obesity therapeutic study and in preclinical studies targeting cancer.

therapies. 2

4

Clinical Trials The following table serves as a summary of our ongoing and completed clinical trials as of September 30, 2015: Drug | Study Name | Stage | Status | Description | ClinicalTrials.gov Identifier | ARC-520 | Heparc-1001 | Phase 1 | Enrollment Complete | Single dose escalation study in healthy volunteers to evaluate safety and tolerability of ARC-520 | NCT01872065 | | Heparc-1002 | Phase 1 | Enrolling | Single dose study to evaluate tolerability of increasing infusion rates of ARC-520 | NCT02535416 | | Heparc-2001 | Phase 2a | Enrollment Complete | Single dose escalation study in HBV patients to evaluate reduction in viral antigens in response to ARC-520 | NCT02065336 | | Heparc-2001 OLE | Phase 2a | Enrolling | Open label multi-dose extension study in patients completing Heparc-2001 | NCT02065336 | | Heparc-2002 | Phase 2b | Enrolling | Multi-dose study to determine the depth of hepatitis B surface antigen (HBsAg) reduction in response to ARC-520 in combination with entecavir or tenofovir in hepatitis B envelope antigen (HBeAg) negative patients | NCT02604199 | | Heparc-2003 | Phase 2b | Enrolling | Multi-dose study to determine the depth of HBsAg reduction in response to ARC-520 in combination with entecavir or tenofovir in HBeAg positive patients | NCT02604212 | | Heparc-2004 | Phase 2b | Enrolling | Multi-dose study to determine the depth of HBsAg reduction in response to ARC-520 in combination with entecavir or tenofovir in HBeAg positive patients | NCT02452528 | | Heparc-2008 (MONARCH) | Phase 2b | Not Yet Enrolling | Open label multi-dose study to evaluate ARC-520 alone and in combination with other therapeutics in patients with chronic HBV | NCT02577029 | ARC-AAT | ARCAAT-1001 | Phase 1a/1b | Enrolling | Single dose escalation study to determine the safety, tolerability and effect on circulating alpha-1 antitrypsin levels of ARC-AAT in healthy volunteers and patients | NCT02363946 |

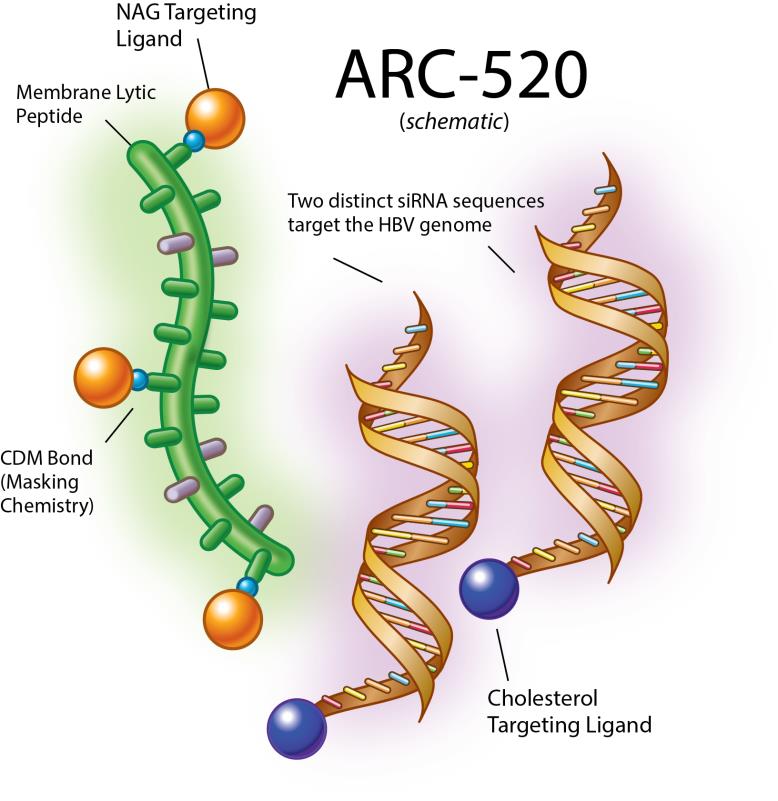

Internal Clinical Programs – ARC-520 ARC-520 – Hepatitis B Virus Infection ARC-520 is an RNAi therapeutic candidate for the treatment of chronic hepatitis B infection with the goal of achieving a functional cure. It is the first clinical candidate to use our proprietary DPC™ technology and includes two siRNA duplexes, each conjugated to a cholesterol derivative to enhance liver delivery and cellular uptake. We have designed ARC-520 to be co-administered with an active excipient, a masked, hepatocyte targeted polymeric amine (the DPC™ delivery system). 5

| |

Figure 1: ARC-520 schematic |

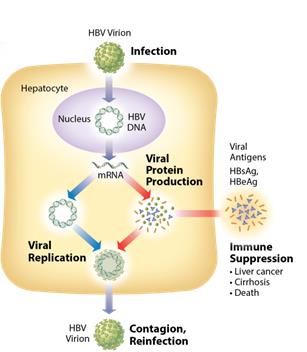

We see the need for a next generation HBV treatment with a finite treatment period and an attractive dosing regimen, and that can be used at earlier stages of disease. We believe a novel therapeutic approach such as this that can effectively treat or provide a functional cure (seroclearance of HBsAg and with or without development of excess patient antibodies against HBsAg) has the potential to take significant market share and may expand the available market to include patients that are currently untreated. Chronic Hepatitis B Virus According to the World Health Organization, 360 million people worldwide are chronically infected with hepatitis B virus, of which 500,000 to 1,000,000 people die each year from HBV related liver disease. Chronic HBV infection is defined by the presence of hepatitis B surface antigen (HBsAg) for more than 6 months. In the immune tolerant phase of chronic infection, which can last for many years, the infected person typically produces very high levels of viral DNA and viral antigens. However, the infection is not cytotoxic and the carrier may have no symptoms of illness. Over time, the ongoing production of viral antigens causes inflammation and necrosis, leading to elevation of liver enzymes such as alanine and aspartate transaminases, hepatitis, fibrosis, and liver cancer (HCC)(hepatocellular carcinoma, or HCC). If untreated, as many as 25% to 40% of chronic HBV carriers ultimately develop cirrhosis or HCC. Antiviral therapy is generally prescribed when liver enzymes become elevated. 6

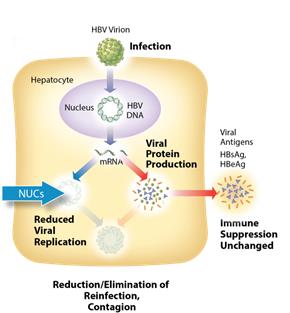

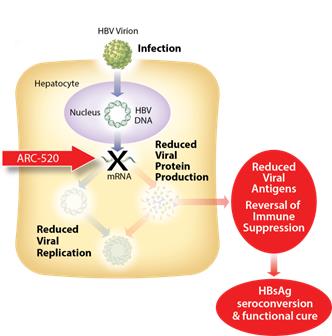

Current Treatments The current standard of care for treatment of chronic HBV infection is a daily oral dose of nucleotide/nucleoside analogs (NUCs) or a regimen of interferon injections 2 to 7 times weekly for approximately one year. NUCs are generally well tolerated, but patients may need lifetime treatment because viral replication often rebounds upon cessation of treatment. Interferon therapeutics can result in a functional cure in up to 20%10-20% of some patient types, but treatment is often associated with significant side effects, including severe flu-like symptoms, marrow suppression, and autoimmune disorders. We see the need for a next generation HBV treatment with fewer side effects, that eliminates the need for interferon based treatment, has a finite treatment period and an attractive dosing regimen, and one that can be used at earlier stagesGoal of disease. We believe a novel therapeutic approach that can effectively treat or provide a functional cure (development of patient antibodies against HBsAg) has the potential to take significant market share and may expand the available market to include patients that are currently untreated.ARC-520 Treatment

ARC-520 is an siRNA therapeutic intended for deliverydesigned to silence the active siteproduction of infection using our proprietary Dynamic Polyconjugate (DPC) technology. ARC-520 consistsall HBV gene products with the goal of two siRNA duplexes, each conjugated toachieving a cholesterol derivative to enhance liver delivery and cellular uptake. We have designed ARC-520 to be co-administered with an active excipient, a masked, hepatocyte targeted polymeric amine. Once the siRNAs and the active excipient are taken up by the hepatocytes, the polymeric amines are unmasked in the endosome and disrupt the endosomal membrane, releasing the siRNA to the cytoplasm where it can engage the RNAi machinery of the cell. 3

functional cure. The siRNAs in ARC-520 are designed to target multiple components of HBV production including the pregenomic RNA that would be reverse transcribed to generate the viral DNA. The siRNAs in ARC-520intervene at the mRNA level, upstream of where NUCs act, and target the mRNAs that produce HBsAg proteins, the viral polymerase, the core protein that forms the capsid, the pre-genomic RNA, the HBeAg, and the HBeAg. A reductionhepatitis B X antigen (HBxAg). NUCs are effective at reducing production of viral antigensparticles, but are ineffective at controlling production of HBsAg and other HBV gene products. Arrowhead believes that a reduction in the production of HBsAg and other proteins that NUCs are ineffective at controlling is considered necessary to effective HBV therapy, because the presence of viralthose proteins isare thought to be a major contributorcontributors to repression of the immune system and the persistence of liver disease secondary to HBV infection.

Figure 2: Chronic HBV mechanism untreated 7

Figure 3: Mechanism of action NUCs  Figure 4: Mechanism of action ARC-520 8

Nonclinical Data Efficacy data in mouse models of HBV infection show that ARC-520 is capable of reducing HBsAg by greater than 3 log (99.9%), HBV DNA by approximately 3 log,logs, and HBeAg to the limit of detection. Pharmacologic effects persist for approximately one month after a single dose of ARC-520.ARC-520 in mice models. Safety data in rodents and non-human primates indicate an acceptable safety margin. WePreclinical data in a chimpanzee chronically infected with HBV demonstrate that intravenous administration of two doses (2 mg/kg on day 1, and 3 mg/kg on day 15) of ARC-520 resulted in substantial and sustained reductions in HBV DNA, HBeAg, and HBsAg, which did not return to baseline until study day 43, 43, and 71, respectively. In addition, an increase in serum alanine transaminase (ALT) occurred 4 weeks after the second dose, coincident with the nadir of circulating HBsAg. This is suggestive of a therapeutic immunological flare, which is thought to be part of a cascade that under chronic therapy may lead to HBsAg seroclearance and functional cure. Observed increases in key chemokine/cytokine mRNAs are also consistent with a T-cell mediated immunological event. Additional nonclinical data from a multiple dose study in 9 chimpanzees were reported in 2015. At the start of the study, five chimpanzees were HBeAg-positive and four chimpanzees were HBeAg-negative. Deep sequencing and phylogenetic analyses indicated the HBV sequence was a chimpanzee variant of human HBV. To reduce viral replication prior to treatment with ARC-520, chimpanzees were treated for 8-24 weeks with entecavir (ETV) or ETV+ tenofovir (TDF) in one case. Following the lead-in period, animals were administered ARC-520 intravenously at 4-week intervals. Dose levels administered were 2, 3, or 4 mg/kg ARC-520, along with maintenance doses of ETV or ETV+TDF. The study showed a robust, sustained direct anti-viral effect on HBsAg production in all HBeAg-positive and -negative chimpanzees during ARC-520 treatment. One chimpanzee achieved sustained virologic response (SVR) off-therapy and two chimpanzees exhibited signs of immune reactivation. HBeAg-positive chimpanzees displayed the highest levels of HBsAg knockdown - up to 2.7 log. In HBeAg-negative chimpanzees, HBsAg knockdown was also substantial - up to 0.9 log. ARC-520 was well tolerated after multiple doses up to 4 mg/kg ARC-520 (highest dose tested). Evidence indicates integrated HBV DNA is a significant source of total HBsAg, especially in HBeAg-negative chimpanzees. Phase 1 (Heparc-1001) Arrowhead completed nine dose cohorts in the Heparc-1001 Phase 1 trial in 2014. The study was designed to characterize the safety profile of ARC-520 across a range of doses and evaluate pharmacokinetics. It was a single-center, randomized, double-blind, placebo-controlled, single dose-escalation, first-in-human study of ARC-520 administered intravenously to healthy adult volunteers. All subjects received either placebo or ARC-520 in doses ranging from 0.01 mg/kg to 4 mg/kg. The study successfully enrolled all 54 subjects (36 received ARC-520, 18 placebo) at a single center in Melbourne, Australia. There have been no reports of serious adverse events (SAEs), no dose limiting toxicities, no discontinuations due to adverse events (AEs), and a modest overall occurrence rate of AEs without a clear dose-related increase in frequency or severity. There has been a modest occurrence rate of non-clinically significant abnormal laboratory tests. There were no reported drug related or clinically significant differences for vital signs or ECGs between subjects receiving drug versus placebo. One arrhythmia noted on telemetry occurred in a subject with similar previously undiagnosed prior cardiac atrial rhythm abnormalities and one occurrence of hypotension that appears to have been artifact from a failing automated blood pressure machine. One occurrence each of moderate flushing and urticarial rash seen at dose levels of 0.3 mg/kg and 2.0 mg/kg respectively led to the subsequent reduction, by half, in infusion rate of ARC-520 as well as the introduction of pretreatment with an oral over-the-counter antihistamine. Since the introduction of these mitigations, no additional signs of hypersensitivity or infusion reactions have been seen. There were mild creatinine elevations in 6% of subjects receiving ARC-520 and 6% receiving placebo, which were transient with rapid (<24 hours) return to baseline. There were no signs of tubular damage on laboratory evaluation and these subjects had no additional clinical symptoms. Overall, the changes in creatinine are similar between ARC-520 and placebo groups and thought to be, at least primarily, due to dietary intake of protein. There were no changes in ALT, AST or CK considered to be clinically significant by the study investigator. 9

In summary, ARC-520, when administered as a single dose up to 4 mg/kg to healthy volunteers, appears to be well tolerated. The table below shows the incidence of treatment emergent adverse events observed in greater than 5% of subjects. | | | Adverse Events >5% All Attributions | Placebo (n=18) | ARC-520 (n=36) | All AEs | 67% | 67% | Mild | 72% | 69% | Moderate | 28% | 31% | Severe | 0% | 0% | Headache | 33% | 14% | URI | 28% | 19% | Somnolence | 6% | 8% | Lethargy | 6% | 6% | Creatinine increase | 6% | 6% | Myalgia | 0% | 6% | Dizziness | 0% | 6% |

Figure 5: Phase 1 AE reporting Phase 2a (Heparc-2001) In 2015 Arrowhead reported data from the Heparc-2001 Phase 2a multicenter, randomized, double-blind, placebo-controlled, dose-escalation study designed to determine the depth and duration of hepatitis B surface antigen (HBsAg) reduction after administration of ARC-520 in combination with entecavir in patients with chronic HBV infection. Secondary objectives included the assessment of safety and tolerability of escalating single doses of ARC-520 co-administered with a fixed dose of entecavir and multiple additional secondary and exploratory endpoints. Significant details about the seven cohorts are included below. | | | | | | | Cohort | Prior entecavir (ETV) | Patient Type | ARC-520 dose | Active/Placebo | Baseline HBsAg Mean (range) Log IU/mL | Status | 1 | Yes | HBeAg-neg | 1.0 mg/kg | 6/2 | 3.4 (3.0-4.2) | Complete/Unblinded | 2 | Yes | HBeAg-neg | 2.0 mg/kg | 6/2 | 3.5 (3.2-4.3) | Complete/Unblinded | 3 | Yes | HBeAg-neg | 3.0 mg/kg | 6/2 | 3.6(3.1-4.0) | Complete/Unblinded | 4 | Yes | HBeAg-neg | 4.0 mg/kg | 6/2 | 3.4 (3.2-4.0) | Complete/Unblinded | 5 | Yes | HBeAg-pos | 4.0 mg/kg | 6/2 | 3.6 (3.1-4.2) | Complete/Unblinded | 6* | Yes | HBeAg-pos | 2 x 2.0 mg/kg (two weeks apart) | 6/0 | 3.3 (3.0-3.6) | Complete/Open label | 7 | No | HBeAg-pos HBeAg-neg | 4.0mg/kg | 6/0 6/0 | 4.0 (0.8-4.9) 2.9 (1.0-3.6) | Ongoing / Openlabel |

Figure 6: Phase 2a dose cohorts In connection with Heparc-2001, fifty-eight patients were successfully dosed with 48 receiving the drug and 10 receiving a placebo. 20 females and 38 males were enrolled, all of Chinese ethnicity, with a mean age of 41 years (range of 23 to 59). Topline results were reported at an analyst and investor day hosted by the Company and additional details were presented at the 2015 AASLD Liver Meeting. To date there have been no serious AEs, no dose limiting toxicities, no discontinuations due to medication AEs, and a modest occurrence rate of AEs. All reported AEs were deemed unrelated to study drug by the principal investigator. Safety labs continue to lack indication of end organ toxicity, with a low occurrence rate of abnormal laboratory tests with no observed relationship to timing or dose.

Adverse Events | 1 mg/kg (N=6) | 2mg/kg (N=6) | 3 mg/kg (N=6) | 4 mg/kg (N=24) | 2 mg/kg x2 (N=6) | Placebo (N=10) | All AEs | 1 | 5 | 1 | 2 | 1 | 0 | Extravasation | | 1 mild | | | | | Malaise | | 1 mod | | | | | Influenza | 1 mild | | | | | | Blood CK increase | | 1 mild | | | | | Diabetes Mellitus | | 1 mild | | | | | Pain in extremity | | | 1 mild | | | | Presyncope | | 1 mod | | | | | Headache | | | | 1 mild | | | Dizziness | | | | 1 mild | | | Fever | | | | | 1 mild | |

Figure 7: Phase 2a AE reporting Arrowhead measured the Log reduction of quantitative HBsAg, HBcrAg, and HBeAg from baseline as an assessment of ARC-520 activity. This is the first time that a reduction in HBsAg, HBcrAg, and HBeAg mediated through RNA interference has been reported in chronic HBV patients. In this study, ARC-520 effectively inhibited cccDNA-derived mRNA with reductions up to 1.9 logs (99%). ARC-520 had a direct antiviral effect that lasted up to 57 days after a single dose. In patients exhibiting a delayed response, duration of over 85 days was observed. The best qHBsAg reduction was seen in treatment naïve HBeAg-positive patients. HBeAg-negative patients showed a delayed response. HBeAg-negative, ETV experienced patients showed a dose response in HBcrAg but qHBsAg dose response was less pronounced. HBeAg positive, ETV experienced patients had a substantially higher reduction in HBeAg and HBcrAg compared to HBsAg. Variations in viral antigen reduction are consistent with lower levels of cccDNA derived mRNA transcripts in chronic ETV patients and HBeAg negative patients. These data are summarized in the figures below. | | | | | | | | | Log reduction from baseline Mean (max) | Cohort | Dose (mg/kg) | HBeAg status | Prior ETV | HBsAg | HBcrAg | HBeAg | 1 | 1 | Neg | Y | -0.2 (-0.3)* | -0.2 (-0.2) | N/A | 2 | 2 | Neg | Y | -0.2 (-0.3)* | -0.5 (-0.5) | N/A | 3 | 3 | Neg | Y | -0.3 (-0.4)* | -0.4 (-0.7) | N/A | 4 | 4 | Neg | Y | -0.4 (-0.5)* | -0.9 (-1.1) | N/A | 5 | 4 | Pos | Y | -0.3 (-0.7)* | -0.9 (-1.1) | -1.2 (-1.7) | 6‡ | 2x2 | Pos | Y | -0.5 (-0.8)+ | -0.7 (-1.2) | Pending | 7‡,† | 4 | Pos | N | -1.5 (-1.9)+ | Pending | Pending | 7‡ | 4 | Neg | N | -0.2 (-0.8)+ | Pending | N/A |

*Roche Elecsys batch analyzed data set +Abbott Architect data ‡Preliminary data, analysis is ongoing †Excluding transitional patient Figure 8: Max reduction in viral antigens 11

Figure 9: Mean reduction in HBsAg in treatment naive patients (cohort 7) Phase 2b Multiple dose and combination studies of ARC-520 aimed at producing functional cures are underway. These studies include Heparc-2001 open label extension, Heparc-2002, Heparc-2003, Heparc-2004, and the MONARCH study (Heparc-2008). There are clinical sites for these studies in the US, Europe, Asia, and Australia/New Zealand. 12

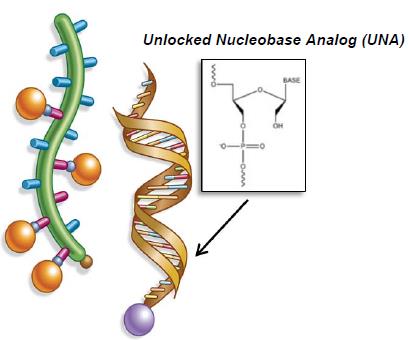

Internal Clinical Programs – ARC-AAT ARC-AAT – Liver Disease Associated with Alpha-1 Antitrypsin Deficiency Arrowhead has developed a therapeutic candidate (ARC-AAT) for the treatment of liver disease associated with Alpha-1 Antitrypsin Deficiency (AATD), a rare genetic disease that severely damages the liver and lungs of affected individuals. ARC-AAT employs a novel unlocked nucleobase analog (UNA)-containing RNAi molecule designed for systemic delivery using the DPC™ delivery system. Pre-clinical studies have demonstrated that ARC-AAT is highly effective at knocking down the Alpha-1 antitrypsin (AAT) gene transcript and reducing the hepatic production of the mutant AAT protein. |

Figure 10: ARC-AAT schematic |

Alpha-1 Antitrypsin Deficiency AATD is a genetic disorder associated with liver disease in children and adults and pulmonary disease in adults. AAT is a circulating glycoprotein protease inhibitor that is primarily synthesized and secreted by liver hepatocytes. Its physiologic function is the inhibition of neutrophil proteases to protect healthy tissues during inflammation and prevent tissue damage. The most common disease variant, the Z mutant, has a single amino acid substitution that results in improper folding of the protein. The mutant protein cannot be effectively secreted and accumulates in globules in the hepatocytes. This triggers continuous hepatocyte injury, leading to fibrosis, cirrhosis, and increased risk of hepatocellular carcinoma. Current Treatments Individuals with the homozygous PiZZ genotype have severe deficiency of functional AAT leading to pulmonary disease and hepatocyte injury and liver disease. Lung disease is frequently treated with AAT augmentation therapy. However, augmentation therapy does nothing to treat liver disease, and there is no specific therapy for hepatic manifestations. There is a significant unmet need as liver transplant, with its attendant morbidity and mortality, is currently conducting IND-enablingthe only available cure. Goal of ARC-AAT Treatment The goal of treatment with ARC-AAT is prevention and potential reversal of Z-AAT accumulation-related liver injury and fibrosis. Reduction of inflammatory Z-AAT protein, which has been clearly defined as the cause of progressive liver disease in AATD patients, is important as it is expected to halt the progression of liver disease and allow fibrotic tissue repair. Preclinical Data In preclinical studies with PiZ mice, which are genetically modified to produce the mutant human AAT (Z-AAT), ARC-AAT induced a goalgreater than 95 percent reduction in circulating AAT after a single dose. The addition of chemical modifications, including UNAs, slowed the rebound in production of AAT compared to entercanonical siRNAs, and produced a substantially improved duration of effect. 13

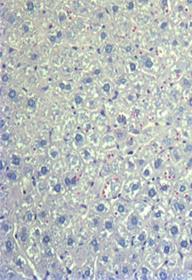

After eight weeks of treatment in multi-dose studies in PiZ mice, soluble (monomeric) and insoluble (polymeric) forms of Z-AAT were greatly reduced in the livers of PiZ mice treated with ARC-AAT. In addition, liver globule burden was substantially reduced from baseline levels and in comparison to treatment with saline, which showed progressive globule formation (shown in the figure below). These data were submitted as an abstract to the 2014 AASLD Liver Meeting and selected for presentation at this conference. | | | Baseline

5 weeks old

| AAT-UNA q2w 13 weeks old

| Saline 13 weeks old

|

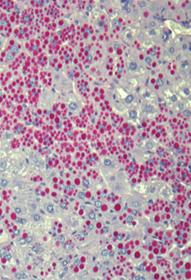

Figure 11: Reduction in Z-AAT globules in livers of PiZ mice In primate studies, knockdown of AAT in serum persisted for over ten weeks with greater than 80 percent knockdown observed at the six-week time point. Multi-dose studies in primates showed a sustained reduction of AAT with once every six weeks dosing, suggesting that once monthly or less frequent dosing is sufficient to maintain ~80-90% knockdown (shown in the figure below).

Figure 12: Long term reduction of AAT in NHPs following repeat dosing with ARC-AAT (ARC-EX1 is a DPC™ delivery system) 14

The Alpha-1 Project Arrowhead has an agreement with The Alpha-1 Project (TAP), the venture philanthropy subsidiary of the Alpha-1 Foundation. TAP’s mission is to support organizations in pursuit of cures and therapies for lung and liver disease caused by Alpha-1 Antitrypsin Deficiency. Under the terms of the agreement, TAP will partially fund the development of ARC-AAT. In addition to the funding, TAP will make its scientific advisors available to Arrowhead, assist with patient recruitment for clinical trials with its Alpha-1 Foundation Patient Research Registry, and engage in other collaborative efforts that support the development of ARC-AAT. Phase 1 Arrowhead is conducting a single dose Phase 1 clinical study in 2013. Adipotide (Formerly Prohibitin-TP01) – Obesity and Metabolic Disorders

Obesityof ARC-AAT. The study is a global health threatmulti-center, randomized, placebo-controlled, double-blind, single dose-escalation, first-in-human study to evaluate the safety, tolerability and onepharmacokinetics of ARC-AAT and the leading causeseffect on circulating AAT levels. The study has been enrolling dose cohorts of preventable deaths in the United States. Arrowhead’s anti-obesity drug candidate, Adipotide, was designedsix participants each, with participants randomized at a ratio of 2:1 (active:placebo) to selectively disrupt the blood supply that supports unhealthy fat by the targeted inductionreceive a single intravenous injection of apoptosis (cell death) in the vasculature of adipose tissue.either ARC-AAT or placebo (normal saline). The Adipotide peptidestudy consists of two functional domains. The homing domain targetsparts; Part A in healthy volunteers and part B currently being conducted in patients with PiZZ genotype AATD. Dosing in patients (part B) began at a membrane associated protein, Prohibitin, on adipose vascular endothelial cells. The membrane disrupting domain causes apoptosis by disrupting mitochondrial membranes inside the cells.

An Investigational New Drug Application (IND) for Adipotide was filed with the FDA, and we began enrolling patients in 2012 as part of a Phase 1 clinical trial to test the safety of the compound in human patients. Our collaborator, MD Anderson Cancer Center in Houston, plans to enroll up to 39 obese prostate cancer patients in the Phase 1 study and has agreed to bear all direct costs of this trial. Up to five dose levels of the drug candidate will be tested in the trial. Three participants will be enrolled at each dose level with the first group of participants receiving the lowestused in healthy volunteers that met pre-defined criteria for AAT knockdown and then continued dose level by injectionescalation may proceed under the skin once per dayprotocol. The study evaluates participants for 28 days and each new group receiving a higher dose than the group before it,following dosing, with additional follow-up if no intolerable side effects are seen. This will continueneeded every 2 weeks until the highest tolerable dose is found or the study terminates.AAT levels return to baseline.

Potential Advantages of Adipotide:

Shown to promote weight loss of 11% to 30% of total body mass in preclinical studies using rodents and spontaneously obese rhesus monkeys after just 28 days of treatment;

Shown to reduce abnormalities in blood chemistry associated with diabetes;

Novel mechanism of action compared to other known therapeutics on the market or in clinical trials;

No modulation of neurotransmitters seen in pre-clinical studies, thus unlikely to have psychological side effects;

No amphetamine-like mechanism of action and thus unlikely to yield GI side effects.

Adipotide is based on Arrowhead’s Homing Peptide™ library developed at MD Anderson Cancer Center. White adipose (fat) tissue is highly vascularized and both the expansion and maintenance of adipose tissue depend on a continued ability to build supporting vasculature. This peptide targeting library provides a map of the unique cell receptors on the vasculature that varies in different tissues. Targeting vasculature based on this variation allows for specific delivery of drug payloads to specific target cells, while avoiding collateral injury to other healthy/non-targeted cells. Using this technique, peptide sequences that target receptors specific to white adipose tissue were identified. Adipotide has been developed by our majority-owned subsidiary, Ablaris Therapeutics, Inc. (“Ablaris”). Arrowhead owns 64% of the fully diluted shares of Ablaris.

CALAA-01 – Solid Tumors

CALAA-01 is a combination of our RONDEL delivery technology and a patented siRNA targeting the M2 subunit of ribonucleotide reductase, a clinically-validated cancer target. Ribonucleotide reductase catalyzes the conversion of ribonucleosides to deoxyribonucleosides and is necessary for DNA synthesis and replication, and thus tumor growth. The internally developed siRNA demonstrates potent anti-proliferative activity across multiple types of cancer cells. CALAA-01 was the first siRNA therapeutic candidate to target cancer in a human clinical study and we believe was also the first successful systemic delivery of an siRNA therapeutic candidate.

In August 2012 enrollment into the Phase 1 clinical trial was completed. Adverse events observed coincided with an increase in certain cytokine levels. Elevation in cytokines is consistent with an acute immune response to the natural siRNA used in CALAA-01. These reactions also appeared to be transient, such that if a patient stayed on CALAA-01, the cytokine responses often subsided. Based on these results, a Phase 1b trial was initiated using a modified dosing schedule in which patients were pretreated with a lower dose to assess whether this strategy can increase patient safety and further increase the maximum tolerated dose. Patient enrollment was completed in August 2012 and analysis of final study data is being prepared.

Interim clinical results were presented at the 2010 American Society of Clinical Oncology meeting (ASCO). Data from 15 patients accrued to 5 dose levels (3, 9, 18, 24, 30 mg/m2) showed that treatment-related adverse events were mostly mild to moderate with fatigue, fever/chills, allergic, or gastrointestinal-related adverse events most frequently observed. Importantly, no changes in coagulation, liver function tests, or kidney function were observed.

4

Analysis of tumor biopsies from three melanoma patients showed the presence of intracellular nanoparticles in amounts that correlated with dose. Additionally, a reduction was found in both the RRM2 messenger RNA and protein levels when compared to pre-dosing tissue. Furthermore, the presence of siRNA-mediated mRNA cleavage products was confirmed by 5’-RACE, demonstrating that siRNA-mediated mRNA cleavage occurred specifically at the site predicted for an RNAi mechanism. These results were published in March 2010 in the scientific journalNature, citing these interim data from our Phase 1 trial as the first evidence of systemic delivery of siRNA, and the successful “silencing” of a widely recognized cancer gene via RNA interference in humans.

Partnered Programs

Cyclosert and CRLX-101 (formerly IT-101)

The linear cyclodextrin-based drug delivery platform, Cyclosert, was designed for the delivery of small molecule drugs. In December 2008, we completed a Phase 1 trial with IT-101, a conjugate of the linear cyclodextrin polymer and Camptothecin, a potent anti-cancer drug, with a positive safety profile and indications of efficacy.Orphan Drug Designation

In June 2009, we entered into a transaction2015, Arrowhead was granted the orphan drug designation for ARC-AAT by the U.S. Food and Drug Administration (FDA). Orphan drug designation provides incentives for sponsors to develop products for rare diseases. These incentives include increased engagement with Cerulean Pharmaceuticals, Inc., a privately-held Boston, Massachusetts based company. Cerulean licensed rightsFDA on drug development activities, exemption from all future product-specific regulatory fees, the opportunity to further researchapply for R&D funding, tax credits, an increased chance of priority review, and commercialize IT-101 (now known as “CRLX-101”), and the Cyclosert platform for all products except for nucleic acids, tubulysin, cytolysin and second generation epothilones. In connection with the transaction, we assigned certain patents to Cerulean and Cerulean granted back to us rights necessary to research and commercialize the excluded products. As such, we retain the rights to the RONDEL siRNA delivery platform, as well as CALAA-01. We received an initial payment7 years of $2.4 million, and may receive development and sales milestones, and royalty payments if CRLX-101 or other products based on the Cyclosert platform are successfully developed. Should Cerulean sublicense CRLX-101 to a third party, we are entitle to receive a percentage of any sublicensing income at rates between 10% and 40%, depending on the stage of the drug’s developmentorphan exclusivity at the time of sublicensing.New Drug Application (NDA).

Tubulin InhibitorPreclinical Programs

ArrowheadIn addition to our clinical candidates, we are actively engaged in the discovery and development of additional pre-clinical stage products for intravenous and subcutaneous administered therapeutics targeting the liver, as well as programs targeting extra-hepatic tissues. We focus on disease targets that are well suited for intervention with targeted RNAi therapeutics using our DPC™ delivery platform.

ARC-521 ARC-521 is a new RNAi-based therapeutic in Arrowhead’s HBV portfolio that was developed to target both cccDNA derived mRNA transcripts, like ARC-520, as well as those from HBV DNA that has integrated into the host DNA. It is intended to address specific patient populations that are predicted to have higher ratios of integrated DNA versus cccDNA. The Company plans to begin clinical studies of ARC-521 in mid-2016. ARC-F12 ARC-F12 is an RNAi-based therapeutic designed to reduce the production of factor 12 with the goal of providing a licenseprophylactic treatment for hereditary angioedema (HAE) and joint development agreement with Vienna, Austria based biotech Tube Pharmaceuticals GmbH, which grants Tube Pharma the right to develop Cyclosert enabled tubulin inhibitors. Tubulysins are a novel tubulin-targeted class of natural compounds with potent anti-proliferative activity against multiple cancer types. Tube Pharmathromboembolic diseases. Arrowhead is conducting preclinical studies.relevant disease models, and is considering other potential studies to support advancement of ARC-F12 into clinical trials. ARC-HIF2 ARC-HIF2 is an RNAi-based therapeutic designed to reduce the production of hypoxia-inducible factor 2α (HIF-2α) to treat clear cell renal cell carcinoma. It is the first drug candidate using a new DPC™ delivery vehicle designed to target tissues outside of the liver. Arrowhead is eligibleconducting tumor models and is working on manufacturing scale up for the new delivery vehicle to receive milestones and royalties on sales.support advancement of ARC-HIF2 into IND-enabling studies. ARC-LPA ARC-LPA is an RNAi-based therapeutic designed to reduce production of apolipoprotein A (apo(a)), a key component of lipoprotein(a) (Lp(a)), which has been genetically linked with increased risk of cardiovascular diseases. ARC-LPA employs Arrowhead’s new hepatic delivery format being developed for subcutaneous administration. This program has not yet been officially designated by Arrowhead as entering pre-IND development. Partner-based Programs Alnylam Pharmaceuticals 15

In January 2012, Arrowhead granted Alnylam Pharmaceuticals, Inc., (“Alnylam”) a license to utilize the Dynamic PolyconjugateDPC™ delivery technology for a single RNAi therapeutic product. Alnylam is collaborating with Arrowhead to develop this technology for an undisclosed target in its “Alnylam 5x15” pipeline, which is focused on genetically defined targets and diseases.target. Alnylam has not publically disclosed what progress, if any, it may have made with respect to this target. Arrowhead is eligible to receive milestone payments and royalties on sales from Alnylam.worldwide sales. Shire In December 2012, Arrowhead signed a research collaboration and license agreement with Shire AG (“Shire”) to develop and commercialize targeted peptide-drug conjugates (PDCs) utilizing Arrowhead’s human-derived Homing Peptide platform and Shire’s therapeutic payloads. Arrowhead may receive research funding and could be eligible for development, regulatory, and commercialization milestone payments of up to $32.8 million for each development candidate, plus additional milestone payments for a second indication, and royalties on worldwide sales. Preclinical Programs

In addition to our clinical candidates and our partner-based programs, we are actively engaged in the discovery and development of additional pre-clinical stage products. We focus on disease targets that are well suited for intervention with guided therapeutics like our PDCs and targeted RNAi therapeutics using our DPC delivery platform. These may include liver disease, oncology, and other therapeutic areas.

RNAI DELIVERY PROGRAM

In October 2011, Arrowhead acquired Roche’s RNAi business, including its RNA therapeutic assets, related intellectual property and research facility in Madison, Wisconsin. We believe that these assets position Arrowhead as one of the most advanced and broadest RNAi therapeutics companies in the world. Arrowhead now possesses the following siRNA assets:

Non-exclusive license from Alnylam to use canonical siRNAs in oncology, respiratory diseases, metabolic diseases and certain liver diseases. This includes a sub-license from Isis Pharmaceuticals giving Arrowhead license for siRNA chemical modifications for these specific disease areas.

Non-exclusive license from City of Hope Comprehensive Cancer Center to Dicer substrate and Meroduplex siRNAs. The Dicer technology may provide advantages over canonical siRNAs in certain circumstances. In addition, different siRNA formats may trigger RNAi more or less efficiently on a target-by-target basis.

Patent estate covering the Dynamic Polyconjugate siRNA delivery system.

Access to certain patents on targeting siRNA drugs with antibodies and small molecules.

5

State-of-the-art laboratory facilities in Madison, Wisconsin, managed by long term leaders in oligonucleotide therapeutics and delivery, including a small animal research facility and an offsite primate colony.

Intellectual property covering Roche’s internally developed liposomal nanoparticle drug delivery technology.

RONDEL siRNA delivery system which has demonstrated gene knockdown in humans in the CALAA-01 clinical trial.

Minority ownership position in Leonardo Biosystems, Inc., a private company developing a multi-stage silicon-based delivery system.

CALAA-01 Phase 1 oncology drug candidate.

We believe this represents one of the broadest siRNA drug technology and delivery portfolios in the world.

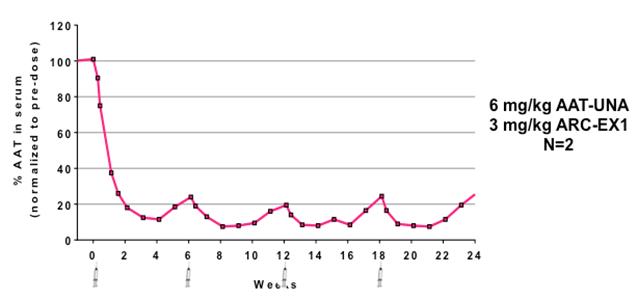

RNA Interference & the Benefits of siRNARNAi Therapeutics RNA interference (RNAi) is a mechanism present in living cells that inhibits the expression of a specific gene, thereby affecting the production of a specific protein. Deemed to be one of the most important recent discoveries in life science with the potential to transform medicine, the discoverers of RNAi were awarded a Nobel Prize in 2006 for their work. Mediated by small interfering RNAs (siRNA), a class of ribonucleic acid (RNA) molecules, 20-25 nucleotides in length, RNAi-based therapeutics canmay leverage this natural pathway of gene silencing to potentially target and shut down specific disease causing genes.

Figure 13: Mechanism of RNA interference Small molecule and antibody drugs have proven effective at inhibiting certain cell surface, intracellular, and extracellular targets. However, certainother drug targets such as intranuclear genes and some proteins have proven difficult to inhibit with traditional drug-based and biologic therapeutics. Developing effective drugs for these targets would have the potential to address large underserved markets for the treatment of many diseases. Using the ability to specifically silence any gene, siRNARNAi therapeutics may be able to address previously “undruggable” targets, unlocking the market potential of such targets. Mechanism of RNA interference

Advantages of RNAi as a Therapeutic Modality | · | Silences the expression of disease causing genes; |

16

Potential to address any target in the transcriptome including previously “undruggable” targets;

| · | Potential to address any target in the transcriptome including previously "undruggable" targets; |

| · | Rapid lead identification; |

| · | Opportunity to use multiple RNA sequences in one drug product for synergistic silencing of related targets; and |

| · | RNAi therapeutics are uniquely suited for personalized medicine through target and cell specific delivery and gene knockdown. |

Rapid lead identification;

Opportunity to use multiple RNA sequences in one drug product for synergistic silencing of related targets; and

siRNAs are uniquely suited for personalized medicine through target and cell specific delivery and knockdown.

6

Addressing the siRNARNAi Delivery Challenge To date, the primary challenge to the development of siRNARNAi therapeutics has been delivering the fragile, often immunogenic and otherwise rapidly cleared siRNARNAi trigger molecules, into the cytoplasm of the cell, where RNAi activity occurs. This hurdle has prevented siRNAmany RNAi therapeutics from reaching their full potential. Many companies have attempted to overcome the delivery challenge. Most early systems involved cholesterol conjugates orvarious carriers such as liposomes. However, development in humans has been limited due to toxicity and immunogenicity of these approaches when studied in clinical trials. To address the delivery challenge, Arrowhead has a leading team of researchers with extensive siRNA therapeutic know-how and two validated delivery platforms:

The Dynamic Polyconjugate system is an amphipathic polymer to which shielding agents and targeting ligands are reversibly attached. | • | | The RONDELTM delivery system utilizes targeted cyclodextrin polymers to deliver siRNA and other oligonucleotides to tumors. Humanin vivo gene knockdown has been demonstrated in a Phase 1 cancer trial, establishing human proof of concept for the RONDEL system.

|

These are both modular systems that may be optimized on a target-by-target basis. Importantly, they also may be targeted to address a variety of tissues.

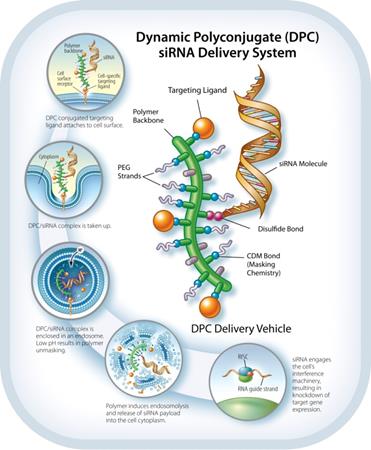

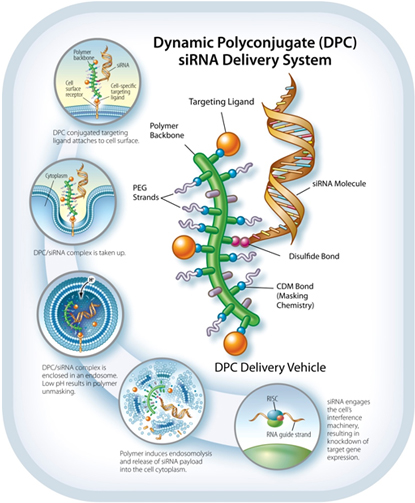

The Dynamic Polyconjugate siRNAPolyconjugate™ RNAi Delivery System

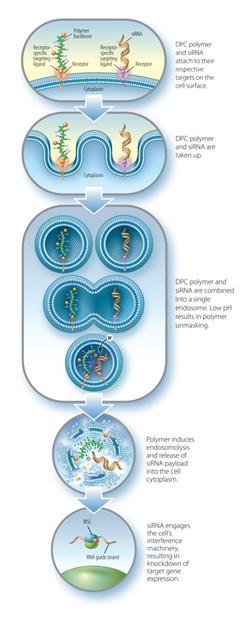

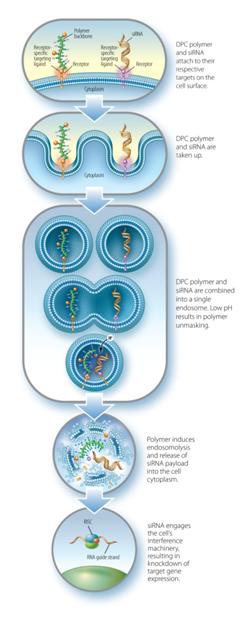

The DPCDPC™ delivery system represents an innovative solution to the siRNARNAi delivery problem, specifically designed to overcome barriers to systemic administration of siRNA.RNAi trigger molecules. Developed by ourArrowhead scientists, in Madison, Wisconsin, the inspiration for DPCDPC™ technology came from the physical characteristics of viruses, nature’s own nanoparticles for nucleic acid delivery. Viruses are efficient at finding their target cells and delivering their nucleic acid payload to the proper cellular compartment. Key features of viruses are their small size, their overall negative surface charge, their specificity for particular cell types based on receptors unique to that cell, and their ability to disassemble and release their nucleic acid cargo to the proper cell compartment in response to cellular triggers. All of these features are incorporated into DPCDPC™ technology. DPCsPrototypical DPC delivery systems are small, nanoparticles,generally 5-20 nanometers (nm) in size, with an amphipathic polymer backbone. Arrowhead has a library of polymers, that may be employed with the system, enabling optimization based on factors such as preferred mode of administration, pharmacokinetics, and target tissue. Shielding agents such as polyethylene glycol and targeting ligands aremay be reversibly attached to the polymer backbone. In some constructs, the siRNARNAi trigger payload is attached to the DPC,DPC™ delivery system, while in other constructs, the siRNARNAi trigger circulates attached to a different carrier. When attached, the DPCDPC™ delivery system construct protects the siRNARNAi trigger payload while allowing the polymer to circulate in the blood without creating undue toxicity. The targeting ligand guides the nanoparticlesit to the cell type of interest where, together with the siRNA,RNAi trigger, it is taken up into a membrane-enclosed cellular compartment known as an endosome. The polymer is selected for its ability to disrupt the endosomal membrane, which releasesallows the siRNARNAi trigger to be released into the cytoplasm. There, it engages the cell’s RNAi machinery, ultimately resulting in knockdown of target gene expression. This lyticmembrane active chemistry of the DPCDPC™ polymeric backbone is modified, or “masked”, using proprietary chemistry.chemistry until it reaches the endosome where pH changes cause the masking chemistries to fall off. Masking of the polymer’s lyticmembrane active chemistry accomplishes two interrelated objectives that are critical toin vivo siRNA RNAi delivery:

Reduction of toxicity by controlling when the membrane lytic property of the polymer is activated.

| · | Reduction of toxicity by controlling when the membrane disruptive property of the polymer is activated; and |

| · | Inhibition of non-specific interactions with blood components and non-targeted cell types. |

Inhibition17

Figure 14: Single molecule DPCs™ 18

Co-injection of non-specific interactions with blood componentsDPCs™ and non-targeted cell types. 7

Arrowhead has developed multiple forms of the prototypical DPCDPC™ delivery system. Our ARC-520 clinical candidate utilizesand ARC-AAT use a DPC™ formulation wherewhereby the siRNARNAi trigger is conjugated to cholesterol and is not attached to the DPC.DPC™. Pre-clinical studies have shown co-injection of the liver-targeted DPCDPC™ polymer together with siRNAthe RNAi trigger conjugated to a lipophilic moiety, such as cholesterol, results in a >500-foldgreater than 500-fold increase in the potency when compared to the siRNA-cholesterolRNAi trigger with cholesterol alone. This formulation retains the potent endosomal escape capabilities of Arrowhead’s DPCArrowhead's DPC™ platform, simplifies drug manufacturing, and creates new targeting opportunities. 8

Figure 15: Mechanism of action for co-injected DPCs 19

DPCs using Co-injection StrategySubcutaneous Administration of RNAi Therapeutics

A DPC formulationArrowhead has also developed multiple delivery formulations for subcutaneous administration has also been developed using Arrowhead’s latest proprietary polymer masking technology.of RNAi therapeutics where the RNAi triggers are conjugated to the delivery vehicle. Using DPCs to deliver siRNA,these vehicles, high-level target gene knockdown is observed at low siRNA doses with limited toxicity in rodents and non-human primates. Arrowhead studies have shown knockdown of 99% in monkeys after a single injection of 1 mg/kg, >90% at 0.5 mg/kg, and 80% in mice at 0.05 mg/kg, which represents greater knockdown at lower doses than reported results of other clinical candidates. PK and biodistribution studies indicate that the new masking technology is highly stable, allowing for maximal bioavailability and long circulation times. Arrowhead is developing this formulation for use in multiple therapeutic areas including oncology.

RONDEL Delivery System

For this delivery system, polymers form the foundation for a three-part RNAi/Oligonucleotide Nanoparticle Delivery (RONDEL) technology. The first component is the positively charged polymer that, when mixed with siRNA, binds to the negatively charged “backbone” of the siRNA. The polymer and siRNA self-assemble into nanoparticles less than 100 nm diameter that are designed to protect the siRNA from nuclease degradation in serum. The cyclodextrin in the polymer enables the surface of the particles to be decorated by stabilizing agents and targeting ligands. These surface modifications are formed by proprietary methods involving the cyclodextrins. The surface-modifying agents have terminal adamantane groups that form inclusion complexes with the cyclodextrin and contain polyethylene glycol (PEG) to endow the particles with properties that prevent aggregation, enhance stability and enable systemic administration. Targeting molecules can be covalently attached to the adamantane-PEG modifier, enabling the siRNA-containing particles to be targeted to tissues of interest.

9

RONDEL Nanoparticle

Based on a novel polymeric sugar (linear cyclodextrin) molecule, RONDEL has been applied thus farobserved in animal studies. Arrowhead intends to the delivery of two classes of therapeutics: siRNAutilize a subcutaneous formulation in its ARC-LPA program and small molecule drugs. The polymer is combined with the drug molecule to form a drug containing nanoparticle between 10 nanometers and 100 nanometers in size. We believe that this particle size is important because drug molecules below 10 nanometers are quickly cleared from the body in the urine while nanoparticles larger than 100 nanometers are not always able to escape the tumor vasculature to reach tumor cells. Nanoparticles between 10 and 100 nanometers can lead to preferential accumulation in tumor tissue,additional programs where the drug can take effect, leaving other tissues less affected. The drug delivery system has the added benefits of increasing solubility and allowing targeting of the nanoparticles.

chronic dosing may be required.Intellectual Property 10

The RONDEL delivery system offers the following advantages: | • | | Generalized delivery system—Binds to and self-assembles with the siRNA to form uniform colloidal-sized particles. Analysis has shown that these particles are spherical and between 10 nm and 100 nm in diameter.

|

Any siRNA sequence can be easily substituted—Because RONDEL binds to the siRNA backbone, other siRNAs sequences can be easily incorporated to form a new drug product.

| • | | Safety—The RONDEL technology has been shown to have a positive safety profilein vitro testing with human cell cultures, and the fully formulated polymer/siRNA particles exhibit a significant therapeutic window of safety in animals, even when repeated doses (up to eight doses over a four week period) are used.

|

| • | | Effective targeted delivery—We have demonstrated successful delivery of functional siRNA therapeutics to tumor cells and to hepatocytes by systemic administration and confirmed sequence-specific gene inhibition.

|

| • | | Human proof of concept—CALAA-01, the first clinical candidate developed using the RONDEL system, has established several important “firsts” in human testing of an siRNA therapeutic including first to show systemic siRNA delivery, first to show dose dependent accumulation in target cells and first to show RNAi mediated mRNA and protein knockdown.

|

CALAA-01 and RONDEL have been developed by Arrowhead’s majority-owned subsidiary, Calando Pharmaceuticals, Inc. (“Calando’). Arrowhead owns 74% of the fully diluted shares of Calando.

HOMING PEPTIDE PROGRAM

In April 2012, Arrowhead acquired Alvos Therapeutics, Inc. (“Alvos”). Alvos licensed a discovery platform and large library of proprietary human-derived Homing Peptides from the MD Anderson Cancer Center. This discovery platform is designed to identify targeting agents, such as peptides, that selectively accumulate in primary and metastatic tumors, associated vasculature, and to 30 healthy tissue types. Such targeting agents are of interest for drug development because they hold the promise of shepherding drugs into specific cells while sparing others. This new platform was acquired because it fit well into our existing business. One of the key advantages of our RNA delivery systems is their ability to be targeted. With a vast proprietary targeting library of our own, we believe that we can enhance the value of our RNAi programs and differentiate our capabilities from those of our competitors. In addition, we believe that we can apply the homing peptide sequences to non-RNA therapeutics and present attractive value to potential partners. The platform has the potential to allow Arrowhead to:

Develop therapeutic agents that hunt down and destroy known tumors, as well as distant unidentified metastases;

Convert cancer therapeutics that generally interact with most cells in the body to “smart” drugs that accumulate primarily at tumor sites and affect cancer cells preferentially, thereby improving the toxicity and side effects of currently used cancer drugs; and

Selectively target non-cancer therapeutics to virtually any tissue type in the body where they can have the desired pharmacologic effect.

This platform is potentially powerful in the specificity of the targeting sequences, the large number of unique sequences and their origin from human screening. In addition, because of the human-based identification process, there is lower risk that animal model data will not translate. Our proprietary library of 42,000 unique targeting sequences can be used with our own delivery platforms, as well as with small molecule drugs. This platform has achieved clinical proof of concept in targeting metastatic prostate cancer with the first sequence tested in humans.

Drs. Renata Pasqualini and Wadih Arap, who developed this technology, run a large laboratory at MD Anderson Cancer Center. They focus on discovering novel cell-surface receptors and validated receptors on tumor sites and identifying peptide sequences that will bind to those receptors. Importantly, their method identifies peptides that are rapidly internalized into cells. These peptide-receptor pairs hold the promise of shuttling therapeutic payloads preferentially and directly into those cells. The ability to target and deliver cytotoxins would address some of the problems with current cancer therapeutics by limiting side effects and increasing efficacy.

In order to discover these receptors and sequences that target them, Drs. Pasqualini and Arap used a technique calledin vivophage display. Over the past several years they have applied phage display screening to end-stage cancer patients with primary and metastatic tumors under rigorous ethical standards. To our knowledge, they are the only group in the world that is generating this type of human-derived data. Direct screening in human cancer patients has the potential to eliminate some of the uncertainty that has plagued current discovery methods with animal models. This strategy sought to map the human vasculature into “zip codes” and has discovered a large number of novel receptors that are expressed only on the cell surface of tumor sites and nowhere else. The library can be further increased by continuing to work with MD Anderson to screen additional patients.

11

Arrowhead is working to apply this technology to targeting our proprietary siRNA delivery vehicles. Our two primary delivery platforms, DPCs and RONDEL, are highly attractive in part because they have been shown to be well tolerated, effective, capable of delivering RNAs to multiple organ systems, and they are targetable. The Homing Peptide library provides our targeted therapeutic program with a powerful new source of flexibility. The library is also valuable in creating a new class of therapeutics, Peptide-Drug Conjugates, or PDCs. By linking the Homing Peptides to traditional small molecule drugs we can potentially transform a therapeutic that interacts with most cells in the body into one that interacts preferentially with the cell of choice. We believe that this transition from untargeted to targeted drugs is a paradigm shift for cancer therapeutics and that our new library puts us at the forefront of this transformation. We intend to build our own pipeline and work with partners to apply our targeting sequences to their drugs. We believe that this specific targeting will enable us to make existing generics safer and more effective and we intend to work with partners to help make their proprietary drugs better. Given the large number of approved APIs for oncology and the thousands of Homing Peptide sequences that we now have, there are many potential combinations of targeting sequence and drug molecules.

PDCs share the promise of the original class of guided therapeutics, antibody-drug conjugates or ADCs, in that they could increase efficacy and decrease toxicity relative to current standard of care oncology products. Benefits of PDCs as a class are as follows:

They are potentially faster, cheaper, and simpler to make than ADCs, making them attractive development projects for biopharmaceutical companies;

Their targets are expressed on a high percentage of multiple tumor types, giving them a larger potential commercial market than genetically targeted agents that are efficacious in only a small subset of patient populations; and

The use of Homing Peptides that were discovered in human cancer patients as the targeting moieties for PDCs potentially increases clinical probability of success.

We believe this unique mix of benefits will be attractive to potential partners in the biopharmaceutical industry. This technology has the potential to facilitate the rapid development of multiple new product candidates, each of which could meet a critical unmet medical need. In addition, screening in man has broad applicability in other therapeutic areas of interest to the biopharmaceutical industry.

Intellectual Property

We controlCompany controls approximately 154306 issued patents (including 66 for DPCs; 25 for hydrodynamic gene delivery; 26 for pH labile molecules; 7 for polyampholyte; 5 for template polymerization; 12 for delivery polymers; 133 for RNAi trigger molecules; 1 for targeting molecules; 1 for liver expression vector; and 29 for Homing Peptides), including European validations)validations, and 292247 patent applications.applications (108 applications in 13 families for DPCs; 140 applications in 23 families for RNAi trigger targets; and 8 for Homing Peptides). The pending applications have been filed throughout the world, including, in the United States, Argentina, ARIPO (Africa Regional Intellectual Property Organization), Australia, Brazil, Canada, Chile, China, Eurasian Patent Organization, Europe, the Arab States of the Gulf,Hong Kong, Israel, India, Indonesia, Iraq, Jordan, Japan, Republic of Korea, Mexico, New Zealand, OAPI (African Intellectual Property Organization), Peru, Philippines, Russian Federation, Saudi Arabia, Singapore, Thailand, Taiwan, Venezuela, Vietnam, and Venezuela.South Africa.

RONDELRNAi Triggers

Calando controls an intellectual property portfolio ofThe Company owns patents directed to certain linear cyclodextrin polymers and related technology (the “Linear Cyclodextrin System”). The portfolio is directedRNAi triggers targeted to both RONDEL and Cyclosert. In June 2009, Calando sold and assigned to Cerulean certain patents (“Cerulean Assigned Patents”) directed toward linear cyclodextrin polymers conjugated to drugs. Additionally, Calando granted Cerulean an exclusive license under its rights toreduce expression of hepatitis B viral proteins as well the Linear Cyclodextrin System to develop and commercialize CRLX-101 and Cerulean Products. Calando retained rights to use the Linear Cyclodextrin System to develop drugs in which a therapeutic agent is (i) a nucleic acid (e.g., siRNA), (ii) a second generation epothilone, (iii) tubulysin or (iv) cytolysin (collectively, the “Calando Products”).RRM2 gene.

| | Patent Group | Estimated Year of Expiration | RNAi Triggers | Patent directed to HBV RNAi triggers | 2032 | Patent directed to RRM2 RNAi triggers | 2031 | α-ENaC | 2028 | β-ENaC | 2031 | β-Catenin | 2033 | KRAS | 2033 | HSF1 | 2030, 2032 | APOC3 | 2034 | Cx43 | 2029 | HIF1A | 2026 | FRP-1 | 2026 | HCV | 2023 | PDtype4 | 2026 | PI4Kinase | 2028 | HRH1 | 2027 | SYK | 2027 | TNF-α | 2027 |

20

Dynamic Polyconjugates The issued patents include approximately 55 patents directed to the RONDEL and CYLCOSERT drug delivery platforms. Included in these 55 patents are approximately 34 patents covering linear cyclodextrin copolymers utilized in RONDEL and CYCLOSERT, issued in the United States, Europe (Austria, Belgium, Switzerland, Germany, Denmark, Spain, Finland, France, the United Kingdom, Greece, Ireland, Israel, Italy, Luxembourg, Monaco, Netherlands, Portugal, Sweden), Australia, Brazil, Canada, China, Cyprus, Japan, Republic of Korea, Mexico, Russian Federation, Singapore and South Africa. Approximately 14 patents are directed to inclusion complexes and drug-cyclodextrin complexes utilized in the RONDEL and CYLCOSERT platforms. These patents have issued in the United States, Australia, China, Israel, Japan, Republic of Korea, Russian Federation, Singapore, Taiwan and South Africa. Approximately seven additional patents issued in the United States and Europe (Austria, Switzerland, Germany, France and the United Kingdom) are directed to supramolecular complexes containing therapeutic agents. Calando also owns a U.S. issued patent (in addition to 14 patents in Europe, i.e., Austria, Belgium, Switzerland, Germany, Denmark, Spain, Finland, France, the United Kingdom, Hungary, Italy, Netherlands, Poland and Sweden) directed to the siRNAs targeting the gene targeted by the active ingredient in CALAA-01, as well as a U.S. patent directed to the siRNA active ingredient of CALAA-02.

12

HOMING PEPTIDES

We also control 18 patentsDPC related to our Homing Peptide platform, related to Adipotide, our drug candidate for the treatment for obesity and related metabolic disorders. Approximately five of these patents are United States patents and the remaining patents are validated in Belgium, Switzerland, Germany, Spain, France, the United Kingdom, Ireland, Greece, Italy, Netherlands, Portugal, Sweden and Turkey.

DPC’S

In addition, we control eleven patents related to our Dynamic Polyconjugate drug delivery platform. These patents have issued in the United States, Australia, Canada, Europe, France, Germany, Italy, Spain, Switzerland, United Kingdom, India, Japan, Mexico, New Zealand, Philippines, Russia, South Korea, Singapore, and South Africa. WeThe Company also control approximately 41controls a number of patents directed to hydrodynamic nucleic acid delivery, which issued in the United States, Australia and Europe (Austria,(validated in Austria, Belgium, Switzerland, Germany, Denmark, Spain, Finland, France, the United Kingdom, Hungary, Ireland, Italy, Netherlands and Sweden).

Thirteen additional patents are directed to various precursors to our DPC delivery platform, and other membrane active polymers, as well as additional drug and gene delivery methodologies and carriers (e.g., lipid- and micelle-based systems).

The approximate year of expiration for each of these various groups of patents are set forth below: | | | Patent Group | | Estimated Year of Expiration | Dynamic PolyconjugatesRONDEL™ and CYCLOSERT™TM (DPCTM) | Linear cyclodextrin copolymersDynamic Polyconjugates

| | 2018 | Inclusion complexes

| | 2021 | Drug-cyclodextrin complexes

| | 2024 | Supramolecular complexes containing therapeutic agents

| | 2019 | CALAA-012027

| Patent directed to RRM2 siRNAsDynamic Polyconjugates – second iteration

| | 2028 | CALAA-02

| Patent directed to HIF-2 alpha (EPAS1) siRNAs

| | 2030 | Adipotide®

| Targeting moieties and conjugates

| | 2021 | Targeted Pharmaceutical Compositions

| | 2021 | Dynamic Polyconjugates® (DPC®)2031

| Membrane Active Polymers | | 2027 | Membrane Active Polymers—Polymers – Additional Iterations | 2024 | Membrane Active Polymers – Additional Iterations | 20242032 | Copolymer Systems | | 2024 | Polynucleotide-Polymer Composition | | 2024 | Polynucleotide-Polymer Composition—Additional IterationsARC-520 Polymer

| 2031 | ARC-521 Composition | 2035 | Masking Chemistry | 2031 | Masking Chemistry | 2035 | Polyampholyte Delivery | | 2017 | pH Labile Molecules | | 2020 | Endosomolytic Polymers | | 2020 | Hydrodynamic delivery

| Various iterations

| | 2015 | Homing PeptidesHydrodynamic delivery

| EphA5 Targeting PeptidesFirst iterations

| | 20272015 | IL-11R Targeting PeptidesSecond iteration

| 2020 | Third iteration | 20222024 |

13

Calando has licensed patents from Alnylam relevant to siRNA therapeutics for both CALAA-01 and CALAA-02. Calando has out-licensed to Tube Pharmaceuticals GmbH, the use of the linear cyclodextrin system for delivering second generation synthetic epothilone drugs. Calando has also out-licensed to Tube Pharmaceuticals GmbH, the use of the linear cyclodextrin system for delivering tubulysin and cytolysin.