| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Oklahoma | 73-0767549 | |

|

| |

| 20 N. Broadway, Oklahoma City, Oklahoma | 73102 | |

| (Address of principal executive offices) | (Zip Code) | |

Title of | Name of | |

| Common Stock, $0.01 par value | New York Stock Exchange | |

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

185,602,632

16, 2016.

| |||||

| ||||||

| Item 1. | ||||||

| Item 1A. | ||||||

| Item 1B. | ||||||

| Item 2. | ||||||

| Item 3. | ||||||

| Item 4. | ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

Item 5. | ||||||

Item 6. | ||||||

Item 7. | ||||||

Item 7A. | ||||||

Item 8. | ||||||

Item 9. | ||||||

| Item 9A. | ||||||

| Item 9B. | ||||||

| ||||||

| ||||||

| ||||||

Item 10. | ||||||

Item 11. | ||||||

Item 12. | ||||||

Item 13. | ||||||

Item 14. | ||||||

| ||||||

Item 15. | ||||||

When we refer to “us,” “we,” “our,” “Company,” or “Continental” we are describing Continental Resources, Inc. and our subsidiaries.

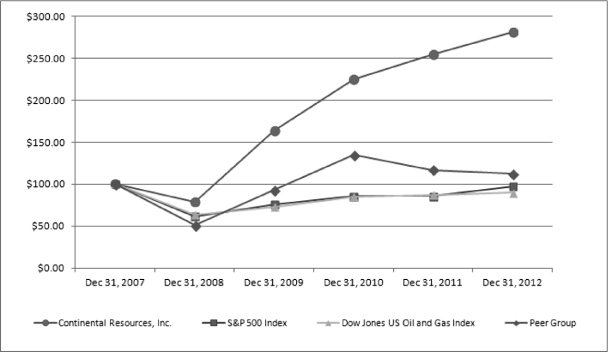

“MBbl” One thousand barrels of crude oil, condensate or natural gas liquids. our strategy; our future operations; our crude oil, natural gas liquids, and natural gas prices and differentials; the timing and amount of future production of crude oil and natural gas and flaring activities; the amount, nature and timing of capital expenditures; estimated revenues, expenses and results of operations; drilling and completing of wells; competition; marketing of crude oil and natural gas; transportation of crude oil, natural gas liquids, and natural gas to markets; property exploitation or property acquisitions and dispositions; costs of exploiting and developing our properties and conducting other operations; our financial position; general economic conditions; credit markets; our liquidity and access to capital; the impact of governmental policies, laws and regulations, as well as regulatory and legal proceedings involving us and of scheduled or potential regulatory or legal changes; our future operating our commodity or other hedging arrangements; and the ability and willingness of current or potential lenders, hedging contract counterparties, customers, and working interest owners to fulfill their obligations to us or to enter into transactions with us in the future on terms that are acceptable to us. report, or otherwise. with no current drilling or production operations. 1980s. For the year ended December 31, 2015, crude oil accounted for approximately 66% of our total production and approximately 85% of our crude oil and natural gas revenues. Crude oil represents approximately 57% of our estimated proved reserves as of December 31, 2015. bit. 2014. North Region: Bakken field North Dakota Bakken Montana Bakken Red River units Cedar Hills Other Red River units Other South Region: Oklahoma Woodford SCOOP (3) Northwest Cana (3) Arkoma Woodford Other East Region (4) Total North Region: Bakken field North Dakota Bakken Montana Bakken Red River units Niobrara - Colorado/Wyoming Other South Region: Oklahoma Woodford SCOOP Northwest Cana Arkoma Woodford Other East Region Total the subsequent section titled . include: strategy, including the following: liquidity and reduced our interest expense. Proved developed producing Proved developed non-producing Proved undeveloped Total proved reserves Standardized Measure North Region: Bakken field North Dakota Bakken Montana Bakken Red River units Cedar Hills Other Red River units Other South Region: Oklahoma Woodford SCOOP Northwest Cana Arkoma Woodford Other Total MBoe Proved reserves at beginning of year Revisions of previous estimates Extensions, discoveries and other additions Production Sales of minerals in place Purchases of minerals in place Proved reserves at end of year presented. and improvements in operating efficiencies as well as other factors. Cana/STACK areas. $50.28 per Bbl. North Region: Bakken field North Dakota Bakken Montana Bakken Red River units Niobrara - Colorado/Wyoming Other South Region: Oklahoma Woodford SCOOP Northwest Cana Arkoma Woodford Other East Region Total 2015: North Region: Bakken field North Dakota Bakken Montana Bakken Red River units Niobrara - Colorado/Wyoming Other South Region: Oklahoma Woodford SCOOP Northwest Cana Arkoma Woodford Other East Region Total dates or the leases are renewed. Exploratory wells: Crude oil Natural gas Dry holes Total exploratory wells Development wells: Crude oil Natural gas Dry holes Total development wells Total wells operating area. return. field. recoveries for these legacy properties. 2016. and STACK 2015. maximize wellhead value for our crude oil production. We continue to assess downstream transportation options Net production volumes: Crude oil (MBbls) (1) North Dakota Bakken Total Company Natural gas (MMcf) North Dakota Bakken Total Company Crude oil equivalents (MBoe) North Dakota Bakken Total Company Average sales prices: (2) Crude oil ($/Bbl) North Dakota Bakken Total Company Natural gas ($/Mcf) North Dakota Bakken Total Company Crude oil equivalents ($/Boe) North Dakota Bakken Total Company Average costs per Boe: (2) Production expenses ($/Boe) North Dakota Bakken Total Company Production taxes and other expenses ($/Boe) General and administrative expenses ($/Boe) (3) DD&A expense ($/Boe) North Region: Bakken field North Dakota Bakken Montana Bakken Red River units Cedar Hills Other Red River units Other South Region: Oklahoma Woodford SCOOP Northwest Cana Arkoma Woodford Other East Region Total 2015: North Region: Bakken field North Dakota Bakken Montana Bakken Red River units Other South Region: Oklahoma Woodford SCOOP Northwest Cana Arkoma Woodford Other Total the same well bore are counted as one well. leasehold sales. In addition, as a result of the significant decrease in commodity prices, the number of providers of materials and services has decreased in the regions where we operate. As a result, the likelihood of experiencing competition and shortages of materials and services may be increased in connection with any period of commodity price recovery. natural gas liquids situated competitors. same terms and under the same rates. When such pipelines operate at full capacity, access is governed by prorating provisions, which may be set forth in the pipelines’ published tariffs. We believe we generally will have access to crude oil pipeline transportation services to the same extent as our similarly situated competitors. natural gas legislative and regulatory changes, including changes in the interpretation of existing requirements or programs to implement those requirements. We do not believe we would be affected by any such regulatory changes in a materially different way than our similarly situated competitors. production industry Dodd-Frank Wall Street Reform and Consumer Protection Act. In July 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted into law. the end-user exception from the clearing requirement for our swaps entered into to hedge our commercial risks, the application of the mandatory clearing requirements connection with wholesale purchases or sales of crude oil or refined petroleum products. Knowing or willful violations of the Commodity Exchange Act may also lead to a felony conviction. require the acquisition of various permits restrict the types, quantities and concentration of various substances that can be released into the environment in connection with crude oil and natural gas drilling, production and transportation activities; limit or prohibit drilling activities on certain lands lying within wilderness, wetlands and other protected areas including areas containing endangered species of plants and animals; require remedial measures to mitigate pollution from former and ongoing operations, such as requirements to close pits and plug abandoned In connection with our peer benchmarking with trade associations. owners. operations or cash flows. significant. markets for crude oil and natural gas have been worldwide, domestic and regional economic conditions impacting the global supply of, and demand for, crude oil and natural gas; the actions of the Organization of Petroleum Exporting the level of national and global crude oil and natural gas exploration and the level of national and global crude oil and natural gas the level and effect of trading in commodity futures markets; changes in supply, demand, and the cost of transporting, processing, and marketing crude oil and natural gas; technological advances affecting energy consumption; the price and availability of alternative expenditures and commitments. operations and cash flows. Should any of the above risks occur, operations and cash flows. revenues. In addition, funding our capital expenditures with additional debt will increase our leverage and doing so with equity securities may result in dilution that reduces the value of your stock. capacity, and regulatory, technological and competitive developments. Drilling for and producing crude oil and natural gas are high risk activities with many uncertainties that could adversely affect our business, financial condition or results of operations. abnormal pressure or irregularities in geological formations; shortages of or delays in obtaining equipment shortages of or delays in obtaining components used in fracture stimulation processes such as water and proppants; political events, public protests, civil disturbances, terrorist acts or cyber attacks; limited availability of financing with acceptable terms; title problems; environmental hazards, such as uncontrollable flows of crude oil, natural gas, brine, well fluids, hydraulic fracturing fluids, toxic gas or other pollutants into the environment, including groundwater and shoreline contamination; spillage or mishandling of crude oil, natural gas, brine, well fluids, hydraulic fracturing fluids, toxic gas or other pollutants by us or by third party service providers; limitations in infrastructure, including transportation, processing and refining capacity, or delays imposed by or resulting from compliance with regulatory The Company's current estimates of reserves could change, potentially in material amounts, in the future, in particular due to a continued decline in, or an extended period of historically low, commodity prices. reserves and, in particular, may be reduced due to the significant decline in commodity prices. the actual prices we receive for sales of crude oil and natural gas; the timing and amount of actual production; and Sensitivities properties if commodity prices remain at their currently low levels or decline further. operations and cash flows. environmental hazards, such as uncontrollable flows of crude oil, natural gas, brine, well fluids, hydraulic fracturing fluids, toxic gas or other pollutants into the environment, including groundwater and shoreline contamination; abnormally pressured formations; mechanical difficulties, such as stuck oilfield drilling and service tools and casing collapse; fires, explosions and ruptures of pipelines; loss of product or property damage occurring as a result of transfer to a rail car or train derailments; adverse weather conditions and natural disasters; and spillage or mishandling of crude oil, natural gas, brine, well fluids, hydraulic fracturing fluids, toxic gas or other pollutants by us or by third party service providers. injury or loss of life; damage to pollution and other environmental damage; regulatory investigations and penalties; suspension of our operations; repair and remediation operations and cash flows. prospect which is ready to drill to a prospect transportation. products. Strict liability or joint and several liability may be imposed under certain laws, which could cause us to become liable for the conduct of others or for consequences of our own actions. gases. operations and cash flows. cash flows. crude oil. legislators attributed to speculative trading in derivatives and commodity instruments related to crude oil and natural gas. Our revenues could therefore be adversely affected if a consequence of the legislation and regulations is to lower operations and cash flows. operations and cash flows. operations and cash flows. to, among other things, incur assets. Our revolving credit facility and three-year term loan also indebtedness, enter into certain sale-leaseback transactions, and consolidate, merge or transfer certain assets. indebtedness, which would adversely affect our financial condition and results of operations. results of operations. associated with our derivative instrument receivables ($ operations and cash flows, and it is difficult to predict how long the current depressed commodity price environment will continue and the ultimate impact it will have on the parties with which we do business. production is less than the volume covered by the derivative instruments; the counterparty to the derivative instrument defaults on its contractual obligations; or there is an increase in the differential between the underlying price in the derivative instrument and actual prices received. election of our directors, determine our corporate and management policies and determine, without the consent of our other shareholders, the outcome of certain corporate transactions or other matters submitted to our shareholders for approval, including potential mergers or acquisitions, asset sales and other significant corporate transactions. recoverable reserves; future crude oil and natural gas prices and the quality of the title to acquired properties; potential environmental and other liabilities. The Company will continue to assert its defenses to the case as certified as well as any future attempt to certify a money damages class. High Low Cash Dividend Period October 1, 2012 to October 31, 2012 November 1, 2012 to November 30, 2012 December 1, 2012 to December 31, 2012 Total Equity Compensation Plans Approved by Shareholders Equity Compensation Plans Not Approved by Shareholders future price performance. Income Statement data (in thousands, except per share data) Crude oil and natural gas sales Gain (loss) on derivative instruments, net (1) Total revenues Income from continuing operations Net income Basic earnings per share: From continuing operations Net income per share Shares used in basic earnings per share Diluted earnings per share: From continuing operations Net income per share Shares used in diluted earnings per share Production Crude oil (MBbl) (2) Natural gas (MMcf) Crude oil equivalents (MBoe) Average sales prices (3) Crude oil ($/Bbl) Natural gas ($/Mcf) Crude oil equivalents ($/Boe) Average costs per Boe ($/Boe) (3) Production expenses Production taxes and other expenses Depreciation, depletion, amortization and accretion General and administrative expenses (4) Proved reserves at December 31 Crude oil (MBbl) Natural gas (MMcf) Crude oil equivalents (MBoe) Other financial data (in thousands) Net cash provided by operating activities Net cash used in investing activities Net cash provided by financing activities EBITDAX (5) Total capital expenditures Balance Sheet data at December 31 (in thousands) Total assets Long-term debt, including current maturities Shareholders’ equityaremay be used throughout this report: TM™” A Continental Resources, Inc. trademark which describes a well site layout which allows for drilling multiple wells from a single pad resulting in less environmental impact and lower drilling and completion costs.a new fieldcrude oil or natural gas in an unproved area, to find a new reservoir in aan existing field previously found to be productive of crude oil or natural gas in another reservoir.reservoir, or to extend a known reservoir beyond the proved area.iat a right anglehorizontally within a specified interval.“HPAI” High pressure air injection.“hydraulic fracturing” A process involving the high pressure injection of water, sand and additives into rock formations to stimulate crude oil and natural gas production.“in-field well” A well drilled between producing wells in a field to provide more efficient recovery of crude oil or natural gas from the reservoir.“injection well” A well into which liquids or gases are injected in order to “push” additional crude oil or natural gas out of underground reservoirs and into the wellbores of producing wells. Typically considered an enhanced recovery process.net acres” The percentage of total acres an owner has out ofpad drilling" or "pad development" Describes a particular number of acres,well site layout which allows for drilling multiple wells from a single pad resulting in less environmental impact and lower drilling and completion costs. Also may be referred to as ECO-Pad drilling or a specified tract. An owner who has a 50% interest in 100 acres owns 50 net acres.development.iirevenuerevenues to be generated from the production of proved reserves using a 12-month unweighted arithmetic average of the first-day-of-the-month commodity prices for the period of January to December, net of estimated production and future development and abandonment costs using prices andbased on costs in effect at the determination date, before income taxes, and without giving effect to non-property-related expenses, discounted to a present value using an annual discount rate of 10% in accordance with the guidelines of the Securities and Exchange Commission (“SEC”). PV-10 is not a financial measure calculated in accordance with generally accepted accounting principles (“GAAP”) and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. Neither PV-10 nor Standardized Measure represents an estimate of the fair market value of the Company’s crude oil and natural gas properties. The Company and others in the industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific tax characteristics of such entities.multi-stage fracturingcompletion technologies.emerging area of crude oil and liquids-rich natural gas properties located in the Anadarko basinBasin of Oklahoma in which we operate.Woodford formation.in which we operate.iii3D (threethree dimensional seismic) defined locations” Locations that have been subjected to 3D seismic testing. We typically use 3D seismic testing to evaluate reservoir presence and/or continuity. We do not typically evaluate reservoir productivity using 3D seismic technology.(3D) seismic”“3D seismic” Seismic surveys using an instrument to send sound waves into the earth and collect data to help geophysicists define the underground configurations. 3D seismic provides three-dimensional pictures. We typically use 3D seismic testing to evaluate reservoir presence and/or continuity. We also use 3D seismic to identify sub-surface hazards to assist in steering, avoiding hazards and determining where to perform enhanced completions.require recently developed technologies to achieve profitability.may lack readily apparent traps, seals and discrete hydrocarbon-water boundaries that typically define conventional reservoirs. These areas tend to have low permeability and may be closely associated with source rock, as is the case with oil and gas shale, tight oil and gas sands and coalbed methane.methane, and generally require horizontal drilling, fracture stimulation treatments or other special recovery processes in order to achieve economic production. In general, unconventional plays require the application of more advanced technology and higher drilling and completion costs to produce relative to conventional plays.waterflood” The injection of water into a crude oil reservoir to “push” additional crude oil out of the reservoir rock and into the wellbores of producing wells. Typically an enhanced recovery process.well bore”“wellbore” The hole drilled by the bit that is equipped for crude oil or natural gas production on a completed well. Also called a well or borehole.ivincludesand information incorporated by reference in this report include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact, including, but not limited to, forecasts or expectations regarding the Company's business and statements or information concerning the Company’s future operations, performance, financial condition, production and reserves, schedules, plans, timing of development, returns,rates of return, budgets, costs, business strategy, objectives, and cash flow,flows, included in this report are forward-looking statements. When used in this report, theThe words “could,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “budget,” “plan,” “continue,” “potential,” “guidance,” “strategy” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements are based on the Company’s current expectations and assumptions about future events and currently available information as to the outcome and timing of future events. Although the Company believes the expectations reflected in the forward-looking statements are reasonable and based on reasonable assumptions, no assurance can be given that such expectations will be correct or achieved or that the assumptions are accurate. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described underPart I, Item 1A. Risk Factors included in this report, quarterly reports, registration statements filed from time to time with the SEC, and other announcements we make from time to time.Without limiting the generality of the foregoing, certain statements incorporated by reference, if any, or included in this report constitute forward-looking statements.strategy;and financial plans;reserves;our technology;our financial strategy;vresults;plans, objectives, expectations and intentions contained in this report that are not historical, including, without limitation, statements regarding our future growth plans;We caution you these forward-lookingForward-looking statements are based on the Company’s current expectations and assumptions about future events and currently available information as to the outcome and timing of future events. Although the Company believes these assumptions and expectations are reasonable, they are inherently subject to all of thenumerous business, economic, competitive, regulatory and other risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the exploration for,Company's control. No assurance can be given that such expectations will be correct or achieved or that the assumptions are accurate or will not change over time. The risks and development, production,uncertainties that may affect the operations, performance and saleresults of crude oilthe business and natural gas. These risksforward-looking statements include, but are not limited to, commodity price volatility, inflation, lack of availability of drilling, completion and production equipment and services, environmental risks, drillingthose risk factors and other operating risks, regulatory changes, the uncertainty inherent in estimating crude oil and natural gas reserves and in projecting future rates of production, cash flows and access to capital, the timing of development expenditures, and the other riskscautionary statements described underPart I, Item 1A. Risk Factors and elsewhere in this report, quarterly reports, registration statements filedwe file from time to time with the SEC,Securities and Exchange Commission, and other announcements we make from time to time.hereof.on which such statement is made. Should one or more of the risks or uncertainties described in this report occur, or should underlying assumptions prove incorrect, ourthe Company's actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.we disclaim any dutythe Company undertakes no obligation to publicly correct or update any forward-looking statements to reflectstatement whether as a result of new information, future events or circumstances after the date of this report.vi“ us,“us,” “our,” “ours” or “the Company” refer to Continental Resources, Inc. and its subsidiaries.Item 1. Business exploration and production company with properties in the North, South and East regions of the United States. The North region consists of properties north of Kansas and west of the Mississippi River and includes North Dakota Bakken, Montana Bakken, and the Red River units. The South region includes Kansas and all properties south of Kansas and west of the Mississippi River including various plays in the SouthSCOOP (South Central Oklahoma Oil Province (“SCOOP”)Province), STACK (Sooner Trend Anadarko Canadian Kingfisher), Northwest Cana and Arkoma Woodford plays inareas of Oklahoma. The SCOOP and Northwest Cana plays were previously combined by the Company and referred to as the Anadarko Woodford play. In December 2012, we sold the producing crude oil and natural gas properties in our East region. Our remaining East region properties areis comprised of undeveloped leasehold acreage east of the Mississippi River that will be managed as part of our exploration program.1989,the late 1980s, our activities and growth remained focused primarily in Oklahoma. In 1989,the late 1980s, we expanded our activity into the North region.region, where a substantial portion of our operations is now concentrated due to our successful leasing and drilling activities in the Bakken field. The North region comprised approximately 68% of our crude oil and natural gas production and approximately 77% of our crude oil and natural gas revenues for the year ended December 31, 2015. Approximately 82%58% of our estimated proved reserves as of December 31, 20122015 are located in the North region. We completed an initial public offeringIn recent years, we have significantly expanded our activity in our South region resulting from our discovery of the SCOOP play and our increased activity in the Northwest Cana and STACK plays, all of which are located in Oklahoma. Our South region comprised approximately 32% of our common stock in 2007,crude oil and natural gas production, 23% of our common stock tradescrude oil and natural gas revenues, and 42% of our estimated proved reserves as of and for the year ended December 31, 2015.New York Stock Exchange underexploration and development of crude oil since the ticker symbol “CLR”.stimulationstimulation) and enhanced recovery technologies allow us to economically develop and produce crude oil and natural gas reserves from unconventional formations. As a result of these efforts, we have grown substantially through the drill bit, adding 649.0 MMBoe of proved crude oil and natural gas reserves through extensions and discoveries from January 1, 2008 through December 31, 2012 compared to 86.7 MMBoe added through proved reserve acquisitions during that same period. In October 2012, we announced a new five-year growth plan to triple our production and proved reserves from year-end 2012 to year-end 2017.2012,2015, our estimated proved reserves were 784.71,226 MMBoe, with estimated proved developed reserves of 317.8525 MMBoe, or 40%43% of our total estimated proved reserves. Crude oil comprised 72% of our total estimated proved reserves as of December 31, 2012. For the year ended December 31, 2012,2015, we generated crude oil and natural gas revenues of $2.4$2.6 billion and operating cash flows of $1.6$1.9 billion. For the year ended December 31, 2012, daily2015, production averaged 97,583221,715 Boe per day, a 58%27% increase over average production of 61,865174,189 Boe per day for the year ended December 31, 2011.2014. Average daily production for the quarter ended December 31, 20122015 increased 42%16% to 106,831224,936 Boe per day from 75,219193,456 Boe per day for the quarter ended December 31, 2011.following table below summarizes our total estimated proved reserves, PV-10 and net producing wells as of December 31, 2012,2015, average daily production for the quarter ended December 31, 20122015 and the reserve-to-production index in our principal regions. Our reserve estimates asoperating areas. The PV-10 values shown below are not intended to represent the fair market value of December 31, 2012 are based primarily on a reserve report prepared by our independent reserve engineers, Ryder Scott Company, L.P (“Ryder Scott”). In preparing its report, Ryder Scott evaluated properties representing approximately 99% of our PV-10, 99% of our proved crude oil reserves, and 96% of our proved natural gas reserves as of December 31, 2012. Our internal technical staff evaluated the remaining properties. Our estimated proved reserves and related future net revenues, PV-10 and Standardized Measure at December 31, 2012 were determined using the 12-month unweightedarithmetic average of the first-day-of-the-month commodity prices for the period of January 2012 through December 2012, without giving effect to derivative transactions, and were held constant throughout the lives of the properties. These prices were $94.71 per Bbl for crude oil and $2.76 per MMBtu for natural gas ($86.56 per Bbl forproperties. There are numerous uncertainties inherent in estimating quantities of crude oil and $4.31 per Mcf for natural gas adjustedreserves. See location and quality differentials). At December 31, 2012 Average daily

production for

fourth quarter

2012

(Boe per day) Annualized

reserve/production

index (2) Proved

reserves

(MBoe) Percent

of total PV-10 (1)

(In millions) Net

producing

wells Percent

of total 517,686 66.0 % $ 8,891 494 59,019 55.2 % 24.0 45,883 5.8 % 995 176 8,503 8.0 % 14.8 55,808 7.1 % 1,573 139 11,058 10.4 % 13.8 22,445 2.9 % 430 121 3,658 3.4 % 16.8 3,147 0.4 % 48 11 967 0.9 % 8.9 62,893 8.0 % 955 34 7,123 6.7 % 24.2 44,888 5.7 % 211 73 9,716 9.1 % 12.7 22,042 2.8 % 61 60 3,225 3.0 % 18.7 9,885 1.3 % 145 286 2,556 2.4 % 10.6 — — — — 1,006 0.9 % — 784,677 100.0 % $ 13,309 1,394 106,831 100.0 % 20.1 December 31, 2015 Average daily

production for

fourth quarter

2015

(Boe per day) Annualized

reserve/production

index (2) Proved

reserves

(MBoe) Percent

of total PV-10 (1)

(In millions) Net

producing

wells Percent

of total North Region: Bakken field North Dakota Bakken 618,197 50.4 % $ 4,005 1,196 125,583 55.8 % 13.5 Montana Bakken 44,837 3.6 % 431 273 10,772 4.8 % 11.4 Red River units Cedar Hills 42,456 3.5 % 523 132 8,658 3.9 % 13.4 Other Red River units 5,603 0.5 % 34 120 2,996 1.3 % 5.1 Other 2,271 0.2 % 20 8 902 0.4 % 6.9 South Region: SCOOP 412,546 33.7 % 2,508 220 64,534 28.7 % 17.5 Northwest Cana/STACK 83,951 6.8 % 378 67 7,709 3.4 % 29.8 Arkoma Woodford 9,912 0.8 % 49 56 2,124 0.9 % 12.8 Other 6,038 0.5 % 38 232 1,658 0.8 % 10.0 Total 1,225,811 100.0 % $ 7,986 2,304 224,936 100.0 % 14.9 (1) PV-10 is a non-GAAP financial measure and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. Standardized Measure at December 31, 2012 is $11.2 billion, a $2.1 billion difference from PV-10 becauserevenues of the income tax effect.approximately $1.5 billion. Neither PV-10 nor Standardized Measure represents an estimate of the fair market value of our crude oil and natural gas properties. We and others in the crude oil and natural gas industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific income tax characteristics of such entities.(2) The Annualized Reserve/Production Index is the number of years that estimated proved reserves would last assuming current production continued at the same rate. This index is calculated by dividing annualized fourth quarter 20122015 production into estimated proved reserve volumes at December 31, 2012.(3)The SCOOP and Northwest Cana plays were previously combined by the Company and referred to as the Anadarko Woodford play.(4)In December 2012, we sold the producing crude oil and natural gas properties in our East region. No proved reserves have been recorded for the East region as of December 31, 2012. SeePart II, Item 8. Notes to Consolidated Financial Statements—Note 13. Property Acquisitions and Dispositions for further discussion of the transaction.2015.following table provides additional informationdownward price pressure intensified in late 2015 and early 2016, with crude oil prices dropping below $27 per barrel in February 2016, a level not seen since 2003. Natural gas prices faced similar downward pressure in 2015, dropping below $1.70 per MMBtu in December 2015.key development areas asplanned non-acquisition capital spending for 2016 to $920 million, a reduction of 63% compared to $2.50 billion of non-acquisition capital spending in 2015. This non-acquisition investment level is designed to target capital expenditures and cash flows being relatively balanced for 2016 at an assumed average West Texas Intermediate benchmark crude oil price of approximately $37 per barrel for the year, with any cash flow deficiencies being funded by borrowings under our revolving credit facility. Our reduced spending is projected to result in a decrease in our 2016 average daily production of approximately 10% compared to 2015.20122015 to approximately 195 gross operated wells at year-end 2016. Our DUC inventory in Oklahoma is expected to increase from 35 gross operated wells at December 31, 2015 to approximately 50 gross operated wells at year-end 2016. We will continue to monitor our capital spending closely based on actual and projected cash flows and could make additional reductions to our 2016 capital spending should commodity prices decrease further. Conversely, a significant improvement in commodity prices could result in an increase in our capital expenditures.budgeted amounts we planchallenges facing our industry, our primary business strategies for 2016 will include: (1) optimizing cash flows through operating efficiencies and cost reductions, (2) high-grading investments based on rates of return and opportunities to spend on exploratoryconvert undeveloped acreage to acreage held by production, and development drilling,(3) working to balance capital workovers,spending with cash flows tofacilitiesmaintain ample liquidity, as elaborated upon in 2013. 2013 Plan Developed acres Undeveloped acres Gross wells

planned for

drilling Capital

expenditures (1)

(in millions) Gross Net Gross Net 758,998 473,068 619,786 393,899 507 $ 2,132 127,276 107,053 219,029 165,783 51 427 150,450 135,483 — — 10 63 11,271 7,726 183,985 103,585 13 32 22,427 8,491 191,916 104,741 35 102 33,023 21,995 379,793 196,172 90 466 115,742 71,539 156,001 106,893 2 5 107,402 26,291 12,064 5,302 — 1 96,803 45,896 115,169 80,197 16 102 — — 210,742 190,474 — — 1,423,392 897,542 2,088,485 1,347,046 724 $ 3,330 (1)The capital expenditures budgeted for 2013 as reflected above include amounts for drilling, capital workovers and facilities and exclude budgeted amounts for land of $220 million, seismic of $20 million, and $30 million for vehicles, computers and other equipment. Potential acquisition expenditures are not budgeted. We expect our cash flows from operations, our remaining cash balance, and our revolving credit facility, including our ability to increase our borrowing capacity thereunder, will be sufficient to satisfy our 2013 capital budget. We may choose to access the capital markets for additional financing to take advantage of business opportunities that may arise if such financing can be arranged at favorable terms. The actual amount and timing of our capital expenditures may differ materially from our estimates as a result of, among other things, available cash flows, unbudgeted acquisitions, actual drilling results, the availability of drilling rigs and other services and equipment, the availability of transportation capacity, and regulatory, technological and competitive developments. Further, a decline in crude oil and natural gas prices could cause us to curtail our actual capital expenditures. Conversely, an increase in commodity prices could result in increased capital expenditures.goalBusiness Strategyincreasebe focused on increasing shareholder value by finding and developing crude oil and natural gas reserves at costs that provide an attractive raterates of return on our investment.return. The principal elements of our businessthis strategy are:FocusGrowing and sustaining a premier portfolio of assets focused on crude oil. During the late 1980s we beganhigh rate-of-return projects. We hold a portfolio of leasehold acreage and drilling opportunities in certain premier U.S. resource plays with varying exposure to believe the valuation potential for crude oil, exceedednatural gas, and natural gas liquids. We pursue opportunities to develop our existing properties as well as explore for new resource plays where significant reserves may be economically developed. Our capital programs are designed to allocate investments to projects that provide opportunities to convert undeveloped acreage to acreage held by production and to maximize hydrocarbon recoveries and rates of natural gas. Accordingly, we began to shift our reservereturn on capital employed. Our operations are primarily focused on the exploration and production profiles toward crude oil. Asdevelopment of December 31, 2012, crude oil, comprised 72% of our total proved reserves and 70% of our 2012 annual production. Althoughbut we do pursuealso allocate capital to liquids-rich natural gas opportunities, such as those found in the SCOOP, weareas that provide attractive rates of return.believe crude oil valuations will be superior to natural gas valuationsmanage through the current commodity price downturn by focusing on improving operating efficiencies and reducing costs. Our key operating areas are characterized by large acreage positions in select unconventional resource plays with multiple stacked geologic formations that provide repeatable drilling opportunities and resource potential. We operate a relative Btu basis for the foreseeable future.Growth Through Drilling. A substantial portionmajority of our annual capital expenditures are invested in drilling projectswells and leasehold acreage acquisitions. From January 1, 2008 through December 31, 2012, proved crude oil and natural gas reserve additions through extensions and discoveries were 649.0 MMBoe compared to 86.7 MMBoe of proved reserve acquisitions.Internally Generated Prospects. Although we periodically evaluate and complete strategic acquisitions, our technical staff has internally generated a substantial portion ofbelieve the opportunities for the investmentconcentration of our capital. As an early entrant in new or emerging plays, we expect to acquire undeveloped acreage at a lower cost than later entrants into a developing play.Focus on Unconventional Crude Oil and Natural Gas Resource Plays. Our experience with horizontal drilling, advanced fracture stimulation and enhanced recovery technologiesoperated assets allows us to commercially develop unconventional crude oilleverage our technical expertise and natural gas resource reservoirs, such asmanage the Red River B Dolomite, Bakken,development of our properties to achieve cost reductions through operating efficiencies and Oklahoma Woodford formations. Production rateseconomies of scale.the Red River unitsvarious aspects of our business, including reductions in spud-to-total depth drilling times and average days to drill horizontal laterals, which translated into substantial reductions in drilling costs in our core areas. Our drilling and completion costs for most operated wells declined on average approximately 25% in 2015 due to operational efficiency gains and lower service costs. In addition to lowering our drilling and completion costs, we also have been increasedoptimize cash flows through the use of enhanced recovery technologies including watercompletion technologies. In North Dakota, we are optimizing cash flows through enhanced completions using new hybrid and high pressure air injection. Ourslickwater designs, which have increased 90-day production rates between 35% and 50% on average. In Oklahoma, we are optimizing cash flows using enhanced completions that target optimum sand and fluid combinations. Initial results from the Red River units, the Bakken field,our 2015 activities are encouraging, and the Oklahoma Woodford play comprised approximately 33,831 MBoe, or 95%,we expect most of our total crude oil2016 well completions in Oklahoma will use enhanced completion methods.natural gas production fora strong balance sheet. Maintaining a strong balance sheet and ample liquidity are key components of our business strategy. For 2016, we will continue our focus on preserving financial flexibility and ample liquidity as we manage the risks facing our industry. Our 2016 capital budget is reflective of decreased commodity prices and has been established based on an expectation of available cash flows, with any cash flow deficiencies expected to be funded by borrowings under our revolving credit facility. As we have done historically to preserve or enhance liquidity we may adjust our capital program throughout the year, endeddivest non-strategic assets, or enter into strategic joint ventures.2012.Acquire Significant Acreage Positions in New or Developing Plays. In addition2015, our proved reserve additions through organic extensions and discoveries were 1,534 MMBoe compared to the 971,634 net undeveloped acres held in the Bakken play in North Dakota and Montana, the Oklahoma Woodford play, and the Niobrara play in Colorado and Wyoming, we held 375,412 net undeveloped acres in other crude oil and natural gas plays as86 MMBoe of December 31, 2012. Our technical staff is focused on identifying and testing new unconventional crude oil and natural gas resource plays where significant reserves could be developed if economically producible volumes can be achieved through advanced drilling, fracture stimulation and enhanced recovery techniques.proved reserve acquisitions during that same period.we believe willto help us successfullymanage through the current commodity price downturn and execute our business strategy:hold 1,347,046held approximately 1.19 million net undeveloped acres and 897,5421.15 million net developed acres under lease in certain premier U.S. resource plays as of December 31, 2012.2015. Approximately 72%59% of theour net undeveloped acres are located within unconventional resource plays in the Bakken, (North DakotaSCOOP, Northwest Cana, STACK and Montana),Arkoma Woodford (Oklahoma)areas. We have developed sizable acreage positions in our core operating areas and believe the Niobrara (Coloradoconcentration of our assets allows us to achieve operating efficiencies and Wyoming). The remaining balancereduce costs through economies of scale. We are among the largest leaseholdersnet undeveloped acreage is located in conventional plays including 3D-defined locations for the Lodgepole (North Dakota), Morrow-Springer (Western Oklahoma) and Frio (South Texas) plays.ExperienceExpertise with Horizontal Drilling and Enhanced RecoveryCompletion Methods. We have substantial experience with horizontal drilling and enhanced recovery methods. In 1992, we drilled our first horizontal well,completion methods and we have drilled over 1,800 horizontal wells since that time. We continue to be a leaderamong the industry leaders in the developmentuse of new drilling and completion technologies. Our trademarked ECO-PadWe continue to optimize drilling concept, which allows forand completion efficiencies through the use of multi-well pad drilling multiple wells from a single pad, is becoming a standard drilling approach in theour operating areas. Further, we are among industry because it improves land use and increases operating efficiencies. We started with drilling four wells per pad but have since begun drilling as many as 14 wells on a pad site. We are also on the leading edge ofleaders in extending lateral drilling lengths, in some instances uplengths. Results to three miles. In 2012, we completed the first multiple-unit spaced well drilled in Oklahoma, which had a horizontal section that was twice the length of previousdate indicate longer laterals in the area. Longer laterals are believed to have a positive impact on well productivity and economics. Additionally, we are pioneering the explorationWe have also been among industry leaders in testing enhanced completion technologies involving various combinations of fluid types, proppant types and evaluationvolumes, and stimulation stage lengths to determine optimal methods for maximizing crude oil recoveries and rates of the lower layers or “benches” of the Three Forks formationreturn. We continually refine our drilling and completion techniques in the Bakken field, initially targeting the first bench of the Three Forks in mid-2008 followed by the successful completion ofan effort to deliver improved results across our first well in the second bench in October 2011. In 2012, we successfully completed the first well ever drilled in the third bench of the Three Forks, the discovery of which may lead to an increase in recoverable reserves for the Company and the Bakken field as a whole.properties.2012,2015, we operated properties comprising 84%87% of our total proved reserves and 83% of our PV-10. By controlling a significant portion of our operations, we are able to more effectively manage the cost and timing of exploration and development of our properties, including the drilling and fracture stimulationcompletion methods used.crude oil and natural gas industry. Our Chief Executive Officer, Harold G. Hamm, began his career in the crude oil and natural gas industry in 1967. Our 9 senior officers have an average of 2934 years of crude oil and natural gas industry experience.Strong Financial Position and Liquidity. We have a revolving credit facility with lender commitments totaling $1.5$2.75 billion and a borrowing base of $3.25 billion as of February 15, 2013, with available borrowing capacity of $655.2 million at that date after considering outstanding borrowings and letters of credit. While our current commitments total $1.5 billion, we have the ability to increase the aggregate commitment levelwhich may be increased up to the lessera total of $2.5$4.0 billion or the borrowing base then in effectupon agreement with participating lenders to provide additional available liquidity if needed to maintain our growth strategy, take advantage of business opportunities and fund our capital program.program and commitments. We believehad approximately $1.9 billion of available borrowing capacity under our planned explorationcredit facility at February 19, 2016 after considering outstanding borrowings and development activitiesletters of credit. We have no near-term debt maturities, with our earliest maturity being a $500 million term loan due in November 2018.be funded substantially fromhowever, trigger increases in our operating cash flowscredit facility's interest rates and borrowingscommitment fees paid on unused borrowing availability under certain circumstances.facility. Our 2013 capital expenditures budget has been established based on our current expectationfacility and refinanced a portion of available cash flows from operations and availability under our revolving credit facility. Should expected available cash flows from operations materially differ from expectations, we believe our credit facility has sufficient availabilityborrowings to fund any deficit or that we can reducean unsecured three-year term loan with a lower interest rate. These transactions enhanced our capital expenditures to be in line with cash flows from operations.TheIn connection with the estimation of proved reserves, the term “reasonable certainty” implies a high degree of confidence that the quantities of crude oil and/or natural gas actually recovered will equal or exceed the estimate. To achieve reasonable certainty, our internal reserve engineers and Ryder Scott Company, L.P (“Ryder Scott”), our independent reserve engineers, employed technologies that have been demonstrated to yield results with consistency and repeatability. The technologies and economic data used in the estimation of our proved reserves include, but are not limited to, well logs, geologic maps including isopach and structure maps, analogy and statistical analysis, and available downhole and production data, seismic data and well test data.tables settable sets forth our estimated proved crude oil and natural gas reserves and PV-10 by reserve category as of December 31, 2012.2015. The total Standardized Measure of discounted cash flows as of December 31, 20122015 is also presented. Our reserve estimates as of December 31, 2015 are based primarily on a reserve report prepared by Ryder Scott. In preparing its report, Ryder Scott evaluated properties representing approximately 99% of our PV-10, 99% of our proved crude oil reserves, and 96%97% of our proved natural gas reserves as of December 31, 2012, and our2015. Our internal technical staff evaluated the remaining properties. A copy of Ryder Scott’s summary report is included as an exhibit to this Annual Report on Form 10-K. PV-10Standardized Measure at December 31, 20122015 were determined using the 12-month unweighted arithmetic average of the first-day-of-the-month commodity prices for the period of January 20122015 through December 2012,2015, without giving effect to derivative transactions, and were held constant throughout the lives of the properties. These prices were $94.71$50.28 per Bbl for crude oil and $2.76$2.58 per MMBtu for natural gas ($86.5641.63 per Bbl for crude oil and $4.31$2.35 per Mcf for natural gas adjusted for location and quality differentials). Crude Oil

(MBbls) Natural Gas

(MMcf) Total

(MBoe) PV-10 (1)

(in millions) 220,392 531,776 309,021 $ 7,710.0 6,478 13,723 8,765 227.8 334,293 795,585 466,891 5,371.1 561,163 1,341,084 784,677 $ 13,308.9 $ 11,180.4 Crude Oil

(MBbls) Natural Gas

(MMcf) Total

(MBoe) PV-10 (1)

(in millions)Proved developed producing 324,631 1,178,434 521,037 $ 5,678.6 Proved developed non-producing 2,167 11,909 4,151 29.0 Proved undeveloped 373,716 1,961,443 700,623 2,278.4 Total proved reserves 700,514 3,151,786 1,225,811 $ 7,986.0 Standardized Measure (1) $ 6,476.3 (1) PV-10 is a non-GAAP financial measure and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. Standardized Measure at December 31, 2012 is $11.2 billion, a $2.1 billion difference from PV-10 becauserevenues of the income tax effect.approximately $1.5 billion. Neither PV-10 nor Standardized Measure represents an estimate of the fair market value of our crude oil and natural gas properties. We and others in the crude oil and natural gas industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies without regard to the specific income tax characteristics of such entities.2012. Proved Developed Proved Undeveloped Crude

Oil

(MBbls) Natural

Gas

(MMcf) Total

(MBoe) Crude

Oil

(MBbls) Natural

Gas

(MMcf) Total

(MBoe) 124,880 189,054 156,389 298,333 377,782 361,297 20,931 25,248 25,139 17,082 21,970 20,744 52,694 15,488 55,275 533 — 533 19,094 355 19,153 3,292 — 3,292 867 12,083 2,881 59 1,245 266 4,594 84,631 18,698 11,922 193,638 44,195 1,806 117,206 21,340 1,844 130,219 23,548 44 66,881 11,192 25 64,951 10,850 1,960 34,553 7,719 1,203 5,780 2,166 226,870 545,499 317,786 334,293 795,585 466,891 Reserves at December 31, 2010, 2011 and 2012 were computed using the 12-month unweighted average of the first-day-of-the-month commodity prices as required by SEC rules. Changes2015. Proved Developed Proved Undeveloped Crude Oil

(MBbls) Natural Gas

(MMcf) Total

(MBoe) Crude Oil

(MBbls) Natural Gas

(MMcf) Total

(MBoe)North Region: Bakken field North Dakota Bakken 211,358 366,248 272,399 269,994 454,819 345,797 Montana Bakken 26,744 31,323 31,964 11,250 9,732 12,872 Red River units Cedar Hills 41,628 4,967 42,456 — — — Other Red River units 5,039 3,386 5,603 — — — Other 253 12,109 2,271 — — — South Region: SCOOP 37,516 575,754 133,475 73,442 1,233,778 279,072 Northwest Cana/STACK 2,736 109,999 21,070 19,030 263,114 62,882 Arkoma Woodford 11 59,404 9,912 — — — Other 1,513 27,153 6,038 — — — Total 326,798 1,190,343 525,188 373,716 1,961,443 700,623 were as follows for the periods indicated: Year Ended December 31, 2012 2011 2010 508,438 364,712 257,293 4,149 2,237 27,629 233,652 161,981 95,233 (35,716 ) (22,581 ) (15,811 ) (7,838 ) — — 81,992 2,089 368 784,677 508,438 364,712 Year Ended December 31, MBoe 2015 2014 2013 Proved reserves at beginning of year 1,351,091 1,084,125 784,677 Revisions of previous estimates (297,198 ) (107,949 ) (96,054 ) Extensions, discoveries and other additions 253,173 440,621 444,654 Production (80,926 ) (63,579 ) (49,610 ) Sales of minerals in place (329 ) (3,227 ) — Purchases of minerals in place — 1,100 458 Proved reserves at end of year 1,225,811 1,351,091 1,084,125 Revisions. Revisions of previous estimates. Revisions represent changes in previous reserve estimates, either upward or downward, resulting from new information normally obtained from development drilling and production history or resulting from a change in economic factors, such as commodity prices, operating costs, or development costs. Revisionsyear ended December 31, 201012-month average price for natural gas decreased 41% from $4.35 per MMBtu for 2014 to $2.58 per MMBtu for 2015. These decreases shortened the economic lives of certain producing properties and caused certain exploration and development projects to become uneconomic which had an adverse impact on our proved reserve estimates, resulting in downward reserve revisions of 185 MMBo and 391 Bcf (totaling 251 MMBoe) in 2015. We may experience additional downward reserve revisions as a result of prices in 2016 if the currently depressed price environment for crude oil and natural gas persists or worsens.duefirst booked. One factor leading to better thanthe removal is an increased emphasis on multi-well pad drilling in the Bakken, which resulted in the removal of PUDs in certain areas in favor of PUDs more likely to be developed with pad drilling where operating efficiencies may be realized. Further, in the SCOOP play we removed certain PUD locations originally planned to be developed with standard lateral drilling lengths in favor of PUDs to be developed with extended length laterals in similar locations. Longer laterals are believed to have a positive impact on well productivity and economics. The combination of these and other factors resulted inhigher average125 Bcf of upward revisions to natural gas proved reserves (netting to 42 MMBoe of downward revisions) in 2015.throughout 2010 compared to 2009.(1)(i) extension of the proved acreage of previously discovered reservoirs through additional drilling in periods subsequent to discovery and (2)(ii) discovery of new fields with proved reserves or of new reservoirs of proved reserves in old fields. Extensions, discoveries and other additions for each of the three years reflected in the table above were primarily due to increases in proved reserves associated with our successful drilling activity and strong production growth in the Bakken field and SCOOP play. Proved reserve additions from our drilling activities in North Dakota. In 2012, we continued to make significant headwaythe Bakken totaled 96 MMBoe, 222 MMBoe and 276 MMBoe for 2015, 2014 and 2013, respectively, while reserve additions in developingSCOOP totaled 93 MMBoe, 208 MMBoe and expanding158 MMBoe for 2015, 2014 and 2013, respectively. Additionally, extensions and discoveries in 2015 were significantly impacted by successful drilling results in the Northwest Cana/STACK area, resulting in proved reserve additions of 57 MMBoe in 2015. See the subsequent section titled Summary of Crude Oil and Natural Gas Properties and Projects for a discussion of our North Dakota Bakken assets, both laterally and vertically, throughstrategic exploration, planning and technology.2015 drilling activities. We expect a significant portion of future reserve additions will come from our major development projects in the Bakken, SCOOP, and Northwest Cana plays.that resultresulting from the disposition of properties during a period. During the year ended December 31, 2012, we disposed of certain non-strategic properties in Oklahoma, Wyoming, and our East region in an effort to redeploy capital to our strategic areas that we believe will deliver higher future growth potential. SeePart II, Item 8. Notes to Consolidated Financial Statements—Note 13.14. Property Acquisitions and Dispositions for further discussion of our 2012notable dispositions. We may continue to seek opportunities to sell non-strategic properties if and when we have the ability to dispose of such assets at favorable terms.that resultresulting from the acquisition of properties during a period. Purchases for the year ended December 31, 2012 primarily reflect the Company’s acquisition of propertiesWe have had no significant mineral purchases in the Bakken play of North Dakota during the year. SeePart II, Item 8. Notes to Consolidated Financial Statements—Note 13. Property Acquisitions and Dispositions andNote 14. Property Transaction with Related Party for further discussion of our 2012 acquisitions. Wepast three years. However, we may continue to participate as a buyer of properties when and if we have the ability to increase our position in strategic plays at favorable terms. Crude Oil

(MBbls) Natural Gas

(MMcf) Total

(MBoe)Proved undeveloped reserves at December 31, 2014 524,223 1,946,335 848,612 Revisions of previous estimates (216,289 ) (315,390 ) (268,855 ) Extensions and discoveries 111,058 546,854 202,201 Sales of minerals in place (63 ) (80 ) (76 ) Purchases of minerals in place — — — Conversion to proved developed reserves (45,213 ) (216,276 ) (81,259 ) Proved undeveloped reserves at December 31, 2015 373,716 1,961,443 700,623 . 96%97% of our proved natural gas reserves as of December 31, 20122015 included in this Annual Report on Form 10-K. The Ryder Scott technical personnel responsible for preparing the reserve estimates presented herein meet the requirements regarding qualifications, independence, objectivity and confidentiality set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers. Refer to Exhibit 99 included with this Annual Report on Form 10-K for further discussion of the qualifications of Ryder Scott personnel.reservesreserve estimates. While we have no formal committee specifically designated to review reserves reporting and the reserves estimation process, a copy of the Ryder ScottProved reserve reportinformation is reviewed by our Audit Committee with representatives of Ryder Scott and by our internal technical staff before the information is filed with the SEC on Form 10-K. Additionally, certain members of our senior management review andquarterlysemi-annual basis review any internally estimated significant changes to our proved reserves.Resource DevelopmentCorporate Reserves is the technical person primarily responsible for overseeing the preparation of our reserve estimates. He has a Bachelor of Science degree in Petroleum Engineering, an MBA in Finance and 2731 years of industry experience with positions of increasing responsibility in operations, acquisitions, engineering and evaluations. He has worked in the area of reserves and reservoir engineering most of his career and is a member of the Society of Petroleum Engineers. The Vice President—Resource DevelopmentCorporate Reserves reports directly to our Senior Vice President—OperationsPresident and Resource Development.Chief Operating Officer. The reserve estimates are reviewed and approved by the President and Chief Operating Officer and certain other members of senior management.Undeveloped Reserves. Reserve and PV-10 Sensitivitiesundeveloped reserves at December 31, 2012reserve and PV-10 estimates were 466,891 MBoe, consistingprepared using 2015 average prices of 334,293 MBbls of$50.28 per Bbl for crude oil and 795,585 MMcf of$2.58 per MMBtu for natural gas. In 2012, we developed approximately 17%Commodity prices existing in February 2016 are lower than the 2015 average prices. If commodity prices do not increase from current levels, our future calculations of ourestimated proved undeveloped reserves booked as of December 31, 2011 through the drilling of 231 gross (127.9 net) development wells at an aggregate capital cost of approximately $892 million. Also in2012, we removed 202 gross (90.0 net) PUD locations,and PV-10 will be based on lower prices which resultedcould result in the removal of 3.5 MMBo and 183.8 Bcf (34.2 MMBoe) ofthen uneconomic reserves from our proved undeveloped reserves. These removals were predominantly due to our decision to declassify 100.4 Bcf (16.7 MMBoe) of proved undeveloped reserves in future periods.Arkoma Woodford district, which consists primarily of dryestimated proved reserves and PV-10 at December 31, 2015 under different pricing scenarios for crude oil and natural gas. For similar reasons, we removed 1.4 MMBoIn these sensitivities, all factors other than the commodity price assumption have been held constant for each well. These sensitivities are only meant to demonstrate the impact that changing commodity prices may have on estimated proved reserves and 73.3 Bcf (13.6 MMBoe) ofPV-10 and there is no assurance these outcomes will be realized.undeveloped reserves in our Northwest Cana district. Given current and projected prices forPV-10 under various crude oil price scenarios, with natural gas we elected to defer drillingprices being held constant at the 2015 average price of $2.58 per MMBtu.

as a result declassified these proved undeveloped reserves accordingly. Estimated future development costs relating toPV-10 under various natural gas price scenarios, with crude oil prices being held constant at the development2015 average price of proved undeveloped reserves are projected to be approximately $1.8 billion in 2013, $2.2 billion in 2014, $2.0 billion in 2015, $1.4 billion in 2016, and $0.9 billion in 2017.Since our entry into the Bakken field, we have acquired a substantial leasehold position. Our drilling programs to date have focused on proving our undeveloped leasehold acreage through strategic exploratory drilling, thereby increasing the amount of leasehold acreage in the secondary term of the lease with no further drilling obligations (i.e., categorized as held by production) and resulting in a reduced amount of leasehold acreage in the primary term of the lease with drilling obligations. While we will continue to drill strategic exploratory wells and build on our current leasehold position, we expect to increase our focus on developing our PUD locations. While full development of our current PUD inventory is expected to occur within five years, we believe additional PUD locations will be generated through drilling activities.

2012: Developed Acres Undeveloped Acres Total Gross Net Gross Net Gross Net 758,998 473,068 619,786 393,899 1,378,784 866,967 127,276 107,053 219,029 165,783 346,305 272,836 150,450 135,483 — — 150,450 135,483 11,271 7,726 183,985 103,585 195,256 111,311 22,427 8,491 191,916 104,741 214,343 113,232 33,023 21,995 379,793 196,172 412,816 218,167 115,742 71,539 156,001 106,893 271,743 178,432 107,402 26,291 12,064 5,302 119,466 31,593 96,803 45,896 115,169 80,197 211,972 126,093 — — 210,742 190,474 210,742 190,474 1,423,392 897,542 2,088,485 1,347,046 3,511,877 2,244,588 Developed acres Undeveloped acres Total Gross Net Gross Net Gross Net North Region: Bakken field North Dakota Bakken 1,053,294 595,396 318,341 205,227 1,371,635 800,623 Montana Bakken 188,424 148,764 154,017 96,049 342,441 244,813 Red River units 158,700 138,716 43,082 26,407 201,782 165,123 Other 17,957 5,731 246,076 202,615 264,033 208,346 South Region: SCOOP 192,863 115,513 578,470 324,307 771,333 439,820 Northwest Cana/STACK (1) 129,163 79,762 138,537 75,459 267,700 155,221 Arkoma Woodford 110,560 26,240 3,388 173 113,948 26,413 Other 80,796 44,281 112,280 60,626 193,076 104,907 East Region — — 224,142 204,012 224,142 204,012 Total 1,931,757 1,154,403 1,818,333 1,194,875 3,750,090 2,349,278 2012 that are expected2015 scheduled to expire over the next three years by region unless production is established within the spacing units covering the acreage prior to the expiration dates: 2013 2014 2015 Gross Net Gross Net Gross Net 245,602 114,101 116,545 63,992 108,842 71,683 71,494 45,749 72,244 59,083 39,654 33,964 — — — — — — 46,283 27,253 16,740 10,823 100,981 52,531 57,785 37,423 5,740 3,253 14,120 8,981 63,855 33,816 118,772 67,201 76,917 44,602 93,126 60,844 28,395 20,987 11,917 8,697 7,762 4,763 270 121 — — 5,101 3,604 2,198 1,294 71,123 49,265 41,196 32,446 9,704 7,543 14,188 9,763 632,204 359,999 370,608 234,297 437,742 279,486 2016 2017 2018 Gross Net Gross Net Gross Net North Region: Bakken field North Dakota Bakken 158,625 92,105 76,643 53,665 25,417 17,474 Montana Bakken 71,649 43,457 52,822 34,576 14,436 9,567 Red River units 13,800 10,190 5,319 3,227 4,931 3,444 Other 13,103 5,879 639 256 17,225 17,129 South Region: SCOOP 207,054 110,529 172,890 104,626 47,703 37,209 Northwest Cana/STACK 36,069 23,657 29,196 15,202 44,087 25,819 Arkoma Woodford — — — — — — Other 48,716 30,052 40,946 19,198 3,834 1,702 East Region 4,688 4,319 60,795 52,840 45 134 Total 553,704 320,188 439,250 283,590 157,678 112,478 2012,2015, we drilled and completed exploratory and development wells as set forth in the table below: 2012 2011 2010 Gross Net Gross Net Gross Net 76 37.0 50 23.4 42 11.8 78 43.8 109 45.9 25 10.9 1 1.0 2 1.3 4 2.2 155 81.8 161 70.6 71 24.9 561 211.3 380 126.1 231 91.5 5 2.4 17 1.6 44 5.2 3 1.1 5 0.6 3 1.0 569 214.8 402 128.3 278 97.7 724 296.6 563 198.9 349 122.6 2015 2014 2013 Gross Net Gross Net Gross Net Exploratory wells: Crude oil 28 19.8 94 70.5 75 51.5 Natural gas 19 1.4 42 8.3 40 23.7 Dry holes 1 1.0 3 1.6 3 2.1 Total exploratory wells 48 22.2 139 80.4 118 77.3 Development wells: Crude oil 707 215.5 897 290.3 734 250.9 Natural gas 142 32.8 64 16.8 26 5.4 Dry holes — — 1 1.0 — — Total development wells 849 248.3 962 308.1 760 256.3 Total wells 897 270.5 1,101 388.5 878 333.6 2012,2015, there were 323417 gross (122.4(178 net) operated and non-operated wells that have been spud and are in the process of drilling, completing or waiting on completion.AsFor 2016, we plan to operate an average of February 15, 2013, we operated 28approximately 19 drilling rigs on our properties.for the year. Our rig activity during 2013for 2016 will depend on potential drilling efficiency gains and crude oil and natural gas prices and potential drilling efficiency gains and, accordingly, our rig count may increase or decrease from currentplanned levels. There canAs a result of the significant decrease in commodity prices, the number of providers of materials and services has decreased in the regions where we operate. As a result, the likelihood of experiencing shortages of materials and services may be no assurance, however, that additional rigs will be available to us at an attractive cost.increased in connection with any period of commodity price recovery. SeePart I, Item 1A. Risk Factors—The unavailability or high cost of additional drilling rigs, equipment, supplies, personnel and oilfield services could adversely affect our ability to execute our exploration and development plans within budget and on a timely basis.Throughoutdiscussreview our budgeted number of wells and capital expenditures for 2013. Although we cannot provide any assurance, we believe2016 in our key operating areas. Our 2016 capital budget is reflective of the depressed commodity price environment and has been established based on an expectation of available cash flows. If cash flows from operations, remaining cash balance, andare materially impacted by a further decline in commodity prices, we have the ability to reduce our capital expenditures or utilize the availability of our revolving credit facility includingif needed to fund our ability to increase our borrowing capacity thereunder, will be sufficient to satisfy our 2013 capital budget. We may choose to access the capital markets for additional financing to take advantage of business opportunities that may arise if such financing can be arranged at favorable terms. The actual amount and timing of our capital expenditures may differ materially from our estimates as a result of, among other things, availableoperations. Conversely, higher cash flows unbudgeted acquisitions, actual drilling results, the availability of drilling rigs and other services and equipment, and regulatory, technological and competitive developments. Further, a decline in commodity prices could cause us to curtail our actual capital expenditures. Conversely,resulting from an increase in commodity prices could result in increased capital expenditures.As referred to throughout this report, a “play” is a term applied to a portion of the explorationproduction cycle following the identification2016 budgeted capital expenditures by geologists and geophysicists of areas with potential crude oil and natural gas reserves. “Conventional plays” are areas believed to be capable of producing crude oil and natural gas occurring in discrete accumulations in structural and stratigraphic traps. “Unconventional plays” are areas believed to be capable of producing crude oil and natural gas occurring in accumulations that are regionally extensive, but require recently developed technologies to achieve profitability. Unconventional plays tend to have low permeability and may be closely associated with source rock as is the case with oil and gas shale, tight oil and gas sands and coalbed methane. Our operations in unconventional plays include operations in the Bakken and Woodford plays and the Red River units. Our operations within conventional plays include operations in the Lodgepole of North Dakota, Morrow-Springer of western Oklahoma and Frio in south Texas. In general, unconventional plays require the application of more advanced technology and higher drilling and completion costs to produce relative to conventional plays. These technologies can include hydraulic fracturing treatments, horizontal wellbores, multilateral wellbores, or some other technique or combination of techniques to expose more of the reservoir to the wellbore.References throughout this report to “3D seismic” refer to seismic surveys of areas by means of an instrument which records the travel time of vibrations sent through the earth and the interpretation thereof. By recording the time interval between the source of the shock wave and the reflected or refracted shock waves from various formations, geophysicists are better able to define the underground configurations. “3D defined locations” are those locations that have been subjected to 3D seismic testing. We typically use 3D seismic testing to evaluate reservoir presence and/or continuity. We do not typically evaluate reservoir productivity using 3D seismic technology. 2016 Plan Gross wells

planned for

completion (1) Net wells

planned for

completion (1) Capital

expenditures