| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Delaware | 20-0484934 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 333 North Canyons Parkway, Livermore, CA | 94551 | |

| (Address of principal executive offices) | (Zip Code) | |

Title of each class: | Name of each exchange on which registered: | |

| Common Stock, par value $.0001 per share | NASDAQ Global Select Market | |

| Large accelerated filer | ¨ | Accelerated filer | ||||

| Non-accelerated filer | Smaller reporting company | ¨ | ||||

The number

registrant’s common stock were outstanding.

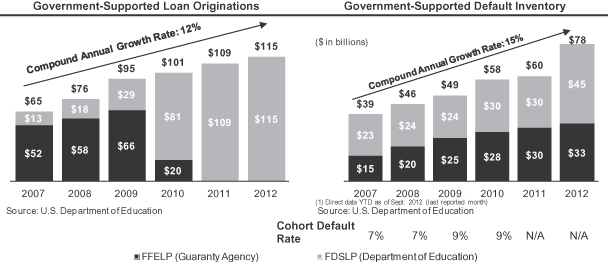

our opportunities and expectations for growth in the student lending, healthcare and other markets; anticipated trends and challenges in our business and competition in the markets in which we operate; our client relationships and future growth opportunities; the adaptability of our technology platform to new markets and processes; our ability to invest in and utilize our data and analytics capabilities to expand our capabilities; our growth strategy of expanding in our existing markets and considering strategic alliances or acquisitions; our ability to meet our liquidity and working capital needs; maintaining, protecting and enhancing our intellectual property; our expectations regarding future expenses; expected future financial performance; and our ability to comply with and adapt to industry regulations and compliance demands. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Corporation. Our website address is www.performantcorp.com. 29 Guaranty Agencies, or "GAs". 2023. FS. recovery outsourcing models. We refer to the patented technology that supports our proprietary workflows as “Smart Bins.” Smart Bins disaggregate otherwise complex recovery processes into a series of simple, efficient and consistent steps that are easily configurable and applicable to different types of recovery-related applications. Our workflow processes integrate a broad range of functions that encompass each stage of a recovery process. Recovery Services private healthcare clients • We use our enhanced data analytics capabilities, which we refer to as Performant Insight, to offer a variety of services from post- and pre-payment audit of healthcare claims to detection of fraud, waste and abuse of healthcare claims, to coordination of benefits and pharmacy fraud detection influenced by our performance under our contracts and our ability to recover funds from defaulted student loans, as measured against the performance of competitors who may service a similar pool of defaulted loans for the same client. To the extent we perform well under our existing contracts and differentiate our services from those of our competitors, we may receive a relatively greater number of student loan placements under these contracts and may improve our ability to obtain future contracts from these clients and other potential clients. services with these initial private healthcare clients, but also gain entry into other related private healthcare opportunities. entirely contingency-based, and our fee for a particular recovery depends on the type of recovery facilitated. We also receive incremental performance incentives based upon our performance as compared to other contractors with the Department of Education, which are comprised of additional inventory allocation volumes and incentive fees. To participate in the Department of Education contracts, firms must follow a highly competitive selection process. For the latest Department of Education contract, the fourth major contract the Department of Education has outsourced to selected vendors, we were selected as one of 17 unrestricted vendors and initiated work on this contract in the fourth quarter of 2009. Our current contract with the Department of Education will expire in April 2015. We are currently subject to a competitive rebidding process for the next contract with the Department of Education. We understand that five other recovery service providers under the current contract have recently received notice from the Department of Education stating an intention to extend their existing contracts past April 2015. To date, we have not received notice of any such extension from the Department of Education, and we are unsure whether we will be provided any such extension of our current contract or when the new contracts will be awarded. We do not believe the Department of Education has completed the current contract extension process. However, due to the timing of the rehabilitation process for loans placed with us by the Department of Education, we expect there will be a minimal impact on our revenues in 2015 if we do not receive an extension of our current contract. Despite notice of their intent to extend the current contract for five recovery service providers, we believe the Department of Education is not permitted to selectively extend the contract for individual recovery service providers. Because all federally-supported student loans are being originated by the Department of Education as a result of SAFRA, our relationship with the Department of Education will become increasingly more important over time. The Department of Education was responsible for approximately 2014. recovery firms must follow in communicating with consumer debtors, including the time, place and manner of such communications. Further, it prohibits harassment or abuse by debt recovery firms, including the threat of violence or criminal prosecution, obscene language or repeated telephone calls made with the intent to abuse or harass. The FDCPA also places restrictions on communications with individuals other than consumer debtors in connection with the collection of any consumer debt and sets forth specific procedures to be followed when communicating with such third parties for purposes of obtaining location information about the consumer. In addition, the FDCPA contains various notice and disclosure requirements and prohibits unfair or misleading representations by debt recovery firms. Finally, the FDCPA imposes certain limitations on lawsuits to collect debts against consumers. Insight. results in the event we are successful in obtaining a second RAC contract, depending on a variety of factors including, among other things, CMS’s evaluation of provider compliance with the new rules, the rules ultimately adopted by CMS with respect to medical necessity reviews of Medicare reimbursement claims associated with short stay inpatient admissions and, more generally, the scope of improper claims that CMS allows us to pursue and our ability to successfully identify improper claims within the permitted scope. In connection with the award of the new RAC contract, CMS has indicated that it is reviewing certain aspects of the RAC contract including the amount of medical records that RAC vendors may request and the timeframes for review and communications between RAC vendors and providers. of typically several firms engaged to provide recovery services to a particular client and, if we are successful in being engaged, we then face continuing competition from the client’s other retained firms based on the client’s benchmarking of the recovery rates of its several vendors. Some of our current and potential competitors in the markets in which we operate may have greater financial, marketing, technological or other resources than we do. The ability of any of our competitors and potential competitors to adopt new and effective technology to better serve our markets may allow them to gain market strength. Increasing levels of competition in the future may result in lower recovery fees, lower volumes of contracted recovery services or higher costs for resources. Any inability to compete effectively in the markets that we serve could adversely affect our business, financial condition and results of operations. changed the structure of the government-supported student loan market by assigning responsibility for all new government-supported student loan originations to the Department of Education, rather than originations by private institutions and backed by one of the amount of defaulted student loans and other receivables that our clients place with us for recovery; the timing of placements of student loans and other receivables which are entirely in the discretion of our clients; the loss or gain of significant clients or changes in the contingency fee rates or other significant terms of our business arrangements with our significant clients; technological and operational issues that may affect our clients and regulatory changes in the markets we service; and general industry and macroeconomic conditions. operations. current or potential clients and adversely impact our financial condition and results of operations. While we have backup systems in many of our operating facilities, an extended outage of utility or network services may harm our ability to operate our business. Further, the situations we plan for and the amount of insurance coverage we maintain for losses as result of failures of our operating systems and infrastructure may not be adequate in any particular case. FCRA and other federal and state regulations that affect our student loan recovery business may result in significant costs, including litigation costs. We may also become subject to regulations promulgated by the United States Consumer Financial Protection Bureau, or CFPB, which was established in July 2011 as part of the Dodd-Frank Act to, among other things, establish regulations regarding consumer financial protection laws. business practices or pay substantial damages or settlement costs as a result of litigation proceedings, which could adversely affect our business operations and results of operations. Moreover, any acquisition may result in a potentially dilutive issuance of equity securities, the incurrence of additional debt and amortization of expenses related to intangible assets, all of which could adversely affect our results of operations and stock price. The price of our common stock could be volatile, and you may not be able to sell your shares at or above the public offering price. mergers and other business combination transactions, including proposed transactions that would result in our stockholders receiving a premium price for their shares; other acquisitions or dispositions of businesses or assets; incurrence of indebtedness and the issuance of equity securities; repurchase of stock and payment of dividends; and the issuance of shares to management under our equity incentive plans. Page ITEM 1.1 ITEM 1A.18ITEM 1B.31ITEM 2.32ITEM 3.32ITEM 4.32ITEM 5. 323334505151 ITEM 9A.51 ITEM 9B.52ITEM 10. 52525252 52 52factsfact contained in this Annual Report on Form 10-K, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short-term and long-term business operations and objectives, and financial needs. Forward-looking statements include, but are not limited to, statements about:We note thatThere are a variety of factors could cause actual results and experience to differ materially from the anticipated results or expectations expressed in our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements are also subject to risks and uncertainties that could cause actual results to differ materially from those expected. These risks and uncertainties include, but are not limited to, those risks discussed in Item 1A of this report.reports filed with the Securities and Exchange Commission.ITEM 1. Business2012,2014, we provided recovery services on approximately $8.2$9.9 billion of combined student loans and other delinquent federal and state receivables and recovered approximately $482$244 million in improper Medicare payments. Our clients include 1113 of the 3130 public sector participants in the student loan industry and these relationships average more than 10 years in length, including a 22-year25-year relationship with the Department of Education. AccordingWe are currently subject to a competitive rebidding process for the next contract with the Department of Education, total government-supported student loan originations were estimated to be approximately $115 billion in 2012, and, asEducation. As of September 30, 2012,2014, approximately $78$100.5 billion of government-supported student loans were in default. In the healthcare market, we are currently one of four prime Medicare Recovery Audit Contractors, or RACs, in the United States for the Centers for Medicare and Medicaid Services, or CMS, and are currently$554$591.2 billion of claims in 2011,2013, of which approximately $43$44 billion were estimated to be improper payments.$150,000$130,000 of revenues per employee during 2012,2014, based on the average number of employees during the year.for our clients to recover, our business objectives are aligned with those of our clients and we are generally not reliant on their spending budgets. Further, our business model does not require significant capital expenditures and we do not purchase loans or obligations.We believe we benefit from a significant degree of revenue visibility due to reasonably predictable recovery outcomes in a substantial portion of our business. 2012,2014, we generated approximately $210.1$195.4 million in revenues, $23.0$9.4 million in net income, $69.6$44.7 million in adjusted EBITDA and $30.6$15.3 million in adjusted net income. See “Adjusted“Managements Discussion and Analysis of Financial Condition and Results of Operations - Adjusted EBITDA and Adjusted Net Income” in Item 7 below for a definition of adjusted EBITDA and adjusted net income and reconciliations of adjusted EBITDA and adjusted net income to net income determined in accordance with generally accepted accounting principles.Corporation in 2005.Student lending is a large and critically-important market in the United States. According to the Department of Education, total government-supported student loan originations were estimated to be approximately $115 billion in the year ended September 30, 2012, and the aggregate dollar amount of these loans has grown at a compound annual growth rate of 11% from 2002 through 2012. This growth has been supported by general demographic trends, increased enrollment, and rising costs of tuition and other expenses that increase the need for borrowed funds among students. In addition to strong underlying origination growth, the default rates among student loan borrowers have increased in recent years. The “cohort default rate,” which is the measure utilized by the Department of Education to track the percentage of government-supported loan borrowers that enter repayment in a certain year ended September 30 and default by the end of the next year ended September 30, has risen from approximately 5% in 2006 to approximately 9% in 2010, the last year for which data is available.31 GAs.$44.7$66.0 billion in the FDSLP and approximately $32.7$34.5 billion in the FFELP as of September 30, 2012.2014. These programs collectively guaranteed approximately $706$977 billion of federal government-supported student loans according to the Congressional Budget Office as of September 30, 2011.2013. Given the operational and logistical complexity involved in managing the recovery of defaulted student loans, the Department of Education and the GAs generally choose to outsource these services to third parties.The tables below show government-supported student loan originations and government-supported default inventory for the years ended 2007 through 2012 as reported by the Department of Education.

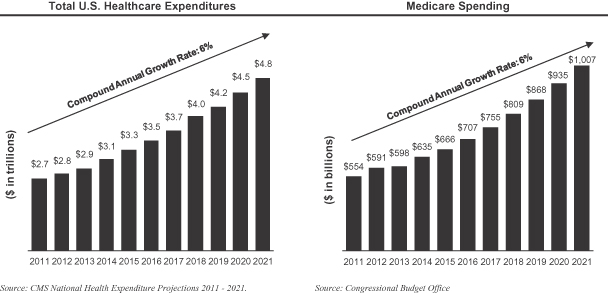

$2.7$2.9 trillion in 20112013 and is forecast to grow at a 6%5.7% compound annual growth rate through 2021.2023. In particular, CMS indicates that federal government-related healthcare spending for 20112013 totaled approximately $1.2$1.0 trillion. This federal government-related spending included approximately $554$591.2 billion for Medicare, which provides a range of healthcare coverage primarily to elderly and disabled Americans, and $408$431.1 billion for Medicaid, which provides federal matching funds for states to finance healthcare for individuals at or below the public assistance level.The tables below show total U.S. healthcare expenditures from 2011 through 2021 and total Medicare spending from 2011 through 2021 as estimated by CMS.

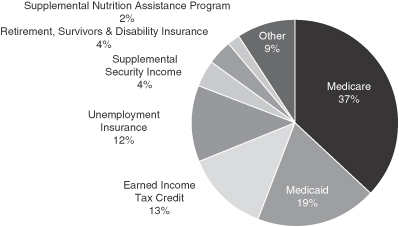

$554$591.2 billion of 2011 Medicare spending in 2013, the Department of Health and Human Services estimated that approximately $43$48 billion, or 8%approximately 8.6%, was improper, and that Medicare is the federal program with the largest amount of improper payments. Medicare improper payments generally involve incorrect coding, procedures performed which were not medically necessary, and incomplete documentation or claims submitted based on outdated fee schedules, among other issues. Likewise, Medicaid improper payments were estimated to be $22 billion, or 5%, of total Medicaid payments for 2011. The following table illustrates the proportion of improper payments among federal programs in the year ended September 30, 2011, according to the Office of Management and Budget.Top Federal Programs with Improper Payments in the Year Ended September 30, 2011

Total = $115 billion(1)Other includes National School Lunch, Pell Grant, and 67 additional programs.that have been paid to healthcare providers. The program was implemented by designating one prime contractor in each of the four major regions in the United States: West, Midwest, South, and Northeast.$1.5 trillion$961 billion in spending in 20112013 and private expenditures are projected to grow more than 5%5.7% annually through 2021.We believe that the demand for recovery of delinquent state taxes will grow asdeficits.deficits, many states have focused on recovery of delinquent state taxes. According to the Center on Budget and Policy Priorities, an independent think tank, 4331 U.S. states faced projected budget shortfalls totaling $107$55 billion in the year ended September 30, 2012, with at least 31 states anticipating deficits for fiscal year 2013. The economic recession hasbeginning in 2008 led to lower income and sales taxes from both individuals and corporations, reducing overall tax revenues and leading to large budget deficits at the state government level. While many states have received federal aid, most have cut services and increased taxes to help close the budget shortfall and have evaluated outsourcing at least some aspect of delinquent tax recovery.Service,Service), or FS, a bureau of the Department of the Treasury, or FMS.Treasury. Since 1996, the FMSFS has recovered more than $54$63 billion in delinquent federal and state debt. For the fiscal year ended September 30, 2011,2013, federal agency recoveries in this market totaled more than $6.2$7 billion,$700$13 million over 2010.2012. A significant portion of these collections are processed by private collection firms on behalf of the FMS.•Scalable and flexible technology-enabled services platform. We have built a proprietary technology platform that is highly flexible, intuitive and easy to use for our recovery and claims specialists. Our platform is easily configurable and deployable across multiple markets and processes. For example, we have successfully extended our platform from the student loan market to the state tax, federal treasury receivables and the healthcare recovery markets, each having its own industry complexities and specific regulations.•Advanced, technology-enabled workflow processes. Our technology-enabled workflow processes, developed over many years of operational experience in recovery services, disaggregate otherwise complex recovery processes into a series of simple, efficient and consistent steps that are easily configurable and applicable to different types of recovery-related applications. We believe our workflow software is highly intuitive and helps our recovery and claims specialists manage each step of the recovery process, while automating a series of otherwise manually-intensive and document-intensive steps in the recovery process. We believe our streamlined workflow technology drives higher efficiencies in our operations, as illustrated by our ability to generate in excess of $150,000 of revenues per employee during 2012, based on the average number of employees during the year. We believe our streamlined workflow technology also improves recovery results relative to more labor-intensive outsourcing models.•Enhanced data and analytics capabilities. Our data and analytics capabilities allow us to achieve strong recovery rates for our clients. We have collected recovery-related data for over two decades, which we combine with large volumes of client and third-party data to effectively analyze our clients’ delinquent or defaulted assets and improper payments. We have also developed a number of analytics tools that we use to score our clients’ recovery inventory, determine the optimal recovery process and allocation of resources, and achieve higher levels of recovery results for our clients. In addition, we utilize analytics tools to continuously measure and test our recovery workflow processes to drive refinements and further enhance the quality and effectiveness of our capabilities. Finally, through astrategic investment, we have acquired enhanced data analytics capabilities, which we refer to as Performant Insight. This investment allows us to expand our capabilities into several new areas including the detection of fraud, waste and abuse in various markets and has assisted in our recovery activities for CMS.•Long-standing client relationships. We believe our long-standing focus on achieving superior recovery performance for our clients and the significant value our clients derive from this focus have helped us achieve long-tenured client relationships, strong contract retention and better access to new clients and future growth opportunities. We have business relationships with 11 of the 31 public sector participants in the student loan market and these relationships average more than 10 years in length, including an approximate 22-year relationship with the Department of Education. In the healthcare market, we have a seven-year relationship with CMS and are currently one of only four prime Medicare RAC contractors.•Extensive domain expertise in complex and regulated markets. We have extensive experience and domain expertise in providing recovery services for government and private institutions that generally operate in complex and regulated markets. We have demonstrated our ability to develop domain expertise in new markets such as healthcare and state tax and federal Treasury receivables. We believe we have the necessary organizational experience to understand and adapt to evolving public policy and how it shapes the regulatory environment and objectives of our clients. We believe this helps us identify and anticipate growth opportunities. For example, we successfully identified government healthcare as a potential growth opportunity that has thus far led to the award of three contracts to us by CMS. Together with our flexible technology platform, we have the ability to adapt our business strategy, to allocate resources and to respond to changes in our regulatory environment to capitalize on new growth opportunities.•Proven and experienced management team. Our management team has significant industry experience and has demonstrated strong execution capabilities. Our senior management team, led by Lisa Im, has been with us for an average of approximately 10 years. This team has successfully grown our revenue base and service offerings beyond the original student loan market into healthcare and delinquent state tax and private financial institutions receivables. Our management team’s industry experience, combined with deep and specialized understanding of complex and highly regulated industries, has enabled us to maintain long-standing client relationships and strong financial results.•Expand our student loan recovery volume. According to the Department of Education, total government-supported student loan originations were estimated to be approximately $115 billion in 2012, and have grown at a 11% compound annual growth rate from 2002 through 2012. The balance of defaulted government-supported student loans was estimated to be approximately $78 billion as of September 30, 2012. While we have long-standing relationships with some of the largest participants in the government-supported student loan market, we believe there are significant opportunities within this growing market to increase the volume of student loans placed with us by existing and new clients. For example, under our contract with the Department of Education, we believe there is an opportunity to grow our placement volume through strong performance. Further, as a result of our relationships with five of the seven largest GAs, we believe we are well-positioned to benefit as a result of any consolidation of smaller GAs over the coming years.•Expand our recovery services in the healthcare market. According to CMS, Medicare spending totaled approximately $554 billion in 2011 and is expected to increase to $1 trillion in 2021, representing a compound annual growth rate of 6%. In the private healthcare market, spending totaled $1.5 trillion in 2011 and is expected to grow more than 6% annually through 2021, according to CMS’ National Health Expenditures Projections. As these large markets continue to grow, we expect the needfor recovery services to increase in the public and private healthcare markets. In the public healthcare space, we intend to utilize the experience gained through our contracts with CMS to pursue additional recovery opportunities in areas such as Medicare Secondary Payor Recovery and state Medicaid recovery. In addition, through our enhanced analytics capabilities, we intend to pursue opportunities to find and eliminate losses prior to payment for healthcare services including the detection of fraud, waste and abuse in the public and private healthcare markets.•Pursue strategic alliances and acquisitions. We intend to selectively consider opportunities to grow through strategic alliances or acquisitions that are complementary to our business. These opportunities may enhance our existing capability or enable us to enter new markets or provide new products or services, such as our licensing of new applied data modeling analytics capabilities that can be used to identify fraudulent or erroneous healthcare claims prior to payment. enhanced analytics capabilities will extend our potential markets, permitting us to pursue significant new business opportunities. We intend to accelerateFor example, we have expanded the use of our data analytics capabilities in the healthcare sector to

Student Loans Healthcare Other Markets • Analyze millions of Medicare Parts A for public and B claims as the prime contractor for recovery services for improper payments in the Northeast region of the United States and provide recovery and audit services for the Department of Education • Provide claims audit, pharmacy management and coordination of benefits functions for one of the nation’s largest health care organizations Our geographical region accounted for approximately 23% of all Medicare spending in 2009 according to CMS. Our relationship with CMS began in 2005 with an initial demonstration contract to recover improper payments for Medicare Secondary Payor claims.WeTo accelerate our abilityprovide Medicare auditappeal in which the appellate court recently remanded the case back to the lower court to rule on the merits of the case. There is a related injunction barring the award of three of the four new RAC contracts pending resolution of this litigation. A fifth RAC contract, which is a new type of RAC contract covering the identification and recovery services across our region following ourof improper claims for durable medical equipment, prosthetics, orthotics and supplies and home health and hospice claims, was not covered by the injunction and was awarded to another party in January 2015. The Company is not a party to this litigation. CMS has stated that the injunction will delay the award of the three contracts until the judge’s ruling on the injunction, which is not expected to occur until late summer 2015. It is uncertain whether CMS will award the RAC contract we outsource certain aspects of our healthcare recovery processnot covered by the injunction in the interim period or will wait to three different subcontractors. Two of these subcontractors provide a specific service to us in connection with our claims recovery process, and one subcontractor is engaged to provideaward all of the new RAC contracts at the same time. CMS also recently announced that it extended our existing RAC contract through December 31, 2015, along with a limited scope of procedures we will be allowed to conduct and a limited scope of claim types we will be permitted to pursue during this extended period. CMS has further indicated they may, at their discretion, approve additional issues that we will be permitted to review and audit during the RAC contract extension period.claims within a portion ofseveral national commercial health plans. Our audit and analytic capabilities have allowed us not only to expand our region. According to CMS, the geographic area allocated to this subcontractor represented approximately 17% of the total Medicare spending in our region in 2009.tennumerous state and municipal governments. Delinquent obligations are placed with us by our clients and we utilize a process that is similar to the student loan recovery process for recovering these obligations.a strategic investment, we acquired enhancedour data analytics capabilities, which we refer to as Performant Insight. Performant Insight, added new capabilities in data warehousing and data processing tools that accelerated our abilitywe are able to review, aggregate, and synthesize very large volumes of structured and unstructured data, at high speeds, from the initial intake of disparate data sources, to the warehousing of the data, to the analysis and reporting of the data. We believe we have built a differentiated, next-generation “end-to-end” data processing solution that will maximize value for current and future customers.enhanced analytics capabilities will extend our potential markets, permitting us to pursue significant new business opportunities. We intend to acceleratehave expanded the use of our data analytics capabilities in the healthcare sector to offer a variety of services from post and pre-payment audit of healthcare claims in both the public and private healthcare sector, to detection of fraud, waste and abuse of healthcare claims, to coordination of benefits and pharmacy fraud detection. For example, in February 2013, we announced a strategic relationship to offer recovery services to identify improper coding, billing and payments for the specialty pharmacy customers of Magellan Health Services Inc. (NASDAQ: MGLN).While our revenues from analytics services are limited to date, we believe these services represent a meaningful future opportunity. We currently offer analytics services to one of the largest national healthcare organizations where our analytics services provide real-time financial and operational cost analyses to help support a broad range of compliance and fiscal management functions across the organization, including claims audit, pharmacy management and coordination of benefits. In addition, we are developing strategies to deploy these services in markets other than healthcare.2224 years. We restructure and recover defaulted student loans distributed directly by the Department of Education as part of the FDSLP. Due to its limited resources and recovery capabilities, the Department of Education outsources much of its defaulted student loan portfolio to third-party vendors for recovery. Recovery fees are13.8%27.2% of our revenues for the year ended December 31, 2012.In addition, we were awarded a contract in January 2013 with the Department of Education to conduct a payment recapture of goods and services, which excludes grants and student loans, contracted for by the department. Under this contract, we identify, evaluate and report the causes for contract overpayments and provide recovery services to assist the Department of Education in recovering these improper payments.severala few years as there generally is a lag between originations and defaults of at least three to four years. When a borrower stops making regular payments on a FFELP loan, the GA is obligated to reimburse the lender approximately 97% of the loan’s principal and accrued interest. GAs then seek to recover and restructure these obligations. The GAs with which we contract generally structure one to1112 of the 3129 active GAs in the U.S., including Great Lakes Higher Education Guaranty Corporation and American Student Assistance Corporation, and American Education Services, each of which waswere responsible for 18.7%, 12.1%15.1% and 10.7%12.7%, respectively, of our revenues for the year ended December 31, 2012.2014. We have had relationships with some GA clients for over 25 years.seven-yearnine-year relationship with CMS. Under our RAC contract with CMS awarded in 2009, we identify and facilitate the recovery of improper PartsPart A and Part B Medicare payments in the Northeast region of the United States and whichStates. The RAC contract accounted for approximately 25.8%14.9% of our revenues for the year ended December 31, 2012.2014. We are currently subject to a competitive rebidding process for the next RAC contract with CMS. The fees that we receive for identifying these improper payments from CMS are entirely contingency-based, and the contingency-fee percentage depends on the methods of recovery, and, in some cases, the type of improper payment that we identify.1517 years in the recovery of delinquent receivables owed to a number of different federal agencies. The debt obligations we help to recover on behalf of the Department of the Treasury include commercial and individual debt obligations. We are one of the four firms servicing the current Department of the Treasury contract. Similar to our other recovery contracts, our fees under this contract are contingency-based. We view this as an important strategic relationship, as it provides us valuable insight into other business opportunities within the federal government.a Senior Vice President of Salesan appropriate sales and Marketing and a salesmarketing team covering various markets. new data analytics business, is supported by staff in Miami Lakes, Florida. We have designed our infrastructure for scalability and redundancy, which allows us to continue to operate in the event of an outage at either datacenter. We maintain an information systems environment with advanced network security intrusion detection and prevention with 24x7 monitoring and security incident response capabilities. We utilize encryption technologies to protect sensitive data on our systems, all data during transmission and all data on redundancy or backup media. We also maintain a comprehensive enterprise-wide information security system based upon recognized standards, including the NIST800 53 and ISO 27002 Code of Practice for Information Security Program Management, to uphold high security standards needed for the protection of sensitive information.issued a request for quotesis currently in connection with the re-biddingprocurement process for the next round of RAC contract in February 2013. Although our RAC contract is currently set to expire in 2014, CMS may terminate our RAC contract as early as August 2013 in connection with this re-bidding process.contracts. We expect that our competition will include the other three RAC service providers: Health Management Systems, Inc., Connolly Consulting, Inc. and CGI Group. We also may face competition from the subcontractors of the current prime RAC contractors, who may seek to use their experience as subcontractors to become prime contractors, and a variety of healthcare consulting and healthcare information services companies are potential competitors.companies. Some of these potential competitors for the secondnext RAC contract may have greater financial and other resources than we do. According to the request for quotes, the competitive factors for this new RAC contract are demonstrated experience in effective recovery services in the healthcare market, sufficient capacity to address claims volumes, maintenance of high standards of recovery practices,technical approach for identifying improper payments, key personnel and staffing, financial capability to perform under the RAC contract and recovery fee rates. We believe that our seven yeareight-year relationship with CMS and our related experience in providing recovery services to identify improper payments allows us to compete favorably with respect to many of these factors. We expect that our performance in identifying claims, managing the claims processes under the current RAC contract, and established systems integration with CMS and related Medicare administrative contractors will also be key factors in determining our continued service to CMS. an annually two table top disaster exercises, conduct routine security risk assessments and maintain a continuous improvement process as part of our security risk mitigation and management activity.ofor settlement of any such claims have not been significant.2012,2014, we havehad two U.S. patents, both covering aspects of the workflow management systems and methods incorporated into our technology-enabled services platform. These patents will expire in December 2019.September 2024. We routinely assess appropriate occasions for seeking additional patent protection for those aspects of our platform and other technologies that we believe may provide competitive advantages to our business. We also rely on certain unpatented proprietary expertise and other know-how, licensed and acquired third-party technologies, and continuous improvements and other developments of our various technologies, all intended to maintain our leadership position in the industry.2012,2014, we ownhad five trademarks registered with the U.S. Patent and Trademark office: Performant,DCS, Performant Recovery, Performant Technologies, Discovery Analytics, and Performant Business Services. We are in the process of registering additional trademarks supporting our business, and we claim common law trademark rights in numerous additional trademarks.2012,2014, we had approximately 1,5001,484 full-time employees. None of our employees is a member of a labor union and we consider our employee relations to be good. the Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, if any, or other filings filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, proxy and information statements. All reports that we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC, 20549. Information about the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.ITEM 1A.Risk Factorsfivefour largest clients represented 81%70% of our revenues for the year ended December 31, 2012,2014, and 75% of our revenues for the year ended December 31, 2013, and any termination of or deterioration in our relationship with any of these clients would result in a decline in our revenues.threetwo GAs. Revenues from our fivefour largest clients represented 81%70% of our revenues for the year ended December 31, 2012. We expect that our revenues will become increasingly concentrated with our major clients as a result of rising business volumes under our RAC contract, which accounted for approximately 25.8%2014 and 75% of our revenues in 2012, compared to approximately 13.2%for the year ended December 31, 2013. All of our revenues in 2011. Ifcontracts with these clients are subject to periodic renewal and re-bidding processes and if we lose one of these clients or if the terms of our relationships with any of these clients become less favorable to us, our revenues would decline, which would harm our business, financial condition and results of operations.subject to periodic renewal or re-bidding processes, are not exclusive and do not commit our clients to provide specified volumes of businessbusiness. In addition, the terms of these contracts may be changed unilaterally and ason short notice by our clients. As a consequence, there is no assurance that we will be able to maintain our revenues and operating results.loanloans and other receivables, which represented approximately 63.0%83% of our revenues in 2012,2014 and 74% of our revenues in the year ended December 31, 2013, enable our clients to unilaterally terminate their contractual relationship with us at any time without penalty, potentially leading to loss of business or renegotiation of terms. Our contracts generally are subject to a periodic rebidding process at the end of the contract term. Further, most of our contracts in these markets allow our clients to unilaterally change the volume of loans and other receivables that are placed with us or the payment terms at any given time. In addition, most of our contracts are not exclusive, with our clients retaining multiple service providers with whom we must compete for placements of loans or other obligations. Therefore, despite our contractual relationships with our clients, our contracts do not provide assurance that we will generate a minimum amount of revenues or that we will receive a specific volume of placements.loansloan and receivables clients, which include four of our five largest clients in 2012, do not renew their agreements with us upon contract expiration,2014 and 2013, reduce the volume of student loan placements provided to us, modify the terms of service, including the success fees we are able to earn upon recovery of defaulted student loans, or any of these clients establish more favorable relationships with our competitors. For example, we have been advised that our contractual arrangementin 2013 in connection with the Department of Education is under review as a result of the Department of Education’s decision to have its recovery vendors promote income-basedincome‑based repayment, or IBR, to defaulted student loans. The IBR program provides flexibility on the required monthly payment for student loan borrowers at an amount intended to be affordable based on a borrower’s income and family size. As a result of the increased application of the IBR program to defaulted student loans, we expect that there will be an increase in the number of loans that become eligible for rehabilitation because more defaulted student loan borrowers will be able to make qualifying payments. In connection with the implementation of the IBR program, we have been advised that the Department of Education will reduceunilaterally reduced the contingency fee rate that we will receive for rehabilitating student loans by approximately 18% effective March 1, 2013, although this change is still subject to further review and finalization by13%. Further, in October 2014, the Department of Education. Any changesEducation announced a change to a fixed fee of $1,710 payable for each loan that is rehabilitated in place of a recovery fee that historically had been based on a percentage of the balance of the rehabilitated loan.contingency fee percentagesnumber of appeals by healthcare providers to the third, or ALJ, level of appeal relating to claims we have audited, and there can be no assurance that our estimated liability for such appeals will be adequate.compensation termsclaims by the provider. Healthcare providers have the right to appeal a claim and may pursue additional levels of appeal if the initial appeal is found in favor of CMS. We accrue an estimated liability for appeals at the time revenue is recognized based on our estimate of the amount of revenue probable of being refunded to CMS following successful appeal based on historical data and other trends relating to such appeals. In addition, if our estimate of liability for appeals with respect to revenues recognized during a prior period changes, we increase or decrease the estimated liability reserve in the current period. Over the course of our existing RAC contract, healthcare providers have increased their pursuit of appeals beyond the first and second levels of appeal to the third level of appeal, where cases are heard by administrative law judges, or ALJs. In our experience, decisions at the third level of appeal are the least favorable as ALJs exercise greater discretion and there is less predictability in the ALJ decisions as compared to appeals at the first or second levels. The pursuit of third level appeals by healthcare providers has also resulted in a backlog of claims at that level of appeal. This increase of ALJ appeals and backlog of claims at the third level of appeal is the primary reason our total estimated liability for appeals (consisting of the estimated liability for appeals plus the contra-accounts-receivable estimated allowance for appeals) has grown from a balance of $5.6 million at December 31, 2012, to $16.4 million at December 31, 2013 to $18.6 million as of December 31, 2014. Our estimates for our appeal reserve are subject to uncertainties, and accordingly we may underestimate the number of successful appeals or the financial impact of successful appeals in a given year or period. To the extent that the amount of commissions that we are required to return to CMS as a result of successful appeals exceeds our estimated appeals reserve, our revenues in the applicable period will be reduced by the amount of such excess. If we underestimate the amount of commissions that are subject to successful appeal, our revenues in future periods could be adversely affected.future contractsin excess of the amount we have reserved for appeals, which could have a significantmaterial negative impact our financial position and liquidity.results.allconnection with obtaining, retaining and performing under our existing client contracts, including our contracts with the Department of the markets in which we operateEducation and CMS, and an inability to compete effectively in the future could harm our relationships with our clients, which would impact our ability to maintain our revenues and operating results.ThoseIn addition, those recovery vendors who produce the highest recovery rates from a client often will be allocated additional placements and in some cases additional success fees. Accordingly, maintaining high levels of recovery performance, and doing so in a cost-effective manner, are important factors in our ability to maintain and grow our revenues and net income and the failure to achieve these objectives could harm our business, financial condition and results of operations.Similarly, we faced a highly competitive bidding process to become one of the four prime RAC contractors that provide recovery services for improper Medicare payments. CMS issued a request for quotes in connection with the re-bidding for the RAC contract in February 2013. Although our RAC contract is currently set to expire in 2014, CMS may terminate our RAC contract as early as August 2013 in connection with the re-bidding process for new RAC contracts. We expect that this process will be competitive. The failure to retain this contract or a significant adverse change in the terms of this contract, which generated approximately 25.8% of our revenues in the year ended December 31, 2012, would seriously harm our ability to maintain or increase our revenues and operating results.2012,2014, revenues under contracts with the U.S. federal government accounted for approximately 42%46% of our total revenues, compared to 27%48% for the year ended December 31, 2011.2013. In addition, fees payable by the U.S. federal government are expected to become a larger percentage of our total revenues over the next several years as a result of legislation that has transferred responsibility for all new student loan origination to the Department of Education. The continuation and exercise of renewal options on existing government contracts and any new government contracts are, among other things, contingent upon the availability of adequate funding for the applicable federal government agency. Changes in federal government spending could directly affect our financial performance. Administration’s proposed budgeton December 26, 2013, reduced the compensation paid to GAs for the year ending September 30, 2013, included a proposal designedrehabilitation of student loans, effective July 1, 2014. This “revenue enhancement” measure reduced from 18.5% to redirect federal government spending to an alternative federal program by decreasing16.0% of the outstanding loan balance, the amount that GAs are compensatedcan charge borrowers when they rehabilitate defaulted loans. Whilea rehabilitated loan is sold by the Obama Administration’s budget proposal was not approved by Congress,GA and eliminated entirely the GAs retention of 18.5% of the outstanding loan balance as a fee for rehabilitation services. The reduction in June 2012,compensation the GAs receive resulted in a bill containing similar provisions reducingdecrease of approximately 25.0% in the compensation ofcontingency fee percentage that we receive from the GAs for assisting in the rehabilitation of defaulted student loans. Further, in October 2014, the Department of Education announced a new fee structure with respect to payment for rehabilitated loans was subsequently introducedto provide a fixed fee of $1,710 payable for each loan that is rehabilitated in place of a recovery fee that historically had been based as a percentage of the balance of the rehabilitated loan. Any additional decrease in the U.S. Senate.3130 government-supported GAs. This legislation, and any future changes in the legislation and regulations that govern these markets, may require us to adapt our business to the new circumstances and we may be unable to do so in a manner that does not adversely affect our business and operations.TheGAs. AsGAs, as a result of SAFRA, the Department of Education will ultimately become the sole source of revenues in this market, although the GAs will continue to service their existing student loan portfolios for many years to come. As a result, over time, and assuming we are successful in entering into a new contract with the Department of Education under the current rebidding process, defaults on student loans originated by the Department of Education will predominate and our ability to maintain the revenues we had previously received from a number of GA clients will depend on our relationship with a single client, the Department of Education. While we have 2224 years of experience in performing student loan recovery services for the Department of Education, we are one of 17 unrestricted recovery service providers on the current Department of Education contract. In 2012, student loanWe understand that five other recovery work forservice providers under the current contract have recently received notice from the Department of Education generated revenuesstating an intention to extend their existing contracts past April 2015, which is the expiration date for the current contract. To date, we have not received notice of $29.0 million, or approximately 13.8% of our total revenues. Theany such extension from the Department of Education, is expected to initiate aand we are unsure whether we will be provided any such extension of our current contract re-compete process duringor when the first half of 2013.new contracts will be awarded. If our relationship with the Department of Education terminates or deteriorates or if the Department of Education, ultimately as the sole holder of defaulted student loans, requires its contractors to agree to less favorable terms, our revenues would significantly decrease, and our business, financial condition and results of operations would be harmed.3129 GAs. This speculation has heightened as a result of the reduction of fees that the GAs will receive for rehabilitating student loans as a result of the Bipartisan Budget Act of 2013. If GAs that are our clients are combined with GAs with whom we do not have a relationship, we could suffer a loss of business. We currently have relationships with 1112 of the 3129 GAs and threetwo of our GA clients were each responsible for more than 10% of our total revenues in 2012.the year ended December 31, 2014 and 2013. The consolidation of our GA clients with others and the failure to provide recovery services to the consolidated entity could decrease our revenues, which could negatively impact our business, financial condition and results of operations.Our ability to derive revenues under our RAC contract will depend in part on the number and types of potentially improper claims that we are allowed to pursue by CMS as well as the amounts that we are allowed to recover for CMS, and our results of operations may be harmed if the scope of claims that we are allowed to pursue is limited.While we are the prime contractor responsible for review of Medicare records for all Part A and Part B claims in our region pursuant to the terms of our RAC contract with CMS, we are not permitted to seek the recovery of an improper claim unless that particular type of claim has been pre-approved by CMS to ensure compliance with applicable Medicare payment policies, as well as national and local coverage determinations. While the revenues we earn under our contract with CMS are determined primarily by the aggregate volume of Medicare claims in our region and our ability to successfully identify improper payments within these claims, the long-term growth of the revenues we derive under our RAC contract will also depend in part on CMS expanding the scope of potentially improper claims that we are allowed to pursue under our RAC contract. If we are unable to continue to identify improper claims within the types of claims that we are permitted to pursue from time to time or if CMS does not expand the scope of potentially improper claims that we are allowed to pursue, our results of operations could be adversely affected.Further, the improper claims approved by CMS and identified by us may be challenged by affected parties and these challenges may lead to changes in our RAC contract instituted by CMS. For example, in November 2012 the American Hospital Association and four hospitals filed a lawsuit against Kathleen Sebelius, the Secretary of the Department of Health and Human Services. The lawsuit claims, among other things, that CMS is acting improperly in completely denying payment for claims initially made under Medicare Part A (inpatient) that should have been made under Medicare Part B (outpatient), rather than remitting the difference between the Part A and Part B payments. This type of improper claim has accounted for a substantial portion of the claims we have identified under our RAC contract. If our contingency fee payment from CMS for identifying these claims is based on the difference between a Part A and Part B payment, our revenues may be harmed.contract;contact;For example, a technology system upgrade at the Department of Education caused fluctuations in our operating results. This upgrade significantly decreased the volume of student loan placements by the Department of Education to all recovery vendors, including us, during 2011 and through September 30, 2012. While we and the other recovery vendors have recently received substantially larger placement volume in the fourth quarter of 2012 as a result of the completion of this technology system upgrade, the majority of the revenues from these placements will be delayed until the third quarter of 2013 because we do not begin to earn rehabilitation revenues from a given placement until at least nine months after receipt of a placement. In addition, for approximately twelve months beginning in September 2011, this technology system upgrade prevented the Department of Education from processing a portion of rehabilitated student loans and accordingly we were not able to recognize certain revenues associated with rehabilitation of loans for this client. However, the Department of Education continued to pay us based on invoices submitted and we recorded these cash receipts as deferred revenues on our balance sheet.Further, our claim recovery volume is currently impacted by a system adjustment that is being implemented by CMS for its Periodic Income Payment providers, or PIP providers. PIP providers are reimbursed for Medicare claims through different processes than other healthcare providers, and CMS is in the process of making certain system adjustments in order to allow these claims to be processed. Prior to April 2012, we were not permitted to audit Medicare claims for these PIP providers, which we estimate to account for approximately 20% of Medicare claims in our region. The improper payments to PIP providers that we have identified were not processed by CMS from April 2012 until January 2013, when a small portion of such payments began to be processed manually. As a result, we will not recognize any revenues from identified improper payments to PIP providers as of December 31, 2012, but we have incurred expenses related to these claims. We estimate that this delayed our recognition of approximately $6 million in revenues in 2012, although we began to recognize a portion of these revenues starting in the first quarter of 2013. CMS remains in the process of implementing the necessary changesto its systems that would allow these claims to be processed automatically and allow us to recognize these revenues and we believe that the necessary upgrade will be complete in the second quarter of 2013. While we believe that this delay in automatic processing is temporary, we are uncertain as to when automatic processing will begin and the failure of CMS to process these and future claims on a timely basis will delay our recognition of the revenues until this is resolved. Because our revenues are dependent on many factors, some of which are outside of our control, we may experience significant fluctuations in our results of operations and as a result volatility in our stock price.Changes in these factors could lead to a reduction in overall recovery rates by our clients, which in turn could adversely affect our business, financial condition and results of operations. In addition,For example, during the global financial crisis beginning in 2008, the market for securitized student loan portfolios was disrupted, resulting in delays in the ability of some GA clients to resell rehabilitated student loans and, as a result, delayingdelays our ability to recognize revenues from these rehabilitated loans.We may not be able Changes in the overall economy could lead to maintain or increasea reduction in overall recovery rates by our profitability,clients, which in turn could adversely affect our business, financial condition and our recent financial results may not be indicative of our future financial results.We may not succeed in maintaining our profitability on a quarterly or annual basis and could incur quarterly or annual losses in future periods. We have incurred additional operating expenses associated with being a public company and we intend to continue to increase our operating expenses as we grow our business. We also expect to continue to make investments in our proprietary technology platform and hire additional employees and subcontractors as we expand our healthcare recovery and other operations, thus incurring additional expenses. If our revenues do not increase to offset these increases in expenses, our operating results could be adversely affected. Our historical revenues and net income growth rates are not indicative of future growth rates. According to CMS, thegeographic area allocated to this subcontractor accounted for approximately 17% of total Medicare spending in our region in 2009. While we believe that we perform appropriate due diligence before we hire subcontractors, our subcontractors may not provide adequate service or otherwise comply with the terms set forth in their agreements. In the event a subcontractor provides deficient performance to one or more of our clients, any such client may reduce the volume of services we are providing under an existing contract or may terminate the relevant contract entirely and we may face claims for breach of contract. Any such disruption in our relations with our clients as a result of services provided by any of our subcontractors could adversely affect our revenues and operating results.ChangesIn addition, the CFPB has investigatory and enforcement authority with respect to existingwhether persons are engaged in unlawful acts or practices in connection with the collection of consumer debts. On April 12, 2013, we received a Civil Investigative Demand, or a CID, from the CFPB requesting production of documents and answers to questions generally related to the Company’s debt collection practices and procedures. The CFPB has not alleged a violation by us of any law or regulation. We responded to the CID, but have not been examined by the CFPB. In light of the possibility that the CFPB may issue interpretative regulations orfor the adoptionFDCPA, the issuance of newsuch regulations could adversely affect our business and results of operations if we are not able to adapt our services and client relationships to meet theany new regulatory structure.The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified board members.As a public company, we are subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, the Dodd-Frank Act and other applicable securities rules and regulations. Compliance with these rules and regulations has increased our legal and financial compliance costs, made some activities more difficult, time-consuming or costly and increased or will continue to increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things,structure that we file annual, quarterly and current reports with respect to our business and operating results. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and, if required, improve our disclosure controls and procedures and internal control over financial reporting to meet this standard, significant resources and management oversight maymight be required. As a result, management’s attention may be diverted from other business concerns, which could adversely affect our business and operating results. Although we have already hired additional employees to comply with these requirements, we may need to hire more employees in the future or engage outside consultants, which will increase our costs and expenses.will first applyapplied to our annual report on Form 10-K for the year endingended December 31, 2013 and complying with these requirements can be difficult. For example, in June 2012, our independent registered public accounting firmwe determined that we had incorrectly accounted for our mandatorily redeemable preferred stock, which required audit adjusting entries for the three-year period ended December 31, 2011. Our failure to detect this error was deemed to be a deficiency in internal control and this deficiency was considered to be a material weakness. To address this situation, our independent registered public accounting firm recommended that the Company emphasize the importance of thoroughly researching all new accounting policies and revisiting accounting policies set for existing transactions when changes in the business or reporting requirements occur or are expected to occur. To prevent issues like these in the future, we have bolstered our technical accounting expertise and, where appropriate, engaged outside consultants with specialized knowledge.As we only recently became a public company following the completion of our initial public offering on August 15, 2012, weWe have limited accounting personnel and other resources with which to address our internal controls and procedures. If we fail to timely achieve and maintain the adequacy of our internal control over financial reporting, we may not be able to produce reliable financial reports or help prevent fraud. Our failure to achieve and maintain effective internal control over financial reporting could prevent us from filing our periodic reports on a timely basis, which could result in the loss of investor confidence in the reliability of our financial statements, harm our business and negatively impact the trading price of our common stock.the later of the year following our first annual report required to be filed with the SEC, or the datesuch time that we are no longer an “emerging growth company” as defined in the JOBS Act, if we continue to take advantage of the exemptions contained in the JOBS Act. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating. Our remediation efforts may not enable us to avoid a material weakness in the future.misappropriationother violation of our patents, trademarks, copyrights, trade secrets, or other intellectual property rights could adversely affect any competitive advantage we currently derive or may derive from our proprietary technology platform and we may incur significant costs associated with litigation that may be necessary to enforce our intellectual property rights.Our current or future indebtedness could adversely affect our business and financial condition and reduce the funds available to us for other purposes, and our failure to comply with the covenants contained in our credit agreement could result in an event of default that could adversely affect our results of operations.As of December 31, 2012, our total debt was $147.8 million. For the year ended December 31, 2012, our consolidated interest expense was approximately $12.4 million. Our ability to make scheduled payments or to refinance our debt obligations and to fund our other liquidity needs depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot make assurances that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal and interest on our indebtedness and to fund our other liquidity needs. If our cash flows and capital resources are insufficient to fund our debt service obligations and allow us to maintain compliance with the covenants under our credit agreement or to fund our other liquidity needs, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness. We cannot ensure that we would be able to take any of these actions, that these actions would be successful and permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, including our credit agreement. If we cannot make scheduled payments on our debt, we will be in default and, as a result, our debt holders could declare all outstanding principal and interest to be due and payable, the lenders under our credit agreement could terminate their commitments to lend us money and foreclose against the assets securing our borrowings and we could be forced into bankruptcy or liquidation.Our debt agreements contain, and any agreements to refinance our debt likely will contain, financial and restrictive covenants that limit our ability to incur additional debt, including to finance future operations or other capital needs, and to engage in other activities that we may believe are in our long-term best interests, including to dispose of or acquire assets. Our failure to comply with these covenants may result in an event of default, which, if not cured or waived, could accelerate the maturity of our indebtedness or result in modifications to our credit terms. If our indebtedness is accelerated, we may not have sufficient cash resources to satisfy our debt obligations and we may not be able to continue our operations as planned.If securities analysts do not publish research or if securities analysts or other third parties publish inaccurate or unfavorable research about us, the price of our common stock could decline.The trading market for our common stock relies in part on the research and reports that securities analysts and other third parties choose to publish about us. We do not control whether these analysts or other third parties provide research regarding our company. The price of our common stock could decline if one or more securities analysts downgrade our common stock or if one or more securities analysts or other third parties publish inaccurate or unfavorable research about us or cease publishing reports about us.Risks Related to Our Common StockWe are subject to certain phase-in provisions of the NASDAQ Marketplace Rules and, as a result, we will not immediately be subject to certain corporate governance provisions.Because of our public offering in February 2013, Parthenon Capital Partners no longer controls a majority of our common stock. As a result, we will no longer be a “controlled company” within the meaning of the corporate governance standards of the NASDAQ Global Select Market. However, we will rely on phase-in provisions for certain stock exchange corporate governance requirements, including:the requirement that a majority of the board of directors consists of independent directors;the requirement that nominating and corporate governance matters be decided solely by independent directors; andthe requirement that employee and officer compensation matters be decided solely by independent directors.We intend to utilize each of these phase-in provisions. As a result, we do not have a majority of independent directors and our nominating and corporate governance and compensation functions are not decided solely by independent directors. Accordingly, you do not have the same protections afforded to stockholders of companies that are subject to all of the stock exchange corporate governance requirements.volatile.$7.55$3.65 on November 27, 2012January 29, 2015 to a high sales price of $14.09 on March 4, 2013. The trading price of our common stock may be significantly affected by various factors, including: quarterly fluctuations in our operating results; the financial projections we may provide to the public, any changes in those projections or our failure to meet those projections; changes in investors’ and analysts’ perception of the business risks and conditions of our business; our ability to meet the earnings estimates and other performance expectations of financial analysts or investors; unfavorable commentary or downgrades of our stock by equity research analysts; termination of lock-up agreements or other restrictions on the ability of our existing stockholders to sell their shares after our public offering in February 2013 and our initial public offering; changes in our capital structure, such as future issuances of debt or equity securities; lawsuits threatened or filed against us; strategic actions by us or our competitors, such as acquisitions or restructurings; new legislation or regulatory actions; changes in our relationship with any of our significant clients; fluctuations in the stock prices of our peer companies or in stock markets in general; and general economic conditions.Future sales, or the perception of future sales, of our common stock may lower our stock price.If our existing stockholders sell a large number of shares of our common stock, the market price of our common stock could decline significantly. In addition, the perception in the public market that our existing stockholders might sell shares of common stock could depress the market price of our common stock, regardless of the actual plans of our existing stockholders. As of March 20, 2013, a total of 46,720,569 shares of common stock were outstanding, assuming that there are no exercises of options after December 31, 2012. Of these shares, the 9,200,000 shares of common stock sold in our February 2013 offering and the 10,350,000 shares that were sold in our initial public offering, will be freely tradable in the public market without restriction or further registration under the Securities Act of 1933, or the Securities Act, unless these shares are held by “affiliates,” as that term is defined in Rule 144 under the Securities Act. 27,728,773 shares are subject to lock-up agreements entered into in connection with our February 2013 offering restricting the sale of those shares until May 2013, unless otherwise extended. The underwriters may waive the lock-up restriction and allow any of the stockholders subject to this restriction to sell their shares at any time.stockholder hasstockholders have the ability to controlinfluence significant corporate activities and our majority stockholder’ssignificant stockholders' interests may not coincide with yours.48.7%27.4% and 19.9% of our common stock, respectively, as of March 20, 2013.December 31, 2014. As a result of itstheir ownership, Parthenon Capital Partner has Partners and Invesco Ltd. havecontrol decision-makinginfluence decision‑making with respect to our business direction and policies. Parthenon Capital Partners and Invesco Ltd. may have interests different from our other stockholders’ interests, and may vote in a manner adverse to those interests. Matters over which Parthenon Capital Partners and Invesco Ltd. can, directly or indirectly, exercise influence include:the election of our board of directors and the appointment and removal of our officers;cause at such time as Parthenon Capital Partners no longer beneficially owns a majority of our outstanding shares;cause; authorizing blank check preferred stock, which could be issued with voting, liquidation, dividend and other rights superior to our common stock; limiting the ability of our stockholders to call and bring business before special meetings and to take action by written consent in lieu of a meeting at such time as Parthenon Capital Partners no longer beneficially owns a majority of our outstanding shares;meeting; limiting our ability to engage in certain business combinations with any “interested stockholder,” other than Parthenon Capital Partners, for a three-year period following the time that the stockholder became an interested stockholder; requiring advance notice of stockholder proposals for business to be conducted at meetings of our stockholders and for nominations of candidates for election to our board of directors; requiring a super majority vote for certain amendments to our amended and restated certificate of incorporation and amended and restated bylaws after the time when Parthenon Capital Partners ceased to beneficially own a majority of our outstanding shares, which occurred in February 2013;bylaws; and limiting the determination of the number of directors on our board of directors and when Parthenon Capital Partners is no longer our majority stockholder, the filling of vacancies or newly created seats on the board, to our board of directors then in office. These provisions, alone or together, could have the effect of delaying or deterring a change in control, could limit the opportunity for our stockholders to receive a premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our common stock.Because we do not intend to pay cash dividends in the foreseeable future, you may not receive any return on investment unless you are able to sell your common stock for a price greater than your purchase price.For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. In addition, our ability to pay dividends is subject to restrictive covenants contained in our credit agreement. As a result, you may not receive any return on investment unless you are able to sell your common stock for a price greater than your purchase price.ITEM 1B.Unresolved Staff CommentsNone.