MISSOURI | | | | MISSOURI | | 43-1450818 | (State or other jurisdiction of | | (IRS Employer | incorporation or organization) | | (IRS Employer

Identification No.) | | | | 12555 Manchester Road | | | Des Peres, Missouri | | 63131 | (Address of principal executive offices) | | (Zip Code) |

(314) 515-2000

Registrant’sRegistrant's telephone number, including area code (314) 515-2000

Securities registered pursuant to Section 12(b) of the Act: | | | Title of each class | | Name of each exchange on which registered | NONENone | | NONENone |

Securities registered pursuant to Section 12(g) of the Act: Limited Partnership Interests (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨o NO x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨o NO x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨o Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨o Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’sregistrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | Large accelerated filer | o | ¨

| | Accelerated filer | | ¨o

| | | | | Non-accelerated filer | x | x (Do(Do not check if a smaller reporting company)

| | Smaller reporting company | | ¨o

|

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨o No x As of February 22, 2013, 648,89726, 2016, 914,542 units of limited partnership interest (“Interests”) are outstanding, each representing $1,000 of limited partner capital. There is no public or private market for such Interests. DOCUMENTS INCORPORATED BY REFERENCE None

THE JONES FINANCIAL COMPANIES, L.L.L.P. TABLE OF CONTENTS PART I

2

PART I The Jones Financial Companies, L.L.L.P. (“JFC”) is a registered limited liability limited partnership organized under the Missouri Revised Uniform Limited Partnership Law of the State of Missouri Revised Statutes.Act. Unless expressly stated, or the context otherwise requires, the terms “Registrant” and “Partnership” refer to JFC and all of its consolidated subsidiaries. The Partnership’s principal operating subsidiary, Edward D. Jones & Co., L.P. (“Edward Jones”), was organized onin February 20, 1941 and reorganized as a limited partnership onin May 23, 1969. JFC was organized onin June 5, 1987 and, along with Edward Jones, was reorganized onin August 28, 1987. As of December 31, 2012,2015, the Partnership operates in two geographic operating segments, the United States of America (“U.S.”) and Canada. Edward Jones is comprised of a U.S. registered broker-dealer in the U.S. and (throughone of Edward Jones’ subsidiaries is a subsidiary) a Canadian registered broker-dealer and primarily serves individual investors. Asin Canada. JFC is the ultimate parent company of Edward Jones JFCand is a holding company. Edward Jones primarily derives its revenue from the retail brokerage business through the sale of listed and unlisted securities and insurance products, investment banking, principal transactions, distribution of mutual fund shares, and through fees related to assets held by and account services provided to its clients.clients, including investment advisory services, the purchase or sale of listed and unlisted securities and insurance products, and principal transactions. Edward Jones primarily conducts business in the U.S. and Canada with its clients, various brokers, dealers, clearing organizations, depositories and banks in the U.S. and in Canada.banks. For financial information related to these two operating segments for the years ended December 31, 2012, 20112015, 2014 and 2010,2013, see Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 8 – Financial Statements and Supplementary Data – Note 1613 to the Consolidated Financial Statements. 3

PART I Item 1. | Business, continued |

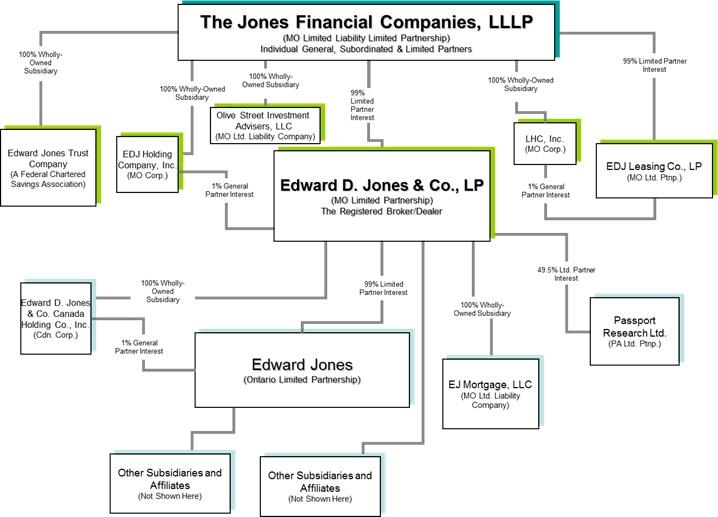

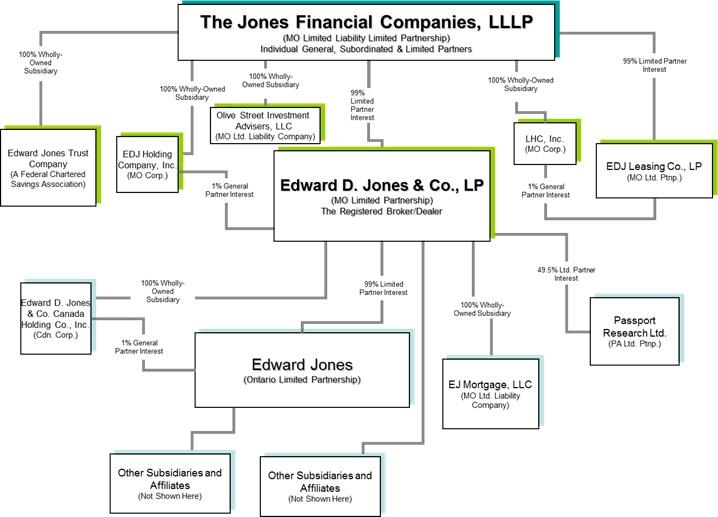

ORGANIZATIONAL STRUCTUREOrganizational Structure.

At December 31, 2012,2015, the Partnership was organized as follows:

For additional information about the Partnership’s other subsidiaries and affiliates, see Exhibit 21.21.1. During 2009, Edward Jones sold 100% of the issued and outstanding shares of its subsidiary, Edward Jones Limited, a United Kingdom (“U.K.”) private limited company engaged in the retail financial services business in the U.K.

Branch Office Network. The Partnership primarily serves serious, long-term individual long-term investors in small to medium-size towns and metropolitan suburbs through its extensive network of branch offices. The Partnership's business model is designed to serve clients through personal relationships with financial advisors and branch office administrators ("BOA") located in the communities where its clients live and work. Financial advisors and BOAs provide tailored solutions and services to their clients while leveraging the resources of the Partnership's home office. The Partnership operated 11,41212,482 branch offices as of February 22, 2013,December 31, 2015, primarily staffed by a single financial advisor and a branch office administrator.BOA. Of this total, the Partnership operated 10,85411,904 branch offices in the U.S. (located in all 50 states, predominantly in communities with populations of under 50,000states) and metropolitan suburbs) and 558578 branch offices in Canada.

4

PART I Item 1. | Business, continued |

Governance.Governance.Unlike a corporation, the Partnership is not governed by a board of directors and has no individuals who are designated as directors. Moreover, none of its securities are listed on a securities exchange and therefore the governance requirements that generally apply to many companies that file periodic reports with the U.S. Securities and Exchange Commission (“SEC”) reporting companies do not apply to it. Under the terms of the Partnership’s EighteenthNineteenth Amended and Restated Agreement of Registered Limited Liability Limited Partnership, Agreement (“the Partnershipdated June 6, 2014, as amended (the “Partnership Agreement”), the Partnership’s Managing Partner has primary responsibility for administering the Partnership’s business, determining its policies and controlling the management and conduct of the Partnership’s business, andits management. The Managing Partner also has the power to admit and dismiss general partners of JFC and to adjust the proportion of their respective interests in JFC. As of February 22, 2013,December 31, 2015, JFC was composed of 373380 general partners, 14,00919,873 limited partners and 297362 subordinated limited partners. See Part III, Item 10 – Directors, Executive Officers and Corporate Governance for a description of the governance structure of the Partnership.

Revenues by Source. The following table sets forth on a continuing operations basis, for the past three years, the sources of the Partnership’s revenues.revenues for the past three years. Due to the interdependence of the activities and departments of the Partnership’s investment business and the inherently arbitrary assumptions required to allocate overhead, it is impractical to identify and specify expenses applicable to each aspect of the Partnership’s operations. Further information on revenue related to the Partnership’s reportable segments is provided in Part II, Item 8 – Financial Statements and Supplementary Data – Note 1613 to the Consolidated Financial Statements and Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations. | | | | | | | | | | | | | | | | | | | | | | | | | (Dollars in thousands) | | 2012 | | | 2011 | | | 2010 | | Asset-based fees | | $ | 2,042,392 | | | | 41 | % | | $ | 1,776,883 | | | | 39 | % | | $ | 1,397,333 | | | | 33 | % | Commissions | | | | | | | | | | | | | | | | | | | | | | | | | Mutual funds | | | 1,050,948 | | | | 20 | % | | | 866,005 | | | | 19 | % | | | 856,020 | | | | 21 | % | Listed securities | | | 450,293 | | | | 9 | % | | | 392,743 | | | | 9 | % | | | 338,605 | | | | 8 | % | Insurance | | | 388,889 | | | | 8 | % | | | 385,184 | | | | 8 | % | | | 326,698 | | | | 8 | % | Over-the-counter securities | | | 88,896 | | | | 2 | % | | | 54,755 | | | | 1 | % | | | 54,529 | | | | 1 | % | | | | | | | | | | | | | | | | | | | | | | | | | | Total commissions | | | 1,979,026 | | | | 39 | % | | | 1,698,687 | | | | 37 | % | | | 1,575,852 | | | | 38 | % | Account and activity fees | | | 573,949 | | | | 11 | % | | | 522,898 | | | | 11 | % | | | 503,264 | | | | 12 | % | Principal transactions | | | 155,895 | | | | 3 | % | | | 284,231 | | | | 6 | % | | | 320,777 | | | | 8 | % | Interest and dividends | | | 133,469 | | | | 3 | % | | | 130,150 | | | | 3 | % | | | 126,769 | | | | 3 | % | Investment banking | | | 111,539 | | | | 2 | % | | | 153,100 | | | | 3 | % | | | 208,615 | | | | 5 | % | Other revenue | | | 31,148 | | | | 1 | % | | | 11,553 | | | | 1 | % | | | 30,489 | | | | 1 | % | | | | | | | | | | | | | | | | | | | | | | | | | | Total revenue | | $ | 5,027,418 | | | | 100 | % | | $ | 4,577,502 | | | | 100 | % | | $ | 4,163,099 | | | | 100 | % | | | | | | | | | | | | | | | | | | | | | | | | | |

($ millions) | | 2015 | | | 2014 | | | 2013 | | Fee revenue | | | | | | | | | | | | | | | | | | | | | | | | | Asset-based fees | | $ | 3,399 | | | | 51% | | | $ | 3,089 | | | | 49% | | | $ | 2,523 | | | | 44% | | Account and activity fees | | | 690 | | | 10% | | | | 617 | | | | 10% | | | | 568 | | | | 10% | | Total fee revenue | | | 4,089 | | | 61% | | | | 3,706 | | | | 59% | | | | 3,091 | | | | 54% | | Trade revenue | | | 2,425 | | | | 36% | | | | 2,460 | | | | 38% | | | | 2,439 | | | | 43% | | Interest and dividends | | | 158 | | | 3% | | | | 135 | | | | 2% | | | | 134 | | | | 2% | | Other revenue | | | 22 | | | 0% | | | | 32 | | | | 1% | | | | 52 | | | | 1% | | Total revenue | | $ | 6,694 | | | 100% | | | $ | 6,333 | | | | 100% | | | $ | 5,716 | | | | 100% | |

Asset-based Fees The Partnership earns fees from investment advisory services offered in the U.S. through Edward Jones Advisory SolutionsSolutions® (“Advisory Solutions”), and Edward Jones Managed Account ProgramProgram® (“MAP”) and in Canada through Edward Jones Portfolio ProgramProgram® (“Portfolio Program”) and Edward Jones Guided Portfolios® (“Guided Portfolios”). Advisory Solutions and MAP are both registered as investment advisory programs with the SECcreated under the Investment Advisers Act of 1940. Portfolio Program isand Guided Portfolios are not requiredsubject to be registered under this actAct as services from this programthese programs are only offered in Canada. In January 2016 the Partnership announced its intention to wind down the MAP program offered in the U.S. The Partnership stopped accepting new assets in the MAP program in January 2016 and intends to close the program by mid-2017. MAP represents less than 1% of asset-based fees revenue and the Partnership expects most of the client assets will be transferred to other programs which offer investment advisory services. Through Advisory Solutions, providesfinancial advisors provide investment advisory services to its clients for a monthlyan annual fee based upon the average daily market value of their assets in the program, and consists of a managed account investedprogram. Clients can choose to invest in Advisory Solutions Fund Models, which invests in affiliated mutual funds, unaffiliated mutual funds, and exchange-traded funds (ETFs) and money market funds, or Advisory Solutions Unified Managed Account models, which also include separately managed allocations (SMAs). PART I

Item 1.

| Business, continued

|

For this program,allocations. When investing in Advisory Solutions, the client mustmay elect either a research or a custom account model. If the client elects a research type model, the Partnership assumes full investment discretion on the account whichand the client assets will be invested in one of numerous different research models developed and managed by Edward Jones’ Mutual Fund Research department.Jones. If the client elects to build a custom model, the Partnership assumes limited investment discretion on the account developedand the investments are selected by the client and his or her financial advisor. The vast majority of client assets within Advisory Solutions are invested in research models.

5

PART I Item 1. | Business, continued |

In 2013, in order to addressaccommodate the current size and expected growth in investment advisory services offered through Advisory Solutions, in 2013as well as potentially lower client investment management expense, the Partnership is planningformed the Bridge Builder Trust (the "Trust") to introduce a newoffer additional fund options for clients invested in Advisory Solutions. The Trust added seven sub-advised mutual fund designed solely for Advisory Solutions.funds to its series in 2015, bringing the total to eight sub-advised funds. At its discretion, the Trust may add additional funds in the future. Olive Street Investment Advisers, L.L.C. (“OLV”("OLV"), a 100% wholly-owned subsidiary of JFC and a Missouri limited liability company, was established in December 2012 to beis the investment adviser to a newthe current sub-advised mutual fund trust.funds. For each of the sub-advised mutual funds in the Trust, OLV is intended to havehas primary responsibility for allocation of funds, setting the mutual fund’s overall investment strategies and the selection and management of subadvisors, and supervisory responsibility for the general management of the trust,mutual funds and selecting and managing sub-advisers, subject to the review and approval by itsof the Trust's board of trustees. As of December 31, 2015, the Trust had client assets under management of $22.6 billion. Through the MAP and Portfolio Program, offerfinancial advisors provide investment advisory services to clients by using independent investment managers and proprietary asset allocation models. Guided Portfolios is a non-discretionary, fee-based program with structured investment guidelines. Fees for a monthly feethese programs are based uponon the average value of client assets in the program, by using independent investment managers. In addition to the advisory programs mentioned above, the Partnership also earns asset-based fees from the trust and investment management services offered to its clients through Edward Jones Trust Company (“EJTC”).program.

The Partnership also earns revenue on clients’ assets through service fees on most of its clients’ assets which are held byand other revenues received under agreements with mutual fund companies and insurance companies. The fees generally range from 15 to 25 basis points (0.15% to 0.25%) of the value of the client assets so held. In addition, theThe Partnership earns revenue sharing from certain mutual fund and insurance vendors.companies. In most cases, this is additional compensation paid by investment advisers, insurance companies or distributors based on a percentage of average vendor assets held by the Partnership’s clients.

In addition to the advisory programs mentioned above, the Partnership earns asset-based fees from the trust services and investment management services offered to its clients on those products covered under the revenue sharing agreements. Revenue sharing agreements that provide forthrough Edward Jones Trust Company (“EJTC”), a fixed annual payment are also included in asset-based fees.wholly-owned subsidiary of JFC. The Partnership is a 49.5% limited partner of Passport Research, Ltd. (“Passport Research”), the investment adviser to certainfor two money market funds made available to the Partnership’sEdward Jones clients. Revenue from this source is primarily based on client assets in the funds. However, due to the current low interest rate environment, the investment adviser voluntarily chose (beginning in March 2009) to reduce certain fees charged to the funds to a level that will maintain a positive client yield on funds. For further information on this reduction of fees, see Part II, Item 7A – Quantitative and Qualitative Disclosures About Market Risk. The Partnership has entered into a non-binding letter of intent to acquire the remaining 50.5% of Passport Research from Federated Investment Management Company ("Federated"), the general partner of Passport Research. The transaction is not expected to have a material impact on the Consolidated Financial Statements. Federated approved the transfer on February 18, 2016 and the transfer is expected to be completed in the fourth quarter of 2016, subject to customary regulatory and fund shareholder approvals. CommissionsAccount and Activity Fees

CommissionsAccount and activity fees include shareholder accounting service fees, Individual Retirement Account (“IRA”) custodial service fees, and other product/service fees.

The Partnership charges fees to certain mutual fund companies for shareholder accounting services, including maintaining client account information and providing other administrative services for the mutual funds. The Partnership acts as the custodian for clients’ IRAs and the clients are charged an annual fee for this and other account services. Account and activity fees also include sales-based revenue is primarily comprisedsharing fees, insurance contract services, and fees earned through a co-branded credit card with a major credit card company. Trade Revenue Trade revenue consists of commissions, charges to clients for the purchase or sale of securities, mutual fund shares, listed and unlisted equity securities and insurance products. The following briefly describes the Partnership’s sourcesproducts, principal transactions and investment banking. Trade revenue is impacted by trading volume, size of commissions revenue.trades and market volatility.

6

PART I Item 1. | Business, continued |

Commissions – Mutual Funds.Funds. The Partnership distributes mutual fund shares in continuous offerings and new underwritings. As a dealer in mutual fund shares, the Partnership receives a dealer’s discount which generally ranges from 1% to 5% of the purchase price of the shares, depending on the terms of each fund’s prospectus and the amount of the purchase. Commissions – EquitiesListed Securities Transactions.. The Partnership receives a commission when it acts as an agent for a client in the purchase or sale of listed securities. These securities include common and preferred stocks and debt securities traded on and off the securities exchanges.unlisted (over-the-counter) securities. The commission is based on the value of the securities purchased or sold. Commissions – Insurance ProductsInsurance.. The Partnership sells life insurance, long-term care insurance, disability insurance, fixed and variable annuities and other types of insurance products of unaffiliated insurance companies to its clients through its financial advisors who hold insurance sales licenses. As an agent for the insurance companies, the Partnership receives commissions on the premiums paid for the policies. Principal TransactionsOver-the-Counter Securities Transactions. Partnership. Revenue is earned from the Partnership's distribution of and participation in principal trading activities in unlisted (over-the-counter) securities transactions are similar to its activities as a broker in listed securities. In connection with client orders to buy or sell securities, the Partnership charges a commission for agency transactions. Account and Activity Fees

Revenue sources include sub-transfer agent accounting services fees, Individual Retirement Account (“IRA”) custodial services fees, and other product/service fees.

The Partnership charges fees to certain mutual funds for sub-transfer agent accounting services, including maintaining client account information and providing other administrative services for the mutual funds. Also, the Partnership acts as the custodian for clients’ IRA accounts and the clients are charged an annual fee for this service. Account and activity fees also include sales based revenue sharing fees pursuant to arrangements with certain mutual fund and insurance vendors where the vendors pay additional compensation to the Partnership based on a percentage of current year sales by the Partnership of products supplied by these vendors. The Partnership receives revenue through a co-branded credit card with a major credit card company and from offering mortgage loans to its clients through a joint venture. However, the joint venture partner has elected to terminate the joint venture arrangement in April 2013 and the Partnership will discontinue offering mortgage loans to its clients at this time.

Principal Transactions

The Partnership makes a market inmunicipal obligations, over-the-counter corporate securities, municipal obligations, government obligations,certificates of deposit, unit investment trusts, mortgage-backed securities and certificates of deposit.government obligations. The Partnership’s market-makingprincipal trading activities are conducted with other dealers in the “wholesale” and “retail” markets where the Partnership acts as a dealer buying from and selling to its clients. In making markets inprincipal trading of securities, the Partnership exposes its capital to the risk of fluctuation in the fair value of its security positions. The Partnership maintains securities positions in inventory solely to support its business of buying securities from and selling securities to its retail clients and does not seek to profit by engaging in proprietary trading for its own account.

PART I

Item 1.

| Business, continued

|

Investment Banking The related unrealized gains and losses for these securities are recorded within trade revenue.

Revenue which was previously classified as investment banking was reclassified to principal transactions for all periods presented. Investment banking revenue is primarily derived from the Partnership’s distribution of unit investment trusts corporate and participation in municipal obligations and government sponsored enterprise obligations. Investment banking revenueunderwriting activities. Revenue also includes underwriting fee revenue related to underwriting and management fees as well as gross acquisition profit / profit/loss and volume concession revenue, which is earned and collected from the issuer. The Partnership’s investment banking activities are performed primarily by its Syndicate, Investment Banking and Unit Investment Trust departments. The principal service which the Partnership renders as an investment banker is the underwriting and distribution of securities, either in a primary distribution on behalf of the issuer of such securities or in a secondary distribution on behalf of a holder of such securities. The roles the Partnership may play include senior manager, co-manager, syndicate member, selling group member, dealer or distributor and encompass both negotiated and competitively bid offerings.

The Partnership historically has not, and does not presently engage in other investment banking activities, such as assisting in mergers and acquisitions, arranging private placement of securities issues with institutions, or providing consulting and financial advisory services to entities. In the caseAs of an underwritten offering managed byDecember 31, 2015, the Partnership closed the Syndicate, Investment Bankingnegotiated municipal obligations underwriting portion of the investment banking business. The revenue and Unit Investment Trust departments may form underwriting syndicates and workcosts associated with the branch office network for sales of the Partnership’s own participation and with other members of the syndicate in the pricing and negotiation of other terms. In offerings managed by others in which the Partnership participates as a syndicate, selling group member, dealer or distributor, these departments serve as active coordinators between the managing underwriter and the Partnership’s branch office network.closure were immaterial.

The underwriting activity of the Partnership involves substantial risks. An underwriter may incur losses if it is unable to resell the securities it is committed to purchase or if it is forced to liquidate all or part of its commitment at less than the agreed upon purchase price. Furthermore, the commitment of capital to an underwriting may adversely affect the Partnership’s capital position and, as such, its participation in an underwriting may be limited by the requirement that it must at all times be in compliance with the SEC’s uniform net capital requirements (the “Uniform Net Capital Rule”).

Interest and Dividends Interest and dividends revenue is earned on client margin (loan) account balances, cash and cash equivalents, cash and investments segregated under federal regulations, securities purchased under agreements to resell, partnership loans, for general partnership interests, inventory securities and investment securities. Loans secured by securities held in client margin accounts provide a source of income to the Partnership. The Partnership is permitted to use securities owned by margin clients having an aggregate market value of generally up to 140% of the debit balance in margin accounts as collateral for the borrowings. The Partnership may also use funds provided by free credit balances in client accounts to finance client margin account borrowings. The Partnership’s interest income is impacted by the level of client margin (loan) account balances, cash and cash equivalents, cash and investments segregated under federal regulations, securities purchased under agreements to resell, partnership loans, for general partnership interests, inventory securities and investment securities and the interest rates earned on each. PART I

Item 1.

| Business, continued

|

Significant Revenue Source As of December 31, 2012,2015, the Partnership distributed mutual funds for approximately 7570 mutual fund vendors, includingcompanies. One company, American Funds Distributors, Inc. which represents 19%, represented 20% of the Partnership’s total revenue for the year ended December 31, 2012. This revenue2015, which consisted of commissions,revenue from trades, asset-based fees and account and activity fees, which are described above. All of theThe revenue generated from this vendorcompany relates to business conducted with the Partnership’s U.S. segment.

7

PART I Item 1. | Business, continued |

BUSINESS OPERATIONS Research Department.The Partnership maintains a Research department to provide specific investment recommendations and market information for clients. The department supplements its own research with the services of an independent research service.services. In addition, the Research department provides recommendations for asset allocation, portfolio rebalancing and investment selections for Advisory Solutions client accounts. Client Account Administration and Operations.Employees in the The Partnership has an Operations division arethat is responsible for activities relating to client securities and the processing of transactions with other broker-dealers, exchanges and clearing organizations. These activities include receipt, identification and delivery of funds and securities, internal financial controls, accounting and personnel functions, office services, custody of client securities and the handling of margin accounts. The Partnership processes substantiallyvirtually all of its own transactions. To expedite the processing of orders, the Partnership’s branch office system isoffices are linked to the home office locations through an extensive communications network. Orders for securities are generally captured at the branch electronically, routed to the home office and forwarded to the appropriate market for execution. The Partnership’s processing of paperwork following the execution of a security transaction is generally automated. There is considerable fluctuation during any one year and from year to year in theThe volume of transactions the Partnership processes.processes fluctuates considerably. The Partnership records such transactions and posts its books on a daily basis. The Partnership has a computerized branch office communication system which is principally utilized for entry of security orders, quotations, messages between offices, research of various client account information, and cash and security receipts functions. Home office personnel, including operationsthose in the Operations and compliance personnel,Compliance divisions, monitor day-to-day operations to determine compliance with applicable laws, rules and regulations. Failure to keep current and accurate books and records can render the Partnership liable to disciplinary action by governmental and self-regulatory organizations (“SROs”).

The Partnership clears and settles virtually all of its listed and over-the-counter equities, municipal bond, corporate bond, mutual fund and annuity transactions for its U.S. broker-dealer through the National Securities Clearing Corporation (“NSCC”), Fixed Income Clearing Corporation (“FICC”) and Depository Trust Company (“DTC”), which are all subsidiaries of the Depository Trust and Clearing Corporation located in New York, New York. In conjunction with clearing and settling transactions with NSCC, the Partnership holds client securities on deposit with DTC in lieu of maintaining physical custody of the certificates. The Partnership also uses a major bank for custody and settlement of U.S. treasury securities and Government National Mortgage Association (“GNMA”)Association), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corporation issues. The Canada broker-dealer handles the routing and settlement of client transactions. In addition, the Canada broker-dealer is a member of the Canadian Depository of Securities (“FHLMC”CDS”) issues.and FundServ for clearing and settlement of transactions. CDS effects clearing of securities on the Canadian National Stock Exchange, Toronto Stock Exchange (“TSX”) and TSX Venture Exchange (“CDNX”). Client securities on deposit are also held with CDS and National Bank Correspondent Network. The Partnership is substantially dependent upon the operational capacity and ability of NSCC, DTC, FICC, and Canadian Depository of Securities (“CDS”).CDS. Any serious delays in the processing of securities transactions encountered by these clearing and depository companies may result in delays of delivery of cash or securities to the Partnership’s clients. PART I

Item 1.

| Business, continued

|

Broadridge Financial Solutions, Inc. (“Broadridge”), along with its U.S. business, Securities Processing Solutions, U.S., and its international business, Securities Processing Solutions, International, provide automated data processing services for client account activity and related records for the Partnership in the U.S. and Canada, respectively. The Partnership does not employ its own floor brokers for transactions on exchanges. The Partnership has arrangements with other brokers to execute the Partnership’s transactions in return for a commission based on the size and type of trade. If, for any reason, any of the Partnership’s clearing, settling or executing agents were to fail, the Partnership and its clients would be subject to possible loss. To the extent that the Partnership would not be able to meet the obligations to the clients, such clients might experience delays in obtaining the protections afforded them.

8

PART I Item 1. | Business, continued |

The CanadianCanada broker-dealer has an agreement with Broadridge to provide the securities processing systems, as well as an agreement with Computershare Trust Company of Canada to act as trustee for cash balances held by clients in their retirement accounts. The CanadianCanada broker-dealer is the custodian for client securities and manages all related securities and cash processing, such as trades, dividends, corporate actions, client cash receipts and disbursements, client tax reporting and statements. The Canadian broker-dealer handles the routing and settlement of client transactions. In addition, the Canadian broker-dealer is a member of CDS and FundServ for clearing and settlement of transactions. CDS effects clearing of securities on the Canadian National Stock Exchange (“CNQ”), Toronto Stock Exchange (“TSX”) and TSX Venture Exchange (“CDNX”). Client securities on deposit are also held with CDS and National Bank Correspondent Network (“NBCN”).

Employees.Employees. The Partnership’s financial advisors are employees (or general partners of the Partnership) and are not independent contractors.. As of February 22, 2013,December 31, 2015, the Partnership had approximately 38,00041,000 full and part-time employees and general partners, including its 12,53014,508 financial advisors. The Partnership’s financial advisors are generally compensated on a commission basis and may in addition, be entitled to bonus compensation based on their respective branch office profitability and the profitability of the Partnership. The Partnership has in the past paidpays bonuses to its non-financial advisor employees pursuant to a discretionary formula established by management.management based on the profitability of the Partnership. Employees of the Partnership in the U.S. are bonded under a blanket policy as required by Financial Industry Regulation Authority, Inc. (“FINRA”) rules.policy. The per occurrencePartnership has an aggregate annual coverage limit for employees in the U.S. is $5.0 million,of $50,000,000 subject to a $2.0 million deductible provision. In addition, there is excess coverage with an annual aggregate amount of $45.0 million.deductibles. Employees of the Partnership in Canada are bonded under a blanket policy as required by the Investment Industry Regulation Organization of Canada (“IIROC”). The Partnership has an annual aggregate amount of coverage for employees in Canada is CAD $25.0 million,of C$50,000,000 with a per occurrence limit of C$25,000,000, subject to a CAD $0.05 million deductible provision per occurrence.deductible. The Partnership maintains ana comprehensive initial training program for prospective financial advisors that spans nearly four months which includes preparation for regulatory exams, concentrated instruction in the classroom and on-the-job training in a branch office. During the first phase, U.S. trainees spend nearly two months studyingstudy Series 7 and Series 66 examination materials and takingtake the examinations. In Canada, financial advisors have the requisite examinations completed prior to being hired. After passing the requisite examinations, trainees spend one week incomplete a comprehensive training program in one of the Partnership’s home office training facilities, followed by seven weeks of on-the-job training in their market andrespective markets in a nearby branch location.locations. This training includes reviewing investments, compliance requirements, office procedures, and understanding client needs, as well as establishing a base of potential clients. One final week is then spent inTo complete the initial comprehensive training program, the trainees return to a home office training facility to complete the initial training program. PART I

Item 1.

| Business, continued

|

Five months later,for additional training. Later in their careers, the financial advisor attends anadvisors attend additional training class in aat home office location, and subsequently,office. In addition, the Partnership offers periodic continuing training to its experienced financial advisors for the entirety of their career.careers. Training programs for the more experienced financial advisors continue to focus on meeting client needs and effective management of the branch office.

The Partnership considers its employee relations to be good and believes that its compensation and employee benefits, which include medical, life and disability insurance plans, and profit sharing and deferred compensation retirement plans,401(k) plan, are competitive with those offered by other firms principally engaged in the securities business. Competition.Competition.The Partnership is subject to intense competition in all phases of its business from other securities firms, many of which are substantially larger than the Partnership in terms of capital, brokerage volume and underwriting activities. In addition, the Partnership encounters competition from other organizations such as banks, insurance companies, and others offering financial services and advice. The Partnership also competes with a number of firms offering discount brokerage services, usually with lower levels of personalized service to individual clients. Further, the financial services industry continues to evolve technologically, with some firms now providing lower cost, computer-based "robo-advice" with limited or no personalized service to clients. Clients are freeable to transfer their business to competing organizations at any time, although a fee may be charged to do so.time. There is also intense competition among firms for financial advisors. The Partnership experiences continued efforts by competing firms to hire away its financial advisors, although the Partnership believes that its rate of turnover of financial advisors is in line with that of other comparable firms. REGULATION Broker-Dealer and Investment Adviser Regulation Broker-dealers areRegulation. The securities industry is subject to extensive federal and state laws, rules and regulations whichthat cover all aspects of the securities business, including sales methods, trade practices among broker-dealers, use and safekeeping of client funds and securities, client payment and margin requirements, capital structure of securities firms, record-keeping, and the conduct of directors, officers and employees.

9

PART I Item 1. | Business, continued |

The SEC is the federalU.S. agency responsible for the administration of the U.S.federal securities laws. Its mission is to protect investors, maintain fair, orderly and efficient markets, and facilitate capital formation. Edward Jones is registered as a broker-dealer and investment adviser with the SEC. Edward Jones is subject to periodic examinations by the SEC, review by a designated examining authority, and certain periodic and ad hoc reporting requirements of securities and customer funds. Much of the regulation of broker-dealers has been delegated to SROs, principally FINRA.FINRA, by the SEC. FINRA adopts rules (which are subject to approval by the SEC) that govern the broker-dealer industry and conducts periodic examinations of Edward Jones’ operations. Securities firms are also subject to regulation by state securities commissions and insurance regulators in those states in which they conduct business. Since Edward Jones is registered as a broker-dealer and sells insurance products in all 50 states, Puerto Rico, the U.S. Virgin Islands and the District of Columbia, Puerto RicoEdward Jones is subject to state regulation in all of these states and the U.S. Virgin Islands.territories. The SEC, SROs and state securities commissionsauthorities may conduct administrative proceedings which can result in censure, fine, suspension or expulsion of a broker-dealer, its officers or employees. Edward Jones has in the past been, and may in the future be, the subject of regulatory actions by various agencies that have the authority to regulate its activities (see Part I, Item 3 – Legal Proceedings for more information). PART I

Item 1.

| Business, continued

|

As an investment dealer in all provinces and territories of Canada, the CanadianEdward Jones' Canada broker-dealer is subject to provincial, territorial and federal laws. All provinces and territorial jurisdictions have established securities administrators to fulfill the administration of securities laws. The CanadianEdward Jones' Canada broker-dealer is also subject to the regulation of the CanadianCanada SRO, IIROC, which oversees the business conduct and financial affairs of its member firms, as well as all trading activity on debt and equity marketplaces in Canada. IIROC fulfills its regulatory obligations by implementing and enforcing rules regarding the proficiency, business and financial conduct of member firms and their registered employees, and marketplace integrity rules regarding trading activity on CanadianCanada debt and equity marketplaces. In addition, Edward Jones, OLV and Passport Research are subject to the rules and regulations promulgated under the Investment Advisers Act of 1940 (“Investment Advisers Act”), which requires investment advisers to register with the SEC. Edward Jones, OLV and Passport Research are registered investment advisers. The rules and regulations promulgated under the Investment Advisers Act govern all aspects of the investment advisory business, including registration, trading practices, custody of client funds and securities, record-keeping, advertising and business conduct. Edward Jones, OLV and Passport Research are subject to periodic examinations by the SEC which is authorized to institute proceedings and impose sanctions for violations of the Investment Advisers Act. Pursuant to U.S. federal law, Edward Jones as a broker-dealer belongs to the Securities Investors Protection Corporation (“SIPC”). For clients in the U.S., SIPC provides $500,000 of coverage for missing cash and securities includingin a client's account, with a maximum of $250,000 for cash claims. Pursuant to IIROC requirements, the CanadianCanada broker-dealer belongs to the Canadian Investor Protection Fund (“CIPF”), a non-profit organization that provides investor protection for investment dealer insolvency. For clients in Canada, CIPF limits coverage to CAD $1,000,000C$1,000,000 in total, which can be any combination of securities and cash. The Partnership currently maintains additional protection for U.S. clients provided by Underwriters at Lloyd’s. The additional protection contract provided by Underwriters at Lloyd’s protects clients’ accounts in excess of the SIPC coverage subject to specified limits. This policy covers theft, misplacement, destruction, burglary, embezzlement or abstraction of cash and client securities up to an aggregate limit of $900 million$900,000,000 (with maximum cash coverage limited to $1,900,000 per client) for covered claims of all U.S. clients of Edward Jones. Market losses are not covered by SIPC or the additional protection. In addition, Edward Jonesthe Partnership has cash and OLV are subjectinvestments segregated in special reserve bank accounts for the benefit for U.S. clients pursuant to the rules and regulationsCustomer Protection Rule 15c3-3 of the Investment AdvisersSecurities Exchange Act of 1940, which require investment advisers to register with the SEC. The Investment Advisers Act’s rules and regulations govern all aspects of the investment advisory business, including registration, trading practices, custody of client funds and securities, record-keeping, advertising and business conduct.1934, as amended (“Customer Protection Rule”).

10

PART I Item 1. | Business, continued |

Additional legislation, changes in rules promulgated by the SEC, the Department of Labor ("DOL") and SROs, and/or changes in the interpretation or enforcement of existing laws and rules, may directly affect the operations and profitability of broker-dealers and investment advisers. With the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), the SEC has been directed to study existing practices in the industry and granted discretionary rulemaking authority to establish, among other things, comparable standards of conduct for broker-dealers and investment advisers when providing personalized investment advice about securities to retail clients and such other clients as the SEC provides by rule. The SEC may engage in rulemaking or issue interpretive guidance concerning the standard of conduct for broker-dealers and investment advisers. FINRA or other regulatory authorities may also issue rules related to the Dodd–Frank Act, but it is unclearAct. In addition, the DOL has published a proposed rule on the definition of the term "fiduciary" and exemptions related thereto in the context of the Employee Retirement Income Security Act. The Partnership cannot predict at this time what impact such rulemaking activities will have on the Partnership or its operations. PART I

Item 1.

| Business, continued

|

Trust Regulation of EJTC and Regulation of JFC as EJTC’s Parent PursuantParent. EJTC is a federally chartered savings and loan association that operates under a limited purpose “trust-only” charter, which generally restricts EJTC to the Dodd-Frank Act, effective July 21, 2011 authority for theacting solely in a trust or fiduciary capacity. EJTC and JFC are subject to supervision and regulation of EJTC was transferred from the Office of Thrift Supervision (“OTS”) toby the Office of the Comptroller of the Currency (“OCC”). As of the same date, responsibility for the supervision and regulation of JFC, based on its status as a savings and loan holding company (“SLHC”) (which such status is the result of its 100% ownership of EJTC), was transferred from the OTS to the Board of Governors of the Federal Reserve System (“FRB”). The Dodd-Frank Act, however, allows entities controlling a savings association that functions solely in a trust or fiduciary capacity to cease to be a SLHC. On October 31, 2012, JFC received confirmation from the FRB that its request to deregister as a SLHC had been approved. JFC is now subject to supervision and regulation as a holding company by the OCC.

Uniform Net Capital Rule Rule.As a result of its activities as a broker-dealer and a member firm of FINRA, Edward Jones is subject to the Uniform Net Capital Rule 15c3-1 of the Securities Exchange Act of 1934, as amended (“Uniform Net Capital Rule”) which is designed to measure the general financial integrity and liquidity of a broker-dealer and the minimum net capital deemed necessary to meet the broker-dealer’s continuing commitments to its clients. The Uniform Net Capital Rule provides for two methods of computing net capital and Edward Jones has adopted what is generally referred to as the alternative method. Minimum required net capital under the alternative method is equal to the greater of $0.25 million$250,000 or 2% of the aggregate debit items, as defined.defined under the Customer Protection Rule. The Uniform Net Capital Rule prohibits withdrawal of equity capital whether by payment of dividends, repurchase of stock or other means, if net capital would thereafter be less than minimum requirements. Additionally, certain withdrawals require the approval of the SEC to the extent they exceed defined levels even though such withdrawals would not cause net capital to be less than 5% of aggregate debit items. In computing net capital, various adjustments are made to exclude assets which are not readily convertible into cash and to provide a conservative valuation of other assets, such as securities owned. Failure to maintain the required net capital may subject Edward Jones to suspension or expulsion by FINRA, the SEC and other regulatory bodies and/or exchanges and may ultimately require liquidation. Edward Jones has, at all times, been in compliance with the Uniform Net Capital Rule. The CanadianCanada broker-dealer and EJTC are also required to maintain specified levels of regulatory capital. Each subsidiaryof these subsidiaries has, at all times, been in compliance with the applicable capital requirements in the jurisdictions in which it operates. PART I

AVAILABLE INFORMATIONItem 1.

| Business, continued

|

The Partnership files annual, quarterly, and current reports and other information with the SEC. The Partnership’s SEC filings are available to the public on the SEC’s website at www.sec.gov. FORWARD-LOOKING STATEMENTS This Annual Report on Form 10-K, and in particular Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements within the meaning of U.S. securities laws. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “will,” “should,” and other expressions which predict or indicate future events and trends and which do not relate to historical matters. You should not rely on forward-looking statements, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Partnership. These risks, uncertainties and other factors may cause the actual results, performance or achievements of the Partnership to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

11

PART I Item 1. | Business, continued |

Some of the factors that might cause differences between forward-looking statements and actual events include, but are not limited to, the following: (1) general economic conditions;conditions, including an economic downturn or volatility in the U.S. and/or global securities markets; (2) regulatory actions; (3) changes in legislation or regulation, including new regulations under the Dodd-Frank Act;Act and any rules promulgated by the DOL; (4) actions of competitors; (5) litigation; (6) the ability of clients, other broker-dealers, banks, depositories and clearing organizations to fulfill contractual obligations; (7) changes in interest rates; (8) changes in technology;technology and other technology-related risks; (9) a fluctuation or decline in the fair value of securities; and (10) the risks discussed under Part I, Item 1A – Risk Factors. These forward-looking statements were based on information, plans, and estimates at the date of this report, and the Partnership does not undertake to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. 12

PART I The Partnership is subject to a number of risks potentially impacting its business, financial condition, results of operations and cash flows. In addition to the risks and uncertainties discussed elsewhere in this Annual Report on Form 10-K, or in the Partnership’s other filings with the SEC, the following are some important factors that could cause the Partnership’s actual results to differ materially from results experienced in the past or those projected in any forward-looking statement. The risks and uncertainties described below are not the only ones facing the Partnership. Additional risks and uncertainties not presently known to the Partnership or that the Partnership currently deems immaterial could also have a material adverse effect on the Partnership’s business and operations. If any of the matters included in the following risks were to occur, the Partnership’s business, financial condition, results of operations and cash flows could be materially adversely affected. RISK RELATED TO THE PARTNERSHIP’S BUSINESS MMARKETarket CONDITIONSonditions —As a part of the securities industry, a downturn in the U.S. and/or global securities markets historically has, and in the past had, andfuture could in the future have, a significant negative effect on revenues and could significantly reduce or eliminate profitability of the Partnership.Partnership. General political and economic conditions and events such as U.S. fiscal monetary policy, economic recession, natural disasters, terrorist attacks, war, changes in local economic and political conditions, regulatory changes or changes in the law, or interest rate or currency rate fluctuations could create a downturn in the U.SU.S. and/or global securities markets. The securities industry, and therefore the Partnership, is highly dependent upon market prices and volumes which are highly unpredictable and volatile in nature. Events such as global recession, frozen credit markets, and institutional failures and government-sponsored bailouts of a number of large financial services companies, as well as debt ceiling debates, and sovereign credit downgrades, could make the capital markets increasingly volatile. Weakened global economic conditions and an unsettled nature of financial markets, among other things, could cause significant declines in the Partnership’s net revenues which willwould adversely impact its overall financial results. WithAs the Partnership’s composition of net revenue nowbecomes more heavily weighted towards asset-based fee revenue, than trade revenue as in the past, a decrease in the market value of assets due to market declines can causehave a much moregreater negative impact on the Partnership’s financial results than experienced in prior years, due to the fact that asset-based fees are earned on the value of the underlying client assets. Conversely, in times

Market volatility could also cause clients to move their investments to lower margin products, or withdraw them, which could have an adverse impact on the profitability of improved market conditions the Partnership’s asset-based fee revenue would be positively impacted due to the increase in the market value of assets on which fees are earned.Partnership. In addition, the Partnership could experience a material reduction in volume and lower securities prices in times of unfavorable economic conditions, which would result in lower commissiontrade revenue, decreased margins and losses in dealer inventory accounts and syndicate positions. This would have a material adverse impact on the profitability of the Partnership’s operations. Financial markets continueFurthermore, if the market were to experience volatility anda downturn or the riskseconomy were to sustained global economic growth remain high. Furthermore,enter into a recession, the Partnership would be subject to increased risk of its clients being unable to meet their commitments, such as margin obligations if there was an economic recession.obligations. If clients are unable to meet their margin obligations, the Partnership has an increased risk of losing money on margin transactions and incurring additional expenses defending or pursuing claims. Developments such as lower revenues and declining profit margins could reduce or eliminate the Partnership’s profitability.

13

PART I Item 1A. | Risk Factors, continued |

LEGISLATIVEANDegislativeand REGULATORYegulatory INITIATIVESnitiatives —Newly adoptedProposed, potential and recently enacted federal and state legislation, rules and pending regulatory proposals intended to reform the financial services industryregulations could significantly impact the regulation and operation of the Partnership and its subsidiaries, its revenue and its profitability.subsidiaries. In addition, such laws, rules and regulations may significantly alter or restrict the Partnership’s historic business practices, which could negatively affect its operating results. The Partnership is subject to extensive regulation by federal and state regulatory agencies and by SROs, within the industry.SROs. The Partnership operates in a regulatory environment that is subject to ongoing change and has seen significantly increased regulation in recent years. The Partnership may be adversely affected as a result of new or revised legislation or regulations, changes in federal, state or foreign tax laws and regulations, or by changes in the interpretation or enforcement of existing laws and regulations. The Partnership continues to monitor several regulatory initiatives and proposed, potential and enacted legislation and rules (“Legislative and Regulatory Initiatives”), including, but not limited to: The Dodd-Frank Act.Act. The Dodd-Frank Act, passed by the U.S. Congress and signed by the Presidentinto law in July 21, 2010, includes provisions that could potentially impact the Partnership’s operations. Since the passage of the Dodd-Frank Act, the Partnership has not been required to enact material changes to its operations. However, the Partnership continues to review and evaluate the provisions of the Dodd-Frank Act and the impending rules to determine what impact or potential impact itthey may have on the financial services industry, the Partnership and its operations. Among the numerous potentially impactful provisions in the Dodd-Frank Act are: (i) pursuant to Section 913 of the Dodd-Frank Act, the SEC staff issued a study recommending a universal fiduciary standard of care applicable to both broker-dealers and investment advisers when providing personalized investment advice about securities to retail clients, and such other clients as the SEC provides by rule. The standard of conduct is expected to require the broker-dealer and investment adviser to act in the best interest of the client without regard to the financial or other interest of the broker-dealer or investment adviser providing the advice;rule; and (ii) pursuant to Section 914 of the Dodd-Frank Act, a new SRO is expected to be proposed to regulate investment advisers.advisers could be proposed. In addition, the Dodd-Frank Act contains new or enhanced regulations that could impact specific securities products offered by the Partnership to investors and specific securities transactions. Proposed rules related to all of these provisions have not yet been adopted by regulators. It is unclearThe Partnership cannot predict what impact any such rules, if adopted, would have on the Partnership. Additionally, the Partnership continues to monitor several other proposed regulations and rules that do not presently appear as though they will have a material impact on the Partnership, such as Title X of the Dodd-Frank Act, which established the Bureau of Consumer Financial Protection with broad authority to issue new regulations, and proposed rules related to Section 956 of the Dodd-Frank Act, which would prohibit certain types of incentive-based compensation arrangements. In their present form, the Partnership does not believe these regulations and rules will have a material impact on the Partnership, but if revised the impact on the Partnership could be material.

It is expected that FINRA or other regulatory authorities will continue to issue rules related to the Dodd-Frank Act in the future and the Partnership will continue to monitor and review any such rules.

PART I

Item 1A.

| Risk Factors, continued

|

Department of Labor. Fiduciary Rule Proposal. In 2010, the Department of Labor (the “DOL”)DOL proposed a modification to a rule that would have impacted the Employee Retirement Income Security Act’s definition of “fiduciary” and potentially limited certain of Edward Jones’ business practices. In September 2011, the DOL announced that it was withdrawing the proposed rule and stated its intention to re-propose the rule in the future. On April 20, 2015, the DOL published in the Federal Register its proposed rule on the definition of the term "fiduciary" and exemptions related thereto. As proposed, the rule would impact qualified accounts, specifically, IRAs and other retirement accounts. The DOL held public hearings on the proposed rule in August 2015. At this time, the DOL has not yet re-proposedpublished a final rule and has publicly expressed there will be changes to the proposal in the final rule. As proposed, the rule butwould impact a significant portion of client assets under care. As proposed, the Partnership expects such re-proposal to occur in the near future. The DOL has indicated that the re-proposed rule willwould have a material impact IRAs and has indicated an intention to address what has been generally described as “third party payments,” such as revenue sharing. The Partnership cannot predict what the re-proposed rule will say, what its scope will be, when or if it will be re-proposed or adopted, or what the impact will be on the Partnership. However, any such rule could impact the operations of Edward Jones and the profitability of the Partnership. International Financial Reporting Standards. The International Accounting Standards Board developed a core set of accounting standards to act as a framework for financial reporting known as the International Financial Reporting Standards (“IFRS”). By 2007, the majority of listed European Union companies, including banks and insurance companies, began using IFRS to prepare financial statements. In contrast, the majority of public companies in the U.S. prepare financial statements under accounting principles generally accepted in the U.S. (“GAAP”).

The SEC is evaluating adoption of IFRS in the U.S. It is unclear at this time whether the SEC will propose mandatory adoption of IFRS or some other form of GAAP and IFRS harmonization.

The Partnership is currently waiting on further guidance from the SEC to determine what impact, if any, the adoption of IFRS in the U.S. could have on its financial position orPartnership's results of operations. If adopted, IFRS could significantly impact the way the Partnership determines income before allocations to partners, allocations to partners, or returns on partnership capital. In addition, switching to IFRS would be a complex endeavor for the Partnership. The Partnership may need to develop new systems and controls around the principles of IFRS and the specific costs associated with this conversion are uncertain.

Rule 12b-1 Fees. The Partnership receives various payments in connection with the purchase, sale and on-going servicing of mutual fund shares by its clients. Those payments include Rule 12b-1 fees (i.e., service fees) and expense reimbursements. Rule 12b-1, under the Investment Company Act of 1940, allows a mutual fund to pay distribution and marketing expenses out of the fund’s assets. The SEC currently does not limit the size of Rule 12b-1 fees that funds may pay. FINRA does impose such limitations. However, in July, 2010 the SEC proposed reform of Rule 12b-1. The proposal called for the rescission of Rule 12b-1 and a proposed new Rule 12b-2 which would allow funds to deduct a fee on an annual basis of up to 25 basis points to pay for distribution expenses without a cumulative cap on this fee. Additionally, the proposal includes other amendments that would permit funds to deduct an asset-based distribution fee in which the fund may deduct ongoing sales charges with no annual limit, but cumulatively the asset-based distribution fee could not exceed the amount of the highest front-end load for a particular fund. The proposed rule also allows funds to create and distribute a class of shares at net asset value and dealers could establish their own fee schedule. The proposal includes additional requirements for disclosure on trade confirmations and in fund documents. These proposed rules have not been enacted and the Partnership cannot predict with any certainty whether or which of these proposals will be enacted in their current form, revised form or not enacted at all. In addition, the Partnership is committing significant resources to be prepared for the opportunities and challenges that will arise as a result of the final rule. We are not yet able to determinepredict how the potential financialfinal DOL rules may differ from the proposed rules. As such, the Partnership cannot predict at this time the full extent of any adverse impact on itsour operating results related to this proposed reform of Rule 12b-1. For further information onor the amount of Rule 12b-1 fees earned by the Partnership, see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations.overall financial services industry.

PART I

Item 1A.

| Risk Factors, continued

|

Health Care Reform.The Patient Protection and Affordable Care Act, (“PPACA”)which was signed into law in March, 2010. PPACA requires employers2010, amended and revised by the Health Care and Education and Reconciliation Act of 2010 (collectively referred to provide affordable coverage with a minimum essential benefit to full-time employees or pay a financial penalty.as the “Affordable Care Act”). The billAffordable Care Act contains provisions that go into effectwill be implemented over the next several years that expand employee eligibility formay impact the Partnership’s medical plan and places limits on plan design. Regulatory guidance required to fully assess the impact of this law is still forthcoming. Accordingly, thePartnership. The Partnership is not yet able to determine the full potential financial impact of the Affordable Care Act. Money Market Mutual Funds. The SEC adopted amendments to the rules that govern money market mutual funds in July 2014. The amendments preserve stable net asset value for certain retail funds and government funds. The amendments also impose, under certain circumstances, liquidity fees and redemption gates on non-government funds. The Partnership continues to evaluate the impact of these amendments on its operating results in future years.operations and to consider the implementation of policies and procedures to address the amendments. Federal “Do Not Call” Regulations.The Partnership is also subject to federal

14

PART I Item 1A. | Risk Factors, continued |

These Legislative and state regulations like other businesses and must evaluate and adapt to new regulations as they are adopted. In particular, the Partnership believes the federal “do not call” regulations enacted in recent years have affectedRegulatory Initiatives may impact the manner in which many of its financial advisors conduct their businesses. While the Partnership believes it is in compliancemarkets its products and services, manages its business and operations, and interacts with these regulations, these regulationsclients and regulators, any or all of which could materially impact the Partnership’s future revenues or results of operations. Money Market Mutual Funds. In May 2010,operations, financial condition, and liquidity. Regulatory changes or changes in the SEC adopted several reforms to money market funds (“MMF”) that were designed to, among other things, strengthen maturity limitations,law could increase diversification,compliance costs which would adversely impact our profitability. However, the Partnership cannot presently predict when or if any of the proposed or potential Legislative and improve liquidity standards. Following those reforms, the President’s Working Group on Financial Markets, the Financial Stability Oversight Council (“FSOC”), and the SEC continued to evaluate and discuss additional reforms to address what they perceived to be structural vulnerabilities in MMFs. In November 2012, the FSOC, using its authority under the Dodd-Frank Act, proposed structural reforms to MMFs. Specifically, the FSOC proposed three alternatives for consideration: requiring MMFs to have (i) a floating net asset value; (ii) a net asset value buffer of 1% with a requirement that a percentage of a shareholder’s highest account value in excess of $100,000 during the previous 30 days be made available for redemption on a delayed basis and be the first amount at risk under certain MMF loss scenarios; and (iii) a net asset value buffer of 3% with other measures that could include more stringent investment diversification requirements, increased minimum liquidity levels, and/or more robust disclosure requirements. These FSOC alternatives are only proposals; they are not rules. It is unclear whether the proposalsRegulatory Initiatives will be adopted in their current form, in a modified form,enacted or at all. It is likelythe impact that any FSOC recommendation would require rulemaking by the SEC, which the SEC would likely propose for further public comment. Based on that, while MMF reforms in the nature of FSOC’s proposals couldLegislative and Regulatory Initiatives will have an impact on the Partnership’s MMF, it is currently unclear what that impact would be.Partnership.

Any of the foregoing regulatory initiatives could adversely affect the Partnership’s business operations, business model, and profitability. The Partnership cannot predict with any certainty whether or which of the regulatory proposals that have not yet been adopted will be adopted, and if so whether they will be adopted in their current form or adopted subject to further revisions. If adopted, some of these initiatives could significantly and adversely impact the Partnership’s operating costs, its structure, its ability to generate revenue, and its overall profitability.

CCOMPETITIONompetition —The Partnership is subject to intense competition for clients and personnel, and many of its competitors have greater resources. All aspects of the Partnership’s business are highly competitive. The Partnership competes for clients and personnel directly with other securities firms and increasingly with other types of organizations and other businesses offering financial services, such as banks and insurance companies. PART I

Item 1A.

| Risk Factors, continued

|

Many of these organizations have substantially greater capital and additional resources, and some entities offer a wider range of financial services. Over the past several years, there has been significant consolidation of firms in the financial services industry, forcing the Partnership to compete with larger firms with greater capital and resources, brokerage volume and underwriting activities, and more competitive pricing. Also, the Partnership continues to compete with a number of firms offering discount brokerage services, usually with lower levels of personalized service to individual clients. Further, the financial services industry continues to evolve technologically, with some firms now providing lower cost, computer-based "robo-advice" with limited or no personalized service to clients. Clients are freeable to transfer their business to competing organizations at any time, although theretime. The Partnership's continued ability to compete based on a business model designed to serve clients through personalized relationships with financial advisors and branch teams in order to provide tailored solutions may be impacted by the evolving financial services industry and client needs. If financial advisors do not meet client needs, the Partnership could lose clients, thereby reducing revenues and profitability. Further, the Partnership faces increased competition for clients from larger firms in its non-urban markets, and from a fee to do so.broad range of firms in the urban and suburban markets in which the Partnership competes. Competition among financial services firms also exists for financial advisors and other personnel. The Partnership’s continued ability to expand its business and to compete effectively depends on the Partnership’s ability to attract qualified employees and to retain and motivate current employees. In addition, the Partnership's business is dependent on financial advisors' ability to attract and retain clients and assets. If the Partnership���sPartnership’s profitability decreases, then bonuses paid to financial advisors and other personnel, along with profit-sharing contributions, may be decreased or eliminated, increasing the risk that personnel could be hired away by competitors. In addition, the Partnership has recently faced increased competition from larger firms in its non-urban markets, and from a broad range of firmsduring an extended downturn in the urban and suburban markets in whicheconomy, there is increased risk the Partnership competes.Partnership’s more successful financial advisors may leave because a significant portion of their compensation is variable based on the Partnership’s profitability. The competitive pressure the Partnership experiences could have an adverse effect on its business, results of operations, financial condition and cash flow. For additional information, see Part I, Item 1—1 – Business Operations—– Business Operations – Competition. BBRANCHranch OFFICEffice SYSTEMystem —The Partnership’s system of maintaining branch offices primarily staffed by one financial advisor may expose the Partnership to risk of loss or liability from the activities of the financial advisors and to increases in rent related to increased real property values. MostThe vast majority of the Partnership’s branch offices are staffed by a single financial advisor and a branch office administrator withoutadministrator. Branch offices do not have an onsite supervisor as would be found at broker-dealers with multi-broker branches. The Partnership’s primary supervisory activity is conducted from its home offices. Although this method of supervision is designed to comply with all applicable industry and regulatory requirements, it is possible that the Partnership is exposed to a risk of loss arising from alleged imprudent or illegal actions of its financial advisors. Furthermore, the Partnership may be exposed to further losses if additional time elapses before its supervisory personnel detect problem activity.

15

PART I Item 1A. | Risk Factors, continued |

The Partnership maintains personal financial and account information and other documents and instruments for its clients at its branch offices, both physically and in electronic format. Despite reasonable precautions, because the branch offices are relatively small and some are in remote locations, the security systems at these branch offices may not prevent theft of such information. If security of a branch is breached and personal financial and account information is stolen, the Partnership’s clients may suffer financial harm and the Partnership could suffer financial harm, reputational damage and regulatory issues. In addition, the Partnership leases its branch office spaces and a material increase in the value of real property may increase the amount of rent paid, which will negatively impact the Partnership’s profitability. PART I

Item 1A.

| Risk Factors, continued

|

INABILITYTOnability to ACHIEVE OURchieve Financial Advisor GROWTHrowth RATEate —If the Partnership is unable to fully achieve its goals for hiring financial advisors or the attrition rate of its financial advisors is higher than its expectations, the Partnership may not be able to meet its planned growth rates or maintain its current number of financial advisors.