Robert Half Legal offers a full suite of legal staffing and consulting services to help organizations manage constantly changing workloads and access expertise across in-demand legal practice areas. Protiviti has gained unique perspectives on the challenges faced by its clients. Protiviti uses these perspectives not only to solve regulatory, risk and compliance problems, but also to help clients become more effective and productive. Protiviti provides solutions to its clients in areas such as business performance improvement, internal audit and financial advisory, IT consulting, restructuring and litigation, risk and compliance, and transaction services. the Company conducts public relations activities designed to enhance public recognition of the Company and its services. This includes outreach to journalists, bloggers and social media influencers, and the distribution of thought leadership via print, video, corporate-maintained social media sites and other online properties. groups in their local communities. 2013 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter 2012 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter 2014. October 1, 2013 to October 31, 2013 November 1, 2013 to November 30, 2013 December 1, 2013 to December 31, 2013 Total October 1, 2013 to December 31, 2013 Income Statement Data: Net service revenues Direct costs of services, consisting of payroll, payroll taxes, insurance costs and reimbursable expenses Gross margin Selling, general and administrative expenses Amortization of intangible assets Interest income, net Income before income taxes Provision for income taxes Net income Net income available to common stockholders Net Income Per Share: Basic Diluted Shares: Basic Diluted Cash Dividends Declared Per Share Balance Sheet Data: Total assets Notes payable and other indebtedness, less current portion Stockholders’ equity extrapolating past results, management believes that it is reasonably likely that future results will be consistent with historical trends and experience. However, if the financial condition of the Company’s customers were to deteriorate, resulting in an impairment of their ability to make payments, or if unexpected events or significant future changes in trends were to occur, additional allowances may be required. operating performance. The discount rate for all reporting units was determined by management based on estimates of risk free interest rates, beta and market risk premiums. The discount rate used was compared to the rate published in various third party research reports, which indicated that the rate was within a range of reasonableness. The primary assumptions related to future operating performance include revenue growth rates and profitability levels. In addition, the impairment assessment requires that management make certain judgments in allocating shared assets and liabilities to the balance sheets of the reporting units. Solely for purposes of establishing inputs for the fair value calculations described above related to its annual goodwill impairment testing, the Company made the following assumptions. The Company assumed that year-to-date trends through the date of the last assessment would continue for all reporting units through units. the ability of the Company's field and corporate leadership teams to grow the business. United States of America ("GAAP") and the rules of the SEC. To help readers understand the Company’s financial performance, the Company supplements its GAAP financial results with revenue growth rates derived from non-GAAP revenue amounts. Variations in the Company’s financial results include the impact of changes in foreign currency exchange rates and billing days. The Company provides “same billing days and constant currency” revenue growth calculations to remove the impact of these items. These calculations show the year-over-year revenue growth rates for the Company’s 2014. U.S., Temporary and consultant staffing As Reported Billing Days Impact Currency Impact Same Billing Days and Constant Currency Permanent placement staffing As Reported Billing Days Impact Currency Impact Same Billing Days and Constant Currency 2014. This year-over-year improvement in gross margin percentage of 0.6% was primarily attributable to higher pay/bill spreads and lower fringe costs driven by lower state unemployment insurance expenses in 2015 compared to 2014. 2015, up from demand. admin compensation and fixed overhead. 2014. 2013. For the Company’s international operations, 2014 revenues increased 6.3%, and on a same-day, constant-currency basis increased 8.5%, compared to 2013. Temporary and consultant staffing As Reported Billing Days Impact Currency Impact Same Billing Days and Constant Currency Permanent placement staffing As Reported Billing Days Impact Currency Impact Same Billing Days and Constant Currency 2013. This year-over-year improvement in gross margin percentage of 0.4% was primarily attributable to lower fringe costs driven by lower state unemployment insurance expenses in 2014 compared to 2013. client demand. 2014 . 2013. benefits and a decrease in federal 15, 2016. Contractual Obligations Long-term debt obligations Operating lease obligations Purchase obligations Other liabilities Total liabilities. Although currency fluctuations impact the Company’s reported results and shareholders’ equity, such fluctuations generally do not affect cash flow or result in actual economic gains or losses. The Company generally has few cross-border transfers of funds, except for transfers to the U.S. for payment of intercompany loans, working capital loans made between the U.S. and the Company’s foreign subsidiaries, and dividends from the Company’s foreign subsidiaries. Cash and cash equivalents Accounts receivable, less allowances of $27,261 and $24,852 Current deferred income taxes Other current assets Total current assets Goodwill Other intangible assets, net Property and equipment, net Other assets Total assets Accounts payable and accrued expenses Accrued payroll costs and retirement obligations Current portion of notes payable and other indebtedness Total current liabilities Notes payable and other indebtedness, less current portion Other liabilities Total liabilities Commitments and Contingencies (Note I) Preferred stock, $.001 par value authorized 5,000,000 shares; issued and outstanding zero shares Common stock, $.001 par value authorized 260,000,000 shares; issued and outstanding 137,466,421 and 139,438,603 shares Capital surplus Accumulated other comprehensive income Retained earnings Total stockholders’ equity Total liabilities and stockholders’ equity Net service revenues Direct costs of services, consisting of payroll, payroll taxes, insurance costs and reimbursable expenses Gross margin Selling, general and administrative expenses Amortization of intangible assets Interest income, net Income before income taxes Provision for income taxes Net income Net income available to common stockholders—diluted Net income per share (Note L): Basic Diluted Shares: Basic Diluted Cash dividends declared per share COMPREHENSIVE INCOME: Net income Foreign currency translation adjustments, net of tax Total comprehensive income COMMON STOCK—SHARES: Balance at beginning of period Net issuances of restricted stock Repurchases of common stock Exercises of stock options Balance at end of period COMMON STOCK—PAR VALUE: Balance at beginning of period Net issuances of restricted stock Repurchases of common stock Exercises of stock options Balance at end of period CAPITAL SURPLUS: Balance at beginning of period Net issuances of restricted stock at par value Repurchases of common stock—excess over par value Cash dividends ($.64 per share, $.60 per share and $.56 per share) Stock-based compensation expense Exercises of stock options—excess over par value Tax impact of equity incentive plans Balance at end of period ACCUMULATED OTHER COMPREHENSIVE INCOME: Balance at beginning of period Foreign currency translation adjustments, net of tax Balance at end of period RETAINED EARNINGS: Balance at beginning of period Net income Repurchases of common stock—excess over par value Cash dividends ($.64 per share and $.60 per share) Balance at end of period CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash provided by operating activities: Amortization of intangible assets Depreciation expense Stock-based compensation expense—restricted stock and stock units Excess tax benefits from stock-based compensation Deferred income taxes Provision for doubtful accounts receivable Changes in assets and liabilities, net of effects of acquisitions: Increase in accounts receivable Increase in accounts payable, accrued expenses, accrued payroll costs and retirement obligations (Decrease) increase in income taxes payable Change in other assets, net of change in other liabilities Net cash flows provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Payment for acquisitions, net of cash acquired Capital expenditures Increase in trusts for employee benefits and retirement plans Net cash flows used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Repurchases of common stock Cash dividends paid Decrease in notes payable and other indebtedness Excess tax benefits from stock-based compensation Proceeds from exercises of stock options Net cash flows used in financing activities Effect of exchange rate changes on cash and cash equivalents Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: Cash paid during the year for: Interest Income taxes, net of refunds Non-cash items: Stock repurchases awaiting settlement estimating the effect of permanent placement candidates who do not remain with its clients through the 90-day guarantee period. Allowances are established to estimate these losses. Fees to clients are generally calculated as a percentage of the new employee’s annual compensation. No fees for permanent placement services are charged to employment candidates. Advertising Costs of these assets is dependent on future taxable income, its ability to use foreign tax credit carryforwards and carrybacks, final U.S. and foreign tax settlements, and the effectiveness of its tax planning strategies in the various relevant jurisdictions. Computer hardware Computer software Furniture and equipment Leasehold improvements Internal-use software development costs Deposits in trusts for employee benefits and retirement plans Other Balance as of December 31, 2011 Acquisitions Foreign currency translation adjustments Balance as of December 31, 2012 Acquisitions Foreign currency translation adjustments Balance as of December 31, 2013 Computer hardware Computer software Furniture and equipment Leasehold improvements Other Property and equipment, cost Accumulated depreciation Property and equipment, net Benefit Costs Payroll and benefits Employee retirement obligations Workers’ compensation Payroll taxes Deferred compensation plan and other benefits related to the Company’s Chief Executive Officer 2014 2015 2016 2017 2018 Thereafter 2013. Current: Federal State Foreign Deferred: Federal and state Foreign Domestic Foreign Federal U.S. income tax rate State income taxes, net of federal tax benefit Non-deductible expenses Non-U.S. income taxed at different rates, net of foreign tax credits Federal tax credits Tax impact of uncertain tax positions Valuation allowance release, net Other, net Effective tax rate (continued) Amortization of franchise rights Amortization of other intangibles Accrued expenses, deducted for tax when paid Capitalized costs for books, deducted for tax Depreciation Federal impact of unrecognized tax benefits Foreign tax credit carryforwards Other, net Current deferred income tax assets, net Long-term deferred income tax liabilities, net Deferred Income Tax Assets Provision for bad debts Employee retirement and other benefit obligations Workers’ compensation Deferred compensation Credits and net operating loss carryforwards Other Total deferred income tax assets Deferred Income Tax Liabilities Amortization of intangible assets Property and equipment basis differences Other Total deferred income tax liabilities Valuation allowance Total deferred income tax assets, net enterprise zone tax credits, respectively. (continued) 2014. Balance at beginning of period Gross increases—tax positions in prior years Gross decreases—tax positions in prior years Gross increases—tax positions in current year Settlements Lapse of statute of limitations Balance at end of period 2014 2015 2016 2017 2018 Thereafter Contingencies (continued) Common stock repurchased (in shares) Common stock repurchased Employee stock plan repurchased (in shares) Employee stock plan repurchased Cash dividends declared per share The Company has not granted any options to purchase common stock since 2006. previous equity awards to which it can be offset. The Company calculates the amount of eligible excess tax benefits that are available to offset future tax shortfalls in accordance with the long-form method described in the FASB authoritative guidance. Restricted stock and stock units Restricted stock and stock units Outstanding, December 31, 2010 Granted Exercised Restrictions lapsed Forfeited Outstanding, December 31, 2011 Granted Exercised Restrictions lapsed Forfeited Outstanding, December 31, 2012 Granted Exercised Restrictions lapsed Forfeited Outstanding, December 31, 2013 Total pre-tax intrinsic value of stock options exercised Total fair value of shares vested Range of $32.36. Basic net income per share: Net income Income allocated to participating securities Net income available to common stockholders Basic weighted average shares Basic net income per share Diluted net income per share: Net income Income allocated to participating securities Net income available to common stockholders Basic weighted average shares Dilutive effect of potential common shares Diluted weighted average shares Diluted net income per share Total number of anti-dilutive potential common shares amount of compensation cost for future service that the Company has not yet recognized, and the amount of tax benefits that would be recorded in capital surplus, if the options were exercised and the stock units and performance-based restricted stock had vested. Net service revenues Temporary and consultant staffing Permanent placement staffing Risk consulting and internal audit services Operating income Temporary and consultant staffing Permanent placement staffing Risk consulting and internal audit services Amortization of intangible assets Interest income, net Income before income taxes Accounts receivable Temporary and consultant staffing Permanent placement staffing Risk consulting and internal audit services Goodwill Temporary and consultant staffing Permanent placement staffing Risk consulting and internal audit services Net service revenues Domestic Foreign Assets, long-lived Domestic Foreign (a) There were no customers that accounted for more than 10% of the Company's total net revenue in any year presented. 2013 Net service revenues Gross margin Income before income taxes Net income Net income available to common stockholders - diluted Basic net income per share Diluted net income per share 2012 Net service revenues Gross margin Income before income taxes Net income Net income available to common stockholders - diluted Basic net income per share Diluted net income per share Quarterly dividend per share Declaration date Record date Payment date 17, 2016 Plan Category Equity compensation plans approved by security holders Equity compensation plans not approved by security holders(a) Total 2014. 2013. 2013. 2013. 2013. Exhibit Annual Performance Bonus Plan, as amended and restated, incorporated by reference to Exhibit 99.1 to Registrant’s Current Report on Form 8-K dated May 23, 2013. Stock Incentive Plan—Form of Restricted Share Agreement for Executive Officers effective April 15, 2013, incorporated by reference to Exhibit 10.1 to Registrant’s Quarterly Report onForm 10-Q for the fiscal quarter ended March 31, 2013. Part II, Item 8 of this Form 10-K formatted in XBRL. Date: February Date: February Date: February Date: February Date: February Date: February Date: February Year Ended December 31, 2011 Allowance for doubtful accounts receivable Deferred tax valuation allowance Year Ended December 31, 2012 Allowance for doubtful accounts receivable Deferred tax valuation allowance Year Ended December 31, 2013 Allowance for doubtful accounts receivable Deferred tax valuation allowanceadvertising,interactive media, design, and marketing and web design fields.Protiviti, which began operations in 2002, is a global business consulting and internal audit firm.Protiviti, which primarily employs professionals specializing in risk, advisory and transactional services, is a wholly-ownedwholly owned subsidiary of the Company.work loadsworkloads for accounting, taxfinance, and financebookkeeping personnel caused by such predictable events as vacations, taking inventories, tax work,month-end activities and special projects, and such unpredictable events as illness and emergencies. Businesses view the use of temporary employees as a means of controlling personnel costs and converting such costs from fixed to variable. The cost and inconvenience to clients of hiring and firing regular employees are eliminated by the use ofAccountempstemporaries. The temporary workers are employees ofAccountempsand are paid byAccountemps. The customer pays a fixed rate only for hours worked.word processorsexecutive and administrative assistants to office managers.receptionists and customer service representatives. OfficeTeamoperates in much the same fashion as theAccountempsdivision.1The Company’sRobert Half Finance & Accounting division specializes in the placement of full-time accounting, financial, tax and bankingaccounting operations personnel. Fees for successfulworkloadcaseload periods) are similar to the demands of the clients of theAccountempsdivision.and senior financial analysts, internal auditors, and business systems analysts for such tasks as financial systems conversions, expansion into new markets, business process reengineering, business systems performance improvement, and post-merger financial consolidation.servesspecializes in identifying for its clients creative professionals in the areas of interactive media, design, marketing, advertising marketing and web designpublic relations. The division places freelance and places project consultants in a variety of positions such as creative directors, graphics designers, web content developers, web designers, media buyers, brand managers, and public relations specialists.Protiviti is a global business consulting and internal audit firm composed of experts specializing in risk, advisory and transactional services. The firmthat helps clientscompanies solve problems in finance, and transactions,technology, operations, technology, litigation, governance, risk and compliance.internal audit. Through its risk management and internal audit heritage, websites,digital, search engine marketing, social media, websites, job banksboards, and trade shows. Direct marketing throughe-mail regular mail and telephone solicitation also constitutes a significant portion of the Company’s total advertising. National advertising conducted by the Company consists primarily of radio, outdoor/billboard,streaming audio, digital display, search engine marketing, social media amplification, and advertisements in national digital and print advertisements in national newspapers, magazines,news publications, websites, social media sites, and trade journals.publications. Additionally, the Company has expanded its use of job boards and aggregators in all aspects of sales and recruitment. Joint marketing arrangements have been entered into with major software manufacturers and typically provide for development of proprietary skills tests, cooperative advertising, joint mailingse-mail campaigns, and similar promotional activities. The Company also actively seeks endorsements and affiliations with professional organizations in the business management, technology, office administration, and professional secretarial fields. In addition,2Local employeesRobert Half staffing and recruiting professionals are encouraged to be active in civic organizations and industry trade groups.2013,2015, the Company conducted its staffing services operations through 345332 offices in 42 states, the District of Columbia and 1817 foreign countries. Office managers are responsible for most activities of their offices, including sales, local advertising and marketing and recruitment.2013,2015, Protiviti had 5956 offices in 23 states and 11 foreign countries.313,00016,100 full-time employees, including approximately 2,7003,300 engaged directly inProtiviti operations. In addition, the Company placed approximately 197,000220,000 temporary employees on assignments with clients during 2013.2015. Employees placed by the Company on assignment with clients are the Company’s employees for all purposes while they are working on assignments. The Company pays the related costs of employment, such as workers’ compensation insurance, state and federal unemployment taxes, social security and certain fringe benefits. The Company provides access to voluntary health insurance coverage to interested temporary employees.crisisdownturn may continue to harm the Company’s business and financial condition. The world economy may continueMany of the Company’s markets, particularly in Europe, are currently experiencing a prolonged economic downturn characterized by high unemployment, limited availability of credit and decreased consumer and business spending. Given the nature of the Company’s business, financial results could be significantly harmed should such a prolongedthis downturn occur.continue for an extended period of time or intensify. In the past, the Company’s business has suffered during periods of high unemployment as demand for staffing services tends to significantly decrease during such periods. ThisThe impact of this downturn on the Company’s business could be further dramatized given the unprecedentedsevere impact it has had and may continue to have on the global labor markets.4Company’sCompany’s business. The demand for the Company’s services, in particular its staffing services, is highly dependent upon the state of the economy and upon the staffing needs of the Company’s clients. Any variation in the economic condition or unemployment levels of the U.S. or of any of the foreign countries in which the Company does business, or in the economic condition of any region of any of the foregoing, or in any specific industry may severely reduce the demand for the Company’s services and thereby significantly decrease the Company’s revenues and profits.results.results. As a provider of temporary and permanent staffing solutions as well as consultant services, the Company’s reputation is dependent upon the performance of the employees it places with its clients and the services rendered by its consultants. The Company depends on its reputation and name recognition to secure engagements and to hire qualified employees and consultants. If the Company’s clients become dissatisfied with the performance of those employees or consultants or if any of those employees or consultants engage in or are believed to have engaged in conduct that is harmful to the Company’s clients, the Company’s ability to maintain or expand its client base may be harmed.alleging various wage and hour related claims that could cause the Company to incur substantial liabilities. The Company and certain subsidiaries are defendants in several actual or asserted class and representative action lawsuits brought by or on behalf of the Company’s current and former employees alleging violations of federal and state law with respect to certain wage and hour related matters.matters, as well as claims challenging the Company’s compliance with the Fair Credit Reporting Act. The various claims made in one or more of such lawsuits include, among other things, the misclassification of certain employees as exempt employees under applicable law, failure to comply with wage statement requirements, failure to compensate certain employees for time spent performing activities related to the interviewing process, and other related wage and hour violations. Such suits seek, as applicable, unspecified amounts for unpaid overtime compensation, penalties, and other damages, as well as attorneys’ fees. It is not possible to predict the outcome of these lawsuits. However, these lawsuits may consume substantial amounts of the Company’s financial and managerial resources and might result in adverse publicity, regardless of the ultimate outcome of the lawsuits. In addition, the Company and its subsidiaries may become subject to similar lawsuits in the same or other jurisdictions. An unfavorable outcome with respect to5operatesoperates in a highly competitive businessand may be unable to retain clients or market share. The staffing services business is highly competitive and, because it is a service business, the barriers to entry are quite low. There are many competitors, some of which have greater resources than the Company, and new competitors are entering the market all the time. In addition, long-term contracts form a negligible portion of the Company’s revenue. Therefore, there can be no assurance that the Company will be able to retain clients or market share in the future. Nor can there be any assurance that the Company will, in light of competitive pressures, be able to remain profitable or, if profitable, maintain its current profit margins.Company.InCompany. In addition, the Company’s temporary services business entails employing individuals on a temporary basis and placing such individuals in clients’ workplaces. Increased government regulation of the workplace or of the employer-employee relationship, or judicial or administrative proceedings related to such regulation, could materially adversely affect the Company. In addition, to the extent that government regulation imposes increased costs upon the Company, such as unemployment insurance taxes, there can be no assurance that such costs will not adversely impact the Company’s profit margins. Further, lawsuits or other proceedings related to the Company’s compliance with government regulations or licensing requirements could materially adversely affect the Company. For example, the Company is currently named as a defendant in litigation challenging its compliance with the Fair Credit Reporting Act. It is not possible to predict the outcome of such litigation; however, such litigation or any future lawsuits or proceedings related to the Company’s compliance with government regulation or licensing requirements could consume substantial amounts of the Company’s financial and managerial resources and might result in adverse publicity, regardless of the ultimate outcome of any such lawsuits or other proceedings. An unfavorable outcome with respect to such litigation or any future lawsuits or proceedings could, individually or in the aggregate, cause the Company to incur substantial liabilities that may have a material adverse effect upon the Company’s business, financial condition or results of operations.(collectively, the “Health Care Reform Laws”(the “PPACA”) werewas signed into law in the United States. The Health Care Reform Laws include a large number of health-related provisions, includingPPACA imposed new mandates on individuals and employers, requiring most individuals to have health insurance and, establishing new regulations on health plans. Although the Health Care Reform Laws do not mandate that employers offer health insurance, beginning in 2015, assessing penalties will be assessed on large employers whothat do not offer health insurance that meets certain coverage, value, or affordability or benefit requirements.standards. Beginning 2015, the Company has redesigned its employee benefits to offer health insurance coverage to its temporary candidates in a way that it believes meets the requirements of the PPACA’s employer mandate. Providing such additional health insurance benefits and an increase in the number of employees who elect to participate in the Company’s employees, or the payment of penalties if such coverage is not provided, willhealth plans may significantly increase the Company’s expense. Ifhealth care-related costs as compared to historical periods. While the Company is unableattempting to raiserecover these costs from its customers, there can be no assurance that it will be successfully able to do so, and any difficulties it encounters in recovering such costs will cause its financial results to suffer.ratesregulations governing the PPACA’s employer mandate are new and subject to interpretation, it charges itsis possible that despite the Company’s efforts, the Company may incur liability in the form of penalties, fines, or damages if:to cover this expense,seek indemnification for health care claims by candidates working on client assignments.increases in expensepenalties, fines, or damages could harmhave a material adverse effect on the Company’s financial and operating results.systems.systems, some of which are managed by third-party vendors. The Company’s primary computer systems and operations are vulnerable to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, catastrophic events and errors in usage by the Company’s employees.employees and those of the Company’s vendors. In particular, the Company’s employees or vendors may have access or exposure to personally identifiable or otherwise confidential information and customer data and systems, the misuse of which could result in legal liability. Cyber-attacks, including attacks motivated by grievances against the business services industry in general or against the Company in particular, may disable or damage its systems. It is possible that the Company’s security controls or those of its third-party vendors over personal and other data and other practices it follows may not prevent the improper access to or disclosure of personally identifiable or otherwise confidential information. Such disclosure or damage to the Company’s systems could harm its reputation and subject it to government sanctions and liability under its contracts and laws that protect personal data and confidential information, resulting in increased costs or loss of revenue. The potential risk of security breaches and cyber-attacks may increase as the Company introduces new service offerings.ThisSimilarly there are a number of proposals currently being considered by the U.S. Congress to further delay or, in some cases, remove the requirements of Sarbanes-Oxley for a number of public companies. These or other similar delays or modifications of the Sarbanes Oxley requirements could decrease demand for Protiviti’sProtiviti’s services.clients.clients or be able to maintain the technology, personnel and other requirements to successfully compete.72013,2015, placement activities were conducted through 345332 offices located in the United States, Canada, the United Kingdom, Belgium, Brazil, France, the Netherlands, Germany, Italy, Luxembourg, Switzerland, Japan, China, Singapore, Australia, New Zealand, Austria, the United Arab Emirates, and Chile. As of December 31, 2013,2015, Protiviti had 5956 offices in the United States, Canada, Australia, China, France, Germany, Italy, the Netherlands, Japan, Singapore, India and the United Kingdom. All of the offices are leased.business, financial condition or results of operations, financial position or cash flows, litigation is subject to certain inherent uncertainties.8Item 5.Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities2014,2016, there were 1,6721,303 holders of record of the Common Stock. Sales Prices High Low $ 42.33 $ 37.16 $ 39.23 $ 30.64 $ 37.75 $ 31.08 $ 37.59 $ 32.22 Sales Prices High Low $ 31.84 $ 25.10 $ 29.41 $ 25.70 $ 32.32 $ 26.00 $ 31.00 $ 26.92 Sales Prices 2015 High Low 4th Quarter $ 54.01 $ 44.95 3rd Quarter $ 58.00 $ 49.18 2nd Quarter $ 60.54 $ 54.58 1st Quarter $ 63.27 $ 55.60 Sales Prices 2014 High Low 4th Quarter $ 59.45 $ 45.30 3rd Quarter $ 53.08 $ 46.98 2nd Quarter $ 48.13 $ 39.57 1st Quarter $ 43.06 $ 38.62 $.16$.20 per share were declared and paid in each quarter of 2013.2015. Cash dividends of $.15$.18 per share were declared and paid in each quarter of 2012. Total

Number of

Shares

Purchased Average

Price Paid

per Share Total

Number of

Shares

Purchased

as Part of

Publicly

Announced

Plans Maximum

Number of

Shares that May

Yet Be

Purchased

Under Publicly

Announced

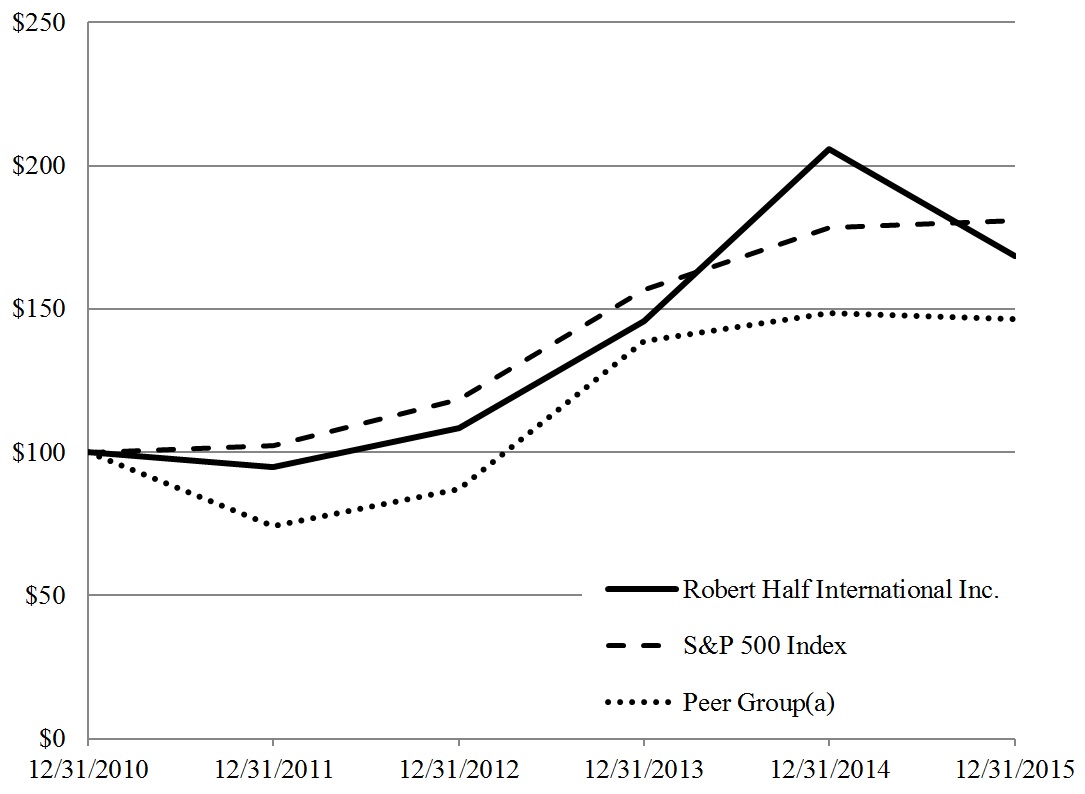

Plans (b) — — — 8,617,378 — — — 8,617,378 1,083,897 (a) $ 39.74 525,816 8,091,562 1,083,897 525,816 October 1, 2015 to October 31, 2015 — — — 11,823,541 November 1, 2015 to November 30, 2015 100,000 $ 50.90 100,000 11,723,541 December 1, 2015 to December 31, 2015 1,590,345 (a) $ 47.22 1,310,947 10,412,594 Total October 1, 2015 to December 31, 2015 1,690,345 1,410,947 (a) Includes 558,081279,398 shares repurchased in connection with employee stock plans, whereby Company shares were tendered by employees for the payment of applicable withholding taxes and/or exercise price.(b) Commencing in October 1997, the Company’s Board of Directors has, at various times, authorized the repurchase, from time to time, of the Company’s common stock on the open market or in privately negotiated transactions depending on market conditions. Since plan inception, a total of 98,000,000108,000,000 shares have been authorized for repurchase of which 89,908,43897,587,406 shares have been repurchased as of December 31, 2013.2015.92013,2015, the cumulative total return of the Company’s Common Stock, an index of certain publicly traded employment services companies, and the S&P 500. The graph assumes the investment of $100 at the beginning of the period depicted in the chart and reinvestment of all dividends. The information presented in the graph was obtained by the Company from outside sources it considers to be reliable but has not been independently verified by the Company.Previously, the peer group for this graph included SFN Group Inc. During the five-year period, SFN Group was acquired by Randstad Holdings N.V. in an all cash transaction. The Company and all of the other members of the peer group are based in the U.S. and traded on either the New York Stock Exchange (“NYSE”) or NASDAQ. Randstad is based in Europe and is not traded on either the NYSE or NASDAQ. Accordingly, the Company believes it is appropriate to adjust its peer group to not include Randstad and to add two other companies that provide professional staffing services (Kforce Inc. and Resources Connection Inc.) that are based in the U.S. and traded on either the NYSE or NASDAQ. The accompanying chart shows the performance of both the new peer group and the old peer group (with SFN Group being included for the period prior to its acquisition and Randstad being included for the period subsequent to its acquisition of SFN Group).