UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended August 30, 2014,27, 2016, or

| ¨ | Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission file number 1-10714

AUTOZONE, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 62-1482048 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 123 South Front Street, Memphis, Tennessee | 38103 | |

| (Address of principal executive offices) | (Zip Code) |

(901) 495-6500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock ($.01 par value) | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 ofRegulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 ofRegulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of thisForm 10-K or any amendment to thisForm 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” inRule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the Registrant is a shell company (as defined inRule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $18,167,987,884.$21,836,021,743.

The number of shares of Common Stock outstanding as of October 20, 2014,17, 2016, was 32,040,703.28,861,394.

Documents Incorporated By Reference

Portions of the definitive Proxy Statement to be filed within 120 days of August 30, 2014,27, 2016, pursuant to Regulation 14A under the Securities Exchange Act of 1934 for the Annual Meeting of Stockholders to be held on December 18, 2014,14, 2016, are incorporated by reference into Part III.

Item 1. | ||||||

| 5 | ||||||

| 6 | ||||||

| 8 | ||||||

| 8 | ||||||

| 9 | ||||||

| 9 | ||||||

| 10 | ||||||

| 10 | ||||||

| 10 | ||||||

Item 1A. | ||||||

Item 1B. | ||||||

Item 2. | ||||||

Item 3. | ||||||

Item 4. | ||||||

Item 5. | ||||||

Item 6. | ||||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||

Item 7A. | ||||||

Item 8. | ||||||

Item 9. | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | |||||

Item 9A. | ||||||

Item 9B. | 73 | |||||

| 74 | ||||||

Item 10. | 74 | |||||

Item 11. | 74 | |||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 74 | ||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 74 | ||||

Item 14. | 74 | |||||

| 75 | ||||||

Item 15. | 75 | |||||

Forward-Looking Statements

Certain statements contained in this annual report are forward-looking statements. Forward-looking statements typically use words such as “believe,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. These are based on assumptions and assessments made by our management in light of experience and perception of historical trends, current conditions, expected future developments and other factors that we believe to be appropriate. These forward-looking statements are subject to a number of risks and uncertainties, including without limitation: product demand; energy prices; weather; competition; credit market conditions; access to available and feasible financing; the impact of recessionary conditions; competition; product demand; the ability to hire and retain qualified employees; consumer debt levels; inflation; weather; raw material costs of our suppliers; energy prices;changes in laws or regulations; war and the prospect of war, including terrorist activity; inflation; the ability to hire and retain qualified employees; construction delays; access to availablethe compromising of the confidentiality, availability, or integrity of information, including cyber security attacks; and feasible financing; and changes in laws or regulations.raw material costs of our suppliers. Certain of these risks are discussed in more detail in the “Risk Factors” section contained in Item 1A under Part 1 of this Annual Report onForm 10-K for the year ended August 30, 2014,27, 2016, and these Risk Factors should be read carefully. Forward-looking statements are not guarantees of future performance and actual results; developments and business decisions may differ from those contemplated by such forward-looking statements, and events described above and in the “Risk Factors” could materially and adversely affect our business. Forward-looking statements speak only as of the date made. Except as required by applicable law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Actual results may materially differ from anticipated results.

AutoZone, Inc. (“AutoZone,” the “Company,” “we,” “our” or “us”) is the nation’s leading retailer and a leading distributor of automotive replacement parts and accessories in the United States. We began operations in 1979 and at August 30, 2014,27, 2016, operated 4,9845,297 AutoZone stores in the United States, including Puerto Rico; 402483 stores in Mexico; and fiveeight stores in Brazil.Brazil; and 26 Interamerican Motor Corporation (“IMC”) branches. Each of our storesAutoZone store carries an extensive product line for cars, sport utility vehicles, vans and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories and non-automotive products. At August 30, 2014,27, 2016, in 3,8454,390 of our domestic AutoZone stores we also havehad a commercial sales program that provides commercial credit and prompt delivery of parts and other products to local, regional and national repair garages, dealers, service stations and public sector accounts. We also have commercial programs in selectAutoZone stores in Mexico as well as in our stores inand Brazil. IMC branches carry an extensive line of original equipment quality import replacement parts. We also sell the ALLDATA brand automotive diagnostic and repair software through www.alldata.com.www.alldata.com and www.alldatadiy.com. Additionally, we sell automotive hard parts, maintenance items, accessories and non-automotive products through www.autozone.com, and accessories, performance and performancereplacement parts through www.autoanything.com, and our commercial customers can make purchases through www.autozonepro.com.www.autozonepro.com and www.imcparts.net. We do not derive revenue from automotive repair or installation services.

At August 30, 2014,27, 2016, our AutoZone stores and IMC branches were in the following locations:

Count | ||||

Alabama | ||||

Alaska | ||||

Arizona | ||||

Arkansas | 62 | |||

California | ||||

Colorado | ||||

Connecticut | ||||

Delaware | ||||

Florida | ||||

Georgia | ||||

Hawaii | 3 | |||

Idaho | ||||

Illinois | ||||

Indiana | ||||

Iowa | ||||

Kansas | ||||

Kentucky | ||||

Louisiana | ||||

Maine | ||||

Maryland | ||||

Massachusetts | ||||

Michigan | ||||

Minnesota | ||||

Mississippi | ||||

Missouri | ||||

Montana | ||||

Nebraska | ||||

Nevada | ||||

New Hampshire | 22 | |||

New Jersey | ||||

New Mexico | 62 | |||

New York | ||||

North Carolina | ||||

North Dakota | ||||

Ohio | ||||

Oklahoma | ||||

Oregon | ||||

Pennsylvania | ||||

Puerto Rico | ||||

Rhode Island | ||||

South Carolina | 86 | |||

South Dakota | 6 | |||

Tennessee | ||||

Texas | ||||

Utah | ||||

Vermont | 2 | |||

Virginia | ||||

Washington | ||||

Washington, DC | 5 | |||

West Virginia | ||||

Wisconsin | ||||

Wyoming | ||||

|

| |||

Total Domestic AutoZone stores | ||||

Mexico | ||||

Brazil | ||||

|

| |||

Total AutoZone stores | ||||

IMC branches | 26 | |||

Total locations | 5,814 | |||

|

|

Marketing and Merchandising Strategy

We are dedicated to providing customers with superior service and trustworthy advice as well as quality automotive parts and products at a great value in conveniently located, well-designed stores. Key elements of this strategy are:

Customer Service

Customer service is the most important element in our marketing and merchandising strategy, which is based upon consumer marketing research. We emphasize that our AutoZoners (employees) should always put customers first by providing prompt, courteous service and trustworthy advice. Our electronic parts catalog assists in the selection of parts as well as identifying any associated warranties that are offered by us or our vendors. We sell automotive hard parts, maintenance items, accessories and non-automotive parts through www.autozone.com for pick-up in store or to be shipped directly to a customer’s home or business. Additionally, we offer smartphone apps that provide customers with store locations, driving directions, operating hours, ability to purchase products and product availability.

Our stores generally open at 7:30 or 8 a.m. and close between 8 and 10 p.m. Monday through Saturday and typically open at 9 a.m. and close between 6 and 9 p.m. on Sunday. However, some stores are open 24 hours, and some have extended hours of 6 or 7 a.m. until midnight seven days a week.

We also provide specialty tools through our Loan-A-Tool program. Customers can borrow a specialty tool, such as a steering wheel puller, for which a do-it-yourself (“DIY”) customer or a repair shop would have little or no use other than for a single job. AutoZoners also provide other free services, including check engine light readings where allowed by law, battery charging, the collection of used oil for recycling and the testing of starters, alternators batteries, sensors and actuators.batteries.

Merchandising

The following tables show some of the types of products that we sell by major category of items:

Failure | Maintenance | Discretionary | ||

A/C Compressors Batteries & Accessories Bearings Belts & Hoses Calipers Carburetors Chassis Clutches CV Axles Engines Fuel Pumps Fuses Ignition Lighting Mufflers Radiators Tire Repair Thermostats Starters & Alternators Water Pumps | Antifreeze & Windshield Washer Fluid | |||

Brake Drums, Rotors, Shoes & Pads | ||||

Chemicals, including Brake & Power | ||||

| ||||

Oil & Transmission Fluid | ||||

Oil, Air, Fuel & Transmission Filters | ||||

Oxygen Sensors | ||||

Paint & Accessories | ||||

Refrigerant & Accessories | ||||

Shock Absorbers & Struts | ||||

Spark Plugs & Wires Windshield Wipers | Air Fresheners Cell Phone Accessories Drinks & Snacks Floor Mats & Seat Covers Interior and Exterior Accessories Mirrors Performance Products Protectants & Cleaners Sealants & Adhesives Steering Wheel Covers Stereos & Radios | |||

Tools | ||||

Wash & Wax | ||||

We believe that the satisfaction of our customers is often impacted by our ability to provide specific automotive products as requested. Each store carries the same basic products, but we tailor our hard parts inventory to the makes and models of the vehicles in each store’s trade area, and our sales floor products are tailored to the local store’s demographics. Our hub stores (including mega hubs, which carry an even broader assortment) carry a larger assortment of products that are delivered to local satellite stores. We are constantly updating the products we offer to ensure that our inventory matches the products our customers need or desire.

Pricing

We want to be perceived by our customers as the value leader in our industry, by consistently providing quality merchandise at the right price, backed by a satisfactory warranty and outstanding customer service. For many of our products, we offer multiple value choices in a good/better/best assortment, with appropriate price and quality differences from the “good” products to the “better” and “best” products. A key differentiating component versus our competitors is our exclusive line of in-house brands, which includes the Econocraft, Valucraft, AutoZone, SureBilt, ProElite, Duralast, Duralast Max, Duralast Gold, Duralast Platinum and Duralast PlatinumProPower brands. We believe that our overall value compares favorably to that of our competitors.

Brand Marketing: Advertising and Promotions

We believe that targeted advertising and promotions play important roles in succeeding in today’s environment. We are constantly working to understand our customers’ wants and needs so that we can build long-lasting, loyal relationships. We utilize promotions, advertising and loyalty card programs primarily to advise customers about the overall importance of vehicle maintenance, our great value and the availability of high quality parts. Broadcast and internet media are our primary advertising methods of driving traffic to our stores. We utilize in-store signage, in-store circulars and creative product placement and promotions to help educate customers about products that they need.

Store Design and Visual Merchandising

We design and build stores for high visual impact. The typical AutoZone store utilizes colorful exterior and interior signage, exposed beams and ductwork and brightly lit interiors. Maintenance products, accessories and non-automotive items are attractively displayed for easy browsing by customers. In-store signage and special displays promote products on floor displays, end caps and shelves.

Our commercial sales program operates in a highly fragmented market, and we are one of the leading distributors of automotive parts and other products to local, regional and national repair garages, dealers, service stations and

public sector accounts in the United States, Puerto Rico and Mexico. As a part of the domestic store program, we offer credit and delivery to our customers, as well as online ordering through www.autozonepro.com.www.autozonepro.com and www.imcparts.net. Through our hub stores, we offer a greater range of parts and products desired by professional technicians. We have dedicated sales teams focused on independent repair shops as well as national, regional and public sector commercial accounts.

Store Formats

Substantially all AutoZone stores are based on standard store formats, resulting in generally consistent appearance, merchandising and product mix. Approximately 85% to 90% of each store’s square footage is selling space, of which approximately 40% to 45% is dedicated to hard parts inventory. The hard parts inventory area is generally fronted by counters or pods that run the depth or length of the store, dividing the hard parts area from the remainder of the store. The remaining selling space contains displays of maintenance, accessories and non-automotive items.

We believe that our stores are “destination stores,” generating their own traffic rather than relying on traffic created by adjacent stores. Therefore, we situate most stores on major thoroughfares with easy access and good parking.

Store Personnel and Training

Each store typically employs from 10 to 16 AutoZoners, including a manager and, in some cases, an assistant manager. We provide on-the-job training as well as formal training programs, including an annual national sales meeting, regular store meetings on specific sales and product topics, standardized training manuals and computer based modules and a specialist program that provides training to AutoZoners in several areas of technical expertise from the Company, our vendors and independent certification agencies. All domestic AutoZoners are encouraged to complete tests resulting in certifications by the National Institute for Automotive Service Excellence (“ASE”), which is broadly recognized for training certification in the automotive industry. Training is supplemented with frequent store visits by management.

Store managers, sales representatives, commercial sales managers and managers at various levels across the organization receive financial incentives through performance-based bonuses. In addition, our growth has provided opportunities for the promotion of qualified AutoZoners. We believe these opportunities are important to attract, motivate and retain high quality AutoZoners.

All store support functions are centralized in our store support centers located in Memphis, Tennessee; Monterrey, Mexico; Chihuahua, Mexico andMexico; Sao Paulo, Brazil.Brazil and Canoga Park, California. We believe that this centralization enhances consistent execution of our merchandising and marketing strategies at the store level, while reducing expenses and cost of sales.

Store Automation

All of our AutoZone stores haveZ-net, our proprietary electronic catalog that enables our AutoZoners to efficiently look up the parts that our customers need and to provide complete job solutions, advice and information for customer vehicles.Z-net provides parts information based on the year, make, model and engine type of a vehicle and also tracks inventory availability at the store, at other nearby stores and through special order. TheZ-net display screens are placed on the hard parts counter or pods, where both the AutoZoner and customer can view the screen.

Our AutoZone stores utilize our computerized proprietary Store Management System, which includes bar code scanning and point-of-sale data collection terminals. The Store Management System provides administrative assistance and improved personnel scheduling at the store level, as well as enhanced merchandising information and improved inventory control. We believe the Store Management System also enhances customer service through faster processing of transactions and simplified warranty and product return procedures.

The following table reflects our storelocation development during the past five fiscal years:

| Fiscal Year | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

Beginning stores | 5,201 | 5,006 | 4,813 | 4,627 | 4,417 | |||||||||||||||

New stores | 190 | 197 | 193 | 188 | 213 | |||||||||||||||

Closed stores | — | 2 | — | 2 | 3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net new stores | 190 | 195 | 193 | 186 | 210 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Relocated stores | 8 | 11 | 10 | 10 | 3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Ending stores | 5,391 | 5,201 | 5,006 | 4,813 | 4,627 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| Fiscal Year | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

Beginning locations | 5,609 | 5,391 | 5,201 | 5,006 | 4,813 | |||||||||||||||

Acquired locations(1) | — | 17 | — | — | — | |||||||||||||||

New locations | 205 | 202 | 190 | 197 | 193 | |||||||||||||||

Closed locations | — | 1 | — | 2 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net new locations | 205 | 201 | 190 | 195 | 193 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Relocated locations | 6 | 5 | 8 | 11 | 10 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Ending locations | 5,814 | 5,609 | 5,391 | 5,201 | 5,006 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| (1) | Includes 17 IMC branches acquired on September 27, 2014. |

We believe that expansion opportunities exist in markets that we do not currently serve, as well as in markets where we can achieve a larger presence. We attempt to obtain high visibility sites in high traffic locations and undertake substantial research prior to entering new markets. The most important criteria for opening a new AutoZone store or IMC branch are the projected future profitability and the ability to achieve our required investment hurdle rate. Key factors in selecting new site and market locations for AutoZone stores and IMC branches include population, demographics, vehicle profile, customer buying trends, commercial businesses, number and strength of competitors’ stores and the cost of real estate. In reviewing the vehicle profile, we also consider the number of vehicles that are seven years old and older, or “our kind of vehicles”; these vehicles are generally no longer under the original manufacturers’ warranties and require more maintenance and repair than newer vehicles. We generally seek to open new AutoZone stores in high visibility sites in high traffic locations within or contiguous to existing market areas and attempt to cluster development in markets in a relatively short period of time. When selecting future sites and market locations for our IMC branches, we look for locations close to major highways to support IMC’s delivery schedule and also consider the population of AutoZone stores in the market. In addition to continuing to lease or develop our own stores,locations, we evaluate and may make strategic acquisitions.

Merchandise is selected and purchased for all AutoZone stores through our store support centers located in Memphis, Tennessee,Tennessee; Monterrey, Mexico and Sao Paulo, Brazil. Merchandise is selected and purchased for all IMC branches through our store support center located in Canoga Park, California. In fiscal 2014,2016, one class of similar products accounted for approximately 1011 percent of our total sales, and one vendor supplied more thanapproximately 10 percent of our purchases. No other class of similar products accounted for 10 percent or more of our total sales, and no other individual vendor provided more than 10 percent of our total purchases. We believe that alternative sources of supply exist, at similar costs, for most types of product sold. Most of our merchandise flows through our distribution centers to our AutoZone stores and IMC branches by our fleet of tractors and trailers or by third-party trucking firms.

OurWe ended fiscal 2016 with 182 hub stores, which have increased our ability to distribute products on a timely basis to many of our stores and to expand our product assortment. A hub store has a larger assortment of products as well as regular replenishment items that can be delivered to a store in its network within 24 hours. Hub stores are generally replenished from distribution centers multiple times per week. Hub stores have increased our ability to distribute products on a timely basis to many of our stores and to expand our product assortment.

During fiscal 2014 and 2015, we tested two new concepts of our supply chain strategy, increased delivery frequency to our stores utilizing our distribution centers and significantly expanded parts assortments in select stores we call mega hubs. Our tests were concluded during fiscal 2015, and both initiatives were expanded to additional locations in fiscal 2016.

Increased delivery frequency focuses on improving our in-stock position of our core store-stocked product by providing deliveries to certain stores multiple times per week. We ended fiscal 2016 with over 1,900 stores receiving deliveries multiple times per week, an increase of approximately 1,000 stores since fiscal 2015.

A mega hub store carries inventory of 80,000 to 100,000 unique SKUs, approximately twice what a hub store carries. Mega hubs provide coverage to both surrounding stores and other hub stores multiple times a day or on an overnight basis. We ended fiscal 2016 with 11 mega hubs, an increase of six since fiscal 2015.

The sale of automotive parts, accessories and maintenance items is highly competitive in many areas, including name recognition, product availability, customer service, store location and price. AutoZone competes in the aftermarket auto parts industry, which includes both the retail DIY and commercial do-it-for-me (“DIFM”) auto parts and products markets.

Competitors include national, regional and local auto parts chains, independently owned parts stores, online parts stores, wholesale distributors, jobbers, repair shops, car washes and auto dealers, in addition to discount and mass merchandise stores, department stores, hardware stores, supermarkets, drugstores, convenience stores, home stores, and other online retailers that sell aftermarket vehicle parts and supplies, chemicals, accessories, tools and maintenance parts. AutoZone competes on the basis of customer service, including the trustworthy advice of our AutoZoners; merchandise quality, selection and availability; price; product warranty; store layouts, location and convenience; and the strength of our AutoZone brand name, trademarks and service marks.

We have registered several service marks and trademarks in the United States Patent and Trademark office as well as in certain other countries, including our service marks, “AutoZone” and “Get in the Zone,” and trademarks, “AutoZone,” “Duralast,” “Duralast Gold,” “Duralast Platinum,” “Duralast ProPower,” “Duralast ProPower Plus,” “Duralast ProPower Ultra,” “Duralast ProPower AGM,” “Valucraft,” “Econocraft,“ProElite,” “SureBilt,” “ALLDATA,” “AutoAnything,” “IMC,” “Loan-A-Tool” and “Z-net.” We believe that these service marks and trademarks are important components of our marketing and merchandising strategies.

As of August 30, 2014,27, 2016, we employed over 76,00084,000 persons, approximately 5759 percent of whom were employed full-time. About 9291 percent of our AutoZoners were employed in stores or in direct field supervision, approximately 5 percent in distribution centers and approximately 34 percent in store support and other functions. Included in the above numbers are approximately 5,7007,500 persons employed in our Mexico and Brazil operations.

We have never experienced any material labor disruption and believe that relations with our AutoZoners are good.

AutoZone’s primary website is at http://www.autozone.com. We make available, free of charge, at our investor relations website, http://www.autozoneinc.com, our Annual Reports onForm 10-K, Quarterly Reports onForm 10-Q, Current Reports onForm 8-K, proxy statements, registration statements and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934, as amended, as soon as reasonably feasible after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

Executive Officers of the Registrant

The following list describes our executive officers. The title of each executive officer includes the words “Customer Satisfaction” which reflects our commitment to customer service. Officers are elected by and serve at the discretion of the Board of Directors.

William C. Rhodes, III, 49—51 — Chairman, President and Chief Executive Officer, Customer Satisfaction

William C. Rhodes, III, was named Chairman of AutoZone during fiscal 2007 and has been President, Chief Executive Officer and a director since March 2005. Prior to his appointment as President and Chief Executive Officer, Mr. Rhodes was Executive Vice President – Store Operations and Commercial. Previously, he held several key management positions with the Company. Prior to 1994, Mr. Rhodes was a manager with Ernst & Young LLP. Mr. Rhodes is a member of the Board of Directors for Dollar General Corporation.Corporation, a discount retailer offering a broad selection of merchandise, including consumables, seasonal, home products and apparel.

William T. Giles, 5557—Chief Financial Officer and Executive Vice President – Finance, Information Technology and ALLDATA, Customer Satisfaction

William T. Giles was named Chief Financial Officer and Executive Vice President – Finance, Information Technology and ALLDATA during October 2012. Prior to that, he was Chief Financial Officer and Executive Vice President – Finance, Information Technology and Store Development from fiscal 2007 to October 2012; Executive Vice President, Chief Financial Officer and Treasurer from June 2006 to December 2006; and Executive Vice President, Chief Financial Officer since May 2006. From 1991 to May 2006, he held several positions with Linens N’ Things, Inc., most recently as the Executive Vice President and Chief Financial Officer. Prior to 1991, he was with Melville, Inc. and PricewaterhouseCoopers. Mr. Giles is a member of the Board of Directors for Brinker International.

Kristen C. Wright, 38—Senior Vice President – General CounselInternational, which owns, operates and franchises the Chili’s Grill & Secretary, Customer SatisfactionBar and Maggiano’s Little Italy restaurant concepts.

Kristen C. Wright was named Senior Vice President, General Counsel & Secretary effective January 2014. She previously held the title of Vice President – Assistant General Counsel & Assistant Secretary from January 2012 to January 2014. Before joining AutoZone, she was a partner with the law firm of Bass, Berry & Sims PLC.

Mark A. Finestone,5355— Executive Vice President – Merchandising, Supply Chain and Marketing, Customer Satisfaction

Mark A. Finestone was named Executive Vice President – Merchandising, Supply Chain and Marketing during October 2015. Previously, he was Senior Vice President – Merchandising and Store Development Customer Satisfaction

Mark A. Finestone was electedsince 2014, Senior Vice President – Merchandising during fiscal 2008. Previously, he wasfrom 2008 to 2014, and Vice President – Merchandising since 2002.from 2002 to 2008. Prior to joining AutoZone in 2002, Mr. Finestone worked for May Department Stores for 19 years where he held a variety of leadership roles which included Divisional Vice President, Merchandising.

William W. Graves,5456— Executive Vice President – Mexico, Brazil, IMC and Store Development, Customer Satisfaction

William W. Graves was named Executive Vice President – Mexico, Brazil, IMC and Store Development during October 2015. Previously, he was Senior Vice President – Supply Chain and International Customer Satisfaction

William W. Graves was named Senior Vice President – Supply Chain and International during Octobersince 2012. Prior thereto, he was Senior Vice President – Supply Chain from fiscal 2006 to October 2012 and Vice President – Supply Chain from fiscal 2000 to fiscal 2006. From 1992 to 2000, Mr. Graves served in various capacities with the Company.

Thomas B. Newbern, 54 — Executive Vice President – Store Operations, Commercial and Loss Prevention, Customer Satisfaction

Thomas B. Newbern was named Executive Vice President – Store Operations, Commercial and Loss Prevention during October 2015. Prior to that, he was Senior Vice President – Store Operations and Loss Prevention since 2014 and Senior Vice President – Store Operations and Store Development since 2012. Previously, Mr. Newbern held the titles Senior Vice President – Store Operations from 2007 to 2012 and Vice President – Store Operations from 1998 to 2007. Prior thereto, he held several key management positions with the Company.

Philip B. Daniele, 47 — Senior Vice President – Commercial, Customer Satisfaction

Philip B. Daniele was elected Senior Vice President – Commercial during November 2015. Prior to that, he was Vice President – Commercial since 2013 and Vice President – Merchandising from 2008 to 2013. Previously, he was Vice President – Store Operations from 2005 to 2008. From 1993 until 2008, Mr. Daniele served in various capacities within the Company.

Ronald B. Griffin, 6062—Senior Vice President and Chief Information Officer, Customer Satisfaction

Ronald B. Griffin was elected Senior Vice President and Chief Information Officer during June 2012. Prior to that, he was Senior Vice President, Global Information Technology at Hewlett-Packard Company. During his tenure at Hewlett-Packard Company, he also served as the Chief Information Officer for the Enterprise Business Division. Prior to that, Mr. Griffin was Executive Vice President and Chief Information Officer for Fleming Companies, Inc. He also spent over 12 years with The Home Depot, Inc., with the last eight years in the role of Chief Information Officer. Mr. Griffin also served at Deloitte & Touche LLP and Delta Air Lines, Inc.

Albert Saltiel, 50James C. Griffith, 51 —Senior Vice President – Marketing, Customer Satisfaction

Albert “Al” Saltiel was elected Senior Vice President – Marketing during April 2013. Prior to that, he was Chief Marketing Officer and a key member of the leadership team at Navistar International Corporation. Mr. Saltiel has also been with Sony Electronics as General Manager, Marketing, and Ford Motor Company where he held multiple marketing roles.

Thomas B. Newbern, 52—Senior Vice President – Store Operations, and Loss Prevention, Customer Satisfaction

Thomas B. NewbernJames C. Griffith was electednamed Senior Vice President–Store Operation andOperations in November 2015. Prior to that, he was Vice President – Store Development duringsince October 2012. Previously, Mr. Newbern held the titles Senior Vice President– Store Operations from fiscal 2007 to October 20122010 and Vice President – Store Operations from fiscal 1998 to fiscalsince 2007. Previously,Prior thereto, he held several key management positions within the Company.

William R. Hackney, 51 — Senior Vice President – Merchandising, Customer Satisfaction

William R. Hackney was named Senior Vice President, Merchandising in October 2015. His career with AutoZone began in 1983, and he has held several key management roles within the Company, including Vice President – Store Operations Support and Vice President – Merchandising.

Rodney C. Halsell, 48 — Senior Vice President –Supply Chain, Customer Satisfaction

Rodney C. Halsell was named Senior Vice President – Supply Chain during October 2015. Prior to that, he was Vice President – Distribution since 2005. From 1985 to 2005, he held several key management positions and served in various capacities with the Company.

Charlie Pleas, III, 49—51 — Senior Vice President and Controller, Customer Satisfaction

Charlie Pleas, III, was elected Senior Vice President and Controller during fiscal 2007. Prior to that, he was Vice President and Controller since 2003. Previously, he was Vice President – Accounting since 2000, and Director of General Accounting since 1996. Prior to joining AutoZone, Mr. Pleas was a Division Controller with Fleming Companies, Inc. where he served in various capacities since 1988. Mr. Pleas is a member of the Board of Directors for Kirkland’s, Inc., a specialty retailer of home décor and gifts.

Larry M. Roesel, 57—Albert Saltiel, 52 —Senior Vice President – Commercial,Marketing and E-Commerce, Customer Satisfaction

Larry M. RoeselAlbert Saltiel was named Senior Vice President – Marketing and E-Commerce during October 2014. Previously, he was elected Senior Vice President–Commercial during fiscal 2007. Marketing since 2013. Prior to that, he was Chief Marketing Officer and a key member of the leadership team at Navistar International Corporation. Mr. Roesel came to AutoZoneSaltiel has also been with more than thirty years of experience with OfficeMax, Inc.Sony Electronics as General Manager, Marketing, and its predecessor,Ford Motor Company where he served in operations, sales and general management.held multiple marketing roles.

Michael A. Womack, 47Richard C. Smith, 52 —Senior Vice President – Human Resources, Customer Satisfaction

Michael A. WomackRichard C. Smith was elected Senior Vice President – Human Resources in June 2012.December 2015. He washas been an AutoZoner since 1985, previously holding the position of Vice President of Human ResourcesStores since 1997. Prior thereto, he served in various capacities with Cintas Corporation and had been with Cintas since 2003.the Company.

Kristen C. Wright, 40 — Senior Vice President – General Counsel & Secretary, Customer Satisfaction

Kristen C. Wright was named Senior Vice President – General Counsel & Secretary effective January 2014. She previously held the title of Vice President – Assistant General Counsel & Assistant Secretary from January 2012 to January 2014. Before joining Cintas, heAutoZone, she was a partner with the Littler Mendelson law firm.firm of Bass, Berry & Sims PLC.

Our business is subject to a variety of risks. Set forth below are certain of the important risks that we face, the occurrence of which could have a material adverse effect on our business. These risks are not the only ones we face. Our business could also be affected by additional factors that are presently unknown to us or that we currently believe to be immaterial to our business.

If demand for our products slows, then our business may be materially adversely affected.

Demand for the products we sell may be affected by a number of factors we cannot control, including:

For the long term, demand for our products may be affected by:

All of these factors could result in immediate and longer term declines in the demand for our products, which could adversely affect our sales, cash flows and overall financial condition.

If we are unable to compete successfully against other businesses that sell the products that we sell, we could lose customers and our sales and profits may decline.

The sale of automotive parts, accessories and maintenance items is highly competitive, and sales volumes are dependent on many factors, including name recognition, product availability, customer service, store location and price. Competitors are opening locations near our existing stores.locations. AutoZone competes as a provider in both the DIY and DIFM auto parts and accessories markets.

Our competitors include national, regional and local auto parts chains, independently owned parts stores, online parts stores, wholesale distributors, jobbers, repair shops, car washes and auto dealers, in addition to discount and mass merchandise stores, hardware stores, supermarkets, drugstores, convenience stores, home stores and other online retailers that sell aftermarket vehicle parts and supplies, chemicals, accessories, tools and maintenance parts. Although we believe we compete effectively on the basis of customer service, including the knowledge and expertise of our AutoZoners; merchandise quality, selection and availability; product warranty; store layout,

location and convenience; price; and the strength of our AutoZone brand name, trademarks and service marks, some of our competitors may gain competitive advantages, such as greater financial and marketing resources allowing them to sell automotive products at lower prices, larger stores with more merchandise, longer operating histories, more frequent customer visits and more effective advertising. With the increasing use of digital tools and social media, and our competitors’ increased focus on optimizing customers’ online experience, our customers are quickly able to compare prices, product assortment and feedback from other customers before purchasing our products either online, in the physical stores, or through a combination of both offerings. If we are unable to continue to develop successful competitive strategies, or if our competitors develop more effective strategies, we could lose customers and our sales and profits may decline.

We may not be able to sustain our historic rate of sales growth.

We have increased our storelocation count in the past five fiscal years, growing from 4,417 stores4,813 locations at August 29, 2009,27, 2011, to 5,391 stores5,814 locations at August 30, 2014,27, 2016, an average store countlocation increase per year of 4%. Additionally, we have increased annual revenues in the past five fiscal years from $6.817$8.073 billion in fiscal 20092011 to $9.475$10.636 billion in fiscal 2014,2016, an average increase per year of 8%6%. Annual revenue growth is driven by the opening of new storeslocations and commercial programs and increases in same store sales. We open new storeslocations only after evaluating customer buying trends and market demand/needs, all of which could be adversely affected by persistent unemployment, wage cuts, small business failures and microeconomic conditions unique to the automotive industry. Same store sales are impacted both by customer demand levels and by the prices we are able to charge for our products, which can also be negatively impacted by the economic pressures mentioned above. We cannot provide any assurance that we will continue to open storeslocations at historical rates or continue to achieve increases in same store sales.

Consolidation among our competitors may negatively impact our business.

Recently some of our competitors have merged. Consolidation among our competitors could enhance their market share and financial position, provide them with the ability to achieve better purchasing terms and provide more competitive prices to customers for whom we compete, and allow them to utilize merger synergies and cost savings to increase advertising and marketing budgets to more effectively compete for customers. Consolidation by our competitors could also increase their access to local market parts assortment. These consolidated competitors could take sales volume away from us in certain markets, could cause us to change our pricing with a negative impact on our margins or could cause us to spend more money to maintain customers or seek new customers, all of which could negatively impact our business.

If we cannot profitably increase our market share in the commercial auto parts business, our sales growth may be limited.

Although we are one of the largest sellers of auto parts in the commercial market, we must effectively compete against national and regional auto parts chains, independently owned parts stores, wholesalers and jobbers in order to increase our commercial market share. Although we believe we compete effectively in the commercial market on the basis of customer service, merchandise quality, selection and availability, price, product warranty, distribution locations and the strength of our AutoZone brand name, trademarks and service marks, some automotive aftermarket jobberschains have been in business for substantially longer periods of time than we have, and as a result have developed long-term customer relationships and have large available inventories. If we are unable to profitably develop new commercial customers, our sales growth may be limited.

A downgrade in our credit ratings or a general disruption in the credit markets could make it more difficult for us to access funds, refinance our debt, obtain new funding or issue securities.

Our short-term and long-term debt is rated investment grade by the major rating agencies. These investment-grade credit ratings have historically allowed us to take advantage of lower interest rates and other favorable terms on our short-term credit lines, in our senior debt offerings and in the commercial paper markets. To maintain our investment-grade ratings, we are required to meet certain financial performance ratios. A change by the rating agencies in these ratios, an increase in our debt, and/or a decline in our earnings could result in downgrades in our credit ratings. A downgrade in our credit ratings could limit our access to public debt markets, limit the institutions willing to provide credit facilities to us, result in more restrictive financial and other covenants in our public and private debt and would likely significantly increase our overall borrowing costs and adversely affect our earnings.

Moreover, significant deterioration in the financial condition of large financial institutions in calendarrecent years 2008 and 2009 resulted in a severe loss of liquidity and availability of credit in global credit markets and in more stringent borrowing terms. During brief time intervals in the fourth quarter of calendar 2008 and the first quarter of calendar 2009,recent years, there was limited liquidity in the commercial paper markets, resulting in an absence of commercial paper buyers and extraordinarily high interest rates on commercial paper. We can provide no assurance that credit market events such as those that occurred in the fourth quarter of 2008 and the first quarter of 2009recent years will not occur again in the foreseeable future. Conditions and events in the global credit marketmarkets could have a material adverse effect on our access to short-term debt and the terms and cost of that debt.

Significant changes in macroeconomic and geo-political factors could adversely affect our financial condition and results of operations.

Macroeconomic conditions impact both our customers and our suppliers. Job growth in the United States has remained relatively slow during the past five yearsyears; however, towards the end of fiscal 2015 and continuing through fiscal 2016, the unemployment rate has not recoveredimproved to pre-recession levels. Moreover, the United States government continues to operate under historically large deficits and debt burden. Continued distress in global credit markets, business failures, significant geo-political conflicts, continued highvolatility in energy prices and other factors continue to affect the global economy. Moreover, rising energy prices could impact our merchandise distribution, commercial delivery, utility and product costs. Over the short term, such factors could positively impact our business. Over a longer period of time, all of these macroeconomic and geo-political conditions could adversely affect our sales growth, margins and overhead, which could adversely affect our financial condition and operations.

Our business depends upon hiring and retaining qualified employees.

We believe that much of our brand value lies in the quality of the more than 76,00084,000 AutoZoners employed in our stores, distribution centers, store support centers, ALLDATA, AutoAnything and AutoAnything.IMC. Our workforce costs represent our largest operating expense, and our business is subject to employment laws and regulations, including requirements related to minimum wage. We cannot be assured that we can continue to hire and retain qualified employees at current wage rates. If we are unable to hire, properly train and/or retain qualified employees, we could experience higher employment costs, reduced sales, losses of customers and diminution of our brand, which could adversely affect our earnings. If we do not maintain competitive wages, our customer service could suffer due to a declining quality of our workforce or, alternatively, our earnings could decrease if we increase our wage rates. A violation or change in employment laws and/or regulations could have a material adverse effect on our results of operations, financial condition and cash flows.

Inability to acquire and provide quality merchandise at competitive prices could adversely affect our sales and results of operations.

We are dependent upon our domestic and international vendors continuing to supply us with quality merchandise.merchandise at favorable prices and payment terms. If our merchandise offerings do not meet our customers’ expectations regarding quality and safety, we could experience lost sales, increased costs and exposure to legal and reputational risk. All of our vendors must comply with applicable product safety laws, and we are dependent on them to ensure that the products we buy comply with all safety and quality standards. Events that give rise to actual, potential or perceived product safety concerns could expose us to government enforcement action or private litigation and result in costly product recalls and other liabilities. To the extent our suppliers are subject to added government regulation of their product design and/or manufacturing processes, the cost of the merchandise we purchase may rise. In addition, negative customer perceptions regarding the safety or quality of the products we sell could cause our customers to seek alternative sources for their needs, resulting in lost sales. In those circumstances, it may be difficult and costly for us to rebuild our reputation and regain the confidence of our customers. Moreover, our vendors are impacted by global economic conditions. Credit market and other macroeconomic conditions could have a material adverse effect on the ability of our suppliers to finance and operate their businesses, resulting in increased product costs and meetdifficulties in meeting our inventory demands. If any of our significant vendors experience financial difficulties or otherwise are unable to deliver merchandise to us on a timely basis, or at all, we could have product shortages in our stores that could adversely affect customers’ perceptions of us and cause us to lose customers and sales.

We directly imported approximately 10% of our purchases (measured at cost) in fiscal 2016, but many of our domestic vendors directly import their products or components of their products. Changes to the prices and flow of these goods for any reason, such as political unrest or acts of war, currency fluctuations, disruptions in maritime lanes, port labor disputes and economic conditions and instability in the countries in which foreign suppliers are located, the financial instability of suppliers, suppliers’ failure to meet our standards, issues with labor practices of our suppliers or labor problems they may experience (such as strikes, stoppages or slowdowns, which could also increase labor costs during and following the disruption), the availability and cost of raw materials to suppliers, increased import duties, merchandise quality or safety issues, transport availability and

cost, increases in wage rates and taxes, transport security, inflation and other factors relating to the suppliers and the countries in which they are located or from which they import, are beyond our control and could adversely affect our operations and profitability. In addition, the United States’ foreign trade policies, tariffs and other impositions on imported goods, trade sanctions imposed on certain countries, the limitation on the importation of certain types of goods or of goods containing certain materials from other countries and other factors relating to foreign trade and port labor agreements are beyond our control. These and other factors affecting our suppliers and our access to products could adversely affect our business and financial performance. As we increase our imports of merchandise from foreign vendors, the risks associated with these imports also will increase.

Our ability to grow depends in part on new storelocation openings, existing storelocation remodels and expansions and effective utilization of our existing supply chain and hub network.

Our continued growth and success will depend in part on our ability to open and operate new storeslocations and expand and remodel existing storeslocations to meet customers’ needs on a timely and profitable basis. Accomplishing our new and existing storelocation expansion goals will depend upon a number of factors, including the ability to partner with developers and landlords to obtain suitable sites for new and expanded storeslocations at acceptable costs, the hiring and training of qualified personnel, particularly at the storelocation management level, and the integration of new storeslocations into existing operations. There can be no assurance we will be able to achieve our storelocation expansion goals, manage our growth effectively, successfully integrate the planned new storeslocations into our operations or operate our new, remodeled and expanded storeslocations profitably.

In addition, we extensively utilize our hub stores,network, our supply chain and logistics management techniques to efficiently stock our stores.locations. We have made, and plan to continue to make, significant investments in our supply chain to improve our ability to provide the best parts at the right price. If we fail to effectively utilize our existing hubs and/or supply chains or if our investments in our supply chain and global sourcing initiative do not provide the anticipated benefits, we could experience sub-optimal inventory levels in our stores,locations or increase our costs, which could adversely affect our sales volume and/or our margins.

Our failure to protect our reputation could have a material adverse effect on our brand name.name and profitability.

We believe our continued strong sales growth is driven in significant part by our brand name. The value in our brand name and its continued effectiveness in driving our sales growth are dependent to a significant degree on our ability to maintain our reputation for safety, high product quality, friendliness, service, trustworthy advice, integrity and business ethics. Any negative publicity about these areas could damage our reputation and may result in reduced demand for our merchandise. The increasing use of technology also poses a risk as customers are able to quickly compare products and prices and use social media to provide feedback in a manner that is rapidly and broadly dispersed. Our reputation could be impacted if a customer has a bad experience and shares it over social media.

Failure to comply with ethical, social, product, labor, environmental and anti-corruption standards could also jeopardize our reputation and potentially lead to various adverse actions by consumer or environmental groups, employees or regulatory bodies. Failure to comply with applicable laws and regulations, to maintain an effective system of internal controls or to provide accurate and timely financial statement information could also hurt our reputation. If we fail to comply with existing or future laws or regulations, we may be subject to governmental or judicial fines or sanctions, while incurring substantial legal fees and costs. In addition, our capital and operating expenses could increase due to implementation of and compliance with existing and future laws and regulations or remediation measures that may be required if we are found to be noncompliant with any existing or future laws or regulations. The inability to pass through any increased expenses through higher prices would have an adverse effect on our results of operations.

Damage to our reputation or loss of consumer confidence for any of these or other reasons could have a material adverse effect on our results of operations and financial condition, as well as require additional resources to rebuild our reputation.

Our success in international operations is dependent on our ability to manage the unique challenges presented by international markets.

The various risks we face in our U.S. operations generally also exist when conducting operations in and sourcing products and materials from outside of the U.S., as well as unique costs and difficulties of managing international operations. Our expansion into international markets may be adversely affected by local laws and customs, U.S. laws applicable to foreign operations and political and economic conditions. Risks inherent in international operations also include potential adverse tax consequences, compliance with the Foreign Corrupt Practices Act and local anti-bribery law, greater difficulty in enforcing intellectual property rights, challenges to identify and gain access to local suppliers and possibly misjudging the response of consumers in foreign countries to our product assortment and marketing strategy.

In addition, our operations in international markets are conducted primarily in the local currency of those countries. Since our consolidated financial statements are denominated in U.S. dollars, amounts of assets, liabilities, net sales and other revenues and expenses denominated in local currencies must be translated into U.S. dollars using exchange rates for the current period. As a result, foreign currency exchange rates and fluctuations in those rates may adversely impact our financial performance.

Failure to protect the privacy and security of customers’, suppliers’, AutoZoners’ or Company information could damage our reputation, subject us to litigation and cause us to incur substantial costs.

Our business, like that of most retailers and distributors, involves the receipt, storage and transmission of personal information about our customers, suppliers and AutoZoners.AutoZoners, some of which is entrusted to third-party service providers and vendors. Failure to protect the security of our customers’, suppliers’, employees’ and company information could subject us to costly regulatory enforcement actions, expose us to litigation and impair our reputation, could suffer.which may have a negative impact on our sales. While we and our third-party service providers and vendors take significant steps to protect customer, supplier, employee and other confidential information, including maintaining compliance with payment card industry standards, ourthese security measures may be breached in the future due to cyber-attack, employee error, fraud, trickery, hacking or other intentional or unintentional acts, and unauthorized parties may obtain access to this data.

Business interruptions The methods used to obtain unauthorized access are constantly evolving, and may negatively impact our store hours, operabilitybe difficult to anticipate or detect for long periods of our computertime. As the regulatory environment related to information security, data collection and other systems, availability of merchandiseuse and otherwise have a material negative effect on our sales and our business.

War or acts of terrorism, political unrest, hurricanes, windstorms, fires, earthquakes and other natural or other disasters or the threat of any of them, mayprivacy becomes increasingly rigorous, compliance with these requirements could also result in certain of our stores being closed for a period of time or permanently or have a negative impact on our ability to obtain merchandise available for sale in our stores. Some of our merchandise is imported from other countries. If imported goods become difficult or impossible to bring into the United States, and if we cannot obtain such merchandise from other sources at similar costs, our sales and profit margins may be negatively affected.

In the event that commercial transportation is curtailed or substantially delayed, our business may be adversely impacted, as we may have difficulty shipping merchandise to our distribution centers and stores resulting in lost sales and/or a potential loss of customer loyalty. Transportation issues could also cause us to cancel purchase orders if we are unable to receive merchandise in our distribution centers.additional costs.

We rely heavily on our computerinformation technology systems for our key business processes. Any failure or interruption in these systems could have a material adverse impact on our business.

We rely extensively on our computerinformation technology systems, some of which are managed or provided by third-party service providers, to manage inventory, process transactions and summarize results. Our systems and the third-party systems we rely on are subject to damage or interruption from power outages, telecommunications failures, computer viruses, security breaches, catastrophic events and catastrophic events.design or usage errors by our AutoZoners, contractors or third-party service providers. Although we and our third-party service providers work diligently to maintain our respective systems, we may not be successful in doing so. If our systems are damaged or fail to function properly, we may incur substantial costs to repair or replace them, and may experience loss of critical data and interruptions or delays in our ability to manage inventories or process transactions, which could result in lost sales, inability to process purchase orders and/or a potential loss of customer loyalty, which could adversely affect our results of operations.

Business interruptions may negatively impact our location hours, operability of our computer and other systems, availability of merchandise and otherwise have a material negative effect on our sales and our business.

War or acts of terrorism, political unrest, hurricanes, windstorms, fires, earthquakes, floods and other natural or other disasters or the threat of any of them, may result in certain of our locations being closed for a period of time or permanently or have a negative impact on our ability to obtain merchandise available for sale in our locations. Some of our merchandise is imported from other countries. If imported goods become difficult or impossible to bring into the United States, and if we cannot obtain such merchandise from other sources at similar costs, our sales and profit margins may be negatively affected.

In the event that commercial transportation is curtailed or substantially delayed, our business may be adversely impacted, as we may have difficulty shipping merchandise to our distribution centers and locations resulting in lost sales and/or a potential loss of customer loyalty. Transportation issues could also cause us to cancel purchase orders if we are unable to receive merchandise in our distribution centers.

Item 1B. Unresolved Staff Comments

None.None.

The following table reflects the square footage and number of leased and owned properties for our AutoZone stores as of August 30, 2014:27, 2016:

| No. of Stores | Square Footage | No. of AZ Stores | AZ Store Square Footage | |||||||||||||

Leased | 2,746 | 17,596,290 | 2,989 | 19,303,087 | ||||||||||||

Owned | 2,645 | 17,828,155 | 2,799 | 18,895,143 | ||||||||||||

|

|

|

| |||||||||||||

Total | 5,391 | 35,424,445 | 5,788 | 38,198,230 | ||||||||||||

|

|

|

| |||||||||||||

We have approximately 4.04.6 million square feet in distribution centers servicing our AutoZone stores, of which approximately 1.31.9 million square feet is leased and the remainder is owned. Our nine distribution centers are located in Arizona, California, Georgia, Illinois, Ohio, Pennsylvania, Tennessee, Texas and Mexico. We currently have a second distribution center in Mexico under construction that is expected to open in early fiscal 2017 and two additional domestic distribution centers under development. Of our 26 IMC branches, 25 branches, consisting of 854,228 square feet, are leased, and one branch, consisting of approximately 23 thousand square feet, is owned. Our primary store support center is located in Memphis, Tennessee, and consists of approximately 260,000 square feet. We also have three additional AutoZone store support centers located in Monterrey, Mexico; Chihuahua, Mexico and Sao Paulo, Brazil.Brazil, and an IMC branch support center located in Canoga Park, California. The ALLDATA headquarters building in Elk Grove, California and the AutoAnything headquarters space in San Diego, California are leased, and we also own or lease other properties that are not material in the aggregate.

In 2004, we acquired a store site in Mount Ephraim, New Jersey that had previously been the site of a gasoline service station and contained evidence of groundwater contamination. Upon acquisition, we voluntarily reported the groundwater contamination issue to the New Jersey Department of Environmental Protection (“NJDEP”) and entered into a Voluntary Remediation Agreement providing for the remediation of the contamination associated with the

property. We have conducted and paid for (at an immaterial cost to us) remediation of contamination on the property. We arehave also investigating,voluntarily investigated and will be addressing,addressed potential vapor intrusion impacts in downgradient residences and businesses. The New Jersey Department of Environmental ProtectionNJDEP has asserted, in a Directive and Notice to Insurers dated February 19, 2013 and again in an Amended Directive and Notice to Insurers dated January 13, 2014 (collectively the “Directives”), that we are liable for the downgradient impacts under a joint and severable liability theory. By letter dated April 23, 2015, NJDEP has demanded payment from us, and other parties, in the amount of approximately $296 thousand for costs incurred by NJDEP in connection with contamination downgradient of the property. By letter dated January 29, 2016, we were informed that NJDEP has filed a lien against the property in connection with approximately $355 thousand in costs incurred by NJDEP in connection with contamination downgradient of the property. We have contested, and will continue to contest, any such assertions due to the existence of other entities/sources of contamination, some of which are named in the Directives and the April 23, 2015 Demand, in the area of the property. Pursuant to the Voluntary Remediation Agreement, upon completion of all remediation required by the agreement, we believe we should be eligible to be reimbursed up to 75 percent of qualified remediation costs by the State of New Jersey. We have asked the state for clarification that the agreement applies to off-site work, and the state is considering the request. Although the aggregate amount of additional costs that we may incur pursuant to the remediation cannot currently be ascertained, we do not currently believe that fulfillment of our obligations under the agreement or otherwise will result in costs that are material to our financial condition, results of operations or cash flow.

In July 2014, we received a subpoena from the District Attorney of the County of Alameda, along with other environmental prosecutorial offices in the state of California, seeking documents and information related to the handling, storage and disposal of hazardous waste. We received notice that the District Attorney will seek injunctive and monetary relief. We are cooperating fully with the request and cannot predict the ultimate outcome of these efforts.efforts, although we have accrued all amounts we believe to be probable and reasonably estimable. We do not believe the ultimate resolution of this matter will have a material adverse effect on our consolidated financial position, results of operations or cash flows.

In April 2016, we received a letter from the California Air Resources Board seeking payment for alleged violations of the California Health and Safety Code related to the sale of certain aftermarket emission parts in the State of California. We do not believe that any resolution of the matter will have a material adverse effect on our consolidated financial position, results of operations or cash flows.

We are involved in various other legal proceedings incidental to the conduct of our business, including several lawsuits containing class-action allegations in which the plaintiffs are current and former hourly and salaried employees who allege various wage and hour violations and unlawful termination practices. We do not currently believe that, either individually or in the aggregate, these matters will result in liabilities material to our financial condition, results of operations or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the symbol “AZO.” On October 20, 2014,17, 2016, there were 2,7042,486 stockholders of record, which does not include the number of beneficial owners whose shares were represented by security position listings.

We currently do not pay a dividend on our common stock. Our ability to pay dividends is subject to limitations imposed by Nevada law. Any future payment of dividends would be dependent upon our financial condition, capital requirements, earnings and cash flow.

The following table sets forth the high and low sales prices per share of common stock, as reported by the New York Stock Exchange, for the periods indicated:

| Price Range of Common Stock | Price Range of Common Stock | |||||||||||||||

| High | Low | |||||||||||||||

Fiscal Year Ended August 30, 2014: | ||||||||||||||||

| Fiscal Year ended August 27, 2016: | High | Low | ||||||||||||||

Fourth quarter | $ | 546.70 | $ | 505.32 | $ | 815.98 | $ | 742.08 | ||||||||

Third quarter | $ | 549.85 | $ | 510.19 | $ | 805.40 | $ | 748.51 | ||||||||

Second quarter | $ | 561.62 | $ | 454.88 | $ | 796.09 | $ | 695.46 | ||||||||

First quarter | $ | 469.61 | $ | 408.90 | $ | 797.29 | $ | 714.37 | ||||||||

Fiscal Year Ended August 31, 2013: | ||||||||||||||||

Fiscal Year Ended August 29, 2015: | ||||||||||||||||

Fourth quarter | $ | 452.19 | $ | 401.93 | $ | 754.90 | $ | 662.70 | ||||||||

Third quarter | $ | 413.28 | $ | 369.47 | $ | 705.00 | $ | 612.68 | ||||||||

Second quarter | $ | 390.11 | $ | 341.98 | $ | 627.30 | $ | 566.08 | ||||||||

First quarter | $ | 386.80 | $ | 351.27 | $ | 576.00 | $ | 491.93 | ||||||||

During 1998, the Company announced a program permitting the Company to repurchase a portion of its outstanding shares not to exceed a dollar maximum established by the Company’s Board of Directors. The program was most recently amended on June 17, 2014,September 22, 2016, to increase the repurchase authorization by $750 millionmillion. This brings the total value of shares authorized to raise the cumulative share repurchase authorization from $14.15 billion to $14.9$17.9 billion.

Shares of common stock repurchased by the Company during the quarter ended August 30, 2014,27, 2016, were as follows:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Dollar Value that May Yet Be Purchased Under the Plans or Programs | ||||||||||||

May 11, 2014, to June 7, 2014 | 28,200 | $ | 528.81 | 28,200 | $ | 291,992,220 | ||||||||||

June 8, 2014, to July 5, 2014 | 93,665 | 527.97 | 93,665 | 992,539,599 | ||||||||||||

July 6, 2014, to August 2, 2014 | 200,140 | 528.05 | 200,140 | 886,855,046 | ||||||||||||

August 3, 2014, to August 30, 2014 | 33,633 | 524.04 | 33,633 | 869,230,140 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | 355,638 | $ | 527.71 | 355,638 | $ | 869,230,140 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Period | Total | Average | Total Number of | Maximum Dollar | ||||||||||||

May 8, 2016, to June 4, 2016 | 123,763 | $ | 767.61 | 123,763 | $ | 670,086,276 | ||||||||||

June 5, 2016, to July 2, 2016 | 270,246 | 758.42 | 270,246 | 465,125,581 | ||||||||||||

July 3, 2016, to July 30, 2016 | — | — | — | 465,125,581 | ||||||||||||

July 31, 2016, to August 27, 2016 | 88,200 | 791.09 | 88,200 | 395,351,207 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | 482,209 | $ | 766.76 | 482,209 | $ | 395,351,207 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

The Company also repurchased, at fairmarket value, an additional 12,460 shares in fiscal 2016, 15,594 shares in fiscal 2015 and 16,013 shares in fiscal 2014 22,915 shares in fiscal 2013, and 24,113 shares in fiscal 2012 from employees electing to sell their stock under the Company’s Sixth Amended and Restated Employee Stock Purchase Plan (the “Employee Plan”), qualified under Section 423 of the Internal Revenue Code, under which all eligible employees may purchase AutoZone’s common stock at 85% of the lower of the market price of the common stock on the first day or last day of each calendar quarter through payroll deductions. Maximum permitted annual purchases are $15,000 per employee or 10 percent of compensation, whichever is less. Under the Employee Plan, 12,662 shares were sold to employees in fiscal 2016, 14,222 shares in fiscal 2015 and 15,355 shares were sold to employees in fiscal 2014, 18,228 shares were sold to employees in fiscal 2013, and 19,403 shares were sold to employees in fiscal 2012.2014. At August 30, 2014, 219,38927, 2016, 192,505 shares of common stock were reserved for future issuance under the Employee Plan.

Once executives have reached the maximum purchases under the Employee Plan, the Fifth Amended and Restated Executive Stock Purchase Plan (the “Executive Plan”) permits all eligible executives to purchase AutoZone’s common stock up to 25 percent of his or her annual salary and bonus. Purchases by executives under the Executive Plan were 1,943 shares in fiscal 2016, 2,229 shares in fiscal 2015 and 3,028 shares in fiscal 2014, 3,454 shares in fiscal 2013, and 3,937 shares in fiscal 2012.2014. At August 30, 2014, 245,92527, 2016, 241,753 shares of common stock were reserved for future issuance under the Executive Plan.

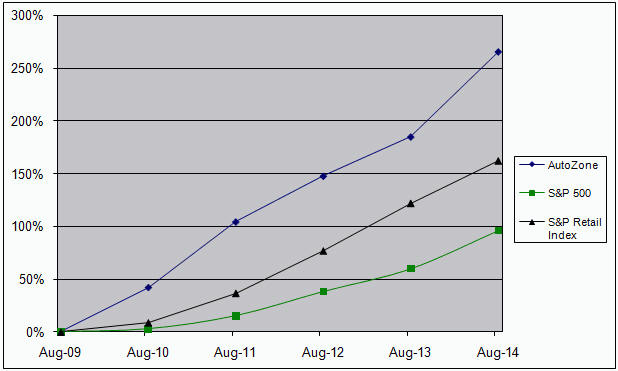

Stock Performance Graph

The graph below presents changes in the value of AutoZone’s stock as compared to Standard & Poor’s 500 Composite Index (“S&P 500”) and to Standard & Poor’s Retail Index (“S&P Retail Index”) for the five-year period beginning August 29, 200927, 2011 and ending August 30, 2014.27, 2016.

Item 6. Selected Financial Data

(in thousands, except per share data, same store sales and selected operating | Fiscal Year Ended August | Fiscal Year Ended August | ||||||||||||||||||||||||||||||||||||||

| 2014 | 2013(1) | 2012 | 2011 | 2010 | 2016 | 2015 | 2014 | 2013(1) | 2012 | |||||||||||||||||||||||||||||||

Income Statement Data | ||||||||||||||||||||||||||||||||||||||||

Net sales | $ | 9,475,313 | $ | 9,147,530 | $ | 8,603,863 | $ | 8,072,973 | $ | 7,362,618 | $ | 10,635,676 | $ | 10,187,340 | $ | 9,475,313 | $ | 9,147,530 | $ | 8,603,863 | ||||||||||||||||||||

Cost of sales, including warehouse and delivery expenses | 4,540,406 | 4,406,595 | 4,171,827 | 3,953,510 | 3,650,874 | 5,026,940 | 4,860,309 | 4,540,406 | 4,406,595 | 4,171,827 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Gross profit | 4,934,907 | 4,740,935 | 4,432,036 | 4,119,463 | 3,711,744 | 5,608,736 | 5,327,031 | 4,934,907 | 4,740,935 | 4,432,036 | ||||||||||||||||||||||||||||||

Operating, selling, general and administrative expenses | 3,104,684 | 2,967,837 | 2,803,145 | 2,624,660 | 2,392,330 | 3,548,341 | 3,373,980 | 3,104,684 | 2,967,837 | 2,803,145 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Operating profit | 1,830,223 | 1,773,098 | 1,628,891 | 1,494,803 | 1,319,414 | 2,060,395 | 1,953,051 | 1,830,223 | 1,773,098 | 1,628,891 | ||||||||||||||||||||||||||||||

Interest expense, net | 167,509 | 185,415 | 175,905 | 170,557 | 158,909 | 147,681 | 150,439 | 167,509 | 185,415 | 175,905 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Income before income taxes | 1,662,714 | 1,587,683 | 1,452,986 | 1,324,246 | 1,160,505 | 1,912,714 | 1,802,612 | 1,662,714 | 1,587,683 | 1,452,986 | ||||||||||||||||||||||||||||||

Income tax expense | 592,970 | 571,203 | 522,613 | 475,272 | 422,194 | 671,707 | 642,371 | 592,970 | 571,203 | 522,613 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Net income | $ | 1,069,744 | $ | 1,016,480 | $ | 930,373 | $ | 848,974 | $ | 738,311 | $ | 1,241,007 | $ | 1,160,241 | $ | 1,069,744 | $ | 1,016,480 | $ | 930,373 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Diluted earnings per share | $ | 31.57 | $ | 27.79 | $ | 23.48 | $ | 19.47 | $ | 14.97 | $ | 40.70 | $ | 36.03 | $ | 31.57 | $ | 27.79 | $ | 23.48 | ||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||||||||||