SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31,

20142016

Commission File Number: 001-36771LendingClub Corporation

(Exact name of registrant as specified in its charter)

|

|

LendingClub Corporation (Exact name of registrant as specified in its charter) |

|

| | |

| Delaware | | 51-0605731 |

(State or other jurisdiction of incorporation or organization) | | Identification No.) |

| | |

| 71 Stevenson Street, Suite 300 | | |

| San Francisco, California | | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class: | | Name of each exchange on which registered: |

| Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes xý No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No xý Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xý No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes xý No ¨ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | |

| Large accelerated filer | | ¨ý | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x¨ (Do not check if a smaller reporting company)

| | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No xý The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant

as of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter, was $1,315,348,311 based on the closing price

of a share of the registrant’s common stock on December 11, 2014 as reported

by the New York Stock Exchange onfor such

date was approximately $4,873.9 million. The registrant has elected to use December 11, 2014, which was the initial trading date on the New York Stock

Exchange, as the calculation date because on June 30, 2014 (the last business day of the registrant’s mostly recently completed second fiscal quarter), the registrant was a privately-held company.Exchange. Shares of the registrant’s common stock held by each executive officer, director and holder of 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purpose.

As of February

25, 2015,23, 2017, there were

371,991,134400,157,603 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement for the Registrant’s

20152017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31,

2014.2016.

Annual Report On Form 10-K

For Fiscal Year Ended December 31, 20142016

Except as the context requires otherwise,

including in the financial statements of Springstone Financial, LLC, as used herein, “Lending Club,”

“company”,“Company,” “we,” “us,” and “our,” refer to LendingClub Corporation, a Delaware corporation, and, where appropriate, its

wholly owned subsidiaries, which include:three subsidiaries:

LC Advisors, LLC (LCA), a wholly-owned, registered investment advisor with the Securities and Exchange Commission (SEC) that acts as the general partner for certain private funds and as advisor to separately managed accounts.

Springstone Financial, LLC (Springstone), a wholly-owned company we acquired in April 2014 that facilitates education and patient finance loans.

RV MP Fund GP, LLC, a wholly-owned subsidiary of LCA that acts as the general partner for a private fund, while LCA acts as the investment manager of this private fund.

LC Trust I (the Trust) is an independent Delaware business trust that acquires loans from the Company and holds them for the sole benefit of certain investors that have purchased a trust certificate (Certificate) issued by the Trust and that are related to specific underlying loans for the benefit of the investor.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 29A27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this Annual Report on Form 10-K (Report) regarding borrowers, credit scoring, Fair Isaac Corporation (“FICO”) or other credit scores, our strategy, future operations, expected losses, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. TheYou can identify these forward-looking statements by words such as “anticipate,” “appear,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “will,” or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. expressions.

These forward-looking statements include, among other things, statements about:

the status of borrowers, the ability of borrowers to repay loans and the plans of borrowers;

interest ratesour ability to maintain investor confidence in the operation of our platform;

the likelihood of investors to continue to, directly or indirectly, invest through our platform;

our ability to secure additional sources of investor commitments for our platform and origination feesthe continued deployment of those investor commitments on loans charged by issuing banks;

the available functionality of a secondary market trading program for notes;platform;

ability to secure additional investors without incentives to participate on the platform;

expected rates of return providedfor investors;

the effectiveness of our platform’s credit scoring models;

the use or potential use of our own capital to investors;purchase loans;

our abilitycommitments or investments in loans to successfully integrate our acquisition of Springstone Financial, LLC (Springstone), including our ability to expand the number of providers that use the products provided through Springstone;

the likelihood of us having to fund contingent commitments, including commitments madesupport: contractual obligations, such as to Springstone’s issuing bank for loans that Springstone facilitates and athat are originated by the issuing bank partner but do not meet the credit support agreementcriteria for purchase by the issuing bank partner (Pool B loans) or repurchase obligations, regulatory commitments, such as direct mail, short-term marketplace equilibrium, the testing or initial launch of alternative loan terms, programs or channels that we do not have entered into with a certificate investor;sufficient performance data on, or customer accommodations;

the potential impact of having to fund any such contingent commitments;

transaction fee or other revenue we expect to recognize whenafter loans are originatedissued by our banking partner;issuing bank partners;

our financial condition and performance, including our ability to remain cash flow positive and the impact that management’s estimates have on our financial performance;performance and the relationship between the interim period and full year results;

capital expenditures;

the impact of new accounting standards;

investor, borrower, platform and loan performance-related factors that may affect our abilityrevenue;

the potential adoption rates and returns related to retainnew products and hire employees and appropriately staff our operations;services;

our ability to prevent security breaches, disruptions in service or comparable eventsthe potential impact of macro-economic developments that could compromiseimpact the personally identifiable or confidential information held incredit performance of our data systems, reduce the attractiveness of the marketplace or adversely impact our ability to service loans;

our ability to preventloans, notes and detect identity theft;certificates, and influence borrower and investor behavior;

our ability to develop and maintain effective internal controls, and our remediation of a material weakness in our internal controls;

our ability to recruit and retain quality employees to support future growth;

our compliance with applicable local, state and federal laws, including the Investment Advisors Act of 1940, the Investment Company Act of 1940 and otherFederal laws;

our compliance with applicable regulations and regulatory developments or court decisions affecting our marketplace;business; and

our estimateother risk factors listed from time to time in reports we file with the SEC.

We caution you that the foregoing list may not contain all of future consumer credit that would meet our standard or custom program credit terms.

the forward-looking statements in this Report. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. We have included important factors in the cautionary statements included in this Report, particularly in the “Risk Factors” section, that could, among other things, cause actual results or events to differ materially from forward-looking statements contained in this Report. Forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this Report carefully and completely and with the understanding that actual future results may be materially different from what we expect. We do not assume any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by law.

PART I

Transforming the banking system to make credit more affordable and investing more rewarding.

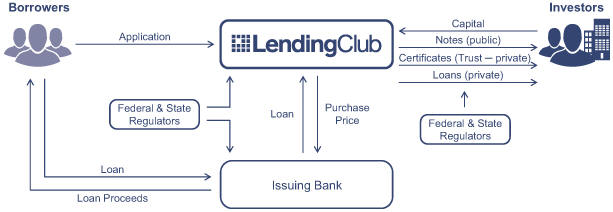

Lending Club is the world’s largest online marketplace for connecting borrowers and investors. As of December 31, 2014, our marketplace facilitated over $7.6 billion in loan originations since it first launched in 2007, of which approximately $2.0 billion were invested in through notes issued pursuant to a shelf registration statement (the Note Registration Statement), $2.9 billion were invested in through certificates issued by an independent trust (Trust) and $2.7 billion were invested in through whole loan sales. In the fourth quarter of 2014, our marketplace facilitated over $1.4 billion of loan originations, of which approximately $0.2 billion were invested in through notes, $0.4 billion were invested in through certificates and $0.8 billion were invested in through whole loan sales. We believe aour technology-powered online marketplace is athe best way to make capital more efficient mechanismaccessible to allocate capital between borrowers and investors thaninvestors. Our marketplace increases efficiency and improves the borrower and investor experience with ease of use and accessibility by substantially reducing the need for physical infrastructure and manual processes that exist in the traditional banking system. Consumers

Qualified consumers and small business owners borrow through Lending Club to lower the cost of their credit and enjoy a bettermore seamless and transparent experience than that provided by traditional bank lending. banks. We believe the range of loan products we facilitate is simple, fair and responsible, making it easier for consumers to budget for monthly repayment and meet their financial goals.

Investors use Lending Club to earn attractive risk-adjusted returns from an asset class that has generally been closed to many investors and only available on a limited basis to

large institutional investors.

Our Through our marketplace, is where borrowerswe are able to make more assets available to more investors, including retail investors, high-net-worth individuals and investors engage in transactions relating to standard or custom program loans. Standard Program Loans which are part of the Standard Loan Program, are three- or five-year unsecured personal loans which are offered to borrowers with a FICO score of at least 660family offices, banks and that meet other strict credit criteria. These loans can be invested in through the purchase of notes issued pursuant to a Note Registration Statement,finance companies, insurance companies, hedge funds, foundations, pension plans and are only available through our website. Separately, qualified investors may also invest in Standard Program Loans in private transactions not facilitated through our website. Custom Program Loans are only invested in through private transactions with qualified investors and cannot be invested in through notes and are not visible through our public website. Custom Program Loans include small business loans, super prime consumer loans, education and patient finance loans and personal loans that do not meet the requirements of Standard Program Loans.

university endowments.

We have developed our proprietary technology platform to support our marketplace and

make availableoffer a variety of

our issuing banks’ loan products to interested

investor channels.investors. Our proprietary technology automates key aspects of our operations, including the borrower application process, data gathering, credit decisioning and scoring, loan funding, investing and servicing, regulatory compliance and fraud detection. Our platform offers sophisticated analytical tools and data to enable investors to make informed decisions and assess their portfolios. Our extensible technology platform has allowed us to expand our offerings from personal loans to include small business loans, and to expand investor classes from individuals to institutions and create various investment vehicles.

We generate revenue from transaction fees from our marketplace’s role in matching borrowers with investorsaccepting and decisioning applications for our bank partners to enable loan originations, servicing fees from investors for matching available loan assets with capital, and management fees from investment funds and other managed accounts. We doWhile our business model is not assumedependent on using our balance sheet and assuming credit risk for loans facilitated by our marketplace, we may use a greater amount of our own capital, compared to past experience, to fulfill regulatory or contractual purchase obligations, or support short-term marketplace equilibrium. We may also use our own capital to invest in loans facilitated byassociated with the testing or initial launch of new or alternative loan terms, programs or channels to establish a track record of performance prior to facilitating third-party investments in these loans, or to support alternative loan purchase programs.

As of December 31, 2016, our marketplace

exceptfacilitated approximately $24.6 billion in

limited circumstancesloans since it first launched in 2007, of which approximately $4.6 billion were invested in through notes issued pursuant to a shelf registration statement (the Note Registration Statement), $6.9 billion were invested in through Certificates issued by the Trust, and

$13.1 billion were invested in

amounts that are not material. The capital to invest in the loans facilitated through

our marketplace comes directly from a wide range of investors, including retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans and university endowments, and through a variety of channels, such as borrower payment dependent investment securities and whole loan

purchases.sales.

Industry Background and Trends

There is an opportunity for the online marketplace model to transform the traditional banking system.

We believe a transparent and open marketplace where borrowers and investors have access to information, complemented by technology and tools, can make credit more affordable, redirect existing pools of capital trapped inside the banking system, and attract new sources of capital to a new asset class. We believe that online marketplaces have the power to

transform the traditional banking system, facilitate more efficient deployment of capital, and improve the global economy.

Personal and Small Business Lending Is Essential to the Economy

We believe the ability of individuals and small businesses to access affordable credit is essential to stimulating and sustaining a healthy, diverse and innovative economy. Lending to consumers provides financial flexibility and gives households better control over when and how to purchase goods and services. While borrower appetite for consumer and small business credit has typically remained strong in most economic environments, general economic factors and conditions, including the general interest rate environment and unemployment rates, may affect borrower willingness to seek loans and investor ability

andor desire to invest in loans.

Borrowers Are Inadequately Served by the Current Banking System

We believe the traditional banking system generally is burdened by its high fixed cost of underwriting and services, in part due to its physical infrastructure and labor- and paper-intensive business processes, compounded by an increasingly complex regulatory environment. As a result, we believe the traditional banking system is ill-suited to meet personal and small business demand

in a fair and affordable way for borrowers. Instead, banks have managed the demand for small balance loans

and has instead relied heavily onby issuing credit cards, which require less personalized underwriting and have higher interest rates. While credit cards are convenient as a payment mechanism, they are an expensive long-term financing solution. Borrowers who carry a balance on their cards are often subject to high, variable interest rates and the possibility of incurring additional fees and penalties. Additionally, many borrowers are charged the same high interest rates on their balances, regardless of an individual’s specific risk profile, so

low risklow-risk borrowers often subsidize

high riskhigh-risk borrowers. In the limited instances when traditional banks make personal loans available, the loan application process is often opaque, frustrating and time consuming.

Investors Have

Had Limited Options to Participate in Personal and Small Business Credit

Historically, access to most personal and small business loans as an investment product was limited to the banks that hold loans on their balance sheet or to structured securitized products that were syndicated to large institutional investors. Depositors effectively fund the loans made by the banking system, but they share little in the direct returns of these loans as evidenced by the low yields on various fixed income investment or deposit products offered by banks. We believe many investors

generally lack the size andshould have access to invest in structured products directly and

are unablebe able to invest in personal and small business credit in a meaningful way. While institutional investors have had some access to this market, most have lacked the tools to customize portfolios to their specific risk

tolerance, which is a feature of ourtolerance. Our marketplace and

products. As a result, weproducts address both of these needs. We believe

the additional capital that could be invested in personal and small business loans,

and has largely been locked out of the

market.market, may be available for use on our marketplace as an alternative to other similarly performing fixed asset investments.

Online Marketplaces Have Proliferated Throughout the Economy

Online marketplaces have emerged to connect buyers and sellers across many industries to increase choice, improve quality, accelerate the speed of decision making and lower costs. We believe a successful online marketplace must act as a trusted intermediary providing transparency, security, supply and demand balance, and ease of use to give marketplace participants an incentive to interact and the confidence to do business together. Initial online marketplaces connected buyers and sellers of goods and services—services – primarily moving demand from offline to online and making the transaction process more efficient. Online marketplaces have more recently evolved to unlock supply and demand that could not previously be matched in an efficient manner offline. The “sharing economy,” a

term that describes this

new marketplace trend, enables a better use of resources by allowing owners of underutilized assets to offer them to people who want them while capturing an economic benefit.

Our

Marketplace Solution

We are the world’s largest online marketplace connecting borrowers and investors. Our technology platform supports this innovative marketplace model to efficiently connect the supply and demand of capital. Our marketplace also substantially reduces the need for physical infrastructure and improves convenience and automation, increasing efficiency, reducing manual processes and improving the overall borrower and investor experience.

We believe that our marketplace provides the following benefits to borrowers:

| • | | Access to Affordable Credit. Our innovative marketplace model, online delivery and process automation enable us to offer borrowers interest rates that are generally lower on average than the rates charged by traditional banks, credit cards or installment loans. |

| • | | Superior Borrower Experience. We offer a fast and easy-to-use online application process and provide borrowers with access to live support and online tools throughout the process and over the life of the loan. |

| • | | Transparency and Fairness. All of the installment loans offered through our marketplace feature a fixed rate that is clearly disclosed to the borrower during the application process, with fixed monthly payments, no hidden fees and the ability to prepay the balance at any time without penalty. Our platform utilizes a computerized, rules-based engine for credit decisioning, which removes the human bias associated with reviewing applications. |

| • | | Fast and Efficient Decisioning. We leverage online data and technology to quickly assess risk, determine a credit rating and assign appropriate interest rates quickly. |

Access to Affordable Credit. Our innovative marketplace model, online delivery and process automation enable us to offer borrowers interest rates that are generally lower on average than the rates charged by traditional banks, credit cards or installment loans.

Superior Borrower Experience. We offer a fast and easy-to-use online application process and provide borrowers with access to live support and online tools throughout the process and over the life of the loan.

Transparency and Fairness. The installment loans offered through our marketplace feature a fixed rate that is clearly disclosed to the borrower during the application process, with fixed monthly payments, no hidden fees and the ability to prepay the balance at any time without penalty. Small business lines of credit have rates based upon the prime rate and allow borrowers to draw in increments, reducing their interest cost. Our platform utilizes an automated, rules-based engine for credit decisioning, which removes the human bias associated with reviewing applications.

Fast and Efficient Decisioning. We leverage online data and technology to quickly assess risk, detect fraud, determine a credit rating and assign appropriate interest rates quickly.

We believe that our marketplace provides the following benefits to investors:

| • | | Access to a New Asset Class. All investors can invest in personal loans facilitated through our Standard Loan Program. Additionally, qualified investors can invest in loans facilitated through our Custom Loan Program in private transactions. These asset classes have historically been entirely funded and held by financial institutions or large institutional investors on a limited basis. |

| • | | Attractive Risk-Adjusted Returns. We have historically offered investors attractive risk-adjusted returns across loans offered through our marketplace. |

| • | | Transparency. We provide investors with transparency and choice in building their loan portfolios. |

| • | | Easy-to-Use Tools. We provide investors with tools to easily build and modify customized and diversified portfolios by selecting loans tailored to their investment objectives and assess the returns on their portfolios or investors may enroll in automated investing, a free service that automatically invests any available cash in loans according to investor-specified criteria. |

Access to a New Asset Class. All investors can invest in personal loans facilitated through our standard loan program. Additionally, qualified investors can invest in loans facilitated through our custom program loan program in private transactions. These asset classes have historically been funded and held by financial institutions or large institutional investors on a limited basis.

Attractive Risk-Adjusted Returns. We offer investors attractive risk-adjusted returns on loans offered through our marketplace.

Transparency. We provide investors with transparency and choice in building their loan portfolios.

Easy-to-Use Tools. We provide investors with tools to easily build and modify customized and diversified portfolios by selecting loans tailored to their investment objectives and to assess the returns on their portfolios. Investors can also enroll in automated investing, a free service that automatically invests any available cash in loans according to investor-specified criteria.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and provide us with competitive advantages in realizing the potential of our market opportunity:

| • | | Leading Online Marketplace. We are the world’s largest online marketplace connecting borrowers and investors, based on over $7.6 billion in loan originations through December 31, 2014, of which approximately $2.0 billion were invested in through notes issued pursuant to the Note Registration Statement, $2.9 billion were invested in through certificates issued by the Trust and $2.7 billion were invested in through whole loan sales. |

| • | | Robust Network Effects. Our online marketplace exhibits network effects that are driven by the number of participants and investments enabled through our marketplace. More participation leads to greater potential to match borrowers with investors. Additionally, increased participation also results in the generation of substantial data that is used to improve the effectiveness of our credit decisioning and scoring models, enhancing our performance record and generating increasing trust in our marketplace. As trust increases, we believe investors will continue to demonstrate a willingness to accept lower risk premiums which will allow us to offer lower interest rates and attract additional high-quality borrowers, thereby reinforcing our track record and fueling a virtuous cycle for our business. We believe that these network effects reinforce our market leadership position. |

| • | | High Borrower and Investor Satisfaction. Borrowers have validated our approach with an aggregate Net Promoter Score in the 70s since we began surveying borrowers in January 2013, which places us at the upper end of customer satisfaction ratings for traditional financial service companies. Additionally, investors are confident transacting on our marketplace, as evidenced by high reinvestment rates. |

| • | | Technology Platform. Our technology platform powers our online marketplace and enables us to deliver innovative solutions to borrowers and investors. Our technology platform automates our operations and, we believe, provides a significant time and cost advantage over traditional banks that run on legacy systems that are inflexible and slow to evolve. |

| • | | Sophisticated Risk Assessment. We use proprietary algorithms that leverage behavioral data, transactional data and employment information to supplement traditional risk assessment tools, such as FICO scores. We have built our technology platform to automate the application of these proprietary algorithms to each individual borrower’s application profile at scale. This approach allows us to evaluate and segment each potential borrower’s risk profile and price it accordingly. In contrast, traditional lenders aggregate borrowers into large pools of risk profiles, which for some borrowers results in higher interest rates despite a more favorable credit profile. |

| • | | Efficient and Attractive Financial Model. Our trusted brand, scale and network effect drives significant borrowing and investing activity on our marketplace. We generate revenue from transaction fees from our marketplace’s role in matching borrowers with investors to enable loan originations, servicing fees from investors and management fees from investment funds and other managed accounts. We do not assume credit risk or use our own capital to invest in loans facilitated by our marketplace, except in limited circumstances and in amounts that are not material. Our technology platform significantly reduces the need for physical infrastructure and lowers our costs, which provides us with significant operating leverage. |

Leading Online Marketplace. We are the world’s largest online marketplace connecting borrowers and investors, based on approximately $8.7 billion in loan originations during the year ended December 31, 2016, of which approximately $1.3 billion were invested in through notes issued pursuant to the Note Registration Statement, $1.4 billion were invested in through certificates issued by the Trust and $6.0 billion were invested in through whole loan sales.

Robust Network Effects. Our online marketplace exhibits network effects that are driven by the number of participants and investments enabled through our marketplace. More participation leads to greater potential to match borrowers with investors. Additionally, increased participation also results in the generation of substantial data that is used to improve the effectiveness of our credit decisioning and scoring models, enhancing our performance record and generating increasing trust in our marketplace. As trust increases, we believe investors will continue to demonstrate a willingness to accept lower risk premiums (all else being equal), which will allow us to offer lower interest rates and attract additional high-quality borrowers, thereby reinforcing our track record and fueling a virtuous cycle for our business. We believe that these network effects reinforce our market leadership position.

Technology Platform. Our technology platform powers our online marketplace and enables us to deliver innovative solutions to borrowers and investors. Our technology platform automates our operations and, we believe, provides a significant time and cost advantage over many traditional banks.

Sophisticated Risk Assessment. We use proprietary algorithms that leverage behavioral data, transactional data and employment information to supplement traditional risk assessment tools, such as Fair Isaac Corporation (FICO) scores. We have built our technology platform to automate the application of these proprietary algorithms to each individual borrower’s application profile at scale. This approach allows us to evaluate and segment each potential borrower’s risk profile and price the loan accordingly. In contrast, traditional lenders aggregate borrowers into large pools of risk profiles, which for some borrowers results in higher interest rates despite a more favorable credit profile.

Our marketplace facilitates several types of loan products for consumers and small businesses.

Personal Loans. Our marketplace facilitates unsecured personal loans through our Standard Loan Program that can be used to make major purchases, refinance credit card balances or for other purposes, at generally lower rates than other alternatives. Standard Loan Program personalPersonal loans are offered through both our standard and custom loan termsprograms. Personal loans approved through our standard loan program include amounts from $1,000 to $35,000, terms$40,000, maturities of three or five years, fixed interest rates, and no prepayment penalties or fees. We believe that these loans are simple, fair and responsible credit products that make it easier for consumers to budget for monthly repayment and meet their financial goals. Personal loans that are approved through the Standard Loan Program are offered to all investors on our marketplace. These loans must meet certain minimum credit requirements, including a FICO score of at least 660, satisfactory debt-to-income ratios, 36 months of credit history and a limited number of credit inquiries in the lastprevious six months. LoansPersonal loans that do not meetare approved through the requirements in terms of credit criteria, maturity or longevity of track record might qualify as a Custom Program Loan. Custom Program Loansstandard loan program are offered to private investors only and are not made available to all investors on theour marketplace. Custom Program Loans include new offerings, including small business, super prime, education and patient finance andPersonal loans that fall outside of the credit criteria offor the standard program.Super Prime Consumer Loans. In December 2014, we began facilitating unsecured Super Prime Consumer Loans throughprogram might qualify under our marketplace in private transactions with certain qualified investors. These loans address the market’s demand for a shorter, smaller size term loan. Super Prime Consumer Loan termscustom program and include amounts from $1,000 to $50,000, termsmaturities of two, three, five or seven years, fixed interest rates from 3.99% to 9.34% and no prepayment penalties or fees.

Education and Patient Finance Loans. In April 2014, we acquired Springstone, which facilitates We facilitate unsecured education and patient finance loans. Installmentinstallment loans and true no-interest loans through Springstone are inand its issuing bank partners. Installment loan terms include amounts ranging from $2,000 to $40,000, have terms$50,000, maturities from 24 to 84 months, fixed interest rates from 3.99% to 17.99%, fixed monthly payments and no prepayment penalties. The true no interestno-interest loan option is interms include amounts ranging from $499 to $32,000 and provides for no required interest payment if the balance is paid in full during the promotional period, which can be six, 12, 18 or 24 months. There is no prepayment penalty and borrowers have the flexibility to pay as much or as little, subject to applicable minimums, of the outstanding balance during the promotional period as they choose. Education and Patient Finance loans are offered to private investors only and are not made publicly available on the marketplace.

Auto Refinancing Loans. Commencing in the fourth quarter, we facilitate secured auto refinance loans that can be used to help eligible consumers save money by refinancing into more affordable loans with better rates, clear terms, and no hidden fees. Loans terms include amounts ranging from $5,000 to $50,000, with maturities ranging from 24 to 72 months. Borrowers are required to make monthly amortizing payments, and there are no prepayment penalties.

We currently facilitate loans in 26 states, with plans to expand nationally in 2017. Auto Refinance Loans are currently offered to private investors only and are not made publicly available on the marketplace.

Small Business Loans.Loans and Lines of Credit. In March 2014, we began facilitating unsecured small business loans, and in October 2015 we began facilitating small business lines of credit. Both of these loan products are offered through our marketplace in private transactions with qualified investors. These loansloan products enable small business owners to expand their business, purchase equipment or inventory, or meet other obligations at an affordable rate. Small business loans generallyand lines of credit are fixed ratefixed- or variable-rate loans in amounts ranging from $15,000$5,000 to $300,000, with maturities of one3 months to five years.5 years, and contain no prepayment penalties or fees. The small business lines of credit allow borrowers to draw funds in amounts they need, thus reducing their interest cost. Small Business loans are offered to private investors only and are not made publicly available on the marketplace.

Investors

Through our marketplace, investors

Investors have the opportunity to invest in a wide range of loans based on term and credit characteristics.

Personal loans that are approved through the standard loan program are offered to all investors on our marketplace, while custom program loans, which include small business, education and patient finance, auto refinance, new offerings, and loans that fall outside of the credit criteria of the standard program, are offered to private investors only and are not made publicly available on the marketplace. Investors receive monthly cash flow and attractive risk-adjusted returns.

InvestorsAll investors are provided with a

borrower’s proprietary credit grade and access to credit profile data on each approved loan as well as access to data on each listed loan and all of the historical performance data for nearly every loan ever invested in through our marketplace. The marketplace enables broad diversification by allowing distribution of investments in loans in increments as small as $25.

We attract a wide range of investors, including retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans and university endowments. We provide these investors with access to a variety of tools and products that seek to address their level of sophistication and desired level of interaction, which can range from low-touch self-directed accounts to high-touch funds and managed accounts. Investors can invest in loans through one or all of the following channels:

Notes:We believeissue notes pursuant to an effective Note Registration Statement. Investors who meet the applicable financial suitability requirements and have completed our strategyinvestor account opening process may purchase unsecured, borrower payment dependent notes that correspond to payments received on an underlying standard program loan selected by the investor. When an investor registers with us, the investor enters into an investor agreement with us that governs the investor’s purchases of pursuingnotes. Our note channel is supported by our website and our investor services group, which provides basic customer support to these investors.

Certificates and Investment Funds: Accredited investors and qualified purchasers may establish a diverserelationship with LCA or another third-party advisor in order to indirectly invest in certificates, or they may directly purchase a certificate or a limited partnership interest in one of eight private funds that purchase certificates. The certificates are issued by the Trust and are unsecured and settled with cash flows from underlying loans selected by the investor. Neither certificates nor limited partnership interests can be purchased through our website. Certificate investors typically seek to invest larger amounts as compared to the average note investors and often desire a more “hands off” approach to investing. Investors in certificates generally pay an asset-based management fee instead of cash flow-based servicing fee paid by note investors.

Whole Loan Purchases: Certain institutional investors, such as banks, seek to hold the actual loan on their balance sheet. To meet this need, we sell entire standard or custom program loans to these investors through purchase agreements. Upon the sale of the loan, the investor base will continue to strengthen our marketplaceowns all right, title and improve our ability to facilitate a wide varietyinterest in the loan. We establish the investors’ accounts and the procedures for the purchase of loans, through a range of business and economic conditions.including any purchase amount limitations, which we control in our discretion. We and our issuing banksthe investor also sell loans in their entiretymake limited representations and warranties and agree to certain investors in private transactions. Afterindemnify each other for breaches of the sale, wepurchase agreement. The investor also agrees to simultaneously enter into

a servicing agreement with us which designates us as the loan servicer for the sold loan. We continue to service

these loans after they are sold and can be removed as the

loan.servicer in limited circumstances. For certain whole loans, under our contractual relationships we are not the servicer. For regulatory purposes, the investor also has access to the underlying borrower information, but is prohibited from contacting or marketing to the borrower in any manner and agrees to hold such borrower information in compliance with all applicable privacy laws. Whole loan purchases are attractive for some investors as it enables them to account for the loan as an asset, which can offer favorable financial reporting and capital reserve treatment.

Key elements of our technology include:

| • | | Highly Automated.

Highly Automated. Our borrower and investor acquisition process, registration, credit decisioning and scoring, servicing and payment systems are highly automated using our internally developed software. We developed our own cash management software to process electronic cash movements, record book entries and calculate cash balances in our borrower and investor fund accounts. In nearly all payment transactions, an Automated Clearing House electronic payment network, referred to as ACH, is used to disburse loan proceeds, pull borrower payments on outstanding loans, receive funds from investors and disburse payments to investors. |

| • | | Scalable Platform. Our scalable infrastructure utilizes standard techniques, such as virtualization, load-balancing and high-availability platforms. Our application and database tiers are designed to be scaled horizontally by adding additional servers as needed. |

| • | | Proprietary Fraud Detection. We use a combination of third-party data, sophisticated analytical tools and current and historical data obtained during the application process to help determine an application’s fraud risk. High-risk applications are subject to further investigation. In cases where we confirm fraud, the application is cancelled, and we identify and flag characteristics of the loan to help refine our fraud detection efforts. |

| • | | Data Integrity and Security. We maintain an effective information security program based on well-established security standards and best practices, such as ISO2700x and NIST 800 series. The program establishes policies and procedures to safeguard the confidentiality, integrity and availability of borrower and investor information. The program also addresses risk assessment, training, access control, encryption, service provider oversight, an incident response program and continuous monitoring and review. |

| • | | Application Programming Interface. Our application programming interface, referred to as our API, provides investors and partners access to publicly available loan attributes and allows them to analyze the data and place orders meeting their criteria without visiting our website. Investors and partners may create their own software that uses the API or they may use a variety of third-party services that invest via our API on behalf of their members. |

Our engineering and product development expense was $34.7 million, $13.9 million and $4.0 million for the years ended December 31, 2014 and 2013 and the nine months ended December 31, 2012, respectively.

Credit Decisioning and Scoring Process

Our marketplace provides an integrated and automated application and credit decisioning and scoring, servicing and payment systems are highly automated using our internally developed software. We developed our own cash management software to process electronic cash movements, record book entries and calculate cash balances in our borrower and investor fund accounts. In nearly all payment transactions, an Automated Clearing House (ACH) electronic payment network is used to disburse loan proceeds, collect borrower loan payments on outstanding loans, receive funds from investors and disburse payments to investors.

Scalable Platform. Our scalable infrastructure utilizes standard techniques, such as virtualization, load-balancing and high-availability platforms. Our application and database tiers are designed to be scaled horizontally by adding additional servers as needed.

Proprietary Fraud Detection. We use a combination of third-party data, sophisticated analytical tools and current and historical data obtained during the loan application process to help determine fraud risk. We have taken measures to detect and reduce the risk of fraud, but these measures need to be continually improved and may not be effective against new and continually evolving forms of fraud or in connection with new product offerings. High-risk loan applications are subject to further investigation. In cases of confirmed fraud, the application is cancelled, and we identify and flag characteristics of the loan application to help refine our fraud detection efforts.

Data Integrity and Security. We maintain an effective information security program based on well-established security standards and best practices, including ISO2700x and NIST 800 series. The program establishes policies and procedures to safeguard the confidentiality, integrity and availability of borrower and investor information. The program also addresses risk assessment, training, access control, encryption, service provider oversight, an incident response program and continuous monitoring and review.

Application Programming Interface. Our application programming interface, referred to as our API, provides investors and partners access to publicly available loan attributes and allows them to analyze the data and place orders meeting their criteria without visiting our website. Investors and partners may create their own software that is extensible touses our API or they may use a variety of loan products. Borrowers comethird-party services that invest via our API.

Lending Club Open Integration. In August 2015, we launched Lending Club Open Integration (LCOI). LCOI allows online advisors and broker-dealers to our marketplaceoffer Lending Club investments quickly and easily to apply online fortheir client bases, using a loan. Duringsuite of API services that integrate directly into their websites. This allows these advisors and broker-dealers to provide the simple application process, our marketplace uses proprietary risk algorithmssame functionality that leverage behavioral data, transactional data and employment information to supplement traditional risk assessment tools, such as FICO scores, to assess the borrower’s risk profile. The marketplace then presents an approved borrower with various loan options, including term, rate and amount, for which they qualify. After the borrower selects their desired loan terms and the rest of the application is completed, our verification processes and teams verify an applicant’s identity, income or employment by connecting to various data sources, directly or through third-party service providers, or by contacting the human resources department of the borrower’s stated employer to ultimately approve the loan request.Regulatory and Compliance Framework

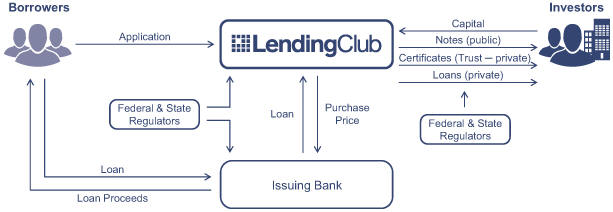

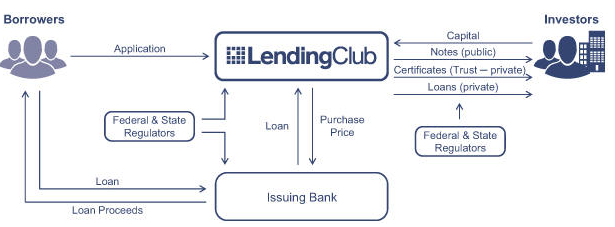

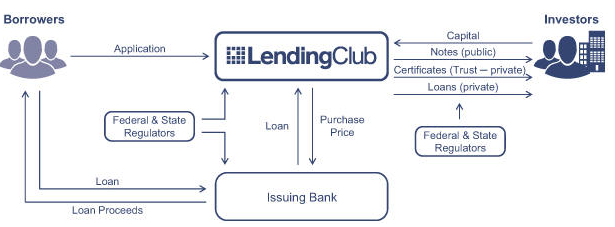

Our marketplace provides a compliance framework that allows investors to participate in consumer and commercial credit as an asset class. We believe that our relationship with issuing banks is a key component of our compliance framework. The banks originate loans to borrowers that applycurrently exists on our website, including money movement, investing, reinvesting, real-time reporting of cash and we subsequently purchase a majority of these loansholdings, and tax reporting.

Relationships with funds providedIssuing Bank Partners

Loans facilitated through our marketplace are originated by

investors through a variety of investment channels, thereby enabling investors to capture the interest rate return on each loan.our issuing bank partners. Our primary issuing bank is WebBank, a Utah-chartered industrial bank that handles a variety of consumer and commercial financing programs.

Additionally, we rely on NBT Bank and Comenity Capital Bank as issuing banks for our education and patient finance loans. We also

executedhave an agreement with Cross River Bank, a New Jersey chartered bank, to operate as our back-up issuing bank in the event WebBank can no longer be an issuing bank.

We have entered into a loan account program agreement with WebBank that governs the terms and conditions between us and WebBank with respect to loans facilitated through our marketplace and originated by WebBank, including our obligations for servicing the loans during the period of time that the loans are owned by WebBank. Under the terms of the loan account program agreement, we pay WebBank a monthly serviceprogram fee based on the amount of loans issued by WebBank and purchased by us or our partners in eacha given month, subject to a minimum monthly fee. Effective in October 2014 WebBank also retains ownership of all loans for two business days and earns any interest receivedAn additional program fee component is dependent on the amount and timing of principal and interest payments made by borrowers of the underlying loans. Under this program structure, the majority of the bank's revenue related to the loans during that time. facilitated on our platform is therefore tied to the terms and performance of the loans. The bank also maintains an ongoing contractual relationship with borrowers, who may seek additional credit through the Lending Club program in the future.

WebBank pays us a transaction fee for our

marketplace’s role in processing loan applications

through our marketplace on WebBank’s behalf. Under a loan sale agreement,

that we entered into with WebBank

may sell us the loan without recourse two business days after

a loan is closed, WebBank

sellsoriginates the loan

to us, including all rights related toand earns interest on the

loan, without recourse.loans during that time. The loan sale agreement prohibits us from securitizing the loans without prior written consent of WebBank. The

initial terms of the loan account program agreement and the loan sale agreement

endterminate in

November 2018,January 2020, with

the possibility of two

automatic, one-year renewal terms, subject to certain early termination provisions as set forth in the agreements.

As part of our ongoing compliance program, we also have customer identification processes in place to enable us to identify user identification fraud and compare user identity against applicable governmental lists, such as the Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network. We compare all users’ identities against these lists at least twice a month for continued compliance and oversight. If a user were to appear on a list, we would take appropriate action to resolve the issue. In addition to our continued identification compliance program, we use our robust technology to assist us in complying with applicable federal anti-money laundering laws. See “Item 1 – Business -Regulations and Licensing” for more information regarding our regulatory framework.

Loan Issuance Mechanism

We have developed an extensible, automated platform that allows us to work with

Our issuing banks tofor education and patient finance loans originate and issueservice each education and patient finance loan issued. Our issuing bank retains some of these loans while others are offered to private investors. For our role in loan facilitation, we earn transaction fees paid by the issuing bank and education and patient service providers at the time of origination by the issuing bank.

Credit Decisioning and Scoring Process

Our marketplace provides an integrated and automated loan application and credit decisioning and scoring process that is extensible to a variety of loan products to an array of applicants. Our service is provided in a seamless fashion to the applicant. A borrower comesproducts. Borrowers come to our website and completesplatform to apply online for a loan. During the simple application for a loan product. We then useprocess, our platform uses proprietary risk algorithms that leverage behavioral data, transactional data and employment information to analyze an applicant’ssupplement traditional risk assessment tools, such as FICO scores, to assess a borrower’s risk profile. Our verification processes and teams then verify the borrower’s identity, income or employment by connecting to various data sources, directly or through third-party service providers, or by contacting the human resources department of the borrower’s stated employer to determine whether to approve the loan request. Borrowers are then assigned one of 35 loan grades, from A1 through G5 based on this risk profile, based uponloan term and loan amount. The platform then presents an approved borrower with various loan options, including term, rate and amount, for which they qualify. Once the issuing bank’s underwriting guidelines. Once anborrower selects the desired loan terms, the rest of the application is completed.

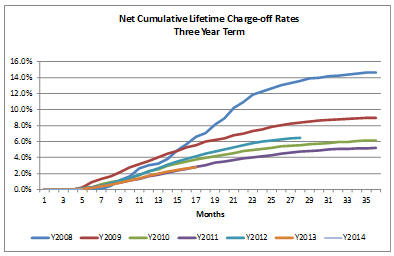

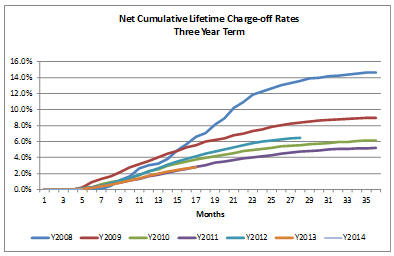

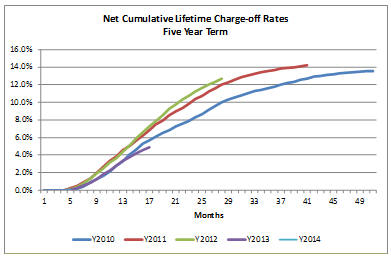

Our marketplace's credit decisioning and scoring models are evaluated on a regular basis and the additional data on loan history experience, borrower behavior, economic factors and prepayment trends that we accumulate are leveraged to continually improve the models. If the platform is unable to effectively evaluate borrowers’ credit worthiness and likelihood of default, borrowers and investors may lose confidence in our marketplace. Additionally, our ability to effectively segment borrowers into relative risk profiles impacts our ability to offer attractive interest rates for borrowers as well as our ability to offer investors solid risk-adjusted returns, both of which directly relate to our users’ confidence in our marketplace. Our marketplace’s credit decisioning and scoring models assign each loan offered on our marketplace a corresponding interest rate and origination fee. Our investors’ returns are a

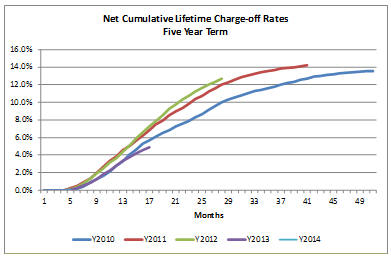

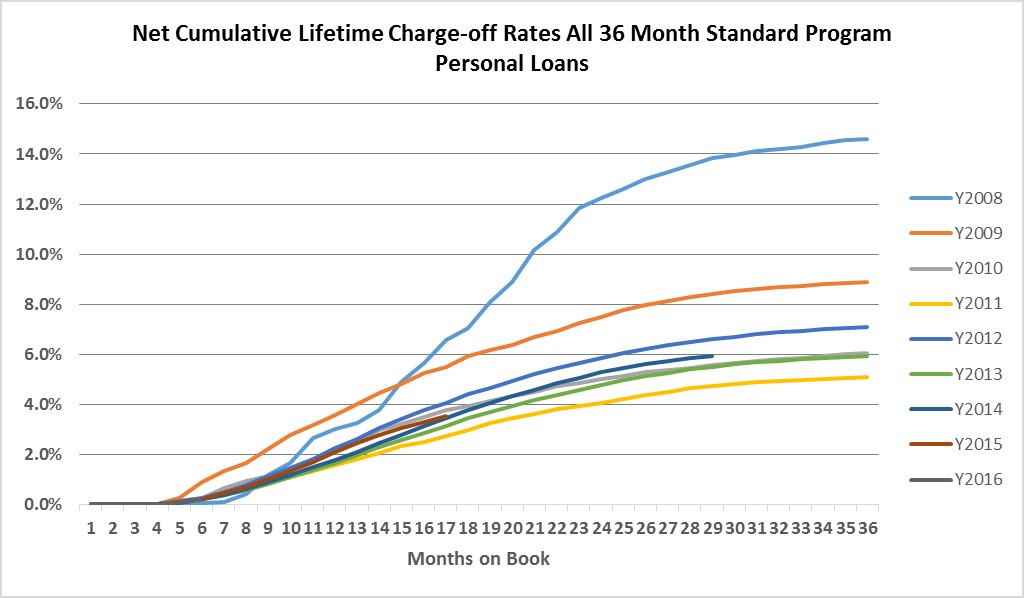

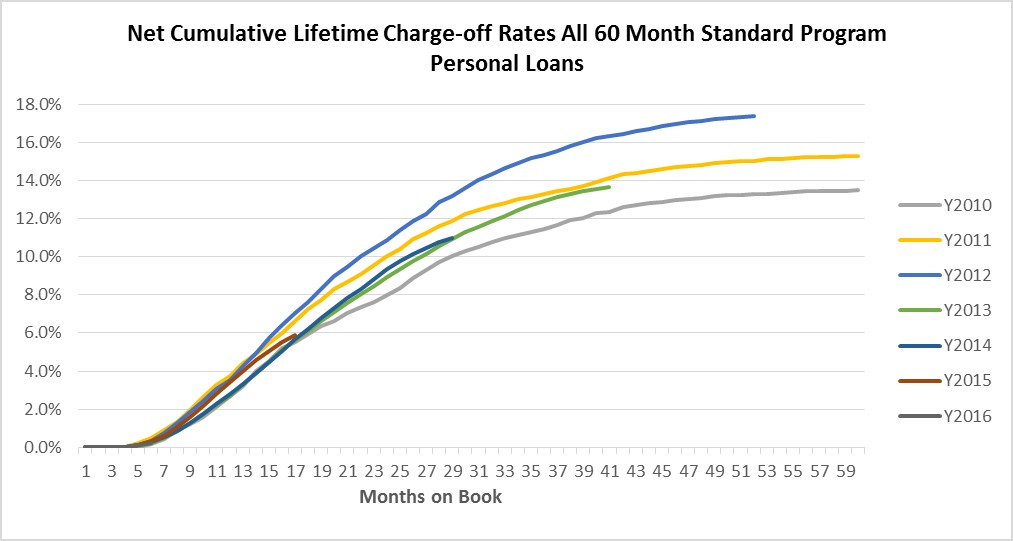

function of the assigned interest rates for each particular loan invested in less any defaults over the term of the applicable loan. We believe we have a history of effectively evaluating borrower’s credit worthiness and likelihood of defaults, as evidenced by the performance of various loan vintages facilitated through our marketplace. If our marketplace's credit decisioning and scoring models ultimately prove to be ineffective, or fail to appropriately account for a decline in the macroeconomic environment, investors may experience higher than expected losses and lose confidence in our business.

Loan Issuance Mechanism

Once a loan application is approved

using the credit decisioning and scoring process described above, we present the borrower with various loan options. After the applicant selects their personalized financing option and completes the application process,

the loan is listed on our marketplace to attract investor commitments, while we

simultaneously perform additional verifications on the borrower. Once the verifications are completed,

the loan will be listed for at least 14 days and

up to 30 days on our marketplace to attract investor commitments. Once sufficient investor commitments are received, the issuing bank originates and issues the loan to the borrower, net of the origination

fee.fee charged and retained by the issuing bank. After the loan is issued, we use the proceeds from these investors to purchase the loan. Investor cash balances (excluding payments in process) are held in a segregated bank or custodial accounts and are not commingled with our monies. We receive a transaction fee from the issuing bank for our marketplace’s role in originating the loan. We also earn a recurring servicing fee from investors and management fees from investment funds and other managed accounts.

We service all

personal and small business loans facilitated through our marketplace, except for

patient and education finance loans

facilitated through Springstone’s platform.and auto refinance loans. Servicing is comprised of account maintenance, collections, processing payments from borrowers and distributions to investors.

We have made arrangements for limited backup servicing with Portfolio Financial Servicing Company.

For

the month of December

2014,2016, approximately

99%98% of loan payments

for loans that we service were made through an ACH withdrawal from the borrower’s bank account.

Loan repaymentsPrincipal and interest payments on loans are remitted utilizing

ACH to segregated bank accounts maintained for the benefit of investors, custodial or other accounts designated by our investors.ACH. This automated process allows us to avoid the time and expense of processing a significant volume of mailed payments and provides a higher degree of certainty for timely payments. This process also provides us with prompt notice in the event of a missed payment, which allows us to respond quickly to resolve the

issuedelinquency with the borrower. Generally, in the first 30 days that a loan is delinquent, our in-house

collectioncollections team works to bring the account current. Once the loan becomes more than 30 days delinquent, we will typically outsource subsequent servicing efforts to third-party collection agencies.

The servicing fee paid by investors is designed to cover the day-to-day processing costs of loans. If a loan needs more intensive collection focus, whether internal or external, we may charge investors a collection fee to compensate us for the costs of this collection activity. This fee varies, with a maximum of up to 35% of the amount recovered. There is no fee charged if there

isare no

recovery, and the fee cannot exceed the proceeds collected.loan payments recovered. We

may sell loans that have been charged-off to

acertain third

party.parties. All proceeds received on these sales are subject to a

standard servicingcollection fee, and the net proceeds are distributed to investors.

In April 2014, we acquired all of the outstanding limited liability company interests of Springstone, which offers education and patient finance loans.

Springstone utilizesWe utilize two issuing banks and a network of

providers. Springstone facilitates two loan products:Anproviders to facilitate the issuance of education and patient finance installment loan with amounts ranging from $2,000 to $40,000, terms from 24 to 84 months, fixed rates from 3.99% to 17.99%, fixed monthly paymentsloans and no prepayment penalties.

A true no interest loan with amounts ranging from $499 to $32,000 that provides for no interest financing if the balance is paid in full during the promotional period, which can be six, 12, 18 or 24 months. There is no prepayment penalty and borrowers have the flexibility to payno-interest loans, as much or as little, subject to applicable minimums, of the outstanding balance during the promotional period as they choose.described above.

Currently, each of Springstone’s issuing banks originate, retain and service each issued loan. For its role in loan facilitation, Springstone earns transaction fees paid by the issuing bank and service provider at the time of origination, which averaged approximately 5% of the initial loan balance as of December 31, 2014. Currently, Springstone does not earn any servicing fees, as loans are originated, retained and serviced by the issuing bank. We currently intend to continue to have these loans funded and serviced through existing issuing banks while we develop plans to integrate these loans into our Standard Loan Program over time.

We compete with financial products and companies that attract borrowers, investors or both. With respect to borrowers, we primarily compete with traditional financial institutions, such as banks, credit unions, credit card issuers and other consumer finance companies. We believe our innovative marketplace model, online delivery and process automation enable us to operate more efficiently and with more competitive rates and higher borrower satisfaction than these competitors.

With respect to investors, we primarily compete with other investment vehicles and asset classes, such as equities, bonds and short-term fixed income securities. We believe that our diverse and customizable investment options give us the flexibility to offer attractive risk-adjusted returns that are

generally uncorrelated with other asset classes.

We compete with other online credit marketplaces, such as Prosper Marketplace, Inc.

and Funding Circle Limited., as well as with other online lenders. We are the world’s largest online marketplace connecting borrowers to investors, which we believe provides us with a major competitive advantage. We believe that our network effects and marketplace dynamics at play make us more attractive and efficient to both borrowers and investors. We anticipate that more established internet, technology and financial services companies that possess large, existing customer bases, substantial financial resources and established distribution channels may enter the market in the future. We believe that our brand, scale, network effect, historical data and performance record provide us with significant competitive advantages over current and future competitors.

Our marketing efforts are designed to attract and retain borrowers and investors and build brand awareness and reputation. We dedicate significant resources to our marketing and brand advertising efforts and strategic relationships. Our marketing efforts are designed to build awareness of Lending Club and attract borrowers and investors to our marketplace. We use a diverse array of marketing channels and are constantly seeking to improve and optimize our experience both on- and offline to achieve efficiency and a high level of borrower and investor satisfaction. Currently, we believe reputation, word of mouth and our direct marketing via mail drives continued organic growth in our investor and borrower base.

We believe mostalso continue to invest in our strategic relationships to raise awareness of our platform and attract borrowers and investors to our marketplace. For example, we have a strategic partnership relationship with a consortium of community banks for our marketplace to offer co-branded personal loans to the participating banks’ customers. As part of this relationship, each community bank is provided initial access to invest in loans sought by their own customers, which may include standard program loans. The customer loans that do not meet the community bank’s investment criteria are then made available for investment through the marketplace. All other loans will continue to be available on our marketplace and accessible on an equal basis and are originated by our issuing banks.

Regulatory and Compliance Framework

The regulatory environment for credit and online marketplaces such as ours is complex, evolving and uncertain, creating both challenges and opportunities that could affect our financial performance. We, and the loans facilitated through our marketplace, are subject to extensive and complex rules and regulations, licensing and examination by various federal, state and local government authorities designed to, among other things, protect borrowers (such as truth in lending, equal credit opportunity, fair credit reporting and fair debt collection practices) and investors. Our primary issuing bank, WebBank, is subject to oversight by the FDIC and the State of Utah. The other two issuing banks are NBT Bank and Comenity Capital Bank. NBT Bank is subject to oversight by the OCC and the New York Department of Financial Services, and Comenity Capital Bank is subject to oversight by the FDIC and the Utah Department of Financial Institutions. These authorities impose obligations and restrictions on our activities and the loans facilitated through our marketplace. For example, these rules limit the fees that may be assessed on the loans, require extensive disclosure to, and consents from, the borrowers and lenders, prohibit discrimination and unfair, deceptive, or abusive acts or practices and may impose multiple qualification and licensing obligations on our activities.

Our compliance framework is a cornerstone of the marketplace that allows investors are satisfiedto participate in consumer and commercial credit as an asset class. Our relationship with their experience, often adding fundsissuing banks is a key component of our compliance framework, as described below.

As part of our ongoing compliance program, we have customer identification processes in place to

their accountenable us to detect and

referring their friendsprevent fraud and

colleaguesidentify customers who may be on government watchlists, such as those from the Office of Foreign Assets Control (OFAC) and the Financial Crimes Enforcement Network. We compare users’ identities against these lists at least twice a month for continued compliance and oversight. If a user were to

us.appear on a list, we would take appropriate action to resolve the issue in accordance with company policies and anti-money laundering obligations. In addition to our continued identification compliance program, we use our proprietary technology to assist us in complying with applicable federal anti-money laundering laws.

Regulations and Licensing

The lending and securities industries are highly regulated.

However, weWe are regulated

very differently than a

bank. Whilebank because, unlike a bank,

haswe are not exposed to capital risk from

both credit and interest rate

risks,risks. Rather, for loans issued through our marketplace loan balances, interest rates and maturities are matched and offset by an equal balance of notes and certificates. Additionally, we do not take deposits and are therefore not regulated by the FDIC in that respect. Our current issuing banks originate all of the loans offered through our marketplace and are subject to regulation by the FDIC

and/or other relevant federal and state regulators.

However, we

The Company and the loans made through our marketplace are subject to extensivehighly regulated. State and complex rules and regulations, licensing and examination by various federal state and local government authorities. For example, our primary issuing bank, WebBank, is subject to oversight by the FDIC and the State of Utah. These authorities impose obligations and restrictions on our activities and the loans facilitated through our marketplace. For example, these ruleslaws limit the fees that may be assessed on the loans, require extensive disclosure to, and consents from, the borrowers and lenders, prohibit discrimination and unfair, and deceptive, or abusive acts or practices and may impose multiple qualification and licensing obligations on our activities. Failure to comply with any of these requirements may result in, among other things, revocation of required licenses or registration, loss of approved status, voiding of the loan contracts, class action lawsuits, administrative enforcement actions and civil and criminal liability.

Further, federal, state and local governmental authorities impose additional obligations and restrictions on our activities and the loans facilitated through our marketplace. For example, our primary issuing bank, WebBank, is subject to oversight by the FDIC and the State of Utah. These and other governmental authorities impose obligations and restrictions on our activities and the loans facilitated through our marketplace. While compliance with such requirements is at times complicated by our novel business model, we believe we are in substantial compliance with these rules and regulations.

Current Regulatory Environment

In May 2015, the U.S. Court of Appeals for the Second Circuit issued its decision in Madden v. Midland Funding, LLC that interpreted the scope of federal preemption under the National Bank Act (NBA) and held that a nonbank assignee of a loan originated by a national bank was not entitled to the benefits of federal preemption of claims of usury. The Second Circuit’s decision is binding on federal courts located in Connecticut, New York, and Vermont, but the decision could also be adopted by other courts. The defendant petitioned the U.S. Supreme Court to review the decision and in March 2016, the Court invited the Solicitor General to file a brief expressing the views of the U.S. on the petition. The Solicitor General filed an amicus brief that stated the Second Circuit decision was incorrect, but that the case was not yet ready to be heard by the Supreme Court. In June 2016, the Supreme Court declined to hear the case. The Federal District Court is now hearing the case in regards to Midland’s alternative claim under a choice of law analysis, and application of state law. The outcome could create potential liability under state statues such as usury and consumer protection statutes.

While we believe that our program is factually distinguishable from the case, we revised our agreement with our primary issuing bank to further distinguish the operation of the program from the court’s analysis of the facts in Madden. Under the revised program structure, an additional component of the program fee arrangement was created. This additional program fee component is dependent on the amount and timing of principal and interest payments made by borrowers of the underlying loans. Under this revised program structure the majority of the bank's revenue related to the loans facilitated on our platform is therefore tied to the terms and performance of the loans. The bank also maintains an ongoing contractual relationship with borrowers, who may seek additional credit through the Lending Club program in the future.

In August 2016, a federal district court in the Central District of California considered a case brought by the Consumer Finance Protection Bureau (CFPB) against CashCall, Inc. In that case, CashCall had an arrangement with a lender owned by a member of the Cheyenne River Sioux Tribe in which loans were offered to borrowers at APR’s that could exceed 300 percent. The district court ruled that, under the facts presented in the case, CashCall should be deemed the “true lender” and could not charge interest rates in excess of state usury laws. In January 2017, the court issued an order staying the decision for interlocutory appeal to the United States Court of Appeals for the Ninth Circuit, over the CFPB's objections. The defendants then filed a petition for appeal with the Ninth Circuit, which is currently pending.

Separately, in September 2016 in Beechum v. Navient Solutions, Inc., also in the federal district court in the Central District of California, the court considered a program in which a national bank had a bank partnership with a nonbank, the Student Loan Marketing Association (SLMA), in which borrowers could receive loans originated by the bank through the SLMA. The court in Beechum rejected the argument that the SLMA was the “true lender,” holding that the face of the borrower transactions showed that the bank had originated the loans and any further analysis to look behind the face of the transaction was inappropriate. We believe that our program is factually distinguishable from the CashCall situation.

Recognizing the growth in online marketplaces such as ours, in July 2015 the U.S. Treasury Department issued a request for information (RFI) to study the various business models and products offered by online marketplace lenders, the potential for online marketplace lending to expand access to credit to historically underserved borrowers and how the financial regulatory framework should evolve to support the safe growth of the industry. We, along with many other interested groups, submitted responses to the Treasury’s RFI by the September 30, 2015 deadline.

On May 10, 2016, the U.S. Treasury Department released a white paper on the online marketplace lending industry to continue the work initiated by the RFI. The white paper includes several recommendations to the federal government and private sector participants to encourage safe growth and access to credit. We cannot predict whether any legislation or proposed rulemaking will actually be introduced or how any legislation or rulemaking will impact our business and results of operations going forward. In December 2016, the Office of the Comptroller of the Currency (the OCC) released a white paper and sought public comment on whether to charter a new type of special

purpose national bank to facilitate the provision of core banking activities through financial technology. We, along with other interested parties, submitted responses to the OCC's proposed special purpose charter (Fintech Charter) in January 2017.

In December 2015, the California Department of Business Oversight (DBO) sent an online survey to fourteen marketplace lenders, including us, requesting information about the business model, online platform, loan performance and investor funding process. In May 2016, the DBO requested additional information from us and other survey participants. We submitted our response to this additional information in June 2016 and continue to cooperate with the DBO's inquiry.

While we are subject to the regulatory and enforcement authority of the Consumer Financial Protection Bureau (CFPB), as a facilitator, servicer or acquirer of consumer credit, the CFPB has recently announced that it intends to expand its supervisory authority, through the use of “larger participant rules,” to cover larger marketplace lenders, non-bank installment lenders and auto lenders. The CFPB has announced larger participant rules for auto lenders but has not yet announced specifics regarding its proposed rulemaking for installment loan lenders and, consequently, there continues to be uncertainty as to how the CFPB’s strategies and priorities, including any final rules, will impact our unsecured installment loan business and our results of operations going forward.

State Licensing Requirements

In most states we believe that the applicable issuing bank, as originator of loans

madefacilitated through our marketplace, satisfies any relevant licensing requirements with respect to the origination of loans applicable to our operations. As needed, we

will seek

the appropriate authorizations to conduct activities

on a uniform basis in

all other states and the

District of Columbia, with the exceptions of Idaho, Iowa, Maine, Nebraska and North Dakota.respective state. State licensing statutes impose a variety of requirements and restrictions on us, including:

record-keeping requirements;

restrictions on servicing practices, including limits on finance charges and fees;

disclosure requirements;

examination requirements;

surety bond and minimum net worth requirements;

financial reporting requirements;

notification requirements for changes in principal officers, stock ownership or corporate control;

restrictions on advertising; and

review requirements for loan forms.

The

These statutes also subject us to the supervisory and examination authority of state regulators in certain cases.