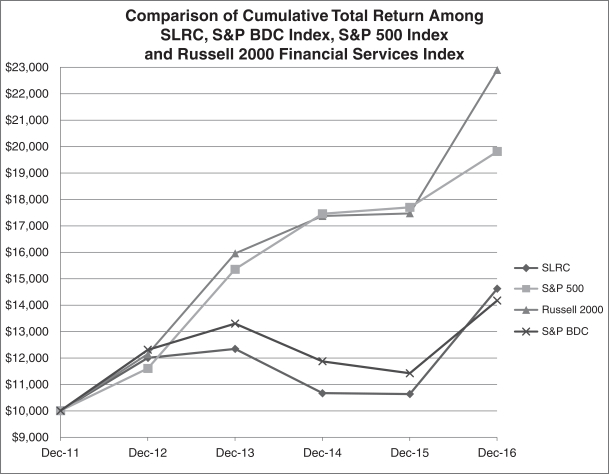

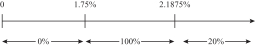

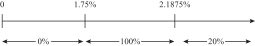

pre-incentive fee net investment income means interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from portfolio companies) accrued during the calendar quarter, minus our operating expenses for the quarter (including the base management fee, expenses payable under the Administration Agreement to Solar Capital Management, and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee).Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with pay in kind interest and zero coupon securities), accrued income that we have not yet received in cash.Pre-incentive fee net investment income does not include any realized capital gains, computed net of all realized capital losses or unrealized capital appreciation or depreciation.Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets at the end of the immediately preceding calendar quarter, is compared to a hurdle of 1.75% per quarter (7.00% annualized). Our net investment income used to calculate this part of the incentive fee is also included in the amount of our gross assets used to calculate the 2.00% base management fee. We pay Solar Capital Partners an incentive fee with respect to ourpre-incentive fee net investment income in each calendar quarter as follows:

no incentive fee in any calendar quarter in which ourpre-incentive fee net investment income does not exceed the hurdle of 1.75%;

100% of ourpre-incentive fee net investment income with respect to that portion of suchpre-incentive fee net investment income, if any, that exceeds the hurdle but is less than 2.1875% in any calendar quarter (8.75% annualized). We refer to this portion of ourpre-incentive fee net investment income (which exceeds the hurdle but is less than 2.1875%) as the“catch-up.” The“catch-up” is meant to provide our investment adviser with 20% of ourpre-incentive fee net investment income as if a hurdle did not apply if this net investment income exceeds 2.1875% in any calendar quarter; and

|

20% of the amount of ourpre-incentive fee net investment income, if any, that exceeds 2.1875% in any calendar quarter (8.75% annualized) is payable to Solar Capital Partners (once the hurdle is reached and thecatch-up is achieved, 20% of allpre-incentive fee investment income thereafter is allocated to Solar Capital Partners).

The following is a graphical representation of the calculation of the income-related portion of the incentive fee:

Quarterly Incentive Fee Based on Net Investment Income

Pre-incentive fee net investment income

(expressed as a percentage of the value of net assets)

Percentage ofpre-incentive fee net investment income

allocated to Solar Capital Partners

These calculations are appropriatelypro-rated for any period of less than three months. You should be aware that a rise in the general level of interest rates can be expected to lead to higher interest rates applicable to our debt investments. Accordingly, an increase in interest rates would make it easier for us to meet or exceed the incentive fee hurdle rate and may result in a substantial increase of the amount of incentive fees payable to our investment adviser with respect topre-incentive fee net investment income.

The second part of the incentive fee is determined and payable in arrears as of the end of each calendar year (or upon termination of the Advisory Agreement, as of the termination date), and equals 20% of our realized capital gains, if any, on a cumulative basis from inception through the end of each calendar year, computed net of