| • | | • | the abilityextent to which our business, the medical community and the global economy will continue to be materially and adversely impacted by the effects of Alimera Sciences, Inc.the COVID-19 pandemic (the “Pandemic”), or Alimera,by other pandemics, epidemics or outbreaks; |

| • | the potential for EYP-1901, as a twice-yearly sustained delivery intravitreal anti-VEGF treatment targeting wet age-related macular degeneration (“wet AMD”), with potential in diabetic retinopathy (“DR”) and retinal vein occlusion (“RVO”); |

| • | our expectations regarding the timing and outcome of our Phase 1 clinical trial for EYP-1901 for the treatment of wet AMD; |

| • | our expectations to obtain regulatory approvalavoid the toxicity seen in the prior clinical trials of orally delivered vorolanib, a tyrosine kinase inhibitor (“TKI”) by delivering vorolanib locally using a bioerodible Durasert® technology as EYP-1901 at a significantly lower total dose; |

| • | our expectations regarding the timing and commercialize ILUVIENclinical development of our product candidates, including EYP-1901 and YUTIQ50; |

| • | the potential advantages of YUTIQ® and DEXYCU® for the treatment ofnon-infectious posterior segment uveitis, in Europe, the Middle East and Africa; eye diseases; |

the implication of results frompre-clinical and clinical trials and our other research activities;

| • | our cash flow expectations from commercial sales of YUTIQ and DEXYCU; |

| • | | • | our intentionsability to manufacture YUTIQ and DEXYCU, or any future products or product candidates, in sufficient quantities and quality; |

| • | our belief that our cash and cash equivalents of $44.9 million at December 31, 2020, combined with the approximately $108.0 million of net proceeds from the February 2021public offering of shares of our common stock and anticipated net cash inflows from product sales will fund our operating plan through the second quarter of 2022, under current expectations regarding (i) the timing and outcomes of our Phase 1 clinical trial for EYP-1901 for the treatment of wet AMD, and (ii) initiation of our Phase 2 clinical trials for EYP-1901 for the treatment of wet AMD; |

| • | our ability to obtain additional capital in sufficient amounts and on terms acceptable to us, and the consequences of failing to do so; |

| • | our future expenses and capital expenditures; |

| • | our expectations regarding the timing and results of the subpoena from the Division of Enforcement of the U.S. Securities and Exchange Commission (“SEC”) seeking production of certain documents and information on topics including product sales and demand, revenue recognition and accounting in relation to product sales, product sales and cash projections, and related financial reporting, disclosure and compliance matters (the “SEC” investigation”); |

| • | our expectations regarding our research into other usesability to obtain and applicationsadequately maintain sufficient intellectual property protection for EYP-1901, YUTIQ, DEXYCU and YUTIQ50 and any future products or product candidates, and to avoid claims of our Durasert™ and Verisome® technology platforms;infringement of third-party intellectual property rights; |

our expectations regarding our ability to obtain and adequately maintain sufficient intellectual property protection for DEXYCU, YUTIQ and our other product candidates, and to avoid claims of infringement of third party intellectual property rights;

| • | our expectation that we will continue to incur significant expenses and that our operating losses and our net cash outflows to fund operations will continue for the foreseeable future; |

our expectation that we will continue to incur significant expenses and that our operating losses and our net cash outflows to fund operations will continue for the foreseeable future;

| • | our expectations regarding our partnership with ImprimisRx; |

the scope and duration of intellectual property protection; and

| • | our expectation regarding the potential for our Paycheck Protection Program Loan (the “PPP Loan”) to be forgiven in full; and |

the effect of legal and regulatory developments.

| • | the effect of legal and regulatory developments. |

Forward-looking statements also include statements other than statements of current or historical fact, including, without limitation, all statements related to any expectations of revenues, expenses, cash flows, earnings or losses from operations, cash required to maintain current and planned operations, capital or other financial items; any statements of the plans, strategies and objectives of management for future operations; any plans or expectations with respect to product research, development and commercialization, including regulatory approvals; any other statements of expectations, plans, intentions or beliefs; and any statements of assumptions underlying any of the foregoing. We often, although not always, identify forward-looking statements by using words or phrases such as “likely”, “expect”, “intend”, “anticipate”, “believe”, “estimate”, “plan”, “project”, “forecast” and “outlook”.

The following are some of the factors that could cause actual results to differ materially from the anticipated results or other expectations expressed, anticipated or implied in our forward-looking statements: uncertainties with respect to: our ability to achieve profitable operations and access to needed capital; fluctuations in our operating results; the number of clinical trials, including clinical trials conducted outside the United States, or U.S., and data required for marketing approval for YUTIQ in the U.S.; our ability to use data in promotion for YUTIQ; our ability to successfully produce commercial supply of DEXYCU and successfully commercialize DEXYCU in the U.S.; our ability to successfully build a commercial infrastructure and enter into and maintain commercial agreements for the launch of DEXYCU and, if approved, YUTIQ; our ability to successfully commercialize YUTIQ, if approved, in the U.S.; potentialoff-label sales of ILUVIEN for uveitis; consequences of fluocinolone acetonide side effects; successful commercialization of, and receipt of revenues from, ILUVIEN for diabetic macular edema, or DME, which depends on Alimera’s ability to continue as a going concern; Alimera’s ability to obtain additional marketing approvals and the effect of pricing and reimbursement decisions on sales of ILUVIEN for DME; Alimera’s ability to obtain marketing approval for ILUVIEN in its licensed territories fornon-infectious posterior segment uveitis; the development of our next-generation Durasert short-acting treatment for uveitis; potential declines in Retisert® royalties; our ability to market and sell products; the success of current and future license agreements, including our agreement with Alimera; termination or breach of current license agreements, including our agreement with Alimera; our dependence on contract research organizations, contract sales organizations, vendors and investigators; effects of competition and other developments affecting sales of products; market acceptance of products; effects of guidelines, recommendations and studies; protection of intellectual property and avoiding intellectual property infringement; retention of key personnel; product liability; industry consolidation; compliance with environmental laws; manufacturing risks; risks and costs of international business operations; effects of the potential exit of the United Kingdom from the European Union; legislative or regulatory changes; volatility of stock price; possible dilution; absence of dividends; and other factors described in our filings with the Securities and Exchange Commission. | • | the extent to which the Pandemic impacts our business, the medical community and the global economy; |

| • | the effectiveness and timeliness of our preclinical studies and clinical trials, and the usefulness of the data; |

| • | uncertainties with respect to the duration, scope and outcome of the SEC investigation and its impact on our financial condition, results of operations and cash flows; |

| • | our ability to achieve profitable operations and access to needed capital; |

| • | fluctuations in our operating results; |

| • | our ability to successfully produce sufficient commercial quantities of YUTIQ and DEXYCU and to successfully commercialize YUTIQ and DEXYCU in the U.S.; |

| • | our ability to sustain and enhance an effective commercial infrastructure and enter into and maintain commercial agreements for the commercialization of YUTIQ and DEXYCU; |

| • | consequences of fluocinolone acetonide side effects for YUTIQ; |

| • | consequences of dexamethasone side effects for DEXYCU; |

| • | the success of current and future license and collaboration agreements, including our agreements with Ocumension Therapeutics (“Ocumension”) and Equinox Science, LLC (“Equinox”); |

| • | our dependence on contract research organizations, contract sales organizations, vendors and investigators; |

| • | effects of competition and other developments affecting sales of products; |

| • | market acceptance of our products; |

| • | protection of intellectual property and avoiding intellectual property infringement; |

| • | other factors described in our filings with the SEC. |

We cannot guarantee that the results and other expectations expressed, anticipated or implied in any forward-looking statement will be realized. The risks set forth under Item 1A of this Annual Report on Form10-K describe major risks to our business, and you should read and interpret any forward-looking statements together with these risks. A variety of factors, including these risks, could cause our actual results and other expectations to differ materially from the anticipated results or other expectations expressed, anticipated or implied in our forward-looking statements. Should known or unknown risks materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated or projected in the forward-looking statements. You should bear this in mind as you consider any forward-looking statements. Our forward-looking statements speak only as of the dates on which they are made. We do not undertake any obligation to publicly update or revise our forward-looking statements even if experience or future changes makes it clear that any projected results expressed or implied in such statements will not be realized. DEXYCU®, YUTIQ®, and Durasert® are our trademarks. Retisert® and Vitrasert® are Bausch & Lomb’s trademarks. ILUVIEN® is Alimera Sciences Inc.’s trademark. Verisome® is a trademark owned by Ramscor, Inc. and exclusively licensed to us. The reports we file or furnish with the SEC, including this Annual Report on Form 10-K, also contain trademarks, trade names and service marks of other companies, which are the property of their respective owners. Risk Factor Summary The risk factors summarized below could materially harm our business, operating results and/or financial condition, impair our future prospects and/or cause the price of our common stock to decline. For more information, see “Item 1A. Risk Factors” in this Annual Report on Form 10-K for the year ended December 31, 2020. Material risks that may affect our business, operating results and financial condition include, but are not necessarily limited to, the following: Risks Related To Our Financial Position and our Capital Resources | • | We will likely need additional capital to fund our operations. If we are unable to obtain sufficient capital, we will need to curtail and reduce our operations and costs and modify our business strategy. |

| • | We have incurred significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future. |

| • | We may never achieve profitability from future operations. |

| • | The ongoing novel coronavirus (COVID-19) pandemic has had and will likely continue to have a material and adverse impact on our business. |

| • | We received a subpoena from the SEC Enforcement Division requesting documents and information in an investigation relating to product sales and demand, revenue recognition and accounting. If the SEC commences an enforcement action against us, the resolution of such an enforcement action could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, we have expended and expect to continue to expend significant financial and managerial resources responding to the SEC subpoena, which could also have a material adverse effect on our business, financial condition, results of operations and cash flows. |

| • | We will need to raise additional capital in the future, which may not be available on favorable terms and may be dilutive to stockholders or impose operational restrictions. |

| • | We must maintain compliance with the terms of our CRG loan or receive a waiver for any non-compliance. Our failure to comply with the covenants or other terms of the loan, including as a result of events beyond our control, could result in a default under the loan agreement that would materially and adversely affect the ongoing viability of our business. |

| • | Our Loan Agreement contains restrictions that limit our flexibility in operating our business. |

| • | Certain potential payments to the Lenders could impede a sale of our company. |

| • | To service our indebtedness, we will require a significant amount of cash and our ability to generate cash depends on many factors beyond our control. |

Risks Related To The Regulatory Approval And Clinical Development Of Our Product Candidates | • | We are substantially dependent on the success of our lead product candidate, EYP-1901, which is in the early stages of development and must go through clinical trials, which are very expensive, time-consuming and difficult to design and implement. The outcomes of clinical trials are uncertain, and delays in the completion of or the termination of any clinical trial of EYP-1901 or our other product candidates could harm our business, financial condition and prospects. |

| • | Clinical trial results may fail to support approval of EYP-1901 or our other product candidates. |

| • | We may expend significant resources to pursue our lead product candidate, EYP-1901 for the potential treatment of wet AMD, and fail to capitalize on the potential of EYP-1901, or our other product candidates, for the potential treatment of other indications that may be more profitable or for which there is a greater likelihood of success. |

| • | Initial results from a clinical trial do not ensure that the trial will be successful and success in early stage clinical trials does not ensure success in later-stage clinical trials. |

| • | We face risks related to health epidemics and outbreaks, including the Pandemic, which could significantly disrupt our preclinical studies and clinical trials. |

| • | We may find it difficult to enroll patients in our clinical trials, which could delay or prevent clinical trials of our product candidates. |

| • | We are largely dependent on the future commercial success of our lead product candidate, EYP-1901. |

Risks Related To The Commercialization Of Our Products And Product Candidates | • | Our current business strategy relies on our ability to successfully commercialize YUTIQ and DEXYCU and in the U.S. Our approved products may not achieve market acceptance or be commercially successful. |

| • | Our products may become subject to unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives, which could harm our business. |

| • | If we fail to comply with reporting and payment obligations under the Medicaid Drug Rebate program or other governmental pricing programs, we could be subject to additional reimbursement requirements, penalties, sanctions, and fines which could have a material adverse effect on our business, financial condition, results of operations and growth prospects. |

| • | Even though regulatory approvals for YUTIQ and DEXYCU have been obtained in the U.S., we will still face extensive FDA regulatory requirements and may face future regulatory difficulties. |

| • | Our relationships with physicians, patients and payors in the U.S. are subject to applicable anti-kickback, fraud and abuse laws and regulations. In addition, we are subject to patient privacy regulation by both the federal government and the states in which we conduct our business. Our failure to comply with these laws could expose us to criminal, civil and administrative sanctions, reputational harm, and could harm our results of operations and financial conditions. |

| • | If the market opportunities for our products and product candidates, including EYP-1901, are smaller than we believe they are, our results of operations may be adversely affected and our business may suffer. |

| • | If any of our products have newly discovered or developed safety problems, our business would be seriously harmed. |

| • | The Affordable Care Act and any changes in healthcare laws may increase the difficulty and cost for us to commercialize DEXYCU and YUTIQ in the U.S. and affect the prices we may obtain. |

| • | Patient assistance programs for pharmaceutical products have come under increasing scrutiny by governments, legislative bodies and enforcement agencies. These activities may result in actions that have the effect of reducing prices or demand for our products, harming our business or reputation, or subjecting us to fines or penalties. |

| • | If competitive products are more effective, have fewer side effects, are more effectively marketed and/or cost less than our products or product candidates, or receive regulatory approval or reach the market earlier, our product candidates may not be approved, and our products or product candidates may not achieve the sales we anticipate and could be rendered noncompetitive or obsolete. |

| • | If the FDA or other applicable regulatory authorities approve generic products that compete with any of our products or product candidates, it could reduce our sales of those products or product candidates. |

Risks Related To Our Intellectual Property | • | If we are unable to protect our intellectual property rights or if our intellectual property rights are inadequate to protect our product candidates, our competitors could develop and commercialize technology and products similar to ours, and our competitive position could be harmed. |

| • | We may become involved in lawsuits to protect or enforce our patents or the patents of our licensors, which could be expensive, time consuming and unsuccessful. |

| • | We may not be able to protect our intellectual property rights throughout the world. |

| • | Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements. |

| • | Third parties may initiate legal proceedings alleging that we are infringing their intellectual property rights, the outcome of which could be uncertain and could harm our business. |

| • | Our competitors may be able to circumvent our patents by developing similar or alternative technologies or products in a non-infringing manner. |

Risks Related To Our Reliance On Third Parties | • | The development and commercialization of our lead product candidate, EYP-1901, is dependent on intellectual property we license from Equinox Science. If we breach our agreement with Equinox or the agreement is terminated, we could lose license rights that are important to our business. |

| • | If we are unable to maintain our agreement with ImprimisRx to co-promote DEXYCU, we may be unable to generate significant revenue from this product. |

| • | If we encounter issues with our CMOs or suppliers, we may need to qualify alternative manufacturers or suppliers, which could impair our ability to sufficiently and timely manufacture and supply DEXYCU. |

| • | We use our own facility for the manufacturing of YUTIQ, which requires significant resources, and which could adversely affect its commercial viability. |

| • | Our YUTIQ manufacturing operations depend on our Watertown, MA facility. If this facility is destroyed or is out of operation for a substantial period of time, our business may be adversely impacted. |

| • | If third-party manufacturers, wholesalers and distributors fail to devote sufficient time and resources to DEXYCU or their performance is substandard, our product supply may be impacted. |

Risks Related To Ownership Of Our Common Stock | • | The trading price of the shares of our common stock has been highly volatile, and purchasers of our common stock could incur substantial losses. |

| • | EW Healthcare and Ocumension own a substantial amount of our common stock and can exert significant control over matters subject to stockholder approval, which would prevent new investors from influencing significant corporate decisions. |

| • | Certain covenants related to our share purchase agreement with Ocumension may restrict our ability to obtain future financing and cause additional dilution for our stockholders. |

Introduction

Our BusinessOverview

We are a specialty biopharmaceuticalpharmaceutical company committed to developing and commercializing innovative ophthalmictherapeutics to help improve the lives of patients with serious eye disorders. Our pipeline leverages our proprietary Durasert® technology for extended intraocular drug delivery including EYP-1901, a potential twice-yearly sustained delivery intravitreal anti-VEGF treatment initially targeting wet age-related macular degeneration (“wet AMD”), the leading cause of vision loss among people 50 years of age and older in the United States. Our product candidate pipeline also includes YUTIQ50, a potential twice-yearly treatment for non-infectious uveitis affecting the posterior segment of the eye, one of the leading causes of blindness. We also have two commercial products: YUTIQ®, a once every three-year treatment for chronic non-infectious uveitis affecting the posterior segment of the eye, and DEXYCU®, a single dose treatment for postoperative inflammation following ocular surgery. Local drug delivery for treating ocular diseases is a significant challenge due to the effectiveness of the blood-eye barrier. This barrier makes it difficult for systemically-administered drugs to reach the eye in sufficient quantities to have a beneficial effect without causing unacceptable adverse side effects to other organs. Our validated Durasert technology, which has already been included in four products approved for marketing by the U.S. Food and Drug Administration (“FDA”), is designed to provide consistent, sustained delivery of small molecule drugs over a period of months to years through a single intravitreal injection. Our lead product candidate, EYP-1901, combines a bioerodible formulation of our proprietary Durasert sustained-release technology with vorolanib, a tyrosine kinase inhibitor (“TKI”). We are currently evaluating EYP-1901 in a Phase 1 clinical trial as a potential twice-yearly sustained delivery intravitreal treatment for wet AMD. Current approved treatments for wet AMD require monthly or bi-monthly eye injections in a physician’s office, which can cause inconvenience and discomfort and often lead to reduced compliance and poor outcomes. In two prior clinical trials of vorolanib as an orally delivered therapyconducted by a third party, vorolanib had a strong clinical signal with no significant ocular adverse events. We expect initial data from the Phase 1 clinical trial in the second half of 2021. YUTIQ® (fluocinolone acetonide intravitreal implant) 0.18 mg for intravitreal injection, is a non-erodible intravitreal implant containing fluocinolone acetonide (“FA”) lasting for up to 36 months and is indicated for the treatment of eye diseases. Our lead product, DEXYCU™chronic non-infectious uveitis affecting the posterior segment of the eye. This disease affects between 60,000 to 100,000 people each year in the U.S., causes approximately 30,000 new cases of blindness every year and is the third leading cause of blindness. YUTIQ utilizes our proprietary Durasert® sustained-release drug delivery technology platform. DEXYCU® (dexamethasone intraocular suspension) 9%, approved by the United States, or U.S., Food and Drug Administration, or FDA, in February 2018,for intraocular administration, is administered as a single dose at the end of ocular surgery and is the first long-acting intraocular product approved by the FDAindicated for the treatment of post-operative ocular inflammation.inflammation, with our primary focus on its use immediately following cataract surgery as a single dose treatment. DEXYCU utilizes our proprietary Verisome® drug-delivery platform, which allowstechnology. We are also developing YUTIQ50 as a potential six-month intravitreal treatment for chronic non-infectious uveitis affecting the posterior segment of the eye. We have consulted with the FDA and identified a clinical pathway for a single intraocular injectionsupplemental new drug application (“sNDA”) filing that releases dexamethasone,we expect will involve a corticosteroid, over time. Thereclinical trial of a small population. We are approximately four million cataract surgeries performed annuallycurrently evaluating the timeline and investment requirements for the initiation of this trial. We are also seeking to enhance our long-term growth potential by expanding EYP-1901 beyond wet AMD into diabetic retinopathy (“DR”) and retinal vein occlusion (“RVO”), both large and growing ocular disease areas. We also plan to potentially identify and advance additional product candidates through clinical and regulatory development. This may be accomplished through internal discovery efforts, potential research collaborations and/or in-licensing arrangements with partner molecules and potential acquisitions of additional ophthalmic products, product candidates or technologies that complement our current product portfolio. The novel coronavirus (COVID-19) pandemic (the “Pandemic”) has had, and will likely continue to have, a material and adverse impact on our business, including as a result of preventive and precautionary measures that we, other businesses, and governments have and will likely continue to take. This includes a significant impact on cash flows from expected revenues due to the closure of ambulatory surgery centers for DEXYCU and a significant reduction in physician office visits impacting YUTIQ. These closures precipitated the restructuring of our commercial organization that was announced on April 1, 2020 along with a reduction in planned spending for calendar year 2020 and into calendar year 2021. Due to the continued Pandemic, these factors continued to have an adverse impact on our revenues, financial condition and cash flows in the U.S.,fourth quarter of 2020 and we planinto the first quarter of 2021. We have experienced and may continue to launch DEXYCUexperience significant and unpredictable reductions in the U.S.demand for our products as customers have shut down their facilities and non-essential surgical procedures have been postponed in the first half of calendar year 2019 with a primary focus on its use following cataract surgery. Our lead product candidate is YUTIQ™, a three-yearnon-erodible fluocinolone acetonide, or FA, insert foran effort to promote social

distancing and to redirect medical resources and priorities towards the treatment ofnon-infectious posterior segment uveitis, or NIPU. Injected into COVID-19. We are monitoring the eye in an office visit, YUTIQ is a tiny micro-insert that delivers a micro-dose of a corticosteroid to the back of the eye on a sustained constant (zero order release) basis for approximately three years. On March 19, 2018, the FDA accepted our New Drug Application, or NDA, for YUTIQPandemic and set an FDA Prescription Drug User Fee Act, or PDUFA, action date of November 5, 2018. YUTIQ is basedits potential effect on our proprietary Durasert™ sustained-release drug delivery technology platform, which can deliver drugs for predetermined periodsfinancial position, results of time ranging from monthsoperations and cash flows.

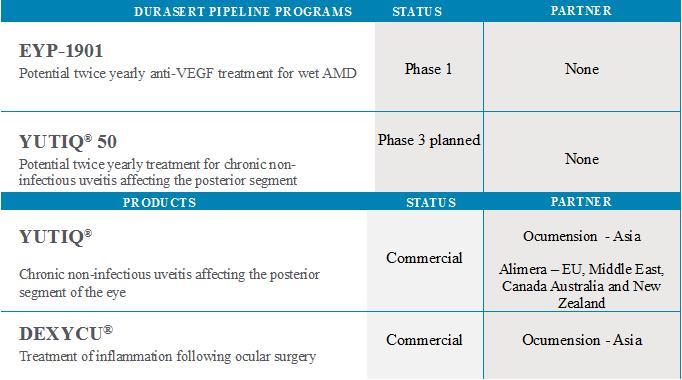

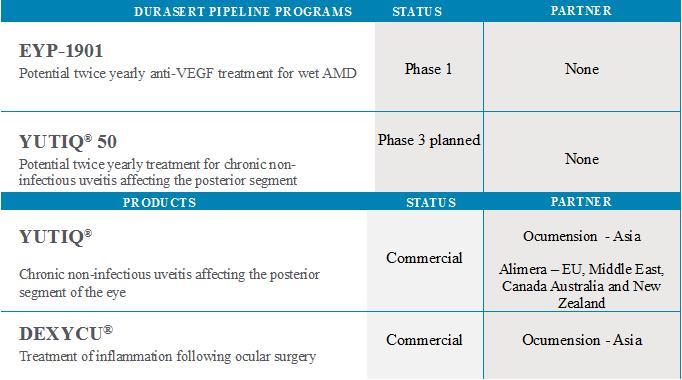

Our Pipeline and Commercial Products The following table describes the stage of each of our programs:

Strategy Our strategy is to years. Posterior segment uveitis isbecome a leading pharmaceutical company commercializing innovative therapeutics to help improve the third leading causelives of blindness in the U.S. and affects between 55,000 to 120,000 people in the U.S. If approved in November 2018, we expect to launch YUTIQ in the U.S. in the first halfpatients with serious eye disorders. The key elements of calendar year 2019.our strategy include: | • | Advance EYP-1901 through clinical development for wet AMD. |

| • | Advance EYP-1901 through clinical development in additional indications, including DR and RVO after completion of a positive Phase 1 clinical trial in wet AMD. |

| • | Advance YUTIQ50 into clinical development for a potential sNDA filing as a twice-yearly sustained delivery treatment for chronic non-infectious uveitis affecting the posterior segment of the eye. |

| • | Identify and in-license, partner or acquire additional transformative ophthalmology products to build long-term stockholder value targeting programs that can utilize our Durasert technologies. |

| • | Grow commercial product revenues for both YUTIQ and DEXYCU in the U.S. |

| • | Leverage our Durasert and Verisome technologies through research collaborations and out-licenses with other pharmaceutical and biopharmaceutical companies, institutions and other organizations. We believe these technologies can provide sustained, targeted delivery of therapeutic agents, resulting in improved therapeutic effectiveness, safer administration and better patient compliance and convenience, with reduced product development risk and cost. |

The Unmet Need in the Treatment of Eye Disease The human eye is an organ which reacts to light to provide sight. The eye has two principal anatomical segments: the anterior segment and the posterior segment. The anterior segment consists of the cornea, iris, pupil, lens and aqueous humor, while the posterior segment consists of the retina, choroid, vitreous humor and the optic nerve.

The tissues and structures in the anterior and posterior segment of the eye work in concert to produce sight. Light from an object or scene enters the eye through the anterior chamber, beginning with the cornea. The cornea bends the light such that it passes freely through the pupil, which is the opening in the center of the iris. The iris works like a shutter in a camera, enlarging or shrinking dependingWe are primarily focused on how much light is entering the eye. After passing through the iris, the light rays pass through the eye’s natural crystalline lens. This clear, flexible structure works like the lens in a camera, shortening and lengthening its width in order to focus light rays properly. Light rays then pass from the anterior segment intodiseases affecting the posterior segment of the eye starting with a dense, transparentgel-like substance, called the vitreous. The vitreous fills the globe of the eyeball, which bathes the eye in nutrients and helps the eye hold its spherical shape. In a normal eye, the light rays come to a sharp focusing point on the retina. The retina functions much like the film in a camera, capturing the light rays, processing them into light impulses through millions of tiny nerve endings and then sending these light impulses through over a million nerve fibers to the optic nerve. Because the process of producing sight requires the precise coordination of the tissues and structures in both the anterior and posterior segments of the eye, if disease affects any one of these components, vision can be impaired or potentially blinded.

Diseases of the anterior chamber of the eye include ocular inflammation, cataracts, dry eye, infection, and refractive disorders. Glaucoma, which is a disease that damages the optic nerve, can also be caused by inflammation in the anterior chamber (inflammatory or uveitic glaucoma). Because the anterior segment is readily accessible, physicians typically treat these diseases with topically-applied eye drops. However, there are several limitations of eye drops. First, the eye often eliminates topically applied medications via tear elimination, limiting the penetration of drugs into the ocular tissue. Second, eye drops are often administered by patients themselves, which often leads to misuse ornon-compliance by patients due to complicated and arduous eye drop regimens.

eye. Diseases of the posterior segment of the eye include conditions such asage-related macular degeneration, or wet AMD, diabetic retinopathy, diabetic macular edema, or DME,DR, RVO and chronic non-infectious uveitis affecting the posterior segment uveitis.of the eye. These diseases frequently result in damage to the vasculature of the eye, leading to poor visual function, and often to proliferation of new, abnormal and leaky blood vessels in the back of the eye. These conditions can lead to retinal damage, scarring and irreversible loss of vision. Because the posterior chambersegment is not readily accessible, physicians typically treat these diseases with intravitreal injections. However, there are several limitations of frequent intravitreal injections. First, these injections can be painful to the eye and often cause swelling or bleeding. Second, repeated intravitreal injections can cause scarring of the eye sclera. The sclera, also known as the white of the eye, is the opaque, fibrous, protective, outer layer of the human eye containing mainly collagen and some elastic fiber. Many patients

with retinal diseases require lifelong treatment and over time, these chronic intravitreal injections can cause significant sclera scarring, increased risk of intraocular infection and vitreous hemorrhage. Further, most ocular drugs are delivered via a bolus injection that requires monthly or bi-monthly re-injections. Each time the patient or the physician lengthens the treatment interval due to either missed appointments, cost to the patient, or lack of reimbursement, the patient’s disease can reactivate, which leads to incremental and cumulative damage to the retina. Over time this may lead to permanent loss of vision. Thus, monthly or bi-monthly injections are not an effective means of delivering a steady state dose to the site of disease. Drug delivery for treating ophthalmic diseases in both Finally, the anterior and posterior segments of the eye is a significant challenge. Due to the effectiveness of theblood-eye barrier, it is difficult for systemically (orally or

intravenously) administered drugs to reach the retina in sufficient quantities to have a beneficial effect without causing adverse side effects to other parts of the body. Injecting drugs in solution directly into the back of the eye can achieve effective, but often transient, dosage levels in the eye, requiring repeated injections. In addition to the issues of inconvenience, cost and noncompliance, repeated intravitreal injections have medical risks, including intraocular infection, perforated sclera and vitreous hemorrhage.

Ophthalmic drugs, whether drops, injections or oral dosage forms, are often not administered on the optimal schedule or at all, because patients do not self-administer as prescribed or do not get medical professional administration as required. The risk of patientnon-compliance increases when treatment involves multiple products or complex or painful dosing regimens, as patients age or suffer cognitive impairment or serious illness, or when the treatment is lengthy or expensive.

Drug delivery for treating ophthalmic diseases in posterior segments of the eye is a significant challenge. Due to the effectiveness of the blood-eye barrier, it is difficult for systemically (orally or intravenously) administered drugs to reach the retina in sufficient quantities to have a beneficial effect without causing adverse side effects to other parts of the body. Due to the drawbacks of traditionalfrequent intravitreal injections, eye drops and oral or systemic injectable delivery, we believe the development of methods to deliver drugs to patients in a more precise, micro dose zero order release, controlled fashion over sustainedlonger periods of time satisfies anwith Durasert can satisfy a large patient and physician unmet medical need by assuring complianceneed. In addition, with less frequent injections, or daily eye drops, we believe patients will be able to thecomply better with their prescribed treatment regimen. Our products, DEXYCU and, if approved, YUTIQ are intended to address diseases of both the anterior and posterior segments of the eye, respectively, through long-acting and sustained delivery technologies. Our Products and Product Candidates

The following table describes the stage of each of our programs:

| | | | | | | Product

| | Disease

| | Approved Products

| | Partner

| DEXYCU

| | Occular post-surgical inflammation | | FDA-approved | | None | ILUVIEN

| | DME | | Approved in the U.S. and 17 EU countries; direct commercialization in the U.S., U.K., Germany, Portugal, Ireland and Austria; distribution through sublicense partners in Spain, Italy, France and various countries in the Middle East | | Alimera | RETISERT

| | Posterior segment uveitis | | FDA-approved; commercialized in the U.S. since 2005 | | Bausch & Lomb | VITRASERT

| | CMV retinitis | | FDA-approved; commercialized from 1996 through 2012 (patent expiration) | | Bausch & Lomb | | | | | Product Candidate

| | Disease

| | Stage of Development

| | Partner

| YUTIQ

| | Posterior segment uveitis | | NDA accepted with PDUFA action date of November 5, 2018

Type II variation accepted for review in the 17 EU countries previously approved for ILUVIEN for DME

| | For U.S.: to commercialize directly pending NDA approval

For EMEA: regulatory, reimbursement and distribution licensed to Alimera under ILUVIEN

| YUTIQshorter-acting uveitis

| | Posterior segment uveitis | | Bioequivalence and animal safety studies | | None | Durasert TKI for Wet AMD

| | Wet AMD | | Pre-clinical | | None |

DEXYCU

DEXYCU is the first long-acting intraocular product approved by the FDA for the treatment of post-operative ocular inflammation. Cataract surgery is one of the most frequent surgical procedures performed in the U.S., with approximately four million procedures performed annually. However, patients can experience post-operative ocular inflammation. Under the current standard of care for inflammation associated with cataract surgery, patients, many of whom are elderly, must self-administer medicated eye drops several times a day over a period of several weeks. DEXYCU, administered as a single intraocular injection at the conclusion of surgery, utilizes our Verisome technology to dispense a biodegradable extended-release formulation of dexamethasone, a corticosteroid, in the posterior chamber directly behind the iris. We believe that a single administration of a corticosteroid at the site of inflammation may benefit patients by eliminatingnon-compliance and dosing errors associated with the current practice of dispensing multiple daily self-administered eye drops following cataract surgery over a period of several weeks.

The efficacy of DEXYCU was demonstrated in a double-masked randomized Phase 3 clinical trial of 394 patients. In the clinical trial, patients received an intraocular dose of 517 micrograms, or mcg, of DEXYCU, 342 mcg of DEXYCU, or placebo administered by a physician at the end of cataract surgery. The primary efficacy outcome in the clinical trial was anterior chamber cell clearing in the study eye on the eighth day following surgery. The percentage of patients meeting the primary efficacy outcome was 20% in the placebo group while 57% and 60% met the primary efficacy outcome in the 342 and 517 mcg DEXYCU treatment groups, respectively. In addition, the percentage of patients receiving rescue medication of ocular steroid or a nonsteroidal anti-inflammatory drug was significantly lower at day one, three, eight, 15 and 30 in the 342 and 517 mcg treatment groups versus placebo. The most common adverse reactions (5 – 15%) reported with DEXYCU were increased intraocular pressure, or IOP, corneal edema and iritis. Other adverse reactions occurring in 1 – 5% of subjects included corneal endothelial cell loss, blepharitis, eye pain, cystoid macular edema, dry eye, ocular inflammation, posterior capsule opacification, blurred vision, reduced visual acuity, vitreous floaters, foreign body sensation, photophobia and vitreous detachment. Warnings and precautions included on the label for DEXYCU include increases in IOP, delayed healing, exacerbation of infection and cataract progression which are side effects generally associated with intraocular steroids.

TheFDA-approved dosage of DEXYCU is 0.005 milliliters, or mL, of dexamethasone 9% (equivalent to 517 mcg), administered as a single dose intraocularly in the posterior chamber, directly behind the iris, at the end of surgery. DEXYCU will be available as a 9% intraocular suspension equivalent to dexamethasone 103.4 mg/mL in a single-dose vial provided in a kit. The drug is encapsulated in the fully bioerodible Verisome technology, which provides a steady release of dexamethasone for up to 22 days post-injection.

We acquired the rights to DEXYCU on March 28, 2018 through the acquisition of Icon Bioscience, Inc., or Icon. We paid Icon’s security holders approximately $15 million at the closing of the transaction, and are obligated to pay certain post-closing contingent cash payments upon the achievement of specified milestones based upon certain net sales and partnering revenue standards, in each case subject to the terms and conditions set forth in that certain Agreement and Plan of Merger, dated March 28, 2018, by and among us, Oculus Merger Sub, Inc., or Merger Sub, Icon and Shareholder Representative Services LLC, solely in its capacityregimen as the representativeburden of Icon’s securityholders, which we referhaving to as the Merger Agreement. These include, but are not limited to, (i) aone-time development milestone of $15.0 million payable in cash upon the first commercial sale of DEXYCU in the U.S., (ii) sales milestone payments totaling up to $95.0 million upon the achievement of certain sales thresholds and subject to certain Centers for Medicare & Medicaid Services, or CMS, reimbursement conditions set forth in the Merger Agreement, (iii) quarterlyearn-out payments equal to 12% on net sales of DEXYCU in a given year, whichearn-out payments will increase to 16% of net sales of DEXYCU in such year beginning in the calendar quarter for such year to the extent aggregate annual consideration of DEXYCU exceeds $200.0 million in such year, (iv) quarterlyearn-out payments equal to 20% of partnering revenue received by us for DEXYCU sales outside of the U.S., and (v) single-digit percentage quarterlyearn-out payments with respect to net sales and/or partnering income, if any, resulting from future clinical development,

regulatory approval and commercialization of any other product candidates we acquired in connection with the acquisition of Icon.

We plan to launch DEXYCU in the U.S. in the first half of calendar year 2019 following the successful scale up of commercial infrastructure and commercial supplies. We plan to commercialize DEXYCU ourselves in the U.S. through a contract sales organization, or CSO, whereby the sales leadership (National Sales Director and Regional Managers) are hired by us, and the key account managers, or KAMs, and sales representatives are hired by the CSO with the option for us to hire these sales reps after a period of time. We believe this flexible sales model provides less execution risk to us as CSOs can leverage costs across multiple clients, and thus are able to cost-effectively build the necessary infrastructure to support sales activities using varied, industry-wide experience to provide the most impactful solutions.

We believe that approximately four million cataract surgeries are performed annually in the U.S. The current standard of care in the U.S. for treating post-operative inflammation is primarily a combination of steroid, antibiotic andnon-steroidal eye drops on a tapered treatment regimen that can last up to four weeks. This eye drop treatment regimen is complicated and can result in up to 100 eye drops being administered over time. Steroid eye drops are the most complicated medication to administer in this regimen, requiring up to 70 eye drops over3-4 weeks on a tapered dosing schedule. Further, cataract surgery patients are often elderly and can have compromised cognitive function, osteoarthritis in their hands and poor eyesight due to the cataract surgery. These complexities can lead to poor compliance due to failing to administer eye drops according to the prescribed schedule, or administering an eye drop but failing to have itfrequently go into the eye, and/or not finishing the treatment regimen. In addition, patients often call their physician’s office multiple times to have themre-explain the treatment regimen. We believe DEXYCU addresses many of these issues and potentially eliminates the need for post-surgical steroid eye drops by providing one injection immediately post-surgery into the same incision site where the new intraocular lens has been placed. We believe physicians will react positively to this single injection because the full steroid dose will be placed at the surgical site where inflammation can occur post-surgery.

Approximately 40% of patients who undergo cataract surgery are covered by Medicare Part B. New drugs approved by the FDA that are part of cataract surgery performed in a hospital outpatient department or ambulatory surgical center may receive an additional transitional pass-through payment under Medicare provided it meets certain criteria, including a “not insignificant” cost criterion. This “pass-through payment” consists of Medicare reimbursement for the drug based on a defined formula for calculating the minimum fee that a manufacturer may charge for the drug.

DEXYCU qualified for Medicare transitional pass-through payment and we received a pass-throughC-code from CMS, which will be effective on October 1, 2018. We have not yet determined final pricing, other than that it will be modestly higher than $485 to ensure we will continue to qualify for pass-through status after including normal industry discounts and rebates given to providers or commercial payors.

Under current CMS regulations, pass-through status applies for a period of three years, measured from the date Medicare makes its first pass-through payment for DEXYCU, following which DEXYCU would be incorporated into the cataract bundled payment system, which will significantly reduce the pricing for DEXYCU. We are working with outside consultants to potentially gain an extension to the transitional payment system, or to separate the drug payment from the bundled cataract surgery payment after the three-year transitional payment ends and continue to be reimbursed separately for a longer period of time, potentially through patent life.

Our DEXYCU U.S. patent portfolio includes two issued patents under an exclusive license from Ramscor, Inc. for all ophthalmic conditions. These two issued patents contain composition claims for delivering biologically active substances using citric acid esters. In addition, two more U.S. applications pertaining to DEXYCU have issued as patents. These patents, one with method of use claims and the other with device claims, will provide further protection for DEXYCU through May 2034.

The drug delivery technology used in DEXYCU is called Verisome. The basic technology can be formulated into numerous products, as a biodegradable solid, gel, or liquid substance that provides drug release in a controlled mannerinjections, usually over a period of weeks to several monthslifetime after diagnosis, presents issues for ocular, systemic, or topical applications. Ophthalmic applications are focused on the ability of this system to create an injectable liquid or slightly viscous gel. Verisome-based products can be injected into the aqueous or vitreous humor as a liquid via a small gauge needle. When the drug is injected into an ocular chamber, it coalesces into a single spherical dose that settles in the lower portion of the chamber. The system is biodegradable and versatile for administering different drugs; furthermore, duration of use can be tailored. Shrinkage of the Verisome sphere over time reflects simultaneous degradation of the delivery system and release of the active agent. In ophthalmology, this mode of delivery offers advantages because the physician can easily assess the status of therapy by observing the drug-containing system within the eye. When the sphere is no longer visible, the entire drug has been released, and no inactive ingredient remains in the eye. Potential applications could include intraocular products to treat inflammation, ocular hypertension and glaucoma.patients.

Durasert Technology Platform Our Durasert technology platform uses proprietary sustained polymerrelease technology to deliver drugs over periods of up to treat chronic diseases, especially those affecting the hard to access posterior segment of the eye.three years through a single intravitreal injection. To date, threefour products utilizing successive generations of the Durasert technology have been approved by the FDA. TheseIn addition to our own YUTIQ, these products include ILUVIEN® (FA intravitreal implant) 0.19 mg, licensed to Alimera Sciences Inc. (“Alimera”), or Alimera, and Retisert® (FA intravitreal implant) 0.59 mg and Vitrasert® (ganciclovir) 4.5 mg, which are both licensed to Bausch & Lomb. Currently,Although the earlier ophthalmic products that utilize the Durasert technology, Retisert and Vitrasert, are surgically implanted, ILUVIEN and YUTIQ were designed to be injected during a physician office visit. The Durasert technology platform utilizescreates a miniaturized, injectable, sustained-releasesustained release insert forof a small moleculesmolecule compound that can deliver a drug for periods of up to three years. This insertThe current FDA-approved products utilize the non-erodible formulation of Durasert. For these products, the drug core matrix is only 3.5 mm in lengthcoated with an external diameterone or more polymer layers, and the permeability of just 0.37 mm.those layers and other design aspects control the rate and duration of drug release. By changing elements of the design, we can alter both the rate and duration of release to meet different therapeutic needs. EYP-1901 utilizes a bioerodible formulation of the Durasert technology. The insert can be administered in an office setting through a needle as small as25-gauge.bioerodible formulation eliminates the non-erodible polymer coating allowing the body to absorb the drug core matrix. Our Durasert technology platform is designed to address the issue ofprovide sustained delivery for ophthalmic diseases and other product candidates. Specifically, our Durasert platformconditions with the following features: | • | | • | Extended Delivery. The delivery of drugs for predetermined periods of time ranging from months to years. We believe that uninterrupted, sustained delivery offers the opportunity to develop products that reduce the need for repeated applications, thereby reducing the risks of patient noncompliance and adverse effects from repeated administrations. |

| • | | • | Controlled Release Rate. The release of therapeutics at a zero order kinetics controlled rate. We believe that this feature allows us to develop products that deliver optimal concentrations of therapeutics over time and eliminate excessive variability in dosing during treatment. |

| • | | • | Localized Delivery. The delivery of therapeutics directly to a target site. We believe this administration can allow the natural barriers of the body to isolate and assist in maintaining appropriate concentrations at the target site in an effort to achieve the maximum therapeutic effect while minimizing unwanted systemic effects. |

Our Durasert technology platform providesProduct Candidates EYP-1901 for wet AMD EYP-1901 is a potential twice-yearly sustained localized delivery intravitreal anti-VEGF treatment initially targeting wet AMD. Wet AMD is when new, abnormal blood vessels grow under the retina. These vessels may leak blood or other fluids, causing scarring of small molecule drugsthe macula. This form of AMD is less common but much more serious. AMD is one of the major causes of vision loss (accounts for 8.7%) of the total vision impairment globally. Age is the greatest risk factor for developing AMD and individuals aged 50+ are more prone to the posterior segmentdisease. Among all AMD patients in the United States, wet AMD accounts for only 10% of cases, yet it alone accounts for 90% of legal blindness.

EYP-1901 Market Opportunity There are several effective and safe treatments for wet AMD available on the eyemarket, including anti-VEGF intravitreal injectable drugs marketed under the brands names Lucentis, Eylea, Beovu and is utilized in threeFDA-approved products and in our product candidates, including YUTIQ and other shorter duration product candidates. InAvastin (off label use). However, these products and product candidates, a drug core is surrounded with one or more polymer layers, and the permeability of those layers and other design aspects of the product or product candidate control the rate and duration of drug release. By changing elements of the design, we can alter both the rate and duration of release to meet different therapeutic needs. Although the earlier ophthalmic products that utilize the Durasert technology, Retisert and Vitrasert, are surgically implanted, ILUVIEN, YUTIQ and our other ophthalmic product candidates are designed totreatments must be injected at the target site in ana physician’s office visit. either monthly, bi-monthly or every three months, which can cause inconvenience and discomfort and often lead to reduced compliance and poor outcomes.YUTIQ

YUTIQ, our lead product candidate, is based on our Durasert technology platform and consists of an injectable, sustained-release micro-insert designed to treat chronic NIPU, intermediate uveitis and panuveitis affecting the posterior segment of the eye. YUTIQ is designed to provide sustained daily release of a total of 0.18 mg of theoff-patent corticosteroid FA at a controlled rate directly to the back of the eye over approximately three years from a single administration performed in an office visit. It is injected with our proprietary inserterSeparate published studies using a25-gauge needle. We are developing YUTIQ independently and have licensed regulatory, reimbursement and distribution rights to Alimera for Europe, the Middle East and Africa, or the EMEA, under its ILUVIEN tradename. Subject to NDA approval by the FDA, we plan to independently commercialize YUTIQreal world data-one study in the U.S. Further,and another that includes Canada, France, Germany, Ireland, Italy, the Netherlands, UK and Venezuela-indicate that despite initial efficacy, approved wet AMD treatments still result in conjunctionvision loss over time.

We believe that EYP-1901, with its possibility for twice yearly injections, has the commercializationpotential to offer wet AMD sufferers a convenient and effective treatment option, if approved. Pre-Clinical and Clinical Development Vorolanib, the active drug candidate in EYP-1901, is a small molecule TKI that blocks all 3 isoforms of DEXYCU,VEGFR, the main driver of the proliferation of blood vessels that are the hallmark of wet AMD. Vorolanib has been previously studied in Phase 1 and 2 clinical trials by Tyrogenix, Inc. (“Tyrogenix”) as an orally delivered therapy for the treatment of wet AMD and data from these trials demonstrated a positive clinical signal. Although the Phase 2 clinical trial was discontinued due to systemic toxicity, no significant ocular adverse events were observed in either clinical trial. The Phase 1 clinical trial of orally delivered vorolanib demonstrated: | • | Best-corrected visual acuity (“BCVA”) was maintained to within 4 letters of baseline at the 24-week endpoint, or improved in all but 1 participant |

| • | 60% (15/25) of patients required no rescue injection while on oral vorolanib therapy |

| • | Mean ocular coherence tomography (“OCT”) thickness in completers was reduced by -50 +/- 97 µm; and |

| • | Mean OCT thickness in treatment-naïve patients was reduced by ~80 µm |

The Phase 2 clinical trial of orally delivered vorolanib demonstrated less anti-VEGF rescue versus placebo for all doses with no ocular toxicity despite a strict pre-defined recue criteria. By delivering vorolanib locally, in the vitreous humor, as EYP-1901 using a bioerodible Durasert formulation at significantly lower doses, we expect to spreadavoid the systemic toxicities seen in the prior clinical trials of vorolanib and typically associated with orally delivered TKIs. This concept has been supported by initial pharmacokinetic (“PK”), safety and GLP toxicology studies including a non-GLP PK and safety study that demonstrated drug levels in the vitreous and retina/choroid above the IC50 for VEGFR. These studies have been conducted in support of the EYP-1901 investigational new drug (“IND”) application filed with the FDA. The IND application for EYP-1901 was filed with the FDA in December 2020 in support of initiation of a Phase 1 clinical trial in wet AMD patients. We enrolled the first patient in the Phase 1 clinical trial in January 2021. The Phase 1 clinical trial is a dose escalation trial of three ascending doses with a total planned enrollment of 13 wet AMD patients. The primary endpoint of the trial is safety, and key secondary endpoints are BCVA and central subfield thickness. Top level data from this clinical trial is anticipated in the second half of 2021, assuming that patient enrollment is not impacted by the Pandemic. Intellectual Property In February 2020, we entered into an Exclusive License Agreement with Equinox Science, LLC (“Equinox”), pursuant to which Equinox granted us an exclusive, sublicensable, royalty-bearing right and license to certain patents and other Equinox intellectual property to research, develop, make, have made, use, sell, offer for sale and import the compound vorolanib and any pharmaceutical products comprising the compound for the prevention or treatment of age-related macular degeneration, diabetic retinopathy and retinal vein occlusion using our commercial, medical, legal, corporateproprietary localized delivery technologies, in each case, throughout the world except China, Hong Kong, Taiwan and Macau (the “Territory”). In consideration for the rights granted by Equinox, we (i) made a one time, non-refundable, non-creditable upfront cash payment of $1.0 million to Equinox in February 2020, and (ii) agreed to pay milestone payments totaling up to $50 million upon the achievement of certain development and regulatory infrastructure over two products.milestones, consisting of (a) completion of a Phase 2 clinical trial for the compound or a licensed product, (b) the filing of a new drug application or foreign equivalent for the compound or a licensed product in the United States, European Union or United Kingdom and (c) regulatory approval of the compound or a licensed product in the United States, European Union or United Kingdom. Posterior segment uveitisWe also agreed to pay Equinox tiered royalties based upon annual net sales of licensed products in the Territory. The royalties are payable with respect to a licensed product in a particular country in the Territory on a country-by-country and licensed product-by-licensed product basis until the later of (i) twelve years after the first commercial sale of such licensed product in such country and (ii)

the first day of the month following the month in which a generic product corresponding to such licensed product is launched in such country (collectively, the “Royalty Term”). The royalty rates range from the high-single digits to low-double digits depending on the level of annual net sales. The royalty rates are subject to reduction during certain periods when there is no valid patent claim that covers a licensed product in a particular country. YUTIQ50 YUTIQ50 is a potential twice-yearly sustained delivery treatment for chronicnon-infectious inflammatory disease uveitis affecting the posterior segment of the eye, often involving the retina, and is a leading cause of blindness in developed countries. It afflicts people of all ages, producing swelling and destroying eye tissues, which can lead to severe vision loss and blindness. In the U.S., posterior segment uveitis is estimated to affect approximately55,000-120,000 people in the U.S., resulting in approximately 30,000 cases of blindness and making it the third leading cause of blindness in the U.S. Patients with posterior segment uveitis are typically treated with ocular injected steroids and systemic steroids, but frequently develop serious side effects from systemic steroids over time that can limit effective dosing. Patients who do not tolerate systemic steroids then are offered—as the last line of treatment—therapy with systemic immunosuppressants or biologics, which themselves can cause severe side effects. YUTIQ Phase 3 Trials

In our two Phase 3 trials to assess the safety and efficacy of YUTIQ, we achieved the primary efficacy endpoint of prevention of recurrence of uveitis through six months with statistical significance (p value of < 0.001 in each study). These studies are randomized, sham injection-controlled, double-masked trials with the primary endpoint of both trials defined as recurrence of uveitis at six months, with patients followed for three years. Our first Phase 3 trial enrolled 129 patients in 16 centers in the U.S. and 17 centers outside the U.S, with 87 eyes treated with YUTIQ and 42 eyes receiving sham injections. Our second Phase 3 trial enrolled 153 patients in 15 centers in India with 101 eyes treated with YUTIQ and 52 eyes receiving sham injections. The36-month patientfollow-up was recently completed in the first of the two Phase 3 trials.

Our first Phase 3 trial met its primary efficacy endpoint of prevention of recurrence of disease at 6 months with statistical significance (p < 0.001, intent to treat analysis; recurrence of 18.4% for YUTIQ versus 78.6% for control). The trial yielded similar efficacy through 12 months of follow up (p < 0.0001, intent to treat analysis; recurrence of 27.6% for YUTIQ versus 85.7% for control). YUTIQ was generally well tolerated through12-months offollow-up. The incremental risk of elevated IOP for YUTIQ-treated eyes compared to control eyes was lower through 12 months than through six months for elevation over 21 mmHg (6.1% versus 10.9%) as well as for the more serious elevation over 25 mmHg (7.6% versus 11.3%). Elevated IOP was generally well treated with eye drops. Through 12 months, the percentage of eyes requiring filtration surgery was low and similar between YUTIQ-treated and control eyes (3.4% versus 2.4%). Of the 63 study eyes with a natural lens at baseline, 33.3% of YUTIQ-treated eyes compared to 4.8% of control eyes required cataract surgery through 12 months. Cataracts are both a side effect of treatment with steroids and a natural consequence of uveitis.

Our second Phase 3 trial also met its primary efficacy endpoint of prevention of recurrence of disease at 6 months with statistical significance (p < 0.001, intent to treat analysis; recurrence of 21.8% for YUTIQ versus 53.8% for control). As in the first Phase 3 trial, YUTIQ was generally well tolerated through 6 months, and12-monthfollow-up efficacy and safety data was consistent with the12-month data from our first Phase 3 trial. The36-month patientfollow-up is expected to be completed in October 2019.

We also conducted a multi-center, randomized, controlled, single-masked study of the safety and utilization of two different inserters for YUTIQ. We enrolled 26 subjects (38 eyes) in this study in 6 centers in the U.S. The utilization and safety results of this study have been included in our NDA filing for YUTIQ.

YUTIQ Regulatory Strategy

On March 19, 2018, the FDA accepted our NDA for YUTIQ and set a PDUFA action date of November 5, 2018. If approved, we plan to launch YUTIQ in the U.S. in the first half of calendar year 2019.

We haveout-licensed the rights for YUTIQ for the treatment of NIPU to Alimera for the EMEA as an extension of our original license agreement with Alimera. Pursuant to the original agreement, we granted worldwide license rights to ILUVIEN for DME and other potentialback-of-the-eye diseases (other than uveitis) utilizing a corticosteroid with our Durasert technology. In the European Economic Area, or EEA, Alimera has submitted our previously-filed YUTIQ data as a Type II variation in each of the 17 countries in which it previously obtained regulatory approval for ILUVIEN for DME. According to Alimera’s public filings, Alimera plans to submit follow-up data supporting its Type II variation application in the fourth quarter of calendar year 2018 and expects it will obtain approval for its application in the first half of calendar 2019.

YUTIQ Marketing Strategy

Subject to approval by the FDA, we intend to commercialize YUTIQ ourselves in the U.S. We believe that the uveitis market in the U.S. is relatively modest in size, with an estimated patient prevalence for NIPU of approximately 55,000 to 120,000 patients. Consequently, the number of retinal physicians who treat the majority of this patient population is estimated to be fewer than 500. As a result, we believe the commercial footprint and cost to market for YUTIQ will be less than a typical pharmaceutical product launch with a larger physician call population. Members of our leadership team have extensive commercialization experience and we believe that commercializing YUTIQ ourselves in the U.S. will maximize the value of YUTIQ to us. Outside of the U.S., we expanded Alimera’s license agreement to include uveitis, including NIPU, in the EMEA. This additional license right was part of the July 10, 2017 amended and restated collaboration agreement with Alimera, or the Amended Alimera Agreement. Alimera has reported that it plans to commercialize the NIPU EMEA indication under its ILUVIEN trademark. We plan to seekout-license partner arrangements in other territories.

Development Product: Shorter Duration YUTIQ

We are developing a next-generation, shorter-duration treatment for posterior segment uveitis, using the same non-erodible Durasert technologyformulation and drugsteroid (FA) as in YUTIQ. This program is designed to offer an intravitreal micro insert with a shorter delivery period, thus providing physicians with flexibility for multiple dosing intervals. Our market research has indicated a strong preference amongst those physicians surveyed for both a six to nine-month drug delivery product and ain addition to the three-year drug delivery option.option provided by YUTIQ. Although we believe many patients would likely opt for a longer-acting treatment option, some doctors may prefer to initially treat their uveitis patients over shorter time periods. We have consulted with the FDA and identified a potential clinical pathway for an sNDA filing that involves a clinical trial of approximately 60 patients, randomized 2:1. We are currently evaluating the timeline and investment requirements for the initiation of this trial.

Development Product: Tyrosine Kinase Inhibitor InsertEYP-1901 for Wet AMDDR and RVO

We are investigatingalso seeking to enhance our long-term growth potential by expanding beyond wet AMD for EYP-1901 and into DR and RVO, both large and growing ocular disease areas.DR is a frequent complication of diabetes mellitus. Slow but progressive changes in the developmentsmall blood vessels of an injectable, bioerodible, sustained-release Durasert insert deliveringthe retina may cause no symptoms or only mild vision problems in early stages. As the disease progresses, retina bleeding and fluid accumulation can eventually lead to blindness. RVO is a tyrosine kinase inhibitor, or TKI, for treatment of wet AMD. AMD, the leadingcommon cause of vision loss in peopleolder individuals with over 65,90% of cases occurring in patients over the age of 55 years. It is the second most commonly treated with intravitreal injectionscommon retinal vascular disease after DR. As in wet AMD, the hypoxic retinal tissue in RVO releases VEGF and inflammatory mediators, thereby inducing the complication of biologics that block vascular endothelial growth factor, or VEGF.FDA-approved Lucentis®macular edema, a cause of significant visual acuity loss. We intend to advance EYP-1901 through clinical development in DR and Eylea® andoff-label useRVO after completion of anti-cancer drug Avastin® are the leading treatments fora successful Phase 1 clinical trial in wet AMD. These biologics must be injected into Our Commercial Products YUTIQ YUTIQ (fluocinolone acetonide intravitreal implant or “FA” 0.18 mg) for intravitreal injection, was approved by the FDA in October 2018 and we commercially launched YUTIQ in the U.S. in February 2019. YUTIQ is indicated for the treatment of chronic non-infectious uveitis affecting the posterior segment of the eye. YUTIQ is a once every three-year treatment utilizing a nonerodable formulation of our proprietary Durasert technology that is administered during a physician office visit. In addition to commercialization of YUTIQ in the U.S., we have (i) licensed regulatory, reimbursement and distribution rights to the product to Alimera for Europe, Middle East, and Africa (“EMEA”)under its ILUVIEN tradename and (ii) licensed clinical development, regulatory, reimbursement and distribution rights to Durasert FA to Ocumension Therapeutics (“Ocumension”) for Mainland China, Hong Kong, Macau, Taiwan, South Korea and other jurisdictions across Southeast Asia. Market Opportunity Chronic non-infectious uveitis affecting the posterior segment of the eye as frequently as monthlyis an inflammatory disease that afflicts people of all ages, producing swelling and typicallydestroying eye tissues, which can lose efficacy over time, resulting inlead to severe vision loss and returnblindness. This disease affects between 60,000 to 100,000 people each year in the U.S. and causes approximately 30,000 new cases of blindness every year. The standard of care treatment for this disease typically involves the use of short-acting corticosteroids to reduce uveitic flares followed by additional treatments of sustained release, lower dose steroids to minimize the risk of further flares. Recent Clinical Development Highlights In March 2020, we announced positive topline 36-month follow-up data from a second Phase 3 trial of YUTIQ for the treatment of chronic non-infectious uveitis affecting the posterior segment of the disease.eye. This second double-masked, randomized Phase 3 trial of YUTIQ enrolled 153 patients in 15 clinical centers in India, with 101 eyes treated with YUTIQ and 52 eyes receiving sham injections. At 36-months, the recurrence rate in YUTIQ randomized eyes was significantly lower than in sham treated eyes (46.5% vs. 75.0%, respectively; p=0.001). Visual acuity gains or losses of 3-lines or more were both similar between treatment groups. Safety data showed no unanticipated side effects at each follow-up timepoint at 12, 24 and 36-months. These positive results were consistent with the findings from the first Phase 3 study of YUTIQ and provide further validation of its long-term ability to reduce uveitic flares.

In November 2020, positive data for YUTIQ® was featured in a presentation at the American Academy of Ophthalmology (AAO) 2020 Virtual Annual Meeting. This presentation demonstrated statistically significant efficacy results from the second Phase 3 trial of YUTIQ. Intellectual Property We own the rights for YUTIQ in the U.S. and all foreign jurisdictions and have licensed these rights in EMEA and Mainland China, Hong Kong, Macau and Taiwan. In August 2020, we expanded the out-license agreement to include South Korea and other jurisdictions across Southeast Asia. We have patent rights for YUTIQ in the U.S. through at least August 2027 and internationally through dates ranging from October 2024 to May 2027. Sales and Marketing YUTIQ was granted a permanent and specific J-code by the Centers for Medicare & Medicaid Services (“CMS”), effective October 1, 2019. Approximately sixteen Key Account Managers (“KAMs”) are dedicated to calling on uveitis and retinal specialists across the U.S. In cancer therapy, TKIs2020, the retinal and uveitis markets were impacted by the Pandemic as most teaching hospitals and many independent practices significantly reduced the patient access and flow into the clinics. As a result, many patients were unable to receive the treatments needed to control the inflammatory disease in a timely manner. We started to see customer demand return in the third and fourth quarter of 2020. DEXYCU DEXYCU (dexamethasone intraocular suspension) 9%, for intraocular administration, was approved by the FDA in February 2018 for the treatment of post-operative ocular inflammation and commercially launched in the U.S. in March 2019 with a primary focus on its use immediately following cataract surgery. DEXYCU is administered as a single dose directly into the surgical site at the end of ocular surgery and is the first long-acting intraocular product approved by the FDA for the treatment of post-operative inflammation. DEXYCU utilizes our proprietary Verisome® drug-delivery technology, which allows for a single intraocular injection that releases dexamethasone, a corticosteroid, for up to 22 days. Market Opportunity DEXYCU is approved for ocular post-surgical inflammation. The initial market we have focused on for DEXYCU is post-operative inflammation associated with cataract surgery as there were approximately 3.8 million cataract surgeries performed in 2018 in the U.S. Prior to the launch of DEXYCU, the standard of care for post-operative reduction of inflammation and pain in cataract surgery had been a combination of steroid, antibiotic and non-steroidal eye drops administered multiple times each day over a period of several weeks. Recent Clinical Development Highlights Positive retrospective case study data supporting DEXYCU was highlighted in an oral presentation at the 2020 Caribbean Eye Meeting in an oral session entitled, “Drug Delivery: Real-World Experience With Dexamethasone Intraocular Suspension”. The ongoing retrospective study is designed to provide large-scale, real-world data on early experiences with DEXYCU from surgeons. Interim results presented are taken orally butfrom 154 patients administered DEXYCU with each time point of data based on patient chart data and frequency of measurement by participating physicians. The proportion of patients with complete anterior chamber cell clearing (cell score=0) was 47.5%, 50.0%, 84.1% and 87.5% at postoperative day 1, 8, 14 and 30, respectively. The proportion of patients with no anterior chamber flares (flare score=0), another measurement of inflammation, was 77.7%, 98.5%, 98.8% and 99.1% at postoperative day 1, 8, 14 and 30, respectively. Mean intraocular pressure at postoperative day 1 was 17.6mmHg, with levels decreasing through to postoperative day 30. In November 2020, positive data DEXYCU was featured in three presentations at the American Academy of Ophthalmology (AAO) 2020 Virtual Annual Meeting. This included positive results from a post-cataract surgery inflammatory reduction data from a multicenter retrospective study of real-world usage of DEXYCU. Intellectual Property We own the worldwide rights to all indications for DEXYCU and in January 2020 we out-licensed clinical development, regulatory, reimbursement and distribution rights for the product in Mainland China, Hong Kong, Macau and Taiwan. In August 2020, we expanded the out-license agreement to include South Korea and other jurisdictions across Southeast Asia.