| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

2020

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Class B Common Stock, $.01 par value

| Large accelerated filer | ☐ | Accelerated filer ☒ | ||||

Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |||

$216,494,411.

1, 2021.

| Page | ||||||

| ||||||

Item 1. | 1 | |||||

| ||||||

Item 1A. | ||||||

| ||||||

Item 1B. | ||||||

| ||||||

Item 2. | ||||||

| ||||||

Item 3. | ||||||

| ||||||

Item 4. | ||||||

| ||||||

Item 5. | ||||||

| ||||||

Item 6. | ||||||

| ||||||

Item 7. | ||||||

| ||||||

Item 7A. | ||||||

| ||||||

Item 8. | ||||||

| ||||||

Item 9. | ||||||

| ||||||

Item 9A. | ||||||

| ||||||

Item 9B. | ||||||

| ||||||

Item 10. | ||||||

| ||||||

Item 11. | ||||||

| ||||||

Item 12. | ||||||

| ||||||

Item 13. | ||||||

| ||||||

Item 14. | ||||||

| ||||||

Item 15. | ||||||

| ||||||

Item 16. | ||||||

Item 1. Business. |

|

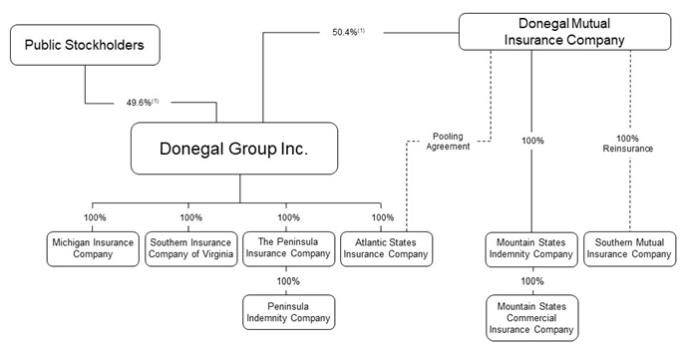

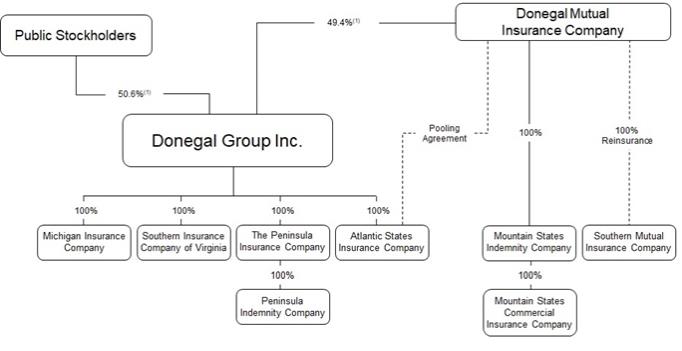

companies that are affiliated with Donegal Mutual.

In July 2018, we consolidated

-1-

Since we established Atlantic States in 1986, Donegal Mutual and our insurance subsidiaries have conducted business together as the Donegal Insurance Group. As the Donegal Insurance Group,

-2-

business Atlantic States derives from the underwriting pool represents a significant percentage of our total consolidated revenues. However, that percentage has gradually decreased over the past few years as we have acquired a number of other property and casualty insurance companies that do not participate in the underwriting pool.

Donegal Mutual completed the merger of Mountain States Mutual Casualty Company, or Mountain States,wholly owns and has a 100% quota-share reinsurance agreement with and into Donegal Mutual effective May 25, 2017. Donegal Mutual was the surviving company in the merger, and Mountain States’ insurance subsidiaries, Mountain States Indemnity Company and Mountain States Commercial Insurance Company, became insurance subsidiaries of Donegal Mutual upon completion of the merger. Upon completion of the merger, Donegal Mutual assumed all of the policy obligations of Mountain States and began to market its products together with its insurance subsidiaries as the Mountain States Insurance Group in four Southwestern states. Donegal Mutual currently plans to place the business of the Mountain States Insurance Group into the underwriting pool beginninginsurance subsidiaries. Beginning with policies effective in 2021. As a result, our consolidated financial results will exclude the results of Donegal Mutual’s operations in those Southwestern states until2021, Donegal Mutual places suchits assumed business from Mountain States insurance subsidiaries into the underwriting pool.

| (1) | Because of the different relative voting power of our Class A common stock and our Class B common stock, our public stockholders hold approximately 29% of the combined voting power of our Class A common stock and our Class B common stock and Donegal Mutual holds approximately 71% of the combined voting power of our Class A common stock and our Class B common stock. |

-3-

respect, with an environment designed to facilitate excellent service to the agents and customers of Donegal Mutual and our insurance subsidiaries. At December 31, 2020, Donegal Mutual had 879 employees, of which 519 were based in its Marietta, Pennsylvania headquarters and 360 were based in regional offices or were permanent remote employees. There were 866 full-time employees and 13 part-time employees. Since March 2020, approximately 90% of Donegal Mutual’s employees have been working remotely from their homes due to health and safety concerns related to the

-4-

stockholders and fair and equitable to Donegal Mutual and its policyholders or if Donegal Mutual and we should mutually agree to certain adjustments to the terms of the agreements. In the case of these reinsurance agreements, the annual adjustments typically relate to the reinsurance premiums, losses and reinstatement premiums. These agreements are ongoing in nature and will continue in effect throughout 20202021 in the ordinary course of our business.

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

Our GAAP combined ratio | 99.5 | % | 110.1 | % | 103.0 | % | 98.1 | % | 99.0 | % | ||||||||||

Our SAP combined ratio | 98.7 | 109.4 | 101.7 | 96.8 | 97.4 | |||||||||||||||

Industry SAP combined ratio(1) | 98.2 | 99.6 | 105.1 | 100.9 | 98.3 | |||||||||||||||

2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

Our GAAP combined ratio | 96.0 | % | 99.5 | % | 110.1 | % | 103.0 | % | 98.1 | % | ||||||||||

Our SAP combined ratio | 95.4 | 98.7 | 109.4 | 101.7 | 96.8 | |||||||||||||||

Industry SAP combined ratio (1) | 99.3 | 99.2 | 99.6 | 104.0 | 100.9 | |||||||||||||||

| (1) | As reported (projected for |

-5-

|

|

field visitations by

|

agencies.

-6-

-7-

Company Name | State of Domicile | Year Control Acquired | Method of Acquisition/Affiliation | |||

| ||||||

| ||||||

| ||||||

| ||||||

Southern Heritage Insurance Company (1) | Georgia | 1998 | Purchase of stock by us in 1998. | |||

Le Mars Mutual Insurance Company of Iowa and then Le Mars Insurance Company (1)(2) | Iowa | 2002 | Surplus note investment by Donegal Mutual in 2002; demutualization in 2004; acquisition of stock by us in 2004. | |||

Peninsula Insurance Group | Maryland | 2004 | Purchase of stock by us in 2004. | |||

Sheboygan Falls Mutual Insurance Company and then Sheboygan Falls Insurance Company (1)(2) | Wisconsin | 2007 | Contribution note investment by Donegal Mutual in 2007; demutualization in 2008; acquisition of stock by us in 2008. | |||

Southern Mutual Insurance Company (3) | Georgia | 2009 | Surplus note investment by Donegal Mutual and quota-share reinsurance in 2009. | |||

Michigan Insurance Company | Michigan | 2010 | Purchase of stock by us and surplus note investment by Donegal Mutual in 2010. | |||

Mountain States Mutual Casualty Company (4) | New Mexico | 2017 | Merger with and into Donegal Mutual in | |||

| (1) | To reduce administrative and compliance costs and expenses, these subsidiaries subsequently merged into one of our existing insurance subsidiaries. |

| (2) | Each of these acquisitions initially took the form of an affiliation with Donegal Mutual. Donegal Mutual provided surplus note financing to the insurance company, and, in connection with that financing, sufficient designees of Donegal Mutual were appointed so as to constitute a majority of the members of the board of directors of the insurance company. Donegal Mutual and the insurance company simultaneously entered into a services agreement whereby Donegal Mutual provided services to improve the operations of the insurance company. Once the insurance company’s results of operations improved to the satisfaction of Donegal Mutual, Donegal Mutual sponsored the demutualization of the insurance company. Upon the consummation of the demutualization, Donegal Mutual converted the surplus note to capital stock of the newly demutualized insurance company. We then purchased all of the capital stock of the insurance company from Donegal Mutual and made an additional capital contribution in cash to provide adequate surplus to support the insurance company’s planned premium growth. |

|

| (3) | Control acquired by Donegal Mutual. |

| (4) | Donegal Mutual completed the merger of Mountain States with and into Donegal Mutual effective May 25, 2017. Donegal Mutual was the surviving company in the merger, and Mountain |

-8-

|

|

|

2020.

|

-9-

portfolios of our insurance subsidiaries consist of both taxable and(5.0%(4.8% at December 31, 2019)2020) of their portfolios in equity securities.

securities that have a history of paying cash dividends or that our insurance subsidiaries expect will appreciate in value over time.

-10-

| Year Ended December 31, | ||||||||||||||||||||||||

| 2019 | 2018 | 2017 | ||||||||||||||||||||||

| (dollars in thousands) | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

Commercial lines: | ||||||||||||||||||||||||

Automobile | $ | 122,142 | 16.2 | % | $ | 108,123 | 14.5 | % | $ | 99,333 | 13.6 | % | ||||||||||||

Workers’ compensation | 113,684 | 15.1 | 109,022 | 14.7 | 109,884 | 15.1 | ||||||||||||||||||

Commercial multi-peril | 138,750 | 18.5 | 117,509 | 15.8 | 110,313 | 15.1 | ||||||||||||||||||

Other | 30,303 | 4.0 | 15,241 | 2.0 | 9,586 | 1.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total commercial lines | 404,879 | 53.8 | 349,895 | 47.0 | 329,116 | 45.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Personal lines: | ||||||||||||||||||||||||

Automobile | 210,507 | 28.0 | 249,275 | 33.5 | 255,297 | 35.0 | ||||||||||||||||||

Homeowners | 117,118 | 15.5 | 123,782 | 16.6 | 125,054 | 17.2 | ||||||||||||||||||

Other | 20,097 | 2.7 | 21,064 | 2.9 | 19,672 | 2.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total personal lines | 347,722 | 46.2 | 394,121 | 53.0 | 400,023 | 54.9 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total business | $ | 752,601 | 100.0 | % | $ | 744,016 | 100.0 | % | $ | 729,139 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Year Ended December 31, | ||||||||||||||||||||||||

2020 | 2019 | 2018 | ||||||||||||||||||||||

| (dollars in thousands) | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

Commercial lines: | ||||||||||||||||||||||||

Automobile | $ | 135,294 | 18.2 | % | $ | 122,142 | 16.2 | % | $ | 108,123 | 14.5 | % | ||||||||||||

Workers’ compensation | 109,960 | 14.8 | 113,684 | 15.1 | 109,022 | 14.7 | ||||||||||||||||||

Commercial multi-peril | 147,993 | 19.9 | 138,750 | 18.5 | 117,509 | 15.8 | ||||||||||||||||||

Other | 32,739 | 4.5 | 30,303 | 4.0 | 15,241 | 2.0 | ||||||||||||||||||

Total commercial lines | 425,986 | 57.4 | 404,879 | 53.8 | 349,895 | 47.0 | ||||||||||||||||||

Personal lines: | ||||||||||||||||||||||||

Automobile | 184,602 | 24.9 | 210,507 | 28.0 | 249,275 | 33.5 | ||||||||||||||||||

Homeowners | 111,886 | 15.1 | 117,118 | 15.5 | 123,782 | 16.6 | ||||||||||||||||||

Other | 19,666 | 2.6 | 20,097 | 2.7 | 21,064 | 2.9 | ||||||||||||||||||

Total personal lines | 316,154 | 42.6 | 347,722 | 46.2 | 394,121 | 53.0 | ||||||||||||||||||

Total business | $ | 742,140 | 100.0 | % | $ | 752,601 | 100.0 | % | $ | 744,016 | 100.0 | % | ||||||||||||

-11-

Pennsylvania | % | |||

Michigan | ||||

Maryland | 9.3 | |||

Georgia | ||||

Virginia | ||||

Delaware | ||||

Wisconsin | ||||

Ohio | ||||

Iowa | 2.3 | |||

Indiana | 2.2 | |||

Tennessee | ||||

Other | ||||

Total | 100.0 | % | ||

-12-

The next release of new systems related to the project will include three personal lines of business and is scheduled for phased implementation beginning in the third quarter of 2021.

-13-

establishing its estimates, an insurer recognizes that its ultimate liability for losses and loss expenses will exceed or be less than such estimates. Our insurance subsidiaries base their estimates of liabilities for losses and loss expenses on assumptions as to future loss trends, expected claims severity, judicial theories of liability and other factors. However, during the loss adjustment period, our insurance subsidiaries may learn additional facts regarding individual claims, and, consequently, it often becomes necessary for our insurance subsidiaries to refine and adjust their estimates for these liabilities. We reflect any adjustments to the liabilities for losses and loss expenses of our insurance subsidiaries in our consolidated results of operations in the period in which our insurance subsidiaries make adjustments to their estimates.

-14-

commercial automobile and personal automobile claims that led our insurance subsidiaries to conclude that their prior actuarial assumptions did not fully anticipate recent changes in severity and reporting trends. Our insurance subsidiaries have encountered increasing difficulties in projecting the ultimate severity of automobile losses over recent accident years, which our insurance subsidiaries attribute to worsening litigation trends and an increased delay in the reporting to our insurance subsidiaries of information with respect to the severity of claims. As a result, our insurance subsidiaries’ actuaries increased their projections of the ultimate cost of our insurance subsidiaries’ prior-year personal automobile and commercial automobile losses, and our insurance subsidiaries added $17.7 million to their reserves for personal automobile and $20.8 million to their reserves for commercial automobile for accident years prior to 2018. The 2017 development represented 1.9% of the December 31, 2016 net carried reserves and resulted primarily from higher-than-expected severity in the commercial multi-peril, personal automobile and commercial automobile lines of business, offset by lower-than-expected severity in the workers’ compensation line of business, for accident years prior to 2017. The majority of the 2017 development related to increases in the liability for losses and loss expenses of prior years for Atlantic States and Peninsula.

-15-

| Year Ended December 31, | ||||||||||||

| (in thousands) | 2019 | 2018 | 2017 | |||||||||

Gross liability for unpaid losses and loss expenses at beginning of year | $ | 814,665 | $ | 676,672 | $ | 606,665 | ||||||

Less reinsurance recoverable | 339,267 | 293,271 | 259,147 | |||||||||

|

|

|

|

|

| |||||||

Net liability for unpaid losses and loss expenses at beginning of year | 475,398 | 383,401 | 347,518 | |||||||||

|

|

|

|

|

| |||||||

Provision for net losses and loss expenses for claims incurred in the current year | 519,320 | 540,827 | 480,647 | |||||||||

Change in provision for estimated net losses and loss expenses for claims incurred in prior years | (12,932 | ) | 35,631 | 6,621 | ||||||||

|

|

|

|

|

| |||||||

Total incurred | 506,388 | 576,458 | 487,268 | |||||||||

|

|

|

|

|

| |||||||

Net losses and loss expense payments for claims incurred during: | ||||||||||||

The current year | 278,924 | 308,578 | 288,380 | |||||||||

Prior years | 195,956 | 175,883 | 163,005 | |||||||||

|

|

|

|

|

| |||||||

Total paid | 474,880 | 484,461 | 451,385 | |||||||||

|

|

|

|

|

| |||||||

Net liability for unpaid losses and loss expenses at end of year | 506,906 | 475,398 | 383,401 | |||||||||

Plus reinsurance recoverable | 362,768 | 339,267 | 293,271 | |||||||||

|

|

|

|

|

| |||||||

Gross liability for unpaid losses and loss expenses at end of year | $ | 869,674 | $ | 814,665 | $ | 676,672 | ||||||

|

|

|

|

|

| |||||||

Year Ended December 31, | ||||||||||||

| (in thousands) | 2020 | 2019 | 2018 | |||||||||

Gross liability for unpaid losses and loss expenses at beginning of year | $ | 869,674 | $ | 814,665 | $ | 676,672 | ||||||

Less reinsurance recoverable | 362,768 | 339,267 | 293,271 | |||||||||

Net liability for unpaid losses and loss expenses at beginning of year | 506,906 | 475,398 | 383,401 | |||||||||

Provision for net losses and loss expenses for claims incurred in the current year | 472,709 | 519,320 | 540,827 | |||||||||

Change in provision for estimated net losses and loss expenses for claims incurred in prior years | (12,945 | ) | (12,932 | ) | 35,631 | |||||||

Total incurred | 459,764 | 506,388 | 576,458 | |||||||||

Net losses and loss expense payments for claims incurred during: | ||||||||||||

The current year | 236,984 | 278,924 | 308,578 | |||||||||

Prior years | 172,497 | 195,956 | 175,883 | |||||||||

Total paid | 409,481 | 474,880 | 484,461 | |||||||||

Net liability for unpaid losses and loss expenses at end of year | 557,189 | 506,906 | 475,398 | |||||||||

Plus reinsurance recoverable | 404,818 | 362,768 | 339,267 | |||||||||

Gross liability for unpaid losses and loss expenses at end of year | $ | 962,007 | $ | 869,674 | $ | 814,665 | ||||||

Amounts shown in the 2010 column

| Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||||||||||||||||||||

Net liability at end of year for unpaid losses and loss expenses | $ | 180,262 | $ | 217,896 | $ | 243,015 | $ | 250,936 | $ | 265,605 | $ | 292,301 | $ | 322,054 | $ | 347,518 | $ | 383,401 | $ | 475,398 | $ | 506,906 | ||||||||||||||||||||||

Net liabilityre-estimated as of: | ||||||||||||||||||||||||||||||||||||||||||||

One year later | 177,377 | 217,728 | 250,611 | 261,294 | 280,074 | 299,501 | 325,043 | 354,139 | 419,032 | 462,466 | ||||||||||||||||||||||||||||||||||

Two years later | 177,741 | 217,355 | 255,612 | 268,877 | 281,782 | 299,919 | 329,115 | 375,741 | 413,535 | |||||||||||||||||||||||||||||||||||

Three years later | 178,403 | 218,449 | 257,349 | 270,473 | 281,666 | 304,855 | 338,118 | 376,060 | ||||||||||||||||||||||||||||||||||||

Four years later | 179,909 | 218,514 | 256,460 | 270,794 | 284,429 | 307,840 | 339,228 | |||||||||||||||||||||||||||||||||||||

Five years later | 179,961 | 218,202 | 255,660 | 271,954 | 285,130 | 310,354 | ||||||||||||||||||||||||||||||||||||||

Six years later | 179,858 | 217,430 | 256,388 | 272,553 | 287,439 | |||||||||||||||||||||||||||||||||||||||

Seven years later | 179,996 | 217,703 | 257,132 | 274,111 | ||||||||||||||||||||||||||||||||||||||||

Eight years later | 180,130 | 218,173 | 257,935 | |||||||||||||||||||||||||||||||||||||||||

Nine years later | 180,487 | 218,603 | ||||||||||||||||||||||||||||||||||||||||||

Ten years later | 180,681 | |||||||||||||||||||||||||||||||||||||||||||

Cumulative deficiency (excess) | 419 | 707 | 14,920 | 23,175 | 21,834 | 18,053 | 17,174 | 28,542 | 30,134 | (12,932 | ) | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Cumulative amount of liability paid through: | ||||||||||||||||||||||||||||||||||||||||||||

One year later | $ | 84,565 | $ | 96,202 | $ | 119,074 | $ | 126,677 | $ | 131,766 | $ | 131,779 | $ | 149,746 | $ | 163,005 | $ | 175,883 | $ | 195,956 | ||||||||||||||||||||||||

Two years later | 123,204 | 148,140 | 181,288 | 191,208 | 194,169 | 206,637 | 228,506 | 250,678 | 276,331 | |||||||||||||||||||||||||||||||||||

Three years later | 147,165 | 178,073 | 217,138 | 225,956 | 233,371 | 251,654 | 274,235 | 306,338 | ||||||||||||||||||||||||||||||||||||

Four years later | 161,363 | 195,948 | 234,392 | 245,094 | 255,451 | 274,248 | 300,715 | |||||||||||||||||||||||||||||||||||||

Five years later | 169,452 | 203,633 | 241,538 | 254,502 | 265,841 | 287,178 | ||||||||||||||||||||||||||||||||||||||

Six years later | 173,153 | 206,731 | 245,774 | 259,437 | 272,431 | |||||||||||||||||||||||||||||||||||||||

Seven years later | 174,376 | 209,527 | 248,195 | 263,386 | ||||||||||||||||||||||||||||||||||||||||

Eight years later | 175,662 | 210,982 | 250,272 | |||||||||||||||||||||||||||||||||||||||||

Nine years later | 176,514 | 212,340 | ||||||||||||||||||||||||||||||||||||||||||

Ten years later | 177,433 | |||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||||||||||||||||

| (in thousands) | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||||||||||||||

Gross liability at end of year | $ | 442,408 | $ | 458,827 | $ | 495,619 | $ | 538,258 | $ | 578,205 | $ | 606,665 | $ | 676,672 | $ | 814,665 | $ | 869,674 | ||||||||||||||||||

Reinsurance recoverable | 199,393 | 207,891 | 230,014 | 245,957 | 256,151 | 259,147 | 293,271 | 339,266 | 362,768 | |||||||||||||||||||||||||||

Net liability at end of year | 243,015 | 250,936 | 265,605 | 292,301 | 322,054 | 347,518 | 383,401 | 475,398 | 506,906 | |||||||||||||||||||||||||||

Grossre-estimated liability | 515,334 | 511,331 | 536,133 | 584,517 | 615,168 | 664,526 | 742,616 | 846,081 | ||||||||||||||||||||||||||||

Re-estimated recoverable | 257,399 | 237,220 | 248,694 | 274,163 | 275,940 | 288,466 | 329,081 | 383,615 | ||||||||||||||||||||||||||||

Netre-estimated liability | 257,935 | 274,111 | 287,439 | 310,354 | 339,228 | 376,060 | 413,535 | 462,466 | ||||||||||||||||||||||||||||

Gross cumulative deficiency (excess) | 72,926 | 52,504 | 40,514 | 46,259 | 36,963 | 57,861 | 65,944 | 31,416 | ||||||||||||||||||||||||||||

-17-

Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||

(in thousands) | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||||||||||||||||

Net liability at end of year for unpaid losses and loss expenses | $ | 217,896 | $ | 243,015 | $ | 250,936 | $ | 265,605 | $ | 292,301 | $ | 322,054 | $ | 347,518 | $ | 383,401 | $ | 475,398 | $ | 506,906 | $ | 557,189 | ||||||||||||||||||||||

Net liability re-estimated as of: | ||||||||||||||||||||||||||||||||||||||||||||

One year later | 217,728 | 250,611 | 261,294 | 280,074 | 299,501 | 325,043 | 354,139 | 419,032 | 462,466 | 493,961 | ||||||||||||||||||||||||||||||||||

Two years later | 217,355 | 255,612 | 268,877 | 281,782 | 299,919 | 329,115 | 375,741 | 413,535 | 450,862 | |||||||||||||||||||||||||||||||||||

Three years later | 218,449 | 257,349 | 270,473 | 281,666 | 304,855 | 338,118 | 376,060 | 404,902 | ||||||||||||||||||||||||||||||||||||

Four years later | 218,514 | 256,460 | 270,794 | 284,429 | 307,840 | 339,228 | 372,230 | |||||||||||||||||||||||||||||||||||||

Five years later | 218,202 | 255,660 | 271,954 | 285,130 | 310,354 | 338,020 | ||||||||||||||||||||||||||||||||||||||

Six years later | 217,430 | 256,388 | 272,553 | 287,439 | 310,380 | |||||||||||||||||||||||||||||||||||||||

Seven years later | 217,703 | 257,132 | 274,111 | 287,063 | ||||||||||||||||||||||||||||||||||||||||

Eight years later | 218,173 | 257,935 | 274,472 | |||||||||||||||||||||||||||||||||||||||||

Nine years later | 218,603 | 258,272 | ||||||||||||||||||||||||||||||||||||||||||

Ten years later | 218,885 | |||||||||||||||||||||||||||||||||||||||||||

Cumulative deficiency (excess) | 989 | 15,257 | 23,536 | 21,458 | 18,079 | 15,966 | 24,712 | 21,501 | (24,536 | ) | (12,945 | ) | ||||||||||||||||||||||||||||||||

Cumulative amount of liability paid through: | ||||||||||||||||||||||||||||||||||||||||||||

One year later | $ | 96,202 | $ | 119,074 | $ | 126,677 | $ | 131,766 | $ | 131,779 | $ | 149,746 | $ | 163,005 | $ | 175,883 | $ | 195,956 | $ | 172,497 | ||||||||||||||||||||||||

Two years later | 148,140 | 181,288 | 191,208 | 194,169 | 206,637 | 228,506 | 250,678 | 276,331 | 275,993 | |||||||||||||||||||||||||||||||||||

Three years later | 178,073 | 217,138 | 225,956 | 233,371 | 251,654 | 274,235 | 306,338 | 317,447 | ||||||||||||||||||||||||||||||||||||

Four years later | 195,948 | 234,392 | 245,094 | 255,451 | 274,248 | 300,715 | 324,628 | |||||||||||||||||||||||||||||||||||||

Five years later | 203,633 | 241,538 | 254,502 | 265,841 | 287,178 | 309,630 | ||||||||||||||||||||||||||||||||||||||

Six years later | 206,731 | 245,774 | 259,437 | 272,431 | 292,327 | |||||||||||||||||||||||||||||||||||||||

Seven years later | 209,527 | 248,195 | 263,386 | 275,357 | ||||||||||||||||||||||||||||||||||||||||

Eight years later | 210,982 | 250,272 | 265,026 | |||||||||||||||||||||||||||||||||||||||||

Nine years later | 212,340 | 251,696 | ||||||||||||||||||||||||||||||||||||||||||

Ten years later | 213,333 | |||||||||||||||||||||||||||||||||||||||||||

Year Ended December 31, | ||||||||||||||||||||||||||||||||||||

(in thousands) | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||||||||||

Gross liability at end of year | $ | 458,827 | $ | 495,619 | $ | 538,258 | $ | 578,205 | $ | 606,665 | $ | 676,672 | $ | 814,665 | $ | 869,674 | $ | 962,007 | ||||||||||||||||||

Reinsurance recoverable | 207,891 | 230,014 | 245,957 | 256,151 | 259,147 | 293,271 | 339,266 | 362,768 | 404,818 | |||||||||||||||||||||||||||

Net liability at end of year | 250,936 | 265,605 | 292,301 | 322,054 | 347,518 | 383,401 | 475,398 | 506,906 | 557,189 | |||||||||||||||||||||||||||

Gross re-estimated liability | 492,274 | 519,465 | 560,090 | 592,023 | 629,162 | 692,908 | 782,595 | 838,833 | ||||||||||||||||||||||||||||

Re-estimated recoverable | 217,802 | 232,402 | 249,710 | 254,003 | 256,932 | 288,006 | 331,733 | 344,872 | ||||||||||||||||||||||||||||

Net re-estimated liability | 274,472 | 287,063 | 310,380 | 338,020 | 372,230 | 404,902 | 450,862 | 493,961 | ||||||||||||||||||||||||||||

Gross cumulative deficiency (excess) | 33,447 | 23,846 | 21,832 | 13,818 | 22,497 | 16,236 | (32,070 | ) | (30,841 | ) | ||||||||||||||||||||||||||

2020.

| (dollars in thousands) | December 31, 2019 | |||||||

Rating(1) | Amount | Percent | ||||||

U.S. Treasury and U.S. agency securities(2) | $ | 463,974 | 44.6 | % | ||||

Aaa or AAA | 26,154 | 2.5 | ||||||

Aa or AA | 212,877 | 20.4 | ||||||

A | 171,822 | 16.5 | ||||||

BBB | 164,217 | 15.8 | ||||||

B | 2,002 | 0.2 | ||||||

|

|

|

| |||||

Total | $ | 1,041,046 | 100.0 | % | ||||

|

|

|

| |||||

| (dollars in thousands) | December 31, 2020 | |||||||

Rating (1) | Amount | Percent | ||||||

U.S. Treasury and U.S. agency securities (2) | $ | 374,483 | 32.8 | % | ||||

Aaa or AAA | 23,734 | 2.1 | ||||||

Aa or AA | 315,352 | 27.6 | ||||||

A | 211,456 | 18.5 | ||||||

BBB | 214,719 | 18.8 | ||||||

B | 2,001 | 0.2 | ||||||

Total | $ | 1,141,745 | 100.0 | % | ||||

| (1) | Ratings assigned by Moody’s Investors Services, Inc. or Standard & Poor’s Corporation. |

| (2) | Includes mortgage-backed securities of |

-18-

| December 31, | ||||||||||||||||||||||||

| 2019 | 2018 | 2017 | ||||||||||||||||||||||

| (dollars in thousands) | Amount | Percent of Total | Amount | Percent of Total | Amount | Percent of Total | ||||||||||||||||||

Fixed maturities(1): | ||||||||||||||||||||||||

Held to maturity: | ||||||||||||||||||||||||

U.S. Treasury securities and obligations of U.S. government corporations and agencies | $ | 82,916 | 7.5 | % | $ | 76,223 | 7.4 | % | $ | 71,736 | 7.1 | % | ||||||||||||

Obligations of states and political subdivisions | 204,634 | 18.4 | 159,292 | 15.5 | 137,581 | 13.7 | ||||||||||||||||||

Corporate securities | 156,399 | 14.1 | 127,010 | 12.3 | 108,025 | 10.7 | ||||||||||||||||||

Mortgage-backed securities | 32,145 | 2.9 | 40,274 | 3.9 | 49,313 | 4.9 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total held to maturity | 476,094 | 42.9 | 402,799 | 39.1 | 366,655 | 36.4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Available for sale: | ||||||||||||||||||||||||

U.S. Treasury securities and obligations of U.S. government corporations and agencies | 19,364 | 1.7 | 44,210 | 4.3 | 44,049 | 4.4 | ||||||||||||||||||

Obligations of states and political subdivisions | 56,796 | 5.1 | 75,216 | 7.3 | 132,117 | 13.1 | ||||||||||||||||||

Corporate securities | 159,244 | 14.3 | 137,833 | 13.4 | 105,740 | 10.5 | ||||||||||||||||||

Mortgage-backed securities | 329,548 | 29.7 | 269,299 | 26.1 | 257,040 | 25.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total available for sale | 564,952 | 50.8 | 526,558 | 51.1 | 538,946 | 53.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total fixed maturities | 1,041,046 | 93.7 | 929,357 | 90.2 | 905,601 | 90.0 | ||||||||||||||||||

Equity securities(2) | 55,477 | 5.0 | 43,667 | 4.2 | 50,445 | 5.0 | ||||||||||||||||||

Investment in affiliate(3) | — | — | 41,026 | 4.0 | 38,774 | 3.9 | ||||||||||||||||||

Short-term investments(4) | 14,030 | 1.3 | 16,749 | 1.6 | 11,050 | 1.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total investments | $ | 1,110,553 | 100.0 | % | $ | 1,030,799 | 100.0 | % | $ | 1,005,870 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

December 31, | ||||||||||||||||||||||||

2020 | 2019 | 2018 | ||||||||||||||||||||||

| (dollars in thousands) | Amount | Percent of Total | Amount | Percent of Total | Amount | Percent of Total | ||||||||||||||||||

Fixed maturities (1) : | ||||||||||||||||||||||||

Held to maturity: | ||||||||||||||||||||||||

U.S. Treasury securities and obligations of U.S. government corporations and agencies | $ | 77,435 | 6.3 | % | $ | 82,916 | 7.5 | % | $ | 76,223 | 7.4 | % | ||||||||||||

Obligations of states and political subdivisions | 312,319 | 25.6 | 204,634 | 18.4 | 159,292 | 15.5 | ||||||||||||||||||

Corporate securities | 173,270 | 14.2 | 156,399 | 14.1 | 127,010 | 12.3 | ||||||||||||||||||

Mortgage-backed securities | 23,585 | 1.9 | 32,145 | 2.9 | 40,274 | 3.9 | ||||||||||||||||||

Total held to maturity | 586,609 | 48.0 | 476,094 | 42.9 | 402,799 | 39.1 | ||||||||||||||||||

Available for sale: | ||||||||||||||||||||||||

U.S. Treasury securities and obligations of U.S. government corporations and agencies | 47,815 | 3.9 | 19,364 | 1.7 | 44,210 | 4.3 | ||||||||||||||||||

Obligations of states and political subdivisions | 68,965 | 5.7 | 56,796 | 5.1 | 75,216 | 7.3 | ||||||||||||||||||

Corporate securities | 212,708 | 17.4 | 159,244 | 14.3 | 137,833 | 13.4 | ||||||||||||||||||

Mortgage-backed securities | 225,648 | 18.5 | 329,548 | 29.7 | 269,299 | 26.1 | ||||||||||||||||||

Total available for sale | 555,136 | 45.5 | 564,952 | 50.8 | 526,558 | 51.1 | ||||||||||||||||||

Total fixed maturities | 1,141,745 | 93.5 | 1,041,046 | 93.7 | 929,357 | 90.2 | ||||||||||||||||||

Equity securities (2) | 58,556 | 4.8 | 55,477 | 5.0 | 43,667 | 4.2 | ||||||||||||||||||

Investment in affiliate (3) | — | — | — | — | 41,026 | 4.0 | ||||||||||||||||||

Short-term investments (4) | 20,901 | 1.7 | 14,030 | 1.3 | 16,749 | 1.6 | ||||||||||||||||||

Total investments | $ | 1,221,202 | 100.0 | % | $ | 1,110,553 | 100.0 | % | $ | 1,030,799 | 100.0 | % | ||||||||||||

| (1) | We refer to Notes 1 and 4 to our Consolidated Financial Statements. We value those fixed maturities we classify as held to maturity at amortized cost; we value those fixed maturities we classify as available for sale at fair value. The total fair value of fixed maturities we classified as held to maturity was $632.6 million at December 31, 2020, $500.3 million at December 31, 2019 and $405.0 million at December 31, |

| (2) | We value equity securities at fair value. The total cost of equity securities was $42.4 million at December 31, 2020, $43.4 million at December 31, 2019 and $40.9 million at December 31, |

| (3) | We valued our investment in our affiliate at cost, adjusted for our share of earnings and losses of our affiliate as well as changes in equity of our affiliate due to unrealized gains and losses. |

| (4) | We value short-term investments at cost, which approximates fair value. |

-19-

| December 31, | ||||||||||||||||||||||||

| 2019 | 2018 | 2017 | ||||||||||||||||||||||

| (dollars in thousands) | Amount | Percent of Total | Amount | Percent of Total | Amount | Percent of Total | ||||||||||||||||||

Due in(1): | ||||||||||||||||||||||||

One year or less | $ | 29,209 | 2.8 | % | $ | 39,282 | 4.2 | % | $ | 53,826 | 6.0 | % | ||||||||||||

Over one year through three years | 71,738 | 6.9 | 74,773 | 8.1 | 74,140 | 8.2 | ||||||||||||||||||

Over three years through five years | 93,982 | 9.0 | 84,987 | 9.1 | 82,476 | 9.1 | ||||||||||||||||||

Over five years through ten years | 297,836 | 28.6 | 256,267 | 27.6 | 221,904 | 24.5 | ||||||||||||||||||

Over ten years through fifteen years | 116,368 | 11.2 | 117,875 | 12.7 | 131,531 | 14.5 | ||||||||||||||||||

Over fifteen years | 70,220 | 6.8 | 46,600 | 5.0 | 35,371 | 3.9 | ||||||||||||||||||

Mortgage-backed securities | 361,693 | 34.7 | 309,573 | 33.3 | 306,353 | 33.8 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| $ | 1,041,046 | 100.0 | % | $ | 929,357 | 100.0 | % | $ | 905,601 | 100.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

December 31, | ||||||||||||||||||||||||

2020 | 2019 | 2018 | ||||||||||||||||||||||

| (dollars in thousands) | Amount | Percent of Total | Amount | Percent of Total | Amount | Percent of Total | ||||||||||||||||||

Due in (1) : | ||||||||||||||||||||||||

One year or less | $ | 73,166 | 6.4 | % | $ | 29,209 | 2.8 | % | $ | 39,282 | 4.2 | % | ||||||||||||

Over one year through three years | 85,805 | 7.5 | 71,738 | 6.9 | 74,773 | 8.1 | ||||||||||||||||||

Over three years through five years | 111,258 | 9.8 | 93,982 | 9.0 | 84,987 | 9.1 | ||||||||||||||||||

Over five years through ten years | 341,947 | 30.0 | 297,836 | 28.6 | 256,267 | 27.6 | ||||||||||||||||||

Over ten years through fifteen years | 139,604 | 12.2 | 116,368 | 11.2 | 117,875 | 12.7 | ||||||||||||||||||

Over fifteen years | 140,732 | 12.3 | 70,220 | 6.8 | 46,600 | 5.0 | ||||||||||||||||||

Mortgage-backed securities | 249,233 | 21.8 | 361,693 | 34.7 | 309,573 | 33.3 | ||||||||||||||||||

| $ | 1,141,745 | 100.0 | % | $ | 1,041,046 | 100.0 | % | $ | 929,357 | 100.0 | % | |||||||||||||

| (1) | Based on stated maturity dates with no prepayment assumptions. Actual maturities will differ because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties. |

| Year Ended December 31, | ||||||||||||

| (dollars in thousands) | 2019 | 2018 | 2017 | |||||||||

Invested assets(1) | $ | 1,070,676 | $ | 1,018,334 | $ | 975,695 | ||||||

Investment income(2) | 29,515 | 26,908 | 23,527 | |||||||||

Average yield | 2.8 | % | 2.6 | % | 2.4 | % | ||||||

Averagetax-equivalent yield | 2.9 | 2.8 | 2.8 | |||||||||

Year Ended December 31, | ||||||||||||

| (dollars in thousands) | 2020 | 2019 | 2018 | |||||||||

Invested assets (1) | $ | 1,165,878 | $ | 1,070,676 | $ | 1,018,334 | ||||||

Investment income (2) | 29,504 | 29,515 | 26,908 | |||||||||

Average yield | 2.5 | % | 2.8 | % | 2.6 | % | ||||||

Average tax-equivalent yield | 2.7 | 2.9 | 2.8 | |||||||||

| (1) | Average of the aggregate invested amounts at the beginning and end of the period. |

| (2) | Investment income is net of investment expenses and does not include investment gains or losses or provision for income taxes. |

-20-

require by a substantial margin.

-21-

of risks attributable to such insureds to each company on the basis of the direct premiums it has written in that state or the number of automobiles it insures in that state. Generally, state law requires participation in these programs as a condition to obtaining a certificate of authority. Our loss ratio on insurance we write under these involuntary programs has traditionally been significantly greater than our loss ratio on insurance we voluntarily write in those states.

Name of Insurance Subsidiary | Ordinary Dividend Amount | |||

Atlantic States | $ | 25,903,087 | ||

MICO | 6,576,859 | |||

Peninsula | 1,983,678 | |||

Southern | 5,440,557 | |||

|

| |||

Total | $ | 39,904,181 | ||

|

| |||

Name of Insurance Subsidiary | Ordinary Dividend Amount | |||

Atlantic States | $ | 27,979,670 | ||

MICO | 12,236,054 | |||

Peninsula | 10,907,098 | |||

Southern | 300,409 | |||

Total | $ | 51,423,231 | ||

-22-

-23-

insurance subsidiaries expect their ultimate liability to be. Significant periods of time often elapse between the occurrence of an insured loss, the reporting of the loss and the settlement of that loss. It is possible that our insurance subsidiaries’ ultimate liability could exceed these estimates because of the future development of known losses, the existence of losses that have occurred but are currently unreported and larger than historical settlements of pending and unreported claims. The process of estimating reserves is inherently judgmental and can be influenced by a number of factors, including the following:

-24-

unanticipated

-25-

-26-

-27-

-28-

marketing systemsdistribution channels other than independent agents.Our

-29-

from stable to negative as a result of the decline in the operating performance of Donegal Mutual and our insurance subsidiaries in 2017 and 2018. In March 2020,2021, A.M. Best affirmed its A (Excellent) ratings of Donegal Mutual and our insurance subsidiaries. However, if A.M. Best were to downgrade the rating of Donegal Mutual or any of our insurance subsidiaries, it would adversely affect the competitive position of Donegal Mutual or that insurance subsidiary and make it more difficult for it to market its products and retain its existing policyholders.

-30-

independent agents. Many of these insurers have greater capital than our insurance subsidiaries and Donegal Mutual, have substantially greater financial, technical and operating resources and have equal or higher ratings from A.M. Best than our insurance subsidiaries.subsidiaries and Donegal Mutual. In addition, our competitors may become increasingly better capitalized in the future as the property and casualty insurance industry continues to consolidate.

Because the

-31-

liable to them for any reinsured losses, the reinsurance agreements do not generally relieve our insurance subsidiaries from their primary liability to their policyholders if the reinsurer fails to pay the reinsurance claims of our insurance subsidiaries. To the extent that a reinsurer is unable to pay losses for which it is liable to our insurance subsidiaries, our insurance subsidiaries remain liable for such losses. At December 31, 2019,2020, our insurance subsidiaries had approximately $141.0$129.5 million of reinsurance receivables from third-party reinsurers relating to paid and unpaid losses. Any insolvency or inability of these reinsurers to make timely payments to our insurance subsidiaries under the terms of their reinsurance agreements would adversely affect the results of operations of our insurance subsidiaries.

The growth and profitability of our insurance subsidiaries depend, in part, on the effective maintenance and ongoing development of Donegal Mutual’s information technology systems, and the allocation of related costs to our insurance subsidiaries may adversely impact their profitability.

Our insurance subsidiaries utilize Donegal Mutual’s information technology systems to conduct their insurance business, including policy quoting and issuance, claims processing, processing of incoming premium payments and other important functions. As a result, the ability of our insurance subsidiaries to grow their business and conduct profitable operations depends on Donegal Mutual’s ability to maintain its existing information technology systems and to develop new technology systems that will support the business of Donegal Mutual and our insurance subsidiaries in a cost-efficient manner and provide information technology capabilities equivalent to those of our competitors. The allocation among our insurance subsidiaries and Donegal Mutual of the costs of developing and maintaining Donegal Mutual’s information technology systems may impact adversely our insurance subsidiaries’ expense ratio and underwriting profitability, and such costs may exceed Donegal Mutual’s and our expectations.

Donegal Mutual is currently in the midst of a multi-year effort to modernize certain of its key infrastructure and applications systems. These new systems are intended to provide various benefits to Donegal Mutual and our insurance subsidiaries, including streamlined workflows and business processes, service enhancements for their agents and policyholders, opportunities to implement new product models and innovative business solutions, greater utilization of data analytics and operational efficiencies. Our insurance subsidiaries will issue workers’ compensation policies from the new systems beginning with new policies effective in May 2020 and renewal policies effective in June 2020. Over the next several years, Donegal Mutual expects to implement new systems for the remaining lines of business Donegal Mutual and our insurance subsidiaries offer currently. Even with Donegal Mutual’s and our best planning and efforts and the involvement of third-party experts, Donegal Mutual may not complete the implementation of these new systems within its planned time frames or budget. Further, Donegal Mutual’s information technology systems may not deliver the benefits Donegal Mutual and we expect and may fail to keep pace with our competitors’ information technology systems. As a result, Donegal Mutual and our insurance subsidiaries may not have the ability to grow their business and meet their profitability objectives.

-32-

Donegal Mutual has established various security measures to protect its information technology systems and confidential data, unanticipated computer viruses, malware, power outages, unauthorized access or other cyberattacks could disrupt those systems or result in the misappropriation or loss of confidential data. Donegal Mutual could experience technology system failures or other outages that would impact the availability of its information technology systems. Donegal Mutual has experienced brief disruptions of systems in the past, including those systems that allow underwriting and processing of new policies. Disruption in the availability of Donegal Mutual’s information technology systems could impactaffect the ability of Donegal Mutual and our insurance subsidiaries to underwrite and process their policies timely, process and settle claims promptly and provide expected levels of customer service to agents and policyholders.

-33-

Item 2. Properties. |

|

Item 3. Legal |

Proceedings. |

Item 4. Mine |

Safety Disclosures. |

-34-

-35-

Period | (a) Total Number of Shares (or Units) Purchased | (b) Average Price Paid per Share (or Unit) | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs | ||||

| Month #1 October 1-31, 2020 | Class A – None Class B – None | Class A – None Class B – None | Class A – None Class B – None | |||||

Month #2 November 1-30, 2020 | Class A – None Class B – None | Class A – None Class B – None | Class A – None Class B – None | |||||

| Month #3 December 1-31, 2020 | Class A – 135,000 Class B – None | Class A – $14.17 Class B – None | Class A – 135,000 Class B – None | (1) | ||||

Total | Class A – 135,000 Class B – None | Class A – $14.17 Class B – None | Class A – 135,000 Class B – None | |||||

| (1) | Donegal Mutual purchased these shares pursuant to its announcement on August 17, 2004 that it will, at its discretion, purchase shares of our Class A common stock and Class B common stock at market prices prevailing from time to time in the open market subject to the provisions of SEC Rule 10b-18 and in privately negotiated transactions. Such announcement did not stipulate a maximum number of shares that may be purchased under this program. |

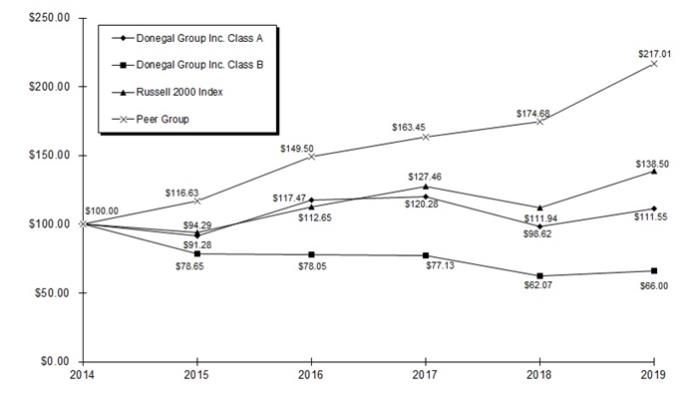

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||||||

Donegal Group Inc. Class A | $ | 100.00 | $ | 91.28 | $ | 117.47 | $ | 120.28 | $ | 98.62 | $ | 111.55 | ||||||||||||

Donegal Group Inc. Class B | 100.00 | 78.65 | 78.05 | 77.13 | 62.07 | 66.00 | ||||||||||||||||||

Russell 2000 Index | 100.00 | 94.29 | 112.65 | 127.46 | 111.94 | 138.50 | ||||||||||||||||||

Peer Group | 100.00 | 116.63 | 149.50 | 163.45 | 174.68 | 217.01 | ||||||||||||||||||

2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||||||||||||||||||

Donegal Group Inc. Class A | $ | 100.00 | $ | 128.69 | $ | 131.77 | $ | 108.04 | $ | 122.20 | $ | 119.72 | ||||||||||||

Donegal Group Inc. Class B | 100.00 | 99.24 | 98.07 | 78.92 | 83.91 | 84.83 | ||||||||||||||||||

Russell 2000 Index | 100.00 | 121.31 | 139.08 | 123.77 | 156.60 | 188.27 | ||||||||||||||||||

Peer Group | 100.00 | 128.19 | 140.15 | 149.78 | 186.07 | 161.93 | ||||||||||||||||||

-36-

Item 6. | Selected Financial Data. |

| Year Ended December 31, | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

Income Statement Data | ||||||||||||||||||||

Premiums earned | $ | 756,078,400 | $ | 741,290,873 | $ | 702,514,755 | $ | 656,204,797 | $ | 605,640,728 | ||||||||||

Investment income, net | 29,514,955 | 26,907,656 | 23,527,304 | 22,632,730 | 20,949,698 | |||||||||||||||

Investment gains (losses) | 21,984,617 | (4,801,509 | ) | 5,705,255 | 2,525,575 | 1,934,424 | ||||||||||||||

Total revenues | 812,451,471 | 771,828,320 | 739,026,537 | 688,423,020 | 636,387,263 | |||||||||||||||

Income (loss) before income tax expense (benefit) | 57,081,030 | (48,236,849 | ) | 12,114,462 | 41,328,407 | 27,592,268 | ||||||||||||||

Income tax expense (benefit) | 9,929,286 | (15,476,509 | ) | 4,998,362 | 10,527,270 | 6,602,235 | ||||||||||||||

Net income (loss) | 47,151,744 | (32,760,340 | ) | 7,116,100 | 30,801,137 | 20,990,033 | ||||||||||||||

Basic earnings (loss) per share - Class A | 1.68 | (1.18 | ) | 0.27 | 1.19 | 0.78 | ||||||||||||||

Diluted earnings (loss) per share - Class A | 1.67 | (1.18 | ) | 0.26 | 1.16 | 0.77 | ||||||||||||||

Cash dividends per share - Class A | 0.58 | 0.57 | 0.56 | 0.55 | 0.54 | |||||||||||||||

Basic earnings (loss) per share - Class B | 1.51 | (1.09 | ) | 0.22 | 1.06 | 0.69 | ||||||||||||||

Diluted earnings (loss) per share - Class B | 1.51 | (1.09 | ) | 0.22 | 1.06 | 0.69 | ||||||||||||||

Cash dividends per share - Class B | 0.51 | 0.50 | 0.49 | 0.48 | 0.47 | |||||||||||||||

Balance Sheet Data at Year End | ||||||||||||||||||||

Total investments | $ | 1,110,553,363 | $ | 1,030,798,566 | $ | 1,005,869,705 | $ | 945,519,655 | $ | 900,822,274 | ||||||||||

Total assets | 1,923,161,131 | 1,832,078,267 | 1,737,919,778 | 1,623,131,037 | 1,537,834,415 | |||||||||||||||

Debt obligations | 40,000,000 | 65,000,000 | 64,000,000 | 74,000,000 | 86,000,000 | |||||||||||||||

Stockholders’ equity | 451,015,519 | 398,869,901 | 448,696,104 | 438,615,320 | 408,388,568 | |||||||||||||||

Book value per share | 15.67 | 14.05 | 15.95 | 16.21 | 15.66 | |||||||||||||||

-37-

Year Ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

Income Statement Data | ||||||||||||||||||||

Premiums earned | $ | 742,040,339 | $ | 756,078,400 | $ | 741,290,873 | $ | 702,514,755 | $ | 656,204,797 | ||||||||||

Investment income, net | 29,504,466 | 29,514,955 | 26,907,656 | 23,527,304 | 22,632,730 | |||||||||||||||

Investment gains (losses) | 2,777,919 | 21,984,617 | (4,801,509 | ) | 5,705,255 | 2,525,575 | ||||||||||||||

Total revenues | 777,819,910 | 812,451,471 | 771,828,320 | 739,026,537 | 688,423,020 | |||||||||||||||

Income (loss) before income tax expense (benefit) | 63,272,503 | 57,081,030 | (48,236,849 | ) | 12,114,462 | 41,328,407 | ||||||||||||||

Income tax expense (benefit) | 10,457,251 | 9,929,286 | (15,476,509 | ) | 4,998,362 | 10,527,270 | ||||||||||||||

Net income (loss) | 52,815,252 | 47,151,744 | (32,760,340 | ) | 7,116,100 | 30,801,137 | ||||||||||||||

Basic earnings (loss) per share - Class A | 1.84 | 1.68 | (1.18 | ) | 0.27 | 1.19 | ||||||||||||||

Diluted earnings (loss) per share - Class A | 1.83 | 1.67 | (1.18 | ) | 0.26 | 1.16 | ||||||||||||||

Cash dividends per share - Class A | 0.60 | 0.58 | 0.57 | 0.56 | 0.55 | |||||||||||||||

Basic earnings (loss) per share - Class B | 1.65 | 1.51 | (1.09 | ) | 0.22 | 1.06 | ||||||||||||||

Diluted earnings (loss) per share - Class B | 1.65 | 1.51 | (1.09 | ) | 0.22 | 1.06 | ||||||||||||||

Cash dividends per share - Class B | 0.53 | 0.51 | 0.50 | 0.49 | 0.48 | |||||||||||||||

Balance Sheet Data at Year End | ||||||||||||||||||||

Total investments | $ | 1,221,201,784 | $ | 1,110,553,363 | $ | 1,030,798,566 | $ | 1,005,869,705 | $ | 945,519,655 | ||||||||||

Total assets | 2,160,520,324 | 1,923,161,131 | 1,832,078,267 | 1,737,919,778 | 1,623,131,037 | |||||||||||||||

Debt obligations | 90,000,000 | 40,000,000 | 65,000,000 | 64,000,000 | 74,000,000 | |||||||||||||||

Stockholders’ equity | 517,774,120 | 451,015,519 | 398,869,901 | 448,696,104 | 438,615,320 | |||||||||||||||

Book value per share | 17.13 | 15.67 | 14.05 | 15.95 | 16.21 | |||||||||||||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

During

2020.

-38-

-39-

represented 2.7% of the December 31, 2018 net carried reserves and resulted primarily from lower-than-expected severity in the workers’ compensation line of business, partially offset by higher-than-expected severity in the commercial automobile and commercial multi-peril lines of business, for accident years prior to 2019. The majority of the 2019 development related to decreases in the liability for losses and loss expenses of prior years for Atlantic States and Michigan.MICO. The 2018 development represented 9.3% of the December 31, 2017 net carried reserves and resulted primarily from higher-than-expected severity in the commercial multi-peril,multi-

-40-

| 2019 | 2018 | |||||||

| (in thousands) | ||||||||

Commercial lines: | ||||||||

Automobile | $ | 126,224 | $ | 106,734 | ||||

Workers’ compensation | 109,060 | 109,512 | ||||||

Commercial multi-peril | 102,424 | 85,937 | ||||||

Other | 9,115 | 5,207 | ||||||

|

|

|

| |||||

Total commercial lines | 346,823 | 307,390 | ||||||

|

|

|

| |||||

Personal lines: | ||||||||

Automobile | 132,191 | 144,788 | ||||||

Homeowners | 23,494 | 18,374 | ||||||

Other | 4,398 | 4,846 | ||||||

|

|

|

| |||||

Total personal lines | 160,083 | 168,008 | ||||||

|

|

|

| |||||

Total commercial and personal lines | 506,906 | 475,398 | ||||||

Plus reinsurance recoverable | 362,768 | 339,267 | ||||||

|

|

|

| |||||

Total liability for losses and loss expenses | $ | 869,674 | $ | 814,665 | ||||

|

|

|

| |||||

2020 | 2019 | |||||||

| (in thousands) | ||||||||

Commercial lines: | ||||||||

Automobile | $ | 151,813 | $ | 126,224 | ||||

Workers’ compensation | 118,037 | 109,060 | ||||||

Commercial multi-peril | 126,299 | 102,424 | ||||||

Other | 13,212 | 9,115 | ||||||

Total commercial lines | 409,361 | 346,823 | ||||||

Personal lines: | ||||||||

Automobile | 120,861 | 132,191 | ||||||

Homeowners | 20,976 | 23,494 | ||||||

Other | 5,991 | 4,398 | ||||||

Total personal lines | 147,828 | 160,083 | ||||||

Total commercial and personal lines | 557,189 | 506,906 | ||||||

Plus reinsurance recoverable | 404,818 | 362,768 | ||||||

Total liability for losses and loss expenses | $ | 962,007 | $ | 869,674 | ||||

Change in Loss and Loss Expense Reserves Net of Reinsurance | Adjusted Loss and Loss Reinsurance at December 31, 2019 | Percentage Change in Equity at December 31, 2019(1) | Adjusted Loss and Loss Reinsurance at December 31, 2018 | Percentage Change in Equity at December 31, 2018(1) | ||||

| (dollars in thousands) | ||||||||

-10.0% | $456,215 | 8.9% | $427,858 | 9.4% | ||||

-7.5 | 468,888 | 6.7 | 439,743 | 7.1 | ||||

-5.0 | 481,561 | 4.4 | 451,628 | 4.7 | ||||

-2.5 | 494,233 | 2.2 | 463,513 | 2.4 | ||||

Base | 506,906 | — | 475,398 | — | ||||

2.5 | 519,579 | -2.2 | 487,283 | -2.4 | ||||

5.0 | 532,251 | -4.4 | 499,168 | -4.7 | ||||

7.5 | 544,924 | -6.7 | 511,053 | -7.1 | ||||

10.0 | 557,597 | -8.9 | 522,938 | -9.4 | ||||

Change in Loss and Loss Expense Reserves Net of Reinsurance | Adjusted Loss and Loss Expense Reserves Net of Reinsurance at December 31, 2020 | Percentage Change in Equity at December 31, 2020(1) | Adjusted Loss and Loss Expense Reserves Net of Reinsurance at December 31, 2019 | Percentage Change in Equity at December 31, 2019(1) | ||||||||||||

| (dollars in thousands) | ||||||||||||||||

-10.0% | $ | 501,470 | 8.5 | % | $ | 456,215 | 8.9 | % | ||||||||

-7.5 | 515,400 | 6.4 | 468,888 | 6.7 | ||||||||||||

-5.0 | 529,330 | 4.3 | 481,561 | 4.4 | ||||||||||||

-2.5 | 543,259 | 2.1 | 494,233 | 2.2 | ||||||||||||

Base | 557,189 | — | 506,906 | — | ||||||||||||

2.5 | 571,119 | -2.1 | 519,579 | -2.2 | ||||||||||||

5.0 | 585,048 | -4.3 | 532,251 | -4.4 | ||||||||||||

7.5 | 598,978 | -6.4 | 544,924 | -6.7 | ||||||||||||

10.0 | 612,908 | -8.5 | 557,597 | -8.9 | ||||||||||||

| (1) | Net of income tax effect. |

-41-

subsidiaries consistently apply actuarial loss reserving techniques and assumptions, which rely on historical information as adjusted to reflect current conditions, including consideration of recent case reserve activity. Our insurance subsidiaries use the most-likely numberpoint estimate their actuaries determine.Forselect.

| For the Year Ended December 31, | ||||||||

| (dollars in thousands) | 2019 | 2018 | ||||||

Number of claims pending, beginning of period | 2,902 | 2,906 | ||||||

Number of claims reported | 6,868 | 6,475 | ||||||

Number of claims settled or dismissed | 6,756 | 6,479 | ||||||

Number of claims pending, end of period | 3,014 | 2,902 | ||||||

Losses paid | $ | 42,043 | $ | 43,129 | ||||

Loss expenses paid | 8,885 | 9,226 | ||||||

-42-

For the Year Ended December 31, | ||||||||

| (dollars in thousands) | 2020 | 2019 | ||||||

Number of claims pending, beginning of period | 3,014 | 2,902 | ||||||

Number of claims reported | 5,935 | 6,868 | ||||||

Number of claims settled or dismissed | 6,051 | 6,756 | ||||||

Number of claims pending, end of period | 2,898 | 3,014 | ||||||

Losses paid | $ | 38,204 | $ | 42,043 | ||||

Loss expenses paid | 9,065 | 8,885 | ||||||

2019.

| Year Ended December 31, | ||||||||||||

| (in thousands) | 2019 | 2018 | 2017 | |||||||||

Net premiums written: | ||||||||||||

Commercial lines: | ||||||||||||

Automobile | $ | 122,142 | $ | 108,123 | $ | 99,333 | ||||||

Workers’ compensation | 113,684 | 109,022 | 109,884 | |||||||||

Commercial multi-peril | 138,750 | 117,509 | 110,313 | |||||||||

Other | 30,303 | 15,241 | 9,586 | |||||||||

|

|

|

|

|

| |||||||

Total commercial lines | 404,879 | 349,895 | 329,116 | |||||||||

|

|

|

|

|

| |||||||

Personal lines: | ||||||||||||

Automobile | 210,507 | 249,275 | 255,297 | |||||||||

Homeowners | 117,118 | 123,782 | 125,054 | |||||||||

Other | 20,097 | 21,064 | 19,672 | |||||||||

|

|

|

|

|

| |||||||

Total personal lines | 347,722 | 394,121 | 400,023 | |||||||||

|

|

|

|

|

| |||||||

Total net premiums written | $ | 752,601 | $ | 744,016 | $ | 729,139 | ||||||

|

|

|

|

|

| |||||||

Components of combined ratio: | ||||||||||||

Loss ratio | 67.0 | % | 77.8 | % | 69.4 | % | ||||||

Expense ratio | 31.3 | 31.6 | 32.9 | |||||||||

Dividend ratio | 1.2 | 0.7 | 0.7 | |||||||||

|

|

|

|

|

| |||||||

Combined ratio | 99.5 | % | 110.1 | % | 103.0 | % | ||||||

|

|

|

|

|

| |||||||

Revenues: | ||||||||||||

Premiums earned: | ||||||||||||

Commercial lines | $ | 385,465 | $ | 337,924 | $ | 318,391 | ||||||

Personal lines | 370,613 | 403,367 | 384,124 | |||||||||

|

|

|

|

|

| |||||||

Total premiums earned | 756,078 | 741,291 | 702,515 | |||||||||

Net investment income | 29,515 | 26,908 | 23,527 | |||||||||

Investment gains (losses) | 21,985 | (4,802 | ) | 5,705 | ||||||||

Equity in earnings of DFSC | 295 | 2,694 | 1,622 | |||||||||

Other | 4,578 | 5,737 | 5,658 | |||||||||

|

|

|

|

|

| |||||||

Total revenues | $ | 812,451 | $ | 771,828 | $ | 739,027 | ||||||

|

|

|

|

|

| |||||||

-43-

Year Ended December 31, | ||||||||||||

| (in thousands) | 2020 | 2019 | 2018 | |||||||||

Net premiums written: | ||||||||||||

Commercial lines: | ||||||||||||

Automobile | $ | 135,294 | $ | 122,142 | $ | 108,123 | ||||||

Workers’ compensation | 109,960 | 113,684 | 109,022 | |||||||||

Commercial multi-peril | 147,993 | 138,750 | 117,509 | |||||||||

Other | 32,739 | 30,303 | 15,241 | |||||||||

Total commercial lines | 425,986 | 404,879 | 349,895 | |||||||||

Personal lines: | ||||||||||||

Automobile | 184,602 | 210,507 | 249,275 | |||||||||

Homeowners | 111,886 | 117,118 | 123,782 | |||||||||

Other | 19,666 | 20,097 | 21,064 | |||||||||

Total personal lines | 316,154 | 347,722 | 394,121 | |||||||||

Total net premiums written | $ | 742,140 | $ | 752,601 | $ | 744,016 | ||||||

Components of combined ratio: | ||||||||||||

Loss ratio | 62.0 | % | 67.0 | % | 77.8 | % | ||||||

Expense ratio | 33.0 | 31.3 | 31.6 | |||||||||

Dividend ratio | 1.0 | 1.2 | 0.7 | |||||||||

Combined ratio | 96.0 | % | 99.5 | % | 110.1 | % | ||||||

Revenues: | ||||||||||||

Net premiums earned: | ||||||||||||

Commercial lines | $ | 412,877 | $ | 385,465 | $ | 337,924 | ||||||

Personal lines | 329,163 | 370,613 | 403,367 | |||||||||

Total net premiums earned | 742,040 | 756,078 | 741,291 | |||||||||

Net investment income | 29,504 | 29,515 | 26,908 | |||||||||

Investment gains (losses) | 2,778 | 21,985 | (4,802 | ) | ||||||||

Equity in earnings of DFSC | — | 295 | 2,694 | |||||||||

Other | 3,497 | 4,578 | 5,737 | |||||||||

Total revenues | $ | 777,819 | $ | 812,451 | $ | 771,828 | ||||||

| Year Ended December 31, | ||||||||||||

| (in thousands) | 2019 | 2018 | 2017 | |||||||||

Components of net income: | ||||||||||||

Underwriting income (loss): | ||||||||||||

Commercial lines | $ | 8,404 | $ | (22,059 | ) | $ | 13,263 | |||||

Personal lines | (1,617 | ) | (53,590 | ) | (39,042 | ) | ||||||

|

|

|

|

|

| |||||||

SAP underwriting income (loss) | 6,787 | (75,649 | ) | (25,779 | ) | |||||||

GAAP adjustments | (3,079 | ) | 894 | 4,408 | ||||||||

|

|

|

|

|

| |||||||

GAAP underwriting income (loss) | 3,708 | (74,755 | ) | (21,371 | ) | |||||||

Net investment income | 29,515 | 26,908 | 23,527 | |||||||||

Investment gains (losses) | 21,985 | (4,802 | ) | 5,705 | ||||||||

Equity in earnings of DFSC | 295 | 2,694 | 1,622 | |||||||||

Other | 1,578 | 1,718 | 2,631 | |||||||||

|

|

|

|

|

| |||||||

Income (loss) before income tax expense (benefit) | 57,081 | (48,237 | ) | 12,114 | ||||||||

Income tax expense (benefit) | 9,929 | (15,477 | ) | 4,998 | ||||||||

|

|

|

|

|

| |||||||

Net income (loss) | $ | 47,152 | $ | (32,760 | ) | $ | 7,116 | |||||

|

|

|

|

|

| |||||||

Year Ended December 31, | ||||||||||||

| (in thousands) | 2020 | 2019 | 2018 | |||||||||

Components of net income (loss): | ||||||||||||

Underwriting income (loss): | ||||||||||||

Commercial lines | $ | (858 | ) | $ | 8,404 | $ | (22,059 | ) | ||||

Personal lines | 31,764 | (1,617 | ) | (53,590 | ) | |||||||

SAP underwriting income (loss) | 30,906 | 6,787 | (75,649 | ) | ||||||||

GAAP adjustments | (959 | ) | (3,079 | ) | 894 | |||||||

GAAP underwriting income (loss) | 29,947 | 3,708 | (74,755 | ) | ||||||||

Net investment income | 29,504 | 29,515 | 26,908 | |||||||||

Investment gains (losses) | 2,778 | 21,985 | (4,802 | ) | ||||||||

Equity in earnings of DFSC | — | 295 | 2,694 | |||||||||

Other | 1,043 | 1,578 | 1,718 | |||||||||

Income (loss) before income tax expense (benefit) | 63,272 | 57,081 | (48,237 | ) | ||||||||

Income tax expense (benefit) | 10,457 | 9,929 | (15,477 | ) | ||||||||

Net income (loss) | $ | 52,815 | $ | 47,152 | $ | (32,760 | ) | |||||

| Year Ended December 31, | ||||||||||||

| 2019 | 2018 | 2017 | ||||||||||

Net premiums earned | $ | 756,078,400 | $ | 741,290,873 | $ | 702,514,755 | ||||||

Change in net unearned premiums | (3,477,111 | ) | 2,724,931 | 26,624,163 | ||||||||

|

|

|

|

|

| |||||||

Net premiums written | $ | 752,601,289 | $ | 744,015,804 | $ | 729,138,918 | ||||||

|

|

|

|

|

| |||||||

2018:

Year Ended December 31, | ||||||||||||

2020 | 2019 | 2018 | ||||||||||

Net premiums earned | $ | 742,040,339 | $ | 756,078,400 | $ | 741,290,873 | ||||||

Change in net unearned premiums | 99,554 | (3,477,111 | ) | 2,724,931 | ||||||||

Net premiums written | $ | 742,139,893 | $ | 752,601,289 | $ | 744,015,804 | ||||||

-44-

| Year Ended December 31, | ||||||||||||

| 2019 | 2018 | 2017 | ||||||||||

GAAP Combined Ratios (Total Lines) | ||||||||||||

Loss ratio(non-weather) | 60.9 | % | 69.0 | % | 61.1 | % | ||||||

Loss ratio (weather-related) | 6.1 | 8.8 | 8.3 | |||||||||

Expense ratio | 31.3 | 31.6 | 32.9 | |||||||||

Dividend ratio | 1.2 | 0.7 | 0.7 | |||||||||

|

|

|

|

|

| |||||||

Combined ratio | 99.5 | % | 110.1 | % | 103.0 | % | ||||||

|

|

|

|

|

| |||||||

Statutory Combined Ratios | ||||||||||||

Commercial lines: | ||||||||||||

Automobile | 117.4 | % | 133.3 | % | 115.0 | % | ||||||

Workers’ compensation | 78.5 | 86.6 | 79.0 | |||||||||

Commercial multi-peril | 93.7 | 98.1 | 96.7 | |||||||||

Other | 72.6 | 54.6 | 10.2 | |||||||||

Total commercial lines | 95.0 | 103.8 | 93.6 | |||||||||

Personal lines: | ||||||||||||

Automobile | 105.7 | 117.4 | 109.3 | |||||||||

Homeowners | 101.2 | 110.5 | 109.9 | |||||||||

Other | 73.2 | 96.4 | 90.8 | |||||||||

Total personal lines | 102.6 | 114.1 | 108.5 | |||||||||

Total commercial and personal lines | 98.7 | 109.4 | 101.7 | |||||||||

-45-

Year Ended December 31, | ||||||||||||

2020 | 2019 | 2018 | ||||||||||

GAAP Combined Ratios (Total Lines) | ||||||||||||

Loss ratio (non-weather) | 55.1 | % | 60.9 | % | 69.0 | % | ||||||

Loss ratio (weather-related) | 6.9 | 6.1 | 8.8 | |||||||||

Expense ratio | 33.0 | 31.3 | 31.6 | |||||||||

Dividend ratio | 1.0 | 1.2 | 0.7 | |||||||||

Combined ratio | 96.0 | % | 99.5 | % | 110.1 | % | ||||||

Statutory Combined Ratios | ||||||||||||

Commercial lines: | ||||||||||||

Automobile | 112.7 | % | 117.4 | % | 133.3 | % | ||||||

Workers’ compensation | 86.3 | 78.5 | 86.6 | |||||||||

Commercial multi-peril | 98.4 | 93.7 | 98.1 | |||||||||

Other | 74.0 | 72.6 | 54.6 | |||||||||

Total commercial lines | 97.8 | 95.0 | 103.8 | |||||||||

Personal lines: | ||||||||||||

Automobile | 91.3 | 105.7 | 117.4 | |||||||||

Homeowners | 97.2 | 101.2 | 110.5 | |||||||||

Other | 74.9 | 73.2 | 96.4 | |||||||||

Total personal lines | 92.4 | 102.6 | 114.1 | |||||||||

Total commercial and personal lines | 95.4 | 98.7 | 109.4 | |||||||||

-46-

YEAR ENDED DECEMBER 31, 2018 COMPARED TO YEAR ENDED DECEMBER 31, 2017

Net Premiums Earned

Our insurance subsidiaries’ net premiums earned increased to $741.3 million for 2018, an increase of $38.8 million, or 5.5%, over 2017, reflecting increases in net premiums written during 2017 and 2018. Our insurance subsidiaries earn premiums and recognize them as income over the terms of the policies they issue. Such terms are generally one year or less in duration. Therefore, increases or decreases in net premiums earned generally reflect increases or decreases in net premiums written in the preceding twelve-month period compared to the same period one year earlier.

Net Premiums Written

Our insurance subsidiaries’ 2018 net premiums written increased 2.0% to $744.0 million, compared to $729.1 million for 2017. We attribute the increase primarily to the impact of premium rate increases and an increase in the writing of new accounts in commercial lines of business. Commercial lines net premiums written increased $20.8 million, or 6.3%, for 2018 compared to 2017. Personal lines net premiums written decreased $5.9 million, or 1.5%, for 2018 compared to 2017. We attribute the decrease in personal lines primarily to net attrition that resulted from increased pricing on renewal policies and underwriting measures our insurance subsidiaries implemented to slow new policy growth.

-47-

Investment Income

For 2018, our net investment income increased to $26.9 million, an increase of $3.4 million, or 14.4%, over 2017. We attribute the increase primarily to an increase in average invested assets.

Net Investment (Losses) Gains

Our net investment (losses) gains in 2018 and 2017 were ($4.8 million) and $5.7 million, respectively. The net investment losses for 2018 were primarily related to a decrease in the market value of the equity securities we held at December 31, 2018. We adopted new accounting guidance effective January 1, 2018 that requires us to measure equity investments at fair value and recognize changes in fair value in our results of operations. The net investment gains for 2017 resulted primarily from strategic sales of equity securities within our investment portfolio and unrealized gains within a limited partnership that invests in equity securities. We did not recognize any impairment losses during 2018 or 2017.

Equity in Earnings of DFSC

Our equity in the earnings of DFSC in 2018 and 2017 was $2.7 million and $1.6 million, respectively. We attribute the increase in DFSC’s earnings primarily to higher net interest income related to loan portfolio growth that DFSC achieved during 2018.

Losses and Loss Expenses

Our insurance subsidiaries’ loss ratio, which is the ratio of incurred losses and loss expenses to premiums earned, was 77.8% in 2018, compared to 69.4% in 2017. Our insurance subsidiaries’ commercial lines loss ratio increased to 72.9% in 2018, compared to 62.0% in 2017. This increase resulted primarily from the commercial automobile loss ratio increasing to 101.9% in 2018, compared to 80.3% in 2017, and the commercial multi-peril loss ratio increasing to 67.0% in 2018, compared to 64.6% in 2017. The personal lines loss ratio was 81.8% in 2018 compared to 75.5% in 2017. Our insurance subsidiaries experienced unfavorable loss reserve development of approximately $35.6 million during 2018 in their reserves for prior accident years, compared to approximately $6.6 million during 2017. The unfavorable loss reserve development resulted primarily from higher-than-expected severity in the commercial multi-peril, personal automobile and commercial automobile lines of business, offset by lower-than-expected severity in the workers’ compensation line of business.

Underwriting Expenses

Our insurance subsidiaries’ expense ratio, which is the ratio of policy acquisition and other underwriting expenses to premiums earned, was 31.6% in 2018, compared to 32.9% in 2017. We attribute the decrease to lower underwriting-based incentive compensation in 2018.

Combined Ratio

Our insurance subsidiaries’ combined ratio was 110.1% and 103.0% in 2018 and 2017, respectively. The combined ratio represents the sum of the loss ratio, the expense ratio and the dividend ratio, which is the ratio of workers’ compensation policy dividends incurred to premiums earned. We attribute the increase in our combined ratio primarily to the increase in our loss ratio.

Interest Expense

Our interest expense in 2018 increased to $2.3 million, compared to $1.6 million in 2017. We attribute the increase to higher interest rates in effect during 2018 compared to 2017.

Income Taxes

Our income tax benefit was $15.5 million in 2018, compared to income tax expense of $5.0 million in 2017. Our 2018 income tax benefit reflected our anticipation of an estimated carryback of our taxable loss in 2018 to prior tax years. Our 2017 income tax expense reflected additional tax expense of $4.8 million in 2017 related to the revaluation of our net deferred tax assets pursuant to the Tax Cuts and Jobs Act (the “TCJA”).

-48-

Net (Loss) Income and (Loss) Earnings Per Share

Our net loss in 2018 was $32.8 million, or $1.18 per share of Class A common stock and $1.09 per share of Class B common stock, compared to net income of $7.1 million, or $0.26 per share of Class A common stock on a diluted basis and $0.22 per share of Class B common stock, in 2017. We had 22.8 million and 22.6 million Class A shares outstanding at December 31, 2018 and 2017, respectively. We had 5.6 million Class B shares outstanding for both periods. There are no outstanding securities that dilute our shares of Class B common stock.

Book Value Per Share

Our stockholders’ equity decreased by $49.8 million in 2018 as a result of our net loss, net unrealized losses within ouravailable-for-sale fixed maturity investments and dividends we declared to our stockholders during the year. Our book value per share decreased to $14.05 at December 31, 2018, compared to $15.95 a year earlier.

-49-

| (in thousands) | Total | Less than 1 year | 1-3 years | 4-5 years | After 5 years | |||||||||||||||

Net liability for unpaid losses and loss expenses of our insurance subsidiaries | $ | 506,906 | $ | 231,924 | $ | 237,195 | $ | 18,976 | $ | 18,811 | ||||||||||

Subordinated debentures | 5,000 | — | — | — | 5,000 | |||||||||||||||

Borrowings under lines of credit | 35,000 | — | — | 35,000 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total contractual obligations | $ | 546,906 | $ | 231,924 | $ | 237,195 | $ | 53,976 | $ | 23,811 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

2020:

| (in thousands) | Total | Less than 1 year | 1-3 years | 4-5 years | After 5 years | |||||||||||||||

Net liability for unpaid losses and loss expenses of our insurance subsidiaries | $ | 557,189 | $ | 256,165 | $ | 260,460 | $ | 20,237 | $ | 20,327 | ||||||||||

Subordinated debentures | 5,000 | — | — | — | 5,000 | |||||||||||||||

Borrowings under lines of credit | 85,000 | 50,000 | — | 35,000 | — | |||||||||||||||

Total contractual obligations | $ | 647,189 | $ | 306,165 | $ | 260,460 | $ | 55,237 | $ | 25,327 | ||||||||||

-50-

| December 31, | ||||||||||||||||

| 2019 | 2018 | |||||||||||||||

| (dollars in thousands) | Amount | Percent of Total | Amount | Percent of Total | ||||||||||||

Fixed maturities: | ||||||||||||||||

Total held to maturity | $ | 476,094 | 42.9 | % | $ | 402,799 | 39.1 | % | ||||||||

Total available for sale | 564,952 | 50.8 | 526,558 | 51.1 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total fixed maturities | 1,041,046 | 93.7 | 929,357 | 90.2 | ||||||||||||

Equity securities | 55,477 | 5.0 | 43,667 | 4.2 | ||||||||||||

Investment in affiliate | — | — | 41,026 | 4.0 | ||||||||||||

Short-term investments | 14,030 | 1.3 | 16,749 | 1.6 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total investments | $ | 1,110,553 | 100.0 | % | $ | 1,030,799 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

December 31, | ||||||||||||||||

2020 | 2019 | |||||||||||||||

| (dollars in thousands) | Amount | Percent of Total | Amount | Percent of Total | ||||||||||||

Fixed maturities: | ||||||||||||||||

Total held to maturity | $ | 586,609 | 48.0 | % | $ | 476,094 | 42.9 | % | ||||||||

Total available for sale | 555,136 | 45.5 | 564,952 | 50.8 | ||||||||||||

Total fixed maturities | 1,141,745 | 93.5 | 1,041,046 | 93.7 | ||||||||||||

Equity securities | 58,556 | 4.8 | 55,477 | 5.0 | ||||||||||||

Short-term investments | 20,901 | 1.7 | 14,030 | 1.3 | ||||||||||||

Total investments | $ | 1,221,202 | 100.0 | % | $ | 1,110,553 | 100.0 | % | ||||||||

2019.

2019.

In January 2016, the FASB issued guidance that generally requires entities to measure equity investments at fair value and recognize changes in fair value in their results of operations. This guidance also simplifies the impairment assessment of equity investments without readily determinable fair values by requiring entities to perform a qualitative assessment to identify impairment. The FASB issued other disclosure and presentation improvements related to financial instruments within the guidance. The guidance was effective for annual and interim reporting periods beginning after December 15, 2017. As a result of the adoption of this guidance on January 1, 2018, we transferred $4.9 million of net unrealized gains from accumulated other comprehensive income (“AOCI”) to retained earnings. We recognized $8.9 million of unrealized gains and $25,751 of unrealized losses on equity securities held at December 31, 2019 in net investment gains for 2019. We recognized $1.2 million of unrealized gains and $4.4 million of unrealized losses on equity securities held at December 31, 2018 in net investment losses for 2018.

-51-

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. |

-52-

| (in thousands) | Principal Cash Flows | Weighted- Average Interest Rate | ||||||

Fixed-maturity and short-term investments: | ||||||||

2020 | $ | 43,644 | 2.40 | % | ||||

2021 | 38,710 | 3.42 | ||||||

2022 | 37,547 | 3.06 | ||||||

2023 | 46,126 | 2.87 | ||||||

2024 | 53,971 | 3.71 | ||||||

Thereafter | 821,889 | 3.47 | ||||||

|

| |||||||

Total | $ | 1,041,887 | ||||||

|

| |||||||

Fair value | $ | 1,079,296 | ||||||

|

| |||||||

Debt: | ||||||||

2024 | $ | 35,000 | 1.74 | % | ||||

Thereafter | 5,000 | 5.00 | ||||||

|

| |||||||

Total | $ | 40,000 | ||||||

|

| |||||||

Fair value | $ | 40,000 | ||||||

|

| |||||||

| (in thousands) | Principal Cash Flows | Weighted- Average Interest Rate | ||||||

Fixed-maturity and short-term investments: | ||||||||

2021 | $ | 97,539 | 1.83 | % | ||||

2022 | 41,382 | 3.15 | ||||||

2023 | 44,923 | 3.22 | ||||||

2024 | 52,046 | 3.58 | ||||||

2025 | 60,038 | 3.53 | ||||||

Thereafter | 839,306 | 3.28 | ||||||

Total | $ | 1,135,234 | ||||||

Fair value | $ | 1,208,677 | ||||||

Debt: | ||||||||

2021 | $ | 50,000 | 0.83 | % | ||||

2024 | 35,000 | 1.74 | % | |||||

Thereafter | 5,000 | 5.00 | ||||||

Total | $ | 90,000 | ||||||

Fair value | $ | 90,000 | ||||||

-53-

| December 31, | ||||||||

| 2019 | 2018 | |||||||

Assets | ||||||||

Investments | ||||||||

Fixed maturities | ||||||||

Held to maturity, at amortized cost (fair value $500,314,344 and $405,038,296) | $ | 476,093,782 | $ | 402,798,518 | ||||

Available for sale, at fair value (amortized cost $556,839,278 and $535,112,451) | 564,951,803 | 526,558,304 | ||||||

Equity securities, at fair value | 55,477,556 | 43,667,009 | ||||||

Investment in Donegal Financial Services Corporation | — | 41,025,975 | ||||||