| Line of Business | Product / Service | Product / service description | Primary pricing method | |||||||||||||||||

IoT Connectivity 73% and 66% of revenue for the years ended 2023 and 2022, respectively | IoT Connectivity as a Service (CaaS) | •IoT Connectivity services offered through our IoT platform ‘KORE One’™ •Our connectivity solutions allow devices to seamlessly and securely connect anywhere in the world across any network connected to the Internet, which we call our multiple devices, multiple locations, multiple carriers CaaS multi-value proposition | Per subscriber per month for lifetime of device (7-10 years and growing) Multi-year contracts with automatic renewals | |||||||||||||||||

IoT Connectivity Enablement as a Service (CEaaS) Not currently provided in the United States | • IoT Connectivity Management Platform as a Service (or individual KORE One engine) • Cellular Core Network as a Service (Cloud Native Evolved Packet Core “EPC”) | |||||||||||||||||||

IoT Solutions 27% and 34% of revenue for the years ended 2023 and 2022, respectively | IoT Device Management Services | • Outsourced platform-enabled services (e.g., logistics, configuration, device management) •Sourcing of third-party devices globally, device design and selection services | Upfront fee per device or per device per month | |||||||||||||||||

| IoT Security Location Based Services (LBS) | •KORE’s SecurityPro® SaaS platform • KORE’s PositionLogic® SaaS platform and LBS APIs | Per subscriber per month | ||||||||||||||||||

Customers

Our customers operate in a wide variety of sectors, including healthcare, fleet and vehicle management, asset management, communication services, and industrial/manufacturing. KORE’s largestNo single customer comprising approximately 21% and 16%accounted for more than 10% of KORE’sour total revenue for the yearsyear ended December 31, 2021 and 2020, respectively, is2023. One customer, a large multinational medical device and health care company.

Key Partners

revenue, respectively | Multi-year contracts with automatic renewals | |||||

Enablement as a Service (CEaaS) | ||||||

Management Services | ||||||

Based Services (LBS) | ||||||

KORE’s Competition and Differentiators

•For IoT Connectivity services: telecom carriers such as T-Mobile and Vodafone; and Mobile Virtual Network Operators such as Aeris and Wireless Logic.

•For IoT Solutions and Analytics: device management services providers such as Velocitor Solutions and Futura Mobility; fleet management SaaS providers such as Fleetmatics and GPS Trackit; and analytics services providers such as Galooli and Intellisite.

5

vertical knowledge and experience (, in Connected Health through the U.S. Food and Drug Administration (“FDA”)FDA Facilities Registration, ISO 9001/13485 certification and HIPAA compliance), itsour breadth of solutions and analytics services, and 3,300+ connectivity-only customers that provide cross-selling opportunities of additional IoT managed services.

e.g.

Intellectual Property

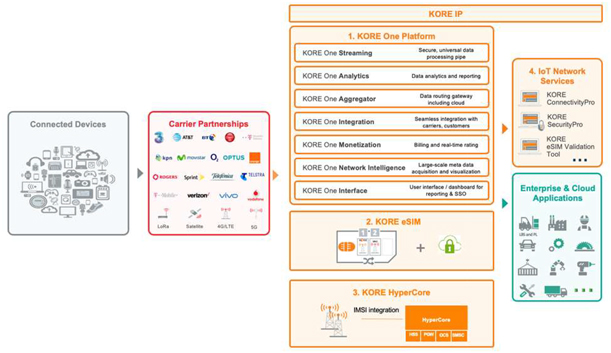

Connectivity and IOT Solutions. The KORE One Platform was built using a microservices-based proprietary architecture and consists of seven (7) keyopen, modular, and scalable engines.

KORE has developed its eSIM which helps in providing(OmniSIM and SuperSim): Our eSIM can provide global and local connectivity usingon a single eSIMSIM, which can be remotely updated with a preferred carrier profile over“over the air,air” or OTA.remotely. The key pieces of intellectual property in this portfolio include KORE’sour eSIM profile, eSIM Validation Tool, and itsour APIs.

Cloud Native HyperCore (Cellular Network as a Service): Any cellular network is comprised of a Radio Access Network (“RAN”), fiber optic backhaul, and a “core network”, the functions of which constitute the “brains” of thisthe network (including switching, authentication, etc.). Cloud Native Evolved Packet Core “EPC”HyperCore provides KOREus as well as some of itsour customers with a cellular “core network” (built on top of a cellular carrier’s RAN and backhaul from a cellular carrier). KORE’sOur intellectual property consists of both a traditional and a cloud-native core network component.

IoT Network and Application Services

•ConnectivityPro: IoT Connectivity Management Platform that provides an array of global IoT Connectivity services such as provisioning connectivity, provisioning users, rating and charging, distribution management, eSIM orchestration, diagnostics, and support.

Apart from the intellectual property listed above, KORE maintainswe maintain one active patent, several trademarks and ownership of domain and website names, all of which we consider our intellectual property.

Employees

Government Regulations and Compliance

HIPAA,

Several jurisdictions have passed laws in this area, and other jurisdictions are considering imposing additional restrictions. These laws continue to develop and may be inconsistent from jurisdiction to jurisdiction. Any entities covered by HIPAA (including entities such as KORE which track health-related data) are required by the HIPAA Privacy Rule to protect and prevent the unauthorized disclosure of patient health information known as protected health information. HIPAA also requires that covered entities comply with the HIPAA Security Rule which requires, among other things that, all covered entities (i) ensure the confidentiality, integrity and availability of all electronicelectronically protected health information; (ii) detect and safeguard against anticipated threats to the security of the information; (iii) protect against anticipated impermissible uses or disclosures; and (iv) certify compliance by their workforce.

For information regarding our oversight and management of cybersecurity and related risks, see Part I, Item 1C, “Cybersecurity”.

6

Available Information

We file electronically with the SEC our annual reports on Form We announce material

10-K,

quarterly reports on Form10-Q,

current reports on Form8-K,

proxy statements and other information. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. We make available on our website at www.korewireless.com, free of charge, copies of these reports and any amendments as soon as reasonably practicable after filing or furnishing them with the SEC.The information contained on the websites referenced in this Annual Report on Form 10-K is not incorporated by reference into this filing. Further, the Company’s references to website URLs are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

An investment in our common stock or other securities involves significant risks. Before making a decision to invest in our common stock or other securities, you should carefully consider the following risks in addition to the public about us, our products and services and other matters through a variety of means, including our website, the investor relations section of our website, press releases, filings with the SEC, and public conference calls,information contained in order to achieve broad distribution of information to the public. We encourage investors and others to review the information we make publicthis Annual Report on Form 10-K. The risks discussed in these locations, as such information could be deemed to be material information.

Summary Risk Factors

We are subject to a number of risks that, if realized, could materially and adversely affect our business, financial condition, liquidity, results

of operations and prospects and our ability to make distributions to our stockholders. Some of our more significant challenges and risks

include, but are not limited to, the following, which are described in greater detail below:

•We face risks related to compliance with laws and regulations, including, without limitation, compliance with the SEC rules and regulations and tax law compliance in various jurisdictions, and failure to comply with these various laws and regulations could result in incurrence of substantial costs or otherwise materially and adversely affect us;

•We are heavily indebted, which subjects us to an increased risk of loss;

•Our significant stockholders and their respective affiliates have significant influence over us and their actions might not be in your best interest as a stockholder;

•The price of our common stock is highly volatile, and investment in our common stock therefore carries increased risk;

•If we are unable to successfully integrate the businesses we have acquired, or any future business acquisitions, our results of operations could be materially and adversely affected;

•The 5G market may take longer to materialize than we expect or, if it does materialize rapidly, we may not be able to meet the development schedule and other customer demands;

•Our development and investments in new technologies, may not generate operating income or contribute to future results of operations that meet our expectations;

•If we are unable to support customers with low latency and/or high throughput IoT use cases, our revenue growth and profitability will be harmed;

•If we are unable to effectively manage our increasingly diverse and complex businesses and operations, our ability to generate growth and revenue from new or existing customers may be adversely affected;

•The loss of our largest customers could significantly and materially adversely impact our revenue and profitability;

•Our products are highly technical and may contain undetected errors, product defects, security vulnerabilities, or software errors;

•If there are interruptions or performance problems associated with the network infrastructure used to provide our services, our customers may experience service outages, which may impact our reputation and future sales;

•Our inability to adapt to rapid technological change in our markets could impair our ability to remain competitive and adversely affect our results of operations;

•The market for the products and services that we offer is rapidly evolving and highly competitive. We may be unable to compete effectively;

•If we are unable to protect our intellectual property and proprietary rights, our competitive position and business could be harmed;

•Failure to maintain the security of our information and technology networks, including information relating to our customers and employees, could adversely affect us;

•Our internal and customer-facing systems, and systems of third parties they rely upon, may be subject to cybersecurity breaches, disruptions, or delays;

•We are subject to evolving privacy laws that are subject to potentially differing interpretations in the United States as well as other jurisdictions that can adversely impact our business and require that we incur substantial costs;

•Our technology contains third-party open-source software components and failure to comply with the terms of the underlying open-source software licenses could restrict our ability to provide our platform;

•We face risks inherent in conducting business internationally, including compliance with international as well as U.S. laws and regulations that apply to our international operations;

7

•We may be subject to legal proceedings and litigation, including intellectual property and privacy disputes, which are costly to defend and could materially harm our business, financial condition and results of operations;

•Our management has identified internal control deficiencies that have resulted in material weaknesses in our internal control over financial reporting and disclosure controls and procedures;

•Our future capital needs are uncertain, and we may need to raise additional funds in the future, but may not be able to raise such additional funds on acceptable terms or at all; and

•We have a history of losses and may not be able to achieve or sustain profitability in the future.

The above list is not exhaustive, and we face additional challenges and risks. Please carefully consider all of the information in this Annual Report on Form 10-K, including the matters set forth below in this Part I, Item 1A.

Risks Related to Our Business and Industry

Our actual operating results may differ significantly from any guidance provided.

Our guidance, including forward-looking statements, is prepared by management and is qualified by, and subject to, a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Many of these uncertainties and contingencies are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. We generally state possible outcomes as high and low ranges which are intended to provide a sensitivity analysis as variables are changed but are not intended to represent that actual results could not fall outside of the suggested ranges.

Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions of the guidance furnished by us will not materialize or will vary significantly from actual results. In particular, guidance relating to the anticipated results of operations of an acquired business is inherently more speculative in nature than other guidance as management will, necessarily, be less familiar with the business, procedures, and operations of the acquired business. Similarly, guidance offered in periods of extreme uncertainty such as geopolitical tensions is inherently more speculative in nature than guidance offered in periods of relative stability. Accordingly, any guidance with respect to our projected financial performance is necessarily only an estimate of what management believes is realizable as of the date the guidance is given. Actual results will vary from the guidance and the variations may be material. Investors should also recognize that the reliability of any forecasted financial data will diminish the further into the future that the data is forecasted.

Actual operating results may be different from our guidance, and such differences may be adverse and material. In light of the foregoing, investors are urged to put the guidance in context and not to place undue reliance on it. In addition, the market price of our common stock may reflect various market assumptions as to the accuracy of our guidance. If our actual results of operations fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially.

Our quarterly results of operations have fluctuated and are likely to continue to fluctuate. As a result, we may fail to meet the expectations of investors or securities analysts, potentially causing our stock price to decline.

Our quarterly operating results, including the levels of our revenue, costs of revenue, exclusive of depreciation and amortization, net loss before income taxes and cash flows, may fluctuate as a result of a variety of factors, including adverse macroeconomic conditions, the product mix that we sell, the relative sales related to our platforms and solutions and other factors which are outside of our control. If our quarterly revenue or results of operations fall below the expectations of investors or securities analysts, the price of our common stock could decline substantially. Fluctuations in our results of operations may be due to a number of factors, including:

•the portion of our revenue attributable to IoT Connectivity and IoT Services, including hardware and other sales;

•our ability to manage the businesses we have acquired, and to integrate and manage any future acquisitions of businesses;

•fluctuations in demand, including due to seasonality or broader economic factors, for our platforms and solutions;

•changes in pricing by us in response to competitive pricing actions;

•the ability of our hardware vendors to continue to manufacture high-quality products and to supply sufficient components and products to meet our demands;

•the timing and success of introductions of new solutions, products or upgrades by us or our competitors and the entrance of new competitors;

•changes in our business and pricing policies or those of our competitors;

•our ability to control costs, including our operating expenses and the costs of the hardware we purchase;

•changes in U.S. trade policies, including new or potential tariffs or penalties on imported products;

•competition, including entry into the industry by new competitors and new offerings by existing competitors;

•issues related to introductions of new or improved products such as supply chain disruptions or shortages of prior generation products or short-term decreased demand for next-generation products;

•perceived or actual problems with the security, privacy, integrity, reliability, quality or compatibility of our solutions, including those related to security breaches in our systems, our subscribers’ systems, unscheduled downtime, or outages;

•the amount and timing of expenditures, including those related to expanding our operations (including through acquisitions), increasing research and development, introducing new solutions or paying litigation expenses;

8

•the ability to effectively manage growth within existing and new markets domestically and abroad;

•changes in the payment terms for our platforms and solutions;

•collectability of receivables due from customers and other third parties;

•the strength of regional, national and global economies; and

•the impact of natural disasters such as earthquakes, hurricanes, fires, power outages, floods, epidemics, pandemics and public health crises, and other catastrophic events or man-made problems such as terrorism, civil unrest and actual or threatened armed conflict, or global or regional economic, political, and social conditions.

We have a history of operating losses and may not be able to achieve or sustain profitability in the future.

We have a history of operating losses, and we may not achieve or maintain profitability in the future. We are not certain whether or when we will be able to achieve or sustain profitability in the future. Additionally, expenses may increase in future periods if we continue to invest in growth, which could negatively affect our future results of operations if our revenue does not increase commensurate with our expenses. Any failure to increase our revenue as we invest in our business, or to manage our costs, could prevent us from achieving or maintaining profitability or positive cash flow. If we are unable to successfully address these risks and challenges, our business, financial condition, results of operations, and prospects could be materially adversely affected.

We have historically grown by acquisition. Investment in new business strategies and acquisitions could result in operating difficulties, dilution of our common stock, and other consequences that could harm our business, financial condition, and operating results.

New business strategies and acquisitions are important elements of our strategy and use of capital. We are likely to continue to evaluate and enter into discussions regarding a wide array of such potential strategic transactions, which could create unforeseen operating difficulties and expenditures. Some of these areas where we face risk include:

•Diversion of management time and focus from operating our business to challenges related to acquisitions and other strategic transactions;

•Failure to successfully integrate the acquired operations, technologies, services and personnel (including cultural integration and retention of employees) and further develop the acquired business and technology;

•Implementation or remediation of controls, procedures, and policies at the acquired company;

•Integration of the acquired company's accounting and administrative systems, and the coordination of product, engineering, and sales and marketing functions;

•Transition of operations, users, and customers onto our existing platforms;

•In the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political, and regulatory risks associated with specific countries;

•Failure to accomplish commercial, strategic or financial objectives with respect to investments;

•Failure to realize the value of investment due to lack of liquidity;

•Liability for activities of the acquired company before the acquisition, including patent and trademark infringement claims, data privacy and security issues, violations of laws, commercial disputes, tax liabilities, warranty claims, product liabilities, and other known and unknown liabilities; and

•Litigation or other claims in connection with the acquired company, including claims from terminated employees, customers, former stockholders, or other third parties.

Our failure to address these risks or other problems encountered in connection with our past or future acquisitions and other strategic transactions could cause us to fail to realize their anticipated benefits, incur unanticipated liabilities, and harm our business generally.

Our acquisitions and other strategic transactions could also result in dilutive issuance of our equity securities, the incurrence of debt, contingent liabilities, amortization expenses, or impairment of goodwill and/or long lived-assets, and restructuring charges. Also, the anticipated benefits or value of our acquisitions and other strategic transactions may not materialize. Further, market reaction to an acquisition may not be as we anticipate. Any or all of the foregoing could materially harm our financial condition and operating results, and / or cause our stock price to decline substantially.

As a public company, we must maintain internal control over financial reporting. We have identified material weaknesses in our internal control over financial reporting. If remediation of such material weaknesses is not effective, or if we fail to develop and maintain proper and effective internal control over financial reporting and disclosure controls and procedures, our ability to produce timely and accurate financial statements, comply with applicable laws and regulations, or access the capital markets could be impaired.

As a public company, our management is responsible for designing, implementing, and actively evaluating our internal control over financial reporting in a manner that meets the standards of publicly traded companies required by Section 404(a) of the Sarbanes-Oxley Act.

The process of designing and implementing effective internal control over financial reporting is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain internal control over financial reporting that are adequate to satisfy our reporting obligations as a public company. The rules governing the standards that must be met for our management to assess our internal control over financial reporting are complex and require significant documentation,

9

testing, and remediation. Testing and maintaining our internal control over financial reporting and remediating material weaknesses may divert our management’s attention from other matters that are important to our business.

We have identified material weaknesses in our internal control over financial reporting as defined in Rule 13a-15(f) under the Exchange Act, which are disclosed in Item 9A, “Controls and Procedures”. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. For a detailed discussion regarding the material weaknesses identified as well as management’s remediation plans, see Part II, Item 9A, “Control and Procedures” in this Annual Report on Form 10-K. If we are unable to accomplish our remediation objectives in a timely and effective fashion, our ability to comply with the financial reporting requirements and other rules that apply to public companies could be impaired. We may not remediate our material weaknesses in a timely and effective manner. Furthermore, new material weaknesses may arise in the future. If our remediation measures are insufficient to address the material weaknesses, or if additional material weaknesses in our internal control are discovered or occur in the future, our financial statements may contain material misstatements and we could be required to restate our financial results.

If we fail to develop and maintain proper and effective internal control over financial reporting, or remediate our current material weaknesses in a timely fashion, our ability to produce timely and accurate financial statements, comply with applicable laws and regulations, or access capital markets could be impaired, and could also cause us to fail to meet our reporting obligations and cause stockholders to lose confidence in our financial results, which could materially and adversely affect us.

Further, there are inherent limitations in the effectiveness of any control system, including the potential for human error and the possible circumvention or overriding of controls and procedures. Additionally, judgments in decision-making can be faulty and breakdowns can occur because of a simple error or mistake. An effective control system can provide only reasonable, not absolute, assurance that the control objectives of the system are adequately met. Finally, projections of any evaluation or assessment of effectiveness of a control system to future periods are subject to the risks that, over time, controls may become inadequate because of changes in an entity’s operating environment or deterioration in the degree of compliance with policies or procedures.

Our senior management team may have limited experience with the complexities of managing a publicly traded company.

Since becoming a public company in 2021, we have been required, on an ongoing basis, to comply with various laws, regulations and requirements, including the requirements of the Exchange Act, related regulations of the SEC, and continued listing requirements of the NYSE, along with certain extremely technical and complex accounting requirements of GAAP, and reports required under these laws, regulations, and requirements, which must be communicated to the market on a timely basis. Our senior management team may have limited experience with these laws, regulations, and requirements, and a failure to timely identify any potential for noncompliance with the foregoing may result in a material adverse event, and have significant consequences to our stockholders.

Risks Related to Our Products and Technology

The 5G market may take longer to materialize than we expect or, if it does materialize rapidly, we may not be able to meet the development schedule and other customer demands.

Our growth depends in part on our ability to extend our technologies and products into new and expanded areas, including 5G. Our development and investments in these new technologies may not generate operating income or contribute to future results of operations that meet our expectations.

We continue to invest significant resources toward advancements primarily in support ofFCC, FAA,Federal Communications Commission, Federal Aviation Administration, the wireless telecommunications industry, and the aviation industry are working on solutions to

4G-

and5G-based

technologies. We also invest in new and expanded product areas by utilizing our existing technical and business expertise and through acquisitions or other strategic transactions. Our future growth depends on our ability to develop leading and cost-effective technologies and products for these new and expanded areas and developing technologies. In particular, our growth depends significantly on our ability to develop and commercialize products using 5G technologies. In January 2022, several major U.S. wireless carriers had to temporarily delay the deployment of new wireless facilities that were meant to facilitate the evolution of their wireless networks to 5G technology in response to concerns of the aviation industry that those 5G facilities could interfere with equipment used for aviation and could impede aviation safety. Although the 10

alleviate those concerns, the timing for resolution is unclear, and such uncertainty could further impact the amount of and timing of 5G network investment. To the extent the 5G rollout is further delayed due to interference with existing technologies, or adoption of 5G is slowed as a result of such concerns, we may incur significant costs and asset impairments, which could adversely affect our business, financial condition, and results of operations.

If we are unable to support customers with low latency and/or high throughput IoT use cases, our revenue growth and profitability will be harmed

As wireless networks have evolved to support higher speeds, IoT devices have included more advanced capabilities such as video, real-time event logging, edge computecomputing services (where computing is completed on or near the site of the sensor), and voice controls. As a result, customers have developed IoT applications that consume more network resources and require much lower network latency. In order to support these new customers and the increasing number of 5G use cases, we must continue to make significant investments in network capacity, infrastructure, and edge virtualization solutions. The timely deployment of higher capacity infrastructure and edge virtualization to support high throughput, low latency IoT applications is critical to keeping and attracting key customers, the failure of which could adversely affect our business, financial condition, and results of operations.

Our products are highly technical and may contain undetected errors, product defects, security vulnerabilities, or software errors.

Our products and solutions, including our software products, are highly technical and complex and, when deployed, may contain errors, defects, or security vulnerabilities including but not limited to vulnerabilities resulting from the use of third-party hardware and software. We must develop our products quickly to keep pace with the rapidly changing market, and we have a history of frequently introducing new products. Products and services as sophisticated as ours could contain undetected errors or defects, especially when first introduced or when new models or versions are released. Such occurrences could result in damage to our reputation, lost revenue, diverted development resources, increased customer service and support costs, warranty claims, and litigation.

We warrant that our products will be free of defectdefects for various periods of time, depending on the product. In addition, certain of our contracts include epidemic failure clauses. If invoked, these clauses may entitle the customer to return or obtain credits for products and inventory, or to cancel outstanding purchase orders even if the products themselves are not defective.

Errors, viruses, or bugs may be present in software or hardware that we acquire or license from third parties and incorporate into our products or in third partythird-party software or hardware that our customers use in conjunction with our products. Our customers’ proprietary software and network firewall protections may corrupt data from our products and create difficulties in implementing our solutions. Changes to third partythird-party software or hardware that our customers use in conjunction with our software could also render our applications inoperable. Any errors, defects, or security vulnerabilities in our products or any defects in, or compatibility issues with, any third-party hardware or software or customers’ network environments discovered after commercial release could result in loss of revenue or delay in revenue recognition, loss of customers, theft of trade secrets, data or intellectual property and increased service and warranty cost, any of which could adversely affect our business, financial condition, and results of operations.

Undiscovered vulnerabilities in our products alone or in combination with third partythird-party hardware or software could expose them to hackers or other unscrupulous third parties who develop and deploy viruses, and other malicious software programs that could attack our products. Actual or perceived security vulnerabilities in our products could harm our reputation and lead some customers to return products, to reduce or delay future purchases, or use competitive products.

If there are interruptions, outages, or performance degradation problems associated with the network infrastructure used to provide our services, customers may experience service outages, thiswhich may impact our reputation and future sales

Our continued success depends, in part, on our ability to provide highly available services to our customers. The majority of our current and future customers expect to use our services 24 hours a day, seven days a week, without interruption or degradation of performance. Since a large majority of customer network traffic routes through hardware managed by us, any outage or performance problem that occurs within this infrastructure could impair the ability of our customers to transmit wireless data traffic to our destination servers, which could negatively impact the customers’ IoT devices or solutions. Potential outages and performance problems may occur due to a variety of factors, including hardware failure, equipment configuration changes, capacity constraints, human error and the introduction of new functionality. Additionally, we depend on services from various third parties to support IoT networks and platforms. If a third party experiences a service outage, a product defect or bug, or performance degradation, such failures could interrupt customers’ ability to use our services, which could also negatively affect their perception of our service reliability. Our services are hosted in our third partythird-party data centers and any outages in these centers from any source including catastrophic events such as terrorist attack, flood,attacks, floods, power failure, earthquake,failures, earthquakes, etc. can impact the availability of our services, which could adversely affect our business, financial condition, and results of operations.

Our internal and customer-facing systems, and systems of third parties we rely upon, may be subject to cybersecurity breaches, disruptions, ransom attacks or delays.

A cybersecurity incident in our own systems or the systems of our third-party providers may compromise the confidentiality, integrity, or availability of our own internal data, the availability of our products, and websites designed to support our customers or our customer data.

11

Computer hackers, ransom attacks, foreign governments, or cyber terrorists may attempt to or succeed in penetrating our network security and our website. The recent discovery of wide-scale cybersecurity intrusions into U.S. government and private company computer networks by alleged Russian state actors underscores the ongoing threat posed by sophisticated and foreign state-sponsored attacks. The frequency of ransomware and malware attacks has also been increasing over time. Unauthorized access and theft to our proprietary business information or customer data or rendering them unusable for our use through encryption, may be accomplished through

break-ins,

sabotage, theft of IoT data streams and transmissions, breach of our secure networkby an unauthorized party, computer viruses, computerattacks, employee theft or misuse, ransomware attacks, breach of the security of the networks of our third-party providers, or other misconduct. Additionally, outside parties may attempt to fraudulently induce employees or users to disclose sensitive or confidential information in order to gain access to data.

denial-of-service

Despite our efforts to maintain the security and integrity of our systems, it is impossible to eliminate this risk. Because the techniques used by computer hackers who may attempt to penetrate and sabotage our network security or our website change frequently, they may take advantage of weaknesses in third-party technology or standards of which we are unaware or that we do not control and may not be recognized until long after they have been launched against a target. We may be unable to anticipate or counter these techniques. It is also possible that unauthorized access to customer data or confidential information may be obtained through inadequate use of security controls by customers, vendors, or business partners. Efforts to prevent hackers from disrupting our service or otherwise accessing our systems are expensive to develop, implement, and maintain. Such efforts require ongoing monitoring and updating as technologies change and efforts to overcome security measures become more sophisticated and may limit the functionality of, or otherwise adversely impact our service offering and systems. A cybersecurity incident affecting our systems may also result in the theft of our intellectual property, proprietary data, or trade secrets, which would compromisepotentially compromising our competitive position, reputation, and operating results. We also may be required to notify regulators about any actual or perceived personal data breachbreach(es) (including the EUEuropean Union Lead Data Protection Authority) as well as the individualsindividual(s) who are affected by the incident within strict time periods.

The systems we rely upon also remain vulnerable to damage or interruption from a number of other factors, including access to the internet, the failure of our network or software systems, or significant variability in visitor traffic on our product websites, earthquakes, floods, fires, power loss, telecommunication failures, computer viruses, human error, and similar events or disruptions. Some of our systems are not fully redundant, and our disaster recovery planning is not sufficient for all eventualities. Our systems are also subject to intentional acts of vandalism. Despite any precautions we may take, the occurrence of a natural disaster, a decision by any of our third-party hosting providers to close a facility we use without adequate notice for financial or other reasons, or other unanticipated problems at our hosting facilities could cause system interruptions and delays, and result in loss of critical data and lengthy interruptions in our services.

We rely on our information systems and those of third parties for activities such as processing customer orders, delivery of products, hosting and providing services and support to our customers, billing and tracking our customers, hosting and managing our customer data, and otherwise running our business. Any disruptions or unexpected incompatibilities in our information systems and those of the third parties upon whomwhich we rely could have a significant impact on our business.

An increasing portion of our revenue comes from subscription solutions and other hosted services in which we store, retrieve, communicate, and manage data that is critical to our customers’ business systems. Disruption of our systems that support these services and solutions could cause disruptions in our customers’ systems and in the businesses that rely on these systems. Any such disruptions could harm our reputation, create liabilities tofor our customers, hurt demand for our services and solutions, and adversely impact our business, financial condition, and results of operations.

We may become involved in litigation that could materially adversely affect our business, financial condition, results of operations, and prospects.

We may become a party to litigation and disputes related to our intellectual property, business practices, regulatory compliance, products, or platform. While we intend to vigorously defend these lawsuits, litigation can be costly and time-consuming, divert the attention of management and key personnel from our business operations, and dissuade prospective customers from subscribing to our products. We may need to settle litigation and disputes on terms that are unfavorable to us, or we may be subject to an unfavorable judgment that may not be reversible upon appeal. The terms of any settlement or judgment may require us to cease some or all of our operations or pay substantial amounts to the other party. In addition, our customer agreements include provisions requiring us to indemnify our customers against liabilities if our products infringe a third-party’sthird party’s intellectual property rights, and we have negotiated other specific indemnities with certain customers, in each case, which could require us to make payments to such customers. During the course of any litigation or dispute, we may make announcements regarding the results of hearings and motions and other interim developments. If securities analysts and investors consider these announcements negative, our stock price may decline. With respect to any intellectual property rights claim, we may have to seek a license to continue practices found to be in violation of third-party rights, which may not be available on reasonable terms and may significantly increase our operating expenses. A license to continue such practices may not be available to us, and we may be required to develop alternative non-infringing technology or practices or discontinue our practices. The development of alternative, non-infringing technology or practices could require significant effort and expenses.expense. Any of the above could materially adversely affect our business, financial condition, and results of operations.

Risks Related to Customers and Demand for Our Solutions

Our inability to adapt to rapid technological change in our markets could impair our ability to remain competitive and adversely affect ourthe results of operations.

12

All of the markets in which we operate are characterized by rapid technological change, frequent introductions of new products, services and solutions, and evolving customer demands. In addition, we are affected by changes in the many industries related to the products or services we offer, including Connectivity services and IoT Solutions offered to our Connected Health, Fleet Management, Communication Services, Asset managementManagement and industrialIndustrial verticals. As the technologies used in each of these industries evolves,evolve, we will face new integration and competition challenges. For example, eSIM and eUICC standards may evolve and the Companywe will have to evolve itsour technology to such standards. If we are unable to adapt to rapid technological change, it could adversely affect our business, financial condition, and results of operations and our ability to remain competitive.

Additionally, the deployment of 5G network technology is subject to a variety of risks, including those related to equipment and spectrum availability, unexpected costs, and regulatory permitting requirements that could cause deployment delays or network performance issues. These issues could result in significant costs or reduce the anticipated benefits of the enhancements to our networks. If our services or solutions fail to gain acceptance in the marketplace, or if costs associated with the implementation and introduction of these services or solutions materially increase, our ability to retain and attract customers could be adversely affected.

We may not be able to retain and increase sales to our existing customers, which could negatively impact our financial results.

We generally seek to license our platform and solutions pursuant to customer subscriptions. However, our customers have no obligation to maintain the subscription and can often terminate with30-days’ 30 days’ notice. We also actively seek to sell additional solutions to our existing customers. If our efforts to satisfy our existing customers are not successful, we may not be able to retain them or sell additional functionality to them and, as a result, our revenue and ability to grow could be adversely affected. Customers may choose not to renew their subscriptions for many reasons, including the belief that our service is not required for their business needs or is otherwise not cost-effective, a desire to reduce discretionary spending or a belief that our competitors’ services provide better value. Additionally, our customers may not renew for reasons entirely out of our control, such as the dissolution of their business or an economic downturn in their industry. A significant increase in our churn rate would have an adverse effect on our business, financial condition, and operating results.

A part of our growth strategy is to sell additional new features and solutions to our existing customers. Our ability to sell new features to customers will depend in significant part on our ability to anticipate industry evolution, practices and standards and to continue to enhance existing solutions or introduce or acquire new solutions on a timely basis to keep pace with technological developments both within our industry and in related industries, and to remain compliant with any regulations mandated by federal agencies or state-mandated or foreign government regulations as they pertain to our customers. However, we may prove unsuccessful either in developing new features or in expanding the third-party software and products with which our solutions integrate. In addition, the success of any enhancement or new feature depends on several factors, including the timely completion, introduction and market acceptance of the enhancement or feature. Any new solutions we develop or acquire might not be introduced in a timely or cost-effective manner and might not achieve the broad market acceptance necessary to generate significant revenue. If any of our competitors implement new technologies before we are able to implement them or better anticipate the innovation and integration opportunities in related industries, those competitors may be able to provide more effective or cheaperless expensive solutions than ours.

The marketability of our products may suffer if wireless telecommunications operators do not deliver acceptable wireless services.

The success of our business depends, in part, on the capacity, affordability, reliability, and prevalence of wireless data networks provided by wireless telecommunications operators and on which our products and solutions operate.

Currently, various wireless telecommunications operators, either individually or jointly with us, sell our products in connection with the sale of their wireless data services to their customers. Growth in demand for wireless data access may be limited if, for example, wireless telecommunications operators cease or materially curtail operations, fail to offer services that customers consider valuable at acceptable prices, change the terms of trade to us including offering us meaningful volume discounts without unduly high volume commitments, fail to maintain sufficient capacity to meet the demand for wireless data access, delay the expansion of their wireless networks and services, fail to offer and maintain reliable wireless network services or fail to market their services effectively. Lack of demand for wireless data access could adversely affect our business, financial condition, and results of operations

Reduction in regulation in certain markets may adversely impact demand for certain of our solutions by reducing the necessity for, or desirability of, our solutions.

Regulatory compliance and reporting are driven by legislation and requirements, which are often subject to change, from regulatory authorities in nearly every jurisdiction globally. For example, in the United States, fleet operators can face numerous complex regulatory requirements, including mandatory Compliance, Safety and Accountability driver safety scoring, hours of service, compliance and fuel tax reporting. TheA reduction in regulation in certain markets may adversely impact demand for certain of our solutions, which could materially and adversely affect our business, financial condition and results of operations. Conversely, an increase in regulation could increase KORE’sour cost of providing services, which could adversely affect our business, financial condition, and results of operations.

Our future success and competitive position are dependent upon our proprietary technology. Despite our efforts to protect our intellectual property, unauthorized parties may attempt to copy or otherwise obtain our software or develop software with the same functionality or to obtain and use information that we regard as proprietary. Others may develop technologies that are similar or superior to our technology or duplicate our technology. In addition, effective copyright, patent, and trade secret protection may be unavailable, limited, or not applied for in certain countries. The steps taken by us to protect our technology might not prevent the misappropriation of such technology.

The value of our products relies substantially on our technical innovation in fields in which there are many current patent filings. Third parties may claim that we or our customers (some of whom are indemnified by us) are infringing their intellectual property rights. For example, individuals and groups may purchase intellectual property assets for the purpose of asserting claims of infringement and attempting to extract settlements from us or our customers. The number of these claims has increased in recent years. As new patents are issued or are brought to our attention by the holders of such patents,customers, and it may be necessary for us to secure a license from such patent holders, redesign our products, or withdraw products from the market. In addition, the legal costs and engineering time required to safeguard intellectual property or to defend against litigation could become a significant expense ofto operations. Any such litigation could require us to incur substantial costs and divert significant valuable resources, including the efforts of our technical and management personnel, which couldpotentially adversely affectaffecting our business, financial condition, and results of operations.

If we are unable to protect our intellectual property and proprietary rights, our competitive position and our business could be harmed.

We rely on a combination of intellectual property laws, trade secrets, confidentiality procedures, and contractual provisions to protect our intellectual property and proprietary rights. Monitoring unauthorized use of our intellectual property is difficult and costly. The steps we have taken to protect our proprietary rights may not be adequate to prevent misappropriation of our intellectual property. We may not be able to detect unauthorized use of, or take appropriate steps to enforce, our intellectual property rights. Our competitors may also independently develop similar technology. In addition, the laws of many countries do not protect our proprietary rights to as great an extent as do the laws of the United States. Any failure by us to meaningfully protect our intellectual property could result in competitors offering products that incorporate our most technologically advanced features, which could seriously reducepotentially reducing demand for our products and solutions. In addition, we may in the future need to initiate infringement claims or litigation. Litigation,

whether we are a plaintiff or a defendant, can be expensive, time consuming, and may divert the efforts of our technical staff and managerial personnel, which could adversely affectaffecting our business, financial condition, and results of operations, whether or not such litigation results in a determination favorable to us.

An assertion by a third partythird-party that we are infringing on its intellectual property could subject us to costly and time-consuming litigation or expensive licenses and our business could be harmed.

The technology industries involving mobile data communications,telecommunications, IoT devices, software, and services are characterized by the existence of a large number of patents, copyrights, trademarks, and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. Much of this litigation involves patent holding companies or other adverse patent owners who have no relevant product revenue of their own, and against whom our own patent portfolio may provide little or no deterrence. One or more patent infringement lawsuits fromevery year in the ordinary course of business.

non-practicing

entities may be brought against us or our subsidiaries We cannot assure you that we or our subsidiaries willmay not prevail in any current or future intellectual property infringement or other litigation given the complex technical issues and inherent uncertainties in such litigation. Defending such claims, regardless of their merit, could be time-consumingtime consuming and distracting to management, result in costly litigation or settlement, cause development delays, or require us or our subsidiaries to enter into royalty or licensing agreements. In addition, we or our subsidiaries could be obligated to indemnify our customers against third parties’ claims of intellectual property infringement based on our products or solutions. If our products or solutions violate any third-party intellectual property rights, we could be required to withdraw them from the market, re-develop them or seek to obtain licenses from third parties, which might not be available on reasonable terms or at all. Any efforts to re-develop our products or solutions, obtain licenses from third parties on favorable terms or license a substitute technology might not be successful and, in any case, might substantially increase our costs and harm our business, financial condition, and operating results. Withdrawal of any of our products or solutions from the market could harm our business, financial condition, and operating results.

In addition, we incorporate open-source software into our products and solutions. Given the nature of open-source software, third parties might assert copyright and other intellectual property infringement claims against us based on our use of certain open-source software programs. The terms of many open-source licenses to which we are subject have not been interpreted by U.S. courts or courts of other jurisdictions, and there is a risk that those licenses could be construed in a manner that imposes unanticipated conditions or restrictions on our ability to commercialize our products and solutions. In that event, we could be required to seek licenses from third parties in order to continue offering our products and solutions, to

re-develop

our solutions, to discontinue sales of our solutions, or to release our proprietary software source code under the terms of an open-source license, any of which could adversely affect our business, financial condition, and results of operations.Risks Related to Competition

The market for the products and services that we offer is rapidly evolving and highly competitive. We may be unable to compete effectively.

14

The market for the products and services that we offer is rapidly evolving and highly competitive. Our products compete with a variety of solutions, including other subscription-based IoT platforms and solutions. We expect competition to continue to increase and intensify, especially in the 5G market. Many of our competitors or potential competitors have significantly greater financial, technical, operational, and marketing resources than we do. These competitors, for example, may be able to respond more rapidly or more effectively than we can to new or emerging technologies, changes in customer requirements, supplier-related developments, or a shift in the business landscape. They also may devote greater or more effective resources than we do to the development, manufacture, promotion, sale, and post-sale support of their respective products and services.

Many of our current and potential competitors have more extensive customer bases and broader customer, supplier, and other industry relationships that they can leverage to establish competitive dealings with many of our current and potential customers. Some of these companies also have more established and larger customer support organizations than we do. In addition, these companies may adopt more aggressive pricing policies or offer more attractive terms to customers than they currently do, or than we are able to do. They may bundle their competitive products with broader product offerings and may introduce new products, services and enhancements. Current and potential competitors might merge or otherwise establish cooperative relationships among themselves or with third parties to enhance their products, services, or market position. In addition, at any time any given customer or supplier of ours could elect to enter our then existingthen-existing line of business and thereafter compete with us, whether directly or indirectly. As a result, it is possible that new competitors or new or otherwise enhanced relationships among existing competitors may emerge and rapidly acquire significant market share to the detriment of our business.

We expect our competitors to continue to improve the features and performance of their current products and to introduce new products, services, and technologies which, if successful, could reduce our sales and the market acceptance of our products, generate increased price competition, and make our products obsolete. For our products to remain competitive, we must, among other things, continue to invest significant resources (financial, human, and otherwise) in, among other things, research and development, sales and marketing, and customer support. We cannot be sure that we willmay not have or will continue to have sufficient resources to make these investments or thatinvestments. Also, we willmay not be able to make the technological advances in the marketplace, meet changing customer requirements, achieve market acceptance and respond to our competitors’ products. If we are unable to compete effectively, it could adversely affect our business, financial condition, and results of operations.

key personnel. We may not be able to maintain and expand our business if we lose members of our senior management team or other key personnel or are not able to hire, retain, and manage additional qualified personnel.

Our success in the future depends in part on the continued contribution of our executive,senior management team and technical, engineering, sales, marketing, operations, and administrative personnel. Recruiting and retaining skilled personnel in the industries in which we operate, including engineers and other technical staff, and skilled sales and marketing personnel, is highly competitive. In addition, in the event that we acquire another business or company, the success of anyan acquisition willmay depend in part on our retention and integration of key personnel from the acquired company or business.

Although we may enter into employment agreements with members of our senior management team and other key personnel, these arrangements do not prevent any of our management or key personnel from leaving us. If one or more of our senior management team or other key personnel is unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all, and other senior management may be required to divert their attention from other aspects of the Company.business. If we lose any of these individuals or are not able to attract or retain qualified personnel in the future, or if we experience delays in hiring required personnel, particularly qualifiedincluding technical, engineering, sales, marketing, operations, and salesadministrative personnel, we may not be able to maintain and expand our business.

Risks Related to Developing and Delivering Our Solutions

We are dependent on telecommunications carriers to provide our IoT Connectivity Services and a disruption in one or more of these relationships could significantly adversely impact our business

Our IoT Connectivity services are built on top of cellular connectivity provided by large telecommunications carriers and while we have a large number of carrier relationships, there is a significant concentration of revenue derived from connectivity built on top of cellular networks provided by our top three carrier relationships, are approximately 41% ofas these three carriers dominate the business for the year ended December 31, 2021. U.S. telecommunications carrier market.

Our inability to keep anon-going ongoing contractual relationship with our existing or desired future telecommunications carrier partners or to maintain favorable terms of trade with them including competitive pricing, reasonable or no volume commitments, payment terms, access to the latest cellular and network technologies including

5G, eSIMs, and eUICC, could adversely affect our ability to sell our connectivity services to customers. KORE’sOur contracts with large telecommunications carriers are not long term,long-term, and so are subject to frequent renegotiation. The outcome of any renegotiation cannot be guaranteed. Additional consolidation of carriers could further reduce our bargaining power in negotiations with carriers, which could adversely affectaffecting our business, financial condition, and results of operations.

15

We are dependent on a limited number of suppliers for certain critical components toof our solutions; a disruption in our supply chain could adversely affect our revenue and results of operations.

Our current reliance on a limited group of suppliers involves risks, including a potential inability to obtain an adequate supply of required products or components to meet customers’ IoT Solutions delivery requirements, a risk that we may accumulate excess inventories if we inaccurately forecast demand for our products, reduced control over pricing and delivery schedules, discontinuation of or increased prices for certain components, and economic conditions that may adversely impact the viability of our suppliers and contract manufacturers. Any disruption in our supply chain could reduce our revenue and adversely impact our financial results. Such a disruption could occur as a result of any number of events, including, but not limited to, increases in wages that drive up prices or labor stoppages, the imposition of regulations, quotas or embargoes on components, a scarcity of, or significant increase in the price of, required electronic components for our products, trade restrictions, tariffs or duties, fluctuations in currency exchange rates, transportation failures affecting the supply chain and shipment of materials and finished goods, third partythird-party interference in the integrity of the products sourced through the supply chain, the unavailability of raw materials, severe weather conditions, natural disasters, civil unrest, military conflicts, geopolitical developments, war or terrorism, including the ongoing conflictconflicts in Ukraine and the Middle East, regional or global pandemics, like COVID-19, and disruptions in utility and other services. In recent months global supply chains have been disrupted by COVID-19 and other factors, resulting in shortages of a number of goods, including chips necessary to produce a wide variety of devices. To the extent we are unable to obtain adequate supplies of chips, this could impact our brand as well as our results of operations. Any inability to obtain adequate deliveries or any other circumstance that would require us to seek alternative sources of supply or to manufacture, assemble, and test such components internally could significantly delay our ability to ship our products, which could damage relationships with current and prospective customers, and could harm our reputation and brand and could adversely affect our business, financial condition, and results of operations.

Natural disasters, civil unrest, public health crises such as theCOVID-19pandemic,and pandemics, political crises, climate change, and other catastrophic events or other events outside of our control could damage our facilities or the facilities of third parties on which we depend and could impact consumer spending.

If any of our facilities or the facilities of our third-party service providers including for example our telecommunications carrier partners, other suppliers of products that are components of our IoT Solutions, or our data center providers, or our other partners isare affected by natural disasters, such as earthquakes, tsunamis, wildfires, power shortages, floods, civil unrest, public health crises (such as pandemics and epidemics), political crises (such as terrorism, war, political instability or other conflict), climate change, or other events outside our control, including a cyberattack, our critical business or IT systems could be destroyed or disrupted and our ability to conduct normal business operations and our revenue, financial condition, and operating results could be adversely affected. For example, the COVID-19 pandemic has impacted, and may continue to have an impact on our operations, including the implementation of various containment measures, such as government-imposed shelter-in-place orders, quarantines, national or regional lockdowns, travel restrictions and other public health safety measures. Specifically, in response to the spread of COVID-19, and in accordance with direction from government authorities, we have, for example, limited the number of such personnel that can be present at our facilities at any one time, mandated the usage of face masks in our facilities, limited the maximum numbers of people allowed in rooms at one time and requested that many of our personnel work remotely. Our business also may be impacted by changes in the severity of the COVID-19 pandemic at different times in the various cities and regions

Our solutions integrate with third-party technologies and if our solutions become incompatible with these technologies, our solutions would lose functionality and our customer acquisition and retention could be adversely affected.

Our solutions integrate with third-party software and devices to allow our solutions to perform key functions. Errors, viruses or bugs may be present in third-party software that our customers use in conjunction with our solutions. Changes to third-party software that our customers use in conjunction with our solutions could also render our solutions inoperable. Customers may conclude that our software is the cause of these errors, bugs or viruses and terminate their subscriptions. The inability to easily integrate with, or any defects in, any third-party software could result in increased costs, or in delays in software releases or updates to our products until such issues have been resolved, which could adversely affect onaffecting our business, financial condition, results of operations, and future prospects and could damagedamaging our reputation.

Any significant disruption in service on our websites or in our computer systems could damage our reputation and result in a loss of customers, which would harmharming our business and operating results.

Our brand, reputation, and ability to attract, retain, and serve our customers are dependent upon the reliable performance of our services and our customers’ ability to access our solutions at all times. Our customers rely on our solutions to make operating decisions related to their businesses, as well as to measure, store and analyze valuable data regarding their businesses. Our solutions are vulnerable to interruption and our data centers are vulnerable to damage or interruption from human error, intentional bad acts, computer viruses or hackers, earthquakes, hurricanes, floods, fires, war, terrorist attacks, power losses, hardware failures, systems failures, telecommunications failures, and similar events, any of which could limit our customers’ ability to access our solutions. Prolonged delays or unforeseen difficulties in connection with adding capacity or upgrading our network architecture may cause our service quality to suffer. Any event that significantly disrupts our service or exposes our data to misuse could damage our reputation and harm our business, financial condition and results of operations, including reducing our revenue, causing us to issue credits to customers, subjecting us to potential liability, increasing our churn rates, or increasing our cost of acquiring new customers.

Risks Related to International Operations

We face risks inherent in conducting business internationally, including compliance with international and U.S. laws and regulations that apply to our international operations

We operate in many parts of the world that have experienced significant governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. These laws and regulations include data privacy requirements, labor relations laws, tax laws, anti-competition regulations, import and trade restrictions, export control laws, and laws that prohibit corrupt payments to governmental officials or certain payments or remunerations to customers, including the U.S. Foreign Corrupt Practices Act (“FCPA”FCPA”), the U.K. Bribery Act, and other anti-corruption laws that have recently been the subject of a substantial increase in

16

global enforcement. Many of our products are subject to U.S. export law restrictions that limit the destinations and types of customers to which our products may be sold or that require an export license in connection with sales outside the United States. Given the high level of complexity of these laws, there is a risk that some provisions may be inadvertently or intentionally breached, for example through fraudulent or negligent behavior of individual employees, our failure to comply with certain formal documentation requirements or otherwise. Also, we may be held liable for actions taken by our local partners. Violations of these laws and regulations could result in fines, criminal sanctions against us, our officers or our employees, and prohibitions or conditions on the conduct of our business. Any such violations could include prohibitions or conditions on our ability to offer our products in one or more countries and could materially damage our reputation, our brand, our international expansion efforts, our ability to attract and retain employees, and our business, financial condition and results of operations.

The FCPA and other anti-corruption laws and regulations (“Anti-Corruption Laws”) prohibit corrupt payments by our employees, vendors or agents. From time to time, we may receive inquiries from authoritiesprimary service KORE provides in the United States and elsewhere about our business activities outsideis mobile broadband Internet connectivity. Historically, the FCC has recognized that broadband internet access services are “information services” subject to limited regulation. In 2015, the FCC issued a “network

neutrality” decision that declared mass-market mobile broadband Internet access to be a commercial mobile radio service subject to certain “telecommunications service” regulations under Title II of the United StatesCommunications Act of 1934. These regulations have the potential to limit the ways that mobile broadband Internet service providers can structure business arrangements and our compliance with Anti-Corruption Laws. While we devote substantial resources to our global compliance programsmanage networks, and have implemented policies, training and internal controls designed to reduce the risk of corrupt payments, our employees, vendors or agents may violate our policies.

In 2017, the FCC voted to return broadband internet access service to its prior classification as “information services.” In 2023 the FCC announced its intention to consider rules aimed at subjecting mass market mobile broadband internet service to regulation under Title II again. KORE’s services are not directly implicated by these rulings because KORE does not provide “mass market” Internet access. However, by virtue of operations. Operations outsideallowing all customers to access any point of the United StatesInternet, KORE’s Connectivity services are closely analogous to the services mentioned in the FCC’s open internet orders, which creates the possibility that the FCC may be affected by changesbegin regulating KORE’s services in trade protection laws, policies and measures, and other regulatory requirements affecting trade and investment.

As a result of our international operations, we are subject to foreign tax regulations. Suchthe FCC’s activities, it is unclear at this time how mobile broadband Internet services will be regulated in the future, and the potential impact those regulations may have on our IoT Connectivity and Services. In addition, while the FCC has not be clear, not consistently appliedsought to specifically regulate the manner in which broadband internet service providers manage network traffic, the FCC has nonetheless continued to adopt other forms of regulation over such services, which in the future may affect our operations and subject us to sudden change, particularly with regard to international transfer pricing. Our earnings could be reduced by the uncertain and changing nature of such tax regulations.

We are subject to evolving privacy laws in the United States and other jurisdictions that are subject to potentially differing interpretations and which could adversely impact our business and require that we incur substantial costs

Existing privacy-related laws and regulations in the United States and other countries are evolving and are subject to potentially differing interpretations, and various U.S. federal and state or other international legislative and regulatory bodies may expand or enact laws regarding privacy and data security-related matters. For example, the EU-U.S. Privacy Shield, a basis for data transfers from the EUEuropean Union to the U.S., was invalidated by the European Court of Justice, and we expect that the international transfer of personal data will present ongoing compliance challenges and complicate our business transactions and operations. Brexit, the United Kingdom’s withdrawal from the European Union, could also lead to further legislative and regulatory changes with regard to personal data transfers between the two territories. New privacy laws have come into effect in Brazil and New Zealand in 2020, and revisions of privacy laws are currently pending in countries like Canada and China. Some countries are considering or have passed legislation that requires local storage and processing of data, including geospatial data.

In addition, in June 2018, California enacted the California Consumer Privacy Act (the “CCPA”“CCPA”), which took effect in January 2020 and has been amended by the California Privacy Rights Act (the “CPRA”“CPRA”), which passed via ballot initiative in November 2020 and will fully taketook effect in January 2023. The CCPA and CPRA, among other things, givesgive California residents expanded rights to access and delete their personal information, opt out of certain personal information sharing, and receive detailed information about how their personal information is used. Other states and the U.S. Congress have introduced data privacy legislation that may impact our business. Data privacy legislation, amendments and revisions to existing data privacy legislation, and other developments impacting data privacy and data protection may require us to modify our data processing practices and policies, increase the complexity of providing our products and services, and cause us to incur substantial costs in an effort to comply. Failure to comply may lead to significant fines and business interruption and could adversely affect our business, financial condition and results of operations.

We generally conduct our international operations through wholly-owned subsidiaries and report our taxable income in various jurisdictions worldwide based on our business operations in those jurisdictions. Our corporate structure and associated transfer pricing policies contemplate the business flows and future growth into the international markets and consider the functions, risks and assets of the various entities involved in the intercompany transactions. The amount of taxes we pay in different jurisdictions will depend to a significant degree on the application of the tax laws of the various jurisdictions to our international business activities, changes in tax rates, new or revised tax laws or interpretations of existing tax laws and policies and our ability to operate our business in a manner consistent with our corporate structure and intercompany arrangements, any or all of which could result in additional tax liabilities or increases in, or in the volatility of, our effective tax rate.

The taxing authorities of the jurisdictions in which we operate may challenge our methodologies for pricing intercompany transactions, which are required to be computed on an arm’s-length basis pursuant to the intercompany arrangements or disagree with our determinations as to the

17

income and expenses attributable to specific jurisdictions. If such a challenge or disagreement were to occur, and our position was not sustained, we could be required to pay additional taxes, interest and penalties, which could result in one-time tax charges, higher effective tax rates, reduced cash flows and lower overall profitability of our operations; in addition, it is uncertain whether any such adverse effects could be mitigated by corresponding adjustments in other jurisdictions with respect to the items affected. Our productsfinancial statements could fail to reflect adequate reserves to cover such a contingency.