| ☒ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . |

Delaware | 87-6284802 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Title of each class | Trading Symbol(s) | Name of each exchange | ||

ProShares Short VIX Short-Term Futures ETF | SVXY | Cboe BZX Exchange | ||

ProShares Ultra Bloomberg Crude Oil | UCO | NYSE Arca | ||

ProShares Ultra Bloomberg Natural Gas | BOIL | NYSE Arca | ||

ProShares Ultra Euro | ULE | NYSE Arca | ||

ProShares Ultra Gold | UGL | NYSE Arca | ||

ProShares Ultra Silver | AGQ | NYSE Arca | ||

ProShares Ultra VIX Short-Term Futures ETF | UVXY | Cboe BZX Exchange | ||

ProShares Ultra Yen | YCL | NYSE Arca | ||

ProShares UltraShort Bloomberg Crude Oil | SCO | NYSE Arca | ||

ProShares UltraShort Bloomberg Natural Gas | KOLD | NYSE Arca |

ProShares UltraShort Euro | EUO | NYSE Arca | ||

ProShares UltraShort Gold | GLL | NYSE Arca | ||

ProShares UltraShort Silver | ZSL | NYSE Arca | ||

ProShares UltraShort Yen | YCS | NYSE Arca | ||

ProShares VIX Mid-Term Futures ETF | VIXM | Cboe BZX Exchange | ||

ProShares VIX Short-Term Futures ETF | VIXY | Cboe BZX Exchange |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ | |||

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ | |||

| Emerging Growth Company | ☐ | |||||

Fund | Aggregate Market Value of the Fund’s Units Held by Non-Affiliates as of June 30, 2023 | Number of Outstanding Units as of February 22, 2024 | ||||||

ProShares Short VIX Short-Term Futures ETF | 282,353,267 | 3,084,307 | ||||||

ProShares Ultra Bloomberg Crude Oil | 738,194,368 | 20,793,096 | ||||||

ProShares Ultra Bloomberg Natural Gas | 1,141,021,278 | 36,968,544 | ||||||

ProShares Ultra Euro | 7,535,435 | 550,000 | ||||||

ProShares Ultra Gold | 180,916,531 | 2,800,000 | ||||||

ProShares Ultra Silver | 356,791,659 | 14,396,526 | ||||||

ProShares Ultra VIX Short-Term Futures ETF | 387,764,059 | 36,424,459 | ||||||

ProShares Ultra Yen | 12,330,974 | 1,349,970 | ||||||

ProShares UltraShort Bloomberg Crude Oil | 112,854,952 | 10,855,220 | ||||||

ProShares UltraShort Bloomberg Natural Gas | 141,324,963 | 866,856 | ||||||

ProShares UltraShort Euro | 50,931,301 | 1,350,000 | ||||||

ProShares UltraShort Gold | 15,809,378 | 496,977 | ||||||

ProShares UltraShort Silver | 19,290,473 | 941,329 | ||||||

ProShares UltraShort Yen | 27,077,656 | 348,580 | ||||||

ProShares VIX Mid-Term Futures ETF | 49,421,413 | 2,287,403 | ||||||

ProShares VIX Short-Term Futures ETF | 230,227,830 | 11,550,947 | ||||||

Fund | Aggregate Market Value of the Fund’s Units Held by Non-Affiliates as ofJune 30, 2022 | Number of Outstanding Units as of February 22, 2023 | ||||||

ProShares Short VIX Short-Term Futures ETF | 403,644,956 | 2,984,307 | ||||||

ProShares Ultra Bloomberg Crude Oil | 1,060,867,238 | 28,043,096 | ||||||

ProShares Ultra Bloomberg Natural Gas | 187,297,842 | 254,987,527 | ||||||

ProShares Ultra Euro | 9,415,626 | 850,000 | ||||||

ProShares Ultra Gold | 239,938,853 | 3,100,000 | ||||||

ProShares Ultra Silver | 355,577,515 | 13,396,526 | ||||||

ProShares Ultra VIX Short-Term Futures ETF | 975,683,533 | 114,578,420 | ||||||

ProShares Ultra Yen | 5,024,773 | 399,970 | ||||||

ProShares UltraShort Bloomberg Crude Oil | 501,157,304 | 8,305,220 | ||||||

ProShares UltraShort Bloomberg Natural Gas | 211,823,446 | 1,366,856 | ||||||

ProShares UltraShort Euro | 62,270,097 | 2,350,000 | ||||||

ProShares UltraShort Gold | 34,611,284 | 496,977 | ||||||

ProShares UltraShort Silver | 33,052,840 | 1,191,329 | ||||||

ProShares UltraShort Yen | 45,568,882 | 398,580 | ||||||

ProShares VIX Mid-Term Futures ETF | 95,721,271 | 2,537,403 | ||||||

ProShares VIX Short-Term Futures ETF | 341,714,316 | 26,932,826 | ||||||

PROSHARES TRUST II

Table of Contents

| Page | |||||||

Part I. | |||||||

| 1 | |||||||

| 20 | |||||||

| 54 | |||||||

| 54 | |||||||

| 54 | |||||||

| 54 | |||||||

Part II. | |||||||

| 55 | |||||||

| 58 | |||||||

| 58 | |||||||

Item 7A. Quantitative and Qualitative Disclosures About Market | |||||||

| 100 | |||||||

| 100 | |||||||

| 101 | |||||||

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent | 101 | ||||||

Part III. | |||||||

Item 10. Directors, Executive Officers and Corporate | 102 | ||||||

| 104 | |||||||

| 105 | |||||||

Item 13. Certain Relationships and Related Transactions, and Director | 105 | ||||||

| 105 | |||||||

Part IV. | |||||||

Item 15. Exhibits and Financial Statement | 106 | ||||||

| 106 | |||||||

| 106 | |||||||

| 107 | |||||||

Part I.

Item 1. Business.

Summary

ProShares Trust II (the “Trust”) is a Delaware statutory trust formed on October 9, 2007 and is currently organized into separate series (each, a “Fund” and collectively, the “Funds”). As of December 31, 2022,2023, the following sixteen series of the Trust have commenced investment operations: (i) ProShares VIX Short-Term Futures ETF and ProShares VIX Mid-Term Futures ETF (each, a “Matching VIX Fund” and collectively, the “Matching VIX Funds”); (ii) ProShares Short VIX Short-Term Futures ETF and ProShares Ultra VIX Short-Term Futures ETF (each, a “Geared VIX Fund” and collectively, the “Geared VIX Funds”); and (iii) ProShares UltraShort Bloomberg Crude Oil, ProShares UltraShort Bloomberg Natural Gas, ProShares UltraShort Gold, ProShares UltraShort Silver, ProShares UltraShort Euro, ProShares UltraShort Yen, ProShares Ultra Bloomberg Crude Oil, ProShares Ultra Bloomberg Natural Gas, ProShares Ultra Gold, ProShares Ultra Silver, ProShares Ultra Euro and ProShares Ultra Yen (each, a “Leveraged Fund” and collectively, the “Leveraged Funds”); Each of the Funds listed above issues common units of beneficial interest (“Shares”), which represent units of fractional undivided beneficial interest in and ownership of only that Fund. The Shares of each Fund, other than the Matching VIX Funds and the Geared VIX Funds, are listed on the NYSE Arca, Inc. (“NYSE Arca”). The Matching VIX Funds and the Geared VIX Funds are listed on the Cboe BZX Exchange (“Cboe BZX”). The Leveraged Funds and the Geared VIX Funds, are collectively referred to as the “Geared Funds”. The Geared VIX Funds and the Matching VIX Funds are collectively referred to as the “VIX Funds”.

On March 15, 2020 ProShare Capital Management LLC announced that it planned to close and liquidate ProShares UltraPro 3x Crude Oil ETF (ticker symbol: OILU) and ProShares UltraPro 3x Short Crude Oil ETF (ticker symbol: OILD). The last day the liquidated funds accepted creation orders was on March 27, 2020. Trading in each liquidated fund was suspended prior to market open on March 30, 2020. Proceeds of the liquidation were sent to shareholders on April 3, 2020. From March 30, 2020 through April 3, 2020, shares of the liquidated funds did not trade on the NYSE Arca nor was there a secondary market for the shares. Any shareholders that remained in a liquidated fund on April 3, 2020 automatically had their shares redeemed for cash at the current net asset value on that day.

On March 11, 2022, ProShares Capital Management LLC announced that it planned to close and liquidate ProShares UltraShort Australian Dollar ETF (ticker symbol: CROC) and ProShares Short Euro ETF (ticker symbol: EUFX). The last day the liquidated funds accepted creation orders was on May 2, 2022. Trading in each liquidated fund was suspended prior to market open on May 3, 2022. Proceeds of the liquidation were sent to shareholders on May 12, 2022. From May 3, 2022 through May 12, 2022, shares of the liquidated funds did not trade on the NYSE Arca nor was there a secondary market for the shares. Any shareholders that remained in a liquidated fund on May 12, 2022 automatically had their shares redeemed for cash at the current net asset value on that day.

The Trust had no operations prior to November 24, 2008, other than matters relating to its organization, the registration of each series under the Securities Act of 1933, as amended, and the sale and issuance to ProShare Capital Management LLC (the “Sponsor”) of fourteen Shares at an aggregate purchase price of $350 in each of the following Funds: ProShares UltraShort Bloomberg Crude Oil, ProShares UltraShort Gold, ProShares UltraShort Silver, ProShares UltraShort Euro, ProShares UltraShort Yen, ProShares Ultra Bloomberg Crude Oil, ProShares Ultra Gold, ProShares Ultra Silver, ProShares Ultra Euro and ProShares Ultra Yen.

The Sponsor also serves as the Trust’s commodity pool operator. Wilmington Trust Company serves as the Trustee of the Trust (the “Trustee”). The Funds are commodity pools, as defined under the Commodity Exchange Act (the “CEA”), and the applicable regulations of the Commodity Futures Trading Commission (the “CFTC”) and are operated by the Sponsor, a commodity pool operator registered with the CFTC. The Trust is not an investment company registered under the Investment Company Act of 1940, as amended.

Groups of Funds are collectively referred to in this Annual Report on Form 10-K in several different ways. References to “Short Funds,Fund,” “UltraShort Funds,” or “Ultra Funds” refer to the different Funds based upon their investment objectives, but without distinguishing among the Funds’ benchmarks. References to “Commodity Index Funds,” “Commodity Funds” and “Currency Funds” refer to the different Funds according to their general benchmark categories without distinguishing among the Funds’ investment objectives or Fund-specific benchmarks. References to “VIX Funds” refer to the different Funds based upon their investment objective and their general benchmark categories.

1

As described in each Fund’s prospectus, each of the Funds intends to invest in “Financial Instruments” (Financial Instruments are instruments whose value is derived from the value of an underlying asset, rate or benchmark including futures contracts, swap agreements, forward contracts and other instruments) as a substitute for investing directly in commodities, currencies, or spot volatility products in order to gain exposure to the VIX Index, natural gas, crude oil, precious metals, or currencies, as applicable. Financial Instruments also are used to produce economically “inverse”, “inverse leveraged” or “leveraged” investment results for the Geared Funds.

The “Short” Fund seeks daily investment results, before fees and expenses, that correspond to one-half the inverse (-0.5x) of the daily performance of its corresponding benchmark. Each “UltraShort” Fund seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the daily performance of its corresponding benchmark. Each “Ultra” Fund seeks daily investment results, before fees and expenses, that

1

correspond to either one and one-half times (1.5x) or two times (2x) the daily performance of its corresponding benchmark. Each Matching VIX Fund seeks investment results, before fees and expenses, both for a single day and over time, that match (1x) the performance of its corresponding benchmark. Daily performance is measured from the calculation of each Fund’s net asset value (“NAV”) to the Fund’s next NAV calculation.

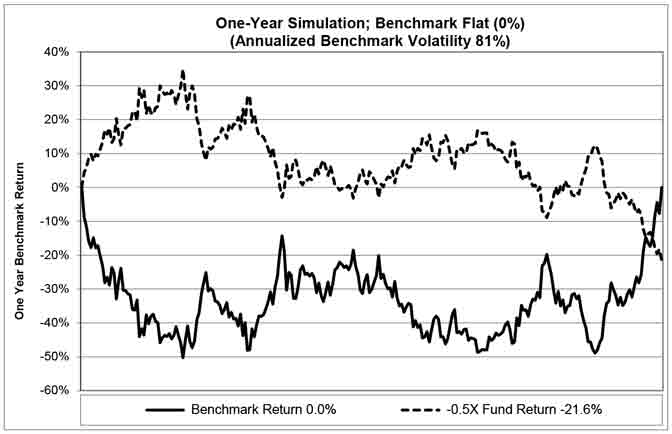

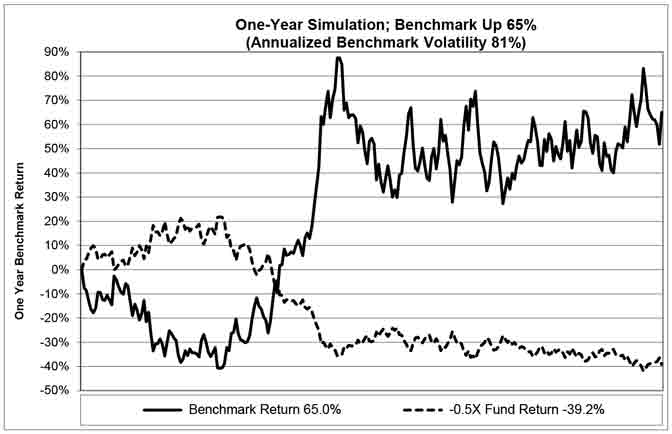

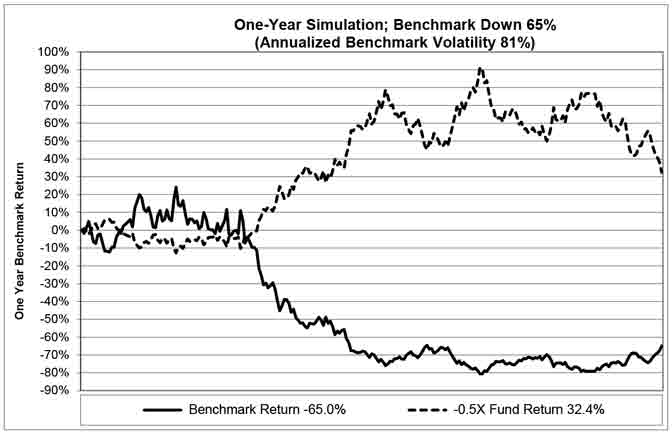

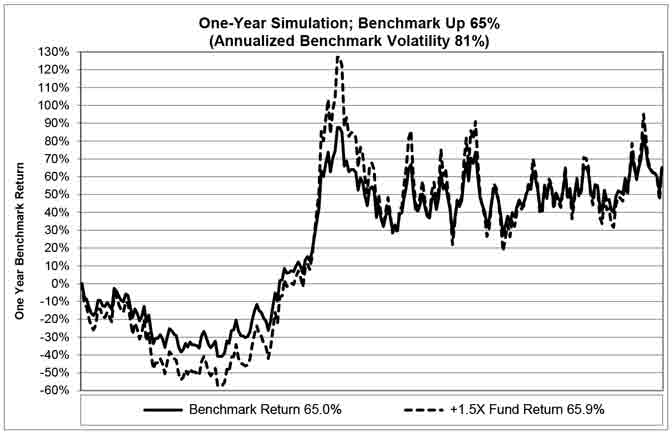

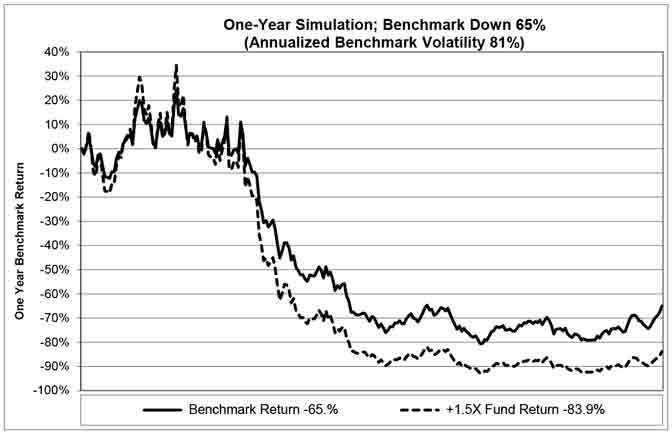

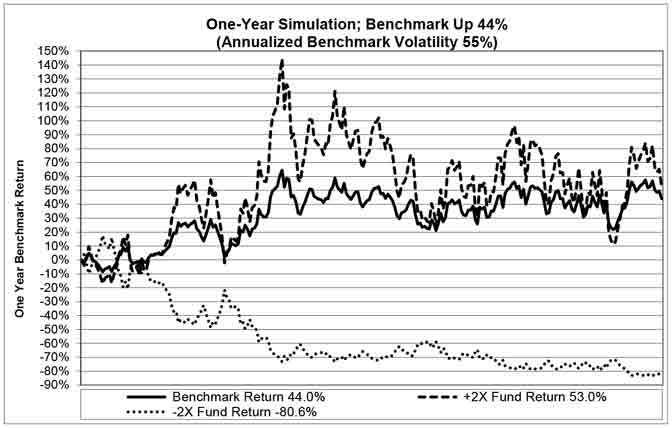

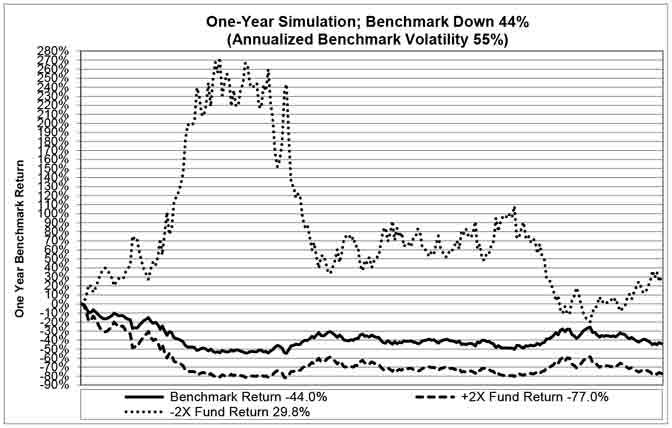

Each Geared Fund seeks investment results for a single day only, not for any other period. This is different from most exchange-traded funds and means that the return of such Fund for a period longer than a single trading day will be the result of each day’s returns compounded over the period, which will very likely differ in amount and possibly even direction from -0.5x, -2x, 1.5x, or 2x, of the return of the benchmark to which such Fund is benchmarked for that period. Volatility of the benchmark may be at least as important to a Geared Fund’s return for the period as the return of the benchmark. Geared Funds that use leverage, are riskier than similarly benchmarked exchange-traded funds that do not use leverage. Accordingly, these Funds may not be suitable for all investors and should be used only by knowledgeable investors who understand the potential consequences of seeking daily leveraged, inverse or inverse leveraged investment results. Shareholders who invest in the Geared Funds should consider actively manage and monitormonitoring and/or periodically rebalancing their investments, as frequently as daily.investments.

Each Matching VIX Fund seeks investment results, before fees and expenses, that match the performance of the S&P 500 VIX Short-Term Futures Index (the “Short-Term VIX Index”) or the S&P 500 VIX Mid-Term Futures Index (the “Mid-Term VIX Index”) (each a “VIX Futures Index”). Each Geared VIX Fund seeks daily investment results, before fees and expenses, that correspond to a multiple or the inverse of the daily performance of the Short-Term VIX Index. Each VIX Fund intends to obtain exposure to its benchmark by taking positions in futures contracts (“VIX futures contracts”) based on the Chicago Board Options Exchange (“Cboe”) Volatility Index (the “VIX”).

ProShares UltraShort Bloomberg Crude Oil, ProShares Ultra Gold, ProShares Ultra Silver, ProShares UltraShort Gold, ProShares UltraShort Silver, ProShares UltraShort Bloomberg Natural Gas, ProShares Ultra Bloomberg Crude Oil, and ProShares Ultra Bloomberg Natural Gas are benchmarked to indexes designed to track the performance of commodity futures contracts, as applicable. The daily performance of these Indexes and the corresponding Funds will likely be very different in amount and possibly even direction from the daily performance of the price of the related physical commodities.

Each Geared Fund continuously offers and redeems its Shares in blocks of 50,000 Shares and each Matching VIX Fund continuously offers and redeems its Shares in blocks of 25,000 Shares (each such block a “Creation Unit”). Only Authorized Participants may purchase and redeem Shares from a Fund and then only in Creation Units. An Authorized Participant is an entity that has entered into an Authorized Participant Agreement with one or more of the Funds. Shares of the Funds are offered to Authorized Participants in Creation Units at each Fund’s respective NAV. Authorized Participants may then offer to the public, from time to time, Shares from any Creation Unit they create at a per-Share market price that varies depending on, among other factors, the trading price of the Shares of each Fund on its applicable listing exchange, the NAV and the supply of and demand for the Shares at the time of the offer. Shares from the same Creation Unit may be offered at different times and may have different offering prices based upon the above factors. The form of Authorized Participant Agreement and related Authorized Participant Handbook set forth the terms and conditions under which an Authorized Participant may purchase or redeem a Creation Unit. Authorized Participants do not receive from any Fund, the Sponsor, or any of their affiliates, any underwriting fees or compensation in connection with their sale of Shares to the public.

Forward Share Splits and Reverse Share SplitsSplits*

On April 3, 2020, the Trust announced a 1-for-25 reverse split of the shares of beneficial interest of ProShares Ultra Bloomberg Crude Oil (ticker symbol: UCO) and a 1-for-10 reverse split of the shares of beneficial interest of ProShares Ultra Bloomberg Natural Gas (ticker symbol: BOIL). The reverse splits were effective prior to market open on April 21, 2020, when the funds began trading at their post-split price. The reverse splits were applied retroactively for all periods presented, reducing the number of shares outstanding and resulting in a proportionate increase in the price per share and per share information of these funds. Therefore, the reverse splits did not change the aggregate net asset value of a shareholder’s investment at the time of the reverse splits.

2

On May 11, 2021, the Trust announced a 1-for-10 reverse split of the shares of beneficial interest of ProShares Ultra VIX Short-Term Futures ETF (ticker symbol: UVXY), a 1-for-4 reverse split of the shares of beneficial interest of ProShares UltraShort Bloomberg Crude Oil (ticker symbol: SCO), a 1-for-4 reverse split of the shares of beneficial interest of ProShares UltraShort Silver (ticker symbol: ZSL) and a 1-for-4 reverse split of the shares of beneficial interest of ProShares VIX Short-Term Futures ETF (ticker symbol: VIXY). The reverse splits were effective prior to market open on May 26, 2021, when the funds began trading at their post-split price. The reverse splits were applied retroactively for all periods presented, reducing the number of shares outstanding and resulted in a proportionate increase in the price per share and the per share information of the 4 funds. Therefore, the reverse splits did not change the aggregate net asset value of a shareholder’s investment at the time of the reverse splits.

On December 22, 2021, the Trust announced a 1-for-5 reverse split of the shares of beneficial interest of ProShares UltraShort Bloomberg Natural Gas ETF (ticker symbol: KOLD). The reverse splits weresplit was effective prior to market open on January 14, 2022, when the fundsfund began trading at theirits post-split price. The reverse splits weresplit was applied retroactively for all periods presented, reducing the number of shares outstanding and resulted in a proportionate increase in the price per share and the per share information of the fund. Therefore, the reverse splitssplit did not change the aggregate net asset value of a shareholder’s investment at the time of the reverse splits.split.

2

On May 11, 2022, the Trust announcedissued a press release announcing a forward share split on ProShares UltraShort Yen and ProShares Ultra Bloomberg Crude Oil and a reverse share split on ProShares UltraShort Bloomberg Natural Gas and ProShares UltraShort Bloomberg Crude Oil. The Splits did not change the value of a shareholder’s investment. ProShares UltraShort Yen executed a 2:1 Forward Split of its shares. ProShares Ultra Bloomberg Crude Oil executed a 4:1 Forward Split of its shares. The Forward Split wasSplits were effective at the market open on May 26, 2022, when the Funds began trading at their post-Forward Split prices. The ticker symbol for the Funds did not change. The Forward SplitSplits decreased the price per share of the Funds with a proportionate increase in the number of shares outstanding. ProShares UltraShort Bloomberg Natural Gas executed a 1:4 Reverse Split of its shares. ProShares UltraShort Bloomberg Crude Oil executed a 1:5 Reverse Split of its shares. The Reverse Split wasSplits were effective at the market open on May 26, 2022, when the Funds began trading at their post-Reverse Split prices. The ticker symbol for the Funds did not change, but the Funds issued new CUSIP numbers (74347Y813 for KOLD and 74347Y797 for SCO). The Reverse SplitSplits increased the price per share of the Funds with a proportionate decrease in the number of shares outstanding.

On June 7, 2023, the Trust issued a press release announcing a reverse share split on ProShares VIX Short-Term Futures ETF, ProShares Ultra VIX Short-Term Futures ETF and ProShares Ultra Bloomberg Natural Gas. The Splits did not change the value of a shareholder’s investment. ProShares VIX Short-Term Futures ETF executed a 1:5 Reverse Split of its shares. ProShares Ultra VIX Short-Term Futures ETF executed a 1:10 Reverse Split of its shares. ProShares Ultra Bloomberg Natural Gas ETF executed a 1:20 Reverse Split of its shares. The Reverse Splits were effective at the market open on June 23, 2023, when the Funds began trading at their post-Reverse Split prices. The ticker symbol for the Funds did not change, but the Funds issued new CUSIP numbers (74347Y789 for VIXY, 74347Y771 for UVXY, and 74347Y763 for BOIL). The Reverse Splits increased the price per share of the Funds with a proportionate decrease in the number of shares outstanding.

| * | See Note 1 of the Notes to Financial Statements in Item 15 of part IV in this Annual Report on Form 10-K. |

Investment Objectives and Principal Investment Strategies

Investment Objectives

The Matching Funds

Investment Objectives of the “Matching VIX” Funds

Each Matching VIX Fund seeks investment results, before fees and expenses, both for a single day andthat over time, that match the performance of the Short-Term VIX Index or the Mid-Term VIX Index (together, the “VIX Futures Indexes”). The VIX Futures Indexes seek to offer exposure to forward market equity volatility through publicly traded futures markets. If a Matching VIX Fund is successful in meeting its objective, its value, before fees and expenses, should gain approximately as much on a percentage basis as the level of its corresponding VIX Futures Index when the benchmark rises. Conversely, its value, before fees and expenses, should lose approximately as much on a percentage basis as the level of its benchmark when the benchmark declines. Each Matching VIX Fund acquires exposure through any one of or combinations of Financial Instruments, including Financial Instruments with respect to the applicable Matching VIX Fund; such that each Matching VIX Fund has exposure intended to approximate its applicable VIX Futures Index at the time of its NAV calculation. The VIX Futures Indexes track the performance of VIX futures contracts; they do not track the performance of the Cboe VIX, and the Matching VIX Funds should not be expected to match the performance of the VIX.

The Geared Funds

Investment Objectives of the “Short” FundsFund

The ProShares Short VIX Short-Term Futures ETF seeks daily investment results, before fees and expenses, that correspond to one-half the inverse (-0.5x) of the daily performance of its benchmark.benchmark (referred to, for Geared Funds, as the “Daily Target”). If the ProShares Short VIX Short-Term Futures ETF is successful in meeting its objective, its value on a given day, before fees and expenses, should gain approximately one-half as much on a percentage basis as its corresponding benchmark when the benchmark declines. Conversely, its value on a given day, before fees and expenses, should lose approximately one-half as much on a percentage basis as the corresponding benchmark when the benchmark

3

rises. The ProShares Short VIX Short-Term Futures ETF will acquire short exposure through any one of or combinations of Financial Instruments, including Financial Instruments with respect to the ProShares Short VIX Short-Term Futures ETF benchmark, such that the Fund has exposure intended to approximate the one-half inverse (-0.5x) of its corresponding benchmark at the time of its NAV calculation. The Fund is benchmarked to the S&P VIX Short-Term Futures Index, an investable index of VIX futures contracts. The Fund is not benchmarked to the VIX.

3

Investment Objectives of the “UltraShort” Funds

Each “UltraShort” Fund seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the daily performance of its corresponding benchmark. Expenses may include, among other things, costs related to the purchase, sale and storage of commodities or currencies and the cost of leverage, all of which may be embedded in Financial Instruments used by that Fund. If an UltraShort Fund is successful in meeting its objective, its value on a given day, before fees and expenses, should gain approximately two times as much on a percentage basis as its corresponding benchmark when the benchmark declines. Conversely, its value on a given day, before fees and expenses, should lose approximately two times as much on a percentage basis as the corresponding benchmark when the benchmark rises. Each UltraShort Fund acquires short exposure through any one of or combinations of Financial Instruments, including Financial Instruments with respect to the applicable UltraShort Fund’s benchmark, such that each UltraShort Fund has exposure intended to approximate two times the inverse (-2x) of its corresponding benchmark at the time of its NAV calculation.

Investment Objectives of the “Ultra” Funds

Each “Ultra” Fund, other than the ProShares Ultra VIX Short-Term Futures ETF, seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of its corresponding benchmark. Expenses may include, among other things, costs related to the purchase, sale and storage of commodities or currencies and the cost of leverage, all of which may be embedded in Financial Instruments used by that Fund. If an Ultra Fund, other than the ProShares Ultra VIX Short-Term Futures ETF, is successful in meeting its objective, its value on a given day, before fees and expenses, should gain approximately two times as much on a percentage basis as its corresponding benchmark when the benchmark rises. Conversely, its value on a given day, before fees and expenses, should lose approximately two times as much on a percentage basis as the corresponding benchmark when the benchmark declines. Each Ultra Fund, other than the ProShares Ultra VIX Short-Term Futures ETF, acquires long exposure through any one of or combinations of Financial Instruments, including Financial Instruments with respect to the applicable Ultra Fund’s benchmark such that each Ultra Fund, other than the ProShares Ultra VIX Short-Term Futures ETF, has exposure intended to approximate two times (2x) its corresponding benchmark at the time of its NAV calculation.

The ProShares Ultra VIX Short-Term Futures ETF seeks daily investment results, before fees and expenses, that correspond to one and one-half times (1.5x) the daily performance of its corresponding benchmark. If the ProShares Ultra VIX Short-Term Futures ETF is successful in meeting its objective, its value on a given day, before fees and expenses, should gain approximately one and one-half times as much on a percentage basis as its corresponding benchmark when the benchmark rises. Conversely, its value on a given day, before fees and expenses, should lose approximately one and one-half times as much on a percentage basis as the corresponding benchmark when the benchmark declines. The ProShares Ultra VIX Short-Term Futures ETF acquires long exposure through any one of or combinations of Financial Instruments, including Financial Instruments with respect to the ProShares Ultra VIX Short-Term Futures ETF benchmark such that the Fund has exposure intended to approximate one and one-half times (1.5x) its corresponding benchmark at the time of its NAV calculation. The Fund is benchmarked to the S&P VIX Short-Term Futures Index, an investable index of VIX futures contracts. The Fund is not benchmarked to the VIX.

The Geared Funds do not seek to achieve their Daily Target for any period other than a day.

The corresponding benchmark for each Fund is listed below:

ProShares VIX Short-Term Futures ETF, ProShares Short VIX Short-Term Futures ETF and ProShares Ultra VIX Short-Term Futures ETF: The S&P 500 VIX Short-Term Futures Index. The S&P 500 VIX Short-Term Futures Index seeks to offer exposure to market volatility through publicly traded futures markets and is designed to measure the return from a rolling long position in the first and second month VIX futures contracts.

ProShares VIX Mid-Term Futures ETF: The S&P 500 VIX Mid-Term Futures Index. The S&P 500 VIX Mid-Term Futures Index seeks to offer exposure to market volatility through publicly traded futures markets and is designed to measure the return from a rolling long position in the fourth, fifth, sixth and seventh month VIX futures contracts.

ProShares UltraShort Bloomberg Crude Oil and ProShares Ultra Bloomberg Crude Oil: The Bloomberg Commodity Balanced WTI Crude Oil IndexSM. The Bloomberg Commodity Balanced WTI Crude Oil IndexSM is designed to track crude oil futures prices.

4

ProShares UltraShort Bloomberg Natural Gas and ProShares Ultra Bloomberg Natural Gas: The Bloomberg Natural Gas SubindexSM. The Bloomberg Natural Gas SubindexSM is designed to track natural gas futures prices traded on the NYMEX.

4

ProShares UltraShort Gold and ProShares Ultra Gold: The Bloomberg Gold SubindexSM. The Bloomberg Gold SubindexSM is intended to reflect the performance of gold, as measured by the price of COMEX gold futures contracts.

ProShares UltraShort Silver and ProShares Ultra Silver: The Bloomberg Silver SubindexSM. The Bloomberg Silver SubindexSM is intended to reflect the performance of silver, as measured by the price of COMEX silver futures contracts.

ProShares UltraShort Euro and ProShares Ultra Euro: The 4:00 p.m. (Eastern Time) spot price of the euro versus the U.S. dollar, using euro/U.S. dollar exchange rate as provided by Bloomberg, expressed in terms of U.S. dollars per unit of foreign currency.

ProShares UltraShort Yen and ProShares Ultra Yen: The 4:00 p.m. (Eastern Time) spot price of the Japanese yen versus the U.S. dollar using the Japanese yen/U.S. dollar exchange rate as provided by Bloomberg, expressed in terms of U.S. dollars per unit of foreign currency.

Principal Investment Strategies

In seeking to achieve each Fund’s investment objective or Daily Target, the Sponsor uses a mathematical approach to investing. Using this approach, the Sponsor determines the type, quantity and mix of Financial Instruments the Sponsor believes, in combination, should produce daily returns consistent with a Fund’s objective.objective or Daily Target. The Funds are not actively managed by traditional methods (e.g., by effecting changes in the composition of a portfolio on the basis of judgments relating to economic, financial and market conditions with a view toward obtaining positive results under all market conditions). Each Fund seeks to remain fully invested at all times in Financial Instruments and money market instruments that, in combination, provide exposure to its underlying benchmark consistent with its investment objective without regard to market conditions, trends or direction.

Certain of the Funds may obtain exposure through Financial Instruments to a representative sample of the components in its underlying index, which have aggregate characteristics similar to those of the underlying benchmark. This “sampling” process typically involves selecting a representative sample of components in the benchmark principally to enhance liquidity and reduce transaction costs while seeking to maintain high correlation with, and similar aggregate characteristics (e.g., underlying commodities and valuations) to, the underlying benchmark. In addition, the Funds may obtain exposure to components not included in the underlying benchmark, invest in assets that are not included in the underlying benchmark or may overweight or underweight certain components contained in the underlying benchmark. For further discussion of the Financial Instruments, see “Information about Financial Instruments and Commodities Markets” below.

Information about Financial Instruments and Commodities Markets

Swap Agreements

Swap agreements are two-party contracts that have traditionally been entered into primarily by institutional investors in over the counter (“OTC”) markets for a specified period ranging from a day to more than a year. However, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) provides for significant reforms of the OTC derivatives markets, including a requirement to execute certain swap and forward transactions on a CFTC-regulated market and/or to clear such transactions through a CFTC-regulated central clearing organization. In a standard swap transaction, the parties agree to exchange the returns on a particular predetermined investment, instrument or index for a fixed or floating rate of return (the “interest rate leg,” which will also include the cost of borrowing for short swaps) in respect of a predetermined notional amount. The notional amount of the agreement reflects the extent of a Fund’s total investment exposure under the swap agreement. Transaction or commission costs are reflected in the benchmark level at which the transaction is entered into. The gross returns to be exchanged are calculated with respect to the notional amount and the benchmark returns to which the swap is linked. Swaps are usually closed out on a net basis, i.e., the two payment streams are netted out in a cash settlement on the payment date specified in the agreement, with the parties receiving or paying, as the case may be, only the net amount of the two payments. Thus, while the notional amount reflects a Fund’s total investment exposure under the swap agreement (i.e., the entire face amount or principal of a swap agreement), the net amount is a Fund’s current obligations (or rights) under the swap agreement, which is the net amount to be paid or received under the agreement based on the relative values of the positions held by each party to the agreement on any given termination date. In a typical swap agreement entered into by an UltraShort Fund or a Short Fund, absent fees, transaction costs and interest, such Fund would be required to make payments to the swap counterparty in the event the benchmark increases and would be entitled to settlement payments in the event the benchmark decreases. In a typical swap agreement entered into by an Ultra Fund, absent fees, transaction costs and interest, the Ultra Fund would be entitled to settlement payments in the event the benchmark increases and would be required to make payments to the swap counterparty in the event the benchmark decreases.

5

Swap agreements involve, to varying degrees, elements of market risk and exposure to loss in excess of the amount which would be reflected on the Statement of Financial Condition. The notional amounts of the agreement reflect the extent of each Ultra Fund’s total investment exposure under the swap agreement. An UltraShort Fund’s or a Short Fund’s exposure is not limited by the notional amount and its exposure is in theory potentially infinite as there is no fixed limit on the increase in any index value. The primary risks associated with the use of swap agreements arise from the inability of counterparties to perform. Each Fund that invests in swaps bears the risk of loss of the net amount, if any, expected to be received under a swap agreement in the event of the default or bankruptcy of a swap counterparty. Each such Fund enters or intends to enter into swap agreements only with major, global financial institutions; however, there are no limitations on the percentage of its assets each Fund may invest in swap agreements with a particular counterparty. Each Fund that invests in swaps may use various techniques to minimize credit risk including early termination or reset and payment, using different counterparties and limiting the net amount due from any individual counterparty.

Each Fund that invests in swaps generally collateralizes the swap agreements with cash and/or certain securities. Collateral posted in connection with OTC derivative transactions is generally held for the benefit of the counterparty in a segregated tri-party account at the Custodian to protect the counterparty against non-payment by the Fund. The counterparty also may collateralize the OTC swap agreements with cash and/or certain securities, which collateral is typically held for the benefit of the Fund in a segregated tri-party account at a third party custodian. In the event of a default by the counterparty, and the Fund is owed money in the OTC swap transaction, such Fund will seek withdrawal of this collateral from the segregated account and may incur certain costs exercising its right with respect to the collateral. These Funds remain subject to credit risk with respect to the amount it expects to receive from counterparties.

The Funds have sought to mitigate these risks in connection with the OTC swaps by generally requiring that the counterparties for each Fund agree to post collateral for the benefit of the Fund, marked to market daily, subject to certain minimum thresholds; however there are no limitations on the percentage of its assets each Fund may invest in swap agreements with a particular counterparty. To the extent any such collateral is insufficient or there are delays in accessing the collateral, the Funds will be exposed to counterparty risk as described above, including possible delays in recovering amounts as a result of bankruptcy proceedings.

The counterparty risk for cleared derivative transactions is generally lower than for OTC derivatives since generally a clearing organization becomes substituted for each counterparty to a cleared derivative contract and, in effect, guarantees the parties’ performance under the contract as each party to a trade looks only to the clearing house for performance of financial obligations. In addition, cleared derivative transactions benefit from daily marking-to-market and settlement, and segregation and minimum capital requirements applicable to intermediaries.

Forward Contracts

A forward contract is a contractual obligation to purchase or sell a specified quantity of a particular underlying asset at or before a specified date in the future at a specified price and, therefore, is economically similar to a futures contract. Unlike futures contracts, however, forward contracts are typically traded in the OTC markets and are not standardized contracts. Forward contracts for a given commodity or currency are generally available for various amounts and maturities and subject to individual negotiation between the parties involved. Moreover, there is generally no direct means of offsetting or closing out a forward contract by taking an offsetting position as one would a futures contract on a U.S. exchange. If a trader desires to close out a forward contract position, he generally will establish an opposite position in the contract but will settle and recognize the profit or loss on both positions simultaneously on the delivery date. Thus, unlike in the futures contract market where a trader who has offset positions will recognize profit or loss immediately, in the forward market a trader with a position that has been offset at a profit will generally not receive such profit until the delivery date, and likewise a trader with a position that has been offset at a loss will generally not have to pay money until the delivery date. In recent years, however, the terms of forward contracts have become more standardized, and in some instances such contracts now provide a right of offset or cash settlement as an alternative to making or taking delivery of the underlying commodity or currency. The primary risks associated with the use of forward contracts arise from the inability of the counterparty to perform.

Each Fund that invests in forward contracts generally collateralizes the OTC forward contracts with cash and/or certain securities. Such collateral is generally held for the benefit of the counterparty in a segregated tri-party account at the Custodian to protect the counterparty against non-payment by the Fund. The counterparty also may collateralize the OTC forward contracts with cash and/or certain securities, which collateral is typically held for the benefit of the Fund in a segregated tri-party account at a third party custodian. In the event of a default by the counterparty, and the Fund is owed money in the OTC forward transaction, such Fund will seek withdrawal of this collateral from the segregated account and may incur certain costs exercising its right with respect to the collateral. These Funds remain subject to credit risk with respect to the amount it expects to receive from OTC counterparties.

6

The Funds have sought to mitigate these risks with respect to OTC forwards by generally requiring that the counterparties for each Fund agree to post collateral for the benefit of the Fund, marked to market daily, subject to certain minimum thresholds; however, there are no limitations on the percentage of its assets each Fund may invest in forward contracts with a particular counterparty. To the extent any such collateral is insufficient or there are delays in accessing the collateral, the Funds will be exposed to counterparty risk as described above, including possible delays in recovering amounts as a result of bankruptcy proceedings.

The forward markets provide what has typically been a highly liquid market for foreign exchange trading, and in certain cases the prices quoted for foreign exchange forward contracts may be more favorable than the prices for foreign exchange futures contracts traded on U.S. exchanges. Forward contracts have traditionally not been cleared or guaranteed by a third party. However, the Dodd-Frank Act provides for significant reforms of OTC derivatives markets. As a result of the Dodd-Frank Act, the CFTC now regulates non- deliverable forwards (including deliverable forwards where the parties do not take delivery). Certain non-deliverable forward contracts, such as non-deliverable foreign exchange forwards, may be subject to regulation as swap agreements, including mandatory clearing. All foreign exchange forwards, including non-deliverable foreign exchange forwards as well as physically settled foreign exchange forwards, are subject to new reporting requirements. Changes in the forward markets may entail increased costs and result in burdensome reporting requirements.

Commercial banks participating in trading OTC foreign exchange forward contracts often do not require margin deposits, but rely upon internal credit limitations and their judgments regarding the creditworthiness of their counterparties. In recent years, however, many OTC market participants in foreign exchange trading have begun to require that their counterparties post margin.

Futures Contracts

A futures contract is a standardized contract traded on, or subject to the rules of, an exchange that calls for the future delivery of a specified quantity and type of commodity at a specified time and place or alternatively, may call for cash settlement as is the case with VIX futures contracts. Futures contracts are traded on a wide variety of commodities, including bonds, interest rates, agricultural products, stock indexes, currencies, energy, metals, economic indicators and statistical measures. The notional size and calendar term of futures contracts on a particular commodity are identical and are not subject to any negotiation, other than with respect to price and the number of contracts traded between the buyer and seller. Each Fund generally deposits cash with a Futures Commission Merchant (“FCM”) for its open positions in futures contracts, which may, in turn, transfer such deposits to the clearing house to protect the clearing house against non-payment by the Fund. The clearing house becomes substituted for each counterparty to a futures contract, and in effect, guarantees performance. In addition, the FCM may require the Funds to deposit collateral in excess of the clearing house’s margin requirements for the FCM’s own protection.

Certain futures contracts, such as VIX futures contracts, as well as stock index contracts and certain commodity futures contracts, settle in cash, reflecting the difference between the contract purchase/sale price and the contract settlement price. The cash settlement mechanism avoids the potential for either side to have to deliver the underlying asset. For other futures contracts, the contractual obligations of a buyer or seller may generally be satisfied by taking or making physical delivery of the underlying asset or by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of delivery. The difference between the price at which the futures contract is purchased or sold and the price paid for the offsetting sale or purchase, after allowance for brokerage commissions, constitutes the profit or loss to the trader.

Regulations

Derivatives exchanges in the United States are subject to regulation under the CEA, by the CFTC, the governmental agency having responsibility for regulation of derivatives exchanges and trading on those exchanges. Following the adoption of the Dodd-Frank Act, the CFTC also has authority to regulate OTC derivative markets, including certain OTC foreign exchange markets. The CFTC has exclusive authority to designate exchanges for the trading of specific futures contracts and options on futures contracts and to prescribe rules and regulations of the marketing of each. The CFTC also regulates the activities of “commodity pool operators” and the CFTC has adopted regulations with respect to certain of such persons’ activities. Pursuant to its authority, the CFTC requires a commodity pool operator, such as the Sponsor, to keep accurate, current and orderly records with respect to each pool it operates. The CFTC may suspend, modify or terminate the registration of any registrant for failure to comply with CFTC rules or regulations. Suspension, restriction or termination of the Sponsor’s registration as a commodity pool operator would prevent it, until such time (if any) as such registration were to be reinstated, from managing, and might result in the termination of the Funds. If the Sponsor were unable to provide services and/or advice to the Funds, the Funds would be unable to pursue their investment objectives unless and until the Sponsor’s ability to provide services and advice to the Funds was reinstated or a replacement for the Sponsor as commodity pool operator could be found. Such an event could result in termination of the Funds.

7

The CEA requires all FCMs to meet and maintain specified fitness and financial requirements, segregate customer funds from proprietary funds and account separately for all customers’ funds and positions, and to maintain specified books and records open to inspection by the staff of the CFTC. See “Item 1A. Risk Factors. Failure of the FCMs to segregate assets may increase losses in the Funds.” in this Annual Report on Form 10-K.

7

The CEA also gives the states certain powers to enforce its provisions and the regulations of the CFTC.

Under certain circumstances, the CEA grants shareholders the right to institute a reparations proceeding before the CFTC against the Sponsor (as a registered commodity pool operator), an FCM, as well as those of their respective employees who are required to be registered under the CEA. Shareholders may also be able to maintain a private right of action for certain violations of the CEA.

Pursuant to authority in the CEA, the National Futures Association (the “NFA”) has been formed and registered with the CFTC as a registered futures association. At the present time, the NFA is the only self-regulatory organization for commodities professionals other than exchanges. As such, the NFA promulgates rules governing the conduct of commodity professionals and disciplines those professionals that do not comply with such standards. The CFTC has delegated to the NFA responsibility for the registration of commodity pool operators, FCMs, swap dealers, commodity trading advisors, introducing brokers and their respective associated persons and floor brokers. The Sponsor is a member of the NFA (the Funds themselves are not required to become members of the NFA). As an NFA member, the Sponsor is subject to NFA standards relating to fair trade practices, financial condition, and consumer protection. The CFTC is prohibited by statute from regulating trading on foreign commodity exchanges and markets.

The CEA and CFTC regulations prohibit market abuse and generally require that all futures exchange-based trading be conducted in compliance with rules designed to ensure the integrity of market prices and without any intent to manipulate prices. CFTC regulations and futures exchange rules also impose limits on the size of the positions that a person may hold or control as well as standards for aggregating certain positions. The rules of the CFTC and the futures exchanges also authorize special emergency actions to halt, suspend or limit trading overall or to restrict, halt, suspend or limit the trading of an individual trader or to otherwise impose special reporting or margin requirements. See also “Item 1A. Risk Factors. Regulatory changes or actions, including the implementation of new legislation, may alter the operations and profitability of the Funds” and “Item 1A. Risk Factors. Regulatory and exchange accountability levels may restrict the creation of Creation Units and the operation of the Trust” in this Annual Report on Form 10-K.

Description of the Bloomberg Commodity Index SM and its Sub-Indexes

Overview of the Bloomberg Family of Indices

Bloomberg Commodity Balanced WTI Crude Oil IndexSM

ProShares UltraShort Bloomberg Crude Oil and ProShares Ultra Bloomberg Crude Oil are designed to correspond, before fees and expenses, to two times the inverse (-2x) or two times (2x), respectively, of the daily performance of the Bloomberg Commodity Balanced WTI Crude Oil IndexSM, a sub-index of the Bloomberg Commodity Index. The Bloomberg Commodity Balanced WTI Crude Oil IndexSM is intended to track the performance of 3 separate contract schedules for WTI Crude Oil futures. One third of the Benchmark follows a monthly roll schedule two months beyond the nearby contract. The second third of the Benchmark follows a June annual roll schedule, while the remaining third follows a December annual roll schedule. The Benchmark weights are equally reset semi-annually in the months of March and September on close of the first business day. The weighting of the futures contracts included in the Benchmark is not linked to the “spot” price of WTI crude oil. For more information about the risks associated with rolling futures positions, see “Item 1A. Risk Factors. Potential negative impact from rolling futures positions” in this Annual Report on Form 10-K.

Bloomberg Natural Gas SubindexSM

ProShares UltraShort Bloomberg Natural Gas and ProShares Ultra Bloomberg Natural Gas are designed to correspond, before fees and expenses, to two times the inverse (-2x) or two times (2x), respectively, of the daily performance of the Bloomberg Natural Gas SubindexSM, a sub-index of the Bloomberg Commodity Index. The Bloomberg Natural Gas SubindexSM is intended to reflect the performance of a rolling position in natural gas futures contracts traded on the NYMEX without regard to income earned on cash positions. An investment in natural gas futures contracts may often perform very differently than the price of physical natural gas (e.g., the wellhead or end-user price of natural gas). See “Item 1A. Risk Factors. The Commodity Index Funds are linked to an index comprised of commodity futures contracts, and are not linked to the spot prices of the underlying physical commodities. Commodity futures contracts may perform very differently from the spot price of the underlying physical commodities” in this Annual Report on Form 10-K.

8

The Bloomberg Natural Gas SubindexSM is based on the Natural Gas component of the Bloomberg Commodity Index, which is described above under “Bloomberg Commodity IndexSM,” and tracks what is known as a rolling futures position. The roll occurs over a period of five Bloomberg Commodity Index business days in certain months according to a pre-determined schedule, generally beginning on the sixth business day of the month and ending on the tenth business day. Each day, approximately 20% of each rolling futures position that is included in the month’s roll is rolled, increasing from 0% to 20%, 40%, 60%, 80% and finally 100%. The exact roll methodology differs between certain commodities. The index will reflect the performance of its underlying natural gas contracts, including the impact of rolling, without regard to income earned on cash positions. For more information about the risks associated with rolling futures positions, see “Item 1A. Risk Factors. Potential negative impact from rolling futures positions” in this Annual Report on Form 10-K.

Bloomberg Gold SubindexSM

ProShares Ultra Gold and ProShares UltraShort Gold are designed to correspond, before fees and expenses, to two times (2x) or two times the inverse (-2x), respectively, of the daily performance of the Bloomberg Gold SubindexSM, a sub-index of the Bloomberg Commodity Index. The Bloomberg Gold Subindex is intended to reflect the performance of gold, as measured by the price of COMEX gold futures contracts, including the impact of rolling, without regard to income earned on cash positions. The Gold Subindex is not directly linked to the “spot price” of gold. Futures contracts may perform very differently from the spot price of gold.

The Gold Subindex is based on the gold component of the Bloomberg Commodity Index and tracks what is known as a rolling futures position. Unlike equities, which entitle the holder to a continuing stake in a corporation, commodity futures contracts specify a delivery date for the underlying physical commodity or its cash equivalent. The Gold Subindex is a “rolling index,” which means that the Gold Subindex does not take physical possession of any commodities. An investor with a rolling futures position is able to avoid delivering (or taking delivery of) underlying physical commodities while maintaining exposure to those commodities. The roll occurs over a period of five Gold Subindex business days in certain months according to a pre-determined schedule, generally beginning on the sixth business day of the month and ending on the tenth business day. Each day, approximately 20% of each rolling futures position that is included in the month’s roll is rolled, increasing from 0% to 20%, 40%, 60%, 80% and finally 100%. The Gold Subindex will reflect the performance of its underlying gold futures contracts, including the impact of rolling, without regard to the income earned on cash positions.

Bloomberg Silver SubindexSM

ProShares Ultra Silver and ProShares UltraShort Silver are designed to correspond, before fees and expenses, to two times (2x) or two times the inverse (-2x), respectively, of the daily performance of the Bloomberg Silver SubindexSM, a sub-index of the Bloomberg Commodity Index. The Bloomberg Silver Subindex is intended to reflect the performance of silver, as measured by the price of COMEX silver futures contracts, including the impact of rolling, without regard to income earned on cash positions. The Silver Subindex is not directly linked to the “spot price” of silver. Futures contracts may perform very differently from the spot price of silver.

The Silver Subindex is based on the silver component of the Bloomberg Commodity Index and tracks what is known as a rolling futures position. Unlike equities, which entitle the holder to a continuing stake in a corporation, commodity futures contracts specify a delivery date for the underlying physical commodity or its cash equivalent. The Silver Subindex is a “rolling index,” which means that the Silver Subindex does not take physical possession of any commodities. An investor with a rolling futures position is able to avoid delivering (or taking delivery of) underlying physical commodities while maintaining exposure to those commodities. The roll occurs over a period of five Silver Subindex business days in certain months according to a pre-determined schedule, generally beginning on the sixth business day of the month and ending on the tenth business day. Each day, approximately 20% of each rolling futures position that is included in the month’s roll is rolled, increasing from 0% to 20%, 40%, 60%, 80% and finally 100%. The Silver Subindex will reflect the performance of its underlying silver futures contracts, including the impact of rolling, without regard to the income earned on cash positions.

Information about the Index Licensor

“Bloomberg®”, “Bloomberg Commodity IndexSM”, “Bloomberg Commodity Balanced WTI Crude Oil IndexSM”, “Bloomberg Natural Gas SubindexSM”, “Bloomberg Gold SubindexSM” and “Bloomberg Silver SubindexSM” are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by ProShares Trust II (“Licensee”).

9

The Products are not sponsored, endorsed, sold or promoted by Bloomberg. Bloomberg does not make any representation or warranty, express or implied, to the owners of or counterparties to the Product(s) or any member of the public regarding the advisability of investing in securities or commodities generally or in the Product(s) particularly. The only relationship of Bloomberg to the Licensee is the licensing of certain trademarks, trade names and service marks and of the Bloomberg Commodity IndexSM, the Bloomberg

9

Commodity Balanced WTI Crude Oil IndexSM, the Bloomberg Natural Gas SubindexSM, the Bloomberg Gold SubindexSM and the Bloomberg Silver SubindexSM, which are determined, composed and calculated by BISL without regard to the Licensee or the Product(s). Bloomberg has no obligation to take the needs of the Licensee or the owners of the Product(s) into consideration in determining, composing or calculating the Bloomberg Commodity IndexSM, the Bloomberg Commodity Balanced WTI Crude Oil IndexSM, the Bloomberg Natural Gas SubindexSM, the Bloomberg Gold SubindexSM or the Bloomberg Silver SubindexSM. Bloomberg is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) are to be converted into cash. Bloomberg shall not have any obligation or liability, including, without limitation, to Products customers, in connection with the administration, marketing or trading of the Product(s).

This Annual Report on Form 10-K relates only to Products and does not relate to the exchange-traded physical commodities underlying any of the Bloomberg Commodity IndexSM, the Bloomberg Commodity Balanced WTI Crude Oil IndexSM, the Bloomberg Natural Gas SubindexSM, the Bloomberg Gold SubindexSM or the Bloomberg Silver SubindexSM components. Purchasers of the Products should not conclude that the inclusion of a futures contract in the Bloomberg Commodity IndexSM, the Bloomberg Commodity Balanced WTI Crude Oil IndexSM, the Bloomberg Natural Gas SubindexSM, the Bloomberg Gold SubindexSM or the Bloomberg Silver SubindexSM is any form of investment recommendation of the futures contract or the underlying exchange-traded physical commodity by Bloomberg. The information in this Annual Report on Form 10-K regarding the Bloomberg Commodity IndexSM, the Bloomberg Commodity Balanced WTI Crude Oil IndexSM, the Bloomberg Natural Gas SubindexSM, the Bloomberg Gold SubindexSM and the Bloomberg Silver SubindexSM components has been derived solely from publicly available documents. Bloomberg has not made any due diligence inquiries with respect to the Bloomberg Commodity IndexSM, the Bloomberg Commodity Balanced WTI Crude Oil IndexSM, the Bloomberg Natural Gas SubindexSM, the Bloomberg Gold SubindexSM or the Bloomberg Silver SubindexSM components in connection with Products. Bloomberg makes no representation that these publicly available documents or any other publicly available information regarding the Bloomberg Commodity IndexSM, the Bloomberg Commodity Balanced WTI Crude Oil IndexSM, the Bloomberg Natural Gas SubindexSM, the Bloomberg Gold SubindexSM or the Bloomberg Silver SubindexSM components, including without limitation a description of factors that affect the prices of such components, are accurate or complete.

BLOOMBERG DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE BLOOMBERG COMMODITY INDEXSM,INDEXSM, THE BLOOMBERG COMMODITY BALANCED WTI CRUDE OIL INDEXSM,INDEXSM, THE BLOOMBERG NATURAL GAS SUBINDEXSM,SUBINDEXSM, THE BLOOMBERG GOLD SUBINDEXSMSUBINDEXSM OR THE BLOOMBERG SILVER SUBINDEXSMSUBINDEXSM OR ANY DATA RELATED THERETO AND SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS THEREIN. BLOOMBERG DOES NOT MAKE ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE LICENSEE, OWNERS OF THE PRODUCT(S) OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE BLOOMBERG COMMODITY INDEXSM,INDEXSM, THE BLOOMBERG COMMODITY BALANCED WTI CRUDE OIL INDEXSM,INDEXSM, THE BLOOMBERG NATURAL GAS SUBINDEXSM,SUBINDEXSM, THE BLOOMBERG GOLD SUBINDEXSMSUBINDEXSM OR THE BLOOMBERG SILVER SUBINDEXSMSUBINDEXSM OR ANY DATA RELATED THERETO. BLOOMBERG DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE BLOOMBERG COMMODITY INDEXSM,INDEXSM, THE BLOOMBERG COMMODITY BALANCED WTI CRUDE OIL INDEXSM,INDEXSM, THE BLOOMBERG NATURAL GAS SUBINDEXSM,SUBINDEXSM, THE BLOOMBERG GOLD SUBINDEXSMSUBINDEXSM OR THE BLOOMBERG SILVER SUBINDEXSMSUBINDEXSM OR ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, TO THE MAXIMUM EXTENT ALLOWED BY LAW, BLOOMBERG, ITS LICENSORS, AND ITS AND THEIR RESPECTIVE EMPLOYEES, CONTRACTORS, AGENTS, SUPPLIERS, AND VENDORS SHALL HAVE NO LIABILITY OR RESPONSIBILITY WHATSOEVER FOR ANY INJURY OR DAMAGES—WHETHERDAMAGES —WHETHER DIRECT, INDIRECT, CONSEQUENTIAL, INCIDENTAL, PUNITIVE OR OTHERWISE—ARISINGOTHERWISE —ARISING IN CONNECTION WITH THE NAME OF PRODUCT OR NAME OF INDEX OR ANY DATA OR VALUES RELATING THERETO—WHETHERTHERETO —WHETHER ARISING FROM THEIR NEGLIGENCE OR OTHERWISE, EVEN IF NOTIFIED OF THE POSSIBILITY THEREOF.

Description of the Currencies Benchmarks

The Currency Funds are designed to correspond, before fees and expenses, to two times the inverse (-2x), or two times (2x) of the daily performance of the spot price of the applicable currency versus the U.S. dollar. The spot price of each currency is measured by the 4:00 p.m. (Eastern Time) spot prices as provided by Bloomberg, expressed in terms of U.S. dollars per unit of foreign currency. The Currency Funds do not necessarily directly or physically hold the underlying currency and will instead seek exposure through the use of certain Financial Instruments whose value is based on the price of the underlying currency to pursue its investment objective.

10

Euro

ProShares UltraShort Euro and ProShares Ultra Euro are designed to correspond, before fees and expenses, to the two times the inverse (-2x), or two times (2x), respectively, of the daily performance of the euro spot price versus the U.S. dollar. These Funds use the 4:00 p.m. (Eastern Time) euro/U.S. dollar exchange rate as provided by Bloomberg, expressed in terms of U.S. dollars per unit of foreign currency, as the basis for the underlying benchmark.

10

In 1998, the European Central Bank in Frankfurt was organized by Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain in order to establish a common currency-the euro. Unlike the U.S. Federal Reserve System, the Bank of Japan and other comparable central banks, the European Central Bank is a central authority that conducts monetary policy for an economic area consisting of many otherwise largely autonomous states.

At its inception on January 1, 1999, the euro was launched as an electronic currency used by banks, foreign exchange dealers and stock markets. In 2002, the euro became cash currency for approximately 300 million citizens of twelve European countries (the eleven countries mentioned above, in addition to Greece). As of December 31, 2022,2023, 23 countries used the euro, including Andorra, Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, San Marino, Slovakia, Slovenia, and the Vatican City.

The European financial markets and the value of the euro have experienced significant volatility, in part related to unemployment, budget deficits and economic downturns. In addition, several member countries of the Economic and Monetary Union (the “EMU”) of the European Union (the “EU”) have experienced credit rating downgrades, rising government debt levels and, for certain EU member countries (including Greece, Spain, Portugal, Ireland and Italy), weaknesses in sovereign debt. Following a referendum in June 2016, the United Kingdom formally exited the EU on January 31, 2020 (known as “Brexit”). During a transition period where the United Kingdom remained subject to EU rules but had no role in the EU law-making process, the United Kingdom and EU representatives negotiated the precise terms of their future relationship, reaching an agreement on December 24, 2020. On December 31, 2020, the transition period concluded and the terms of the new agreement went into effect on January 1, 2021. The complete impact of the new agreement, as well as the full scope and nature of the consequences of the exit, are not at this time known and are unlikely to be known for a significant period of time, but the future direction of the value of non-U.S. currencies or the U.S. dollar and, in turn, affect the value of the Currency Funds. In addition, these uncertainties could increase volatility in the market prices of non-U.S. currencies or the U.S. dollar and, in turn, affect the value of the Currency Funds. The effects of Brexit will depend on agreements the UK negotiates to retain access to EU markets either during a transitional period or more permanently. Brexit could lead to legal and tax uncertainty and potentially divergent national laws and regulations as the UK determines which EU laws to replace and replicate.

Although the European countries that have adopted the euro are members of the European Union (“EU”), the United Kingdom, Denmark and Sweden are EU members that have not adopted the euro as their national currency.

Japanese Yen

ProShares UltraShort Yen and ProShares Ultra Yen are designed to correspond, before fees and expenses, to two times the inverse (-2x) or two times (2x), respectively, of the daily performance of the Japanese yen spot price versus the U.S. dollar. These Funds use the 4:00 p.m. (Eastern Time) Japanese yen/U.S. dollar exchange rate as provided by Bloomberg, expressed in terms of U.S. dollars per unit of foreign currency, as the basis for the underlying benchmark.

The Japanese yen has been the official currency of Japan since 1871. The Bank of Japan has been operating as the central bank of Japan since 1882.

Description of the VIX Futures Indexes

The VIX Funds seek to offer exposure to forward equity market volatility by obtaining exposure to the VIX Futures Indexes, which are based on publicly traded VIX futures contracts. The VIX Futures Indexes are intended to reflect the returns that are potentially available through an unleveraged investment in the VIX futures contracts comprising each VIX Futures Index. The VIX, which is not the index underlying the VIX Funds, is calculated based on the prices of put and call options on the S&P 500. The VIX Funds can be expected to perform very differently from the VIX.

The Short-Term VIX Index employs rules for selecting VIX futures contracts comprising the Short-Term VIX Index and a formula to calculate a level for that index from the prices of these VIX futures contracts. Specifically, the VIX futures contracts comprising the Short-Term VIX Index represent the prices of two near-term VIX futures contracts, replicating a position that rolls the nearest month VIX futures to the next month VIX futures on a daily basis in equal fractional amounts. This results in a constant weighted average maturity of one-month. The roll period begins on the Tuesday prior to the monthly Cboe VIX futures settlement and runs through the Tuesday prior to the subsequent month’s Cboe VIX futures settlement date.

11

The Mid-Term VIX Index also employs rules for selecting its VIX futures contracts comprising the Mid-Term VIX Index and a formula to calculate a level for that index from the prices of these VIX futures contracts. Specifically, the VIX futures contracts comprising the Mid-Term VIX Index represent the prices for four contract months of VIX futures contracts, representing a rolling long position in the fourth, fifth, sixth and seventh month VIX futures contracts. The Mid-Term VIX Index rolls continuously throughout each month while maintaining positions in the fifth and sixth month contracts. This results in a constant weighted average maturity of five months.

11

The level of each VIX Futures Index will be published by Bloomberg L.P. in real time and at the close of trading on each VIX Futures Index business day under the following ticker symbols:

Index | Bloomberg Ticker Symbol | ||||||

S&P 500 VIX Short-Term Futures Index | SPVXSP | ||||||

S&P 500 VIX Mid-Term Futures Index | SPVXMPID | ||||||

The performance of the VIX Futures Indexes is influenced by the S&P 500 (and options thereon) and the VIX. A description of VIX futures contracts, the VIX and the S&P 500 follows:

VIX Futures Contracts

Both VIX Futures Indexes are comprised of VIX futures contracts. VIX futures contracts were first launched for trading by the Cboe in 2004. VIX futures contracts allow investors to invest based on their view of the forward implied market volatility of the S&P 500. Investors that believe the forward implied market volatility of the S&P 500 will increase may buy VIX futures contracts. Conversely, investors that believe that the forward implied market volatility of the S&P 500 will decline may sell VIX futures contracts.

While the VIX represents a measure of the current expected volatility of the S&P 500 over the next 30 days, the prices of VIX futures contracts are based on the current expectation of the expected 30-day volatility of the S&P 500 on the expiration date of the futures contract. Since the VIX and VIX futures contracts are two distinctly different measures, the VIX and VIX futures contracts generally behave quite differently.

The VIX

The VIX Funds are not linked to the VIX and can be expected to perform very differently from the VIX. The VIX is an index designed to measure the implied volatility of the S&P 500 over 30 days in the future, and is calculated based on the prices of certain put and call options on the S&P 500. The VIX is reflective of the premium paid by investors for certain options linked to the level of the S&P 500. During periods of rising investor uncertainty, including periods of market instability, the implied level of volatility of the S&P 500 typically increases and, consequently, the prices of options linked to the S&P 500 typically increase (assuming all other relevant factors remain constant or have negligible changes). This, in turn, causes the level of the VIX to increase. The VIX has historically had a negative correlation to the S&P 500. The VIX was developed by the Cboe and is calculated, maintained and published by the Cboe. The Cboe has no obligation to continue to publish, and may discontinue the publication of, the VIX. The VIX is reported by Bloomberg under the ticker symbol “VIX.”

The calculation of the VIX involves a formula that uses the prices of a weighted series of out-of-the-money put and call options on the level of the S&P 500 (“SPX Options”) with two adjacent expiry terms to derive a constant 30-day forward measure of market volatility. The VIX is calculated independent of any particular option pricing model and in doing so seeks to eliminate any biases which may otherwise be included in using options pricing methodology based on certain assumptions. Although the VIX measures the

12

30-day forward volatility of the S&P 500 as implied by the SPX Options, 30-day options are only available once a month. To arrive at the VIX level, a broad range of out-of-the-money SPX Options expiring on the two closest nearby months (“near term options” and “next term options,” respectively) are selected in order to bracket a 30-day calendar period. SPX Options having a maturity of less than eight days are excluded at the outset and, when the near term options have eight days or less left to expiration, the VIX rolls to the second and third contract months in order to minimize pricing anomalies that occur close to expiration. The model-free implied volatility using prices of the near term options and next term options are then calculated on a strike price weighted average basis in order to arrive at a single average implied volatility value for each month. The results of each of the two months are then interpolated to arrive at a single value with a constant maturity of 30 days to expiration.

The S&P 500

The S&P 500 is an index that measures large-cap U.S. stock market performance. It is a float-adjusted market capitalization weighted index of 500 U.S. operating companies and real estate investment trusts selected by the S&P U.S. Index Committee through a non-non-mechanical mechanical process that factor in criteria such as domicile, investible weight factor, liquidity, market capitalization and financial viability. Changes to the index composition are made on an as needed basis. There is no scheduled reconstitution. Rather, changes in response to corporate actions and market developments can be made at any time. As of December 31, 2022,2023, the S&P 500 included companies with capitalizations between $3.6$4.9 billion and $2.1$3.0 trillion. The average capitalization of the companies comprising the Index was approximately $67.2$83.6 billion. S&P publishes the S&P 500. The daily calculation of the current value of the S&P 500 is based on the relative value of the aggregate market value of the common stocks of 500 companies as of a particular time compared to the

12

aggregate average initial market value of the common stocks of 500 similar companies at the time of the inception of the S&P 500. The 500 companies are not the 500 largest publicly traded companies and not all 500 companies are listed on the NYSE. Constituent selection is at the discretion of the Index Committee and is based on eligibility criteria. The indices have a fixed constituent company count of 500, 400, and 600, respectively. Sector balance, as measured by a comparison of each GICs sector’s weight in the S&P Total Market Index, in the relevant capitalization range, is also considered in the selection of companies for the indices. S&P may from time-to-time, in its sole discretion, add companies to, or delete companies from, the S&P 500 to achieve the objectives stated above. Relevant criteria employed by S&P include the viability of the particular company, the extent to which that company represents the industry group to which it is assigned, the extent to which the company’s common stock is widely held and the market value and trading activity of the common stock of that company.

THE VIX FUNDS ARE NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY S&P AND ITS AFFILIATES OR CBOE. S&P AND CBOE MAKE NO REPRESENTATION, CONDITION OR WARRANTY, EXPRESS OR IMPLIED, TO THE OWNERS OF THE VIX FUNDS OR ANY MEMBER OF THE PUBLIC REGARDING THE ADVISABILITY OF INVESTING IN SECURITIES GENERALLY OR IN THE VIX FUNDS PARTICULARLY OR THE ABILITY OF THE INDEXES TO TRACK MARKET PERFORMANCE AND/OR OF GROUPS OF ASSETS OR ASSET CLASSES AND/OR TO ACHIEVE ITS STATED OBJECTIVE AND/OR TO FORM THE BASIS OF A SUCCESSFUL INVESTMENT STRATEGY, AS APPLICABLE. S&P’S AND CBOE’S ONLY RELATIONSHIP TO THE TRUST ON BEHALF OF ITS APPLICABLE SERIES AND THE SPONSOR IS THE LICENSING OF CERTAIN TRADEMARKS AND TRADE NAMES AND OF THE VIX FUTURES INDEXES WHICH ARE DETERMINED, COMPOSED AND CALCULATED BY S&P WITHOUT REGARD TO THE TRUST ON BEHALF OF ITS APPLICABLE SERIES AND THE SPONSOR OR THE VIX FUNDS. S&P HAS NO OBLIGATION TO TAKE THE NEEDS OF THE TRUST ON BEHALF OF ITS APPLICABLE SERIES AND THE SPONSOR OR THE OWNERS OF THE VIX FUNDS INTO CONSIDERATION IN DETERMINING, COMPOSING OR CALCULATING THE VIX FUTURES INDEXES. S&P AND CBOE ARE NOT ADVISORS TO THE VIX FUNDS AND ARE NOT RESPONSIBLE FOR AND HAVE NOT PARTICIPATED IN THE DETERMINATION OF THE PRICES AND AMOUNT OF THE VIX FUNDS OR THE TIMING OF THE ISSUANCE OR SALE OF THE VIX FUNDS OR IN THE DETERMINATION OR CALCULATION OF THE EQUATION BY WHICH THE VIX FUND SHARES ARE TO BE CONVERTED INTO CASH. S&P AND CBOE HAVE NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE ADMINISTRATION, MARKETING, OR TRADING OF THE VIX FUNDS.

NEITHER S&P DOW JONES INDICES NOR THIRD PARTY LICENSOR GURANTEES THE ADEQUACY, ACCURACY, TIMELINESS, AND/OR THE COMPLETENESS OF THE S&P 500 VIX MID-TERM FUTURES INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION, (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESEPECT THERETO. NEITHER S&P DOW JONES INDICES NOR CBOE SHALL BE SUBJECT TO ANY DAMANGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND CBOE MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARCIULAR PRUPOSE OR USE AS TO RESULTS TO BE OBTAINED BY PROSHARES TRUST II, ON BEHALF OF ITS APPLICABLE SERIES, AND PROSHARE CAPITAL MANAGEMENT LLC, OWNERS OF THE FUND, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P 500 VIX SHORT-TERM FUTURES ER MCAP INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR CBOE, BE LIABLE FOR ANY INDEIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO,

13

LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBLITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND PROSHARES TRUST II, ON BEHALF OF ITS APPLICABLE SERIES, OR PROSHARE CAPITAL MANAGEMENT LLC, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

Creation and Redemption of Shares

Each Fund creates and redeems Shares from time to time, but only in one or more Creation Units. A Creation Unit is a block of 50,000 Shares of a Geared Fund or a block of 25,000 Shares of a Matching VIX Fund. Creation Units may be created or redeemed only by Authorized Participants. Except when aggregated in Creation Units, the Shares are not redeemable securities.