| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

2023

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

| Indiana | 82-3784946 | |||||||

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | |||||||

| 19100 Ridgewood Parkway, | Suite 1200 | ||||||||

San Antonio, | Texas |

| |||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||

| Title of each class | Trading Symbols | Name of each exchange on which registered | ||||||

Class A Common Stock, no par value | BH.A | New York Stock Exchange | ||||||

| Class B Common Stock, no par value | BH | New York Stock Exchange

| ||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

| Large accelerated filer | ¨ | Accelerated filer | x | Non-accelerated filer | ¨ | Smaller reporting company | x | Emerging growth company | ¨ | ||||||||||||||||||||

$201,503,586.

| Class A common stock – | 206,864 | ||||

| Class B common stock – | 2,068,640 | ||||

| Page No. | |||||||||||

| Item 1B. | |||||||||||

Issuance of Dual Class Common Stock

On March 5, 2018, the Company entered into an agreement with its predecessor registrant, now known as OBH Inc. (the “Predecessor”), and BH Merger Company, a wholly owned subsidiary of the Company. Pursuant to the agreement on April 30, 2018, BH Merger Company merged with and into the Predecessor, with the Predecessor continuing as the surviving corporation and a wholly owned subsidiary of the Company.

As a result of the April 30, 2018 transaction, the Company has two classes of common stock, designated Class A common stock and Class B common stock. A share of Class B common stock has economic rights equivalent to 1/5th of a share of Class A common stock; however, Class B common stock has no voting rights. Upon completion of the transaction, every ten (10) shares of common stock outstanding on April 30, 2018 converted into (i) ten (10) shares of Class B common stock and (ii) one (1) share of Class A common stock.

Since May 1, 2018, theBiglari beneficially owns shares of the Company’s Class A common stock have traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “BH.A” and the sharesCompany that represent approximately 66.8% of the Company’s Class B common stock have traded oneconomic interest and approximately 71.0% of the NYSE under the ticker symbol “BH”.

voting interest.

Steak n Shake is engaged in the ownership, operation, and franchising of Steak n Shake restaurants.

Western Sizzlin is engaged primarily in the franchising of restaurants.

Operations

1

Franchising

In addition to the traditional franchise arrangements described above, Steak n Shake initiated a new franchise partner program during 2018 to transition company-operated restaurants to such franchisees. The franchise agreement stipulates that the franchisee make an upfront investment totaling $10,000. Steak n Shake, as the franchisor, assesses a fee of up to 15% of sales as well as 50% of profits. Potential franchisees are screened based on entrepreneurial attitude and ability, but they become franchise partners based on achievement. Each must meet the gold standard in service. Franchise partners are required to be hands-on operators. We limit a franchisee to a single location.

Regulations

Licenses

Our

First Guard competes for truck insurance with other companies. The commercial truck insurance business is highly competitive in the areas of price and service. Vigorous competition is provided by large, well-capitalized companies and by small regional insurers. First Guard’s insurance products are marketed primarily through direct response methods via the Internet or by telephone. First Guard’s cost-efficient direct response marketing methods enable it to be a low-cost truck insurer. First Guard uses its own claim staff to manage claims. Seasonal variations in First Guard’s insurance business are not significant. However, extraordinary weather conditions or other factors may have a significant effect upon the frequency or severity of claims.

The insurance business is stringently regulated by state insurance departments. First Guard is headquartered in Venice, Florida.

2

Media

Employees

The Company employs 18,684 persons.

humanity. We seek to associate with people of high character and competence.

3

We are a “controlled company” within the meaning of the New York Stock Exchange rules and thus can rely on exemptions from certain corporate governance requirements.

Our historical growth rate is The Company does not indicative of our future growth.

When evaluating our historical growthhave a governance and prospects for future growth, it is important to consider that while our business philosophy has remained constant our mix of business has changed and will continue to change. Our business model makes it difficult to assess our prospects for future growth.

nominating committee.

requirements.

Competition.

Each of ourlower earnings.

Unfavorable domestic and international

Toearnings.

Our operating businesses face a varietyand investments.

There is no assurance thatdemand for our international operations will remain profitable. Our international operations are subject to all of the risks associated with our domestic operations, as well as a number of additional risks, varying substantially country by country. These include,inter alia, international economicproducts and political conditions, corruption, terrorism, social and ethnic unrest, foreign currency fluctuations, differing cultures and consumer preferences. Our expansion into international markets could also create risks to our brands.

In addition, we may become subject to foreign governmental regulations that impact the way we do business with our international franchisees and vendors. These include antitrust and tax requirements, anti-boycott regulations, international trade regulations, the USA Patriot Act, the Foreign Corrupt Practices Act, and applicable local law. Failure to comply with any such legal requirements could subject us to monetary liabilitiesservices, credit losses when customers and other sanctions, which could harm our businesscounterparties fail to satisfy their obligations to us, and our financial condition.

4

We may not be able to adequately protect our intellectual property, which could decrease the value of our brand and products.

The success of our business depends on the continued ability to use the existing trademarks, service marks, and other components of our brand to increase brand awareness and further develop branded products. While we take steps to protect our intellectual property, our rights to our trademarks could be challenged by third parties or our use of these trademarks may result in a liability for trademark infringement, trademark dilution, or unfair competition, adversely affecting our profitability. We may also become subject to these risks in the international markets in which we operate and in which we plan to expand. Any impairment of our intellectual property or brands, including due to changes in U.S. or foreign intellectual property laws or the absence of effective legal protections or enforcement measures, could adversely impact our business, financial condition and results of operations.

Certain agreements with our Chairman and CEO may have an adverse effect on our financial position.

We have entered into a license agreement with Sardar Biglari, Chairman and Chief Executive Officer, under which Mr. Biglari has granted the Company an exclusive license to use his name when connected to the provision of certain products and services, as well as a sublicense agreement with Steak n Shake that,inter alia, grants Steak n Shake the right to use the trademark “Steak n Shake by Biglari.” In the event of a change of control of the Company or Mr. Biglari’s termination without cause or resignation following specified occurrences, including (1) his removal as Chairman of the Board or Chief Executive Officer or (2) his not maintaining sole capital allocation authority, Mr. Biglari would be entitled to receive revenue-based royalty payments related to the usage of his name under the terms of the license agreement for a defined period of no less than five years. In addition, we have an incentive agreement with Mr. Biglari, in which he is entitled to receive performance-based annual incentive payments contingent on the growth of the Company’s adjusted book value in each fiscal year.

5

Changes in economic conditions may have an adverse impact on our restaurant operations.

Our cash flows and financial position could be negatively impacted if we are unable to comply with the restrictions and covenants in Steak n Shake’s debt agreements.

Covenants in Steak n Shake’s credit facility include restrictions on, among other things, its ability to incur additional indebtedness and to make distributions to the Company. Steak n Shake’s ability to make payments on its credit facility and to fund operations depends on its ability to generate cash, which is subject to general economic, financial, competitive, regulatory and other factors that are beyond our control. Steak n Shake may not generate sufficient cash flow from operations to service this debt or to fund its other liquidity needs. Steak n Shake’s failure to service its debt could constitute an event of default that, if not cured or waived, could result, among other things, in the acceleration of their indebtedness, which could negatively impact our operations. However, neither the Company nor any of our affiliates provide any guarantees of Steak n Shake’s debts.

We cannot predict whether we will continue to be able to anticipate and react to changing food costs by adjusting our purchasing practices, menu offerings, and menu prices, and a failure to do so could adversely affect our operating results.

6

In recent years, there has been an increased legislative, regulatory, and consumer focus on nutrition and advertising practices in the food industry. As a result, restaurantRestaurant operations may becomeare also subject to regulatory initiatives in the area of nutrition disclosure or advertising, such as requirements to provide information about the nutritional content of our food products, which could increase expenses.products. The operation of the Steak n Shake and Western Sizzlin franchise systemsystems is also subject to franchise laws and regulations enacted by a number of states, and to rules promulgated by the U.S. Federal Trade Commission. Any future legislation regulating franchise relationships may negatively affect our operations, particularly our relationshiprelationships with franchisees. Failure to comply with new or existing franchise laws and regulations in any jurisdiction, or to obtain required government approvals, could result in a ban or temporary suspension on future franchise sales. Further national, state, and local government initiatives, such as mandatory health insurance coverage or proposed increases in minimum wage rates, could adversely affect our business.

Our

Our

7

Risks Relating to Our Insurance Business

Our media business faces significant competition from other magazine publishers and new forms of media, including digital media, and as a result our media business may not be able to improve its operating results.

Our media business competes principally with other magazine publishers. The proliferation of choices available to consumers for information and entertainment has resulted in audience fragmentation and has negatively impacted overall consumer demand for print magazines and intensified competition with other magazine publishers for share of print magazine readership. Our media business also competes with digital publishers and other forms of media. This competition has intensified as a result of the growing popularity of mobile devices and the shift in preference of some consumers from print media to digital media for the delivery and consumption of content.

Competition among print magazine and digital publishers for advertising is primarily based on the circulation and readership of magazines and the number of visitors to websites, respectively, and the demographics of customers, advertising rates, plus the effectiveness of advertising sales teams. The proliferation of new platforms available to advertisers, combined with continuing competition from print platforms, has impacted both the amount of advertising our media business is able to sell and the rates it can command.

8

Our pursuit of licensingLicensing opportunities for the Maxim brand may provebe difficult to be unsuccessful.

maintain.

Because magazines are generally discretionary purchasesthe effects of volatile commodity prices.

Item 1B. Unresolved Staff Comments |

None.

9

None.

2018,2023, restaurant operations included 685492 company-operated and franchise locations. Restaurant operations own the land and building for 153 restaurants.142 restaurants; they also own one other property. The following table lists the locations of the restaurants as of December 31, 2018. Steak n Shake Western Sizzlin Company Operated Franchise Company Operated Franchise Total Domestic: Alabama 2 7 - 6 15 Arizona 1 1 - - 2 Arkansas - 7 - 16 23 California 1 6 - 1 8 Colorado 2 2 - - 4 Delaware - 1 - - 1 Florida 80 4 - - 84 Georgia 22 17 - 5 44 Illinois 61 10 - - 71 Indiana 68 5 - - 73 Iowa 3 - - - 3 Kansas - 4 - - 4 Kentucky 14 10 - - 24 Louisiana - 1 - - 1 Maryland - 1 - 1 2 Michigan 19 - - - 19 Mississippi - 4 - 1 5 Missouri 37 24 - - 61 Nevada - 6 - - 6 North Carolina 6 11 - 6 23 Ohio 63 3 - 1 67 Oklahoma - 3 - 7 10 Pennsylvania 7 6 - - 13 South Carolina 1 5 - 3 9 Tennessee 9 17 - 4 30 Texas 14 18 - 1 33 Virginia - 8 3 3 14 Washington - 1 - - 1 West Virginia - 2 1 - 3 International: France 2 20 - - 22 Italy - 2 - - 2 Portugal - 4 - - 4 Qatar - 1 - - 1 Saudi Arabia - 1 - - 1 Spain 1 1 - - 2 Total 413 213 4 55 685 Steak n Shake Western Sizzlin Company

OperatedFranchise

PartnerTraditional

FranchiseCompany

OperatedFranchise Total Domestic: Alabama 1 1 4 — 5 11 Arkansas — — 4 — 6 10 California — — 2 — — 2 Colorado 1 — — — — 1 Florida 16 60 5 — — 81 Georgia 7 11 10 — 4 32 Illinois 37 17 8 — — 62 Indiana 35 20 1 — — 56 Iowa 2 1 1 — — 4 Kansas — — 2 — — 2 Kentucky — 12 6 — — 18 Louisiana — — 1 — — 1 Maryland — — — — 1 1 Michigan 7 6 1 — — 14 Mississippi — — 6 — 1 7 Missouri 6 14 20 — — 40 Nebraska — — 1 — — 1 Nevada — — 5 — — 5 North Carolina 1 5 2 — 6 14 Ohio 27 19 1 — 1 48 Oklahoma — — 2 — 2 4 Pennsylvania 1 — 1 — — 2 South Carolina 1 — 2 — 1 4 Tennessee 1 7 9 — 3 20 Texas 1 8 10 — — 19 Virginia — — 4 2 2 8 Washington, D.C. — — 1 — — 1 West Virginia — — 2 1 — 3 International: France 2 — 17 — — 19 Monaco 1 — — — — 1 Spain 1 — — — — 1 Total 148 181 128 3 32 492 Item 3.Legal Proceedings

We are involved in various legal proceedings

On January 29, 2018, a shareholder of the Company filed a purported class action complaint against the Company and the members of our Board of Directors in the Superior Court of Hamilton County, Indiana. The shareholder generally alleges claims of breach of fiduciary duty by the members of our Board of Directors and unjust enrichment to Mr. Biglari as a result of the issuance of a dual class structure.

On March 26, 2018, a shareholder of the Company filed a purported class action complaint against the Company and the members of our Board of Directors in the Superior Court of Hamilton County, Indiana. This shareholder generally alleges claims of breach of fiduciary duty by the members of our Board of Directors. This shareholder sought to enjoin the shareholder vote on April 26, 2018 to approve the issuance of the dual class structure. On April 16, 2018, the shareholders withdrew their motions to enjoin the shareholder vote on April 26, 2018.

On May 17, 2018, the shareholders who filed the January 29, 2018 complaint and the March 26, 2018 complaint filed a new, consolidated complaint against the Company and the members of our Board of Directors in the Superior Court of Hamilton County, Indiana. The shareholders generally allege claims of breach of fiduciary duty by the members of our Board of Directors and unjust enrichment to Mr. Biglari arising out of the issuance of the dual class structure. The shareholders seek, for themselves and on behalf of all other shareholders as a class, a declaration that the defendants breached their dutyContingencies - Note 15 to the shareholders and the class, and to recover unspecified damages, pre-judgment and post-judgment interest, and an awardConsolidated Financial Statements included in Item 8 for a discussion of their attorneys’ fees and other costs.

On December 14, 2018, the Judge of the Superior Court of Hamilton County, Indiana issued an order granting the Company’s motion to dismiss the shareholders’ lawsuits. On January 11, 2019, the shareholders filed an appeal of the Judge’s order dismissing the lawsuits.

The Company believes the claims in each case are without merit and intends to defend these cases vigorously.

1, 2024.

11

Total Number of Class A Shares Purchased Average Price Paid per Class A Share Total Number of Class B Shares Purchased Average Price Paid per Class B Share Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Maximum Number of Shares That May Yet Be Purchased Under Plans or Programs October 1, 2023 - October 31, 2023 — $ — — $ — — — November 1, 2023 - November 30, 2023 — $ — — $ — — — December 1, 2023 - December 31, 2023 1,100 $ 828.69 9,813 $ 164.99 — — Total 1,100 9,813 —

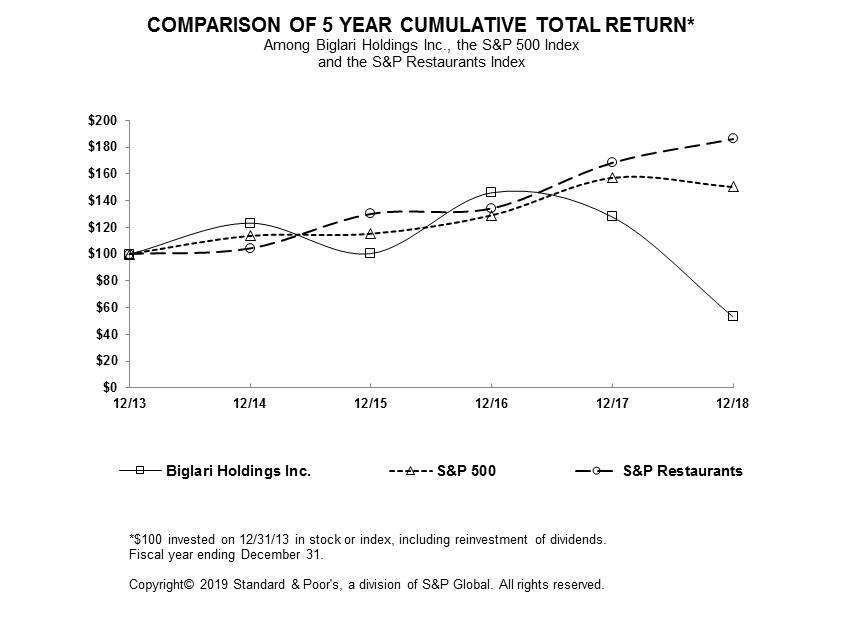

Performance Graph

The graph below matches Biglari Holdings Inc.'s cumulative 5-year total shareholder return on its Class A common stock and Class B common stock with the cumulative total returns of the S&P 500 Index and the S&P Restaurants Index. The graph tracks the performance of a $100 investment in our common stock and in each index (with the reinvestment of all dividends) from December 31, 2013 to December 31, 2018.

The preceding stock price performance graph and related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filings under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except to the extent that we specifically incorporate it by reference into such filings.

Securities Authorized for Issuance Under Equity Compensation Plans

Biglari Holdings does not have any equity compensation plans.

12

(dollars in thousands except per share data)

| 2018 | 2017 | 2016 | 2015 | |||||||||||||

| Revenue: | ||||||||||||||||

| Total revenues | $ | 809,894 | $ | 839,804 | $ | 850,076 | $ | 861,452 | ||||||||

| Earnings: | ||||||||||||||||

| Net earnings (loss) | $ | 19,392 | $ | 50,071 | $ | 99,451 | $ | (15,843 | ) | |||||||

| Net earnings (loss) per equivalent Class A share | $ | 55.71 | $ | 136.01 | $ | 271.22 | $ | (33.94 | ) | |||||||

| Year-end data: | ||||||||||||||||

| Total assets | $ | 1,029,493 | $ | 1,063,584 | $ | 1,096,967 | $ | 987,079 | ||||||||

| Long-term notes payable and other borrowings | 240,001 | 256,994 | 281,555 | 296,062 | ||||||||||||

| Biglari Holdings Inc. shareholders’ equity | $ | 570,455 | $ | 571,328 | $ | 531,940 | $ | 451,372 | ||||||||

| Transition Period | 52 Weeks Ended | |||||||

| Fiscal | ||||||||

| 2014 | 2014 | |||||||

| Revenue: | ||||||||

| Total revenues | $ | 224,450 | $ | 793,811 | ||||

| Earnings: | ||||||||

| Net earnings attributable to Biglari Holdings Inc. | $ | 91,050 | $ | 28,804 | ||||

| Net earnings per equivalent Class A share | $ | 161.63 | $ | 56.16 | ||||

| Year-end data: | ||||||||

| Total assets | $ | 1,298,509 | $ | 1,156,310 | ||||

| Long-term notes payable and other borrowings | 309,003 | 311,448 | ||||||

| Biglari Holdings Inc. shareholders’ equity | $ | 725,551 | $ | 638,717 | ||||

Earnings per share of common stock is based on the weighted average number of shares outstanding during the period. The issuance of dual class common stock on April 30, 2018 is applied to years 2014 through 2017 on a retrospective basis for the calculation of earnings per share. The Company has applied the “two-class method” of computing earnings per share as prescribed in ASC 260, “Earnings Per Share.”

For total assets, periods prior to 2016 were adjusted for the reclassifications of debt issuance costs and deferred taxes. For long-term notes payable and other borrowings, periods prior to 2016 were adjusted for the reclassification of debt issuance.

As of January 1, 2018, franchise royalties and fees are composed of royalties and fees from Steak n Shake and Western Sizzlin franchisees. Royalties are based upon a percentage of sales of the franchise restaurant and are recognized as earned. Franchise royalties are billed on a monthly basis. Initial franchise fees when a new restaurant opens or at the start of a new franchise term are recorded as deferred revenue when received and recognized as revenue over the term of the franchise agreement. This represents a change in methodology under the January 1, 2018 adoption of ASC 606 for we have historically recognized initial franchise fees upon the opening of a franchise restaurant. Comparative prior periods have not been adjusted.

Years 2015 through 2018 ended December 31. In 2014, the Company’s Board of Directors approved a change in the Company’s fiscal year-end moving from the last Wednesday in September to December 31 of each year. Transition period is for September 25, 2014 to December 31, 2014. Fiscal year 2014 ended on the last Wednesday nearest September 30.

13

Preferred Shares. Abraxas Petroleum operates oil and natural gas properties in the Permian Basin. The purchase price allocation included $70,200 of oil and gas properties, cash of $21,726, and liabilities, net of other assets, of $11,926. The Company’s financial results include the results of Abraxas Petroleum from the initial acquisition date to the end of the calendar year. generally discusses 2023 and 2022 items. Discussions of 2021 items can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 27, 2023. revenue during 2022. General and administrative expenses increased gains on the sale of real estate. First Guard’s insurance products are marketed primarily through direct response methods via the Internet or by telephone. First Guard’s cost-efficient direct response marketing methods enable it to be a low-cost our periodic earnings. Investment gains and losses in 2023 and 2022 were mainly derived from our investments in equity securities and included unrealized gains and losses from market price changes during the period. We believe that investment gains/losses are generally meaningless for analytical purposes in understanding our reported quarterly or annual results. These gains and losses have caused and will continue to cause significant volatility in our periodic earnings. 2022. Other $7,271. $6,662. acquire Abraxas Petroleum. credit. 2023, follows. Income Taxes Not applicable. 24, 2024 2021. COMPREHENSIVE INCOME 2021) voting interest. December 31, our aggregate insurance operating results. However, we consider investment gains and losses, whether realized or unrealized, as non-operating. whether the wells found proved reserves. Costs of wells that are assigned proved reserves remain capitalized. Costs are also capitalized for exploratory wells that have found crude oil and natural gas reserves, even if the reserves cannot be classified as proved when the drilling is completed, provided the exploratory well has found a sufficient quantity of reserves to justify its completion as a producing well and the company is making sufficient progress assessing the reserves and the economic and operating viability of the project. All other exploratory wells and costs are expensed. We did not have any property acquisition or exploration activities during 2023, and our development costs were nominal. $443 of deferred revenue during 2024. During the 2024. Insurance premiums are earned over the terms of the related policies. Expenses incurred in connection with acquiring new insurance business, including acquisition costs, are charged to operations as incurred. Premiums earned are stated net of amounts ceded to reinsurer. Gas revenue. production taxes. Use of Estimates the new guidance on our disclosures. recorded noncontrolling interests attributable to the interest held by other shareholders. The 2022, respectively. Gains/losses from investment partnerships recorded in the Company’s consolidated statements of earnings are presented below. 2023, 2022, or 2021. The depletion expense related to oil and gas properties was $9,533, $7,024, and $7,600 during 2023, 2022, and 2021, respectively. The accretion expense of the Company’s asset retirement obligations was $695, $540, and $438 during 2023, 2022, and 2021, respectively. Depletion and accretion expense are included in depreciation, depletion, and amortization expense within the consolidated statement of earnings. Accumulated depreciation, depletion, and accretion on oil and gas properties was $44,716 and $35,072 as of December 31, 2023 and 2022, respectively. No goodwill was recorded with the acquisition of Southern Oil or Abraxas Petroleum. 10. Unpaid Loss and Loss Adjustment Expense 2023. Our deferred tax assets and liabilities consist of the following. $3,881 as of December 31, 2022. Corp. stock and the related incentive reallocations are eliminated in our financial statements. sheets: hierarchy. 2023. 2023.per shareper-share data)media, property and casualty insurance, licensing and restaurants.media, restaurants, and oil and gas. The Company’s largest operating subsidiaries are involved in the franchising and operating of restaurants. Biglari Holdings is founded and led by Sardar Biglari, Chairman and Chief Executive Officer of the Company.Holdings and its major operating subsidiaries. The Company’s long-term objective is to maximize per-share intrinsic value.Holdings’ management system combines decentralized operations with centralized financial decision-making. Operating decisions for the various business units are made by their respective managers. All major operating, investment and capital allocation decisions are made for the Company and its subsidiaries by Mr. Biglari.2018,2023, Mr. Biglari’s beneficial ownership was approximately 56.9% of the Company’s outstanding Class A common stock and 54.3% of the Company’s outstanding Class B common stock.Issuance of Dual Class Common StockOn March 5, 2018, the Company entered into an agreement with its predecessor registrant, now known as OBH Inc. (the “Predecessor”), and BH Merger Company, a wholly owned subsidiary of the Company. Pursuant to the agreement on April 30, 2018, BH Merger Company merged with and into the Predecessor, with the Predecessor continuing as the surviving corporation and a wholly owned subsidiary of the Company.As a result of the April 30, 2018 transaction, the Company has two classes of common stock, designated Class A common stock and Class B common stock. A share of Class B common stock has economic rights equivalent to 1/5th of a share of Class A common stock; however, Class B common stock has no voting rights. Upon completion of the transaction, every ten (10) shares of common stock outstanding on April 30, 2018 converted into (i) ten (10) shares of Class B common stock and (ii) one (1) share of Class A common stock.Since May 1, 2018, theBiglari beneficially owns shares of the Company’s Class ACompany that represent approximately 66.8% of the economic interest and approximately 71.0% of the voting interest.have traded onof Abraxas Petroleum. On June 14, 2023, the New York Stock Exchange (“NYSE”) under the ticker symbol “BH.A” and the sharesremaining 10% of the Company’s Class Boutstanding common stock have traded onof Abraxas Petroleum was acquired for $5,387. The Company used working capital including its line of credit to fund the NYSE underpurchase of the ticker symbol “BH”. Amounts are recorded after deducting income taxes. 2018 2017 2016 Operating businesses: Restaurant $ (2,613 ) $ 9,725 $ 24,834 Insurance 4,915 3,097 3,313 Media 796 435 (6,385 ) Other 472 506 (157 ) Total operating businesses 3,570 13,763 21,605 Corporate (8,661 ) 32,072 (6,387 ) Investment partnership gains 33,240 11,080 91,332 Interest expense on notes payable (8,757 ) (6,844 ) (7,099 ) $ 19,392 $ 50,071 $ 99,451 2023 2022 2021 Operating businesses: Restaurant $ 21,831 $ 9,383 $ 11,235 Insurance 10,262 7,662 11,290 Oil and gas 25,406 19,091 7,528 Brand licensing 8 1,313 2,364 Interest expense (531) (305) (841) Corporate and other (17,814) (9,806) (9,829) Total operating businesses 39,162 27,338 21,747 Investment partnership gains (losses) 14,646 (56,961) 8,899 Investment gains (losses) 1,731 (2,682) 4,832 Net earnings (loss) 55,539 (32,305) 35,478 Earnings (loss) attributable to noncontrolling interest 591 (287) — Net earnings (loss) attributable to Biglari Holdings Inc. shareholders $ 54,948 $ (32,018) $ 35,478 14 Management’s(continued)685492 company-operated and franchise restaurants as of December 31, 2018.

Steak n Shake Western Sizzlin Company- operated Franchise Company-operated Franchise Total Total stores as of December 31, 2015 417 144 4 66 631 Net restaurants opened (closed) — 29 (1 ) (2 ) 26 Total stores as of December 31, 2016 417 173 3 64 657 Net restaurants opened (closed) (2 ) 27 1 (6 ) 20 Total stores as of December 31, 2017 415 200 4 58 677 Net restaurants opened (closed) (2 ) 13 — (3 ) 8 Total stores as of December 31, 2018 413 213 4 55 685 The term “same-store sales” refers to the sales2023.Steak n Shake Western Sizzlin Company-

operatedFranchise

PartnerTraditional

FranchiseCompany-

operatedFranchise Total Stores on December 31, 2020 276 86 194 3 39 598 Corporate stores transitioned (73) 73 — — — — Net restaurants opened (closed) (4) — (16) — (1) (21) Stores on December 31, 2021 199 159 178 3 38 577 Corporate stores transitioned (16) 16 — — — — Net restaurants opened (closed) (6) — (24) — (2) (32) Stores on December 31, 2022 177 175 154 3 36 545 Corporate stores transitioned (6) 7 (1) — — — Net restaurants opened (closed) (23) (1) (25) — (4) (53) Stores on December 31, 2023 148 181 128 3 32 492 company-operated units open at least 18 months at the beginningDecember 31, 2023, 17 of the current period and have remained open through the end148 company-operated Steak n Shake stores were closed. Steak n Shake plans to sell or lease 10 of the period. Same-store traffic measures17 locations and refranchise the numberbalance.2018, 20172023, 2022, and 20162021 are summarized below. 2018 2017 2016 Revenue Net sales $ 740,922 $ 781,856 $ 795,322 Franchise royalties and fees 30,998 20,773 18,794 Other revenue 3,770 4,524 3,798 Total revenue 775,690 807,153 817,914 Restaurant cost of sales Cost of food 223,273 30.1 % 238,143 30.5 % 221,657 27.9 % Restaurant operating costs 393,348 53.1 % 404,373 51.7 % 395,262 49.7 % Rent 19,835 2.7 % 18,514 2.4 % 18,047 2.3 % Total cost of sales 636,456 661,030 634,966 Selling, general and administrative General and administrative 57,684 7.4 % 60,527 7.5 % 59,446 7.3 % Marketing 55,063 7.1 % 49,589 6.1 % 51,324 6.3 % Other expenses 8,060 1.0 % 4,011 0.5 % 3,907 0.5 % Total selling, general and administrative 120,807 15.6 % 114,127 14.1 % 114,677 14.0 % Depreciation and amortization 18,831 2.4 % 20,623 2.6 % 21,573 2.6 % Interest on obligations under leases 8,207 9,082 9,475 Earnings before income taxes (8,611 ) 2,291 37,223 Income tax expense (benefit) (5,998 ) (7,434 ) 12,389 Net earnings (loss) $ (2,613 ) $ 9,725 $ 24,834 2023 2022 2021 Revenue Net sales $ 152,545 $ 149,184 $ 187,913 Franchise partner fees 72,552 63,853 55,641 Franchise royalties and fees 16,443 19,678 21,736 Other revenue 9,317 8,853 6,000 Total revenue 250,857 241,568 271,290 Restaurant cost of sales Cost of food 44,993 29.5 % 44,461 29.8 % 55,315 29.4 % Labor costs 47,090 30.9 % 50,524 33.9 % 58,159 30.9 % Occupancy and other 45,903 30.1 % 45,279 30.4 % 54,017 28.7 % Total cost of sales 137,986 140,264 167,491 Selling, general and administrative General and administrative 44,120 17.6 % 40,206 16.6 % 39,940 14.7 % Marketing 12,631 5.0 % 13,921 5.8 % 13,923 5.1 % Other expenses (income) (7,935) (3.2) % (2,294) (0.9) % 3,323 1.2 % Total selling, general and administrative 48,816 51,833 57,186 Impairments 3,947 1.6 % 3,520 1.5 % 4,635 1.7 % Depreciation and amortization 27,031 10.8 % 27,496 11.4 % 21,484 7.9 % Interest on finance leases and obligations 5,114 5,493 6,039 Earnings before income taxes 27,963 12,962 14,455 Income tax expense 6,132 3,579 3,220 Contribution to net earnings $ 21,831 $ 9,383 $ 11,235 restaurant operatinglabor, and occupancy and other costs and rent expense are expressed as a percentage of net sales.15 Net sales during 2018 were $740,922 representing a decrease of $40,934 when compared to 2017. decreased performance of our restaurant operations in 2018 was largely driven by Steak n Shake’s same-store sales, which decreased 5.1% whereas customer traffic decreased by 7.0%. Net sales during 2017 were $781,856 representing a decrease of $13,466 when compared to 2016. The decreased performance of our restaurant operations in 2017 was largely driven by Steak n Shake’s same-store sales. In 2017, Steak n Shake’s same-store sales decreased by 1.8% compared to 2016.In 2018, franchise royalties and fees increased $10,225 or 49.2%. During 2018, Steak n Shake opened 33 franchise units and closed 20. Western Sizzlin opened one franchise unit and closed four.generated by the traditional franchising business were $16,443 during 2023 as compared to $19,678 during 2022. The increasedecrease in franchise royalties and fees was primarily due to the adoptionclosing of new ASC 606 accounting guidance for revenue recognition. Franchise marketing contributions are now reflected in revenue with a corresponding increase in marketing expense. As a result,certain traditional franchise revenue increased by $9,417 or 45.3% during 2018. Franchise royalties and fees during 2017 increased $1,979stores. There were 160 traditional units open on December 31, 2023, as compared to 2016. In 2017 Steak n Shake opened 40 franchise190 units and closed thirteen. During the same period, six Western Sizzlin franchise units closed. open on December 31, 2022.increase in franchise fees and royalties during 2017 are primarily attributable to new Steak n Shake franchise units, which opened in 2017 and 2016.Costcost of food at company-operated units in 20182023 was $223,273$44,993, or 30.1%29.5% of net sales as compared with $238,143to $44,461, or 30.5%29.8% of net sales in 2017 and $221,657 or 27.9%2022. The cost of food expressed as a percentage of net sales in 2016. 2023 remained consistent with 2022.increase as a percentlabor costs at company-operated restaurants during 2023 were $47,090, or 30.9% of net sales during 2018 and 2017as compared to 2016 was attributable to increased commodity costs.Restaurant operating costs during 2018 were $393,348$50,524, or 53.1% of net sales, compared to $404,373 or 51.7%33.9% of net sales in 2017 and $395,262 or 49.7% of net sales2022. The 3-percentage-point decrease in 2016. Totalcosts was primarily attributable to a 2.7-percentage-point decrease in Steak n Shake’s labor costs as a percentresult of net sales during 2018 and 2017 increased compared to the respective prior years principally due to higher wages.Selling, generala gain in productivity.20182023 were $120,807$44,120, or 15.6%17.6% of total revenues.General and administrative expenses decreased by $2,843 during 2018revenue as compared to 2017, primarily because of decreased personnel costs.Marketing expense increased by $5,474 in 2018 compared to 2017 primarily due to the adoption of new accounting guidance. New ASC 606 accounting guidance requires the Company to recognize franchise fees as revenue and reflect advertising expenditures made on behalf of the franchisees as marketing expense. The new guidance increased marketing expenses by $9,689 during 2018.Other expenses increased by $4,049 during 2018 compared to 2017. The increase in other expenses was primarily due to asset impairments of $5,677.Selling, general and administrative expenses during 2017 were $114,127$40,206, or 14.1%16.6% of total revenues.by $1,081 during 20172023 as compared to 2016,2022 primarily because of higher salaries and wages. An increase in overall personnel and additional franchise partner training accounted for much of the increase in general and administrative expenses.recruiting.Marketing expense decreased by $1,735 in 2017during 2023 compared to 20162022 primarily because of a decrease in promotions.$8,207$5,114 during 2018,2023 versus $9,082$5,493 during 2017 and $9,475 during 2016.2022. The year over yearyear-over-year decrease in interest expense iswas primarily attributable to the maturity and retirement of lease obligations.2023 2022 Revenue Net sales and other $ 324,281 $ 296,045 Restaurant cost of sales Cost of food $ 91,317 28.2 % $ 81,952 27.7 % Labor costs 86,286 26.6 % 84,191 28.4 % Occupancy and other 66,135 20.4 % 59,647 20.1 % Total cost of sales $ 243,738 $ 225,790 total obligations under leases outstanding at December 31, 2018 were $64,200, compared to $80,752 at December 31, 2017 and $89,498 at December 31, 2016. 16 2023 2022 2021 Underwriting gain (loss) attributable to: First Guard $ 9,492 $ 6,578 $ 10,573 Southern Pioneer (1,038) (1,277) 1,744 Pre-tax underwriting gain 8,454 5,301 12,317 Income tax expense 1,775 1,113 2,587 Net underwriting gain $ 6,679 $ 4,188 $ 9,730 2023 2022 2021 Premiums earned $ 61,225 $ 59,949 $ 55,411 Insurance losses 35,668 37,187 27,649 Underwriting expenses 17,103 17,461 15,445 Pre-tax underwriting gain 8,454 5,301 12,317 Other income and expenses Investment income 3,074 1,380 704 Other income 1,555 3,223 1,414 Total other income 4,629 4,603 2,118 Earnings before income taxes 13,083 9,904 14,435 Income tax expense 2,821 2,242 3,145 Contribution to net earnings $ 10,262 $ 7,662 $ 11,290 Earnings of our insurance business are summarized below. 2018 2017 2016 Premiums earned $ 26,465 $ 24,242 $ 22,397 Insurance losses 15,457 14,959 12,641 Underwriting expenses 5,374 4,765 4,843 Pre-tax underwriting gain 5,634 4,518 4,913 Other income and expenses Investment income and commissions 1,163 701 600 Other expense (582 ) (449 ) (378 ) Total other income 581 252 222 Earnings before income taxes 6,215 4,770 5,135 Income tax expense 1,300 1,673 1,822 Contribution to net earnings $ 4,915 $ 3,097 $ 3,313 trucking insurer.In 2018, A summary of First Guard’s underwriting results follows.2023 2022 2021 Amount % Amount % Amount % Premiums earned $ 36,917 100.0 % $ 35,914 100.0 % $ 33,521 100.0 % Insurance losses 20,861 56.5 % 22,299 62.1 % 16,338 48.7 % Underwriting expenses 6,564 17.8 % 7,037 19.6 % 6,610 19.7 % Total losses and expenses 27,425 74.3 % 29,336 81.7 % 22,948 68.4 % Pre-tax underwriting gain $ 9,492 $ 6,578 $ 10,573 increased $2,223 or 9.2%was 56.5% during 2023 as compared to 2017. Premiums62.1% during 2022. First Guard’s underwriting results in 2023 were in line with its historical performance despite cost inflation in property and physical damage claims, which began to accelerate in 2022.2023 2022 2021 Amount % Amount % Amount % Premiums earned $ 24,308 100.0 % $ 24,035 100.0 % $ 21,890 100.0 % Insurance losses 14,807 60.9 % 14,888 61.9 % 11,311 51.7 % Underwriting expenses 10,539 43.4 % 10,424 43.4 % 8,835 40.4 % Total losses and expenses 25,346 104.3 % 25,312 105.3 % 20,146 92.1 % Pre-tax underwriting gain (loss) $ (1,038) $ (1,277) $ 1,744 2017 increased $1,845 or 8.2%2023 as compared to 2016. Pre-tax underwriting gain61.9% during 20182022. Southern Pioneer’s performance in both years was $5,634, an increase of $1,116 (24.7%) comparedprimarily attributable to 2017. Pre-tax underwriting gain during 2017 was $4,518, a decrease of $395 (8.0%) compared to 2016. We strive to generate pre-tax underwriting profits every year.Insurance premiums and other on the statement of earnings includes premiums earned, investment income and commissions, which are included in other income in the above table.17 2023 2022 2021 Interest, dividends, and other investment income: First Guard $ 1,873 $ 751 $ 133 Southern Pioneer 1,201 629 571 Pre-tax investment income 3,074 1,380 704 Income tax expense 646 289 148 Net investment income $ 2,428 $ 1,091 $ 556 2023 2022 2021 Oil and gas revenue $ 45,071 $ 57,546 $ 33,004 Oil and gas production costs 17,365 17,842 10,470 Depreciation, depletion, and accretion 10,339 8,013 8,073 Gain on sale of properties (13,563) — — General and administrative expenses 5,164 6,500 4,748 Earnings before income taxes 25,766 25,191 9,713 Income tax expense (benefit) 360 6,100 2,185 Contribution to net earnings $ 25,406 $ 19,091 $ 7,528 2023 2022 Oil and gas revenue $ 27,576 $ 11,455 Oil and gas production costs 9,605 4,487 Depreciation, depletion, and accretion 6,359 2,510 Gain on sale of properties (13,563) — General and administrative expenses 2,765 3,806 Earnings before income taxes 22,410 652 Income tax expense (benefit) (384) 154 Contribution to net earnings $ 22,794 $ 498 2023 2022 2021 Oil and gas revenue $ 17,495 $ 46,091 $ 33,004 Oil and gas production costs 7,760 13,355 10,470 Depreciation, depletion, and accretion 3,980 5,503 8,073 General and administrative expenses 2,399 2,694 4,748 Earnings before income taxes 3,356 24,539 9,713 Income tax expense 744 5,946 2,185 Contribution to net earnings $ 2,612 $ 18,593 $ 7,528 medialicensing and licensing.media. Earnings of our media operations are summarized below. 2018 2017 2016 Revenue $ 6,576 $ 7,708 $ 9,165 Media cost of sales 4,152 6,527 15,834 Selling, general and administrative expenses 1,329 1,570 3,000 Depreciation and amortization 27 50 409 Earnings (loss) before income taxes 1,068 (439 ) (10,078 ) Income tax expense (benefit) 272 (874 ) (3,693 ) Contribution to net earnings $ 796 $ 435 $ (6,385 ) 2023 2022 2021 Licensing and media revenue $ 2,118 $ 4,577 $ 3,203 Licensing and media cost 1,840 2,695 2,275 General and administrative expenses 267 122 114 Earnings before income taxes 11 1,760 814 Income tax expense 3 447 (1,550) Contribution to net earnings $ 8 $ 1,313 $ 2,364 We have taken the risk on the belief that the probability for gain in value more than justifies the risk of loss. 2018 2017 2016 Investment partnership gains $ 40,411 $ 6,965 $ 135,886 Loss on contribution of securities to investment partnership — — (306 ) Investment partnership gains 40,411 6,965 135,580 Income tax expense (benefit) 7,171 (4,115 ) 44,248 Contribution to net earnings $ 33,240 $ 11,080 $ 91,332 2023 2022 2021 Investment partnership gains (losses) $ 19,440 $ (75,953) $ 10,953 Tax expense (benefit) 4,794 (18,992) 2,054 Contribution to net earnings $ 14,646 $ (56,961) $ 8,899 gains and gains/losses from changes in the market values of underlying investments held by the investment partnerships and dividends earned by the partnerships. The volatility of the gains and losses during the various years is attributable to changes in market values of investments. Dividend income has a lower effective tax rate than income from changescapital gains. These gains and losses have caused and will continue to cause significant volatility in market values.The investments held by the investment partnerships are largely concentrated in the common stock of one investee, Cracker Barrel Old Country Store, Inc.eliminated.18 2018 2017 2016 Interest expense on notes payable and other borrowings $ (11,677 ) $ (11,040 ) $ (11,450 ) Income tax benefit (2,920 ) (4,196 ) (4,351 ) Interest expense net of tax $ (8,757 ) $ (6,844 ) $ (7,099 ) 2023 2022 2021 Interest expense on notes payable and other borrowings $ (681) $ (399) $ (1,121) Tax benefit (150) (94) (280) Interest expense net of tax $ (531) $ (305) $ (841) outstanding balance onCompany paid Steak n Shake’s outstanding credit facility in full in February 2021. On September 13, 2022, Biglari Holdings entered into a line of credit in an aggregate principal amount of up to $30,000. There was no balance on the line of credit on December 31, 20182023. The balance on the line of credit was $183,698 compared to $185,898$10,000 on December 31, 2017. The decrease in the outstanding balance was due to debt payments of $2,200 during 2018. The interest rate was 6.28% and 5.32% as of December 31, 2018 and 2017, respectively. Interest expense during 2018 increased by $637 compared to 2017, primarily due to higher interest rates during 2018. Interest expense during 2017 decreased by $410 compared to 2016, primarily due to lower debt during 2017.Consolidateda benefit of $2,637$9,308 in 20182023 versus a benefit of $62,961$10,722 in 20172022. During 2023, the Company recognized tax benefits of $5,660 associated with the tax attributes of Abraxas Petroleum’s oil and gas properties offset by an increase in tax expense of $46,812$23,786 for investment partnership gains in 2016. The income tax benefit of $2,637 was primarily from the use of employment tax credits generated by restaurant operations. The 2017 Tax Cuts2023.Jobs Act reduces the U.S. statutory corporate tax rate from 35% to 21% for our tax years beginning in 2018, which resulted in the re-measurement of the federal portion of our deferred tax assets and liabilities as of December 31, 2017. The change in the tax rate resulted in a onetime deferred tax benefit of $51,707 during 2017. The deferred income tax benefit is derived from a re-measurement in deferred tax balances to the new statutory rate applicable to unrealized gains on marketable securities held by the Company and in the investment partnerships.Corporateinof the restaurant, insurance, mediabrand licensing, and oil and gas businesses. Corporate and other companies. Corporate net losses during 2018 were $8,661 versus net earningsincreased in 2023 compared to 2022 primarily due to an incentive fee of $32,072 during 2017 and net losses of $6,387 during 2016. In 2017, an increase in shareholders’ equity was derived from a re-measurement in deferred tax liability to the new statutory rate applicable to unrealized gains on marketable securities. The majority of the Company’s deferred tax liabilities associated with unrealized gains on marketable securities are held in the corporate account. 20182023, was $570,455, a decrease$599,330, an increase of $873$52,364 as compared to the December 31, 20172022 balance. Shareholders’The increase in shareholders’ equity increased by $19,392 inwas primarily due to net income of $54,948 and wasan increase in additional paid-in capital for purchases of noncontrolling interest of $3,806, offset by an increasea change in treasury stock of $19,292. The increase in treasury stock was primarily a result of recording our proportionate interest in shares of the Company’s stock purchased during 2018 by The Lion Fund II, L.P. under a Rule 10b5-1 trading plan. The shares purchased by the investment partnership are legally outstanding but under accounting convention the Company’s proportional ownership of the shares is reflected as treasury shares in the consolidated financial statements. December 31, 2018 2017 Cash and cash equivalents $ 48,557 $ 58,577 Investments 33,860 23,289 Investments reported in other current assets and other assets 4,463 4,463 Fair value of interest in investment partnerships 715,102 925,279 Total cash and investments 801,982 1,011,608 Less: portion of Company stock held by investment partnerships (157,622 ) (359,258 ) Carrying value of cash and investments on balance sheet $ 644,360 $ 652,350 December 31, 2023 2022 Cash and cash equivalents $ 28,066 $ 37,467 Investments 91,879 69,466 Fair value of interest in investment partnerships 472,772 383,004 Total cash and investments 592,717 489,937 Less: portion of Company stock held by investment partnerships (273,669) (227,210) Carrying value of cash and investments on balance sheet $ 319,048 $ 262,727 19 2018 2017 2016 Net cash provided by operating activities $ 20,678 $ 25,780 $ 63,349 Net cash used in investing activities (25,290 ) (11,548 ) (28,795 ) Net cash used in financing activities (7,530 ) (23,000 ) (15,231 ) Effect of exchange rate changes on cash (78 ) 165 (38 ) Increase (decrease) in cash, cash equivalents and restricted cash $ (12,220 ) $ (8,603 ) $ 19,285 2023 2022 2021 Net cash provided by operating activities $ 73,002 $ 127,825 $ 228,767 Net cash used in investing activities (66,080) (136,605) (58,525) Net cash provided by (used in) financing activities (16,132) 3,860 (156,157) Effect of exchange rate changes on cash 59 38 (64) Increase (decrease) in cash, cash equivalents, and restricted cash $ (9,151) $ (4,882) $ 14,021 2018,2023, cash from operating activities decreased by $5,102$54,823 as compared to 2017 and by $42,671 compared to 2016. Net earnings (excluding non-cash items) were $3,061 during 2018, $3,316 during 2017 and $28,780 during 2016.2022. The decrease in net earnings during 2018 and 2017 compared to 2016change was primarily dueattributable to decreases in restaurant net earnings. Distributionsdistributions from investment partnerships of $14,500 in 2023 compared to $70,700 in 2022. The distributions during 2022 were $29,660 during 2018, $9,395 during 2017 and $26,265 during 2016. Changes in working capital accounts were a decrease of $12,043 during 2018, and increases during 2017 and 2016 of $13,069 and $8,304, respectively. The decrease of working capital accounts during 2018 was primarily tiedused to the payment of the 2017 CEO incentive fee of $7,353. And the accrual of the 2017 CEO incentive fee increased working capital accounts during 2017.increasedwas $70,525 lower during 2018 by $13,7422023 as compared to 2017, and decreased by $3,505 compared to 2016.2022. Capital expenditures during 2018 were $7,259$6,341 higher in 2022 primarily due to Steak n Shake’s implementation of a self-service model. Proceeds from sales of property and $6,630equipment were $19,309 higher than capital expenditures during 2017in 2023 primarily due to the sale of oil and 2016, respectively. Purchasesgas properties for $13,563 and the sale of investments,restaurant properties for $10,883. During 2022, the Company acquired 90% of Abraxas Petroleum for $58,274, net of redemptionscash acquired. In 2023, the Company acquired the remaining 10% of fixed maturity securitiesAbraxas Petroleum for $5,387.2018 were $9,273 and $6,385 higher than purchases2023 was primarily due to net repayments on the Company’s line of investmentscredit. Cash provided by financing activities of $3,860 during 2017 and 2016, respectively. Distributions from investment partnerships2022 was primarily due to net borrowings on the Company’s line of $39,040 during 2018 were reinvested into the investment partnerships during 2018.During 2018, 2017 and 2016 we incurred debt payments of $7,579, $23,030 and $15,295, respectively. Debt obligations were reduced in 2018 because of additional principal payments on long-term debt during 2017 and 2016.anticipated cash flows generated from operations and cash on hand, existing credit facilities, and the sale of excess properties and investments.hand. We continually review available financing alternatives.Steak n Shake FacilityMarch 19, 2014, Steak n Shake and its subsidiariesSeptember 13, 2022, Biglari Holdings entered into a credit agreement which provided for a senior secured term loan facility in an aggregate principal amountline of $220,000 and a senior secured revolving credit facility in an aggregate principal amount of up to $30,000. On October 27, 2017, Steak n Shake determined to end the use of its senior secured revolving credit facility. In 2017, Steak n Shake deposited cash to satisfy required collateral for casualty insurance previously collateralized by lettersThe line of credit issued through the revolving credit facility. The deposits are recorded in other assets under restricted cash in the consolidated balance sheets.The term loan is scheduled to mature on March 19, 2021. It amortizes at an annual rate of 1.0% in equal quarterly installments, beginning June 30, 2014, at 0.25% of the original principal amount of the term loan, subject to mandatory prepayments from excess cash flow, asset sales and other events described in the credit agreement. The balance will be due at maturity.Steak n Shake has the right to request an incremental term loan facility from participating lenders and/or eligible assignees at any time, up to an aggregate total principal amount not to exceed $70,000 if certain customary conditions within the credit agreement are met.Borrowings bear interest at a rate per annum equal to a base rate or a Eurodollar rate (minimum of 1%) plus an applicable margin. Interest on the term loan is basedavailable on a Eurodollar rate plus an applicable marginrevolving basis until September 13, 2024. The line of 3.75% or on the prime rate plus an applicable margin of 2.75%. The interest rate on the term loan was 6.28% and 5.32% as of December 31, 2018 and 2017, respectively.The credit agreement includes customary affirmative and negative covenants, and events of default.as well as financial maintenance covenants. As of December 31, 2018,2023, we were in compliance with all covenants. Steak n Shake’sThere was no balance on the line of credit facility contains restrictions on its ability to pay dividends to Biglari Holdings.20 ContentsManagement’s Discussion and Analysis(continued)The term loancredit is secured by first priority security interests in substantially all the assets of Steak n Shake. Disruptions in debt capital markets that restrict access to funding when needed could adversely affect the results of operations, liquidity and capital resources of Steak n Shake. Biglari Holdings is not a guarantor under the credit facility.$500. As of December 31, 2018, $183,698 was outstanding under the term loan.Western Sizzlin RevolverAs of December 31, 2018,2023 and 2022, Western Sizzlin had no debt outstanding under theits revolver.Management’s discussion and analysis of financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. managementus to make estimates and judgments concerning transactions that will be settled several yearsin determining the amounts reflected in the future. Amounts recognized in our consolidated financial statements from suchstatements. Such estimates areand judgments necessarily based on numerous assumptions involvinginvolve varying, and potentiallypossibly significant, degrees of judgment and uncertainty. Accordingly, thecertain amounts currently reflectedrecorded in our consolidatedthe financial statements will likely increase or decreasebe adjusted in the future as additionalbased on new available information becomes available.We believe the following criticaland changes in other facts and circumstances. A discussion of our principal accounting policies represent our morethat required the application of significant judgments and estimates used in preparation of our consolidated financial statements. Given the current composition of our business, we do not believe that any accounting policies related to our insurance or media businesses were critical to the preparation of our consolidated financial statements as of and for the year ended December 31, 2018.(i) Biglari Holdings Inc., and (ii) the wholly owned subsidiaries of Biglari Holdings Inc. in which control can be exercised. In evaluating whether we have a controlling interest in entities in which we would consolidate, we consider the following: (1) for voting interest entities, we consolidate those entities in which we own a majority of the voting interests; and (2) for limited partnership entities, we consolidate those entities if we are the general partner of such entities and for which no substantive removal rights exist. The analysis as to whether to consolidate an entity is subject to a significant amount of judgment. Some of the criteria considered include the determination as to the degree of control over an entity by its various equity holders and the design of the entity. All intercompany accounts and transactions are eliminated in consolidation.TheDetermining the future cash flows expected to be generated by an asset requires significant judgment regarding future performance of the asset, fair market value if the asset were to be sold, and other financial and economic assumptions.InsuranceWe currently self-insure a significant portion of expected losses under our workers’ compensation, general liability, directors’officers’ liability, and auto liability insurance programs. For certain programs, we purchase reinsurance for individual and aggregate claims that exceed predetermined limits. We record a liability for all unresolved claims and ournatural gas reserves are estimates of incurred but not reported (“IBNR”) claims atfuture production that impact certain asset and expense accounts. Proved reserves are the anticipated costestimated quantities of oil and gas that geoscience and engineering data demonstrate with reasonable certainty to us. The liability estimate is basedbe economically producible in the future under existing economic conditions, operating methods, and government regulations. Proved reserves include both developed and undeveloped volumes. Proved developed reserves represent volumes expected to be recovered through existing wells with existing equipment and operating methods. Proved undeveloped reserves are volumes expected to be recovered from new wells on information receivedundrilled proved acreage, or from insurance companies, combined with management’s judgments regarding frequency and severity of claims, claims development history, and settlement practices. Significant judgmentexisting wells where expenditure is required for recompletion. We estimate our proved oil and natural gas reserves in accordance with the guidelines established by the SEC. Due to estimate IBNR claims as parties have yet to assert a claim, and therefore the degree to which injuries have been incurredinherent uncertainties and the related costs have not yet been determined. Additionally,limited nature of reservoir data, estimates about future costs involve significant judgment regarding legislation, case jurisdictions, and other matters.21 Management’s Discussion and Analysis(continued)would beare unable to be utilized;utilized, we would record a valuation allowance against the unrealizable amount and record that amount as a charge against earnings. Due to changing tax laws and state income tax rates, significant judgment is required to estimate the effective tax rate expected to applyapplicable to tax differences that are expected to reversearising from reversal in the future. We must also make estimates about the sufficiency of taxable income in future periods to offset any deductions related to deferred tax assets currently recorded. As of December 31, 2018, a change of one percentage point in an enacted tax rate would have an impact of approximately $3,800 on net earnings.We recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate resolution.are required to assessevaluate goodwill and any indefinite-lived intangible assets for impairment annually, or more frequently if circumstances indicate impairment may have occurred. Goodwill impairment occurs when the estimated fair value of goodwill is less than its carrying value. The valuation methodology and underlying financial information included in our determination of fair value require significant management judgments.managerial judgment. Based on a review of the qualitative factors, if we determine it is not more likely than not that the fair value is less than the carrying value, we may bypass the quantitative impairment test. We may also elect not to perform the qualitative assessment for the reporting unit or intangible assets and perform a quantitative impairment test instead.both marketof, such assets. When we determine a lease exists, we record a right-of-use asset and income approachescorresponding lease liability on our consolidated balance sheets. Right-of-use assets represent our right to derive fair value. The judgments in these two approaches include, butuse an underlying asset for the lease term. Lease liabilities represent our obligation to make lease payments arising from the lease. Right-of-use assets are not limited to, comparable market multiples, long-term projectionsrecognized at the commencement date at the value of future financial performance,the lease liability and are adjusted for any prepayments, lease incentives received, and initial direct costs incurred. Lease liabilities are recognized at the selection of appropriate discount rates used to determinelease commencement date based on the present value of future cash flows. Changesremaining lease payments over the lease term. As the discount rate implicit in such estimatesthe lease is not readily determinable in most of our leases, we use our incremental borrowing rate based on the information available at the commencement date in determining the present value of lease payments. Our lease terms include options to extend or terminate the applicationlease when it is reasonably certain that we will exercise that option. We do not record lease contracts with a term of alternative assumptions could produce significantly different results.LeasesRestaurant operations12 months or less on our consolidated balance sheets. We recognize fixed lease certain properties underexpense for operating leases. Many of these lease agreements contain rent holidays, rent escalation clauses and/or contingent rent provisions. Rent expense is recognizedleases on a straight-line basis over the expected lease term, including cancelable option periods when failure to exercise such options would result in an economic penalty. We use a time period for straight-line rentterm. For finance leases, we recognize amortization expense calculation that equals or exceedson the time period used for depreciation. In addition, the rent commencement date ofright-of-use asset and interest expense on the lease term isliability over the earlier of the date when they become legally obligated for the rent payments or the date when they take access to the grounds for build out. Accounting for leases involves significant management judgment.22 Contractual ObligationsOur significant contractual obligations and commitments as of December 31, 2018 are shown in the following table. Payments due by period Contractual Obligations Less than

1 year 1 – 3 years 3 – 5 years More than

5 years Total Long-term debt (1)(2) $ 11,926 $ 193,562 $ — $ — $ 205,488 Capital leases and finance obligations (1) 11,169 14,075 4,543 1,673 31,460 Operating leases (3) 18,397 34,611 30,811 38,499 122,318 Purchase commitments (4) 7,320 8,699 1,000 — 17,019 Other long-term liabilities (5) — — — 2,149 2,149 Total $ 48,812 $ 250,947 $ 36,354 $ 42,321 $ 378,434 ________________(1)Includes principal and interest and assumes payoff of indebtedness at maturity date.(2)Includes outstanding borrowings under the Credit Facility.(3)Excludes amounts to be paid for contingent rents. Includes amounts to be paid for subleased properties.(4)Includes agreements to purchase goods or services that are enforceable and legally binding on us and that specify all significant terms. Excludes agreements that are cancelable without penalty.(5)Includes liabilities for Non-Qualified Deferred Compensation Plan. Excludes our unrecognized tax benefits of $341 as of December 31, 2018 because we cannot make a reliable estimate of the timing of cash payments.Off-Balance Sheet ArrangementsWe have no off-balance sheet arrangements other than operating leases entered into in the normal course of business.23 Item 7A. and Qualitative Disclosures About Market RiskThe majority of our investments are conducted through investment partnerships which generally hold common stocks. We also hold marketable securities directly. Through investments in the investment partnerships we hold a concentrated position in the common stock of Cracker Barrel Old Country Store, Inc. A significant decline in the general stock market or in the prices of major investments may produce a large net loss and decrease in our consolidated shareholders’ equity. Decreases in values of equity investments can have a materially adverse effect on our earnings and on consolidated shareholders’ equity.We prefer to hold equity investments for very long periods of time so we are not troubled by short-term price volatility with respect to our investments. Our interests in the investment partnerships are committed on a rolling 5-year basis, and any distributions upon our withdrawal of funds will be paid out over two years (and may be paid in kind rather than in cash).Qualitative Disclosures About Market prices for equity securities are subject to fluctuation. Consequently, the amount realized in the subsequent sale of an investment may significantly differ from the reported market value. A hypothetical 10% increase or decrease in the market price of our investments would result in a respective increase or decrease in the fair market value of our investments of $59,581, along with a corresponding change in shareholders’ equity of approximately 8%.Borrowings on Steak n Shake’s credit facility bear interest at a rate per annum equal to a base rate or a Eurodollar rate (minimum of 1%) plus an applicable margin. Interest on the term loan is based on a Eurodollar rate plus an applicable margin of 3.75% or on the prime rate plus an applicable margin of 2.75%. At December 31, 2018, a hypothetical 100 basis point increase in short-term interest rates would have an impact of approximately $1,400 on our net earnings.We have had minimal exposure to foreign currency exchange rate fluctuations in 2018, 2017 and 2016.24 Item 8.Financial Statements and Supplementary DataShareholdersthe shareholders and the Board of Directors of Biglari Holdings Inc."Company"“Company”) as of December 31, 20182023 and 2017,2022, the related consolidated statements of earnings, comprehensive income, changes in shareholders’ equity, and cash flows for each of the three years in the period ended December 31, 2018,2023, and the related notes (collectively referred to as the "financial statements"“financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 20182023 and 2017,2022, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2018,2023, in conformity with accounting principles generally accepted in the United States of America.Company'sCompany’s internal control over financial reporting as of December 31, 2018,2023, based on criteria established inInternal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 23, 2019,24, 2024 expressed an unqualified opinion on the Company'sCompany’s internal control over financial reporting.Company'sCompany’s management. Our responsibility is to express an opinion on the Company'sCompany’s financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.34 and Note 1214 to the consolidated financial statements, the Company and its subsidiaries have invested in investment partnerships in the form of limited partnership interests. These investment partnerships represent related parties, and such investments are subject to a rolling five-year lock up period under the terms of the respective partnership agreements.agreements for the investment partnerships. The value of these investments reported in the Company’s consolidated balance sheets as of December 31, 20182023 and 20172022 totals $557,480,000$199,103,000 and $566,021,000,$155,794,000, respectively. Our opinion is not modified with respect to this matter.Indianapolis, Indiana23, 2019Company'sCompany’s auditor since 2003.25 Shareholdersshareholders and the Board of Directors of Biglari Holdings Inc.2018,2023, based on criteria established inInternal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2018,2023, based on criteria established inInternal Control — Integrated Framework (2013) issued by COSO.2018,2023, of the Company and our report dated February 23, 2019,24, 2024, expressed an unqualified opinion on those financial statements and included an emphasis of a matter paragraph relating to the Company’s investment in related party investment partnerships.Overover Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.Indianapolis, Indiana23, 201926 December 31, 2018 2017 Assets Current assets: Cash and cash equivalents $ 48,557 $ 58,577 Investments 33,860 23,289 Receivables 15,743 16,284 Inventories 7,537 7,268 Other current assets 9,236 7,221 Total current assets 114,933 112,639 Property and equipment 274,716 295,800 Goodwill 40,052 40,081 Other intangible assets 28,114 26,564 Investment partnerships 557,480 566,021 Other assets 14,198 22,479 Total assets $ 1,029,493 $ 1,063,584 Liabilities and shareholders’ equity Liabilities Current liabilities: Accounts payable and accrued expenses $ 117,265 $ 128,744 Current portion of notes payable and other borrowings 5,720 6,748 Total current liabilities 122,985 135,492 Long-term notes payable and other borrowings 240,001 256,994 Deferred taxes 86,871 88,401 Other liabilities 9,181 11,369 Total liabilities 459,038 492,256 Shareholders’ equity Common stock 1,138 1,071 Additional paid-in capital 381,904 382,014 Retained earnings 564,160 565,504 Accumulated other comprehensive loss (2,516 ) (1,404 ) Treasury stock, at cost (374,231 ) (375,857 ) Biglari Holdings Inc. shareholders’ equity 570,455 571,328 Total liabilities and shareholders’ equity $ 1,029,493 $ 1,063,584 December 31, 2023 2022 Assets Current assets: Cash and cash equivalents $ 28,066 $ 37,467 Investments 91,879 69,466 Receivables 22,241 29,375 Inventories 2,980 3,851 Other current assets 7,385 10,495 Total current assets 152,551 150,654 Property and equipment 380,491 400,725 Operating lease assets 32,215 34,739 Goodwill 53,530 53,513 Other intangible assets 23,230 23,037 Investment partnerships 199,103 155,794 Other assets 8,302 10,012 Total assets $ 849,422 $ 828,474 Liabilities and shareholders’ equity Liabilities Current liabilities: Accounts payable and accrued expenses $ 66,743 $ 78,616 Loss and loss adjustment expenses 15,168 16,805 Unearned premiums 14,334 12,495 Current portion of lease obligations 14,855 16,981 Line of credit — 10,000 Total current liabilities 111,100 134,897 Lease obligations 86,389 91,844 Deferred taxes 37,939 31,343 Asset retirement obligations 14,316 14,068 Other liabilities 348 754 Total liabilities 250,092 272,906 Shareholders’ equity Common stock 1,138 1,138 Additional paid-in capital 385,594 381,788 Retained earnings 631,458 576,510 Accumulated other comprehensive loss (2,518) (2,790) Treasury stock, at cost (416,342) (409,680) Biglari Holdings Inc. shareholders’ equity 599,330 546,966 Noncontrolling interests — 8,602 Total shareholders’ equity 599,330 555,568 Total liabilities and shareholders’ equity $ 849,422 $ 828,474 27 Year Ended

December 31, 2018 2017 2016 Revenues Restaurant operations $ 775,690 $ 807,153 $ 817,914 Insurance premiums and other 27,628 24,943 22,997 Media advertising and other 6,576 7,708 9,165 809,894 839,804 850,076 Cost and expenses Restaurant cost of sales 636,456 661,030 634,966 Insurance losses and underwriting expenses 20,831 19,724 17,484 Media cost of sales 4,152 6,527 15,834 Selling, general and administrative 132,909 130,808 127,259 Depreciation and amortization 19,318 21,448 22,925 813,666 839,537 818,468 Other income (expenses) Interest expense (11,677 ) (11,040 ) (11,450 ) Interest on obligations under leases (8,207 ) (9,082 ) (9,475 ) Investment partnership gains 40,411 6,965 135,580 Total other income (expenses) 20,527 (13,157 ) 114,655 Earnings (loss) before income taxes 16,755 (12,890 ) 146,263 Income tax expense (benefit) (2,637 ) (62,961 ) 46,812 Net earnings $ 19,392 $ 50,071 $ 99,451 Earnings per share Net earnings per equivalent Class A share * $ 55.71 $ 136.01 $ 271.22 Year Ended December 31, 2023 2022 2021 Revenue Restaurant operations $ 250,857 $ 241,568 $ 271,290 Insurance premiums and other 67,272 64,540 58,609 Oil and gas 45,071 57,546 33,004 Licensing and media 2,118 4,577 3,203 Total revenue 365,318 368,231 366,106 Cost and expenses Restaurant cost of sales 137,986 140,264 167,491 Insurance losses and underwriting expenses 52,771 54,648 43,094 Oil and gas production costs 17,365 17,842 10,470 Licensing and media costs 1,840 2,695 2,275 Selling, general and administrative 77,002 70,608 76,018 Gain on sale of oil and gas properties (13,563) — — Impairments 3,947 3,520 4,635 Depreciation, depletion, and amortization 38,979 36,443 30,050 Interest expense on leases 5,114 5,493 6,039 Interest expense on debt 681 399 1,121 Total cost and expenses 322,122 331,912 341,193 Other income (expenses) Investment gains (losses) 2,211 (3,393) 6,401 Investment partnership gains (losses) 19,440 (75,953) 10,953 Total other income (expenses) 21,651 (79,346) 17,354 Earnings (loss) before income taxes 64,847 (43,027) 42,267 Income tax expense (benefit) 9,308 (10,722) 6,789 Net earnings (loss) 55,539 (32,305) 35,478 Earnings (loss) attributable to noncontrolling interest 591 (287) — Net earnings (loss) attributable to Biglari Holdings Inc. shareholders $ 54,948 $ (32,018) $ 35,478 Net earnings (loss) per equivalent Class A share * $ 189.49 $ (107.43) $ 111.83 $11.14$37.90 for 2018, $27.202023, $(21.49) for 20172022, and $54.24$22.37 for 2016.CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME(dollars in thousands) Year Ended

December 31, 2018 2017 2016 Net earnings $ 19,392 $ 50,071 $ 99,451 Other comprehensive income: Reclassification of investment appreciation in net earnings (73 ) — 306 Applicable income taxes 15 — (113 ) Net change in unrealized gains on investments — 284 568 Applicable income taxes — (89 ) (211 ) Foreign currency translation (1,054 ) 1,985 (455 ) Other comprehensive income (loss), net (1,112 ) 2,180 95 Total comprehensive income $ 18,280 $ 52,251 $ 99,546 28 CASH FLOWS Year Ended