UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2020 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to | |

Commission File No. 000-51068

VETANOVA INC

(Mark one)Exact name of registrant as specified in its charter)

| Nevada | 85-1736272 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 335 A Josephine St. Denver CO | 80206 | |

| (Address of principal executive offices) | (Zip Code) |

QRegistrant’s telephone number (303) 248-6883

Securities registered pursuant to Section 12(b) of the Exchange Act: Annual report underNone

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

For

Indicate by check mark whether the Fiscal YearApril 30, 2009,

or

£Transition reportregistrant has submitted electronically every Interactive Data File required to be submitted pursuant to Section 13 or 15(d)Rule 405 of Regulation S-T during the Securities Exchange Act of 1934preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Commission file number: 000-50427

YUKON GOLD CORPORATION, INC.(Exact name of registrant as specified in its charter)

139 Grand River St. N., PO Box 510Paris, Ontario N3L 3T6 Canada(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:210-355-3233

Securities registered under Section 12(b) of the Exchange Act:None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

Checkif disclosure of delinquent filers in responsepursuant to Item 405 of Regulation S-K is not contained in this form,herein, and no disclosure will not be contained, to the best of registrant'sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicateby check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporter.reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act:

| [ ] Large Accelerated Filer | ||

| [ ] Non-accelerated | [X] Smaller reporting company | |

| [X] Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Issuer's revenues for its

As of December 31, 2020, 194,971,866 shares of the registrant’s Common Stock were outstanding. As of December 31, 2020, the last business day of the registrant’s most recent completed fiscal year: $0.

Theyear, the aggregate market value of the registrant’s Common Stock held by non-affiliates of the issuer, as of April 30, 2009registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $1,214,686 for the issuer’s Common Stock reported for such date$1,524,341 based on the OTC Bulletin Board. For purposeslast sale price as reported by the Over-The-Counter-Bulletin-Board on such date. The number of this disclosure, shares of Common Stock held by persons who the issuer believes beneficially own more than 5% of the outstanding shares of Common Stock and shares held by officers and directors of the issuer have been excluded because such persons may be deemed to be affiliates of the issuer. This determination is not necessarily conclusive.

As of April 30, 2009, 40,489,535 shares of the issuer’s Common Stock were outstanding.registrant’s common stock outstanding as of March 25, 2021 is 215,475,502.

Transitional Small Business Disclosure Yes

o No xFORWARD LOOKING STATEMENTS

This registration statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are generally identified through the inclusion of words such as “anticipate,” “believe,” “contemplate,” “estimate,” “expect,” “forecast,” “intend,” “may,” “objective,” “outlook,” “plan,” “potential,” “project,” “seek,” “should,” “strategy,” “target” or “will” or variations of such words or similar expressions. All statements addressing our future operating performance, and statements addressing events and developments that we expect or anticipate will occur in the future, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based upon currently available information, operating plans, and projections about future events and trends. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from those predicted or expressed in this registration statement. These risks and uncertainties include those set forth under the heading “Risk Factors” and elsewhere in this registration statement. Investors are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Unless the context requires otherwise, references in this registration statement to “the Company,” “our company,” “our,” “us,” “we” and similar terms refer to VETANOVA INC.

VETANOVA and the VETANOVA logo design are our trademarks. For convenience, these trademarks appear in this registration statement without ™ symbols, but that practice does not mean that we will not assert, to the fullest extent under applicable law, our rights to the trademarks. This registration statement may include trademarks, tradenames and service marks owned by other organizations.

VETANOVA INC

Annual report on form 10-k

year ended december 31, 2020

TABLE OF CONTENTS

This Annual Report

The Company is in the business of building and operating solar powered, state of the art, greenhouse facilities which will grow fruits and vegetables for distribution to local markets along the I-25 corridor in Colorado.

As its initial development project, the Company expects to purchase, develop and operate four adjoining parcels of approximately 39 acres each, totaling approximately 157 acres in rural Pueblo County, Colorado (“Pueblo Complex”). The Pueblo Complex is currently majority owned by VitaNova Partners, LLC (“VitaNova”). The Pueblo Complex has an existing greenhouse facility consisting of 90,000 sq ft of growing space and 15,000 sq ft of warehouse space, another partially built greenhouse and two parcels of vacant land.

In 2020, VitaNova began acquiring and now owns or controls a supermajority of the equity interests of the four parcels in the Pueblo Complex. The Pueblo Complex was significantly underpowered with only 300KVA of electrical power and no natural gas available. The lack of power made the initial greenhouse facility unsuitable for its intended purpose. Since acquiring control VitaNova has installed 1500KVA electrical service and is retrofitting the existing greenhouse with electrical environmental equipment that can be solar powered.

The Company received preliminary approval from C-PACE, a Colorado specialized solar financing program developed by federal, state and county governments. The Company is in the process of developing engineering necessary to complete the C-Pace financing application.

The Company recently completed a private placement and raised $556,129 by issuing 55,612,831 common shares along with 55,612,831 2-year warrants exercisable at $0.20 per share. VitaNova and John McKowen (“McKowen”) are considered affiliates and control entities of the Company. The Company currently has no independent directors. Both VitaNova and the Company have a common board member, Mr. McKowen. The Company expects to appoint independent directors after the purchase of Directors and Officers insurance.

On July 5, 2018, Mr. McKowen purchased a control block of 440,000 common shares of the acquired shell and appointed himself as its sole board member and Chief Executive Officer. On July 17, 2020, Mr. McKowen transferred the control block to VitaNova and began restructuring the Company. The Company currently is a non reporting publicly traded shell on OTC Market Pink Sheets, symbol VTNA. As part of the restructuring, the Company issued 55,612,837 common shares to VitaNova and 29,369,230 common shares to Mr. McKowen, which is proportional to Mr. McKowen’s ownership of VitaNova.

Mr. McKowen was also issued 58,738,460 shares that are subject to repurchase by the Company for a price of $0.0001 per share, of which 29,369,230 shares will be released from repurchase if warrants issued in Company’s recent private placement are exercised to acquire at least 42,140,266 shares of Common Stock; and 29,369,230 shares will be released from repurchase if, prior to December 31, 2022, the Company completes a “sale lease back” of a solar powered property and receives gross proceeds of a least $6,000,000 from the sale. For purposes of federal securities laws, Mr. McKowen is deemed to beneficially own 56,052,837 shares purchased by VitaNova because of his ability to control VitaNova, as an officer and member of VitaNova.

On February 1, 2021, the Company filed a registration statement Form 10-K contains forward-looking statements within10 to voluntarily register common stock, par value $.0001 per share of the meaning ofCompany, pursuant to Section 27A12(g) of the Securities Exchange Act of 1933, as1934, or the Exchange Act. The Company believes that when the Form 10 becomes effective, 60 days after the Form 10 filing, it will no longer be a shell company.

The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in the Company. Additional risks and uncertainties not currently known to the Company and the Company’s management or currently deem immaterial may also have a material adverse effect on the Company’s business, financial condition, results of operations, prospects and/or its share price. As used herein, references to “we,” “us” and “our” are intended to refer to the Company and management.

In addition to reviewing other information in this information statement, you should carefully consider the following risk factors when evaluating us.

Our success will depend, to a large degree, on the expertise and experience of our sole executive officer.

Effective June 27, 2018, John McKowen was appointed to be our Chief Executive Officer. Mr. McKowen is our sole executive officer. Our success in identifying investment opportunities and pursuing and managing such investments will be, to a large degree, dependent upon Mr. McKowen’s expertise and experience and his ability to attract and retain quality personnel. We do not maintain a key person life insurance policy on Mr. McKowen. The loss of Mr. McKowen would significantly delay or prevent the achievement of our business objectives. If Mr. McKowen is unable or unwilling to continue his employment with us, we may not be able to replace him in a timely manner and we will have no executive personnel with experience operating our company. We may incur additional expenses to recruit and retain qualified replacements.

John McKowen holds 88,107,690 or approximately 45.19% of the outstanding shares of the Company. VitaNova, a related party, holds another 56,052,837 or approximately 28.75% of the outstanding shares. John McKowen is the largest shareholder of VitaNova and its CEO. John McKowen currently controls the votes of approximately 73.94% Company’s outstanding shares. As a result, John McKowen is able to exercise a significant level of control over all matters requiring stockholder approval, including the election of directors, appointment and removal of officers, any amendment of the amended and Section 21Erestated certificate of incorporation, approval of mergers, and other business combination transactions requiring stockholder approval, John McKowen can dictate the direction of the Company through his voting power, which may create conflicts of interest with other shareholders.

Our current management resources may not be sufficient for the future, and we have no assurance that we can attract additional qualified personnel.

There can be no assurance that the current level of management is sufficient to perform all responsibilities necessary or beneficial for management to perform. Our success in attracting additional qualified personnel will depend on many factors, including our ability to provide them with competitive compensation arrangements, equity participation and other benefits. There is no assurance that we will be successful in attracting highly qualified individuals in key management positions.

The requirements of being a public company may strain our resources and distract management.

As a result of filing the registration statement, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). These requirements are extensive. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls over financial reporting.

We may incur significant costs associated with our public company reporting requirements and costs associated with applicable corporate governance requirements. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. This may divert management’s attention from other business concerns, which include, without limitation, statements aboutcould have a material adverse effect on our explorations, development, effortsbusiness, financial condition and results of operations. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to raise capital, expectedobtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Ineffective internal controls could impact the Company’s business and operating results.

The Company’s internal control over financial performancereporting may not prevent or detect misstatements because of the inherent limitations of internal controls, including the possibility of human error, the circumvention or overriding of controls, poorly designed or ineffective controls, or fraud. Internal controls that are deemed to be effective can provide only reasonable assurance with respect to the preparation and fair presentation of the Company’s financial statements. If the Company fails to maintain the adequacy of its internal controls, including the failure to implement new or improve existing controls, or fails to properly execute or properly test these controls, the Company’s business and operating results could be negatively impacted and the Company could fail to meet its financial reporting obligations.

Risks Related to Covid-19.

COVID-19 continues to impact worldwide economic activity, and the governments of many countries, states, cities and other aspectsgeographic regions have taken preventative or protective actions, which are creating disruption in global supply chains such as closures or other restrictions on the conduct of business operations of manufacturers, suppliers and vendors. The increased global demand on shipping and transport services may cause us to experience delays in the future, which could impact our ability to obtain materials or build our greenhouses in a timely manner. These factors could otherwise disrupt our operations and could negatively impact our business, financial condition and results of operations.

Although we have not experienced material financial impacts due to the pandemic, the fluid nature of the COVID-19 pandemic and uncertainties regarding the related economic impact are likely to result in sustained market turmoil, which could also negatively impact our business, financial condition and cash flows. Although our business is considered an “essential business,” the COVID-19 pandemic could result in labor shortages, which could result in our inability to plant and harvest crops at full capacity and could result in spoilage or loss of unharvested crops. The impact of COVID-19 on any of our suppliers, distributors, transportation or logistics providers may negatively affect our costs of operation and our supply chain. If the disruptions caused by COVID-19, including decreased availability of labor, continue for an extended period of time, our ability to meet the demands of distributors and customers may be materially impacted.

Further, COVID-19 may impact customer and consumer demand. Retail and grocery stores may be impacted if governments continue to implement regional business identifiedclosures, quarantines, travel restrictions and other social distancing directives to slow the spread of the virus. There may also be significant reductions or volatility in this Annual Report,consumer demand for our products due to travel restrictions or social distancing directives, as well as other reports that we filethe temporary inability of consumers to purchase these products due to illness, quarantine or financial hardship, shifts in demand away from time to time with the Securitiesone or more of our products, decreased consumer confidence and Exchange Commission. Any statements aboutspending or pantry-loading activity, any of which may negatively impact our business, financial results, financial condition and operations contained in this Annual Report that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “expects,” “intends,” “projects,” or similar expressions are intended to identify forward-looking statements. Our actual results could differ materially from those expressed or implied by these forward-looking statementsincluding as a result of various factors,an increased difficulty in planning for operations and future growing seasons.

The extent of COVID-19’s effect on our operational and financial performance will depend on future developments, including the risk factorsduration, spread and intensity of the pandemic, all of which are uncertain and difficult to predict considering the rapidly evolving landscape. As a result, it is not currently possible to ascertain the overall impact of COVID-19 on our business. However, if the pandemic continues to persist as a severe worldwide health crisis, the disease could negatively impact our business, financial condition results of operations and cash flows, and may also have the effect of heightening many of the other risks described below and elsewhere in this report. “Risk Factors” section.

Risks Relating to Our Financial Condition

If our business plans are not successful, we may not be able to continue operations as a going concern and our shareholders may lose their entire investment in us.

We undertake no obligationneed to update publicly any forward-looking statements for any reason, except as required by law, even as new information becomes availableincur additional debt or other events occur in the future.

Item 1. Description of Business.

In this report, the terms “Yukon Gold”, “Company,” “we,” “us” and “our” refer to Yukon Gold Corporation, Inc. The term “common stock” refers to the Company’s common stock, par value $0.0001 per share.

Yukon Gold is an exploration stage mining company. Our objective is to explore and, if warranted and feasible, to develop mineralized material on the mineral claims located in the Mayo Mining District of Yukon, Canada. We hold these claims through our wholly owned subsidiary, Yukon Gold Corp., an Ontario, Canada Corporation (“YGC”). All of our exploration activities are undertaken through YGC. Our mineral claims are referred to herein collectively as the “Marg Property.” We cannot ascertain at this time whether a commercially viable mineral resource exists on the Marg Property.

Subsequent to the period covered by this annual report, on May 21, 2009, the Company sold all of its rights to the Mount Hinton Property, as further described in Note 19 in the Consolidated Financial Statements for the year ended April 30, 2009 included in this report.

RISK FACTORS

|

Yukon Gold does not have sufficient working capital to maintain its ongoing operations, to prepare and file regular reports required to meet the disclosure requirements of the Securities and Exchange Commission or the Ontario Securities Commission or to meet the requirements of the exchanges on which our stock trades. We run the risk of being de-listed on all exchanges in which our stock currently trades.

On August 26, 2009, the Toronto Stock Exchange ("TSX"), announced that it would de-list the Company’s common shares, effective at the close of the market on September 25, 2009. The decision was based upon the Company’s failure to meet multiple listing requirements of TSX. The Company is appealing this decision

1

|

Yukon Gold must immediately secure additional financing to remain viable. Management of Yukon Gold believes that we must identify and purchase new mineral propertiesissue equity in order to fund working capital requirements and to make real estate acquisitions and other investments. We cannot assure you that debt or equity financing will be available to us on acceptable terms or at all. If we are not able to obtain such financing.sufficient financing, we may be unable to maintain or grow our business.

|

Yukon Gold has

If we raise funds through the issuance of debt or equity, any debt securities or preferred stock issued may have rights, preferences and privileges senior to those of holders of our common stock in certain mineral claims located in Yukon, Canada. To date we have done limited explorationthe event of a liquidation, and the terms of the property covered bydebt securities may impose restrictions on our mineral claims. We do not haveoperations. If we raise funds through the issuance of equity, the issuance will dilute your ownership interest.

Risks Relating to Our Business

Our limited operating history makes it difficult for investors to evaluate our business.

Thus, there is a mine or a mining business of any kind. There is no assurance that we will develop an operating business in the future.

|

Currently, we have no source of revenue, we do not have working capital to complete our exploration programs (including feasibility studies) and we do not have any commitments to obtain additional financing. We have novery limited operating history upon which an evaluation of our future success or failurebusiness and prospects can be made.based. Our ability to achievebusiness and maintain profitabilityprospects must be considered in light of the risks, expenses and positive cash flowdifficulties encountered by companies in their early stages of development, particularly companies in new and rapidly changing markets, such is dependent upon:ours.

We are in the capital necessary to conduct this exploration and preserve our interest in these mineral claims;

We expect to acquire real estate properties, “as is” with only limited representation and warranties from the property seller regarding matters affecting the condition, use and ownership of the property. There may makealso be environmental conditions associated with properties we acquire of which we are unaware despite our business more attractivediligent efforts. If environmental contamination exists on properties we acquire or develop after acquisition, we could become subject to investors in exploration stage mining companies.

Failure to raiseliability for the necessary capital to continue exploration and development could cause us to go out of business.

|

The Company has includedcontamination. As a “going concern” qualificationresult, if defects in the Consolidated Financial Statementsproperty (including any building on the property) or other matters adversely affecting the property are discovered, including but not limited to the effect that we are an exploration stage company and have no established sources of revenue. In the event that we are unable to raise additional capital and/or locate mineral resources, as to which in each case there can be no assurance,environmental matters, we may not be able to continuepursue a claim for any or all of the damages against the property seller. Such a situation could harm our business, financial condition, liquidity and results of operations.

We expect to acquire real estate assets, which we intend to finance primarily through newly issued equity or debt. Our access to capital will depend upon a number of factors over which we have little or no control, including general market conditions and the market’s perception of our current and potential future earnings. If we are unable to obtain capital on terms and conditions, we find acceptable, we will likely have to reduce the number of properties we purchase.

We face significant risks associated with the development and redevelopment of the properties we acquire. Development and redevelopment entail risks that could adversely impact our financial position and results of operations including:

| ● | construction costs, which may exceed our estimates due to increases in materials, labor or other costs, which could make the project less profitable and require us to commit additional funds to complete the project; | |

| ● | permitting or construction delays, which may result in increased project costs, as well as deferred revenue; | |

| ● | unavailability of raw materials when needed, which may result in project delays, stoppages or interruptions, which could make the project less profitable; | |

| ● | health and safety incidents and accidents; | |

| ● | poor performance or nonperformance with any of our contractors, subcontractors or other third parties on whom we rely; | |

| ● | unforeseen engineering, environmental or geological problems, which may result in delays or increased costs; | |

| ● | labor stoppages, slowdowns or interruptions; | |

| ● | liabilities, expenses or project delays, stoppages or interruptions as a result of challenges by third parties in legal proceedings; and weather-related and geological interference, including hurricanes, earthquakes, landslides, floods, drought, wildfires and other events, which may result in delays or increased costs. |

Risks Related to Our Common Stock

To finance our planned operations, we may sell additional shares of our stock. Any additional equity financing that we receive may involve substantial dilution to our pre-financing shareholders. We may also issue stock to acquire assets or businesses. In the event that any such shares are issued, the proportionate ownership and voting power of other shareholders will be reduced.

Because we do not anticipate paying any dividends in the near future, investors in our common stock probably will not derive any profits from their investment in us for the foreseeable future, other than through any price appreciation of our common stock. Thus, it is likely that investor profits, if any, will be limited for the near future.

The market prices for our common stock may be volatile. In addition, the existencetrading volume may fluctuate, resulting in significant price variations. Some of the “going concern” qualificationfactors that could negatively affect the share price or results in fluctuations in the price or trading volume of our auditor’s reportcommon stock include:

| ● | our actual or projected operating results, financial condition, cash flows and liquidity or changes in business strategy or prospects: | |

| ● | changes in government policies, regulations or laws; | |

| ● | the performance of our current property and additional properties we acquire; | |

| ● | our ability to make acquisitions on preferable terms or at all; | |

| ● | equity issuances by us or share resales by our stockholders, or the perception that such issuances or resales may occur; | |

| ● | actual or anticipated accounting problems; | |

| ● | changes in market values of similar companies; | |

| ● | adverse market reaction to any increased indebtedness we may incur in the future; | |

| ● | interest rate changes; | |

| ● | additions to or departures of our senior management team; | |

| ● | speculation in the press or negative press in general; and | |

| ● | market and economic conditions generally, including the current state of the credit and capital markets and the market and economic conditions. |

Our common stock is quoted only on the OTC Pink marketplace, which may make it more difficult for usyou to resell shares when you want at prices you find attractive.

Our common shares trade on the OTC Bulletin Board, which is an electronic quotation medium used by subscribing broker-dealers to reflect dealer quotations on a real-time basis. This over-the-counter market provides significantly less liquidity and regulatory oversight than the Nasdaq Stock Market. Securities that are thinly traded on the OTC Bulletin Board often experience a significant spread between the market maker’s bid and asked prices. Therefore, prices for actual transactions in securities traded on the OTC Bulletin Board may be difficult to obtain additional financing. If we areand holders of our common stock may be unable to obtainresell their shares when they want at prices they find attractive.

Shares that are eligible for future sale may have an adverse effect on the price of our common stock.

The regulation of penny stocks by SEC and FINRA may discourage the tradability of Common Stock.

We are classified as a “penny stock” company. The Common Stock currently trades on the OTC Market and is subject to an SEC rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. For purposes of the rule, the phrase “accredited investors” means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 (not including the principal residence) or having an annual income that exceeds $200,000 (or that, when combined with a spouse’s income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Effectively, this discourages broker- dealers from executing trades in penny stocks. Consequently, the rule will affect the ability of purchasers in this offering to sell their securities in any market that may develop therefore because it imposes additional financing, youregulatory burdens on penny stock transactions.

In addition, the SEC has adopted a number of rules to regulate “penny stocks,” including Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7 and 15g-9 under the Exchange Act. Our Common Stock constitutes a “penny stock” within the meaning of these rules, and these rules impose additional regulatory burdens that may lose all or partaffect the ability of your investment.holders to sell Common Stock in any market that may develop.

The market for penny stocks has suffered in recent years from patterns of fraud and abuse, including:

| control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; | |

| ● | manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; | |

| ● | “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; | |

| ● | excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and | |

| ● | wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, causing investor losses. |

Our common stock is considered

We generally are not in a "penny stock" andposition to dictate the sale of our stock by you will be subject to the "penny stock rules"behavior of the Securitiesmarket or of broker-dealers who participate in the market.

Penny Stock Regulation

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price of less than $5.00. Excluded from the penny stock designation are securities listed on certain national securities exchanges or quoted on NASDAQ, provided that current price and Exchange Commission.volume information with respect to transactions in such securities is provided by the exchange/system or sold to established customers or accredited investors. The penny stock rules require broker-dealersa broker-dealer, prior to take steps before making anya transaction in a penny stock trades in customer accounts. Asnot otherwise exempt from the rules, to deliver a result, our shares could be illiquidstandardized risk disclosure document that provides information about penny stocks and there could be delaysthe risks in the trading of ourpenny stock which would negatively affect your ability to sell your sharesmarket. The broker-dealer also must provide the customer with current bid and could negatively affectoffer quotations for the trading price of your shares.

|

The Company conductspenny stock, the majority of its business activities in Canadian dollars. Consequently, the Company is subject to gains or losses due to fluctuations in Canadian currency relative to the US dollar.

2

Item 2. Description of Property

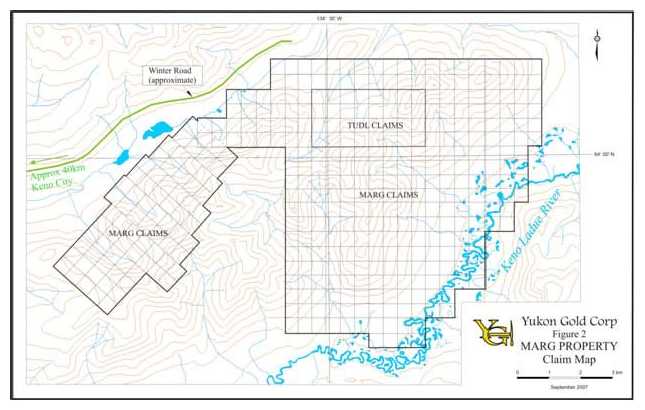

The Marg Property

The Marg Property consists of 402 contiguous mineral claims covering approximately 20,000 acres. Access to the claim group is possible either by helicopter, based in Mayo, Yukon Territory, Canada, located approximately 80 km to the southwest or by small aircraft to a small airstrip located near the Marg deposit. A 50 kilometer winter road from Keno City to the property boundary was completed in 1997. The camp site on the property provides accommodation for up to 12 people. Presently the hydroelectric power grid terminates at Keno City some 50km to the southwest and water is available from the Keno Ladue River, which flows through the property.

The rock formationscompensation of the Marg propertybroker-dealer and its salesperson in connection with the transaction, and the immediate area are divided into four major units which are repeated by southeast dipping thrust faults. The two major faults aremonthly account statements showing the Tombstone Thrust and the Robert Service Thrust. One thrust panel contains the Marg Zone mineralization. Within the thrust panel he rocks within the thrust sheets appear to be tabular. The thrust panel containing the Marg Zone is composedmarket value of repeated sequences of quartzite, quartz-sericite phyllite and black graphite phyllite. The quartz-sericite phyllite is probably metamorphosed equivalents of volcanic rocks and metasedimentary rocks. The graphite phyllite is the metamorphosed equivalent of a black shale.

Our claims,each penny stock held in the name of our wholly owned subsidiary “Yukon Gold Corp,” are registeredcustomer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the Mining Recorders Office inbroker-dealer must make a special written determination that the Mayo Mining District ofpenny stock is a suitable investment for the Yukon Territorypurchaser and give usreceive the rightpurchaser’s written agreement to explore and mine minerals from the property covered by the claims. These claims are tabulated below:transaction.

3

Marg Property Claimsheld byYukon Gold Corp.

Marg Acquisition Agreement

The following is a descriptionThese disclosure requirements may have the effect of the Company’s acquisition of the Marg property. During the period covered by this report, the Company completed its acquisition of the Marg property and currently owns it outright.

In March of 2005, our wholly owned Canadian subsidiary, YGC, acquired from Medallion Capital Corp. (“Medallion”) all of Medallion's rights to purchase and develop the Marg Property which consists of 402 contiguous mineral claims covering approximately 20,000 acres located in the central area of Yukon, Canada. The price paid by the Company was Medallion's cost to acquire the interest. Medallion is owned and controlled by a former director of the Company, Stafford Kelley. The rights acquired by YGC arise under a Property Purchase Agreement between Medallion and Atna Resources Ltd. (“Atna”), hereinafter referred to as the “Marg Acquisition Agreement.” Under the terms of the Marg Acquisition Agreement the Company paid $119,189 (CDN$150,000) cash and 133,333 common shares as a down payment. The Company made payments under the Marg Acquisition Agreement of $43,406 (CDN$50,000) cash and an additional 133,333 common shares of the Company on December 12, 2005; $86,805 (CDN$100,000) cash and an additional 133,334 common shares of the Company on December 12, 2006 and $98,697 (CDN$100,000) in cash on December 12, 2007. The Company agreed to make subsequent payments under the Agreement of: $167,645 (CDN$200,000) in cash and/or common shares of the Company (or some combination thereof to be determined) on or before December 12, 2008. On December 4, 2008 the Company and Atna Resources Ltd. (“Atna”) entered into a letter agreement (the “Amendment Agreement”) amending the purchase agreement by which the Company acquired its Marg Property (the “Marg Acquisition Agreement”). Under the terms of the Marg Acquisition Agreement the Company was required to pay to Atna $167,645 (CDN$200,000) (in cash or shares of the Company’s common stock) on December 12, 2008. In lieu of making such payment, the Amendment Agreement permitted the Company to pay Atna $19,980 (CDN$25,000) in cash on December 12, 2008 (paid) and $188,600 (CDN$225,000) (payable in cash or shares of the Company’s common stock) on April 30, 2009. On April 30, 2009, the Company issued to Atna 6,838,906 common shares which represent $188,600 (CDN$225,000), whereby the common shares were valued at $0.0276 (CDN $0.0329) each. Upon the commencement of commercial production at the Marg Property, the Company will pay to Atna $838,223 (CDN$1,000,000) in cash and/or common shares of the Company, or some combination thereof to be determined.

4

Our expenditures for exploration on the Marg Property are as follows: On May 16, 2006 the Company accepted a proposed work program, budget and cash call schedule for the Marg Property totaling $1,674,866 (CDN$1,872,500) for the 2006 Work Program. On May 15, 2006 the Company paid $199,016 (CDN$222,500) to the contractor, on June 1, 2006 the Company paid $536,673 (CDN$600,000) to the contractor, and on July 20, 2006 the Company paid $357,782 (CDN$400,000) to the contractor. The fourth payment of $357,782 (CDN$400,000) was paid on August 20, 2006 and the fifth payment of $223,613 (CDN$250,000) paid on September 20, 2006. On April 2, 2007 the Company accepted a proposed work program, budget and cash call schedule for the Marg project totaling $2,100,528 (CDN$2,281,880) for the 2007 Work Program. The Company had approximately $515,561(CDN$550,000) on deposit left over from the 2006 cash call schedule. On May 15, 2007 the Company paid $703,037 (CDN$750,000), on June 15, 2007 the Company paid $703,037 (CDN$750,000), and on July 15, 2007 the Company paid $703,037 (CDN$750,000) being three of the four cash call payments. The fourth and final payment of $402,244 (CDN$380,000) was paid on August 15, 2007. On August 31, 2007 the Company re-allocated $537,864 (CDN$508,120), being the balance of the third cash call payment for the Mount Hinton 2007 Work Program from cash call funds previously allocated to the Marg Project. These re-allocated funds were not needed for the Marg Project. As of January 23, 2008, unused funds of $388,524 (CDN$390,000) were refunded by our work program manager to the Company.

Exploration at Marg Property

The Marg property has had an extensive exploration history with numerous owners and work programs. The area was first staked in 1965 to follow-up anomalous results in a government stream sediment survey. The initial exploration was directed towards finding silver bearing veins but when none were discovered the claims were allowed to lapse. In 1982 the ground was re-staked by a consortium looking for “SEDEX” style lead-zinc mineralization and this resulted in the discovery of the Marg mineralization. In the following years, exploration consisted of geochemical and geophysical surveying, geological mapping, hand trenching and diamond drilling which progressively expanded the limits of the known mineralization. This work was done by various companies who entered into agreements to explore the ground or relinquish their interests. To date a total of 34,203 meters of diamond drilling has been performed on the Marg property.

Yukon Gold started its exploration efforts in 2005 when 1,184.6 meters were drilled in four holes. Exploration continued in 2006 and 2007 when nine holes totaling 2,986 meters and 3,307 were drilled respectively. The programs were managed by Archer Cathro & Associates (1981) and were designed to test the “down-dip” extent of the mineralization. During 2008 the company completed 3,674 metres of drilling in ten holes.

5

Three estimates on the Marg mineralization that are compliant with Canadian National Instrument No. 43-101 (“NI 43-101”) have been prepared. The first completed by P. Holbek (2005) used the polygonal method the in the second by G. Giroux and R. Carne (2007) used a block model method and the third by Scott Wilson RPA (2008) used a block model method. The Giroux and Carne estimate was based on copper equivalent cutoffs while the Holbek and Scott Wilson RPA estimates were based on NSR values as indicated. The Scott Wilson RPA estimate incorporated all drilling to the end of 2007 The mineralization is contained in four zones with strike lengths from 650 metres to 1,200 metres. Results of these two estimates are tabulated below:

| Giroux/Carne | Holbek | Scott Wilson RPA | ||||||

| Cut-Off | 0.5% Cu | 1.00% Cu | C$40 NSR | C$70NSR | ||||

| Indicated | Inferred | Indicated | Inferred | Indicated | Inferred | Indicated | Inferred | |

| Mineralized Material Tonnes | 1,930,000 | 6,300,000 | 1,720,000 | 4,800,000 | 4,646,200 | 880,800 | 5,700,000 | 2,150,000 |

| % Copper | 1.84 | 1.55 | 1.97 | 1.81 | 1.80 | 1.55 | 1.52 | 1.18 |

| % Zinc | 4.34 | 4.22 | 4.59 | 4.64 | 4.77 | 3.75 | 3.66 | 3.39 |

| % Lead | 2.28 | 2.09 | 2.40 | 2.28 | 2.57 | 1.90 | 1.91 | 1.63 |

| Silver (g/t) | 56.66 | 50.62 | 59.72 | 55.4 | 65 | 50.42 | 48 | 38 |

| Gold (g/t) | 0.90 | 0.72 | 0.95 | .78 | 0.99 | 0.95 | 0.78 | .65 |

The latest estimate, prepared by Scott Wilson RPA in July of 2008 was based on the following parameters:

1. The classification of mineral resources follows CIM Definition Standards for Indicated Resources.2. Mineral resources have been estimated by kriging into blocks constrained by wireframed mineral lenses.3. NSR values are based on assumed metallurgical recoveries of 60% for Cu, 80% for Zn, and 60% for Pb; and on metal prices of US$2.50 for Cu, US$0.90 for Zn, US$0.70 for Pb, US$13.50 for Ag and US$800 for Au; and foreign exchange of C$1.00=US$ 0.90.

We note that the terms “indicated resources” and “resources” (used above) refer to a standard that is recognized in Canada but is not accepted by the United States Securities and Exchange Commission (the “SEC”) for disclosure purposes. Generally, an “indicated” or “inferred” estimate does not rise toreducing the level of certainty required by SEC guidelines. A “resource” should not be confused with a “reserve,” which has been established using stricter guidelines and may carry an estimate of dollar value.

All previous operators employed Chemex Labs in Vancouver for their analytical work. In Yukon Gold’s 2006 to 2007 programs, all core sampling, collection of geotechnical data and core logging was done on site. Mineralized intervals were split and one-half was sent to ALS Chemex Labs, North Vancouver, B.C. Blank samples consisting of barren limestone were routinely inserted into the sample stream. Duplicate samples collected by quartering core were inserted into the sample stream. Prepared pulps and coarse rejects were sent as check samples to Acme Analytical Laboratories Ltd. in Vancouver. Reanalysis for results greater than 1% copper, lead or zinc were routinely carried out. The drill core is stored on the property at the camp location. The 2008 program also used the ALS Chemex Laboratories. Standard basemetal samples and blank samples were included with all shipments to the laboratory and duplicate, quarter-core samples were forwarded to G&T Metallurgical Services Ltd, from all mineralized intervals in order to provide check assays

At the laboratory, core samples were weighed, dried and crushed to 70% minus 2 mm, before a 250 g split was taken and pulverized to better than 85% minus 75 microns. A 10 gram split of the pulverized fraction was dissolved in aqua regia and analyzed for 50 elements by a combination of ICPMS and ICPAES techniques. Over limit copper, lead, zinc and silver values were determined using atomic absorption spectroscopy (AAS). A 30 gram split was analyzed for gold with a fire assay preparation and AAS finish. ALS Chemex operates according to the guidelines set out in ISO/IEC Guide 25 "General requirements for the competence of calibration and testing laboratories" and the company is certified to ISO 9002 by KPMG in Canada and other countries. Duplicate analyses were performed by Acme Analytical Laboratories in Vancouver using a process similar to Chemex for drilling between 2005 and 2008 and by G&T Metallurgical Services Ltd for the 2008 drilling.

6

Though the property is without known mineral reserves, Yukon Gold believes that exploration potential within the Marg Property is good. Presently the hydroelectric power grid terminates at Keno City some 50km to the southwest and water is available from the Keno Ladue River which flows through the property.

During the summer of 2008, we undertook an exploration program at the Marg Property to extend the currently known mineralization, verify continuity of mineralization and provide samples for initial metallurgical test work. The drilling results of the nine holes drilled at the Marg Propertytrading activity in the summer of 2008 are generally consistent with the previous results from prior drilling programs reflected in the Company’s mineral report. We continue to hit mineralized material to the west of known resources.

In November 2008, Yukon Gold announced the results of the 2008 diamond drill program The results of the drilling program are summarized below:

| Hole_ID | from | to | core width (m) | Cu % | Pb % | Zn % | Ag g/t | Au g/t |

| M-108 | 111.42 | 111.85 | 0.43 | 1.49 | 2.20 | 3.84 | 53.90 | 1.33 |

| 158.29 | 162.8 | 4.51 | 0.60 | 1.26 | 2.19 | 44.27 | 2.04 | |

| 181.6 | 185.8 | 4.20 | 1.67 | 3.40 | 5.53 | 82.81 | 1.81 | |

| 195.8 | 196.43 | 0.63 | 0.17 | 1.37 | 1.75 | 26.70 | 0.36 | |

| M-109 | 145.8 | 157.35 | 11.55 | 1.72 | 1.72 | 3.64 | 42.41 | 0.63 |

| M-110 | 246.1 | 255.9 | 9.80 | 2.15 | 3.50 | 7.37 | 79.26 | 1.25 |

| 290.8 | 291.3 | 0.50 | 1.69 | 1.97 | 3.86 | 93.50 | 1.34 | |

| 295.5 | 306 | 10.50 | 1.03 | 1.69 | 3.23 | 46.71 | 0.90 | |

| M-111 | 294.2 | 299.9 | 5.70 | 1.52 | 2.06 | 4.71 | 44.20 | 0.93 |

| 332.77 | 337.6 | 4.83 | 0.87 | 1.63 | 3.10 | 39.03 | 0.52 | |

| M-112 | 294.65 | 295.2 | 0.55 | 1.78 | 3.49 | 6.92 | 75.70 | 1.69 |

| 298.2 | 301.9 | 3.70 | 1.89 | 2.26 | 6.53 | 69.05 | 1.05 | |

| 314.3 | 315.7 | 1.40 | 0.97 | 1.55 | 3.05 | 44.14 | 0.47 | |

| 332.9 | 336 | 3.10 | 0.64 | 0.73 | 1.43 | 20.35 | 0.23 | |

| M-113 | 329.7 | 335.7 | 6.00 | 2.24 | 1.01 | 2.25 | 15.04 | 0.01 |

| 379.6 | 380.4 | 0.80 | 1.60 | 2.40 | 4.65 | 59.00 | 0.55 | |

| M-114 | 418.6 | 420.1 | 1.50 | 0.38 | 0.48 | 0.86 | 10.74 | 0.13 |

| including | ||||||||

| 419.6 | 420.1 | 0.50 | 0.90 | 1.16 | 2.03 | 25.80 | 0.24 | |

| M-115 | 275.8 | 276.3 | 0.50 | 0.17 | 1.94 | 3.37 | 67.20 | 0.03 |

| M-116 | 333.1 | 335.15 | 2.05 | 0.17 | 0.60 | 1.71 | 10.63 | 0.08 |

| including | ||||||||

| 334.6 | 335.15 | 0.55 | 0.36 | 1.59 | 4.36 | 24.10 | 0.15 | |

| M-116 | 361.35 | 362.5 | 1.15 | 1.60 | 0.86 | 2.61 | 24.16 | 0.44 |

| including | ||||||||

| 361.95 | 362.5 | 0.55 | 3.05 | 1.55 | 4.78 | 42.30 | 0.81 | |

M-117 No Significant Intersections | ||||||||

7

Again, the reader is cautioned that the terms “indicated” and “inferred” are not terms that are recognized by the SEC's guidelines for disclosure of mineral properties, however, they are recognized defined terms under Canadian disclosure guidelines. Generally, an “indicated” or “inferred” estimate does not rise to the level of certainty required by SEC guidelines. Also, the internal review was based on comparisons with proximate deposits and associated feasibility studies at then current metal prices, estimated trucking and shipping costs, industry treatment and refining costs, average metallurgical recoveries and concentrate grades from five VMS deposits. The internal review has not been analyzed by an independent Qualified Person and therefore the results of this review should not be relied upon. Yukon Gold believes that the internal review provides an indication of the potential of the Marg Deposit and is relevant to ongoing exploration.

GLOSSARY

In this annual report, we use certain capitalized and abbreviated terms, as well as technical terms, which are defined below.

8

9

10

11

Corporate Office

The Company’s corporate offices were located at 55 York Street, Suite 401, Toronto, Ontario M5J 1R7 until August 26, 2009. The Company entered into a five-year lease, which was executed on March 27, 2006. The lease commenced on July 1, 2006. Minimum lease commitments under the lease were as follows:

| Minimum lease | ||||||

| Years ending April 30, | commitment | |||||

| 2010 | $ | 41,693 | (CDN $49,740 | ) | ||

| 2011 | $ | 42,005 | (CDN $50,112 | ) | ||

| 2012 | $ | 7,002 | (CDN $ 8,353 | ) |

Following the period covered by this report, the Company defaulted under the lease and the landlord has reserved its legal rights. The Company’s mailing address, as of the date of this report is 139 Grand River Street, N., P.O. Box 510, Paris, Ontario N3L 3T6. The Company currently does not have corporate offices.

Item 3. Legal Proceedings.

There is no material legal proceeding pending or, to the best of our knowledge, threatened against the Company or its subsidiaries. It is possible that one or more creditors of the Company will bring an action to enforce a debt.

Item 4. Submission of Matters to Vote of Security Holders.

None. Our last annual meeting was held on March 18, 2008.

PART II

Item 5. Marketsecondary market for Common EquityStock, and Related Stockholder Matters.investors therefore may find it more difficult to sell their Common Stock.

As of April 30, 2009, there were 40,489,535 shares of common stock outstanding, held by 611 shareholders of record. 28,990,440 common shares were issued and outstanding as of April 30, 2008.

Private Placements of Securities for the Year Ended April 30, 2008

On August 16, 2007 the Company completed a private placement (the “Financing”) with Northern Securities Inc. (“Northern”), acting as agent. The Financing was comprised of the sale of 1,916,666 units (the “Units”) at $0.42 (CDN$0.45) per Unit (the “Unit Issue Price”) for gross proceeds of $802,101 (CDN$862,499.70) and the sale of 543,615 flow-through units (the “Flow-Through Units” which qualify as flow-through shares for the purposes of the Canadian Income Tax Act) at $0.49 (CDN$0.52) per Flow-Through Unit (the “Flow-Through Unit Issue Price”) for gross proceeds of $262,884 (CDN$282,680). The proceeds raised were allocated between the offering of shares and the sale of tax benefits. A liability of $35,381 was recognized for the sale of taxable benefits, which was reversed and credited to income when the Company renounced resource expenditure deduction to the investor. Each Unit consisted of one non-flow through common share (“Common Share”) and one half of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant is exercisable into one Common Share until August 16, 2009 at an exercise price of $0.60 (CDN$0.60) per share. Each Flow-Through Unit consisted of one flow-through common share and one half of one Common Share purchase warrant (each whole warrant, an “FT Warrant”). Each FT Warrant is exercisable into one Common Share until August 16, 2009 at an exercise price of $0.70 (CDN$0.70) per share. The Company paid Northern a commission equal to 8% of the aggregate gross proceeds which amounted to $85,199 (CDN$91,614) and issued 153,333 “Unit Compensation Warrants” and 43,489 “FT Unit Compensation Warrants”. Each Unit Compensation Warrant is exercisable into one Unit at the Unit Issue Price until August 16, 2009. Each FT Unit Compensation Warrant is exercisable into one Common Share and one half of one FT Warrant at the Flow-Through Unit Issue Price until August 16, 2009. Yukon Gold also granted Northern an option (the “Over-Allotment Option”) exercisable until October 15, 2007 to offer for sale up to an additional $468,691 (CDN$500,000) of Units and/or Flow-Through Units on the same terms and conditions. The Company paid a $70,304 (CDN$75,000) due diligence fee to Northern at closing. The Company reimbursed Northern expenses of $18,600 (CDN$20,000) and legal fees of $18,000 (CDN$20,000).

12

On November 16, 2007 the Company completed the second part of a private placement (the “Second Financing”) with Northern acting as agent. The Second Financing was comprised of the sale of 2,438,888 units (the “Units”) at $0.46 (CDN$0.45) per Unit (the “Unit Issue Price”) for gross proceeds of $1,127,028 (CDN$1,097,500) and the sale of 1,071,770 flow through units (the “Flow-Through Units”) at $0.53 (CDN$0.52) per Flow-Through Unit (the “Flow-Through Unit Issue Price”) for gross proceeds of $572,315 (CDN$557,320). The proceeds raised were allocated between the offering of shares and the sale of tax benefits. A liability of $77,043 was recognized for the sale of taxable benefits, which was reversed and credited to income when the Company renounced resource expenditure deduction to the investor. The closing represented the final tranche of a $2,816,673 (CDN$2.8 million) private placement with Northern announced on July 24, 2007. Each Unit consists of one non-flow through common share (“Common Share”) and one half of one Common Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant is exercisable into one Common Share until November 16, 2009 at an exercise price of $0.60 (CDN$0.60) per share. Each Flow-Through Unit consists of one flow-through common share and one half of one Common Share purchase warrant (each whole warrant, an “FT Warrant”). Each FT Warrant is exercisable into one Common Share until November 16, 2009 at an exercise price of $0.70 (CDN$0.70) per share. Yukon Gold paid Northern a commission equal to 8% of the aggregate gross proceeds and issued 195,111 “Unit Compensation Warrants” and 85,741 “FT Unit Compensation Warrants”. Each Unit Compensation Warrant is exercisable into one Common Share and one half of one Common Share purchase warrant at the Unit Issue Price until November 16, 2009. Each full Common share purchase warrant is exercisable at $0.60 (CDN$0.60) . Each FT Unit Compensation Warrant is exercisable into one Common Share and one half of one Common Share purchase warrant at the Flow-Through Unit Issue Price. Each full Common Share purchase warrant is exercisable at $0.70 (CDN$0.70) .

The foregoing private placements were undertaken pursuant to an exemption offered by Regulation S ( “Regulation S”)Rule 144 promulgated under the Securities Exchange Act of 1933,1934, as amended (the “Securities Act”).

Private Placements is not available as an exemption from registration for the Year ended April 30, 2009

On July 23, 2008, the Company closed a non-brokered private placement for up to $976,563 (CDN$1,000,000). The Company completed the salere-sale of 4,134,000 common shares on a flow-through basis at a price of $0.15 (CDN$0.15) per share for gross proceeds of $613,778 (CDN$620,100). The Company paid a 5% finders fee on this private placement. The proceeds from the private placement of flow-through shares were used by Yukon Gold for program expenditures on the Marg Property and the Mount Hinton Property (then partially owned by the Company). The flow through shares were issued at market without any additional price charged for sale of taxable benefits. The private placement was exempt from registration under the Securities Act, pursuant to an exemption afforded by Regulation S.

Other Sales or Issuances of Unregistered Securities

Year ended April 30, 2008

On July 7, 2007 the Company issued 136,364 common shares in settlement of a property payment on the Company’s former Mount Hinton property. The shares represent $57,252 (CDN$60,000) which is 40%Shares by its shareholders. Consequently, holders of the contracted payment and were valued at $0.42 (CDN$0.44) each. The issuance of these shares was undertaken pursuant to a negotiated asset acquisition agreement with the Hinton Syndicate and was exempt from registration under the Securities Act pursuant to an exemption afforded by Regulation S.

13

Year ended April 30, 2009

On July 7, 2008, the Company issued 476,189 common shares in settlement of a property payment on the Company’s former Mount Hinton property. These shares represent $58,887 (CDN$60,000), which is 40% of the contracted payment, and were valued at $0.123 (CDN$0.126) each. The balance of the property payment in the amount of $88,330 (CDN$90,000) was paid in cash.

On May 16, 2008, the Company entered into a consulting agreement with Clarke Capital Group Inc. (“Clarke”) pursuant to which Clarke was retained to provide the Company with investor relations and business communications services for an initial term of 6 months, renewable thereafter for an additional 6-month term. Upon execution of the Clarke Agreement the Company paid Clarke $14,648 (CDN$15,000). Pursuant to the Clarke Agreement, the Company issued Clarke 50,000 shares of common stock on July 14, 2008.

The Company assumed the rights to acquire the Marg Property under a Property Purchase Agreement with Atna Resources Ltd. (“Atna”). The Company had agreed to make subsequent payments under the Agreement of: $163,066 (CDN$200,000) in cash and/or commonrestricted shares of the Company (or some combination thereofmay be unable to re-sell their shares or deposit shares with a legend in brokerage account. The Company has plans to register the re-sale of its Shares but may not be determined) onable to complete the filing of a registration statement.

Item 1B. Unresolved Staff Comments

None

The Company does not own or before December 12, 2008. On December 4, 2008lease corporate offices. Communications are conducted primarily through the internet using cyber meeting applications. Corporate records are maintained at the Company CEO’s and Atna Resources Ltd. (“Atna”) entered into a letter agreement (the “Amendment Agreement”) amending the purchase agreement by whichSecretary’s home offices.

On July 1, 2020, the Company acquired its Marg Property (the “Marg Acquisition Agreement”). Undersigned a five-year lease for a 158 irrigated acre farm, located at 2083 County Road 104, Walsenburg, Colorado 81089. The lease rate is $5,250 per month and is renewable for another five years at the terms of the Marg Acquisition Agreement the Company was required to pay to Atna $163,066 (CDN$200,000) (in cash or shares of the Company’s common stock) on December 12, 2008. In lieu of making such payment, the Amendment Agreement permitted the Company to pay Atna $19,980 (CDN$25,000) in cash on December 12, 2008 (paid) and $188,600 (CDN$225,000) (payable in cash or shares of the Company’s common stock) on April 30, 2009. On April 30, 2009, the Company issued to Atna 6,838,906 common shares which represent $188,600 (CDN$225,000), whereby common shares were valued at $0.0276 (CDN$0.0329) each. As a result, the Company owns 100% of the Marg property.

Purchase Warrants

The following table summarizes the warrants outstanding as of the year ended April 30, 2009.

| Number of | |||||||||

| Warrants | Exercise | ||||||||

| Granted | Prices | Expiry Date | |||||||

| $ | |||||||||

| Outstanding at April 30, 2007 and average exercise price | 5,415,703 | 0.97 | |||||||

| Granted in year 2007-2008 | 1,111,665 | 0.60 | August 16, 2009 | ||||||

| Granted in year 2007-2008 | 315,296 | 0.70 | August 16, 2009 | ||||||

| Granted in year 2007-2008 | 1,414,554 | 0.60 | November 16, 2009 | ||||||

| Granted in year 2007-2008 | 621,626 | 0.70 | November 16, 2009 | ||||||

| Granted in year 2007-2008 | 250,000 | 0.24 | December 15, 2012 | ||||||

| Granted in year 2007-2008 | 250,000 | 0.24 | June 15, 2013 | ||||||

| Exercised in year 2007-2008 | - | - | |||||||

| Expired in year 2007-2008 | (377,794 | ) | (1.00 | ) | |||||

| Cancelled in year 2007-2008 | - | - | |||||||

| Outstanding at April 30, 2008 and average exercise price | 9,001,050 | 0.86 | |||||||

| Granted in year 2008-2009 | - | - | |||||||

| Exercised in year 2008-2009 | - | - | |||||||

| Cancelled in year 2008-2009 | - | - | |||||||

| Expired in year 2008-2009 | (2,665,669 | ) | (0.90 | ) | |||||

| Expired in year 2008-2009 | (245,455 | ) | (1.00 | ) | |||||

| Expired in year 2008-2009 | (533,133 | ) | (0.60 | ) | |||||

| Expired in year 2008-2009 | (643,652 | ) | (1.05 | ) | |||||

| Outstanding at April 30, 2009 and average exercise price | 4,913,141 | 0.83 |

14

The warrants do not confer upon the holders any rights or interest as a shareholder of the Company.

On November 27, 2007 the board of directors approved the extension of the expiry dates of the following warrants by one (1) year: (a) 2,665,669 warrants expiring on March 28, 2008 exercisable at $0.90 per warrant to March 28, 2009, having a fair value of $76,483; (b) 950,000 warrants expiring on October 4, 2008 which are exercisable at $2.00 per warrant to October 4, 2009, having a fair market value of $5,144; and (c) 533,133 Broker warrants expiring on March 28, 2008 exercisable at $0.60 per unit to March 28, 2009 having a fair market value of $28,645.

Outstanding Share Data

As at April 30, 2009, 40,489,535 common shares of the Company were outstanding.

Of the options to purchase common shares issued to the Company’s directors, officers and consultants under the Company’s 2003 stocksole option plan, 1,566,000 remained outstanding with exercise prices ranging from $0.55 to $1.19 and expiry dates ranging from August 4, 2009 to January 20, 2011. If exercised, 1,566,000 common shares of the Company would be issued, generating proceeds of $1,383,660. Subsequent to the year end, options to issue 240,000 common shares were forfeited on August 4, 2009 due to the resignation of a director of the Company.

Of the 2,899,044 options available to purchase common shares by the Company’s directors, officers and consultants under the Company’s 2006 stock option plan, 1,487,500 granted options remained outstanding with exercise prices ranging from to $0.17 (CDN$0.20) to $0.38 (CDN$0.45) and expiry dates ranging from August 4, 2009 to April 8, 2013. If exercised, 1,487,500 common shares of the Company would be issued, generating proceeds of $364,522 (CDN$434,875). Subsequent to the year end, options to issue 200,000 common shares were cancelled on June 25, 2009 due to the resignation of an officer of the Company. Subsequent toIn January, 2021, the year end, options to issue 100,000 common shares were alsoCompany cancelled on August 4, 2009 due to the resignation of a director oflease with no further obligations from the Company.

15

On April 30, 2009, 4,913,141 share purchase warrants were exercisable

We may from time to time, be a party to legal proceedings, which arise in the ordinary course of our business. We are not aware of any pending or threatened litigation that, if resolved against us, would have a material adverse effect on our financial position, results of operation or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and expiring between August 16, 2009 and June 15, 2013. If exercised, 4,913,141 common shares would be issued, generating proceedsIssuer Purchases of $4,077,907.Equity Securities

| Number of | |||||||||

| securities | |||||||||

| remaining | |||||||||

| available for | |||||||||

| Number of | Weighted- | future | |||||||

| securities to | average | issuance | |||||||

| be issued | exercise | under equity | |||||||

| upon | price of | compensation | |||||||

| exercise of | outstanding | plans | |||||||

| outstanding | options, | (excluding | |||||||

| options, | warrants | securities | |||||||

| warrants | and | reflected in | |||||||

| and rights | rights | column (a)) | |||||||

| (a) | (b) | (c) | |||||||

| Equity compensation plans approved by security holders | 4,913,141 | $ | 0.83 | 4,077,907 | |||||

| Equity compensation plans not approved by securities holders | N/A | N/A | N/A | ||||||

| Total | 4,913,141 | $ | 0.83 | 4,077,907 |

Market Information

Our common stock is tradedquoted on the OverPink Open Market of the Counter Bulletin Board sponsored by the National Association of Securities Dealers, Inc.OTC Market Group under the symbol “YGDC.” The Over“VTNA”. Because the Counter Bulletin Board doescommon stock is not have any quantitative or qualitative standards such as those required for companiestraded on an exchange, it may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if it were listed on a national securities exchange. The following table sets forth, for the Nasdaq Small Cap Market or National Market System. Ourperiods indicated, the high and low closing sales pricesprice of our common stock during the fiscal years ended April 30, 2009 and 2008 are as follows:

provided by OTC Markets Group Inc. on its website www.otcmarkets.com. These quotations representprices reflect inter-dealer prices, without retain mark-up mark-down or commission, and may not represent actual transactions.

| FISCAL YEAR 2009 | HIGH | LOW | ||||

| First Quarter | $ | 0.22 | $ | 0.11 | ||

| Second Quarter | $ | 0.15 | $ | 0.02 | ||

| Third Quarter | $ | 0.07 | $ | 0.02 | ||

| Fourth Quarter | $ | 0.05 | $ | 0.02 |

| FISCAL YEAR 2008 | HIGH | LOW | ||||

| First Quarter | $ | 0.69 | $ | 0.37 | ||

| Second Quarter | $ | 0.59 | $ | 0.33 | ||

| Third Quarter | $ | 0.50 | $ | 0.21 | ||

| Fourth Quarter | $ | 0.30 | $ | 0.18 |

As

Price Range of April 19, 2006, our stock began trading onCommon Stock

The following table sets forth, for the Toronto Stock Exchange underperiods indicated, the symbol “YK.” The high and low tradingdaily closing prices forof our common stock for the two most recently completed fiscal year periods indicated below are as follows:years while trading on the markets noted above.

16

| Period (Quarter Ended) | High | Low | ||||||

| December 31, 2020 | $ | 0.80 | $ | 0.0001 | ||||

| September 30, 2020 | 0.31 | 0.11 | ||||||

| June 30, 2020 | 0.15 | 0.12 | ||||||

| March 31, 2020 | 0.58 | 0.12 | ||||||

| December 31, 2019 | 0.58 | 0.10 | ||||||

| September 30, 2019 | 0.60 | 0.30 | ||||||

| June 30, 2019 | 0.6675 | 0.31 | ||||||

| March 31, 2019 | 0.99 | 0.65 | ||||||

Our Transfer Agent

Our transfer agent is Equity Transfer & Trust Services, Inc. with offices at 200 University Ave., Suite 400, Toronto, Ontario M5H 4H1. Their phone number is 416-361-0930. The transfer agent is responsible for all record-keeping and administrative functions in connection with the common sharesauthorized capital stock consists of stock.

Dividends

We have not declared any cash dividends on our common stock. We plan to retain any future earnings, if any, for exploration programs, administrative expenses and development of the Company and its assets.

Securities Authorized for Issuance Under Equity Compensation Plans.

On October 28, 2003, we adopted the 2003 Stock Option Plan (the "2003 Plan") under which our officers, directors, consultants, advisors and employees may receive stock options. The aggregate number of500,000,000 shares of common stock, $0.0001 par value per share.

Recent sales of unregistered securities

There have been the following sales of equity during the year ended December 31, 2020:

| ● | 35,109,231 shares issued for $351,092, and | |

| ● | 35,109,231 warrants to purchase shares at $0.20 per share expiring September 30, 2022 unless subject to an accelerated expiration, and | |

| ● | 103,622,845 shares issued to management and consultants, of which 69,081,897 shares are subject to clawback, and | |

| ● | 55,612,837 shares issued to VitaNova Partners, LLC |

| 9 |

Transfer Agent

The transfer agent and registrar for our common stock is Olde Monmouth Stock Transfer Co., Inc, whose address is 200 Memorial Parkway, Atlantic Highlands, NJ, 07716. Phone: +1 (732) 872-2727.

Equity Compensation Plan Information

There are no equity compensation plans in force.

Issuer Purchases of Equity Securities

The Company did not repurchase any shares of our common stock during the years ended December31, 2019 and December 31, 2020.

Item 6. Selected Financial Data

See the financial statements annexed to this Registration Statement, which financial statements are incorporated herein by reference.

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Annual Report on Form 10-K (“Annual Report”), including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements regarding future events and our future results that are based on current expectations, estimates, forecasts, and projections about the industry in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “may,” “will,” “would,” “could,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. These forward looking statements may be issuedinclude, among others, statements concerning our expectations regarding our business, growth prospects, revenue trends, operating costs, results of operations, working capital requirements, access to funding, competition and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. These forward-looking statements are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ materially and adversely from expectations expressed or implied in forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in this Report under the 2003 Plansection entitled “Risk Factors” in Item 1A of Part I and elsewhere, and in other reports we file with the SEC, specifically the most recent report on Form 10. While forward-looking statements are based on reasonable expectations of our management at the time that they are made, you should not rely on them. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Executive Overview

The Company is 5,000,000. Options granted underin the 2003 Plan were either "incentive stock options", intended to qualify as such under the provisionsbusiness of section 422building and operating sustainable photovoltaic (“PV”) solar powered, state of the Internal Revenue Codeart, greenhouse facilities which grow high value greenhouse produce.

As its initial development project, the Company expects to purchase, develop and operate four adjoining parcels of 1986, as from time to time amended (the "Code"approximately 39 acres each, totaling approximately 157 acres in rural Pueblo County, Colorado (“Pueblo Complex”) or "unqualified stock options". The 2003 PlanPueblo Complex is administeredcurrently majority owned by VitaNova Partners, LLC (“VitaNova”). The Pueblo Complex has an existing greenhouse facility consisting of 90,000 sq ft of growing space and 15,000 sq ft of warehouse space, another partially built greenhouse and two parcels of vacant land.

In 2020, VitaNova began acquiring and now owns or controls a supermajority of the preferred or controlling equity interests of the four parcels in the Pueblo Complex. The Pueblo Complex was significantly underpowered with only 300KVA of electrical power and no natural gas available. The lack of power made the initial greenhouse facility unsuitable for its intended purpose. Since acquiring control VitaNova has installed 1500KVA electrical service and is retrofitting the existing greenhouse with electrical environmental equipment that can be solar powered.

The Company received preliminary approval from C-PACE, a Colorado specialized solar financing program by federal, state and county governments. The Company is in the process of developing engineering necessary to developed complete the C-Pace financing application.

The Company recently completed a private placement and raised $556,129 by issuing 55,612,900 common shares along with 55,612,900 2-year warrants exercisable at $0.20 per share. VitaNova and John McKowen (“McKowen”) are considered affiliates and control entities of the Company. The Company currently has no independent directors. Both VitaNova and the Company have a common board member, Mr. McKowen. The Company expects to appoint independent directors after the purchase of Directors and Officers insurance.

On July 5, 2018, Mr. McKowen purchased a control block of 440,000 common shares of the acquired shell and appointed himself as its sole board member and Chief Executive Officer. On July 17, 2020, Mr. McKowen transferred the control block to VitaNova and began restructuring the Company. The Company currently is a non reporting publicly traded shell on OTC Market Pink Sheets, symbol VTNA. As part of the restructuring, the Company issued 55,612,837 common shares to VitaNova and 29,369,230 common shares to Mr. McKowen, which is proportional to Mr. McKowen’s ownership of VitaNova.

Mr. McKowen was also issued 88,107,690, of which 58,738,460 shares that are subject to repurchase by the BoardCompany for a price of Directors.$0.0001 per share. Of the 58,738,460 shares 29,369,230 shares will be released from repurchase if warrants issued in Company’s recent private placement are exercised to acquire at least 42,140,266 shares of Common Stock; and 29,369,230 shares will be released from repurchase if, prior to December 31, 2022, the Company completes a “sale lease back” of a solar powered property and receives gross proceeds of a least $6,000,000 from the sale. For purposes of federal securities laws, Mr. McKowen is deemed to beneficially own 56,052,837 shares purchased by VitaNova because of his ability to control VitaNova, as an officer and member of VitaNova.