TABLE OF CONTENTS

| PART I | ||||||||||||||

| Item | Business | 1 | ||||||||||||

| Item | Risk Factors | 2 | ||||||||||||

| Item 1B | Unresolved Staff Comments | 4 | ||||||||||||

| Item 2 | Properties | 4 | ||||||||||||

| Item 3 | Legal Proceedings | 4 | ||||||||||||

| Item 4 | Submission of Matters to a Vote of Security Holders | 5 | ||||||||||||

| PART II | ||||||||||||||

| Item 5 | Market for the Company’s Common Equity and Related Stockholder Matters and Issuer | 6 | ||||||||||||

| Item 6 | Selected Financial Data | 7 | ||||||||||||

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 7 | ||||||||||||

| Item 7A | Quantitative and Qualitative Disclosures | 21 | ||||||||||||

| Item 8 | Consolidated Financial Statements and Supplementary Data | 22 | ||||||||||||

| Item 9 | Changes | 63 | ||||||||||||

| Item 9A | Controls and Procedures | 63 | ||||||||||||

| Item 9B | Other Information | 63 | ||||||||||||

| PART III | ||||||||||||||

| Item | Directors, Executive Officers and Corporate Goverance | 64 | ||||||||||||

| Item 11 | Executive Compensation | 64 | ||||||||||||

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder | 64 | ||||||||||||

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 64 | ||||||||||||

| Item 14 | Principal Accountant Fees and Services | 64 | ||||||||||||

| PART IV | ||||||||||||||

| Item 15 | Exhibits and Financial Statement Schedules | 65 | ||||||||||||

PART I

Item 1. Business

General

The Certification of the Chief Executive Officer required by Section 303A.12(a) of The New York Stock Exchange Listing Standards relating to the Company’s compliance with The New York Stock Exchange Corporate Governance Listing Standards was submitted to The New York Stock Exchange on June 2, 2006.

Information Regarding Business Segments and Geographic Areas

Employees

Competition

Merchandise Purchases

1

Item 1A. Risk Factors

The statements contained in this Annual Report on Form 10-K and incorporated by reference (“Annual Report”) that are not historical facts, including, but not limited to, statements regarding our expected financial position, business and financing plans found in “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “may,” “believes,” “expects,” “plans,” “intends,” “anticipates” and similar expressions identify forward-looking statements. The actual results of the future events described in these forward-looking statements could differ materially from those stated in the forward-looking statements.

Our actual results may differ materially due to the risks and uncertainties discussed in this Annual Report, including those discussed below. Additional risks and uncertainties that we do not presently know about or that we currently consider to be insignificant may also affect our business operations and financial performance. Accordingly, readers of the Annual Report should consider these risks and uncertainties in evaluating the information and are cautioned not to place undue reliance on the forward-looking statements contained herein. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

The industry in which we operate is dependent upon fashion trends, customer preferences and other fashion-related factors.

The athletic footwear and apparel industry is subject to changing fashion trends and customer preferences. We cannot guarantee that our merchandise selection will accurately reflect customer preferences when it is offered for sale or that we will be able to identify and respond quickly to fashion changes, particularly given the long lead times for ordering much of our merchandise from vendors. For example, we order athletic footwear four to six months prior to delivery to our stores. If we fail to anticipate accurately either the market for the merchandise in our stores or our customers’ purchasing habits, we may be forced to rely on markdowns or promotional sales to dispose of excess, slow moving inventory, which could have a material adverse effect on our business, financial condition, and results of operations.

A substantial portion of our highest margin sales are to young males (ages 12–25), many of whom we believe purchase athletic footwear and licensed apparel as a fashion statement and are frequent purchasers of athletic footwear. Any shift in fashion trends that would make athletic footwear or licensed apparel less attractive to these customers could have a material adverse effect on our business, financial condition, and results of operations.

The businesses in which we operate are highly competitive.

The retail athletic footwear and apparel business is highly competitive with relatively low barriers to entry. Our athletic footwear and apparel operations compete primarily with athletic footwear specialty stores, sporting goods stores and superstores, department stores, discount stores, traditional shoe stores, and mass merchandisers, many of which are units of national or regional chains that have significant financial and marketing resources. The principal competitive factors in our markets are price, quality, selection of merchandise, reputation, store location, advertising, and customer service. We cannot assure you that we will continue to be able to compete successfully against existing or future competitors. Our expansion into markets served by our competitors and entry of new competitors or expansion of existing competitors into our markets could have a material adverse effect on our business, financial condition, and results of operations.

Although we sell merchandise via the Internet, a significant shift in customer buying patterns to purchasing athletic footwear, athletic apparel, and sporting goods via the Internet could have a material adverse effect on our business results. In addition, some of our vendors distribute products directly through the Internet and others may follow. Some vendors operate retail stores and some have indicated that further retail stores will open. Should this continue to occur, and if our customers decide to purchase directly from our vendors, it could have a material adverse effect on our business, financial condition, and results of operations.

2

We depend on mall traffic and our ability to identify suitable store locations.

Our sales, particularly in the United States and Canada, are dependent in part on a high volume of mall traffic. Our stores are located primarily in enclosed regional and neighborhood malls. Mall traffic may be adversely affected by, among other things, economic downturns, the closing of anchor department stores or changes in customer preferences or acts of terrorism. A decline in the popularity of mall shopping among our target customers could have a material adverse effect on us.

To take advantage of customer traffic and the shopping preferences of our customers, we need to maintain or acquire stores in desirable locations such as in regional and neighborhood malls anchored by major department stores. We cannot be certain that desirable mall locations will continue to be available.

The effects of natural disasters, terrorism, acts of war and retail industry conditions may adversely affect our business.

Natural disasters, including hurricanes, floods, and tornados may affect store and distribution center operations. In addition, acts of terrorism, acts of war, and military action both in the United States and abroad can have a significant effect on economic conditions and may negatively affect our ability to purchase merchandise from vendors for sale to our customers. Any significant declines in general economic conditions, public safety concerns or uncertainties regarding future economic prospects that affect customer spending habits could have a material adverse effect on customer purchases of our products.

A change in the relationship with any of our key vendors or the unavailability of our key products at competitive prices could affect our financial health.

Our business is dependent to a significant degree upon our ability to purchase brand-name merchandise at competitive prices, including the receipt of volume discounts, cooperative advertising, and markdown allowances from our vendors. The Company purchased approximately 78 percent of its merchandise in 2006 from its top five vendors and expects to continue to obtain a significant percentage of its athletic product from these vendors in future periods. Approximately 50 percent was purchased from one vendor — Nike, Inc. (“Nike”). Each of our operating divisions is highly dependent on Nike, they individually purchase 40 to 65 percent of their merchandise from Nike. We have no long-term supply contracts with any of our vendors. Our inability to obtain merchandise in a timely manner from major suppliers (particularly Nike) as a result of business decisions by our suppliers or any disruption in the supply chain could have a material adverse effect on our business, financial condition, and results of operations. Because of our strong dependence on Nike, any adverse development in Nike’s financial condition and results of operations or the inability of Nike to develop and manufacture products that appeal to our target customers could also have an adverse effect on our business, financial condition, and results of operations. We cannot be certain that we will be able to acquire merchandise at competitive prices or on competitive terms in the future.

Merchandise that is high profile and in high demand is allocated by our vendors based upon their internal criteria. Although we have generally been able to purchase sufficient quantities of this merchandise in the past, we cannot be certain that our vendors will continue to allocate sufficient amounts of such merchandise to us in the future. In addition, our vendors provide support to us through cooperative advertising allowances and promotional events. We cannot be certain that such assistance from our vendors will continue in the future. These risks could have a material adverse effect on our business, financial condition, and results of operations.

We may experience fluctuations in and cyclicality of our comparable store sales results.

Our comparable-store sales have fluctuated significantly in the past, on both an annual and a quarterly basis, and we expect them to continue to fluctuate in the future. A variety of factors affect our comparable-store sales results, including, among others, fashion trends, the highly competitive retail store sales environment, economic conditions, timing of promotional events, changes in our merchandise mix, calendar shifts of holiday periods, and weather conditions.

Many of our products, particularly high-end athletic footwear and licensed apparel, represent discretionary purchases. Accordingly, customer demand for these products could decline in a recession or if our customers develop other priorities for their discretionary spending. These risks could have a material adverse effect on our business, financial condition, and results of operations.

3

Our operations may be adversely affected by economic or political conditions in other countries.

Approximately 24 percent of our sales and a significant portion of our operating profits for 2006 were attributable to our sales in Europe, Canada, New Zealand, and Australia. As a result, our business is subject to the risks associated with doing business outside of the United States, such as foreign governmental regulations, foreign customer preferences, political unrest, disruptions or delays in shipments, and changes in economic conditions in countries in which we operate. Although we enter into forward foreign exchange contracts and option contracts to reduce the effect of foreign currency exchange rate fluctuations, our operations may be adversely affected by significant changes in the value of the U.S. dollar as it relates to certain foreign currencies.

In addition, because we and our suppliers have a substantial amount of our products manufactured in foreign countries, our ability to obtain sufficient quantities of merchandise on favorable terms may be affected by governmental regulations, trade restrictions, and economic, labor, and other conditions in the countries from which our suppliers obtain their product.

Our business is subject to economic cycles and retail industry conditions. Purchases of discretionary athletic footwear, apparel, and related products, tend to decline during recessionary periods when disposable income is low and customers are hesitant to use available credit.

Complications in our distribution centers and other factors affecting the distribution of merchandise may affect our business.

We operate three distribution centers worldwide to support our athletic business. If complications arise with any facility or any facility is severely damaged or destroyed, the other distribution centers may not be able to support the resulting additional distribution demands. This may adversely affect our ability to deliver inventory on a timely basis. We depend upon UPS for shipment of a significant amount of merchandise. An interruption in service by UPS for any reason could cause temporary disruptions in our business, a loss of sales and profits, and other material adverse effects.

Our freight cost is affected by changes in fuel prices through surcharges. Increases in fuel prices and surcharges and other factors may increase freight costs and thereby increase our cost of sales.

A major failure of our information systems could harm our business.

We depend on information systems to process transactions, manage inventory, operate our website, purchase, sell and ship goods on a timely basis and maintain cost-efficient operations. Any material disruption or slowdown of our systems could cause information to be lost or delayed which could have a negative effect on our business. We may experience operational problems with our information systems as a result of system failures, viruses, computer “hackers” or other causes. We cannot be assured that our systems will be adequate to support future growth.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Item 3. Legal Proceedings

4

Item 4. Submission of Matters to a Vote of Security Holders

Executive Officers of the Company

| Chairman of the Board, President and Chief Executive Officer | Matthew D. Serra | |||||

| President and Chief Executive Officer - Foot Locker, Inc. — International | Ronald J. Halls | |||||

| President and Chief Executive Officer - Foot Locker, Inc. — U.S.A. | Richard T. Mina | |||||

| Senior Vice President, General Counsel and Secretary | Gary M. Bahler | |||||

| Senior Vice President — Real Estate | Jeffrey L. Berk | |||||

| Senior Vice President, | Peter D. Brown | |||||

| Senior Vice President and Chief Financial Officer | ||||||

| Senior Vice President — Strategic Planning | Lauren B. Peters | |||||

| Senior Vice President — Human Resources | Laurie J. Petrucci | |||||

| Vice President and Chief Accounting Officer | Giovanna Cipriano | |||||

| Vice President and Treasurer | ||||||

Richard T. Mina, age 50, has served as President and Chief Executive Officer of Foot Locker, Inc.- U.S.A. since February 2, 2003. He served as President and Chief Executive Officer of Champs Sports, an operating division of the Company, from April 1999 to February 1, 2003. He served as President of Foot Locker Europe from January 1996 to April 1999.

2

Robert W. McHugh, age 48, has served as Senior Vice President and Chief Financial Officer since November 2005. He served as Vice President and Chief FinancialAccounting Officer from January 2000 to November 2005.

Lauren B. Peters, age 45, has served as Senior Vice President — Strategic Planning since April 2002. Ms. Peters served as Vice President — Planning from January 2000 to April 2002.

Laurie J. Petrucci, age 48, has served as Senior Vice President — Human Resources since May 2001. Ms. Petrucci served as Senior Vice President — Human Resources of Ladythe Foot Locker Worldwide division from October 1999March 2000 to August 2000, and as Director of the Company’s Profit Improvement Task Force from November 1998 to October 1999.May 2001.

John Maurer, age 47, has served as Vice President — Taxationand Treasurer since September 12, 2006. Mr. Maurer served as Assistant Treasurer from November 1997April 2002 to January 2000.September 11, 2006.

5

PART II

Item 5. Market for the Company’s Common Equity, and Related Stockholder Matters and Issuer Purchases of Equity Securities

There were no purchases of common stock during the fourth quarter of 2006. On February 15, 2006, the Company announced that its Board of Directors authorized a $150 million, three-year share repurchase plan program. During 2006, the Company repurchased 334,200 of common stock at a cost of approximately $8 million. On March 7, 2007, the Company announced that its Board of Directors authorized a new $300 million, three-year share repurchase program replacing the earlier $150 million program.

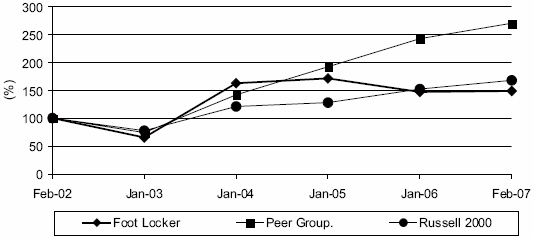

Performance Graph

The following graph compares the cumulative 5-year total return to shareholders on Foot Locker, Inc.’s common stock relative to the total returns of the Russell 2000 Index and a selected peer group, which represents its peers as retailers in the athletic footwear and apparel industry. The peer group comprises:

- Dick’s Sporting Goods, Inc.

- The Finish Line, Inc.

- Hibbett Sporting Goods, Inc., and

- Genesco, Inc., whose business includes operations outside of the athletic footwear and apparel retailing.

In 2005, the peer group also included The Sports Authority, Inc. On January 23, 2006, The Sports Authority, Inc. announced it had agreed to go private through an acquisition by Leonard Green & Partners LP and certain members of its senior management and, therefore, it was not included in this year's performance graph.

Indexed Share Price Performance

6

Item 6. Selected Financial Data

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Business Overview

3

Athletic Stores

Footaction— Footaction is a national athletic footwear and apparel retailer. The primary customers are young urban males that seek street-inspired fashion styles. Its 373 stores are located throughout the United States and Canada.Puerto Rico and focus on marquee allocated footwear and branded apparel. The Champs SportsFootaction stores have an average of 3,9002,900 selling square feet.

Lady Foot Locker — Lady Foot Locker is a leading U.S. retailer of athletic footwear, apparel and accessories for women. Its stores carry major athletic footwear and apparel brands, as well as casual wear and an assortment of proprietary merchandise designed for a variety of activities, including running, basketball, walking, and fitness. Its 557 stores are located in the United States, Puerto Rico, the U. S. Virgin Islands, and Guam and have an average of 1,300 selling square feet.

Kids Foot Locker — Kids Foot Locker is a national children’s athletic retailer that offers the largest selection of brand-name athletic footwear, apparel and accessories for children. Its stores feature an environment geared to appeal to both parents and children. Its 335 stores are located in the United States, Puerto Rico, and the U.S. Virgin Islands and have an average of 1,400 selling square feet.

7

Store Profile

| At | At | |||||||

| January 28, 2006 | Opened | Closed | February 3, 2007 | |||||

| Foot Locker | 2,121 | 57 | 77 | 2,101 | ||||

| Champs Sports | 556 | 27 | 7 | 576 | ||||

| Footaction | 363 | 17 | 7 | 373 | ||||

| Lady Foot Locker | 554 | 22 | 19 | 557 | ||||

| Kids Foot Locker | 327 | 23 | 15 | 335 | ||||

| Total Athletic Stores | 3,921 | 146 | 125 | 3,942 |

| At February 1, 2003 | Opened | Closed | At January 31, 2004 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Foot Locker | 2,060 | 94 | 66 | 2,088 | ||||||||||||||

| Lady Foot Locker | 606 | 2 | 24 | 584 | ||||||||||||||

| Kids Foot Locker | 377 | — | 20 | 357 | ||||||||||||||

| Champs Sports | 582 | 17 | 18 | 581 | ||||||||||||||

| Total Athletic Stores | 3,625 | 113 | 128 | 3,610 | ||||||||||||||

4

Direct-to-Customers

Saleswww.ESPNshop.com, where consumers can purchase athletic footwear, apparel and equipment which will be managed by SegmentFootlocker.com. Both the catalog and the e-commerce site feature a variety of ESPN-branded and non-ESPN-branded athletically inspired merchandise.

In March of 2006, the Company entered into a ten-year area development agreement with the Alshaya Trading Co. W.L.L., in which the Company agreed to enter into separate license agreements for the operation of a minimum of 75 Foot Locker stores, subject to certain restrictions, located within the Middle East. Three of these franchised stores were operational at February 3, 2007. Revenue from the three franchised stores was not significant for the year-ended February 3, 2007. These stores are not included in the Company’s operating store count above.

Overview of Consolidated Results

2006 was a challenging year for the Company due to the continued highly competitive retail environment both in the United States and abroad. The 2006 results represent the 53 weeks ended February 3, 2007 as compared with the 52 weeks in the 2005 and 2004 reporting years. Income from continuing operations in 2006, after-tax, was $247 million, or $1.58 per diluted share, as compared with $263 million or $1.67 per diluted share in 2005. The following were the financial highlights of 2006:

- Contributed $68 million to its U.S. and Canadian qualified pension plans. The U.S. payment was made inadvance of ERISA requirements.

- Repaid $50 million of its 5-year term loan, in advance of the regularly scheduled payment dates of May 2007and May 2008.

- Purchased and retired $38 million of the $200 million 8.50 percent debentures payable in 2022 at a $2 milliondiscount from face value, bringing the outstanding amount to $134 million as of February 3, 2007.

- Declared and paid dividends totaling $61 million. In the fourth quarter the Company increased its quarterlydividend per share by 39 percent.

- Repurchased $8 million of common stock.

8

Additionally, the following were the key factors affecting the Company’s performance during 2006:

- The 53rdweek increased sales by $95 million and increased net income by $18 million or $0.11 per dilutedshare.

- Included in 2006 is a non-cash impairment charge of $17 million ($12 million after-tax), or $0.08 per dilutedshare, recorded to write-down the value of long-lived assets of underperforming stores in the Company’sEuropean operations. This was necessitated by the continued declines in sales and division profit, principallyas the result of a fashion shift from higher priced marquee footwear to lower priced low-profile footwear and acontinued highly competitive environment, particularly for the sale of low-profile footwear styles.

- During the first quarter of 2006, the Company adopted SFAS No. 123(R), “Share-Based Payment.” The Companyhas recorded an incremental $6 million of share-based compensation in 2006. Additionally, the Companyrecorded a cumulative effect of a change in accounting of $1 million to reflect estimated forfeitures for priorperiods related to the Company’s nonvested restricted stock awards.

The following table summarizesrepresents a summary of sales by segment, after reclassification for businesses disposed. The disposition of all businesses previously held for disposal was completed by the end of 2001:

| 2003 | 2002 | 2001 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Athletic Stores | $ | 4,413 | $ | 4,160 | $ | 3,999 | ||||||||||||

| Direct-to-Customers | 366 | 349 | 326 | |||||||||||||||

| 4,779 | 4,509 | 4,325 | ||||||||||||||||

Disposed(1) | — | — | 54 | |||||||||||||||

| $ | 4,779 | $ | 4,509 | $ | 4,379 | |||||||||||||

Division Profit

| 2006 | 2005 | 2004 | |||||||||||

| (in millions) | |||||||||||||

| Sales | |||||||||||||

| Athletic Stores | $ | 5,370 | $ | 5,272 | $ | 4,989 | |||||||

| Direct-to-Customers | 380 | 381 | 366 | ||||||||||

| $ | 5,750 | $ | 5,653 | $ | 5,355 | ||||||||

| Operating Result | |||||||||||||

| Athletic Stores | $ | 405 | $ | 419 | $ | 420 | |||||||

| Direct-to-Customers | 45 | 48 | 45 | ||||||||||

| Division profit | 450 | 467 | 465 | ||||||||||

| Restructuring charges(1) | (1 | ) | — | (2 | ) | ||||||||

| Total division profit | 449 | 467 | 463 | ||||||||||

| Corporate expense | (68 | ) | (58 | ) | (74 | ) | |||||||

| Total operating profit | 381 | 409 | 389 | ||||||||||

| Other income | 14 | 6 | — | ||||||||||

| Interest expense, net | 3 | 10 | 15 | ||||||||||

| Income from continuing operations before income taxes | $ | 392 | $ | 405 | $ | 374 | |||||||

| 2003 | 2002 | 2001 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Athletic Stores | $ | 363 | $ | 279 | $ | 283 | ||||||||||||

| Direct-to-Customers | 53 | 40 | 24 | |||||||||||||||

| Division profit from ongoing operations | 416 | 319 | 307 | |||||||||||||||

Disposed(1) | — | — | (12 | ) | ||||||||||||||

Restructuring income (charges)(2) | (1 | ) | 2 | (33 | ) | |||||||||||||

| Total division profit | 415 | 321 | 262 | |||||||||||||||

Corporate expense(3) | (73 | ) | (52 | ) | (65 | ) | ||||||||||||

| Total operating profit | 342 | 269 | 197 | |||||||||||||||

| Non-operating income | — | 3 | 2 | |||||||||||||||

| Interest expense, net | (18 | ) | (26 | ) | (24 | ) | ||||||||||||

| Income from continuing operations before | ||||||||||||||||||

| income taxes | $ | 324 | $ | 246 | $ | 175 | ||||||||||||

| (1) |

5

Sales

Sales of $4,509$5,653 million in 20022005 increased 3.0by 5.6 percent from sales of $4,379$5,355 million in 2001. Excluding sales from businesses disposed and the2004. The effect of foreign currency fluctuations 2002on sales was not significant. This increase was primarily related to increased by 3.1 percent as compared with 2001 primarily as a result ofsales in the new store opening program.Company’s Footaction and Champs Sports formats. Comparable-store sales increased by 0.12.7 percent.

Gross Margin

Segment Information

Athletic Stores

| 2003 | 2002 | 2001 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Sales | $ | 4,413 | $ | 4,160 | $ | 3,999 | ||||||||||||

Division profit | ||||||||||||||||||

| Stores | $ | 363 | $ | 279 | $ | 283 | ||||||||||||

| Restructuring income | — | 1 | — | |||||||||||||||

| Total division profit | $ | 363 | $ | 280 | $ | 283 | ||||||||||||

| Sales as a percentage of consolidated total | 92 | % | 92 | % | 92 | % | ||||||||||||

| Number of stores at year end | 3,610 | 3,625 | 3,590 | |||||||||||||||

| Selling square footage (in millions) | 7.92 | 8.04 | 7.94 | |||||||||||||||

| Gross square footage (in millions) | 13.14 | 13.22 | 13.14 | |||||||||||||||

6

7

Direct-to-Customers

| 2003 | 2002 | 2001 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Sales | $ | 366 | $ | 349 | $ | 326 | ||||||||||||

| Division profit | $ | 53 | $ | 40 | $ | 24 | ||||||||||||

| Sales as a percentage of consolidated total | 8 | % | 8 | % | 7 | % | ||||||||||||

8

All Other Businesses

| 2003 | 2002 | 2001 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

Sales | $ | — | $ | — | $ | 54 | ||||||||||||

Division profit (loss) | ||||||||||||||||||

| Disposed | $ | — | $ | — | $ | (12 | ) | |||||||||||

| Restructuring income (charges) | (1 | ) | 1 | (33 | ) | |||||||||||||

| Total division profit (loss) | $ | (1 | ) | $ | 1 | $ | (45 | ) | ||||||||||

| Sales as a percentage of consolidated total | — | % | — | % | 1 | % | ||||||||||||

Corporate Expense

The increase in corporate expense in 20032006 as compared with 2005 of $10 million reflects the adoption of SFAS No. 123(R) that resulted in incremental compensation expense of $6 million and a charge of $4 million for anticipated settlements of certain legal matters. The effect of the 53rd week on corporate expense was not significant. Depreciation and amortization included in corporate expense amounted to $22 million in 2006, $24 million in 2005, and $23 million in 2004.

The decrease in corporate expense in 2005 as compared with 2004 primarily included decreased incentive bonuses of $14 million; a $3 million decrease in costs associated with the Company’s loyalty program, as 2004 represented the initial costs to launch the program; and decreased restricted stock expense of $2 million. In addition, 2004 included $5 million for the integration of the Footaction stores. Included in 2005 was also a settlement of $3 million pursuant to a class action settlement with Visa and MasterCard related to past overcharges for certain debit card transactions. These decreases were offset, in part, by a charge of $4 million due to the potential insolvency of one of the Company’s insurance carriers and legal and settlement costs of $5 million.

Other Income

During 2006, the Company terminated two of its leases for approximately $5 million, which resulted in a net gain of $4 million. In addition, the Company finalized its insurance claims related to Hurricane Katrina, which resulted in a gain of $8 million, which represents amounts in excess of losses. Also during 2006, the Company purchased and retired $38 million of long-term debt at a discount from face value of $2 million. The 2005 amounts represent $3 million related to the insurance recoveries associated with Hurricane Katrina, as well as $3 million of a net gain on foreign currency option contracts that were entered into by the Company to mitigate the effect of fluctuating foreign exchange rates on the reporting of euro-denominated earnings.

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses increased by $34 million to $1,163 million in 2006, or by 3.0 percent, as compared with 2005. SG&A as a percentage of sales increased to 20.2 percent as compared with 20.0 percent in 2005. Excluding the effect of foreign currency fluctuations and the 53rd week, SG&A would have increased by 1.4 percent. This increase is primarily the result of incremental share-based compensation included in corporate expense, associated with the adoption of SFAS No. 123(R) of $6 million. Additionally, the net benefit cost for the Company’s pension and postretirement plans reflected a reduction of $5 million, primarily as a result of additional contributions and improved pension fund asset performance.

10

SG&A increased by $41 million to $1,129 million in 2005, or by 3.8 percent, as compared with 2004. SG&A as a percentage of sales decreased to 20.0 percent as compared with 20.3 percent in 2004. The increase in SG&A is primarily related to an increase in payroll and related costs. The effect of including Footaction for the full fiscal year is an incremental $21 million, excluding the integration costs. During 2005, the Company donated 82,500 pairs of athletic footwear with a cost of $2 million to Save the Children Foundation. This donation benefited the tsunami victims in Banda Aceh, Indonesia, and Save the Children programs in the United States.

Depreciation and Amortization

Depreciation and amortization of $175 million increased by 2.3 percent in 2006 from $171 million in 2005. This increase primarily reflects additional depreciation and amortization for the Athletic Stores segment due to capital spending and the effect of foreign currency fluctuations of approximately $1 million.

Depreciation and amortization of $171 million increased by 11.0 percent in 2005 from $154 million in 2004. This increase primarily reflects additional depreciation and amortization for the Athletic Stores segment due to capital spending and adjustments to depreciable lives of certain fixed assets. Additionally, depreciation and amortization for the Footaction format increased by $6 million as compared with 2004, primarily due to increased capital expenditures related to store improvements and point-of-sale equipment.

Interest Expense, Net

| 2006 | 2005 | 2004 | |||||||||||

| (in millions) | |||||||||||||

| Interest expense | $ | 23 | $ | 23 | $ | 22 | |||||||

| Interest income | (20 | ) | (13 | ) | (7 | ) | |||||||

| Interest expense, net | $ | 3 | $ | 10 | $ | 15 | |||||||

| Weighted-average interest rate (excluding facility fees): | |||||||||||||

| Short-term debt | — | % | — | % | — | % | |||||||

| Long-term debt | 7.8 | % | 6.2 | % | 5.2 | % | |||||||

| Total debt | 7.8 | % | 6.2 | % | 5.2 | % | |||||||

| Short-term debt outstanding during the year: | |||||||||||||

| High | $ | — | $ | — | $ | — | |||||||

| Weighted-average | $ | — | $ | — | $ | — | |||||||

Interest expense of $23 million remained unchanged from 2005. Interest rate swap agreements did not significantly affect interest expense in 2006.

Interest income is generated through the investment of cash equivalents, short-term investments, the accretion of the Northern Group note to its face value and accrual of interest on the outstanding principal, as well as interest on income tax refunds. The increase in interest income of $7 million in 2006 was primarily related to increased compensation costs for incentive bonusesinterest income earned on cash, cash equivalents, and short-term investments. Interest income related to cash, cash equivalents and short-term investments was $14 million in 2006 and $11 million in 2005. Interest income on the Northern Group note amounted to $2 million in both 2006 and 2005. Also included in interest income is the effect of the Company’s cross currency swaps, which totaled $3 million in 2006 and was not significant in 2005.

Interest expense of $23 million increased by 4.5 percent in 2005 from $22 million in 2004 primarily attributable to higher interest rates. Interest rate swap agreements reduced interest expense by approximately $1 million and $3 million in 2005 and 2004, respectively.

The increase in interest income of $6 million in 2005 as compared with 2004 was primarily related to increased interest income earned on short-term investments due to higher interest rates and increased restricted stock expenseshort-term investment balances. Interest income related to additional grants.

9

Results of Operations

Selling, General and Administrative Expenses

11

Income Taxes

The effective tax rate for 2006 was 36.9 percent as compared with 2002.35.0 percent in the prior year. The increase in the rate is primarily due to the change in the mix of U.S. and international profits and the $17 million impairment charge relating to the Company’s European operations, as well as a $6 million valuation allowance adjustment recorded in 2005.

The effective tax rate for 2005 was 35.0 percent as compared with 31.7 percent in 2004. The increase was attributable to less benefit from non-recurring items than in 2004 and a higher percentage of the Company’s income earned in the United States, rather than from lower-taxed international operations. During 2005, the Company restructured its Canadian continuing business, which resulted in a $6 million reduction to its income tax valuation allowance related to Canadian tax loss carry-forwards and unclaimed tax depreciation. Additionally, the Company recorded an income tax benefit of $3 million in discontinued operations related to its former Canadian operations. During 2004, the Company settled foreign and domestic income tax examinations and reviews that resulted in reductions of its income tax provision for continuing operations by $14 million and discontinued operations by $37 million.

Segment Information

The Company evaluates performance based on several factors, the primary financial measure of which is division profit. Division profit reflects income from continuing operations before income taxes, corporate expense, non-operating income, and net interest expense.

Athletic Stores

| 2006 | 2005 | 2004 | |||||||||

| (in millions) | |||||||||||

| Sales | $ | 5,370 | $ | 5,272 | $ | 4,989 | |||||

| Division profit | $ | 405 | $ | 419 | $ | 420 | |||||

| Sales as a percentage of consolidated total | 93 | % | 93 | % | 93 | % | |||||

| Division profit margin | 7.5 | % | 7.9 | % | 8.4 | % | |||||

| Number of stores at year end | 3,942 | 3,921 | 3,967 | ||||||||

| Selling square footage (in millions) | 8.74 | 8.71 | 8.89 | ||||||||

| Gross square footage (in millions) | 14.55 | 14.48 | 14.78 | ||||||||

2006 compared with 2005

Athletic Stores sales of $5,370 million increased 1.9 percent in 2006, as compared with $5,272 million in 2005. Excluding the effect of foreign currency fluctuations, primarily related to the euro, SG&Aand the effect of the 53rd week, sales from athletic store formats decreased by 0.6 percent in 2006. Footaction and Champs Sports significantly increased sales, primarily from the sales of marquee basketball and running footwear. This was offset primarily by 2.7 percent. The increases were related to additional payroll costs of $16 milliondecreased sales in Europe, primarily as a result of new store openings and $12 million related to compensation costs for incentive bonusesFoot Locker Europe. Foot Locker Europe’s sales declined due to the Company’s performance. Additionally, pension expense increasedcontinued difficult athletic retail environment, particularly in France, the U.K and Italy. Comparable-store sales decreased by $81.1 percent in 2006.

Division profit from Athletic Stores decreased by 3.3 percent to $405 million due to the decline in plan asset values experienced2006 from $419 million in prior years, partially offset by a $4 million increase in the recognition of postretirement income and foreign exchange gain recorded in 2002. During 2002, the Company recorded asset impairment charges of $6 million and $1 million related to the Kids Foot Locker and Lady Foot Locker formats, respectively. SG&A2005. Division profit as a percentage of sales remained relatively flatdecreased to 7.5 percent. The decrease in division profit is primarily attributable to the Foot Locker Europe division due to the fashion shift from higher priced marquee footwear to lower priced low-profile footwear styles and a highly competitive retail environment, particularly for the sale of low-profile footwear styles. Included in the Athletic Stores division profit for 2006 is an impairment charge of $17 million related to the Company’s European operations, consistent with the Company’s recoverability of long-lived assets policy. The charge was comprised primarily of stores located in the U.K. and France. As previously disclosed in 2005, the Company was monitoring the progress of the European operations and the possible analysis of recoverability of store long-lived assets pursuant to SFAS No. 144. Excluding the impairment charge, Athletic Stores division profit increased by 0.7 percent as compared with the corresponding prior yearprior-year period.

2005 compared with 2004

Athletic Stores sales of $5,272 million increased by $55.7 percent in 2005, as compared with $4,989 million in 2002 to $928 million. The increase included $13 million related to new store openings, $11 million related to2004. Excluding the impacteffect of foreign currency fluctuations, primarily related to the euro, and $10 million related tosales from athletic store formats increased pension costs. The increase5.5 percent in pension costs resulted from the decline2005. Comparable-store sales increased by 2.6 percent in the retirement plans’ asset values experienced in prior years and the expected long-term rate of return used to determine the expense.2005. These increases were partially offsetprimarily driven by $29 million in the reduction in SG&A expensessales related to the dispositionsFootaction division, which was acquired in May 2004. Approximately $126 million of SFMB and the Burger King and Popeye’s franchises during the third quarter of 2001, and a $3 million increase in income related toFootaction represented the postretirement plan. Theinclusion of their operations for the full year in 2005. Champs Sports experienced a strong increase in postretirement incomesales during 2005, as this format benefited from higher quantities of $3marquee athletic footwear and private-label apparel. Foot Locker Canada also experienced increased sales. Excluding the effect of foreign currency fluctuations, Foot Locker Europe’s sales were essentially flat as compared with the corresponding prior-year period.

Division profit from Athletic Stores decreased by 0.2 percent to $419 million resultedin 2005 from the amortization of the associated gains. SG&A,$420 million in 2004. Division profit as a percentage of sales decreased to 20.67.9 percent in 20022005 from 21.18.4 percent in 2001. During 2002,2004. This decline is primarily a result of the Company recorded asset impairment charges of $6 milliondecreased profit from the European operations as compared with the prior year. The continued weak economy, the increased competitive environment and $1 million relateda fashion shift from higher priced marquee footwear to the Kidslower priced low-profile footwear negatively affected Europe’s operating results. In addition during 2005, Foot Locker and Lady Foot Locker formats, respectively, compared with $2 million in 2001 for the Lady Foot Locker format. SG&A in 2002 was reduced by a net foreign exchange gain of $4 million related to intercompany foreign currency denominated firm commitments.

Depreciation and Amortization

Interest Expense, Net

| 2003 | 2002 | 2001 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Interest expense | $ | 26 | $ | 33 | $ | 35 | ||||||||||||

| Interest income | (8 | ) | (7 | ) | (11 | ) | ||||||||||||

| Interest expense, net | $ | 18 | $ | 26 | $ | 24 | ||||||||||||

| Weighted-average interest rate (excluding facility fees): | ||||||||||||||||||

| Short-term debt | — | % | — | % | 6.0 | % | ||||||||||||

| Long-term debt | 6.1 | % | 7.2 | % | 7.4 | % | ||||||||||||

| Total debt | 6.1 | % | 7.2 | % | 7.4 | % | ||||||||||||

| Short-term debt outstanding during the year: | ||||||||||||||||||

| High | $ | — | $ | — | $ | 11 | ||||||||||||

| Weighted-average | $ | — | $ | — | $ | — | ||||||||||||

10

Direct-to-Customers

| 2006 | 2005 | 2004 | |||||||||

| (in millions) | |||||||||||

| Sales | $ | 380 | $ | 381 | $ | 366 | |||||

| Division profit | $ | 45 | $ | 48 | $ | 45 | |||||

| Sales as a percentage of consolidated total | 7 | % | 7 | % | 7 | % | |||||

| Division profit margin | 11.8 | % | 12.6 | % | 12.3 | % | |||||

2006 compared with 2005

Direct-to-Customers sales decreased to $380 million in 2006, as compared with $381 million in 2005. Internet sales increased to $270 million, increasing by 11.1 percent debenturesas compared with 2005. Catalog sales decreased by 20.3 percent to variable rate debt and subsequently entered into two additional swaps during 2003, totaling $50$110 million in 2006 from $138 million in 2005. Management believes that the decrease in catalog sales, which allowedwas substantially offset by the Company to lower the net amount of interest expense being paid at each interest payment date. The swaps reduced interest expense by approximately $4 million. The remaining decreaseincrease in Internet sales, is a result of customers browsing and selecting products through its catalogs and then making their purchases via the lower debt balanceInternet. Sales for the Direct-to-Customer business were negatively affected by the termination of a third party arrangement in the early part of 2006.

The Direct-to-Customers business generated division profit of $45 million in 2006, as compared with $48 million in 2005. Division profit, as a percentage of sales, decreased to 11.8 percent in 2006 from 12.6 percent in 2005. Several initiatives were implemented to mitigate the Company repurchased $19 millionloss of revenue from the cancelled third party contract, such as expanding the ESPN offerings. However, these iniatitives did not fully offset the loss in profit which resulted in a decline in division profit. The effect of the 8.5053rd week on this segment was not significant.

2005 compared with 2004

Direct-to-Customers sales increased 4.1 percent debentures in 2003 and $9to $381 million in 2005, as compared with $366 million 2004. The growth of the latter part of 2002. Interest expenseInternet business continued to drive sales in 2005. Internet sales increased by 14.6 percent to $243 million from $212 million in 2004. Catalog sales decreased by 10.4 percent to $138 million in 2005 from $154 million in 2004. Management believes that the decrease in catalog sales, which was further reduced assubstantially offset by the increase in Internet sales, is a result of customers browsing and selecting products through its catalogs and then making their purchases via the repaymentInternet.

The Direct-to-Customers business generated division profit of the remaining $32 million of the $40 million 7.00 percent medium-term notes that matured in October 2002.

Income Taxes

11

13

Liquidity and Capital Resources

Cash Flow and Liquidity

Planned capital expenditures for 20042007 are $141approximately $170 million, of which $97$144 million relates to new store openings and modernizations of existing stores, and $44$26 million reflects the development of information systems and other support facilities. In addition, planned lease acquisition costs are $24 million and primarily relate to the Company’s operations in Europe. The Company has the ability to revise and reschedule the anticipated capital expenditure program, should the Company’s financial position require it.

Any materially adverse reaction tochange in customer demand, fashion trends, competitive market forces or customer acceptance of the Company’s merchandise mix and retail locations, uncertainties related to the effect of competitive products and pricing, customer acceptance of the Company’s merchandise mix and retail locations, the Company’s reliance on a few key vendors for a significant portion of its merchandise purchases, (and on one key vendor for approximately 40 percent of its merchandise purchases), risks associated with foreign global sourcing or economic conditions worldwide could affect the ability of the Company to continue to fund its needs from business operations.

Operating activities offrom continuing operations provided cash of $264$189 million in 20032006 as compared with $347$349 million in 2002.2005. These amounts reflect income from continuing operations adjusted for non-cash items and working capital changes. The decrease was primarily the result of a $50 million pension contribution and working capital usage, partially offset by increased income from continuing operations. Income from continuing operations increased by $54 million in 2003. Working capital usage included higher net cash outflow for merchandise inventories in 2003 as compared with 2002 andDuring 2006, the Company increased itsrecorded a non-cash impairment charge of $17 million related to the operations in Europe. The decline in operating cash flows of $160 million is primarily due to a reduction of accounts payable at year-end reflecting an acceleration of inventory position to accommodate anticipated salesreceipts earlier in 2004. The decrease in income taxes payable was attributable to increased payments made during 2003. The Company received a refund of tax and interest of $13 million during the fourth quarter of 2003.

12

14

During 2005, the Company received $1 million from an escrow account upon the resolution of a Footaction lease matter relating to the 2004 acquisition. The change was due to a $34Company’s purchase of short-term investments, net of sales, increased by $31 million in 2005 as compared with an increase of $9 million in capital2004. Capital expenditures of $155 million in 20022005 and $156 million in 2004 primarily related to store remodelingsremodeling and new stores. Lease acquisition costs were $18 million and $20 million in 2002 and 2001, respectively. Proceeds from sales of real estate and other assets and investments were $6 million in 2002 compared with $20 million in 2001. Proceeds from the condemnation of the Company’s part-owned and part-leased property contributed $6The Company also received $3 million of cash receivedinsurance proceeds related to the hurricanes in 2002. Proceeds from2005, representing the salesportion of The San Francisco Music Box Company and the Burger King and Popeye’s franchises contributed $14 million and $5 millioninsurance recoveries in cash, respectively, in 2001.

Net cash used in financing activities of continuing operations was $105 million in 2005 as compared with net cash provided of $167 million in 2004. The Company repaid $35 million of its 5-year, $175 million term loan during 2005 and declared and paid dividends totaling $49 million in 2005 and $39 million in 2004. During 2005 and 2004, the Company received proceeds from the issuance of common and treasury stock in connection with employee stock programs of $27$14 million and $10$33 million, respectively.

Capital Structure

During 2004, the Company obtained a 5-year, $175 million term loan to finance a portion of the $40 million 7.00 percent medium-term notes. During 2002,purchase price of the Footaction stores. Concurrent with the financing of a portion of the Footaction acquisition, the Company repaid the balance of the $40 million 7.00 percent medium-term notes that were due in October 2002 and $9 million of the $200 million of debentures due in 2022. There were no outstanding borrowings under the Company’samended its revolving credit agreement, as of February 1, 2003 and February 2, 2002. During 2002,thereby extending the Company declared and paid a $0.03 per share dividend during the fourth quarter of $4 million.

Capital Structure

13

During 2006, the Company purchased and retired $9$38 million of the $200 million 8.50 percent notes duedebentures payable in 2022 contributingat a $2 million discount from face value bringing the outstanding amount to the reduction$134 million as of debt and capital lease obligations. During the fourth quarter of 2002, the Board of Directors initiated the Company’s dividend program and declared and paid a dividend of $0.03 per share.

Credit Rating

Debt Capitalization and credit metrics despite shifts in consumer preferences and a challenging retail environment.” The Company is working toward attaining an investment grade rating from both agencies.

Debt Capitalization

15

| 2006 | 2005 | ||||||

| (in millions) | |||||||

| Cash, cash equivalents and short-term investments, net of debt and | |||||||

| capital lease obligations | $ | 236 | $ | 261 | |||

| Present value of operating leases | 2,069 | 1,934 | |||||

| Total net debt | 1,833 | 1,673 | |||||

| Shareholders’ equity | 2,295 | 2,027 | |||||

| Total capitalization | $ | 4,128 | $ | 3,700 | |||

| Net debt capitalization percent | 44.4 | % | 45.2 | % | |||

| Net debt capitalization percent without operating leases | — | % | — | % | |||

| 2003 | 2002 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | |||||||||||

| Cash and cash equivalents, net of debt and capital lease obligations | $ | 112 | $ | — | |||||||

| Present value of operating leases | 1,683 | 1,571 | |||||||||

| Total net debt | 1,571 | 1,571 | |||||||||

| Shareholders’ equity | 1,375 | 1,110 | |||||||||

| Total capitalization | $ | 2,946 | $ | 2,681 | |||||||

| Net debt capitalization percent | 53.3 | % | 58.6 | % | |||||||

| Net debt capitalization percent without operating leases | — | % | — | % | |||||||

Excluding the present value of operating leases, the Company’s cash, cash equivalents and short-term investments, net of debt and capital lease obligations, increased to $261 million at January 28, 2006 from $127 million at January 29, 2005. The Company reduced debt and capital lease obligations by $39 million, while increasing cash, cash equivalents and short-term investments by $95 million. Additionally, the present value of the operating leases decreased by $55 million representing the net change of lease renewals, the effect of foreign currency fluctuations primarily related to the euro and the result of the closure of 25 stores due to the hurricanes. Including the present value of operating leases, the Company’s net debt capitalization percent decreased 520 basis points in 2005. The increase in shareholders’ equity relates to net income of $264 million in 2005, $26 million related to stock plans, and a decrease of $25 million in the foreign exchange currency translation adjustment, primarily related to the value of the euro in relation to the U.S. contribution was madedollar. The Company declared and paid dividends totaling $49 million during 2005.The Company repurchased approximately 1.6 million shares for $35 million during the year. During 2005, the Company reduced its minimum liability for the Company’s pension plans by $15 million, primarily as a result of the plans’ asset performance. The Company contributed $19 million and $7 million to the Company’s U.S. and Canadian qualified pension plans, respectively, in advance of ERISA requirements.

14

16

Contractual Obligations and Commitments

| Payments Due by Period | ||||||||||||||||

| Less than | 2 –3 | 3 –5 | After 5 | |||||||||||||

| Contractual Cash Obligations | Total | 1Year | Years | Years | Years | |||||||||||

| (in millions) | ||||||||||||||||

| Long-term debt(1) | $ | 220 | $ | — | $ | 90 | $ | — | $ | 130 | ||||||

| Operating leases | 2,739 | 486 | 803 | 621 | 829 | |||||||||||

| Capital lease obligations | 14 | 14 | — | — | — | |||||||||||

| Other long-term liabilities(2) | — | — | — | — | — | |||||||||||

| Total contractual cash obligations | $ | 2,973 | $ | 500 | $ | 893 | $ | 621 | $ | 959 | ||||||

| ____________________ | ||||||||||||||||

| Payments Due by Period | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contractual Cash Obligations | Total | Less than 1 Year | 2 – 3 Years | 4 – 5 Years | After 5 Years | ||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

Long-term debt(1) | $ | 321 | $ | — | $ | — | $ | 150 | $ | 171 | |||||||||||||

| Operating leases | 2,366 | 387 | 693 | 533 | 753 | ||||||||||||||||||

| Capital lease obligations | 14 | — | — | 14 | — | ||||||||||||||||||

Other long-term liabilities(2) | — | — | — | — | — | ||||||||||||||||||

| Total contractual cash obligations | $ | 2,701 | $ | 387 | $ | 693 | $ | 697 | $ | 924 | |||||||||||||

| Amount of Commitment Expiration by Period | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Commercial Commitments | Total Amounts Committed | Less than 1 Year | 2 – 3 Years | 4 – 5 Years | After 5 Years | ||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Line of credit | $ | 176 | $ | — | $ | 176 | $ | — | $ | — | |||||||||||||

| Stand-by letters of credit | 24 | — | 24 | — | — | ||||||||||||||||||

Purchase commitments(3) | 1,377 | 1,377 | — | — | — | ||||||||||||||||||

Other(4) | 56 | 6 | 19 | 27 | 4 | ||||||||||||||||||

| Total commercial commitments | $ | 1,633 | $ | 1,383 | $ | 219 | $ | 27 | $ | 4 | |||||||||||||

| (1) | The |

| (2) | The Company’s other liabilities in the Consolidated Balance Sheet as of | |

| Total | Amount of Commitment Expiration by Period | |||||||||||||||

| Amounts | Less than | 2 –3 | 3 –5 | After 5 | ||||||||||||

| Other Commercial Commitments | Committed | 1Year | Years | Years | Years | |||||||||||

| (in millions) | ||||||||||||||||

| Line of credit | $ | 186 | $ | — | $ | 186 | $ | — | $ — | |||||||

| Stand-by letters of credit | 14 | — | 14 | — | — | |||||||||||

| Purchase commitments(3) | 1,676 | 1,670 | 5 | 1 | — | |||||||||||

| Other(4) | 53 | 25 | 21 | 7 | — | |||||||||||

| Total commercial commitments | $ | 1,929 | $ | 1,695 | $ | 226 | $ | 8 | $ — | |||||||

| ____________________ | ||||||||||||||||

| (3) | Represents open purchase orders, as well as minimum required purchases under merchandise contractual agreements, at |

| (4) | Represents | |

15

Critical Accounting Policies

17

Statements and Supplementary Data” is a summary of the Company’s most significant accounting policies. In some cases, management is required to calculate amounts based on estimates for matters that are inherently uncertain. The Company believes the following to be the most critical of those accounting policies that necessitate subjective judgments.

Merchandise Inventories

Vendor AllowancesReimbursements

Impairment of Long-Lived Assets

16

18

exceeds its estimated fair value. The fair value of each of the Company’s reporting units exceeded its carrying value as of February 2, 2003.the beginning of the year. The Company used a combination of a discounted cash flow approach and market-based approach to determine the fair value of a reporting unit, whichunit. The latter requires judgment and uses one or more methods to compare the reporting unit with similar businesses, business ownership interests or securities that have been sold.

During 2006, the Company recorded an impairment charge of $17 million ($12 million after-tax) to write-down long-lived assets such as store fixtures and leasehold improvements in 69 stores in the European operations to their estimated fair value.

Share-Based Compensation

The Company estimates the fair value of options granted using the Black-Scholes option pricing model. The Company estimates the expected term of options granted using its historical exercise and post-vesting employment termination patterns, which the Company believes are representative of future behavior. Changing the expected term by one year changes the fair value by 10 to 15 percent depending if the change was an increase or decrease to the expected term. The Company estimates the expected volatility of its common stock at the grant date using a weighted-average of the Company’s historical volatility and implied volatility from traded options on the Company’s common stock. A 50 basis point change in volatility would have a 1 percent change to the fair value. The risk-free interest rate assumption is determined using the Federal Reserve nominal rates for U.S. Treasury zero-coupon bonds with maturities similar to those of the expected term of the award being valued. The expected dividend yield is derived from the Company’s historical experience. A 50 basis point change to the dividend yield would change the fair value by approximately 5 percent. The Company records stock-based compensation expense only for those awards expected to vest using an estimated forfeiture rate based on its historical pre-vesting forfeiture data, which it believes are representative of future behavior, and periodically will revise those estimates in subsequent periods if actual forfeitures differ from those estimates.

The Black-Scholes option valuation model requires the use of subjective assumptions. Changes in these assumptions can materially affect the fair value of the options. The Company may elect to use different assumptions under the Black-Scholes option pricing model in the future if there is a difference between the assumptions used in determining stock-based compensation cost and the actual factors that become known over time.

The guidance in SFAS No. 123(R) is relatively new and best practices are not well established. The application of these principles may be subject to further interpretation and refinement over time. There are significant differences among valuation models and there is a possibility that the Company will adopt different valuation models and assumptions in the future. This may result in both a lack of comparability with other companies that use different models, methods, and assumptions, and in a lack of consistency in future periods.

Pension and Postretirement Liabilities

Long-Term Rate of Return Assumption - The expected long-term rate of return on invested plan assets is a component of pension expense and the rate is based on the plans’ weighted-average target asset allocation of 64 percent equity securities and 36 percent fixed income investments, as well as historical and future expected performance of those assets. The target asset allocation is selected to obtain an investment return that is sufficient to cover the expected benefit payments based on the timing of settlements and to reduce future contributions by the Company. The Company’s common stock represented approximately two1 percent of the total pension plans’ assets at January 31, 2004.February 3, 2007. A decrease of 50 basis points in the weighted-average expected long-term rate of return would have increased 20032006 pension expense by approximately $2.5$3 million. The actual return on plan assets in a given year may differ from the expected long-term rate of return and the resulting gain or loss is deferred and amortized into the plans’ performance over time.

19

Discount Rate - An assumed discount rate is used to measure the present value of future cash flow obligations of the plans and the interest cost component of pension expense and postretirement income. The discount rate selected to measure the present value of the Company’s benefit obligations as of February 3, 2007 was derived using a cash flow matching method whereby the Company compares the plans’ projected payment obligations by year with the corresponding yield on the Citibank Pension Discount Curve. The cash flows are then discounted to their present value and an overall discount rate is selected with reference to the long-term corporate bond yield.determined. A decrease of 50 basis points in the weighted-average discount rate would have increased the accumulated benefit obligation as of January 31, 2004February 3, 2007 of the pension and postretirement plansplan by approximately $30$28 million and approximately $0.6 million, respectively.the effect on the postretirement plan would not be significant. Such a decrease would not have significantly changed 20032006 pension expense or postretirement income.

There is limited risk to the Company for increases in healthcare costs related to the postretirement plan as, beginning in 2001, new retirees have assumed the full expected costs and then existing retirees and future retirees have assumed all increases in such costs since the beginning of fiscal year 2001. The additional minimum liability included in shareholders’ equity at January 31, 2004 for the pension plans represented the amount by which the accumulated benefit obligation exceeded the fair market value of the plan assets. The Company was able to reduce the additional minimum liability by $16 million during 2003 to reflect the better performance of the plans’ assets as well as a $50 million contribution made in February 2003.

Income Taxes

In accordance with GAAP, deferred tax assets are recognized for tax credit and net operating loss carryforwards, reduced by a valuation allowance, which is established when it is more likely than not that some portion or all of the deferred tax assets will not be realized. Management is required to estimate taxable income for future years by taxing jurisdiction and to use its judgment to determine whether or not to record a valuation allowance for part or all of a deferred tax asset. A one percent change in the Company’s overall statutory tax rate for 2006 would have resulted in a $3 million change in the carrying value of the net deferred tax asset and a corresponding charge or credit to income tax expense woulddepending on whether such tax rate change was a decrease or increase.

The Company has operations in multiple taxing jurisdictions and is subject to audit in these jurisdictions. Tax audits by their nature are often complex and can require several years to resolve. Accruals of tax contingencies require management to make estimates and judgments with respect to the ultimate outcome of tax audits. Actual results could vary from these estimates.

The Company expects its 2007 effective tax rate to be $22 millionapproximately 37.5 percent. The actual rate will primarily depend upon the percentage of the Company’s income earned in 2004 had the Company not made the $44 million contribution to its U.S. qualified retirement plan and the $6 million required contribution to its Canadian qualified retirement plan.

Discontinued, Repositioning and Restructuring Reserves

17

Income Taxes

Business Concentration

18

20

Disclosure Regarding Forward-Looking Statements

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

19

21

Item 8. Consolidated Financial Statements and Supplementary Data

MANAGEMENT’S REPORT

|  |

| MATTHEW D. SERRA, | ROBERT W. MCHUGH, |

| Chairman of the Board, | Senior Vice President and |

| President and Chief Executive Officer | Chief Financial Officer |

22

MATTHEW D. SERRA, ChairmanMANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The management of the Board, PresidentCompany is responsible for establishing andChief Executive Officer

BRUCE L. HARTMAN,Executive Vice President and ChiefThe Company’s independent registered public accounting firm has issued their attestation report on management’s assessment of the Company’s internal control over financial reporting. That report appears in this Annual Report on Form 10-K under the heading,Report of Independent Registered Public Accounting Firm on Internal Control Over Financial OfficerReporting

|  |

| MATTHEW D. SERRA, | ROBERT W. MCHUGH, |

| Chairman of the Board, | Senior Vice President and |

| President and Chief Executive Officer | Chief Financial Officer |

April 1, 20042, 2007

20

23

REPORT OF INDEPENDENT AUDITORS’ REPORTREGISTERED PUBLIC ACCOUNTING FIRM

To theThe Board of Directors and Shareholders of

Foot Locker, Inc.

/s/ KPMG LLP

New York, New YorkMarchApril 2, 20042007

21

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The Board of Directors and Shareholders of

Foot Locker, Inc.

We have audited management’s assessment, included in the accompanying Management’s Report on Internal Control Over Financial Reporting, that Foot Locker, Inc. maintained effective internal control over financial reporting as of February 3, 2007, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Foot Locker, Inc.’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express an opinion on management’s assessment and an opinion on the effectiveness of the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, evaluating management’s assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, management’s assessment that Foot Locker, Inc. maintained effective internal control over financial reporting as of February 3, 2007, is fairly stated, in all material respects, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Also, in our opinion, Foot Locker, Inc. maintained, in all material respects, effective internal control over financial reporting as of February 3, 2007, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Foot Locker, Inc. and subsidiaries as of February 3, 2007 and January 28, 2006, and the related consolidated statements of operations, comprehensive income, shareholders’ equity, and cash flows for each of the years in the three-year period ended February 3, 2007, and our report dated April 2, 2007 expressed an unqualified opinion on those consolidated financial statements.

/s/ KPMG LLP

New York, New York

April 2, 2007

25

CONSOLIDATED STATEMENTS OF OPERATIONS

| 2003 | 2002 | 2001 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions, except per share amounts) | |||||||||||||||

Sales | $ | 4,779 | $ | 4,509 | $ | 4,379 | |||||||||

| Costs and expenses | |||||||||||||||

| Cost of sales | 3,302 | 3,165 | 3,071 | ||||||||||||

| Selling, general and administrative expenses | 987 | 928 | 923 | ||||||||||||

| Depreciation and amortization | 147 | 149 | 154 | ||||||||||||

| Restructuring charges (income) | 1 | (2 | ) | 34 | |||||||||||

| Interest expense, net | 18 | 26 | 24 | ||||||||||||

| 4,455 | 4,266 | 4,206 | |||||||||||||

| Other income | — | (3 | ) | (2 | ) | ||||||||||

| 4,455 | 4,263 | 4,204 | |||||||||||||

| Income from continuing operations before income taxes | 324 | 246 | 175 | ||||||||||||

| Income tax expense | 115 | 84 | 64 | ||||||||||||

Income from continuing operations | 209 | 162 | 111 | ||||||||||||

| Loss on disposal of discontinued operations, net of income tax benefit of $4, $2, and $—, respectively | (1 | ) | (9 | ) | (19 | ) | |||||||||

| Cumulative effect of accounting change, net of income tax benefit of $— | (1 | ) | — | — | |||||||||||

Net income | $ | 207 | $ | 153 | $ | 92 | |||||||||

| Basic earnings per share: | |||||||||||||||

| Income from continuing operations | $ | 1.47 | $ | 1.15 | $ | 0.79 | |||||||||

| Loss from discontinued operations | (0.01 | ) | (0.06 | ) | (0.13 | ) | |||||||||

| Cumulative effect of accounting change | — | — | — | ||||||||||||

| Net income | $ | 1.46 | $ | 1.09 | $ | 0.66 | |||||||||

| Diluted earnings per share: | |||||||||||||||

| Income from continuing operations | $ | 1.40 | $ | 1.10 | $ | 0.77 | |||||||||

| Loss from discontinued operations | (0.01 | ) | (0.05 | ) | (0.13 | ) | |||||||||

| Cumulative effect of accounting change | — | — | — | ||||||||||||

| Net income | $ | 1.39 | $ | 1.05 | $ | 0.64 | |||||||||

| 2006 | 2005 | 2004 | ||||||||

| (in millions, except per share amounts) | ||||||||||

| Sales | $ | 5,750 | $ | 5,653 | $ | 5,355 | ||||

| Costs and expenses | ||||||||||

| Cost of sales | 4,014 | 3,944 | 3,722 | |||||||

| Selling, general and administrative expenses | 1,163 | 1,129 | 1,090 | |||||||

| Depreciation and amortization | 175 | 171 | 154 | |||||||

| Impairment charge | 17 | — | — | |||||||

| Interest expense, net | 3 | 10 | 15 | |||||||

| 5,372 | 5,254 | 4,981 | ||||||||

| Other income | (14 | ) | (6 | ) | — | |||||

| 5,358 | 5,248 | 4,981 | ||||||||

| Income from continuing operations before income taxes | 392 | 405 | 374 | |||||||

| Income tax expense | 145 | 142 | 119 | |||||||

| Income from continuing operations | 247 | 263 | 255 | |||||||

| Income on disposal of discontinued operations, | ||||||||||

| net of income tax benefit of $1, $3, and $37, respectively | 3 | 1 | 38 | |||||||

| Cumulative effect of accounting change, | ||||||||||

| net of income tax benefit of $ — | 1 | — | — | |||||||

| Net income | $ | 251 | $ | 264 | $ | 293 | ||||

| Basic earnings per share: | ||||||||||

| Income from continuing operations | $ | 1.59 | $ | 1.70 | $ | 1.69 | ||||

| Income from discontinued operations | 0.02 | 0.01 | 0.25 | |||||||

| Cumulative effect of accounting change | 0.01 | — | — | |||||||

| Net income | $ | 1.62 | $ | 1.71 | $ | 1.94 | ||||

| Diluted earnings per share: | ||||||||||

| Income from continuing operations | $ | 1.58 | $ | 1.67 | $ | 1.64 | ||||

| Income from discontinued operations | 0.02 | 0.01 | 0.24 | |||||||

| Cumulative effect of accounting change | — | — | — | |||||||

| Net income | $ | 1.60 | $ | 1.68 | $ | 1.88 | ||||

See Accompanying Notes to Consolidated Financial Statements.

22

26

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

| 2003 | 2002 | 2001 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | |||||||||||||||

Net income | $ | 207 | $ | 153 | $ | 92 | |||||||||

Other comprehensive income (loss), net of tax | |||||||||||||||

Foreign currency translation adjustment: | |||||||||||||||

| Translation adjustment arising during the period | 31 | 38 | (12 | ) | |||||||||||

Cash flow hedges: | |||||||||||||||

| Cumulative effect of accounting change, net of income tax expense of $1 | — | — | 1 | ||||||||||||

| Change in fair value of derivatives, net of income tax | — | — | — | ||||||||||||

| Reclassification adjustments, net of income tax benefit of $1 | (1 | ) | — | (1 | ) | ||||||||||

Net change in cash flow hedges | (1 | ) | — | — | |||||||||||

Minimum pension liability adjustment: | |||||||||||||||

| Minimum pension liability adjustment, net of deferred tax expense (benefit) of $10, $(56) and $(71), respectively | 16 | (83 | ) | (115 | ) | ||||||||||

Comprehensive income (loss) | $ | 253 | $ | 108 | $ | (35 | ) | ||||||||

| 2006 | 2005 | 2004 | |||||||||

| (in millions) | |||||||||||

| Net income | $ | 251 | $ | 264 | $ | 293 | |||||

| Other comprehensive income, net of tax | |||||||||||

| Foreign currency translation adjustment: | |||||||||||

| Translation adjustment arising during the period, net of tax | 27 | (25 | ) | 19 | |||||||

| Cash flow hedges: | |||||||||||

| Change in fair value of derivatives, net of income tax | — | 2 | (1 | ) | |||||||

| Reclassification adjustments, net of income tax | — | (1 | ) | 1 | |||||||

| Net change in cash flow hedges | — | 1 | — | ||||||||

| Minimum pension liability adjustment: | |||||||||||

| Minimum pension liability adjustment, net of deferred tax expense | |||||||||||

| (benefit) of $120, $10 and $(9) million, respectively | 181 | 15 | (14 | ) | |||||||

| Comprehensive income | $ | 459 | $ | 255 | $ | 298 | |||||