TABLE OF CONTENTS

| PART I | |||||||||||||

| Item | Business | 1 | |||||||||||

| Item | Risk Factors | 2 | |||||||||||

| Item 1B | Unresolved Staff Comments | 4 | |||||||||||

| Item 2 | Properties | 5 | |||||||||||

| Item 3 | Legal Proceedings | 5 | |||||||||||

| Item 4 | Submission of Matters to a Vote of Security Holders | 5 | |||||||||||

| PART II | |||||||||||||

| Item 5 | Market for the Company’s Common Equity, | ||||||||||||

| Purchases of Equity Securities | 6 | ||||||||||||

| Item 6 | Selected Financial Data | 8 | |||||||||||

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 8 | |||||||||||

| Item 7A | Quantitative and Qualitative Disclosures | 22 | |||||||||||

| Item 8 | Consolidated Financial Statements and Supplementary Data | 23 | |||||||||||

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 64 | |||||||||||

| Item 9A | 64 | ||||||||||||

| Item 9B | Other Information | 64 | |||||||||||

| PART III | |||||||||||||

| Item | Directors, Executive Officers and Corporate Governance | 65 | |||||||||||

| Item 11 | Executive Compensation | 65 | |||||||||||

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related | ||||||||||||

| Stockholder Matters | 65 | ||||||||||||

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 65 | |||||||||||

| Item 14 | Principal Accountant Fees and Services | 65 | |||||||||||

| PART IV | |||||||||||||

| Item 15 | Exhibits and Financial Statement Schedules | 66 | |||||||||||

PART I

Item 1. Business

|

General

Information Regarding Business Segments and Geographic Areas

Employees

Competition

Merchandise Purchases

1

The statements contained in this Annual Report on Form 10-K (“Annual Report”) that are not historical facts, including, but not limited to, statements regarding our expected financial position, business and financing plans found in “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “may,” “believes,” “expects,” “plans,” “intends,” “anticipates” and similar expressions identify forward-looking statements. The actual results of the future events described in these forward-looking statements could differ materially from those stated in the forward-looking statements.

Our actual results may differ materially due to the risks and uncertainties discussed in this Annual Report, including those discussed below. Additional risks and uncertainties that we do not presently know about or that we currently consider to be insignificant may also affect our business operations and financial performance. Accordingly, readers of the Annual Report should consider these risks and uncertainties in evaluating the information and are cautioned not to place undue reliance on the forward-looking statements contained herein. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

The industry in which we operate is dependent upon fashion trends, customer preferences and other fashion-related factors.

The athletic footwear and apparel industry is subject to changing fashion trends and customer preferences. We cannot guarantee that our merchandise selection will accurately reflect customer preferences when it is offered for sale or that we will be able to identify and respond quickly to fashion changes, particularly given the long lead times for ordering much of our merchandise from vendors. For example, we order the bulk of our athletic footwear four to six months prior to delivery to our stores. If we fail to anticipate accurately either the market for the merchandise in our stores or our customers’ purchasing habits, we may be forced to rely on markdowns or promotional sales to dispose of excess, slow moving inventory, which could have a material adverse effect on our business, financial condition, and results of operations.

A substantial portion of our highest margin sales are to young males (ages 12–25), many of whom we believe purchase athletic footwear and licensed apparel as a fashion statement and are frequent purchasers of athletic footwear. Any shift in fashion trends that would make athletic footwear or licensed apparel less attractive to these customers could have a material adverse effect on our business, financial condition, and results of operations.

The businesses in which we operate are highly competitive.

The retail athletic footwear and apparel business is highly competitive with relatively low barriers to entry. Our athletic footwear and apparel operations compete primarily with athletic footwear specialty stores, sporting goods stores and superstores, department stores, discount stores, traditional shoe stores, and mass merchandisers, many of which are units of national or regional chains that have significant financial and marketing resources. The principal competitive factors in our markets are price, quality, selection of merchandise, reputation, store location, advertising, and customer service. We cannot assure you that we will continue to be able to compete successfully against existing or future competitors. Our expansion into markets served by our competitors and entry of new competitors or expansion of existing competitors into our markets could have a material adverse effect on our business, financial condition, and results of operations.

Although we sell merchandise via the Internet, a significant shift in customer buying patterns to purchasing athletic footwear, athletic apparel, and sporting goods via the Internet could have a material adverse effect on our business results. In addition, some of our vendors distribute products directly through the Internet and others may follow. Some vendors operate retail stores and some have indicated that further retail stores will open. Should this continue to occur, and if our customers decide to purchase directly from our vendors, it could have a material adverse effect on our business, financial condition, and results of operations.

2

We depend on mall traffic and our ability to identify suitable store locations.

Our sales, particularly in the United States and Canada, are dependent in part on a high volume of mall traffic. Our stores are located primarily in enclosed regional and neighborhood malls. Mall traffic may be adversely affected by, among other things, economic downturns, the closing of anchor department stores or changes in customer preferences or acts of terrorism. A decline in the popularity of mall shopping among our target customers could have a material adverse effect on us.

To take advantage of customer traffic and the shopping preferences of our customers, we need to maintain or acquire stores in desirable locations such as in regional and neighborhood malls anchored by major department stores. We cannot be certain that desirable mall locations will continue to be available.

The effects of natural disasters, terrorism, acts of war and retail industry conditions may adversely affect our business.

Natural disasters, including hurricanes, floods, and tornados may affect store and distribution center operations. In addition, acts of terrorism, acts of war, and military action both in the United States and abroad can have a significant effect on economic conditions and may negatively affect our ability to purchase merchandise from vendors for sale to our customers. Any significant declines in general economic conditions, public safety concerns or uncertainties regarding future economic prospects that affect customer spending habits could have a material adverse effect on customer purchases of our products.

A change in the relationship with any of our key vendors or the unavailability of our key products at competitive prices could affect our financial health.

Our business is dependent to a significant degree upon our ability to purchase brand-name merchandise at competitive prices, including the receipt of volume discounts, cooperative advertising, and markdown allowances from our vendors. The Company purchased approximately 77 percent of its merchandise in 2007 from its top five vendors and expects to continue to obtain a significant percentage of its athletic product from these vendors in future periods. Approximately 56 percent was purchased from one vendor — Nike, Inc. (“Nike”). Each of our operating divisions is highly dependent on Nike; they individually purchase 43 to 74 percent of their merchandise from Nike. We have no long-term supply contracts with any of our vendors. Our inability to obtain merchandise in a timely manner from major suppliers (particularly Nike) as a result of business decisions by our suppliers or any disruption in the supply chain could have a material adverse effect on our business, financial condition, and results of operations. Because of our strong dependence on Nike, any adverse development in Nike’s financial condition and results of operations or the inability of Nike to develop and manufacture products that appeal to our target customers could also have an adverse effect on our business, financial condition, and results of operations. We cannot be certain that we will be able to acquire merchandise at competitive prices or on competitive terms in the future.

Merchandise that is high profile and in high demand is allocated by our vendors based upon their internal criteria. Although we have generally been able to purchase sufficient quantities of this merchandise in the past, we cannot be certain that our vendors will continue to allocate sufficient amounts of such merchandise to us in the future. In addition, our vendors provide support to us through cooperative advertising allowances and promotional events. We cannot be certain that such assistance from our vendors will continue in the future. These risks could have a material adverse effect on our business, financial condition, and results of operations.

We may experience fluctuations in and cyclicality of our comparable-store sales results.

Our comparable-store sales have fluctuated significantly in the past, on both an annual and a quarterly basis, and we expect them to continue to fluctuate in the future. A variety of factors affect our comparable-store sales results, including, among others, fashion trends, the highly competitive retail store sales environment, economic conditions, timing of promotional events, changes in our merchandise mix, calendar shifts of holiday periods, and weather conditions.

Many of our products, particularly high-end athletic footwear and licensed apparel, represent discretionary purchases. Accordingly, customer demand for these products could decline in a recession or if our customers develop other priorities for their discretionary spending. These risks could have a material adverse effect on our business, financial condition, and results of operations.

3

Our operations may be adversely affected by economic or political conditions in other countries.

Approximately 27 percent of our sales and a significant portion of our operating results for 2007 were attributable to our sales in Europe, Canada, New Zealand, and Australia. As a result, our business is subject to the risks associated with doing business outside of the United States, such as foreign governmental regulations, foreign customer preferences, political unrest, disruptions or delays in shipments, and changes in economic conditions in countries in which we operate. Although we enter into forward foreign exchange contracts and option contracts to reduce the effect of foreign currency exchange rate fluctuations, our operations may be adversely affected by significant changes in the value of the U.S. dollar as it relates to certain foreign currencies.

In addition, because we and our suppliers have a substantial amount of our products manufactured in foreign countries, our ability to obtain sufficient quantities of merchandise on favorable terms may be affected by governmental regulations, trade restrictions, and economic, labor, and other conditions in the countries from which our suppliers obtain their product.

Our business is subject to economic cycles and retail industry conditions. Purchases of discretionary athletic footwear, apparel, and related products, tend to decline during recessionary periods when disposable income is low and customers are hesitant to use available credit.

Complications in our distribution centers and other factors affecting the distribution of merchandise may affect our business.

We operate four distribution centers worldwide to support our athletic business. In addition to the distribution centers that we operate, we have additional third-party arrangements related to our operations in Canada, Australia and New Zealand. If complications arise with any facility or any facility is severely damaged or destroyed, the other distribution centers may not be able to support the resulting additional distribution demands. This may adversely affect our ability to deliver inventory on a timely basis. We depend upon UPS for shipment of a significant amount of merchandise. An interruption in service by UPS for any reason could cause temporary disruptions in our business, a loss of sales and profits, and other material adverse effects.

Our freight cost is affected by changes in fuel prices through surcharges. Increases in fuel prices and surcharges and other factors may increase freight costs and thereby increase our cost of sales.

A major failure of our information systems could harm our business.

We depend on information systems to process transactions, manage inventory, operate our website, purchase, sell and ship goods on a timely basis and maintain cost-efficient operations. Any material disruption or slowdown of our systems could cause information to be lost or delayed which could have a negative effect on our business. We may experience operational problems with our information systems as a result of system failures, viruses, computer “hackers” or other causes. We cannot be assured that our systems will be adequate to support future growth.

Unauthorized disclosure of sensitive or confidential customer information, whether through a breach of the Company’s computer system or otherwise, could severely harm our business.

As part of the Company’s normal course of business, it collects, processes, and retains sensitive and confidential customer information. Despite the security measurers the Company has in place, its facilities and systems may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human error, or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information by the Company could severely damage its reputation, expose it to the risks of litigation and liability, disrupt its operations and harm its business.

Item 1B. Unresolved Staff Comments

None.

4

Item 2. Properties

The properties of the Company and its consolidated subsidiaries consist of land, leased and owned stores, and administrative and distribution facilities. TotalGross operating square footage and total selling area for the Athletic Stores segment at the end of 20042007 was approximately 8.8914.12 and 8.50 million square feet.feet, respectively. These properties, which are primarily leased, are located in the United States, Canada, various European countries, Australia, and New Zealand.

Item 3. Legal Proceedings

Information regarding the Company’s legal proceedings are leased and partly sublet, occupying approximately 0.26 million square feet.

Item 4. Submission of such proceedings will haveMatters to a material effect on the Company’s consolidated financial position, liquidity, or resultsVote of operations.

Executive Officers of the Company

| Chairman of the Board, President and Chief Executive Officer | Matthew D. Serra | |||||

| President and Chief Executive Officer - Foot Locker, Inc. — International | Ronald J. Halls | |||||

| President and Chief Executive Officer - Foot Locker, Inc. — U.S.A. | Richard T. Mina | |||||

| Senior Vice President, General Counsel and Secretary | Gary M. Bahler | |||||

| Senior Vice President — Real Estate | Jeffrey L. Berk | |||||

| Senior Vice President, | Peter D. Brown | |||||

| Senior Vice President and Chief Financial Officer | ||||||

| Senior Vice President — Strategic Planning | Lauren B. Peters | |||||

| Senior Vice President — Human Resources | Laurie J. Petrucci | |||||

| Vice President and Chief Accounting Officer | Giovanna Cipriano | |||||

| Vice President and Treasurer | ||||||

2

5

Robert W. McHugh, age 49, has served as Senior Vice President and Chief Financial Officer since November 2005. He served as Vice President and Chief FinancialAccounting Officer from January 2000 to November 2005.

Lauren B. Peters, age 46, has served as Senior Vice President — Strategic Planning since April 2002. Ms. Peters served as Vice President — Planning from January 2000 to April 2002.

Laurie J. Petrucci, age 49, has served as Senior Vice President — Human Resources since May 2001. Ms. Petrucci served as Senior Vice President — Human Resources of Ladythe Foot Locker Worldwide division from October 1999March 2000 to August 2000.May 2001.

There are no family relationships among the executive officers or directors of the Company.

PART II

| Item 5. | Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| Total Number of Shares Purchased(1) | Average Price Paid per Share(1) | Total Number of Shares Purchased as Part of Publicly Announced Program(2) | Approximate Dollar Value of Shares that May Yet be Purchased Under the Program(2) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Oct. 31, 2004 through Nov. 27, 2004 | — | $ | — | — | $50,000,000 | |||||||||||||

| Nov. 28, 2004 through Jan. 1, 2005 | 6,670 | 26.28 | — | 50,000,000 | ||||||||||||||

| Jan. 2, 2005 through Jan. 29, 2005 | — | — | — | 50,000,000 | ||||||||||||||

| Total | 6,670 | $ | 26.28 | — | ||||||||||||||

6

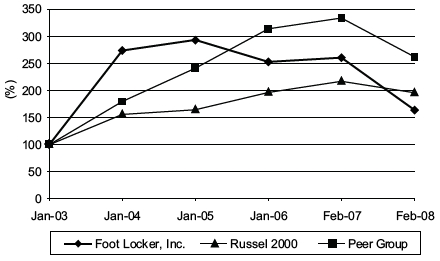

Performance Graph

The following graph compares the cumulative five-year total return to shareholders on Foot Locker, Inc.’s common stock relative to the total returns of the Russell 2000 Index and a selected peer group, which represents its peers as retailers in the athletic footwear and apparel industry. The peer group comprises:

- Dick’s Sporting Goods, Inc.

- The Finish Line, Inc.

- Hibbett Sporting Goods, Inc., and

- Genesco, Inc., whose business includes operations outside of the athletic footwear and apparel retailing.

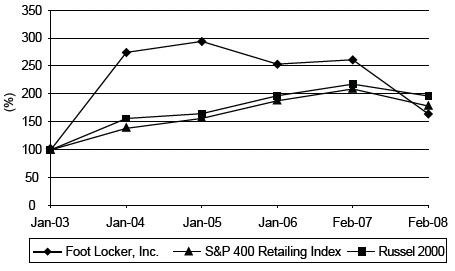

The Company has historically constructed a selected peer group in its performance graph. However, due to the declining number of public company peers in the athletic footwear and apparel industry, the Company has determined it would be more appropriate to use the S&P 400 Retailing Index, rather than the selected peer group. The next graph compares the cumulative five-year total shareholder return on our common stock against the cumulative five-year total return of the S&P 400 Retailing Index and the Russell 2000 Index.

Indexed Share Price Performance

7

Item 6. Selected Financial Data

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

Business Overview

3

including television campaigns and sponsorships of various sporting events, Foot Locker, Inc. reinforces its image with a consistent

Athletic Stores

8

Store Profile

| At | At | |||||||||||||||

| February 3, 2007 | Opened | Closed | February 2, 2008 | |||||||||||||

| Foot Locker | 2,101 | 66 | 161 | 2,006 | ||||||||||||

| Champs Sports | 576 | 22 | 22 | 576 | ||||||||||||

| Footaction | 373 | 6 | 23 | 356 | ||||||||||||

| Lady Foot Locker | 557 | 10 | 41 | 526 | ||||||||||||

| Kids Foot Locker | 335 | 13 | 27 | 321 | ||||||||||||

| Total Athletic Stores | 3,942 | 117 | 274 | 3,785 | ||||||||||||

| At January 31, 2004 | Acquired | Opened | Closed | At January 29, 2005 | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Foot Locker | 2,088 | 11 | 84 | 48 | 2,135 | ||||||||||||||||||

| Champs Sports | 581 | — | 5 | 16 | 570 | ||||||||||||||||||

| Footaction | — | 349 | 4 | 4 | 349 | ||||||||||||||||||

| Lady Foot Locker | 584 | — | 2 | 19 | 567 | ||||||||||||||||||

| Kids Foot Locker | �� | 357 | — | 1 | 12 | 346 | |||||||||||||||||

| Total Athletic Stores | 3,610 | 360 | 96 | 99 | 3,967 | ||||||||||||||||||

Direct-to-Customers

4

the Amazon.com website and the Foot Locker brands are featured in the Amazon.com specialty stores for apparel and accessories and sporting goods.

Franchise Operations

In March of 2006, the Company entered into a ten-year area development agreement with the Alshaya Trading Co. W.L.L., in which the Company agreed to enter into separate license agreements for the operation of a minimum of 75 Foot Locker stores, subject to certain restrictions, located within the Middle East. Additionally in March 2007, the Company entered into a ten-year agreement with another third party for the exclusive right to open and operate up to 33 Foot Locker stores in the Republic of South Korea. A total of 10 franchised stores were operational at February 2, 2008. Revenue from the 10 franchised stores was not significant for the year-ended February 2, 2008. These stores are not included in the Company’s operating store count above.

Overview of Consolidated Results

The 2007 results represent the 52 weeks ended February 2, 2008 as compared with the prior year which represented the 53 weeks ended February 3, 2007. Income from continuing operations was $49 million or $0.32 per diluted share as compared with the corresponding prior-year period of $247 million or $1.58 per diluted share. Difficult industry trends as well as internal factors affected the 2007 results. Sales of low-profile and casual footwear significantly declined and sales of branded and licensed apparel were weak. Internal factors contributing to the decline included oversupplied inventory, due, in part, to the lack of a clear fashion trend in athletic footwear and apparel, which necessitated higher than normal markdowns.

Executive Summary The following key factors affected the Company’s results in the current year and comparability with the prior year:

- Comparable-store sales declined 6.3 percent.

- Gross margin was negatively affected by higher markdowns primarily to liquidate slow-moving merchandiseand lower vendor allowances.

- Included in 2007 were charges associated with the Company’s store closing program and non-cash impairmentcharges totaling $128 million, pre-tax, or $0.52 per diluted share. Impairment charges totaling $124 million wererecorded to write-down the value of long-lived assets of underperforming stores in the Company’s U.S. retailstore operations and for stores included in the store closing program. The Company

reportedclosed 33 unproductivestores during 2007 as part of the announced store closing program. Included in 2006 was an impairment chargeof $17 million, or $0.08 per diluted share, to write-down long-lived assets of the European operations.

9

- Included in 2007 was a Canadian income tax valuation allowance adjustment that increased net income by$65 million, or $0.42 per diluted share.

- The 53rdweek of 2006 represented $95 million in sales and net income of $18 million, or $0.11 perdiluted share.

Despite the difficult year experienced, the Company ended the year in a strong financial position. Key highlights of the year included:

- Cash and cash equivalents as of February 2, 2008 were $488 million, reflecting cash flow provided by operationsof $283 million.

- Merchandise inventories were reduced by approximately 4 percent, excluding the effect of foreign currencyfluctuations.

- Repaid $2 million of its 5-year term loan, in advance of the regularly scheduled payment date of May 2008.

- Purchased and retired $5 million of the $200 million 8.50 percent debentures payable in 2022, bringing theoutstanding amount to $129 million as of February 2, 2008.

- Dividends totaling $77 million were declared and paid.

- $50 million of common stock was repurchased.

The following table represents a summary of sales and operating results, reconciled to (loss) income from continuing operations before income taxes.

| 2007 | 2006 | 2005 | ||||||||||

| (in millions) | ||||||||||||

| Sales | ||||||||||||

| Athletic Stores | $ | 5,071 | $ | 5,370 | $ | 5,272 | ||||||

| Direct-to-Customers | 364 | 380 | 381 | |||||||||

| Family Footwear | 2 | — | — | |||||||||

| $ | 5,437 | $ | 5,750 | $ | 5,653 | |||||||

| Operating Results | ||||||||||||

| Athletic Stores | $ | (27 | ) | $ | 405 | $ | 419 | |||||

| Direct-to-Customers | 40 | 45 | 48 | |||||||||

| Family Footwear (1) | (6 | ) | — | — | ||||||||

| Division profit | 7 | 450 | 467 | |||||||||

| Restructuring income (charge)(2) | 2 | (1 | ) | — | ||||||||

| Total division profit | 9 | 449 | 467 | |||||||||

| Corporate expense | (59 | ) | (68 | ) | (58 | ) | ||||||

| Total operating (loss) profit | (50 | ) | 381 | 409 | ||||||||

| Other income | 1 | 14 | 6 | |||||||||

| Interest expense, net | 1 | 3 | 10 | |||||||||

| (Loss) income from continuing operations before income taxes | $ | (50 | ) | $ | 392 | $ | 405 | |||||

| (1) | During the first quarter of 2007, the Company launched a new family footwear concept, Footquarters. The concept’s results did not meet the Company’s expectations and, therefore, the Company decided not to further invest in this business. These stores were converted to the Company’s other formats. Included in the operating loss of $6 million, was approximately $2 million of costs associated with the removal of signage and the write-off of unusable fixtures. | |

| (2) | During 2007, the Company adjusted its 1993 Repositioning and 1991 Restructuring reserve by $2 million primarily due to favorable lease terminations. During 2006, the Company recorded a restructuring charge of $1 million, which represented a revision to the original estimate of the lease liability associated with the guarantee of The San Francisco Music Box Company distribution center. These amounts are included in selling, general and administrative expenses in the Consolidated Statements of Operations. | |

On March 11, 2008, we filed a Current Report on Form 8-K, which included a press release announcing our fourth quarter and full year 2007 financial results. In completing our final analysis, we determined that our income tax benefit was overstated by $2 million. While not material to understanding fourth quarter and full year 2007 financial results contained in the March 10, 2008, press release, the amount disclosed above has been recorded in our actual results for the fourth quarter and full year ended January 29, 2005 of $255 million, or $1.64 per diluted share, an increase of 22 percent as compared with 2003. Net income2007. We believe noting this change is beneficial to understanding the actual results for the fourth quarter and full year ended January 29, 2005 increased2007 contained in this financial report. Accordingly, the full year 2007 income tax benefit was reduced from $101 million reported in the press release to $293 million, or $1.88 per diluted share, and includes $0.24 per diluted share from discontinued operations. Earningsa benefit of $99 million. Diluted earnings per share of $0.24 or $38 million in discontinued operations reflectsfor the resolution of U.S. income tax examinations of $37 million, as well as income of $1 million relatedfull year 2007 was changed from $0.34 to a refund of custom duties related to certain of the businesses that comprised the Specialty Footwear segment.

10

Sales

| 2004 | 2003 | 2002 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Athletic Stores | $ | 4,989 | $ | 4,413 | $ | 4,160 | ||||||||||||

| Direct-to-Customers | 366 | 366 | 349 | |||||||||||||||

| $ | 5,355 | $ | 4,779 | $ | 4,509 | |||||||||||||

Sales of the Company’s acquisition of 349 Footaction stores in May 2004 and the acquisition of 11 stores in the Republic of Ireland in late October 2004, which accounted for $332 million and $5$5,750 million in sales, respectively, for 2004. Comparable-store sales2006 increased by 0.9 percent. The remaining increase is a result of the Company’s continuation of the new store-opening program.

Gross Margin

5

Division Profit

| 2004 | 2003 | 2002 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | |||||||||||||||

| Athletic Stores | $ | 420 | $ | 363 | $279 | ||||||||||

| Direct-to-Customers | 45 | 53 | 40 | ||||||||||||

| Division profit | 465 | 416 | 319 | ||||||||||||

Restructuring (charges) income(1) | (2 | ) | (1 | ) | 2 | ||||||||||

| Total division profit | 463 | 415 | 321 | ||||||||||||

| Corporate expense | (74 | ) | (73 | ) | (52 | ) | |||||||||

| Total operating profit | 389 | 342 | 269 | ||||||||||||

Non-operating income(2) | — | — | 3 | ||||||||||||

| Interest expense, net | (15 | ) | (18 | ) | (26) | ||||||||||

| Income from continuing operations before income taxes | $ | 374 | $ | 324 | $ 246 | ||||||||||

Segment Information

Athletic Stores

| 2004 | 2003 | 2002 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | |||||||||||||||

| Sales | $ | 4,989 | $ | 4,413 | $4,160 | ||||||||||

Division profit | |||||||||||||||

| Stores | $ | 420 | $ | 363 | $279 | ||||||||||

| Restructuring income | — | — | 1 | ||||||||||||

| Total division profit | $ | 420 | $ | 363 | $ 280 | ||||||||||

| Sales as a percentage of consolidated total | 93 | % | 92 | % | 92% | ||||||||||

| Number of stores at year end | 3,967 | 3,610 | 3,625 | ||||||||||||

| Selling square footage (in millions) | 8.89 | 7.92 | 8.04 | ||||||||||||

| Gross square footage (in millions) | 14.78 | 13.14 | 13.22 | ||||||||||||

6

2004 compared with 2003

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses increased by $13 million to $1,176 million in 2003.2007, or by 1.1 percent, as compared with 2006. SG&A as a percentage of sales increased to 21.6 percent as compared with 20.2 percent in 2006. The increase in SG&A as a percentage of sales is due to the decline in sales. Excluding the effect of foreign currency fluctuations primarily related to the euro, sales from athletic store formats increased 10.6 percent in 2004. This increase was primarily driven by incremental sales related to the acquisition of the 349 Footaction stores in May 2004 totaling $332 million and the sales of53rd week in 2006, SG&A decreased by $2 million. This decrease primarily reflected savings associated with operating fewer stores, as well as controlling variable expenses as compared with the 11 stores acquired in the Republic of Ireland amounting to $5 million. The balance of the increase primarily reflects new store growth. Total Athletic Stores comparable-store salesprior-year period.

SG&A increased by 1.0 percent in 2004.

2003 compared with 2002

7

Direct-to-Customerspension fund asset performance.

| 2004 | 2003 | 2002 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Sales | $ | 366 | $ | 366 | $ | 349 | ||||||||||||

| Division profit | $ | 45 | $ | 53 | $ | 40 | ||||||||||||

| Sales as a percentage of consolidated total | 7 | % | 8 | % | 8 | % | ||||||||||||

2004 compared with 2003

2003 compared with 2002

Corporate Expense

11

The increase in corporate expense in 20032006 as compared with 2002 was primarily related to increased2005 of $10 million reflects the adoption of SFAS No. 123(R) that resulted in incremental compensation costs for incentive bonuses and increased restricted stock expense from additional grants.

8

Costs and Expenses

Selling, General and Administrative Expenses

Depreciation and Amortization

Interest Expense, Net

| 2004 | 2003 | 2002 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | ||||||||||||||||||

| Interest expense | $ | 22 | $ | 26 | $ | 33 | ||||||||||||

| Interest income | (7 | ) | (8 | ) | (7 | ) | ||||||||||||

| Interest expense, net | $ | 15 | $ | 18 | $ | 26 | ||||||||||||

| Weighted-average interest rate (excluding facility fees): | ||||||||||||||||||

| Short-term debt | — | % | — | % | — | % | ||||||||||||

| Long-term debt | 5.2 | % | 6.1 | % | 7.2 | % | ||||||||||||

| Total debt | 5.2 | % | 6.1 | % | 7.2 | % | ||||||||||||

| Short-term debt outstanding during the year: | ||||||||||||||||||

| High | $ | — | $ | — | $ | — | ||||||||||||

| Weighted-average | $ | — | $ | — | $ | — | ||||||||||||

Depreciation and amortization of $175 million term loan that commencedincreased by 2.3 percent in May 2004.

9

Interest Expense, Net

| 2007 | 2006 | 2005 | ||||||||||

| (in millions) | ||||||||||||

| Interest expense | $ | 21 | $ | 23 | $ | 23 | ||||||

| Interest income | (20 | ) | (20 | ) | (13 | ) | ||||||

| Interest expense, net | $ | 1 | $ | 3 | $ | 10 | ||||||

| Weighted-average interest rate (excluding facility fees): | ||||||||||||

| Short-term debt | — | % | — | % | — | % | ||||||

| Long-term debt | 6.8 | % | 7.8 | % | 6.2 | % | ||||||

| Total debt | 6.8 | % | 7.8 | % | 6.2 | % | ||||||

| Short-term debt outstanding during the year: | ||||||||||||

| High | $ | — | $ | — | $ | — | ||||||

| Weighted-average | $ | — | $ | — | $ | — | ||||||

Interest income of $20 million remained unchanged from 2006. Interest income is generated through the investment of cash equivalents, short-term investments, the accretion of the Northern Group note to its face value and accrual of interest on the outstanding principal, as well as interest onthe effect of the Company’s cross currency swaps. Interest income tax refunds. The decrease in interest income of $1related to cash, cash equivalents and short-term investments was $16 million in 2004 was primarily related to2007 and $14 million in 2006. Interest income on the reduction of interest income earned on tax refunds and settlements as they were received during 2003. The Northern Group note was recorded in the fourth quarter of 2002 and interest income amounted to $2 million in both 20042007 and 2003.2006. The cross currency swaps income totaled $1 million in 2007 as compared with $3 million in 2006.

Interest expense of $23 million in 2006 remained unchanged from 2005. Interest rate swap agreements did not significantly affect interest expense in 2006.

The increase in interest income of $7 million in 2006 as compared with 2005 was primarily related to increased interest income earned on cash, cash equivalents, and short-term investments. Interest income related to cash, cash equivalents and short-term investments was $5$14 million in 20042006 and 2003.

12

Other Income

In 2007, other income included a $1 million gain related to a final settlement with the Company’s insurance carriers of a claim related to a store damaged by a fire in 2006. Additionally, the Company sold two of its lease interests in Europe for a gain of $1 million. These gains were offset primarily by premiums paid for foreign currency option contracts. The 2006 amounts included a net gain of $4 million from the termination of two of the Company’s leases for approximately $5 million and insurance claims related to Hurricane Katrina that resulted in a gain of $8 million, which represented amounts in excess of losses. Also during 2006, the Company purchased and retired $38 million of long-term debt at a discount from face value of $2 million. Interest income of $1 million and $2 million was related to tax refunds and settlements in 2003 and 2002, respectively.

Income Taxes

The effective tax rate for 2006 was principally36.9 percent as compared with 35.0 percent in the prior year. The increase in the rate is primarily due to the change in the mix of U.S. and international profits and the $17 million impairment charge relating to the Company’s European operations, as well as a $6 million valuation allowance adjustment recorded in 2005.

Segment Information

The Company evaluates performance based on several factors, the primary financial measure of which is division profit. Division profit (loss) reflects income (loss) from continuing operations before income taxes, corporate expense, non-operating income, and net interest expense.

Athletic Stores

| 2007 | 2006 | 2005 | ||||||||||

| (in millions) | ||||||||||||

| Sales | $ | 5,071 | $ | 5,370 | $ | 5,272 | ||||||

| Division (loss) profit | $ | (27 | ) | $ | 405 | $ | 419 | |||||

| Sales as a percentage of consolidated total | 93 | % | 93 | % | 93 | % | ||||||

| Division (loss) profit margin | (0.5 | )% | 7.5 | % | 7.9 | % | ||||||

| Number of stores at year end | 3,785 | 3,942 | 3,921 | |||||||||

| Selling square footage (in millions) | 8.50 | 8.74 | 8.71 | |||||||||

| Gross square footage (in millions) | 14.12 | 14.55 | 14.48 | |||||||||

2007 compared with 2006

Athletic Stores sales of $5,071 million decreased 5.6 percent in 2007, as compared with $5,370 million in 2006. Excluding the effect of foreign currency fluctuations, primarily related to the euro, sales from athletic store formats decreased by 7.8 percent in 2007. The decline in sales for the year ended February 2, 2008 was primarily related to the domestic operations. Sales in the U.S. were negatively affected by a lower ratecontinuing weakening in consumer spending, unseasonable warmer weather, and a lack of tax onclear fashion trend in athletic footwear and apparel. Internationally, comparable-store sales declined mid-single digits. In Europe, sales of low-profile footwear styles declined, while the sales trend of higher priced technical footwear was higher than the prior year. Comparable-store sales for the Athletic Stores segment decreased by 6.6 percent in 2007.

Athletic Stores reported a loss of $27 million in 2007 as compared with a profit of $405 million in 2006. The decrease in division profit was attributable to the U.S operations. The decline in the U.S. operations was offset, in part, by increases in most international formats. Included in the Athletic Stores division results for 2007 are non-cash impairment charges of $117 million to write-down long-lived assets such as store fixtures and leasehold improvements for 1,395 stores at the Company’s foreignU.S. store operations and the settlement of tax examinations.

13

the Company also came toevaluated the recoverability of long-lived assets considering the revised estimated future cash flows. The Company recorded an agreement on the pre-filing reviewadditional non-cash impairment charge of the Company’s income tax return for 2003. As$7 million as a result of these actions bythis analysis. Exit costs related to 33 stores that closed during 2007, comprising primarily lease termination costs of $4 million, were recognized in accordance with SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities.”

2006 compared with 2005

Athletic Stores sales of $5,370 million increased 1.9 percent in 2006, as compared with $5,272 million in 2005. Excluding the IRS, the Company reduced its income tax provision for continuing operations by $7 million and discontinued operations by $37 million. During the third quartereffect of 2004 the IRS completed its post-filing review of the Company’s income tax return for 2003 resulting in a $2 million reductionforeign currency fluctuations, primarily related to the income tax provision. During the fourth quarter of 2004 the Company completed an analysis ofeuro, and the effect of the completion53rd week, sales from athletic store formats decreased by 0.6 percent in 2006. Footaction and Champs Sports significantly increased sales, primarily from the sale of marquee basketball and running footwear. This was offset primarily by decreased sales in Foot Locker Europe. Foot Locker Europe’s sales declined due to the IRS’s examinationcontinued difficult athletic retail environment, particularly in France, the U.K. and reviewItaly. Comparable-store sales for the Athletic Stores segment decreased by 1.1 percent in 2006.

Division profit from Athletic Stores decreased by 3.3 percent to $405 million in 2006 from $419 million in 2005. Division profit as a percentage of sales decreased to 7.5 percent. The decrease in division profit is primarily attributable to the Foot Locker Europe division due to the fashion shift from higher priced marquee footwear to lower priced low-profile footwear styles and a highly competitive retail environment, particularly for the sale of low-profile footwear styles. Included in the Athletic Stores division profit for 2006 is an impairment charge of $17 million related to the Company’s income tax returns. This analysis resultedEuropean operations, consistent with the Company’s recoverability of long-lived assets policy. The charge was comprised primarily of stores located in a reduction to the income tax provision of $3 million.

Direct-to-Customers

| 2007 | 2006 | 2005 | ||||||||||

| (in millions) | ||||||||||||

| Sales | $ | 364 | $ | 380 | $ | 381 | ||||||

| Division profit | $ | 40 | $ | 45 | $ | 48 | ||||||

| Sales as a percentage of consolidated total | 7 | % | 7 | % | 7 | % | ||||||

| Division profit margin | 11.0 | % | 11.8 | % | 12.6 | % | ||||||

2007 compared with 2006

Direct-to-Customers sales decreased 4.2 percent to $364 million in 2007, as compared with $380 million in 2006. Internet sales increased by 6.3 percent to $287 million, as compared with 2006. Catalog sales decreased by 30.0 percent to $77 million in 2007 from $110 million in 2006. Management believes that the decrease in catalog sales, which was substantially offset by the increase in Internet sales, is a result of customers browsing and selecting products through its catalogs and then making their purchases via the Internet. Sales were negatively affected by reduced sales from third party arrangements, as well as weakened consumer spending for athletic footwear and apparel.

The Direct-to-Customers business generated division profit of $40 million in 2007, as compared with $45 million in 2006. Division profit, as a percentage of sales, decreased to 11.0 percent in 2002.2007 from 11.8 percent in 2006. The increased tax rate was primarily duedecline in division profit is a result of lower sales.

2006 compared with 2005

Direct-to-Customers sales decreased to the Company recording tax benefits of $5$380 million in 20032006, as compared to $9with $381 million in 2002. In addition2005. Internet sales increased to $270 million, increasing by 11.1 percent as compared with 2005. Catalog sales decreased by 20.3 percent to $110 million in 2006 from $138 million in 2005. Management believes that the rate increased due todecrease in catalog sales, which was substantially offset by the increase in Internet sales, is a shift in taxable income from lower to higher tax jurisdictions. During 2003,result of customers browsing and selecting products through its catalogs and then making their purchases via the Company recordedInternet. Sales for the Direct-to-Customer business were negatively affected by the termination of a $1 million tax benefit related to state tax law changes, a $2 million tax benefit related to a reductionthird party arrangement in the valuation allowance for deferred tax assets relatedearly part of 2006.

14

The Direct-to-Customers business generated division profit of $45 million in 2006, as compared with $48 million in 2005. Division profit, as a percentage of sales, decreased to 11.8 percent in 2006 from 12.6 percent in 2005. Several initiatives were implemented to mitigate the loss of revenue from the cancelled third party contract, such as expanding the ESPN offerings. However, these initiatives did not fully offset the loss in profit which resulted in a multi-state tax planning strategy, a $1 million tax benefit related to a reductiondecline in the valuation allowance for foreign tax loss carryforwards, and a tax benefit of $1 million related to the settlement of tax examinations.

10

Liquidity and Capital Resources

Liquidity

Planned capital expenditures for 2008 are approximately $158 million, of which $135 million relates to modernizations of existing stores and 13 percentnew store openings, and 14 percent from another in 2004$23 million reflects the development of information systems and 2003, respectively.

Cash Flow

Net cash provided by investing activities of the Company’s continuing operations was $117 million in 2007 as compared with $108 million used in investing activities in 2006. During 2007, the Company liquidated most of its short-term investments, which represented auction rate securities, due to issues in the global credit and capital markets. Capital expenditures of $148 million in 2007 and $165 million in 2006 primarily related to store remodeling and new stores. During 2007, the Company received $21 million representing the maturity of an investment of $14 million and the repayment of a note of $7 million.

Net cash used in investing activities of the Company’s continuing operations was $424$108 million in 20042006 as compared with $265$182 million in 2003. During 2004, the Company paid $226 million for the purchase of 349 Footaction stores from Footstar, Inc. and paid €13 million (approximately $17 million, of which $1 million remains to be paid) for the purchase of 11 stores in the Republic of Ireland.2005. The Company’s purchase of short-term investments, net of sales, increaseddecreased by $9$49 million in 20042006 as compared with an increase of $106$31 million in 2003.2005. Capital expenditures of $156$165 million in 20042006 and $144$155 million in 20032005 primarily related to store remodelingsremodeling and new stores. Lease acquisition costs, primarilyDuring 2006, the Company received net proceeds of $4 million as a result a lease termination. The Company also received $4 million of insurance proceeds from its insurance carriers related to securethe final settlement of the property and extend leasesequipment claims for prime locations in Europe, were $17 million and $15 million in 2004 and 2003, respectively.

11

Capital Structure

In October 2007, the Company amended its revolving credit agreement thereby, extendingto provide for a one-year extension of the maturity daterevolving credit facility to May 2009 from July 2006. On January 31, 2005,19, 2010 and a reduction in the fixed charge coverage ratio to no less than 1.25:1 for the fourth quarter of 2007 and the first quarter of 2008, increasing to 2.0:1 by the first quarter of 2010. The amendment also permits the payment of dividends by the Company prepaidof up to $90 million in 2008 and up to $100 million for each year thereafter. On February 19, 2008, the first principal payment of $18Company further amended its revolving credit facility to increase the amount permitted to be paid as dividends in 2008 to $95 million. With regard to stock repurchases, the amendment provides that not more than $50 million which would have been due in May 2005.the aggregate may be expended after October 26, 2007 unless the fixed charge coverage ratio is at least 2.0:1 for the quarter immediately preceding any such repurchase and the Company has delivered its annual audited financial statements with respect to 2007. The agreement includes various restrictive financial covenants with which the Company was in compliance on January 29, 2005.

Credit Rating

12

Debt Capitalization and Equity

| 2007 | 2006 | |||||||

| (in millions) | ||||||||

| Long-term debt and obligations under capital lease | $ | 221 | $ | 234 | ||||

| Present value of operating leases | 2,126 | 2,069 | ||||||

| Total debt including the present value of operating leases | 2,347 | 2,303 | ||||||

| Less: | ||||||||

| Cash and cash equivalents | 488 | 221 | ||||||

| Short-term investments | 5 | 249 | ||||||

| Total net debt including the present value of operating leases | 1,854 | 1,833 | ||||||

| Shareholders’ equity | 2,271 | 2,295 | ||||||

| Total capitalization | $ | 4,125 | $ | 4,128 | ||||

| Total net debt capitalization percent including the present value of | ||||||||

| operating leases | 44.9 | % | 44.4 | % | ||||

| Net debt capitalization percent | — | % | — | % | ||||

| 2004 | 2003 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) | |||||||||||

| Cash, cash equivalents and short-term investments, net of debt | |||||||||||

| and capital lease obligations | $ | 131 | $ | 112 | |||||||

| Present value of operating leases | 1,989 | 1,683 | |||||||||

| Total net debt | 1,858 | 1,571 | |||||||||

| Shareholders’ equity | 1,830 | 1,375 | |||||||||

| Total capitalization | $ | 3,688 | $ | 2,946 | |||||||

| Net debt capitalization percent | 50.4 | % | 53.3 | % | |||||||

| Net debt capitalization percent without operating leases | — | % | — | % | |||||||

13

17

Contractual Obligations and Commitments

| Payments Due by Period | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contractual Cash Obligations | Total | Less than 1 Year | 2 – 3 Years | 4 – 5 Years | After 5 Years | ||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Long-term debt | $ | 351 | $ | 18 | $ | 44 | $ | 113 | $ | 176 | |||||||||||||

| Operating leases | 2,723 | 449 | 806 | 578 | 890 | ||||||||||||||||||

| Capital lease obligations | 14 | — | 14 | — | — | ||||||||||||||||||

Other long-term liabilities(1) | — | — | — | — | — | ||||||||||||||||||

| Total contractual cash obligations | $ | 3,088 | $ | 467 | $ | 864 | $ | 691 | $ | 1,066 | |||||||||||||

| Payments Due by Period | ||||||||||||||||||||

| Less than | 2 – 3 | 3 – 5 | After 5 | |||||||||||||||||

| Contractual Cash Obligations | Total | 1 Year | Years | Years | Years | |||||||||||||||

| (in millions) | ||||||||||||||||||||

| Long-term debt(1) | $ | 221 | $ | — | $ | 88 | $ | — | $ | 133 | ||||||||||

| Operating leases(2) | 2,793 | 487 | 832 | 651 | 823 | |||||||||||||||

| Other long-term liabilities(3) | — | — | — | — | — | |||||||||||||||

| Total contractual cash obligations | $ | 3,014 | $ | 487 | $ | 920 | $ | 651 | $ | 956 | ||||||||||

| (1) | The amounts presented above represent the contractual maturities of the Company’s long-term debt, excluding interest. Additional information is included in the “Long-Term Debt and Obligations under Capital Leases” footnote under “Item 8. Consolidated Financial Statements and Supplementary Data.” | |

| (2) | The amounts presented represent the future minimum lease payments under non-cancelable operating leases. In addition to minimum rent, certain of the Company’s leases require the payment of additional costs for insurance, maintenance, and other costs. These costs have historically represented approximately 25 to 30 percent of the minimum rent amount. These additional amounts are not included in the table of contractual commitments as the timing and/or amounts of such payments are unknown. | |

| (3) | The Company’s other liabilities in the Consolidated Balance Sheet as of | |

| Amount of Commitment Expiration by Period | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Commercial Commitments | Total Amounts Committed | Less than 1 Year | 2 – 3 Years | 4 – 5 Years | After 5 Years | ||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Line of credit | $ | 175 | $ | — | $ | — | $ | 175 | $ | — | |||||||||||||

| Stand-by letters of credit | 25 | — | — | 25 | — | ||||||||||||||||||

Purchase commitments(2) | 1,696 | 1,686 | 6 | 4 | — | ||||||||||||||||||

Other(3) | 131 | 41 | 58 | 28 | 4 | ||||||||||||||||||

| Total commercial commitments | $ | 2,027 | $ | 1,727 | $ | 64 | $ | 232 | $ | 4 | |||||||||||||

| Total | Amount of Commitment Expiration by Period | |||||||||||||||||||||

| Amounts | Less than | 2 – 3 | 3 – 5 | After 5 | ||||||||||||||||||

| Contractual Cash Obligations | Committed | 1 Year | Years | Years | Years | |||||||||||||||||

| (in millions) | ||||||||||||||||||||||

| Line of credit | $ | 189 | $ | — | $ | 189 | $ | — | $ | — | ||||||||||||

| Stand-by letters of credit | 11 | — | 11 | — | — | |||||||||||||||||

| Purchase commitments(4) | 1,453 | 1,450 | 3 | — | — | |||||||||||||||||

| Other(5) | 57 | 19 | 33 | 5 | — | |||||||||||||||||

| Total commercial commitments | $ | 1,710 | $ | 1,469 | $ | 236 | $ | 5 | $ | — | ||||||||||||

| Represents open purchase orders, as well as minimum required purchases under merchandise contractual agreements, at |

| (5) | Represents payments required by non-merchandise purchase agreements and minimum royalty requirements. | |

18

Critical Accounting Policies

14

Business Combinations

Merchandise Inventories

Vendor Reimbursements

Impairment of Long-Lived Assets

19

future cash flows by store, which is generally measured by discounting the expected future cash flows at the Company’s weighted-average cost of capital. Management believes its policy is reasonable and is consistently applied. Future expected cash flows are based upon estimates that, if not achieved, may result in significantly different results. Long-lived tangible

During 2007, the Company recorded non-cash impairment charges totaling $124 million primarily to write-down long-lived assets such as store fixtures and intangible assets with finite lives primarily include property and equipment and intangible lease acquisition costs.

The fair value of each of the Company’s reporting units exceeded its carrying value as of February 1, 2004.the beginning of the year. The Company used a combination of a discounted cash flow approach and market-based approach to determine the

15

fair value of a reporting unit. The latter requires judgment and uses one or more methods to compare the reporting unit with similar businesses, business ownership interests or securities that have been sold.

During the third and fourth quarters of 2007, the Company performed reviews of its U.S. Athletic stores’ goodwill, as a result of the SFAS No. 144 recoverability analysis. These analyses did not result in an impairment charge.

Share-Based Compensation

The Company estimates the fair value of options granted using the Black-Scholes option pricing model. The Company estimates the expected term of options granted using its historical exercise and post-vesting employment termination patterns, which the Company believes are representative of future behavior. Changing the expected term by one year changes the fair value by 10 to 15 percent depending if the change was an increase or decrease to the expected term. The Company estimates the expected volatility of its common stock at the grant date using a weighted-average of the Company’s historical volatility and implied volatility from traded options on the Company’s common stock. A 50 basis point change in volatility would have a 1 percent change to the fair value. The risk-free interest rate assumption is determined using the Federal Reserve nominal rates for U.S. Treasury zero-coupon bonds with maturities similar to those of the expected term of the award being valued. The expected dividend yield is derived from the Company’s historical experience. A 50 basis point change to the dividend yield would change the fair value by approximately 5 percent. The Company records stock-based compensation expense only for those awards expected to vest using an estimated forfeiture rate based on its historical pre-vesting forfeiture data, which it believes are representative of future behavior, and periodically will revise those estimates in subsequent periods if actual forfeitures differ from those estimates.

The Black-Scholes option valuation model requires the use of subjective assumptions. Changes in these assumptions can materially affect the fair value of the options. The Company may elect to use different assumptions under the Black-Scholes option pricing model in the future if there is a difference between the assumptions used in determining stock-based compensation cost and the actual factors that become known over time.

Pension and Postretirement Liabilities

Long-Term Rate of Return Assumption - The expected long-term rate of return on invested pension plan assets is a component of pension expense and theexpense. The rate is based on the plans’ weighted-average target asset allocation, of 64 percent equity securities and 36 percent fixed income investments, as well as historical and future expected performance of those assets. The target asset allocation is selected to obtain an investment return that is sufficient to cover the expected benefit payments based on the timing of settlements and to reduce future contributions by the Company. The Company’s common stock represented approximately 21 percent of the total pension plans’ assets at January 29, 2005.February 2, 2008.

20

The weighted-average long-term rate of return used to determine 2007 pension expense was 8.85 percent. A decrease of 50 basis points in the weighted-average expected long-term rate of return would have increased 20042007 pension expense by approximately $3 million. The actual return on plan assets in a given year may differ from the expected long-term rate of return and the resulting gain or loss is deferred and amortized into the plans’ performanceexpense over time.

Discount Rate - An assumed discount rate is used to measure the present value of future cash flow obligations of the plans and the interest cost component of pension expense and postretirement income. The discount rate selected to measure the present value of the Company’s U.S. benefit obligations as of February 2, 2008 was derived using a cash flow matching method whereby the Company compares the plans’ projected payment obligations by year with the corresponding yield on the Citibank Pension Discount Curve. The cash flows are then discounted to their present value and an overall discount rate is determined. The discount rate selected with reference to measure the Aa long-term corporatepresent value of the Company’s Canadian benefit obligations as of February 2, 2008 was developed by using the plan’s bond yield.portfolio indices which match the benefit obligations.

A decrease of 50 basis points in the weighted-average discount rate would have increased the accumulated benefit obligation as of January 29, 2005February 2, 2008 of the pension and postretirement plans by approximately $30$27 million and approximately $1 million, respectively.the effect on the postretirement plan would not be significant. Such a decrease would not have significantly changed 20042007 pension expense or postretirement income.

There is limited risk to the Company for increases in healthcarehealth care costs related to the postretirement plan as, beginning in 2001, new retirees have assumed the full expected costs and existingthen-existing retirees and future retirees have assumed all increases in such costs since the beginning of fiscal year 2001. The additional minimum liability included in shareholders’ equity at January 29, 2005 for the pension plans represented the amount by which the accumulated benefit obligation exceeded the fair market value of the plan assets. The Company contributed $44 million to the U.S. qualified pension plan and contributed $6 million to the Canadian qualified pension plan in February 2004. In addition, $56 million was contributed to the U.S. qualified pension plan in September 2004.

Income Taxes

16

Discontinued, Repositioning and Restructuring Reserves

21

and Disclosure Regarding Discontinued Operations,” which requires changes in the carrying value of assets received as consideration from the disposal of a discontinued operation to be classified within continuing operations. The purchaser has made all payments required under the terms of the Note,note; however, the business has sustained unexpected operating losses during the past fiscal year. The Company has evaluated the projected performance of the business and will continue to monitor its results during the coming year. At January 29, 2005, $9February 2, 2008, CAD$15.5 million remains outstanding on the Note.

Disclosure Regarding Forward-Looking Statements

Information regarding interest rate risk management and foreign exchange risk management is included in the “Financial Instruments and Risk Management” footnote under “Item 8. Consolidated Financial Statements and Supplementary Data.”

17

22

Item 8. Consolidated Financial Statements and Supplementary Data

|

MANAGEMENT’S REPORT

|   | |||||||||

| MATTHEW D. SERRA, | ROBERT W. MCHUGH, | |||||||||

| Chairman of the Board, | Senior Vice President and | |||||||||

| President and Chief Executive Officer | Chief Financial Officer | |||||||||

| March 31, 2008 | ||||||||||

March 28, 2005

18

23

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

|   | |||||||||

| MATTHEW D. SERRA, | ROBERT W. MCHUGH, | |||||||||

| Chairman of the Board, | Senior Vice President and | |||||||||

| President and Chief Executive Officer | Chief Financial Officer | |||||||||

| March 31, 2008 | ||||||||||

March 28, 2005

19

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Foot Locker, Inc.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includesstatements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Foot Locker, Inc. and subsidiaries as of January 29, 2005February 2, 2008 and January 31, 2004,February 3, 2007, and the results of their operations and their cash flows for each of the years in the three-year period ended January 29, 2005,February 2, 2008 in conformity with U.S. generally accepted accounting principles.

As discussed in the Notes to Consolidated Financial Statements, effective February 4, 2007, the Company adopted Statement of Financial Accounting Standards Interpretation (“FIN”) No. 48, “Accounting for Uncertainty in Income Taxes.” Effective February 3, 2007, the Company adopted Statement of Financial Accounting Standards (“SFAS”) No 158, “Employers’ Accounting for Defined Benefit Pension and Other Post Retirement Plans – An Amendment of FASB Statements No. 87, 88, 106, and 132(R).” In addition, effective January 29, 2006, the Company adopted SFAS No. 123(R), “Share-Based Payment,” and SFAS No. 151, “Inventory Costs – An Amendment of ARB No. 43, Chapter 4,” as well as changed their method for quantifying errors based on SEC Staff Accounting Bulletin No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements.”

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Foot Locker, Inc.’s internal control over financial reporting as of January 29, 2005,February 2, 2008, based on criteria established in Internal Control —– Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated March 28, 200531, 2008 expressed an unqualified opinion on management’s assessment of, and the effective operationeffectiveness of internal control over financial reporting.

March

20

25

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON

INTERNAL CONTROL OVER FINANCIAL REPORTING

Foot Locker, Inc.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, evaluating management’s assessment,assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control andbased on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U.S. generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, management’s assessment that Foot Locker, Inc. maintained effective internal control over financial reporting as of January 29, 2005, is fairly stated, in all material respects, based on criteria established in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Also, in our opinion, Foot Locker, Inc. maintained, in all material respects, effective internal control over financial reporting as of January 29, 2005,February 2, 2008, based on criteria established in Internal Control —- Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).Commission.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Foot Locker, Inc. and subsidiaries as of January 29, 2005February 2, 2008 and January 31, 2004,February 3, 2007, and the related consolidated statements of operations, comprehensive income, shareholders’ equity, and cash flows for each of the years in the three-year period ended January 29, 2005,February 2, 2008, and our report dated March 28, 200531, 2008 expressed an unqualified opinion on those consolidated financial statements.

March

21

26

CONSOLIDATED STATEMENTS OF OPERATIONS

| 2004 | 2003 | 2002 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions, except per share amounts) | |||||||||||||||

Sales | $ | 5,355 | $ | 4,779 | $ | 4,509 | |||||||||

| Costs and expenses | |||||||||||||||

| Cost of sales | 3,722 | 3,297 | 3,161 | ||||||||||||

| Selling, general and administrative expenses | 1,088 | 987 | 928 | ||||||||||||

| Depreciation and amortization | 154 | 152 | 153 | ||||||||||||

| Restructuring charges (income) | 2 | 1 | (2 | ) | |||||||||||

| Interest expense, net | 15 | 18 | 26 | ||||||||||||

| 4,981 | 4,455 | 4,266 | |||||||||||||

| Other income (expense) | — | — | (3 | ) | |||||||||||

| 4,981 | 4,455 | 4,263 | |||||||||||||

| Income from continuing operations before income taxes | 374 | 324 | 246 | ||||||||||||

| Income tax expense | 119 | 115 | 84 | ||||||||||||

Income from continuing operations | 255 | 209 | 162 | ||||||||||||

| Income (loss) on disposal of discontinued operations, net of income tax benefit of $37, $4, and $2, respectively | 38 | (1 | ) | (9 | ) | ||||||||||

| Cumulative effect of accounting change, net of income tax benefit of $ — | — | (1 | ) | — | |||||||||||

Net income | $ | 293 | $ | 207 | $ | 153 | |||||||||

| Basic earnings per share: | |||||||||||||||

| Income from continuing operations | $ | 1.69 | $ | 1.47 | $ | 1.15 | |||||||||

| Income (loss) from discontinued operations | 0.25 | (0.01 | ) | (0.06 | ) | ||||||||||

| Cumulative effect of accounting change | — | — | — | ||||||||||||

| Net income | $ | 1.94 | $ | 1.46 | $ | 1.09 | |||||||||

| Diluted earnings per share: | |||||||||||||||

| Income from continuing operations | $ | 1.64 | $ | 1.40 | $ | 1.10 | |||||||||

| Income (loss) from discontinued operations | 0.24 | (0.01 | ) | (0.05 | ) | ||||||||||

| Cumulative effect of accounting change | — | — | — | ||||||||||||

| Net income | $ | 1.88 | $ | 1.39 | $ | 1.05 | |||||||||

| 2007 | 2006 | 2005 | ||||||||||

| (in millions, except per share amounts) | ||||||||||||

| Sales | $ | 5,437 | $ | 5,750 | $ | 5,653 | ||||||

| Costs and expenses | ||||||||||||

| Cost of sales | 4,017 | 4,014 | 3,944 | |||||||||

| Selling, general and administrative expenses | 1,176 | 1,163 | 1,129 | |||||||||

| Depreciation and amortization | 166 | 175 | 171 | |||||||||

| Impairment charges and store closing program costs | 128 | 17 | — | |||||||||

| Interest expense, net | 1 | 3 | 10 | |||||||||

| 5,488 | 5,372 | 5,254 | ||||||||||

| Other income | (1 | ) | (14 | ) | (6 | ) | ||||||

| 5,487 | 5,358 | 5,248 | ||||||||||

| (Loss) Income from continuing operations before income taxes | (50 | ) | 392 | 405 | ||||||||

| Income tax (benefit) expense | (99 | ) | 145 | 142 | ||||||||

| Income from continuing operations | 49 | 247 | 263 | |||||||||

| Income on disposal of discontinued operations, | ||||||||||||

| net of income tax expense (benefit) of $1, $1, and $(3), respectively | 2 | 3 | 1 | |||||||||

| Cumulative effect of accounting change, | ||||||||||||

| net of income tax benefit of $ — | — | 1 | — | |||||||||

| Net income | $ | 51 | $ | 251 | $ | 264 | ||||||

| Basic earnings per share: | ||||||||||||

| Income from continuing operations | $ | 0.32 | $ | 1.59 | $ | 1.70 | ||||||

| Income from discontinued operations | 0.01 | 0.02 | 0.01 | |||||||||

| Cumulative effect of accounting change | — | 0.01 | — | |||||||||

| Net income | $ | 0.33 | $ | 1.62 | $ | 1.71 | ||||||

| Diluted earnings per share: | ||||||||||||

| Income from continuing operations | $ | 0.32 | $ | 1.58 | $ | 1.67 | ||||||

| Income from discontinued operations | 0.01 | 0.02 | 0.01 | |||||||||

| Cumulative effect of accounting change | — | — | — | |||||||||

| Net income | $ | 0.33 | $ | 1.60 | $ | 1.68 | ||||||

See Accompanying Notes to Consolidated Financial Statements.

27

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| 2007 | 2006 | 2005 | |||||||||

| (in millions) | |||||||||||

| Net income | $ | 51 | $ | 251 | $ | 264 | |||||

| Other comprehensive income, net of tax | |||||||||||

| Foreign currency translation adjustment: | |||||||||||

| Translation adjustment arising during the period, net of tax | 60 | 27 | (25 | ) | |||||||

| Cash flow hedges: | |||||||||||

| Change in fair value of derivatives, net of income tax | 1 | — | 2 | ||||||||

| Reclassification adjustments, net of income tax | — | — | (1 | ) | |||||||

| Net change in cash flow hedges: | 1 | — | 1 | ||||||||

| Minimum pension liability adjustment: | |||||||||||

| Minimum pension liability adjustment, net of deferred tax expense | |||||||||||

| of $-, $120 and $10 million, respectively | — | 181 | 15 | ||||||||

| Pension and postretirement plan adjustments, net of income tax | |||||||||||

| benefit of $11 million | (20 | ) | — | — | |||||||

| Unrealized loss on available-for-sale securities | (2 | ) | — | — | |||||||

| Comprehensive income | $ | 90 | $ | 459 | $ | 255 | |||||

See Accompanying Notes to Consolidated Financial Statements.

28

CONSOLIDATED BALANCE SHEETS

| 2007 | 2006 | |||||

| (in millions) | ||||||

| ASSETS | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ | 488 | $ | 221 | ||

| Short-term investments | 5 | 249 | ||||

| Merchandise inventories | 1,281 | 1,303 | ||||

| Other current assets | 290 | 261 | ||||

| 2,064 | 2,034 | |||||

| Property and equipment, net | 521 | 654 | ||||

| Deferred taxes | 243 | 109 | ||||

| Goodwill | 266 | 264 | ||||

| Intangible assets, net | 96 | 105 | ||||

| Other assets | 58 | 83 | ||||

| $ | 3,248 | $ | 3,249 | |||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||

| Current liabilities | ||||||

| Accounts payable | $ | 233 | $ | 256 | ||

| Accrued and other liabilities | 268 | 246 | ||||

| Current portion of long-term debt and obligations under capital leases | — | 14 | ||||

| 501 | 516 | |||||

| Long-term debt and obligations under capital leases | 221 | 220 | ||||

| Other liabilities | 255 | 218 | ||||

| Total liabilities | 977 | 954 | ||||

| Shareholders’ equity | 2,271 | 2,295 | ||||

| $ | 3,248 | $ | 3,249 | |||

See Accompanying Notes to Consolidated Financial Statements.

29

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

| 2007 | 2006 | 2005 | |||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||||||

| (shares in thousands, amounts in millions) | |||||||||||||||||||||

| Common Stock and Paid-In Capital | |||||||||||||||||||||

| Par value $0.01 per share, 500 million shares authorized | |||||||||||||||||||||

| Issued at beginning of year | 157,810 | $ | 653 | 157,280 | $ | 635 | 156,155 | $ | 608 | ||||||||||||

| Restricted stock issued under stock option and award plans | 513 | — | — | (3 | ) | 225 | — | ||||||||||||||

| Forfeitures of restricted stock | — | — | — | — | — | 2 | |||||||||||||||

| Share-based compensation expense | — | 10 | — | 10 | — | 6 | |||||||||||||||

| Issued under director and employee stock plans, net of tax | 674 | 13 | 530 | 11 | 900 | 19 | |||||||||||||||

| Issued at end of year | 158,997 | 676 | 157,810 | 653 | 157,280 | 635 | |||||||||||||||

| Common stock in treasury at beginning of year | (2,107 | ) | (47 | ) | (1,776 | ) | (38 | ) | (64 | ) | (2 | ) | |||||||||

| Reissued under employee stock plans | — | — | 122 | 3 | 90 | 2 | |||||||||||||||

| Restricted stock issued under stock option and award plans | — | — | 157 | 3 | — | — | |||||||||||||||

| Forfeitures/cancellations of restricted stock | (25 | ) | — | (30 | ) | (1 | ) | (135 | ) | (2 | ) | ||||||||||

| Shares of common stock used to satisfy tax | |||||||||||||||||||||

| withholding obligations | (95 | ) | (2 | ) | (241 | ) | (6 | ) | (49 | ) | (1 | ) | |||||||||

| Stock repurchases | (2,283 | ) | (50 | ) | (334 | ) | (8 | ) | (1,590 | ) | (35 | ) | |||||||||

| Exchange of options | (13 | ) | — | (5 | ) | — | (28 | ) | — | ||||||||||||

| Common stock in treasury at end of year | (4,523 | ) | (99 | ) | (2,107 | ) | (47 | ) | (1,776 | ) | (38 | ) | |||||||||

| 154,474 | 577 | 155,703 | 606 | 155,504 | 597 | ||||||||||||||||

| Retained Earnings | |||||||||||||||||||||

| Balance at beginning of year | 1,785 | 1,601 | 1,386 | ||||||||||||||||||

| Cumulative effect of adjustments resulting from | |||||||||||||||||||||

| the adoption of SAB 108, net of tax (see note 3) | — | (6 | ) | — | |||||||||||||||||

| Cumulative effect of adjustments resulting from | |||||||||||||||||||||