ENTERPRISE FINANCIAL SERVICES CORP20052006 ANNUAL REPORT ON FORM 10-K

|

| Page | |

|

| ||

|

| ||

|

|

| |

Item 1: | 1 | ||

|

|

| |

Item 1A: | 6 | ||

|

|

| |

Item 1B: | 8 | ||

|

|

| |

Item 2: | 8 | ||

|

|

| |

Item 3: | 8 | ||

|

|

| |

Item 4: | 8 | ||

|

|

| |

|

| ||

|

|

| |

Item 5: | 9 | ||

|

|

| |

Item 6: |

| 11 | |

|

|

| |

Item 7: | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 12 |

|

|

| |

Item 7A: | 36 | ||

|

|

| |

Item 8: | 36 | ||

|

|

| |

Item 9: | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 36 | |

|

|

| |

Item 9A: | 36 | ||

|

|

| |

Item 9B: | 36 | ||

|

|

| |

|

| ||

|

|

| |

Item 10: | Directors, | 37 | |

|

|

| |

Item 11: | 37 | ||

|

|

| |

Item 12: | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 37 | |

|

|

| |

Item 13: | Certain Relationships and Related | 37 | |

|

|

| |

Item 14: | 37 | ||

|

|

| |

|

| ||

|

|

| |

Item 15: |

| 37 | |

|

|

| |

| Management’s Report on Internal Control over Financial Reporting |

| 38 |

|

|

| |

|

| 39 | |

|

|

| |

|

| 41 | |

|

|

| |

| 74 | ||

|

|

| |

| 75 | ||

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

Readers should note that in addition to the historical information contained herein, some of the information in this report contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements typically are identified with use of terms such as “may,” “will,” “expect,” “anticipate,” “estimate”“estimate,” “potential,” “could”: and similar words, although some forward-looking statements are expressed differently. You should be aware that Enterprise Financial Services Corp’sthe Company’s actual results could differ materially from those contained in the forward-looking statements due to a number of factors, including: burdens imposed by federal and state regulation, including changes in accounting regulation or standards;standards of banks,banks; credit risk; exposure to general and local economic conditions; risks associated with rapid increase or decrease in prevailing interest rates; consolidation within the banking industry; competition from banks and other financial institutions; our ability to attract and retain relationship officers and other key personnel and technological developments; all of which could cause Enterprise Financial Services Corp’sthe Company’s actual results to differ from those set forth in the forward-looking statements.

Other factors that could cause results to differ from expected results include the acquisition of Millennium, the integration of our recent acquisition of NorthStar and our recent acquisition of Clayco, all of which could result in costs and expenses that are greater, or benefits that are less, than we currently anticipate, or the assumption of unanticipated liabilities.

Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s analysis only as of the date of the statements. The Company does not intend to publicly revise or update forward-looking statements to reflect events or circumstances that arise after the date of this report. Readers should carefully review all disclosures we file from time to time with the Securities and Exchange Commission which are available on our website at www.enterprisebank.com.

General

Enterprise Financial Services Corp (“EFSC” or “the Company”), a Delaware corporation, is a financial holding company headquartered in St. Louis, Missouri. At December 31, 2005,2006, our wholly owned subsidiary, Enterprise Bank & Trust (“Enterprise” or “the Bank”), a Missouri chartered trust company with banking powers, was the largest publicly held bank, in asset size, headquartered in St. Louis, Missouri, with $1.3$1.5 billion in assets. Enterprise is a regional bank primarily serving the St. Louis and Kansas City metropolitan areas.

The Company’s stated mission is “to guide our clients to a lifetime of financial success.” We have established an accompanying corporate vision “to build an exceptional company that clients value, shareholders prize and where our associates flourish.” These tenets are fundamental to the Company’s business strategies and operations.

Enterprise is highly focused on serving the needs of private businesses, their owner families and other professionals. This is achieved through two primary lines of business: commercial banking and wealth management. We compete withoffer full product lines in each line of business. We believe our technology combined with the associates who deliver products and services to our clients offer meaningful advantages in product value, product selection and customer service, all of which advance our objectives of enhancing our business model, gaining market share and improving profitability.

The commercial banking line of business offers a broad range of business and personal banking services. Lending services include commercial, commercial real estate, financial and industrial development, real estate construction and development, residential real estate, and consumer loans. A wide variety of deposit products and a complete suite of treasury management services supplementcomplement our lending capabilities.

The wealth management line of business provides fee-based corporate and personal financial consulting, advisory and trust services to our target market.markets. Corporate consulting services are focused in the areas of retirement plans, management compensation and management succession planning. Personal financial consulting includes estate planning, investment management and retirement planning. On October 21,In 2005, we acquired controlling interest in Millennium Brokerage Group, LLC (“Millennium”), a life insurance advisory and brokerage operation serving life agents, banks, CPA firms, property and casualty groups and financial advisors. Millennium’s capabilities, market reach and industry presence have significantly enhancesenhanced our wealth management productbusiness line and opensopened new wholesale marketing opportunities for the Company while strengtheningexpanding our fee income sources.

Our executive offices are located at 150 North Meramec, Clayton, MO 63105 and our telephone number is (314) 725-5500.

1

Available Information

The Company’s Internet website is www.enterprisebank.com. We make available free of charge on or through our website, variousVarious reports that we file with or furnishprovided to the Securities and Exchange Commission (“SEC”), including our annual reports, quarterly reports, current reports and proxy statements.statements are available free of charge on our website. These reports are made available as soon as reasonably practicable after they are filed with or furnished to the SEC.

2006 Acquisitions

1

Acquisition

On October 13, 2005,July 5, 2006, the Company through its new wholly-owned subsidiary, Millenium Holding Company, Inc., executed a Membership Interest Purchase Agreement providing forcompleted the acquisition of Millennium. Millennium is headquarteredNorth Star Bancshares, Inc. and its wholly owned subsidiary, NorthStar Bank N.A. (“NorthStar”), a $187.5 million banking company in Nashville, Tennessee and operates life insurance advisory and brokerage operations from thirteen offices serving life agents, banks, CPA firms, property & casualty groups, and financial advisorsKansas City, MO, for $36.0 million in 49 states. The transaction is structured as a step acquisition with an initial payout of $15 million, 65% cash and 35% company stock, for 60% of Millennium’s membership interests with two subsequent payouts in years 2008 and 2010 for the remaining interests. The consideration mix betweenEFSC stock and cash for subsequent payouts are atcash. NorthStar Bancshares, Inc. was merged into Enterprise Financial Services Corp on the Company’s discretion withacquisition date. In October 2006, we successfully integrated NorthStar’s systems and accounts into Enterprise Bank & Trust’s and converted four of five NorthStar branches to Enterprise branches. One NorthStar branch was closed.

As a maximum of 70% stock. Future payouts are conditioned upon certain pre-tax income performance targets up to a maximum of $36 million, inclusiveresult of the initial $15NorthStar acquisition, at December 31, 2006 the Bank’s assets in the Kansas City market grew to approximately $400.0 million, payout. EFSC is contractually entitled to a priority return on its investment of 23.1% (pre-tax) before additional distributions to the Millennium principals. Please refer to the Form 8-K filed byoperating from six branches.

On November 22, 2006, the Company on October 13, 2005entered into a definitive agreement to acquire Kansas City-based Clayco Banc Corporation (“Clayco”) for more information. Additional information can also be found$37.0 million in Note 2 toEFSC stock and cash. Clayco is the consolidated financial statements laterparent company of the $201.9 million Great American Bank (“Great American”) with branches in this document.DeSoto, KS and Claycomo, MO. The transaction closed on October 21,February 28, 2007. We do not expect to integrate Great American into Enterprise Bank & Trust until early 2008.

With the acquisition of Clayco, assets in the Kansas City market will total approximately $600.0 million – roughly a threefold increase since year-end 2005.

See Note 2 – Acquisitions and Note 4 - Subsequent Events in this filing for more information.

Business Strategy

Business Strategy

Our general business strategy is to generate superior shareholder returns by concentrating on private businesses, their owner families and other success-minded individuals and providing comprehensive financial services through our banking and wealth management lines of business.

Key success factors in pursuing this strategy include a focused and relationship oriented direct and wholesalerelationship-oriented distribution and sales approach, emphasis on growing wealth management revenues, aggressive credit and interest rate risk management, advanced technology and tightly managed expense growth.

Building long-term client relationships – The Bank’s historical growth strategy has been both client and assetrelationship driven. The Bank continuously seeks to add clients who fit our target market of business owners and associated families. Those relationships are maintained, cultivated and expanded over time. This strategy enables the Bank to attract clients with significant and growing borrowing needs, in tandem with the Bank’s increasing capacity to fund client loan requests. The Bank’s officers are typically highly experienced and trained to establish and develop long-term relationships. As a result of its long-term relationship orientation, the Bank is able to fund loan growth primarily with core deposits from its business and professional clients. This is supplemented by borrowing from the Federal Home Loan Bank, and by issuing brokered certificates of deposits, priced at or below the Bank’s alternative cost of funds.

Growing wealth managementTrust business – Enterprise Trust, a division of the Bank, has grown to $1.4$1.6 billion in assets under administration in 7eight years by offering primarily fiduciary and financial advisory services. We staffemploy a full complement of attorneys, certified financial planners, estate planning professionals, as well as other investment professionals who offer a broad range of services for business owners and other high net worth individuals. Employing an intensive, personalized methodology, Enterprise Trust representatives assist clients in defining lifetime goals and buildingdesigning plans for achievingto achieve them. Consistent with the Company’s long-term relationship strategy, Trust representatives maintain close contact with clients ensuring follow up, discipline, and appropriate adjustments as circumstances change. The results have been excellent, as measured by client satisfaction, rapid growth, and contributions to Company earnings.

Wholesale distribution opportunities – Historically, we have distributed products and services directly to clients through local offices of the Bank. However, the application of newer technologies to the delivery of bank and trust products, coupled with the increasing trend toward consolidation of financial services, has created an opportunity for the Company to pursue a wholesale distribution strategy to complement our direct operations. In a wholesale arrangement, Enterprise distributes products and services indirectly to clients through an intermediary, such as another bank, financial services firm or financial advisor.

2

Our acquisition of Millennium is one example of how we are executing our wholesale strategy. Millennium provides life insurance products and related consulting services to other independent life insurance agents, CPA firms, banks, property & casualty insurance agents and financial advisors.

As another component of this wholesale strategy, the Company has applied to the Office of Thrift Supervision for a federal savings bank charter with trust-only authority. This charter, if approved, will allow the Company to offer its trust advisory and fiduciary services, through both direct and wholesale distribution, on a nationwide basis.

The Bank also offers selected deposit products through several existing wholesale distribution arrangements.

Capitalizing on technology – We view our technological capabilities to be a competitive advantage. Our systems provide Internet banking, expanded treasury management products, checks and document imaging, as well as a 24-hour24–hour voice response system. Other services currently offered by the Bank include controlled disbursements, repurchase agreements and sweep investment accounts. Our treasury management suite of products blends advanced technology and personal service, often creating a competitive advantage over larger, nationwide banks. Technology is also utilized extensively in internal systems, operational support functions to improve customer service, and management reporting and analysis.

Maintaining asset quality and controlling interest rate risk – OurSenior Management and the head of Credit administration monitor our asset quality is monitored through regular reviews of loans by the loan officers.loans. In addition, the loan portfolio is subject to ongoing monitoring by a loan review officer whofunction that reports directly to the audit committee of our board of directors. At December 31, 2005, our ratio of non-performing loans to total loans was 0.12%, compared to 0.20% at December 31, 2004, which is significantly better than industry standards.

The Bank’s investment policy is designed to enhance its net income and return on equity through: prudent management of risk; ensuring liquidity to meet cash-flow requirements; managing interest rate risk:risk; ensuring availability of collateral for public deposits, advances and repurchase agreements; and to seek asset diversification. Through our Asset/Liability Management Committee (“ALCO”), Bank liquidity is managed by structuring the maturity dates of investments to maintain an appropriate relationship between assets and liabilities while maximizing interest rate spreads.

2

Accordingly, the ALCO monitors the sensitivity of assets and liabilities with respect to changes in interest rates and maturities and directs the overall acquisition and allocation of funds. ALCO also utilizes derivative financial instruments to assist in the management of interest rate sensitivity by modifying the re-pricing, maturity and option characteristics of certain assets and liabilities.

Expense management – The Company is focused on leveraging its current expense base and measures the “efficiency ratio” as a benchmark for improvement. The efficiency ratio is equal to noninterest expense divided by total revenue (net interest income plus noninterestno interest income). This ratio was 64% in 2005, improved from 67% in 2004. Continued improvement is targeted to maintain strong earnings per share growth and generate higher returns on equity.

Wholesale distribution opportunities – Historically, we have distributed products and services directly to clients through local offices of the Bank. However, the application of newer technologies to new Bank products and services, such as Health Savings Accounts, has enabled us to pursue a wholesale distribution strategy to complement our direct operations. In a wholesale arrangement, Enterprise distributes products and services indirectly to clients through an intermediary, such as another bank, financial services firm, advisor or Company subsidiary.

Our recent acquisition of Millennium is one example of how we are executing our wholesale strategy. Millennium provides life insurance products and related consulting services to other independent life insurance agents, CPA firms, banks, property & casualty insurance agents and financial advisors. Millennium is expected to generate substantial fee income and also to serve as an additional distribution platform for trust and banking services.

Market Areas and Approach to Geographic ExpansionIn the

The Bank has four banking facilities in St. Louis metropolitan area,area. The St. Louis region enjoys a stable, diverse economic base and is ranked the Bank has facilities in Clayton, St. Peters, St. Charles and Sunset Hills, Missouri. The Bank also has facilities in Johnson County, Kansas and an office18th largest MSA in the Country Club Plaza districtUnited States. It is an attractive market for us with nearly 60,000 privately held businesses and over 80,000 households with investible assets of $1.0 million or more. As noted previously, we are the largest publicly-held, locally headquartered bank in this market.

In 2006 the Company substantially strengthened its market position in Kansas City. Kansas City is also a rich private company market with over 48,000 businesses and over 54,000 households with investible assets of $1.0 million or more. As mentioned previously, the Company almost doubled its size in Kansas City Missouri.in 2006. The Company choseplanned acquisition of Clayco Banc Corporation will increase the Company’s assets in the Kansas City market to locateroughly $600.0 million on a pro-forma basis, making Enterprise one of the fastest growing banks in each of these markets based on high growth potential, high concentration of closely-held businesses and the large number of professionals and executives.

|

|

| Kansas City |

The Company, as part of its expansion effort, plans to continue its strategy of operating relatively fewer offices with a larger asset base per office, emphasizing commercial banking and wealth management and employing experienced staff who are compensated on the basis of performance and customer service. In addition, we are now employing a national

By virtue of its Millennium subsidiary and other wholesale strategy made possible bydistribution operations, subject to applicable regulatory restrictions, the Millennium distribution platform.Company provides services beyond St. Louis and Kansas City in markets across the United States.

3

Competition

The Company and its subsidiaries operate in highly competitive markets. Our geographic markets are served by a number of large multi-bank holding companies with substantial capital resources and lending capacity. Many of the larger banks have established specialized units, which target private businesses and high net worth individuals. In addition,Also, both the St. Louis and Kansas City markets are experiencing an increase in de novo banks, which have either opened or are in the application stage. In addition to other financial holding companies and commercial banks, we compete with credit unions, investment managers, brokerage firms, money managers and other providers of financial services and products.

Supervision and Regulation

The Company and the Bank are subject to state and federal banking laws and regulations which impose specific requirements or restrictions on and provide for general regulatory oversight with respect to virtually all aspects of operations. These laws and regulations are intended to protect depositors, not shareholders.and shareholders to some extent. To the extent that the following summary describes statutory or regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions. Any change in applicable laws or regulations may have a material effect on the business and prospects of the Company. The numerous regulations and policies promulgated by the regulatory authorities create a difficult and ever-changing atmosphere in which to operate. The Company and the Bank commit substantial resources in order to comply with these statutes, regulations and policies. The Company is unable to predict the nature or the extent of the effect on its business and earnings that fiscal or monetary policies, economic control, or new federal or state legislation may have in the future.

3

Millennium and the investment management industry in general are subject to extensive regulation in the United States at both the federal and state level, as well as by self-regulatory organizations such as the National Association of Securities Dealers, Inc. (“NASD”). The Securities and Exchange Commission is the federal agency that is primarily responsible for the regulation of investment advisers. Millennium is licensed to sell insurance, including variable insurance policies, in various states and is subject to regulation by the NASD. This regulation includes supervisory and organizational procedures intended to assure compliance with securities laws, including qualification and licensing of supervisory and sales personnel and rules designed to promote high standards of commercial honorintegrity and justfair and equitable principles of trade.

The Holding Company

The Company is a financial holding company registered under the Bank Holding Company Act of 1956, as amended (“BHCA”). As a financial holding company, the Company is subject to regulation and examination by the Federal Reserve Board, and is required to file periodic reports of its operations and such additional information as the Federal Reserve may require. In order to remain a financial holding company, the Company must continue to be considered well managed and well capitalized by the Federal Reserve and have at least a “satisfactory” rating under the Community Reinvestment Act. See “Capital Resources” in the Management Discussion and Analysis for more information on our capital adequacy and “The“Enterprise Bank – Community Reinvestment Act” below for more information on Community Reinvestment.

Acquisitions: With certain limited exceptions, the BHCA requires every financial holding company or bank holding company to obtain the prior approval of the Federal Reserve before (i) acquiring substantially all the assets of any bank, (ii) acquiring direct or indirect ownership or control of any voting shares of any bank if, after such acquisition, it would own or control more than 5% of the voting shares of such bank (unless it already owns or controls the majority of such shares), or (iii) merging or consolidating with another bank holding company. Federal legislation permits bank holding companies to acquire control of banks throughout the United States.

Permissible Activities: The Gramm-Leach-Bliley Act of 1999 (“GLBA”) eliminates many of the restrictions placed on the activities of certain qualified financial or bank holding companies. A financial holding company such as EFSC can expand into wide variety of financial services, including securities activities, insurance and merchant banking without the prior approval of the Federal Reserve.

Privacy Regulation: GLBA also imposes restrictions on the Company and the Bank regarding the sharing of customer non-public personal information with non-affiliated third parties unless the customer has had an opportunity to opt out of the disclosure. GLBA also imposes periodic disclosure requirements concerning the Company and the Bank policies and practices regarding data sharing with affiliated and non-affiliated parties.

Source of Strength; Cross-Guarantee. In accordance with Federal Reserve policy, we are expected to act as a source of financial strength to the Bank and to commit resources to support the Bank. The Federal Reserve takes the position that in implementing this policy, it may require us to provide financial support when we otherwise would not consider ourselves able to do so.

4

Sarbanes-Oxley Act. On July 30, 2002, President Bush signed into law the Sarbanes-Oxley Act of 2002 (“SOX”). The stated goals of SOX are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies and to protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the securities laws. The proposed changes are intended to allow shareholders to monitor the performance of companies and directors more easily and efficiently.

SOX generally applies to all companies, both U.S. and non-U.S., that file or are required to file periodic reports with the SEC under the Securities Exchange Act of 1934 and includes specific additional disclosure requirements and new corporate governance rules. The Act addresses, among other matters, (i) certification of financial statements by the chief executive officer and the chief financial officer, (ii) management assessment of internal controls with the issuer’s auditor attesting to and reporting on such assessment, (iii) the forfeiture of certain bonuses in the event of a restatement of financial results. In addition, public companies whose securities are listed on a national securities exchange must satisfy the following additional requirements: (i) the company’s audit committee must appoint and oversee the company’s auditors, (ii) each member of the company’s audit committee must be independent, (iii) the company’s audit committee must establish procedures for receiving complaints regarding accounting, internal accounting controls and audit-related matters, (iv) the company’s audit committee must have the authority to engage independent advisors and (v) the company must provide appropriate funding to its audit committee, as determined by the audit committee. SOX also requires the registered public accounting firm that issues the audit report to issue a report on management’s attestation on internal control over financial reporting.

4

TheEnterprise Bank

& Trust

The Bank is a Missouri trust company with banking powers. It is not a member of the Federal Reserve system.System. The Missouri Division of Finance and the FDICFederal Deposit Insurance Corporation (“FDIC”) are primary regulators for the Bank. These regulatory authorities regulate or monitor all areas of the Bank’s operations, including security devices and procedures, adequacy of capitalization and loss reserves, loans, investments, borrowings, deposits, mergers, issuance of securities, payment of dividends, interest rates payable on deposits, interest rates or fees chargeable on loans, establishment of branches, corporate reorganizations, maintenance of books and records, and adequacy of staff training to carry on safe lending and deposit gathering practices. The Bank must maintain certain capital ratios and is subject to limitations on aggregate investments in real estate, bank premises, and furniture and fixtures.

Transactions with Affiliates and Insiders: The Bank is subject to the provisions of Regulation W promulgated by the Federal Reserve, which encompasses Sections 23A and 23B of the Federal Reserve Act. Regulation W places limits and conditions on the amount of loans or extensions of credit to, investments in, or certain other transactions with, affiliates and on the amount of advances to third parties collateralized by the securities or obligations of affiliates. Regulation W also prohibits, among other things, an institution from engaging in certain transactions with certain affiliates unless the transactions are on terms substantially the same, or at least as favorable to such institution or its subsidiaries, as those prevailing at the time for comparable transactions with nonaffiliated companies.

Community Reinvestment Act: The Community Reinvestment Act (“CRA”) requires that, in connection with examinations of financial institutions within its jurisdiction, the FDIC shall evaluate the record of the financial institutions in meeting the credit needs of their local communities, including low and moderate income neighborhoods, consistent with the safe and sound operation of those institutions. These factors are also considered in evaluating mergers, acquisitions, and applications to open a branch or facility. The Company has a satisfactory rating under CRA.

USA Patriot Act: On October 26, 2001, President Bush signed into law the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “USA PATRIOT Act”). Among its other provisions, the USA PATRIOT Act requires each financial institution to: (i) establish an anti-money laundering program; (ii) establish due diligence policies, procedures and controls with respect to its private banking accounts and correspondent banking accounts involving foreign individuals and certain foreign banks; and (iii) implement certain due diligence policies, procedures and controls with regard to correspondent accounts in the United States for, or on behalf of, a foreign bank that does not have a physical presence in any country. In addition, the USA PATRIOT Act contains a provision encouraging cooperation among financial institutions, regulatory authorities and law enforcement authorities with respect to individuals, entities and organizations engaged in, or reasonably suspected of engaging in, terrorist acts or money laundering activities.

Check 21: The Check Clearing for the 21st Century Act (“Check 21”) was signed into law on October 28, 2003, and became effective on October 28, 2004. Check 21 is designed to foster innovation in the payments system and to enhance its efficiency by reducing some of the legal impediments to check clearing. The law facilitates check clearing by creating a new negotiable instrument called a substitute check, which permits banks to clear original checks, to process check information electronically, and to deliver substitute checks to banks that want to continue

5

receiving paper checks. A substitute check is the legal equivalent of the original check and includes all the information contained on the original check. The law does not require banks to accept checks in electronic form nor does it require banks to use the new authority granted by the ActCheck 21 to create substitute checks.

Limitations on Loans and Transaction: The Federal Reserve Act generally imposes certain limitations on extensions of credit and other transactions by and between banks that are members of the Federal Reserve and other affiliates (which includes any holding company of which a bank is a subsidiary and any other non-bank subsidiary of such holding company). Banks that are not members of the Federal Reserve are also subject to these limitations. Further, federal law prohibits a bank holding company and its subsidiaries from engaging in certain tie-in arrangements in connection with any extension of credit, lease or sale of property or the furnishing of services.

Other Regulations: Interest and certain other charges collected or contracted for by the Bank are subject to state usury laws and certain federal laws concerning interest rates. The Bank’s loan operations are also subject to certain federal laws applicable to credit transactions, such as the federal Truth-In-Lending Act governing disclosures of credit terms to consumer borrowers; the Home Mortgage Disclosure Act of 1975 requiring financial institutions to provide information to enable the public and public officials to determine whether a financial institution is fulfilling its obligation to help meet the housing needs of the community it serves; the Equal Credit Opportunity Act

5

prohibiting discrimination on the basis of race, creed or other prohibited factors in extending credit; the Fair Credit Reporting Act of 1978 governing these and provision of information to credit reporting agencies; the Fair Debt Collection Act governing the manner in which consumer debts may be collected by collection agencies; the Soldiers’ and Sailors Civil Relief Act of 1940, governing the repayment terms of, and property rights underlying obligations of persons in military service; and the rules and regulations of the various federal agencies charged with the responsibility of implementing such federal laws. The deposit operations of the Bank are also subject to the Right to Financial Privacy Act, which imposes a duty to maintain confidentiality of consumer financial records and prescribes procedures for complying with administrative subpoenas of financial records, and the Electronic Funds Transfer Act and Regulation E issued by the Federal Reserve Board to implement that act, which governs automatic deposits to and withdrawals from deposit accounts and customers’ rights and liabilities arising from the use of automated teller machines and other electronic banking services.

Deposit Insurance: The deposits of the Bank are currently insured by the FDIC to a maximum of $100,000 per depositor, subject to certain aggregation rules. The FDIC establishes rates for the payment of premiums by federally insured banks for deposit insurance. An insurance fund is maintained for commercial banks, with insurance premiums from the industry used to offset losses from insurance payouts when banks and thrifts fail. The FDIC has adopted a risk-based deposit insurance premium system for all insured depository institutions, including the Bank, which requires premiums from a depository institution based upon its capital levels and risk profile, as determined by its primary federal regulator on a semiannual basis.

At any given time, the Company is subject to any number of risk factors that may affect the market price of the Company���sCompany’s stock. Some of the specific risks include the following:

Falling interest rates may reduce our net income and future cash flows. Since June 30, 2004, the U.S. Federal Reserve has increased its target for the federal funds rate fourteen times to 4.50%. If interest rates would start to fall, and if rates on the Bank’s loans and investments reprice downwards faster than the rates on the deposits and borrowings, we would experience compression of our interest rate spread and net interest margin, which would have a negative effect on our profitability.

Recent and possible future acquisitions could involve risks and challenges that could adversely affect our ability to achieve our profitability goals for acquired businesses or realize anticipated benefits of those acquisitions. We have experienced strong growth in the past several years and our strategy of future growth, while not dependent on, might include the acquisition of banking branches, other financial institutions and other wealth management companies. Most recently, we completed a partial acquisition of Millennium Brokerage Group LLC. However, we cannot assure investors that it will be able to identify suitable future acquisition opportunities or finance and complete any particular acquisition, combination or other transaction on acceptable terms and prices. There can be no assurance that the Company will be able to develop and integrate acquired businesses without adversely affecting the Company’s financial performance. In addition, all acquisitions involve a number of risks and challenges that could adversely affect our ability to achieve anticipated benefits of acquisitions.

The Bank’s allowance for loan losses may be inadequate, which could impair our earnings. The Bank’s allowance for loan losses may not be adequate to cover actual loan losses and if the Bank is required to increase its reserve, current earnings maywill be reduced. Our experience shows that some borrowers either will not pay on time or will not pay at all, which will require the Bank to “charge-off”charge-off the defaulted loan or loans. We provide for losses by reserving what we believe to be an adequate amount to absorb any probable inherent losses. A “charge-off”charge-off reduces the Bank’s allowance for loan losses. If the Bank’s reserves were insufficient, it would be required to increase reserves by recording a larger provision for loan losses, which would reduce earnings for that period.

Changes in economic conditions could cause an increase in delinquencies and non-performing assets, including loan charge-offs, which in turn may negatively affect the Company’s income and growth. The Bank’s loan portfolio includes many real estate securedDemand for loans demand for which may decrease during economic downturns as a result of, among other things, an increase in unemployment, a decrease in real estate values or increases in interest rates. These factors could depress our earnings and consequently our financial condition because:

| • | customers may not want or need the Company’s products and services; |

| • | borrowers may not be able to repay their loans; |

| • | the value of the collateral securing the Bank’s loans to borrowers may decline; and |

| • | the quality of the Bank’s loan portfolio may decline. |

6

Any of the latter threethese scenarios could cause an increase in delinquencies and non-performing assets or require us to “charge-off”charge-off a percentage of loans and/or increase the provisions for loan losses, which would reduce our earnings.

A prolonged flat or inverted yield curve may reduce our net income and cash flows. The interest rate yield curve is normally upward sloping where absolute interest rates are higher as the maturity of the financial instrument lengthens. During 2006, the curve became inverted where rates were lower on longer-term maturities. If this condition persists throughout 2007, we will likely experience continued compression of our interest rate spread and related net interest rate margin, which would have a negative impact on our profitability.

Because the Bank competes primarily on the basis of the interest rates it offers depositors and the terms of loans it offers borrowers, the Bank’s margins could decrease if it were required to increase deposit rates or lower interest rates on loans in response to competitive pressure. The Bank faces intense competition both in making loans and attracting deposits. It competes primarily on the basis of its depository rates, the terms of the loans it originates and the quality of its financial and depository services. This competition has made it more difficult for the Bank to make new loans and at times has forced us to offer higher deposit rates in our market areas. We expect competition to increase in the future as a result of legislative, regulatory and technological changes and the continuing trend of consolidation in the financial services industry. Technological advances, for example, have lowered barriers to market entry, enabled banks to expand their geographic reach by providing services over the Internet and enabled non-depository institutions to offer products and services that traditionally have been provided by banks. Recent changes in federal banking law permit affiliation among banks, securities firms and insurance companies, which also will change the competitive environment in which we conduct business. Some of the institutions with which we compete are significantly larger than us and, therefore, have significantly greater resources.

A real estate downturn in our geographic markets could hurt our business because a majority of our loans are secured by real estate. If real estate prices decline the value of real estate collateral securing our loans could be reduced. Our ability to recover on defaulted loans by foreclosing and selling real estate collateral would be diminished and we would likely suffer losses on defaulted loans. As of December 31, 2006, approximately 60% of the book value of our loan portfolio consisted of loans collateralized by various types of real estate. Substantially all of our real property collateral is located in Missouri and Kansas. Any such downturn could have a material adverse effect on our business, financial condition and results of operations.

Recent supervisory guidance on commercial real estate concentrations could restrict our activities and impose financial requirements or limitations on the conduct of business. The office of the Comptroller of the Currency, The Board of Governors of the Federal Reserve System and the FDIC recently finalized joint supervisory guidance on sound risk management practices for concentrations in commercial real estate lending. The guidance is intended to help ensure that institutions pursuing a significant commercial real estate lending strategy remain healthy and profitable while continuing to serve the credit needs of the community.

Our commercial real estate portfolio as of December 31, 2006 meets the definition of a commercial real estate concentration as set forth in the guidelines. If our risk management practices are found to be deficient, it could result in increased reserves and capital costs.

Recent and possible future acquisitions could involve risks and challenges that could adversely affect our ability to achieve our profitability goals for acquired businesses or realize anticipated benefits of those acquisitions. We have experienced strong growth in the past several years and our strategy of future growth, while not dependent on, might include the acquisition of banking branches, other financial institutions and other wealth management companies. However, we cannot assure investors that we will be able to identify suitable future acquisition opportunities or finance and complete any particular acquisition, combination or other transaction on acceptable terms and prices. There can be no assurance that we will be able to develop and integrate acquired businesses without adversely affecting our financial performance. In addition, all acquisitions involve a number of risks and challenges that could adversely affect our ability to achieve anticipated benefits of acquisitions.

Business Continuity Plans may not adequately anticipate all risks. We are subject to events that could impact or disrupt our business, although our goal is to ensure continuous service delivery to our customers. We have undertaken an enterprise-wide Business Continuity Plan in order to respond to and guard against this risk. However, no plan can fully eliminate such risk and there can be no assurance that our Plan will be successful.

Future Government Regulation Could Hinder Future Performance. The Company is a registered bankfinancial holding company under the Bank Holding Company Act of 1956. Accordingly, both the Company and the Bank are subject to extensive government regulation, legislation and control. These laws limit the manner in which the Company operates. Management cannot predict whether, or the extent to which, the government and governmental organizations may change any of these laws or controls. Changes in authoritative accounting guidance by the

7

Financial Accounting Standards Board or other regulatory agencies could affect the Company in ways that are not currently determinable. Management cannot predict how any of these changes would adversely affect the Company’s business.

Federal and state law limits the Company’s ability to declare and pay dividends. In addition, the Board of Governors of the Federal Reserve System may impose restrictions on the Company’s ability to declare and pay dividends on its common stock.

Employees

At December 31, 20052006 we had approximately 261329 full-time equivalent employees (including Millennium).employees. None of the Company’s employees is covered by a collective bargaining agreement. Management believes that its relationship with its employees is good.

7

ITEM 1B: UNRESOLVED SEC COMMENTS

Not applicable.

Banking facilitiesAs of December 31, 2005, we had five banking locations in Missouri and one in Kansas.

Our executive offices are located at 150 North Meramec, Clayton, Missouri, 63105. As of December 31, 2006, we had four banking locations in the St. Louis metropolitan area and six banking locations in the Kansas City metropolitan area. The Bank owns two of the banking facilities and leases the remainder. In addition,March 2006, the Bank leases our Operations CenterCompany purchased its operations center located in St. Louis County, Missouri. The terms of the leases expire between 20102009 and 2017 and most of the leases include one or more renewal options of 5 years. All the leases are classified as operating leases. We believe all our properties are in good condition.

In January 2006, the Company entered into an agreement to purchase the Operations Center location. We expect the purchase to close in first quarter 2006.

The following table sets forth specific information on each banking location.

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Wealth management facilities

Enterprise Trust, a division of the Bank has offices in St. Louis and Kansas City. The St. Louis office is located at the Clayton branch and the Kansas City office is located at the Overland Park branch. Expenses related to the space used by Enterprise Trust are allocated to the Wealth Management segment.

As of December 31, 2005,2006, Millennium had 13 locations in 11 states throughout the United States. The executive offices are located in Nashville, TN. None of the locations areis owned by Millennium. The leases are classified as operating leases and expire in various years through 2009.2011.

The Company and its subsidiaries are, from time to time, parties to various legal proceedings arising out of their businesses. Management believes that there are no such proceedings pending or threatened against the Company or its subsidiaries which, if determined adversely, would have a material adverse effect on the business, financial condition, results of operations or cash flows of the Company or any of its subsidiaries.

ITEM 4: SUBMISSION OF MATTERS TO VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders in the quarter ended December 31, 2005.2006.

8

ITEM 5: MARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASE OF EQUITY SECURITIES

Effective February 8, 2005, the Company’s common stock began trading on the NASDAQ National Market under the symbol “EFSC”. Prior to that date, the common stock was not traded on an exchange but was traded on the Over-The-Counter Bulletin Board. Below are the dividends declared by quarter along with what the Company believes are the high and low closing sales prices for the common stock. There may have been other transactions at prices not known to the Company. As of February 22, 2006,21, 2007, the Company had 707835 common stock shareholders of record and a market price of $26.50$29.75 per share.

|

| Market Price |

|

|

|

| ||||

|

|

| Dividends |

| ||||||

|

| High |

| Low |

|

| ||||

|

|

|

|

| ||||||

2005 |

|

|

|

|

|

|

|

|

|

|

Fourth Quarter |

| $ | 23.17 |

| $ | 19.58 |

| $ | 0.0350 |

|

Third Quarter |

|

| 25.87 |

|

| 20.77 |

| $ | 0.0350 |

|

Second Quarter |

|

| 24.71 |

|

| 18.80 |

| $ | 0.0350 |

|

First Quarter |

|

| 20.75 |

|

| 18.17 |

| $ | 0.0350 |

|

2004 |

|

|

|

|

|

|

|

|

|

|

Fourth Quarter |

| $ | 19.80 |

| $ | 14.50 |

| $ | 0.0250 |

|

Third Quarter |

|

| 15.00 |

|

| 14.00 |

| $ | 0.0250 |

|

Second Quarter |

|

| 15.25 |

|

| 13.40 |

| $ | 0.0250 |

|

First Quarter |

|

| 14.10 |

|

| 13.15 |

| $ | 0.0250 |

|

The Company has authorizednumber of holders of record does not represent the repurchaseactual number of upbeneficial owners of our common stock because securities dealers and others frequently hold shares in “street name” for the benefit of individual owners who have the right to 500,000 shares of its common stock. In the quarter ended December 31, 2005, the Company repurchased no shares of its common stock.vote shares.

|

| 2006 |

| 2005 |

| ||||||||||||||||||||

|

|

|

| ||||||||||||||||||||||

|

| 4th Qtr |

| 3rd Qtr |

| 2nd Qtr |

| 1st Qtr |

| 4th Qtr |

| 3rd Qtr |

| 2nd Qtr |

| 1st Qtr |

| ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

High |

| $ | 33.87 |

| $ | 31.29 |

| $ | 28.49 |

| $ | 27.40 |

| $ | 23.17 |

| $ | 25.87 |

| $ | 24.71 |

| $ | 20.75 |

|

Low |

|

| 29.54 |

|

| 25.46 |

|

| 24.88 |

|

| 22.73 |

|

| 19.58 |

|

| 20.77 |

|

| 18.80 |

|

| 18.17 |

|

Dividends declared |

|

| 0.045 |

|

| 0.045 |

|

| 0.045 |

|

| 0.045 |

|

| 0.035 |

|

| 0.035 |

|

| 0.035 |

|

| 0.035 |

|

Dividends

The holders of shares of common stock of the Company are entitled to receive dividends when declared by the Company’s Board of Directors out of funds legally available for the purpose of paying dividends. The amount of dividends, if any, that may be declared by the Company will be dependent on many factors, including future earnings, bank regulatory capital requirements and business conditions as they affect the Bank. As a result, no assurance can be given that dividends will be paid in the future with respect to the Company’s common stock. In addition, the Company currently plans to retain most of its earnings for growth.

Common Stock

The authorized capital stock of the Company consists of 20,000,000 shares of common stock, par value $.01$0.01 per share. The Company has asked the shareholders to increase the number of authorized common shares to 30,000,0000. The shareholders will vote on this matter at the 2007 Annual Meeting. Please see the Company’s Proxy Statement for its 2007 annual meeting to be held on Wednesday, April 18, 2007 for more information.

Holders of the common stock are entitled to one vote per share on all matters on which the holders of common stock are entitled to vote. In all elections of directors, holders of common stock have the right to cast votes equaling the number of shares of common stock held by such stockholder multiplied by the number of directors to be elected. All of such votes may be cast for a single director or may be distributed among the number of directors to be elected, or any two or more directors, as such stockholder elects. Holders of common stock have no preemptive, conversion, redemption, or sinking fund rights. In the event of a liquidation, dissolution or winding-up of the Company, holders of common stock are entitled to share equally and ratably in the assets of the Company, if any, remaining after the payment of all liabilities of the Company.

The Company has authorized the repurchase of up to 500,000 shares of its common stock. In the quarter ended December 31, 2006, the Company repurchased no shares of its common stock.

See Note 17 – Compensation Plans in this filing for information about securities authorized for issuance under equity compensation plans.

9

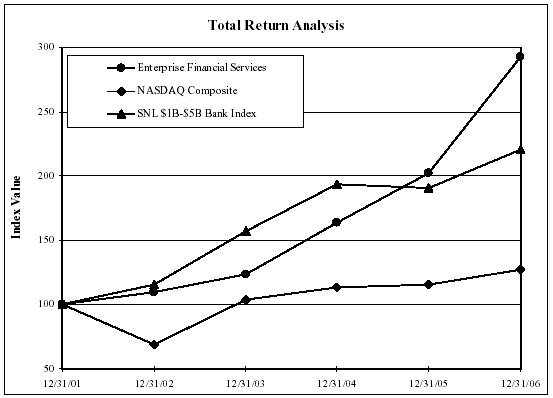

The following Stock Performance Graph and related information should not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission nor shall such performance be incorporated by reference into any future filings under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

9The following graph compares the Company’s cumulative total shareholder return on its common stock from December 31, 2001 through December 31, 2006. The graph compares the Company’s common stock with the NASDAQ Composite and the SNL $1B-$5B Bank Index. The graph assumes an investment of $100.00 in the Company’s common stock and each index on December 31, 2001 and reinvestment of all quarterly dividends. The investment is measured as of each subsequent fiscal year end. There is no assurance that the Company’s common stock performance will continue in the future with the same or similar results as shown in the graph.

STOCK PERFORMANCE GRAPH

|

| Period Ending |

| ||||||||||||||||

|

|

| |||||||||||||||||

Index |

| 12/31/01 |

| 12/31/02 |

| 12/31/03 |

| 12/31/04 |

| 12/31/05 |

| 12/31/06 |

| ||||||

|

|

|

|

|

|

| |||||||||||||

Enterprise Financial Services |

|

| 100.00 |

|

| 109.41 |

|

| 123.27 |

|

| 163.97 |

|

| 202.36 |

|

| 292.56 |

|

NASDAQ Composite |

|

| 100.00 |

|

| 68.76 |

|

| 103.67 |

|

| 113.16 |

|

| 115.57 |

|

| 127.58 |

|

SNL $1B-$5B Bank Index |

|

| 100.00 |

|

| 115.44 |

|

| 156.98 |

|

| 193.74 |

|

| 190.43 |

|

| 220.36 |

|

10

ITEM 6: SELECTED FINANCIAL DATA

The following table summarizesconsolidated selected financial data is derived from the Company’s audited financial statements as of and for the Company for the periods indicated.five years ended December 31, 2006. This information should be read in connection with our audited consolidated financial statements, related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere in this report.

|

| Year ended December 31, |

|

| Year ended December 31, |

| ||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||||

(in thousands, except per share data) |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| 2001 |

|

| 2006 |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

EARNINGS SUMMARY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Interest income |

| $ | 68,108 |

| $ | 48,893 |

| $ | 43,245 |

| $ | 45,207 |

| $ | 52,612 |

|

| $ | 94,418 |

| $ | 68,108 |

| $ | 48,893 |

| $ | 43,245 |

| $ | 45,207 |

|

Interest expense |

|

| 23,541 |

| 12,169 |

| 10,544 |

| 14,343 |

| 23,810 |

|

|

| 43,141 |

| 23,541 |

| 12,169 |

| 10,544 |

| 14,343 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

Net interest income |

|

| 44,567 |

| 36,724 |

| 32,701 |

| 30,864 |

| 28,802 |

|

|

| 51,277 |

| 44,567 |

| 36,724 |

| 32,701 |

| 30,864 |

| ||||||||

Provision for loan losses |

|

| 1,490 |

| 2,212 |

| 3,627 |

| 2,251 |

| 3,230 |

|

|

| 2,127 |

| 1,490 |

| 2,212 |

| 3,627 |

| 2,251 |

| ||||||||

Noninterest income |

|

| 8,964 |

| 7,122 |

| 10,091 |

| 5,366 |

| (2,035 | ) |

|

| 16,916 |

| 8,967 |

| 7,122 |

| 10,091 |

| 5,366 |

| ||||||||

Noninterest expense |

|

| 34,321 |

| 29,331 |

| 28,215 |

| 27,364 |

| 24,830 |

|

|

| 41,394 |

| 34,324 |

| 29,331 |

| 28,215 |

| 27,364 |

| ||||||||

Minority interest in net income of consolidated subsidiary |

|

| (113 | ) |

| — |

| — |

| — |

| — |

|

|

| (875 | ) |

| (113 | ) |

| — |

| — |

| — |

| |||||

Income before income taxes |

|

| 17,607 |

| 12,303 |

| 10,950 |

| 6,615 |

| (1,293 | ) |

|

| 23,797 |

| 17,607 |

| 12,303 |

| 10,950 |

| 6,615 |

| ||||||||

Income taxes |

|

| 6,312 |

| 4,088 |

| 4,025 |

| 1,614 |

| 1,242 |

|

|

| 8,325 |

| 6,312 |

| 4,088 |

| 4,025 |

| 1,614 |

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

NET INCOME (loss) |

| $ | 11,295 |

| $ | 8,215 |

| $ | 6,925 |

| $ | 5,001 |

| $ | (2,535 | ) | ||||||||||||||||

NET INCOME |

| $ | 15,472 |

| $ | 11,295 |

| $ | 8,215 |

| $ | 6,925 |

| $ | 5,001 |

| ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

PER SHARE DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Net income (loss) per share-basic |

| $ | 1.12 |

| $ | 0.85 |

| $ | 0.72 |

| $ | 0.53 |

| $ | (0.28 | ) | ||||||||||||||||

Net income (loss) per share-diluted |

|

| 1.05 |

| 0.82 |

| 0.70 |

| 0.52 |

| (0.28 | ) | ||||||||||||||||||||

Net income per share-basic |

| $ | 1.41 |

| $ | 1.12 |

| $ | 0.85 |

| $ | 0.72 |

| $ | 0.53 |

| ||||||||||||||||

Net income per share-diluted |

|

| 1.36 |

| 1.05 |

| 0.82 |

| 0.70 |

| 0.52 |

| ||||||||||||||||||||

Cash dividends per share |

|

| 0.14 |

| 0.10 |

| 0.08 |

| 0.07 |

| 0.06 |

|

|

| 0.18 |

| 0.14 |

| 0.10 |

| 0.08 |

| 0.07 |

| ||||||||

Book value per share |

|

| 8.85 |

| 7.44 |

| 6.80 |

| 6.19 |

| 5.60 |

|

|

| 11.52 |

| 8.85 |

| 7.44 |

| 6.80 |

| 6.19 |

| ||||||||

BALANCE SHEET DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Year end balances: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Loans |

| $ | 1,002,379 |

| $ | 898,505 |

| $ | 783,878 |

| $ | 679,799 |

| $ | 602,747 |

|

| $ | 1,311,723 |

| $ | 1,002,379 |

| $ | 898,505 |

| $ | 783,878 |

| $ | 679,799 |

|

Allowance for loan losses |

| 12,990 |

| 11,665 |

| 10,590 |

| 8,600 |

| 7,296 |

|

| 16,988 |

| 12,990 |

| 11,665 |

| 10,590 |

| 8,600 |

| ||||||||||

Goodwill |

| 29,983 |

| 12,042 |

| 1,938 |

| 1,938 |

| 1,938 |

| |||||||||||||||||||||

Intangibles, net |

| 5,789 |

| 4,548 |

| 135 |

| 315 |

| 475 |

| |||||||||||||||||||||

Assets held for sale |

| — |

| — |

| — |

| 36,401 |

| 40,575 |

|

| — |

| — |

| — |

| — |

| 36,401 |

| ||||||||||

Assets |

| 1,286,968 |

| 1,059,950 |

| 907,726 |

| 877,251 |

| 795,590 |

|

| 1,535,587 |

| 1,286,968 |

| 1,059,950 |

| 907,726 |

| 877,251 |

| ||||||||||

Deposits |

| 1,116,244 |

| 939,628 |

| 796,400 |

| 716,314 |

| 655,553 |

|

| 1,315,508 |

| 1,116,244 |

| 939,628 |

| 796,400 |

| 716,314 |

| ||||||||||

Subordinated debentures |

| 30,930 |

| 20,620 |

| 15,464 |

| 15,464 |

| 11,340 |

|

| 35,054 |

| 30,930 |

| 20,620 |

| 15,464 |

| 15,464 |

| ||||||||||

Borrowings |

| 36,931 |

| 20,164 |

| 24,147 |

| 31,823 |

| 15,399 |

|

| 40,752 |

| 36,931 |

| 20,164 |

| 24,147 |

| 31,823 |

| ||||||||||

Liabilities held for sale |

| — |

| — |

| — |

| 50,053 |

| 58,800 |

|

| — |

| — |

| — |

| — |

| 50,053 |

| ||||||||||

Shareholders’ equity |

| 92,605 |

| 72,726 |

| 65,388 |

| 58,810 |

| 51,897 |

|

| 132,994 |

| 92,605 |

| 72,726 |

| 65,388 |

| 58,810 |

| ||||||||||

Average balances: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Loans |

| 964,259 |

| 847,270 |

| 738,572 |

| 693,551 |

| 613,539 |

|

| 1,159,110 |

| 964,259 |

| 847,270 |

| 738,572 |

| 693,551 |

| ||||||||||

Earning assets |

| 1,100,559 |

| 967,854 |

| 825,973 |

| 779,194 |

| 701,582 |

|

| 1,300,378 |

| 1,100,559 |

| 967,854 |

| 825,973 |

| 779,194 |

| ||||||||||

Assets |

| 1,148,691 |

| 1,008,022 |

| 868,303 |

| 820,730 |

| 743,503 |

|

| 1,385,726 |

| 1,148,691 |

| 1,008,022 |

| 868,303 |

| 820,730 |

| ||||||||||

Interest-bearing liabilities |

| 859,912 |

| 748,434 |

| 647,087 |

| 629,651 |

| 583,343 |

|

| 1,055,520 |

| 859,912 |

| 748,434 |

| 647,087 |

| 629,651 |

| ||||||||||

Shareholders’ equity |

| 81,511 |

| 68,854 |

| 63,175 |

| 55,361 |

| 56,623 |

|

| 113,000 |

| 81,511 |

| 68,854 |

| 63,175 |

| 55,361 |

| ||||||||||

SELECTED RATIOS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Return on average equity |

|

| 13.86 | % |

| 11.93 | % |

| 10.96 | % |

| 9.03 | % |

| N/A | % |

|

| 13.69 | % |

| 13.86 | % |

| 11.93 | % |

| 10.96 | % |

| 9.03 | % |

Return on average assets |

|

| 0.98 |

| 0.81 |

| 0.80 |

| 0.61 |

| N/A |

|

|

| 1.12 |

| 0.98 |

| 0.81 |

| 0.80 |

| 0.61 |

| ||||||||

Efficiency ratio |

|

| 64.11 |

| 66.90 |

| 65.94 |

| 75.53 |

| 92.76 |

|

|

| 60.70 |

| 64.12 |

| 66.90 |

| 65.94 |

| 75.53 |

| ||||||||

Average equity to average assets |

|

| 7.10 |

| 6.83 |

| 7.28 |

| 6.75 |

| 7.62 |

|

|

| 8.15 |

| 7.10 |

| 6.83 |

| 7.28 |

| 6.75 |

| ||||||||

Yield on average interest-earning assets |

|

| 6.25 |

| 5.10 |

| 5.29 |

| 5.84 |

| 7.52 |

|

|

| 7.33 |

| 6.25 |

| 5.10 |

| 5.29 |

| 5.84 |

| ||||||||

Cost of interest-bearing liabilities |

|

| 2.74 |

| 1.63 |

| 1.63 |

| 2.28 |

| 4.09 |

|

|

| 4.09 |

| 2.74 |

| 1.63 |

| 1.63 |

| 2.28 |

| ||||||||

Net interest rate spread |

|

| 3.51 |

| 3.47 |

| 3.66 |

| 3.56 |

| 3.43 |

|

|

| 3.24 |

| 3.51 |

| 3.47 |

| 3.66 |

| 3.56 |

| ||||||||

Net interest rate margin |

|

| 4.11 |

| 3.84 |

| 4.01 |

| 4.00 |

| 4.12 |

|

|

| 4.01 |

| 4.11 |

| 3.84 |

| 4.01 |

| 4.00 |

| ||||||||

Nonperforming loans to total loans |

|

| 0.14 |

| 0.20 |

| 0.20 |

| 0.57 |

| 0.62 |

|

|

| 0.49 |

| 0.14 |

| 0.20 |

| 0.20 |

| 0.57 |

| ||||||||

Nonperforming assets to total assets |

|

| 0.11 |

| 0.18 |

| 0.17 |

| 0.46 |

| 0.49 |

|

|

| 0.52 |

| 0.11 |

| 0.18 |

| 0.17 |

| 0.46 |

| ||||||||

Net chargeoffs to average loans |

|

| 0.02 |

| 0.13 |

| 0.22 |

| 0.14 |

| 0.49 |

|

|

| 0.10 |

| 0.02 |

| 0.13 |

| 0.22 |

| 0.14 |

| ||||||||

Allowance for loan losses to total loans |

|

| 1.30 |

| 1.30 |

| 1.35 |

| 1.27 |

| 1.21 |

|

|

| 1.30 |

| 1.30 |

| 1.30 |

| 1.35 |

| 1.27 |

| ||||||||

Dividend payout ratio - basic |

|

| 12.58 |

| 11.76 |

| 11.11 |

| 13.21 |

| N/A |

|

|

| 12.78 |

| 12.58 |

| 11.76 |

| 11.11 |

| 13.21 |

| ||||||||

1011

ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Introduction

INTRODUCTION

The following discussion and analysisobjective of this section is intended to review the significant factorsprovide an overview of the financial condition and results of operations of the Company for the three-year periodthree years ended December 31, 2005.2006. It should be read in conjunction with the accompanying consolidated financial statementsConsolidated Financial Statements, Notes and the selectedother financial data presented elsewhere in this report.

The Company has prepared all of the consolidated financial information in this report, in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). In preparing the consolidated financial statements in accordance with U.S. GAAP, the Company makes estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurances that actual results will not differ from those estimates.

EXECUTIVE SUMMARYThis overview of management’s discussion and analysis highlights selected information in this document and may not contain all ofparticularly the information that is important to you. For a more complete understanding of trends, events, commitments, uncertainties, liquidity, capital resources and critical accounting estimates, you should carefully read this entire document.

Net income increased 37% to $11.3 million or $1.05 per fully diluted share compared to $8.2 million or $0.82 per fully diluted share in 2004.

Our banking line of business posted strong loan and deposit growth. Average earning assets increased by $132.7 million or 14%. Portfolio loans grew by $104 million, or 12% and ended the year at $1 billion. The investment portfolio grew to $136 million, a $14 million or 11% increase over 2004. Deposits grew 19%, or $177 million and the bank was able to maintain an attractive deposit mix, with 20% of the total held in interest free demand deposits.

Asset quality remained strong. Non-performing loans were just $1.4 million or 0.14% of portfolio loans and net charge-offs represented only 0.02% of average loans for the year. The allowance for loan losses was $13.0 million or 1.30% of portfolio loans vs. $11.7 million (also 1.30%) at the end of 2004. The increase in the allowance was the net result of $1.5 million of provision for loan losses slightly offset by $200,000 of net loan charge-offs in the year. In 2004, the provision for loan losses was $2.2 million and net loan charge-offs were $1.1 million. The decline in the provision for loan losses was due to lower non-performing loan levels, continued strengthening of the St. Louis and Kansas City economies and continued low delinquency rates.

The Company’s fully tax-equivalent net interest rate margin increased from 3.84% to 4.11%, year-to-year. The 27 basis point improvement in net interest rate margin was primarily due to rising interest rates and the greater benefit of free balances (demand deposits and shareholders’ equity). In 2005, the net interest spread improved 4 basis points to 3.51% as increases in earning asset yields were largely offset by increases in the cost of interest-bearing liabilities.

Deposit service charges of $2.1 million were essentially flat with those posted in 2004. A rising earnings credit rate throughout 2005 offset much of the benefit of the growth in numbers of accounts and services provided during the year.

Total Wealth Management income increased by 53%, or $2.3 million, to $6.5 million during the year driven by strong growth in the company’s Trust and Wealth Products Groups. This included $780,000 of commission income earned by Millennium, which was acquired in October 2005. Factoring out the benefit of the Millennium acquisition, the company’s Wealth Management business increased its income by $1.5 million or 35% for the year. Assets under administration increased almost $225 million in 2005 as the result of a 25% increase in the net number of Trust client relationships. This increase was offset by $250 million of assets managed in a special common trust fund account which were distributed to clients as called for by contact in the fourth quarter of 2005.

During the late third and throughout the fourth quarter of 2005, the Company elected to reposition a portion of its investment portfolio and recognized net losses of $494,000. Increases in market rates for the two through four-year maturity ranges and the company’s overall interest rate sensitivity presented an opportunity to strengthen the expected total return on portfolio investments for 2006 and 2007.

11

Whileregarding the Company’s long range business model (see Form 8-K filing dated July 22, 2005) calls for noninterest expenses to grow on average 10% or less per year through 2010, these expenses grew 17% or $5 millionoperations described in 2005 over the $29.3 million reported in 2004. Excluding expenses incurred by Millennium of $504,000 and $152,000 of amortization expenses related to that acquisition, noninterest expenses increased $4.3 million or 15%. Our three-year compound annual growth rate (ending 2005) in noninterest expenses was 8%, still well under our 10% goal, and expense management remains a priority for us. The Company’s efficiency ratio improved from 67% to 64% in 2005.

Employee compensation and benefits represent the largest expense increase. This was primarily due to increased payouts under the Company’s incentive bonus programs, including the 401(k) match program, which are tied to performance targets. See “NonInterest Expense” below for more information.

For the year ended December 31, 2005, the effective tax rate for the Company was 35.8%, an increase from the 33.2% rate in 2004. During 2004 the Company recognized a $241,000 reversal of the remaining deferred tax valuation allowance related to Merchant Banking losses in 2001 and the Company recognized state income tax refunds of $163,000 related to amendments of prior state income tax returns. See “Income Taxes” below for more information. Item 1.

CRITICAL ACCOUNTING POLICIES

The following accounting policies are considered most critical to the understanding of the Company’s financial condition and results of operations. These critical accounting policies require management’s most difficult, subjective and complex judgments about matters that are inherently uncertain. Because these estimates and judgments are based on current circumstances, they may change over time or prove to be inaccurate based on actual experiences. In the event that different assumptions or conditions were to prevail, and depending upon the severity of such changes, the possibility of a materially different financial condition and/or results of operations could reasonably be expected. The impact and any associated risks related to our critical accounting policies on our business operations are discussed throughout “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” where such policies affect our reported and expected financial results. For a detailed discussion on the application of these and other accounting policies, see Note 1 to our Consolidated Financial Statements.– Significant Accounting Policies in this filing.

The Company has prepared all of the consolidated financial information in this report in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The Company makes estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurances that actual results will not differ from those estimates.

Allowance for Loan LossesSubject to the use of estimates, assumptions, and judgments, management’s evaluation process used to determine the adequacy of the

The Company maintains an allowance for loan losses combines several factors:(“the allowance”), which is intended to be management’s ongoingbest estimate of probable inherent losses in the outstanding loan portfolio. The allowance is based on management’s continuing review and evaluation of the loan portfolio;portfolio. The review and evaluation combines several factors including: consideration of past loan loss experience; trends in past due and nonperforming loans; risk characteristics of the various classifications of loans; existing economic conditions; the fair value of underlying collateral; and other qualitative and quantitative factors which could affect probable credit losses.

Because current economic conditions can change and future events are inherently difficult to predict, the anticipated amount of estimated loan losses, and therefore the adequacy of the allowance, could change significantly. As an integral part of their examination process, various regulatory agencies also review the allowance for loan losses. SuchThese agencies may require that certain loan balances be charged off when their credit evaluations differ from those of management, based on their judgments about information available to them at the time of their examination. The Company believes the allowance for loan losses is adequate and properly recorded in the consolidated financial statements.

Derivative Financial Instruments

The Company employsuses derivative financial instruments to assist in its management ofmanaging interest rate sensitivity by modifyingsensitivity. The derivative financial instruments used are interest rate swaps. Derivative financial instruments are required to be measured at fair value and recognized as either assets or liabilities in the repricing, maturityconsolidated financial statements. Fair value represents the payment the Company would receive or pay if the item were sold or bought in a current transaction. Fair values are generally based on market quotes. The accounting for changes in fair value (gains or losses) of a derivative depends on whether the derivative is designated and option characteristicsqualifies for “hedge accounting.” In accordance with Statement of certain assetsFinancial Accounting Standards No. 133 (“SFAS No. 133”) Accounting for Derivative Instruments and liabilities. Hedging Activities, the Corporation assigns derivatives to one of these categories at the purchase date: