ITEM 6.SELECTED FINANCIAL DATA.

| Fiscal Years Ended |

| February 3, | | January 28, | | January 29, | | January 31, | | February 1, |

| 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| (53 weeks) | | (52 weeks) | | (52 weeks) | | (52 weeks) | | (52 weeks) |

| (In millions, except per share amounts) |

| Sales | $ | 66,111 | | $ | 60,553 | | $ | 56,434 | | | $ | 53,791 | | $ | 51,760 | |

| Earnings (loss) before cumulative effect of accounting | | | | | | | | | | | | | | | | |

| change | | 1,115 | | | 958 | | | (104 | ) | | | 285 | | | 1,218 | |

| Cumulative effect of accounting change(1) | | — | | | — | | | — | | | | — | | | (16 | ) |

| Net earnings (loss) | | 1,115 | | | 958 | | | (104 | ) | | | 285 | | | 1,202 | |

| Diluted earnings (loss) per share: | | | | | | | | | | | | | | | | |

| Earnings (loss) before cumulative effect of accounting | | | | | | | | | | | | | | | | |

| change | | 1.54 | | | 1.31 | | | (0.14 | ) | | | 0.38 | | | 1.54 | |

| Cumulative effect of accounting change(1) | | — | | | — | | | — | | | | — | | | (0.02 | ) |

| Net earnings (loss) | | 1.54 | | | 1.31 | | | (0.14 | ) | | | 0.38 | | | 1.52 | |

| Total assets | | 21,215 | | | 20,482 | | | 20,491 | | | | 20,767 | | | 20,349 | |

| Long-term liabilities, including obligations under capital | | | | | | | | | | | | | | | | |

| leases and financing obligations | | 8,711 | | | 9,377 | | | 10,537 | | | | 10,515 | | | 10,569 | |

| Shareowners’ equity | | 4,923 | | | 4,390 | | | 3,619 | | | | 4,068 | | | 3,937 | |

| Cash dividends per common share(2) | | 0.195 | | | — | | | — | | | | — | | | — | |

| | Fiscal Years Ended | |

| | January 31,

2009

(52 weeks) | | February 2,

2008

(52 weeks) | | February 3,

2007

(53 weeks) | | January 28,

2006

(52 weeks) | | January 29,

2005

(52 weeks) | |

| | (In millions, except per share amounts) | |

Sales | | $ | 76,000 | | $ | 70,235 | | $ | 66,111 | | $ | 60,553 | | $ | 56,434 | |

Net earnings (loss) | | 1,249 | | 1,181 | | 1,115 | | 958 | | (104 | ) |

Diluted earnings (loss) per share: | | | | | | | | | | | |

Net earnings (loss) | | 1.90 | | 1.69 | | 1.54 | | 1.31 | | (0.14 | ) |

Total assets | | 23,211 | | 22,293 | | 21,210 | | 20,478 | | 20,491 | |

Long-term liabilities, including obligations under capital leases and financing obligations | | 10,311 | | 8,696 | | 8,711 | | 9,377 | | 10,537 | |

Shareowners’ equity | | 5,176 | | 4,914 | | 4,923 | | 4,390 | | 3,619 | |

Cash dividends per common share | | 0.345 | | 0.29 | | 0.195 | | — | | — | |

| | | | | | | | | | | | | | | | |

10

(1) | | Amounts are net of tax. |

|

(2) | | During the fiscal year ended February 2, 2002, the Company was prohibited from paying cash dividends under the terms of its previous Credit Agreement. On May 22, 2002, the Company entered into a new Credit Agreement, at which time the restriction on payment of cash dividends was eliminated. |

ITEM 7. | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.OPERATIONS. |

OUR BUSINESS

The Kroger Co. was founded in 1883 and incorporated in 1902. It is one of the nation’s largest retailers, as measured by revenue, operating 2,4682,481 supermarket and multi-department stores under two dozen banners including Kroger, Ralphs, Fred Meyer, Food 4 Less, King Soopers, Smith’s, Fry’s, Fry’s Marketplace, Dillons, QFC and City Market. Of these stores, 631 had781 have fuel centers. We also operate 779771 convenience stores and 412385 fine jewelry stores.

Kroger operates 4240 manufacturing plants, primarily bakeries and dairies, which supply approximately 55%40% of the corporate brand units sold in the Company’sour retail outlets.

Our revenues are earned and cash is generated as consumer products are sold to customers in our stores. We earn income predominately by selling products at price levels that produce revenues in excess of ourthe costs we incur to make these products available to our customers. Such costs include procurement and distribution costs, facility occupancy and operational costs, and overhead expenses. Our operations are reported as a single reportable segment: the retail sale of merchandise to individual customers.

OUR 2006 2008 PERFORMANCE

The continued focus

By focusing on the customer through our Customer 1st strategy, we were able to report solid results for fiscal year 2008 in a particularly tough economy. At the beginning of our associates on delivering improved service, product selection and valuethe year, we expected to our customers generated a year of significantly improvedgrow supermarket identical supermarket sales growth, excluding fuel sales, in 2006. Our identical supermarket sales, excluding fuel, sales, grew at 5.6% in 2006. These results followed strong 2005by 3% to 5%. For 2008, supermarket identical supermarket sales, excluding fuel, sales,were 5.0%, meeting the upper end of 3.5% in 2005our original guidance.

At the outset of fiscal year 2008, Kroger’s earnings guidance was a range of $1.83 to $1.90 per diluted share. Our 2008 earnings was $1.90 per diluted share or $1.92 per diluted share, excluding the effect of a $.02 per diluted share charge for damage and 0.8% in 2004.disruption caused by Hurricane Ike. Our 2008 earnings of $1.92 per diluted share, excluding the charge for damage and disruption caused by Hurricane Ike, represents a growth rate of 13.6% over Kroger’s 2007 full-year earnings of $1.69 per diluted share. We believe that this growth plus Kroger’s dividend yield of more than 1%, creates a strong return for shareholders.

Increasing

Our market share helped us achievealso rose in 2008. Based on our results. Our internal data and analysis, showswe estimate that we hold the #1 or #2our market share positionincreased approximately 61 basis points in 38 of2008 across our 4442 major markets. We define a major market as one in which we operate nine or more stores. OurThis is the fourth consecutive year Kroger has achieved significant market share increased in 36 of these 44 major markets, declined in seven and remained unchanged in one. On a volume-weighted basis, our overallgain. Over the past four years combined, Kroger’s market share in these 44our major markets has increased approximately 65225 basis points during 2006.points. Market share is critical to us because it allows us to leverage the fixed costs in our business over a wider revenue base. We hold the number one or number two market share position in 39 of or our 42 major markets. Our fundamental operating philosophy is to maintain and increase market share.

We compete against a total of 1,262 supercenters, an increase of 133 over 2005. There are 34

These market share results demonstrate to us that our long-term strategy is working. As population growth continues in the major markets in which supercenters have achieved at least a #3where we operate, we intend to continue to grow Kroger’s business by maintaining our existing strong market share position. Our overall market share in these 34 major markets,and by building on a volume-weighted basis, increased over 70 basis points during 2006. Our market share increased in 27 of these 34 major markets, declined in six and remained unchanged in one.

All of the market share estimates described above are based on our internal data and analysis.additional opportunities for sales growth. We believe they are reliable but can provide no other assurance of reliability. We believe this market share analysis illustratesestimate that Kroger continued to achieve significant growth in 2006, even in the face of aggressive expansion in the supermarket industry by supercenters, intense price competition, increasing fragmentation of retail formats and market consolidation. Our retail price investments, combined with our service and selling initiatives, led to these market share gains in 2006. We believe there is still significant room for growth. In our 44 major markets, we estimate approximately 47%45% of the share in thoseour major markets continues to be— as much as $100 billion — is held by competitors without ourwho do not have Kroger’s economies of scale. Our economies of scale allow us to deliver increasing value to customers, which is a competitive edge, particularly in today’s economic climate.

We were able to balance our sales growth with earnings growth. Our net earnings increased 16.4% to $1.54 per diluted share in 2006, from $1.31 per diluted share in 2005. Earnings growth was primarily driven by strong identical supermarket sales growth, improving operating margins and fewer shares outstanding. In addition, fiscal 2006 included a 53rd week that benefited the year by an estimated $0.07 per diluted share, adjustments to certain deferred tax balances that benefited the year by $0.03 per diluted share, expense totaling $0.03 per diluted share for increases in legal reserves, and $0.06 per diluted share of expense for the adoption of stock option expensing.

FUTURE EXPECTATIONS

While we were pleased with our 2006 results, we must continue to adjust ourKroger’s business model is structured to meet the changing needs and expectations of our customers. Our plan requires balance between sales growth, earnings growth and profitable capital investment.

We expect to achieve identical supermarket sales growth through merchandising and operating initiatives that improve the shopping experience for our customers and continue building customer loyalty. We expect identical supermarket sales growth, excluding fuel sales, of 3%-5% in 2007.

To the extent that these sales initiatives involve price reductions or additional costs, we expect they will be funded by operating cost reductions and productivity improvements. We expect sales improvements and cost reductions, combined with fewer shares outstanding, to driveproduce sustainable earnings per share growth in 2007.a variety of economic and competitive conditions, primarily through strong identical sales growth. We expectbelieve this is the right approach to produce sustainable earnings per sharegrowth over a long period of time. We recognize that continual investment in 2007 of $1.60-$1.65 per diluted share. This represents earnings per share growth of approximately 9%-12% in 2007, net of the effect of a 53rd week in fiscal 2006 of approximately $0.07 per diluted share.our Customer 1

In addition, on March 15, 2007, the Board of Directors declared an increase in Kroger’s quarterly dividendst strategy is necessary to $0.075 per share.drive strong, sustainable identical sales growth. We believe that this Customer 1st

Further discussion on strategy along with our industry, the current economic environmentfinancial strategies are delivering value to customers, shareholders, bondholders, and our related strategic plans is included in the “Outlook” section.associates, and so we remain committed to our plan.

11

RESULTSOF OPERATIONS

The following discussion summarizes our operating results for 20062008 compared to 20052007 and for 20052007 compared to 2004.2006. Comparability is affected by certain income and expense items that fluctuated significantly between and among the periods, including goodwill and asset impairment charges and a labor dispute in southern California in 2004.periods.

Net Earnings (Loss)

Net earnings totaled $1,115 million$1.2 billion for 2006,2008, compared to net earnings totaling $958 million$1.2 billion in 20052007 and a net loss totaling $104 million$1.1 billion in 2004.2006. The increase in our net earnings for 2006,2008, compared to 20052007 and 2004,2006, resulted from improvements in the southern California market and the leveraging of fixed costs with strong non-fuel identical supermarket sales growth as well as the effect ofand strong fuel results. In addition, 2006 net earnings included a 53rd week in 2006. In addition, 2004 was negatively affected by goodwill charges totaling $904 million, as well as a labor dispute in southern California. week.

Earnings per diluted share totaled $1.54$1.90 or $1.92, excluding the effect of a $.02 per diluted share charge for damage and disruption caused by Hurricane Ike, in 2006,2008, compared to $1.31 per share in 2005 and a net loss of $0.14$1.69 per diluted share in 2004.2007 and $1.54 per diluted share in 2006. Earnings per diluted share increased 13.6% in 2008, excluding the effect of a $.02 per diluted share charge for damage and disruption caused by Hurricane Ike, compared to 2007. Earnings per diluted share increased 15% in 2007, compared to 2006, after adjusting for the extra week in fiscal 2006. Net earnings in 2006 benefited from a 53rd week by $0.07an estimated $.07 per share due to the 53rd week and $0.03 per share from the adjustment of certain deferred tax balances. Net earnings in 2006 also included expense of $0.03 per share recorded for legal reserves. Net earnings were reduced by $1.16 per share in 2004 due to the effects of goodwill impairment charges.share. Our earnings per share growth in 20062008, 2007 and 20052006 resulted from increased net earnings, strong identical sales growth and the repurchase of Kroger stock. During fiscal 2008, we repurchased 24 million shares of Kroger stock for a total investment of $637 million. During fiscal 2007, we repurchased 53 million shares of our stock for a total investment of $1.4 billion. During fiscal 2006, we repurchased 29 million shares of Kroger stock for a total investment of $633 million. During fiscal 2005, we repurchased 15 million shares of

Sales

Total Sales

(in millions)

| | 2008 | | Percentage

Increase | | 2007 | | Percentage

Increase | | 2006 | |

Total food store sales without fuel | | $ | 63,795 | | 6.1 | % | $ | 60,142 | | 4.2 | % | $ | 57,712 | |

Total food store fuel sales | | 7,464 | | 30.0 | % | 5,741 | | 28.9 | % | 4,455 | |

| | | | | | | | | | | |

Total food store sales | | $ | 71,259 | | 8.2 | % | $ | 65,883 | | 6.0 | % | $ | 62,167 | |

Other sales(1) | | 4,741 | | 8.9 | % | 4,352 | | 10.3 | % | 3,944 | |

| | | | | | | | | | | |

Total Sales | | $ | 76,000 | | 8.2 | % | $ | 70,235 | | 6.2 | % | $ | 66,111 | |

(1) Other sales primarily relate to sales at convenience stores, including fuel, jewelry stores and sales by our stock for a total investment of $252 million. During fiscal 2004, we repurchased 20 million shares of Kroger stock for a total investment of $319 million.manufacturing plants to outside customers.

Sales

| Total Sales |

| (in millions) |

| | | | | Percentage | | | | | Percentage | | | |

| | 2006 | | Increase | | 2005 | | Increase | | 2004 |

| Total food store sales without fuel | $ | 57,712 | | 7.9 | % | | $ | 53,472 | | 4.6 | % | | $ | 51,106 |

| Total food store fuel sales | | 4,455 | | 26.3 | % | | | 3,526 | | 53.0 | % | | | 2,305 |

| |

| Total food store sales | $ | 62,167 | | 9.1 | % | | $ | 56,998 | | 6.7 | % | | $ | 53,411 |

| Other sales(1) | | 3,944 | | 10.9 | % | | | 3,555 | | 17.6 | % | | | 3,023 |

| |

| Total Sales | $ | 66,111 | | 9.2 | % | | $ | 60,553 | | 7.3 | % | | $ | 56,434 |

(1) | | Other sales primarily relate to sales at convenience stores, including fuel, jewelry stores and sales by our manufacturing plants to outside firms. |

The growth in our total sales in 2008 over fiscal 2007 was primarily the result of identical storesupermarket sales increases, the addition of a 53rd week in 2006increased fuel gallon sales, and inflation in pharmacyacross most departments. Identical supermarket sales and some perishable commodities. Increasedtotal sales, excluding fuel, increased due to increased transaction count and average transaction size, were both responsible for our increases in identical supermarket sales, excluding retail fuel operations.and inflation across all departments. After adjusting for the extra week in fiscal 2006, total sales increased 7.0%8.2% in 2007 over fiscal 2005.2006.

We define a supermarket as identical when it has been in operation without expansion or relocation for five full quarters. Fuel center discounts received at our fuel centers and earned based on in-store purchases are included in all of the supermarket identical sales results calculations illustrated below. Differences between total supermarket sales and identical supermarket sales primarily relate to changes in supermarket square footage. Annualized identical supermarket sales include all sales at the Fred Meyer multi-department stores. We calculate annualized identical supermarket sales based on a summation ofby adding together four quarters of identical supermarket sales. Our identical supermarket sales results are summarized in the table below, based on the 53-week52-week period of 2006,2008, compared to the same 53-week52-week period of the previous year. The identical store count in the table below represents the total number of identical supermarkets as of January 31, 2009 and February 2, 2008.

12

| Identical Supermarket Sales |

| (in millions) |

| | 2006 | | 2005 |

| Including supermarket fuel centers | $ | 59,592 | | | $ | 55,993 | |

| Excluding supermarket fuel centers | $ | 55,399 | | | $ | 52,483 | |

| |

| Including supermarket fuel centers | | 6.4 | % | | | 5.3 | % |

| Excluding supermarket fuel centers | | 5.6 | % | | | 3.5 | % |

Identical Supermarket Sales

(in millions)

| | 2008 | | 2007 | |

Including supermarket fuel centers | | $ | 67,185 | | $ | 62,878 | |

Excluding supermarket fuel centers | | $ | 60,300 | | $ | 57,416 | |

| | | | | | | |

Including supermarket fuel centers | | 6.9 | % | 6.9 | % |

Excluding supermarket fuel centers | | 5.0 | % | 5.3 | % |

Identical 4th Quarter store count | | 2,369 | | 2,280 | |

We define a supermarket as comparable when it has been in operation for five full quarters, including expansions and relocations. As is the case for identical supermarket sales, fuel center discounts received at our fuel centers and earned based on in-store purchases are included in all of the supermarket comparable sales results calculations illustrated below. Annualized comparable supermarket sales include all Fred Meyer multi-department stores. We calculate annualized comparable supermarket sales based on a summation ofby adding together four quarters of comparable sales. Our annualized comparable supermarket sales results are summarized in the table below, based on the 53-week52-week period of 2006,2008, compared to the same 53-week52-week period of the previous year. The comparable store count in the table below represents the total number of comparable supermarkets as of January 31, 2009 and February 2, 2008.

| Comparable Supermarket Sales |

| (in millions) |

| | 2006 | | 2005 |

| Including supermarket fuel centers | $ | 61,045 | | | $ | 57,203 | |

| Excluding supermarket fuel centers | $ | 56,702 | | | $ | 53,622 | |

| |

| Including supermarket fuel centers | | 6.7 | % | | | 5.9 | % |

| Excluding supermarket fuel centers | | 5.7 | % | | | 3.9 | % |

Comparable Supermarket Sales

(in millions)

| | 2008 | | 2007 | |

Including supermarket fuel centers | | $ | 69,762 | | $ | 65,066 | |

Excluding supermarket fuel centers | | $ | 62,492 | | $ | 59,372 | |

| | | | | | | |

Including supermarket fuel centers | | 7.2 | % | 7.2 | % |

Excluding supermarket fuel centers | | 5.3 | % | 5.5 | % |

Comparable 4th Quarter store count | | 2,444 | | 2,352 | |

FIFO Gross Margin

We calculate First-In, First-Out (“FIFO”) Gross Margin as follows: Salessales minus merchandise costs, plus Last-In, First-Out (“LIFO”) charge (credit). Merchandise costs includeincluding advertising, warehousing and transportation, but excluding the Last-In, First-Out (“LIFO”) charge. Merchandise costs exclude depreciation expense and rent expense. FIFO gross margin is an important measure used by our management to evaluate merchandising and operational effectiveness.

Our FIFO gross margin rates were 24.27%, 24.80%23.20% in 2008, 23.65% in 2007 and 25.38%24.27% in 2006, 2005 and 2004, respectively. Retail2006. Our retail fuel sales loweredreduce our FIFO gross margin rate due to the very low FIFO gross margin on retail fuel sales as compared to non-fuel sales. Excluding the effect of retail fuel operations, our FIFO gross margin rates were 26.43%, 26.69%decreased 15 basis points in 2008, 20 basis points in 2007 and 26.73%26 basis points in 2006, 2005 and 2004, respectively.2006. The decrease in our non-fuel FIFO gross margin rate reflects our continued reinvestment of operating cost savings into lower prices for our customers. In addition, FIFO gross margin in 2008, compared to 2007, decreased due to high inflation in product costs.

LIFO Charge

The LIFO charge was $196 million in 2008, $154 million in 2007 and $50 million in 2006. Like many food retailers, we continued to experience product cost inflation in 2008 at levels that have not occurred for several years. This increase in product cost inflation caused the increase in the LIFO charge in 2008, compared to 2007 and 2006. In addition, product cost inflation in 2007, compared to 2006, caused the increase in the LIFO charge in 2007 compared to 2006.

Operating, General and Administrative Expenses

Operating, general and administrative (“OG&A”) expenses consist primarily of employee-related costs such as wages, health care benefit costs and retirement plan costs. Among other items, rentcosts, utilities and credit card fees. Rent expense, depreciation and amortization expense, and interest expense are not included in OG&A.

13

OG&A expenses, as a percent of sales, were 17.91%, 18.21%16.95% in 2008, 17.31% in 2007 and 18.76%17.91% in 2006, 2005 and 2004, respectively.2006. The growth in our retail fuel sales lowersreduces our OG&A rate due to the very low OG&A rate on retail fuel sales as compared to non-fuel sales. Excluding the effect of retail fuel operations, our OG&A expenses, as a percent of sales were 19.59%, 19.68%excluding fuel, decreased 3 basis points in 2008, 33 basis points in 2007 and 19.81%9 basis points in 2006, 2005 and 2004, respectively. Excluding2006. The decrease in our OG&A rate in 2008, excluding the effect of retail fuel operations, expenses recorded for legal reserveswas primarily the result of increased identical supermarkets sales growth and stock option expense,a settlement received from credit card processers, partially offset by the $25 million charge related to Hurricane Ike and increases in credit card fees and health care costs. The decrease in our OG&A rate declined 28 basis points in 2006. This decrease2007, excluding the effect of retail fuel operations, was driven byprimarily the result of strong identical store sales growth, by increasing store laborincreased productivity, and by progress we havethat was made in 2007 in controlling our utility, health care and pension costs. These improvements were partially offset by increases in pension expense and credit card fees. Excluding the effect of retail fuel operations and expenses recorded for one-time legal reserves, our OG&A rate declined 16 basis points in 2006.

Rent Expense

Rent expense was $659 million in 2008, as compared to $644 million in 2007 and $649 million in 2006, as compared to $661 million and $680 million in 2005 and 2004, respectively.2006. Rent expense, as a percent of sales, was 0.98%0.87% in 2006,2008, as compared to 1.09%0.92% in 20052007 and 1.21%0.98% in 2004.2006. The decrease in rent expense, as a percent of sales, reflects our increasing sales leverage and our continued emphasis on ownership of real estate when available, as well as decreased charges for closed-store future rent liabilities in 2006 and 2005 compared to 2004.owning rather than leasing whenever possible.

Depreciation and Amortization Expense

Depreciation and amortization expense was $1,272 million, $1,265 million$1.4 billion in 2008, $1.4 billion in 2007 and $1,256 million for 2006, 2005 and 2004, respectively.$1.3 billion in 2006. The increases in depreciation and amortization expense were the result of capital expenditures totaling $1,777 million, $1,306 million$2.2 billion in 2008, $2.1 billion in 2007 and $1,634 million$1.8 billion in 2006, 2005 and 2004, respectively.2006. Depreciation and amortization expense, as a percent of sales, was 1.92%, 2.09%1.90% in 2008, 1.93% in 2007 and 2.23%1.92% in 2006, 2005 and 2004, respectively.2006. The decrease in our depreciation and amortization expense in 2008, compared to 2007, as a percent of sales, is primarily the result of totalincreasing sales. The increase in our depreciation and amortization expense in 2007, compared to 2006, as a percent of sales, increases.is due to an annual depreciation charge in both years with 2006 containing 53 weeks of sales due to the structure of our fiscal calendar.

Interest Expense

Net interest expense totaled $485 million in 2008, $474 million in 2007 and $488 million $510 million and $557 millionin 2006. The increase in interest expense in 2008, compared to 2007, was primarily the result of an increase in the average total debt balance for 2006, 2005 and 2004, respectively.the year, partially offset by interest income related to the mark-to-market of ineffective fair value swaps. The decrease in interest expense in 2007, compared to 2006, was the result of replacing borrowings with new borrowings at a lower interest rate. The average borrowings. During 2006, we reduced total debt $173 million from $7.2 billion as of January 28, 2006,balance in 2007 was comparable to $7.1 billion as of February 3, 2007. Interest expense in 2004 included $25 million related to the early retirement of debt.2006.

Income Taxes

Our effective income tax rate was 36.2%, 37.2%36.5% in 2008, 35.4% in 2007 and 136.4% for 2006, 2005 and 2004, respectively.36.2% in 2006. The effective tax rates for 2006 and 2005 differthose years differed from the federal statutory rate primarily due to the effect of state income taxes. In addition, the effective tax rate for 2004 due to the impairment of non-deductible goodwill in 2004. The effective income tax rates also differ2007 differs from the expected federal statutory rate in all years presented due to the effectresolution of state taxes as well as thesome tax issues. The effective rate in 2006 includes an adjustment of certainsome deferred tax balancesbalances.

During the third quarter of 2007, we resolved favorably some outstanding tax issues. This resulted in 2006.a 2007 tax benefit of approximately $40 million and reduced our effective tax rate by 1.9%.

During

In 2006, during the reconciliation of our deferred tax balances, and after the filing of our annual federal and state tax returns, we identified adjustments to be made in the previousprior years’ deferred tax reconciliation. We corrected these deferred tax balances in our Consolidated Financial Statements for the year ended February 3, 2007, which resulted in a reduction of our fiscal 2006 provision for income tax expense of approximately $21 million and reduced the rate by 120 basis points.1.2%. We do not believe these adjustments are material to our Consolidated Financial Statements for the year ended February 3, 2007, or to any prior years’ Consolidated Financial Statements. As a result, we have not restated any prior year amounts.

14

COMMON STOCK REPURCHASE PROGRAM

We maintain a stock repurchase programprograms that compliescomply with Securities Exchange Act Rule 10b5-1 toand allow for the orderly repurchase of our common stock, from time to time. We made open market purchases totaling $448 million in 2008, $1.2 billion in 2007 and $374 million $239 million and $291 millionin 2006 under thisthese repurchase program during fiscal 2006, 2005 and 2004, respectively.programs. In addition to thisthese repurchase program,programs, in December 1999 we began a program to repurchase common stock to reduce dilution resulting from our employee stock option plans. This program is solely funded by proceeds from stock option exercises, includingand the tax benefit from these exercises. We repurchased approximately $189 million in 2008, $270 million in 2007 and $259 million $13 million and $28 millionin 2006 under the stock option programprograms.

In 2008, to preserve liquidity and financial flexibility, we reduced the amount of stock repurchased during 2006, 2005 and 2004, respectively.the year, decreasing the cash used for stock purchases in 2008, compared to 2007.

CAPITAL EXPENDITURES

Capital expenditures, including changes in construction-in-progress payablepayables and excluding acquisitions, totaled $1,777 million$2.2 billion in 20062008 compared to $1,306 million$2.1 billion in 20052007 and $1,634 million$1.8 billion in 2004.2006. The declineincrease in 2005capital spending in 2008 compared to 2007 and 2006 was the result of our emphasis on the tightening of capital and increasing our focus on remodels, merchandising and productivity projects. The table below shows our supermarket storing activity and our total food store square footage:

| Supermarket Storing Activity |

| | 2006 | | 2005 | | 2004 |

| Beginning of year | 2,507 | | | 2,532 | | | 2,532 | |

| Opened | 20 | | | 28 | | | 41 | |

| Opened (relocation) | 17 | | | 12 | | | 20 | |

| Acquired | 1 | | | 1 | | | 15 | |

| Acquired (relocation) | — | | | — | | | 3 | |

| Closed (operational) | (60 | ) | | (54 | ) | | (56 | ) |

| Closed (relocation) | (17 | ) | | (12 | ) | | (23 | ) |

| |

| End of year | 2,468 | | | 2,507 | | | 2,532 | |

| |

| Total food store square footage (in millions) | 142 | | | 142 | | | 141 | |

Supermarket Storing Activity

| | 2008 | | 2007 | | 2006 | |

Beginning of year | | 2,486 | | 2,468 | | 2,507 | |

Opened | | 21 | | 23 | | 20 | |

Opened (relocation) | | 14 | | 9 | | 17 | |

Acquired | | 6 | | 38 | | 1 | |

Acquired (relocation) | | 3 | | 1 | | — | |

Closed (operational) | | (32 | ) | (43 | ) | (60 | ) |

Closed (relocation) | | (17 | ) | (10 | ) | (17 | ) |

| | | | | | | |

End of year | | 2,481 | | 2,486 | | 2,468 | |

| | | | | | | |

Total food store square footage (in millions) | | 147 | | 145 | | 142 | |

CRITICAL ACCOUNTING POLICIES

We have chosen accounting policies that we believe are appropriate to report accurately and fairly our operating results and financial position, and we apply those accounting policies in a consistent manner. Our significant accounting policies are summarized in Note 1 to the Consolidated Financial Statements.

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses, and related disclosures of contingent assets and liabilities. We base our estimates on historical experience and other factors we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results could differ from those estimates.

We believe that the following accounting policies are the most critical in the preparation of our financial statements because they involve the most difficult, subjective or complex judgments about the effect of matters that are inherently uncertain.

15

Self-Insurance Costs

We primarily are self-insured for costs related to workers’ compensation and general liability claims. The liabilities represent our best estimate, using generally accepted actuarial reserving methods, of the ultimate obligations for reported claims plus those incurred but not reported for all claims incurred through February 3, 2007. CaseJanuary 31, 2009. We establish case reserves are established for reported claims using case-basis evaluation of the underlying claim data and are updatedwe update as information becomes known.

For both workers’ compensation and general liability claims, we have purchased stop-loss coverage to limit our exposure to any significant exposure on a per claim basis. We are insured for covered costs in excess of these per claim limits. TheWe account for the liabilities for workers’ compensation claims are accounted for on a present value basis utilizing a risk-adjusted discount rate. A 25 basis point decrease in our discount rate would increase our liability by approximately $3$4 million. General liability claims are not discounted.

We are also similarly self-insured for property-related losses. We have purchased stop-loss coverage to limit our exposure to losses in excess of $25 million on a per claim basis, except in the case of an earthquake, for which stop-loss coverage is in excess of $50 million per claim, up to $200 million per claim in California and $300 million outside of California.

The assumptions underlying the ultimate costs of existing claim losses are subject to a high degree of unpredictability, which can affect the liability recorded for such claims. For example, variability in inflation rates of health care costs inherent in these claims can affect the amounts realized. Similarly, changes in legal trends and interpretations, as well as a change in the nature and method of how claims are settled can affect ultimate costs. Our estimates of liabilities incurred do not anticipate significant changes in historical trends for these variables, and any changes could have a considerable effect uponon future claim costs and currently recorded liabilities.

Impairments of Long-Lived Assets

In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, we monitor the carrying value of long-lived assets for potential impairment each quarter based on whether certain trigger events have occurred. These events include current period losses combined with a history of losses or a projection of continuing losses or a significant decrease in the market value of an asset. When a trigger event occurs, we perform an impairment calculation, comparing projected undiscounted cash flows, utilizing current cash flow information and expected growth rates related to specific stores, to the carrying value for those stores. If we identify impairment for long-lived assets to be held and used, we compare the assets’ current carrying value to the assets’ fair value. Fair value is determined based on market values or discounted future cash flows to the asset’s current carrying value.flows. We record impairment when the carrying value exceeds the discounted cash flows.fair market value. With respect to owned property and equipment held for disposal, we adjust the value of the property and equipment to reflect recoverable values based on our previous efforts to dispose of similar assets and current economic conditions. We recognize impairment for the excess of the carrying value over the estimated fair market value, reduced by estimated direct costs of disposal. We recorded asset impairments in the normal course of business totaling $26 million in 2008, $24 million in 2007 and $61 million in 2006. We record costs to reduce the carrying value of long-lived assets in the Consolidated Statements of Operations as “Operating, general and administrative” expense.

The factors that most significantly affect the impairment calculation are our estimates of future cash flows. Our cash flow projections look several years into the future and include assumptions on variables such as inflation, the economy and market competition. Application of alternative assumptions and definitions, such as reviewing long-lived assets for impairment at a different organizational level, could produce significantly different results.

Goodwill

Goodwill

We review goodwill for impairment during the fourth quarter of each year, and also upon the occurrence of trigger events. TheWe perform reviews are performed at the operating division level. Generally, fair value representsis determined using a multiple of earnings, or discounted projected future cash flows, and we compare fair value to the carrying value of a division for purposes of identifying potential impairment. We base projected future cash flows on management’s knowledge of the current operating environment and expectations for the future. If we identify potential for impairment, we measure the fair value of a division against the fair value of its underlying assets and liabilities, excluding goodwill, to estimate an implied fair value of the division’s goodwill. We recognize goodwill impairment for any excess of the carrying value of the division’s goodwill over the implied fair value. If actual results differ significantly from anticipated future results for certain reporting units, we would need to recognize an impairment loss for any excess of the carrying value of the division’s goodwill over the implied fair value. Results of the goodwill impairment reviews performed during 2006, 20052008, 2007 and 20042006 are summarized in Note 2 to the Consolidated Financial Statements.

16

The annual impairment review requires the extensive use of accounting judgment and financial estimates. Application of alternative assumptions and definitions, such as reviewing goodwill for impairment at a different organizational level, could produce significantly different results. Similar to our policy on impairment of long-lived assets, the cash flow projections embedded in our goodwill impairment reviews can be affected by several items such as inflation, business valuations in the market, the economy and market competition.

Intangible Assets

In addition to goodwill, we have recorded intangible assets totaling $26 million, $22 million and $28 million for leasehold equities, liquor licenses and pharmacy prescription file purchases, respectively, at February 3, 2007. Balances at January 28, 2006, were $35 million, $20 million and $30 million for lease equities, liquor licenses and pharmacy prescription files, respectively. We amortize leasehold equities over the remaining life of the lease. We do not amortize owned liquor licenses, however, we amortize liquor licenses that must be renewed over their useful lives. We amortize pharmacy prescription file purchases over seven years. We consider these assets annually during our testing for impairment.

Store Closing Costs

We provide for closed store liabilities relating to the present value of the estimated remaining noncancellable lease payments after the closing date, net of estimated subtenant income. We estimate the net lease liabilities using a discount rate to calculate the present value of the remaining net rent payments on closed stores. TheWe usually pay closed store lease liabilities usually are paid over the lease terms associated with the closed stores, which generally have remaining terms ranging from one to 20 years. Adjustments to closed store liabilities primarily relate to changes in subtenant income and actual exit costs differing from original estimates. Adjustments are madeWe make adjustments for changes in estimates in the period in which the change becomes known. We review store closing liabilities quarterly to ensure that any accrued amount that is not a sufficient estimate of future costs, or that no longer is needed for its originally intended purpose, is adjusted to incomeearnings in the proper period.

We estimate subtenant income, future cash flows and asset recovery values based on our experience and knowledge of the market in which the closed store is located, our previous efforts to dispose of similar assets and current economic conditions. The ultimate cost of the disposition of the leases and the related assets is affected by current real estate markets, inflation rates and general economic conditions.

We reduce owned stores held for disposal to their estimated net realizable value. We account for costs to reduce the carrying values of property, equipment and leasehold improvements in accordance with our policy on impairment of long-lived assets. We classify inventory write-downs in connection with store closings, if any, in “Merchandise costs.” We expense costs to transfer inventory and equipment from closed stores as they are incurred.

Post-Retirement Benefit Plans,” Kroger contributes to several multi-employer pension plans based on obligations arising under collective bargaining agreements with unions representing employees covered by those agreements. The funding status of most of those pension funds has deteriorated, and it is probable that the Company’s contributions to those funds will increase significantly over the next several years. Despite the fact that the pension obligations of these funds are not the liability or responsibility of the Company, there is a risk that the agencies that rate Kroger’s outstanding debt instruments could view the underfunded nature of these plans unfavorably when determining their ratings on our debt securities. Any downgrading of Kroger’s debt ratings likely would increase Kroger’s cost of borrowing.

INSURANCE

We use a combination of insurance and self-insurance to provide for potential liability for workers’ compensation, automobile and general liability, property, director and officers’ liability, and employee health care benefits. Any actuarial projection of losses is subject to a high degree of variability. Changes in legal trends and interpretations, variability in inflation rates, changes in the nature and method of claims settlement, benefit level changes due to changes in applicable laws, insolvency or insurance carriers, and changes in discount rates could all affect ultimate settlements of claims.

CURRENT ECONOMIC CONDITIONS

The global economy and financial markets have declined and experienced volatility due to uncertainties related to energy prices, availability of credit, difficulties in the banking and financial services sectors, the decline in the housing market, diminished market liquidity, falling consumer confidence and rising unemployment rates. As a result, consumers are more cautious. This could lead to reduced consumer spending, to consumers switching to a less expensive mix of products, or to consumers trading down to discounters for grocery items, all of which could affect our sales growth. We are unable to predict when the global economy and financial markets will improve. If the global economy and financial markets do not improve, our results of operations and financial condition could be adversely affected.

ITEM 1B.UNRESOLVED STAFF COMMENTS.

None.

5

ITEM 2.PROPERTIES.

As of January 31, 2009, the Company operated more than 3,600 owned or leased supermarkets, convenience stores, fine jewelry stores, distribution warehouses and food processing facilities through divisions, subsidiaries or affiliates. These facilities are located throughout the United States. A majority of the properties used to conduct the Company’s business are leased.

The Company generally owns store equipment, fixtures and leasehold improvements, as well as processing and manufacturing equipment. The total cost of the Company’s owned assets and capitalized leases at January 31, 2009, was $23.9 billion while the accumulated depreciation was $10.7 billion.

Leased premises generally have base terms ranging from ten-to-twenty years with renewal options for additional periods. Some options provide the right to purchase the property after conclusion of the lease term. Store rentals are normally payable monthly at a stated amount or at a guaranteed minimum amount plus a percentage of sales over a stated dollar volume. Rentals for the distribution, manufacturing and miscellaneous facilities generally are payable monthly at stated amounts. For additional information on lease obligations, see Note 8 to the Consolidated Financial Statements.

ITEM 3.LEGAL PROCEEDINGS.

On October 6, 2006, the Company petitioned the Tax Court (In Re: Ralphs Grocery Company and Subsidiaries, formerly known as Ralphs Supermarkets, Inc., Docket No. 20364-06) for a redetermination of deficiencies set by the Commissioner of Internal Revenue. The dispute at issue involves a 1992 transaction in which Ralphs Holding Company acquired the stock of Ralphs Grocery Company and made an election under Section 338(h)(10) of the Internal Revenue Code. The Commissioner has determined that the acquisition of the stock was not a purchase as defined by Section 338(h)(3) of the Internal Revenue Code and that the acquisition does not qualify as a purchase. The Company believes that it has strong arguments in favor of its position and believes it is more likely than not that its position will be sustained. However, due to the inherent uncertainty involved in the litigation process, there can be no assurances that the Tax Court will rule in favor of the Company. As of January 31, 2009, an adverse decision would require a cash payment of up to approximately $436 million, including interest.

On February 2, 2004, the Attorney General for the State of California filed an action in Los Angeles federal court (California, ex rel Lockyer v. Safeway, Inc. dba Vons, a Safeway Company; Albertson’s, Inc. and Ralphs Grocery Company, a division of The Kroger Co., United States District Court Central District of California, Case No. CV04-0687) alleging that the Mutual Strike Assistance Agreement (the “Agreement”) between the Company, Albertson’s, Inc. and Safeway Inc. (collectively, the “Retailers”), which was designed to prevent the union from placing disproportionate pressure on one or more of the Retailers by picketing such Retailer(s) but not the other Retailer(s) during the labor dispute in southern California, violated Section 1 of the Sherman Act. The lawsuit seeks declarative and injunctive relief. On May 28, 2008, pursuant to a stipulation between the parties, the court entered a final judgment in favor of the defendants. As a result of the stipulation and final judgment, there are no further claims to be litigated at the trial court level. The Attorney General has appealed a trial court ruling to the Ninth Circuit Court of Appeals and the defendants are appealing a separate ruling. Although this lawsuit is subject to uncertainties inherent in the litigation process, based on the information presently available to the Company, management does not expect that the ultimate resolution of this action will have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

Various claims and lawsuits arising in the normal course of business, including suits charging violations of certain antitrust, wage and hour, or civil rights laws, are pending against the Company. Some of these suits purport or have been determined to be class actions and/or seek substantial damages. Any damages that may be awarded in antitrust cases will be automatically trebled. Although it is not possible at this time to evaluate the merits of all of these claims and lawsuits, nor their likelihood of success, the Company is of the belief that any resulting liability will not have a material adverse effect on the Company’s financial position.

The Company continually evaluates its exposure to loss contingencies arising from pending or threatened litigation and believes it has made adequate provisions therefor. Nonetheless, assessing and predicting the outcomes of these matters involve substantial uncertainties. It remains possible that despite management’s current belief, material differences in actual outcomes or changes in management’s evaluation or predictions could arise that could have a material adverse impact on the Company’s financial condition or results of operation.

6

ITEM 4.SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

(a)

COMMON STOCK PRICE RANGE

| | 2008 | | 2007 | |

Quarter | | High | | Low | | High | | Low | |

1st | | $ | 28.13 | | $ | 23.39 | | $ | 30.43 | | $ | 24.74 | |

2nd | | $ | 30.99 | | $ | 25.86 | | $ | 31.94 | | $ | 23.95 | |

3rd | | $ | 29.91 | | $ | 22.30 | | $ | 30.00 | | $ | 25.30 | |

4th | | $ | 29.03 | | $ | 22.40 | | $ | 29.35 | | $ | 24.23 | |

Main trading market: New York Stock Exchange (Symbol KR)

Number of shareholders of record at year-end 2008: 45,939

Number of shareholders of record at March 27, 2009: 45,712

During fiscal 2006, the Company’s Board of Directors adopted a dividend policy and paid three quarterly dividends of $0.065 per share. During fiscal 2007, the Company paid one quarterly dividend of $0.065 and three quarterly dividends of $0.075. During fiscal 2008, the Company paid one quarterly dividend of $0.075 and three quarterly dividends of $0.09. On March 1, 2009, the Company paid a quarterly dividend of $0.09 per share. On March 12, 2009, the Company announced that its Board of Directors has declared a quarterly dividend of $0.09 per share, payable on June 1, 2009, to shareholders of record at the close of business on May 15, 2009.

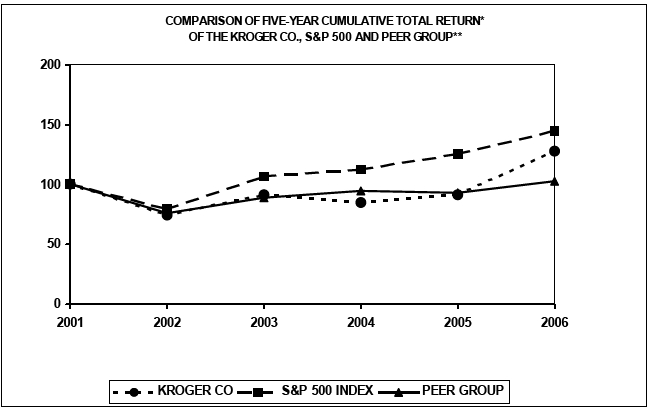

PERFORMANCE GRAPH

Set forth below is a line graph comparing the five-year cumulative total shareholder return on Kroger’s common stock, based on the market price of the common stock and assuming reinvestment of dividends, with the cumulative total return of companies in the Standard & Poor’s 500 Stock Index, a peer group composed of food and drug companies and a former peer group.

Historically, our peer group has consisted of the major food store companies. In recent years there have been significant changes in the industry, including consolidation and increased competition from supercenters, drug chains, and discount stores. As a result, several years ago we changed our peer group (the “Former Peer Group”) to include companies operating supermarkets, supercenters and warehouse clubs in the United States as well as the major drug chains with which Kroger competes. This year, we changed our peer group (the “Peer Group”) once again to add Tesco plc, as it has become a significant competitor in the U.S. market.

7

| | Base

Period | | INDEXED RETURNS

Years Ending | |

Company Name/Index | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | |

The Kroger Co. | | 100 | | 93.04 | | 100.22 | | 140.78 | | 143.01 | | 125.42 | |

S&P 500 Index | | 100 | | 105.34 | | 117.59 | | 135.22 | | 132.78 | | 80.51 | |

Peer Group | | 100 | | 108.99 | | 107.87 | | 122.24 | | 125.95 | | 102.29 | |

Former Peer Group | | 100 | | 107.06 | | 104.95 | | 115.57 | | 119.97 | | 96.11 | |

Kroger’s fiscal year ends on the Saturday closest to January 31.

* Total assumes $100 invested on February 1, 2004, in The Kroger Co., S&P 500 Index, the Peer Group and the Former Peer Group with reinvestment of dividends.

** The Peer Group consists of Albertson’s, Inc., Costco Wholesale Corp., CVS Corp, Delhaize Group SA (ADR), Great Atlantic & Pacific Tea Company, Inc., Koninklijke Ahold NV (ADR), Marsh Supermarkets Inc. (Class A), Safeway, Inc., Supervalu Inc., Target Corp., Tesco plc, Wal-Mart Stores Inc., Walgreen Co., Whole Foods Market Inc. and Winn-Dixie Stores, Inc. Albertson’s, Inc., was substantially acquired by Supervalu in July 2006, and is included through 2005. Marsh Supermarkets was acquired by Marsh Supermarkets Holding Corp. in September 2006, and is included through 2005. Winn-Dixie emerged from bankruptcy in 2006 as a new issue and returns for the old and new issue were calculated then weighted to determine the 2006 return.

*** The Former Peer Group consists of Albertson’s, Inc., Costco Wholesale Corp., CVS Corp, Delhaize Group SA (ADR), Great Atlantic & Pacific Tea Company, Inc., Koninklijke Ahold NV (ADR), Marsh Supermarkets Inc. (Class A), Safeway, Inc., Supervalu Inc., Target Corp., Wal-Mart Stores Inc., Walgreen Co., Whole Foods Market Inc. and Winn-Dixie Stores, Inc. Albertson’s, Inc., was substantially acquired by Supervalu in July 2006, and is included through 2005. Marsh Supermarkets was acquired by Marsh Supermarkets Holding Corp. in September 2006, and is included through 2005. Winn-Dixie emerged from bankruptcy in 2006 as a new issue and returns for the old and new issue were calculated then weighted to determine the 2006 return.

Data supplied by Standard & Poor’s.

The foregoing Performance Graph will not be deemed incorporated by reference into any other filing, absent an express reference thereto.

8

(c)

ISSUER PURCHASES OF EQUITY SECURITIES

Period (1) | | Total Number

of Shares

Purchased | | Average

Price Paid

Per Share | | Total Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs (2) | | Maximum Dollar

Value of Shares

that May Yet Be

Purchased Under

the Plans or

Programs (3)

(in millions) | |

First period - four weeks | | | | | | | | | |

November 9, 2008 to December 6, 2008 | | 13,315 | | $ | 28.63 | | — | | $ | 493 | |

Second period - four weeks | | | | | | | | | |

December 7, 2008 to January 3, 2009 | | 479,385 | | $ | 25.62 | | 450,500 | | $ | 493 | |

Third period – four weeks | | | | | | | | | |

January 4, 2009 to January 31, 2009 | | 164 | | $ | 24.77 | | — | | $ | 493 | |

| | | | | | | | | |

Total | | 492,864 | | $ | 25.70 | | 450,500 | | $ | 493 | |

(1) | The reported periods conform to the Company’s fiscal calendar composed of thirteen 28-day periods. The fourth quarter of 2008 contained three 28-day periods. |

| |

(2) | Shares were repurchased under a program announced on December 6, 1999, to repurchase common stock to reduce dilution resulting from our employee stock option plans. The program is limited to proceeds received from exercises of stock options and the tax benefits associated therewith. The program has no expiration date but may be terminated by the Board of Directors at any time. Total shares purchased include shares that were surrendered to the Company by participants in the Company’s long-term incentive plans to pay for taxes on restricted stock awards. |

| |

(3) | Amounts shown in this column reflect amounts remaining under the $1 billion stock repurchase program, authorized by the Board of Directors on January 18, 2008. The program has no expiration date but may be terminated by the Board of Directors at any time. Amounts to be invested under the program utilizing option exercise proceeds are dependent upon option exercise activity. |

9

ITEM 6. SELECTED FINANCIAL DATA.

| | Fiscal Years Ended | |

| | January 31,

2009

(52 weeks) | | February 2,

2008

(52 weeks) | | February 3,

2007

(53 weeks) | | January 28,

2006

(52 weeks) | | January 29,

2005

(52 weeks) | |

| | (In millions, except per share amounts) | |

Sales | | $ | 76,000 | | $ | 70,235 | | $ | 66,111 | | $ | 60,553 | | $ | 56,434 | |

Net earnings (loss) | | 1,249 | | 1,181 | | 1,115 | | 958 | | (104 | ) |

Diluted earnings (loss) per share: | | | | | | | | | | | |

Net earnings (loss) | | 1.90 | | 1.69 | | 1.54 | | 1.31 | | (0.14 | ) |

Total assets | | 23,211 | | 22,293 | | 21,210 | | 20,478 | | 20,491 | |

Long-term liabilities, including obligations under capital leases and financing obligations | | 10,311 | | 8,696 | | 8,711 | | 9,377 | | 10,537 | |

Shareowners’ equity | | 5,176 | | 4,914 | | 4,923 | | 4,390 | | 3,619 | |

Cash dividends per common share | | 0.345 | | 0.29 | | 0.195 | | — | | — | |

| | | | | | | | | | | | | | | | |

10

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

OUR BUSINESS

The Kroger Co. was founded in 1883 and incorporated in 1902. It is one of the nation’s largest retailers, as measured by revenue, operating 2,481 supermarket and multi-department stores under two dozen banners including Kroger, Ralphs, Fred Meyer, Food 4 Less, King Soopers, Smith’s, Fry’s, Fry’s Marketplace, Dillons, QFC and City Market. Of these stores, 781 have fuel centers. We also operate 771 convenience stores and 385 fine jewelry stores.

Kroger operates 40 manufacturing plants, primarily bakeries and dairies, which supply approximately 40% of the corporate brand units sold in our retail outlets.

Our revenues are earned and cash is generated as consumer products are sold to customers in our stores. We earn income predominately by selling products at price levels that produce revenues in excess of the costs we incur to make these products available to our customers. Such costs include procurement and distribution costs, facility occupancy and operational costs, and overhead expenses. Our operations are reported as a single reportable segment: the retail sale of merchandise to individual customers.

OUR 2008 PERFORMANCE

By focusing on the customer through our Customer 1st strategy, we were able to report solid results for fiscal year 2008 in a particularly tough economy. At the beginning of the year, we expected to grow supermarket identical sales, excluding fuel, by 3% to 5%. For 2008, supermarket identical sales, excluding fuel, were 5.0%, meeting the upper end of our original guidance.

At the outset of fiscal year 2008, Kroger’s earnings guidance was a range of $1.83 to $1.90 per diluted share. Our 2008 earnings was $1.90 per diluted share or $1.92 per diluted share, excluding the effect of a $.02 per diluted share charge for damage and disruption caused by Hurricane Ike. Our 2008 earnings of $1.92 per diluted share, excluding the charge for damage and disruption caused by Hurricane Ike, represents a growth rate of 13.6% over Kroger’s 2007 full-year earnings of $1.69 per diluted share. We believe that this growth plus Kroger’s dividend yield of more than 1%, creates a strong return for shareholders.

Our market share also rose in 2008. Based on our internal data and analysis, we estimate that our market share increased approximately 61 basis points in 2008 across our 42 major markets. We define a major market as one in which we operate nine or more stores. This is the fourth consecutive year Kroger has achieved significant market share gain. Over the past four years combined, Kroger’s market share in our major markets has increased approximately 225 basis points. Market share is critical to us because it allows us to leverage the fixed costs in our business over a wider revenue base. We hold the number one or number two market share position in 39 of or our 42 major markets. Our fundamental operating philosophy is to maintain and increase market share.

These market share results demonstrate to us that our long-term strategy is working. As population growth continues in the major markets where we operate, we intend to continue to grow Kroger’s business by maintaining our existing strong market share and by building on additional opportunities for sales growth. We estimate that approximately 45% of the share in our major markets — as much as $100 billion — is held by competitors who do not have Kroger’s economies of scale. Our economies of scale allow us to deliver increasing value to customers, which is a competitive edge, particularly in today’s economic climate.

Kroger’s business model is structured to produce sustainable earnings per share growth in a variety of economic and competitive conditions, primarily through strong identical sales growth. We believe this is the right approach to produce sustainable earnings growth over a long period of time. We recognize that continual investment in our Customer 1st strategy is necessary to drive strong, sustainable identical sales growth. We believe that this Customer 1st strategy along with our financial strategies are delivering value to customers, shareholders, bondholders, and our associates, and so we remain committed to our plan.

11

RESULTS OF OPERATIONS

The following discussion summarizes our operating results for 2008 compared to 2007 and for 2007 compared to 2006. Comparability is affected by certain income and expense items that fluctuated significantly between and among the periods.

Net Earnings

Net earnings totaled $1.2 billion for 2008, compared to net earnings totaling $1.2 billion in 2007 and $1.1 billion in 2006. The increase in our net earnings for 2008, compared to 2007 and 2006, resulted from strong non-fuel identical supermarket sales growth and strong fuel results. In addition, 2006 net earnings included a 53rd week.

Earnings per diluted share totaled $1.90 or $1.92, excluding the effect of a $.02 per diluted share charge for damage and disruption caused by Hurricane Ike, in 2008, compared to $1.69 per diluted share in 2007 and $1.54 per diluted share in 2006. Earnings per diluted share increased 13.6% in 2008, excluding the effect of a $.02 per diluted share charge for damage and disruption caused by Hurricane Ike, compared to 2007. Earnings per diluted share increased 15% in 2007, compared to 2006, after adjusting for the extra week in fiscal 2006. Net earnings in 2006 benefited from a 53rd week by an estimated $.07 per share. Our earnings per share growth in 2008, 2007 and 2006 resulted from increased net earnings, strong identical sales growth and the repurchase of Kroger stock. During fiscal 2008, we repurchased 24 million shares of Kroger stock for a total investment of $637 million. During fiscal 2007, we repurchased 53 million shares of our stock for a total investment of $1.4 billion. During fiscal 2006, we repurchased 29 million shares of Kroger stock for a total investment of $633 million.

Sales

Total Sales

(in millions)

| | 2008 | | Percentage

Increase | | 2007 | | Percentage

Increase | | 2006 | |

Total food store sales without fuel | | $ | 63,795 | | 6.1 | % | $ | 60,142 | | 4.2 | % | $ | 57,712 | |

Total food store fuel sales | | 7,464 | | 30.0 | % | 5,741 | | 28.9 | % | 4,455 | |

| | | | | | | | | | | |

Total food store sales | | $ | 71,259 | | 8.2 | % | $ | 65,883 | | 6.0 | % | $ | 62,167 | |

Other sales(1) | | 4,741 | | 8.9 | % | 4,352 | | 10.3 | % | 3,944 | |

| | | | | | | | | | | |

Total Sales | | $ | 76,000 | | 8.2 | % | $ | 70,235 | | 6.2 | % | $ | 66,111 | |

(1) Other sales primarily relate to sales at convenience stores, including fuel, jewelry stores and sales by our manufacturing plants to outside customers.

The growth in our total sales in 2008 over fiscal 2007 was primarily the result of identical supermarket sales increases, increased fuel gallon sales, and inflation across most departments. Identical supermarket sales and total sales, excluding fuel, increased due to increased transaction count and average transaction size, and inflation across all departments. After adjusting for the extra week in fiscal 2006, total sales increased 8.2% in 2007 over fiscal 2006.

We define a supermarket as identical when it has been in operation without expansion or relocation for five full quarters. Fuel center discounts received at our fuel centers and earned based on in-store purchases are included in all of the supermarket identical sales results calculations illustrated below. Differences between total supermarket sales and identical supermarket sales primarily relate to changes in supermarket square footage. Annualized identical supermarket sales include all sales at the Fred Meyer multi-department stores. We calculate annualized identical supermarket sales by adding together four quarters of identical supermarket sales. Our identical supermarket sales results are summarized in the table below, based on the 52-week period of 2008, compared to the 52-week period of the previous year. The identical store count in the table below represents the total number of identical supermarkets as of January 31, 2009 and February 2, 2008.

12

Identical Supermarket Sales

(in millions)

| | 2008 | | 2007 | |

Including supermarket fuel centers | | $ | 67,185 | | $ | 62,878 | |

Excluding supermarket fuel centers | | $ | 60,300 | | $ | 57,416 | |

| | | | | | | |

Including supermarket fuel centers | | 6.9 | % | 6.9 | % |

Excluding supermarket fuel centers | | 5.0 | % | 5.3 | % |

Identical 4th Quarter store count | | 2,369 | | 2,280 | |

We define a supermarket as comparable when it has been in operation for five full quarters, including expansions and relocations. As is the case for identical supermarket sales, fuel center discounts received at our fuel centers and earned based on in-store purchases are included in all of the supermarket comparable sales results calculations illustrated below. Annualized comparable supermarket sales include all Fred Meyer multi-department stores. We calculate annualized comparable supermarket sales by adding together four quarters of comparable sales. Our annualized comparable supermarket sales results are summarized in the table below, based on the 52-week period of 2008, compared to the same 52-week period of the previous year. The comparable store count in the table below represents the total number of comparable supermarkets as of January 31, 2009 and February 2, 2008.

Comparable Supermarket Sales

(in millions)

| | 2008 | | 2007 | |

Including supermarket fuel centers | | $ | 69,762 | | $ | 65,066 | |

Excluding supermarket fuel centers | | $ | 62,492 | | $ | 59,372 | |

| | | | | | | |

Including supermarket fuel centers | | 7.2 | % | 7.2 | % |

Excluding supermarket fuel centers | | 5.3 | % | 5.5 | % |

Comparable 4th Quarter store count | | 2,444 | | 2,352 | |

FIFO Gross Margin

We calculate First-In, First-Out (“FIFO”) Gross Margin as sales minus merchandise costs, including advertising, warehousing and transportation, but excluding the Last-In, First-Out (“LIFO”) charge. Merchandise costs exclude depreciation and rent expense. FIFO gross margin is an important measure used by management to evaluate merchandising and operational effectiveness.

Our FIFO gross margin rates were 23.20% in 2008, 23.65% in 2007 and 24.27% in 2006. Our retail fuel sales reduce our FIFO gross margin rate due to the very low FIFO gross margin on retail fuel sales as compared to non-fuel sales. Excluding the effect of retail fuel operations, our FIFO gross margin rates decreased 15 basis points in 2008, 20 basis points in 2007 and 26 basis points in 2006. The decrease in our non-fuel FIFO gross margin rate reflects our continued reinvestment of operating cost savings into lower prices for our customers. In addition, FIFO gross margin in 2008, compared to 2007, decreased due to high inflation in product costs.

LIFO Charge

The LIFO charge was $196 million in 2008, $154 million in 2007 and $50 million in 2006. Like many food retailers, we continued to experience product cost inflation in 2008 at levels that have not occurred for several years. This increase in product cost inflation caused the increase in the LIFO charge in 2008, compared to 2007 and 2006. In addition, product cost inflation in 2007, compared to 2006, caused the increase in the LIFO charge in 2007 compared to 2006.

Operating, General and Administrative Expenses

Operating, general and administrative (“OG&A”) expenses consist primarily of employee-related costs such as wages, health care benefit costs and retirement plan costs, utilities and credit card fees. Rent expense, depreciation and amortization expense, and interest expense are not included in OG&A.

13

OG&A expenses, as a percent of sales, were 16.95% in 2008, 17.31% in 2007 and 17.91% in 2006. The growth in our retail fuel sales reduces our OG&A rate due to the very low OG&A rate on retail fuel sales as compared to non-fuel sales. OG&A expenses, as a percent of sales excluding fuel, decreased 3 basis points in 2008, 33 basis points in 2007 and 9 basis points in 2006. The decrease in our OG&A rate in 2008, excluding the effect of retail fuel operations, was primarily the result of increased identical supermarkets sales growth and a settlement received from credit card processers, partially offset by the $25 million charge related to Hurricane Ike and increases in credit card fees and health care costs. The decrease in our OG&A rate in 2007, excluding the effect of retail fuel operations, was primarily the result of strong identical sales growth, increased productivity, and progress that was made in 2007 in controlling our utility, health care and pension costs. These improvements were partially offset by increases in credit card fees. Excluding the effect of retail fuel operations and expenses recorded for one-time legal reserves, our OG&A rate declined 16 basis points in 2006.

Rent Expense

Rent expense was $659 million in 2008, as compared to $644 million in 2007 and $649 million in 2006. Rent expense, as a percent of sales, was 0.87% in 2008, as compared to 0.92% in 2007 and 0.98% in 2006. The decrease in rent expense, as a percent of sales, reflects our increasing sales and our continued emphasis on owning rather than leasing whenever possible.

Depreciation and Amortization Expense

Depreciation expense was $1.4 billion in 2008, $1.4 billion in 2007 and $1.3 billion in 2006. The increases in depreciation and amortization expense were the result of capital expenditures totaling $2.2 billion in 2008, $2.1 billion in 2007 and $1.8 billion in 2006. Depreciation and amortization expense, as a percent of sales, was 1.90% in 2008, 1.93% in 2007 and 1.92% in 2006. The decrease in depreciation and amortization expense in 2008, compared to 2007, as a percent of sales, is primarily the result of increasing sales. The increase in our depreciation and amortization expense in 2007, compared to 2006, as a percent of sales, is due to an annual depreciation charge in both years with 2006 containing 53 weeks of sales due to the structure of our fiscal calendar.

Interest Expense

Net interest expense totaled $485 million in 2008, $474 million in 2007 and $488 million in 2006. The increase in interest expense in 2008, compared to 2007, was primarily the result of an increase in the average total debt balance for the year, partially offset by interest income related to the mark-to-market of ineffective fair value swaps. The decrease in interest expense in 2007, compared to 2006, was the result of replacing borrowings with new borrowings at a lower interest rate. The average total debt balance in 2007 was comparable to 2006.

Income Taxes

Our effective income tax rate was 36.5% in 2008, 35.4% in 2007 and 36.2% in 2006. The effective tax rates for those years differed from the federal statutory rate primarily due to the effect of state income taxes. In addition, the effective tax rate for 2007 differs from the expected federal statutory rate due to the resolution of some tax issues. The effective rate in 2006 includes an adjustment of some deferred tax balances.

During the third quarter of 2007, we resolved favorably some outstanding tax issues. This resulted in a 2007 tax benefit of approximately $40 million and reduced our effective tax rate by 1.9%.

In 2006, during the reconciliation of our deferred tax balances, and after the filing of our annual federal and state tax returns, we identified adjustments to be made in prior years’ deferred tax reconciliation. We corrected these deferred tax balances in our Consolidated Financial Statements for the year ended February 3, 2007, which resulted in a reduction of our fiscal 2006 provision for income tax expense of approximately $21 million and reduced the rate by 1.2%. We do not believe these adjustments are material to our Consolidated Financial Statements for the year ended February 3, 2007, or to any prior years’ Consolidated Financial Statements. As a result, we have not restated any prior year amounts.

14

COMMON STOCK REPURCHASE PROGRAM

We maintain stock repurchase programs that comply with Securities Exchange Act Rule 10b5-1 and allow for the orderly repurchase of our common stock, from time to time. We made open market purchases totaling $448 million in 2008, $1.2 billion in 2007 and $374 million in 2006 under these repurchase programs. In addition to these repurchase programs, in December 1999 we began a program to repurchase common stock to reduce dilution resulting from our employee stock option plans. This program is solely funded by proceeds from stock option exercises, and the tax benefit from these exercises. We repurchased approximately $189 million in 2008, $270 million in 2007 and $259 million in 2006 under the stock option programs.

In 2008, to preserve liquidity and financial flexibility, we reduced the amount of stock repurchased during the year, decreasing the cash used for stock purchases in 2008, compared to 2007.

CAPITAL EXPENDITURES

Capital expenditures, including changes in construction-in-progress payables and excluding acquisitions, totaled $2.2 billion in 2008 compared to $2.1 billion in 2007 and $1.8 billion in 2006. The increase in capital spending in 2008 compared to 2007 and 2006 was the result of increasing our focus on remodels, merchandising and productivity projects. The table below shows our supermarket storing activity and our total food store square footage:

Supermarket Storing Activity

| | 2008 | | 2007 | | 2006 | |

Beginning of year | | 2,486 | | 2,468 | | 2,507 | |

Opened | | 21 | | 23 | | 20 | |

Opened (relocation) | | 14 | | 9 | | 17 | |

Acquired | | 6 | | 38 | | 1 | |

Acquired (relocation) | | 3 | | 1 | | — | |

Closed (operational) | | (32 | ) | (43 | ) | (60 | ) |

Closed (relocation) | | (17 | ) | (10 | ) | (17 | ) |

| | | | | | | |

End of year | | 2,481 | | 2,486 | | 2,468 | |

| | | | | | | |

Total food store square footage (in millions) | | 147 | | 145 | | 142 | |

CRITICAL ACCOUNTING POLICIES

We have chosen accounting policies that we believe are appropriate to report accurately and fairly our operating results and financial position, and we apply those accounting policies in a consistent manner. Our significant accounting policies are summarized in Note 1 to the Consolidated Financial Statements.

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses, and related disclosures of contingent assets and liabilities. We base our estimates on historical experience and other factors we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results could differ from those estimates.

We believe that the following accounting policies are the most critical in the preparation of our financial statements because they involve the most difficult, subjective or complex judgments about the effect of matters that are inherently uncertain.

15

Self-Insurance Costs

We primarily are self-insured for costs related to workers’ compensation and general liability claims. The liabilities represent our best estimate, using generally accepted actuarial reserving methods, of the ultimate obligations for reported claims plus those incurred but not reported for all claims incurred through January 31, 2009. We establish case reserves for reported claims using case-basis evaluation of the underlying claim data and we update as information becomes known.

For both workers’ compensation and general liability claims, we have purchased stop-loss coverage to limit our exposure to any significant exposure on a per claim basis. We are insured for covered costs in excess of these per claim limits. We account for the liabilities for workers’ compensation claims on a present value basis utilizing a risk-adjusted discount rate. A 25 basis point decrease in our discount rate would increase our liability by approximately $4 million. General liability claims are not discounted.

We are also similarly self-insured for property-related losses. We have purchased stop-loss coverage to limit our exposure to losses in excess of $25 million on a per claim basis, except in the case of an earthquake, for which stop-loss coverage is in excess of $50 million per claim, up to $200 million per claim in California and $300 million outside of California.

The assumptions underlying the ultimate costs of existing claim losses are subject to a high degree of unpredictability, which can affect the liability recorded for such claims. For example, variability in inflation rates of health care costs inherent in these claims can affect the amounts realized. Similarly, changes in legal trends and interpretations, as well as a change in the nature and method of how claims are settled can affect ultimate costs. Our estimates of liabilities incurred do not anticipate significant changes in historical trends for these variables, and any changes could have a considerable effect on future claim costs and currently recorded liabilities.

Impairments of Long-Lived Assets