UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended MarchDecember 31, 2013

OR 15(d)

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________

Commission File Number 000-54896

Intra-Cellular Therapies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 36-4742850 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer | |

Identification No.) |

430 East 29th Street New York, New York 10016 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (212) 923-3344 |

Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.0001 Par Value Per Share | The NASDAQ Global Select Market |

Securities registered underpursuant to Section 12(g) of the Exchange Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o ¨No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o ¨No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xNo o¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website,Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes xNo o¨

Indicate by check mark if there is no disclosure of delinquent filers in responsepursuant to Item 405 of Regulation S-K (§229.405 of this chapter)is not contained herein, and no disclosure will not be contained, to the best of registrant'sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large | ||||||

| accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated | ||||||

| Smaller reporting company | ¨ | |||||

Indicate by check mark whether the issuerregistrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x ¨No ox

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $750.7 million.

As of March 31, 2013, there were no non-affiliate holders of common stock ofFebruary 25, 2016, the Company.

| Page | ||||||

| 4 | ||||||

Item 1. | Business | 4 | ||||

Item 1A. | Risk Factors | 29 | ||||

Item 1B. | Unresolved Staff Comments | 52 | ||||

Item 2. | Properties | 52 | ||||

Item 3. | Legal Proceedings | 52 | ||||

Item 4. | Mine Safety Disclosures | 52 | ||||

| 53 | ||||||

Item 5. | 53 | |||||

Item 6. | Selected Financial Data | 55 | ||||

Item 7. | Management’s Discussion And Analysis Of Financial Condition And Results Of Operations | 56 | ||||

Item 7A. | Quantitative And Qualitative Disclosures About Market Risk | 71 | ||||

Item 8. | Financial Statements And Supplementary Data | 71 | ||||

Item 9. | Changes In And Disagreements With Accountants On Accounting And Financial Disclosure | 71 | ||||

Item 9A. | Controls And Procedures | 71 | ||||

Item 9B. | Other Information | 73 | ||||

| 74 | ||||||

Item 10. | Directors, Executive Officers And Corporate Governance | 74 | ||||

Item 11. | Executive Compensation | 74 | ||||

Item 12. | Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters | 74 | ||||

Item 13. | Certain Relationships And Related Transactions, And Director Independence | 74 | ||||

Item 14. | Principal Accounting Fees And Services | 74 | ||||

| 75 | ||||||

Item 15. | Exhibits, Financial Statement Schedules | 75 | ||||

| Signatures | 79 | |||||

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: Certain statements madeinformation required in Part III of this Annual Report on Form 10-K is incorporated by reference from the Registrant’s Proxy Statement for the 2016 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission.

All brand names or trademarks appearing in this report are “forward-looking statements” (within the meaningproperty of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this report is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the Private Securities Litigation Reform Acttrademark or trade dress owners. Unless the context requires otherwise, references in this report to the “Company,” “we,” “us,” and “our” refer to Intra-Cellular Therapies, Inc. and its wholly-owned subsidiary, ITI, Inc.

| Item 1. | BUSINESS |

Overview

We are a biopharmaceutical company focused on the discovery and clinical development of 1995) regardinginnovative, small molecule drugs that address underserved medical needs in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms within the planscentral nervous system, or CNS. ITI-007 is our lead drug development candidate with mechanisms of action that, we believe, may represent an effective treatment across multiple therapeutic indications. In our pre-clinical and objectivesclinical trials to date, ITI-007 combines potent serotonin 5-HT2A receptor antagonism, dopamine receptor phosphoprotein modulation, or DPPM, glutamatergic modulation, and serotonin reuptake inhibition into a single drug candidate for the treatment of managementacute and residual schizophrenia and the treatment of bipolar disorder, including bipolar depression. At dopamine D2 receptors, ITI-007 has been demonstrated to have dual properties and to act as both a pre-synaptic partial agonist and a post-synaptic antagonist. ITI-007 has also been demonstrated to have affinity for future operations. Such statements involve knowndopamine D1 receptors and unknown risks, uncertaintiesindirectly stimulate phosphorylation of glutamatergic NMDA GluN2B receptors in a mesolimbic specific manner. We believe that this regional selectivity in brain areas thought to mediate the efficacy of antipsychotic drugs, together with serotonergic, glutamatergic, and dopaminergic interactions, may result in efficacy for a broad array of symptoms associated with schizophrenia and bipolar disorder with improved psychosocial function. The serotonin reuptake inhibition potentially allows for antidepressant activity in the treatment of schizoaffective disorder, other disorders with co-morbid depression, and/or as a stand-alone treatment for major depressive disorder. We believe ITI-007 may also be useful for the treatment of other psychiatric and neurodegenerative disorders, particularly behavioral disturbances associated with dementia, autism, and other factors that may cause actualCNS diseases. ITI-007 is in Phase 3 clinical development as a novel treatment for schizophrenia and bipolar depression.

ITI-007 for the Treatment of Schizophrenia

In September 2015, we announced top-line clinical results performancefrom our first Phase 3 clinical trial of ITI-007 for the treatment of patients with schizophrenia. This randomized, double-blind, placebo-controlled Phase 3 clinical trial was conducted at 12 sites in the United States with 450 patients randomized (1:1:1) to receive either 60 mg of ITI-007, 40 mg of ITI-007 or achievementsplacebo once daily in the morning for 28 days. The pre-specified primary efficacy measure was change from baseline versus placebo at study endpoint (4 weeks) on the centrally rated Positive and Negative Syndrome Scale, or PANSS, total score. In this trial, the once-daily dose of Oneida Resources Corp. (the “Company”)60 mg of ITI-007 met the primary endpoint and demonstrated antipsychotic efficacy with statistically significant superiority over placebo at week 4 (study endpoint) with additional improvements observed in social function. Moreover, the 60 mg dose of ITI-007 showed significant antipsychotic efficacy as early as week 1, which was maintained at every time point throughout the entire study. ITI-007 showed a dose-related improvement in symptoms of schizophrenia with the 40 mg dose approximating the trajectory of improvement seen with the 60 mg dose, but the effect with 40 mg did not reach statistical significance on the primary endpoint. In addition, the 60 mg dose of ITI-007 met the key secondary endpoint of statistically significant improvement on the Clinical Global Impression Scale for Severity of Illness, or CGI-S. The 40 mg dose of ITI-007 also demonstrated a statistically significant improvement versus placebo on the CGI-S, though not formally tested against placebo as a key secondary endpoint since it did not separate on the primary endpoint. Consistent with previous studies, ITI-007 had a favorable safety and tolerability profile as evidenced by motoric, metabolic, and cardiovascular characteristics similar to be materially differentplacebo, and no clinically significant changes in akathisia, extrapyramidal symptoms, prolactin, body weight, glucose, insulin, or lipids.

In September 2015, we also announced top-line data from any future results, performancean open-label positron emission tomography, or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risksPET, study of ITI-007 examining brain occupancy of striatal D2 receptors. This study was conducted in patients diagnosed with schizophrenia who were otherwise healthy and uncertainties. The Company's plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgmentsstable with respect to amongtheir psychosis. After washout from their previous antipsychotic medication for at least two weeks, PET was used to determine target occupancy in brain regions at baseline (drug-free) and again after two weeks of once daily ITI-007 oral administration. In this trial, the 60 mg dose of ITI-007 was associated with a mean of approximately 40% striatal dopamine D2 receptor occupancy. As predicted by preclinical and earlier clinical data, ITI-007 demonstrated antipsychotic effect at relatively low striatal D2 receptor occupancy, lower than the occupancy range required by most other things, future economic, competitiveantipsychotic drugs. Unlike any existing schizophrenia treatment, this dopamine receptor phosphoprotein modulator, or DPPM, acts as a pre-synaptic partial agonist and market conditionspost-synaptic antagonist at D2 receptors. We believe this mechanism likely contributes to the favorable safety profile of ITI-007, with reduced risk for hyperprolactinemia, akathisia, extrapyramidal symptoms, and future business decisions, allother motoric side effects.

The top-line results from our first Phase 3 clinical trial of ITI-007 confirm the earlier Phase 2 results that we announced in December 2013, in which ITI-007 exhibited antipsychotic efficacy in a randomized, double-blind, placebo and active controlled clinical trial in patients with an acutely exacerbated episode of schizophrenia. In this Phase 2 trial, 335 patients were randomized to receive one of four treatments: 60 mg of ITI-007, 120 mg of ITI-007, 4 mg of risperidone (active control) or placebo in a 1:1:1:1 ratio, orally once daily for 28 days. The primary endpoint for this clinical trial was change from baseline to Day 28 on the PANSS total score. In this study, ITI-007 met the trial’s pre-specified primary endpoint, improving symptoms associated with schizophrenia as measured by a statistically significant and clinically meaningful decrease in the PANSS total score. The trial also met key secondary outcome measures related to efficacy on PANSS subscales and safety. We are difficultalso conducting a second Phase 3 clinical trial in schizophrenia that we initiated in the second quarter of 2015, with over 600 patients planned to be enrolled in the trial. In this trial, we are randomizing patients to two doses of ITI-007 (60 mg or impossible20 mg), risperidone (active control) or placebo over a 6-week treatment duration, and the primary outcome measure is change from baseline to predict accuratelyDay 42 on the PANSS total score. We expect patient enrollment will be completed in the second quarter of 2016. Subject to timely enrollment, we anticipate top-line results from the second Phase 3 clinical trial will be available in mid-2016.

In addition to our two Phase 3 clinical trials, we will need to complete other clinical and non-clinical trials and manufacturing and pre-commercialization activities necessary to support the submission of a planned New Drug Application, or NDA, for ITI-007 in schizophrenia, which we currently expect could occur in the first half of 2017.

ITI-007 for the Treatment of Depressive Episodes Associated with Bipolar Disorder (Bipolar Depression)

Our bipolar depression program consists of two Phase 3 multi-center, randomized, double-blind, placebo-controlled clinical trials: one to evaluate ITI-007 as a monotherapy and the other to evaluate ITI-007 as an adjunctive therapy with lithium or valproate. In each trial, approximately 550 patients with a clinical diagnosis of Bipolar I or Bipolar II disorder and who are experiencing a current major depressive episode will be randomized to receive one of three treatments: 60 mg ITI-007, 40 mg ITI-007, or placebo in a 1:1:1 ratio orally once daily for 6 weeks. In the ITI-007-401 trial, patients will receive ITI-007 or placebo as a monotherapy. In the ITI-007-402 trial, patients will receive ITI-007 or placebo adjunctive to their existing mood stabilizer lithium or valproate. We initiated our bipolar depression program in the third quarter of 2015.

The primary endpoint for both clinical trials is change from baseline at Day 42 on the Montgomery-Åsberg Depression Rating Scale, or MADRS, total score versus placebo. The MADRS is a well-validated 10-item checklist that measures the ability of a drug to reduce overall severity of depressive symptoms. Individual items are rated by an expert clinician on a scale of 0 to 6 in which a score of 6 represents the most depressed evaluation for each item assessed. The total score ranges from 0 to 60. Secondary endpoints include measures of social function and quality of life that may illustrate the differentiated clinical profile of ITI-007. Safety and tolerability are also assessed in both clinical trials.

Other Indications for ITI-007

In the fourth quarter of 2014, we announced the top-line data from ITI-007-200, a Phase 1/2 clinical trial designed to evaluate the safety, tolerability and pharmacokinetics of low doses of ITI-007 in healthy geriatric subjects and in patients with dementia, including Alzheimer’s disease. The completion of this study marks an important milestone in our strategy to develop low doses of ITI-007 for the treatment of behavioral disturbances associated with dementia and related disorders. The ITI-007-200 trial results to date indicate that ITI-007 is safe and well-tolerated across a range of low doses, has linear- and dose-related pharmacokinetics and improves cognition in the elderly. The most frequent adverse event was mild sedation at the higher doses. We believe these results further position ITI-007 as a development candidate for the treatment of behavioral disturbances in patients with dementia and other neuropsychiatric and neurological conditions. We plan to initiate late phase clinical programs evaluating ITI-007 in patients with behavioral disturbances associated with dementia and related disorders, including Alzheimer’s disease, in the first half of 2016.

We are also pursuing clinical development of ITI-007 for the treatment of additional CNS diseases and disorders. At the lowest doses, ITI-007 has been demonstrated to act primarily as a potent 5-HT2A serotonin receptor antagonist. As the dose is increased, additional benefits are derived from the engagement of additional drug targets, including modest dopamine receptor modulation and modest inhibition of serotonin transporters. We believe that combined interactions at these receptors may provide additional benefits above and beyond selective 5-HT2A antagonism for treating agitation, aggression and sleep disturbances in diseases that include dementia, Alzheimer’s disease, Huntington’s disease and autism spectrum disorders, while avoiding many of the side effects associated with more robust dopamine receptor antagonism. As the dose of ITI-007 is further increased, leading to moderate dopamine receptor modulation, inhibition of serotonin transporters, and indirect glutamate modulation, these actions complement the complete blockade of 5-HT2A serotonin receptors. At a dose of 60 mg, ITI-007 has been shown effective in treating the symptoms associated with schizophrenia, and we believe this higher dose range will be useful for the treatment of bipolar disorder, depressive disorders and other neuropsychiatric diseases.

Given the potential utility for ITI-007 and follow-on compounds to treat these additional indications, we may investigate, either on our own or with a partner, agitation, aggression and sleep disturbances in additional diseases that include autism spectrum disorders; depressive disorder; intermittent explosive disorder; non-motor symptoms and motor complications associated with Parkinson’s disease; and post-traumatic stress disorder. We hold exclusive, worldwide commercialization rights to ITI-007 and a family of compounds from Bristol-Myers Squibb Company pursuant to an exclusive license.

Other Product Candidates

We have a second major program called ITI-002 that has yielded a portfolio of compounds that selectively inhibits the enzyme phosphodiesterase type 1, or PDE1. We believe PDE1 helps regulate brain activity related to cognition, memory processes and movement/coordination. On February 25, 2011, we (through our wholly owned operating subsidiary, ITI) and Takeda Pharmaceutical Company Limited, or Takeda, entered into a license and collaboration agreement, or the Takeda License Agreement, under which are beyondwe agreed to collaborate to research, develop and commercialize our proprietary compound ITI-214 and other selected compounds that selectively inhibit PDE1 for use in the controlprevention and treatment of human diseases. On October 31, 2014, we entered into an agreement with Takeda terminating the Takeda License Agreement, or the Termination Agreement, pursuant to which all rights granted under the Takeda License Agreement were returned to us. On September 15, 2015, Takeda completed the transfer of the Company. AlthoughInvestigational New Drug application, or IND, for ITI-214 to us. ITI-214 is the Company believesfirst compound in its assumptions underlyingclass to successfully advance into Phase 1 clinical trials. We intend to pursue the forward-looking statements are reasonable, anydevelopment of our PDE program, including ITI-214 for the assumptions could prove inaccuratetreatment of several CNS and therefore, there can be no assurance the forward-looking statements includednon-CNS conditions, which may include cognition in this Report will prove to be accurate. In light of the significant uncertainties inherentParkinson’s disease, cognition in Alzheimer’s disease, cognition in schizophrenia and in other non-CNS indications. Other compounds in the forward-looking statements included herein,PDE portfolio are also being advanced for the inclusiontreatment of such information should not be regarded asvarious indications.

Our pipeline also includes pre-clinical programs that are focused on advancing drugs for the treatment of schizophrenia, Parkinson’s disease, Alzheimer’s disease and other neuropsychiatric and neurodegenerative disorders. We are also investigating the development of treatments for disease modification of neurodegenerative disorders and non-CNS diseases.

We have assembled a representation bymanagement team with significant industry experience to lead the Company or anydiscovery and development of our product candidates. We complement our management team with a group of scientific and clinical advisors that includes recognized experts in the fields of schizophrenia and other person that the objectives and plansCNS disorders, including Nobel laureate, Dr. Paul Greengard, one of the Company will be achieved.

We were originally incorporated in the State of Delaware in August 2012 under the name “Oneida Resources Corp.” Prior to a reverse merger that occurred on August 29, 2012 and maintains its principal executive office at c/o Samir Masri CPA Firm P.C., 175 Great Neck Road, Suite 403, Great Neck, NY 11021. Since inception,2013, or the Company has been engaged in organizational efforts and obtaining initial financing. The CompanyMerger, Oneida Resources Corp. was formed as a vehicle to investigate and, if such investigation warrants, acquire a target“shell” company or business seeking the perceived advantages of being a publicly held corporation. The Company filed a registration statement on Form 10 with the U.S. Securities and Exchange Commission (the “SEC”) on February 8, 2013, and since its effectiveness, the Company has focused on identifying a possible business combination. The Company selected March 31 as its fiscal year end.

Our corporate headquarters and laboratory are located at 430 East 29th Street, New York, New York 10016, and our telephone number is (646) 440-9333. We also have an office in Towson, Maryland. We maintain a website at www.intracellulartherapies.com, to which we regularly post copies of our press releases as well as additional information about us. Our filings with the SEC will be available free of charge through the Investor Relations section of our website as soon as reasonably practicable after being electronically filed with or furnished to the SEC. Information contained in our website does not constitute a part of this report or our other filings with the SEC.

Our Strategy

Our goal is to discover and develop novel small molecule therapeutics for the treatment of CNS diseases in order to improve the lives of people suffering from such illnesses. Using our key understanding of intracellular signaling, we seek to accomplish our goal, using our in-house expert drug discovery and clinical development teams, in two ways:

The key elements of our strategy are to:

Our Drug Discovery Platform and Capabilities

Based on the pioneering efforts of our co-founder and Nobel laureate, Dr. Paul Greengard, we have developed a detailed understanding of intracellular signaling pathways and intracellular targets. We have used that knowledge to develop several state of the art technology platforms, including one called CNSProfileTM. This technology monitors the phosphoprotein changes elicited by major psychotropic drug classes and subclasses, and generates a unique molecular signature for drug compounds. By monitoring how the levels of these phosphoproteins changein vivo, we identify intracellular signaling pathways through which several major drug classes operate. Along with what we believe to be state of the art drug discovery efforts, we have used, and may continue to use, this information as a tool to validate our selection of preclinical candidate molecules.

During the years ended December 31, 2015 and 2014, we incurred $87.7 million and $21.2 million in research and development expenses, respectively.

Given the nature of our research and development and business activities, we do not expect that compliance with federal, state and local environmental laws will result in material costs or have a significant negative effect on our operations.

Disease and Market Overview

Our programs for small molecule therapeutics are designed to address various CNS diseases that we believe are underserved or unmet by currently available therapies and that represent large potential commercial market opportunities for us. Background information on the CNS diseases and related commercial markets that may be addressed by our programs is set forth below.

Schizophrenia

Schizophrenia is a disabling and chronic mental illness that is characterized by multiple symptoms during an acute phase of the disorder that can include so-called “positive” symptoms, such as hearing voices, grandiose beliefs and suspiciousness or paranoia. These symptoms can be accompanied by additional, harder to treat symptoms, such as social withdrawal, blunted emotional response and speech deficits, collectively referred to as “negative” symptoms, difficulty concentrating and disorganized thoughts, or cognitive impairment, depression and insomnia. Such residual symptoms often persist even after the acute positive symptoms subside, and contribute substantially to the social and employment disability associated with schizophrenia. Current antipsychotic medications provide some relief for the symptoms associated with the acute phase of the disorder, but they do not effectively treat the residual phase symptoms associated with chronic schizophrenia. Currently available medications used to treat acute schizophrenia are limited in their use due to side effects that can include movement disorders, weight gain, metabolic disturbances, and cardiovascular disorders. Indeed, the side effects associated with current antipsychotic medications often make some of the residual phase symptoms, such as negative symptoms and social function, worse. There is an unmet medical need for new therapies that have improved side effect and efficacy profiles.

According to the National Institute of Mental Health, over 1% of the world’s population suffers from schizophrenia, and more than 2.5 million Americans suffer from the illness in any given year. Worldwide sales of antipsychotic drugs exceeded $14 billion in 2014. These drugs have been increasingly used by physicians to address a range of disorders in addition to schizophrenia, including bipolar disorder and a variety of psychoses and related conditions in elderly patients. Despite their commercial success, current antipsychotic drugs have substantial limitations, including inadequate efficacy and severe side effects.

The first-generation, or typical, antipsychotics that were introduced in the late-1950s block dopamine receptors. While typical antipsychotics are effective against positive symptoms of schizophrenia in many patients, these drugs often induce disabling motor disturbances, and they fail to address or worsen most of the negative symptoms and cognitive disturbances associated with schizophrenia.

Most schizophrenia patients in the United States are treated today with second-generation, or atypical, antipsychotics, which induce fewer motor disturbances than typical antipsychotics, but still fail to address most of the negative symptoms of schizophrenia and other symptoms associated with social function impairment. Many patients with schizophrenia have deficits in social function. Social function is the ability to recognize, understand, process and use external cues to solve problems, maintain work performance, and conduct interpersonal relationships. Deficits in social function often remain after positive symptoms, such as hallucinations and delusions, have resolved in these patients. In addition, currently prescribed treatments do not effectively address or may exacerbate cognitive disturbances associated with schizophrenia. It is believed that the efficacy of atypical antipsychotics is due to their interactions with dopamine and 5-HT2A receptors. The side effects induced by the atypical agents may include weight gain, non-insulin dependent (type II) diabetes, cardiovascular side effects, sleep disturbances, and motor disturbances. We believe that these side effects generally arise either from non-essential receptor interactions or from excessive dopamine blockade.

The limitations of currently available antipsychotics result in poor patient compliance. A landmark study funded by the National Institute of Mental Health, the Clinical Antipsychotic Trials of Intervention Effectiveness, also referred to as CATIE, which was published in The New England Journal of Medicine in September 2005, found that 74% of patients taking typical or atypical antipsychotics discontinued treatment within 18 months because of side effects or lack of efficacy. We believe there is a large underserved medical need for new therapies that have improved side effect and efficacy profiles.

Bipolar Disorder

Bipolar disorder, sometimes referred to as manic-depressive illness, is characterized by extreme shifts in mood. Individuals with bipolar disorder may experience intense feelings of over-excitement, irritability, and impulsivity with grandiose beliefs and racing thoughts, referred to as a manic episode. Symptoms of depression may include feeling tired, hopeless and sad, with difficulty concentrating and thoughts of suicide. Some people experience both types of symptoms in the same “mixed” episode. Severe symptoms of bipolar disorder can be associated with hallucinations or delusions, otherwise referred to as psychosis.

Bipolar disorder affects approximately 5.7 million adults in the United States in any given year, or about 2.6 percent of the adult U.S. population. In 2012, therapeutics used to treat bipolar disorder had global sales of approximately $6 billion.

Bipolar disorder is often treated with antipsychotic medications alone or in combination with mood stabilizers. The side effects and safety risks associated with antipsychotic drugs in patients with bipolar disorder are similar to those experienced by patients with schizophrenia. Moreover, a large national research program conducted from 1998 to 2005 called the Systematic Treatment Enhancement Program for Bipolar Disorder, or STEP-BD, followed 4,360 patients with bipolar disorder long term and showed that about half of patients who were treated for bipolar disorder still experienced lingering and recurrent symptoms, indicating a clear need for improved treatments.

Behavioral Disturbances in Dementia, Including Alzheimer’s Disease

It has been estimated that 44.4 million people worldwide were living with dementia in 2013, including over 5.2 million patients with Alzheimer’s disease in the United States. This number is expected to increase to 75.6 million by 2030 and to increase to 135.5 million by 2050. While the diagnostic criteria for Alzheimer’s disease and other dementias mostly focus on the related cognitive deficits, it is often the behavioral and psychiatric symptoms that are most troublesome for caregivers and lead to poor quality of life for patients.

Several behavioral symptoms are quite prevalent in patients with dementia, including patients with Alzheimer’s disease. In view of the potential multiple effects of ITI-007 on aggression, agitation, sleep disorders and depression, and its safety profile to date, we believe that ITI-007 may provide a novel therapy for treating the behavioral disturbances accompanying dementia, including Alzheimer’s disease.

The FDA has not approved any drug to treat the behavioral symptoms of dementia, including Alzheimer’s disease. As symptoms progress and become more severe, physicians often resort to off-label use of antipsychotic medications in these patients. Current antipsychotic drugs are associated with a number of side effects, which can be problematic for elderly patients with dementia. In addition, antipsychotic drugs may exacerbate the cognitive disturbances associated with dementia. We believe there is a large unmet medical need for a safe and effective therapy to treat the behavioral symptoms in patients with dementia, including Alzheimer’s disease.

Alzheimer’s Disease

Alzheimer’s disease is a progressive neurodegenerative disorder that slowly destroys memory and thinking skills, and eventually even the ability to carry out simple tasks. Its symptoms include cognitive dysfunction, memory abnormalities, progressive impairment in activities of daily living, and a host of behavioral and neuropsychiatric symptoms. Alzheimer’s disease primarily affects older people and, in most cases, symptoms first appear after age 60. Alzheimer’s disease gets worse over time and is fatal.

The market for Alzheimer’s disease therapeutics is categorized into two segments: acetylcholinesterase inhibitors and NMDA receptor antagonists, which include Aricept®, Namenda®, Exelon® and Ebixa®. These two segments had total sales of $4.9 billion in 2013.

According to the Alzheimer’s Association, 5.2 million people in the United States are living with Alzheimer’s disease, and it is currently the fifth leading cause of death for people age 65 and older. It has been estimated that 44.4 million people worldwide were living with dementia in 2013. This number is expected to increase to 75.6 million by 2030 and to increase to 135.5 million by 2050. While the diagnostic criteria for Alzheimer’s disease mostly focus on the related cognitive deficits, it is often the behavioral and psychiatric symptoms that are most troublesome for caregivers and lead to poor quality of life for patients. These symptoms include agitation, aggressive behaviors, depression, sleep disorders, and psychosis. Studies have suggested that approximately 60% of patients with Alzheimer’s disease experience agitation/aggression, up to 87% of patients experience depression, approximately 60% of patients experience sleep disturbances, particularly as an increased likelihood of day-night reversal, and approximately 20% to 51% of Alzheimer’s disease patients may develop psychosis at some point in the disease process, commonly consisting of hallucinations and delusions. The diagnosis of Alzheimer’s disease psychosis is associated with more rapid cognitive and functional decline and institutionalization. Sleep disturbances increase the likelihood of day-night reversion, increased agitation and increased caregiver stress that strongly influences decisions for nursing home placement.

The FDA has not approved any drug to treat the behavioral symptoms of Alzheimer’s disease. As symptoms progress and become more severe, physicians often resort to off-label use of antipsychotic medications in these patients. Current antipsychotic drugs are associated with a number of side effects, which can be problematic for elderly patients with Alzheimer’s disease. In addition, antipsychotic drugs may exacerbate the cognitive disturbances associated with Alzheimer’s disease. Current antipsychotic drugs also have a boxed warning for use in elderly patients with dementia-related psychosis due to increased mortality and morbidity. There is a large unmet medical need for a safe and effective therapy to treat the behavioral symptoms in patients with Alzheimer’s disease.

Parkinson’s Disease

Parkinson’s disease is a chronic and progressive neurodegenerative disorder that involves malfunction and death of neurons in a region of the brain that controls movement. This neurodegeneration creates a shortage of an important brain signaling chemical, or neurotransmitter, known as dopamine, thereby rendering patients unable

to direct or control their movements in a normal manner. Parkinson’s disease is characterized by well-known motor symptoms, including tremors, limb stiffness, slowness of movements, and difficulties with posture and balance, as well as by non-motor symptoms, which include sleep disturbances, mood disorders, cognitive impairment and psychosis. Parkinson’s disease progresses slowly in most people and the severity of symptoms tends to worsen over time.

Parkinson’s disease is the second most common neurodegenerative disorder after Alzheimer’s disease. According to the National Parkinson Foundation, about 1 million people in the United States and from approximately 4 to 6 million people worldwide suffer from this disease. Parkinson’s disease is more common in people over 60 years of age, and the prevalence of this disease is expected to increase significantly as the average age of the population increases. Parkinson’s disease patients are commonly treated with dopamine replacement therapies, such as levodopa, commonly referred to as L-DOPA, which is metabolized to dopamine, and dopamine agonists, which are molecules that mimic the action of dopamine. Sales of therapeutics such as L-DOPA and dopamine agonists used to treat the motor symptoms of the disease reached $2.3 billion in 2013.

Non-motor symptoms can be particularly distressing and even more troublesome to patients with Parkinson’s disease than the primary motor disturbances. Non-motor symptoms substantially contribute to the burden of Parkinson’s disease and deeply affect the quality of life of patients and their caregivers. Non-motor symptoms of Parkinson’s disease are associated with increased caregiver stress and burden, nursing home placement, and increased morbidity and mortality.

Treatment of non-motor symptoms associated with Parkinson’s disease poses a challenge to physicians. Current dopamine replacement drugs used to treat the motor symptoms of Parkinson’s disease do not help, and sometimes worsen, the non-motor symptoms. No drugs are currently approved by the FDA for treating the broad non-motor symptoms associated with Parkinson’s disease, and this remains a large unmet medical need.

Depression

Major depressive disorder, or MDD, is a brain disorder that can be associated with symptoms of sadness, hopelessness, helplessness, feelings of guilt, irritability, loss of interest in formerly pleasurable activities, cognitive impairment, disturbed sleep patterns, and suicide ideation or behavior. Different people may experience different symptoms, but everyone with major depression experiences symptoms that are severe enough to interfere with everyday functioning, such as the ability to concentrate at work or school, social interactions, eating and sleeping. Sometimes the depressive episode can be so severe it is accompanied by psychosis (hallucinations and delusions). According to the National Institute of Mental Health, approximately 3% of teenagers and approximately 7% of adults experience MDD each year. Worldwide sales of antidepressant drugs reached $9.3 billion in 2013. The antidepressant market is primarily composed of selective serotonin reuptake inhibitors such as Lexapro® (marketed by Forest Laboratories and Lundbeck) and selective norepinephrine reuptake inhibitors, or SNRIs, such as Cymbalta® (marketed by Eli Lilly). Antipsychotics such as Seroquel® (marketed by Astrazeneca) and Abilify® (marketed jointly by Bristol-Myers Squibb and Otsuka Pharmaceutical) are also used as adjunctive treatments with antidepressant treatment. The National Institute of Mental Health-funded Sequenced Treatment Alternatives to Relieve Depression, or STAR*D, study showed that only one-third of treated patients experience complete remission of depressive symptoms. Nearly two-thirds of patients were considered treatment-resistant.

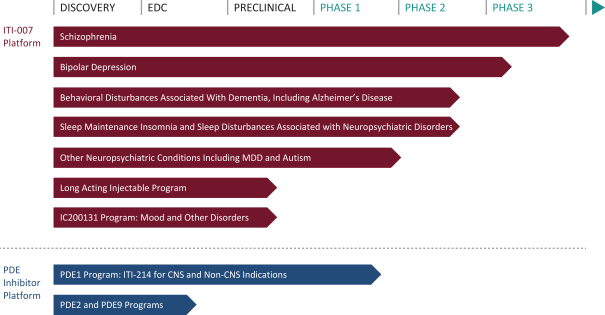

Our Clinical Programs

Our pipeline includes two product candidates in clinical development and two product candidates in advanced pre-clinical testing. We believe that our product candidates offer innovative therapeutic approaches and may provide significant advantages relative to current therapies. The following table summarizes our product candidates and programs:

OUR THERAPEUTIC PIPELINE

ITI-007 Program

Our lead product candidate, ITI-007, possesses mechanisms of action that we believe may represent an effective treatment across multiple therapeutic indications. ITI-007 is in Phase 3 clinical trials for the treatment of schizophrenia. In our pre-clinical and clinical trials to date, we have demonstrated that ITI-007 combines potent serotonin 5-HT2A receptor antagonism, dopamine receptor phosphoprotein modulation, or DPPM, glutamatergic modulation and serotonin reuptake inhibition into a single drug candidate for the treatment of acute and residual schizophrenia. At dopamine D2 receptors, ITI-007 has been demonstrated to have dual properties and to act as both a pre-synaptic partial agonist and a post-synaptic antagonist. ITI-007 has also been demonstrated to have affinity for dopamine D1 receptors and indirectly stimulate phosphorylation of glutamatergic NMDA NR2B, or GluN2B, receptors in a mesolimbic specific manner. We believe that this regional selectivity in brain areas thought to mediate the efficacy of antipsychotic drugs, together with serotonergic, glutamatergic, and dopaminergic interactions, may result in antipsychotic efficacy for positive, negative, affective and cognitive symptoms associated with schizophrenia. The serotonin reuptake inhibition could allow for antidepressant activity for the treatment of schizoaffective disorder, other disorders with co-morbid depression, and/or as a stand-alone treatment for major depressive disorder. We believe ITI-007 may also be useful for the treatment of bipolar disorder and other psychiatric and neurodegenerative disorders, particularly behavioral disturbances associated with dementia, autism and other CNS diseases.

We believe these features of ITI-007 may be able to improve the quality of life of patients with schizophrenia and enhance social function to allow them to integrate more fully into their families and their

workplaces. In addition, ITI-007 may be shown to treat disorders at either low-doses (e.g., sleep, aggression and agitation) or high-doses (e.g., acute exacerbated and residual schizophrenia, bipolar disorders, and mood disorders).

Phase 1 studies to support multiple clinical indications

We conducted a series of Phase 1 safety studies of ITI-007 in Europe and the United States during the period from 2007 to 2011. All of the studies conducted to date in the United States have been conducted under an Investigational New Drug application, or IND, filed in 2007 by ITI. Data from these studies are being used to support the clinical development of ITI-007 in multiple indications, including schizophrenia, sleep disorders in neuropsychiatric and neurodegenerative disease, major depressive disorders, bipolar disorders, behavioral disturbances in dementia and Alzheimer’s disease, autism, posttraumatic stress disorder, or PTSD, and intermittent explosive disorder, or IED. We have completed the following three Phase 1 trials in healthy volunteers:

We continued Phase 1 development of ITI-007 in patients with schizophrenia in order to advance ITI-007 in this target therapeutic indication. Specifically, we conducted the following additional studies:

ITI-007 for the treatment of exacerbated and residual schizophrenia

In multiple clinical trials of ITI-007 in patients with schizophrenia, the drug candidate has demonstrated clinical signals consistent with reductions in psychosis, depression and insomnia. Reductions in psychosis are consistent with the potential to treat acute schizophrenia, whereas reductions in depression and insomnia are

consistent with the potential to treat residual phase schizophrenia. ITI-007 has been shown to be safe and well-tolerated across a wide range of doses in these studies. Further, at doses that have demonstrated clinical activity, ITI-007 has caused fewer adverse effects than those typically associated with antipsychotic drug treatment, such as impaired motor function. These adverse side effects can be a major cause of patient noncompliance with current antipsychotic therapies and can lead to poorer social function.

Phase 2 Clinical Trial (ITI-007-005)

ITI-007 exhibited antipsychotic efficacy in ITI-007-005, a randomized, double-blind, placebo and active controlled Phase 2 clinical trial in patients with an acutely exacerbated episode of schizophrenia. In December 2013, we announced the clinical results from this Phase 2 trial. In this Phase 2 trial, 335 patients were randomized to receive one of four treatments: 60 mg of ITI-007, 120 mg of ITI-007, 4 mg of risperidone (active control) or placebo in a 1:1:1:1 ratio. Patients received study treatment orally once daily in the morning for 28 days. Of those randomized, 311 patients were included in the intent-to-treat primary analysis. Subject participation lasted approximately 7 to 8 weeks, including a one week screening period, a four week treatment period followed by stabilization on standard of care, and a safety follow up visit approximately two weeks after stabilization. The primary endpoint for this clinical trial was change from baseline to Day 28 on the PANSS total score. The PANSS is a well-validated 30-item rating scale that measures the ability of a drug to reduce schizophrenia symptom severity. The PANSS measures positive symptoms, such as delusions, suspiciousness, and hallucinations; negative symptoms, such as blunted affect, social and emotional withdrawal, and stereotyped thinking; and general psychopathology, such as anxiety, tension, depression, and active social avoidance.

Secondary endpoints in this trial included weekly assessments of the PANSS total score as well as its subscales (Positive Symptom Subscale, Negative Symptom Subscale, and General Psychopathology Subscale) and the Negative Symptom Factor (based on a subset of PANSS questions), individual item response on the PANSS, and the Calgary Depression Scale for Schizophrenia. Safety and tolerability were also assessed.

In December 2013, we announced that topline results from the ITI-007-005 study indicated that ITI-007 met the trial’s pre-specified primary endpoint, improving symptoms associated with schizophrenia as measured by a statistically significant and clinically meaningful decrease in the PANSS total score. The trial also met key secondary outcome measures related to efficacy on PANSS subscales and safety.

Many patients with schizophrenia have deficits in social function. Social function is the ability to recognize, understand, process and use external cues to solve problems, maintain work performance and conduct interpersonal relationships. Deficits in social function often remain after positive symptoms, such as hallucinations and delusions, have resolved in these patients. In the Phase 2 trial, ITI-007 exhibited a differentiating response profile across a broad range of symptoms that we believe is consistent with improvements in these social functioning deficits. The study also showed that ITI-007 was well-tolerated at the tested doses. ITI-007 demonstrated a favorable safety profile in the study without characteristic antipsychotic drug side effects or any serious adverse events.

ITI-007 at a dose of 60 mg demonstrated a statistically significant improvement in psychosis (p = 0.017) on the trial’s pre-specified primary endpoint, which was change from baseline on the PANSS total score, compared to placebo. The primary statistical analysis was pre-specified and used a Mixed-Effect Model Repeated Measure method for handling missing data in the intent-to-treat, or ITT, study population and a Bonferroni procedure to correct for multiple two-sided comparisons (each dose of ITI-007 compared to placebo). The trial’s pre-specified sensitivity analysis on the primary endpoint used the analysis of covariance, or ANCOVA, model and last observation carried forward, or LOCF, method for handling missing data for the ITT population and confirmed the positive outcome with statistically significant improvements compared to placebo in patients receiving the 60 mg dose of ITI-007 (p = 0.011). ITI-007 at a dose of 60 mg also significantly improved the positive symptom subscale (p < 0.05) and the general psychopathology subscale (p < 0.05) on the PANSS after 28 days of treatment using the ANCOVA-LOCF on the ITT population.

The improvement in the PANSS total score in the 120 mg dose group did not reach statistical significance. We believe that it is possible that sedation, the most frequent side effect in the 120 mg dose group, interfered with the ability to detect an efficacy signal at this dose administered once daily in the morning. Approximately 32.5% of subjects randomized to 120 mg of ITI-007 experienced sedation/somnolence, compared to 21% of subjects randomized to risperidone, 17% of subjects randomized to 60 mg of ITI-007, and 13% randomized to placebo. We believe that nighttime administration may be more appropriate for testing the effectiveness of the 120 mg dose of ITI-007 in this patient population. In the trial, the 60 mg dose of ITI-007 was effective when administered once daily in the morning.

Consistent with preliminary indications from the interim analysis and with the drug candidate’s pharmacological profile, ITI-007 at a dose of 60 mg significantly improved certain items on the negative symptom and general psychopathology subscales consistent with improved social function. The study was statistically powered only on the primary endpoint. ITI-007 did significantly improve many secondary endpoints, although the study was not designed for significance on secondary endpoints and was not powered to detect statistical differences in subgroup analyses.

A high percentage (74%) of randomized subjects completed trial participation. Only 19% of subjects discontinued from study treatment during the 28 day study treatment period, and an additional 7% of subjects completed study treatment but were lost to follow up.

In the Phase 2 trial, ITI-007 was well-tolerated. The most frequent AE was sedation, as described above. There were no serious adverse events related to ITI-007. There were no clinically meaningful changes in safety measures with ITI-007. Notably, ITI-007 demonstrated a favorable metabolic profile with no increase of blood levels of glucose, insulin, cholesterol or triglycerides over a four week treatment period. Moreover, in contrast to risperidone, 60 mg of ITI-007 was effective with no difference from placebo on weight change parameters, prolactin levels, extrapyramidal symptoms (EPS) or akathisia. ITI-007 was not associated with EPS as measured by the Simpson-Angus Scale, Barnes Akathisia Rating Scale, or Abnormal Involuntary Movement Scale. There was no increase in suicidal ideation or behavior with ITI-007.

Phase 3 Clinical Trials and Regulatory Plans

We are proceeding with Phase 3 development of ITI-007 for the treatment of schizophrenia. We are conducting two randomized, double-blind, placebo-controlled Phase 3 clinical trials of ITI-007 in patients with acutely exacerbated schizophrenia. In September 2015, we announced top-line clinical results from our first Phase 3 clinical trial of ITI-007 for the treatment of patients with schizophrenia. This randomized, double-blind, placebo-controlled Phase 3 clinical trial was conducted at 12 sites in the United States with 450 patients randomized (1:1:1) to receive either 60 mg of ITI-007, 40 mg of ITI-007 or placebo once daily in the morning for 28 days. The pre-specified primary efficacy measure was change from baseline versus placebo at study endpoint (4 weeks) on the centrally rated Positive and Negative Syndrome Scale, or PANSS, total score. In this trial, the once-daily dose of 60 mg of ITI-007 met the primary endpoint and demonstrated antipsychotic efficacy with statistically significant superiority over placebo at week 4 (study endpoint) with additional improvements observed in social function. Moreover, the 60 mg dose of ITI-007 showed significant antipsychotic efficacy as early as week 1, which was maintained at every time point throughout the entire study. ITI-007 showed a dose-related improvement in symptoms of schizophrenia with the 40 mg dose approximating the trajectory of improvement seen with the 60 mg dose, but the effect with 40 mg did not reach statistical significance on the primary endpoint. In addition, the 60 mg dose of ITI-007 met the key secondary endpoint of statistically significant improvement on the Clinical Global Impression Scale for Severity of Illness, or CGI-S. The 40 mg dose of ITI-007 also demonstrated a statistically significant improvement versus placebo on the CGI-S, though not formally tested against placebo since it did not separate on the primary endpoint. Consistent with previous studies, ITI-007 had a favorable safety and tolerability profile as evidenced by motoric, metabolic, and cardiovascular characteristics similar to placebo, and no clinically significant changes in akathisia, extrapyramidal symptoms, prolactin, body weight, glucose, insulin, or lipids. We are also conducting a second Phase 3 clinical trial in schizophrenia that we initiated in the second quarter of 2015, with over 600 patients

planned to be enrolled in the trial. In this trial, we are randomizing patients to two doses of ITI-007 (60 mg or 20 mg), risperidone (active control) or placebo over a 6-week treatment duration, and the primary outcome measure is change from baseline to Day 42 on the PANSS total score. We expect patient enrollment will be completed in the second quarter of 2016. Subject to timely enrollment, we anticipate top-line results from the second Phase 3 clinical trial will be available in mid-2016.

In addition to our Phase 3 clinical trials, we will need to complete other clinical and non-clinical trials and manufacturing and pre-commercialization activities necessary to support the submission of a planned NDA for ITI-007 in schizophrenia, which we currently expect could occur in the first half of 2017. Additional meetings with the FDA may be requested, as needed, to discuss in greater detail our plans for schizophrenia, and other elements of our regulatory strategy, including additional therapeutic indications, as the program progresses. Our clinical plans may change based on any discussions with the FDA, the relative success and cost of our research, preclinical and clinical development programs, whether we are able to enter into future collaborations, and any unforeseen delays or cash needs. If the FDA does not agree with our clinical development plans for ITI-007, our development of ITI-007 may be delayed and the costs of our development of ITI-007 could increase, which would have a material adverse effect on our business, financial condition and results of operations.

We are also developing long acting injectable formulations of ITI-007 for the treatment of schizophrenia. This is a pre-clinical stage development program.

PET study of ITI-007 in patients with stable schizophrenia

On September 16, 2015, we announced top-line data from an open-label positron emission tomography, or PET, study of ITI-007 examining brain occupancy of striatal D2 receptors. This study was conducted in patients diagnosed with schizophrenia who were otherwise healthy and stable with respect to their psychosis. After washout from their previous antipsychotic medication for at least two weeks, PET was used to determine target occupancy in brain regions at baseline (drug-free) and again after two weeks of once daily ITI-007 oral administration. In this trial, the 60 mg dose of ITI-007 was associated with a mean of approximately 40% striatal dopamine D2 receptor occupancy. As predicted by preclinical and earlier clinical data, ITI-007 demonstrated antipsychotic effect at relatively low striatal D2 receptor occupancy, lower than the occupancy range required by most other antipsychotic drugs. Unlike any existing schizophrenia treatment, this dopamine receptor phosphoprotein modulator, or DPPM, acts as a pre-synaptic partial agonist and post-synaptic antagonist at D2 receptors. We believe this mechanism likely contributes to the favorable safety profile of ITI-007, with reduced risk for hyperprolactinemia, akathisia, extrapyramidal symptoms, and other motoric side effects.

ITI-007 for the treatment of depressive episodes associated with bipolar disorder (bipolar depression)

The pharmacological profile of ITI-007 offers the potential to treat bipolar mania, depression, and mixed symptoms at doses similar to those targeted for the treatment of schizophrenia. We believe that ITI-007 may be effective alone or in combination with mood stabilizers. Given that many patients with bipolar disorder also experience disturbed sleep and cognitive impairment similar to that observed in schizophrenia, we believe that ITI-007 may treat a wide array of symptoms in patients with bipolar disorder, including improvement of cognition and sleep.

Our bipolar depression program consists of two Phase 3 multi-center, randomized, double-blind, placebo-controlled clinical trials: one to evaluate ITI-007 as a monotherapy and the other to evaluate ITI-007 as an adjunctive therapy with lithium or valproate. In each trial, approximately 550 patients with a clinical diagnosis of Bipolar I or Bipolar II disorder and who are experiencing a current major depressive episode will be randomized to receive one of three treatments: 60 mg ITI-007, 40 mg ITI-007, or placebo in a 1:1:1 ratio orally once daily for 6 weeks. In the ITI-007-401 trial, patients will receive ITI-007 or placebo as a monotherapy. In the ITI-007-402 trial, patients will receive ITI-007 or placebo adjunctive to their existing mood stabilizer lithium or valproate. We initiated our bipolar depression program in the third quarter of 2015.

The primary endpoint for both clinical trials is change from baseline at Day 42 on the Montgomery-Åsberg Depression Rating Scale (MADRS) total score versus placebo. The MADRS is a well-validated 10-item checklist that measures the ability of a drug to reduce overall severity of depressive symptoms. Individual items are rated

by an expert clinician on a scale of 0 to 6 in which a score of 6 represents the most depressed evaluation for each item assessed. The total score ranges from 0 to 60. Secondary endpoints include measures of social function and quality of life that may illustrate the differentiated clinical profile of ITI-007. Safety and tolerability are also assessed in both clinical trials.

ITI-007 for the treatment of behavioral disturbances associated with dementia, including Alzheimer’s disease

Behavioral disturbances are common in dementia and Alzheimer’s disease. These disturbances are a major component of the burden to caregivers, and often lead to institutionalization. Although currently available treatments for patients with dementia mainly address cognitive disturbances, behavioral disturbances are considerably more problematic and likely more amenable to drug treatment. Several behavioral symptoms are quite prevalent in patients with dementia, including patients with Alzheimer’s disease. In the fourth quarter of 2014, we announced the top-line data from ITI-007-200, a Phase 1/2 clinical trial designed to evaluate the safety, tolerability and pharmacokinetics of low doses of ITI-007 in healthy geriatric subjects and in patients with dementia, including Alzheimer’s disease. The ITI-007-200 clinical trial was conducted in two parts. Part 1 was a randomized, double-blind, placebo-controlled multiple ascending dose evaluation of ITI-007 in healthy geriatric subjects. In each of three cohorts in Part 1, approximately 10 subjects were randomized to receive ITI-007 (N=8) or placebo (N=2) orally once daily in the morning for seven days. Doses of ITI-007 up to and including 30 mg were evaluated in three cohorts in Part 1. In Part 2, eight patients with dementia were randomized to receive 9 mg ITI-007 (N=5) or placebo (N=3) orally once a day in the evening for seven days. The primary objectives of the study were to evaluate the safety, tolerability and pharmacokinetics of ITI-007 in the elderly and in the target dementia patient population. Secondary measures were included to explore the effects of ITI-007 on cognition and agitation. The Hopkins Verbal Learning Test-R, or HVLT-R, was used to assess cognition in healthy geriatric subjects and dementia patients. The results demonstrated impaired verbal learning and memory (recall and recognition memory) by dementia patients relative to healthy geriatric subjects. Moreover, the data indicated that healthy geriatric subjects treated with ITI-007 for approximately one week experienced an improvement in verbal learning and memory relative to placebo-treated subjects. Dementia patients treated with ITI-007 showed enhanced recognition memory, making fewer false positive errors (i.e., responding ‘yes’ to non-target words) than patients treated with placebo. Other secondary endpoints in the ITI-007-200 clinical trial included the assessment of agitation. However, none of the study participants experienced agitation at baseline or during the study, and therefore no signals on this behavioral endpoint could be assessed. The completion of this study marks an important milestone in our strategy to develop low doses of ITI-007 for the treatment of behavioral disturbances associated with dementia and related disorders. The ITI-007-200 trial results to date indicate that ITI-007 is safe and well-tolerated across a range of low doses, has linear- and dose-related pharmacokinetics and improves cognition in the elderly. The most frequent adverse event was mild sedation at the higher doses. We believe these results further position ITI-007 as a development candidate for the treatment of behavioral disturbances in patients with dementia and other neuropsychiatric and neurological conditions. We plan to initiate additional clinical programs evaluating ITI-007 in patients with behavioral disturbances associated with dementia and related disorders, including Alzheimer’s disease, in the first half of 2016.

ITI-007 for the treatment of sleep disturbances associated with neurologic and psychiatric disorders

A Phase 2 double-blind, placebo controlled cross-over clinical trial conducted in 19 patients with primary insomnia with disturbed sleep maintenance at low doses of ITI-007 was completed in 2008 in Europe. The primary outcome measure was slow wave sleep as determined by polysomnography. ITI-007 demonstrated a dose-related statistically significant increase in slow wave sleep. Secondary measures were consistent with improvement of sleep maintenance in patients with primary insomnia, indicated by decreased waking after sleep onset, increased total sleep time, and no increase in latency to sleep onset. At these low doses ITI-007 did not induce sleep, but rather helped maintain sleep once sleep had been initiated. In addition, ITI-007 was not associated with next day cognitive impairment, or “hang-over” effects. We believe that ITI-007 may be particularly useful in the treatment of sleep disorders that accompany neuropsychiatric and neurologic disorders, including schizophrenia, autism spectrum disorder, or ASD, Parkinson’s disease and dementia. Previous work

has suggested that selective 5-HT2A receptor antagonists increase deep, slow wave sleep in both humans and animals. We believe, however, that other neuropharmacological mechanisms, in addition to 5-HT2A receptor antagonism, such as engaging some dopamine modulation, may be beneficial for the successful treatment of sleep maintenance insomnia, or SMI, in humans. We believe that ITI-007 represents a new approach to the treatment of sleep maintenance insomnia because of its business planunique pharmacology and neuropharmacological interactions beyond selective 5-HT2A receptor antagonism. We believe that ITI-007 offers a potentially new approach to the treatment of sleep maintenance disorders, particularly in those disorders that accompany neuropsychiatric and neurologic disorders. Many of these disorders are accompanied by profound sleep deficits, which impair daytime functioning including cognition, exacerbate disease symptoms and increase the cost of care. We are presently exploring clinical designs to incorporate the examination of sleep disturbances in one or more of these indications. There is no assurance that any such design would be sufficient for an FDA approval for this indication.

ITI-007 for the treatment of sleep and behavioral disturbances associated with autism spectrum disorder

Sleep problems are common in patients with ASD and are not adequately treated by currently available interventions. Approximately two thirds of children and adolescents with ASD experience sleep problems, higher than the rate of sleep problems in age-matched developmentally typical children. Moreover, individuals with ASD suffer from behavioral disturbances, including aggression, irritability, anxiety and depression. With its multiple pathway mechanism of action, we believe that ITI-007 could address the multi-faceted behavioral symptoms associated with ASD. 5-HT2A receptor antagonism is predicted to mergeincrease slow wave sleep, improve sleep maintenance and reduce aggression. D2 receptor modulation is predicted to improve sleep maintenance and reduce irritability and aggression. Serotonin reuptake inhibition is predicted to reduce anxiety and depression. Accordingly, we believe that ITI-007 could improve sleep maintenance, reduce behavioral disturbances and enhance social interaction in patients with ASD. We believe that our completed Phase 1 studies support advancing ITI-007 into Phase 2 trials in this patient population, and we are presently exploring the feasibility of such trials.

ITI-007 for the treatment of depression and other mood disorders

As a potent 5-HT2A receptor antagonist and serotonin reuptake inhibitor, we believe that ITI-007 could improve symptoms of depression with fewer side effects than selective serotonin reuptake inhibitors, or SSRIs. Dopamine modulation by ITI-007 may reduce irritability and aggression that can accompany many mood disorders. As such, ITI-007 may be effective for the treatment of mood disorders including MDD, PTSD, and IED. We are presently exploring the feasibility of clinical studies in these indications.

ITI-002 (PDE1) Program

We have a second major program called ITI-002 that has yielded a portfolio of compounds that selectively inhibits the enzyme phosphodiesterase type 1, or PDE1. We believe PDE1 helps regulate brain activity related to cognition, memory processes and movement/coordination. In addition, PDE1 inhibitors may have utility in treating non-CNS disorders. On February 25, 2011, we (through our wholly owned operating subsidiary, ITI) and Takeda Pharmaceutical Company Limited, or Takeda, entered into a license and collaboration agreement, or the Takeda License Agreement, under which we agreed to collaborate to research, develop and commercialize our proprietary compound ITI-214 and other selected compounds that selectively inhibit PDE1 for use in the prevention and treatment of human diseases. Takeda conducted four Phase 1 studies. A single rising dose study was conducted in the U.S. in healthy male and female, Japanese and non-Japanese volunteers. In a second U.S. study, ITI-214 was administered once daily over 14 days to healthy volunteers and patients with stable schizophrenia. In a third study, conducted in Japan, ITI-214 was administered for seven days at multiple rising oral doses in both male and female healthy volunteers. A fourth study compared the relative bioavailability of oral formulations of ITI-214 used in all previous studies to an immediate-release tablet, either with or without food in healthy volunteers. In these studies, ITI-214 demonstrated a favorable safety profile and was generally

well-tolerated across a broad range of doses both in healthy volunteers and in patients with schizophrenia with a pharmacokinetic profile that supports once daily dosing. ITI-214 is the first compound in its class to successfully advance into Phase 1 clinical trials. On October 31, 2014, we entered into an agreement with Takeda terminating the Takeda License Agreement, or the Termination Agreement, pursuant to which all rights granted under the Takeda License Agreement were returned to us. On September 15, 2015, Takeda completed the transfer of the Investigational New Drug application, or IND, for ITI-214 to us. We intend to pursue the development of our PDE program, including ITI-214 for the treatment of several CNS and non-CNS conditions, which may include cognition in Parkinson’s disease, cognition in Alzheimer’s disease, cognition in schizophrenia and in other non-CNS indications. Other compounds in the PDE portfolio are also being advanced for the treatment of various indications.

Additional PDE Programs

There are multiple forms and isoforms of PDE with distinct roles in intracellular signaling. We have developed strong internal expertise in the design and synthesis of inhibitors specific for individual PDE isoforms. Based on our understanding of the expression and functions of these isoforms in the CNS, we have identified PDE2 and PDE9 as compelling targets for drug discovery. We believe that inhibitors of these PDEs may be useful in treating neurodegeneration and bioenergetic failure in a variety of CNS diseases.

Intellectual Property

Our Patent Portfolio

As of February 1, 2016, we owned or controlled approximately 70 patent families filed in the United States and other major markets worldwide, including approximately 54 issued or allowed U.S. patents, 41 pending U.S. patent applications, 214 issued foreign patents, and 194 pending foreign patent applications, directed to novel compounds, formulations, methods of treatment, synthetic methods, and platform technologies.

Our ITI-007 program on novel compounds for neuropsychiatric and neurodegenerative diseases includes patents exclusively in-licensed from Bristol-Myers Squibb on families of compounds, including the ITI-007 lead molecule. We have extensively characterized this lead and filed additional patent applications on polymorphs, formulations, additional indications, derivatives and additional compounds. The ITI-007 lead molecule has composition of matter protection through 2025 and additional Orange Book-listable protection to 2034. Additionally, we expect to have data exclusivity in the European Union for up to 11 years from commercial launch. We also have a follow-on program, directed to compounds structurally related to the ITI-007 lead, but having composition of matter protection beyond 2031.

Our program on PDE1 inhibitors for cognition and dopamine-mediated disorders, such as Parkinson’s disease, includes patent protection for the lead molecule, ITI-214, as well as a wide range of filings on other proprietary compounds and indications. The ITI-214 lead molecule has composition of matter protection to 2029, with possible extensions and additional Orange Book-listable protection to 2034. Additionally, we expect to have data exclusivity in the European Union for up to 11 years from commercial launch. We are also evaluating potential follow-on compounds for ITI-214 which would have patent protection beyond 2030.

We have also filed patent applications on novel proprietary targets and lead compounds for Alzheimer’s disease, which would provide compound protection beyond 2028 or beyond 2034, depending on which compound is ultimately selected for development.

License Agreement

The Bristol-Myers Squibb License Agreement

On May 31, 2005, we entered into a worldwide, exclusive License Agreement with Bristol-Myers Squibb Company, or BMS, pursuant to which we hold a license to certain patents and know-how of BMS relating to ITI-007 and other specified compounds. The agreement was amended on November 3, 2010. The licensed rights are

exclusive, except BMS retains rights in specified compounds in the fields of obesity, diabetes, metabolic syndrome and cardiovascular disease. However, BMS has no right to use, develop or commercialize ITI-007 and other specified compounds in any field of use. We have the right to grant sublicenses of the rights conveyed by BMS. We are obliged under the license to use commercially reasonable efforts to develop and commercialize the licensed technology. We are also prohibited from engaging in the clinical development or commercialization of specified competitive compounds.

Under the agreement, we made an upfront payment of $1.0 million to BMS, a milestone payment of $1.25 million in December 2013, and a milestone payment of $1.5 million in December 2014 following the initiation of our first Phase 3 clinical trial for ITI-007 for patients with exacerbated schizophrenia. Possible milestone payments remaining total $12.0 million. Under the agreement, we may be obliged to make other milestone payments to BMS for each licensed product of up to an aggregate of approximately $14.75 million. We are also obliged to make tiered single digit percentage royalty payments on sales of licensed products. We are obliged to pay to BMS a percentage of non-royalty payments made in consideration of any sublicense.

The agreement extends, and royalties are payable, on a country-by-country and product-by-product basis, through the later of ten years after first commercial sale of a licensed product in such country, expiration of the last licensed patent covering a licensed product, its method of manufacture or use, or the expiration of other government grants providing market exclusivity, subject to certain rights of the parties to terminate the agreement on the occurrence of certain events. On termination of the agreement, we may be obliged to convey to BMS rights in developments relating to a licensed compound or licensed product, including regulatory filings, research results and other intellectual property rights.

Collaboration Agreement

The Takeda Pharmaceutical License and Collaboration Agreement and Termination Agreement

On February 25, 2011, we entered into a license and collaboration agreement with Takeda Pharmaceutical Company Limited under which we agreed to collaborate to research, develop and commercialize our proprietary compound ITI-214 and other selected compounds that selectively inhibit PDE1 for use in the prevention and treatment of human diseases. As part of the agreement, we assigned to Takeda certain patents owned by us that claim ITI-214 and granted Takeda an exclusive license to develop and commercialize compounds identified in the conduct of the research program that satisfy specified criteria. However, we retained rights to all compounds that do not meet the specified criteria and we continue to develop PDE1 inhibitors outside the scope of the agreement. Upon execution of the agreement, Takeda made a nonrefundable payment to us.

Under the terms of the agreement, we conducted a research program with an unidentified company or companies." Under SEC Rule 12b-2initial term of three years to identify and characterize compounds that meet certain specified criteria sufficient for further development by Takeda. This research program ended in February 2014. We were responsible for our expenses incurred in the conduct of certain research activities specified in the research plan. Takeda agreed to reimburse us for expenses we incurred in conducting additional research activities.

On October 31, 2014, we entered into an agreement with Takeda terminating the Takeda License Agreement, pursuant to which all rights granted under the Exchange Act,Takeda License Agreement were returned to us. On September 15, 2015, Takeda completed the Companytransfer of the Investigational New Drug application, or IND, for ITI-214 to us. ITI-214 is the first compound in its class to successfully advance into Phase 1 clinical trials. We intend to pursue the development of our PDE program, including ITI-214 for the treatment of several CNS and non-CNS conditions, which may include cognition in Parkinson’s disease, cognition in Alzheimer’s disease, cognition in schizophrenia and in other non-CNS indications. Other compounds in the PDE portfolio are also qualifiesbeing advanced for the treatment of various indications.

Manufacturing

We do not own or operate manufacturing facilities for the production of any of our product candidates, nor do we have plans to develop our own manufacturing operations in the foreseeable future. We currently rely on third-party contract manufacturers for all of our required raw materials, active pharmaceutical ingredient, or API, and finished product for our preclinical research and clinical trials, including the Phase 3 trials for ITI-007 for the treatment of schizophrenia and the treatment of bipolar depression. We believe that we would be able to contract with other third-party contract manufacturers to obtain API if our existing sources of API were no longer available, but there is no assurance that API would be available from other third-party manufacturers on acceptable terms, on the timeframe that our business would require, or at all. We do not have long-term agreements with our existing third-party contract manufacturers. We also do not have any current contractual relationships for the manufacture of commercial supplies of any of our product candidates if they are approved. As ITI-007 and any of our other product candidates continue to progress towards potential regulatory approval, we intend to enter into agreements with a third-party contract manufacturer and one or more back-up manufacturers for the commercial production of those products. Development and commercial quantities of any products that we develop will need to be manufactured in facilities, and by processes, that comply with the requirements of the FDA and the regulatory agencies of other jurisdictions in which we are seeking approval. We currently employ internal resources to manage our manufacturing contractors.

Sales and Marketing