FORM 10-K

x ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

o ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File Number: 333-114564

(Exact name of registrant as specified in its charter)

| Nevada | 98-0550699 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

20955 Pathfinder Road, Suite 200 Diamond Bar CA, USA | 91765 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Title of each class: | Name of each exchange on which registered: | |

| None | None |

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, par value $0.001 per share.None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o ☐ No x☒

Indicate by check mark if the registrant is not required to file reports pursuant Section 13 or 15(d) of the Exchange Act. Yes o ☐ No ☒

x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x ☒ No o☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’sregistrant���s knowledge, in definitive proxy or information statements incorporated by reference inPart IIIIII of this Form 10-K or any amendment to this Form 10-K. o☐

Indicate by check mark whether the registrant is a large accelerated filer, and accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer | ||

| Non-accelerated filer | Smaller reporting company | ||

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o ☐ No x

State the aggregate market value of shares ofthe voting and non-voting common stockequity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter was 16,499,346. The aggregate market valuequarter: $546,874.72 based on 13,476,868 non-affiliates shares of voting and nonvoting common stock held by non-affiliates of the registrant, based upon the closing bid quotation for the registrant’s common stock, as reported on the OTC Bulletin Board quotation service, as of June 30, 2013 was $4,289,830.

The number of shares of the registrant’s common stock outstanding as of April 8, 2014March 30, 2017 was 31,518,518.

Documents Incorporated by Reference: None

CHINA CARBON GRAPHITE GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2013

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report on Form 10-K, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

OTHER PERTINENT INFORMATION

Unless the context specifically states or implies otherwise, references in this Annual Report on Form 10-K to “we,” “us,” and words of like import refer to China Carbon Graphite Group, Inc., its wholly-owned subsidiaries, Talent International Investment Limited (“Talent”), XingheYongle Carbon Co., Ltd. (“Yongle”), Golden Ivy Limited (“BVI Co.,”), Royal Elite New Energy Science and Technology (Shanghai) Co., Ltd. (“Royal Shanghai”) and Royal Elite International Limited (“Royal HK”), and its controlled entity, Xinghe Xingyong Carbon Co., Ltd. (“Xingyong”), which is a variable interest entity that has entered into contractual arrangements with Yongle. Xingyong’s financial statements are consolidated.

Our business is conducted in the People’sPeople's Republic of China (“China”("China" or the “PRC”"PRC"). “RMB”"RMB" refers to Renminbiyuan,Renminbi, or the Yuan, the official currency of the PRC. Our consolidated financial statements are presented in U.S. dollars in accordance with U.S. GAAP. In this Annual Report, we refer to assets, obligations, commitments and liabilities in our financial statements in U.S. dollars. These dollar references are based on the exchange rate of RMB to U.S. dollars, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars, which may result in an increase or decrease in the amount of our obligations (expressed in U.S. dollars) and the value of our assets.

Business Overview of Our Business

We are engaged in the manufacturemanufacturing of graphite-basedgraphene, graphene oxide and graphite bipolar plates products in the PRC. Our products are used in the manufacturing process for other products, particularly non-ferrous metals and steel, and are incorporated in various types of products or processes, such as atomic reactors. We currently manufacture and sell primarily the following types of graphite products:

Our business scope includes manufacturing and consumer (household) commodities to both business and consumers throughselling primarily the website by paying a fee for each transaction conducted through the website.

| ● | graphene; | |

| ● | graphene oxide; and | |

| ● | graphite bipolar plates |

Our Growth Strategy

Some of our future business plans, including the expansion ofpromoting our product offerings to include nuclear, solaronline portal and semiconductor productspotential acquisition and pursuing an acquisition,merger, would likely require us to obtain additional funds from equity or debt markets, or to borrow additional funds from local banks. We currently have no commitments from any financing sources. There is no assurance that we will be able to raise any funds on terms favorable to us, or at all. In the event that we issue shares of equity or convertible securities, holdings of our existing stockholders would be diluted. In addition, there is no assurance that we will be able to successfully manage and integrate the production and sale of new products.

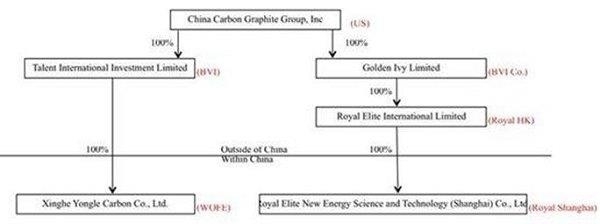

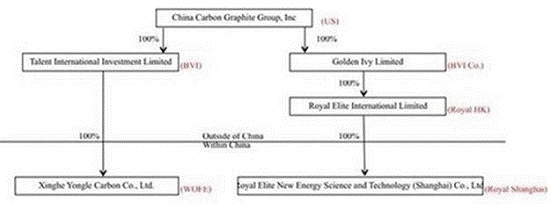

Organizational Structure

We were incorporated in Nevada on February 13, 2003 as Achievers Magazine Inc. On December 17, 2007, we completed a reverse merger with Talent International Investment Limited, or Talent, a company incorporated in the British Virgin Islands on February 1, 2007.2007 (“Talent”). Following the reverse merger, our name was changed to China“China Carbon Graphite Group, Inc.

As a result of the reverse merger, Talent became a wholly-owned subsidiary of the Company. Talent wholly owns Yongle, which is a wholly foreign-owned enterprise organized under the laws of the PRC. On December 14, 2007, Yongle executed a series of exclusive contractual agreements with Xingyong, an operating company organized under the laws of the PRC. Xingyong was founded in 1986 as a state-owned company and converted into a private enterprise in 2001.

PRC law currently has limits on foreign ownership of certain companies. To comply with these foreign ownership restrictions, we operateoperated our businesses in the PRC through Xingyong. Xingyong has the licenses and approvals necessary to operate in the PRC. We havehad contractual agreements with Xingyong and its stockholders pursuant to which we havehad the ability to substantially influence Xingyong’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring stockholder approval. As a result of our contractual agreements with Xingyong, we arewere able to control Xingyong. Consequently, we consolidate Xingyong’s financial statements

| 1 |

Sale of Xingyong.On June 10, 2014, the Company entered into an asset purchase agreement (the “Agreement”) by and among the Company and its wholly-owned subsidiary, Yongle (together with our financial statements. There are certain risks related to our contractual arrangements with Xingyong, which are discussed below in Item. 1A under the heading “Risk Factors—Risks Related to Our Corporate Structure.”

The Company’s results of operations related to Xingyong have since been reclassified as discontinued operations on a quarterlyretrospective basis and is determined based on a number of factors, including but not limited to the complexity of the services provided and the commercial value of the services provided. The term of the exclusive technical consulting and services agreement is 10 years from the date thereof. Yongle may extend the term of such agreement. The parties may terminate the agreement, prior to its expiration, upon the mutual consent of Yongle and Xingyong.

Equity Pledge Agreement . Pursuant to an equity pledge agreement, dated December 7, 2007, each of the shareholders of Xingyong pledged his equity interest in Xingyong to Yongle to secure Xingyong’s obligations under the VIE agreements described above. In addition, the shareholders of Xingyong agreed not to transfer, sell, pledge, dispose of or create any encumbrance on any equity interests in Xingyong that would affect Yongle’s interests. The equity pledge agreement will expire when Xingyong fully performs its obligations under the various VIE agreements described above.

On December 23, 2013, we acquired Golden Ivy Limited, a British Virgin Island company (“BVI Co.,”). Pursuant to the terms of the acquisition, we will issueissued an aggregate of 5,000,000 shares of common stock, par value $0.001 per share, to the former shareholders of BVI Co. in exchange for 100% of the issued and outstanding equity of BVI Co. . BVI Co. then becomebecame a wholly owned subsidiary of the Company. The shares were issued on January 16, 2014.

BVI Co. currently has twoone business operationsoperation as follows (collectively the(the “Business”):

| ● | A business-to-business and business-to-consumers Internet portal (www.roycarbon.com) for graphite related products. |

The Business and the facilities related thereto are all located in the People’s Republic of China (“China”). The Business is conducted by Royal Elite New Energy Science and Technology (Shanghai) Co., Ltd. (“Royal Shanghai”), a wholly foreign owned enterprise under laws of China. Royal Shanghai is wholly owned by Royal Elite International Limited, a Hong Kong company, (“Royal HK”), which is wholly owned by BVI Co. The Business currently generates minimal sales.

Royal Shanghai was set up in Shanghai on June 9, 2010. Royal HK was set up in Hong Kong on January 8, 2010.

| 2 |

Organizational Structure Chart

The following chart sets forth our organizational structure:

Our Products

Through our newly acquired subsidiary we now manufacture and sell the following products:

| ● | grapheme; | |

| ● | graphene oxide; and |

| ● | graphite bipolar plates. |

Graphene Oxide has wide applications as a conductive agent, such as in lithium ion batteries, super capacitors, rubber and plastic additives, conductive ink, special coating, transparent conductive thin films and chips.

Graphite bipolar plates are primarily used in solar power storage.

For the year ended December 31, 2013, one supplier accounted for 10% or more of our total purchases, representing 25.7%. For the year ended December 31, 2012, two suppliers accounted for 10% or more of our total purchases, representing 51.6% and 16.3%, respectively.

Our customers include over 200 distributors located throughout 22 provinces in China as well as end users located in China. Our distributors sold our products to end users both in China and in foreign countries, including, among others, Japan, the United States, Spain, England, South Korea and India. These end users consist of companies in various industries, including automobile, defense, molding, machinery and tool manufacturers. Our direct sales consist of sales of our graphite electrodes to steel manufacturers and metallurgy companies located in China and sales of our fine grain graphite and high purity graphite products to molding companies located in China.mainly international customers.

| 3 |

We generally do not enter into long-term contracts with our distributors or customers. Our distributors and customers generally purchase our products pursuant to purchase orders. We currently have one long-term agreement with one of our distributors; however, the volume of sales from such distributor is not material to our business.

Our distributors and customers generally purchase on credit, depending on their credit history and volume of purchases from us. During 2010, as a result of the global economic recovery and the expansion of our production capacity, we experienced an increased demand for our products and increased sales. This trend continued in 2011 due to the continued recovery of the global economy. However since the beginning of 2012, the demand of our products decreased due to lower production levels by the steel companies that are our major clients. This led to a decrease in our net accounts receivable from $11.2 million at December 31, 2012 to $4.49 million at December 31, 2013.

We have not spent a significant amount of capital on advertising. Our sales and marketing force consists of 30 people located at our Inner Mongolia facility who market our products primarily to distributors, and, to a lesser extent, end users, in the PRC. Our marketing effort is oriented toward working with distributors, who purchase our products and then sell them to end users in China and in foreign countries, including Japan, the United States, Spain, England, South Korea and India.

Competition and Competitive Advantages

We compete with a large number of domestic and international companies that manufacture graphitegraphene and grapheme related products. Because of the nature of the products that we sell, we believe that the reputation of the manufacturer and the quality of the product may be as important as price.

Government Regulations

Statutory Reserve

On December 31, 2013, the Company acquired new operations carried through BVI Co., and its subsidiaries Royal HK and Shanghai HK.Royal Shanghai. All of the cash generated by our operations has been held by our China entities. In order to transfer such cash to our parent entity, China Carbon Graphite Group, Inc., which is a Nevada Corporation, we would need to rely on dividends, loans or advances made by our PRC subsidiaries or VIE entity. Such transfers may be subject to certain regulations or risks. To date, our parent entity has paid its expenses by raising capital through private placement transactions. In the future, in the event that our parent entity is unable to raise needed funds from private investors, XingyongRoyal Shanghai would have to transfer funds to our parent entity through our wholly-owned subsidiaries, TalentRoyal HK and Yongle.

PRC regulations relating to statutory reserves and currency conversion would impact our ability to transfer cash within our corporate structure. The Company Law of the PRC applicable to Chinese companies provides that net after tax income should be allocated by the following rules:

| 1. | 10% of after tax income to be allocated to a statutory surplus reserve until the reserve amounts to 50% of the company’s registered capital. | |

| 2. | If the accumulate balance of statutory surplus reserve is not enough to make up the Company’s cumulative prior years’ losses, the current year’s after tax income should be first used to make up the losses before the statutory surplus reverse is drawn. | |

| 3. | Allocation can be made to the discretionary surplus reserve, if such a reserve is approved at the meeting of the equity owners. |

Therefore, the Company is required to maintain a statutory reserve in China that limits any equity distributions to its shareholders. The maximum amount of the shareholders has not been reached. The company has never distributed earnings to shareholders and has consistently stated in the Company’s filings it has no intentions to do so.

| 4 |

The RMB is notcannot be freely convertibleexchanged into Dollars. The State Administration of Foreign Exchange (“SAFE”) administers foreign exchange dealings and requires that they be conducted though designated financial institutions. Foreign Investment Enterprises, such as Xingyong and Royal Shanghai, may purchase foreign currency from designated financial institutions in connection with current account transactions, including profit repatriation.

These factors will limit the amount of funds that we can transfer from Xingyongand Royal Shanghai to our parent entity and may delay any such transfer. In addition, upon repatriation of earnings of Xingyongand Royal Shanghai to the United States, those earnings may become subject to United States federal and state income taxes. We have not accrued any U.S. federal or state tax liability on the undistributed earnings of our foreign subsidiary because those funds are intended to be indefinitely reinvested in our international operations. Accordingly, taxes imposed upon repatriation of those earnings to the U.S. would reduce the net worth of the Company.

Environmental Regulations

We believe that we are in compliance in all material respects with all applicable environmental protection laws and regulations.

Circular 106 Compliance and Approval

The State Administration of Foreign Exchange (“SAFE”) issued an official notice known as “Circular 106,” which requires the owners of any Chinese company to obtain SAFE’s approval before establishing any offshore holding company structure to facilitate foreign financing or subsequent acquisitions in China. We believe that our wholly-owned subsidiarysubsidiaries Talent wasand BVI. Co. were not required to obtain SAFE’s approval to establish its offshore companycompanies Yongle and Royal HK as a “special purpose vehicle” for capital raising activities on behalf of XingyongRoyal Shanghai because the owners of Xingyong are not stockholders of Talent, and Talent’s sole stockholder is not a resident of the PRC.

Restrictions on Exports of Natural Resources

In 2010, the Chinese government decided to implement a number of new restrictions on natural resource industry sectors. As a result, domestic Chinese companies in certain natural resource industries face export restrictions. Such restrictions may limit our ability to export our products in the future, or may increase the expense of our exports, which may impact our business.

Employees

As of December 31, 2013 and 2012,2016, we had 5707 full-time employees, of whom 210 were in manufacturing, 262 were technical employees who were also engaged in research and development, 64 were executive and administrative employees and 34 were sales and marketing employees. We believe that our relationship with our employees is good.

| Item 1A. | Risk Factors. |

From time to time, information provided by us, including but not limited to statements in this report, or other statements made by or on our behalf, may contain “forward-looking” information. Such statements involve a number of risks, uncertainties, and contingencies, many of which are beyond our control, which may cause actual results, performance, or achievements to differ materially from those anticipated. Set forth below are important factors that could cause our results, performance, or achievements to differ materially from those in any forward-looking statements made by us or on our behalf.

Going Concern

The Company’s consolidated financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As of and for the period ended December 31, 2013,2016, the Company has incurred significant operating losses working capital deficit, and negative net cash flows from operating activities. The Company’s sales revenue declined significantly for the period ended December 31, 20132016 as compared to the same period prior year, and the demand for the Company’s products remains highly uncertain.

The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

We have incurred significant net losses in each of 2012the years in 2015 and 2013.2016. We have funded our operations through debt financings.equity financings and loans. We anticipate that our revenue will not significantly increase from current level in the near future, thereby leading to continued losses until the PRC steel market andwe further develop our business recover.

The limited operating history of our newly acquired subsidiaries Royal HK and Royal Shanghai makes it difficult to evaluate its current business and future prospects and its inability to execute on its current business plan may adversely affect its results of operations and prospects.

Our newly acquired subsidiary, Royal

Shanghai, is a development stage company that has generated limited revenues to date. Therefore, Royal Shanghai not only has a very limited operating history, but also a limited track record in executing its business model which includes, among other things, manufacturing and operating a website. Royal Shanghai’s limited operating history makes it difficult to evaluate its current business model and future prospects.In light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development with limited operating history, there is a significant risk that Royal Shanghai will not be able to:

| ● | implement or execute its current business plan, or demonstrate that its business plan is sound; and/or |

| ● | raise sufficient funds in the capital markets or otherwise to effectuate its long-term business plan. |

| 6 |

Royal Shanghai’s inability to execute any one of the foregoing or similar matters may adversely affect our results of operations and prospects.

Risks Related to Our Business

If the downturn of the steel industry in China continues, we may have decreaseddifficulties increasing our sales, which may impair our ability to continue operating our business.

Steel consumption is highly cyclical and follows general economic and industrial conditions both worldwide and in regional markets. The steel industry has historically been characterized by significant decreases of demand during periods of economic weakness. In 2013,2016, the Chinese steel industry experienced a significant decrease in demand, which in turn led to a significant decrease in demand for our products, which serve as raw materials for the steel industry. As a result, our sales decreased in 2013. If the steel industry continues to downturn, our business will be affected.

At December 31, 2013, we had short-term bank loans of approximately $40.6 million and long-term bank loans of approximately $22.6 million. These bank loans, which are secured by liens on our fixed assets and land use rights, are due between January 2014 and July 2016, including approximately $40.6 million short-term bank loans and $18.1 million long-term bank loans owed to the Construction Bank of China. Historically, we have rolled over our short-term loans when they became due. However, we cannot assure investors that our lenders, including the Construction Bank of China, will not demand repayment when these loans mature. If the lenders demand repayment when due, we may not be able to obtain the necessary funds to pay off these loans, which could result in the imposition of penalties, including a 50% increase in interest rates and a request from the banks for additional security for the loans. Our cash reserves, including restricted cash, which at December 31, 2013 were $35.8 million, are insufficient to pay off our loans when due.

Some of our expansion plans, including the expansionpromotion of our product offerings to include nuclear, solaron line portal and semiconductor productsthe potential acquisition and pursuing an acquisition,merger plan, would likely require us to obtain additional funds from equity or debt markets, or to borrow additional funds from local banks. We currently have no commitments from any financing sources. There is no assurance that we will be able to raise any funds on terms favorable to us, or at all. In the event that we issue shares of equity or convertible securities, holdings of our existing stockholders would be diluted.

Our revenue is dependent in large part on significant orders from a limited number of distributors, who may vary from period to period. During the year ended December 31, 2013, two distributors accounted for 10% or more of sales revenues, representing 37.0% and 18.5%, respectively of our revenue, and during the year ended December 31, 2012, three distributors accounted for approximately $31.06 million, or 65.9%, of our revenue. We do not have long-term contracts with these distributors. Demand for our products depends on a variety of factors including, but not limited to, the financial condition of our distributors, the end users of our products and their customers and general economic conditions. If sales to any of our large distributors are substantially reduced for any reason, as occurred during the recent economic downturn, such reduction may have a material adverse effect on our business, financial condition and results of operations.

Our business operations take place primarily in the PRC. Because Chinese laws, regulations and policies are constantly changing, our Chinese operations face several risks summarized below.

Limitations on Chinese economic market reforms may discourage foreign investment in Chinese businesses.

The value of investments in Chinese businesses could be adversely affected by political, economic and social uncertainties in China. The economic reforms introduced in China in recent years are regarded by China’s national government as a way to introduce economic market forces into China. Given the overriding desire of the national government leadership to maintain stability in China amid rapid social and economic changes in the country, the economic market reforms of recent years could be slowed, or even reversed.

| 7 |

Any change in policy by the Chinese government may adversely affect investments in Chinese businesses.

Changes in policy could result in the imposition of restrictions on currency conversion, imports or the source of supplies, as well as new laws affecting joint ventures and foreign-owned enterprises doing business in China. Although China has been pursuing economic reforms, events such as a change in leadership or social disruptions that may occur upon the proposed privatization of certain state-owned industries, may significantly affect the government’s ability to continue with its reform.

We face economic risks in doing business in China because the Chinese economy is more volatile than other countries.

As a developing nation, China’s economy is more volatile than those of developed Western industrial nations. It differs significantly from that of the U.S. or a Western European country in such respects as structure, level of development, capital reinvestment, legal recourse, resource allocation and self-sufficiency. Only in recent years has the Chinese economy moved from what had been a command economy through the 1970s to one that during the 1990s encouraged substantial private economic activity. In 1993, the Constitution of China was amended to reinforce such economic reforms. The trends of the 1990s indicate that future policies of the Chinese government will likely emphasize greater utilization of market forces. For example, in 1999 the Government announced plans to amend the Chinese Constitution to recognize private property, although private businesses will likely remain subordinate to state-owned companies, which are the mainstay of the Chinese economy. However, we cannot assure investors that, under some circumstances, the government’s pursuit of economic reforms will not be restrained or curtailed. Actions by the national government of China may have a significant adverse effect on economic conditions in the country as a whole and on the economic prospects of our Chinese operations.

PRC regulations relating to acquisitions of PRC companies by foreign entities may limit our ability to acquire PRC companies and adversely affect the implementation of our acquisition strategy as well as our business and prospects.

The PRC State Administration of Foreign Exchange, or SAFE, issued a public notice in January 2005 concerning foreign exchange regulations on mergers and acquisitions in China. The public notice states that if an offshore company controlled by PRC residents intends to acquire a PRC company, such acquisition will be subject to strict examination by the relevant foreign exchange authorities. The public notice also states that the approval of the relevant foreign exchange authorities is required for any sale or transfer by the PRC residents of a PRC company’s assets or equity interests to foreign entities, such as us, for equity interests or assets of the foreign entities.

| 8 |

In April 2005, SAFE issued another public notice further explaining the January notice. In accordance with the April notice, if an acquisition of a PRC company by an offshore company controlled by PRC residents has been confirmed by a Foreign Investment Enterprise Certificate prior to the promulgation of the January notice, the PRC residents must each submit a registration form to the local SAFE branch with respect to their respective ownership interests in the offshore company, and must also file an amendment to such registration if the offshore company experiences material events, such as changes in the share capital, share transfer, mergers and acquisitions, spin-off transactions or use of assets in China to guarantee offshore obligations.

On May 31, 2007, SAFE issued another official notice known as “Circular 106,” which requires the owners of any Chinese company to obtain SAFE’s approval before establishing any offshore holding company structure to facilitate foreign financing or subsequent acquisitions in China.

If we decide to acquire a company organized under the laws of the PRC, we cannot assure investors that we or the owners of such company, as the case may be, will be able to obtain the necessary approvals, filings and registrations for the acquisition. This may restrict our ability to implement our acquisition strategy and adversely affect our business and prospects.

Fluctuation in the value of the RMB may have a material adverse effect on the value of our stock.

Fluctuations in the value of the RMB against the U.S. dollar and other currencies may be affected by, among other things, changes in China’s political and economic conditions. On July 21, 2005, the Chinese government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the new policy, the RMB is permitted to fluctuate within a narrow and managed bandrange against a basketpool of certain foreign currencies. This change in policy has resulted in the appreciation of the RMB against the U.S. dollar. While the international reaction to the RMB revaluation has generally been positive, there remains significant international pressure on the Chinese government to adopt an even more flexible currency policy, which could result in further and more significant appreciation of the RMB against the U.S. dollar. Because approximately 90% of our costs and expenses are denominated in RMB, the revaluation in July 2005 and potential future revaluation has and could further increase our costs. In addition, as we rely entirely on dividends paid to us by our operating subsidiary, any significant revaluationdevaluation of the RMB, which we have seen signs of in the last couple of years, may have a material adverse effect on our revenues and financial condition, and the value of, and any of our dividends payable on our ordinary shares in foreign currency.

Capital outflow policies in the PRC may hamper our ability to remit income to the United States.

The PRC has adopted currency and capital transfer regulations. These regulations may require that we comply with complex regulations for the movement of capital and as a result we may not be able to remit all income earned and proceeds received in connection with our operations to the United States or to our stockholders.

| 9 |

China’s foreign currency control policies may impair the ability of our Chinese operating company to pay dividends to us.

Because our operations are conducted through our Chinese operating company, we rely on dividends and other distributions from our Chinese operating company to provide us with cash flow to pay dividends or meet our other obligations. Any dividend payment is subject to foreign exchange rules governing repatriation. Any liquidation is subject to the relevant government agency’s approval and supervision as well as the foreign exchange control. Current regulations in China permit our operating company to pay dividends to us only out of accumulated distributable profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, our Chinese operating company is required to set aside at least 10% (up to an aggregate amount equal to half of our registered capital) of its accumulated profits each year for employee welfare. Such cash reserves may not be distributed as cash dividends. In addition, if our operating company in China incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments to us. The inability of our operating company to pay dividends or make other payments to us may have a material adverse effect on our financial condition.

Because our funds are held in banks that do not provide insurance, the failure of any bank in which we deposit our funds may affect our ability to continue to operate.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash may impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue to operate.

If we are unable to obtain business insurance in the PRC, we may not be protected from risks that are customarily covered by insurance in the United States.

Business insurance is not readily available in the PRC. To the extent that we suffer a loss of a type that would normally be covered by insurance in the United States, such as product liability and general liability insurance, we would incur significant expenses in both defending any action and in paying any claims that result from a settlement or judgment. We have not obtained fire, casualty and theft insurance, and there is no insurance coverage for our raw materials, goods and merchandise, furniture and buildings in China. Any losses incurred by us will have to be borne by us without any assistance, and we may not have sufficient capital to cover material damage to, or the loss of, our production facility due to fire, severe weather, flood or other cause, and such damage or loss may have a material adverse effect on our financial condition, business and prospects.

The Chinese legal and judicial system may negatively impact foreign investors because the Chinese legal system is not yet comprehensive.

In 1982, the National People’s Congress amended the Constitution of China to authorize foreign investment and guarantee the “lawful rights and interests” of foreign investors in China. However, China’s system of laws is not yet comprehensive. The legal and judicial systems in China are still under development, and enforcement of existing laws is inconsistent. Many judges in China lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the Chinese judiciary is relatively inexperienced in enforcing the laws that exist, anticipation of judicial decision-making is more uncertain than in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. China’s legal system is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges adjudicating other cases. In addition, the interpretation of Chinese laws may shift to reflect domestic political changes.

| 10 |

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. We cannot assure you that a change in leadership, social or political disruption, or unforeseen circumstances affecting China’s political, economic or social life, will not affect the Chinese government’s ability to continue to support and pursue these reforms. Such a shift may have a material adverse effect on our business and prospects.

Because our principal assets are located outside of the United States and some of our directors and all of our executive officers reside outside of the United States, it may be difficult for investors to enforce your rights based on U.S. federal securities laws against us and our officers and directors in the United States or to enforce judgments of U.S. courts against us or them in the PRC.

Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification may result in unfavorable tax consequences to us and our non-PRC shareholders.

China passed a New Enterprise Income Tax Law, or the New EIT Law, which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with de facto management bodies within China is considered a resident enterprise, meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 clarified that dividends and other income paid by such resident enterprises will be considered to be PRC source income and subject to PRC withholding tax. This recent circular also subjects such resident enterprises to various reporting requirements with the PRC tax authorities.

Although substantially all of our management is currently located in the PRC, it remains unclear whether the PRC tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. We do not currently consider our company to be a PRC resident enterprise. However, if the PRC tax authorities determine that we are a resident enterprise for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences may follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. This would also mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as tax-exempt income, we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC authorities responsible for enforcing the withholding tax have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, dividends paid to stockholders with respect to their shares of our common stock or any gains realized from transfer of such shares may generally be subject to PRC withholding taxes on such dividends or gains at a rate of 10% if the shareholders are deemed to be a non-resident enterprise or at a rate of 20% if the shareholders are deemed to be a non-resident individual.

| 11 |

It may be difficult for our stockholders to effect service of process against our subsidiaries and our officers and directors.

Our operating subsidiaries and substantially all of our assets are located outside of the United States. Investors may find it difficult to enforce their legal rights based on the civil liability provisions of U.S. federal securities laws against us in the courts of either the United States or the PRC and, even if civil judgments are obtained in courts of the United States, to enforce such judgments in the courts of the PRC. In addition, it is unclear whether extradition treaties in effect between the United States and the PRC would permit effective enforcement of criminal penalties under U.S. federal securities laws or otherwise against us or those of our officers and directors that reside outside of the United States.

The Chinese economy is evolving and we may be harmed by any economic reform.

Although the Chinese government owns the majority of productive assets in China, during the past several years the government has implemented economic reform measures that emphasize decentralization and encourage private economic activity. Because these economic reform measures may be inconsistent or ineffective, we are unable to assure investors that:

| we will be able to capitalize on economic reforms; |

| the Chinese government will continue its pursuit of economic reform policies; |

| the economic policies, even if pursued, will be successful; |

| economic policies will not be significantly altered from time to time; and |

| business operations in China will not become subject to the risk of nationalization. |

Since 1979, the Chinese government has reformed its economic system. Because many reforms are unprecedented or experimental, they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or in the disparities in per capita wealth between regions within China, may lead to further readjustment of the reform measures. This refining and readjustment process may negatively affect our operations.

| 12 |

Price inflation in China could affect our results of operation if we are unable to pass along raw material price increases to our customers.

Inflation in China has continued to rise over the last few years. Because we purchase raw materials from suppliers in China, price inflation has caused an increase in the cost of our raw materials. Price inflation may affect the results of our operations if we are unable to pass along the price increases to our customers. Similarly, the cost of constructing our new facility and the installation of equipment may increase as a result of these recent inflationary trends, which are expected to continue in the near future. In addition, if inflation continues to rise in China, China could lose its competitive advantage as a low-cost manufacturing venue, which may in turn lessen the competitive advantages of our being based in China. Accordingly, inflation in China may weaken our competitiveness domestically and in international markets.

Failure to comply with the U.S. Foreign Corrupt Practices Act may subject us to penalties and other adverse consequences.

We are subject to the U.S. Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time to time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our reputation and our business, financial condition and results of operations.

| 13 |

Risks Related to our Common Stock

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

The SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring every public company to include a management report on such company’s internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of internal controls over financial reporting.

During our assessment of the effectiveness of internal control over financial reporting as of December 31, 2013,2016, we identified significant deficiencies related to: (i) lack of entity level controls establishing a “tone at the top”, including but not limited to, communication between committee members and senior management regarding corporate decisions and planning; (ii) insufficient knowledge of accounting and financial reporting with respect to the requirements and application of both U.S. GAAP and SEC guidelines; (iii) an inadequate amount of review by management of the financial statement reporting process, including understanding and reporting all required disclosures necessary, by those in charge of corporate governance; (iv) lack of corporate governance policies in place, such as an internal audit function, fraud and risk assessment policies and a whistleblower policy; and (v) inadequate segregation of duties over certain information system access controls. We cannot assure investors that, if our independent auditors are required to attest to our internal controls, they will agree with our analysis or will not have identified other material weaknesses in our internal controls or disclosure controls.

Our reporting obligations as a public company place a significant strain on our management and operational and financial resources and systems. Effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to prevent fraud. As a result, our failure to achieve and maintain effective internal controls over financial reporting may result in the loss of investor confidence in the reliability of our financial statements, which in turn may harm our business and negatively impact the trading price of our stock. Furthermore, we anticipate that we will continue to incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 and other requirements of the Sarbanes-Oxley Act.

There is a limited market for our common stock, which may make it difficult for holders of our common stock to sell their stock.

Our common stock trades on the OTC Bulletin BoardMarkets under the symbol CHGI.OB.CHGI. There is a limited trading market for our common stock and at times there is no trading in our common stock. Accordingly, there can be no assurance as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our common stock, or the prices at which holders may be able to sell our common stock. Further, many brokerage firms will not process transactions involving low price stocks, especially those that come within the definition of a “penny stock.” If we cease to be quoted, holders of our common stock may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our common stock, and the market value of our common stock would likely decline.

| 14 |

If a more active trading market for our common stock develops, the market price of our common stock is likely to be highly volatile and subject to wide fluctuations, and holders of our common stock may be unable to sell their shares at or above the price at which they were acquired.

The market price of our common stock is likely to be highly volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including:

| quarterly variations in our revenues and operating expenses; |

| developments in the financial markets and worldwide economies; |

| announcements of innovations or new products or services by us or our competitors; |

| announcements by the PRC government relating to regulations that govern our industry; |

| significant sales of our common stock or other securities in the open market; |

| variations in interest rates; |

| changes in the market valuations of other comparable companies; and |

| changes in accounting principles. |

In addition, the market for Chinese companies that went public in the U.S. through reverse mergers, such as ours, is currently extremely volatile primarily due primarily to recent allegations and, in some instances, findings of fraud among some of these companies. If a stockholder were to file a class action suit against us following a period of volatility in the price of our securities, we would incur substantial legal fees and our management’s attention and resources would be diverted from operating our business to responding to such litigation, which may harm our business and reputation.

We have not paid dividends in the past and do not expect to pay dividends to holders of our common stock for the foreseeable future, and any return on investment may be limited to potential future appreciation on the value of our common stock.

We currently intend to retain any future earnings to support the development and expansion of our business and do not anticipate paying cash dividends in the foreseeable future. To the extent that we do not pay dividends, our stock may be less valuable because a return on investment will occur only if, and to the extent that, our stock price appreciates, which may never occur. In addition, holders of our common stock must rely on sales of their common stock after price appreciation as the only way to realize a return on their investment, and if the price of our stock does not appreciate, then there will be no return on their investment.

| 15 |

If we become subject to the recent scrutiny and negative publicity involving U.S.-listed Chinese companies, our business operations, stock price and reputation could be harmed.

Recently, U.S. public companies that have substantially all of their operations in China, and in particular companies that have completed reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity resulting from financial and accounting irregularities, a lack of effective internal control over financial reporting, inadequate corporate governance policies or a lack of adherence thereto and allegations of fraud. As a result, the publicly traded stock of many U.S.-listed Chinese companies has sharply declined in value. Many of these companies are now subject to shareholder lawsuits, SEC enforcement actions and are conducting internal and external investigations into the allegations. It is unclear what effect this may have on our Company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend the Company, which may impact our business operations and the value of our stock.

The rights of the holders of our common stock may be impaired by the potential issuance of preferred stock.

Our board of directors has the right to create new series of preferred stock. As a result, the board of directors may, without stockholder approval, issue preferred stock with voting, dividend, conversion, liquidation or other rights that may adversely affect the voting power and equity interest of the holders of our common stock. Although we have no present intention to issue any additional shares of preferred stock or to create any new series of preferred stock, we may issue such shares in the future.

Not required

There is no private ownership of land in China and all urban land ownership is held by the government, its agencies and collectives. Land use rights can be obtained from the government for a period of up to 50 years for industrial usage, 40 years for commercial usage and 70 years for residential usage, and are typically renewable. Land use rights can be transferred upon approval by the State Land Administration Bureau and payment of the required land transfer fee.

Our principal executive office is located at 20955 Pathfinder Road, Suite 200, Diamond Bar, CA 91765, and our telephone number is (909) 843-6518. As of March 30, 2017, the Company uses, this land use right as collateralleases its corporate mailing address for its short-term bank loans. We believe that our facilities are sufficientan annual fee of $1,440.

Royal Shanghai leases an office in Shanghai China. The lease term of the office space is from January 1, 2015 to meet ourMarch 31, 2017. The current and near future requirements and that any additional space that we may require would be available on commercially reasonable terms.

We are not aware of any material existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceedings or pending litigation. There are no proceedings in which any of our current directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to us.

| Mine Safety Disclosures. |

Not Applicable.

| 16 |

| Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Our

common stock is quoted on the OTCThe following table sets forth, for the periods indicated, the high and low bid prices of our common stock.

| High | Low | |||||||

| Fiscal Year Ended December 31, 2014 | ||||||||

| First Quarter | $ | 0.16 | $ | 0.11 | ||||

Second Quarter (through April 12, 2014) | $ | 0.14 | $ | 0.11 | ||||

| Fiscal Year Ended December 31, 2013 | ||||||||

| First Quarter | $ | 0.68 | $ | 0.40 | ||||

| Second Quarter | $ | 0.42 | $ | 0.24 | ||||

| Third Quarter | $ | 0.28 | $ | 0.11 | ||||

| Fourth Quarter | $ | 0.18 | $ | 0.12 | ||||

| Fiscal Year Ended December 31, 2012 | ||||||||

| First Quarter | $ | 1.22 | $ | 0.45 | ||||

| Second Quarter | $ | 0.98 | $ | 0.51 | ||||

| Third Quarter | $ | 0.68 | $ | 0.33 | ||||

| Fourth Quarter | $ | 0.72 | $ | 0.33 | ||||

| High | Low | |||||||

| Fiscal Year Ended December 31, 2017 | ||||||||

| First Quarter | $ | 0.065 | $ | 0.0311 | ||||

| Second Quarter | $ | N/A | $ | N/A | ||||

| Third Quarter | $ | N/A | $ | N/A | ||||

| Four Quarter | $ | N/A | $ | N/A | ||||

| Fiscal Year Ended December 31, 2016 | ||||||||

| First Quarter | $ | 0.04 | $ | 0.01 | ||||

| Second Quarter | $ | 0.35 | $ | 0.013 | ||||

| Third Quarter | $ | 0.0495 | $ | 0.013 | ||||

| Fourth Quarter | $ | 0.065 | $ | 0.013 | ||||

| Fiscal Year Ended December 31, 2015 | ||||||||

| First Quarter | $ | 0.06 | $ | 0.03 | ||||

| Second Quarter | $ | 0.05 | $ | 0.02 | ||||

| Third Quarter | $ | 0.04 | $ | 0.03 | ||||

| Fourth Quarter | $ | 0.05 | $ | 0.01 | ||||

Number of Holders of Our Common Stock

As of March 30, 2017, there were

Transfer Agent

The transfer agent for the common stock is Empire Stock Transfer Inc. The transfer agent’s address is 2470 Saint Rose Parkway, Suite 304, Henderson, NV, and its telephone number is (702) 974-1444.

Dividend Policy

While we are required to pay dividends on the shares of our Series B Preferred Stock, we have never declared or paid cash dividends on our common stock and have no present plans to do so in the foreseeable future. In addition, any dividend payment that the Company makes is subject to foreign exchange rules governing repatriation. Current regulations in China permit our operating company to pay dividends to us only out of accumulated distributable profits, if any, determined in accordance with Chinese accounting standards and regulations. The inability of our operating company to pay dividends or make other payments to us may limit our ability to pay dividends to holders of our Series B Preferred Stock.

As of December 31, 2013,2016, there were no shares of our Series A Preferred Stock outstanding and 300,000 shares of ouror Series B Preferred Stock outstanding. Any future decisions regarding dividends will be made by our board of directors. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

| 17 |

Recent Sales of Series B Preferred Stock

On December 22, 2011, all outstanding shares of Series B Preferred Stock became redeemable. The redeemable preferred stock was recorded as temporary equity as of December 31, 2012 and December 31, 2013. The redemption price for the outstanding shares of Series B Preferred Stock is $320,000.

On March 8, 2016, the stockholders.

On March 8, 2016, the stockholders.

On December 23, 2016, the stockholders.

On December 23, 2016, the Company issued 50,000 and Rule 506 of Regulation D, based upon representations made by the stockholders.

On December 23, 2016, the stockholders.

On December 23, 2016, the Company sold 3,200,000 shares of common stock to Xiangxin Sun for a purchase price of $320,000, or $0.10 per share.The issuance of the shares has been determined to be exempt from registration under the Securities Act and Rule 506in reliance on Section 4(2) of Regulation D, based upon representations made by the stockholders.

| Selected Financial Data. |

Not required.

| 18 |

The following discussion of the results of our operations and financial condition should be read in conjunction with our financial statements and the related notes, which appear elsewhere in this report. The following discussion includes forward-looking statements. For a discussion of important factors that could cause actual results to differ from our forward-looking statements, see the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements” above.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “ believes,“believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, undue reliance should not be placed on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. This Annual Report should be read in its entirety and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Overview

We are engaged in the manufacturesale of graphite-basedgraphene, graphene oxide and graphite bipolar plates products in the PRC andPRC. We also operate 1a business-to-business and business-to-consumers Internet portal (www.roycarbon.com) for graphite related products. Our products are used inVendors can sell raw materials, industrial commodities and consumer (household) commodities to both business and consumers through the manufacturing processwebsite by paying a fee for each transaction conducted through the website.

As of other products, particularly non-ferrous metals and steel, and are incorporated in various types of products or processes, such as atomic reactors. We currently manufacture and sell primarily the following products:

PRC regulations grant broad powers to the government to adjust the price of raw materials and manufactured products. Although the government has not imposed price controls on our raw materials or our products, it is possible that price controls may be implemented in the future, thereby affecting our results of operations and financial condition.

| 19 |

The following table sets forth the results of our operations for the periods indicated in U.S. dollars and as a percentage of net sales (dollars in thousands):

| Year ended December 31, | ||||||||||||||||

| 2013 | 2012 | |||||||||||||||

| Sales | $ | 9,527 | 100.0 | % | $ | 31,483 | 100.0 | % | ||||||||

| Cost of goods sold | 32,690 | 343.1 | % | 24,708 | 78.5 | % | ||||||||||

| Gross profit (loss) | (23,163 | ) | (243.1 | )% | 6,775 | 21.5 | % | |||||||||

| Operating expenses | ||||||||||||||||

| Selling expenses | 60 | 0.6 | % | 254 | 0.8 | % | ||||||||||

| General and administrative | 10,076 | 105.8 | % | 6,785 | 21.6 | % | ||||||||||

| Impairment of property, plant and equipment and construction in progress | 24,606 | 258.3 | % | - | - | % | ||||||||||

| Depreciation and amortization | 636 | 6.7 | % | 237 | 0.8 | % | ||||||||||

| Income (loss) from operations | (58,541 | ) | (614.5 | )% | (501 | ) | (1.6 | )% | ||||||||

| Other income | 820 | 8.6 | % | 1,652 | 5.2 | % | ||||||||||

| Other expense | - | 0.0 | % | (357 | ) | (1.1 | )% | |||||||||

| Change in fair value of warrants | 211 | 2.2 | % | (50 | ) | (0.2 | )% | |||||||||

| Interest income | 877 | 9.2 | % | 313 | 1.0 | % | ||||||||||

| Interest expense | (5,247 | ) | (55.1 | )% | (4,618 | ) | (14.7 | )% | ||||||||

| Net loss | (61,879 | ) | (649.5 | )% | (3,562 | ) | (11.3 | )% | ||||||||

| Preferred Stock Dividend | (8 | ) | (0.1 | )% | (19 | ) | (0.1 | )% | ||||||||

| Net loss available to common shareholders | $ | (61,887 | ) | (649.6 | )% | $ | (3,580 | ) | (11.4 | )% | ||||||

| Years ended December 31, | ||||||||||||||||

| 2016 | 2015 | |||||||||||||||

| Sales | $ | 809,909 | 100.00 | % | $ | 323,369 | 100.00 | % | ||||||||

| Cost of Goods Sold | 648,152 | 80.03 | % | 244,993 | 75.76 | % | ||||||||||

| Gross Profit | 161,757 | 19.97 | % | 78,376 | 24.24 | % | ||||||||||

| Operating Expenses | ||||||||||||||||

| Selling expenses | 29,335 | 3.62 | % | 26,794 | 8.29 | % | ||||||||||

| General and administrative | 418,050 | 51.62 | % | 958,895 | 296.53 | % | ||||||||||

| Bad debt expense - related party | - | - | % | 1,543,734 | 477.39 | % | ||||||||||

| Total operating expenses | 447,385 | 55.24 | % | 2,529,423 | 782.21 | % | ||||||||||

| Loss from continuing operations before other income (expense) and income taxes | (285,628 | ) | -35.27 | % | (2,451,047 | ) | -757.97 | % | ||||||||

| Other Income (Expense) | ||||||||||||||||

| Interest expense | (2,686 | ) | -0.33 | % | (2,117 | ) | -0.65 | % | ||||||||

| Interest income | - | - | - | - | ||||||||||||

| Other income (expense), net | 80,452 | 9.93 | % | 82,699 | 25.57 | % | ||||||||||

| Total other expense (income), net | 77,767 | 9.60 | % | 80,582 | 24.92 | % | ||||||||||

| Loss from continuing operations before income taxes | (207,862 | ) | -25.66 | % | (2,370,465 | ) | -733.05 | % | ||||||||

| Income Tax Expense | - | 0.00 | % | - | 0.00 | % | ||||||||||

| Net loss | (207,862 | ) | -25.66 | % | (2,370,465 | ) | -733.05 | % | ||||||||

| Preferred Stock Dividends | - | 0.00 | % | - | 0.00 | % | ||||||||||

| Net Loss Available To Common Shareholders | (207,862 | ) | -25.66 | % | (2,370,465 | ) | -733.05 | % | ||||||||

Fiscal Years Ended December 31, 2016 and 2015

SalesSales..

During the year ended December 31, 2013,2016, we had sales of $

| 2013 Sales | % of Total Sales | 2012 Sales | % of Total Sales | |||||||||||||

| Graphite Electrodes | $ | 2,640,623 | 27.7 | % | $ | 4,606,297 | 14.6 | % | ||||||||

| Fine Grain Graphite | 3,578,206 | 37.6 | % | 13,180,892 | 41.9 | % | ||||||||||

| High Purity Graphite | 2,811,612 | 29.5 | % | 13,208,307 | 42.0 | % | ||||||||||

| Others (1) | 496,268 | 5.2 | % | 487,356 | 1.5 | % | ||||||||||

| Total | $ | 9,526,709 | 100.0 | % | $ | 31,482,852 | 100.0 | % | ||||||||

Cost of goods sold; gross marginsold..

Our cost of goods sold consists of the cost of raw materials, utilities, labor, depreciation expenses in our manufacturing facilities, and inventory impairmentpurchase cost. During the year ended December 31, 2013,2016, our cost of goods sold was $32,689,538,$648,152, compared to $24,707,625$244,993 for the cost of goods sold for the year ended December 31, 2012,2015, an increase of $7,981,913,$403,159 or approximately 32.3%164.56%. The increase in the cost of sales was primarily attributable to the significant increase in sales volume.

| 20 |

Gross profit.

Our gross profit increased from $78,376 for the year ended December 31, 2013 compared2015 to the same period 2012 was mainly due to $21,089,248 impairment loss of inventory charged to cost of goods sold, and due to decrease in sales volume and due to decreased average raw material cost.

Gross profit Margin.

Our gross loss of (243.1)%profit margin decreased from 24.2% for the year ended December 31, 2013.

Operating expenses.

Operating expenses totaled $447,385 for the year ended December 31, 2012, an increase of $28,101,780, or approximately 386.2%.

On June 10, 2014, the Company entered into an asset purchase agreement (the “Agreement”) by and among the Company and its wholly-owned subsidiary, Yongle (together with the Company, the “Sellers”), and Dengyong Jin and Benhua Du (collectively “Purchasers”). Pursuant to the Agreement, the Purchasers will, following the satisfaction or waiver of applicable conditions to closing, purchase all of the rights and obligations of Yongle under the Contractual Arrangements. The Purchasers collectively hold 100% of the outstanding equity interests of Xingyong. The purchase price under the Agreement is $1,543,734 (RMB 10 million), including $575,813 (RMB 3.73 million) in cash and the cancellation of the registrant’s repayment obligations of $967,921 (RMB 6.27 million) previously advanced by Dengyong Jin to the Company. The disposal of Xingyong became effective on June 30, 2014 after approved by a decreasespecial meeting of $193,978, or 76.5%. The decrease was shareholders. $1,543,734 is receivable from Mr. Jin for disposal of Xingyong. As of December 31, 2015, $1,543,734 has been recorded as bad debt expenses.

mainly due to decreased sales commissionSelling, general and lower shipping and handlingadministrative expenses.

Selling expenses duringincreased from $26,794 for the year ended December 31, 2013 as compared2015 to $29,335 for the year ended December 31, 2012, which resulted from lower2016, an increase of $2,541, or 9.48%. The increase is mainly attributed to increased shipping and handling costs because increased sales.

Our general and administrative expenses consist of salaries, office expenses, utilities, business travel, amortization expenses, public company expenses (including legal expenses accounting expenses and investor relationsaccounting expenses) and stock compensation. General and administrative expenses were $10,075,818$418,050 for the year ended December 31, 2013,2016, compared to $6,785,273$958,895 for the year ended December 31, 2012, an increase2015, a decrease of $3,290,545,$540,845 or 48.5%56.40%.

Bad debt expenses of $3,372,295 for the year ended December 31, 2013 compared to the year ended December 31, 2012.

r the year ended December 31, 2012, depreciation and amortization was allocated between costs of goods sold and selling, general and administrative expenses in the amounts $3,061,627 and $237,082, respectively. The decrease in depreciation and amortization expenses is due to Company made adjustments for depreciation and amortization expenses in the year ended December 31, 2012 .

As a result of the factors described above, operating loss was $(58,540,568)$285,628 for the year ended December 31, 2013,2016, compared to operating loss of $(500,733)$2,451,047 for the year ended December 31, 2012, an increase2015, a decrease of approximately $58,039,835,$2,165,419, or 11,591.0%88.35%.

Other income and expenses.

Our interest expense was $5,246,606$2,686 for the year ended December 31, 2013,2016, compared to $4,618,413$2,117 for the year ended December 31, 2012, reflecting increased interest payments on loans from banks. Other2015.

Rental income which consisted of government grants, was $819,970$80,452 and $82,699 were recorded as other income for the yearyears ended December 31, 2013, compared to $1,651,640 for the year ended December 31, 2012. Income from changes in the fair value of our warrants as a result of adopting ASC 820-10 was $

Income tax.

During the years ended December 31, 20132016 and 2012,2015, we benefited from a 100% tax holiday from the PRC enterprise tax. As a result, we had nodid not incur any income tax due for these periods. The enterprise income tax at the statutory rates would have been approximately $0 and $0, respectively, for 2013 and 2012 without consideration of adjustments on taxable income. The tax holiday is from 2008 through 2017.

Net (loss).

As a result of the factors described above, our net loss for the year ended December 31, 20132016 was $(61,878,880),$207,862, compared to net loss of $(3,561,515)$2,370,465 for the year ended December 31, 2012, an increase2015, a decrease of $58,317,365,$2,162,603, or 1,637.4% for the reasons stated above.91.23%.

| 21 |

Foreign currency translation.

Our consolidated financial statements are expressed in U.S. dollars but the functional currency of our operating subsidiary is RMB. Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the financial statements denominated in RMB into U.S. dollars are included in determining comprehensive income. Our foreign currency translation gain for the year ended December 31, 20132016 was $445,224,$12,791, compared to $1,039,383a translation loss of $60,107 for the year ended December 31, 2012, a decrease2015, an increase of $594,159, or 57.2%.

Pursuant to the terms of a private placement that closed on December 22, 2009 and January 13, 2010, the Series B Preferred Stock offers a 6% dividend. The preferred stock dividend is payable quarterly commencing April 1, 2010 until December 31, 2011. We incurred dividend expenses of $8,199 and $18,717 for the years ended December 31, 2013 and 2012, respectively. The expenses incurred in 2012 and 2013 reflect adjustments for under booked preferred dividend expenses.

Net loss available to our common stockholders was $(61,887,079),$207,862, or $(2.39) and $(2.39)$(0.01) per share (basic and diluted), for the yearyears ended December 31, 2013,2016, compared to net loss of $(3,580,232),$2,370,465, or $(0.15) and $(0.15)net loss of $(0.07) per share (basic and diluted), for the yearyears ended December 31, 2012.

All of our business operations wereare carried out by Xingyong. On December 23, 2013, the Company acquired new operations carried through BVI Co.,Royal Shanghai, and its subsidiaries Royal HK and Shanghai HK, whose operations have generated nominal revenues between December 23, 2013 to December 31, 2013. Allall of the cash generated by our operations has been held by our China entities.

PRC regulations relating to statutory reserves and currency conversion would impact our ability to transfer cash within our corporate structure. The Company Law of the PRC applicable to Chinese companies provides that net after tax income should be allocated by the following rules:

| 1. | 10% of after tax income to be allocated to a statutory surplus reserve until the reserve amounts to 50% of the company’s registered capital. |

| 2. | If the accumulate balance of statutory surplus reserve is not enough to make up the Company’s cumulative prior years’ losses, the current year’s after tax income should be first used to make up the losses before the statutory surplus reverse is drawn. |

| 3. | Allocation can be made to the discretionary surplus reserve, if such a reserve is approved at the meeting of the equity owners. |

Therefore, the Company is required to maintain a statutory reserve in China that limits any equity distributions to its shareholders. The maximum amount of the shareholders has not been reached. The company has never distributed earnings to shareholders and has consistently stated in the Company’s filings it has no intentions to do so.

The RMB is notcannot be freely convertibleexchanged into the Dollars. The State Administration of Foreign Exchange (“SAFE”) administers foreign exchange dealings and requires that they be conducted though designated financial institutions. Foreign Investment Enterprises, such as Xingyong,Royal Shanghai, may purchase foreign currency from designated financial institutions in connection with current account transactions, including profit repatriation.

These factors will limit the amount of funds that we can transfer from XingyongRoyal Shanghai to our parent entity and may delay any such transfer. In addition, upon repatriation of earnings of XingyongRoyal Shanghai to the United States, those earnings may become subject to United States federal and state income taxes. We have not accrued any U.S. federal or state tax liability on the undistributed earnings of our foreign subsidiary because those funds are intended to be indefinitely reinvested in our international operations. Accordingly, taxes imposed upon repatriation of those earnings to the U.S. would reduce the net worth of the Company.