UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20162023

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37513

JM GLOBAL HOLDING COMPANYGD CULTURE GROUP LIMITED

(Exact name of registrant as specified in its charter)

| 47-3709051 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification |

| ||

| (Address of principal executive offices) | (Zip Code) |

Issuer’sRegistrant’s telephone number:number, including area code: (561) 900-3672+1-347-2590292

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol(s) | Name of Each Exchange on Which Registered: | ||

| Common Stock, par value $0.0001 per share | GDC | The | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See definitionthe definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||

| Emerging growth company | ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒☐ No ☐☒

As of June 30, 2016,2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock outstanding other than shares held by persons who may be deemed affiliatesnon-affiliates of the registrant, computed by reference to the closing sales price for the common stock of $9.75,$4.27 as of such date, as reported on the Nasdaq Capital Market, was $19,500,000.$12,654,414.

As of March 27, 2017,April 1, 2024, there were 6,562,5007,887,411 shares of common stock, par value $0.0001 per share, of the registrant issued and outstanding.

TABLE OF CONTENTS

i

Conventions that Apply to this Annual Report

Unless otherwise indicated or the context requires otherwise, references in this annual report (the “Report”) to:

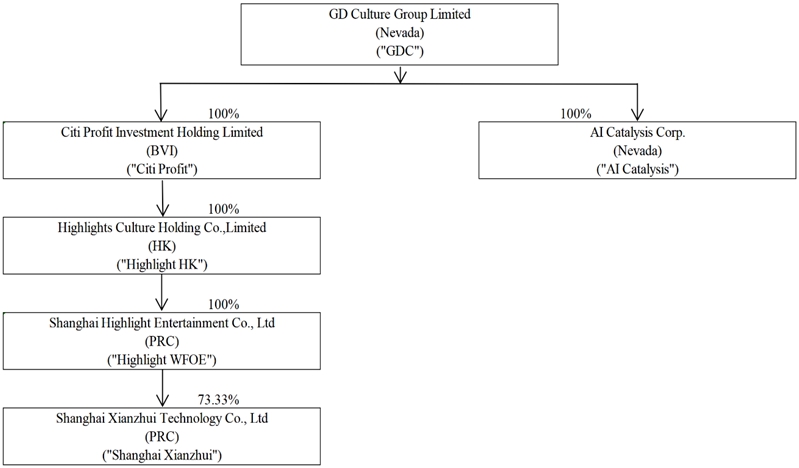

| “AI Catalysis” are to AI Catalysis Corp., a Neveda company, which is wholly owned by GDC; |

| ● | “Citi Profit” are to Citi Profit Investment Holding Limited, a British Virgin Islands company, which is wholly owned by GDC; |

| ● | “GDC” and the “Company” are to GD Culture Group Limited (formerly known as JM Global Holding Company, TMSR Holding Company Limited and Code Chain New Continent Limited), a Nevada Corporation; |

| ● | “Highlight HK” are to Highlights Culture Holding Co., Limited, a Hong Kong SAR company, which is wholly owned by Citi Profit; |

| ● | “Highlight WFOE” are to Shanghai Highlight Entertainment Co., Ltd., a PRC company, which is wholly owned by Highlight HK; |

| ● | “PRC” or “China” are to the People’s Republic of China, excluding, for the purpose of this report, Taiwan, Hong Kong and Macau; |

| ● | “RMB” or “Renminbi” are to the legal currency of China; and |

| ● | “Shanghai Xianzhui” are to Shanghai Xianzhui Technology Co., Ltd., a joint venture, of which Highlight Entertainment Co. Ltd. owns 73.3333% of the total equity interest; |

| ● | “we”, “our”, “us” are to the Company and its subsidiaries; |

| ● | “Yuan Ma” are to Shanghai Yuanma Food and Beverage Management Co., Ltd., a PRC company, which is a variable interest entity for accounting purposes; |

| ● | “$”, “US$” or “U.S. Dollars” are to the legal currency of the United States. |

Unless otherwise indicated, all references to common stock, warrants to purchase common stock, share data, per share data, and related information have been retroactively adjusted, where applicable, in this Report to reflect a 1-to-30 reverse stock split of our common stock which became effective on November 9, 2022 as if they had occurred at the beginning of the earlier period presented.

ii

Unless otherwise stated in this Annual Report on Form 10-K (this “Report”), references to:

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This Report including, without limitation,contains statements under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statementsthat may be deemed to be “forward-looking statements” within the meaning of Section 27Athe federal securities laws. These statements relate to anticipated future events, future results of the Securities Act of 1933operations and Section 21E of the Securities Exchange Act of 1934. Theseor future financial performance. In some cases, you can identify forward-looking statements can be identified by thetheir use of forward-looking terminology including the words “believes,such as “anticipate,” “estimates,“believe,” “anticipates,“could,” “expects,“estimate,” “intends,“expect,” “plans,“future,” “intend,” “may,” “will,“ought to,” “potential,“plan,” “projects,“possible,” “potentially,” “predicts,” “continue,“project,” or “should,” or, in each case, their negative“will,” “would,” negatives of such terms or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts. These statements are based on management’s current expectations, but actual results may differ materially due to various factors, including, but not limited to:

The forward-looking statements contained in this Report are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated.similar terms. These forward-looking statements involve a number ofknown and unknown risks, uncertainties (some of which are beyond our control) and other assumptionsfactors that may cause our actual results, performance or performanceachievements to be materially different from thoseany future results, performance or achievements expressed or implied by thesethe forward-looking statements. TheseThe forward-looking statements in this Report include, without limitation, statements relating to:

| ● | our goals and strategies; | |

| ● | our future business development, results of operations and financial condition; | |

| ● | our estimates regarding expenses, future revenues, capital requirements and our need for additional financing; | |

| ● | our estimates regarding the market opportunity for our services; | |

| ● | the impact of government laws and regulations; | |

| ● | our ability to recruit and retain qualified personnel; | |

| ● | our failure to comply with regulatory guidelines; | |

| ● | uncertainty in industry demand; | |

| ● | general economic conditions and market conditions in the virtual content production industry; | |

| ● | future sales of large blocks or our securities, which may adversely impact our share price; and | |

| ● | depth of the trading market in our securities. |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties, include, but are not limited to,including those factors described under the headingin Item 1A “Risk Factors.” Should one or more of these risks or uncertainties materialize, or

You should not unduly rely on any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. WeAlthough we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update or revisepublicly any forward-looking statements whether as a resultfor any reason after the date of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described under “Risk Factors” may not be exhaustive.

By their nature, forward-lookingthis Report, to conform these statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developmentsor to changes in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Report. In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this Report, those results or developments may not be indicative of results or developments in subsequent periods.expectations.

iii

PART I

Item 1. Business

IntroductionOverview

GD Culture Group Limited (formerly known as JM Global Holding Company, TMSR Holding Company Limited, and Code Chain New Continent Limited), focuses its business on three segments mainly through the Company and two subsidiaries, AI Catalysis and Shanghai Xianzhui: 1) AI-driven digital human creation and customization; 2) Live streaming and e-commerce and 3) Live streaming interactive game. The company has relentlessly been focusing on serving its customers and creating value for them through the continual innovation and optimization of its products and services.

For AI-driven digital human creation and customization sector, the Company uses AI algorithms and software to generate realistic 3D or 2D digital human models. AI algorithms and machine learning models are used to simulate human characteristics, such as facial expressions, body movements, and even speech patterns. These models can be customized to create and personalize lifelike digital representations of humans. Customization may involve adjusting facial features, body proportions, skin textures, hair styles, clothing, and more. Once created and customized, digital humans find applications in a wide range of industries, including gaming, entertainment, advertising, education, and more. Depending on the specific industry and the application scenario, the Company helps the customers to define the objectives to achieve with digital humans, choose the technology for character customization, then create unique aviators and deploy in the chosen platform.

For live streaming and e-commerce sector, the Company applies digital human technology in live streaming e-commerce businesses. Livestream usage is taking off globally. The integration of cutting-edge AI digital human technologies and live streaming platforms will transform the way businesses, sellers and consumers engage in online commerce. Digital anchors can offer long-duration intelligent live broadcasting. It also supports customized avatars that perfectly adapt to different live streaming scenarios. The company has introduced online e-commerce businesses on TikTok under different accounts.

For live streaming interactive game sector, the Company has launched a live-streamed game called “Trible Light.” This game is owned by the company, and we independently operate it. Currently, the game is being livestreamed on TikTok (TikTok account: almplify001). In addition to “Trible Light,” we have also introduced other licensed games on the same TikTok account, providing a diverse gaming experience for the players.

We areaim to generate revenue from: 1) Service revenue and advertising revenue from digital human creation and customization; 2) Products’ sales revenue from social live streaming e-commerce business; and 3) Virtual paid gifts revenue from live streaming interactive gaming.

Our principal executive office is located at 810 Seventh Avenue, 22nd Floor, New York, NY 10019, and our telephone number is: +1-347-2590292.

Corporate History and Structure

The following is an organizational chart setting forth our corporate structure as of the date of this Report.

GDC, formerly known as Code Chain New Continent Limited, TMSR Holding Company Limited and JM Global Holding Company, was a blank check company formedincorporated in Delaware on April 201510, 2015. The Company was formed for the purpose of effectingacquiring, through a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, exchangeable share transaction or other similar business combination withtransaction, one or more operating businesses or entities,assets. On June 20, 2018, the Company consummated the reincorporation. As a result, the Company changed its state of incorporation from Delaware to Nevada and implemented a 2-for-1 forward stock split of the Company’s common stock.

Citi Profit is a company formed under the laws of the British Virgin Islands in August 2019 and is wholly owned by GDC. It is a holding company with no material operations of its own.

Highlight HK is a company formed under the laws of Hong Kong SAR in November 2022 and is wholly owned by Citi Profit. It is a holding company with no material operations of its own.

Highlight WFOE or Shanghai Highlight is a company formed under the laws of the PRC in January 2023 and is wholly owned by Highlight HK. It is a holding company with no material operations of its own.

Shanghai Xianzhui is a company formed under the laws of the PRC in August 2023 for social media marketing purposes. It is a joint venture, of which we refer to throughout this Report as our initial business combination. We have generated no revenues to dateHighlight WFOE owns 73.3333% of the total equity interest.

AI Catalysis is a company formed under the laws of Neveda in May 2023, and we do not expect that we will generateis a wholly-owned subsidiary of GDC. It is an operating revenues at the earliest until we consummate our initial business combination.

For our initial business combination we are focused on industries that complement our management team’s background,company focusing on AI-driven digital human creation and customization, live streaming and e-commerce, and live streaming interactive game.

As previously disclosed in the consumer products sectorcurrent reports on Form 8-K of the Company filed on September 19, 2022 and February 28, 2023, on September 16, 2022, Makesi IoT Technology (Shanghai) Co., Ltd., a then indirect subsidiary of the Company (“Makesi WFOE”), Shanghai Highlight Media Co., Ltd., a PRC company (“Highlight Media”), and the shareholders of Shanghai Highlight (the “Highlight Media Shareholders”) entered into certain Technical Consultation and Services Agreement., Equity Pledge Agreement, Equity Option Agreement, Voting Rights Proxy and Financial Support Agreement, which was assigned by Makesi WFOE to Highlight WFOE on February 27, 2023 (such agreements, as assigned, the “VIE Agreements”). The VIE Agreements established a “Variable Interest Entity” (VIE) structure, pursuant to which the Company treated Highlight Media as a consolidated affiliated entity and consolidated the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under accounting principles generally accepted in the United States (which may includeof America (“U.S. GAAP”).

On September 26, 2023, Highlight WFOE entered into a business basedtermination agreement (the “Termination Agreement”) with Highlight Media, the Highlight Media Shareholders and a third party to terminate the VIE Agreements and for the third party to pay the Company $100,000 as consideration to the termination of the VIE Agreements. As a result of such termination, the Company will no longer treat Highlight Media as a consolidated affiliated entity or consolidate the financial results and balance sheet of Highlight Media in the United States which has distribution opportunities outsideCompany’s consolidated financial statements under U.S. GAAP.

Reverse Stock Split

On November 4, 2022, the United States). Consumer products include goods and services that are bought for personal and household use and intended for direct use or consumption. We are focused on established products that haveCompany filed a long historyCertificate of consumer demand, are used frequently and must be replaced as opposedAmendment to durable items that people keep forthe Articles of Incorporation (the “Certificate of Amendment”) with the Nevada Secretary of State to effect a long time, such as cars and furniture. These type of products and segments are also easier to manage and operationally forecast, with which our management team and directors have much experience.

We believe our management team has the skills and experience to identify, evaluate and consummate a business combination and is positioned to assist businesses we acquire. Our management team’s network and investing and operating experience do not guarantee a successful initial business combination. The members of our management team are not required to devote any significant amount of time to our business and are concurrently involved with other businesses. There is no guarantee that our current officers and directors will continue in their respective roles, or in any other role, after our initial business combination, and their expertise may only be of benefit to us until our initial business combination is completed. Past performance by our management team is not a guarantee of success with respect to any business combination we may consummate.

We anticipate structuring our initial business combination to acquire 100% of the equity interest or assets of the target business or businesses. However, we may structure our initial business combination to acquire less than 100% of the equity interest or assets of the target business, but only if we (or any entity that is a successor to us in a business combination) acquire a majorityreverse stock split of the outstanding voting securities or assets of the target. We believe that, if we own a majority of the target’s outstanding voting securities, we will not be required to register as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act, since the securities of a majority owned subsidiary that is not itself deemed an investment company are not deemed to be “investment securities” as defined in the Investment Company Act, and since we expect that 60% or more of the value of our total assets (excluding government securities and cash) will be represented by the securities of our target business which we expect will be an operating business. Even if we own a majority interest in the target, our stockholders prior to the business combination may collectively own a minority interest in the post business combination company, depending on valuations ascribed to the target and us in the business combination transaction.

Nasdaq rules require that our initial business combination must be with one or more target businesses that together have a fair market value equal to at least 80% of the balance in the trust account (less any taxes payable on interest) at the time of our signing a definitive agreement in connection with our initial business combination. The fair market value of the target or targets will be determined by our board of directors based upon one or more standards generally accepted by the financial community, such as discounted cash flow valuation or value of comparable businesses. If our board is not independently able to determine the fair market value of the target business or businesses, we will obtain an opinion with respect to the satisfaction of such criteria from an independent investment banking firm that is a member of the Financial Industry Regulating Authority, or FINRA, and reasonably acceptable to Cantor Fitzgerald & Co., or Cantor Fitzgerald, the underwriter of our initial public offering. However, if our securities are not listed on Nasdaq or another securities exchange, we will no longer be required to consummate a business combination with a target whose fair market value equals at least 80% of the balance in the trust account (less any taxes payable on interest).

Business Strategy

We seek to capitalize on the significant consumer products knowledge, experience and contacts of Qi (Jacky) Zhang, the Chairman of our Board of Directors, Tim Richerson, our Chief Executive Officer, Chief Financial Officer and a director, and the financial expertise of Peter Nathanial, our President and a director, to identify, evaluate, acquire and operate a target business. If we elect to pursue an investment outside of the consumer products industry, our management’s expertise related to that industry may not be directly applicable to its evaluation or operation, and the information contained in this Report regarding that industry might not be relevant to an understanding of the business that we elect to acquire.

We seek to acquire established consumer product branded businesses that we believe are fundamentally sound but potentially in need of financial, operational, strategic or managerial redirection to maximize value. We do not intend to acquire start-up companies, companies with speculative business plans or companies that are excessively leveraged.

Our acquisition and value creation strategy is to identify, acquire, and after our initial business combination, to build, a diversified consumer products branded company. We are focused on consumer companies that distribute a broad range of products for various customers and end use markets in multiple channels (a few examples are selling these products through retail stores, purchasing online or via a direct selling experience) but also might be limited in geography. We believe our management team has prior and current experience and access to sales channels and consumer markets outside the United States as well that could be helpful in a consumer product business combination.

We have identified the following criteria that we use in evaluating business transaction opportunities. We expect that no individual criterion will entirely determine a decision to pursue a particular opportunity. Further, any particular business transaction opportunity which we ultimately determine to pursue may not meet one or more of these criteria:

Significant Activities Since Inception

On July 29, 2015, we consummated our initial public offering of 5,000,000 units, each unit consisting of one shareshares of common stock, par value $0.0001 per shares, of the Company at a ratio of one-for-thirty (30), which became effective at 12:01 a.m. on November 9, 2022. Upon effectiveness of the reverse stock split, every thirty (30) outstanding shares of common stock were combined into and automatically become one share and oneof common stock. The Company’s warrants (OTC Pink: CCNCW) was adjusted so that each warrant is to purchase one-half of one shares of common stock at a price of $86.40 per half share ($172.50 per whole share). The warrants expired on February 5, 2023.

Unless otherwise indicated, all references to common stock, warrants to purchase common stock, share data, per share data, and related information have been retroactively adjusted, where applicable, in this Report to reflect the reverse stock split of our common stock as if they had occurred at the beginning of the earlier period presented.

Name Change

Effective as of January 10, 2023, the Company changed its corporate name from “Code Chain New Continent Limited” to “GD Culture Group Limited” pursuant to a Certificate of Amendment to the Company’s Articles of Incorporation. In connection with the name change, effective as of the opening of trading on January 10, 2023, the Company’s common stock is trading on the Nasdaq Capital Market under the ticker symbol “GDC”.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic did not have a material impact on our business or results of operation during the fiscal years ended December 31, 2023 and 2022. However, the extent to which the COVID-19 pandemic may negatively impact the general economy and our business is highly uncertain and cannot be accurately predicted. These uncertainties may impede our ability to conduct our operations and could materially and adversely affect our business, financial condition and results of operations, and as a result could adversely affect our stock price and create more volatility.

Recent Regulatory Developments

On January 4, 2022, the Cyberspace Administration of China, or CAC, issued the revised Measures on Cyberspace Security Review (the “Revised Measures”), which came into effect on February 15, 2022. Under the Revised Measures, any “network platform operator” controlling personal information of no less than one million users which seeks to list in a foreign stock exchange should also be subject to cyber security review.

We believe Shanghai Xianzhui is not a “network platform operator” who control over one million personal information as mentioned above, given that: (i) Shanghai Xianzhui does not possess a large amount of personal information in our business operations and (ii) data processed in Shanghai Xianzhui’s business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. As such, we believe Shanghai Xianzhui is not currently subject to the cyber security review by the CAC. However, the definition of “network platform operator” is unclear and it is also unclear on how it will be interpreted and implemented by the relevant PRC governmental authorities. See “Risk factors — Risk Factors Related to Doing Business in China — Shanghai Xianzhui may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. Shanghai Xianzhui may be required to suspend its business, be liable for improper use or appropriation of personal information provided by our customers or face other penalties.”

On July 6, 2021, the relevant PRC governmental authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. As these opinions were recently issued, official guidance and related implementation rules have not been issued yet and the interpretation of these opinions remains unclear at this stage. As of the date of this Report, we have not received any inquiry, notice, warning, or sanctions regarding listing abroad or offshore offering from the China Securities Regulatory Commission (“CSRC”) or any other PRC governmental authorities. See “Risk Factors — Risk Factors Related to Doing Business in China — The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if Shanghai Xianzhui or GDC were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our common stock may significantly decline or become worthless, which would materially affect the interest of the investors.”

On February 17, 2023, the CSRC released the Trial Administrative Measures for Administration of Overseas Securities Offerings and Listings by Domestic Companies (the “Trial Measures”) and five supporting guidelines, which came into effect on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, should fulfill the filing procedures and report relevant information to the CSRC. If a domestic company fails to complete the filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties by the CSRC, such as order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. As a listed company, we believe that we and all of our PRC subsidiaries are not required to fulfill filing procedures with the CSRC to continue to offer our securities, or continue listing on the Nasdaq Capital Market. However, there are substantial uncertainties regarding the interpretation and application of the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors (“M&A Rules”), other PRC Laws and future PRC laws and regulations, and there can be no assurance that any governmental agency will not take a view that is contrary to or otherwise different from our belief stated herein. See “Risk Factors - Risk Factors Relating to Doing Business in China - The CSRC has released the Trial Measures for Administration of Overseas Securities Offerings and Listings by Domestic Companies (the “Trial Measures”). With such rules in effect, the Chinese government may exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to continue to offer our securities to investors and could cause the value of our securities to significantly decline or become worthless.”

We believe that we are currently not required to obtain any permission or approval from the CSRC and the CAC in the PRC to issue securities to foreign investors. However, there is no guarantee that this will continue to be the case in the future in relation to any future offerings of our company or the continued listing of our company’s securities on the Nasdaq Capital Market, or even in the event such permission or approval is required and obtained, it will not be subsequently revoked or rescinded. If we do not receive or maintain the approvals, or we inadvertently conclude that such approvals are not required, or applicable laws, regulations, or interpretations change such that we are required to obtain approval in the future, we may be subject to an investigation by competent regulators, fines or penalties, or an order prohibiting us from conducting an offering, and these risks could result in a material adverse change in our operations and the value of our securities, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless.

Implication of the Holding Foreign Company Accountable Act

The Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020. The HFCAA states that if the SEC determines that an issuer’s audit reports issued by a registered public accounting firm have not been subject to inspection by the Public Company Accounting Oversight Board (United States) (the “PCAOB”) for three consecutive years beginning in 2021, the SEC shall prohibit such issuer’s securities from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCAA. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year under a process to be subsequently established by the SEC. If we fail to meet the new rules before the deadline specified thereunder, we could face possible prohibition from trading on a national securities exchange or on the OTC Markets, deregistration from the SEC and/or other risks, which may materially and adversely affect, or effectively terminate, our securities trading in the United States. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCAA. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the prohibition on trading. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the U.S. Securities and Exchange Commission (the “SEC”), the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination.

Our previous auditor, Enrome LLP, has been inspected by the PCAOB on a regular basis in the audit period. Our current auditor, HTL International, LLC (“HTL”), has been inspected by the PCAOB on a regular basis as well. If it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate. Moreover, if trading in our securities is prohibited under the HFCAA in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, an exchange may determine to delist our securities. See “Risk Factors—Risks Related to Doing Business in China — The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies.”

Asset Transfer between our Company and our Subsidiaries

During the fiscal years ended December 31, 2023, GDC transferred a total of $2,100,000 to its subsidiary AI Catalysis Corp.

During the fiscal years ended December 31, 2022, there was no transfer of assets between GDC and its subsidiaries.

Our Products and Services

GDC operates in the following distinct business sectors through the Company and two subsidiaries, AI Catalysis Corp. and Shanghai Xianzhui: 1) AI-driven digital human creation and customization; 2) Live streaming and e-commerce and 3) Live streaming interactive game. The company has relentlessly been focusing on serving its customers and creating value for them through the continual innovation and optimization of its products and services.

| 1. | AI-Driven Digital Human |

| - | Digital Human Creation and Customization |

The Company uses AI algorithms and software to generate realistic 3D or 2D digital human models. AI algorithms and machine learning models are used to simulate human characteristics, such as facial expressions, body movements, and even speech patterns. These models can be customized to create and personalize lifelike digital representations of humans. Customization may involve adjusting facial features, body proportions, skin textures, hair styles, clothing, and more.

| - | Digital Human Technology Application |

Once created and customized, digital humans find applications in a wide range of industries, including gaming, entertainment, advertising, education, and more. Depending on the specific industry and the application scenario, the Company helps the customers to define the objectives to achieve with digital humans, choose the technology for character customization, then create unique aviators and deploy in the chosen platform.

The Company currently plans to generate lifelike digital humans for the following key business areas:

| ● | Virtual Influencers and Social Media |

The Company aims to create digital humans to gain popularity as virtual influencers on social media platforms. These virtual personalities can collaborate with brands and engage with followers, blurring the line between fiction and reality.

A well-thought-out narrative to create digital characters with diversified personal identity, appearance, storytelling, and actions can resonate with its audience and influence them on notable social media platforms. It aims to attract a large following on social media and has the ability to produce responsible content 24/7. The Company also uses open source AI tools to create unconventional digital characters and videos.

| ● | Online Marketing and Advertising |

Digital humans can be used in marketing campaigns and advertisements to engage with consumers. They can serve as virtual brand ambassadors or spokespersons, providing a more personal and interactive experience. The Company creates customized digital humans to support the clients’ marketing efforts.

| 2. | E-Commerce and Live Streaming |

| - | Digital Human in E-Commerce and Live Streaming |

The Company applies digital human technology in live streaming e-commerce businesses. Livestream usage is taking off globally. The integration of cutting-edge AI digital human technologies and live streaming platforms will transform the way businesses, sellers and consumers engage in online commerce. Digital anchors can offer long-duration intelligent live broadcasting. It also supports customized avatars that perfectly adapt to different live streaming scenarios.

| - | E-Commerce on Social Media Platforms |

The company has introduced online e-commerce businesses on TikTok. Our focus is on capturing TikTok’s popular trend by offering carefully selected product choices with smooth delivery. We aim to redefine the online shopping experience by providing a diverse range of products with real-time interaction capabilities. Currently, our product offerings include popular Asian snacks, small home appliances, gardening tools, 3C products, and more. We plan to introduce additional product types, such as Asian branded beauty products, personal care, fashion, and more trending popular items in Asia, to TikTok consumers.

| - | E-Commerce Live Streaming Businesses |

The Company intends to expand its e-commerce offerings on the social media platform into live-streaming. We plan to diversify our livestream hosts by incorporating different styles and personalities. In addition to the real-time improvisation by hosts during each live streaming session, our community interactions generate another form of content. The variety of real-time interactions between viewers and hosts or among viewers creates viewer-generated content, which becomes part of the overall entertainment and social experience offered on our platform. Such content enhances the sense of involvement and makes it more enjoyable to watch live streaming while customers are shopping online.

| 3. | Live Streaming Interactive Game |

The Company has launched a live-streamed game called “Trible Light.” This game is owned by the company, and we independently operate it. Currently, the game is being livestreamed on TikTok (TikTok account: almplify001). In addition to “Trible Light,” we have also introduced other licensed games on the same TikTok account, providing a diverse gaming experience for the players.

These interactive live streaming games on the TikTok platform are specifically designed for young game enthusiasts worldwide. They offer real-time and immersive gaming experiences, where viewers can actively participate as players during the livestream. Our livestream hosts enhance the experience by providing commentary, tips, and insights to engage and excite the players. Furthermore, this unique live streaming format allows viewers to gift virtual tokens to their favorite hosts, fostering a sense of community among our gaming audience.

This innovative gaming style is already popular in Asia which offers instant, thrill-packed experiences for TikTok enthusiasts. The game is user-friendly, entertaining, and available whenever players decide to participate. We plan to continuously diversify our game offerings to provide more enjoyable options based on viewers’ preferences. AI Catalysis intends to expand anchor personalities. Currently, the company has collaborated with two hosts - one with a great sense of humor and another with keen gaming insights. The game has gained significant momentum and has captured the attention of many TikTok users.

AI Catalysis plans to diversify its game offerings and collaborate with various TikTok personalities. In both e-commerce and live streaming and live streaming interactive game business sectors, AI Catalysis is committed to serving the TikTok audience 24/7. We also have plans to introduce digital hosts to ensure continuous entertainment.

Revenue Model

We aim to generate revenue from: 1) Service revenue and advertising revenue from digital human creation and customization; 2) Products’ sales revenue from social live streaming e-commerce business; 3) Virtual paid gifts revenue from live streaming interactive gaming.

| 1. | Digital Human Creation and Customization Services |

The Company will monetize our services through:

| - | Services fee for custom avatar creation: to provide customized services to our customers for designing and generating unique digital human avatars. Our target customers are mainly individuals or small and medium-sized businesses (“SMB”) in the consumer industry. For SMB customers, digital humans can be used in advertising and marketing campaigns to create engaging content, or engaging with consumers on social media platforms as a brand ambassador or spokespeople to increase brand visibility and loyalty. We can also provide ongoing maintenance, updates, and support for their digital humans. Based on the scope of work and complexity of the project, the company provides advice, project planning, and strategy development in exchange for consulting fees. |

| - | Advertising partnership fee: When the Company’s own virtual influencers gain a significant following or visibility on the social media platforms, we consider partnering with brands for sponsored content or advertising opportunities related to the digital human work. |

| - | Licensing fee: license the right to clients to use, deploy, or integrate digital human avatars or characters created by the company for a fee. Licensing agreements can vary based on usage, duration, and exclusivity. |

| 2. | Social and Live Streaming E-Commerce Gross Merchandise Value |

| - | Product sales: Hosts or influencers showcase products, answer questions from viewers, and encourage viewers to make purchases of the products in real time during live streaming. |

| - | Virtual gifts and tipping: Viewers have the option to send virtual gifts or tips to hosts or influencers during live streams. These virtual gifts are purchased with real money, and the platform and the host/influencers share the revenue generated from virtual gifting. |

| 3. | Live Streaming Interactive Gaming |

| - | Virtual paid gifts: Virtual paid gifts from viewers are the main revenue source for the live streaming gaming industry. Virtual gifting is a considerably successful business model that stimulates streamers’ content generation and viewer-streamer interactions. Live streaming platforms earn revenues from sales of paid gifts, and streamers earn a proportion of the received gifts or donations or tips from fans. |

Our Customers

AI Catalysis’ main business is conducting virtual human live streams and bullet chat game broadcasts on TikTok, with expected revenue primarily coming from user tips.

Our Suppliers

The Company’s top three suppliers are Lida Global Limited, Shanghai Alliance Information Technology Co., Ltd. and Jinhe Capital Limited.

Employees

As of April 1, 2024, our Company has 8 full-time employees in total.

We have not experienced any significant labor disputes and consider our relationship with our employees to be good. Our employees are not covered by any collective bargaining agreement.

As we continue to expand our business, we believe it is critical to hire and retain top talent. We believe we have the ability to attract and retain high quality talents based on our competitive salaries, annual performance-based bonus system, and equity incentive program for senior employees and executives.

Recent Development

Disposition of Wuge

On September 28, 2022, the Company entered into a termination agreement with Wuge and the shareholders of Wuge, i.e., Wei Xu, former Chief Executive Officer, President and Chairman of the Board of the Company, and Bibo Lin, former Vice President and Director of the Company, and two entities controlled by Wei Xu, to terminate certain technical consultation and services agreement., equity pledge agreement, equity option agreement, voting rights proxy and financial support agreement, by and among Makesi WFOE, Wuge, and the shareholders of Wuge. As a result, Wuge ceased to be a VIE of Makesi WFOE and operations of Wuge have been designated as discontinued operations. In exchange for such termination, on March 9, 2023, the Company cancelled 133,333 shares of common stock that were issued to the shareholders of Wuge in January 2020.

Registered Direct Offering (“May 2023 Offering”)

On May 1, 2023, the Company entered into a placement agency agreement, with Univest Securities, LLC, as the placement agent. Pursuant to the placement agency agreement, the placement agent agrees to use its reasonable best efforts to sell the Company’s common stock in a registered direct offering (the “RD Offering”), and a concurrent private placement (the “PIPE Offering”, together with the RD Offering, collectively the “May 2023 Offering”). The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities.

In the RD Offering, an aggregate of 310,168 shares of common stock of the Company, par value $0.0001 per share, and pre-funded warrants to purchase up to an aggregate of 844,351 shares of common stock (the “Pre-Funded Warrants”, and the common stock underlying such warrants, the “Pre-Funded Warrant Shares”) are sold to certain purchasers (the “Purchasers”), pursuant to a securities purchase agreement, dated May 1, 2023 (the “RD Securities Purchase Agreement”). The purchase price of each share of common stock is $8.27. The purchase price of each Pre-funded Warrant is $8.269, which equals the price per common stock being sold to the public in the May 2023 Offering, minus $0.001. The RD Offering is being made pursuant to a shelf registration statement (No. 333-254366) on Form S-3, which was declared effective by the SEC on March 26, 2021, and related prospectus supplement.

In connection with the Pre-Funded Warrant Shares, “Pre-funded” refers to the fact that the purchase price of the warrants in the offering includes almost the entire exercise price that will be paid under the Pre-funded Warrants, except for a nominal remaining exercise price of $0.001. The purpose of the Pre-funded Warrants is to enable Purchasers that may have restrictions on their ability to beneficially own more than 4.99% (or, upon election of the holder, 9.99%) of the Company’s outstanding common stock following the consummation of the offering the opportunity to make an investment in the Company without triggering their ownership restrictions, by receiving Pre-funded Warrants in lieu of the Company’s common stock which would result in such ownership of more than 4.99% (or 9.99%), and receive the ability to exercise their option to purchase the shares underlying the Pre-funded Warrants at such nominal price at a later date. In the RD Offering, each Pre-funded Warrant is exercisable for one share of our common stock, with an exercise price equal to $0.001 per share, at any time that the Pre-funded Warrant is outstanding. The Pre-funded Warrants will be exercisable immediately after issuance and will expire five (5) years from the date of issuance. The holder of a Pre-funded Warrant will not be deemed a holder of our underlying common stock until the Pre-funded Warrant is exercised.

In the concurrent PIPE Offering, warrants to purchase up to 1,154,519 shares of common stock (the “Unregistered Warrants”, and the common stock underlying such warrants, the “Unregistered Warrant Shares”) are also sold to the Purchasers, pursuant to a private warrant securities purchase agreement, dated May 1, 2023. The Unregistered Warrants are exercisable immediately after issuance and will expire five (5) years from the date of issuance. The Exercise Price of the Unregistered Warrants is $8.27, subject to adjustment as provided in the form of Unregistered Warrants.

The Company also paid the placement agent a total cash fee equal to 7.0% of the aggregate gross proceeds received in the May 2023 Offering and a non-accountable expense allowance equal to 1% of the aggregate gross proceeds. The placement agent were also reimbursed for certain out-of-pocket accountable expenses incurred in this offering up to $150,000. The placement agent also received warrants to purchase up to 115,452 shares of common stock (equal to 5.0% of the aggregate number of common stocks, Pre-Funded Warrant Shares, and the Unregistered Warrant Shares) at an exercise price of $5.75$9.924 per half share, ($11.50which represents 120% of the offering price of each share of common stock. The placement agent’s warrants will have substantially the same terms as the Unregistered Warrants.

The net proceeds from the May 2023 Offering, after deducting placement agent discounts and commissions and estimated offering expenses payable by the Company, are approximately $8.53 million (assuming the Unregistered Warrants are not exercised). The Company intends to use the net proceeds from the Offering for working capital and general corporate purposes.

Amendment to the May 2023 Offering

On May 16, 2023, the Company entered into an amendment to the RD Securities Purchase Agreement with the Purchasers, pursuant to which the purchase price of each share of common stock was increased to $8.35 and the purchase price of each Pre-funded Warrant was increased to $8.349. Concurrently, the Company entered into an amendment to the PIPE Securities Purchase Agreement with the Purchasers, pursuant to which the exercise price of each Unregistered Warrant was increased to $8.35 per whole share)share of common stock. The Company will receive net proceeds of $84,972.60, after deducting placement agent’s 7% cash fee and 1% non-accountable expense allowance, as a result of such amendments. The Company plans to use the net proceeds for working capital and general corporate purposes. In addition, as a result of such amendments and pursuant to the placement agency agreement, the Company amended and restated the placement agent’s warrants to increase the exercise price to $10.02 per share.

Software Purchase Agreement dated June 22, 2023

On June 22, 2023, the Company entered into a software purchase agreement (the “Agreement”) with Northeast Management LLC, a seller unaffiliated with the Company (the “Seller”). Pursuant to the Agreement, the Company agreed to purchase and the Seller agreed to sell all of Seller’s right, title, and interest in and to the certain software. The purchase price of the software shall be $750,000, payable in the form of issuance of 187,500 shares of common stock of the Company (the “Shares”), valued at $4.00 per share. The Company plans to use the software to develop video games. On June 26, 2023, the Company issued the Shares to the Seller’s designees and the transaction was completed.

Share Purchase Agreement dated June 26, 2023

On June 26, 2023, the Company entered into a share purchase agreement (the “Agreement”) with a buyer unaffiliated with the Company (the “Buyer”). Pursuant to the Agreement, the Company agreed to sell and the Buyer agreed to purchase all the issued and outstanding equity interest in TMSR Holdings Limited (“TMSR”), a company incorporated under the laws of Hong Kong and an indirect subsidiary of Company. The purchase price for the transaction contemplated by the Agreement shall be $100,000. TMSR has a direct wholly-owned subsidiary, Makesi WFOE, and an indirect wholly-owned subsidiary, Yuan Ma. The sale of TMSR will include the sale of Makesi WFOE and Yuan Ma. None of TMSR, Makesi WFOE or Yuan Ma has any assets, employees or operation. The sale of TMSR will not have any impact on the Company’s consolidated financial statements.

Termination of the VIE Agreements

As previously disclosed in the current reports on Form 8-K of the Company filed on September 19, 2022 and February 28, 2023, on September 16, 2022, Makesi WFOE, Highlight Media, and the Highlight Media Shareholders entered into certain Technical Consultation and Services Agreement., Equity Pledge Agreement, Equity Option Agreement, Voting Rights Proxy and Financial Support Agreement, which was assigned by Makesi WFOE to Highlight WFOE on February 27, 2023 (such agreements, as assigned, the “VIE Agreements”). The VIE Agreements established a “Variable Interest Entity” (VIE) structure, pursuant to which the Company treated Highlight Media as a consolidated affiliated entity and consolidated the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under U.S. GAAP.

On September 26, 2023, Highlight WFOE entered into the Termination Agreement with Highlight Media, the Highlight Media Shareholders and a third party to terminate the VIE Agreements and for the third party to pay the Company $100,000 as consideration to the termination of the VIE Agreements. As a result of such termination, the Company will no longer treat Highlight Media as a consolidated affiliated entity or consolidate the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under U.S. GAAP.

The Establishment of the Joint Venture

On August 10, 2023, Shanghai Highlight, an indirect subsidiary of the Company, Beijing Hehe Property Management Co., Ltd. (“Beijing Hehe”), and a third party, established Shanghai Xianzhui under the laws of the People’s Republic of China for social media marketing. Shanghai Highlight owned 60% of the equity interest of Shanghai Xianzhui , Beijing Hehe owned 20% of the equity interest of Shanghai Xianzhui and the third party owned the remaining 20% of the equity interest of Shanghai Xianzhui.

Equity Purchase Agreement dated October 27, 2023 and the Amendment to the Equity Purchase Agreement dated November 10, 2023

On October 27, 2023, the Company entered into an equity purchase agreement (the “Agreement”) with Shanghai Highlight and Beijing Hehe, pursuant to which the Shanghai Highlight agreed to purchase the 20% equity interest in Shanghai Xianzhui from Beijing Hehe and the Company agreed to issue 600,000 shares of common stock of the Company, valued at $2.7820 per share, the average closing bid price of the common stock of GDC as of the five trading days immediately preceding the date of the Agreement, to Beijing Hehe or its assigns. The closing of the transaction shall take place within thirty (30) days from the execution of the Agreement. The Agreement is effective for thirty (30) days from the date of the Agreement, which can be extended for additional thirty (30) days upon all parties’ written agreement. The Company or Shanghai Highlight may terminate the Agreement at any time with a three (3) day advance written notice to Beijing Hehe.

On November 10, 2023, the Company entered into an amended and restated equity purchase agreement (the “Amended and Restated Agreement”) that amended and replaced the Original Agreement. Pursuant to the Amended and Restated Agreement, Shanghai Highlight agreed to purchase the 13.3333% equity interest in Shanghai Xianzhui from Beijing Hehe and the Company agreed to issue 400,000 shares of common stock of the Company, valued at the Per Share Price, to Beijing Hehe or its assigns.

Pursuant to the Amended and Restated Agreement, the closing of the transaction shall take place within thirty (30) days from the execution of the Amended and Restated Agreement. The Amended and Restated Agreement is effective for thirty (30) days from the date of the Amended and Restated Agreement, which can be extended for additional thirty (30) days upon all parties’ written agreement. The Company or Shanghai Highlight may terminate the Amended and Restated Agreement at any time with a three (3) day advance written notice to Beijing Hehe.

On January 11, 2024, the Company issued the Shares and the transaction is completed. Up to the date of this Report, the Company owns 73.3333% of the total equity interest of Shanghai Xianzhui.

Registered Direct Offering (“November 2023 Offering”)

On November 1, 2023, the Company entered into a placement agency agreement, with Univest Securities, LLC, as the placement agent. Pursuant to the placement agency agreement, the Placement Agent agrees to use its reasonable best efforts to sell the Company’s common stock in a registered direct offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities.

In the November 2023 Offering, (i) an aggregate of 1,436,253 shares of common stock of the Company, par value $0.0001 per share, (ii) pre-funded warrants to purchase up to an aggregate of 1,876,103 shares of common stock (the “Pre-Funded Warrants”, and the common stock underlying such warrants, the “Pre-Funded Warrant Shares”), and (iii) registered warrants to purchase up to an aggregate of 3,312,356 shares of common stock (the “Registered Warrants”, and the common stock underlying such warrants, the “Registered Warrant Shares”) are sold to certain purchasers (the “Purchasers”), pursuant to a securities purchase agreement, dated October 31, 2023 (the “November 2023 Securities Purchase Agreement”). The purchase price of each share of common stock is $3.019. The purchase price of each Pre-funded Warrant is $3.018, which equals the price per common stock being sold in this November 2023 Offering, minus $0.001. The Pre-funded Warrants will be exercisable immediately after issuance and will expire five (5) years from the date of issuance. The Registered Warrants will be exercisable immediately and will expire five (5) years from the date of issuance.

The November 2023 Offering is being made pursuant to a shelf registration statement (No. 333-254366) on Form S-1 (File No. 333-204995). S-3, which was declared effective by the SEC on March 26, 2021, and related prospectus supplement.

The units were sold in our initial public offering at an offering price of $10.00 per unit, generating grossnet proceeds of $50,000,000 (before underwritingfrom the November 2023 Offering, after deducting placement agent discounts and commissions and estimated offering expenses)expenses payable by the Company, are approximately $9.05 million (assuming the Registered Warrants are not exercised). Simultaneously with the consummation of our initial public offering, we completed a private placement of 250,000 units at a price of $10.00 per unit, issuedThe Company intends to Zhong Hui Holding Limited, our sponsor, generating gross proceeds of $2,500,000. A total of $50,000,000 fromuse the net proceeds from our initial public offeringthe November 2023 Offering for working capital and general corporate purposes.

Pursuant to the placement agency agreement, the Company has agreed to pay the Placement Agent a total cash fee equal to 7.0% of the aggregate gross proceeds received in the November 2023 Offering. The Company also agreed to reimburse the Placement Agent certain out-of-pocket accountable expenses incurred in this November 2023 Offering up to $150,000.

In concurrent with the November 2023 Offering, on November 1, 2023, the Company entered into certain warrant exchange agreements (the “Warrant Exchange Agreements”) with certain holders of the Unregistered Warrants, as defined in the section titled “Registered Direct Offering (‘May 2023 Offering’)”, to purchase up to 1,154,519 shares of the Company’s common stock (the “Holders”). Pursuant to the Warrant Exchange Agreements, the Holders shall surrender the Unregistered Warrants, and the privateCompany shall cancel the Unregistered Warrants and shall issue to Holders pre-funded warrants to purchase up to 577,260 shares of the Company’s common stock (the “Exchange Warrants”). The Exchange Warrants were issued to Holders on November 3, 2023 and the warrant exchange closed on the same day.

Amendment to the November 2023 Offering

On November 17, 2023, the Company entered into an amendment to the November 2023 Securities Purchase Agreement with the Purchasers, pursuant to which Exhibit B to the November 2023 Securities Purchase Agreement (form of Registered Warrants) was deleted and replaced with an amended and restated the Form of Registered Warrant, to remove Section 2(b) Adjustment Upon Issuance of Common Stock and Section 2(e) Other Events. The Registered Warrants that were issued to Purchasers under the November 2023 Securities Purchase Agreement were returned to and cancelled by the Company on November 17, 2023. Concurrently, the Company issued amended and restated Registered Warrants to each Purchaser.

Registered Direct Offering (“March 2024 Offering”)

On March 22, 2024, the Company entered into a placement were placedagency agreement, with Univest Securities, LLC, as the placement agent. Pursuant to the placement agency agreement, the placement agent agrees to use its reasonable best efforts to sell the Company’s common stock in a trust account establishedregistered direct offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the benefitpurchase or sale of our public stockholders. any specific number or dollar amount of securities.

The units began trading on July 24, 2015 onIn the NASDAQ Stock Market under the symbol “WYIGU”. Commencing on September 11, 2015, the securities comprising the units began separate trading. The units,March 2024 Offering, an aggregate of 810,277 shares of common stock and warrants are trading on the NASDAQ Stock Market under the symbols “WYIGU,” “WYIG” and “WYIGW.”were sold to certain purchasers, pursuant to a securities purchase agreement, dated March 22, 2024. The purchase price of each Common Share is $1.144.

The March 2024 Offering is being made pursuant to a shelf registration statement (No. 333-254366) on Form S-3, which was declared effective by the SEC on March 26, 2021, and related prospectus supplement.

The net proceeds from the March 2024 Offering, after deducting placement agent discounts and commissions and estimated offering expenses payable by the Company, are approximately $830,000. The Company intends to use the net proceeds from the March 2024 Offering for working capital and general corporate purposes.

Pursuant to the placement agency agreement, the Company has agreed to pay the placement agent a total cash fee equal to 4.0% of the aggregate gross proceeds received in the March 2024 Offering.

Pursuant to the placement agency agreement, the Company agreed to issue the placement agent warrants to the placement agent to purchase up to 40,514 shares of Common Stock (equal to 5.0% of the aggregate number of Common Shares) at an exercise price of $1.373 per share, which represents 120% of the offering price.

Environmental Matters

As of December 31, 2023, the Company, Shanghai Xianzhui and Ai Catalysis were not subject to any fines or legal action involving non-compliance with any relevant environmental regulation, nor are we aware of any threatened or pending action, including by any environmental regulatory authority.

Governmental Regulations in PRC

Business license

Any company that conducts business in the PRC must have a business license that covers a particular type of work. The Company’s PRC operating company, Shanghai Xianzhui’s business license covers its present business of technology development and consulting, and technical support for digital humans.

Employment laws

Shanghai Xianzhui are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, citizenship requirements, work permits and travel restrictions. These include local labor laws and regulations, which may require substantial resources for compliance. China’s National Labor Law, which became effective on January 1, 1995, and amended on August 27, 2009, and China’s National Labor Contract Law, which became effective on January 1, 2008, and amended on December 28, 2012, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract.

Intellectual property protection in China

Patent. The PRC has domestic laws for the protection of copyrights, patents, trademarks and trade secrets. The PRC is also signatory to some of the world’s major intellectual property conventions, including:

| Convention establishing the World Intellectual Property Organization (WIPO Convention) (June 4, 1980); |

| ● | Paris Convention for the Protection of Industrial Property (March 19, 1985); |

| ● | Patent Cooperation Treaty (January 1, 1994); and |

| ● | The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPs) (November 11, 2001). |

Patents in the PRC are governed by the China Patent Law and its Implementing Regulations, each of which went into effect in 1985. Amended versions of the China Patent Law and its Implementing Regulations came into effect in 1993, 2001 and 2009, respectively.

The PRC is signatory to the Paris Convention for the Protection of Industrial Property, in accordance with which any person who has duly filed an application for a patent in one signatory country shall enjoy, for the purposes of filing in the other countries, a right of priority during the period fixed in the convention (12 months for inventions and utility models, and 6 months for industrial designs).

The Patent Law covers three kinds of patents — patents for inventions, utility models and designs. The Chinese patent system adopts the principle of first to file, which means that a patent may be granted only to the person who first files an application. Consistent with international practice, the PRC allows the patenting of inventions or utility models that possess the characteristics of novelty, inventiveness and practical applicability only. For a design to be patentable it cannot be identical with, or similar to, any design which, before the date of filing, has been publicly disclosed in publications in the country or abroad or has been publicly used in the country, and should not be in conflict with any prior right of another.

Copyright. Copyright in the PRC, including copyrighted software, is principally protected under the Copyright Law of the PRC and related rules and regulations. Under the Copyright Law, the term of protection for copyrighted software is 50 years.

Trademark. Registered trademarks are protected under the Trademark Law of the PRC and related rules and regulations. Trademarks are registered with the Trademark Office of the SAIC. Where registration is sought for a trademark that is identical or similar to another trademark which has already been registered or given preliminary examination and approval for use in the same or similar category of commodities or services, the application for registration of such trademark may be rejected. Trademark registrations are effective for a renewable ten-year period, unless otherwise revoked. The duration of a trademark is 10 years from the date of registration.

Domain names. Domain name registrations are handled through domain name service agencies established under the relevant regulations, and applicants become domain name holders upon successful registration.

EffectingRegulations on Tax

PRC Corporate Income Tax

The PRC corporate income tax, or CIT, is calculated based on the taxable income determined under the applicable CIT Law and its implementation rules, which became effective on January 1, 2008 and amended on February 24, 2017. The CIT Law imposes a uniform corporate income tax rate of 25% on all resident enterprises in China, including foreign-invested enterprises.

Uncertainties exist with respect to how the CIT Law applies to the tax residence status of The Company and our Initial Business Combinationoffshore subsidiaries. Under the CIT Law, an enterprise established outside of China with a “de facto management body” within China is considered a “resident enterprise,” which means that it is treated in a manner similar to a Chinese enterprise for corporate income tax purposes. Although the implementation rules of the CIT Law define “de facto management body” as a managing body that exercises substantive and overall management and control over the production and business, personnel, accounting books and assets of an enterprise, the only official guidance for this definition currently available is set forth in Circular 82 issued by the State Administration of Taxation, which provides guidance on the determination of the tax residence status of a Chinese-controlled offshore incorporated enterprise, defined as an enterprise that is incorporated under the laws of a foreign country or territory and that has a PRC enterprise or enterprise group as its primary controlling shareholder. Although the Company does not have a PRC enterprise or enterprise group as our primary controlling shareholder and is therefore not a Chinese-controlled offshore incorporated enterprise within the meaning of Circular 82, in the absence of guidance specifically applicable to us, we have applied the guidance set forth in Circular 82 to evaluate the tax residence status of The Company and our subsidiaries organized outside the PRC.

General

We intendAccording to effectuate our initial business combination using cash from the proceedsCircular 82, a Chinese-controlled offshore incorporated enterprise will be regarded as a PRC tax resident by virtue of our initial publichaving a “de facto management body” in China and the private placement, our capital stock, debt or a combination of these as the considerationwill be subject to be paid in our initial business combination.

If we pay for our initial business combination using stock or debt securities, or we do not usePRC corporate income tax on its worldwide income only if all of the funds released from the trust account for paymentfollowing criteria are met:

| ● | the primary location of the day-to-day operational management is in the PRC; |

| ● | decisions relating to the enterprise’s financial and human resource matters are made or are subject to approval by organizations or personnel in the PRC; |

| ● | the enterprise’s primary assets, accounting books and records, company seals, and board and shareholders meeting minutes are located or maintained in the PRC; and |

| ● | 50% or more of voting board members or senior executives habitually reside in the PRC. |

We do not believe that we meet any of the purchase priceconditions outlined in connectionthe immediately preceding paragraph.

We believe none of our entities outside of China is a PRC resident enterprise for PRC tax purposes. However, the tax resident status of an enterprise is subject to determination by the PRC tax authorities and uncertainties remain with respect to the interpretation of the term “de facto management body.” As all of our business combinationmanagement members are based in China, it remains unclear how the tax residency rule will apply to our case. If the PRC tax authorities determine that we or any of our subsidiaries outside of China is a PRC resident enterprise for redemptionsPRC enterprise income tax purposes, then we or purchasessuch subsidiary could be subject to PRC tax at a rate of 25% on its world-wide income, which could materially reduce our net income. In addition, we will also be subject to PRC enterprise income tax reporting obligations. Furthermore, if the PRC tax authorities determine that we are a PRC resident enterprise for enterprise income tax purposes, gains realized on the sale or other disposition of our common stock may be subject to PRC tax, at a rate of 10% in the case of non-PRC enterprises or 20% in the case of non-PRC individuals (in each case, subject to the provisions of any applicable tax treaty), if such gains are deemed to be from PRC sources. It is unclear whether non-PRC shareholders of our company would be able to claim the benefits of any tax treaties between their country of tax residence and the PRC in the event that we are treated as a PRC resident enterprise. Any such tax may reduce the returns on your investment in our common stock.

Value-Added Tax and Business Tax