UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended AugustDecember 31, 20172022

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-50298001-35813

ORAMED PHARMACEUTICALS INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 98-0376008 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| (Address of Principal Executive Offices) | (Zip Code) |

+972-2-566-0001844-967-2633

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

| Title of each class | Trading symbol | Name of each exchange on which registered | ||

| Common Stock, par value $0.012 | ORMP | The Nasdaq Capital Market, Tel Aviv Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.012 par value per share

None.

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and"emerging “emerging growth company"company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | �� | |

| Emerging growth company | ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $56,748,843,$169,594,349 based on a price of $6.05,$4.58, being the last price at which the shares of the registrant’s common stock were sold on The Nasdaq Capital Market prior to the end of the most recently completed second fiscal quarter.

IndicateAs of March 6, 2023, the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 14,306,100registrant had 39,783,813 shares of common stock issued and outstanding as of November 28, 2017.outstanding.

ORAMED PHARMACEUTICALS INC.

FORM 10-K(FOR THE FISCAL YEAR ENDED AUGUST 31, 2017)

TABLE OF CONTENTS

i

INTRODUCTION AND USE OF CERTAIN TERMS

On February 28, 2022, our Board of Directors, or our Board, approved a change of the Company’s fiscal year from the period beginning on September 1 and ending on August 31 to the period beginning on January 1 and ending on December 31. As a result, the Company filed a Transition Report on Form 10-Q with the Securities and Exchange Commission, or the SEC, on March 30, 2022 that included financial information for the transition period from September 1, 2021 through December 31, 2021, or the Transition Period. Subsequent to that report, the Company’s fiscal year now begins on January 1 and ends on December 31. This Annual Report on Form 10-K is the Company’s first annual report presenting its new fiscal year, and reports financial results for the 12 month period ended December 31, 2022.

As used in this Annual Report on Form 10-K, the terms “we,” “us,” “our,” the “Company,” and “Oramed” mean Oramed Pharmaceuticals Inc. and our wholly-owned Israeli subsidiary, Oramed Ltd.,subsidiaries, unless otherwise indicated. All dollar amounts refer to U.S. dollars unless otherwise indicated.

On AugustDecember 31, 2017,2022, the exchange rate between the New Israeli Shekel, or NIS, and the dollar, as quoted by the Bank of Israel, was NIS 3.5963.519 to $1.00. Unless indicated otherwise by the context, statements in this Annual Report on Form 10-K that provide the dollar equivalent of NIS amounts or provide the NIS equivalent of dollar amounts are based on such exchange rate.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this Annual Report on Form 10-K that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws.laws and the Israeli securities law. Words such as “expects,” “anticipates,” “intends,” “plans,” “planned expenditures,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, or our achievements, or industry results, expressed or implied by such forward-looking statements. Such forward-looking statements appear in Item 1 - “Business”“Item 1. Business” and Item 7 - “Management's“Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as elsewhere in this Annual Report on Form 10-K and include, among other statements, statements regarding the following:

| ● | our comprehensive analysis of data from our ORA-D-013-1 Phase 3 trial to understand if there is a path forward for our oral insulin candidate; |

| ● | our plan to evaluate potential strategic opportunities; |

| ● | our ability to enhance value for our stockholders; |

| ● | the expected development and potential benefits from our |

| ● | the prospects of entering into additional license agreements, or other partnerships or forms of cooperation with other companies or medical institutions; |

| ● | future milestones, conditions and royalties under our license agreements; |

| ● | expected timing of a clinical study for the |

| ● | our research and development plans, including pre-clinical and clinical trials plans and the timing of enrollment, obtaining results and conclusion of |

| ● | our belief that our technology has the potential to deliver medications and vaccines orally that today can only be delivered via injection; |

| ● | the competitive ability of our technology based on product efficacy, safety, patient convenience, reliability, value and patent position; |

ii

| ● | the potential market demand for our products; |

| ● | our ability to obtain patent protection for our intellectual property; |

| ● | our expectation that |

| ● | our expectations regarding our short- and long-term capital requirements; |

| ● | our outlook for the coming months and future periods, including but not limited to our expectations regarding future revenue and expenses; and |

| ● | information with respect to any other plans and strategies for our business. |

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us.us at the time of such statements. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those discussed herein, including those risks described in Item“Item 1A. "Risk Factors",Risk Factors,” and expressed from time to time in our other filings with the Securities and Exchange Commission, or SEC. In addition, historic results of scientific research, clinical and preclinical trials do not guarantee that the conclusions of future research or trials would not suggest different conclusions. Also, historic results referred to in this Annual Report on Form 10-K could be interpreted differently in light of additional research, clinical and preclinical trials results. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. Except as required by law, we undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report on Form 10-K which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

iii

PART I

DESCRIPTION OF BUSINESSDescription of Business

Research and Development

We are currently a pharmaceutical company currently engaged in the research and development of innovative pharmaceutical solutions including an oral insulin capsule to be usedwith a technology platform that allows for the treatment of individuals with diabetes, and the use of orally ingestible capsules or pills fororal delivery of other polypeptides.

Oral insulin: We are seeking to revolutionize the treatment of diabetes through our proprietary flagship product, an orally ingestible insulin capsule, or ORMD-0801. In August 2017, we had a call with the U.S. Food and Drug Administration, or FDA, regarding ORMD-0801. During the call, the FDA advised that the regulatory pathway for the submission of ORMD-0801 would be a Biologics License Application, or BLA. Such a pathway would grant us 12 years of marketing exclusivity for ORMD-0801, if approved, and an additional six months of exclusivity may be granted to us if the product also receives approval for use in pediatric patients. We plan to initiate in the first quarter of calendar year 2018, a clamp study on six type 1 diabetic patients and a three-month dose-ranging clinical trial on approximately 240 type 2 diabetic patients to assess the safety and evaluate the effect of ORMD-0801 on HbA1c, the main FDA registrational endpoint. In February 2017, we completed a Phase IIa dose finding clinical trial which was initiated in October 2016 in order to better define the optimal dosing of ORMD-0801. In April 2016, we completed a Phase IIb clinical trial on 180 type 2 adult diabetic patients that was initiated in June 2015 and conducted in 33 sites in the United States. This double-blind, randomized, 28-day dosing clinical trial was conducted under an Investigational New Drug application, or IND, with the FDA. The clinical trial, designed to assess the safety and efficacy of ORMD-0801, investigated ORMD-0801 over a 28 day treatment period and had statistical power to give us greater insight into the drug’s efficacy. The trial indicated a statistically significant lowering of blood glucose levels versus placebo across several endpoints, with no serious or severe adverse issues related to the drug. The trial successfully met all of its primary and most of its secondary and exploratory endpoints for both safety and efficacy. Prior to that trial, we completed Phase IIa clinical trials in patients with both type 1 and type 2 diabetes. Our technology allows insulin to travel from the gastrointestinal tract via the portal vein to the bloodstream, revolutionizing the manner in which insulin is delivered. It enables its passage in a more physiological manner than current delivery methods of insulin. Our technology is a platform that has the potential to deliver medications and vaccines orally that today can only be delivered via injection.

Oral Glucagon-like peptide-1: Glucagon-like peptide-1, or GLP-1, is an incretin hormone, which is a type of gastrointestinal hormone that stimulates the secretion of insulin from the pancreas. The incretin concept was hypothesized when it was noted that glucose ingested by mouth (oral) stimulated two to three times more insulin release than the same amount of glucose administered intravenously. In addition to stimulating insulin release, GLP-1 was found to suppress glucagon release (a hormone involved in the regulation of glucose) from the pancreas, slow gastric emptying to reduce the rate of absorption of nutrients into the blood stream, and increase satiety. Other important beneficial attributes of GLP-1 are its effects of increasing the number of beta cells (cells that manufacture and release insulin) in the pancreas and, possibly, protection of the heart. In addition to our flagship product, the ORMD-0801 insulin capsule, we are using our technology for an orally ingestible GLP-1 capsule, or ORMD-0901. In August 2015, we began a non-FDA clinical trial outside of the United States for our oral exenatide capsule on type 2 diabetic patients. The trial was completed during the second quarter of calendar year 2016 and indicated positive results as it showed ORMD-0901 to be safe and well tolerated and also demonstrated encouraging efficacy data. We completed a three-month pre-clinical toxicology study in March 2017, anticipate receiving the final report during the fourth quarter of calendar year 2017 and expect to file an IND and move directly into a pharmacokinetics study, followed by a large Phase II trial in the United States under an FDA IND.

Diabetes: Diabetes is a disease in which the body does not produce or properly use insulin. Insulin is a hormone that causes sugar to be absorbed into cells, where the sugar is converted into energy needed for daily life. The cause of diabetes is attributed both to genetics (type 1 diabetes) and, most often, to environmental factors such as obesity and lack of exercise (type 2 diabetes). According to the International Diabetes Federation, or IDF, an estimated 415 million adults worldwide suffered from diabetes in 2015 and the IDF projects this number will increase to 642 million by 2040. Also, according to the IDF, in 2015, an estimated 5.3 million people died from diabetes. According to the American Diabetes Association, or ADA, in the United States there were approximately 30.3 million people with diabetes, or 9.4% of the United States population in 2015. Diabetes is a leading cause of blindness, kidney failure, heart attack, stroke and amputation.

therapeutic proteins.

Intellectual property: We own a portfolio of patents and patent applications covering our technologies, and we are aggressively protecting these technology developments on a worldwide basis.

Management: We are led by a highly-experienced management team knowledgeable in the treatment of diabetes. Our Chief Scientific Officer, Miriam Kidron, PhD, is a world-recognized pharmacologist and a biochemist and the innovator primarily responsible for our oral insulin technology development and know-how.

Scientific Advisory Board: Our management team has access to our internationally recognized Scientific Advisory Board whose members are thought-leaders in their respective areas. The Scientific Advisory Board is comprised of Dr. Roy Eldor, Professor Ele Ferrannini, Professor Avram Hershko, Dr. Harold Jacob and Dr. Harvey L. Katzeff.

Strategy

Short Term Business Strategy

We plan to conduct further research and development on the technology covered by the patent application “Methods and Composition for Oral Administration of Proteins,” which we acquired from Hadasit Medical Research Services and Development Ltd. in 2006, and which is granted in various foreign jurisdictions, as well as the other patents we have filed in various foreign jurisdictions since then, as discussed below under“—Patents and Licenses” and below under“Item 1A. Risk Factors”.

Through our research and development efforts, we have successfully developed an oral dosage form that willintended to withstand the harsh environment of the stomach and intestines and will be effective in deliveringeffectively deliver active biological insulin or other proteins, such as exenatide, for the treatment of diabetes.proteins. The excipients that are added to the proteins in the formulation process mustare not intended to modify the proteins chemically or biologically, and the dosage form mustis designed to be safe to ingest. We plan to continue to conduct clinical trials to show the effectiveness of our technology.

On January 11, 2023, we announced that our Phase 3 trial, or the ORA-D-013-1 Phase 3 trial, did not meet its primary and secondary endpoints. As a result, we terminated both ORA-D-013-1 and ORA-D-013-2 Phase 3 clinical trials. In parallel, we have initiated a comprehensive analysis of the data to understand if there is a path forward for our oral insulin candidate. We originally filedare examining our existing pipeline and have commenced an INDevaluation process of potential strategic opportunities, with the FDA in December 2012goal of enhancing value for clearanceour stockholders.

Research and Development

Oral insulin

Type 2 Diabetes: We conducted the ORA-D-013-1 Phase 3 trial on patients with type 2 diabetes, or T2D, with inadequate glycaemic control who were on two or three oral glucose-lowering agents. The primary endpoint of the trial was to begin a Phase II clinical trialevaluate the efficacy of our oral insulin capsule, ORMD-0801, compared to placebo in order to evaluateimproving glycaemic control as assessed by HbA1c, with a secondary efficacy endpoint of assessing the safety, tolerability and efficacychange from baseline in type 2 diabetic volunteers. Because the identical formulation of ORMD-0801 had not yet been studied in humansfasting plasma glucose at bedtime, in February 2013, the FDA noted concerns about mitigating potential risks of severe hypoglycemia and requested that we perform a sub-study in a controlled in-patient setting for a one-week period prior to beginning the larger multi-centered Phase II trial. As a result, we withdrew the original IND and, in April 2013, we submitted a new IND for the Phase IIa study. Following the FDA’s clearance to proceed in May 2013, we began the Phase IIa study in July 2013. As26 weeks. On January 11, 2023, we announced in January 2014,that the ORA-D-013-1 Phase IIa study met all3 trial did not meet its primary and secondary endpoints. Specifically,Following the Phase IIa study evaluated the pharmacodynamic effects of ORMD-0801 on mean nighttime glucose (determined using a continuous glucose monitor). The results showed that ORMD-0801 exhibited a sound safety profile, led to reduced mean daytime and nighttime glucose readings and lowered fasting blood glucose concentrations, when compared to placebo. In addition, no serious adverse events occurred during this study, and the only adverse events that occurred were not drug related.

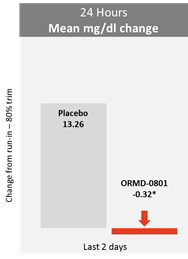

In light of these results, in June 2015, we initiated the Phase IIb clinical trial on 180 type 2 adult diabetic patients which was completed in April 2016. This double-blind, randomized, 28-day dosing clinical trial was designed to assess the safety and efficacy of ORMD-0801, and was conducted in 33 sites in the United States. The trial indicated a statistically significant lowering of blood glucose levels versus placebo across several endpoints, with no serious or severe adverse issues related to the drug. The trial successfully met all of its primary and most of its secondary and exploratory endpoints. The trial primarily evaluated the nighttime glucose lowering effect and safety of ORMD-0801 compared to a placebo. The results of the mean nighttime glucose showedORA-D-013-1 Phase 3 trial, we also terminated the ORA-D-013-2 Phase 3 trial, a significant difference in mean change from run-in versus placebo. ORMD-0801 oral insulin was safesecond Phase 3 trial that included T2D patients with inadequate glycaemic control who were attempting to manage their condition with either diet alone or with diet and well-tolerated for the dosing regimen in this trial. The trial further evaluated the effect of ORMD-0801 on mean 24-hour glucose, fasting glucose, and daytime glucose and the results showed a statistically significant difference in mean change from run-in versus placebo. Two examples of the data gleaned from this study are shown below:

metformin.

|  |

* Indicates Statistically Significant Difference from Placebo (p-Value<0.05)

No significant difference was shown in change in morning fasting serum insulin, C-Peptide, or triglycerides.

Following the significant results of the Phase IIb trial, we initiated in October 2016 an additional Phase IIa dose finding clinical trial which was completed in February 2017. This randomized, double-blind trial was conducted on 32 type 2 adult diabetic patients in order to better define the optimal dosing of ORMD-0801 moving forward. The results of the trial indicated a positive safety profile and potentially meaningful efficacy of ORMD-0801, as the efficacy data suggest ORMD-0801 improves glucose control.

NASH: In March 2017,December 2020, we initiated a six-month toxicology study to allowdouble blind, placebo controlled clinical trial of ORMD-0801 for the usetreatment of our oral insulin capsule for a longer period than previously performed,non-alcoholic steatohepatitis, or NASH, in preparation for our proposed upcoming three-month clinicalT2D. On September 13, 2022, we reported positive top line results from this trial, for type 2. We anticipate receiving the final report of this study in the first quarter of calendar year 2018.

In August 2017, we had a call with the FDA regarding ORMD-0801. During the call, the FDA advised that the regulatory pathway for submission of ORMD-0801 would be a BLA. Such a pathway would grant a full 12 years of marketing exclusivity for ORMD-0801, if approved. On top of this, an additional six months of exclusivity may be granted if the product also receives approval for use in pediatric patients. The FDA confirmed that the approach to nonclinical toxicology, chemistry manufacturing controls and qualification of excipients would be driven by their published guidance documents. We plan to initiate in the first quarter of calendar year 2018 a three-month dose-ranging clinical trial on approximately 240 type 2 diabetes patients to assess the safety and evaluate the effect of ORMD-0801 on HbA1c, the main FDA registrational endpoint. In addition, the FDA confirmed our ability to use insulin from different suppliers in a Phase III study.

In February 2014, we submitted a protocol to the FDA to initiate a Phase IIa trial of our oral insulin capsule for type 1 diabetes volunteers. The protocol was submitted under our existing IND to include both type 1 and type 2 diabetes indications. Beginning in March 2014, the double-blind, randomized, placebo controlled, seven-day treatment study design was carried out at an inpatient setting on 25 type 1 diabetic patients. As we announced in October 2014, the results showeddemonstrating that ORMD-0801 oral insulin given before meals appeared to be safe and well-tolerated for the dosing regimen in this study. Although the study was not powered to show statistical significance, there were internally consistent trends observed. Consistent with the timing of administration, the data showed a decrease in bolus insulin, a decrease in post-prandial glucose, a decrease in daytime glucose by continual glucose monitoring and an increase in post-prandial hypoglycemia in the active group, demonstrating the efficacy of ORMD-0801.

We also plan to conduct a glucose clamp study of our oral insulin capsule on six type 1 diabetic patients in the first quarter of calendar year 2018. The glucose clamp is a method for quantifying insulin absorption in order to measure a patient’s insulin sensitivity and how well a patient metabolizes glucose.

Should our Phase IIb three-month dosing clinical trial successfully meet its primary endpoints, we anticipate initiating two six-month Phase III clinical trials on both type 1 and type 2 diabetic patients, following which we expect to file a New Drug Application with a potential approval by the third quarter of calendar year 2023.

In September 2013, we submitted a pre-IND package to the FDA for ORMD-0901. In August 2015, we began a non-FDA clinical trial outside of the United States on type 2 diabetic patients. The trial was completed during the second quarter of calendar year 2016 and indicated positive results as it showed ORMD-0901 to be safe and well tolerated and demonstrated encouraging efficacy data. We completed a three-month pre-clinical toxicology studyat 8 mg twice daily dosing, meeting the primary endpoint of no difference in March 2017 and anticipate receiving the final report during the fourth quarter of calendar year 2017. We expect to file an IND during the first quarter of calendar year 2018 and move directly into a small pharmacokinetics study followed by a large Phase II trial in the United States under an FDA IND.

Clinical trials are planned in order to substantiate our results as well asadverse events for purposes of making future filings for drug approval. We also plan to conduct further research and development by deploying our proprietary drug delivery technology for the delivery of other polypeptides in addition to insulin, and to develop other innovative pharmaceutical products.

The table below gives an overview of our primary product pipeline (calendar quarters):

ORMD-0801

|  |

| |||

|

| ||||

|  |

| |||

Another component of our business strategy is to partner with other companies or medical institutions in order to further develop our technology and commence pre-commercialization activities. On November 30, 2015, we, our Israeli subsidiary and HTIT entered into a Technology License Agreement, which was further amended, according to which we granted HTIT an exclusive commercialization license in the territory of the People's Republic of China, Macau and Hong Kong, or the Territory, related to our oral insulin capsule, ORMD-0801. Pursuant to this license agreement, HTIT will conduct, at its own expense, certain pre-commercialization and regulatory activities with respect to our technology related to the ORMD-0801 capsule, and will pay certain royalties and an aggregate of approximately $37.5 million (see “Out-Licensed Technology” below). We plan to seek additional partnerships or forms of cooperation with other companies or medical institutions. While our strategy is to partner with an appropriate party, no assurance can be given that we will in fact be able to reach an agreeable partnership with any third party. Under certain circumstances, we may determine to develop one or more of our oral dosage forms on our own, either world-wide or in select territories.

Long Term Business Strategy

If our oral insulin capsule or other drug delivery solutions show significant promise in clinical trials, we plan to ultimately seek a strategic commercial partner, or partners, with extensive experience in the development, commercialization, and marketing of insulin applications and/or other orally digestible drugs. We anticipate such partner or partners would be responsible for, or substantially support, late stage clinical trials (Phase III) to increase the likelihood of obtaining regulatory approvals and registrations in the appropriate markets in a timely manner. We further anticipate that such partner, or partners, would also be responsible for sales, marketing and support of our oral insulin capsule in these markets. Such planned strategic partnership, or partnerships, may provide a marketing and sales infrastructure for our products as well as financial and operational support for global clinical trials, post marketing studies, label expansions and other regulatory requirements concerning future clinical development in the United States and elsewhere. Any future strategic partner, or partners, may also provide capital and expertise that would enable the partnership to develop new oral dosage forms for other polypeptides. While our strategy is to partner with an appropriate party, no assurance can be given that we will in fact be able to reach an agreeable partnership with any third party. Under certain circumstances, we may determine to develop one or more of our oral dosage forms on our own, either world-wide or in select territories.

Other Planned Strategic Activities

In addition to developing our own oral dosage form drug portfolio, we are, on an on-going basis, considering in-licensing and other means of obtaining additional technologies to complement and/or expand our current product portfolio. Our goal is to create a well-balanced product portfolio that will enhance and complement our existing drug portfolio.

Product Development

Research and Development Summary

We devote the majority of our efforts to research and development, including clinical studies for our lead clinical product candidates, as described below.

Orally Ingestible Insulin

During the fiscal year ended August 31, 2007, we conducted several clinical studies of our orally ingestible insulin that were intended to assess both the safety/tolerability and absorption properties of our proprietary oral insulin. Based on the pharmacokinetic and pharmacologic outcomes of these trials, we decided to continue the development of our oral insulin product.

During the fiscal year ended August 31, 2008, we successfully completed animal studies and non-FDA approved clinical trials using our oral insulin capsule, including a Phase Ib clinical trial in healthy human volunteers with the intent of dose optimization; a Phase IIa study to evaluate the safety and efficacy of our oral insulin capsule in type 2 diabetic volunteers at Hadassah Medical Center in Jerusalem; and a Phase IIa study to evaluate the safety and efficacy of our oral insulin capsule on type 1 diabetic volunteers.

Our successful non-FDA clinical trials continued in the fiscal year ended August 31, 2009, or fiscal 2009, with a Phase IIb study in South Africa to evaluate the safety, tolerability and efficacy of our oral insulin capsule on type 2 diabetic volunteers.

In September 2010, we reported the successful results of an exploratory clinical trial testing the effectiveness of our oral insulin capsule in type 1 diabetes patients suffering from uncontrolled diabetes. Unstable or labile diabetes is characterized by recurrent, unpredictable and dramatic blood glucose swings often linked with irregular hyperglycemia and sometimes serious hypoglycemia affecting type 1 diabetes patients. This successfully completed exploratory study was a proof of concept study for defining a novel indication for ORMD-0801. We believe the encouraging results justify further clinical development of ORMD-0801 capsule application toward management of uncontrolled diabetes.

In March 2011, we reported that we successfully completed a comprehensive toxicity study for our oral insulin capsule. The study was completed under conditions prescribed by the FDA Good Laboratory Practices regulations.

We began FDA-approved clinical trials of ORMD-0801 in July 2013, with the Phase IIa study, which evaluated the pharmacodynamic effects of ORMD-0801 on mean nighttime glucose (determined using a continuous glucose monitor) on 30 volunteers with type 2 diabetes. As we announced in January 2014, the results showed that ORMD-0801 exhibited a sound safety profile, led to reduced mean daytime and nighttime glucose readings and lowered fasting blood glucose concentrations, when compared to placebo.

In March 2014, we began an FDA-approved Phase IIa trial of ORMD-0801 in volunteers with type 1 diabetes. As we announced in October 2014, the results showed that ORMD-0801 oral insulin given before meals appeared to be safe and well-tolerated for the dosing regimen in this study. Although the study was not powered to show statistical significance, there were internally consistent trends observed. Consistent with the timing of administration, the data showed a decrease in bolus insulin, a decrease in post-prandial glucose, a decrease in daytime glucose by continual glucose monitoring and an increase in post-prandial hypoglycemia in the active group, demonstrating the efficacy of ORMD-0801.

In June 2015, we initiated a Phase IIb clinical trial on 180 type 2 adult diabetic patients, which was completed in April 2016. This double-blind, randomized, 28-day dosing clinical trial was designed to assess the safety and efficacy of ORMD-0801 and was conducted in 33 sites in the United States. The trial indicated a statistically significant lowering of blood glucose levels versus placebo across several endpoints, with no serious or severe adverse issues related to the drug. The trial successfully met all of its primary and most of its secondary and exploratory endpoints for both safety and efficacy.

In October 2016, we initiated an additional Phase IIa, dose finding clinical trial which was completed in February 2017. This randomized, double-blind trial was conducted on 32 type 2 adult diabetic patients in order to better define the optimal dosing of ORMD-0801 moving forward. The results of the trial indicated a positive safety profile and potentially meaningful efficacy of ORMD-0801, as the efficacy data suggest ORMD-0801 improves glucose control.

In March 2017, we initiated a six-month toxicology study to allow for the use of our oral insulin capsule for a longer period than previously performed, in preparation for our proposed upcoming three-month clinical trial for type 2 diabetes. We anticipate receiving the final report of this study in the first quarter of calendar year 2018.

In August 2017, we had a call with the FDA regarding ORMD-0801. During the call, the FDA advised that the regulatory pathway for submission of ORMD-0801 would be a BLA. Such a pathway would grant a full 12 years of marketing exclusivity for ORMD-0801, if approved, and an additional six months of exclusivity may be granted to us if the product also receives approval for use in pediatric patients. We plan to initiate in the first quarter of calendar year 2018 a three-month dose-ranging clinical trial on approximately 240 type 2 diabetes patients to assess the safety and evaluate the effect of ORMD-0801 on HbA1c, the main FDA registrational endpoint.

We utilize Clinical Research Organizations, or CROs, to conduct our clinical studies.

GLP-1 Analog

During fiscal 2009, we completed pre-clinical trials of ORMD-0901, an analog for GLP-1, which suggested that the GLP-1 analog (exenatide-4), when combined with Oramed’s capsule technology, is absorbed through the gastrointestinal tract and retains its biological activity.

In December 2009, we completed non-FDA approved clinical trial in healthy, male volunteers conducted at Hadassah University Medical Center in Jerusalem. This study evaluated the safety and efficacy of ORMD-0901. The results of the study indicated that ORMD-0901 was well tolerated by all subjects and demonstrated physiological activity, as extrapolated from ensuing subject insulin levels when compared to those observed after treatment with placebo.

In January 2013, we began a clinical trial for our oral exenatide capsule on healthy volunteers and type 2 diabetic patients. Based on this study, we decided to make slight adjustments in the manufacturing of these capsules and have begun pre-toxicology studies on the new capsules.

In September 2013, we submitted a pre-IND package to the FDA for ORMD-0901.

In August 2015, we began a non-FDA clinical trial outside of the United States for ORMD-0901 on type 2 diabetic patients. The trial was completed during the second quarter of calendar year 2016 and indicated positive results as it showed ORMD-0901 to be safe and well tolerated and also demonstrated encouraging efficacy data.

We completed a three-month toxicology study in March 2017 and anticipate receiving the final report during the fourth quarter of calendar year 2017 and expect to file an IND and move directly into a pharmacokinetics study followed by a large Phase II trial in the United States under an FDA IND.

Combination Therapy

In June 2012, we presented an abstract, which reported the impact of our oral insulin capsule, ORMD-0801, delivered in combination with our oral exenatide capsule ORMD-0901. The work assessed the safety and effectiveness of a combination of oral insulin and oral exenatide treatments delivered to pigs prior to food intake. The drug combination resulted in significantly improved blood glucose regulation when compared to administration of each drug separately.

In the near term, we are focusing our efforts on the development of our flagship products, oral insulin and oral exenatide. Once these two products have progressed further in clinical trials, we intend to conduct additional studies with the oral combination therapy.

Feasibility study

In August 2015, we entered into an agreement with a large international pharmaceutical company, or the Pharma Company, pursuant to which we conducted a feasibility study, using one of the Pharma Company's propriety injectable compounds. The study used our proprietary technology in order to deliver the compound orally. Following the successful completion of the first stage of the study in July 2016, we continued to the second step of the study. The study will provide data required for decision making on whether to enter into a license agreement between the parties.

Other products

During the first quarter of calendar 2017, we began developing a new drug candidate, a weight loss treatment in the form of an oral leptin capsule, and in April 2017, Israel’s Ministry of Health approved our commencement of a proof of concept single dose study for our oral leptin drug candidate to evaluate its pharmacokinetic and pharmacodynamics (glucagon reduction) in 10 type 1 adult diabetic patients. The study is projected to initiate in calendar year 2018 and be completed during calendar year 2019.

In November 2017, Israel’s Ministry of Health approved us to initiate an exploratory clinical study of our oral insulin capsule, ORMD-0801, in patients with nonalcoholic steatohepatitis (NASH). The proposed three-month treatment study will assess the effectiveness of ORMD-0801 in reducing liver fat content inflammationover the 12-week treatment period by observing several independent measures. All the measurements showed a consistent clinically meaningful trend in favor of ORMD-0801. We are currently evaluating our path forward for ORMD-0801 for NASH.

Oral Vaccine

On March 18, 2021, we entered into a license agreement, or the Oravax License Agreement, with Oravax, our 63% owned joint venture, pursuant to which we granted to Oravax an exclusive, worldwide license of our rights in certain patents and fibrosis in patients with NASH. We expectrelated intellectual property relating to initiateour proprietary oral delivery technology to further develop, manufacture and commercialize oral vaccines for COVID-19 and other novel coronaviruses based on Premas Biotech Pvt. Ltd.’s, or Premas’s, proprietary vaccine technology involving a triple antigen virus like particle, or the study duringOravax product, which was previously owned by Cystron Biotech LLC, and later acquired by Akers Biosciences Inc., or Akers. Effective January 1, 2022, Oravax transferred its rights and obligations under the end of calendar year 2017 and complete it during calendar year 2019.Oravax License Agreement to its wholly-owned subsidiary, Oravax Medical Ltd. For further details regarding the Oravax License Agreement, see note 12 to our audited consolidated financial statements.

In October 2021, Oravax’s oral virus-like particle, or VLP, COVID-19 vaccine received clearance from the South African Health Products Regulatory Authority (SAPHRA) to initiate a Phase 1 trial. On December 14, 2021, Oravax screened and enrolled the first participant in this Phase 1 clinical trial. The trial protocol was divided into two cohorts each comprised of 12 participants, with a 42-day safety waiting period between cohorts. Due to several factors, including the fact that many volunteers did not qualify during screening due to prior asymptomatic COVID-19 infection and other conditions, the rate of enrollment was slower than anticipated and as a result, we added an additional clinical site. On October 11, 2022, Oravax reported positive preliminary Phase 1 data for Cohort A of this trial, meeting primary and secondary endpoints of safety and immunogenicity. These results included significant antibody response (2-6 fold over baseline) as measured by multiple markers of immune response to VLP vaccine antigens observed in the majority of the patients dosed, and no safety issues were observed, including mild symptoms. Cohort B completed dosing on January 5, 2023 and data is expected in the first half of 2023.

On December 29, 2021, Oravax signed a cooperation and purchase agreement for an initial pre-purchase of 10 million doses of oral COVID-19 vaccines with Tan Thanh Holdings to commercialize the vaccine in Southeast Asia.

Raw Materials

Our oral insulin capsule is currently manufactured by Swiss Caps AG.Fidelio Healthcare, a diversified European Contract Development and Manufacturing Organization (CDMO) in the pharmaceutical and healthcare industries.

One of our oral capsule ingredients is being developed and produced by an Indian company.

In July 2010, Oramed Ltd. entered into the Manufacturing and Supply Agreement or MSA, with Sanofi-Aventis Deutschland GMBH, or Sanofi-Aventis. According to the MSA,agreement, Sanofi-Aventis will supplysupplies Oramed Ltd. with specified quantities of recombinant human insulin to be used for clinical trials.

We purchase,have purchased, pursuant to separate agreements with third parties, the raw materials required for the manufacturing of our oral capsule. We generally depend upon a limited number of suppliers for the raw materials. Although alternative sources of supply for these materials are generally available, we could incur significant costs and disruptions if we would need to change suppliers. The termination of our relationships with our suppliers or the failure of these suppliers to meet our requirements for raw materials on a timely and cost-effective basis could have a material adverse effect on our business, prospects, financial condition and results of operations.

PatentsMarket Overview

Diabetes is a disease in which the body does not produce or properly use insulin. Insulin is a hormone that causes sugar to be absorbed into cells, where the sugar is converted into energy needed for daily life. The cause of diabetes is attributed both to genetics (type 1 diabetes, or T1D) and, Licensesmost often, to environmental factors such as obesity and lack of exercise (T2D). According to the International Diabetes Federation, or IDF, an estimated 537 million adults (20-79 years) worldwide suffered from diabetes in 2021 and the IDF projects this number will increase to 783 million by 2045. Also, according to the IDF, in 2021, an estimated 6.7 million people died from diabetes. According to the American Diabetes Association, or ADA, in the United States there were approximately 37.3 million people with diabetes, or 11.3% of the United States population in 2019. Diabetes is a leading cause of blindness, kidney failure, heart attack, stroke and amputation.

Impact of COVID-19

We do not expect any material impact on our development timeline and our liquidity due to COVID-19. However, we experienced approximately six months of delays in clinical trials due to slow-downs of recruitment for trials generally. On the other hand, Oravax continues to develop its oral vaccine, the demand for which may be reduced if COVID-19 continues to abate. We continue to assess the effect on our operations by monitoring the status of COVID-19.

Intellectual Property and Patents

We own a portfolio of patents and patent applications covering our technologies, and we are aggressively protecting these technology developments on a worldwide basis.

We maintain a proactive intellectual property strategy, which includes patent filings in multiple jurisdictions, including the United States and other commercially significant markets. We hold 2637 patent applications currently pending, with respect to various compositions, methods of production and oral administration of proteins and exenatide. Expiration dates for pending patents, if granted, will fall between 2026 and 2034.2039.

We hold 64112 patents, seventeentwenty of which were issued induring the fiscal 2017, fifteen of which were issued in September 2017 and two of which were allowed in Europe and Canada,year ended December 31, 2022, including patents issued by the United States, Swiss, German, French, U.K., Italian, Dutch,Netherlands, Swedish, Spanish, Australian, Israeli, Japanese, New Zealand, South African, Russian, Canadian, Hong Kong, Chinese, European and Indian patent offices that cover a part of our technology, which allows for the oral delivery of proteins; patents issued by the Australian, Canadian, European, Austrian, Belgian, French, German, Irish, Italian, Luxembourg, , Monaco, Dutch,Netherlands, Norwegian, Spanish, Swedish, Swiss, U.K., Israeli, New Zealand, South African, Russian, Brazilian and RussianJapanese patent offices that cover part of our technology for the oral delivery of exenatide; and patents issued by the European, Austrian, Belgian, Danish,Denmark, French, German, Irish, Italian, Luxembourg, , Monaco, Netherland,Netherlands, Norway, Spanish, Swedish, Swiss, U.K. and Japanese patent offices for treating diabetes.

Consistent with our strategy to seek protection in key markets worldwide, we have been and will continue to pursue the patent applications and corresponding foreign counterparts of such applications. We believe that our success will depend on our ability to obtain patent protection for our intellectual property.

Our patent strategy is as follows:

| ● | Aggressively protect all current and future technological developments to assure strong and broad protection by filing patents and/or continuations in part as appropriate, |

| ● | Protect technological developments at various levels, in a complementary manner, including the base technology, as well as specific applications of the technology, and |

| ● | Establish comprehensive coverage in the United States and in all relevant foreign markets in anticipation of future commercialization opportunities. |

Trademarks and Trade Secrets

We have trademark applications pending in Israel, with Corresponding international trademark applications in Australia, Brazil, Canada, China, Colombia, the European Union, India, Indonesia, Japan, Kazakhstan, Korea, Malaysia, Mexico, New Zealand, Norway, Oman, Philippines, Russia, Singapore, Switzerland, Thailand, Turkey, Ukraine, United Arab Emirates, United Kingdom, U.S.A., Uzbekistan and Vietnam.

We also rely on trade secrets and unpatentable know-how that we seek to protect, in part, by confidentiality agreements. Our policy is to require our employees, consultants, contractors, manufacturers, outside scientific collaborators and sponsored researchers, our board of directors, or our Board, technical review board and other advisors, to execute confidentiality agreements upon the commencement of employment or consulting relationships with us. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific limited circumstances. We also require signed confidentiality or material transfer agreements from any company that is to receive our confidential information. In the case of employees, consultants and contractors, the agreements provide that all inventions conceived by the individual while rendering services to us shall be assigned to us as the exclusive property of ourthe Company. There can be no assurance, however, that all persons who we desire to sign such agreements will sign, or if they do, that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets or unpatentable know-how will not otherwise become known or be independently developed by competitors.

Out-Licensed Technology

Entera Bio

In June 2010, our wholly-owned subsidiary, Oramed Ltd., entered into a joint venture agreement with DNA GROUP (T.R.) Ltd. (formerly D.N.A Biomedical Solutions Ltd.), or D.N.A,DNA, for the establishment of Entera Bio LTD,Ltd., or Entera.

Under the terms of a license agreement that was entered into between Oramed Ltd. and Entera in August 2010, we out-licensed technology to Entera, on an exclusive basis, for the development of oral delivery drugs for certain indications to be agreed upon between the parties. The out-licensed technology differs from our main delivery technology that is used for oral insulin and GLP-1 analog and is subject to different patent applications. Entera’s initial development effort is for an oral formulation for the treatment of osteoporosis. In March 2011, weOramed Ltd. sold shares of Entera to DNA, retaining 117,000 ordinary shares (after giving effect to a stock split by Entera in July 2018). In consideration for the shares sold to DNA, the Company received, among other payments, ordinary shares of DNA (see also note 3 to our audited consolidated financial statements).

As part of this agreement, Oramed Ltd. entered into a patent transfer agreement, to replaceor the original license agreement upon closing pursuantPatent Transfer Agreement, according to which Oramed Ltd. assigned to Entera all of its right, title and interest in andrights to a patent application related to the patent applicationoral administration of proteins that it hadhas licensed to Entera since August 2010, in August 2010. Under this agreement, Oramed Ltd. is entitled to receive from Enterareturn for royalties of 3% of Entera’s net revenues (as defined in the agreement) and a license back of that patent application for use in respect of diabetes and influenza.

In March As of December 31, 2022, Entera had not paid any royalties to Oramed Ltd. On December 11, 2018, Entera announced that it had entered into a research collaboration and license agreement with Amgen, Inc., or Amgen. To the extent that the license granted to Amgen results in net revenues as defined in the Patent Transfer Agreement, Oramed Ltd. will be entitled to the aforementioned royalties. As part of a consulting agreement with a third party dated February 15, 2011, we also consummated a transaction with D.N.A, whereby weOramed Ltd. is obliged to pay this third party royalties of 8% of the net royalties received in respect of the patent that was sold to D.N.A 47% of Entera’s outstanding share capital on an undiluted basis, retaining a 3% interest as ofEntera in March 2011. In consideration for the shares sold to D.N.A, the Company received, among other payments, 4,202,334 ordinary shares of D.N.A

The D.N.A ordinary shares are traded on the Tel Aviv Stock Exchange and have a quoted price, which is subject to market fluctuations, and may, at times, have a price below the value on the date we acquired such shares. In addition, the ordinary shares of D.N.A have historically experienced low trading volume; as a result, there is no guarantee that we will be able to resell the ordinary shares of D.N.A at the prevailing market prices. During the years ended AugustDecember 31, 2017, 20162022, 2021 and 2015,four month period ended December 2021, we did not sell any of the D.N.ADNA’s ordinary shares. As of AugustDecember 31, 2017,2022, we held approximately 7.9%1.4% of D.N.A’sDNA’s outstanding ordinary shares and approximately 0.4% of Entera’s outstanding ordinary shares.

In November 2017, Entera filed with the SEC a draft registration statement on Form F-1 for the initial public offering by Entera, a listing of its shares on the Nasdaq and for potential resale by certain selling stockholders of Entera's ordinary shares previously issued.HTIT

In June 2016, Entera announced that it had obtained orphan status from the European Medicines Agency, or EMA, for its oral treatment for hypoparathyroidism. EMA approval is in addition to the orphan status it obtained from the FDA for the same oral treatment in April 2014.

In July 2015, Entera announced it had completed a phase IIa study to assess the safety and efficacy of its oral treatment for hypoparathyroidism and that the goals of the study were achieved.

On November 30, 2015, we our Israeli subsidiary and HTIT entered into a Technology License Agreement, or TLA, with Hefei Tianhui Incubator of Technologies Co., Ltd., or HTIT, and on December 21, 2015, these parties entered into an Amended and Restated Technology License Agreement that was further amended by the parties on June 3, 2016 and July 24, 2016, or the HTIT License Agreement. According to the HTIT License Agreement, we granted HTIT an exclusive commercialization license in the Territory,territory of the People’s Republic of China, Macau and Hong Kong, related to our oral insulin capsule, ORMD-0801, or the Product. Pursuant to the HTIT License Agreement, HTIT will conduct, at its own expense, certain pre-commercialization and regulatory activities with respect to our technology and ORMD-0801 capsule, and will pay (i) royalties of 10% on net sales of the related commercialized products to be sold by HTIT in the Territory,territory, or Royalties, and (ii) an aggregate of $37.5 million, of which $3 million iswas payable immediately, $8 million will be paid subject to our entry into certain agreements with certain third parties, and $26.5 million will be payable upon achievement of certain milestones and conditions. In the event that we will not meet certain conditions, the Royalties rate may be reduced to a minimum of 8%. Following the final expiration of our patents covering the technology in the Territoryterritory in 2033, the Royalties rate may be reduced, under certain circumstances, to 5%.

The royalty payment obligation shall apply during the period of time beginning upon the first commercial sale of the Product in the Territory,territory, and ending upon the later of (i) the expiration of the last-to-expire licensed patents in the Territory;territory; and (ii) 15 years after the first commercial sale of the Product in the Territory, or the Royalty Term.

territory. The HTIT License Agreement shall remain in effect until the expiration of the Royalty Term.royalty term. The HTIT License Agreement contains customary termination provisions.

The initial payment of $3 million was Through December 31, 2022, we received in January 2016. Following the achievement of certain milestones, the second and thirdaggregate milestone payments of $6.5$20.5 million and $4 million, respectively, were received in July 2016 andout of the fourth milestone paymentaggregate amount of $4 million was received in October 2016.$37.5 million.

On August 21, 2020, we received a letter from HTIT, disputing certain pending payment obligations of HTIT under the TLA. We alsowholly dispute said claims and we are in discussions with HTIT in an attempt to reach a mutually agreeable solution. We are currently evaluating with HTIT a path forward to continue our collaboration, following the results of our ORA-D-013-1 Phase 3 trial.

Oravax License

In consideration for the grant of the license under the Oravax License Agreement, we will receive (i) royalties equal to 7.5% on net sales, as defined in the Oravax License Agreement, of each product commercialized by Oravax, its affiliates and permitted sublicensees related to the license during the term specified in the Oravax License Agreement, (ii) sublicensing fees equal to 15% of any non-sales-based consideration received by Oravax from a permitted sublicensee and (iii) other payments ranging between $25 million to $100 million, based on certain sales milestones being achieved by Oravax. The parties further agreed to establish a development and steering committee, which will consist of three members, of which two members will be appointed by us, that will oversee the ongoing research, development, clinical and regulatory activity with respect to the Oravax product. In addition, we agreed to buy and Oravax agreed to issue to us 1,890,000 shares of common stock of Oravax, representing 63% of the common stock of Oravax for the aggregate amount of $1.5 million. Akers contributed $1.5 million in cash to Oravax and a license agreement to the Oravax product. Nadav Kidron, the Company’s President and Chief Executive Officer, was one of the former members of Cystron. See note 12 to our audited consolidated financial statements.

Medicox License

On November 13, 2022, we entered into a separate securities purchasedistribution license agreement with HTIT,Medicox Co., Ltd., or Medicox. an emerging biotech company with a consortium of proven partnerships in the SPA, pursuantRepublic of Korea. The agreement grants Medicox the exclusive license to which HTIT invested $12apply for regulatory approval and distribute ORMD-0801 for ten years in the Republic of Korea. Medicox will comply with agreed distribution targets and will purchase ORMD-0801 at an agreed upon transfer price per capsule. In addition, Medicox will pay Oramed up to $15 million in usdevelopmental milestones, $2 million of which have already been received by Oramed to date, and up to 15% royalties on gross sales. Medicox will also be responsible for gaining regulatory approval in December 2015 (see – “Liquidity and capital resources” below). In connectionthe Republic of Korea.

We are currently evaluating with Medicox a path forward to continue our collaboration, following the License Agreement and the SPA, we received a non-refundable paymentresults of $500,000 as a no-shop fee.our ORA-D-013-1 Phase 3 trial.

Government Regulation

The Drug Development Process

Regulatory requirements for the approval of new drugs vary from one country to another. In order to obtain approval to market our drug portfolio, we need to go through a different regulatory process in each country in which we apply for such approval. In some cases, information gathered during the approval process in one country can be used as supporting information for the approval process in another country. As a strategic decision, we decided to first explore the FDA regulatory pathway. The following is a summary of the FDA’s requirements.

The FDA requires that pharmaceutical and certain other therapeutic products undergo significant clinical experimentation and clinical testing prior to their marketing or introduction to the general public. Clinical testing, known as clinical trials or clinical studies, is either conducted internally by life science, pharmaceutical or biotechnology companies or is conducted on behalf of these companies by CROs.

The process of conducting clinical studiestrials is highly regulated by the FDA, as well as by other governmental and professional bodies. Below we describe the principal framework in which clinical studiestrials are conducted, as well as describe a number of the parties involved in these studies.trials.

Protocols.Protocols. Before commencing human clinical studies,trials, the sponsor of a new drug or therapeutic product must submit an IND application to the FDA. The application contains, among other documents, what is known in the industry as a protocol. A protocol is the blueprint for each drug study. The protocol sets forth, among other things, the following:

| ● | Who must be recruited as qualified participants, |

| ● | How often to administer the drug or product, |

| ● | What tests to perform on the participants, and |

| ● | What dosage of the drug or amount of the product to give to the participants. |

Institutional Review Board.Board. An institutional review board is an independent committee of professionals and lay persons which reviews clinical research studiestrials involving human beings and is required to adhere to guidelines issued by the FDA. The institutional review board does not report to the FDA, but its records are audited by the FDA. Its members are not appointed by the FDA. All clinical studiestrials must be approved by an institutional review board. The institutional review board’s role is to protect the rights of the participants in the clinical studies.trials. It approves the protocols to be used, the advertisements which the company or CRO conducting the study proposes to use to recruit participants, and the form of consent which the participants will be required to sign prior to their participation in the clinical studies.

trials.

Clinical Trials.Trials. Human clinical studiestrials or testing of a potential product are generally done in three stages known as Phase I1 through Phase III3 testing. The names of the phases are derived from the regulations of the FDA. Generally, there are multiple studiestrials conducted in each phase.

Phase I.1. Phase I studies1 trials involve testing a drug or product on a limited number of healthy or patient participants, typically 24 to 100 people at a time. Phase I studies1 trials determine a product’s basic safety and how the product is absorbed by, and eliminated from, the body. This phase lasts an average of six months to a year.

Phase II.2. Phase II2 trials involve testing of no more than 300 participants at a time who may suffer from the targeted disease or condition. Phase II2 testing typically lasts an average of one to two years. In Phase II,2, the drug is tested to determine its safety and effectiveness for treating a specific illness or condition. Phase II2 testing also involves determining acceptable dosage levels of the drug. Phase II studies2 trials may be split into Phase IIa2a and Phase IIb sub-studies.2b sub-trials. Phase IIa studies2a trials may be conducted with patient volunteers and are exploratory (non-pivotal) studies,trials, typically designed to evaluate clinical efficacy or biological activity. Phase IIb studies2b trials are conducted with patients defined to evaluate definite dose range and evaluate efficacy. If Phase II studies2 trials show that a new drug has an acceptable range of safety risks and probable effectiveness, a company will generally continue to review the substance in Phase III studies.3 trials.

Phase III.3. Phase III studies3 trials involve testing large numbers of participants, typically several hundred to several thousand persons. The purpose is to verify effectiveness and long-term safety on a large scale. These studiestrials generally last two to three years. Phase III studies3 trials are conducted at multiple locations or sites. Like the other phases, Phase III3 requires the site to keep detailed records of data collected and procedures performed.

Biological License Application.Application. The results of the clinical trials for a biological product are submitted to the FDA as part of a Biological License Application, or BLA. Following the completion of Phase III studies,3 trials, assuming the sponsor of a potential product in the United States believes it has sufficient information to support the safety and effectiveness of its product, the sponsor will generally submit a BLA to the FDA requesting that the product be approved for marketing. The application is a comprehensive, multi-volume filing that includes the results of all clinical studies,trials, information about the drug’s composition, and the sponsor’s plans for producing, packaging and labeling the product. The FDA’s review of an application can take a few months to many years, with the average review lasting 18 months. Once approved, drugs and other products may be marketed in the United States, subject to any conditions imposed by the FDA. Approval of a BLA provides 12 years of exclusivity in the U.S. market.

Phase IV.4. The FDA may require that the sponsor conduct additional clinical trials following new drug approval. The purpose of these trials, known as Phase IV studies,4 trials, is to monitor long-term risks and benefits, study different dosage levels or evaluate safety and effectiveness. In recent years, the FDA has increased its reliance on these trials. Phase IV studies4 trials usually involve thousands of participants. Phase IV studies4 trials also may be initiated by the company sponsoring the new drug to gain broader market value for an approved drug.

European Regulation. Similar to the U.S., a European sponsor of a biological product may submit a Marketing Approval Application to the European Medicines Agency, or EMA, for the registration of the product. The approval process in Europe consists of several stages, which together are summed up to 210 days from the time of submission of the application (net, without periods in which the sponsor provides answers to questions raised by the agency) following which, a Marketing Approval may be granted. During the approval process, the sponsor'ssponsor’s manufacturing facilities will be audited in order to assess Good Manufacturing Practice compliance.

The drug approval process is time-consuming, involves substantial expenditures of resources, and depends upon a number of factors, including the severity of the illness in question, the availability of alternative treatments, and the risks and benefits demonstrated in the clinical trials.

Other Regulations

Various federal, state and local laws, regulations, and recommendations relating to safe working conditions, laboratory practices, the experimental use of animals, the environment and the purchase, storage, movement, import, export, use, and disposal of hazardous or potentially hazardous substances, including radioactive compounds and infectious disease agents, used in connection with our research are applicable to our activities. They include, among others, the U.S. Atomic Energy Act, the Clean Air Act, the Clean Water Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, and Resources Conservation and Recovery Act, national restrictions on technology transfer, import, export, and customs regulations, and other present and possible future local, state, or federal regulation. The compliance with these and other laws, regulations and recommendations can be time-consuming and involve substantial costs. In addition, the extent of governmental regulation which might result from future legislation or administrative action cannot be accurately predicted and may have a material adverse effect on our business, financial condition, results of operations and prospects.

Competition

Competition in General

Competition in the area of biomedical and pharmaceutical research and development is intense and significantly depends on scientific and technological factors. These factors include the availability of patent and other protection for technology and products, the ability to commercialize technological developments and the ability to obtain regulatory approval for testing, manufacturing and marketing. Our competitors include major pharmaceutical, medical products, chemical and specialized biotechnology companies, many of which have financial, technical and marketing resources significantly greater than ours. In addition, many biotechnology companies have formed collaborations with large, established companies to support research, development and commercialization of products that may be competitive with ours. Academic institutions, governmental agencies and other public and private research organizations are also conducting research activities and seeking patent protection and may commercialize products on their own or through joint ventures. We are aware of certain other products manufactured or under development by competitors that are used for the treatment of the diseases and health conditions that we have targeted for product development. We can provide no assurance that developments by others will not render our technology obsolete or noncompetitive, that we will be able to keep pace with new technological developments or that our technology will be able to supplant established products and methodologies in the therapeutic areas that are targeted by us. The foregoing factors could have a material adverse effect on our business, prospects, financial condition and results of operations. These companies, as well as academic institutions, governmental agencies and private research organizations, also compete with us in recruiting and retaining highly qualified scientific personnel and consultants.

Competition within our sector is increasing, so we will encounter competition from existing firms that offer competitive solutions in diabetes treatment solutions. These competitive companies could develop products that are superior to, or have greater market acceptance, than the products being developed by us. We will have to compete against other biotechnology and pharmaceutical companies with greater market recognition and greater financial, marketing and other resources.

Our competition will be determined in part by the potential indications for which our technology is developed and ultimately approved by regulatory authorities. In addition, the first product to reach the market in a therapeutic or preventive area is often at a significant competitive advantage relative to later entrants to the market. Accordingly, the relative speed with which we, or our potential corporate partners, can develop products, complete the clinical trials and approval processes and supply commercial quantities of the products to the market are expected to be important competitive factors. Our competitive position will also depend on our ability to attract and retain qualified scientific and other personnel, develop effective proprietary products, develop and implement production and marketing plans, obtain and maintain patent protection and secure adequate capital resources. We expect our technology, if approved for sale, to compete primarily on the basis of product efficacy, safety, patient convenience, reliability, value and patent position.

Competition for Our Oral Insulin Capsule

We anticipate theanticipated that our oral insulin capsule towould be a competitive diabetes drug because of its anticipated efficacy and safety profile. The followingprofile; however, there are other treatment options for type 1T1D and type 2 diabetic patients:

Several entities who are actively developing oral insulin capsules and/or alternatives to insulin are thoughtor cause the body to be: Diabetology (UK), Biocon Limited (India) and Midatech (UK).

produce more insulin.

Scientific Advisory Board

We maintain a Scientific Advisory Board consisting of internationally recognized scientists who advise us on scientific and technical aspects of our business. The Scientific Advisory Board meets periodically to review specific projects and to assess the value of new technologies and developments to us. In addition, individual members of the Scientific Advisory Board meet with us periodically to provide advice in their particular areas of expertise. The Scientific Advisory Board consists of the following members, information with respect to whom is set forth below: Dr. Roy Eldor, Professor Ele Ferrannini, Dr. Alexander Fleming, Professor Avram Hershko, Dr. Harold Jacob, Dr. Julio Rosenstock, Dr. Jay Skyler and Dr. Harvey L. Katzeff.Anne Peters.

Dr. Roy Eldor,MD, PhD, joined the Oramed Scientific Advisory Board in July 2016. He is an endocrinologist, internist and researcher with over twenty years of clinical and scientific experience. He is currently Director of the Diabetes Unit at the Institute of Endocrinology, Metabolism & Hypertension at the Tel-Aviv Sourasky Medical Center. Prior to that, Dr. Eldor served as Principal Scientist at Merck Research Laboratories, Clinical Research -– Diabetes & Endocrinology, Rahway, New Jersey.Endocrinology. He has previously served as a senior physician in internal medicine at the Diabetes Unit in Hadassah Hebrew University Hospital in Jerusalem, Israel; and the Diabetes Division at the University of Texas Health Science Center in San Antonio, Texas (under the guidance of Dr. R.A. DeFronzo).Texas. Dr. Eldor is a recognized expert, with over 3550 peer reviewed papers and book chapters, and has been a guest speaker at numerous international forums.

Professor Ele Ferrannini,MD, joined the Oramed Scientific Advisory Board in February 2007. He is a past President to the European Association for the Study of Diabetes (EASD), which supports scientists, physicians and students from all over the world who are interested in diabetes and related subjects in Europe and performs functions similar to that of the ADAAmerican Diabetes Association in the United States. Professor Ferrannini has worked with various institutions including the Department of Clinical & Experimental Medicine at the University of Pisa School of Medicine, and CNR (National Research Council) Institute of Clinical Physiology in Pisa, Italy; and the Diabetes Division, Department of Medicine at the University of Texas Health Science Center atin San Antonio, Texas. He has also had extensive training in internal medicine and endocrinology, and has specialized in diabetes studies.trials. Professor Ferrannini has received a Certificate of the Educational Council for Foreign Medical Graduates from the University of Bologna, and with cum laude honors completed a subspecialty in Diabetes and Metabolic Diseases at the University of Torino.Torino, cum laude. He has published over 500 original papers and 50 book chapters and he is a “highly cited researcher,” according to the Institute for Scientific Information.

Dr. Alexander Fleming, MD, joined the Oramed Scientific Advisory Board in December 2019. Dr. Fleming, an endocrinologist, is Founder and Executive Chairman of Kinexum, a strategic advisory firm. From 1986 to 1998, he served at the FDA as a supervisory medical officer in the Division of Metabolism and Endocrine Drug Products and was responsible for landmark approvals of the first statin, metformin, and other endocrine and metabolic therapies. He also represented the FDA at the World Health Organization and on multiple expert working groups of the International Conference on Harmonization (ICH). Dr. Fleming coined the term, Metabesity, which refers to the constellation of major chronic diseases and the aging process itself, all which share common metabolic root causes and potential preventive therapies. He organized the first Congress on Metabesity in London in October 2017, followed by annual conferences. In 2020, Dr. Fleming founded the non-profit Kitalys Institute as a means of producing Metabesity conferences and advancing interventions of any kind that can improve health and healthspan.